Abstract

The liberalisation of energy markets entails the appearance of market risks which must be borne by market participants: producers, retailers and final consumers. Some of these risks can be managed by participating in the forward markets and transferring it to other agents who are willing to bear it and command a compensation for it. Thus, forward prices are made up of two components: the expected spot price at a future date and the forward risk premium. In this chapter we analyse the factors influencing the evolution of electricity forward prices in Spain. These factors include the forward prices for natural gas and CO2 emission rights, as well as the electricity forward prices in Germany and in France and spot prices in Spain. We also analyse the behaviour of the ex-post electricity forward risk premia in Germany, France and Spain, and in particular we find a positive correlation between ex-post electricity risk premia in these three countries as well as between risk premia for electricity and natural gas futures prices.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

The electricity sector is organised around four separate main activities: generation, transmission, distribution and retail supply. While the activities of transmission and distribution (and the way the system operates) are a natural monopoly, and therefore have to operate within a highly regulated framework, electricity generation and retail supply can be open to the competitive wholesale market.

The standard process of liberalisation of the electricity sector, which began in some countries in the early 1990s, was meant to restructure the wholesale and retail activities within the framework of a competitive market where prices are determined by the interaction between supply and demand. The remaining activities of transmission and distribution, as well as the system operations, continue to be regulated; see [12, 13].

Within this framework, we distinguish between a wholesale market in which the electricity generators compete to sell their product to retailers or directly to large industrial consumers and a market where retailers compete to sell electricity to the final consumers who do not actively participate in the main wholesale market (for instance, domestic consumers, small and medium size firms, public bodies).

The main wholesale market can be interpreted as a group of sequential markets in time where electricity is traded ahead of its production/consumption. At one end there is the electricity forward market where electricity is traded years before it is produced/consumed. At the other extreme we have the day-ahead market (which is also referred to as the spot market) and the intra-day market which allows the agents to adjust their positions up to a few hours before delivery.

Thus, as a consequence of the liberalisation process, those firms that run services of power generation and/or retail supply can find themselves exposed to market prices, which are determined and fluctuate according to changes in the levels of supply and demand.

On the one hand, demand shows very marked seasonal patterns both in the very short term (each hour of the day and night) and during the different months of the year, when consumption can be on average higher or lower. It also exhibits unexpected changes (for instance, due to variations in weather) that affect the price of electricity in the wholesale markets.

On the other hand, the supply of electricity also shows predictable patterns plus random events which affect it in the medium as well as the very short term. For example, at each moment of the day, the supply of electricity depends on the effective capacity of power generation of the market at that specific time; on the available technologies at every minute (which in the case of wind power, photovoltaic, and run-of-river hydro production depend on the weather conditions); and, finally, on the price fluctuations of the commodities used as inputs to produce electricity (natural gas, coal, oil and its by-products, as well as on some markets, such as the European Union, on CO2 emission rights); see [5].

It is also worth remembering that electricity cannot be stored. For this reason, market participants cannot hold inventories to smooth abrupt changes in prices which are due to unexpected variations in those factors that affect the demand and the power generation capacity.

Therefore, in an environment in which spot prices are determined by the interaction between supply and demand, market participants are highly exposed to price and volume risk because they are not able to smooth both expected and unexpected changes in the key factors that affect generation costs and electricity demand.Footnote 1 For instance, a generator that is able to pass on the fluctuations in the prices of fuel to electricity tariffs (i.e. paid by households, small firms) is much less exposed to swings in fuel prices than those who cannot transfer cost changes to final consumers. If the uncertainty around fuel prices were the main concern, generators could hedge this risk by purchasing oil, gas and/or coal in the forward markets which, relative to the electricity market, are highly developed and liquid, but the generators will still be exposed to volume risk. However, in general there are many other factors that affect the volatility of wholesale electricity prices and to manage these risks market participants prefer to participate in the electricity forward markets (trading futures, forwards or more complex derivatives such as options) and/or make operational decisions that allow them to set the desired level of exposure to price and volume risk. In particular, an energy company can cover its exposure to the spot price risk (risk of falling prices in the spot market) through the forward sale of its expected output (selling futures or forwards). It can also consider a vertical integration, for instance, becoming a retailer, thus selling directly all or part of its expected output to the final consumer.

Forward markets play an important role both as a mechanism for transferring risk between agents and in the process of gathering information that leads to price discovery. In other words, by determining the price for electricity delivered at a future date, they also contribute to determining price expectations at this future date or period—below we discuss that forward prices can be decomposed in an expectation component and a risk premium component. Also, the information about forward prices on the main market has significant repercussions on the prices that the final consumers pay. In fact, for large electricity consumers, the direct participation in the forward markets can be an alternative to negotiating with electricity retailers.

In the past few years, trading volumes of futures and forwards in Europe have increased in a sustained way. Total trading volumes, both in exchanges and in the over-the-counter (OTC) markets, have grown by 25 % over the period 2006–2010. In fact, if we look further back, volumes have increased every year since the late 1990s, with 2004 being the only exception. The growth in trading volumes (German, France, Scandinavia) is at least partially explained by the progress of the liberalisation process; see [17].

An example of the influence of liberalisation is that observed in Spain, where volumes traded in the forward electricity market have experienced a remarkable increase. In 2007, volume traded in OTC forward markets was 38.5 TWh while in 2011 OTC volume rose to 284 TWh. This increase was driven, among other factors, by the development of new forward trading mechanisms (mainly based on auction mechanisms); the creation of the MIBEL derivatives market known as OMIP; a higher number of participants in the forward market; and the progressive disappearance of regulated electricity tariffs for bigger consumers as well as, in July 2009, the creation of “last resort” tariffs, which are mainly fixed according to a forward trading mechanism. Initially, energy prices were set by the government without using a cost-reflective mechanism, whereas nowadays 3-month forward contracts are auctioned and the auction price is used as reference to set tariffs for final consumers.

