Abstract

Sugarcane is one of the major agricultural commodities of Pakistan. The crop is grown on an area of 1.22 million hectares, with a total production of 73.40 million tons. Sugarcane’s role has been limited to sugar production in the past; however, it can play significant role toward energy matrix of the country. Being a developing nation of 197 million people, energy demands of the country are sky-high, whereas indigenous energy resources are meager. Pakistan meets its petroleum demands majorly through imports, while the country is also facing power shortage for more than a decade. Hence, sugarcane, as an energy crop, can play significant role in providing bioenergy in the form of ethanol-blended fuels as well as cogenerated electricity. Pakistan State Oil evaluated E10 blend on limited outlets in 2006 followed by its marketing in 2010. Indigenous ethanol production has increased over time because of new taxes on export of molasses. Fuel grade ethanol is also already being produced by some distilleries; nevertheless, these initiatives have not contributed much toward country’s energy matrix because of absence of policies requiring ethanol blends at national level till date. Sugarcane sector can also serve for bioelectricity production in Pakistan. The country has potential to engender approximately 3000 MW of electricity from sugarcane. Various economic incentives have been offered to power producing sugar mills; nevertheless, there is need to increase the support, especially regarding financing for upgrading current low-pressure technology of the mills. Since there is scarcity of hydropower in sugarcane crushing season, cane industry can play important role in tackling the energy shortfall of the country in such months. This chapter analyzes the current status and future perspectives of cane-derived fuels and energy production in Pakistan.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Sugarcane, the largest crop commodity with respect to total production, is grown in more than 70 countries all over the world to meet the global sugar needs (FAOSTAT 2017). However, it is also one of the most suitable sources of bioenergy as it exhibits the highest number of the major characteristics for an energy crop. Sugarcane is among worlds’ best photosynthesizers and sucrose producers. Moreover, it records the greatest output to input ratio for biofuel engenderment, making it one of the most efficient crops for the purpose (Khan 2018). Further, the automated harvest technology for sugarcane, no requisites of prime agricultural lands in certain countries, and the already established sugar industry make the crop one of the best fits for the product.

Sugarcane also addresses one of the major concerns against biofuel crops, i.e., food security, as it yields huge biomass supplying lignocellulosic materials—source of second-generation biofuels—which does not affect the food production (Khan et al. 2017b; Matsuoka et al. 2015). Presently, the ethanol production from sugarcane is mainly done from cane juice and molasses. Biomass and field leftovers can also be employed for obtaining cellulosic biofuels; however, the conversion of raw materials of the commodity into cellulosic biofuels is extremely intricate (Pereira et al. 2015). Once the second-generation approaches have been perfected, sugarcane can be excellently utilized for producing this class of biofuels, along with the traditional production of cane sugar and ethanol.

Sugarcane bagasse can also find applications in electricity cogeneration, another form of bioenergy. Such energy would not only satisfy the requirements of the sugar mills, but surplus energy can be supplied to the national grids (Leal 2007). Even more, sugarcane sector can also provide biogas for domestic uses (Rabelo et al. 2011). It indicates that sugarcane plays vital role in providing energy to the major cane cultivating countries such as Brazil, India, China, Thailand, Pakistan, and many more.

Pakistan, being the fifth largest cane producer, can extensively employ sugarcane for meeting its fuel and energy requirements. The country spends huge foreign exchange for meeting oil needs of the country. Moreover, Pakistan is facing huge electricity shortfalls since many years. Thus, sugarcane can play important role in diversifying Pakistan’s energy matrix, reducing oil imports, and adding bioelectricity to the national grid.

2 Sugarcane Crop Situation in Pakistan

Sugarcane is one of the most important cash crops of Pakistan. It is the largest crop of the country with respect to total production (Fig. 9.1) (FAOSTAT 2017). Sugarcane was farmed on area of 1.22 million ha (Mha) in the year 2017, while its total production was 73.40 million tons (MT). The sugarcane production has constantly increased in the country over time (Fig. 9.2). Pakistan ranks at fifth position in overall sugarcane cultivation in the world, following only Brazil, India, China, and Thailand (FAOSTAT 2017, Pakistan Bureau of Statistics [PBS] 2017).

Most produced commodities in Pakistan in 2017. (Source: FAOSTAT 2017)

Production and area of sugarcane cultivation in Pakistan from 1961 till 2017. (Source: FAOSTAT 2017)

According to Pakistan Economic Survey, the yield of sugarcane crop has increased from 55.98 t ha−1 in 2010, to 61.97 t ha−1 by 2017, whereas area as well as total production has also shown growth, generally, over the said period (Ministry of Finance [MoF] 2018). Sugarcane is being cultivated in all four provinces of the country. Punjab, Sindh, and Khyber Pakhtunkhwa are growing the crop since independence, whereas its cultivation in Balochistan started in 1969. Punjab is the largest cane-producing province with total production of 49.61 MT, followed by Sindh, Khyber Pakhtunkhwa, and Balochistan. The Punjab province also leads in average sugarcane yield per hectare. Its yield is 63.78 t ha−1, whereas Sindh, the second largest producer, harvests 63.05 t ha−1. Khyber Pakhtunkhwa and Balochistan harvest 47.46 t and 45.14 t of sugarcane per hectare, respectively. The share of Punjab in sugarcane cultivation with respect to area under cultivation is 62%, while the other two major provinces, Sindh and Khyber Pakhtunkhwa, contribute for approximately 28% and 10% area, respectively (Punjab Agriculture Marketing Information Service 2017).

In recent years, the sugarcane production and area under cultivation have increased significantly. Improvements have also been observed in yield of the crop. However, the average sugar recovery has reduced from 10% to 9.87% over the last five cropping seasons. In the same period, however, total sugar production surged from 5.036 MT to 7.005 MT (Fig. 9.3) (Ministry of Finance 2018; Pakistan Sugar Mills Association [PSMA] 2018).

Variations in total sugarcane production, area under cultivation, and per hectare yields of sugarcane in Pakistan since 2010 (Ministry of Finance 2018)

Sugarcane fulfils 99% sugar requirements of Pakistan, as sugar beet’s cultivation is only marginal. Sugar industry is the second largest industry of Pakistan following only cotton sector. Pakistan is the greatest per capita sugar consumer of South Asia, surpassing the other three main sugarcane-growing countries in the region, i.e., India, China, and Thailand (Azam and Khan 2010). Sugarcane sector is also supporting production of various other products including alcohol, paper, and press mud. Moreover, raw material for confectioneries and chip board is also provided by the sugar mills. Additionally, its molasses is being exported for earning foreign exchange (Almazan et al. 1999). Contribution of the sugarcane sector toward total agricultural value addition is 3.1%, while its share in GDP of the country is 0.6% (MoF 2015).

