Abstract

We consider a market model with four correlated factors and two stochastic volatilities, one of which is rapid-changing, while another one is slow-changing in time. An advanced Monte Carlo method based on the theory of cubature in Wiener space is used to find the no-arbitrage price of the European call option in the above model.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

MSC 2010 Classification

36.1 Introduction

Consider a market model

where \(\mathbf {X}(t):[0,T]\rightarrow \mathbb {R}^m\) is a stochastic process, \(\mu :[0,T]\times \mathbb {R}^m\rightarrow \mathbb {R}^m\) is the drift, \(\mathbf {V}_i:[0,T]\times \mathbb {R}^m\rightarrow \mathbb {R}^{m}\) are the diffusion coefficients and \({W}^*_i(t)\) are the standard independent Brownian motions under the risk-neutral probability measure \(\mathsf {P}^*\) defined on a measurable space \((\varOmega ,\mathfrak {F})\). Currently, two general methods of pricing contingent claims in such a model are available: the Feynman–Kac theorem and Monte Carlo simulation.

Using the former method, Canhanga et al. [1,2,3,4,5,6,7] priced a European call option in the model with stochastic security price S, two stochastic volatilities \(V_1\) and \(V_2\) and four factors:

Here r is the spot risk-free interest rate, q is the continuously compounded dividend rate, \(\lambda _1\), \(\lambda _2\) are two constants determining market prices of variance risks, the processes \(V_1, V_2\) are mean-reverting variance processes with reversion rates of \(\frac{1}{\varepsilon }\), \(\delta \), volatilities \(\sqrt{\frac{1}{\varepsilon }}\xi _1\) and \(\sqrt{\delta } \xi _2\), and long run averages of \(\theta _1\), \(\theta _2\) respectively. The processes \(W_i^*\) are independent Brownian motions. Note that the model (36.2) is a particular case of model (36.1) for \(m=3, d=4\). In Ni et al. [15], they used the latter method and compared the answers.

We would like also to refer to the comprehensive books on Monte Carlo based on Glasserman [10] and other stochastic approximation methods by Silvestrov [18, 19] for pricing processes, where the readers also can find extended bibliographies of works in the area.

In this paper, we apply an advanced numerical Monte Carlo scheme, based on the theory of cubature in Wiener space, to the system (36.2) and discuss the advantages and the properties of the scheme.

The rest of the paper is organised as follows. In Sect. 36.2 we give a quick introduction to the advanced Monte Carlo simulation scheme using theory of cubature in Wiener space. The simulation algorithm is described in details in Sect. 36.3. The results of simulation are presented in Sect. 36.4. Section 36.5 concludes. Necessary results from tensor algebra are described in Sect. 36.6.

36.2 Stochastic Cubature Formulae

To introduce the subject, consider the one-dimensional Itô stochastic differential equation in integral form:

and assume that the functions \(\mu \) and \(\sigma \) are infinitely differentiable and satisfy the linear growth bound. For any twice continuously differentiable function f, the Itô formula gives

where

Apply the Itô formula (36.4) to the functions \(f=\mu \) and \(f=\sigma \) in (36.3). We obtain the simplest non-trivial Taylor–Itô expansion

with remainder

see Kloeden and Platen [12]. One can continue the above process to arbitrarily high order. The result by Kloeden and Platen [12, Sect. 5.5] is complicated, because the differential operator \(\mathcal {L}^0\) contains the second derivative.

To overcome this difficulty, replace Eq. (36.3) with the equivalent one-dimensional Stratonovich stochastic differential equation in integral form:

where the second integral is the Stratonovich stochastic integral and the coefficients \(\tilde{\mu }\) and \(\mu \) are connected with the Stratonovich correction

The solution of a Stratonovich stochastic differential equation transforms according to the deterministic chain rule, so Eq. (36.4) becomes

where

The simplest nontrivial Stratonovich–Itô expansion takes the form

with remainder

Write down the market model (36.1) in the Stratonovich form

where the Stratonovich correction takes the form

Define the action of the vector field \(\mathbf {V}_i\) on the set of infinitely differentiable functions \(f(\mathbf {y})\) by

Let k be a nonnegative integer, and let \(\alpha \) be either the empty set if \(k=0\) or a multi-index \(\alpha =(\alpha _1,\ldots ,\alpha _k)\) with integer components \(0\le \alpha _i\le d\). Define the number \(\Vert \alpha \Vert \) as k plus the number of zeroes among the \(\alpha _i\)’s and call it the degree of \(\alpha \). Let \(I(t,\varnothing ,\circ \mathrm {d}\mathbf {W}^*)\) be the identity operator, and let

be the multiple Stratonovich integral. The Stratonovich–Itô expansion takes the form

where n is a positive integer, and where the remainder \(R_n\) contains multiple Stratonovich integrals of degrees greater than n.