The objective of this chapter is to carry out a first analysis of the main determinants of electricity forward prices and forward risk premium in the Spanish market, where we also draw comparisons with the French and German electricity wholesale market. In Sect. 8.2, we present a brief overview of how forward markets work and the types of agents who participate in these markets. In Sect. 8.3, we summarise the academic literature that studies the determining factors of forward prices and the forward premium. With the aim of discussing the current situation of the electricity forward market in Spain, in Sect. 8.4, we examine the main factors that determine the Spanish electricity forward prices. We also study the relationship between forward prices in Spain, Germany and France and take into account the relationship between the forward prices in Spain and the forward prices of natural gas in the European markets, as well as the price of CO2 emission rights. At the end of this chapter, we employ a regression analysis to determine and quantify the links and factors that affect these markets. Section 8.5 examines the evolution of the Spanish ex-post electricity forward premium. To do so, we briefly analyse the evolution of the forward premium calculated with the equilibrium prices of the CESUR call auctions and the futures prices quoted in OMIP. We also analyse the relationship between electricity forward premia in Germany, France and Spain, as well as the relationship between these forward premia and natural gas forward premia in the European markets. Finally, Sect. 8.6 concludes.

Forward Markets: Brief Summary of Their Functions and Operations and Types of Market Participants

Forward markets play two basic economic functions: price determination and transfer of risk among agents. Forward markets allow agents to agree today on a fixed price for delivery of the underlying at a future period which reflects the information and expectations of different market participants. Clearly, the existence of prices associated with the future delivery of a commodity affects the investment decisions that the economic agents have to make today. For instance, if a farmer sees the price at which she can secure the sale of her harvest in the future (after harvesting), she can take into account this information when deciding whether she should or should not sow a crop (invest). Forward markets, or derivatives market in general, thus play a function of “price discovery”.

Forward markets also allow agents to hedge risk and to reach the desired level of risk exposure. Those agents who wish to reduce their exposure to spot price fluctuations can do so by transferring such risk to the ones who are willing to accept it for different reasons. For instance, if two agents who are exposed to the same risk but hold opposite positions (i.e. the producer of a commodity and a consumer of that same commodity) wish to reduce their exposure to future spot price fluctuations, they will be interested in doing a forward transaction. There are also agents who are more tolerant to risk than others and who are willing to buy the risk of the less tolerant participants, provided the price is attractive (risk premium). In this instance, those who are less tolerant to risk (i.e. with a higher degree of risk aversion) may be willing to pay a premium to reduce their risk exposure. And those who are more tolerant to risk are willing to increase their risk exposure in exchange for compensation (risk premium).

Exchange Traded and Over-the-Counter Markets

The trade of forward energy commodities, just like the trade of financial products, can take place in exchange traded markets (futures markets) or in OTC markets. The main difference between exchange traded (for instance, futures contracts) and OTC (for instance, forward contracts) markets is that the former requires a competent body to grant them administrative authority as well as approve its regulations.

The OTC market is a bilateral market, which is self-regulated as the agents agree the terms of the transaction, including the nature of the products that are exchanged, and the generic terms of the contracts. These terms include eligible contract participants and modes of settlement; credit guarantees required from the counterparties; events that might cause the termination of the contract between the counterparties; quantity and quality of the underlying.

In order for the agents to be able to participate in the OTC market, the first step is to open lines of credit between the negotiating parties. Therefore, the higher the number of firms with which the agents have operational agreements, the better price they will obtain in the OTC market (as the number of counterparties will be higher). In all cases, even though the counterparty credit risk management in the OTC markets is bilateral, the OTC transactions can also be registered for clearing and settlement via the Central Counterparties Clearing Houses (CCH).

To reduce counterparty search costs and increase liquidity, the OTC markets can be organised around brokers who facilitate the search of price information—performing an important role in the “price discovery” process. They also identify counterparties in the market and execute transactions on behalf of other market participants. Brokers do not hold positions of their own; i.e. they do not hold inventories of forward contracts.

Futures markets are regulated and require previous administrative authorisation on the part of the respective country’s financial regulator in order to perform their activities. The market regulations, transaction costs, settlement structure and liquidity requirements will have to be approved by the financial regulator. Finally, market agents must become members to be able to trade with other members.

The futures market negotiation platform allows its members to submit orders to buy and sell contracts. The matching of these orders is anonymous which is due to the fact that the CCH intervenes in every futures transaction between a buyer and a seller. The CCH bears the counterparty risk: becomes the seller to every buyer and the buyer to every seller and if one of the party defaults the CCH honours the contract. Moreover, one of the advantages of standardising the contracts that trade in the exchange is that market participants are easily able to unwind their positions. Finally, it is worth noting that the CCH can also register OTC transactions for settlement.

In order to have enough capital to bear the market participants’ credit risk, the CCH establishes a set of minimum credit requirements for membership and market participation. Once a transaction has taken place, the CCH also demands a minimum margin requirement from a buyer and a seller. Later, and on a daily basis, the Clearing House calculates the market value of the participant’s open position on that day (mark to market). If the position generates a loss higher than the collateral, the CCH can demand additional guarantees (margin call). If the margin call is not covered by the clearing member, the CCH can close the agent’s position. Finally, in the case of a participant defaulting, the CCH can make extraordinary margin calls to the rest of market participants in order to guarantee that the CCH has enough funds.

Types of Agents

In general terms, there exist three types of market participants in the futures and the OTC markets: hedgers, speculators, and arbitrageurs.

Hedgers mainly participate in the forward market with the objective of reducing the natural exposure to price risk of a certain commodity. An example is a producer who wishes to reduce her exposure to the future price volatility of her produce. In this case, the agent is exposed to the cash price fluctuations when she sells her product. She participates in the forward market to hedge or reduce her exposure to price risk, by forward selling a percentage of his expected production.

Speculators are agents who take positions according to their expectations about the future price of the underlying. In this sense, speculators participate in the market by taking price risk and expecting to profit from advantageous price fluctuations or earning (on average) the risk premium. Also, speculators may be willing to participate in the forward market to diversify their own portfolio.

For instance, an investment bank with a certain investment portfolio might be interested in becoming an energy forward market participant. The bank’s positions in the forward market consists of a hedging component and a speculative component. In the hedging component the bank takes advantage of the correlation between the variations in the energy forward market and his own portfolio. His participation in the energy forward market allows to reduce the aggregated risk values of his portfolio (diversification effect). Thus, this explains the increased interest on the part of some financial institutions to participate in the energy forward market (such as oil). Their participation in these markets allows them to hedge, among other risks, inflation risk, which affects negatively the profitability of their purely financial portfolio. Therefore, speculators can be interested in becoming energy forward market participants, in order to diversify their portfolios, and hedge the global risk value of their investments. Finally, the bank’s speculative component is designed to profit from the risk premium in the forward market.