3 Sugar Industry of the Country

Sugar industry is a well-established industry in Pakistan. A total of 90 sugar mills are currently established in the country, out of which 45 are installed in Punjab, 38 in Sindh, and 07 in Khyber Pakhtunkhwa (PSMA 2017). Sugar mills in Pakistan, in season 2016–2017, crushed a total of 70.989 MT of sugarcane, manufacturing 7.005 MT of sugar (Table 9.1). The industry is currently producing surplus sugar and has potential to export the same. However, government policies discourage export of sugar as the country has suffered some severe sugar crisis in the past.

Industrial capacity of sugar mills is currently more than 70 million tons. Sugar industry of the country provides employment to 47,000 persons directly, and about a million overall. Mill-wise cane crushing, sugar production, recovery, and molasses engenderment data are presented in Table 9.2.

4 Energy Scenario of Pakistan

Pakistan does not have ample resources of energy to meet its needs (Table 9.3). Being a developing economy of more than 197 million people, the country has huge demands for petroleum as well as electricity. Petroleum requirements are fulfilled by imports from other nations, and thus, scarcity of oil resources creates one of the biggest burdens on country’s import bills. Major traditional fuels used by automotive sector of Pakistan include petrol, diesel, liquefied petroleum gas (LPG), and compressed natural gas (CNG).

The indigenous resources of the country only fulfil 18% of the total demand of petroleum products (Tariq et al. 2014). Oil demands of Pakistan have steadily increased over time. Transport sector, alone, accounts for more than 50% of the domestic petroleum consumption (Tariq et al. 2014). Within the last 5 years, petroleum consumption has escalated to 589 thousand barrels per day (B D−1) starting from 442 B D−1. Petroleum products share as much as approximately 40% toward overall energy consumption of the country (British Petroleum Company plc 2018).

Petroleum products are the greatest import of the country. Petroleum imports amplified by 30.5% year-on-year basis in 2017–2018. An import bill of $12.928 billion was recorded against $9.912 billion for the previous year. Regarding amounts spent on importing crude oil, a growth of 60.35% was observed as it costed the country ~$3.738 billion. However, keeping in view the imported quantity for the same, the growth was 28.72%, highlighting that the rise in import bills was more related to increase in international prices, depicting that Pakistan’s economy is very much dependent on international oil prices (Arshad Hussain 2018).

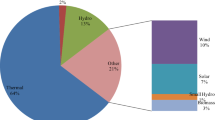

Regarding electricity consumption of the country, Pakistan has a total installed capacity of 25,000 MW. Top three sources of electricity are fossil fuel, hydro, and nuclear (Fig. 9.4) (Hussain et al. 2016). Use of biomass, abundantly available in the country, has largely been underexploited. Supply and demand scenario of energy sector in Pakistan has remained extremely unbalanced for more than a decade. The country faced significant challenges in revamping its energy sector to fulfill the rising demands of power.

Top three electricity sources of Pakistan. (Modified from Hussain et al. 2016)

5 Sugarcane as a Fuel and Energy Source for Pakistan

Being one of the major cane producers of the world, Pakistan has a decent potential for producing cane-derived fuel and energy. Sugarcane is an excellent source of bioethanol as well as bioelectricity and can hence support energy needs of the country. Either first or second-generation ethanol can be obtained from sugarcane. The first-generation ethanol is produced from sucrose, cane juice, or molasses, whereas lignocellulosic biomass of the cane can be exploited for second-generation ethanol production. Ethanol, obtained from sugarcane, can be used as gasoline blend for consumption by vehicles (Khan et al. 2017a). Sugarcane bagasse, another byproduct in cane crushing, can be employed for electricity production (Khan 2018). Hence, molasses and bagasse are of great concern regarding cane energy production. Therefore, sugarcane can play important role toward petroleum fuels as well as power production (British Petroleum Company plc 2018).

5.1 Molasses Production in Pakistan

Molasses is the main source of ethanol in Pakistan. Ethanol can be utilized in fuel blending for economic and environmental reasons. Molasses production in Pakistan has gradually increased over time, attributed to rise in cane and sugar production and area under cane cultivation. Total molasses yield of Pakistan was 2.034 MT in 2011, which elevated to 3.077 MT in the year 2017 (PSMA 2017). Molasses and ethanol find applications in several domestic industries including pharma, food, cosmetics, and paper industry (Arifeen 2014).

Molasses is available in surplus amounts in Pakistan. The nation has been a major exporter of molasses to European Union (EU), Saudi Arabia, United Arab Emirates, and Afghanistan (Arifeen 2014). However, changes in import policies of EU have made molasses export to the region economically non-feasible. Consequently, Pakistan’s export of molasses has greatly declined over time, in spite of increase in its production (Table 9.4). Pakistan recorded molasses export of 0.101 MT in 2017 as compared to 1.75 MT in 2000 (PSMA 2017).

Recognizing the advantages of employing molasses indigenously for various products rather than exporting it, Pakistan has imposed taxes on its export. As a result, domestic use of molasses in ethanol production has augmented in recent past. Ali et al. (2012) analyzed the ethanol production potential of Pakistan from molasses. Based on the ethanol recovery of around 240–270 l per ton of molasses, they projected that a total of two million tons of molasses (overall production at that time) could yield >0.6 MT of ethanol, which could be exported earning around $144 million. Pakistan’s current molasses production is 3 MT, which can hence yield around 0.9 MT of ethanol as per their projection.

5.2 Bagasse Production

Bagasse is a leftover after juice and sugar extraction during sugarcane milling. It is residual dry fiber, which can be utilized for producing another form of bioenergy, i.e., bioelectricity. Bagasse is approximately fourth part of the cane, composed of 50% cellulose, 25% hemicellulose, and 25% lignin (Rabelo et al. 2011). Sugar industry generally uses bagasse as a captive fuel for steam generation. Total calorific value of bagasse is around 2300 kcal kg−1 or 9731.984 kJ kg−1 (Arshad and Ahmed 2016; Sudhakar and Vijay 2013). High pressure boilers and special steam turbines are used by the sugar mills for electricity generation. By and large, one ton of bagasse produces 0.450 MWh of electricity (Arshad and Ahmed 2016).

