Abstract

This chapter presents a review of knowledge on oil and gas exploration and production in the Mediterranean Sea. Oil and gas production and exploration is not so important in the Mediterranean Sea, unlike in the Gulf of Mexico, the North Sea, or the Caspian Sea, but its history goes back to the early twentieth century when hydrocarbon exploration activities started in Greece. In the Aegean Sea, a small number of significant oil discoveries were made in the mid-1970s at Prinos with production continuing to the present day. Today, the Eastern Mediterranean Sea, and the east coast of Italy in the Adriatic Sea, is the location of the majority of oil and gas exploration and exploitation activities. In 2002 it was estimated that there was a reserve of around 50 billion barrels of oil and 8 trillion m3 of gas in the region (about 4% of world reserves) and, in 2005, there were over 350 wells drilled for offshore production in the waters off Italy, Egypt, Greece, Libya, Tunisia, and Spain of which the majority were located along the Northern and Central Adriatic coasts of Italy. In the last decade, there has been serious development of offshore gas fields along the Mediterranean coasts of Israel, Palestine, Cyprus, and Egypt which in the near future will completely change the gas market in this region.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Oil and gas production and exploration is not so important in the Mediterranean Sea, unlike in the Gulf of Mexico, the North Sea, or the Caspian Sea [1, 2], but its history goes back to the early twentieth century when hydrocarbon exploration activities started in Greece. In the Aegean Sea, a small number of significant oil discoveries were made in the mid-1970s at Prinos (with a smaller gas discovery at South Kavala) with production continuing to the present day. Initial estimated reserves for the Prinos fields were 90 million barrels (MMbbl), which have now been increased to 290 MMbbls, with 110 MMbbls already having been produced since 1981 [3].

Today, the Eastern Mediterranean Sea, and the east coast of Italy in the Adriatic Sea, is the location of the majority of oil and gas exploration and exploitation activities (Fig. 1). In 2002 it was estimated that there was a reserve of around 50 billion barrels of oil and 8 trillion m3 of gas in the region (about 4% of world reserves) and, in 2005, there were over 350 wells drilled for offshore production in the waters off Italy, Egypt, Greece, Libya, Tunisia, and Spain of which the majority were located along the Northern and Central Adriatic coasts of Italy (around 90 of the 127 offshore platforms for the extraction of gas in Italian waters in 2007) [4,5,6].

Oil and gas exploration and exploitation activities in the Eastern Mediterranean (http://www.greekamericannewsagency.com/english-menu/english/politics/30945-egypt-has-joined-greece-and-greek-cyprus-in-calling-for-turkey-to-stop-exploration-work-off-the-cyprus-coast). Copyright © 2012 Pytheas Limited

In 2011, gas was discovered in the Leviathan Gas Field (Fig. 2), 135 km off the coast of Israel, with an estimated volume of 16 trillion cubic feet (tcf) of gas (approximately 453 million m3) [7]. In August 2017 a contract was signed to drill two wells and complete four production wells in the Leviathan Gas Field [8].

Gas fields, active and potential gas pipelines, and gas terminals in the Southeastern Mediterranean (https://www.vestifinance.ru/articles/97771)

In the last decade, there have also been significant exploration activities off the coast of Cyprus, following the development of new technologies to assess and reach previously inaccessible reserves, worth an estimated $131 billion [9]. Most recently, the drilling of up to 25 new wells and installation of two new platforms were planned up to 2021 in the Prinos and Prinos North oil fields in the Gulf of Kavala offshore of Northern Greece [10].

Finally, in the last decade, there is a serious development of offshore gas and oil fields along the Mediterranean coasts of Egypt, where the most active companies are BP, BG, IEOC, EGAS, Total, RWE Dea, and Dana Gas. BG is active in five concessions. Dana Gas, a regional company, has about 10 producing fields. In August 2015, Eni announced the discovery of the Zohr gas field 150 km from Egypt’s north coast. The reserve is estimated as 30 trillion standard cubic feet (trn scf) of natural gas, making it the largest in the Mediterranean. This discovery seems to increase Egypt’s total gas reserves by about 40% [11].

