Abstract

This study consists of two chapters (I and II, in Chaps. 16 and 17, respectively). One of the two chapters discusses an empirical study in which this research explains how to use DEA environmental assessment to establish corporate sustainability. The other chapter summarizes previous works on the research area. The first chapter (I) discusses that environmental assessment and protection are important concerns in modern business. Consumers are interested in environmental protection and they avoid purchasing products from dirty-imaged companies even if their prices are much less than the ones produced by green-imaged companies. A green image (often, not reality) of corporations is recently becoming very important for corporate survivability in a global market. By extending previous works on environment assessment and corporate sustainability, where companies need to consider both economic prosperity and pollution prevention in their business operations, this study discusses a use of Data Envelopment Analysis (DEA) for environmental assessment by utilizing the radial measurement. The proposed approach analytically incorporates different combinations of disposability concepts into the proposed radial models. It is easily envisioned that the proposed radial measurement for environmental assessment can guide corporate leaders and managers in identifying how to invest for eco-technology innovation on the abatement of undesirable outputs (e.g., industrial pollution). To document the practicality, this study applies the proposed approach to 153 observations on S&P 500 corporations in 2012 and 2013. The empirical investigation confirms that investors pay more serious attention on company’s green image for corporate sustainability in a long horizon than profitability in a short horizon.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

16.1 Introduction

This study consists of two chapters. This chapter discusses an empirical study in which this research explains how to use DEA environmental assessmentFootnote 1 to establish corporate sustainability within U.S. industrial sectors where DEA stands for Data Envelopment Analysis and U.S. stands for the United States of America. The other section summarizes previous works on the research area.

The Intergovernmental Panel on Climate Change (IPCC),Footnote 2 established by United Nations environmental program, has recently reported a policy suggestion in April (2014) that it is necessary for us to reduce an amount of Greenhouse Gas (GHG) emissions, in particular CO2, by 40–70 % (compared with 2010) until 2050 and to reduce it at the level of almost zero by the end of this twenty-first century via shifting our current systems to energy-efficient ones. Otherwise, the global warming and climate change will destroy our natural and socio-economic systems.

Although it is almost impossible to establish our societies that do not produce any GHG emissions , the global warming and climate change have been influencing corporate behaviors and operations because all firms need to change their business strategies in order to adapt various regulation changes for preventing industrial pollutions at the level of U.S. federal and local governments. More importantly, consumers do not purchase any products and services from a dirty-imaged company even if the price is much less than that of a green-imaged company. The conventional business logic and practice (e.g., less expensive price and high quality) do not function anymore in modern corporations because they are now belonging to part of a world-wide trend toward a sustainable society.

The benefits from adapting GHG technologies range from intangible ones, such as improved public images as good (green) corporate citizen, to measurable ones such as their lower direct and indirect emission levels. Unfortunately, acknowledging the importance of reducing GHG emissions , many companies often misunderstand a business linkage between the cost of GHG technologies and their overall performances and business opportunities. It may be true in a myopic horizon that environmental protection requires a large amount of investment for GHG reduction and the investment does not produce any direct benefit to them.

However, such a business concern is different in a long term horizon. As discussed by Porter and van der Linde (1995), “environmental regulation does not jeopardize corporate performance, but rather providing firms with an opportunity to improve efficiency and competitiveness through environmental innovations in processes and products”. In modern business reality, some companies clearly understand the trade-off between their investments for low GHG emissions, including low-carbon technologies , and enhancement in operational performance and its related profit. The companies with a green image become more competitive and strategic in today’s environmentally conscious markets. This clearly indicates that modern corporations in all the sectors need to consider their technology investments on environmental protection and corporate performance enhancement from the perspective of corporate sustainability in short and long term horizons.

A business difficulty, associated with attaining such corporate sustainability, is that business leaders and academia do not have a practical methodology for assessing the performance of firms in terms of their operational and environmental achievements. Furthermore, is there any methodology that can guide their investment strategies for attaining the corporate stainability?

In replying such important inquiries, this study proposes a holistic methodology, or DEA, to evaluate the performance of firms from their levels of corporate sustainability. The proposed use of DEA, referred to as “DEA environmental assessment”, has four research concerns to be explored in this study. First, it incorporates two disposability concepts such as natural disposability and managerial disposability , where operational performance is the first priority and environmental performance is the second priority in the natural disposability. An opposite priority order is found in the managerial disposability. Outputs and inputs, characterizing their operational and environmental performance, are separated under disposability combinations. Second, this study investigates the concept of congestion on undesirable outputs, referred to as “Desirable Congestion (DC) ”, in order to identify effective investment for preventing industrial pollutions. The conventional concept of congestion is “Undesirable Congestion (UC) ”, which is applied to desirable outputs. Third, as an empirical study, this research applies the proposed approach, originated from different disposability combinations, for the performance evaluation of S&P 500 companies. It is necessary for us to examine different disposability concepts and methodologies to obtain useful policy and business suggestions for guiding a large policy issue such as the global warming and climate change . See Wang et al. (2014), Sueyoshi and Wang (2014a, b) and Sueyoshi and Yuan (2015b). Finally, this study describes business implications obtained from the proposed DEA application.

The remainder of this study is organized as follows. Section 16.2 provides a brief literature review on DEA environmental assessment. See Chap. 17 of this study provides a detailed literature study on DEA environmental assessment. Section 16.3 discusses underlying concepts incorporated into the proposed approach. Section 16.4 describes radial models under different disposability concepts. Section 16.5 summarizes investment strategy. Section 16.6 applies the proposed approach to evaluate the unified (environmental and operational) performance of S&P 500 companies and summarizes empirical results obtained from the application. Section 16.7 concludes this research along with future extensions.