Bagasse has huge potential for electricity generation. Bhattacharyya and Thang (2004) demonstrated that 3 kg of bagasse is needed for obtaining 1kWh of electricity through conventional technology. Moreover, Harijan et al. (2008) documented that 1 kWh electricity generation requires about 2 kg of bagasse. However, Purohit and Michaelowa (2007) illustrated that same amount of electricity can be produced only from 1.6 kg of bagasse.

Pakistan, a developing economy suffering from power crisis, is in urgent need of every possible route of adding power to the national grid. Electricity potential of bagasse in this regard is predicted to be around 1598–2894 GWh for the country (Arshad and Ahmed 2016). Sugar sector’s potential for bagasse production and electricity generation from the same has been discussed in coming sections.

5.3 Trash and Tops

Sugarcane trash can also be utilized for energy production since it is a source of lignocellulosic materials (Pereira et al. 2015). Pakistan’s sugarcane sector yields tons of trash every year which do not find appropriate applications. Cane trash and tops account for around 30% of the plant by weight, out of which 20% is shared by the tops. Although leaving trash in certain amounts is recommended for maintaining the land fertility, the quantity of trash available in fields is higher than what is required for this purpose. Hence, Pakistan can also employ the sugarcane leftovers for energy production (Aziz 2013). Keeping in view the current cane cultivation in Pakistan, the estimated available trash amounts to 7.548 MT. The projected thermal energy of this quantity of cane trash would be 50,572,940 GJ, which can offer a power potential of around 14,367 GWH per annum (Table 9.5).

6 Sugarcane Ethanol Production in Pakistan

Sugarcane is an excellent source of ethanol, which can be used as a transport fuel. Fuel ethanol is being produced in many of the cane-growing countries. Brazil, being a potential example in this regard, has extensively utilized sugarcane ethanol to fulfill its fuel demands. Ethanol can find applications as a stand-alone fuel or as a blend in gasoline in any ratio (Lisboa et al. 2011). For cane-producing countries like Pakistan, adoption of ethanol-blended fuel is a viable idea as it can help in decreasing the oil imports of the nation and provide environmental benefits.

Cane molasses is a cost-effective and abundantly available source of ethanol production. Industrial base for this feedstock already exists and is well-settled; however, the potential of molasses toward biofuel blending has remained untapped by now. Plentiful availability of molasses indicates that enhancing ethanol production in Pakistan will not affect the cultivation of other crops ensuring food security—the greatest concern against biofuels (Arifeen 2014).

Molasses’ percentage from the crushed cane is around 4%, whereas the ethanol yields are up to 270 l per ton of molasses. Hence, as per current production of 3.08 MT of molasses, 770 million liters (ML) of ethanol can be produced (Arshad 2010; PSMA 2017). Pakistan is already producing surplus sugarcane, and the sugar industry of the country is continuously carrying-over the stocks of previous years (PSMA 2017). As of 2012, ~24.5 MT of sugarcane were available in excess after fulfilling the local demands of sugar. Subjecting this excess crop to ethanol for ethanol blending instead could yield up to 274 ML of ethanol. Considering the gasoline demand of 1435 MT for the same year, ethanol could substitute around 19.1% of annual gasoline consumption (Tariq et al. 2014).

Twenty-one distilleries are operating in the country having a capacity of two million tons of molasses processing, which can yield up to 400,000 tons of ethanol every year (Table 9.6). This amount is far higher than ethanol’s current domestic applications, indicating that Pakistan does have surplus ethanol available for blending purposes (Ahmad et al. 2015; Arshad 2010). Arshad (2010) mentioned that Pakistan was producing 270,000 tons of ethanol per annum, in spite of its potential of around 400,000 tons year−1 in the mentioned year. Ahmad et al. (2015) reported the sum of ethanol demand of the country and exports to be around 80,200 tons, highlighting the possible availability of 318,000 tons of ethanol. Additionally, ethanol production in sugar mills also largely depends on the milling efficiency (fermentation, distillation, and dehydration processes). If milling efficiency of the sugar mills improves up to 47–48%, sugar industry may enhance ethanol production by 20–30% in Pakistan. On area basis, Eastwood (2011) suggested that 800 gallons of ethanol can be produced from one acre of sugarcane.

Ethanol can play three distinct roles in Pakistan. It can be used by domestic industries, can be exported abroad, and can be used for fuel blending. Pakistan’s ethanol has majorly been exported, and its role in fuel blending has not been exploited well. Pakistan exports un-denatured ethyl alcohol and ethyl alcohol spirit (Table 9.7). The country has been the second largest exporter of ethanol to EU, following only Brazil. Moreover, Pakistani ethanol has also been exported to United Kingdom, China, and United States (Arifeen 2014). Tariq et al. (2014) analyzed the ethanol production capacity of Pakistan’s sugar sector and projected that the country has potential to generate 274 ML of ethanol annually, without diverting the production of food products from cane crop.

Fuel grade ethanol needs to be ~99.8% pure. Molecular sieve technology can be employed for manufacturing fuel grade ethanol. In Pakistan, many of the sugar mills like Al-Abbas, Premier, Crescent, Habib, Colony, and Mehran have already installed their own distilleries. Moreover, eight distilleries have mounted the sieve technology for manufacturing fuel grade ethanol from the industrial alcohol (Khan et al. 2007). Unicol, a joint venture of three sugar mills, viz., Faran, Mehran, and Mirpur Khas sugar mills, has a capacity of producing 200,000 l of ethanol per day. This plant produces ethanol of up to 99.9% purity, apart from two other categories having >96%, and > 92% purity (Arifeen 2014).

Various ratios of ethanol can be implemented in Pakistan, keeping in view its production scenario. Tariq et al. (2014) designated E8 as the best possible blending rate for the country evaluating the ethanol production status of the country. The authors estimated that adopting this blend can reduce up to 0.5 MT of CO2 emissions by the year 2030. However, it has been seen that startling rise in sugarcane production in recent years already surpassed their projection for ethanol engenderment and Pakistan’s exports of ethanol rose up to 600 ML in 2017 (Fig. 9.5) (Agra-net 2018). At current production rate, Pakistan has potential to attain up to 10% blending of ethanol.

