Abstract

In this paper, we establish the pricing framework of European options in the presence of the looping contagion risk. First, the looping contagion risk model is transformed into a martingale form and the semi-explicit risk-neutral pricing formula is established for the pricing of European options. Then the pricing partial differential equations (PDEs) are derived and solved by the stable alternating direction implicit (ADI) methods. Moreover, the ADI methods in this paper are proved to be unconditionally stable through Fourier analysis framework. Finally, the Monte Carlo simulations are performed and combined with the numerical solutions of PDEs to compute the desired option prices via the semi-explicit pricing formula. Numerical examples are given to confirm the convergence of the numerical methods and the economic analysis is provided to illustrate the economic effect of the looping contagion risk on option prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The valuation of financial options is an active topic in quantitative finance and plays an important role in risk management and hedging. The celebrated Black-Scholes formulas (see e.g., [2, 32]) under geometric Brownian motion (GBM) are regarded as the seminal works in the field. To meet more realistic market demands, growing interests have focused on a variety of stochastic models for financial option pricing such as regime-switching models (see e.g., [12, 13, 17, 20, 28, 38]), jump-diffusion models (see e.g., [5, 25, 26, 33]) and state-dependent regime-switching jump-diffusion models (see e.g., [8, 9, 14, 27, 35]).

The contagion risk has recently received considerable attention from the scholars and practitioners since it frequently happens in the realistic financial markets. Clearly, the conventional dependence modelling for underlying assets through covariance matrix cannot capture the sudden market co-movements and the failure of a company has direct impacts on the performance of other linked companies. For instance, the default of Lehman Brother leads to a sharp fall of stock price of other other investment banks during the global financial crisis in years 2007-2008. To better capture such financial phenomenon, the contagion risk models are introduced to the credit risk field (see [10, 21]). Since then, growing interests have focused on the financial contagion risk (see e.g., [11, 15, 18, 19, 36]). Among them, Jiao and Pham [23] consider a financial market with a stock which jumps downward at the default time of a counter-party and they also discuss the expected utility maximization problems. Jiao and Pham [24] further study an optimal investment problem under a contagion risk model subject to multiple jumps and defaults. Gu et al. [16] confirm that the contagion risk has great impact on pricing and hedging portfolio credit derivatives. Bo and Capponi [4] consider the optimal investment problem in credit derivatives portfolio by taking into account the contagion risk. Capponi and Frei [7] provide a genuine looping contagion default structure based on the fact that the default intensities of companies are functions of stock prices and some external factors. Indeed, there exists a certain inherent connection between the looping contagion paradigm and the hard-to-borrow model established by Avellaneda and Lipkin [1] (also see Ma and Zhu [29] for the option pricing problem), where the latter model assumes that the jump of the stock price decreases the buy-in rate while the increase of the buy-in rate leads to the stock price jumps.

To explore an interaction between the market and the credit risks, and its impacts on dynamic portfolio optimization, Jia et al. [22] introduce a looping contagion model which considers single financial market with a risk-free bank account, a non-defaultable stock and a defaultable stock. The defaultable stock admits that the underlying company may default when the stock value is worthless. Although the non-defaultable stock may default from theoretical point of view, the probability to this event is assumed to be negligible by researchers for simplicity and such non-defaultable stock is also simply referred to as a stock. Moreover, the default time is the first jump time of an intensity process depending on the stock price, the defaultable stock price as well as the stock price jump at default time. Unlike the existing literature, the aim of this paper is to establish the pricing framework for European options by taking the looping contagion risk into account and the main contributions of this paper are summarized as follows:

-

The pricing framework for financial options in the presence of the looping contagion risk is first established.

-

Unconditionally stable numerical methods for the pricing PDEs are studied and analyzed through Fourier analysis technique.

-

Some economic explanations by means of sensitivity analysis are provided to show the impacts of the looping contagion risk on option prices.

The rest of this paper is organized as follows. In Sect. 2, the looping contagion model under physical measure is transformed into that under risk-neutral measure for option pricing. In Sect. 3, the semi-explicit pricing formula for European call options is derived and pricing PDEs associated with the boundary conditions are established. In Sect. 4, the unconditionally stable ADI methods are proposed to solve the pricing PDEs and combined with the Monte Carlo simulations to compute the option prices via the semi-explicit pricing formula. In Sect. 5, some numerical examples are presented to confirm the convergence of the numerical methods and the sensitivity analysis of some important parameters is conducted. In the final section, we conclude the paper.

2 Looping contagion risk model

In this paper, we consider a financial market model which contains a risk-free bank account \((B_{t})_{t\in [0,T]}\) with the interest rate r, a stock \((S_{t})_{t\in [0,T]}\) and a defaultable stock \((P_{t})_{t\in [0,T]}\). The defaultable stock P which defaults randomly, is correlated with the stock dynamics S. More specifically, the defaultable stock P induces a jump of the stock price S. Besides, the stock price S will affect the default of the defaultable stock P by default intensity.

