Abstract

The electricity price and production volume determine the revenue of a renewable electricity producer. Feed-in variations to power plants and high price volatility result in significant cash flow uncertainty. A copula-based Monte Carlo model is used to relate price and production volume and to find optimal hedge ratios through minimization of risk measures such as variance, hedge effectiveness, cash flow at risk, and conditional cash flow at risk. In our case study, all risk measures argue for an optimal hedge ratio between 35 and 60% of expected production. The highest risk reduction is achieved by the use of forward contracts with long time to maturity but at the expense of a low risk premium. Conversely, short-term futures and forwards only provide marginal risk reduction, but can yield attractive positive risk premiums. These findings underline the importance of distinguishing the use of derivative contracts for speculation and hedging purposes, through positions in short-term and long-term contracts, respectively.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

With increasing use of renewable sources in the deregulated electricity markets, power producers are faced with production volume risk caused by varying feed-in. This comes in addition to price risk. In this chapter we develop a copula-based approach to the simultaneous price and production risk for renewable electricity producers.

We will use a Norwegian hydropower producer as a case; however, the analysis is general enough to be relevant for, e.g., a wind power producer in Spain or solar power in Germany.

Copula is a statistical tool which has recently received much attention in the financial literature and is popular in practice. Genest, Gendron [20] show that from 2000 to 2005 the number of documents published on copula theory per year increased by a factor of nine. According to their survey, the financial industry is by far the field where copulas have been applied most frequently, due to their advantages in modeling non-normal returns and dependency between extreme values of assets.

It is interesting to extend the copula approach from its traditional financial applications to commodity markets. In addition, it can be of interest for a renewables producer to have an alternative financial approach to the traditional optimization method for risk management purposes.

It would be great to be able to report that copula-based analysis provides significant changes in hedge ratios compared to benchmark methods. This is not the case in our study, however; calculations using historical data (not copulas) recommend about the same hedge ratios, which hover around 50% across different maturities. That is, the recommendation is to sell of around half of the expected future production, using month, quarter, and year contracts. This cuts the risk in half, using variance and value-at-risk-related measures.

This chapter proceeds along the following lines: Sect. 13.2 treats more thoroughly how risks faced by hydropower producers can be measured, modeled, and managed. In Sect. 13.3 the hedge ratios obtained from historical price and production data are considered. The derivation of the copula-based Monte Carlo model is explained in Sect. 13.4. Hedge ratio results from the simulation for various risk measures are then obtained and discussed in Sect. 13.5. Finally, Sect. 13.6 concludes.

2 Market and Institutional Background

Price and production volume are identified to be the main risk factors faced by hydropower producers. Measurement and management of these risks are first discussed. Subsequently, important elements in hedging decisions such as taxation questions and risk premium are treated. Finally, the copula framework used to connect the two identified risk factors is presented.

2.1 Measuring Operational Risks

Illustration of standard deviation in cash flow, CFaR and CCFaR. PDF (cash flow) represents the probability density function of a cash flow distribution. From the figure it appears that tail events affect standard deviation, CFaR, and CCFaR differently. Long, fat tails will not affect the standard deviation a lot, but the CFaR and especially the CCFaR will take much lower values for these extreme scenarios. CFaR and CCFaR are thus good measures for the downside risk

Variance in return, value at risk (VaR), and conditional value at risk (CVaR) [29] are risk measures commonly used by financial companies, but have also been introduced in nonfinancial firms and in the commodity literature. These risk measures are often used to evaluate and find optimal hedging strategies. Fleten et at. [18] consider a hydropower producer and use VaR, CVaR, and standard deviation of the producer’s revenue as risk measures to obtain optimal hedging positions. VaR is also used as a risk measure in [35] to find a producer’s optimal power portfolio. Unger [34] and Kettunen et al. [22] use CVaR.

The variance approach is relatively easy to implement in a model where a hydropower producer’s cash flow volatility depends on the price risk and production uncertainty. Ederington’s hedging effectiveness measure, e, defined in (13.1), can be used for a comprehensive comparison of the variance reduction achieved in hedged power portfolios with different hedge ratios to the variance of an unhedged portfolio [14].

In (13.1), \(V ar(U)\) and Var(H) is the variance of the unhedged and hedged positions, respectively. The Ederington hedging effectiveness measure gives the percentage reduction in variance achieved by the hedged portfolio. One shortcoming of the variance risk measure is that it may give misleading results for asymmetrical and non-normal distributions which are common in power portfolios [28]. This results in higher possibilities of extreme undesirable outcomes in the cash flow.

CFaR and CCFaRFootnote 1 are based on the VaR framework and measure the downside risk in the cash flow. They may therefore be better suited than variance to describe risk for asymmetrical distributions. CFaR α is defined as the α-quantile of the distribution of the cash flow, π. Thus, α is the confidence level as represented in (13.2). CFaR and CCFaR are illustrated in Fig. 13.1.

Standard values of acceptable cash flow threshold values are α = 1 %, 5%, or 10%. The CFaR α represents the threshold cash flow value such that α % of possible cash flow outcomes over a given time horizon are equal or below this value. The choice of the threshold value, α, reflects the risk aversion of a company. By reducing α a firm is more reluctant to accept uncertainty in its cash flow. The appropriate α value for a hydropower producer will be elaborated further in Sect.13.5.4. CCFaR is used to measure the expected value of the cash flow when it is known to be equal or lower than the CFaR α value. The definition of CCFaR is given in (13.3):

2.2 Available Hedging Instruments

The system spot price at Nord Pool is the price obtained in a supply-demand equilibrium in the market without considering transmission grid congestions and capacity constraints. Transmission bottlenecks give rise to different local zonal market prices. Hedging price risk by using futures is a well-discussed topic in the literature [15, 19]. In addition to futures, a power producer can use several other derivative contracts to hedge the price risk, including contracts for difference (to hedge zonal price risks), swing contracts, and options.

Futures and forwards in the electricity market differ from the contracts in the financial market, since they are delivered over a period instead of on a specific day. These power derivatives are therefore comparable to financial swaps [6]. Both futures and forwards traded at the Eltermin market are standardized contracts with denomination in EUR per MWh, and the system spot price is the underlying of these contracts. Futures contracts consist of daily and weekly agreements and are rolling contracts for the next 6 weeks [27]. They are marked-to-market with daily settlement of the change in the market price in the trading period. The difference between the price on the last trading day, called closing price, and the system spot price is used to calculate the settlements in the delivery period. Forward contracts are settled in the same way as futures, but have no marked-to-market settlement in the trading period. Profits/losses are accumulated in the trading period and realized when the delivery period ends. Due to no margin requirements prior to delivery, the liquidity of these long-term contracts is higher than the liquidity of futures [9]. Forward contracts have monthly, quarterly, and yearly delivery periods.

Contracts for differences are the third type of derivative contracts traded at Nord Pool. These agreements are used to hedge the price differences between local areas and the system spot price caused by congestions in the transmission grid. A hydropower producer sells the electricity for the local area price, which not necessarily equals the system spot price. Thus hedging with just swaps will not eliminate all price risk. By using CfDs in combination with swaps it is possible to create a perfect price hedge. The liquidity of these contracts is however low and only traded for five of the thirteen local areas in the Nordic power market. Options available at Nord Pool are European-style calls and puts with quarterly and annual forward contracts as the underlying. These contracts are useful because they offer several strategies to hedge variation in prices [27]. Nevertheless, options are not widely traded and may be expensive to use in hedging policies due to high transactions costs. For a more thorough description of different derivative instruments used in electricity risk management see [12].

Sanda et al. [30] analyzed the hedging policies of twelve different Norwegian hydropower firms. According to their study futures and forward contracts have the highest traded volume and are the most commonly used hedging derivatives. These findings and the low liquidity in both CfDs and options argue for the consideration of only swaps for hedging decisions in this chapter. Still, these products do not necessarily give a perfect price hedge alone.

