Abstract

Goal programming is the approach used for multicriteria decision making when the decision maker aims to minimize deviations between the achievement of goals and their aspiration levels. In the presence of skewness in the portfolio selection problems, the goal programming technique is an excellent and powerful quantitative tool in which the investor’s preferences among objectives are incorporated. In this study, in the mean–variance–skewness framework, the utilization of the goal programming model allows to determine the trade-off frontier or efficient frontier for a given level of decision maker’s preferences in relation to the selected parameters. Each change in the strength of preference for the expected value in relation to the third moment is a trade-off frontier in the appropriate two-dimensional space or on the surface of efficient portfolios in three-dimensional space.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The analysts basing on the Markowitz portfolio selection model have focused on the expected return and variance and have stated that an investor should always choose an efficient portfolio. They have assumed that the return rates of stocks have a normal (symmetrical) probability distribution or the utility function is quadratic. The assumption regarding a symmetrical distribution of the rate of return is unrealistic and has no empirical evidence [12, 15, 23]. Many researchers argue that higher order moments of the portfolio’s return are relevant to investors’ decisions and cannot be ignored. Scott and Horvath [25] have shown that if the distribution of random rates of return is asymmetric or the investor’s utility function is a function of a higher degree than the quadratic function, the assessment of the investment should be based on at least the third and fourth order moments. As a result of the evidence against the assumption of the normality of the rate of return distribution, the multiobjective portfolio selection model incorporates the higher moments. In general, investors prefer high values for odd moments and low ones for even moments. Increasing the positive value of an odd moment can be interpreted as decreasing extreme values on the side of losses and increasing them on the gains’ side.

The importance of skewness in the rate of return distribution is introduced by Arditti in the stocks’ pricing [1, 2]. He claims that investors prefer positive skewness as a result of decreasing absolute risk aversion. The preference for positive skewness is also related to the concept of prudence introduced by Kimball [16]. A prudent investor is characterized by a special behavior in a situation of risk i.e. a precautionary saving or limiting consumption. In the context of the theory of expected utility, prudence means the convexity of marginal utility [5, 18, 19].

The first publications in which portfolio selection models incorporating skewness measures were proposed, appeared in the 1970s [26, 27]. Maximizing skewness expresses the basic preferences of the decision maker and leads to an increase in the chances of achieving above-average rates of return. Currently, different approaches to the multicriteria portfolio selection are proposed, such as the use of goal programming or the use of the utility functions of distribution moments [13, 20, 21].

The literature also explores efficient portfolios in terms of the first three moments of the rate of return distribution [3, 10]. In addition, the problem of diversification of optimal portfolios depending on the investor’s preferences regarding the skewness of the rate of return is discussed. Independent research confirms that the greater the strength of preference for skewness, the lower the degree of portfolio diversification [11, 14, 26].

To sum up, the main purpose of this study is to propose a mean–variance–skewness goal programming model for portfolio selection based on the investor’s preferences.

The paper is organized as follows: Sect. 11.2 provides discussion on the portfolio selection problem with third-order moments. The theoretical framework of the goal programming model is discussed in Sect. 11.3. The numerical results are illustrated in Sect. 11.4. Conclusion of the study and some computational details are presented in the final section.

2 Skewness in Portfolio Selection

In the presence of skewness, the portfolio selection problem turns into a nonconvex optimization problem which can be characterized by a number of conflicting and competing objective functions. To solve this complicated task, various approaches have been proposed in the literature. Konno et al. [17], Boyle and Ding [4] applied the method of linear approximation of quadratic and cubic expressions in the optimization model and in this way brought the issue to the convex programming problem.

The goal programming (GP) has been the most widely used approach in decision-making problems with several conflicting and competing objectives. An important feature of GP is the existence of optimal solution. Generally, the GP models vary in the form of the achievement function, which minimizes the unwanted deviations (absolute or relative) of the model’s goals [20].