Oil and gas exploration or production also takes place off the coasts of Algeria, Spain, Libya, Tunisia, Malta, and Turkey.

Oil and gas exploration and production activities pose a serious threat to the marine and coastal zone environment, the seabed, and sea-bottom habitats and species, since oil contamination can persist in the marine environment for many years, depending on the oil type, the location of a spill, and the area in which the contamination occurs [12,13,14,15,16]. Today, accidental spills from offshore platforms represent only about 1% of petroleum discharged in North American waters, for example, and about 3% worldwide [6, 17]. In the Mediterranean Sea this share should be even less than 1% of total oil pollution as the number of offshore oil and gas platforms is small in comparison with other regions of the World Ocean (Fig. 3).

Number of offshore rigs worldwide by region in January 2018 [18]. Source: Rigzone.com © Statista 2018. Additional Information: Worldwide; As of January 2018

In the North Sea and the Gulf of Mexico (United States), 184 and 175 offshore rigs are located, respectively, as of January 2018, while in the Mediterranean Sea, there are only 26 rigs. Globally, the number of oil platforms had been expected to rise from 389 units in 2010 to 500 in 2017 [18]. Offshore oil rigs enable producers to extract and process oil and natural gas through drilled wells. Rigs can also store the extracted products before being transported to land for refining and marketing. There are several different types of offshore rigs for use in the oceans and seas such as fixed platforms that are anchored directly onto the seabed by concrete or steel legs and tension leg platforms that float but remain in place by being tethered to the seabed (Fig. 4) [19]. There are some risks involved with the operation of offshore drilling, including explosions and fires, resulting in a serious and large-scale oil pollution of the sea, as it was the case with Deepwater Horizon in April 2010 in Gulf of Mexico.

Different types of offshore oil platforms: (1) and (2) conventional fixed platforms; (3) compliant tower; (4) and (5) vertically moored tension leg and mini tension leg platform; (6) spar; (7) and (8) semi-submersibles; (9) floating production, storage, and offloading facility; (10) subsea completion and tieback to host facility [19]

In this chapter we review information on offshore oil and gas exploration and production in different countries of the Mediterranean Sea.

2 Oil and Gas Production in the Mediterranean Sea

2.1 Greece

The history of oil production in Greece goes back to the early twentieth century when hydrocarbon exploration activities started here. In the northern part of the Aegean Sea, a small number of significant oil discoveries were made in the 1970s at Prinos (Fig. 5) with a smaller gas discovery at South Kavala and with production continuing to the present day. Initial estimated reserves for the Prinos oil fields were 90 MMbbl, which has now been increased to 290 MMbbl, with 110 MMbbl already having been produced since 1981 [3].

The Prinos D oil production platform in the northern part of the Aegean Sea (1982) (https://en.wikipedia.org/wiki/Prinos_oil_field)

In 2011 Greece approved the start of oil exploration and drilling in three locations with an estimated output of 250 to 300 million barrels over the next 15 to 20 years. In 2012 Greece started oil and gas exploration in the Ionian Sea as well as the Libyan Sea, within the Greek Exclusive Economic Zone, south of Crete. The Ministry of the Environment, Energy, and Climate Change announced that there was interest from various countries (including Norway and the United States) in oil and gas exploration in these regions. Most recently, the drilling of up to 25 new wells and installation of two new platforms were planned up to 2021 in the Prinos and Prinos North oil fields in the Gulf of Kavala offshore of Northern Greece [10].

The Prinos North Oil Field is one of the satellite fields within the Prinos-Kavala Basin. It is located approximately 3 km north of the Prinos Oil Field and about 18 km southwest of the mainland of Eastern Macedonia, Northern Greece, where the depth is 38 m (Fig. 6). Since 2008, Energean Oil and Gas Company has invested more than US$30 million in redeveloping the field to revive oil production which was interrupted in 2004. Prinos North 2017 exit production was 263 barrels per day, and the cumulative oil production is 4.2 MMbbls. Currently only one well is producing oil [20].

