Abstract

The use of a proper investment policy by fund managers has a huge impact on the results achieved. Asset selection for the portfolio is of key importance, in line with the investment policy declared by the fund, and the appropriate timing of changes in the assets in the portfolio. This research aims to assess whether managers in the Polish market have the ability to select assets with a sense of market timing and selectivity. The research concerns domestic equity funds operating in between 2003 and 2017, from which 15 were selected. The entire research period was divided into three five-year sub-periods, to some extent coinciding with changing market conditions, and seven two-year periods, covering the years 2003–2016. It was assumed that the results for the entire period describe long-term strategies of funds, five-year and two-year periods, being respectively the medium and short term. The basis for calculations was the monthly rates of return on participation units. The research was carried out using the Treynor–Mazuy, Henriksson–Merton, and Busse models. WIBOR 1M was accepted as a risk-free rate, and the WIG index was the market factor. The summary of the research is a comparison of the results regarding the selectivity of asset selection, market timing, and the ability of managers of open investment fund portfolios to respond to the market situation. The final conclusions are not very favorable for the managers, and the clients require active involvement in the selection of funds.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

JEL Codes

1 Introduction

Clients of open-end mutual funds entrust their savings to professionals hoping for better investment results than they would be able to achieve themselves. Their motivations also include access to a market that requires appropriate knowledge and skills, namely the stock market. Lacking adequate knowledge, an individual investor is exposed to many forms of risk that accompany investments on the stock exchange. An additional barrier is access to information and the amount of work that is required to analyze financial statements, market trends, macroeconomic indicators, etc., on an ongoing basis. Therefore, clients of open-ended investment funds in shares decide to bear the costs of which are to be the payment for the professionalism and skills of those managing the investment portfolios. In the financial press and on specialized sites dedicated to capital markets, one can find rankings based on the results of funds achieved over different periods of time: a month, a year, from the beginning of activity, etc. Unfortunately, these are usually based on appropriate rates of return without taking into account the risk. Sometimes, an information indicator appears (e.g., on the Analizy Online portal), which takes into account the ratio of the excess rate of return to the risk measured by standard deviation. It is included in the group of standard measures such as Sharpe, Treynor, or Jensen ratios and many others. Their importance for the assessment of investment effectiveness is quite significant, but they do not refer directly to management skills, only to the final result of the investment. This is why these rankings differ significantly depending on the market situation; see Karpio and Żebrowska-Suchodolska [12]. Thus, they show that managers are not able to adapt their investment policy to the changing market situation. Therefore, investing savings in units of a particular fund does not guarantee profits in the long term, or even in the medium term. It exposes customers to losses, forcing them to actively manage deposits through, for example, changes in funds depending on the anticipated market situation. This, in turn, requires the client to undertake actions that are within the competence of fund managers and what clients pay them to do.

The aim of this work, therefore, is an econometric analysis of the ability to use market trends, market timing, and the ability to carefully select assets for open-end mutual fund portfolios. For this purpose, three models were used: Treynor–Mazuy, Henriksson–Merton, and Busse. The first two take into account the market trend measured by the excess of the percentage changes in the market index above the risk-free rate. They differ in the definition of the variable related to market timing skill. In contrast, the Busse model in addition includes market risk. The aim of the work is to compare management skills as described by these three different models and thus the measures of investment efficiency. Next, the stability of the ranking positions is examined, which provides information on whether there are leaders among investment funds or not.

The studies took into account entities operating continuously on the Polish capital market between the years 2003–2017. The models are constructed for the entire period and for two- and five-year sub-periods. This is to examine the skills of managing fund portfolios at different investment time horizons. It was assumed that the entire 15-year period corresponds to long-term investments, and the five-year and two-year periods to the medium- and short-term, respectively. In addition, the unit of participation was taken into account without consideration of management fees and commissions.