Projection of ethanol production potential of Pakistan. (Source: Tariq et al. 2014)

Rise in ethanol production—if used for fuel blending—can help in saving huge foreign exchange by reducing country’s petroleum import bills. Ethanol is a clean, low-carbon, and environmental-friendly fuel (Lisboa et al. 2011). Utilizing ethanol, or its blends in the energy sector, will not only benefit the country economically, but it will also contribute toward environmental commitments of the nation for reducing CO2 emissions. Ethanol works as an oxygenate in fuel blends. It has 37% oxygen by weight which augments the octane rating of the fuel, leading to complete combustion and reduction in environmentally hazardous emissions (Tariq et al. 2014). Also, first-generation ethanol production from sugarcane is cost-competitive as the conventional technology used for the purpose does not require expensive enzymatic pretreatments (Leal 2007). Furthermore, indigenous production of this fuel source will bring huge socioeconomic benefits to the local population by providing various direct and indirect jobs in cane production, sugar milling, and ethanol distillation.

For using ethanol in petroleum sector of the country, in 2006, Government of Pakistan directed the Pakistan State Oil (PSO) company to evaluate the performance of ethanol-blended fuel in selected cities. This was first attempt in the country for targeting biofuels adoption in future. After evaluation, PSO expanded its network of outlets providing E10 blends, and the marketing of blended fuel was also started in 2010. In order to promote adoption E10, economic incentives were also offered. However, till date, the venture did not progress majorly because of lack of coordination among involved stakeholders, improper planning and implementation, and no strict policies regarding blended fuels.

7 Sugarcane Bioenergy Production in Pakistan

Apart from being a source of ethanol-based biofuels, sugarcane sector can also provide bioelectricity. Cane bagasse, residual fiber collected after sugar extraction from sugarcane, can be employed for this purpose through cogeneration—the simultaneous production of heat and electricity (Naqvi et al. 2013; Kent 2010).

Sugarcane bagasse is widely employed for energy production in many countries such as Mauritius, Brazil, and India. Khoodaruth (2014) reported that sugarcane bagasse is contributing for 14% of electricity needs in Mauritius and its share is expected to increase up to 28% in recent future. Similarly, Ram and Banerjee (2003) illustrated that 3500 MW of electricity was being generated from sugarcane bagasse in India. Mbohwa (2003), and Mbohwa and Fukuda (2003) speculated that 210 MW can be obtained from bagasse cogeneration systems in Zimbabwe.

Bagasse has good potential for bioenergy production in Pakistan as country’s power shortfalls, diminishing reserves of natural resources, environmental pollution, and economic disquiet have induced interests into renewable, sustainable, and environment-friendly sources of energy. Pakistan’s total power generation capacity is 25,374 MW; 16,619 MW (65.50%) is shared by thermal sources, 7116 MW (28.04%) by hydroelectric, 787 MW (3.10%) by nuclear, and only 852 MW (3.36%) by renewable sources such as bagasse, wind, and solar (National Electric Power Regulatory Authority [NEPRA] 2016). The figures depict that bagasse has not been exploited to full capacity for energy production in the country.

Munir et al. (2004) reported that 11 kg of steam is needed to produce 1 kW of electricity and conservative boilers can generate 2.2 ton of steam from one ton of bagasse when 23 bars pressure is applied at 350 °C temperature. However, sophisticated modern pressure boilers can operate at 65 bar pressure with 510 °C temperature generating 2.40 tons of steam (Junqueira 2005). Hence, 1 kW of electricity can be cogenerated using only 5 kg of steam. A typical sugar mill processing 2000 tons of sugarcane has potential to generate 11 MW of electricity. Generally, requirements of such mills’ own uses would be around 2 MW, and therefore, the rest (9 MW) can be sold to the grid. Hence, if this unexplored resource is utilized in Pakistan, up to 3000 MW of electrical energy can be added to the system through existing technology (PSMA 2016).

Interestingly, this 2000–3000 MWh of electricity by the sugar mills would be provided during the crushing season, which ranges from November to March every year. Pakistan suffers from extreme blackouts in same months because of reduction in hydropower production (PSMA 2016). Moreover, adopting the cogeneration technology at mills, 3613 MWh of electricity can be obtained. Electricity generation potential of Pakistani sugar mills through existing and cogeneration technology, as estimated by Arshad and Ahmed (2016), has been presented in Tables 9.8 and 9.9.

Shakarganj Mills Limited (SML) installed the first biogas-based electricity generation plant of the country in 2008. Faisalabad Electric Supply Company signed an agreement with the facility in the same year for inclusion into national grid. Pakistan was suffering from serious energy shortfall of 5000 MW in the said period, and such plant could contribute toward betterment of the situation by fulfilling the needs of 50,000 houses in the area where the mill is located. The plant uses Jenbacher gas engine which employs the extort from spent wash, collected during ethanol production from molasses, as feedstock. The capacity of the plant is 8.512 MW, and it has potential to cause 20,000 tons of certified emission reductions. Therefore, this project has been registered with United Nations Framework Convention on Climate Change (UNFCCC) by the Carbon Services Pakistan (DAWN 2008).

In February 2008, Al-Moiz industries situated at Dera Ismail Khan signed a conformity for electricity generation to supply up to 15 MW to national grid. The length of the agreement was 10 years, and the tariff was set at PKR 4.88 kWh−1, together with bagasse fuel cost of PKR 3.62 kWh−1. Later, Shakarganj Energy (Pvt.) Limited also initiated a bagasse-based isolated generation company having capacity of 31.50 MW. As of 2016, seven sugar units are exporting their excess electricity to the national grid in Pakistan, while four are in process.

Sugar mills are producing energy for their own use since 1990s. A renewable energy policy was launched by Pakistan in 2006. A list of bagasse-based power projects under said renewable policy is presented in Table 9.10, while Table 9.11 presented an overview of bagasse-based captive power producers. Most of the units are making use of Steam Turbine technology, as evident from the said tables. Energy production from cane is increasing in the country over time. A rise of 63 MW has been observed within a year (in 2015–2016). The overall input into National Transmission and Dispatch Company’s system by the bagasse-based energy plants is 146 MW, summing their contribution to be 556 GWh (NEPRA 2016).

8 National Policies

Pakistan’s national policies, by now, have not focused much on adopting bioethanol or its blends. However, attempts have indeed been made to limited extent in the past.

