Abstract

The purpose of this chapter is to provide an example of the methods and procedures used by university specialists in developing potato production cost estimates for potato growers. The methods and procedures described are those used by the University of Idaho, illustrating a typical approach used in developing cost of production estimates. Also discussed are procedures that a grower might use to develop cost-of-production estimates for individual farms.

Growers who use published cost-of-production estimates need to understand their intended use and limitations. It is equally important that producers follow appropriate procedures when constructing cost-of-production estimates, which provide important information that can help growers manage their potato operations. The terms “cost of production,” “costs and returns estimates,” and “budgets” will be used interchangeably throughout this chapter.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

Introduction

The purpose of this chapter is to provide an example of the methods and procedures used by university specialists in developing potato production cost estimates for potato growers. The methods and procedures described are those used by the University of Idaho, illustrating a typical approach used in developing cost of production estimates. Also discussed are procedures that a grower might use to develop cost-of-production estimates for individual farms.

Growers who use published cost-of-production estimates need to understand their intended use and limitations. It is equally important that producers follow appropriate procedures when constructing cost-of-production estimates, which provide important information that can help growers manage their potato operations. The terms “cost of production,” “costs and returns estimates,” and “budgets” will be used interchangeably throughout this chapter.

Costs and Returns Estimates

Many individuals and groups, including producers, processors, politicians, and consumers, have interest in the costs associated with producing agricultural commodities and whether profitable returns can be achieved. Commodity costs and returns estimates (CARs) are used to characterize the economic performance of a single commodity for an individual, a region, or even a nation. However, the intended use of a CAR estimate will influence how the costs and revenues are calculated and organized.

Availability and accessibility of data can also influence the process. Even when CAR estimates are prepared for the same intended use, many differences of opinion exist as to which costs to include, how the costs should be calculated, and how the costs should be organized. A direct comparison of CAR estimates is appropriate only when they are prepared using similar procedures. To minimize the chance of misinterpretation, the procedures and assumptions used to develop a CAR estimate should be clearly stated, along with the intended use.

Publication of the Commodity Costs and Returns Estimation Handbook in 1998 by the American Agricultural Economics Association (AAEA 1998) has helped to standardize procedures used in the development of cost-of-production estimates among land-grant universities and the USDA. The handbook summarizes issues associated with construction, use, and interpretation of CAR estimates. The handbook also discusses alternative methods for estimating cost of production and identifies conceptual and practical issues faced when evaluating alternative estimating methods. The Commodity Costs and Returns Estimation Handbook discusses the relative merits of alternatives and suggests guidelines to apply when preparing cost estimates for alternative uses.

The University of Idaho CAR estimates conform to the AAEA recommendations, except in use of nominal, rather than real, interest rates. Since not all the issues related to cost of production could be discussed in this chapter, individuals interested in more information should refer to the AAEA Handbook (AAEA 1998).

CAR estimates can be constructed using either historic or projected cost data. The scope of the CAR estimate can be narrow and represent an individual grower, for example, or it can be a composite that represents the costs for a region, state, or nation. The cost data can be from actual farm records or can be synthesized or “generated” for a model farm using a standard set of assumptions and procedures.

Growers with an interest in calculating cost-of-production estimates need to keep this use in mind as they develop their record-keeping system. Even with a detailed enterprise accounting system, however, certain costs will be tracked only on a whole-farm basis. These whole-farm costs will need to be allocated to different enterprises, an issue that will be discussed later.

Enterprise Budgets

Budgeting is a systematic approach to organizing revenue and cost data used in comparing and analyzing alternatives and in making management decisions. Budgets provide revenue and cost estimates or projections and should be an integral part of any planning process. An enterprise budget format is generally used for cost-of-production estimates. An enterprise is any coherent portion of a farm business that can be separated and analyzed as a distinct entity.

Traditionally, each crop is treated as a separate enterprise. Different enterprise designations can be made, however. Each field or pivot, for example, could be treated as a separate enterprise. The record system for the farm would have to be organized with this in mind so that the account structure would support the enterprise structure.