16.2 Literature Review

First of all, see Chap. 17 of this study that lists 407 previous studies. Therefore, it is important for us to note only the position of this research. That is, a limited number of previous studies on applied energy have discussed corporate sustainability and investment strategy by using DEA environmental assessment. Exceptions can be found in Wang et al. (2014), Sueyoshi and Wang (2014a, b) and Sueyoshi and Yuan (2015b). Such a business concern is very important for environmental assessment for all industrial sectors in not only the U.S. but also other industrial nations. This research will explore the issue as an empirical study. That is the purpose of this study.

16.3 Underlying Concepts for DEA Environmental Assessment

16.3.1 Abbreviations and nomenclatures

All abbreviations and nomenclatures used in this study (Chaps. 16 and 17) are summarized as follows.

-

DC: Desirable Congestion,

-

DMU: Decision Making Unit,

-

DEA: Data Envelopment Analysis,

-

DTS: Damages to Scale,

-

DTR: Damages to Return,

-

EPA: Environmental Protection Agency

-

GHG: Greenhouse Gas

-

IPCC: Intergovernmental Panel on Climate Change

-

OPEC: Organization of the Petroleum Exporting Counties

-

RTS: Returns to Scale,

-

UC: Undesirable Congestion,

-

URS: Unrestricted,

-

UE: Unified Efficiency,

-

UEN: Unified Efficiency under Natural disposability,

-

UEM: Unified Efficiency under Managerial disposability,

-

UENM: Unified Efficiency under Natural & Managerial disposability,

-

X: A column vector of m inputs,

-

G: A column vector of s desirable outputs,

-

B: A column vector of h undesirable outputs,

-

d x i : An unknown slack variable of the ith input,

-

d g r : An unknown slack variable of the rth desirable output,

-

d b f : An unknown slack variable of the fth undesirable output,

-

λ: An unknown column vector of intensity (or structural) variables,

-

R x i : A data range related to the ith input,

-

R g r : A data range related to the rth desirable output,

-

R b f : A data range related to the fth undesirable output,

-

vi: A dual variable of the ith input,

-

u r : A dual variable of the rth desirable output,

-

w f : A dual variable of the fth undesirable output and

-

σ: A dual variable to indicate the intercept of a supporting hyperplane on a production and pollution possibility set.

16.3.2 Natural and Managerial Disposabil ity

Let us consider \( X\in {R}_{+}^m \) as an input vector, \( G\in {R}_{+}^s \) as a desirable output vector and \( B\in {R}_{+}^h \) as an undesirable output vector. These vectors are referred to as “production factors” in this study. In addition to the vectors, the subscript (j) is used to stand for the jth DMU (Decision Making Unit: corresponding to an organization in private and public sectors) and λ j indicates the jth intensity variable (j = 1 , … , n) which is used for connecting production factors.

Using an axiomatic expression, unified (operational and environmental) production and pollution possibility sets to express natural and managerial disposability are specified by the following two types of output vectors and an input vector, respectively:

The difference between the two concepts on disposability is that production technology under natural disposability, or P N(X), has \( X\ge {\displaystyle {\sum}_{j=1}^n{X}_j{\lambda}_j} \). Meanwhile, the managerial disposability, or P M(X), has \( X\le {\displaystyle {\sum}_{j=1}^n{X}_j{\lambda}_j} \). The two disposability concepts intuitively appeal to us because an efficiency frontier for desirable outputs locates above or on all observations, while that of undesirable outputs locates below or on the observations. See Porter and van der Linde (1995) on a description on the use of managerial disposability from corporate strategy.

It is important to note that the operational performance is the first priority and the environmental performance is the second one under natural disposability in assessing the unified efficiency. In contrast, the managerial disposability has an opposite priority order in the assessment. This study considers the disposability concepts as two different criteria for environmental assessment.

In the previous research efforts by DEA environmental assessment, an input vector is usually assumed to project toward a decreasing direction. This assumption is often inconsistent with the reality of environmental protection in a private sector. For example, let us consider a manufacturing firm that can increase the input vector if its marginal (or average) cost is less than the marginal (or average) sale because the business condition produces profit to the firm. Thus, the conventional use of DEA is often unacceptable in a private sector because the previous DEA studies have implicitly assumed the minimization on total production cost. The cost concept may be acceptable for the performance analysis of many organizations in a public sector, but not for a private sector. Thus, it can be easily imagined that DEA environmental assessment in the private sector, as discussed in this study, is different from that of the public sector. The cost concept for guiding organizations in the private sector is marginal cost or average cost, not the total cost. Furthermore, the opportunity cost, originated from business risk due to industrial pollutions and the other types of various problems (e.g., the disaster of Fukushima Daiichi nuclear power plant ), has a major role in modern business. As mentioned previously, no consumer buys products from dirty-imaged companies even if their prices are much less than those of green-imaged companies. Such opportunity cost is very important in managing modern business. See, for example, the corporate sandal of Volkswagen, found in 2015, that has been long cheating on CO2 emission produced by its cars. It will take a long time for the car company to recover the trust from consumers.

16.3.3 Unification Between Natural and Managerial Disposability

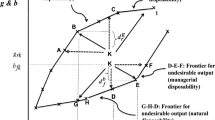

Figure 16.1, adapted from Sueyoshi and Yuan (2015b), depicts a unification process for combining desirable and undesirable outputs, which is separated into the three stages (from I to III). For our visual convenience, Fig. 16.1 depicts the case of a single component of the three production factors. It is easily extendable to the case of multiple components in the proposed DEA formulation.

First stage (I) has two components (A) and (B). The first component (A) of the stage (I) indicates the production relationship between an input (x) and a desirable output (g) under the assumption that all DMUs produce a same amount of undesirable output (b). The production possible set (PrPS) is listed below a convex curve (F g ) in the x-g space. The set, indicating the location of all DMUs under the convex curve, is structured by the concept of natural disposability.

Here, it is important to note that, as summarized in Table 17.1, most of previous studies on DEA environmental assessment belong to Stage I(A) in their conceptual frameworks.