Arbitrageurs are agents who analyse the price differential between two assets and profit from possible inconsistencies between their prices or of other financial products linked to them. For example, arbitrageurs operate in two different markets where the underlying is very similar (or where there is a strong correlation between the assets).

In order to guarantee the liquidity of a forward market, it is necessary that these three agents coexist. In a market solely made of hedgers, there will be less liquidity since the volume of exchanges is reduced because most transactions will only take place between two hedgers with opposite positions (for instance, a producer and a consumer). With the presence of agents who operate with a diverse scope, the number of potential transactions increases and the hedging possibilities multiply. Therefore, hedgers benefit from a high number of heterogeneous market participants, among whom there are speculators.

Finally, we note two additional types of agents who play an important role in developing market liquidity: the aforementioned brokers and the “market makers”. Both agents contribute to reduce the counterparty search costs and therefore the cost of the transaction.

The brokers’ basic function is to facilitate trading between two agents with opposite positions. They also facilitate access to the market to those clients who operate in it occasionally or are not big enough to participate in it. The OTC market normally operates through brokers, who centralise the counterparty search, which should otherwise be bilateral, in exchange for a search fee. Brokers channel and centralise the information about those agents who wish to carry out transactions (type of contracts, volumes and target price). In this type of operations, the broker who is a market member searches for counterparties for the agent willing to trade. During the first phase prior to buying and selling, negotiations are anonymous. Once the transaction has taken place, the broker discloses the identity of the counterparties. Recall that in the futures market all transactions are anonymous. In the bilateral OTC market, on the other hand, each counterparty’s identity is disclosed, once the transaction has taken place.

The main difference between brokers and “market makers” is that the former do not hold positions of their own and only bring together buyers and sellers. Market makers, on the other hand, are liquidity providers who are constantly ready to buy and sell contracts whilst holding positions and therefore are exposed to inventory risk.

The Relationship Between Forward and Spot Prices:A Theoretical Framework

Here we review two theories that explain how equilibrium prices of forward contracts written on commodities are obtained. In particular, we look at price formation under the “cost-of-carry” and “hedging pressures” theories. The former was developed by [15] and the latter was developed by [16] which is usually employed to analyse prices of forward contracts when the underlying commodity is non-storable as in the case of electricity. Subsequently, we revise the main empirical results about the determinants of forward prices and risk premium.

Valuation of Forward Contracts Where the Underlying Is a Storable Commodity: Cost-of-Carry Formula

One of the most used and liquid financial instruments in the commodity markets is the futures contract (and forward contracts). If we assume that

-

1.

The costs of storing the underlying commodity are zero

-

2.

The underlying commodity does not pay dividends or the owner of the underlying commodity does not receive any additional profit from its storage

the market price of a future contract at time t will only depend on three variables: the value of the underlying asset S(t), the risk-free rate r and the contract maturity T. In this case, it is easy to show that the price of the future contract at time t (t < T) is given by

Storage costs are important and affect the price of the forward contract. Let us assume that storage costs are q per unit of time and per unit of the commodity. Then, the price of the forward contract becomes

Moreover, it could also be the case that the owner of the commodity derives certain value or yield from keeping the commodity in her possession. For example, from a strategic point of view, an owner of stored natural gas can impute some value to the fact that he can access the natural gas should the need arise and is convenient for him. The value derived from owning the commodity or from receiving a yield from the commodity is known as “convenience yield”. If we assume that the owner of the commodity receives a yield of c per unit of time, then we can show that the arbitrage-free price of the forward contract is

In this section we analysed the determinants of forward prices based on the theory of storage originating with [15]; below we examine [16] theory about the role of futures contracts as instruments to hedge price risk. Although in the past these were considered alternative theories to value forward contracts, nowadays they may be regarded as complementary.

The Theory of Hedging Pressure to Value Futures Contracts

The theory of hedging pressure to value forwards is complementary to the theory of storage. The hedging pressure hypothesis applies to commodities in general—storable or non-storable. Since electricity cannot be stored, the theory that we shortly expose is the main line of analysis in the academic literature to value forward prices in the electricity market.

According to the theory of hedging pressure originating with [16], the futures contract is an instrument to hedge away price risk, as it allows the agent to secure the price at which an underlying asset can be bought or sold at a future date. From this perspective, the futures contract plays a similar role to an insurance policy, in that it eliminates the price risk. Consequently, the price of a futures contract is the sum of the expected price of the underlying at a future date and the anticipated risk premium (“price of the insurance policy”). The risk premium is the price that the hedger is willing to pay to hedge away her exposure to price volatility. In other words, the risk premium is the compensation required by the agent who is willing to take the price risk. The expected risk premium is therefore the price associated with the transfer of risk between agents involved in the exchange of a futures/forward contract.

Generally, the prices of futures contracts differ from the expected price of the underlying at the future date of expiration, due to the existence of a risk premium that certain agents are willing to pay to hedge away the price risk. Similarly, it amounts to the risk that other agents are willing to take on.

The sign of the risk premium will depend on whether the hedgers are mainly producers or consumers, as well as on the number and type of agents who are willing to take on the risk (hedgers and speculators). Keynes, in his original work, assumed that the hedgers were mainly producers, which resulted in a negative risk premium. The producers were willing to sell their expected output at a fixed price (hedging away the spot price risk), which was lower than the expected future spot price. The lower price, associated with the risk premium, results in the lower profit they are willing to make to hedge away the price risk. Subsequent analyses by [9, 10] generalise the hedging pressure hypothesis, relating the risk premium to the net positions of hedgers (which can vary in time); see [6, 7] for a discussion in gas and electricity markets.

Indeed, the sign of the risk premium of a same commodity varies in time, since the risks which producers and consumers are facing can be seasonal. During periods of high demand, spot prices can reach high levels and be very volatile, due to the convexity of the offer curve and the possibility of positive spikes in prices (positive asymmetry in the underlying price distribution). In these periods, consumers desire to be less exposed to the spot price fluctuation and are more willing to pay a positive risk premium or to accept a forward price higher than the expected spot price. During these same periods, producers can prefer to be exposed to (potential) positive price shocks (positive asymmetry in the underlying price distribution) and be less inclined to offer cover, i.e. sell forwards or futures contracts. The risk premium to secure a price during these periods and to hedge away possible losses from the exposure to the spot price (with a positive asymmetric price distribution) can be high.