Assume that \((\Omega ,\mathcal {G},\mathbb {P})\) is a complete probability space with an enlarged filtration \(\mathbb {G}=\mathbb {F}\vee \mathbb {H}\) given by \(\mathcal {G}_{t}=\mathcal {F}_{t}\vee \mathcal {H}_{t}\), where \(\mathbb {G}=(\mathcal {G}_{t})_{t\in [0,T]}\), \(\mathbb {F}=(\mathcal {F}_{t})_{t\in [0,T]}\) and \(\mathbb {H}=(\mathcal {H}_{t})_{t\in [0,T]}\). Let \(\tau\) be the random default time of the defaultable stock P defined on \((\Omega ,\mathcal {G},\mathbb {P})\). Then \((\mathcal {H}_{t})_{t\in [0,T]}\) can be defined by \(\mathcal {H}_{t}:=\sigma (H_{u}:u\le t)\) and \(H_{t}:=\textbf{1}_{\{\tau \le t\}}\), where \(\textbf{1}_{\{\cdot \}}\) represents the indicator function. Moreover, the default indicator process \(\mathcal ({H}_{t})_{t\ge 0}\) is associated with an intensity process \((\lambda _{t})_{t\ge 0}\) which is bounded and given by \(\lambda _{t}=\lambda (S_{t},P_{t})\) whose formulation is given by [22] (also see its exact formulation (51) in Sect. 5). Let \((W_{t}^{S})_{t\in [0,T]}\) and \((W_{t}^{P})_{t\in [0,T]}\) denote two standard Brownian motions on \((\Omega ,\mathcal {G},\mathbb {P})\) with the correlation coefficient \(\rho \in [-1,1]\), which are independent of \((H_{t})_{t\ge 0}\). Then the looping contagion risk model is given by the following stochastic differential equations (SDEs):

where \(\mu ^{S}\) and \(\mu ^{P}\) are the drift rates of the stock S and the defaultable stock P respectively, \(\sigma ^{S}\) and \(\sigma ^{P}\) the corresponding volatilities, and \(L<1\) the percentage loss of stock S upon the default of defaultable stock P. Apparently, the defaultable stock price P falls to zero and the stock price S drops by a percentage of L at default time \(\tau\). For more general set-ups, we refer the reader to Jia et al. [22].

According to Mansuy and Yor [31], any \(\mathbb {G}\)-predictable process \(\varphi\) can be written in the following form:

where \(\varphi _{t}^{F}\) is \(\mathbb {F}\)-adapted and \(\varphi _{t}^{d}(\theta )\) is measurable with respect to \(\mathcal {F}_{t}\otimes \mathcal {B}(\mathbb {R}_{+})\) for all \(t\in [0,T]\). Thus we have

where \(S_{t}^{F}\), \(P_{t}^{F}\) are \(\mathbb {F}\)-adapted, and \(S_{t}^{d}(\theta )\), \(P_{t}^{d}(\theta )\) are \(\theta\)-measurable and \(\mathbb {F}\)-adapted. If we denote \(S_{\tau }^{F}=\lim \limits _{t\rightarrow \tau ^{-}}S_{t}^{F}\) and \(P_{\tau }^{F}=\lim \limits _{t\rightarrow \tau ^{-}}P_{t}^{F}\), then the stock dynamics \(S_{t}\) satisfies the following SDEs:

and the defaultable stock dynamics \(P_{t}\) satisfies the following SDEs under the physical measure \(\mathbb {P}\):

where \(\mu ^{S}\), \(\sigma ^{S}\), \(\mu ^{P}\), \(\sigma ^{P}\), L are nonnegative constants, \((\mu ^{S})^{d}(\tau )\), \((\sigma ^{S})^{d}(\tau )\) and \(S_{t}^{d}(\tau )\) are \(\mathcal {F}_{t}\otimes \mathcal {B}\big ([0,t)\big )\)-measurable functions for all \(t\in [0,T]\). Apparently, the drift and diffusion coefficients \((\mu , \sigma )\) of the stock price S switches from \(\big (\mu ^{S}, \sigma ^{S}\big )\) to \(\big ((\mu ^{S})^{d}(\tau ), (\sigma ^{S})^{d}(\tau )\big )\) when occurring a default, and the post-default coefficients may depend on the default time \(\tau\). Here for simplicity, we assume that

where \(\mu _{1}, \sigma _{1}, \mu _{2}, \sigma _{2}, \mu _{3}, \sigma _{3}\) are nonnegative constants.

We below transform the physical measure \(\mathbb {P}\) into an equivalent martingale measure for option pricing. To facilitate such transformation, we define the \(\mathbb {G}\)-adapted process as follows

with

By assuming \(\mathbb {E}\big [\int _{0}^{T}\Vert \Theta (t)\Vert ^{2} Z^{2}(t)\textrm{d}t\big ] <\infty\), a probability measure \(\mathbb {Q}\) that is equivalent to \(\mathbb {P}\) on \((\Omega ,\mathcal {G})\), can be defined with the Radon-Nikodym density