The polynomial goal programming (PGP) approach to the portfolio selection with skewness was proposed by Lai [21]. This article initiated the intensive development of literature, in which portfolio optimization is conceived as a multiple goal programming problem. Lai [21] and authors of the other papers [8, 9, 24] assumed that the portfolio decision depends on the percentage invested in each asset and constructed a PGP model that the portfolio choice can be rescaled and restricted on the unit variance space. This PGP methodology has become popular for empirical research looking at skewness persistence in a variety of international markets [7, 22]. Canela and Collazo [6] pointed that under certain conditions, the PGP method can produce mathematically feasible solutions, which would be unfeasible from a financial point of view.

Chen and Shia [7] stressed that assets and portfolio returns tend to be asymmetrically distributed and using variance as the measure of investment risk is inappropriate and unreasonable. They proposed a new portfolio selection model which uses downside risk in the form of “lower partial moments” instead of variance as the risk measurement in the goal programming portfolio model.

Yaghoobi and Tamiz [28] considered the GP portfolio selection model in which aspiration levels were not known precisely. They used the fuzzy approach where imprecise level was treated as a fuzzy goal.

In our approach, the goal programming model with the weighted linear function of relative deviations from the model’s goals is considered. We utilize the GP to determine the trade-off frontiers of portfolios of selected stocks which constitute WIG20 index on the Warsaw Stock Exchange.

3 Goal Programming Models

In this study, the investor’s preferences for skewness and expected value of the distribution of the rate of return are incorporated in portfolio selection problem.

Let us introduce some symbols. Shares of stocks in portfolio form a vector \({\mathbf{x}} = [x_{1} ,x_{2} , \ldots ,x_{N} ]\), where \(x_{1} + x_{2} + \cdots + x_{N} = 1\) and \(x_{i} \ge 0\) for \(i = 1, \ldots ,N\). The condition for nonnegativity of shares means that short sale is forbidden. Random rates of return of stocks in portfolio make up a vector \({\mathbf{R}} = [R_{1} ,R_{2} , \ldots ,R_{N} ]\). Rate of return of portfolio is a random variable which distribution is generated by the random rates of return of shares \(R_{P} = R_{1} x_{1} + R_{2} x_{2} + \cdots + R_{N} x_{N}\). Our optimization models make use of three moments of a portfolio random rate of return \(R_{P}\): the expected value of the portfolio (\(E_{P}\)) which is the first-order moment, the variance of the portfolio (\(V_{P}\)) which is the second central moment and the skewness of the portfolio (\(S_{P}\)) measured by the third central moment and written as

where the symbol \(\otimes\) denotes the Kronecker product. The matrix \({\mathbf{M}}_{3}\) consist of the third central moments and co-moments of the random rate of return of stocks

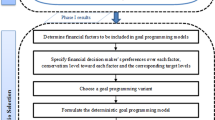

Our method of research (optimization) has three stages. In the first stage for a given value of portfolio variance (\(V_{0}\)), the expected value of optimal portfolio (\(E_{P}^{*}\)) is determined. Next, in the second stage for a given value of portfolio variance (\(V_{0}\)), the skewness of optimal portfolio (\(S_{P}^{*}\)) is determined. And in the last stage, optimal values \(E_{P}^{*}\) and \(S_{P}^{*}\) are used as goal values (aspiration levels) and for given values \(V_{0}\), \(E_{P}^{*}\) and \(S_{P}^{*}\) the optimal portfolio with the minimal deviation from the goal values is determined. In our procedure (method), the meaningful values of variance has to be higher than the variance of the global minimum variance portfolio and lower than the minimum of the variances of stock with the highest expected rate of return and stock with the highest skewness.

