Abstract

Background: Cryptocurrencies are highly valued without understanding the health of the underlying ecosystems. Previous work shows factors which determinate the exchange rate. However, the technological determinants show decreasing significance. Objective: This paper explores whether the Open-source Software Ecosystem Health Operationalization (OSEHO) framework can be used to extend the given technology factors. Method: By conducting the OSEHO in a case-study on three distinct cryptocurrency ecosystems, this paper gives a better insight in the ecosystem’s value, longevity and propensity for growth and the relation of these factors to the cryptocurrency value. Results: The ‘healthiest’ cryptocurrency ecosystem also shows the highest economic health. Two metrics from the OSEHO show strong positive significant correlation with the exchange rate. Conclusion: Metrics from the OSEHO show promising indications to be technological determinants for the exchange rate. This research can be used as a foundation for further econometric tests or research on other aspects of cryptocurrencies.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Cryptocurrencies have attracted significant attention in recent years [1]. These cryptocurrencies are based on blockchain technology, wherein a blockchain is essentially “a public ledger with potential as a worldwide, decentralized record for the registration, inventory and transfer of all assets” [2]. The reason these blockchain technologies are so popular is because its central attributes provide security, anonymity, and data integrity [3], while building on computer cryptology and a decentralized or peer-to-peer network. Therefore, no centralized institutes are necessary to ensure trust among the users. Using blockchain technology for financial transactions, as cryptocurrencies do, is merely one of the possible applications, as the blockchain technology may be used for the transfer of all possible assets, as is stated by Swan [2].

There is research on the exchange rate and value of cryptocurrencies, such as the work of Li and Wang [1], but there is little research on the health of the technology behind the cryptocurrencies. Li and Wang propose technical factors that determinate the exchange rate. However, these factors show decreasing significance as the technology becomes more mature. This paper proposes the health of the cryptocurrency ecosystems as a new technological factor for determining the exchange rate.

In order to assess the health of cryptocurrency technologies, this paper approaches the cryptocurrencies from a software ecosystem point of view, wherein a software ecosystem is defined by Jansen [4] as “a set of actors functioning as a unit and interacting with a shared market for software and services, together with the relationships among them. These relationships are frequently underpinned by a common technological platform or market and operate through the exchange of information, resources and artifacts”.

Looking at cryptocurrencies as software ecosystems, it is possible to use a measurement framework to assess the health of cryptocurrency ecosystems. The Open Source Ecosystem Health Operationalization framework (OSEHO) by Jansen [5] can be used to establish the health of software ecosystems. This makes it possible to compare the cryptocurrency ecosystems health, based on a framework, with the currency exchange rate. There are signs of field maturity identified by the increase in published journal articles and the number of existing ecosystems studies.

The increase in published journal articles and the number of existing ecosystem studies are signs of growing field maturity. However, the tools specific for software ecosystems may still need further research to be generalised, as Manikas identified [6].

Therefore, the contribution of this paper is twofold. Firstly, the application of the OSEHO on the cryptocurrency software ecosystems helps generalising the framework. Secondly, this paper explores another use of the OSEHO by examining the metrics in the framework for possible indicators for extending the model by Li and Wang [1]. This leads to the following research question:

-

Research question : What are the possibilities of using the health of cryptocurrency software ecosystems as an influencing factor on the exchange rate of cryptocurrencies?

This research question will be answered based on a case-study of the three highest-valued distinct cryptocurrencies, where value is expressed in market capitalisation [7]. These are Bitcoin, Ethereum and Ripple at the time of writing. The basis for this choice is two-fold: on the one hand, the choice has been made to focus on distinct coins, rather than hard forks or multiple coins built on the same blockchain, and on the other hand the choice has been made to focus on coins for which most information is available.

Bitcoin (BTC) is the oldest of the three cryptocurrencies, being launched in 2007, and in fact the first actual application of blockchain technology as a means of a decentralised, electronic cash system [2]. Ethereum is the newest of these blockchains, which launched in 2015. Aside from the currency, the Ether (ETH), this ecosystem offers a vast range of possibilities in the form of smart contracts and as a decentralised application platform [8]. The last cryptocurrency considered in this study, Ripple (XRP), was launched in 2012 by Ripple Labs, a for-profit enterprise and offers a faster and more robust transaction protocol than other cryptocurrencies [7, 9].