Therefore according to the multidimensional Girsanov theorem, one can deduce that \(\widetilde{W_{t}}=W_{t}+\int _{0}^{t}\Theta (u)\textrm{d}u\) is a two-dimensional Brownian motion with correlation \(\rho\), and \(\widetilde{W_{t}}=\Big (\widetilde{W_{t}}^{S}, \widetilde{W_{t}}^{P}\Big )\), \(W_{t}=\big (W_{t}^{S}, W_{t}^{P}\big )\). Thus we have

which means that the stock dynamics (5) - (7) under the physical measure \(\mathbb {P}\) can be written as an equivalent form under the martingale measure \(\mathbb {Q}\):

Also the defaultable stock dynamics (8) - (9) can be written as

3 Pricing PDEs and semi-explicit pricing formula

In this section, we derive the pricing PDEs and the semi-explicit pricing formula in the presence of the looping contagion risk. To this end, we first consider the case where no default happens in the life of the option (i.e., \(\tau >T\)), and summarize the main results into the following theorem.

Theorem 3.1

Assume that the underlying asset follows the dynamic processes (13) – (14) under the risk-neutral measure \(\mathbb {Q}\) and there is no default in the life of the option. Denote the value function of European call option at current time t as \(\widehat{V}(t,S,P)\) in this case, then \(\widehat{V}(t,S,P)\) satisfies the following partial differential equation:

with the terminal and boundary conditions

where T is the expiry date, K the strike price and the differential operator \(\mathbb {L}\) is defined as

Proof

The detailed derivations and explanations of the above PDE with the initial and boundary conditions can be seen in Appendix A. \(\square\)

Remark 3.1

Since the defaultable stock P would default in the financial market once its price hits zero, hence the defaultable stock price P does not equal 0 in \(t\in [0,T]\). This is contradiction with the assumption that there is no default in the life of the option.

Below we establish the governing PDE for the case where the default happens in the life of the option.

Theorem 3.2

Assume that the underlying asset follows the dynamic processes (13) – (14) under the risk-neutral measure \(\mathbb {Q}\) and the default happens in the life of the option (i.e., \(0\le \tau \le T\)). Let \(\widetilde{V}^{d}(t,S)\) (\(\widetilde{V}^{F}(t,S,P)\)) denote the value function of European call option written on after-default (before-default) of the defaultable stock P. Then \(\widetilde{V}^{d}(t,S)\) satisfies the following PDE

with the terminal condition

Furthermore, \(\widetilde{V}^{F}(t,S,P)\) satisfies the following PDE

with the initial and boundary conditions

where the operator \(\mathbb {L}\) is defined by (22).

Proof

See Appendix B. \(\square\)

Remark 3.2

Since the default stock P would disappear in the financial market once its price hits zero, this fact means that the defaultable stock price P does not equal zero at \(t\in [0,\tau )\). This contradicts the fact that \(\tau\) is the default time of the stock P.

Remark 3.3

We know that the Black-Scholes equation (23) has the solution

where \(\hbox {BS}(t,x; K,r,\sigma )\) is Black-Scholes formula defined by

with \(\delta _{1}=\frac{\ln \frac{x}{K}+(r+\frac{\sigma ^{2}}{2})(T-t)}{\sigma \sqrt{T-t}}\), \(\delta _{2}=\delta _{1}-\sigma \sqrt{T-t} =\frac{\ln \frac{x}{K}+(r-\frac{\sigma ^{2}}{2})(T-t)}{\sigma \sqrt{T-t}}\), and \(N(\cdot )\) represents the standard normal distribution. Therefore, to obtain the final option price under the such circumstance, we have to solve the equation (25) with the terminal condition

Remark 3.4

From (25), we can see that the value of European call option depends on a given default \(\tau\) for \(\tau \in [0,T]\) when the default happens in the life of the option. Then the option value at the initial time is denoted by \(\widetilde{V}^{F}(0,S,P;\tau )\) which is just the solution of the PDE (25) with the boundary conditions (26) for any fixed default time \(\tau \in [0,T]\).

Below we are ready to present the final semi-explicit pricing formula for European call options.

Theorem 3.3

The semi-explicit pricing formula for European call options at the initial time under the looping contagion risk model (13)–(14) is given by

where \(\widehat{V}(0,S,P)\) is obtained by solving the PDE (20) with the boundary conditions (21) at time 0, and \(\widetilde{V}^{F}(0,S,P; t)\) the solution to the PDE (25) with the boundary conditions (26) at time 0.

Proof

See Appendix C. \(\square\)

Finally, we summarize the main results into the following algorithm.

PDE methods for pricing the European call options under the looping contagion risk model:

-

Step 1: Discretize the SDEs (15) and (18) via Euler method. Then generate M sample paths for both stock price S and defaultable stock price P, which are used to calculate the value of intensity function \(\lambda\) with \(\lambda _0=\lambda (S_{0},P_{0})\).

