Abstract

This chapter introduces Arcturus, an international database of dynamic pricing and time-of-use pricing studies. It contains the demand response impacts of 163 pricing treatments that were offered on an experimental or full-scale basis in 34 projects in seven countries located in four continents. The treatments included various types of dynamic pricing rates and simple time-of-use rates, some of which were offered with enabling technologies such as smart thermostats. The demand response impacts of these treatments vary widely, from 0 % to more than 50 %, and this discrepancy has led some observers to conclude that we still do not know whether customers respond to dynamic pricing. We find that much of the discrepancy in the results goes away when demand response is expressed as a function of the peak-to-off-peak price ratio. We then observe that customers respond to rising prices by lowering their peak demand in a fairly consistent fashion across the studies. The response curve is nonlinear and is shaped in the form of an arc: as the price incentive to reduce peak use is raised, customers respond by lowering peak use, but at a decreasing rate. We also find that the use of enabling technologies boosts the amount of demand response. Overall, we find a significant amount of consistency in the experimental results, especially when the results are disaggregated into two categories of rates: time-of-use rates and dynamic pricing rates. This consistency evokes the consistency that was found in earlier analysis of time-of-use pricing studies that was carried out by EPRI in the early 1980s. Our analysis supports the case for the rollout of dynamic pricing wherever advanced metering infrastructure is in place.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Many utilities have been deploying advanced metering infrastructure (AMI) as part of their grid modernization activities. In addition to yielding operational efficiencies in the distribution system, such as lowering the cost of reading meters, faster detection of outages, and theft detection, AMI is also the enabler of dynamic and time-of-use pricing (called time-varying pricing in the rest of this chapter).Footnote 1 Through the use of time-varying rates, utilities can lower their cost of doing business and customer bills by lowering, since such rates lower peak loads and improve utility load factors [8].

As of this writing, about a quarter of US households are on smart meters; the number is projected to approach a hundred percent in a decade. However, only two percent of the households are on any type of time-varying rate and only a very small percentage of these households are on any form of dynamic pricing rate.Footnote 2

Over the past decade, a number of dynamic pricing and time-of-use studies have been conducted around the globe in order to inform policy making. Some of these have been randomized experiments, some have been quasi-experiments, some have been demonstrations, and some have been full-scale deployments. A full-blown meta-analysis would require the analyst to normalize for differences in experimental design, which in turn would require access to detailed information on the experiment design, implementation, and findings. Such a study was carried out by EPRI in the early 1980s by using data from five experiments with time-of-use pricing [1]. Lack of individual customer data prevents us from carrying out such an analysis at this time. However, as a first step in that direction, we have assembled the results from 34 studies in a database called Arcturus.Footnote 3

The 34 studies in our analysis encompass a total of 163 “treatments” where a treatment is defined as a unique combination of a time-varying pricing design and enabling technology. At first glance, there is little consistency in the results: the amount of demand response exhibited across the 163 treatments ranges from 0 to 58 %. This wide range of impacts has led observers such as Joskow [10] and some policy makers to conclude that our understanding of customer behavior is not strong enough to proceed with universal deployment of dynamic pricing and time-of-use pricing, even though smart meters are being deployed. However, this range just represents the raw data, unfiltered by the intensity of the price signal that was conveyed to participants. If the data from those treatments that only featured time-varying prices are plotted separately from those that featured time-varying prices with enabling technology, even sharper results are obtained, as enabling technologies increase demand response even more.

We examine the impact of the price ratio on the magnitude of the reduction in peak demand using a log-linear regression model. Because the amount of demand response varies with the presence or absence of enabling technology, such as a smart thermostat, an energy orb or an in-home display, we include a variable that indicates the use of enabling technologies.Footnote 4 We find a statistically significant relationship between the price ratio and the amount of peak reduction. The interaction variable between price and the use of enabling technologies is also statistically significant indicating that there is a boost to the peak reduction when prices are paired with enabling technologies. This relationship is termed the Arc of Price Responsiveness for reasons that will become clear later in this chapter.

2 The Time-Varying Rate Designs

Time-varying rate designs charge different electricity rates at different times of the day and year.Footnote 5 These rates reflect the time-varying cost of supplying electricity and incentivize consumers to decrease their electrical usage during peak hours and/or shift consumption to less expensive off-peak hours. This chapter examines the resulting peak demand reductions from four types of time-varying rates: time-of-use (TOU), critical peak pricing (CPP), peak-time rebate (PTR), and variable peak pricing (VPP) rates. The last three options fall under the rubric of dynamic pricing. While real-time pricing (RTP) rates also fall into that rubric and have been offered to customers in some of the published studies, the lack of a clear price ratio inhibits us from using these treatments in this chapter.