In 2006, the Government of Pakistan initiated a pilot project by Alternate Energy Development Board (AEDB) for evaluating the use of E10 blend (10% ethanol +90% oil) in the country. The ethanol for the program was to be supplied by indigenous sources. Also, provincial governments were encouraged to enhance the blended fuel in the same year. The pilot project was launched in Islamabad by Pakistan State Oil (PSO), followed by opening of selected outlets in Karachi, and then Lahore. The program was conducted for half a year and 25 pre-identified vehicles using E10 blend were analyzed for performance (PSO 2006).

Pakistan Sugar Mills Association, in 2006, recommended that a 10% ethanol should be mandated through discussion with oil companies. They also suggested that substantial tax cuts should be offered for making operations for production of required quantities of ethanol possible, proposing the removal of GST as a major incentive in this regard. Later, in 2009, Economic Coordination Committee (ECC) permitted the E10 marketing on limited basis. The plan to manufacture E10-blended petrol was to be undertaken jointly by Ministry of Petroleum and Ministry of Industries and Production. ECC proposed that GST should be reduced, whereas petroleum levy should also be exempted. Later on, Petroleum Ministry proposed that PSO will initiate marketing E10 in 2010 in Karachi (Ali et al. 2012; PSO 2010).

In 2010, the E10 program was planned to be expanded to other cities including Rawalpindi, Sheikhupura, Gujranwala, Sialkot, Jhelum, and Mirpur Khas. The Oil and Gas Regulatory Authority (OGRA) fixed the price of E10 at PKR 62.61 per liter, which was less by PKR 2.5 per liter than the price of petrol at that time, to offer an economic incentive for promoting the blended fuel. Government also fixed 15% duty on export of molasses to encourage its domestic use in ethanol production, instead. Even the move to assess pure ethanol for public transport was under consideration. In 2010, PSO expanded the E10 availability at some outlets in Punjab province (Ali et al. 2012; PSO 2010).

In spite of significant efforts during 2006–2010, the policies did not remain consistent. Also, Pakistan aggressively initiated indigenous oil explorations. Investments in the petroleum sector were increased and several multinational companies are still conducting the oil reserves surveys in the country. Hence, till date, the E10 venture did not progress, majorly because of the lack of coordination among involved stakeholders and improper planning and implementation. On an optimistic side, renewable fuels projects are again being highlighted by the Government of Pakistan, and it can be hoped that role of renewable fuels, including cane ethanol, might increase in the coming years.

Pakistan has also suffered from extreme electricity crisis in the past decade and has explored various possible ways of energy extraction, including cane bagasse. J-tariff was launched by the government of Pakistan in 1990s for export of electricity from sugar industry to national grid on “as and when delivered” basis. However, only 4 MW of energy could be supplied. According to the tariff, sugar mills were supposed to bear the cost of interconnectivity, and in lieu of that, industry was allowed to adjust electricity consumption from the national grid. Some sugar mills acknowledged the tariff and connected their facilities with 11 kV grids. The tariff was set at PKR1.70 kWh−1 (for fuel cost only) and remained fixed for many years, leading to decline in interest of the sugar industry with the passage of time (Arshad and Ahmed 2016).

In 2002, new policy was formulated by the government which curtailed the industry benefits; as a result, electricity generation from sugar industry was reduced to very low level by 2007. The renewable policy of 2002 did not include biomass in its priorities of renewable energy sources. During the last 10 years, government has made many changes in the power generation policies, but no fruitful results were obtained (Mirjat et al. 2017). In 2007, the “National Policy for Power Co-Generation by Sugar Industry” was notified. In this policy, incentives were offered to the sugar industry to encourage mills to contribute toward power production. Purchase of power and payments for the same were guaranteed; moreover, tax cuts and concisions on import of technology were offered. Additionally, to address the investment issues, State Bank of Pakistan was requested to offer loans at lower interest rates of 6% for the renewable projects, instead of 12% (Khan 2018).

In 2012, a dynamic energy policy dealing with all sectors, i.e., bagasse, biomass, solar, and energy from waste, was introduced. The policy also introduced prominent financial and fiscal motivations to investors. Exceptional emphasis was put on the industries that could produce more than 50 MW of electricity. Moreover, prompt payment to energy producers was ensured. The said policy also encouraged independent power producer (IPP), which was adopted by many of the sugar mills. The tariff was linked with the natural gas prices, making it cost-effective for the industry. This policy also focused on development and initiation of the energy projects at a greater pace. Private Power and Infrastructure Board (PPIB) and NEPRA were directed to make decisions on such cases in a set time frame. Sugar mills, through this policy, were requested to complete the power projects within a period of 3 years, while NEPRA was advised to complete the feasibility report in a period of 1.5 months (Arshad and Ahmed 2016). NEPRA, in 2015, amended the upfront tariff approved in 2013, adjusting the new levelized tariff to PKR 10.7291 kWh−1 for bagasse-based cogeneration projects (NEPRA 2016, 2017).

Pakistan is still suffering from energy shortfall which becomes extreme in summers and when water reservoirs are low in winters. The winter period positions parallel to cane crushing season, suggesting that cane energy can help Pakistan tackle its blackouts when the hydropower production is low. Pakistan has still not explored the significant capacity of cane crop for adding energy to the grid, in spite of the fact that sugar industry’s potential role in power production is very promising. Upgradation of technology at the sugar mills and higher incentives for bagasse-based IPPs can indeed enhance the industry’s contribution toward energy sector of the country.

9 Advantages of Sugarcane-Based Fuels and Energy for Pakistan

The role of sugarcane sector in energy production is important for Pakistan for economic, social, and environmental reasons. As a source of biofuel, sugarcane-derived ethanol can significantly reduce country’s oil imports, which are one of major burdens on economy. Transport sector of the country is the biggest consumer of imported petroleum, accounting for more than 50% (Arifeen 2018). Adopting ethanol-blended fuel in the country can substantially reduce the import burden of the country as this ethanol will come from indigenous crop source. Current molasses capacity of the country can meet the requirements for E10 blending, which does not require any amendment in vehicles’ engines (Ali et al. 2012).

The energy demands of the country are expanding continuously, while the domestic reserves are limited. Sugar sector can help in overcoming the electricity shortage which has adversely affected the country for more than a decade. Power sector needs support from diverse sources so that uncertainty toward domestics use, business, and industrialization could be eliminated. Sugarcane sector has great potential for power generation, which can be enhanced even more by installing efficient power plants and high pressure boilers, replacing the conventional ones used currently (Valasai et al. 2017; Zuberi et al. 2013). Bagasse, a by-product of cane processing, can provide 3000 MW for national grid in current scenario (PSMA 2016).