2 Literature Review

The first research on market sensitivity dates back to the 1960s. At that time, Jensen formulated a single-index model and an alpha coefficient, now called Jensen’s alpha coefficient. His model was subsequently applied in research by Carlson [3], Ippolito [10] or Grinblatt and Titman [7], among others. Both Ippolito, and Grinblatt and Titman pointed to managers obtaining above-average rates of return. In addition, they suggested that higher growth rates or the smallest net asset value is more likely to have above-average rates of return. In turn, Carlson [3] indicated that the results obtained depend on the selection of the period and the market index.

The two most used models of market timing and selectivity are the models created by Treynor–Mazuy [18] and Henriksson–Merton [9]. Studies of market sensitivity using these models have been performed for a number of markets. Noteworthy here is the work of Chang and Lewellen [4], or Gallo and Swanson [6], who studied the US market. Gallo and Swanson, using the Treynor–Mazuya model, indicate in their research the absence of market timing, and Chang and Lewellen [4] point to its existence to a small extent using the Henriksson–Merton model (for 67 mutual funds in 1971–1979). More recent studies include the work of Sheikh and Noreen [16], in which the authors analyze market timing using the Treynor–Mazuya model. Investigating 50 randomly selected funds on the American market between 1990 and 2008, they conclude that managers do not demonstrate the ability to sense the market and those funds are not able to achieve better results than the market. Research has been carried out on the Indian market by, among others, Rao and Venkanteswarlu [15]. Their research has shown that managers do not have the skill of market timing. Gudimetla [8] has also conducted research on the Indian market. When examining sectoral funds in 2012–2015, he came to the conclusion that they do not show market timing. On the other hand, out of 41 Indian market funds surveyed in 2008–2013 only a few of them showed selectivity. A study of 15 Greek equity funds in the years 2000–2008 using the Treynor–Mazuy model indicates a lack of selectivity and to a small extent market timing Koulis et al. [13]. Research on the Greek market was also performed by Philippas and Tsionas [14] or Thanou [17]. In turn, of the 28 Pakistani market funds examined in 2005–2011 using the Treynor–Mazuya model, two showed characteristics of timing and only one any of selectivity Ahmat and Sattar [1]. Busse [2] pointed out in his research that, taking into account the market situation, managers can change the exposure to risk. He thus proposed a model that takes into account risk variability.

In the case of the Polish market, research on investment funds has been conducted using the Treynor–Mazuy or Henriksson–Merton models by Jamróz [11], Węgrzyn [20], Żelazowska [22], Ważna [19], Witkowska et al. [21], among others. These authors’ research on for various types of funds and various periods indicates the existence of funds that demonstrate the ability to select stocks appropriately.

3 Models of Portfolio Investment Management Skills

Among the econometric models that are applied in research in investment portfolio management skills, three were used in this work. Two of them, namely the Treynor–Mazuy and the Henriksson–Merton models, concentrate on excess rate of return over a risk-free rate. The third model, the Busse model, takes into account the risk measured by variability, i.e., the standard deviation. It therefore takes into account a factor that is very important from the point of view of active management of the investment portfolio. Considering risk when making investment decisions, rather than just using return rates, indicates the ability, or lack thereof, to adjust investment policy to market risk. Managers should take into account both the rates of return and risk if they are to actively approach the work funds charge their client’s fees for. As a consequence, these three models are aimed at singling out potential leaders among investment funds, both from the point of view of the ability to choose the right assets, to adapt to changing market conditions, and to take advantage of the opportunities offered by market volatility.