The work in this paper is continued in the next section with a literature review. Section 3 describes the research methodology, such as the data collection methods. In Sects. 4 and 5 the results are presented and analysed. Subsequently, the limitations of the study are discussed in Sect. 6. Finally, the conclusion on the application of the ecosystem health of cryptocurrency ecosystems as a technological factor in the framework by Li and Wang is made in Sect. 7.

2 Related Works

This section describes the context of this research from three perspectives, starting with an introduction of the blockchain technology, after which the cryptocurrencies, as part of the blockchain, and software ecosystems are elaborated upon.

2.1 Blockchain

Swan [2] puts the blockchain in the computing paradigm as the fifth disruptive paradigm since the mainframe in the 1970s. Yli-Huumo [3] states that the blockchain is a decentralized or peer-to-peer environment for transactions, where all the transactions are recorded to a public ledger, visible to everyone. The goal of the blockchain is to provide anonymity, security, privacy, and transparency to all its users.

This is possible because the public ledger cannot be modified or deleted after the data is approved by all nodes [3]. This strong point, data integrity, is the reason why it is the fifth disruptive computer paradigm [2]. Next to this strong point, Swan [2] also defines technical challenges for the adaption of blockchain, these are: (1) Throughput, (2) Latency, (3) Size and bandwidth, (4) Security, (5) Wasted resources, (6) Usability, and (7) Versioning, hard forks, and multiple chains.

2.2 Cryptocurrencies

Cryptocurrencies are digital assets, secured on a blockchain by cryptography. Most of the cryptocurrencies to date are created by private individuals, organisations, or firms [7]. Bitcoin for example relies on two fundamental technologies from cryptography, as explained by Böhme et al. [10]. These two are public-private key cryptography to store and spend money, and cryptography validation of transactions.

Cryptocurrencies are no traditional fiat currencies, whose value is determined by law, but they operate resembling a free market system [11]. White [7] shows that the value of cryptocurrencies can be expressed in a market cap (price per unit multiplied by number of units outstanding). Since the cryptocurrencies are no traditional fiat currencies, a curiosity derived on which determinants define the value of the cryptocurrencies. Related works show determinants for the Bitcoin exchange rates (which is the price per unit), most of them are summarised in the work by Li and Wang [1] as shown in Table 1. The economic factors are researched and determined in previous works that are elaborated by Li and Wang [1]. They also show that these economic factors have a significant impact in determining the exchange rate.

The technology factors as determinants are based on the work of Kristoufek [12, 13], and Garcia et al. [14]. The public recognition is proved to be a significant factor for determining the exchange rate by Kristoufek [12]. The other technological factors however show that their impact diminishes over time [1]. This leaves a gap in the research field on which technological factors influence the exchange rate of cryptocurrencies and may therefore be used to replace the mining technology and-difficulty in a more mature ecosystem. Li and Wang also state that there is room for extension in this model, in terms of other determinants.

2.3 Software Ecosystem Health

Software ecosystems, or at least its concept first appeared in the book by Messerschmitt and Szyperski [15] in 2003. Since then, and especially since 2007, the area has been gaining popularity in the research field by rapidly evolving both in volume and empirical focus [6, 16].

A specific theory on software ecosystems is its health, one of the first definitions of software ecosystem health is given by Lucassen et al. [17] being: “longevity and a propensity for growth”. This definition is derived from the work of den Hartigh [18], covering the health of business ecosystems. In the work of den Hartigh, three determinants of ecosystem health from Iansiti and Levien [19] are defined as:

-

Robustness, the capability of an ecosystem to face and survive disruptions.

-

Productivity, the efficiency with which an ecosystem converts inputs into outputs.

-

Niche creation, the capacity to create meaningful diversity and thereby novel capabilities.