In this context, it is expected that the entry of speculators in the market, as agents who are willing to offer cover (to buy or sell futures contracts to producers or consumers), can reduce the risk premium, as the market becomes more competitive.

The risk premium is therefore the price associated with the transfer of risk between speculators and hedgers. Like any other prices, a high-risk premium discourages certain agents to hedge. For a determined level of risk premium, they might prefer to be more exposed to the spot price fluctuations. Therefore, at a higher level of (expected) risk premium, demand for cover is lower. Similarly, a high-risk premium will incentivise speculators to participate in the market, if there are no major costs or barriers to their entry. For a high level of expected risk premium, they will be willing to offer cover, in exchange of taking on the price risk.

Therefore, like in any other markets, speculators will participate with the hope to obtain a gain. In their case, the incentives to enter the market come from the expectation of gaining a profit from taking on the risk premium from the hedgers. They are also incentivised to participate due to the diversification effect that futures contracts have on their portfolio (for instance, electricity futures).

The risk premium is an important concept that affects the costs and the benefits of hedging. At the same time, decisions about production, storage and consumption are made taking into account the role that futures prices play as indicators of future spot prices. Therefore, it is important to understand the difference between futures prices and spot prices in the future (risk premium).

The Forward Risk Premium: Ex-ante vs Ex-post

According to the theory of hedging pressure, the price of a forward contract can be decomposed into the sum of two terms: the expected price of the underlying and a risk premium. This risk premium could either be positive or negative. Thus, if the price of the forward contract is above the expected value of the underlying, i.e. the risk premium is positive, the consumers (buyers of the forward contract) are willing to pay over and above the expected value of the commodity to avoid exposure to fluctuations in the price of the commodity. Similarly, if the price of the forward contract is below the expected value of the commodity, the producers are willing to offer a discount so that they can avoid exposure to changes in the value of the commodity they would otherwise have to sell in the spot market.

There are two ways in which one can define the forward risk premium: ex-ante and ex-post. The ex-ante forward premium is defined as the difference between the forward price and the expected price of the underlying commodity. Thus, the ex-ante forward premium is not directly observable from market data and requires to model the dynamics of the underlying commodity to be able to calculate the expected value of the commodity at a later date. Therefore, the main disadvantage of this approach is that different models for the stochastic dynamics of the commodity will generally result in different values for the expected price of the commodity.

The ex-post forward premium (or realised forward premium) is defined as the difference between the forward and the realised spot price on the day (or days) that the forward contract expires.

Therefore

where we recall that F(t, T) refers to the forward’s price at time t for delivery of the underlying at the future date T, and here S(T) is the mean of the (realised) spot price during the delivery period T (if the delivery period is one day then it is the spot price on that day).

For example, the delivery period T could be from the 1st of January until 31st of January of the same year, and in this case S(T) is the mean of the electricity price during all the days in January. Finally, \(\mathbb{E}_{t}\) is the expectations operator conditioned on the information up until time t.

Note that the ex-post risk premium can be decomposed in the following way:

In other words, the ex-post forward premium can be interpreted as the sum of (a) the ex-ante forward premium, and (b) the difference between the expected value of the price of the commodity during the delivery period and the realised price during the delivery period, i.e. the forecast error.

Forward Premium: Empirical Studies

A number of studies have measured the forward premia in the most important electricity markets in the USA and Europe; see [1–4, 6, 8, 11, 14, 18, 19].

[6] study the forward premia dynamics of England and Wales during the period 1999–2006 NordPool during 2000–2006 and PJM during 1999–2006. The authors find that in all markets the ex-ante forward premia (using monthly forwards) are highest when the volatility of demand is also highest. For example, in the PJM market, the forward premium is between 30 $/MWh and 75 $/MWh during the months of May, June and July during 1999 and 2000. These results are similar to those of [2] for the same period.

[6] also find that in all markets the forward premium is seasonal and there are months where it is positive and others when it is negative. For instance, in the PJM there are months during the 1999–2000 period when the premia are negative. Similarly, in the England and Wales market they find that the forward premia are negative between February and July during 2002 to 2005, and in NordPool the forward premia are also negative during February, April, May, June and July between 2003 and 2006. The intuition is that when sellers of forwards are keen to lock in revenues, they are willing to offer forward contracts at a discount below the expected value of the commodity, thus the forward premia become negative because \(F(t,T) < \mathbb{E}_{t}[S(T)]\). Similarly, when consumers are pushing forward prices above the expected value of the commodity, the forward premia are positive, \(F(t,T) > \mathbb{E}_{t}[S(T)]\); this is the case in England and Wales during August and January due to high demand and high volatility of demand as well as increased probability of observing spikes in prices.

Moreover, [18] analyse forward prices in the PJM market during the period 1999–2005. The authors find that for some days during July in 1999–2001 the forward premia reached values of around 50 $/MWh. After this period, the premium decreases and in 2005 it is around 19 $/MWh. Their study shows that periods of high forward premia coincide with those when the probability of observing spikes is also highest which is normally around the summer months.

[8] analyse the forward premia in the Spanish market during the period 2003–2008. They find that the ex-post premium using monthly contracts is not statistically significant different from zero although there is considerable variation from month to month. Moreover, [14] analyse the forward premia in the NordPool market during 1997–2007 and find that, on average, the forward premia are positive and seasonal: during the winter months it is high and during the summer it is zero. [1, 4] also look at the dynamics of the forward premia in England and Wales and Germany, respectively.

The recent work of [19] studies different factors that affect the dynamics of the electricity forward premia in the European Energy Exchange (EEX) using monthly contracts. The authors find that the forward premia in gas contracts have an effect on the forward premia of electricity contracts, particularly the premia in the peak electricity contracts. We note that the findings we present in this chapter (see Sect. 8.5) show that the (ex-post) quarterly forward premia in wholesale electricity markets is related to the quarterly forward premia of neighbouring markets (France and Germany) and the (ex-post) forward premia found in the gas forward markets. Therefore, our results lend support to those of [19].

In the next Sect. 8.4, we analyse the dynamics of forward prices as well as their key determinants, before analysing, in Sect. 8.5, the dynamics of the forward premia.