Job creation is another important benefit Pakistan can achieve from adopting sugarcane biofuels and bioenergy. Being the second largest industry of the country, the sugar industry is spread across the country indicating that such jobs will be generated in rural and economically deprived areas of the state—giving this strategy a unique edge over oil imports for the purpose which does not provide socioeconomic opportunities. Such jobs will not only be created in mills and distilleries for skilled and non-skilled workers, but farmers and labor involved in cane production in the country will also benefit. Moreover, sugarcane production will return higher profits, enhancing the livelihood of rural communities involved in cane production (Arshad and Ahmed 2016).

Bagasse electricity production is also important because of the fact that it does not only limit the use of fossil fuels for power generation, but also reduces the impacts of sugar mills on environment by decreasing amounts of environmentally hazardous materials disposed of otherwise. Natural decay of bagasse generates methane gas, which impacts the ozone layer negatively (Janke et al. 2015). Pakistan is among the list of countries which are most vulnerable to the climate change. Hence, global, as well as internal, attempts to mitigate climate change are extremely important for the country (Khan et al. 2016). Furthermore, cane ethanol blending also cuts the carbon monoxide and hydrocarbons’ exhaust as an advantage toward environmental aspects (Goldemberg et al. 2008).

Air pollution in Pakistan is several times high as compared to the international recommended standards. The life cycle analysis of well to wheels for ethanol has shown that ethanol has least CO2 emissions among the transport fuels. Moreover, octane number of ethanol is 120, while, on the other hand, that of petrol is around 108.6, suggesting that ethanol blends can enhance the octane number of the fuel mitigating the use of hazardous substances like methyl tertiary butyl ether (MTBE). Therefore, adopting ethanol-based biofuels can help Pakistan limit greenhouse gases’ (GHG) emissions as well (Arshad 2010; Shahad et al. 2008).

10 Limitations and Challenges

In spite of being a huge importer of petroleum on one hand, and a substantial producer of cane ethanol on the other, no significant use of fuel blending highlights the shortcomings at policy level. Absence of mandatory blending requirements at national level has limited the use of ethanol in fuel sector. Consistent policies and strict implementation are necessary for launching and adoption of ethanol-blended fuel. Proper marketing to build trust in the drivers for new fuel type is another challenge. Moreover, such blends need also to be provided at lower costs, so that the consumers could prioritize opting for blended fuel (Ali et al. 2012).

Financial reasons have been the greatest hindrance for mills to progress toward cane fuel and energy production. Upgradation of technology at distilleries and mills’ boilers is necessary for Pakistan’s case to enhance the efficiency and production capacity of such projects. However, the payback period of these huge investments is long, making the investors reluctant to involve in such programs. Low profit loans must be provided to encourage investments in this sector.

Regarding power production, government and mills have differed on tariff issues as the mills demanded higher tariffs keeping in view the large investments required in upgrading their boilers. Duration for launching the project, fuel availability, technical hurdles, and necessity of using demineralized water put barrier toward this industry. Also, remote location of mills, although an advantage from certain aspects, necessitates infrastructure development in some cases. Costs of connecting with the grid lines also represses the export of surplus energy to the national grid (Arshad and Ahmed 2016).

Challenges exist at the level of cane farming as well. Per hectare yield of the country is low as compared to many of the other cane-growing countries. Being a perennial and water-loving crop, sugarcane requires intensive agronomic practices for obtaining high cane yield and sugar recovery. Unapproved varieties are being planted, while other factors like limited irrigation resources, lack of technology adoption, irregular use of fertilizers, and poor management practices also introduce issues at cane production level. (Buzacott 1965; Dunckelman and Legendre 1982; Haq et al. 1974).

11 Future Perspectives

In spite of increase in local production and imports of oil and liquefied natural gas, Pakistan does not have enough supplies of energy to meet its demands. Power breakdowns happen routinely, especially when water reservoirs are low; CNG for transport sectors is available only on limited days; and gas supplies for domestic consumption are also not enough to satisfy the requirements. Thus, Pakistan needs to explore new possible routes of energy extraction for meeting the supply and demand gaps, which is expected to enhance renewable sources’ (including sugarcane) role in energy matrix of the country.

Moreover, Pakistan is a signatory to various international environmental commitments and is one of the most actively involved countries of the world in mitigating climate change. Therefore, the country is anticipated to exploit renewable sources of energy for environmental reasons as well. Pakistan has recently completed Billion Trees Project in one of its provinces and is now on its way to planting 10 billion trees—showing the commitments of the nation to combat climate change (Constable 2018). Projects employing renewable energy in transport sector have already been planned for country’s largest and highly populated city, i.e., Karachi. Hence, it can be expected that the national priorities are set to increase the renewable fuels’ usage in the country.

Energy security and lower dependence on imported gasoline are other incentives ethanol fuels can offer. Having huge quantities of molasses available, and already well-set sugar industry, it can be estimated on an optimistic approach that ethanol may find applications for blending purposes in future. Ethanol blends can offer several advantages like reduction in air pollution and lower GHG emissions, complete burning of fuel, and the cuts in CO2 emissions. Moreover, ethanol blends in the country can provide higher economic returns to distilleries against its exports. Hence, it can become a priority fuel of the country in coming years (Arifeen 2014).

Several measures can be helpful in enhancing sugarcane’s role in bioenergy sector of Pakistan. Imposing higher taxes on molasses’ export, and removing the same on industrial alcohol for boosting its production, can help. Financial support toward power plants and distilleries is another essentiality. Moreover, blending mandates need to be launched for ensuring sustainability toward ethanol fuel production. PSO can play significant role in marketing and expanding blended fuel availability.

12 Conclusion

Ethanol’s role has remained limited in Pakistan’s energy matrix. Attempts to enhance its position as a fuel blend have not produced significant results because of lack of planning and implementation in this multi-stakeholders sector. Nevertheless, keeping in view the availability of molasses, current economic scenario of the country, and its commitment toward climatic and socioeconomic goals, it can be anticipated that sugarcane bioethanol may be emphasized again in upcoming polices. The scope of sugarcane-based cogeneration of bioelectricity also holds great potential to tackle the electricity deficit in Pakistan; however, this phenomenon also has remained largely underexploited. Changing national policies and the insecurity of the investors are major reasons in this regard. Some of the mills are already supplying the cogenerated electricity to national grid; however, many others may follow if better incentives and economic support are offered. Pakistan is suffering from energy shortage, and therefore, renewable sources like sugarcane can contribute significantly toward ethanol-blended fuels as well as cogenerated electricity for the country.