In all models, the symbols \(r_{A,t} ,\;r_{f,t}\) and \(r_{M,t}\) mean, respectively, the return on the fund A portfolio, the risk-free rate and the percentage change in the market index in the period t. All interest rates are calculated in a “traditional” way not logarithmic. The upper letters in the alpha and beta coefficients will identify them in all models. In the following, they will be HM and BU, respectively, for the Henriksson–Merton and Busse models. The following equation describing the Treynor–Mazuy model [18] is adopted:

The constant term \(\alpha_{A}^{\text{TM}}\) is a measure of the ability to select assets for the portfolio regardless of the market situation, and \(\beta_{A}^{\text{TM}}\) describes the manager’s ability to use market trends. The \(\delta_{A}\) coefficient is a measure of market timing skills. It should be noted that the variable at the \(\delta_{A}\) is raised to a square; therefore, a positive value of the coefficient indicates the skill of market timing regardless of whether the variable is positive or negative. The expression of the professionalism of managers is the management of both a rising market \(\left( {r_{M,t} - r_{f,t} > 0} \right)\) and a falling one \(\left( {r_{M,t} - r_{f,t} < 0} \right)\). It is slightly different with the coefficient \(\beta_{A}^{\text{TM}}\). In order to earn profits from using market trends, the portfolio should have a positive \(\beta_{A}^{\text{TM}}\) value when the market is up and down when it is in decline. Another way to describe management skills is the Henriksson–Merton model [9], which can be described by the equation:

The variable \(\gamma_{A}\) is equal to \(y_{M,t} = \hbox{max} \left\{ {0,r_{M,t} - r_{f,t} } \right\}\). As a consequence, the coefficient \(\gamma_{A}\), similar to the Treynor–Mazuy model, is a measure of market timing, but this time only a raising market is taken into account \(\left( {r_{M,t} - r_{f,t} > 0} \right)\). The interpretation of the remaining coefficients is the same as before. Indeed, another model of describing management skills was proposed by Busse [2]. In addition to the return rates, it takes into account the risk and as a consequence has the form of the equation:

where \(\sigma_{M,t}\) is the volatility of the market in the period t measured by the standard deviation, and \(\bar{\sigma }_{M}\) is the average volatility Foran and O’Sullivan [5]. The above equation results from the standard formulation of the CAPM model and the assumption by Busse that the market beta coefficient is a linear function of volatility. The coefficient \(\lambda_{A}\), depending on the sign, describes the ability to adapt investment policy to changes in market risk in conjunction with the market situation. A negative value means that with high market volatility, the return on the portfolio should change against the market. Thus, in this case, the portfolio has less risk exposure when the anticipated scenario assumes the shape of a rising market. Consequently, it is desirable that the fund’s portfolio have a negative value of the \(\lambda_{A}\) coefficient.

In all models, the significance of the estimators of structural parameters was tested at 5%, testing the following two-tailed hypotheses: \(H_{0} {:}\; {\text{parameter}} = 0\) and \(H_{1} {:}\; {\text{parameter}} \ne 0\). In order not to complicate the determinations in the further part of the work, the parameter estimators will be marked with the same symbols as the structural parameters.

4 Methodical Assumptions

As mentioned above, the research covered open-end equity mutual funds operating on the Polish capital market between 2003 and 2017. They are as follows (in brackets their short names are given, under which they will appear in the further part of the work): Arka BZ WBK Akcji Polskich (Arka), Aviva Investors Polskich Akcji (Aviva), Investor Top 25 Małych Spółek (AXA), Esaliens Akcji (Esaliens), Investor Akcji (Investor), Investor Akcji Spółek Dywidendowych (Investor D), Millennium Akcji (Millennium), NN Akcji (NN), Novo Akcji (Novo), Pioneer Akcji Polskich (Pioneer), PZU Akcji Krakowiak (PZU), Rockbridge Akcji (Rock), Rockbridge Akcji Dynamicznych Spółek (Rock D), Skarbiec Akcja (Skarbiec), UniKorona Akcje (UniKorona).