In the first stage for selected values of variance \(V_{0}\), we optimized a well-known Markowitz portfolio selection model of the form

The expected rate of return of optimal portfolio based on model (11.3) is noted as \(E_{P}^{*}\). The optimal portfolio which maximizes the skewness for a given variance is the following:

The desirable value of skewness is noted as \(S_{P}^{*}\). To determine an optimal portfolio which for a given variance is closest to the desirable values of expected rate of return and skewness, we propose the following goal programming model

where de is a deviation of the expected portfolio rate of return from a desired value \(E_{P}^{*}\), ds is a deviation of portfolio skewness from a desired value \(S_{P}^{*}\), \(\upalpha \in \langle 0,1\rangle\) is a weight (weighting coefficient). The objective function minimizes the relative deviations from desired values. The strength of preference toward a desired expected return is reflected by a weight α, and the strength of preference toward a desired skewness is reflected by a weight (\(1 -\upalpha\)). If \(\upalpha = 1\), the portfolio preferred by an investor is that whose expected rate of return is as close as possible to the maximum rate of return for a given risk level and the optimal portfolio of (11.5) is the same as a solution of model (11.3). Similarly if \(\upalpha = 0\), the investor prefers a portfolio that guarantees the achievement of extreme values of a positive rate of return for a given level of risk and the optimal portfolio of (11.5) is the same as a solution of model (11.4). For the assumed values of \(V_{0}\) and α, the solution of model (11.5) is the optimal portfolio \({\mathbf{x}} = [x_{1} ,x_{2} , \ldots ,x_{N} ]\); however, in our research the parameters of the distribution of the return rate of the portfolio x will be analyzed, not its structure.

Moreover, for different values of variance the optimal values of objective function of (11.3) and (11.4) are used to determine the boundary lines of the expected rate of return and skewness of the optimal portfolios of (11.5). In the mean–variance space, an area between the efficient frontier based on the solutions of model (11.3) and the line of the expected returns of the optimal portfolios of (11.4) is a set of feasible portfolios when the strength of preference toward the desired expected rate of return is considered. Likewise, in the skewness–variance space, there is the set of portfolios when the strength of preference toward a desired skewness of rate of return is considered.

4 Data and Tools

Our major interest is to determine the set of efficient portfolios consisting of solutions of goal programming approach to portfolio selection problem. The purpose of our analysis is to illustrate how selected parameters of the return rate distribution of the optimal portfolio vary for investors with different preferences for the expected value and skewness. These preferences are expressed by means of the α parameter.

The data set contains daily logarithmic rates of return for the year 2017 for all 20 shares being components of the WIG20 index on the Warsaw Stock Exchange. Calculations were made in the SAS software using the NLP solver and self-prepared programs.

In this paper, we analyze the expected values and skewness of logarithmic rates of return of optimal portfolios for various values of variance. Values of variance have to be from the interval \(V_{0} \in \left\langle {V_{\text{GMVP}} ,\mathop {\hbox{min} }\limits_{i} \left\{ {V_{{\hbox{max} \,E_{i} }} ,V_{{\hbox{max} \,S_{i} }} } \right\}} \right\rangle\) where \(V_{\text{GMVP}}\) is a variance of the global minimum variance portfolio, \(V_{{\hbox{max} \,E_{i} }}\) is a variance of a stock with the highest expected value, \(V_{{\hbox{max} \,S_{i} }}\) is a variance of a stock with the highest skewness. In other words, the assumed variance \(V_{0}\) has to be not lower than the minimal variance of all portfolios and not higher than the lower from variances of the maximum expected value share and the maximum skewness share. Table 11.1 shows the first three moments of logarithmic returns for all 20 shares and the global minimal variance portfolio (GMVP) in the analyzed period.

Based on the values in Table 11.1, the interval of the assumed variance \(V_{0}\) is \(\langle 0.592,2.908\rangle\). In the optimization models (11.3)–(11.5), we considered values rounded to 0.1.