2.3 Taxation Influences the Hedging Decision of a Hydropower Producer

Hydropower producers in Norway are subjected to four different taxes: income tax, resource rent tax, natural resource tax, and property tax. The resource rent tax is 30% of spot revenues for plants of a certain age, and it is directly determined by the spot price. As a result, the resource rent tax may influence the hedging strategy of a producer since deviations between the spot price and the hedged price are transformed into a relative tax gain or loss. The resource rent tax is calculated from the power plants’ production sales value individually, where operating costs, concession costs, property tax, depreciation costs, and a nontaxed revenue are deduced from the calculated revenue.

Other taxes are less sensitive to hedging decisions in the sense that they are either fixed, as the natural resource tax of 13 NOK/MWh of the average production over the last seven years, or calculated as a percentage of the revenue such as the income tax and the property tax of 28% and 0.2–0.7%, respectively. Since the property tax is deductible from the resource rent tax, the total tax paid by an unhedged producer is \(28\% + 30\% = 58\%\) of the sales value when costs are ignored. For a hedged producer this number is somewhat different dependent on its hedging performance and hedging level.

A cash flow after tax portfolio model for Norwegian hydropower producers, which utilizes swaps to hedge price risk and includes taxation issues, can be developed to find optimal hedge ratios. The revenue after tax of the hedged portfolio, Π, is defined in (13.4), but neglects the variable and fixed costs faced by hydropower producers. The transaction and margin costs in trading swaps are also ignored.

In (13.4), P represents the actual production volume, \(\bar{P}\) the expected production volume, S the spot price, F the swap price, H the hedge ratio, and T C and T RR are corporate and resource rent tax, respectively.

The variance in profit after tax of a hedged portfolio is given by (13.5). The Var(F) term is set equal to zero since the swap price is locked when a producer enter a swap agreement.

The risk reduction achieved in variance in revenue after tax depends on the chosen hedge ratio, H, of the individual hydropower producer. By minimizing (13.5) with respect to H, the optimal hedge ratio, H ∗, is obtained:

By assuming no uncertainty in the production volume, \(E[P] =\bar{ P} \rightarrow Cov(PS,S) =\bar{ P}V ar(S)\), the hedge ratio expression in (13.6) simplifies to (13.7):

The hedge ratio H Tax−neutral ∗ developed in (13.7) states that hydropower producers should hedge 58.3% of their expected production volume. Sanda et al. [30] derive the same hedge ratio for a Norwegian hydropower producer, which means that 58.3% of expected production must be sold in derivative contracts to obtain a fully hedged power portfolio.

One shortcoming with (13.5) to (13.7) is that the variance in swaps is set equal to zero, thus neglecting the possible effect of these contracts’ term structure on the variance. To deal with this shortcoming, one might generate price and production scenarios and use (13.4) directly to measure the risk in the resulting cash flow scenarios.

2.4 Effects of Hedging Strategies for Hydropower Producers

Norwegian hydropower producers experience a negative relationship between electricity prices and production and pay a resource rent tax on spot revenues. These factors reduce and set an upper bound for the optimal hedging level well below 100%, as shown for the tax-neutral portfolio in Sect. 13.2.3.

Fleten et al. [18] argue that “the main reason for the negative correlation between price and hydropower production in the Norwegian market is that the market is regional, and 99% of the electricity production comes from hydropower.” The inflow to the water reservoirs is the main factor determining the production volume, and reservoir inflow depends on precipitation. Local precipitation is correlated with national precipitation, so periods with high water reservoir levels or water reservoir shortages often occur synchronously for all hydropower companies in Norway [18]. Dry and cold or wet and warm periods often tend to coincide within the Nordic countries. Electricity consumption depends on the need for residential heating in Norway. Consequently, the demand for power by customers and production willingness among producers often mismatch. Thus, price and production tend to be negatively correlated. The negative correlation works as a natural hedge and decreases the hydropower producers’ variance in revenue. Further, this limits their incentive to invest in derivative contracts to hedge price risk.

Hydropower producers’ hedging policies vary with their risk aversion, with risk averse producers hedging large parts of their expected production. Multiple optimization methods have been developed using both static and dynamic hedging approaches to investigate different hedging strategies and find optimal hedge ratios. Fleten et al. [18] develop an optimization model to examine the performance of static hedge positions for hydropower producers. They find that the use of forwards to hedge price risk significantly reduces the revenue risk with just a minor decrease in revenue. It is also shown that hedging costs are higher when producers uses contracts with long time to maturity.

Sanda et al. [30] find evidence of an extensive risk management practice among Norwegian hydropower companies. An interesting discovery is that hedging reduces the downside risk in cash flow, measured by CFaR, in ten out of twelve firms. Surprisingly, derivative investments contribute significantly to the firms’ profit without any substantial decrease in cash flow variance. This finding is explained by the prevalent use of selective hedging, meaning incorporating own market views in hedging decisions.

2.5 Connection Between Electricity Spot and Swap Prices

Electricity is a non-storable commodity, and therefore the usual cost-of-carry relationship in finance is not applicable [7, 10, 23, 24]. The risk premium approach has emerged as a method to investigate the spot-forward price relationship. Fama, French [17], Longstaff, Wang [23] and Adam, Fernando [1] define the risk premium as in (13.8):

where F(t, T) is the forward price at time t with delivery at time T, E t [S(T)] is the expected electricity spot price at time T, and R(t, T) is the risk premium. According to [23] the forward risk premium represents “the equilibrium compensation for bearing the price and/or demand risk for the underlying commodity.” The literature treating this topic has shown that the risk premium sign does not need to be strictly negative [7, 21, 23]. A motivation for including a risk premium approach in hedging strategy decisions is to benefit from the possible positive risk premiums and hence the excess return such contracts can provide [1]. For a more thorough examination of risk premiums in commodity markets see [17].

Botterud et al. [8] use the risk premium approach to examine the relationship between the spot and futures prices in the Nordic electricity market from 1995 to 2001. They explain the sign of the risk premium by the risk aversion and flexibility of both buyers and sellers. Hydropower producers are able to quickly ramp production, allowing them to take advantage of the market price fluctuations by adjusting their generation. The attractiveness of fixing the price by using futures for hedging all of the expected production is therefore reduced. At the same time, the production flexibility enables producers to profit from price peaks in the spot market. On the other hand, the demand side has limited ability to adjust demand with respect to spot price changes. As a consequence it may be attractive to fix the price for expected future demand in order to reduce the negative effect of large price spikes. Botterud et al. [8] find that futures prices on average have been higher than spot prices in the period of 1995 to 2001, which according to (13.8) gives a positive risk premium and in this way contradicts the classical literature. They pinpoint that the results should be treated with caution due to the limited data available in the electricity market.

Lucia and Torró [25] examine the sign and size of the risk premium in the Nordic electricity market between 1998 and 2007. They find that risk premiums on average are positive and vary throughout the year. Positive risk premiums are observed for contracts in periods where demand is high, such as during autumn and winter. This result is in accordance with the equilibrium model of [7]. They also find significant evidence of a structural break in the prediction power of this model in the Nord Pool market after the winter 2002–2003.

2.6 Copula, a Tool to Link Price and Production

Correlation is a key factor in risk management as risk generally is the result of both the variance of individual variables and their covariance. As an example the risk in a portfolio of stocks is dependent on not only the individual variance of the shares but also how they tend to covariate. Analogously, most of the risk in the revenue of a hydropower supplier stems from the individual risk of the price and the production volumes, and how these covariate. Historically the most popular way to describe covariance between two or more variables have been the Pearson correlation coefficient, \(\varrho\), explained in [3]. This coefficient is a simple and exact measure for covariance between elliptically distributed variables, but as distributions get more non-normal, skewed, heavy-tailed, and tail-dependent, the correlation coefficient tend to underestimate risk [16].