The Stage I has the other component (B) which is structured by the concept of managerial disposability. A pollution possibility set (PoPS) , locating above the concave curve of a pollution function (F b ), indicates the location of all DMUs in the x-b space under the assumption that they produce a same amount of a desirable output (g).

The second stage (II) unifies the two components of Stage I. The horizontal and vertical coordinates for Stage II indicate x and g&b, respectively. The unification makes it possible to identify the production and pollution possibility sets (Pr&PoPS) between the convex (F g ) and concave (F b ) curves. All DMUs, locating within the Pr&PoPS, is shaped by an intersection between the production and pollution possibility sets.

Assumption for Output Unification: The third stage (III) incorporates the assumption that “undesirable outputs are by-products of desirable outputs”. The assumption seems trivial to us, but it drastically changes the structure of DEA environmental assessment. For example, the assumption changes the two curves (F g and F b ) to be shaped by a convex form, as depicted in the bottom-right hand side of Fig. 16.1. Here, it is important to note that the production curve (F g ) should have an increasing trend along with an input enhancement. However, the pollution curve (F b ) should have an increase tread due to the assumption, and then it should have a decrease trend because of eco-technology innovation or other types of environmental efforts for pollution reduction (a fuel mix strategy or a use of inputs with less CO2 emission). Consequently, both curves should have a convex form, which is structurally different from the two (I and II) stages of Fig. 16.1. Thus, Fig. 16.1 visually describes a rationale regarding why DEA environmental assessment is more complicated and more difficult than a conventional use of DEA, as mentioned previously. Thus, the existence of undesirable outputs makes the assessment very difficult from the conventional use of DEA, as depicted in Fig. 16.1.

16.3.4 Desirable Congestion (DC)

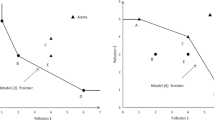

Figure 16.2 exhibits a desirable output (g) on the horizontal axis and an undesirable output (b) on the vertical axis. The negative slope of a supporting hyperplane indicates an occurrence of DC, or eco-technology to reduce an amount of an undesirable output. The occurrence of DC implies that an enlarged input (x) increases a desirable output (g) and decreases an undesirable output vector (b). This study is interested in an occurrence of DC because we look for corporate sustainability that indicates economic prosperity and environmental protection by eco-technology innovation. Equality constraints should be assigned to desirable outputs (G) in the case.

It is important to note the following two concerns on Fig. 16.2.

-

(a)

The convex curve needs an assumption that undesirable outputs are by-products of desirable output. It becomes a concave curve without the assumption.

-

(b)

An occurrence of desirable congestion (DC) implies that we can measure eco-technology innovation to reduce the amount of undesirable outputs.

16.4 Unified Efficiency

16.4.1 Unified Efficiency (UE)

The unified (operational and environmental) performance, or often referred to as DebrewFootnote 3-FarrellFootnote 4 measure, of DMUs (Decision Making Unites: organizations to be measured) is characterized by their production activities that utilize inputs to yield desirable and undesirable outputs. This study considers n DMUs, or organizations to be evaluated by DEA. An important feature of DEA environmental assessment is that the achievement of each DMU is relatively compared with those of the remaining others. The performance level is referred to as “an efficiency measure”.

The proposed approach uses the following data ranges related to inputs, desirable and undesirable outputs:

respectively. All the three data ranges are identified from an observed data set so that they are given to us before computing the proposed approach. Later, the inputs are further separated into two categories by the two disposability concepts . However, it is not necessary to change anything on the input ranges because they are determined by observations on each input.

The research efforts by Sueyoshi and Goto (2012b, c, 2013a, b, 2014a, b) have proposed the following radial model for DEA environmental assessment:

where ξ is an inefficiency score, indicating a distance between an efficiency frontier and an observed vector of desirable and undesirable outputs. This study sets ε s as 0.0001 for our computation convenience to reduce an influence of slacks. A subjective decision may occur on the selection of ε s . Historically, it was considered that ε s was a Non-Archimedean small number in DEA. However, none knows what it is in reality. In avoiding such a specification difficulty, it is possible for us to use \( {\varepsilon}_s=0 \) in Model (16.2). However, in the case, dual variables may become zero on some production factors so that information on production factors in a data set is not fully utilized in Model (16.2). This is problematic and unacceptable as a computational result of DEA performance assessment.

The two slacks related to the ith input are mathematically defined as \( {d}_i^{x+}=\left(\left|{d}_i^x\right|+{d}_i^x\right)/2 \) and \( {d}_i^{x-}=\left(\left|{d}_i^x\right|-{d}_i^x\right)/2 \). They are mutually exclusive so that a simultaneous occurrence of both \( {d}_i^{x+}>0 \) and \( {d}_i^{x-}>0 \) (i = 1, … , m) should be excluded from the optimal solution of Model (16.2). When the simultaneous occurrence occurs on Model (16.2), a computer code usually produces “an unbounded solution” because of violating the nonlinear conditions.

To make Model (16.2) satisfy the nonlinear conditions, the previous studies (e.g., Sueyoshi and Goto 2012a) have suggested the following two computational alternatives:

-

(a)

One of the two alternatives is that Model (16.2) incorporates the nonlinear conditions into Model (16.2) as side constraints and then we solve Model (16.2) with \( {d}_i^{x+}{d}_i^{x-}=0 \) ( i = 1, … , m) as a nonlinear programming problem.

-

(b)

The other alternative is that Model (16.2) incorporate the following side constraints: \( {d}_i^{x+}\le M{z}_i^{+} \), \( {d}_i^{x-}\le M{z}_i^{-} \), \( {z}_i^{+}+{z}_i^{-}\le 1 \), \( {z}_{i}^{+} \) and \( {z}_i^{-} \): binary (i = 1, … m) and solve Model (16.2) with the side constraints as a mixed integer programming problem. Here, M stands for a very large number that we need to prescribe before our computational operation.

After solving Model (16.2) with the nonlinear conditions, the level of unified efficiency (UE) of the kth DMU is determined by

Here, the inefficiency score and slacks within the parentheses are obtained from the optimality of Model (16.2).