The OSEHO by Jansen [5] operationalises the three determinants for software ecosystems. Apart from the three pillars being the determinants Jansen added two layers in the OSEHO, the network level and project level. The network level operationalises the determinants for the ecosystem domain whereas the project level covers the analysis of projects within the software ecosystem. When using the OSEHO, it is important to first set goals about what you want to accomplish with the health measurement. After a goal is set, one can start with selecting the scope and metrics. When these are selected, there follows an assessment on whether there is sufficient data available. If this is the case, the data collection can start. The last, but certainly not the least part is analysing the data and satisfy the goals set in the first place [5].

Previous studies on e-commerce ecosystems [20], content management systems [21] and an open source framework [22] assessed these ecosystems with the OSEHO framework. More applications of OSEHO are needed to generalise the framework, which would fill a gap in the field of software ecosystems as identified by Manikas [6].

3 Research Method

The goal of this research is to find out if the health of a cryptocurrency ecosystem influences the exchange rate of the cryptocurrency. Therefore, this study hypothesises that there are metrics in the OSEHO framework that show significant relations with the exchange rate. To be able to check this hypothesis, two sub questions are drawn up:

-

RQ1.1: How can the OSEHO framework be used to assess the health of the cryptocurrency ecosystem?

-

RQ1.2 : Which metrics in the OSEHO framework show signs that they are related with the exchange rate?

Cryptocurrencies are relatively young and exist since 2007. The research field is still nascent and therefore the focus of this study is explorative [2]. To accomplish the research goal, a case study approach has been chosen, where a number of cryptocurrencies have been chosen for which data will be collected. The collected data will be used to fill in the OSEHO framework.

The case study consists of five steps to be able to answer the research questions. Step one to four are needed to answer sub question one and step five is needed to answer sub question two.

Step one is to select the scope of the study, in this case three ecosystems in the shape of cryptocurrencies: Bitcoin, Ethereum, and Ripple. Step two is to select metrics from the OSEHO framework to measure the health of the cryptocurrency ecosystems. Step three is the gathering of data where whenever possible the data consists of a number of data points over time. This is necessary to see if that metric influences the exchange rate. Step four is filling in the data in the OSEHO framework and analysing it. The last step, step five, is to see if the metrics over time are influencing the exchange rate. In this step the metrics over time are set against the exchange rate to see if there is any relation between them. To test this relation a statistical analysis is performed.

3.1 Ecosystem Health Metrics

The metrics are split in three categories: Productivity, Robustness and Niche creation, as shown in Table 2. Not all metrics in the OSEHO framework were used for this study. Instead a selection has been made based on the relevance of the metrics of this topic the availability of data, and previous research.

The first metric that will be collected is the number of new projects (1) for each cryptocurrency. This will tell how many related GitHub projects, such as plug-ins or wallets are released from January 1st, 2017 till December 15th, 2017. This number contribute to the productivity of the ecosystem. The second metric collected is the added knowledge (2). When developers can ask questions on knowledge bases (e.g. Stack Overflow), the ecosystem will benefit from it by the fact that there is a community within an ecosystem where people help each other with questions regarding the development [23]. This metric is measured by collecting the number of questions with the tag of the cryptocurrency attached. Apart from StackOverflow, both Bitcoin and Ethereum have a distinct stack exchange where questions can be asked. The number of questions from these exchanges are also measured. Another metric to measure the productivity from developers within an ecosystem is the lines of code over time (3) [17]. The number of lines of code added over time tells something about how productive the development of an ecosystem is. The spinoffs and forks (4), number of tickets (5) and number of patents (6) are also measured to compare the productivity of developers within an ecosystem.

To measure the robustness of an ecosystem other metrics are used. First the cohesion (7) of the ecosystem is measured by collecting the number of distinct APIs for the ecosystem [24]. APIs make it possible to connect software within or even outside an ecosystem, which enables better communication between clients and the ecosystem. Another metric that can be used to measure the robustness of an ecosystem is the number of active developers (8). The number of active developers shows how dependent an ecosystem is on individual developers. A higher number of active developers shows that the ecosystem is relatively more robust. An active developer is defined as a developer who has committed one or more lines of code to the respective cryptocurrency repositories within the last year. The second metric for robustness is the number of users of an ecosystem (9). This metric shows how many users were actively trading the cryptocurrencies in the last year. The number of transactions (10) is measured over time to see if the ecosystem still grows. The last metric for robustness is the search statistics (11). This metric shows which ecosystem was the most popular search term on Google and which ecosystem has the most interest over time. Van Lingen et al. [21] defines the findability on Google an indicator of ecosystem health, but only if the ecosystems are compared with each other. This data cannot be used to compare with the exchange rate, because this data is relative, but it can be used to compare the cryptocurrencies among themselves.