-

Step 2: Divide the time interval [0, T] into \(N_{T}-1\) equidistant subintervals, and [0, t] into \(N_{t}-1\) equidistant subintervals. Then the expectation \(\widetilde{\mathbb {E}}\Big [e^{-\int _{0}^{T}\lambda _{u}\textrm{d}u}\Big ]\) can be computed as follows:

$$\begin{aligned} \widetilde{\mathbb {E}}\Big [e^{-\int _{0}^{T}\lambda _{u}\textrm{d}u}\Big ]\approx \frac{1}{M}\sum _{i=1}^{M}e^{-\sum _{j=1}^{N_{T}-1}\frac{1}{2}\big (\lambda _{j}^{(i)}+\lambda _{j+1}^{(i)}\big )\Delta t}, \end{aligned}$$also the expectation \(\widetilde{\mathbb {E}}\Big [\lambda _{t} e^{-\int _{0}^{t}\lambda _{u}\textrm{d}u}\Big ]\) can be computed as:

$$\begin{aligned} \widetilde{\mathbb {E}}\Big [\lambda _{t} e^{-\int _{0}^{t}\lambda _{u}\textrm{d}u}\Big ]\approx \frac{1}{M}\sum _{i=1}^{M}\lambda _{N_{t}}^{(i)}e^{-\sum _{j=1}^{N_{t}-1}\frac{1}{2}\big (\lambda _{j}^{(i)}+\lambda _{j+1}^{(i)}\big )\Delta t}, \end{aligned}$$where \(\lambda _{j}^{(i)}\) represents the value of \(\lambda\) at the i-th path and j-th time.

-

Step 3: Use ADI scheme to solve the PDE (20) and obtain the option price \(\widehat{V}(0,S,P)\) in the case where no default happens in the life of the option.

-

Step 4: Choose a partition \(\Pi =\{t_{1},t_{2},\ldots ,t_{\mathcal {N}}\}\) for [0, T], in which the partition point in \(\Pi\) is the default time of the counterparty.

-

Step 5: For each fixed default time \(t_{i}\), calculate option price \(\widetilde{V}^{F}(0,S,P; t_{i})\) by using ADI scheme to solve the PDE (25).

-

Step 6: Compute European call option prices via the following formula:

$$\begin{aligned} V(0,S,P)&\approx \widehat{V}(0,S,P)\widetilde{\mathbb {E}}\Big [e^{-\int _{0}^{T}\lambda _{u}\textrm{d}u}\Big ]+\sum _{i=1}^{\mathcal {N}-1}\frac{1}{2}\bigg (\widetilde{V}^{F}(0,S,P; t_{i})\widetilde{\mathbb {E}}\Big [\lambda _{t_{i}} e^{-\int _{0}^{t_{i}}\lambda _{u}\textrm{d}u}\Big ]\nonumber \\&+\widetilde{V}^{F}(0,S,P; t_{i+1})\widetilde{\mathbb {E}}\Big [\lambda _{t_{i+1}} e^{-\int _{0}^{t_{i+1}}\lambda _{u}\textrm{d}u}\Big ]\bigg )\Delta t_{i}, \end{aligned}$$(31)where \(\Delta t_{i}=t_{i+1}-t_{i}\) represents the step size of i-th subinterval of the partition \(\Pi\).

4 Numerical methods

In this section, we construct the alternating direction implicit (ADI) schemes to solve the prcing PDEs (20) and (25), and these numerical methods are computationally efficient for solving the multidimensional PDEs and have been also developed for the multi-factor derivative pricing problems (see e.g., [6, 30, 37]). For convenience, we introduce the following differential operators:

Using transformation of time variable \(\xi =T-t\) and denote \(\widehat{U}(\xi ,S,P):=\widehat{V}(T-t,S,P)\), then the PDE (20) can be written as

with the initial and boundary conditions

Similarly denote \(\widetilde{U}(\zeta ,S,P)=\widetilde{V}^{F}(T-t,S,P)\), then the PDE (25) is written as:

with the initial and boundary conditions

For the aim of computation, the semi-infinite domain is truncated into a finite one as

where \(S_{\textrm{max}}\), \(P_{\textrm{min}}\) and \(P_{\textrm{max}}\) should be appropriately set to match with the boundary conditions respectively. More specifically, the value of \(S_{\textrm{max}}\) is generally three or four times the strike price K (see e.g., [30]). Since \(P\in (0,+\infty )\), thus we can set \(P_{\textrm{min}}\) to be a sufficiently small positive value such that the corresponding boundaries \(\frac{\partial \widehat{U}(\xi ,S,P_{\textrm{min}})}{\partial P}\approx 0\) and \(\frac{\partial \widetilde{U}(\zeta ,S,P_{\textrm{min}})}{\partial P}\approx 0\) hold. Moreover, since the intensity function \(\lambda (S,P)\) is monotonically non-increasing and bounded with respect to P, thus we have the fact \(\lim _{P\rightarrow \infty }\lambda (S,P)=\lambda _m\), here \(\lambda _m\) is the aforementioned minimum value of \(\lambda\). Consequently, we can choose a sufficiently large \(P_{\textrm{max}}\) such that \(\lambda (S,P_{\textrm{max}})\approx \lambda _m\) and its value has little effect on the option prices. We define the following uniform spatial and time meshes:

where I, J and N are the number of meshes in the S, P and \(\xi\) directions, and \(\Delta S=S_{\textrm{max}}/I\), \(\Delta P=\left( P_{\textrm{max}}-P_{\textrm{min}}\right) /J\) and \(\Delta \xi =T/N\) are step sizes.