16.4.2 Unified Efficiency under Natural Disposability (UEN)

Formulation for Stage I (A): The research efforts of Sueyoshi and Goto (2012b, c, 2013a, b, 2014a, b) and Sueyoshi and Yuan (2015a, b) have proposed the following radial model to measure the unified efficiency of the kth DMU under natural disposabilit) y:

A unified efficiency score (UEN) ) under natural disposability on the kth DMU is measured by

where the inefficiency score and all slack variables are determined on the optimality of Model (16.4). The equation within the parenthesis, obtained from the optimality of Model (16.4), indicates the level of unified inefficiency under natural disposability. The unified efficiency is obtained by subtracting the level of inefficiency from unity.

16.4.3 Unified Efficiency under Managerial Disposability (UEM)

Formulation for Stage I (B): Shifting our research interest from natural disposability to managerial disposability, where the first priority is environmental performance and the second priority is operational performance, this study utilizes the following radial model that measures the unified efficiency of the kth DMU (Sueyoshi and Goto 2012b, c, 2013a, b, 2014a, b; Sueyoshi and Yuan 2015a, b):

An important feature of Model (16.6) is that it changes \( +{d}_i^{x-} \) of Model (16.4) to \( -{d}_i^{x+} \) in order to attain the status of managerial disposability. No other change is found in Model (16.6).

A unified efficiency score (UEM) on the kth DMU under managerial disposability is measured by

where the inefficiency score and all slack variables are determined on the optimality of Model (16.6). The equation within the parenthesis, obtained from the optimality of Model (16.6), indicates the level of unified inefficiency under managerial disposability. The unified efficiency is obtained by subtracting the level of inefficiency from unity.

16.4.4 Unified Efficiency under Natural and Managerial Disposability (UENM)

Formulation for Stage II: A possible unification between Models (16.4) and (16.6) is that it combines the two models along with the separation on inputs into two categories under natural and managerial disposability. Consequently, inputs and outputs are classified into four categories (2 input groups × 2 output groups) for the measurement of UENM. This study proposes the following radial model measures the level of UENM (Goto et al. 2014):

Here, the number of original m inputs are newly separated into \( {m}^{-} \) (under natural disposability) and \( {m}^{+} \) (under managerial disposability), respectively, in Model (16.8). The model maintains m = m − + m +. One of the two input categories uses inputs \( \left({x}_{ij}^{-}\right) \) whose slacks \( \left({d}_i^{x-}\right) \) for i = 1, …, m − are formulated under natural disposability . For example, the number of employees belongs to the input category. Meanwhile, the other category contains inputs \( \left({x}_{qj}^{+}\right) \) whose slacks \( \left({d}_q^{x+}\right) \) for q = 1, …, m + are formulated under managerial disposability. For example, the amount of capital investment for eco-technology innovation belongs to the input category. As formulated in Model (16.8), the input vector of the jth DMU is separated into the two groups under natural and managerial disposability.

The level of unified efficiency (UENM) under natural and managerial disposability is measured by

The dual formulation of Model (16.8) becomes as follows:

where vi (i = 1, … , m −), z q (q = 1, … , m +), u r (r = 1, … , s) and w f (f = 1, …, h) are all dual variables related to the first, second, third and fourth groups of constraints in Model (16.8). The dual variable (σ), which is unrestricted, is obtained from the last equation of Model (16.8). The objective value of Model (16.8) equals that of Model (16.10) on optimality.

A contribution of UENM, measured by Models (16.8) and (16.10), is that these models combine the two disposability concepts into a single criterion where they are equally treated in environmental assessment. A drawback of UENM is that it does not incorporate an occurrence of DC, or eco-green technology innovation on undesirable outputs. See Stage II of Fig. 16.1 that visually describes the methodological difficulty.

To intuitively describe a rationale on why Models (16.8) and (16.10) have a difficulty in measuring eco-technology innovation, this study returns to Model (16.10) by which the supporting hyperplane is expressed by \( v{x}^{-}-z{x}^{+}-ug+wb+\sigma =0 \), or \( wb=-v{x}^{-}+z{x}^{+}+ug-\sigma \), in the case where all production factors have a single component. Since w is positive in its sign, the supporting hyperplane is unacceptable because an increase in the input under natural disposability (\( {x}^{-} \)) decreases the undesirable output. Such an observation should be reversely applicable to the input under managerial disposability (\( {x}^{+} \)). The relationship is unacceptable for this study so that Models (16.8) and (16.10) need to be reorganized as in the next section.

16.4.5 Unified Efficiency under Natural and Managerial Disposability: UENM(DC) with a Possible Occurrence of Desirable Congestion (Eco-technology Innovation)

Formulation for Stage III: To identify a possible occurrence DC, or eco-technology innovation , this study reorganizes the hyperplane like \( v{x}^{-}-z{x}^{+}+ug-wb\kern0.15em +\sigma =0 \). The corresponding dual formulation to satisfy the requirement in the case of multiple production factors becomes as follows:

The primal formulation of Model (16.11) can be specified as follows:

The unified efficiency score, or UENM(DC), is measured by

where the inefficiency score and slacks are determined on the optimality of Model (16.12).

16.5 Investment Strategy

After solving Model (16.12), this study can identify an occurrence of DC, or green technology innovation for pollution mitigation , by the following rule along with the assumption on a unique optimal solution (Sueyoshi and Goto 2014b):

-

(a)

if \( {u}_r^{+*}=0 \) for some (at least one) r, then “weak DC” occurs on the kth DMU,

-

(b)

if \( {u}_r^{+*}<0 \) for some (at least one) r, then “strong DC” occurs on the kth DMU and

-

(c)

if \( {u}_r^{+*}>0 \) for all r, then “no DC” occurs on the kth DMU.