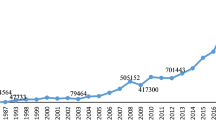

In addition to the entire period from 2003 to 2017, the studies were repeated for the following two-year sub-periods: 2003–2004, 2005–2006, 2007–2008, 2009–2010, 2011–2012, 2013–2014, and 2015–2016, and the five-year periods 2003–2007, 2008–2012, 2013–2017. The choice of various sub-periods was aimed at accounting for the investment time horizon from the point of view of potential customers. The authors found it interesting to explore the problem of careful asset selection, the use of market conditions, and the adjustment of investment policy to market volatility in different periods of time. This will make it possible to additionally link the given elements of management strategies to changing market conditions. As a risk-free rate, the WIBOR 1M from the interbank market was adopted, i.e., in the period for which the changes in share units were calculated. The benchmark describing the situation on the Polish stock market was the WIG index. This indicator was chosen for two reasons. It is strongly correlated with the WIG20 index and thus similarly describes the market situation. In addition, many funds have shares in portfolios that are not part of the WIG20 index but are included in the WIG. All percentage changes, both fund participation units and the market factor and risk-free rate, were calculated on a monthly basis. It was assumed that this is the period corresponding to possible changes in the funds’ investment portfolios.

4.1 Research Results in 2003–2017

The results obtained over the entire research period will be presented first. It turns out that some aspects are shared by the sub-periods. Table 21.1 presents the results of parameter estimation of all the models considered.

It is easy to see that only the beta factors, which in all models describe the use of market trends, are different from zero. Their average values are equal to \(\overline{\beta }^{\text{TM}} = 0.8513\), \(\overline{\beta }^{\text{HM}} = 0.9236\), \(\overline{\beta }^{\text{BU}} = 0.8204\). It should be noted that they are less than one, which means that managers fail to build “better” portfolios than the market measured by the surplus of the WIG index above the risk-free rate. The table shows that only the portfolios of the Pioneer fund had a beta coefficient slightly higher than one and only in the Treynor–Mazuy and Henriksson–Merton models. In the Busse model, it is less than one, as for all other funds. The coefficients of variation of the beta coefficients of the models indicate a relatively small dispersion around the mean values and have the values \(V_{\text{TM}} = 7.9\%\), \(V_{\text{HM}} = 6.7\%\), \(V_{\text{BU}} = 9\%\), which proves that the values of the beta coefficients for various investment funds show a relatively small dispersion.

The alpha coefficients that indicate the ability to carefully select assets for portfolios in most cases are statistically insignificant. In particular, in the Treynor–Mazuy model, only one factor is different from zero and negative. In the Henriksson–Merton model, there are four (three positive and one negative), and in the Busse model seven (six positive and one negative). Moreover, the coefficients that are significantly different from zero have very low values. Therefore, it can be concluded that the managers show a negligible degree of ability to carefully select assets for the portfolio in a way that increases the investment performance of the funds (rate of return on participation units).

The analysis of market timing skills is also not encouraging. The first two models, which in this case do not take risk into account, show some similarity. Of the 15 coefficients in the Treynor–Mazuy model, eight are significantly different from zero and five in the Henriksson–Merton model. However, all of them are negative, which means that managers react to changes in the market in a manner opposite to what they should do. The third Busse model confirms this conclusion, as nine lambda coefficients are statistically significant and positive. One lambda coefficient in the case of the UniKorona fund is significant and negative, which means that only one manager reacts to changes in the market situation and risk in a way that leads to an increase in the rate of return on participation units.

The results presented here justify the creation of fund rankings only on the basis of beta coefficients. From the point of view of the analysis of the equity mutual funds market, the answer to the question is whether the ranking items created on the basis of different models are compatible with each other. Spearman’s rank correlation coefficient can be a measure. Its values are as follows: \(\rho_{\text{TM,HM}} = 0.6357,\) \(\rho_{\text{TM,BU}} = 0.8929,\) \(\rho_{\text{HM,BU}} = 0.3464,\). The first two are statistically significant, and the third one is not. As a consequence, it can be concluded that following the trend measured by beta factors indicates a relatively high consistency of rankings created on the basis of the Treynor–Mazuy model and the other two models. However, the rankings based on the Henriksson–Merton and Busse model are characterized by a lack of correlation. In this case, the rankings differ from each other considerably. It is difficult to explain this result, but the answer may lie in the definitions of risk in Busse and Henriksson–Merton models. However, the Treynor–Mazuy model does not take risk into account.