Let \(\widehat{U}^{n}_{i,j}\) denote the approximation of \(\widehat{U}(\xi _{n},S_{i},P_{j})\) at mesh point \((\xi _{n},S_{i},P_{j})\). Then the PDE (35) can be discretized via the following \(\theta\)-scheme, for \(i=1,2,\ldots ,I;j=0,1,\ldots ,J\) and \(n=0,1,\ldots ,N-1\):

where \(0\le \theta \le 1\), and the difference operators \(\widehat{\mathbb {L}}_{1},\widehat{\mathbb {L}}_{2}\) and \(\widehat{\mathbb {L}}_{3}\) are defined as

Simplifying (43) gives that

Since the terms among (47) behave like \(\Delta \xi \theta \widehat{\mathbb {L}}_{3}\big (\widehat{U}^{n+1}_{i,j}-\widehat{U}^{n}_{i,j}\big )\sim \mathcal {O}(\Delta \xi ^{2})\) and \(\Delta \xi ^{2}\theta ^{2}\widehat{\mathbb {L}}_{1} \widehat{\mathbb {L}}_{2}\big (\widehat{U}^{n+1}_{i,j}-\widehat{U}^{n}_{i,j}\big )\sim \mathcal {O}(\Delta \xi ^{3})\), these terms can be regarded as higher-order error terms and dropped out from the scheme. We then obtain a simpler form of scheme as follows:

Since the following identity holds

which enables the scheme (48) to be written as the following ADI scheme, for \(i=1,2,\ldots ,I;j=0,1,\ldots ,J\); \(n=0,1,\ldots ,\widetilde{n},\ldots ,N-1\) and \(\widetilde{n}=0,1,\ldots ,N-1\),

with the discretized initial and boundary conditions

where we can replace the fictitious nodal values \(\widehat{U}^{n}_{I+1,j}, \widehat{U}^{n}_{i,-1}\) and \(\widehat{U}^{n}_{i,J+1}\) by their inner nodal values respectively.

Similarly, denote the approximation of \(\widetilde{U}(\zeta _{n},S_{i},P_{j})\) at mesh point \((\zeta _{n},S_{i},P_{j})\) by \(\widetilde{U}^{n}_{i,j}\), then the PDE (37) can be discretized as the following ADI scheme, for \(i=1,2,\ldots ,I;j=0,1,\ldots ,J\); \(n=\widetilde{n},\widetilde{n}+1,\ldots ,N-1\) and \(\widetilde{n}=0,1,\ldots ,N-1\),

with the discretized initial and boundary conditions

where we can replace the fictitious nodal values \(\widetilde{U}^{n}_{I+1,j}, \widetilde{U}^{n}_{i,-1}\) and \(\widetilde{U}^{n}_{i,J+1}\) by their inner nodal values respectively.

Theorem 4.1

The ADI scheme (49) is unconditionally stable provided that \(\theta \ge \frac{1}{2}\).

Proof

See Appendix D. \(\square\)

Theorem 4.2

The ADI scheme (50) is unconditionally stable provided that \(\theta \ge \frac{1}{2}\).

Proof

The proof is indicated by that for the ADI scheme (49). \(\square\)

5 Numerical examples

In this section, we carry out two numerical examples to verify the PDE approach studied in this paper for pricing European call options under the looping contagion model. To be convincing, the first example tests the convergence rates of ADI scheme (49) and (50). The second example shows the impacts of the looping contagion risk on option prices. Moreover, the intensity function \(\lambda\) is given by (see Jia et al. [22]):

with the minimum intensity \(\lambda _{m}=0.05\), the maximum intensity \(\lambda _{M}=1.0\), and the parameter \(\alpha =1\). Here, \(\lambda _{0}\) determines the initial intensity and the weights \(k_{1}, k_{2}\) (\(k_{1}+ k_{2}=1\)) control the sensitivity of intensity \(\lambda\) to stock prices S and P. As an example, we set \(k_{1}=k_{2}=0.5\) and \(\lambda _{0}=5.0\) such that the initial intensity is 0.1 when \(S_{0}=50, P_{0}=50\).

To test the convergence rates of the ADI schemes, let \(\widehat{U}^{I,J,N}(\xi ,S,P)\) be the continuous form of the computational solutions of the ADI scheme (49) with respect to the number of S-direction meshes I, P-direction meshes J and time meshes N. When we test the convergence rates for S-direction, we may fix the number of J and N and vary I. Then the convergence rate of the ADI scheme (49) for S-direction can be calculated by the following log-formula with respect to three consecutive levels \(I=I_{1},\,I_{2},\,I_{3}\):

where the \(L^{2}\)-norm is defined by

Similarly, we can define the convergence rates for P-direction and time, and for the ADI scheme (50).

Example 5.1

The aim of this example is to illustrate the convergence rates of ADI scheme (49) and ADI scheme (50) for European call option pricing in the presence of the looping contagion risk. In the test, we set \(S_{\max }=100\), \(P_{\min }=0.05\) and \(P_{\max }=200\), and the model parameters are taken as \(r=0.05,\,\sigma _{1}=0.2,\, \sigma _{2}=0.4, \,\sigma _{3}=0.3, \,\rho =0.6,\, L=0.2,\,T=2,\,\tau =1,\,K=25\).