Copulas represent a new way to describe the dependency structure of the covariance between distributions and were introduced by [31]. He showed that every joint distribution can be written as in (13.9) where C is a copula and \(F_{1}(x_{1}),\ldots,F_{n}(x_{n})\) are cumulative probabilities of the variables \(x_{1},\ldots,x_{n}\). The mostly used copulas are bivariate, and a bivariate function must satisfy four properties to qualify as a two-dimensional copula. These are listed in (13.10) and explained thoroughly in [2].

There exist a large number of functions C defined in (13.9), satisfying the properties of a bivariate copula listed in (13.10). These functions have different dependency structure and can therefore be adapted to various problems requiring a more flexible tool than the linear correlation coefficient. Copula functions have parameters that need calibration to provide an optimal fit to the data. The estimation of the copula parameters is usually done by a maximum likelihood estimation of the joint distribution of the dependent variables. Once the likelihood value is obtained, the best copula can be selected based on an information criterion such as the Akaike information criterion (AIC) or Bayesian information criterion (BIC). If the existing families of copulas provide an unsatisfying fit to the data an alternative approach could be to implement an empirical copula. Alexander [2] presents a straightforward way to create the empirical copula following (13.11). In (13.11) \(\hat{C}\) is the cumulative copula function, \(\hat{c}\) is the density function, T is the number of observations, and x and y are the two dependent variables. For a more thorough study of the copula framework see [33].

Following (13.11) one obtains an empirical copula density function, \(\hat{c}\), and cumulative distribution function, \(\hat{C}\), for the joint densities as illustrated in Tables 13.1 and 13.2, respectively.

Copulas have not yet been given much attention in the nonfinancial literature, and the use of copulas in risk modeling for electricity suppliers in the Nordic power market is not an exception. So far, copulas have mainly been applied to commodity markets to determine the spark spread [5]. Still, there are several reasons to believe that copulas will have the ability to describe the dependency structure between price and production in a better way than a linear correlation coefficient. Risks faced by hydropower producers have several characteristics in common with risks encountered in traditional financial applications. First, electricity prices are far from normally distributed. Second, one could expect a strong tail dependency between price and production. High prices often occur during cold winters with high production despite low production willingness due to low reservoir levels. Low prices are common during wet periods where producers generate as much as they can to reduce the risk of spillage. Thus, a copula’s advantage in modeling non-normal distributions and dependency between extreme values seems like a desirable feature in hydropower risk management.

Finally we note that copulas are not a panacea in risk management. A natural alternative, favored by most electricity companies, is using a fundamental (bottom-up) model to capture the relationship between local production and local price. The advantage of such an approach includes the possibility to consider increased renewable penetration over time.

3 Hedge Ratios Obtained from Historical Data

The purpose of this chapter is to examine optimal swap hedging strategies for hydropower producers to reduce risks. It is therefore of interest to investigate the historically optimal hedge ratios. These historical hedging levels can be used as benchmarks for the theoretically obtained hedge ratios from the model later in this chapter. Historical spot and swap prices along with production volumes for a Norwegian hydropower producer are considered from 2006 to 2010 on a weekly basis. Table 13.3 summarizes what are found to be the optimal static hedge ratios and how to optimally invest in selected swap contracts with one week, one month, one quarter, and one year to delivery, in order to minimize the risk in the 2006 to 2010 period. Variance is minimized; CFaR 5% and CCFaR 5% are maximized and compared with the natural hedge situation. The natural hedge is the same as selling all production in the spot market. For the obtained hedge ratios, it is assumed that a rolling investment in the front contract is taken. A 10% investment in weekly contracts would therefore imply a sale of 10% of next week’s expected production in weekly contracts each Friday from 2006 to 2010.

The first row in Table 13.3 presents the expected cash flow of each strategy compared with the natural hedge case. The cash flow of the unhedged scenario is therefore 100%. When the other risk measures are considered a cash flow of 95.9%, 98.3%, and 99.3% of the unhedged return is obtained for minimum variance, maximum CFaR 5% , and maximum CCFaR 5% , respectively. As all expected cash flow values for the risk measures are below 100% there are costs associated with hedging. Variance in expected revenue is illustrated on the second row. As before, the minimized risk measures’ variance is compared with the unhedged variance. The variance is thus reduced by hedging. Hedge effectiveness illustrates the same as the variance and represents the percentage decrease in variance of each strategy compared to the unhedged case. In this way the sum of the variance and hedge effectiveness row is 100% for each column. CFaR 5% and CCFaR 5% are maximized on row four and five, respectively, and the listed numbers illustrate the percentage of the unhedged expected cash flow the CFaR 5% and CCFaR 5% attain. For example, the CFaR 5% value of 44.6% for the natural hedge situation means that in 5% of the outcomes the cash flow will be less or equal to 44.6% of the unhedged expected cash flow. The higher this value is, the better, since it represent the worst case cash flow. CCFaR 5% measure more extreme values than CFaR 5% , so the percentage numbers for CCFaR are lower. As seen in the table hedging reduces downside risk. The hedge ratios, (HR), in Table 13.3 represent the percentage of the expected production a producer should hedge to minimize the risk measure in question. It is specified how this hedging level should be allocated between weekly, monthly, quarterly, and yearly contracts. In this way the four last rows sum to 100 % for the different risk measures. The total investment in each contract is therefore the suggested hedge ratio multiplied with the percentage of the hedge in the contracts.

Examining Table 13.3 one observes that hedging might reduce risks at the expense of a slightly reduced cash flow. Depending on the considered risk measure, different optimal hedge ratios are obtained. The more a risk measure considers tail risk and extreme values, the lower the optimal hedge ratio is. Finally, it seems undesirable to invest in weekly swaps to eliminate risk. These results are not surprising as short-term swaps are more correlated to spot prices than long-term swaps and will therefore eliminate less risk. Also, it seems reasonable that risk measures that consider extreme events give lower hedge ratios. A producer will as an example incur a great loss if it is highly hedged when a price spike occurs. Although such events are rare, they will affect the CFaR 5% and even more the CCFaR 5% but only have a marginal effect on the variance.

In this historical analysis weekly risk is considered. Natural seasonal cash flow differences, due to price and production differences between winter and summer months, are attempted hedged away. The reason to consider weekly variations despite this obvious drawback is the short, five-year, time horizon of available swap data. For a hydropower producer, annual cash flow fluctuations are of greater interest than weekly variations. However, it is meaningless to investigate risk measures such as CFaR 5% and CCFaR 5% in a data set consisting of five observations.

With the historical optimal hedge ratios in mind it is time to develop a model that can provide data for a theoretical risk analysis.

4 Derivation of the Copula-Based Monte Carlo Model

An overview over the copula-based Monte Carlo model. Model 1 represents the spot price model of [4] which is used to generate spot prices. Together with historical production, the spot prices are used to construct an empirical copula. From the copula, a large sample of dependent cumulative probability values for price and production is randomly generated. The cumulative probabilities are then linked to production and spot/swap numbers. To connect spot/swap prices a new model is necessary since model 1, used for the input values, cannot be employed to estimate swaps with the available data. The two-factor model developed in [24] is therefore used, and constitutes model 2

A challenge in financial risk management is how to cope with non-normality of the distributions of risky variables and their interdependency. As discussed in Sect. 13.2.6, a copula framework will be developed to deal with some of the shortcomings of existing linear correlation models. Further, knowledge about the price-production dependency structure can be valuable for hedging decisions in order to define adequate hedge ratios and optimal use of the available derivative contracts.

To investigate and evaluate hedge ratios a copula-based Monte Carlo simulation approach is used to generate possible cash flow outcomes for a hydropower producer. Dependent electricity spot/swap prices, S/F, and production volumes, P, must be simulated to obtain the cash flow outcomes, since these factors are the only dynamic variables in the cash flow expression in (13.4). Figure 13.2 illustrates how a large sample of dependent prices and production volumes can be generated through a copula-based Monte Carlo simulation. The copula-based Monte Carlo simulation will be described in four steps for explanatory reasons. First, the input variables, production and price (model 1), to the empirical copula are treated in step 1. Then, in step 2, the construction of the empirical copula is elaborated. Subsequently, step 3 explains the generation of correlated cumulative probability values for price and production. Finally, the procedure of linking these cumulative probabilities to production values, spot, and swap prices is considered in step 4.