For the niche creation, the variety in the ecosystem is important to capture. This study uses two metrics which are derived from Lucassen et al. [17]. The first metric is the variety in development technologies (12), which shows how many different programming languages are used to develop the software in the repository. The second metric is the variety in projects (13). This is measured to compare how many projects are building upon the technology and thus extending the ecosystems. To measure variety, wallets are excluded as niche-projects, because wallets are focused on the main purpose of the ecosystem, which is the cryptocurrency, whereas for example the blockchain- and smart-contract applications provide a better insight in the niche-creation within an ecosystem.

3.2 Data Collection

The data was collected through different sources on December 15th, 2017. Data collected from GitHub was retrieved with GHTorrent [25] and gitstatsFootnote 1. The GHTorrent project is created by a research group of the TU Delft. It provides a MySQL database which can retrieve information by entering queries using the DBLite web-based client. For every new project using one of the cryptocurrencies the name and creation date is retrieved. Because GHTorrent is an archive, not all data is up to date on the repository level. Therefore, another tool is used to inspect the repositories itself. Gitstats1 is used to gather specific information within a repository, for example the number of contributors and lines of codes added over time. This application is written in Python and produces a JSON file. For Bitcoin and Ripple the core application was used. For Ethereum there are five different implementations of the blockchain, out of which Go-Ethereum was the most-popular and only actively-supported repository at the time of writing. Therefore, the information about Ethereum is collected solely from this repository, to prevent duplicity in the data set.

The data from the website Stack Overflow was gathered by using the data dump which is released every month. This dataset can be searched using SQL queries.

The number of patents is retrieved for each cryptocurrency from the Google patent database. For the data directly related to the cryptocurrency itself (e.g. value, number of transactions) a dataset from Kaggle is used which retrieved the data from several sources, for example different coin exchanges. Kaggle is a website where datasets are published. The last method used for retrieving data is collecting search statistics. To measure this, a Google trend analysis is executed to retrieve the number of times there has been searched for a certain cryptocurrency. This data is relative instead of absolute and therefore no hard conclusions can be drawn from this metric. A summary of the metrics per category and the corresponding sources can be found in Table 2.

4 Results

The results from the data collection are presented in this chapter. Each subsection elaborates on the different parts of the OSEHO framework being productivity, robustness and niche creation.

4.1 Productivity

The first six metrics used from the OSEHO as listed in Table 2 account for the productivity. The data about the productivity metrics is presented in Table 3. The first thing that draws attention are the missing metrics on Ripple. It became clear when mining the data, that there are numerous other applications with a naming that contains ‘Ripple’, other than the cryptocurrency. The search results for XRP were not complete and would give distorted results, for the search terms for the other metrics were complete. Therefore, to prevent incorrect data and/or data pollution, this study does not include the data for Ripple for these metrics.

Since 01/01/2017, cumulatively 5499 new projects were added on GitHub where ‘Bitcoin’ was mentioned, respectively 345 for Ethereum. The added projects are shown in Fig. 1, which clearly shows a strong increase in the new projects added for Bitcoin near the end of 2017.

The added knowledge came from mining Stack Overflow, where there were 1117 questions asked about Bitcoin and 721 for Ethereum on Stack Overflow. Bitcoin and Ethereum are having an own stack exchange where questions can be asked. On these exchanges Bitcoin has 17,470 questions and Ethereum has 12,496 questions on their stack exchange. The lines of code added over time derived from mining the repositories of the cryptocurrencies in GitHub. The data on the lines of code is available since GitHub started to document the data about lines of code or since the opening of the repository in GitHub. For Bitcoin, this was on the 28th of April 2013, Ethereum on the 7th of August 2015 and Ripple on the 5th of August 2013. The number in the table represents the total lines of code on the date of data collection, where Ripple has the highest number of 1,142,042 lines, followed by Ethereum with 779,818 lines and finally Bitcoin with 420,121 lines. From the same repositories, the number of forks and tickets were collected. With the number of forks being 12,646 for Bitcoin, 3100 for Ethereum, and 518 for Ripple. Bitcoin also shows the highest number of tickets with 3535, followed by Ethereum with 2771, and Ripple with 299. The patents that were published on Google for the cryptocurrencies were collected, where Ethereum has more published patents than Bitcoin, having 741 against 569 patents.