An Analysis of the Key Determinants of Electricity Forward Prices in Spain

In this section we examine a few of the key determinants of electricity forward prices in Spain. Firstly, we present a brief review of the electricity generation mix in Spain. Secondly, given the marginal role of combined cycle gas turbine (CCGT) in the Spanish electricity market, we study the relationship between electricity forward prices and an indicator of forward variable costs of a CCGT plant that takes into account forward prices for natural gas on the European reference marketsFootnote 2 and prices of CO2 emission rights. Thirdly, we analyse the correlation between electricity forward prices in Spain, France, and Germany. Finally, we present the results of a preliminary econometric analysis where we show that there are relevant factors which are specific to the Spanish spot market and contribute to determining the yearly forward prices. Among them, we include the international prices for natural gas, coal and CO2 emission rights, and the electricity futures prices in neighbouring countries.

Energy Balance and Installed Power Capacity by Energy Technologiesin Spain

Up to 31st December 2010, the installed power capacity in Spain amounted to 97,447 MWh, of which 63,833 MWh was generated by conventional units and 33,614 MWh by renewable producers; see Table 8.1. The installed capacity of CCGT plants is the highest in the Spanish generation park, amounts to 25,220, MWh, and it is followed by wind power turbines (19,813 MWh); hydro power stations run by conventional operators (16,657 MWh); and coal-fired thermal power plants (11,380 MWh).

In terms of generated power, the CCGT plants produced almost 65 TWh in 2010, which represents 25 % of the electricity demand in mainland Spain. This was 17 % lower than in the previous year, due to the combined effect of lower electricity demand and a higher output from renewables. In 2010, hydro power generation amounted to 38 TWh (a 59 % increase compared to 2009), whilst wind technology generated 42,6 TWh (an increase of 18,5 % compared to the previous year); see Table 8.2.

From Tables 8.1 and 8.2 it can be seen that CCGT plants play a very important role in the energy mix in Spain (marginal technology), irrespective of the annual variations between electricity-generating technologies in the energy balance. For this reason, it is not surprising that natural gas prices and CO2 emission rights also play an important role in the evolution of the wholesale electricity spot and forward prices in Spain. In the next subsection, we analyse the relationship between natural gas and CO2 forward prices and Spanish electricity forward prices.

Electricity Forward Prices in Spain, Natural Gas Forward Prices and CO2 Emission Rights

Given the marginal role of CCGT technology in the Spanish electricity market, it seems reasonable to assume that natural gas prices and CO2 emission rights play an important role in determining electricity forward prices. Even though renewable power plants are important in the energy mix, calculating the impact of energy production from these technologies (especially from wind turbines) a few months ahead is very difficult. For this reason, it is reasonable to think that fluctuations in natural gas forward prices have a larger impact on electricity forward prices than daily or weekly variation in wind power production. In other words, information about the wind turbine production during a specific month does not provide agents with relevant information regarding wind production (and hence expected prices) a few months in the future.

In this sense, Fig. 8.1 shows the evolution of the calendar-year electricity futures contract with delivery in 2011 (OMIP contract FTB YR-11), and the evolution of an indicator of forward variable energy cost of a CCGT, that takes into account the price of the natural gas futures contract with delivery in 2011 and the price of CO2 emission rights (EUA-11), through the corresponding efficiency and emissions rate. The figure shows the high correlation between the price of the calendar-year electricity futures contract and the calendar-year natural gas futures contract (and the price of the EUA-11 contract). With the exception of the period between February and April 2010, when the indicator was below 40 euro/MWh, the price of the calendar-year electricity contract was \((+/-)10\) % within the range of the variable forward cost indicator.

Figures 8.2 and 8.3, respectively, show the evolution of the price of three-month electricity futures price with delivery in Q4 2010 (FTB Q4-10) and Q1 2011 (FTB Q1-11) and the variable forward energy cost indicator.

From Figs. 8.1–8.3 we can conclude that the price trend of electricity futures contracts in Spain can be at least partly explained by the evolution of natural gas forward prices on the European markets and those of CO2 emission rights.

Electricity Forward Prices in Spain, France, and Germany

It is a known fact that the electricity interconnection capacity between Spain and France, and thus with the rest of Europe, is very limited. Indeed, Spain is an “energy island”. However, as Figs. 8.4 and 8.5 show, the prices of electricity forward contracts in Spain and those in France and Germany are correlated. Specifically, Fig. 8.4 shows the daily evolution of the price of three-month base-load futures with delivery in Q4 2010 in France, Germany and Spain during the period between January and September 2010. Figure 8.5, instead, shows the daily evolution of the price of calendar-year base-load futures with delivery in 2010, between January 2008 and December 2009. In both figures, we observe that the trend that Spanish forward prices follow is similar to the one followed by forward contracts in France and in Germany. However, the difference between the French and the German contracts is lower than the difference between each one of these and the Spanish contract. Likewise, the difference between electricity forward prices in France and Germany is smaller and less volatile than the spread between the electricity forward prices in either one of these countries and the Spanish contract.

The correlation between electricity forward prices in these three countries is at least partly explained by the fact that the fuel forward markets—such as the natural gas and the coal markets—and the contracts for CO2 emission rights are European. Therefore, although Spain can be considered an energy island, the dependence of electricity forward prices on international natural gas, coal and CO2 prices is a channel for the interdependence between electricity forward prices in Spain and forward electricity prices in Germany or France.

Finally, Fig. 8.6 shows the average price of three-month futures contracts in Germany, France and Spain. The figure also includes the equilibrium price at the CESUR (supplier of last resort) call auctions in the Spanish market, where the contract auctioned is a three-month (base-load) forward contract (equivalent to the quarterly contract traded at the Iberian futures market, OMIP). In general terms, we observe that there is a positive correlation between the average prices of the contracts taken into account.

Average price during the final days of negotiation of three-month futures in France, Germany and Spain and the equilibrium price of the equivalent contract from the CESUR call auctions (three-month base-load contract). Source: EEX/Powernext, OMIP, CESUR call auction administrator. Authors’ calculations

Regression Model: Summary of the Key Determinants of Futures Prices

Natural gas and coal forward prices (with delivery during the same period) and the prices of CO2 emission rights are among the potential explanatory factors of the evolution of electricity forward prices in Spain. Other explanatory factors include the electricity forward prices of equivalent contracts (base-load contracts with delivery during the same period) in neighbouring countries (France and Germany), as well as factors which are intrinsic to the Spanish electricity market (for instance, the level of hydro reserves).