4.2 Research Results in Five-Year Periods

Divided into five-year periods, it can be seen that in the first period, there was a bull market, with the exception of the end of year 2007. The years 2008–2012 are a period of changing economic conditions, including a decisive decline, as well as a rise and another fall. The third period is also characterized by economic volatility, but is definitely less dynamic than in the previous period.

As mentioned in Sect. 21.4.1, some aspects of the test results for the entire period remain valid in this case as well as the next two-year periods. One can speak here about the significance of the structural parameter estimators of the models. Beta coefficients are statistically significant in most cases. Unfortunately, this can not be said about the other coefficients. The number of significant estimators, apart from the beta coefficient, is given in Table 21.2.

In the case of the alpha coefficients, the second period is the best. In that period, eight of them are statistically significant in the case of the Treynor–Mazuy and Busse models. However, it should be added that all of them are negative. This results in a decrease in the rate of return from fund participation units. In the Busse model, between the years 2013–2017, ten lambda coefficients were statistically significant, but all were positive. This indicates a mismatch of portfolios to risk, leading to adverse changes in the rate of return. As a consequence, just as before, only the beta coefficients provide the basis for evaluating managers. These were gathered in Table 21.3.

Beta coefficients are only sporadically larger than one which means that managers rarely manage to build a portfolio that yields a return rate greater than the WIG surplus above the risk-free rate. This conclusion is confirmed by the average value, which is lower than one for all models and for all sub-periods. Moreover, the coefficients of variation are relatively small. One can therefore risk saying that managers have similar strategies regarding the use of market trends. It is also worth noting that these conclusions do not depend on the market situation. In the years 2003–2007, aside from 2007, there was a bull market. In the remaining sub-periods, the economic situation was volatile, but the upward trend prevailed. This should be used by managers to increase profits, but from the point of view of beta coefficients, this did not happen. Only the volatility of this measure of effectiveness is significantly lower in the years 2008–2012 compared to the remaining periods.

The analysis of ranking positions based on beta coefficients and occupied in subsequent periods in the analyzed models additionally confirms the above conclusions. It turns out that for all models, Spearman’s rank correlation coefficients between rankings created for subsequent sub-periods within each model are statistically insignificant. It should be noted that the rankings were created without taking the Rock D fund into account, because in the first period the beta factor was insignificant. Spearman’s coefficients calculated for rankings based on different models are given in Table 21.4.

The table shows that there is a very large correlation between the ranking items created on the basis of the Henriksson–Marton and Busse models in 2003–2007 and 2013–2017. It can be assumed that the ranking of funds is then practically the same. A similar situation takes place for the Treynor–Mazuy and Henriksson–Merton models in 2008–2012 and 2013–2017, but at a slightly lower level. However, the insignificance of coefficients means that the ranking positions differ significantly. This is the case for fully two periods in the Treynor–Mazuy model and in the Busse models for the first two sub-periods. This is evidence of instability in the ranking positions. This is a very unfavorable situation for fund clients.

4.3 Research Results in Two-Year Periods

In this case, the entire research period does not include 2017 and covers the years 2013–2016. This is related to the need to maintain identical two-year periods. In two-year periods, corresponding to investing in the short term, the situation is analogous to the previous ones. In the vast majority of cases, beta factor estimates are statistically significant. However, estimators of other structural parameters are not. In the years 2003–2004, 2005–2006, 2009–2010, there was an almost uniform increase in the index. The years 2013–2014 are also characterized by an increase in the index, but its fluctuations are clearly greater than in other periods of the boom. However, the years 2007–2008, coinciding with the period of the global financial crisis, show a sharp drop in WIG values (Table 21.5).