4.2 Robustness

The level of robustness on the cryptocurrencies are measured with the five metrics as described in Sect. 3. The results of the data collection for these metrics are presented in Table 3. This time, the lack of data for Ripple was caused by data scarcity. Where Kaggle had data sets on Bitcoin and Ethereum, there were no data sets available with information on these metrics for Ripple. ProgrammableWeb provided the data for the cohesion metric, where the number of APIs defined the cohesion. Bitcoin had 353 APIs, where Ethereum had 7 and Ripple 3.

Active developers were collected from GitHub repositories, where anyone who contributed in the year 2017 was considered an active developer. Again, Bitcoin takes the lead with 147 active developers, Ethereum follows with 133, and finally Ripple has 20 active developers. The active developers over time provides a slightly different view, as Fig. 4 shows that the number of active developers per month for Bitcoin is significantly higher, although Ethereum does show an upward trend in 2017.

Because of data scarcity, it was not possible to collect either the unique daily or the number of total unique users for the three cryptocurrencies. For Ethereum the total number of unique users came down to 10,557,839 where Bitcoin showed 714,349 unique daily users. Thus, the number of new unique users may be derived from the Ethereum data, but this does not compare to the daily unique users of Bitcoin. For Ripple, this information was not readily available.

The number of transactions is the total number of transactions on the blockchain at the time of data collection, being 269,460,981 for Bitcoin and 78,973,725 for Ethereum.

Bitcoin was searched the most, followed by Ethereum and Ripple. These relative statistics can be quantified as shown in the works of Kristoufek [12]. Although possible, this is not necessary for the comparative nature of this study and therefore left out of scope.

4.3 Niche Creation

This subsection elaborates on the results from the data collection on the niche creation of the cryptocurrencies, the last two metrics, variety in development technologies and projects are presented in Table 3. For niche creation, both metrics were available for Ripple as well. The development technologies were defined as the different programming languages in the GitHub repositories. Ripple shows the highest number with 98 languages, where Bitcoin is second with 58, and Ethereum last with 52.

The variety in projects derived from search results in GitHub. When searching for the wallets of the cryptocurrencies, Bitcoin showed the highest number of results, however, this is not the point of interest for niche creation. Therefore, this metric shows the sum of search results containing either ‘blockchain’ or ‘smart contract’ and excluding the term ‘wallet’. Ethereum came up on top with 1170 results, out of which a big part, 518 projects, mentioned smart contracts. Bitcoin came second, with 466 results, out of which 12 contained a smart contract tag, and Ripple came last, with 2 blockchain projects.

5 Analysis

In this chapter, the results from the data collection are analysed. This is divided in two subsections; the first subsection is dedicated to analysing the metrics from the OSEHO framework. From this analysis, a comparison between the cryptocurrencies and their ecosystem health is made. The second subsection explores the metrics with values over time and the correlation of these with the USD exchange rate in order to see if these may be used as an extension on the model of Li and Wang [1].

5.1 Health Comparison

Looking at valuation of the cryptocurrencies at December 14th, 2017 as shown in Table 4, one would say that Bitcoin, next to being the oldest ecosystem, is financially the most successful cryptocurrency at that time. This is in line with the OSEHO framework, where Bitcoin appears to be the healthiest ecosystem, as it shows the best results for 8 out of the 13 metrics. When looking at this in the 3 different levels of the OSEHO framework, Bitcoin has the highest productivity and robustness, but not the highest niche creation. Therefore, this subsection elaborates on the metrics where Bitcoin does not show the highest value and on the metrics with noteworthy findings which arose during the data collection.

The metrics where Bitcoin did not show the highest value are: (1) Lines of code added over time, (2) Number of patents, (3) Variety in development technologies, and (4) Variety in projects.