The enterprise budget tracks one production cycle—usually a 12-month period—and lists all expected revenue and costs. The enterprise budget can also include the quantity, time of use, and cost of each input used, along with expected yield and price.

Idaho’s Costs and Returns Estimates

Understanding the budgeting procedures used by University of Idaho specialists will help commercial potato growers worldwide understand the potential uses and limitations of these cost estimates. It should also help if growers choose to modify these costs to fit individual farm situations.

The University of Idaho’s crop CAR estimates are revised and published biennially in odd-numbered years. UI specialists use a computer program, Budget Planner, to generate individual crop CAR estimates. Crop CAR estimates are developed for four distinct geographic regions of the state. Three of these are located in the potato-producing areas of southern Idaho—Southwestern, Southcentral, and Eastern Idaho. Climate and soil conditions not only influence which crops are produced in each region, but also influence the specific production practices for those regions.

Even within a region where production practices are similar, costs can and do vary from farm to farm. Each farm has a unique set of resources with different levels of productivity, specific pest problems, and grower management skills. While the University of Idaho CAR estimates serve as useful benchmarks, they represent only single-point estimates that can’t possibly capture the inherent variability that exists in production costs. These potato production cost estimates are representative or typical for a region. They are not, however, the average cost of producing potatoes.

Basic Assumptions

The University of Idaho cost-of-production estimates are affected by the assumptions made in depicting a representative farm for a region. Each region has a model farm (or farms), with assumptions about farm size, crop rotation, typical production practices, equipment used, and irrigation system. Budget Planner calculates machinery costs and labor requirements using standard engineering equations developed by the American Society of Agricultural Engineers.

The potato production costs published by the University of Idaho are based on survey data collected from Idaho farmers, farm supply businesses, and Extension faculty, as well as private consultants and industry representatives. Information on tillage, planting, fertilization, pest control, irrigation, and harvesting is collected from growers. In addition to the type of machinery and the number of workers used to perform field or custom operations, the type and quantity of inputs used is also collected. Survey information is then used to construct a model farm and develop typical production practices that are replicated by the computer program to generate costs on a per-acre basis.

The University of Idaho currently publishes seven potato budgets (Table 19.1). A sample cost-of-production estimate for Eastern Idaho’s southern region is shown in Table 19.2 (operating costs) and Table 19.3 (ownership costs). Some potato budgets include the cost of on-farm storage and/or fumigation, while others do not. The cost of potato storage for the Eastern Idaho sample budget is shown in Table 19.4. The cost per hundredweight (cwt) of potatoes produced are shown both for field-run and paid yield.

Budget Procedures and Assumptions

Historical input prices are used to generate the University of Idaho’s costs and returns estimates. Input prices come from surveys of farm supply businesses collected in the year when the CAR estimates are revised. The potato price used to calculate revenue in the budgets with on-farm storage is a 3-year average based on the most recent Idaho Agricultural Statistics Service (IASS) All Potato Prices seasonal average.

A background and assumptions page for each budget describes the key assumptions used in developing Idaho’s potato costs and returns estimates. This section describes the model farm’s size, irrigation system, water source, and crop rotation, as well as its tillage, fertilization, pest management, and irrigation practices. If the CAR estimate includes on-farm storage, the length of storage and the type of storage facility are described. The machinery, labor, land, and capital resources used in production of the crop are also described. This information is critical to understanding how the costs are generated and the uses and limitations of these cost estimates.

The yield in a CAR estimate is used to calculate gross revenue. It can also be used to calculate break-even prices needed to cover various costs. Yield is also the basis for some costs, such as promotion and inspection fees paid by growers, as well as storage costs. The yields used in most crop budgets are 5-year rolling averages based on historical IASS data. Yields used in the potato budgets are based on a 3-year rolling average.

A microcomputer program, called Budget Planner, from the University of California at Davis is used to calculate the cost estimates. The computer program replicates each field operation using tractors and equipment typically used by producers. The cost to own and operate machinery is computed by the program and summarized for the model farm.