It is worth considering that the influence and relevance of each possible explanatory variable might change according to the forward contract taken into account. Intuitively, it would seem reasonable to think that the evolution of daily prices on the spot market or the level of hydro resources might have more influence on those forwards with a delivery nearer in time (i.e. contracts close to the delivery period), for instance, monthly contracts with delivery in one month. Comparatively, it is reasonable to assume that forward prices of fuels or electricity forward prices in France and Germany might have more influence on those contracts with a longer delivery. Although a complete analysis of the factors that affect Spanish electricity forwards for different time-to-delivery contracts is beyond the scope of this chapter, we present a preliminary model to analyse the factors influencing the Spanish calendar-year futures prices with delivery in 2011. A future interesting line of research would be to compare the different sensitivities of electricity forward prices in different countries to the same common factors (i.e. international natural gas, coal and CO2 prices).

Table 8.3 shows the results of a regression analysis using the calendar-year futures contract with delivery in 2011 traded in the Iberian electricity futures market OMIP. In this case, the explanatory factors are the: French electricity futures contract covering one year ahead (Cal-11 elec. FR); natural gas contract with delivery in 2011 quoted on the European Energy Exchange (Cal-11 gas nat. EEX); European calendar-year coal contract with delivery in 2011 (ARA Coal Year Futures Cal-11); and CO2 emission rights in 2011 (EUA-11). Likewise, we include the level of hydro reserves compared to the average during the same week in the past 5 years “Diff. Hydro Reserv” and the fluctuating average during the past 30 days of the spot market price (“spot price moving average”).

The results of the regression analysis show that the model obtains a high R 2 = 0. 83 coefficient. The signs of the estimated variables are as expected. This means that the higher (lower) the price for natural gas, coal, emission rights and moving average of the electricity spot, the higher (lower) the price of the calendar-year electricity futures. Likewise, higher levels of hydro reserves (compared to the historical average) should exercise a downward price pressure on forward prices—this is borne out by the results of the regression model. Finally, we observe that the price of natural gas and the EUA-11 also have a significant influence on the equivalent contract (calendar-year contract with expiry in 2011) in France. Whilst statistically significant, the correlation coefficient linked to the coal forward contract, instead, is less influential. Hydro reserves play an important role (the correlation coefficient is significant). However, the moving spot price average, though statistically significant, is associated to a very small coefficient. Therefore, its effect on the forward price with expiry in 2011 is negligible.

According to the results of the regression model, some of the factors that partially explain the evolution of the electricity futures prices in Spain include the evolution of forward prices for natural gas in Europe; the CO2 emission rights; and, finally, the electricity forward prices in France.

In the next section, we analyse the evolution of the ex-post forward premium in Spain. We also examine the correlation that can potentially exist between risk premia in European futures and risk premia in natural gas futures.

An Analysis of the Ex-post Risk Premium

In this section we examine the evolution of the ex-post electricity forward risk premium calculated from the futures prices (and ex-post spot prices) of France, Germany and Spain. For the Spanish case, we take into account the ex-post forward risk premium obtained from the difference between futures prices traded at the Iberian electricity futures market OMIP and (ex-post) spot prices, and also the one obtained from the difference between the equilibrium prices of CESUR (supplier of last resort) call auction and the corresponding (ex-post) spot prices.

In particular, we firstly analyse the evolution of ex-post electricity forward risk premium in Spain. Secondly, we compare the evolution of the forward risk premium in each of the three markets we analyse: France, Germany and Spain. The results show a high correlation between the electricity forward risk premia in these three countries. Thirdly, we perform a comparative analysis of the forward premium in the electricity and the natural gas markets. The goal of this last analysis is to provide some empirical evidence on the relationship between the electricity forward risk premium and the natural gas forward risk premium.

An Analysis of Electricity Ex-post Forward Risk Premia in Spain

In this section the evolution of the ex-post forward risk premium in Spain is analysed. We calculate the ex-post risk premium calculated from the quarterly forward prices and from CESUR call auctions. Firstly, we show the evolution of ex-post risk premium computed as the difference between equilibrium prices of the CESUR call auctions offering three-month base-load products and the ex-post spot (day-ahead) prices. In the quarterly CESUR auction, suppliers of last resort purchase three-month base-load forward contracts with delivery in the next quarter. The equilibrium price of the auction is the main determinant of energy cost component of electricity tariffs of last resort in Spain. Therefore, both the evolution of the equilibrium prices in the CESUR auction and the evolution of the ex-post forward risk premium have important implications for policy makers in Spain.

Figure 8.7 shows, for the period between July 2007 and March 2012, the evolution of the OMEL day-ahead average spot price and the equilibrium price of the CESUR call auctions (three-month base-load products) over the delivery period (three months after the date the call auction was held). From Fig. 8.7 we see that for the period July 2007 to June 2009 spot prices during certain quarters are higher than the price resulting from the CESUR call auctions, resulting in a negative ex-post forward risk premium. Thus, there are alternating quarterly periods with positive and negative ex-post forward risk premia (see also Fig. 8.8 below). However, during the second semester of 2009 and the first semester of 2010, we observe how the difference between the price resulting from the CESUR call auctions and the day-ahead spot prices is clearly positive. The differences are very high, especially during the first semester of 2010, although it must be stressed that spot prices during this period were abnormally low (compared to historical levels), due to the very high levels of wind and hydro production in Spain during that period. From the last part of the figure, second semester of 2010 and year 2011, it can be seen that differences between CESUR call auctions and ex-post spot prices returned to a lower level, although on average the ex-post forward premium has been positive (i.e. CESUR call auction equilibrium prices are above ex-post spot prices).

Figure 8.8 shows the ex-post forward risk premium for three-month base-load contracts, calculated using OMIP traded futures prices and the prices of the CESUR call auctions. In this figure, we observe how the forward risk premium calculated using OMIP traded futures prices or the CESUR prices alternates in sign during the first eight quarter intervals (from Q3 of 2007 to Q2 of 2009). Nevertheless, from Q3 of 2009 to the last quarter interval we analyse (Q4-10), the differential has been generally positive. It is worth noting that the only quarter, when the risk premium calculated using OMIP traded futures prices and the prices resulting from the CESUR call auctions differ in sign, is the second quarter of 2010. The main reason for this difference is that the CESUR call auction that obtained this quarterly price was held in December 2009, i.e. this was one of the two auctions held six months in advance of the delivery period. At the time, the price of the three-month contract with expiry during the second quarter of 2010 was higher than the one obtained during the month of March 2010. Therefore, a factor that also affects the risk premium which is obtained starting from the prices resulting from the CESUR call auctions is the timing of the auctions and in particular the time between the auction is held and the start of the delivery period. In other words, the hedging or procurement strategy employed by any hedger is an important factor behind the ex-post forward risk premium that a particular hedger may obtain.