Note that if \( {u}_r^{+*}<0 \) for some r and \( {u}_{r^{\prime}}^{+*}=0 \) for the other r′, then this study considers that the strong DC occurs on the kth DMU. It is indeed true that \( {u}_r^{+*}<0 \) for all r is the best case because an increase in any desirable output always decreases an amount of undesirable outputs. Meanwhile, if \( {u}_r^{+*}<0 \) is identified for some r, then it indicates that there is a chance to reduce an amount of undesirable output(s). Therefore, this study also considers the second case as an investment opportunity because we want to reduce an amount of industrial pollution as much as possible.

Under an occurrence of strong DC (i.e., \( {u}_r^{+*}<0 \) for at least one r), the effect of investment on undesirable outputs is determined by the following rule:

-

(a)

if \( {z}_q^{*}>{\varepsilon}_s{R}_q^x \) for q in Model (16.12), then the qth input for investment under managerial disposability can effectively decrease an amount of undesirable outputs and

-

(b)

if \( {z}_q^{*}={\varepsilon}_s{R}_q^x \) for q in Model (16.12), then the qth input for investment has a limited effect on decreasing an amount of undesirable outputs.

The investment on inputs under managerial disposability is not recommended in the other two cases (i.e., no and weak DC). Furthermore, this study uses “a limited effect” in the second case. The term implies that if this study drops the data range on the qth input in Model (16.12), then there is a high likelihood that z * q may become zero. Moreover, \( {\mathrm{z}}_q^{*}>\varepsilon {R}_q^x \) are required for some q, but not necessary for all q.

Finally, it is important to note that the proposed investment classification needs at least two desirable outputs because unrestricted u in Model (16.12) cannot produce a negative value on the dual variable, so being unable to identify an investment opportunity, in the case of a single desirable output. Thus, the investment rule discussed in this study needs multiple desirable outputs.

16.6 Empirical Study

This study obtains a data set from Wang et al. (2014) and Sueyoshi and Wang (2014a) whose data source is the Carbon Disclosure Project (CDP) and COMPUSTAT . The CDP builds the world’s largest database regarding corporate performance and climate change by collecting data sets via annual online questionnaire sent out to major firms across the world. This study utilizes the data on S&P 500 companies for 2012 and 2013, including the companies’ direct and indirect GHG emission, the investment in carbon mitigation and the corresponding total estimated GHG saving.

It is important to note the two concerns on the data set. One of the two concerns is that among the S&P 500 companies responding to the CDP survey, some companies choose not to provide detailed information of their climate change strategies. This study excludes all of such companies that have refused to disclose information in any of the above data fields. The other concern is that the usage of survey data depends upon the accuracy and trustworthiness of the self-reported information. The CDP data indicates whether a company’s emission has been verified by a third-party institution. To address the second concern about data accuracy, this study restricts the data sample to companies that have obtained third-party verification of their GHG emissions. Eventually, this study has obtained a panel of 153 observations from S&P 500 companies over the annual periods 2012–2013. The selected companies include consumer discretionary companies such as General Motors, consumer staple companies such as PepsiCo, energy companies such as Chevron, health care companies such as Pfizer, industrial companies such as Boeing, information technology like Google and Intel, material companies such as Alcoa. This study has confirmed matching between the CDP data set and the operational characteristics and financial performance of firms obtained from COMPUSTAT.

The data set consists of the following operational, environmental and financial factors:

-

(a)

Estimated CO 2 Saving : This indicates the annual CO2 saving from a company’s current emission level after the investment in abatement technologies. The variable can be regarded as a measure of a company’s technology capacity.

-

(b)

Return on Assets: This is defined as the ratio between net income and total assets. It is incorporated as a measure of firm profitability .

-

(c)

Direct CO 2 Emission: This measures an amount of emissions from sources owned by a company. The cost of adapting pollution prevention practices and the effectiveness of pollution prevention as a strategy for reducing emissions may vary with a scale of current emission.

-

(d)

Indirect CO 2 Emission : This measures an amount of emissions from generation of electricity, steam, heating and cooling purchased by a company offsite.

-

(e)

Number of Employees: This is regarded as a proxy for a firm size. Larger firms may have more resources to adapt CO2 mitigation practices.

-

(f)

Working Capital: This is included to indicate the operating liquidity of a firm. Firms with higher working capital may invest more in CO2 mitigation.

-

(g)

R&D Expense: This is another measure of a firm’s technology capacity. It is expected that firms with higher R&D expense is more likely to acquire and implement efficient emission control technology.

-

(h)

Total Assets: This includes current assets, property, plant and equipment, all of which are used as another proxy for a corporate size.

-

(i)

Investment in CO 2 Abatement : This gives a total amount of investment that a company is required to make to achieve the estimated annual CO2 saving. Profit maximizing firms are expected to choose technology according to their cost performance and effectiveness in mitigating the amount of CO2 emissions.

In summary, this study utilizes two desirable outputs (i.e., estimated annual CO2 saving and return on assets), two undesirable outputs (i.e., direct and indirect CO2 emissions), three inputs under natural disposability (i.e., number of employees, working capital and total assets), two inputs under managerial disposability (i.e., investment in CO2 abatement and R&D expense).

Table 16.1 documents descriptive statistics on the data set used in this study in which Avg., S.D. Min. and Max. indicate average, standard deviation, minimum and maximum, respectively. To control for heterogeneity across sectors, this study further calculates industry-adjusted index to be used in DEA models for all the variables. The index of a variable is the ratio of its actual value to the industry average of that variable.

Table 16.2 summarizes five unified efficiency scores, or UE, UEN, UEM, UENM and UENM(DC), of firms in the IT industry as an illustrative purpose. As summarized at the bottom of Table 16.2, the five unified efficiency measures are 0.3587 in UE, 0.4853 in UEN, 0.5800 in UEM, 0.6295 in UENM and 0.7425 in UENM(DC), respectively, on average. UE is a unified efficiency measure for operational and environmental performance, UEN is a measure which has the first priority on operational performance and the second one on environmental performance. UNM indicates an opposite case. UENM combines the two disposability concepts. UENM(DC) incorporates a possible occurrence of eco-technology innovation to reduce the amount of undesirable outputs. For example, Applied Materials Inc. (2012) exhibited the status of efficiency in the five efficiency measures. The other firms have some level of inefficiency in these measures.