Model Farm

The cost-of-production estimate presented in Tables 19.2, 19.3, and 19.4 is typical for growing, harvesting, sorting, and storing irrigated Russet Burbank commercial potatoes for a 3-county area of Eastern Idaho. A 2400-ac model farm grows 800 ac of potatoes, using a typical 3-year rotation of potatoes followed by 2 years of grain. The farm uses a center-pivot irrigation system, pumping surface water from a canal so that irrigation power includes only the cost to pressurize the water. The farm is located in an irrigation district where a flat fee per acre is paid for water.

After the stubble from the preceding grain crop is chopped, the potato ground is irrigated, disked, and ripped in the fall, and subsequently chisel plowed and marked out in the spring before planting. Potatoes are planted in early May using two 6-row planters with a 36-in row spacing. The seeding rate is 21 cwt per acre that includes an additional 5% (1 cwt) to account for waste during cutting and planting.

Potatoes are cultivated and hilled in late May with a basin tillage tool. In September, vines are rolled and sprayed with a desiccant. Potato harvest begins 3 weeks later using a 4-row harvester, 4-row windrower, and six 10-wheeler trucks. Potatoes are hauled from the field to a location where they are sorted and cleaned. From there they can go directly into on-farm storage or be transferred to a semi and transported to a processor or fresh pack shed.

Most fertilizer is custom applied in a split preplant application in fall and spring. A starter fertilizer is applied at row mark out, and additional nitrogen is applied, as needed, through the irrigation system.

The weed control program uses cultural, mechanical (tillage and cultivation), and herbicidal control methods. For insect control, a systemic insecticide is banded at planting, and four foliar insecticides are applied by air in July and August. Six foliar fungicide applications are made for blight, white mold, and other diseases, starting in July. Some fungicide applications are made by chemigation, while others are applied by air in a tank mix with an insecticide.

Potatoes in this model farm receive 21 in of water during the growing season and 1.0 in pre-harvest in September. Water applied to the grain stubble the previous fall before tillage is also credited to potatoes, bringing the total to 24 in.

Enterprise Budget Structure

The CAR estimates produced by the University of Idaho are based on economic costs, not accounting costs. Accounting costs typically include only out-of-pocket costs and ignore opportunity costs. Economic costs place a market value on all inputs, regardless of whether they are purchased (an out-of-pocket expense) or provided by the producer (a foregone opportunity). For resources supplied by the farmer, such as land or labor, there is foregone income, or an “opportunity cost.” For example, owned land could be leased to someone else, and the farmer could be working for wages.

Crop costs and returns estimates are developed on a per-acre basis, providing a common production unit for making comparisons between different crops. Gross returns or revenue is the first category in an enterprise budget. While it seems obvious, units for price and yield should correspond. Potato yield is generally measured in cwt or tons, so the price should also be per cwt or per ton. If the yield is field run, the price should be for field-run potatoes. If storage costs are not included, then a harvest-time price should be used. The price should correspond to the actual or assumed time of sale.

Operating and Ownership Costs

Costs in an enterprise budget are classified as either operating (variable) or ownership (fixed). Operating costs are those incurred only when production takes place, and they are typically used up or transformed during the production cycle. Seed, fertilizer, fuel, pesticides, hired labor, and water are all operating costs.

With the exception of labor and machinery costs, it is relatively easy to assign operating costs to a particular crop enterprise. It is also fairly easy for a grower to modify the operating costs in a published CAR estimate to match those on an individual farm.

In contrast to operating costs, ownership costs are associated with assets used in the production process that last for more than one production cycle. Many of these costs will continue even when production doesn’t take place, hence the term “fixed costs.” Ownership costs include the DIRTI-five: Depreciation, Interest, Repairs (that are a function of time and not of use), Taxes, and Insurance.

The assets generating fixed costs include machinery, buildings, and land. In addition to lasting more than one production cycle, these assets are typically used for more than one enterprise. Several different procedures can be used to allocate these costs over time and between different enterprises (crops) on the farm.