5 Results

By changing the values of variance in models (11.3) and (11.4), we obtain optimal portfolios and we can construct efficient frontiers in mean–variance and skewness–variance spaces. In addition, for each efficient frontier, a sequence of values of the considered parameter: the third moment (as a measure of skewness) and the expected value (mean), can be calculated for optimal solutions of the other model. Precisely, in the mean–variance space, we determine the line of expected values for the optimal portfolios of the model with the skewness maximization (11.4), and in the skewness–variance space the line of the values of third moments for the optimal portfolios of the model with the maximization of the expected value (11.3). Area between the efficient frontier and the obtained line represents a set of trade-offs between the expected return and skewness.

The optimal solution of the goal programming model (11.5) for a fixed level of α and variance \(V_{0}\) is the portfolio with the following parameters: the expected value of the portfolio’s rate of return \(E_{P} (\upalpha,V_{0} )\), variance \(V_{0}\), and skewness of the portfolio’s rate of return \(S_{P} (\upalpha,V_{0} )\). Generally, by solving the model (11.5) for a fixed α and any value of variance \(V_{0} \in \left\langle {V_{\text{GMVP}} ,\mathop {\hbox{min} }\limits_{i} \left\{ {V_{{\hbox{max} \,E_{i} }} ,V_{{\hbox{max} \,S_{i} }} } \right\}} \right\rangle\), we obtain optimal portfolios whose expected values of the portfolio’s rate of return \(E_{P} (\upalpha,V_{0} )\) and skewness of the portfolio’s rate of return \(S_{P} (\upalpha,V_{0} )\) create trade-off frontier in a corresponding two-dimensional space (mean–variance space in Fig. 11.1a, skewness–variance space in Fig. 11.1b).

Let P1 be the portfolio with the maximum expected value for a given variance, and P2, the portfolio with the maximum skewness for a given variance. Both portfolios can be presented in two spaces: mean–variance (Fig. 11.1a) and skewness–variance (Fig. 11.1b). Any portfolio P belonging to the P1P2 segment has higher expected value than P2 (Fig. 11.1a) at the expense of lower skewness than P2 (Fig. 11.1b), and at the same time, portfolio P has higher skewness than P1 (Fig. 11.1b) at the expense of lower expected value than P1 (Fig. 11.1a).

Applying the proposed goal programming model (11.5) for any level of preference α for the expected value in relation to the skewness allows to picture the corresponding trade-off frontier in two-dimensional space (mean–variance or skewness–variance). Changing the value of parameter α allows us to analyze various alternatives in which a different emphasis is placed on the expected value and skewness.

The trade-off frontiers are situated between the efficient frontier and the lower restrictive line. For α close to 1, in the mean–variance plane the trade-off frontiers are close to the efficient frontier, and in the skewness–variance plane to the lower restrictive line. Figure 11.2a–d shows the trade-off frontiers for four levels of the preference strength α (0.3, 0.4, 0.6 and 0.7, respectively), in the mean–variance plane based on the quotations of 20 stocks listed on the Warsaw Stock Exchange in 2017. The value 0.5 of the preference strength means that for an investor, the high expected value of the portfolio is just as important as the high skewness. We have analyzed the trade-off frontiers for many values of α and noted that when decreasing the value of α initially the trade-off frontiers move away from the efficient frontier relatively slower than for lower values of α. Similar behavior was observed for data from other periods we have analyzed. This means that if the investors prefer higher values of expected rates of return of optimal portfolios at the expense of lower skewness, a gradual weakening of the preference strength causes a slow decrease in the expected value, while further lowering a value of α (which is equivalent to stronger preference for skewness) causes a radical reduction in the expected value.

Opposite patterns are observed in the skewness–variance plane. Figure 11.3a–d illustrates the trade-off frontiers for four levels of the preference strength α (0.3, 0.4, 0.6 and 0.7, respectively), in the skewness–variance plane. Analyzing the trade-off frontiers for different values of α, we stated that when decreasing the value of α initially the trade-off frontiers move closer to the efficient frontier (in skewness–variance plane) relatively faster than for lower values of α. We noted that the small changes in the investor’s preferences for the expected rate of return of a portfolio are related to the relatively large changes in the portfolio skewness. Thus, the sensitivity to changes in the investor’s preferences is greater for the skewness of the portfolio rate of return than for the expected value. Analogous behavior was observed for data from the other periods.