To explain the implications of the five efficiency measures , let us pay attention to Yahoo! Inc. The firm had 0.0354 in UE, 0.0622 in UEN, 0.5679 in UEM, 0.3346 in UENM and 1.0000 in UENM(DC) during 2012. These measures indicated the status of inefficiency in the first four performance measures. However, the efficiency (1.0000) in UENM(DC) indicated that the firm had a very high level of investment opportunity in 2012. Such an investment changed the status of the other four efficiency measures from inefficiency to efficiency in 2013. As a result of investment on technology innovation in 2012, the Yahoo! did not need the investment for technology innovation anymore so that the measure of UENM(DC) dropped to 0.1317 in 2013.

Table 16.3 allows us to compare the performance of the seven main industrial sectors and their industrial subgroups. In the table, the materials sector exhibited the best performance (0.501), the energy sector was the second (0.3709) and the IT sector was the third (0.3587) in their UE measures. Meanwhile, the energy sector was the best (0.7290), the IT sector was the second (0.6295) and the material sector was the third (0.5919) in terms of their UENM measures. The major difference between UE and UENM is that the latter has the input classification under the two disposability concepts , but the former does not have such a classification. This study used both R&D expenditure and investment in CO2 abatement as the inputs under managerial disposability. The computational result of Table 16.3 indicated that the energy sector had the most promising area for investment on technology innovation among the seven industrial sectors.

Table 16.4 lists dual variables, the type of DC (S: Strong DC and No: No DC) and the type of investment effect (E: effective and L: limited) on the IT sector. A blank space indicates that the type is no DC so that it is not necessary for us to consider an opportunity for investment. Table 16.5 summarizes the effective and limited investment opportunities on the seven industrial sectors. On overall average, 46 observations (30.07 %) were rated as efficient observations and 2 firms (1.31 %) among 153 total observations were rated as limited investments in terms of developing green technology innovation for corporate sustainability.

In Table 16.5, the energy sector had the highest fraction (46.15 %) of effective investments, marked by E, among the seven industrial sectors, along with limited investment effect (7.69 %). This result indicated that investment for technology innovation in the energy section was the most effective in developing corporate sustainability, compared with the other six industrial sectors. In other words, the energy sector produces a large amount of CO2 emission. Therefore, it is important for the United States to start controlling the amount of CO2 emission by paying attention to the investment to firms in the energy sector.

It is important to note that the examination of firms with E (effective investment) provides us with a guidance on which firms have proper technology to enhance corporate sustainability . Such a firm selection can reduce the number of technically advanced firms and makes it possible that we can identify the type of technology to be used for a specific industry although different industries have distinct technology structures and developments on production and environmental protection.

Finally, as documented in these tables, DEA environmental assessment may provide corporate leaders, investors and other individuals who are interested in corporate sustainability with a guideline on which firm(s) they should invest for enhancing the corporate sustainability.

16.7 Conclusion and Future Extensions

Environmental assessment and corporate sustainability have recently become a very important business concern because consumers are interested in environmental protection . A green image is recently essential for corporate survivability in a global market where companies must compete with each other in domestic and international markets.

As a new type of methodology for assessing the corporate sustainability, this study proposed a use of DEA radial measurement for environmental assessment. By shifting DEA models from the non-radial measurement (Sueyoshi and Goto 2012a) to the radial measurement, this study discussed the new use of environmental assessment to determine the five unified efficiency measures that could serve as an empirical basis for developing corporate sustainability. Furthermore, in discussing a use of DEA environmental assessment, this study considered both R&D expenditure and investment in CO2 abatement as inputs for managerial disposability. This type of application had never been explored in any previous DEA studies on environmental assessment. It is easily envisioned that the proposed DEA approach will provide corporate leaders with guidance on environmental strategy and investment on technology selection. Such selection, identified by examining firms with strong DC, is useful in establishing corporate sustainability.

To demonstrate the practicality of the proposed approach, this study applied it to 153 observations of all S&P 500 corporations in 2012 and 2013. The empirical investigation suggested that it is necessary for investors to pay more serious attention to company’s green image, so enhancing sustainability, than profitability in a short term horizon. A contribution of this study was that corporate leaders and investors could evaluate and plan the development of their corporate sustainability by utilizing information generated by the proposed approach.

It is true that the proposed environmental assessment is not yet perfect. There are four research issues as future extensions of this study. First, the technology innovation needs a time lag until it can fully exert its effect. Thus, the proposed approach needs to incorporate a time horizon in the computational process. For the research purpose, it is necessary for us to combine the proposed approach with the time series measurement proposed by the research efforts (Sueyoshi and Goto 2014c, Sueyoshi and Wang 2014b). Second, it is also important to make a theoretical linkage between the proposed approach and investment behavior in portfolio analysis. Third, technology innovation and selection may depend upon the type of industry. Different industries need different technology structures. See Sueyoshi and Yuan (2015b). Hence, the technology selection needs to consider a combination among different technology structures. This study did not explore the important aspect on technology. Finally, this study assumes that the proposed DEA approach produces a unique solution. However, DEA often suffers from an occurrence of multiple solutions. It is important to incorporate SCSCs (Strong Complementary Slackness Conditions) into the proposed computational framework. Such research tasks will be important future extensions of this study.

In conclusion, it is hoped that this study makes a contribution in the development of corporate sustainability. We look forward to seeing research extension, as discussed in this study.

Notes

- 1.