Numerics in Tables 1 and 2 show that both ADI schemes (49) and (50) achieve second-order convergence rates for space and first-order convergence rates for time.

Example 5.2

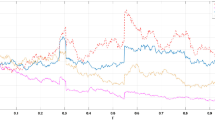

This example calculates the European call option prices at initial time through the pricing formula (31). In this test, we set \(K=25\), \(T=1\), \(r = 0.05,\; \sigma _1=0.2,\;\sigma _2=0.4,\;\sigma _3=0.3,\; \rho = 0.3,\;S_{max}=100,\; P_{min}=0.05,\;P_{max}=200\). The European call option prices at initial time are plotted in Figs. 1 and 2, from which we can obtain some important findings as follows. The first significant phenomenon is that the European call option price increases with the increasing of the stock price just as the counterparty risk model. From Fig. 2, we can see that the European call option price decreases with the increasing of the defaultable stock price \(P_{0}\). The interpretable reasons for these phenomenons are just that smaller defaultable stock price implies higher possibility of the counterparty default that means higher risk for investors. Hence, the investors need more risk premium. Moreover from Figs. 1 and 2, we observe that larger L indicates higher European call option price. Besides, Fig. 2 also demonstrates that larger L leads to greater impact of the defaultable stock on European call option price under the looping contagion risk model.

6 Conclusions

In this paper, we studied the looping contagion model for European call option pricing. We first transformed the looping contagion risk model into the martingale form for option pricing. We then derived the semi-explicit pricing formula for European call options whose implementation requires two procedures. First, two pricing PDEs with the boundary conditions were established and the stable ADI methods were developed to solve the PDEs. Then, we combined the Monte Carlo simulations with the numerical solutions of the pricing PDEs to obtain the desired option prices via semi-explicit pricing formula. Numerical examples confirmed the convergence of the numerical methods and some economic analyses of the model for European call option pricing were provided.

Data Availibility

Not applicable as no datasets were used during the current study.

References

Avellaneda, M., Lipkin, M.: A dynamic model for hard-to-borrow stocks. Risk 22, 92–97 (2009)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–659 (1973)

Bielecki, T.R., Rutkowski, M.: Credit Risk: Modeling, Valuation and Hedging. Springer, Berlin (2003)

Bo, L., Capponi, A.: Optimal investment in credit derivatives portfolio under contagion risk. Math. Finance 26, 785–834 (2016)

Cai, N., Kou, S.: Pricing Asian options under a hyper-exponential jump diffusion model. Oper. Res. 60, 64–77 (2012)

Chen, W.T., Xu, L.B., Zhu, S.P.: Stock loan valuation under a stochastic interest rate model. Comput. Math. Appl. 70, 1757–1771 (2015)

Capponi, A., Frei, C.: Systemic influences on optimal equity-credit investment. Manag. Sci. 63, 2756–2771 (2017)

Chen, Y.Z., Xiao, A.G., Wang, W.S.: An IMEX-BDF\(2\) compact scheme for pricing options under regime-switching jump-diffusion models. Math. Methods Appl. Sci. 42, 2646–2663 (2019)

Dang, D.M., Nguyen, D., Sewell, G.: Numerical schemes for pricing Asian options under state-dependent regime-switching jump-diffusion models. Comput. Math. Appl. 71, 443–458 (2016)

Davis, M., Lo, V.: Infectious defaults. Quant. Finance 1, 382–387 (2001)

Egloff, D., Leippold, M., Vanini, P.: A simple model of credit contagion. J. Bank. Finance 31, 2475–2492 (2007)

Elliott, R.J., Krishnamurthy, V., Sass, J.: Moment based regression algorithms for the drift and volatility estimation in continuous-time Markov switching models. Econometr. J. 11, 244–270 (2008)

Elliott, R.J., Nishide, K., Osakwe, C.J.U.: Heston-type stochastic volatility with a Markov switching regime. J. Futures Mark. 36, 902–919 (2016)

Florescu, I., Liu, R.H., Mariani, M.C., Sewell, G.: Numerical schemes for option pricing in regime-switching jump-diffusion models. Int. J. Theor. Appl. Finance 16, 1–25 (2013)

Giesecke, K., Weber, S.: Cyclical correlations, credit contagion, and portfolio losses. J. Bank. Finance 28, 3003–3096 (2004)

Gu, J.W., Ching, W.K., Siu, T.K., Zheng, H.: On pricing basket credit default swaps. Quant. Finance 13, 1845–1854 (2013)

Hamilton, J.D.: A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57, 357–384 (1989)

Herbertsson, A., Rootzen, H.: Pricing k-th to default swaps under default contagion, the matrix-analytic approach, Journal of Computational. Finance 12, 49–78 (2006)

Herbertsson, A.: Pricing synthetic CDO tranches in a model with default contagion using the matrix-analytic approach, Journal of Credit. Risk 4, 3–35 (2007)