Such behaviors for arithmetic means of expected values and skewnesses of the portfolio rates of return for various values of α are illustrated in Fig. 11.4a, b, respectively.

As we consider the first three moments of the distribution of the portfolio rate of return, the trade-off frontier can be presented in three-dimensional space mean–variance–skewness. Figure 11.5 shows the parameters of optimal portfolios being the solutions of the model (11.5) for selected α (1, 0.4 and 0). For continuous values of α, the trade-off frontiers would create an irregular surface of efficient portfolios, which results from nonlinear conditions in the model (11.5).

The nonlinear optimization models (11.4) and (11.5) are nonconvex. Due to the fact that there is no algorithm for solving such optimization problems and often they have many local optima, the solution reported by a computer solving tool sometimes may not be a global optimum. Furthermore, if a solver is run multiple times, different solutions can be obtained. The SAS optimization NLP solver can be run in multistart mode in which a number of starting points are randomly generated and can converge to different local optima. The solution reported as optimal is in fact one of the local optima with the best objective value. Therefore, the obtained solution is not guaranteed to be global optimum.

6 Conclusion

Our results clearly show a strong trade-off between expected value and skewness which was traditionally assumed to be present only between expected value and variance. The investors aware of additional criteria would have to accept a lower rate of return if they chose to optimize the skewness of the portfolio rate of return. This means that the observed efficient frontier based only on mean–variance optimization is not an adequate efficient frontier and could lead investors toward sub-optimal decisions when the skewness is considered. The incorporation of skewness into an investor’s portfolio decision provokes a great change in the resultant optimal portfolio allocation.

Our study adopts the GP approach to include third moment of rate of return distribution in portfolio optimization process. The investors’ aim is to provide portfolios with the highest expected rate of return and the highest third central moment. Because these criteria are mutually competitive, investor expresses his own preferences for one criterion relative to the other one by the subjective value of the parameter measuring the preference strength. This parameter appears in the objective function in a properly constructed GP model. We have proposed to use optimal solutions of the GP model to determine trade-off frontiers which show how individual preferences trade expected rate of return for skewness. Moreover, trade-off frontiers allow us to examine the intensity of changes in the value of the rate of return distribution parameters of optimal portfolios depending on the subjective measure of the strength of preferences.

References

Arditti, F.D.: Risk and the required return on equity. J. Financ. 22, 19–36 (1967)

Arditti, F.D.: Skewness and investor’s decisions: a reply. J. Financ. Quant. Anal. 10, 173–176 (1975)

Arditti, F.D., Levy, H.: Portfolio efficiency analysis in three moments: the multiperiod case. J. Financ. 30(3), 797–809 (1975)

Boyle, P., Ding, B.: Portfolio selection with skewness. In: Breton, M., Ben-Ameur, H. (eds.) Numerical Methods in Finance, pp. 227–240. Springer (2005)

Briec, W., Kerstens, K., Jokung, O.: Mean-variance-skewness portfolio performance gauging: a general shortage function and dual approach. Manage. Sci. 53(1), 135–149 (2007)

Canela, M.A., Collazo, E.P.: Portfolio selection with skewness in emerging market industries. Emerg. Mark. Rev. 8(3), 230–250 (2007)

Chen, H.H., Shia, B.C.: Multinational portfolio construction using polynomial goal programming and lower partial moments. J. Chin. Stat. Assoc. 45, 130–143 (2007)

Chunhachinda, P., Dandapani, K., Hamid, S., Prakash, A.J.: Portfolio selection and skewness: evidence from international stock markets. J. Bank. Finance 21, 143–167 (1997)

Davies, R.J., Kat, H.M., Lu, S.: Fund of hedge funds portfolio selection: a multiple-objective approach. J. Deriv. Hedge Funds 15(2), 91–115 (2009)