Glover and Sueyoshi (2009) discussed the history of DEA from the contributions of Professor William W. Cooper who first invented DEA from the linkage of L1 regression proposed in eighteenth century. Both DEA and L1 regression have a close linkage in these developments. See also Ijiri and Sueyoshi (2010) that discussed the contributions of Professor Cooper from the perspective of “social economics” and “social accounting”, both have provided DEA development with a conceptual backbone. A contribution of the previous DEA efforts for environmental assessment was that they found the importance of separating outputs into desirable and undesirable outputs. That was a contribution, indeed. Previous DEA research efforts in the past decades, including Boccard (2014), Chitkara (1999), Cooper et al. (1996), Korhonen and Luptacik (2004), Mou (2014), Sarica and Or (2007), Shrivastava et al. (2012), Sueyoshi and Goto (2011), Sueyoshi and Yuan (2015a, 2015b), Zhang et al. (2013), Zhou et al. (2013) and many other articles. An important feature of these previous DEA studies was that they mainly used radial models for DEA environmental assessment.

- 2.

See IPCC’s webpage (http://ipcc.ch/index.htm).

- 3.

Gérard Debreu (July 4, 1921–December 31, 2004) was a French economist and mathematician, who came to have United States citizenship. Best known as a professor of economics at the University of California, Berkeley, where he began working in 1962. Gerard Debreu’s contributions are in general equilibrium theory—highly abstract theory about whether and how each market reaches equilibrium. In a famous paper, coauthored with Kenneth Arrow and published in 1954, Debreu proved that under fairly unrestrictive assumptions, prices may exist for bring markets into equilibrium. In his 1959 book, The Theory of Value, Debreu introduced more general equilibrium theory, using complex analytic tools from mathematics—set theory and topology—to prove his theorems. In 1983 Debreu was awarded the Nobel Prize for having incorporated new analytical methods into economic theory and for his rigorous reformulation of the theory of general equilibrium. See http://books.google.co.jp/books?id=Z6Oy4L6LSwC&pg=PA140&lpg=PA140&dq=debreu+farrell&source=bl&ots=aLkVeuwk9u&sig=SYkaHtL56JXvZjUW0jJHg33cw0o&hl=ja&sa=X&ei=QZ03VPP1CtXc8AWAyoCQDA&ved=0CEoQ6AEwBg#v=onepage&q=debreu%20farrell&f=false

- 4.

His name was Michael James Farrell who was an applied economist at University of Cambridge, UK. Unfortunately, his study had a difficulty in finding his personal information on his birth and death dates. Since his contribution had been long supported by many production economists, this study needs to review his contributions from the perspective of DEA. Our review discussion is based upon the three articles (Farrell 1954; Farrell 1957; Farrell and Fieldhouse 1962). The first article (Farrell 1954: An application of activity analysis to the theory on the firm) was prepared when he visited Yale University (USA) where he could meet T.C. Koopmans and J. Tobin. In the article (1954, p. 292), he discussed “activity analysis”, proposed by Koopmans, which could explore the corporate behavior of a firm by an application of “linear programming”. In his article, the production relationship between production factors could be expressed by a static model in multiple periods. As a result, linear programming could be applicable to the assessment of corporate behavior. The second article (Farrell 1957: The measurement of productive efficiency) was innovative and it was closely related to the classical DEA development by providing the methodology with a conceptual basis. The article discussed an efficient production function, inspired by the activity analysis of linear programming (1957, p. 11) and started discussing an efficiency measure, referred to as “technical efficiency”, which was first discussed in Debreu’s “coefficient of resource utilization” (Debreu 1951). In addition to the concept of technical efficiency, According to his article (1957, p. 255), “an efficient production function might be expressed by a theoretical function specified by “engineers”. However, such an engineering-based empirical function was complicated and practically impossible to measure the theoretical efficiency function from the perspective of production economics. This study pays attention to the fact that Farrell (1957) has used the term “technical efficiency” because of his awareness on the engineering perspective, following Debreu (1951). Here, we may have simple questions such as “what engineering was” and “what type of technology was” in his economics context. It is very clear to us that the production technology in the middle of the twentieth century is by far different from the current one in the beginning of the twenty-first century. Fully acknowledging his contribution in production economics, this study does not use the term “technical efficiency” to avoid our confusion with “technology innovation” on industrial pollution that is the gist of this chapter. The second article (1957, p. 255 and p. 260) also discussed “price efficiency” and “overall efficiency” under increasing and diminishing RTS. These economic concepts have long provided us with a conceptual basis on DEA. No wonder why many studies have discussed his contribution as a staring study of DEA even if he did not mention anything on DEA. Finally, the third article (1962, Farrell and Fieldhouse: Estimating efficient production function under increasing returns to scale) extended Farrell’s study (1967) by discussing a linear programming structure that was solved by the simplex method of linear programming (1967, pp. 265–266). Their study documented two interesting concerns from our perspective. One of the interesting concerns was that they knew an occurrence of degeneracy, or multiple solutions. The other concern was that they discussed the importance of a dual formulation, not discussed by production economists even nowadays. As discussed by Glover and Sueyoshi (2009), it is easily imagined that their appendix on the method of computation (1967, pp. 264–267) was guided by Alan Hoffman, as a reviewer of their manuscript, who was an operations researcher. Consequently, their description on computation is still useful in modern DEA algorithmic development. It may be true that many DEA researchers have been long discussing the concept of technical efficiency, due to Farrell’s engineering concern, but not paying serious attention its dual formulation, as discussed by their works (1967). As documented in their study (1967), the collaboration between production economics and operations research/management science is essential in extending new research dimensions on DEA.

References

Boccard, N. (2014). The cost of nuclear electricity: France after Fukushima. Energy Policy, 66, 450–461.

Chitkara, P. (1999). A data envelopment analysis approach to evaluation of operational inefficiencies in power generating units: A case study of Indian power plants. IEEE Transactions on Power Systems, 14, 419–425.

Cooper, W. W., Huang, Z., Li, S., Lelas, V., & Sullivan, D. W. (1996). Survey of mathematical programming models in air pollution management. European Journal of Operational Research, 96, 1–35.