Custom Operators

Many growers find it more cost effective to use a custom operator than to own all the equipment or to supply all the needed labor. Money paid to a custom operator is classified as an operating cost. Where the cost shows up on a CAR estimate is different when a grower performs the service than when a custom operator is used.

The custom charge includes machinery costs that would be classified as ownership costs if the grower owned the equipment and provided the service. This can make a significant difference when comparing only operating costs or only ownership costs, especially when one CAR estimate uses owner-operator costs and another CAR estimate uses custom-based costs.

Estimated Operating Costs

The CAR estimates published by the University of Idaho list all inputs used in the production process. This makes it easier for users to modify these cost estimates to fit their situation, and it also makes it easier to update and revise the cost estimates. The individual inputs are listed along with the quantity applied and the cost per unit of input and per acre. The computer program used to calculate production costs, however, does place certain constraints on how inputs are classified or the sequence in which they appear on the printed copies.

Similar inputs are grouped together under a common heading. These headings include fertilizers, pesticides/chemicals, seed, irrigation costs, custom and consultant fees, field labor, and machinery costs. The quantity applied per acre, the unit of measure, and the cost per unit of the input are also listed. Multiplying the quantity applied by the price per unit gives the cost per acre. This is a fairly straightforward process for most operating inputs, especially purchased inputs.

Seed Costs

The sample budget operating costs (Table 19.2) shows a total seed expense of $289.80 for 21 cwt of G3 (third generation) seed valued at $11.95 per cwt, plus the cost of cutting seed, estimated at $1.85 per cwt. The cost of seed should include transportation cost as well as the cost of the seed itself. The cost of seed treatment is listed in the pesticide/chemicals category and will vary considerably based on the type of product used.

While many commercial potato growers cut and treat their own seed, accurately calculating seed cutting costs can be difficult. The type and quantity of fertilizer applied is listed, except for the micronutrients. Micronutrient application varies substantially by grower and even by field. The $26 per ac charge covers the cost of micronutrients and other soil amendments typically applied.

Fertilizer and Pesticide Costs

Fertilizer and pesticides are typically the two biggest operating cost categories in a potato budget. In the example potato budget, fertilizer ($317/ac) and pesticides ($233/ac) together account for 35% of operating costs (Table 19.2). Nitrogen fertilizer comes from several different products that have different costs. The price per pound of pre-plant nitrogen ($0.41) is based on 46-0-0-0, while the price per pound for liquid nitrogen ($0.49) applied post planting is based on 32-0-0-0. Pesticides include all products applied to control weeds, insects, nematodes, and diseases. The total quantity of product listed may represent one application, as with the 3.5 pints of Eptam® 7E, or multiple applications, as with Dithane®, where two applications of 1.6 quarts each are being applied.

Irrigation Costs

Irrigation costs ($96/ac) include the cost of water, power, and irrigation system repairs. Irrigation labor is included in the field labor category. Irrigation water for the model farm is delivered through a canal with a fixed water assessment fee charged per acre. The water assessment is the average charge made by irrigation districts/canal companies in Southeastern Idaho that are surveyed each time the crop budgets are revised.

Since the model farm uses surface water, the $1.89 per ac-inch power charge is only for pressurization. For a field using groundwater, the cost will vary based on the lift as well as service provider.

Irrigation costs are calculated using information from University of Idaho irrigation cost publications. Irrigation power costs are calculated using Idaho Power rates and the 160-ac center pivot with a corner system described in Bulletin 787 (Patterson et al. 1996). The effective energy charge per kilowatt hour used in 2018 was $0.6052, the demand charge per kilowatt was $6.97, and the monthly service charge was $22.00.

Season-long irrigation power costs and repairs are calculated for the entire field and then converted to an acre-inch basis. The 24 in of water includes 21 in applied during the growing season, 1 in applied before harvest, and 2 in applied the previous fall prior to tillage. The center-pivot irrigation system application efficiency is assumed to be 80%. The pumping plant efficiency (electric motor and pump)—used to calculate kilowatt-hours—is 62%.