Dudzińska-Baryła, R., Kopańska-Bródka, D., Michalska, E.: Analiza portfeli narożnych z uwzględnieniem skośności. Finanse, Rynki Finansowe, Ubezpieczenia 75, 123–133 (in Polish) (2015). https://doi.org/10.18276/frfu.2015.75-10

Dudzińska-Baryła, R., Kopańska-Bródka, D., Michalska, E.: Diversification problem in mean-variance-skewness portfolio models. In: Pražák, P. (ed.) Conference Proceedings, 35rd International Conference Mathematical Methods in Economics, University of Hradec Králové, Czech Republic, pp. 137–142 (2017)

Fama, E.F.: The behavior of stock market prices. J. Bus. 38(1), 34–105 (1965)

Harvey, C.R., Liechty, J.C., Liechty, M.W., Müller, P.: Portfolio selection with higher moments. Quant. Financ. 10(5), 469–485 (2010)

Kane, A.: Skewness preference and portfolio choice. J. Financ. Quant. Anal. 17, 15–25 (1982)

Kendall, M.G., Hill, A.B.: The analysis of economic time-series—Part I: Prices. J. R. Stat. Soc., Ser. A 116(1), 11–34 (1953)

Kimball, M.S.: Precautionary saving in the small and in the large. Econometrica 58(1), 53–73 (1990)

Konno, H., Shirakawa, H., Yamazaki, H.: A mean-absolute deviation-skewness portfolio optimization model. Ann. Oper. Res. 45, 205–220 (1993)

Kopańska-Bródka, D.: Miary intensywności zachowań rozważnych. Studia Ekonomiczne. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach 135, 79–87 (in Polish) (2013)

Kopańska-Bródka, D.: Związki miar awersji do ryzyka z funkcjami zależnymi od parametrów rozkładu. Studia Ekonomiczne. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach 163, 253–266 (in Polish) (2013)

Kopańska-Bródka, D.: Optymalny portfel inwestycyjny z kryterium maksymalnej skośności. Studia Ekonomiczne. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach 208, 46–58 (in Polish) (2014)

Lai, T.Y.: Portfolio selection with skewness: a multiple-objective approach. Rev. Quant. Financ. Acc. 1, 293–305 (1991)

Naqvi, B., Mirza, N., Naqvi, W.A., Rizvi, S.K.A.: Portfolio optimisation with higher moments of risk at the Pakistan Stock Exchange. Econ. Res.-Ekonomska Istraživanja 30(1), 1594–1610 (2017)

Piasecki, K., Tomasik, E.: Rozkład stóp zwrotu z instrumentów polskiego rynku kapitałowego. Edu-Libri, Kraków-Warszawa (in Polish) (2013)

Prakash, A.J., Chang, C.H., Pactwa, T.E.: Selecting a portfolio with skewness: recent evidence from US, European, and Latin American equity markets. J. Bank. Finance 27, 1375–1390 (2003)

Scott, R., Horvath, P.: On the direction of preference for moments of higher order than the variance. J. Finance 35, 915–919 (1980)

Simkowitz, M.A., Beedles, W.L.: Diversification in a three-moment world. J. Financ. Quant. Anal. 13(5), 927–941 (1978)

Simonson, D.: The speculative behavior of mutual funds. J. Finance 27, 381–391 (1972)

Yaghoobi, M.A., Tamiz, M.: On improving a weighted additive model for fuzzy goal programming problems. Int. Rev. Fuzzy Math. 1, 115–129 (2006)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Kopańska-Bródka, D., Dudzińska-Baryła, R., Michalska, E. (2019). The Investor’s Preferences in the Portfolio Selection Problem Based on the Goal Programming Approach. In: Tarczyński, W., Nermend, K. (eds) Effective Investments on Capital Markets. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-21274-2_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-21274-2_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-21273-5

Online ISBN: 978-3-030-21274-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)