Let \(C_{\mathbf {0},\mathrm {BV}}([0,1];\mathbb {R}^{d+1})\) be the Banach space of \(\mathbb {R}^{d+1}\)-valued continuous functions of bounded variation in [0, 1] which start at \(\mathbf {0}\in \mathbb {R}^{d+1}\) with norm

where \(\mathrm {Var}([0,1];g_i)\) is the total variation of the ith component \(g_i\) of a function \(\mathbf {g}\in C_{\mathbf {0},\mathrm {BV}}([0,1];\mathbb {R}^{d+1})\). Let \(\mathfrak {B}\) be the \(\sigma \)-field of the Borel sets of the above space. A random path is a measurable map \(\omega :\varOmega \rightarrow C_{\mathbf {0},\mathrm {BV}}([0,1];\mathbb {R}^{d+1})\).

Along with the system (36.5), consider the following system of random ordinary differential equations in the integral form:

Let \(\tilde{\mathbf {X}}_{\omega }(t)\) be its solution.

Define the time-scaled random path \(\omega [t](s):\varOmega \rightarrow C_{\mathbf {0},\mathrm {BV}}([0,t];\mathbb {R}^{d+1})\) by

and the probability measure \(\mu \) on \(\mathfrak {B}\) by

Let \(f(\mathbf {y})\) be the discounted payoff of a financial instrument. We would like to estimate the weak approximation error

when we replace the true price \(\mathsf {E}^*[f(\mathbf {X}(t))]\) of the financial instrument with its approximate value \(\mathsf {E}[f(\tilde{\mathbf {X}}_{\omega [t]}(t))]\). The deterministic Taylor formula for \(f(\tilde{\mathbf {X}}_{\omega [t]}(t))\) has the form

where

The following definition was proposed by Kusuoka [13].

Definition 36.1

(The moment matching condition) The measure \(\mu \) satisfies the moment matching condition of order n and is called a cubature formula of degree n, if

For such a measure \(\mu \) we obtain

and we expect that this difference is small. Indeed, we have

Theorem 36.1

(Tanaka [20]) Let \(\mu \) satisfies the moment matching condition. If f is infinitely differentiable with bounded derivatives of all orders, then there exists a constant \(C=C(n,f)\) such that

If t is not small, create N independent copies \(\omega ^{(i)}\) of the random path \(\omega \) and define a new random path \(\overline{\omega }\) in [0, 1] by

if \((i-1)/N\le t<i/N\).

Theorem 36.2

(Tanaka [20]) If f is infinitely differentiable with bounded derivatives of all orders, then there exists a constant \(C=C(n,f)\) such that

Using the results in Kusuoka [13], one can show the convergence for the case of only Lipschitz continuous f under mild conditions on the vector fields \(V_i\). We will not consider these generalisations here.

Definition 36.2

(Lyons and Victoir [14]) A measure \(\mu \) is called a classical cubature formula of degree n if it satisfies the moment matching condition of order n and is supported on a finite set.

In the case of a classical cubature formula the approximation \(\mathsf {E}[f(\tilde{\mathbf {X}}_{\overline{\omega }}(1))]\) can be computed exactly (without integration error!) by solving the system (36.7). Lyons and Victoir [14] proved the existence of classical cubature formulae and gave explicit but complicated examples for arbitrary d and degrees \(n=3\) and \(n=5\). Gyurkó and Lyons [11] found even more sophisticated classical cubature formulae in some cases of \(n\ge 7\) for \(d=1\), 2.

In calculations, we will use a simple non-classical cubature formula of degree 5 proposed by Ninomiya and Victoir [16].

Example 36.1

(The Ninomiya–Victoir scheme) Let \(\varLambda \) be a Bernoulli random variable independent of \(\mathbf {W}(t)\) and taking values \(\pm 1\) with probability 1/2. The random path is

This non-classical cubature formula is of degree 5.