Ten lambda coefficients in the Busse model were statistically significant in the years 2015–2017. However, all the values were positive, which indicates that risk management is incompatible with the market. In all other periods and models, only a small number of factors related to market timing were statistically significant. Beta coefficients were collected in Tables 21.6, 21.7, and 21.8.

In the first two periods and in all models, we have to do with relatively high volatility exceeding 20%. Bear in mind that these are periods of boom. Thus, the high volatility shows that the efficiency of managers following the market trend was characterized by a widespread. At the same time, the average beta factor has a relatively low value, much less than one. Therefore, the managers were not able to beat the market, despite the fact that the market situation offered opportunities to do so. Taking all the models into account, only the Arka fund portfolio in 2005–2006 had a beta factor greater than one. In the next boom period, 2009–2010, the coefficient of variation of the beta parameter has a much lower value than in other periods and its average value of 0.8 is higher than in previous periods of market growth. In the case of the Henriksson–Merton model in periods of changing market conditions (2011–2012 and 2015–2016), the average value of the beta coefficient exceeded one. This value cannot be interpreted unequivocally positively, because following the market trend when the economic downturn is a negative activity. Note that in the years 2007–2008, there was a bear market, and in 2009–2010 a bull market. In the first case, the average beta coefficients, in all models, exceeds 0.9. In the second, it is greater than 0.6. The coefficients of variation are relatively low. Thus, the conclusion to be drawn states that managers follow the market trend independently of the market situation and are not able to use the bull market to improve their investment performance. This conclusion is confirmed by the analysis of Spearman’s rank correlation coefficients. In the case of rankings created for each model separately in subsequent sub-periods, almost all ratios are statistically insignificant. The situation is different in the case of correlations between rankings based on different models.

Table 21.9 shows that comparison of rankings created on the basis of the Treynor–Mazuy and Henriksson–Merton and Treynor–Mazuy and Busse models produces completely different results. Of the 14 coefficients, only four are statistically significant. In the years 2013–2014, when there was an upward trend, but with the relatively high volatility on the stock exchange index, both ratios are significant and positive. Thus, during this period, regardless of the model, the majority of market leaders remained leaders. An interesting result is obtained for the rankings based on Henriksson–Merton and Busse models. Only one correlation coefficient (2009–2010) is zero from a statistical point of view. The remaining ones are positive with high values. It can be concluded that the rankings created on the basis of these two models carry the same information about the effectiveness of managers from the point of view of beta coefficients.

5 Conclusion

The research carried out on 15 open investment funds of shares operating on the Polish capital market does not lead to optimistic conclusions. The 15-year period considered is long enough to cover changing market conditions and gives the managers the opportunity to demonstrate their skills. The fee is paid by clients regardless of whether the fund made a profit or suffered a loss. In return, the client has the right to expect professional management of the fund’s assets and thus also her or his savings. This professionalism is the careful selection of portfolio components that should yield a profit regardless of the market situation. Skillful use of changing market conditions is measured by an appropriate correlation of changes in participation units with the factor of the market. Finally, there are managers having market timing skills, i.e., predicting changes in the economic situation and making appropriate changes in the composition of portfolios. Returning to the elements mentioned above used in the assessment of the effectiveness of fund portfolio management, it can be concluded that the ability to carefully select assets is at best unsatisfactory. The measure of this is the constant terms in the considered models. In nearly all periods and in nearly all models, the vast majority of alpha coefficients were statistically insignificant. The exceptions were the years 2008–2012, when eight of fifteen coefficients were statistically significant in the Treynor–Mazuy and Busse models. These, however, were negative, which can be said to have been particularly disadvantageous for fund clients.

The analysis of managers’ use of market timing, unfortunately, does not offer flattering portrait. The delta, gamma, and lambda coefficients in the models under consideration show statistical properties similar to those of the alpha coefficients. The vast majority of them are either irrelevant or statistically significant but with the undesired sign. The Busse model is worth highlighting here. In the entire research period, eight lambda coefficients were statistically significant, but only one was negative. However, in the years 2013–2017 and 2015–2016, ten of them were different from zero, but had positive values. This means that the linking of the anticipated market situation with the risk was almost always insignificant.