Huang, Y., Forsyth, P.A., Labahn, G.: Methods for pricing American options under regime-switching. SIAM J. Sci. Comput. 33, 2144–2168 (2011)

Jarrow, R.A., Yu, F.: Counterparty risk and the pricing of defaultable securities. J. Finance 56, 1765–1799 (2001)

Jia, L., Pistorius, M., Zheng, H.: Dynamic portfolio optimization with looping contagion risk. SIAM J. Financ. Math. 10, 1–36 (2019)

Jiao, Y., Pham, H.: Optimal investment with counterparty risk: a default-density model approach. Finance Stochast. 15, 725–753 (2011)

Jiao, Y., Kharroubi, I., Pham, H.: Optimal investment under multiple defaults risk: a bsde-decomposition approach. Ann. Appl. Probab. 23, 455–491 (2013)

Kwon, Y., Lee, Y.: A second-order finite difference method for option pricing under jump-diffusion models. SIAM J. Numer. Anal. 49, 2598–2617 (2011)

Kou, S.G.: A jump-diffusion model for option pricing. Manag. Sci. 48, 1086–1101 (2002)

Ma, J.T., Tang, H.J., Zhu, S.P.: Connection between trinomial trees and finite difference methods for option pricing with state-dependent switching rates. Int. J. Comput. Math. 95, 341–360 (2018)

Ma, J.T., Zhou, Z.Q.: Convergence analysis of iterative Laplace transform methods for the coupled PDEs from regime-switching option pricing. J. Sci. Comput. 75, 1656–1674 (2018)

Ma, G.Y., Zhu, S.P.: Pricing American call options under a hard-to-borrow stock model. Eur. J. Appl. Math. 29, 494–514 (2018)

Ma, G.Y., Zhu, S.P., Chen, W.T.: Pricing European call options under a hard-to-borrow stock model. Appl. Math. Comput. 357, 243–257 (2019)

Mansuy, R., Yor, M.: Random Times and Enlargements of Filtrations in a Brownian Setting. Springer, Berlin (2005)

Merton, R.C.: The theory of rational option pricing, The Bell Journal of Economics and Management. Science 4, 141–183 (1973)

Merton, R.C.: Option pricing when the underlying stock returns are discontinuous. J. Financ. Econ. 3, 125–144 (1976)

Strikwerda, J.C.: Finite Difference Schemes and Partial Differential Equations. Siam (2004)

Yousuf, M., Khaliq, A.Q.M., Alrabeei, S.: Solving complex PIDE systems for pricing American option under multi-state regime switching jump-diffusion model. Comput. Math. Appl. 75, 2989–3001 (2018)

Yu, F.: Correlated defaults in intensity-based models. Math. Finance 17, 155–173 (2007)

Zhu, S.P., Chen, W.T.: A predictor-corrector scheme based on the ADI method for pricing American puts with stochastic volatility. Comput. Math. Appl. 62, 1–26 (2011)

Zhu, S.P., Badran, A., Lu, X.P.: A new exact solution for pricing European options in a two-state regime-switching economy. Comput. Math. Appl. 64, 2744–2755 (2012)

Acknowledgements

The authors are sincerely grateful to the editor and anonymous referees for their valuable comments that have led to a greatly improved paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No potential conflict of interest was reported by the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The work was supported by the Innovative Team Program of the Neijiang Normal University (Grant No. 2019TD02). The work was supported by Research Fund Program of Tuojiang River Basin High-quality Development Research Center (Grant No. TYZX2023-01).

Appendices

Appendix A: Proof of Theorem 3.1

Proof

Assume that no default happens in the life of the option (i.e., \(\tau >T\)), then the stock dynamics (13) and the defaultable stock dynamics (14) under the risk-neutral measure \(\mathbb {Q}\) can be respectively rewritten as follows

Recall that the value of European call option is defined as \(\widehat{V}(t,S,P)=\widetilde{\mathbb {E}}\big [e^{-r(T-t)}(S_{T}-K)^{+}\mid S_{t}=S, P_{t}=P\big ]\), and the intensity process \(\lambda\) is the function with respect to S and P. Then using (53), (54) and applying Ito’s lemma, we derive that

where the dt term must be zero according to the martingale representation theorem. Therefore, we achieve that

with the terminal condition \(\widehat{V}(T,S,P)=(S-K)^{+}\). To close the above governing PDE, some appropriate boundary conditions need to be imposed. The boundary conditions in the S-direction are similar to those for the well-known Heston model. Specifically, we have

which means that the value of European call option becomes worthless if the stock price S goes to zero. On the other hand, the far-field boundary condition is also imposed as follows

We below impose the boundary conditions in the P-direction. First, recall that t is the default time when the defaultable price P hits zero and the stock P would be vanished at this time in the market. In other words, the option price \(\widehat{V}(t,S,P)\) is independent of the defaultable stock price P at the default time and this fact indicates that:

Besides, since the intensity function \(\lambda =\lambda (S,P)\) is bounded and non-increasing with respect to P, then we obtain that \(\lambda \rightarrow \lambda _{m}\) if the defaultable stock price P goes to infinity, where \(\lambda _{m}\) is the minimum value of \(\lambda\). Then the looping contagion model in this case reduces to an exogenous counterparty default model which means that the option price is independent of defaultable stock price. Thus the Neumann boundary condition is established as follows:

where we complete the proof of this theorem. \(\square\)