Ripple had the most lines of code over time. An explanation for this can be that Ripple is a protocol, which is slightly different from blockchains such as Bitcoin and Ethereum. Ethereum has more lines of code than Bitcoin, probably since the blockchain of Ethereum is more comprehensive: Ethereum example allows the use of smart contracts whereas Bitcoin does not. For both Ripple and Bitcoin, the lines of code increase gradually over time, whereas Ethereum sees a major drop in the lines of code of over 2.5 million lines of code, caused by a major clean-up on July 12th, 2017.

The highest number of patents is claimed by Ethereum with 741 patents, Bitcoin shows 569 patents. This indicates that the technology of the Ethereum blockchain shows more promising applications than that of the Bitcoin. On this point, the Ethereum software ecosystem scores better than the Bitcoin software ecosystem, in terms of new technologies and blockchain applications.

For the variety in development technologies, Ripple shows the highest number of development languages. However, the data collection for Ethereum only took place on Go-Ethereum, where other repositories for Ethereum are written in other languages. Therefore, it is hard to conclude that Ripple supports the most languages, as Ethereum might exceed them. One thing is clear though, which is that Bitcoin is built upon the least variety in development technologies. This shows that the interest in the Bitcoin core from the developers’ perspective is narrow compared to the other ecosystems.

For the variety in projects, Ethereum has the most variety in projects (1170) followed by Bitcoin (466). When looking at the number of new projects Bitcoin has the most, 5499, followed by Ethereum with 345. This can be explained by the fact that Bitcoin is popular and a lot of people copy the repository of Bitcoin to their own repository. However, to develop applications Ethereum is the most popular blockchain technology, showing a higher variety in the projects produced. This is in line with the number of patents, both show that Ethereum is a promising software ecosystem.

Another noteworthy metric is the added knowledge. Bitcoin and Ethereum both have their own Stack exchange for sharing knowledge, for which the results are given in the table as well. Here should be mentioned that this does not mean that the Stackexchange only contains questions regarding the respective cryptocurrency. In fact, both contain questions regarding the ‘other’ cryptocurrency and in the case of Bitcoin an even higher number of other cryptocurrencies, and on StackOverflow numerous questions also contain both tags.

5.2 Exploring Indicators

The ecosystem health metrics which were captured over time are the number of new projects (1), the lines of code added over time (3), the number of active developers (8) and the number of transactions (10). The number of active users has been found, but given the different numbers obtained for this metric, the metric has been left out of the research.

To find correlations between the metrics available over time and the exchange rate, a Pearson’s product-moment correlation test was conducted. The results from the correlation tests is shown in Table 5.

The correlation tests show interesting results. The only metric that shows no significant correlation with the exchange rate is the number of active developers on Bitcoin. The number of transactions is also a determinant from the model by Li and Wang [1], the strong, positive, and significant correlations shown in Table 5 confirm their findings.

The lines of code also show significant correlations with the exchange rate on all cryptocurrencies. Unfortunately, Ethereum shows a negative correlation, this can be explained by the enormous drop in the lines of code due to a major clean-up on July 12th, 2017. Possibly the difference in lines of code, rather than the actual lines of code, is correlated to the exchange rate. A metric that is significantly positive for Bitcoin as well as for Ethereum is the number of new projects, showing potential as an indicator for the exchange rate. The number of active developers however shows mixed results for the different cryptocurrencies, possibly because the number of active developers does not show a lot of variation over time.

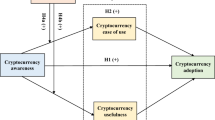

Figure 2 visualises the possible future determinants for the exchange rate of cryptocurrencies. Mining difficulty is becoming less significant and is therefore left out as determining factor. There was no positive correlation found in the metric active developers, therefore that one is also left out as a determinant.

6 Discussion

Every research has limitations, this one is not an exception. The first limitation is the fact that this study only focuses on one Ethereum implementation, and therefore only mined the data from the most popular and most used repository of Ethereum, while there are other Ethereum repositories on hand. Bitcoin and Ripple only have one implementation, and therefore do not have this problem. When comparing Ripple with the other two cryptocurrencies it stands out that it is different. Ripple is more of a platform with value instead of a cryptocurrency. The ecosystems are not around that long, especially Ethereum, and not only are the software ecosystems not yet mature, the markets of the corresponding cryptocurrencies are also highly volatile.