4.1 Production and Price Input to the Empirical Copula

This section will treat the input variables, price and production, to the copula and represents step 1 in Fig. 13.2. An empirical copula requires a large sample of correlated data points to capture the existing dependency structure. Hence, long data series of price and production are necessary. Figure 13.3 depicts the historical average weekly system spot prices and average weekly production volumes for a Norwegian hydropower producer from 2000 to 2011.

Time series of weekly historical system spot prices and production volumes from 2000 to 2011. Prices are obtained from Nord Pool’s ftp server and production volumes are received from a Norwegian hydropower producer. The figures reveal that neither the price nor the production is normally distributed and both functions seem to be extremely volatile and contain spikes. (a) Average weekly system spot prices (b) Average weekly production volumes

As the electricity price dynamics have changed over the years, a modified and simplified model following the work of [4] has been selected to estimate historical prices conserving the pricing dynamics observed today. Besides, this model enables an estimation of electricity prices going further back than the available market spot prices, satisfying the need of long data series for the empirical copula construction. The spot price model, model 1 in Fig. 13.2, is defined in (13.12) with deviation from normal accumulated reservoir levels (\(\Delta _{H_{t}}\)), 12-month accumulated inflow (I 12M ), and an inflation-adjusted oil product index (O Adj. ) as inputs. The data are obtained from the Norwegian Water Resources and Energy Directorate (NVE), Nord Pool, and Reuters EcoWin, respectively. Nord Pool also provided the spot prices used to calibrate this price model. To prevent estimated spot prices to fall too low, the oil index is adjusted according to the consumer price index. Seasonal load variations are also accounted for by inclusion of a sine function.

All data are collected on weekly basis and span from 1986 to 2011, except the spot prices used for the 2005–2011 calibration period. In (13.12), the adjusted oil index and spot prices are transformed by the natural logarithm. Table 13.4 summarizes the descriptive data of the input variables. The data are observed to be non-normally distributed as the normality Jarque-Bera test is rejected for all factors included in Table 13.4 with a p-value of less than 0.001.

Estimated coefficient values, obtained from the least sum of squares approach, are presented in Table 13.5. All coefficients are significant. From the coefficient’s sign it is apparent that a negative hydrobalance deviation, representing low reservoir levels, leads to higher prices. Surprisingly, high yearly inflow has historically contributed to higher prices, which contradicts common sense. The influence of this variable can hence be questioned. However, as seen in the descriptive statistics, the product of the inflow coefficient and the range of the variable is only a third of the hydrobalance deviation effect, and it might therefore work as a counterweight. Finally, fuel costs represented by an oil index are as expected positively correlated to the spot price. Having the regression coefficients, weekly time series of electricity spot prices can be generated. Electricity prices are generated back to 1986, when the history of the underlying input variables starts.

Autocorrelation plots of historical spot prices from 2000 to 2011. Autocorrelation of weekly data is strong and persistent for many weeks. The autocorrelation from one quarter to the next is less prominent than for consecutive weeks, though the quarterly autocorrelation is still existent. Quarterly data are better suited as input to the empirical copula than weekly data. (a) Autocorrelation plot of average weekly historical spot prices (b) Autocorrelation plot of average quarterly historical spot prices

The empirical copula requires a large number of data points to capture the dependency structure of the input variables. However, for a hydropower producer the annual variations in cash flow and hence the yearly dependency between the underlying variables is most interesting, since seasonal effects are expected and preferably should not affect the dependency structure of the copula. Although a 26-year history of data is estimated, yearly prices do not provide sufficient data points for a robust estimation. By comparing the autocorrelation in price and production it is seen that the autocorrelation is higher for prices than for the production. Therefore the prices must be considered in an autocorrelation analysis. Prices are highly autocorrelated (see Fig. 13.4), which set a lower bound to the frequency of the input price data. Autocorrelated input to an empirical copula results in a dependency structure where some outcomes will have a much higher probability than in reality, which is clearly an undesirable feature. Weekly data should therefore be avoided as input to the empirical copula and one should strive to use low-frequency data to limit the negative effect of autocorrelation. If high-frequency data are selected, seasonality and autocorrelation will be problematic. Conversely, long-term average will not permit a well-fitted copula, due to the lack of data. For this reason, quarterly data are selected as input to the copula. In this way, the autocorrelation of the input price is reduced from the weekly resolution and a considerable number of data, 104 points, are used in the empirical copula calibration. Nevertheless, seasonal effects will still be present and result in more extreme variations in the output scenarios than would have been the situation if annual data were used. To exemplify, the range of the output scenarios is wider for seasonal than for yearly data since high production/prices occurring during the winter can coexist with low production/prices from the summer. This is a shortcoming of the model.

An overview of the estimated spot prices from (13.12) and the actual realized spot prices in the 1986–2011 and 2005–2011 period, respectively. Prior to 2003, the estimated prices were at a significant lower level than in the 2003–2011 period. This is due to the level of the underlying variables to the price model. The price jump in the model bodes well with the detected structural break in [25]

The modeled weekly prices are converted into quarterly data and paired with quarterly historical production volumes for a Norwegian hydropower producer. Historical production volumes are used and not production plans, as [30] confirmed that historical average production is more accurate for predicting production. Descriptive data for the quarterly price and production used as input to the empirical copula is shown in Table 13.6. Comparing the modeled quarterly 1986–2011 price data in Table 13.6 with the weekly observed 2005–2011 price data in Table 13.4, it appears that the average of the quarterly data is lower than the weekly calibration data. The reason for this is the level of the input variables to the model which resulted in lower prices from 1986 to 2005 than from 2005 to 2011, and the difference in price average is therefore not surprising. Figure 13.5 illustrates this trend well, with electricity prices being low until 2003 where they suddenly increased. During the winter 2002–2003 there was a shock in the market and this may have shifted the price level and price behavior [25]. The estimated price model seems to capture this shift quite well. Also, the range of the quarterly data is narrower than that of the weekly data as quarterly average reduces the magnitude of spikes. Still, the minimum quarterly price is lower than the weekly price, and the minimum quarterly price was thus realized prior to 2005. Finally, the Jarque-Bera test, JB, underlines the non-normality of the input data, which further motivate the copula approach.

4.2 Construction of the Empirical Copula

With the input variables to the copula explained, the next step will be to create a copula to relate the dependency between price and production and this constitutes step 2 in Fig. 13.2.

There exist numerous predefined copula functions with different dependency structures between the variables of interest, such as the Clayton and Gumbel copula treated in detail in [33]. As explained in Sect. 13.2.6 copulas have mainly been applied to relate risks in stock portfolios, and a literature search for copulas applied to track dependency between price and production for commodities has been without success.

Empirical copula based on average quarterly price and production data from 1986 to 2011. Note that the x- and y-axis represent the cumulative probability values of the input price and production distributions. The level curves could have been smoother if a larger data sample were used to generate the copula. Alternatively, a possibility could be to smooth the data points in the empirical copula. (a) Joint cumulative probability of price and production, C(u, v) (b) Level curves of the copula

Relationship between estimated quarterly electricity spot prices from (13.12), actual quarterly production volumes for a hydropower producer, and their respective cumulative distributions for the 1986 to 2011 period. From the horizontal flat part of the cumulative price curve it appears that some extreme price spikes have occurred during the sample period (a) Cumulative distribution of the electricity price (b) Cumulative distribution of the production volume

To explain the obtained empirical copula, the joint cumulative distribution and its level curves, depicted in Fig. 13.6, can be investigated. The cumulative probabilities of possible prices F(u | v = V ), obtained from the copula C(u, v), given a production corresponding to the cumulative probability v = V are represented in (13.13):

The numerator in the equation represents the cumulative probability for the (u,V ) sample space in Fig. 13.6 where u is variable and V is fixed. For example, with V = 0. 1 corresponding to a production of approximately 290 GWh/quarter (Fig. 13.7b), a plot of the conditional cumulative price probability distribution, F(u | V ), can be generated by using (13.13). The resulting conditional cumulative probability distribution is graphed in Fig. 13.8. Note that u = F(u) as u is a cumulative probability.