Appendix B: Proof of Theorem 3.2

Proof

Assume that the default happens in the life of the option (i.e., \(0 \le \tau \le T\)), then the stock dynamics (13) and the defaultable stock dynamics (14) under the risk-neutral measure \(\mathbb {Q}\) before default can be rewritten as follows, respectively,

Since the defaultable stock price P identically vanishes after default, hence the stock dynamics \(S_{t}\) can be written as

and the stock price S at the default time \(\tau\) satisfies \(S_{\tau }^{d}(\tau )=S_{\tau }^{F}(1-L)\).

Recall that the defaultable stock P would vanish in the market once it defaults, and the value of European call option after the defaultable stock P defaults, is defined by \(\widetilde{V}^{d}=\widetilde{\mathbb {E}}\big [e^{-r(T-t)}(S_{T}-K)^{+}\mid S_{t}=S\big ]\). Then applying Ito’s lemma and using (62) yield

where the dt term must be zero according to the martingale representation theorem. Therefore, we achieve that

with the terminal condition \(\widetilde{V}^{d}(T,S)=(S-K)^{+}\), where we complete the proof for (23) and (24).

Furthermore, the value of European call option before the default of the defaultable stock P is denoted by \(\widetilde{V}^{F}(t,S,P)\). Then applying Ito’s lemma and using (60), (61), we derive that

where the dt term must be zero according to the martingale representation theorem. Therefore, we achieve that

Since the value of European call option is continuous at default time \(\tau\), therefore we obtain the following terminal condition:

To solve the above two-dimensional PDE, some appropriate boundary conditions need to be imposed. Since \(S_{\tau }=0\) and \(S_{T}=0\) due to \(S_{t}=0\,(t<\tau )\), these facts lead to

whose financial meanings are obvious. Moreover, it is easy to verify that

where we can deduce that the far-field boundary condition satisfies

Now we are ready to impose the boundary conditions in the P-direction. Just like the boundary conditions (58) and (59), the boundary conditions in the P-direction in this case are given by

and

This completes the proof of this theorem. \(\square\)

Appendix C: Proof of Theorem 3.3

Proof

According to Bielecki and Rutkowski [3], the default time \(\tau\) of defaultable stock P can be represented by

where \({\chi }\) is a standard exponential random variable defined on the probability space \((\Omega ,\mathcal {G},\mathbb {P})\) and is independent of the filtration \(\mathbb {F}\). Thus, we have

which implies that the density of the default time \(\tau\) satisfies

If no default happens in the life of the option (i.e. \(\tau >T\)), then the Theorem 3.1 implies that the European call option price at the initial time under the looping contagion risk model is given by \(\widehat{V}(0,S,P)\).

If the default happens in the life of the option (i.e., \(0\le \tau \le T\)) for any fixed default time \(\tau\). Then according to Theorem 3.2, the European call option price at time 0 is given by \(\widetilde{V}^{F}(0,S,P;\tau )\). Consequently, the European call option price at the initial time under the looping contagion model (13) and (14) can be calculated as:

where we complete the proof. \(\square\)

Appendix D: Proof of Theorem 4.1

Proof

Following Von Neumann stability analysis with the frozen coefficient technique (see e.g., [30, 34]), we have \(\widehat{U}^{n}_{i,j}=g^{n}_{1}e^{\imath i\phi }e^{\imath j\psi }\) and \(\widehat{Z}^{n+1}_{i,j}=g^{n}_{1}g_{2}e^{\imath i\phi }e^{\imath j\psi }\), where \(\phi ,\psi \in [-\pi ,\pi ]\), \(\imath =\sqrt{-1}\), \(g_{1}\) is the amplification factor of (49a) and \(g_{2}\) the amplification factor of (49b). Therefore, the linear systems (49a) and (49b) can be rewritten as

where we derive that

where

Denote the real part of complex number by \(\mathcal {R}(\cdot )\), then we have

Define \(\mathcal {V}_{k}=\left( \sqrt{-2\Delta \xi \mathcal {R}(z_{k})},\frac{|1+\theta \Delta \xi z_{k}|}{\sqrt{2\theta }}\right) '\) for \(k=1,2\). Since we have, for \(k=1,2\),

where \((\cdot )^{*}\) denotes a conjugate complex number.

Using (77), we have

where we derive that

Using (76), we derive that for \(\theta \ge \frac{1}{2}\),

which implies that the propsed ADI scheme is unconditionally stable provided that \(\theta \ge \frac{1}{2}\). \(\square\)

About this article

Cite this article

He, T., Chen, Y. Pricing European options under stochastic looping contagion risk model. Japan J. Indust. Appl. Math. 41, 585–608 (2024). https://doi.org/10.1007/s13160-023-00622-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13160-023-00622-6

Keywords

- Option pricing

- Looping contagion risk

- Default intensity process

- Partial differential equations (PDEs)

- Alternating direction implicit method