36.3 The Simulation Algorithm

As a first step, apply the Stratonovich correction (36.6) to the system (36.2). We obtain the system (36.5) with

and

Next, we write down the system (36.7), using the Ninomiya–Victoir scheme (36.8). Following Ninomiya and Victoir [16], denote by \(\exp (\mathbf {V}_i)\mathbf {x}\) the solution at time 1 of the boundary value problem

Let T be the maturity and K be the strike price of the European call option with Lipschitz continuous payoff \(f(S(T))=\max \{S(T)-K,0\}\). Divide the interval [0, T] into N intervals of equal length. Let \(\mathbf {Z}^i\), \(0\le i\le N-1\) be the independent standard normal 4-dimensional random vectors, let \(\varLambda _i\), \(0\le i\le N-1\) be the Bernoulli random variables of Example 36.1, and assume all of them are independent. Define the set of random vectors \(\mathbf {X}^{i/N}\), \(0\le i\le N-1\) by

where the upper formula is used whenever \(\varLambda _i=1\), while the lower formula is used whenever \(\varLambda _i=-1\). By [16, Theorem 2.1], for an arbitrary Lipschitz continuous function f we have

where C is a constant.

The solution to the systems (36.9) has the form

and

where

We can implement this algorithm/scheme with weak convergence of order two using Monte-Carlo technique to obtain \(\mathsf {E}[f(\mathbf {X}^{1})]\). For convenience we refer to this scheme hereafter as the “advanced MC” scheme. For illustration, in Fig. 36.1 we plot 20 paths using the “advanced MC” scheme (right) in comparison to the original paths (approximated by Euler scheme). Note that in this figure the “advanced MC” scheme has a small number of time steps i.e. \(N =5\). However the approximation in European option price is plausible even with such a small value of N, as to be shown in the next section.

36.4 Numerical Results

We implement the advanced MC scheme using MATLAB in a PC with Intel i5-5200U CPU and 16 GB RAM. We consider European option pricing in the model (36.2) under the set of parameters in Table 36.1 unless stated otherwise. The initial values are \(S_0 = 100, V_1= 0.03, V_2=0.03\) and the day convention is assumed to be 252 trading days per year. The problem is to compute the option price as a discounted expectation i.e. \(C = e^{-rT}\mathsf {E}[f(S_T)]\).

We use N time steps on the time interval [0, T] and simulate \(M=\) 100,000 sample paths which follow our scheme. In this way we generate M independent realisations of the random variable \(S_T\), \(S_{i,T}, i = 1, \ldots , M\), and approximating

Note that \(\hat{C}\) is a random variable with mean C (only approximately due to the discretisation error) and standard deviation \(\sigma _C\) of order \(O(\sqrt{M})\) by the central limit theorem. We do an experiment of 50 trails and obtain \(\hat{C}_i, i=1, \ldots , 50\). We compute the mean and standard deviation of these 50 draws of \(\hat{C}\), denote it as \(\hat{C}_{avg}\) and \(s_{\hat{C}}\) respectively. The quantity \(\hat{C}_{avg}\) is our approximation price. Note that \(\hat{C}_{avg} \approx \mathsf {E}[\hat{C}] \approx C\) and \(s_{\hat{C}} \approx \sigma _C\).

Most of the experiments have been performed using both the traditional order-one Euler–Maruyama scheme and the order-two advanced MC scheme. For both schemes, while fixing M, increasing N will reduce the discretisation error and improve accuracy of \(\hat{C}_{avg}\), reducing the value of \(\sigma _C\) is mainly achieved by increasing the number of sample paths M (or using variance-reduction techniques). For the same M and N, both schemes have similar values for standard error \(s_{\hat{C}}\), hence we focus on the effect of N on the accuracy of \(\hat{C}_{avg}\). A reference price \(C_{CZ}\) is calculated for each experiment using the approach by Chiarella and Ziveyi [9]. For small values of model parameters \(\varepsilon \) and \(\delta \), i.e. when the variance processes are fast mean-reverting and slow mean-reverting respectively, the price \(C_{CZ}\) is very close to the approximated price using an asymptotic approach in Canhanga et al. [1] and [7]. For other values of \(\varepsilon \) and \(\delta \) we have run Monte-Carlo simulations using the traditional Euler–Maruyama scheme and confirmed that \(C_{CZ}\) is accurate enough as a reference price. We refer to Canhanga et al. [15] for an option pricing formula adapted to the model (36.2) using the Chiarella and Ziveyi approach.