Custom and Consulting Costs

In addition to hiring custom operators, many growers also hire a consultant to provide water and fertility management. This charge is grouped with custom charges. While it isn’t possible to tell from Table 19.2 which inputs are being applied by which custom operation, the Background and Assumptions page in each sample budget typically provides this information.

Some of the abbreviations can also be confusing. The 5 g designation on the custom aerial application, for example, is for the 5 g application rate charged by an aerial applicator. The 5 g rate is often used for fungicide applications, while a 3 g rate is charged for applying most insecticides.

Machinery Costs

Machinery operating costs ($144/ac) include fuel (gasoline and diesel), lube, and machinery repairs. All these values are calculated by the computer program using equations derived by the American Society of Agricultural Engineers. Basically, the computer program farms the field with the selected implements and tractors.

Most producers accumulate fuel and repair costs for the entire farm. The allocation of these whole-farm expenses to specific crops can be made using several allocation schemes. Growers should use or develop a scheme that is both simple and reasonably accurate. An equal distribution per acre, regardless of crop, may be simple, but not that accurate. Weighting the distribution based on expected gross revenue may improve accuracy and still meet the criteria of being simple.

Field and Sorting Labor Costs

Unlike growers who typically don’t track labor to individual crops, the simulation approach used by the computer program accomplishes this by basing labor hours on the machinery hours calculated by the program. Based on speed, width, and field efficiency, the program calculates and accumulates machinery hours associated with each field operation.

Machine labor is calculated by multiplying the machine hours by 1.2. This accounts for time spent getting equipment to and from the field as well as time spent servicing it. Machine labor is calculated for all tractors, trucks, and self-propelled equipment. A market value is attached to all labor. No distinction is made between hired labor and unpaid family labor.

Sorting labor is based on the time needed to harvest all the potato acres, multiplied by the number of workers and their pay rate, divided by the number of potato acres. To base the labor sorting cost on per cwt as shown in Table 19.2, simply divide by the field-run yield.

General farm labor is the category name given to less skilled workers who do not operate machinery during planting and harvesting. The hourly labor charges include a base wage plus a percentage for various payroll taxes, workers’ compensation, transportation, and other benefits. The overhead charge applied to the base wage used in the University of Idaho program calculates amounts of 15% for general farm labor, 25–30% for irrigation labor, and 25% for equipment operator labor.

Other Production Costs

The “Other” cost category contains two items: crop insurance and promotion fees and dues. Crop insurance is self-explanatory. Promotion fees and dues includes the grower’s share (60%) of the advertising tax assessed by the Idaho Potato Commission, the promotion tax paid to the National Potato Promotion Board, 50% of the dockside inspection fee, and membership dues in grower organizations. This works out to approximately $0.18 per cwt.

Interest

The last operating cost item listed is interest on operating capital. Producers use a combination of their own money and borrowed money and only pay interest on what they borrow. Since the University of Idaho’s cost estimates are based on economic costs, no distinction is made as to the source of the capital. A market rate of interest is charged against all expenditures from the month the input is used until the harvest month.

Not all the interest on operating capital is listed in this last category. In the potato budgets with storage costs, an opportunity cost is calculated on the value of the potatoes during storage.

Calculating Individual Operating Costs

The type of accounting system used by a grower will determine how easy or difficult it is to derive enterprise-specific costs. Many growers have accounting systems that are designed to merely collect the cost information required to fill out Internal Revenue Service (IRS) Schedule F (Form 1040). Most growers do not use enterprise accounting, and it is not worth the effort to use enterprise accounting if the additional information available is not used for management decisions.

The question to ask is: How much does it cost to keep enterprise accounts compared to the value of the information? A sophisticated enterprise accounting system will have only limited value if the invoices from vendors don’t provide the necessary detail needed to allocate the costs. Even without an enterprise accounting system, it is possible to develop reasonable, easy-to-use allocations for the different costs.