A time-of-use (TOU) rate could either be a time-of-day rate, in which the day is divided into time periods with varying rates, or a seasonal rate into which the year is divided into multiple seasons and different rates provided for different seasons. TOU rates are fixed by period and consequently offer certainty as to what the rate will be and when they will occur. In a time-of-day rate, a peak period might be defined as the period from 12 p.m. to 6 p.m. on weekdays, with the remaining hours being off-peak. The price would be higher during the peak period and lower during the off-peak period, mirroring the variation in marginal costs by pricing period. TOU rates with three periods have also been offered. Such rate schemes include a shoulder (or mid-peak) period, where the cost of electricity is lower than peak period rates, but higher than off-peak period rates. Additionally, TOU rates may include two peak periods (such as a morning peak from 8 a.m. to 10 a.m. and an afternoon peak from 2 p.m. to 6 p.m.).

On a critical peak price (CPP) rate, customers pay higher peak period prices during the few days a year when wholesale prices are the highest (typically the top 10–15 days of the year which account for 10 to 20 % of system peak load). This higher peak price reflects both energy and capacity costs and, as a result of being spread over relatively few hours of the year, can be in excess of $1 per kWh. In return, the customers pay a discounted off-peak price that more accurately reflects lower off-peak energy supply costs for the duration of the season (or year). Customers are typically notified of an upcoming “critical peak event” one day in advance, but if enabling technologies are used, these rates can also be activated on a day basis.

Like on a CPP rate, customers on variable peak price (VPP) rates pay higher peak period prices during a few days a year when wholesale prices are highest. The main difference between a critical peak price and a variable peak price is that the variable peak price varies from one event day to the next, as determined by market rates. On-peak prices generally vary each day based on day-ahead market prices. On non-event days, the VPP rate acts like a normal TOU rate, with fixed period prices.

If a CPP tariff cannot be rolled out because of political or regulatory constraints, some parties have suggested the deployment of a peak-time rebate (PTR). Instead of charging a higher rate during critical events, participants are paid for load reductions (estimated relative to a forecast of what the customer otherwise would have consumed). If customers do not wish to participate, they simply buy electricity through at the existing rate. There is no rate discount during non-event hours.

Participants in real-time pricing (RTP) programs pay for energy at a rate that is linked to the hourly market price for electricity. Depending on their size, participants are typically made aware of the hourly prices on either a day-ahead or hour-ahead basis. Typically, only the largest customers—above one megawatt of load—face hour-ahead prices. These programs post prices that most accurately reflect the cost of producing electricity during each hour of the day and thus provide the best price signals to customers, giving them the incentive to reduce consumption at the most expensive times.

Figure 1 presents a visual representation of these rate types.

Enabling technologies such as programmable thermostats and in-home displays (IHDs) can be offered with time-varying rates in order to enhance the effectiveness of the rates by automating response and minimizing customer transaction costs. Programmable communicating thermostats (PCTs) can receive a signal during a critical peak pricing event and automatically reduce air-conditioning usage to a level that is specified by the customer, reducing the need to manually respond to high-priced events. Information-enhancing technologies such as in-home displays (IHDs) can give customer information such as the amount of electricity that they are using, what it is costing them, how that translates into their carbon footprint, how close they are to energy savings goals, and other such data. The information can also be provided online through Web portals or even through a smartphone. Energy orbs provide visual feedback to customers by changing color depending on the price of electricity.

3 The 34 Studies

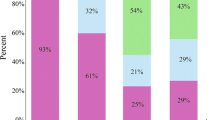

The 34 studies encompassing 163 experimental treatments in the Arcturus database span four continents and seven countries. Figure 2 sorts the peak reductions for each of the 163 experimental treatments from lowest to highest. At first glance, there is little consistency in the results, for demand response varies from 0 to 58 %. Some of the variation in demand response can be attributed to the different rate types tested, while the rest is potentially due to other factors such as differences in experimental design, socio-demographic characteristics, and climate conditions. Grouping the results by rate type slightly improves the resolution, but not by much. There still remains significant variation among pricing types, as shown in Fig. 3. Due to their tendency to have higher price ratios than TOU rates, we hypothesize that CPP and PTR rates tend to result in higher customer response.Footnote 6 We hypothesize that this is primarily due to the use of high price ratios for these rates. By filtering by rate type and the use of enabling technologies, as done in Fig. 4, we can see a clearer picture emerge from the data. The use of enabling technology appears to increase demand response to levels above pricing-only observations for a given price ratio.