Illustration of the cumulative price distribution conditional on a fixed production corresponding to a cumulative probability V = 0. 1. The conditional price distribution obtained from the copula is compared to an assumed situation with independent price and production. The flat parts of the curve in the 0. 3 ≤ u ≤ 0. 4 and 0. 7 ≤ u ≤ 0. 9 areas are probably due to lack of data. Note that u = F(u) as u is a cumulative probability. The conditional probability curve lies above the unconditional probability curve; thus based on the copula approach one should expect higher than usual spot prices when the production is low

From Fig. 13.8 it appears that conditional on a low production, V = 0. 1, the expected prices are generally higher than if prices and production volumes were independent. A similar analysis with production conditional on price can be performed by switching u and v.

4.3 Scenario Generation of Prices and Production

The next step in the model, step 3 depicted in Fig. 13.2, is to generate dependent cumulative probabilities of price and production volume.

The empirical copula function developed in Sect. 13.4.2 is used to generate numerous scenarios of price and production. These scenarios are simulated by first drawing one random uniformly distributed number between zero and one, representing the cumulated probability for the production, (V ). In order to relate the cumulated production probability with a correlated cumulative price probability a new random uniformly distributed number between zero and one, W, is drawn and multiplied with the cumulative price probability, V. This product, VW, represents the conditional copula value C(u, v = V ), where V is known and u is yet to be determined. As \(V W = C(u,v = V )\), (13.14) can be used to find the unknown u:

From the equation it appears that W is the conditional cumulative probability of u given v = V, F(u | v = V ), defined in (13.13). The relationship between u and F(u | v = V ) was elaborated in Sect. 13.4.2 and exemplified with V = 0. 1 in Fig. 13.8. To obtain u it is sufficient to find the abscissa of the function F(u | v = V ) with ordinate W. The determination of u is illustrated in Fig. 13.9, where random values of V and W are drawn equal to 0.1 and 0.6, respectively. The cumulative price probability, u, is then found to equal 0.47.

Illustration of how to obtain the cumulative price probability u when a random cumulative production probability of V = 0. 1 is drawn. A random W-value of 0.6 is also generated to link the production to a correlated random price. A resulting pair of (u, V ) with values (0.47,0.1) is obtained from this simulation

The process of sampling correlated pairs of (u,v)-values from the empirical copula distribution can be repeated a large number of times and hence forms a copula-based Monte Carlo simulation.

4.4 Connecting the Cumulative Probability Pairs, (u,v), to Production Values and Spot/Swap Prices

The last step in the simulation process, step 4 in Fig. 13.2, is to link the cumulative probabilities from step 3 to production and price numbers.

First, production is considered. A data set of cumulative probabilities for production, v, has previously been generated. These probabilities are linked to the same distribution of quarterly production data used as input to the empirical copula. The relationship between production and its cumulative probabilities is illustrated in Fig. 13.7b. To obtain the production value corresponding to the cumulative probability v one must find the abscissa of the curve in the figure with ordinate v. The production value is found by interpolation of the cumulative distribution.

Second, prices are generated. The process is more cumbersome than for the production, as swap prices must be linked to the electricity spot prices. This is necessary since swap prices are required in later risk analysis, where swaps with different maturities are included in the hedging strategy. The model used for generating input spot prices cannot be used to simulate historic swap prices, due to some missing input variables for forward price estimation. To generate a data set with related pairs of spot and swap prices, the method of [24] has been selected. Their two-factor model is defined in (13.15) and (13.16). This model will be treated in depth before an explanation of how to link cumulative price probabilities to spot and swap prices is given.

In this model spot-forward prices can be approximated with two Brownian motions, a mean-reverting short-term factor, χ t , and a long-term trend factor, ξ t . These factors are driven by correlated normal error terms, dZ χ and dZ ξ , with a correlation coefficient \(\varrho\). The spot and swap prices are internally consistent, stochastic, and time dependent. Seasonality in prices is accounted for by adding a sine function with period one year, f(t). The spot price S t and the forward price F T, t with time to maturity T, at time t, are defined to follow (13.16):

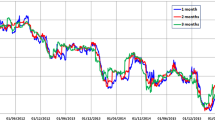

The forward price model is estimated using historical daily input data for spot, weekly, monthly, quarterly, and yearly contracts from 02.01.2006 to 30.04.2010. This period is chosen as some of the forward contracts had a different structure prior to 2006 and the available data stopped in 2010. 26,064 observations are considered, consisting of 23 different swap contracts and the system spot price. The number of days to delivery for the contracts is also used as input to the Kalman filter estimation. Descriptive data for historical spot and some selected forward contracts used as input to the Kalman filter are presented in Table 13.7.

Coefficients and the two factors, χ t and ξ t , are estimated by running a Kalman filter on (13.15). For an introduction to Kalman filtering see [13]. The results are summarized in Table 13.8 and Fig. 13.10.

Estimated time series for the long-term factor ξ t and short-term factor χ t from the [24] two-factor model. The factors have a relatively low correlation coefficient of −0.27 and two factors provide better fit than a one-factor model. No clear trend can be seen for the long-term factor ξ t which should not come as a surprise since electricity is not a commodity from which an investor expect any return. The short-term factor fluctuates around a zero mean which could be expected for a mean-reverting process. (a) Long term factor ξ t (b)Short term factor χ t

These coefficients and factors can be used to generate spot and swap prices, and such simulation yields spot and contract prices with descriptive statistics summarized in Table 13.9. The output data are observed to be non-normal.

Comparing the statistics of the input data to the Kalman filter (Table 13.7), with the output in Table 13.9, it appears that the range of the output data is narrower than in the input data and the standard deviation slightly lower. The difference is most prominent for short-term contracts. These observations should not come as a surprise since a well-known shortcoming of two-factor models, such as the one derived by [24], is the volatility structure they assume. Although such models fit observed prices quite well, the volatility term structure is not captured accurately. Cortazar, Naranjo [11] show how such models tend to underestimate the volatility structure of oil and copper forwards. As the erroneous volatility estimation is particularly strong not only for short-term contracts, but also for long-term contracts, the estimated volatility is consistently below that of their observed data. As electricity shares many of the same properties as other commodities it is likely that the same problem arises for electricity swaps, just as observed in Tables 13.7 and 13.9. The tendency to underestimate volatility in swap contracts is an observation one needs to bear in mind during the later risk analysis.

Having described the pricing relationship between spot and swap prices thoroughly, it is possible to create one single distribution including these two variables. This distribution can then be linked to the cumulated probabilities u. First, a table with possible spot and swap prices with different maturities are generated, as represented in Table 13.10.

In Tab. 13.10, the first column represents the date with daily frequency. The last date in the table, t = 0, can be considered as today, whereas the negative times above represent the number of days prior to today. The spot price S t and swap prices F T, t , where T describes the different swaps, are then generated for each date t with (13.16).

A time analysis of the realized prices obtained by a producer in the derivative market is then conducted, as depicted in Table 13.11. The motivation is to relate the prices of swap contracts and thereby the realized price for the electricity sold, with spot prices. This new way to illustrate spot and swap prices might be useful to investigate the effect of swaps in hedging decisions. The producer achieves a realized price F t for the electricity it sells in the derivative market at time t given by (13.17), where F T, t correspond to the different swaps traded at time t. \(W_{F_{T}}\) is the weight of a producer’s total derivative investment positioned in each contract. \(F_{T,t=(t-T)}\) represents the swap price T days ahead of time t. Note that \(\sum _{T}W_{F_{T}} = 1\).