This research shows some interesting results. However, to draw conclusions on whether the metrics from the OSEHO can actually extend the model by Li and Wang [1], more econometrical tests are needed. The statistical tests used in Subsect. 5.2 showed significance but are not strong enough to conclude that the changes in the price are caused by the metric, for example since it doesn’t keep time series in mind. This leaves possibilities in future research, where this research can be used as a foundation so that future research doesn’t have to start from scratch.

This is the first suggestion for future research, which would be using our data set and the results from this study and perform a more fitting statistical analysis to draw conclusion on extending the model by Li and Wang [1]. The second suggestion is to extend the research on the health of the cryptocurrency ecosystems. This extension could be twofold, one where more sorts of cryptocurrencies are considered, and one where more metrics of the OSEHO are mined over time. For example, the patents and the variety in projects are interesting metrics but currently not mined over time, and these might prove to be interesting technical determinants as well. The extension of the research on the health of the cryptocurrency ecosystems could result in a cryptocurrency ecosystem health operationalization. Which could consist of metrics from both the OSEHO and cryptocurrency literature. To make sure future research does not have to start from scratch. The dataset used for this research is made publicFootnote 2.

7 Conclusion

This exploratory research provides an application of the OSEHO framework on the software ecosystems of three cryptocurrencies, answering the following research question: What are the possibilities of using the health of cryptocurrency software ecosystems as an influencing factor on the exchange rate of cryptocurrencies?

Three case studies, where data was mined from different sources showed that Bitcoin has the healthiest software ecosystem at the time of data collection. Some other interesting findings were that Ethereum shows a potential for growth in its productivity and niche creation, even outweighing Bitcoin on some metrics in the OSEHO framework.

With the metrics from the OSEHO correlation tests were performed to see if there are signs that these metrics have significant relations with the exchange rate of the cryptocurrencies. This would indicate that they are possible extensions on the model by Li and Wang [1]. The results show at least two potential metrics, being number of new projects and lines of code. However, stronger econometric statistical tests are needed to confirm this and to be able to predict exchange rates. Nevertheless, this research extended the model by Li and Wang with two possible determinants and verified parts of the model on other cryptocurrencies. The OSEHO framework showed to be a useful tool to not only measure the health of software ecosystems, but also to provide a foundation of quantitative data for statistical tests.

This research contributes to science by further adopting the OSEHO framework, by not only using it for health measurement, but also for further investigation on characteristics of software ecosystems. The second contribution is a verification and extension on the model by Li and Wang [1]. Indication show that metrics from the OSEHO framework can be used to extend the model. The third contribution is filling a gap in a nascent field of cryptocurrencies, by performing case studies on the three cryptocurrencies. The findings in this research can be used as a foundation for further scientific research on cryptocurrencies as a whole or by diving deeper in the determinants for the exchange rate of cryptocurrencies.

References

Li, X., Wang, C.A.: The technology and economic determinants of cryptocurrency exchange rates: the case of Bitcoin. Decis. Support Syst. 95, 49–60 (2017)

Swan, M.: Blockchain: Blueprint for a New Economy. O’Reilly Media, Sebastopol (2015)

Yli-Huumo, J., Ko, D., Choi, S., Park, S., Smolander, K.: Where is current research on blockchain technology? - a systematic review. PLoS ONE 11, 1–27 (2016)

Jansen, S., Finkelstein, A., Brinkkemper, S.: A sense of community: a research agenda for software ecosystems. In: 2009 31st International Conference on Software Engineering-Companion, pp. 187–190 (2009)

Jansen, S.: Measuring the health of open source software ecosystems: beyond the scope of project health. Inf. Softw. Technol. 56, 1508–1519 (2014)

Manikas, K.: Revisiting software ecosystems research: a longitudinal literature study. J. Syst. Softw. 117, 84–103 (2016)

White, L.H.: The market for cryptocurrencies. Cato J. 35, 383–402 (2015)