Even after sorting the observations by rate type and the use of enabling technology, significant unexplained variation remains. As hypothesized before, the range of results may be due to the variation in the peak-to-off-peak price ratio employed across the studies among other reasons. In order to examine this, we carried out an exploratory data analysis by plotting demand response as a function of the price ratio. The plots initially focus only on pricing treatments that were not accompanied by enabling technology. As seen below in Fig. 5, the 92 price-only treatments fall into a tight pattern. These are then followed by plots that focus on pricing treatments that were also technology-enabled.

The 71 treatments involving price and enabling technologies have a more diffuse pattern, but peak reductions still tend to increase with the peak-to-off-peak price ratio. In addition, for a given price ratio, peak reductions for these technology-enabled treatments tend to be greater than those exhibited by price-only treatments (Fig. 6).

We took this exploratory analysis one step further and estimated a simple regression model for the 163 experimental treatments to quantify the effect of the price ratio and use of enabling technology on demand response. For the purposes of this cursory analysis, we assumed that the main determinant of the variations in the peak reduction is the variations in the peak-to-off-peak price ratio. Using a log-linear specification, we model the amount of demand response, expressed as a percentage, as a function of the log of the price ratio, with and without enabling technology.

where

- y:

-

peak demand reduction expressed in percentages;

- ln (price ratio):

-

natural logarithm of peak-to-off-peak price ratio;

- ln (price ratio × tech):

-

interaction between the ln (price ratio) and tech dummy variable (where tech takes the value of 1 when enabling technology is offered in conjunction with price)

Table 1 presents the regression results.

The results reveal that as the peak-to-off-peak price ratio increases, the peak reduction also increases. In addition, the positive and significant relationship between peak reduction and the ln(price ratio × tech) variable indicates that the use of enabling technology further boosts demand response. The R-squared value of 0.37 means that approximately 37 % of the variation in the dependent variable (i.e., peak demand reduction) can be explained by the independent variables.

As seen in Fig. 7, the analysis yields two “arcs of price responsiveness” for pricing-only treatments and technology-enabled pricing treatments. These Arcs of Price Responsiveness can be used to make preliminary assessments about expected customer impacts from various time-varying rates. For example, for a peak-to-off-peak price ratio of 5:1, the expected peak reductions for price-only and price-technology treatments are 12.7 and 21.6 %, respectively. For a price ratio of 10:1, these reductions would increase to 16.2 and 29.0 %, respectively.

Figure 7 also shows that some of the 163 treatments yielded either extremely high or extremely low impacts. In order to minimize the impact of these outliers on the regression estimators, we re-estimated the models using a robust regression technique that utilizes the MM-estimator. This reduces the influence of moderate outliers and completely eliminates the impact of gross outliers by down-weighting their influence in estimating the parameters of the model. “Moderate” and “gross” outliers are defined based upon the scale of the data and such that, were there truly no outliers, all observations would receive the same treatment as in a standard ordinary least squares model.

The regression results from the MM-estimation are presented in Table 2.

As done earlier, the Arcs of Price Responsiveness (shown in Fig. 8) can be used to make preliminary assessments about expected demand response from time-varying rates. For a price ratio of 5:1, the expected peak reduction in price-only and price-tech experimental treatments is 11.5 and 20.1 %, respectively. For a price ratio of 10:1, expected peak period reductions are 15.2 and 27.6 %, respectively.Footnote 7 The preliminary results with the 5:1 price ratio are similar to the results from the California Statewide Pricing Pilot (SPP) in 2005; this study featured a CPP rate with a price ratio of 6.56 and resulted in a 13 % peak reduction [3].

While this approach led to some interesting and statistically significant results, it became apparent that the analysis could be refined by splitting the Arcturus database and corresponding regressions into two: one for TOU-only treatments and one for dynamic pricing treatments (i.e., CPP, PTR, and VPP). Not only are TOU price ratios consistently lower than other rate types, as can be seen in Figs. 9 and 10, but customer reactions to TOU pricing are probably different. In TOU pricing, the altered rates are applied every day, as opposed to only on discrete event days which is the case in dynamic pricing. This gives TOU customers more opportunity to change their energy consumption habits, leading to greater impacts from TOU. On the other hand, it is easier to change behavior for a few hours per year on dynamic pricing rates.

Table 3 presents the regression results of the TOU-only arc using MM-estimation.

The results again reveal that as the peak-to-off-peak price ratio increases, the peak reduction also increases. In addition, the positive and significant relationship between peak reduction and the ln(price ratio × tech) variable indicates that the use of enabling technology further boosts demand response.