36.4.1 Rate of Convergence

An inspection of formulas in the advanced MC scheme indicates that, for the same number of time steps, i.e. for same N, the traditional Euler–Maruyama scheme involves simpler computation and hence should run faster which is indeed the case in simulations. It should be possible to improve the performance of the advanced MC scheme and hence reduce its execution time without altering the problem/algorithm but our main concern is on comparing rate of convergence. As a scheme with weak convergence of order two, the advanced MC scheme has its relative errors decreasing faster with respect to N in many cases. We found the clearest evidence under a large mean-reversion rate e.g. for \(\varepsilon \le 0.01\), as illustrated in Tables 36.2 (\(\varepsilon = 0.01\)) and 36.3 (\(\varepsilon = 0.001\)). This advantage of advanced Monte-Carlo scheme is more obvious for the smaller value of N and for the smaller value of \(\varepsilon \) i.e. \(\varepsilon = 0.001\). Experiments in Tables 36.2 and 36.3 use \(K=90\). Similar pattern in the rate of convergence can be observed for other values of K under large mean-reversion rates, as shown in Fig. 36.2. Here we plot the relative errors of the two schemes for 8 different values of \(N: N = 2^{10-p}\) for \(1\le p \le 8\). Note that for the case of \(K=120\) we plot the relative errors only for \(N: N = 2^{10-p}\) for \(1\le p \le 7\). In other words we drop the case of \(p=8\), i.e. \(N=4\) since the relative error of the Euler scheme is far too large for such a small value of N.

As we are pricing a plain vanilla European option, the traditional Euler–Maruyama scheme is sufficiently accurate with a moderate large N. A larger N might be needed if we use Euler–Maruyama scheme in pricing for example an Asian option. In the examples above, let \(N\ge 100\), both schemes perform well and in general generate relative errors of similar magnitude for same values of M and N. Therefore our discussions hereafter concentrate on the properties of the advanced MC scheme by itself.

36.4.2 The Effect of Mean-Reversion Rates

As the model was proposed in Canhanga et al. [1,2,3,4,5,6,7] as having a fast mean-reverting variance process and a slow mean-reverting process. It is interesting to study how the mean-reversion rates \(1/\varepsilon \) and \(\delta \) affect the accuracy of \(\hat{C}_{avg}\). We fix the number of sample path \(M =\) 100,000 and let the number of time steps be \(N=5\). Note that \(T=\frac{90}{252}\) here so \(N=5\) is relatively small. The parameters are as shown in Table 36.1 with \(K=100\), i.e. we price an at-the-money(ATM) option. The relative error (Rel error) is defined as \(|\hat{C}_{avg}-C_{CZ}|/C_{CZ}\).

As \(\hat{C}_{avg}\) is a random variable, the values of relative errors will be slightly different in another experiment but the pattern is similar. Table 36.4 indicates that, under these value of M and N, the approximations are poor when \(\varepsilon \) is too small (\(\varepsilon < 0.01\)) i.e. the mean-reversion rate for the process \(V_1\) is too large. We study also the effect of a slow mean-reversion rate (small \(\delta \)) and the effect of different combinations of mean-reversion rates. The results are given in Table 36.5, from which we conclude that slow mean reversion rate has little impact on the accuracy of our scheme. We discuss below on how to fix the problem of large mean reversion rate.

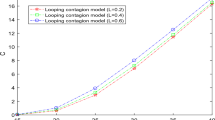

As shown in Tables 36.4 and 36.5, when the mean-reversion rate \(\frac{1}{\varepsilon }\) is too large, a small value of \(N=5\) is not sufficient. Increasing M reduces \(s_{\hat{C}}\) but does not help much with reducing Rel error. The problem can be fixed by increasing N. Figure 36.3 shows how the relative error decreases as one increases N under \(\varepsilon = 0.001\). To save time, the experiments behind this figure were carried out for smaller \(M (= 50000)\). In particular, the relative error reduced from 55.54 to \(0.31\%\) when we increase N from \(N=5\) to \( N= 320\).