To exemplify how to interpret Table 13.11, a two-week swap is considered at time t = 0, the last row in the table. The F 2W, −14 entry illustrates that the price of a two-week swap at time \(t = 0 - 14 = -14\) thus two weeks before t = 0 can be considered as the realized price of the electricity if production is hedged using this contract at time \(t = -14\). This hedged price can therefore be compared with the spot price at t = 0. A similar approach can be made for all other dates t and for all other maturities T. Thus, the volatility of the realized cash flow over time can be examined by using (13.4) with S t , F t , and H as input variables.

To create an empirical distribution for spot/swap prices, the rows in Table 13.11 are sorted with increasing spot price, but retaining the same swap prices to the spot prices as in the table. The rows in the table are thus shuffled.

Having created an empirical distribution for spot/swap prices it is now possible to link the cumulative price probabilities, u from step 3 in Fig. 13.2, to simulated spot and swap prices. This is simply done by finding the two successive rows in the sorted table corresponding to the nearest lower and higher u and interpolating between these two rows for each spot and swap contract, as illustrated in Table 13.12. Hence, daily spot and swap prices for all u can be obtained. The price output of the copula will therefore be based on daily and not quarterly data, even though the production has quarterly resolution. The minimum, average, and maximum values of the output price from the Kalman filter, Table 13.9, are to some extent higher than the quarterly data used as input to the empirical copula, Table 13.6. Nonetheless, the standard deviations of the two data sets are almost identical, and since the risk measures in this chapter will be based on relative measures, the choice of working with two different pricing models will not disturb the risk analysis a lot.

As pairs of related spot, swap, and production values now are available, sums and products of these variables can easily be calculated. From the variance of these sums and products it is possible to obtain covariance between price and production that were previously unavailable. This copula-based Monte Carlo simulation can hence be applied to evaluate the price and production uncertainty on cash flow with measures such as CFaR, CCFaR, and hedge effectiveness. The large number of different swap contracts available from the two-factor model also renders possible an analysis of how the term structures of such contracts influence the hedging performance and the hedge ratios of a hydropower producer.

5 Results and Discussion

With the copula-based Monte Carlo model developed in Sect. 13.4, 10,000 scenarios of dependent electricity spot, swap, and production values are generated. These values and different hedge ratios are then used as input to the expression of the hydropower producer’s cash flow in (13.4). Thus, for each hedge ratio the resulting 10,000 cash flow scenarios can be used to examine the cash flow uncertainty expressed by different risk measures.

5.1 Risk Premium

Annualized risk premiums for different forward contracts. Calculated from (13.18). There is a clear downward trend in the annualized risk premium with respect to the time to maturity. Short-term swaps are therefore economically more attractive to hydropower producers than long-term contracts

Before the risk of the cash flow is assessed, an analysis of the risk premium of several swaps traded in the 2006 to 2010 period at Nord Pool is conducted. The risk premium is studied to judge the attractiveness of these derivatives. As mentioned in Sect. 13.2.5 the risk premium of the traded swaps may be connected to the term structure of the contracts. Hence, the risk premium is examined to enable an analysis of the trade-off between risk and return. The risk premium is defined according to (13.18):

where t is a date, T is the time to expiration of a contract, and P is the delivery length of the contract. Thus, \((\sum _{t=T-P}^{T}S_{t})/P\) is the average spot price during the delivery period and F T, t is the forward price of a swap contract with time to maturity, T, at time t.

A summary of the annualized risk premiums is depicted in Fig. 13.11. The figure reveals the tendency of a decreasing risk premium when the time to maturity of these contracts increases. This is consistent with the findings of [8]. Also, the slightly negative drift term, μ ξ , in (13.16) for the-long term evolution in forward prices bodes well with the decreasing risk premium since the price of the contract then decreases with the time to maturity. The decreasing risk premium with longer time to maturity is also consistent with the hedging pressure in the market, explained in Sect. 13.2.5. Consumers tend to hedge themselves in the short term whereas producers often prefer long-term contracts in their hedging strategies. This creates an unbalanced demand-supply situation for swap contracts which affects the pricing of the contracts in the direction of higher risk premiums for short-term contracts and low or even negative risk premiums for forwards with long time to maturity. The risk premium present in swap agreements argues for the use of short-term contracts by producers to obtain an advantageous realized price for the electricity secured in the derivative market. However, the risk premium has little to do with the elimination of risk as yearly variations and extreme prices will still affect the cash flow greatly. Thus, both the risk premiums and the contracts’ abilities to reduce risk should be considered in the hedging decisions.

5.2 Minimum Variance Analysis

A minimum variance analysis can be carried out to measure and reduce risk. With dependent price and production data series from the copula-based Monte Carlo simulation, variance in cash flow can be minimized by choosing a hedge ratio according to (13.6) in Sect. 13.2.3. The hedge ratio represents the percentage of the expected production that should be sold in the forward market. Still, this analysis does not take into account which swaps to include in a power portfolio since (13.6) ignores the term structure of these derivatives, thus neglecting that weekly and yearly contracts affect risk reduction differently. However, this approach gives a benchmark for the optimal hedge ratio.

Figure 13.12 depicts the standard deviation of the electricity producer’s income as a function of the hedge ratio. Minimum variance is obtained for a hedge ratio of about 57.0%. This hedge ratio is consistent and almost equal to the tax-neutral hedge of 58.3% elaborated in Sect. 13.2.3. Hence, the copula framework used to generate price and production pairs has only marginal effect on the variance of the cash flow and barely changes the optimal hedging level. The figure still underlines the significant variance reduction effect of hedging. For a non-hedged producer the volatility of the cash flow is about 42% and drops to approximately 28% when the optimal hedging level is chosen. A question yet to be answered is how the time horizon of different derivative contracts affects risk reduction and how a power portfolio should be composed. Possibly, the optimal hedge ratio can be affected by this choice.

5.3 Restricted Minimum Variance Analysis

Unrestricted and restricted scenarios for price and production for a hydropower producer. The density of the points underlines the probability of the outcomes. Some small discontinuities are the result of lack of input data to the empirical copula. In the restricted copula analysis, some scenarios that greatly exceed historic outcomes have been eliminated. For the unrestricted situation the optimal hedge ratio is 57.0% and it drops to 51.0% for the restricted scenario. The unrestricted scenarios will be used in later risk analyses (a) Unrestricted scenarios (b) Restricted scenario

The generated series for price and production applied to evaluate volatility in the previous section permit scenarios where both very high price and production are connected. Persistent high prices are only viable in the hydro-dominated Nord Pool area during cold and dry periods, which drain the reservoirs to a critical level. During these periods very high production is not desirable, and the very high price and production scenario is therefore unlikely. For this reason it is interesting to investigate the consequence of excluding the assumed improbable scenarios from the data set. An illustration of the effect of the data set when the high price, high production scenarios are deleted is shown in Fig. 13.13. The consequence on the optimal hedge ratio is a minimum variance obtained for a hedging level of 51.0% of the expected production. The reduction from the unrestricted simulation emphasis that a producer should be careful to hedge as much as the tax-neutral hedge of 58.3% and should probably have a ceiling of the hedge ratio closer to 50% when risk reduction is measured by the variance framework. A lower optimal hedging level is the result of a more prominent natural hedge for the restricted copula case, reflecting a more negative correlation between price and production, than observed in the unrestricted minimum variance analysis. In the next analyses, the unrestricted copula scenarios are considered.

5.4 Cash Flow at Risk Analysis

Cash flow at risk is used as a tool to measure downside risk which is relevant for a hydropower producer that operates in a sector where prices are subjected to extreme fluctuations. CFaR and CCFaR are treated more closely in Sect. 13.2.1. The chosen threshold value of these risk measures is set equal to α = 5%. This risk level reflects the secure environment in which hydropower producers operate with stable earnings and low probability of facing financial distress. These criteria should be determining when a company chooses risk measures, according to [32], and CFaR 5% and CCFaR 5% seem suitable. An even higher risk threshold can also be argued for; Fleten et al. [18] use as an example a VaR 10% to monitor risk for a hydropower producer.