As done earlier, the Arcs of Price Responsiveness (shown in Fig. 11) can be used to make preliminary assessments about expected demand response from time-varying rates. For a price ratio of 2:1, the expected peak reduction in price-only and price-tech experimental treatments is 4.7 and 9.4 %, respectively. For a price ratio of 5:1, expected peak period reductions are 9.9 and 20.7 %, respectively. The preliminary results with the 2:1 price ratio are similar to the results from the California Statewide Pricing Pilot (SPP) in 2005; this study featured a TOU rate with a price ratio of 2:1 and resulted in a 4–5 % peak reduction [3].

Table 4 presents the regression results of the non-TOU arc (CPP, PTR, and VPP) using MM-estimation.

The results again reveal that as the peak-to-off-peak price ratio increases, the peak reduction also increases, although the relationship is weaker and less significant. However, the positive and significant relationship between peak reduction and the ln(price ratio × tech) variable remains strong and indicates that the use of enabling technology further boosts demand response.

As done earlier, the Arcs of Price Responsiveness (shown in Fig. 12) can be used to make preliminary assessments about expected demand response from time-varying rates. For a price ratio of 5:1, the expected peak reduction in price-only and price-tech experimental treatments is 13.8 and 21.7 %, respectively. For a price ratio of 10:1, expected peak period reductions are 15.9 and 27.2 %, respectively.

4 Comparison to Earlier Meta-Analysis of TOU Experiments

It is useful to put the results of our analysis in historical perspective. We have done this by comparing them to an earlier meta-analysis of TOU pricing experiments. This was carried out in the early 1980s by Christensen Associates under contract to EPRI and managed by Ahmad Faruqui. In this meta-analysis, data from the five best residential TOU experiments were combined and analyzed. This yielded a variety of elasticities of substitution: (1) for the average household across all five experiments, (2) for households with all major electric appliances living in a hot climate, and (3) for households with no major electric appliances in a cool climate [1]. The elasticity of substitution for this meta-analysis captures a customer’s decision to shift usage from higher-priced peak periods to lower-priced off-peak periods. Using Brattle’s price impact simulation model (PRISM), which grew out of California’s Statewide Pricing Pilot, we have used these elasticities to simulate the impact of different price ratios on peak demand [8]. The results are shown in Fig. 13.

And to put these results in perspective, Fig. 14 shows the new Arc of Price Responsiveness for pricing-only TOU treatments superimposed on the previous figure. The results are similar between the average household results from the early 1980s and the price-only result from the recent studies.

5 Elasticity Estimates

In our review of these 34 studies, we find that the impacts also vary widely among the experiments using the same rate design. Other than the differences in the peak-to-off-peak price ratios, this variation is largely attributed to the variation in price elasticities and sample designs. Most studies estimated two types of elasticities: (1) substitution elasticity that captures customers to substitute relatively inexpensive off-peak consumption for relative expensive peak consumption and (2) own price elasticity that captures the change in the level of overall consumption due to the changes in the average daily price. Based on our review, substitution elasticities from the experiments range from −0.07 to −0.40 while the own price elasticities range from −0.02 to −0.10. Availability of the enabling technologies, ownership of central air-conditioning, and the type of the days studies (weekend vs. weekday) are some of the factors that yield variations in the price elasticities.

Price elasticities allow the estimation of peak impacts for a given time-varying rate design. Brattle’s PRISM model predicts the changes in electricity usage that are induced by time-varying rates by utilizing a constant elasticity of substitution (CES) demand system. This demand system consists of two equations. The substitution equation predicts the ratio of peak-to-off-peak quantities as a function of the ratio of peak-to-off-peak prices and other factors. The daily energy usage equation predicts the daily electricity usage as a function of daily price and other factors. Once the demand system is estimated, the resulting equations are solved to determine the changes in electricity usage associated with a time-varying rate. PRISM has the capability to predict these changes for peak and off-peak hours for both critical and non-critical peak days. Moreover, PRISM allows predictions to vary by other exogenous factor such as the saturation of central air-conditioning and variations in climate. The model can be set to demonstrate these impacts on different customer types.

6 Conclusion

Our survey of 34 time-varying rate projects across four continents and seven countries has shown convincingly that the amount of demand response increases as the peak-to-off-peak price ratio increases but at a diminishing rate. Enabling technologies, coupled with dynamic pricing, enhance demand response.

Of course, there are many drivers of demand response besides the price ratio. These include the length of the peak period, the number of pricing periods, climate, and appliance ownership. Additionally, the manner in which dynamic pricing rates are marketed to customers has an undeniable impact on customer response, since marketing shapes customer awareness and education. Finally, the non-random selection of customers into some of the time-varying rate experiments can affect the validity of their results.