36.4.3 The Effect of Moneyness

In this section we consider various strike prices K. The effect of mean-reversion rate e.g. \(\varepsilon \) is similar to the at-the-money case studied above. We fix therefore \(\varepsilon = 0.1\) in all experiments. Also \(T=\frac{90}{252}, N=5\). The values of \(s_{\hat{C}}\) of these experiments are in the range of \(0.012-0.017\). Table 36.6 lists out the reference prices, our approximation prices and the relative errors. It suggests that the accuracy of \(\hat{C}_{avg}\) is good for deep in-the-money, in-the-money, at-the-money and moderately out-of-the-money options with relative error of order \(10^{-4}\) or \(10^{-3}\). For deep out-of-the-money options, i.e., when \(K\ge 120\), the relative error is of order \(10^{-2}\). Increasing N from 5 to 100 yields only a slight improvement in reducing Rel error (0.0275) and increasing M simultaneously (from 100000 to 500000) reduces \(s_{\hat{C}}\) to 0.0037 but does not reduce Rel error. In particular when \(K=130\), increasing N from \(N=16\) to \(N=1024\) does not change the magnitude of the relative error of about 3 percent. On the other hand, the Euler–Maruyama scheme gives approximations very consistent with our algorithm even under large N and M. Therefore some caution should be paid while pricing a deep out-of-the-money option.

36.4.4 The Effect of Correlation Coefficient

Our advanced Monte-Carlo scheme provides good approximation for any combination of the pair \((\rho _{13}, \rho _{24})\). The only warning is that none of the correlation coefficients may take value zero. This is because \(\rho _{13}\) and \(\rho _{24}\) appear as denominators in our algorithm as shown in Sect. 36.3. However, for the zero correlation case, i.e. \(\rho _{13}=0\) and/or \(\rho _{24} =0 \), one may instead use a correlation coefficient that is very close to zero. For example with \(\rho _{13}=0.0001\), our advanced Monte-Carlo scheme performs well.

36.5 Conclusions and Further Remarks

We obtained an advanced Monte-Carlo algorithm/scheme with explicit expressions using Ninomiya–Victoir scheme. The numerical results show that this algorithm in general gives accurate approximation for European option pricing under the parameters studied. A larger number of time steps, i.e. a larger N, is required when the mean-reversion rate is too high, for example if \(\varepsilon = 0.001\). Some caution should be paid when one prices a deep out-of-the-money option. If the mean-reversion rate is large, it is clear that the advanced Monte-Carlo scheme has a better order of convergence than the first-order Euler–Maruyama scheme. Further studies may involve exotic option pricing with comparison to the traditional Euler–Maruyama scheme.

36.6 Cubature on a Tensor Algebra

Let \(\{\,\mathbf {e}_i:0\le i\le d\,\}\) be the standard basis of the space \(\mathbb {R}^{1+d}\). Define \(\mathsf {e}_{\varnothing }=1\) and

for any multi-index \(\alpha =(\alpha _1,\ldots ,\alpha _k)\). Let \(U_k(\mathbb {R}^{1+d})\) be the linear space of rank k tensors with the basis \(\{\,\mathsf {e}_{\alpha }:\Vert \alpha \Vert =k\,\}\). Denote by \(T(\mathbb {R}^{1+d})\) the direct sum of the spaces \(U_k(\mathbb {R}^{1+d})\) over all nonnegative k, and let \(\mathsf {a}_0\in U_0(\mathbb {R}^{1+d})\), ..., \(\mathsf {a}_k\in U_k(\mathbb {R}^{1+d})\), ...be the components of an element \(\mathsf {a}\in T(\mathbb {R}^{1+d})\). Define the sum, tensor product, the action of scalars by