Costs, such as fuel or labor, are always going to present a problem unless growers log each machine operation and worker by field, which is an unlikely scenario. Until producers develop something specific to their operations, they might use the values in published enterprise budgets as proxy values or to calculate a percentage for allocation.

Using the University of Idaho Southeastern Idaho budget (Table 19.2), for example, fuel use per acre in potato production is roughly three times the amount used to grow an acre of wheat. If the total fuel bill for an individual’s 2400-ac farm was $125,000, and 800 ac of potatoes and 1600 ac of grain were grown, 60% of the fuel should be allocated to the potatoes and 40% to wheat, or roughly $75,000 and $50,000, respectively. On a per-acre basis for potatoes this totals $77.44. A potato grower may allocate general farm labor using the same method, or even the same percentages.

A grower may have to allocate costs for fertilizer, irrigation power, machine repair, interest on operating capital, and many other inputs using an arbitrary allocation system until an enterprise accounting system is developed. While a percentage allocation may not be as precise as an enterprise accounting system, it is better than making no attempt to allocate expenses to specific crops, and it may prove to be the best alternative.

Ownership Costs

Ownership costs, as stated earlier, are associated with assets that can be used for more than one production cycle. These include machinery, buildings, and land. Ownership costs are further divided into cash and non-cash costs. This section explains how ownership costs are calculated in the University of Idaho CAR estimates.

Ownership costs are based on the assumed values of the machinery and equipment. While not shown in this section, the published CAR estimates contain a table listing all the equipment used in producing that crop. The current replacement cost (or value) of all equipment is also included. The standard practice in the University of Idaho CAR estimates is to calculate ownership costs based on 75% of the replacement cost of new machinery and equipment.

Tax Life Vs. Useful Life

A distinction should be made between tax depreciation and management depreciation when discussing ownership costs. Depreciation is a measure of the reduction in value of an asset over time. For tax purposes, depreciation is spread over the tax life of an asset as defined by the IRS. Management depreciation, in contrast, spreads depreciation over the expected useful life.

The tax life of most farm equipment is currently defined as 7 years. The useful life could be 10–20 years. Management depreciation should be used in constructing enterprise budgets. For growers, this means keeping two sets of depreciation records.

Interest Cost

An interest charge based on the value of the equipment should also be calculated. It makes no difference whether the money is borrowed or supplied by the grower. In the first instance, the interest charge would be an actual cash expense. In the second, the interest calculation is a non-cash opportunity cost. The money could have been invested elsewhere, so the cost to the grower is the foregone income from this alternative investment.

The Budget Planner software used by the University of Idaho uses the capital recovery method to calculate the depreciation and interest on machinery. The total for all equipment used in potato production is listed as Equipment under the Non-Cash Ownership Costs (Depreciation and Interest). Depreciation and interest for the potato storage facility and potato storage equipment are listed separately, but in the same category. Since the Budget Planner software calculates costs on a field-operation basis, storage costs are calculated outside the program.

Taxes and Insurance

Taxes and insurance are the other two ownership costs. In the University of Idaho costs and returns estimates, these are based on the average level of investment, which is calculated by dividing the sum of the purchase price and the salvage value by two. Idaho eliminated property taxes on farm equipment in 2001, so there is no property tax shown in the CAR estimate. The annual insurance cost for each piece of equipment is calculated and then allocated to the appropriate crop(s) based on the percentage of use.

For equipment that is used 100% on potatoes, all the ownership costs are assigned to potatoes. But certain equipment, such as tractors and trucks, are used in producing other crops as well. The ownership costs for this equipment need to be allocated to the different enterprises in proportion to their use. This means that the ownership costs will not be simply divided by the total farm acres. For example, while the farm may have twice as many acres of grain as potatoes, the potato crop may account for 50% of the ownership costs for trucks and tractors based on use.