Because we were unable to control for these factors in this meta-analysis, there are some outliers in our dataset which require further inspection. Even then, the surprising amount of consistency in the results shows that utilities and policy makers can be confident that dynamic pricing and time-of-use pricing will yield significant load reductions.

Notes

- 1.

Time-varying pricing refers to time-of-use (TOU) rates as well as dispatchable rate structures such as critical peak prices (CPP) and real-time prices (RTP). AMI is only a prerequisite for dynamic pricing programs, whereas TOU rates can be implemented with legacy meters.

- 2.

Federal Energy Regulatory Commission.

- 3.

Faruqui and Sergici [5] and Flaim et al. [9] summarize the results from some recent studies but do not attempt a meta-analysis of the type reported here. A previous meta-analysis, more limited in scope that this one, is contained in Faruqui and Palmer [4]. A comprehensive bibliography on dynamic pricing can be found in Enright and Faruqui [2].

- 4.

Some studies characterize only smart thermostats as enabling technologies as these devices automatically adjust temperature settings without requiring an action from the customers. For the purposes of this chapter, we characterize smart thermostats, energy orbs, and in-home displays as enabling technologies since these devices either automate actions for customers or equip them with information to act on.

- 5.

For a detailed discussion of time-varying rates, see Faruqui et al. [7].

- 6.

For the PTR rate, the effective critical peak price is calculated by adding the peak-time rebate to the rate the customer normally pays during that time period (in the absence of the rebate). This is essentially the opportunity cost of consuming every kWh of electricity.

- 7.

By using MM-estimation, our re-estimated arcs predict impacts that are lower than before.

References

Caves D, Christensen L, Herriges J (1984) Consistency of residential customer response in time-of-use electricity pricing experiments. J Econometrics 26:179–203

Enright T, Faruqui A (2013) A bibliography on dynamic pricing and time-of-use rates, version 2.0. Retrieved from SSRN http://ssrn.com/abstract=2178674

Faruqui A, George SS (2005) Quantifying customer response to dynamic pricing. Electr J 18(4):53–63

Faruqui A, Palmer J (2012) The discovery of price responsiveness—A survey of experiments involving dynamic pricing of electricity. EDI Q 4(1):15–18

Faruqui A, Sergici S (2010) Household response to dynamic pricing of electricity—A survey of 15 experiments. J Regul Econ 38(2):193–225

Faruqui A, Sergici S (2011) Dynamic pricing of electricity in the Mid-Atlantic Region: econometric results from the Baltimore gas and electric company experiment. J Regul Econ 40(1):82–109

Faruqui A, Hledik R, Palmer J (2012) Time-varying and dynamic rate design. Prepared for the Regulatory Assistance Project (RAP). http://raponline.org/document/download/id/5131

Faruqui A, Hledik R, Tsoukalis J (2009) The power of dynamic pricing. Electr J 22(3):42–56. Available at http://www.sciencedirect.com/science/article/pii/S1040619009000414

Flaim T, Neenan B, Robinson J (2013) Pilot paralysis: why dynamic pricing remains overhyped and underachieved. Electr J 26(4):8–21

Joskow PL (2012) Creating a smarter U.S. electricity grid. J Econ Perspect 26(1):29–48

Acknowledgment

This chapter is an updated republication of the paper “Arcturus: International Evidence on Dynamic Pricing” by Ahmad Faruqui and Sanem Sergici, The Electricity Journal 26 (7), 55–65. The copyright permission for reusing the paper has been granted by Elsevier. The authors would like to thank Eric Shultz and Isaac Toussie of Brattle for their excellent research assistance in developing Arcturus and to Toni Enright for assistance in editing and formatting the chapter. We have also benefited from numerous discussions on dynamic pricing with Ryan Hledik and Neil Lessem of Brattle. Finally, Faruqui would like to acknowledge his debt to J. Robert Malko (now a professor at Utah state) for instilling in him a love for time-varying rates when both worked in the Electric Utility Rate Design Study at EPRI.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer-Verlag London

About this chapter

Cite this chapter

Faruqui, A., Sergici, S. (2014). Arcturus: An International Repository of Evidence on Dynamic Pricing. In: Mah, D., Hills, P., Li, V., Balme, R. (eds) Smart Grid Applications and Developments. Green Energy and Technology. Springer, London. https://doi.org/10.1007/978-1-4471-6281-0_4

Download citation

DOI: https://doi.org/10.1007/978-1-4471-6281-0_4

Published:

Publisher Name: Springer, London

Print ISBN: 978-1-4471-6280-3

Online ISBN: 978-1-4471-6281-0

eBook Packages: EnergyEnergy (R0)