The situation is different from the one described above, when we consider beta factors as a measure of the managers’ ability to use market trends. In all periods and models, only in a few cases are they statistically insignificant and these almost always apply to the same fund. In addition, they always have positive values. It is worth mentioning that this is not an unambiguously positive situation from the point of view of customers. The studies also included bear market periods, which is when managers should build portfolios leading to negative beta factors. This conclusion is confirmed by the statistical characteristics of these coefficients in almost all models and all sub-periods under consideration. Their average values are greater than 0.6 and not higher than 0.94, except for the Henriksson–Merton model in 2011–2012 and the Busse model in 2015–2016. In those periods, the average is slightly larger than one. The calculation of variation coefficients for beta parameters shows that in all models and all sub-periods, the distribution of their values around the averages is small. It can be concluded that the managers of all funds follow the market in a very similar way. Moreover, their approach is more reminiscent of index funds rather than aggressive stock strategies.

Another element of the research conducted was the persistence of ranking positions. Due to the fact that the beta coefficients were statistically significant, the rankings could only be created based on this parameter. In the entire 2003–2017 period, there is relatively high compatibility of ranking items based on the Treynor–Mazuy model and the other two models. Therefore, relatively low- or high-ranking positions in this model remain the same for both. However, the situation is quite different when we consider the Henriksson–Merton and Busse models, where the Spearman’s coefficient is equal to zero from the statistical point of view. Thus, leaders become “marauders” and vice versa. The situation changes radically when we repeat the calculations for sub-periods. In the case of five-year periods, all three correlation coefficients between the rankings created on the basis of the Henriksson–Merton and Busse models are important. In 2003–2007 and 2013–2017, they have values greater than 0.9, and in 2008–2012, the coefficient is slightly greater than 0.5. In other cases, three coefficients are insignificant and three significant, but they have values close to 0.7. A similar situation occurs for two-year sub-periods. In the case of the Henriksson–Merton and Busse models for seven sub-periods, only one factor is statistically insignificant (2009–2010), while in the others they have high values, often significantly above 0.9. The correlation coefficients between rankings based on the Treynor–Mazuy and Henriksson–Merton models are insignificant in four cases and in three cases statistically significant, but they show values much lower than in the previous pair of models. Consequently, it can be stated that depending on the pair of models and the period of selected for study, rankings based on beta factors lead to very different results from the point of view of market persistence. Relatively high agreement exists between the Henriksson–Merton and Busse models.

One might be tempted to say that over the past 15 years, the market for open-end mutual funds has been characterized by low management efficiency. Managers paid the most attention to following the market trend, without even trying to predict it. The ability to carefully select assets was practically non-existent, and probably not considered. On the other hand, the effects of the active use of market timing were counterproductive. As a consequence, the portfolios of funds that should be actively managed, not to say aggressively, rather resemble the portfolios of index funds. As a consequence, clients of funds are exposed to not very encouraging profits from the entrusted money. One solution is systematic payment of small amounts with active selection and possible change of funds depending on the market situation.

References

Ahmat, J., Sattar, A.: Estimation of fund selectivity and market timing: performance of Pakistani mutual funds. Glob. Manage. J. Acad. Corp. Stud. 6(2), 162–169 (2016)

Busse, J.A.: Another Look at Mutual Fund Tournaments. Working paper Emory University (1999)

Carlson, R.: Aggregate performance of mutual funds, 1948–1967. J. Fin. Quant. Anal. 5(1), 1–32 (1970)

Chang, E.C., Lewellen, W.G.: Market timing and mutual fund performance. J. Bus. 57, 57–72 (1984)

Foran, J., O’Sullivan, N.: Mutual fund skill in timing market volatility and liquidity. Forthcoming, Int. J. Fin. Econ. (2017). Available at SSRN: https://ssrn.com/abstract=2977795