References

Agra-net (2018) Pakistan – Ethanol exports hit record high. https://www.agra-net.com/agra/world-ethanol-and-biofuels-report/biofuel-news/ethanol/pakistan%2D%2D-ethanol-exports-hit-record-high%2D%2D1.htm. Accessed 16 Jan 2019

Ahmad M, Jan HA, Sultana S, Zafar M, Ashraf MA, Ullah K (2015) Prospects for the production of biodiesel in Pakistan. In: Biofuels-status and perspective. InTech Open, London

Ali T, Huang J, Yang J (2012) An overview of biofuels sector of Pakistan: status and policies. Int J Econ Res 3:69–76

Almazan O, Gonzalez L, Galvez L (1999) The sugarcane, its by-products and co-products. In: Proceedings of the third annual meeting of Agricultural Scientists, Food and Agricultural Research Council. Réduit, 17-18 November 1999

Arifeen M (2014) Molasses production, exports on the rise. http://blog.pakistaneconomist.com/2018/03/22/molasses-production-exports-rise/. Accessed 6 Jan 2019

Arifeen M (2018) Review of oil and gas consumption last year. Pakistan Economist. http://www.pakistaneconomist.com/2018/08/06/review-of-oil-and-gas-consumption-last-year/. Accessed 17 Jan 2019

Arshad M (2010) Bioethanol: a sustainable and environment friendly solution for Pakistan. A Scientific J. COMSATS–Sci Vision(2010):16–17

Arshad M, Ahmed S (2016) Cogeneration through bagasse: a renewable strategy to meet the future energy needs. Renew Sust Energ Rev 54:732–737

Azam M, Khan M (2010) Significance of the sugarcane crops with special reference to NWFP. Sarhad J Agric 26:289–295

Aziz N (2013) Biomass energy potential in Pakistan. https://www.researchgate.net/publication/236268398_boimass_potential_in_Pakistan. Accessed 9 Jan 2019

Bhattacharyya SC, Thang DNQ (2004) Economic buy-back rates for electricity from cogeneration: case of sugar industry in Vietnam. Energy 29(7):1039–1051

British Petroleum Company plc (2018) BP statistical review of world energy. https://wwwbpcom/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review/bp-stats-review-2018-full-reportpdf Accessed 15 Nov 2018

Buzacott JH (1965) Cane varieties and breeding. In: Kim NJ, Mungomery RW, Hughes CG (eds) Manual of cane growing. Elsevier, New York, pp 220–253

Constable P (2018) Pakistan plans to plant 10 billion trees to combat decades of deforestation. Independent. https://www.independent.co.uk/news/world/asia/pakistan-trees-planting-billions-forests-deforestation-imran-khan-environment-khyber-pakhtunkhwa-a8584241.html. Accessed 13 Jan 2019

Das VG, Uqaili MA, Memon HR, Samoo SR, Mirjat NH, Harijan K (2017) Overcoming electricity crisis in Pakistan: a review of sustainable electricity options. Renew Sust Energ Rev 72:734–745

DAWN (2008) First sugarcane biogas plant in Pakistan. https://www.dawn.com/news/828663. Accessed 7 Jan 2019

Dunckelman PH, Legendre BL (1982) Guide to sugarcane breeding in the temperate zone. Agricultural reviews and manuals, ARM-S-United States Department of Agriculture, Science and Education Administration, Agricultural Research, Southern Region

Eastwood E (2011) Global warming: what else can you do about it? iUniverse Inc, Bloomington

FAOSTAT (2017) Sugarcane production in the world. http://www.fao.org/faostat/en/#data/QC/visualize. Accessed 5 Jan 2019

Goldemberg J, Coelho ST, Guardabassi P (2008) The sustainability of ethanol production from sugarcane. Energy Policy 36:2086–2097. https://doi.org/10.1016/j.enpol.2008.02.028

Naqvi SHA, Dahot MU, Khan MY, Xu JH, Rafiq M (2013) Usage of sugarcane bagasse as an energy source for the production of lipase by Aspergillus fumigatus. Pak J Bot 45(1):279–284

Haq MS, Rahman MM, Mia MM, Ahmed HU (1974) Disease resistance of some mutants induced by gamma rays. In: Induced mutations for disease resistance in crop plants. In: Proceedings of a research co-ordination meeting on induced mutations for disease resistance in crop plants. International Atomic Energy Agency, Vienna, p 150

Harijan K, Uqaili MA, Memon MD (2008) Potential of bagasse based cogeneration in Pakistan. In: Proceeding of world renewable energy congress-X, Glasgow, pp 19–25

Hussain A (2018) Country’s oil import bill surges by 30.43pc to $12.928bn. Pakistan today. https://profit.pakistantoday.com.pk/2018/06/20/countrys-oil-import-bill-surges-by-30-43pc-to-12-928bn/. Accessed 9 Jan 2019

Hussain A, Rahman M, Memon JA (2016) Forecasting electricity consumption in Pakistan: the way forward. Energy Policy 90:73–80

Janke L, Leite A, Nikolausz M, Schmidt T, Liebetrau J, Nelles M, Stinner W (2015) Biogas production from sugarcane waste: assessment on kinetic challenges for process designing. Int J Mol Sci 16:20685–20703

Junqueira M (2005) Carbon credits from cogeneration with bagasse. In: Bioenergy-realizing the potential. Elsevier, New York, pp 201–212

Kent GA (2010) Estimating bagasse production. In: Proceedings of the Conference of the Australian Society of Sugar Cane Technologists, Bundaberg, 11-14 May 2010, pp 546–558

Khan SZ (2018) Bagasse power cogeneration in Pakistan. https://wiki.uef.fi/display/BIOMAP/Sikander+Zaman+Khan%2C+Bagasse+Power+Cogeneration+in+Pakistan. Accessed 7 Jan 2019

Khan SR, Khan SA, Yusuf M (2007) Biofuels trade and sustainable development: the case of Pakistan. The Sustainable Development Policy Institute (SDPI), Working document.