The cash flow at risk analysis conducted in this chapter considers the time horizon of the hedging, which was a shortcoming of the minimum variance approach in the previous sections. For contracts with long time to maturity, the spot price has time to deviate a lot from the expected level if price estimates were wrong. Long-term contracts are therefore less correlated with the spot price in their maturity period than contracts with shorter time to maturity. For these short-term contracts, estimates are rarely far out of range. Stated differently, since one knows less about what will happen far into the future than the possible outcome of the next days or weeks, long-term contracts are less correlated with the spot price in their delivery period than short-term contracts. This feature can be the reason behind some of the characteristics of the calculated CFaR 5% and CCFaR 5% in Fig. 13.14 that are discussed below. The CFaR 5% and CCFaR 5% as percentage of expected cash flow in the figures are defined in (13.19). High CFaR 5% and CCFaR 5% values are favorable, since the threshold values then are closer to the expected cash flow.

First, as the time to maturity of the contracts contained in the hedged portfolio increases, the downside risk measured by CFaR 5% and CCFaR 5% is reduced when the optimal hedge ratio is chosen. For a portfolio with one-week contracts, Fig. 13.14a, the CFaR 5% is only 40% of the mean for all hedge ratios. With yearly contracts, Fig. 13.14d, the same number is about 70% for an optimal hedge ratio. Second, when contracts with longer time to maturity are used, the optimal hedge ratio drops. For short-term contracts there is no clear optimal hedge ratio; Fig. 13.14a reveals an almost flat behavior. A relatively high hedge ratio would therefore not imply less risk than a lower one. The optimal hedge ratio then drops successively for monthly and quarterly contracts, Figs. 13.14b and 13.14c, and attains a minimum level of approximately 35% when CCFaR 5% is assessed for one-year contracts in Fig. 13.14d. The hedge

Downside risk in cash flow for a producer hedging only 1-week futures, 1-month forward, 1-quarter forward, and 1-year forward contracts as a function of the hedge ratio. CFaR and CCFaR are represented as a percentage of expected cash flow. For long-term swaps the CFaR and CCFaR curves are more parabolic and can eliminate more downside risk than short-term contracts, as observed by the higher obtained values. The hedge ratio that reduces most downside risk is the abscissa of the maximum of the curves, and the optimal hedging level drops with the length of the hedged contracts. (a) Power portfolio containing spot and 1-week contracts (b) Power portfolio containing spot and 1-month contracts (c) Power portfolio containing spot and 1-quarter contracts (d) Power portfolio containing spot and 1-year contracts

ratio that minimizes downside risk is always lower for CCFaR 5% than for CFaR 5% , as CCFaR 5% punishes extreme events more severely than CFaR 5% . Thirdly, when the time to maturity of the contracts increases, it is more important to choose the correct hedge ratio. Short-time horizons yield relatively flat CFaR 5% and CCFaR 5% curves whereas longer-time horizons yield a more parabolic-shaped CFaR 5% and CCFaR 5% curve. Thus, an overhedged producer using long-term swaps may experience higher risk than an unhedged producer if its hedge ratio greatly exceeds the optimal level.

5.5 Hedge Effectiveness

Hedging effectiveness, defined in (13.1), has also been assessed to evaluate how swap contracts with different maturities affect the variance reduction in cash flow. Hedge effectiveness is treated more thoroughly in Sect. 13.2.1. The hedge effectiveness analysis conducted herein includes the time perspective of the hedge as opposed to the minimum variance analysis in Sect. 13.5.2. The results of the hedge effectiveness analysis are presented in Figs. 13.15 and 13.16.

The figure underlines that any contract with a time to maturity of less than two months is not likely to eliminate more than 10% of the variance in cash flow at any hedging level. Conversely, contracts with longer time to maturity may eliminate almost 50% of the producer’s revenue variance. This result emphasizes that it is pointless to use short-term swaps if the aim is to reduce variance in cash flow. The finding can possibly explain the surprising result in an empirical analysis of hedging policies among Norwegian hydropower producers by [30]. In their study the majority of producers did not obtain a significant reduction in their cash flow volatility. However, they achieved a substantial part of their profit from their hedging program. It seems therefore likely that many hydropower producers focus on increased profitability rather than risk reduction. If the aim of the hedge is to reduce risk, the hedge effectiveness analysis underlines that most risk is eliminated for hedge ratios in the 40–60% area (Fig. 13.16a, b, and c). As explained in Sect. 13.5.4, overhedging can be very risky, and Fig. 13.16d stresses how the variance reduction collapses when the hedging level increases to 90% of the expected production. Overhedging may hence result in increased volatility and all risk protection can be lost. As hedging generally leads to reduced revenue, overhedging implies higher risk and lower return.

Hedge effectiveness for swaps with different maturities for various hedge ratios. The discontinuity in the increasing hedge effectiveness trend observed for 1-month and 1-quarter forwards might be due to the different contract structure than for the preceding points on the abscissa. The increasing hedge effectiveness with time to maturity illustrates that long-term contracts eliminate more risk than short-term contracts at an adequate hedging level. The optimal hedging level is between 40 and 60%. When overhedged, as in Fig. 13.16d, the hedge effect collapses and leads to increased cash flow volatility. (a) 40 % Hedge (b) 50 % Hedge (c) 60 % Hedge (d) 90 % Hedge

5.6 Model Results Compared with Historical Hedge Ratios

In Sect. 13.3, Table 13.3, the optimal hedge ratios obtained from the historical data are 47.5%, 28.0 %, and 15.9% for minimum variance, CFaR 5% , and CCFaR 5% , respectively. In the analyses following the copula-based Monte Carlo simulation, Sects. 13.5.4 and 13.5.5, the optimal hedging levels are 40–60% for the hedge effectiveness approach and about 45% and 35% for CFaR 5% and CCFaR 5% . The empirical variance is compared to hedge effectiveness since both measures minimize variance and include the time perspective. Thus, it appears that the empirical results are in line with the outcome of simulations conducted in this chapter. However, the empirical results tend to recommend slightly lower hedge ratios than the copula-based values. As discussed previously this could be founded in the estimation of the spot-swap relationship with a two-factor model which normally underestimates the volatility of the swap contracts. The estimated swap contracts may therefore be more risky than supposed in the analyses. If a more complete and complex model for the spot-swap price relationship had been selected, the obtained optimal hedge ratios would probably have been lower.

It is also interesting to observe that none of the historical optimal hedging strategies involve investment in weekly contracts. This same observation is discussed in the CFaR 5% , CCFaR 5% , and hedge effectiveness analyses with a conclusion that weekly contracts are too correlated with the spot price to provide risk elimination, and at best yield a positive risk premium for the producer.

Finally, it seems like the empirical analysis obtains less risk elimination, measured by hedge effectiveness, CFaR 5% , and CCFaR 5% , than the copula framework claims possible. This problem questions the adequacy and robustness of the copula-based Monte Carlo simulation.

5.7 Implications

The implications of the previous analyses are that a producer should adjust its hedging strategy according to the purpose of the hedge. The minimum variance analysis provides an easy and comprehensive picture of the optimal hedging level, with a target hedge ratio in the 51–57.0% range. However, this analysis seems too simplistic as it ignores the term structure effects of the swap contracts. The analysis shows that it is possible to reduce the standard deviation in cash flow from about 42% in the unhedged case to approximately 28% when an optimal hedge ratio is chosen; see Fig. 13.12.