A Comparative Analysis of the Forward Premium in Spain, France and Germany

In previous sections, we observed that there is a positive correlation between electricity forward prices in Germany, France and Spain. In this section, we analyse the ex-post forward risk premia obtained from quarterly forward prices in these three countries. As in the previous section, in the case of the Spanish market, the forward risk premia is calculated both from futures prices traded at the Iberian derivatives market OMIP as well as from the prices resulting from the CESUR call auctions (where contracts traded are quarterly base-load forward contracts).

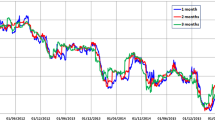

In Fig. 8.9 we show that the evolution of quarterly ex-post forward risk premia in different markets maintains a certain correlation. During the quarters in which the risk premium is positive (negative) in Germany and in France, it is also positive (negative) in the Spanish market.

Average price during the last trading days of three-month electricity futures in France, Germany and Spain, and the equilibrium price for the equivalent contract resulting from the CESUR call auctions. Source: Authors’ calculations from data supplied by OMIP, OMEL and the CESUR auction administrator

It is worth noting the evolution of the ex-post risk premium from the CESUR call auctions during the second semester of 2009 and the first semester of 2010. In Q4 of 2009 and Q1 of 2010, the ex-post risk premium obtained from the CESUR call auctions in Spain is much higher than the one in Germany and in France. This also includes the risk premium that is calculated using futures prices obtained during the last trading days on the OMIP market. Likewise, the risk premium obtained from the CESUR call auctions is positive during Q2 of 2010. During the same quarter, instead, the risk premium obtained from the OMIP traded futures price, as well as the risk premia in Germany and in France, is negative. As explained above, the fact that the sign of the risk premium obtained from CESUR call auction prices and the one obtained from OMIP futures prices is different is due to the fact that for that quarter the corresponding CESUR call auction was celebrated in October (rather than in December). As a result, the difference in the sign of the risk premium provides evidence on the effect of the procurement or hedging strategy in the resulting ex-post forward premium.

Among the possible factors that affected with greater or lesser intensity the risk premium during these quarters, we include the low prices obtained on the spot market, with a high number of hours in which the spot price was zero; the interval between call auctions employed at the time; the relatively high volumes that were acquired during the ninth and the tenth CESUR call auctions; and, finally, the more relevant contribution of the CESUR call auctions in the formation of last resort tariffs. In any case, we stress the fact that the size and sign of the ex-post forward risk premia in France, Germany and Spain has positive correlation. This positive correlation means that there is some kind of integration among the electricity markets we analyse, and we hypothesise that there may exist a common factor that drives the ex-post electricity forward risk premium. In the next section, we analyse the relationship between the electricity forward premium and the natural gas forward premium.

A Comparative Analysis of the Forward Premium in the Electricity and the Natural Gas Markets

In previous section, we argued that natural gas forward contracts in Europe are one of the determinants of the evolution of electricity forward prices. In particular, we showed in Sect. 8.4.4 above the role of natural gas forward prices in the Spanish forward electricity prices. Given the correlation we observe between electricity forward prices in Spain, France and Germany, it is worth considering the evolution of the forward risk premia for electricity and natural gas. In fact, in the previous section, we showed that the evolution of the forward risk premia in France, Spain and Germany follows a similar trend which suggests the existence of a “common factor” that affects the forward prices and, thus, the risk premia in the three markets (perhaps with different degrees of intensity). Figure 8.10 shows the electricity forward risk premia in Germany, France and Spain (see also Fig. 8.9) and the forward risk premia for natural gas (with settlement in the NBP and TTF gas markets). All the ex-post forward risk premia are calculated using the three-month contracts with expiry during the following quarter.

As it can be seen from Fig. 8.10, the ex-post risk premia for the three-month contracts calculated using the natural gas forwards and the electricity forwards, respectively, follow similar trends. Even though the magnitudes of the risk premia differ, we observe that there is a high correlation between natural gas risk premia and electricity forward risk premia. Specifically, the average natural gas risk premia (1.26 EUR/MWh in NBP and 1.02 EUR/MWh in TTF) are lower than the average risk premia for three-month electricity contracts (4.56 EUR/MWh in Germany; 4.75 EUR/MWh in France; and 3.53 EUR/MWh in Spain), at least for the contracts and the period we analyse.

The correlations between the natural gas and the electricity risk premia are always positive, as Fig. 8.10 depicts. The correlation matrix shows that the correlation between the electricity forward contracts is, in the three cases, somewhat higher with the TTF contract than with the NBP contract. Moreover, the correlation between electricity risk premia and natural gas risk premia is higher in France and Germany than in Spain (if we analyse both TTF and NBP data). Specifically, the correlation between the French and German electricity risk premia and the natural gas risk premia fluctuates between 0.69 and 0.76 (TTF and NBP data). The correlation between the Spanish electricity risk premium and the natural gas risk premium fluctuates between 0.35 and 0.41 in the NBP and TTP gas markets, respectively.

Although it is beyond the scope of this chapter, some promising lines of research would be to analyse if the correlation between natural gas forward risk premia and electricity forward risk premium behaves in the same way when futures contracts with different maturities (monthly or annual contracts) are considered. On the other hand, by enlarging the period of analysis, it would be interesting if the correlation between natural gas and forward premia is time varying, and if this is the case, it would be also worth interesting to analyse possible determinants of this hypothetical time-varying correlation.

Conclusions and Future Work

The liberalisation of energy markets entails the appearance of market risks which must be borne by market participants: producers, retailers and final consumers. Some of these risks can be managed by participating in the forward markets. These markets are instrumental to fix in advance the prices at which the agents buy and sell power at a future date. Therefore the liquidity of forward markets and in particular the liquidity of forward contracts with different maturities will affect the possibilities that agents have to obtain the desired levels of exposure to spot price risk.