Gallo, J., Swanson, P.: Comparative measures of performance for US based international equity mutual funds. J. Bank. Fin. 20(10), 1635–1650 (1996)

Grinblatt, M., Titman, S.: Mutual fund performance: an analysis of quarterly portfolio holdings. J. Bus. 62(3), 393–416 (1989)

Gudimetla, A.: Timing and Selectivity in Indian Sector Mutual Funds Performance. Jawaharlal Nehru Technological University Hyderabad, India (2015)

Henriksson, R., Merton, R.: On market timing and investment performance, II statistical procedures for evaluating forecasting skills. J. Bus. 54(4), 513–533 (1981)

Ippolito, R.A.: Efficiency with costly information: a study of mutual fund performance, 1965–1984. Quart. J. Econ. 104(1), 1–23 (1989)

Jamróz, P.: Parametryczna ocena umiejętności selektywności i wyczucia rynku zarządzających OFI akcji. Zeszyty Naukowe Uniwersytetu Szczecińskiego 639, Finanse, Rynki finansowe, Ubezpieczenia nr 37, pp. 221–231 (2011)

Karpio, A., Żebrowska-Suchodolska, D.: Dostosowywanie polityki inwestycyjnej FIO do zmiennej koniunktury rynkowej w latach 2003–2010. Metody i zastosowania ekonometrii współczesnej, vol. VII, pp. 105–115 (2013)

Koulis, A., Beneki, Ch., Adman, M., Botsaris, Ch.: An assessment of the performance of Greek mutual equity funds selectivity and market timing. Appl. Math. Sci. 5(4), 159–171 (2011)

Philippas, N., Tsionas, E.: Performance evaluation: an review article and an empirical investigation of Greek mutual fund managers. Int. Bus. Econ. Res. J. 1(6), 31–44 (2002)

Rao, K.V., Venkateswarlu, K.: Market Timing Abilities of Fund Managers—A Case Study of Unit Trust of India. UTI Institute of Capital Markets and Tata Mcgraw Hill Publications, Indian Capital Markets—Trends and Dimensions (2000)

Sheikh, M.J., Noreen, U.: Validity of efficient market hypothesis: evidence from UK mutual funds. Afr. J. Bus. Manage. 6(2), 514–520 (2012)

Thanou, E.: Mutual fund evaluation during up and down market conditions: the case of Greek equity mutual funds. Int. Res. J. Fin. Econ. 13, 84–93 (2008)

Treynor, J.L., Mazuy, K.: Can mutual funds outguess the market? Harvard Bus. Rev. 44, 131–136 (1966)

Ważna, E.: Efektywność inwestowania otwartych funduszy inwestycyjnych w Polsce w latach 2007–2014. Zeszyty Naukowe Uczelni Vistula 56(5), 64–83 (2017)

Węgrzyn, T.: Efektywność funduszy inwestycyjnych stosujących aktywne strategie zarządzania portfelem. Studia Ekonomiczne. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach nr 239, pp. 141–152 (2015)

Witkowska, D., Kompa, K., Grabska, M.: Badanie informacyjnej efektywności rynku w formie silnej na przykładzie wybranych funduszy inwestycyjnych. Metody Ilościowe w Badaniach Ekonomicznych X, 265–285 (2009)

Żelazowska, I.: Wyczucie rynku w działalności funduszy inwestycyjnych akcji w Polsce- badanie empiryczne. Annales, LI 1, 125–134 (2017)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Żebrowska-Suchodolska, D., Karpio, A. (2020). Market Timing Models for Equity Funds Operating on the Polish Market in the Years 2003–2017. In: Nermend, K., Łatuszyńska, M. (eds) Experimental and Quantitative Methods in Contemporary Economics. CMEE 2018. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-30251-1_21

Download citation

DOI: https://doi.org/10.1007/978-3-030-30251-1_21

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-30250-4

Online ISBN: 978-3-030-30251-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)