Extension of the variance approach by observing hedge effectiveness of different hedging strategies, consisting of investing a variable part of the expected production in one swap contract at a time, is shown in Figs. 13.15 and 13.16. The hedging effectiveness measure supports the minimum variance approach, but specifies that the maximum risk reduction is only possible with long-term contracts. Besides, it is shown that hedging by use of short-term contracts is almost pointless if the aim is to reduce risk. The CFaR 5% and CCFaR 5% analyses present similar results. Short-term contracts have only a marginal risk-reducing effect, shown by the flat curves in Fig. 13.14a, and the investment in these derivatives therefore provides negligible risk protection for a hydropower producer. On the other hand, the long-term contracts may reduce risk significantly, depicted by the parabolic CFaR 5% and CCFaR 5% curves in Fig. 13.14c and d. The hedge effectiveness, CFaR 5% , and CCFaR 5% approaches show that hedging by means of swaps with longer time to maturity can almost halve the volatility and the downside risk in cash flow if appropriate hedge ratios are chosen. Note that a detailed analysis of the appropriate hedge ratios should be undertaken to prevent risky overhedging.

Nevertheless, the attractiveness of the long-term contracts lies only in their risk-reducing nature as they are priced with a marginally positive or even a negative risk premium as depicted in Fig. 13.11. Conversely, short-term contracts are generally priced with a positive risk premium and the premium decreases as the maturity, and hence the risk-eliminating ability of the swaps increases. Fleten et al. [18] also find that hedging costs are higher when producers use contracts with long time to maturity. Thus, the usual risk-reward relationship, faithful to the findings of [26], also applies to the hedging strategy of hydropower producers.

Swaps can therefore be used for two main purposes by a hydropower producer: as speculation in short-term contracts with the aim to obtain attractive prices, but without eliminating much risk, and alternatively as risk-reduction strategies investing in long-term, risk-reducing swaps, achieving a less attractive premium for this risk protection. These double possible uses of these derivatives can probably be the source of the troubling findings of [30], discussed briefly in Sect. 13.5.5. The tendency of hydropower companies to profit from their hedging transactions rather than reducing cash flow volatility can therefore be founded in hedging biased towards short-term instead of long-term contracts. Translated, this means that hydropower companies engage in value adding rather than risk-reducing hedging strategies.

6 Conclusion

For renewables producers, price and feed-in uncertainty are the two most important operational risk factors. An empirical copula is suggested to link the price and production volume in a new way. The copula offers an improved relationship between variables, including flexibility in tail dependency and normality assumptions, which a linear correlation coefficient does not allow. This chapter develops a copula-based Monte Carlo model to investigate hedge ratios for Norwegian hydropower producers taking into account price and production volume uncertainties. The variances in revenue, hedge effectiveness, CFaR, and CCFaR are used as risk measures to examine how swaps with different maturities affect a hydropower producer’s hedging strategy and hedge ratios.

Swaps with short time to maturity are shown to have little effect on risk reduction measured by hedge effectiveness, CFaR, and CCFaR. Conversely, long-term contracts should be preferred in order to obtain the highest level of risk reduction measured by the proposed risk measures. Also, the optimal hedge ratio shifts towards lower levels when the time to maturity of the hedged swaps included in the power portfolio increases. This is due to the long-term contracts’ lower correlation with the spot price which offers a better risk reduction than short-term swaps. Overhedging, meaning hedging too much of the expected production, in long-term derivatives may result in a risk increase in cash flow instead of risk reduction. The assessed risk measures give different results when it comes to the optimal hedge ratio. Thus, it may be problematic to recommend one specific risk measure and one single hedge ratio. The choice of risk measure must therefore be based on the hydropower producer’s approach to risk. Anyway, for all risk measures a hedge ratio of 35–60 % of expected production invested in long-term contracts is observed to give the highest risk reduction.

The hedging performance of swap contracts is seen in light of the expected risk premium for these derivatives. The risk premium is a decreasing function of the time to maturity of the swaps, and the low or even negative premium achieved for long-term contracts can be considered as a cost of the provided risk reduction. Hence, swap agreements can be used for two main purposes by a hydropower producer: as speculation in short-term contracts with the aim to obtain attractive prices but without removing much risk and alternatively as a risk-reduction strategy taking positions in long-term swaps with a negative or less attractive risk premium.

The copula-based model developed in this chapter has some shortcomings. First, the issue with two sets of prices is problematic, with one set used to construct the copula and another set of spot and swap prices used as an output distribution from the copula. The swap price model also underestimates the volatility structure and contributes to higher optimal hedge ratios. Preferably one single pricing model able to simulate a long history of spot and swap prices consistent with today’s pricing level and independent of the production should have been used. Second, price hedging has only been assessed in this chapter and not production risk. This is due to the nonexistent market for weather derivatives in the Nord Pool area which can allow producers to hedge their inflow risk and thereby the production uncertainty. Finally, prices and production volumes are seasonally dependent and the natural revenue variations based on the seasonal fluctuation are to some extent attempted hedged away. The optimal hedge ratios for a hydropower producer might therefore be lower than those recommended in this chapter, since yearly variations are more interesting for a hydropower producer than seasonal fluctuations. Quarterly data are considered to provide a sufficient sample size for the empirical copula estimation. Another effect of using quarterly and not annual data is that the autocorrelation of the input data to the empirical copula is higher. This results in some scenarios with a higher probability than what is actually the case. Consequently, the copula-based Monte Carlo simulation generates more of these scenarios, affecting the analysis of the output data sample. This may in worst case give misleading results. A purely empirical copula approach for price and production modeling can therefore be problematic. In further research it might be interesting to go beyond the empirical framework and make more assumptions to deal with seasonality, autocorrelation, and lack of data.

7 Acknowledgements

We greatly appreciate the contribution from Siri Line Hove Ås and Henning Nymann at TrønderEnergi for providing data and answering all our questions. Further, we would like to thank the staff at Nord Pool and the Norwegian Water Resources and Energy Directorate (NVE) for providing us with necessary data. We are also grateful for comments at the ElCarbonRisk workshop in Molde May 21–22, 2012. We recognize the Norwegian research center CenSES, Centre for Sustainable Energy Studies, and acknowledge financial support from the Research Council of Norway through project 199904.

Notes

- 1.

Cash flow at risk and conditional cash flow at risk.

References

Adam TR, Fernando CS (2006) Hedging speculation and shareholder value. J Financ Econ 81(2), 283–309

Alexander C (2008) Practical Financial Econometrics, Market Risk Analysis, vol 2. Wiley, Chichester

Alexander C (2008) Quantitative Methods in Finance, Market Risk Analysis, vol 1. Wiley, Chichester

Andresen A, Sollie JM Hybrid modelling of the electricity spot price in the Nordic electricity market (2011). Working paper, Norwegian University of Science and Technology

Benth FE, Kettler PC (2011) Dynamic copula models for the spark spread. Quant Finance 11(3):407–421

Benth FE, Koekebakker S (2008) Stochastic modeling of financial electricity contracts. Energ Econ 30(3):1116–1157

Bessembinder H, Lemmon ML (2002) Equilibrium pricing and optimal hedging in electricity forward markets. The J Finance 57(3):1347–1382

Botterud A, Bhattacharyya AK, Ilic M (2002) Futures and spot prices an analysis of the Scandinavian electricity market. In: Proceedings of the 34th Annual North American Power Symposium (NAPS) 2002

Botterud A, Kristiansen T, Ilic MD (2010) The relationship between spot and futures prices in the Nord Pool electricity market. Energ Econ 32:967–978

Cartea A, Villaplana P (2008) Spot price modeling and the valuation of electricity forward contracts: the role of demand and capacity. J Bank Finance 32, 2502–2519

Cortazar G, Naranjo L (2006) An N-factor Gaussian model of oil futures prices. The J Futures Markets 26(3):243–268

Deng SJ, Oren SS (2006) Electricity derivatives and risk management. Energy 31:940–953

Durbin J, Koopman SJ (2001) Time series analysis by state space methods. Oxford University Press

Ederington LH (1979) The hedging performance of the new futures markets. The J Finance 34(1):157–170