Achieving the desired level of risk implies transferring part of the risk to other agents who are willing to bear it and command a compensation for it. This compensation is the forward risk premium which is implicit in the forward price. Thus, forward prices are made up of two components: the expected spot price at a future date and the forward risk premium.

In this article we show that there are various factors that influence the evolution of electricity forward prices in Spain. These factors include among others the forward prices for natural gas and CO2 emission rights, as well as the electricity forward prices in Germany and in France and spot prices in Spain. An interesting line of future research would be to analyse if the influence of these factors in the evolution of electricity forward prices depends on the maturity of the forward contracts, i.e. if the sensitivities of forward prices to those factors is time-to-maturity dependent.

We also analyse the behaviour of the ex-post electricity forward risk premia in Germany, France and Spain. In particular, the ex-post risk premium analysis has highlighted a positive correlation between ex-post electricity risk premia in Germany, France and Spain, as well as between risk premia for electricity and natural gas futures prices. Another possible line of research would be to analyse if the correlation between natural gas and forward premia is time varying and in particular to study the factors that may influence the correlation between natural gas and electricity forward premia and how they affect the electricity risk premia in different European countries.

The supervision of the forward price formation process for short, medium and long-term contracts should be of particular interest to the supervisory authority, both in terms of market fundamentals and microstructure. Although energy regulators may face some asymmetries in the capacity of supervision of regulated futures markets and OTC forward markets, it is crucial that energy regulators, possibly in coordination with financial regulators, do have access to futures and forward trading data. In this regard, the recent publication of European Union (EU) Regulation 1227/2011 on wholesale energy market integrity and transparency (REMIT) will help regulators to prevent use of insider information and other forms of market abuse which distort wholesale energy prices. Since liquidity and price formation in wholesale forward markets have an important influence on hedging ability of industrial consumers and generators and may have an important influence on retail prices, regulators should be interested on understanding price formation in electricity and natural gas forward markets and their possible interactions.

Notes

- 1.

Volume risk refers to the risk that generators (retailers) face because they do not know the quantity of electricity that they will be required to produce (supply to final consumers) in the future.

- 2.

It has to be taken into account that in Spain, a developed gas market with liquid and transparent spot and forward gas prices does not exist.

References

Benth, F. E., Cartea, Á., and Kiesel, R.: Pricing forward contracts in power markets by the certainty equivalence principle: Explaining the sign of the market risk premium. Journal of Banking & Finance, 32(10), 2006–2021, (2008).

Bessembinder, H., and Lemmon, M.L.: Equilibrium pricing and optimal hedging in electricity forward markets. J. Finance, LVII(3), 1347–1382, (2002).

Capitán Herráiz, Á., and Rodríguez Monroy, C.: Analysis of the efficiency of the Iberian power futures market. Energy Policy, 37(9), 3566–3579 (2009).

Cartea, Á., and Figueroa, M. G.: Pricing in electricity markets: a mean rreverting jump diffusion model with seasonality. App. Math. Finance, 12(4), 313–335, (2005).

Cartea, Á., Figueroa, M. G., and Geman, H.: Modelling Electricity Prices with Forward Looking Capacity Constraints. Appl. Math. Finance, 16(2), 103–122 (2009).

Cartea, Á., and Villaplana, P.: Spot price modeling and the valuation of electricity forward contracts: The role of demand and capacity. Journal of Banking & Finance, 32(12), 2502–2519, (2008).

Cartea, Á., and Williams, T.:UK Gas Markets: the Market Price of Risk and Applications to Multiple Interruptible Supply Contracts. Energy Economics. 30(3), 829–846, (2008).

Furió, D., and Meneu, V.: Expectations and forward risk premium in the Spanish deregulated power market. Energy Policy, 38(2), 784–793 (2010).

Hirshleifer, D.: Determinants of Hedging and Risk Premia in Commodity Futures Markets. Journal of Financial and Quantitative Analysis, 24(3), 313–331, (1989).

Hirshleifer, D.: Hedging Pressure and Futures Price Movements in a General Equilibrium Model. Econometrica, 58(2), 411–428, (1990).

Huisman, R., and Kilic, M.: Is power production flexibility a substitute for storability? Evidence from electricity future prices. Tinbergen Institute Discussion Paper No. 10-070/2, (2010).

Joskow, P. L.: Lessons Learned from Electricity Market Liberalization. The Energy Journal, 29, 9–42, (2008).

Littlechild, S.: Electricity: regulatory developments around the world. Beesley Lectures on Regulation, (2001).

Lucía, J. J., and Torro, H.: On the risk premium in Nordic electricity futures prices. International Review of Economics and Finance, 20(4), 750–763 (2011).

Kaldor, N.: Speculation and Economic Stability. Rev. Economic Studies. 7(1), 1–27, (1939).

Keynes, J. M.: A Treatise on Money. MacMillan, London, (1930).

Ofgem: GB wholesale electricity market liquidity: summer 2010 assessment. Available at http://www.ofgem.gov.uk/, (2010).

Pirrong, C. and Jermakyan, M.: The price of power: The valuation of power and weather derivatives. Journal of Banking & Finance, 32(12), 2520–2529, (2008).

Redl, C., and Bunn, D. W.: Determinants of the Premium in Forward Contracts. Working Paper Series. SSRN eLibrary, available at http://ssrn.com/paper=1791677, (2011).

Acknowledgements

Villaplana acknowledges financial support from Consejería de Educación y Ciencia, Junta de Comunidades de Castilla-La Mancha, Ref. PPII11-0290-0305, project: “Valoración de activos derivados y gestión de riesgos en mercados financieros y energéticos”. The contents of this document are the sole responsibility of the authors and do not necessarily represent the views of the Comisión Nacional de Energía. We would like to thank Carlos González-Pedraz, Rüdiger Kiesel and Fred Espen Benth for comments.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer Science+Business Media New York

About this chapter

Cite this chapter

Cartea, Á., Villaplana, P. (2014). An Analysis of the Main Determinants of Electricity Forward Prices and Forward Risk Premia. In: Benth, F., Kholodnyi, V., Laurence, P. (eds) Quantitative Energy Finance. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7248-3_8

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7248-3_8

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7247-6

Online ISBN: 978-1-4614-7248-3

eBook Packages: Business and EconomicsEconomics and Finance (R0)