Value of Land

Unlike other capital assets, land is not a depreciable asset according to the IRS. And unless the land is being farmed in such a way as to degrade its productivity, excessive erosion for example, the land should last forever. But the money invested in land could be invested elsewhere. To avoid the issue of whether land is owned or leased and to be consistent with calculating economic costs, the land cost in University of Idaho crop budgets is a 1-year cash rent that includes an irrigation system. Repair costs for the irrigation system are classified as an operating cost under the Irrigation heading.

Other Ownership Costs

Two costs not related to land or equipment also appear as ownership costs. The first is general overhead. This is calculated at 2.5% of cash expenses and serves as a proxy for general farm expenses that are not typically assigned to a specific enterprise. It includes such things as legal fees, accounting and tax preparation fees, office expenses, and general farm utilities.

The second non-land, non-equipment expense is the management fee. This is an opportunity cost, and it is a residual in many costs and returns estimates. Because the University of Idaho budget specialists choose to include a management fee as an economic expense, all costs are accounted for except a return to risk. The management fee is calculated as 5% of total expenses (without management). The charge for the land and irrigation system is typically the largest ownership cost.

Calculating Individual Ownership Costs

While not as precise as the capital recovery method, calculating depreciation on a straight-line basis over the years of useful life is appropriate. This should be done for each piece of equipment. In a similar vein, interest can be calculated on the average level of investment.

Calculating annual ownership costs may be time consuming, but it is not difficult. The purchase price minus the expected salvage value gives total depreciation. Depreciation should be spread over the years of expected life to arrive at annual management depreciation.

Exclusive or Multi-Use Equipment

If the machine is used exclusively for one crop, the entire amount is allocated to that crop. The annual depreciation can then be allocated on a per-acre basis by dividing by the number of acres of that crop. If the machine is used on more than one crop, then part of the annual depreciation needs to be allocated to each crop. This value is then spread over the relevant acres.

For example, a $170,000 potato harvester is expected to last 10 years and have a $20,000 salvage value at the end of 10 years.

If the harvester is used on 800 ac, the annual per-acre management depreciation is $18.75.

Calculating annual depreciation for a tractor on this farm could follow the same procedure. The annual depreciation, however, would need to be allocated to different crops based on the hours the tractor is used on each crop.

Since most farms don’t track machine time to specific crops, an approximation (informed guess) will suffice. The crop-specific depreciation can be allocated per acre in the same manner as the harvester.

While the interest on investment calculation is slightly different, the allocation procedure to the different crops on which the machine is used is the same. Interest should be calculated on the average level of investment, or the purchase price plus the salvage value divided by two. Using the potato harvester example:

The interest rate can either be what is charged on a machinery loan or what a grower could earn on that money if invested in an alternative investment. Using a 6.0% interest rate, the annual interest charge would be:

Again, this can be allocated on a per-acre basis.

Calculating Costs for Taxes and Insurance

The remaining ownership costs, property taxes and insurance, can be the actual costs taken from records and allocated to the appropriate equipment, or they can be calculated costs using an insurance rate and tax rate applied to the average investment, as calculated previously. The simplest method is to allocate these costs on an equal per-acre basis across the farm.

To deal with the obvious bias in this method, a crop such as potatoes might be assigned a higher percent of the costs. Using our example farm, potatoes might receive 50% of the cost even though they account for only 33% of the acres. The tradeoff in choosing between different allocation or calculation methods is often between time and precision. Producers should try to find a method that minimizes time yet provides a reasonably accurate estimate.

Storage Costs

Like most farm commodities, potatoes are placed in storage after harvest. The additional costs incurred storing potatoes should be added to the field production costs to get a total cost of production that the grower needs to recoup. This would include both operating and ownership costs. Operating costs would typically include labor, power, insurance, interest, sprout inhibitors, sanitation, and shrink. In the example, labor costs are included in the base cost of production (sorting labor) and not in the storage operating costs. Like field machinery, discussed earlier, the storage facility and the equipment used to place the potatoes in storage (even-flow bin, sorters/sizers, conveyers, and pilers) have an ownership cost component and would be calculated in a similar fashion. While the basic production unit found in Tables 19.2, 19.3, and 19.4 was an acre, storage costs are much easier to deal with on a per-cwt basis. Once calculated, storage costs can simply be added to the cost per cwt to grow, harvest, and sort potatoes based on a field-run yield basis from Table 19.4. Because potato growers are not paid for all potatoes that they deliver to a fresh-pack shed or processor, it is important to calculate costs on a paid-yield basis as well as the original field-run value. The paid yield shown in Table 19.4 is 90% of the field-run yield.