Buterin, V.: Ethereum white paper (2013)

Schwartz, D., Youngs, N., Britto, A.: The Ripple Protocol Consensus Algorithm. Ripple Labs Inc White Paper, pp. 1–8 (2014)

Böhme, R., Christin, N., Edelman, B., Moore, T.: Bitcoin: economics, technology, and governance. J. Econ. Perspect. 29, 213–238 (2015)

Bouoiyour, J., Selmi, R.: What does Bitcoin look like? Ann. Econ. Financ. 16, 449–492 (2015)

Kristoufek, L.: BitCoin meets Google Trends and Wikipedia: quantifying the relationship between phenomena of the Internet era. Sci. Rep. 3, 1–7 (2013)

Kristoufek, L.: What are the main drivers of the Bitcoin price? Evidence from wavelet coherence analysis. PLoS ONE 10, 1–15 (2015)

Garcia, D., Tessone, C.J., Mavrodiev, P., Perony, N.: The digital traces of bubbles: feedback cycles between socio-economic signals in the Bitcoin economy. J. R. Soc. Interface. 11 (2014)

Messerschmitt, D.G., Szyperski, C.: Software Ecosystem: Understanding an Indispensable Technology and Industry. MIT Press, Cambridge (2003)

Manikas, K., Hansen, K.M.: Software ecosystems-a systematic literature review. J. Syst. Softw. 86, 1294–1306 (2013)

Lucassen, G., van Rooij, K., Jansen, S.: Ecosystem health of cloud PaaS providers. In: Herzwurm, G., Margaria, T. (eds.) ICSOB 2013. LNBIP, vol. 150, pp. 183–194. Springer, Heidelberg (2013). https://doi.org/10.1007/978-3-642-39336-5_18

Den Hartigh, E., Tol, M., Visscher, W.: The health measurement of a business ecosystem. In: ECCON 2006 Annual Meetingm, vol. 2783565, pp. 1–39 (2006)

Iansiti, M., Levien, R.: Strategy as ecology. Harv. Bus. Rev. 82, 68–81 (2004)

Alami, D., Rodríguez, M., Jansen, S.: Relating health to platform success. In: Proceedings of the 2015 European Conference on Software Architecture Workshops - ECSAW 2015, pp. 1–6 (2015)

van Lingen, S., Palomba, A., Lucassen, G.: On the software ecosystem health of open source content management systems. In: Proceedings of the 5th International Workshop on Software Ecosystems, vol. 987, pp. 45–56 (2013)

van Vulpen, P., Menkveld, A., Jansen, S.: Health measurement of data-scarce software ecosystems: a case study of Apple’s ResearchKit. In: Ojala, A., Holmström Olsson, H., Werder, K. (eds.) ICSOB 2017. LNBIP, vol. 304, pp. 131–145. Springer, Cham (2017). https://doi.org/10.1007/978-3-319-69191-6_9

Seichter, D., Dhungana, D., Pleuss, A., Hauptmann, B.: Knowledge management in software ecosystems: software artefacts as first-class citizens. In: Proceedings of the 4th European Conference on Software Architecture: Companion Volume (ECSA 2010), pp. 119–126 (2010)

Hoving, R., Slot, G., Jansen, S.: Python: characteristics identification of a free open source software ecosystem. In: 2013 7th IEEE International Conference on Digital Ecosystems and Technologies (DEST), pp. 13–18. IEEE (2013)

Gousios, G.: The GHTorrent dataset and tool suite. In: Proceedings of the 10th Working Conference on Mining Software Repositories, pp. 233–236 (2013)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Switzerland AG

About this paper

Cite this paper

Berkhout, M., van den Brink, F., van Zwienen, M., van Vulpen, P., Jansen, S. (2018). Software Ecosystem Health of Cryptocurrencies. In: Wnuk, K., Brinkkemper, S. (eds) Software Business. ICSOB 2018. Lecture Notes in Business Information Processing, vol 336. Springer, Cham. https://doi.org/10.1007/978-3-030-04840-2_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-04840-2_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-04839-6

Online ISBN: 978-3-030-04840-2

eBook Packages: Computer ScienceComputer Science (R0)