With this operations, \(T(\mathbb {R}^{1+d})\) becomes an associative algebra. Define the exponent and logarithm on \(T(\mathbb {R}^{1+d})\) by

where the series converge coordinate-wise. The truncated tensor algebra of degree n, \(T^{(n)}(\mathbb {R}^{1+d})\), is the direct sum of the linear spaces \(U_k(\mathbb {R}^{1+d})\), \(0\le k\le n\). Let \(\pi _n\) be the natural projection of \(T(\mathbb {R}^{1+d})\) to \(T^{(n)}(\mathbb {R}^{1+d})\). Finally, the operation \([\mathsf {a},\mathsf {b}]=\mathsf {a}\otimes \mathsf {b}-\mathsf {b}\otimes \mathbf {a}\) defines a Lie bracket on both \(T(\mathbb {R}^{1+d})\) and \(T^{(n)}(\mathbb {R}^{1+d})\). Let \(\mathcal {U}\) be the space of linear combinations of finite sequences of Lie brackets of elements of \(\mathbb {R}^{1+d}\). Then \(\mathcal {U}\) is the free Lie algebra generated by \(\mathbb {R}^{1+d}\), see [17]. An element of the set \(\pi _n(\mathcal {U})\) is called a Lie polynomial of degree n, and an element \(\mathsf {a}\in T(\mathbb {R}^{1+d})\) is called a Lie series if all \(\pi _n\mathsf {a}\) are Lie polynomials.

Define a map \(\mathcal {S}:C_{\mathbf {0},\mathrm {BV}}([0,T];\mathbb {R}^{d+1})\rightarrow T(\mathbb {R}^{1+d})\) by

and call \(\mathcal {S}(\omega )\) the signature of the path \(\omega \). Not all elements in \(T(\mathbb {R}^{1+d})\) represent a signature. However, Chen [8] proved the following result. The truncated logarithmic signature \(\pi _n\ln \mathcal {S}(\omega )\) of any path \(\omega \in C_{\mathbf {0},\mathrm {BV}}([0,T];\mathbb {R}^{d+1})\) is a Lie polynomial. Conversely, for any Lie polynomial \(\mathcal {L}\in \pi _n\mathcal {U}\) there is a path \(\omega \in C_{\mathbf {0},\mathrm {BV}}([0,T];\mathbb {R}^{1+d})\) with \(\pi _n\ln \mathcal {S}(\omega )=\mathcal {L}\).

Similarly, define the Wiener signature by

It is easy to see the following. A measure \(\mu \) is a classical cubature formula of degree n if and only if there are Lie polynomials \(\mathcal {L}_1\), ..., \(\mathcal {L}_m\) and positive weights \(\lambda _1\), ..., \(\lambda _m\) such that

The expectation in the left hand side of this equation was calculated by Lyons and Victoir in [14]. They obtained the following result:

In order to find a classical cubature formula of degree n, one has to find Lie polynomials \(\mathcal {L}_1\), ..., \(\mathcal {L}_m\in \pi _m\mathcal {U}\) and positive weights \(\lambda _1\), ..., \(\lambda _m\) with \(\lambda _1+\cdots +\lambda _m=1\) such that

Given the solution, we need to construct the paths \(\omega _j\) of bounded variation on [0, T] satisfying \(\pi _n\ln \mathcal {S}(\omega _j)=\mathcal {L}_j\). To perform these tasks, Gyurkó, Lyons, and Victoir use methods based on technical tools from the theory of free Lie algebras like the Lyndon words basis, the Philip Hall basis, Poincaré–Birkhoff–Witt theorem and Baker–Campbell–Hausdorff formula, see [11, 14, 17] and Chap. 35 in this book.

References

Canhanga, B., Malyarenko, A., Murara, J.P., Ni, Y., Silvestrov, S.: Numerical studies on asymptotics of European option under multiscale stochastic volatility. Methodol. Comput. Appl. Probab. 19(4), 1075–1087 (2017)

Canhanga, B., Malyarenko, A., Murara, J.P., Silvestrov, S.: Pricing European options under stochastic volatilities models. In: Silvestrov, S., Rančić, M. (eds.), Engineering Mathematics. I. Springer Proceedings in Mathematics & Statistics, vol. 178, 315–338. Springer, Cham (2016)

Canhanga, B., Malyarenko, A., Ni, Y., Rančić, M., Silvestrov, S.: Analytical and numerical studies on the second-order asymptotic expansion method for European option pricing under two-factor stochastic volatilities. Comm. Statist. Theory Methods 47(6), 1328–1349 (2018)

Canhanga, B., Malyarenko, A., Ni, Y., Rančić, M., Silvestrov, S.: Calibration of multiscale two-factor stochastic volatility models: A second-order asymptotic expansion approach. In: Skiadas, C.H. (ed.) Proceedings SMTDA2018, 409–422. International Society for the Advancement of Science and Technology, ISAST (2018)