Khan MA, Khan JA, Ali Z, Ahmad I, Ahmad MN (2016) The challenge of climate change and policy response in Pakistan. Environ Earth Sci 75:1–16. https://doi.org/10.1007/s12665-015-5127-7

Khan MT, Seema N, Khan IA, Yasmine S (2017a) Applications and potential of sugarcane as an energy crop. In: Agricultural research updates. Nova Science Publishers Inc., New York, pp 1–24

Khan MT, Seema N, Khan IA, Yasmine S (2017b) The green fuels: evaluation, perspectives, and potential of sugarcane as an energy source. Environ Res J 10(4):381–396

Khoodaruth A (2014) Optimization of a cogenerated energy systems: the cane biomass flexi-factory case study. Energy Proc 62:656–666

Leal MRLV (2007) The potential of sugarcane as an energy source. XXVI International Society of Sugarcane Technologists Congress 26:23–34

Lisboa CC, Butterbach-Bahl K, Mauder M, Kiese R (2011) Bioethanol production from sugarcane and emissions of greenhouse gases – known and unknowns. GCB Bioenergy 3:277–292. https://doi.org/10.1111/j.1757-1707.2011.01095.x

Matsuoka S, Bressiani J, Maccheroni W, Fouto I (2015) Sugarcane bioenergy. In: Sugarcane, pp 383–405. https://doi.org/10.1016/B978-0-12-802239-9.00018-9

Mbohwa C (2003) Bagasse energy cogeneration potential in the Zimbabwean sugar industry. Renew Energy 28:191–204

Mbohwa C, Fukuda S (2003) Electricity from bagasse in Zimbabwe. Biomass Bioenergy 25:197–207

Ministry of Finance (2015) Pakistan economic survey 2014–15. Islamabad. http://www.finance.gov.pk/survey/chapters_15/02_Agricultre.pdf. Accessed 10 Nov 2018

Ministry of Finance (2018) Pakistan economic survey. Islamabad. http://www.finance.gov.pk/survey/chapters_18/02-Agriculture.pdf. Accessed 10 Nov 2018

Mirjat NH, Uqaili MA, Harijan K, Valasai GD, Shaikh F, Waris M (2017) A review of energy and power planning and policies of Pakistan. Renew Sust Energ Rev 79:110–127

Munir A, Tahir AR, Sabir MS, Ejaz K (2004) Efficiency calculations of bagasse fired boiler on the basis of flue gases temperature and total heat values of steam. Pak J Life Soc Sci 2(1):36–39

National Electric Power Regulatory Authority (2016) State of industry report 2016. https://www.nepra.org.pk/Publications/State%20of%20Industry%20Reports/NEPRA%20State%20of%20Industry%20Report%202016.pdf. Accessed 10 Nov 2018

National Electric Power Regulatory Authority (2017) Annual report 2016–17. https://www.nepra.org.pk/Publications/Annual%20Reports/Annual%20report%202016-2017.pdf. Accessed 10 Nov 2018

Pakistan Bureau of Statistics (2017) Area and production of important crops. Islamabad

Pakistan State Oil (2006) PSO launches ‘E10 Gasoline’ in Lahore. https://psopk.com/en/media-center/press-releases/news-details?newsId=29. Accessed 7 Jan 2019

Pakistan State Oil (2010) PSO Launches E-10 Fuel in Punjab. https://psopk.com/en/media-center/press-releases/news-details?newsId=150. Accessed 17 Jan 2019

Pakistan Sugar Mills Association (2016) Annual report. Islamabad. http://www.psmacentre.com/documents/annual-report-2016.pdf. Accessed 17 Jan 2019

Pakistan Sugar Mills Association (2017) Annual report. Islamabad. http://www.psmacentre.com/documents/Annual%20Report%202017.pdf. Accessed 17 Jan 2019

Pakistan Sugar Mills Association (2018) Annual report. Islamabad. http://www.psmacentre.com/documents/PSMA%20Annual%20Report%202018.pdf. Accessed 10 Jun 2019

Pereira S, Maehara L, Machado C, Farinas C (2015) 2G ethanol from the whole sugarcane lignocellulosic biomass. Biotechnol Biofuels 8:44. https://doi.org/10.1186/s13068-015-0224-0

Punjab Agriculture Marketing Information Service (2017) Province wise average yield of sugarcane. http://www.amis.pk/Agristatistics/Data/HTMLFinal/Sugarcane/Yeild.html. Accessed 5 Jan 2019

Purohit P, Michaelowa A (2007) CDM potential of bagasse cogeneration in India. Energy Policy 35(10):4779–4798

Rabelo SC, Carrere H, Maciel Filho R, Costa AC (2011) Production of bioethanol, methane and heat from sugarcane bagasse in a biorefinery concept. Bioresour Technol 102:7887–7895. https://doi.org/10.1016/j.biortech.2011.05.081

Ram JR, Banerjee R (2003) Energy and cogeneration targeting for a sugar factory. Appl Therm Eng 23(12):1567–1575

Shahad HAK, Al-Baghdadi MARS, Abdol-Hamid HR (2008) Ethanol as an octane enhancer for the commercial gasoline fuels. Iraqi J Mech Mater Eng 8:96–109

Sudhakar J, Vijay P (2013) Control of moisture content in bagasse by using bagasse dryer. Int J Eng Trends Technol 4(5):1331–1333

Tariq MA, Zuberi MJS, Baker D (2014) Ethanol production and fuel substitution in Pakistan promoting sustainable transportation and mitigating climate change. 13th International Conference on Clean Energy, ICCE14

Zuberi MJS, Hasany SZ, Tariq MA, Fahrioglu M (2013) Assessment of biomass energy resources potential in Pakistan for power generation. In: Power engineering, energy and electrical drives (POWERENG), 4th international conference on power engineering, energy and electrical drives, Istanbul, pp 1301–1306

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Khan, M.T., Khan, I.A., Yasmeen, S., Nizamani, G.S., Afghan, S. (2019). Sugarcane Biofuels and Bioenergy Production in Pakistan: Current Scenario, Potential, and Future Avenues. In: Khan, M., Khan, I. (eds) Sugarcane Biofuels. Springer, Cham. https://doi.org/10.1007/978-3-030-18597-8_9

Download citation

DOI: https://doi.org/10.1007/978-3-030-18597-8_9

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-18596-1

Online ISBN: 978-3-030-18597-8

eBook Packages: Biomedical and Life SciencesBiomedical and Life Sciences (R0)