Debreu, G. (1951). The Coefficient of Resource Utilization, Econometrica, 19, 273–292.

Debreu, G. (1959). Theory of Value, Colonial Press, Inc, Massachusetts, USA.

Farrell, M.J. (1954). An application of activity analysis to the theory of the firm. Econometrica, 22, 291–302.

Farrell, M.J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, Series A, 120, Part 3, 253–290.

Farrell, M.J., & Fieldhouse, M. (1962). Production functions under increasing returns to scale. Journal of the Royal Statistical Society, Series A (General) 125, 252–267

Glover, F., & Sueyoshi, T. (2009). Contributions of Professor William W. Cooper in operations research and management science. European Journal of Operational Research, 197, 1–16.

Goto, M., Ootsuka, A., & Sueyoshi, T. (2014). DEA (data envelopment analysis) assessment of operational and environmental efficiencies on Japanese regional industries. Energy, 66, 535–549.

Ijiri, Y., & Sueyoshi, T. (2010). Accounting essays by Professor William W. Cooper: Revisiting in commemoration of his 95th birthday. ABACUS: A Journal of Accounting, Finance and Business Studies, 46, 464–505.

Korhonen, P. J., & Luptacik, M. (2004). Eco-efficiency analysis of power plants: An extension of data envelopment analysis. European Journal of Operational Research, 2004, 437–446.

Mou, D. (2014). Understanding China’s electricity market reform from the perspective of the coal-fired power disparity. Energy Policy, 74, 224–234.

Porter, M. E., & van der Linde, C. (1995). Toward a new conception of the environment competitiveness relationship. Journal of Economic Perspectives, 9, 97–118.

Sarica, K., & Or, I. (2007). Efficiency assessment of Turkish power plants using data envelopment analysis. Energy, 32, 1484–1499.

Shrivastava, N., Sharma, S., & Chauhan, K. (2012). Efficiency assessment and benchmarking of thermal power plants in India. Energy Policy, 40, 159–176.

Sueyoshi, T., & Goto, M. (2011). DEA approach for unified efficiency measurement: Assessment of Japanese fossil fuel power generation. Energy Economics, 33, 195–208.

Sueyoshi, T., & Goto, M. (2012a). Data envelopment analysis for environmental assessment: Comparison between public and private ownership in petroleum industry. European Journal of Operational Research, 216, 668–678.

Sueyoshi, T., & Goto, M. (2012b). DEA radial measurement for environmental assessment and planning: Desirable procedures to evaluate fossil fuel power plants. Energy Policy, 41, 422–432.

Sueyoshi, T., & Goto, M. (2012c). Environmental assessment by DEA radial measurement: U.S. coal-fired power plants in ISO (independent system operator) and RTO (regional transmission organization). Energy Economics, 34, 663–676.

Sueyoshi, T., & Goto, M. (2013a). A comparative study among fossil fuel power plants in PJM and California ISO by DEA environmental assessment. Energy Economics, 40, 130–145.

Sueyoshi, T., & Goto, M. (2013b). DEA environmental assessment in a time horizon: Malmquist index on fuel mix, electricity and CO2 of industrial nations. Energy Economics, 40, 370–382.

Sueyoshi, T., & Goto, M. (2014a). DEA radial measurement for environmental assessment: A comparative study between Japanese chemical and pharmaceutical firms. Applied Energy, 115, 502–513.

Sueyoshi, T., & Goto, M. (2014b). Investment strategy for sustainable society by development of regional economies and prevention of industrial pollutions in Japanese manufacturing sectors. Energy Economics, 42, 299–312.

Sueyoshi, T., & Goto, M. (2014c). Environmental assessment for corporate sustainability by resource utilization and technology innovation: DEA radial measurement on Japanese industrial sectors. Energy Economics, 46, 295–307.

Sueyoshi, T., & Wang, D. (2014a). Radial and non-radial approaches for environmental assessment by data envelopment analysis: Corporate sustainability and effective investment for technology innovation. Energy Economics, 45, 537–551.

Sueyoshi, T., & Wang, D. (2014b). Sustainability development for supply chain management in U.S. petroleum industry by DEA environmental assessment. Energy Economics, 46, 360–374.

Sueyoshi, T., & Yuan, Y. (2015a). China’s regional sustainability and diversity: DEA environmental assessment on economic development and air pollution. Energy Economics, 49, 239–256.

Sueyoshi, T., & Yuan, Y. (2015b). Comparison among U.S. industrial sectors by DEA environmental assessment: Equipped with analytical capability to handle zero and negative values in production factors. Energy Economics 52(Part A), 69–86.

Wang, D., Li, S., & Sueyoshi, T. (2014). DEA environmental assessment on U.S. industrial sectors: Investment for improvement in operational and environmental performance for corporate sustainability. Energy Economics, 45, 254–267.

Zhang, N., Zhou, P., & Choi, Y. (2013). Energy efficiency, CO2 emission performance and technology gaps in fossil fuel electricity generation in Korea: A meta-frontier non-radial directional distance function analysis. Energy Policy, 56, 653–662.

Zhou, Y., Xing, X., Fang, K., Liang, D., & Xu, C. (2013). Environmental efficiency analysis of power industry in China based on an entropy SBM model. Energy Policy, 57, 68–75.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2016 Springer Science+Business Media New York

About this chapter

Cite this chapter

Sueyoshi, T. (2016). DEA Environmental Assessment (I): Concepts and Methodologies. In: Hwang, SN., Lee, HS., Zhu, J. (eds) Handbook of Operations Analytics Using Data Envelopment Analysis. International Series in Operations Research & Management Science, vol 239. Springer, Boston, MA. https://doi.org/10.1007/978-1-4899-7705-2_16

Download citation

DOI: https://doi.org/10.1007/978-1-4899-7705-2_16

Published:

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4899-7703-8

Online ISBN: 978-1-4899-7705-2

eBook Packages: Business and ManagementBusiness and Management (R0)