Canhanga, B., Malyarenko, A., Ni, Y., Silvestrov, S.: Perturbation methods for pricing European options in a model with two stochastic volatilities. In: Manca, R., McClean, S., Skiadas, C.H. (eds.) New Trends in Stochastic Modeling and Data Analysis, 199–210. International Society for the Advancement of Science and Technology, ISAST (2015)

Canhanga, B., Malyarenko, A., Ni, Y., Silvestrov, S.: Second order asymptotic expansion for pricing European options in a model with two stochastic volatilities. In: Skiadas, C.H. (ed.) ASMDA 2015 Proceedings, 37–52. International Society for the Advancement of Science and Technology, ISAST (2015)

Canhanga, B., Ni, Y., Rančić, M., Malyarenko, A., Silvestrov, S.: Numerical methods on European option second order asymptotic expansions for multiscale stochastic volatility. In: International Conference on Mathematical Problems in Engineering, Aerospace and Sciences, American Institute of Physics Conference Series, vol. 1798, 1–10 (2017)

Chen, K.T.: Integration of paths, geometric invariants and a generalized Baker-Hausdorff formula. Ann. of Math. 2(65), 163–178 (1957)

Chiarella, C., Ziveyi, J.: Pricing American options written on two underlying assets. Quant. Finance 14(3), 409–426 (2014)

Glasserman, P.: Monte Carlo Methods in Financial Engineering. Applications of Mathematics (New York), vol. 53. Springer, New York (2004)

Gyurkó, L.G., Lyons, T.J.: Efficient and practical implementations of cubature on Wiener space. Stochastic Analysis 2010, 73–111. Springer, Heidelberg (2011)

Kloeden, P.E., Platen, E.: Numerical Solution of Stochastic Differential Equations. Applications of Mathematics (New York), vol. 23. Springer, Berlin (1992)

Kusuoka, S.: Approximation of expectation of diffusion process and mathematical finance. In: Maruyama M., Sunada, T. (eds.), Taniguchi Conference on Mathematics, Nara 1998. Advanced Studies in Pure Mathematics 31, Mathematical Society of Japan, Tokyo, 147–165 (2001)

Lyons, T., Victoir, N.: Cubature on Wiener space. Proc. R. Soc. Lond. Ser. A Math. Phys. Eng. Sci. 460(2041), 169–198 (2004)

Ni, Y., Canhanga, B., Malyarenko, A., Silvestrov, S.: Approximation methods of European option pricing in multiscale stochastic volatility model. In: International Conference on Mathematical Problems in Engineering, Aerospace and Sciences. American Institute of Physics Conference Series, vol. 1798 (2017)

Ninomiya, S., Victoir, N.: Weak approximation of stochastic differential equations and application to derivative pricing. Appl. Math. Finance 15(1–2), 107–121 (2008)

Reutenauer, C.: Free Lie algebras. London Mathematical Society Monographs. New Series, vol. 7. The Clarendon Press, Oxford University Press, New York (1993)

Silvestrov, D.S.: American-Type Options—Stochastic Approximation Methods. Vol. 1. De Gruyter Studies in Mathematics, vol. 56. De Gruyter, Berlin (2014)

Silvestrov, D.S.: American-Type Options—Stochastic Approximation Methods. Vol. 2. De Gruyter Studies in Mathematics, vol. 57. De Gruyter, Berlin (2015)

Tanaka, H.: Cubature formula on Wiener space from the viewpoint of splitting methods. RIMS Kôkuûroku 1844, 50–59 (2013)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Canhanga, B., Malyarenko, A., Murara, JP., Ni, Y., Silvestrov, S. (2020). Advanced Monte Carlo Pricing of European Options in a Market Model with Two Stochastic Volatilities. In: Silvestrov, S., Malyarenko, A., Rančić, M. (eds) Algebraic Structures and Applications. SPAS 2017. Springer Proceedings in Mathematics & Statistics, vol 317. Springer, Cham. https://doi.org/10.1007/978-3-030-41850-2_36

Download citation

DOI: https://doi.org/10.1007/978-3-030-41850-2_36

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-41849-6

Online ISBN: 978-3-030-41850-2

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)