The storage system ownership and repair costs per cwt are added to the base cost of production. These costs are basically fixed and don’t vary based on the length of the storage period. Table 19.4 also shows a cumulative storage operating cost by month from October to June. These values are added to the base cost of production and storage ownership and repair costs. As is apparent from an examination of Table 19.4, storage costs are a very significant component in the overall cost of potato production.

If the storage facility has a separate meter, calculating power cost per cwt is simply dividing the monthly cost by the size of the storage facility. There are two types of insurance that should be accounted for in storage costs. The cost of insuring the storage facility itself should be included as an ownership cost. The cost of insuring the stored potato crop should be included in the monthly operating costs. A sprout inhibitor is applied once or twice based on the length of storage. Application costs for many products are based on a cwt of stored potatoes, which makes it an easy value to include in the monthly storage costs. Don’t forget to include the cost of chemicals used to sanitize the storage facility and storage equipment. Shrink and interest on the value of the crop are two of the biggest cost components. The base value of the cost of producing the crop is used in calculating interest in Table 19.4. This is a cash cost if the operating line of credit has not been paid. It is an opportunity cost of capital if the grower has not borrowed money to raise the potato crop. Potatoes respire and, therefore, lose moisture while in storage. The amount of loss will vary by variety, the condition of the crop going into storage, the type of air system in the storage facility, and the length of storage. The monthly value of shrink is based on the initial cost of production times a percentage shrink and other deterioration loss. The initial 3–4 weeks of storage has a larger shrink value than subsequent months (2%). November through March have a monthly shrink loss of 0.5%, while April through May have a shrink value of 0.75%. By June, this has increased to 1%. These are typical for Russet Burbank in a modern above-ground storage without a refrigeration unit and two applications of a sprout inhibitor.

Summary

The cost of potato production is influenced by all factors that determine the productivity of land, the type of resources committed to the production process, and the alternative uses of these resources. There is no single cost of potato production that fits all Idaho growers or even growers in one region.

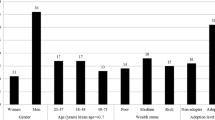

Table 19.5 provides a summary of 2018 operating and ownership costs per acre by major cost category, as well as cost per cwt for field run and paid yield for Colorado, Idaho, Washington and Wisconsin. While the values in any given cost category vary considerably between states, the overall cost per cwt on a paid-yield basis shows less variability. The high cost of potato production should encourage every grower to calculate their individual production costs so that their management and marketing decisions are based on reality.

References

AAEA (1998) American agricultural economics task force on commodity costs and returns commodity, costs and returns estimation handbook. USDA, Ames

Patterson PE, King BA, Smathers RL (1996) Economics of low-pressure sprinkler irrigation systems: center-pivot and linear move. Bulletin 787. University of Idaho Extension, Moscow

Acknowledgement

Unless otherwise noted, data were adapted from collections of University of Idaho Extension educators, scientists, and researchers, who wrote the chapters of the first edition of this textbook.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Patterson, P.E., Eborn, B. (2020). Cost of Production. In: Stark, J., Thornton, M., Nolte, P. (eds) Potato Production Systems. Springer, Cham. https://doi.org/10.1007/978-3-030-39157-7_19

Download citation

DOI: https://doi.org/10.1007/978-3-030-39157-7_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-39156-0

Online ISBN: 978-3-030-39157-7

eBook Packages: Biomedical and Life SciencesBiomedical and Life Sciences (R0)