Oil and gas fields operated by Energean in the northern part of the Aegean Sea [20]

The Prinos Oil Field is the main structure in the Prinos-Kavala Basin (Fig. 6), located offshore in the Gulf of Kavala. It covers an area of 6 km2 and is about 8 km northwest of the island of Thassos and 18 km south of the mainland of Northern Greece (depth 31 m). Prinos 2P reserves have been independently audited at 17.8 MMbbls of oil and 2.9 billion cubic feet (Bcf) of gas, while 2C contingent resources are 15.6 MMbbls of oil and 4.9 Bcf of gas. Currently, 14 wells are producing and 4 are injecting sea water. Prinos 2017 exit production reached 3,823 bbls and cumulative production stands at 111 MMbbls [20].

The Epsilon Oil Field (Fig. 6) has 19 million barrels of oil equivalent (MMboe) 2P reserves which have been audited by Netherland Sewell & Associates Inc. (NSAI). Energean is developing the field through a new project which consists of (1) drilling of up to nine wells until 2020; drilling of an Extended Reach Drilling (ERD) well and a vertical one are in progress; and (2) the design, fabrication, installation, commissioning, and subsequent operation of a new well-head jacket platform (called Lamda) approximately 3.5 km northwest of the existing Prinos platforms [20].

In November 2015, Energean was awarded a 3-year extension to the duration of the South Kavala (Fig. 6) license, from where gas is produced since 1981. A development plan is under evaluation and includes the installation of downhole pumps in two of the existing wells to remove liquids from the well bores and enable the field to be placed back into continuous production, increase condensate yields, and bring recovery up to 98.5%. The remaining gas reserves are approximately 2.6 Bcf. The depleted field is suitable to be converted into an underground gas storage (UGS) linked to the TAP pipeline that will transport gas 2 km from Energean’s onshore processing plant [20].

A dispute between Greece and Turkey over territorial waters in the Aegean Sea poses substantial obstacles to oil exploration in the Aegean Sea.

In the Ionian Sea Energean Oil and Gas Company is the operator of the proven Katakolo (West Katakolo-1, West Katakolo-2, and South Katakolo-1) offshore oil and gas fields, for which the company was granted a 25-year exploitation license in November 2016. The Katakolo license covers an onshore, shallow water, and deep water area of 545 km2 on the west coast of the Peloponnese. The water depth is 200–300 m, while the depth of the reservoir is 2,300–2,600 m. Drilling is planned for 2019 and production is planned to start in 2020 [20].

Recently, the European Bank for Reconstruction and Development (EBRD) has identified energy as one of its core activities in Greece. In addition to supporting green energy with a €300 million renewables framework, the EBRD has also provided a US$ 90 million loan to Energean Oil and Gas Company for the development of the company’s assets. This loan has now been complemented with a technical assistance program for the implementation of new regulations to strengthen the safety of oil protection and increase the protection of humans and the environment [21].

2.2 Montenegro

Oil and gas exploration activity in Montenegro took place in 1949–1966, when the state company Nafta Crne Gore drilled 16 onshore exploration wells which showed no discoveries despite the presence of oil and gas in several drilled wells. In 1973, responsibility for exploration for hydrocarbons in Montenegro was taken over by the government-owned Jugopetrol Kotor which, in cooperation with foreign oil companies, conducted over 10,000 km seismic research in the offshore region. One nearshore and 3 offshore wells were drilled between 1975 and 1991. The JJ-1 well (TD at 4,700 m) found significant quantities of natural gas within the clastic deposits of the Oligocene. The JJ-3 well recovered 183bbls of oil from Cretaceous age shelfal carbonates. Additional offshore wells had significant gas shows in Lower Tertiary sands but were not tested [20].

The eastern Adriatic Sea over decades remained substantially underexplored, despite having all the necessary hydrocarbon-generating components in place as well as the western offshore. The Adriatic Sea has been a prolific hydrocarbon-producing province for over 50 years for oil in Italy and gas in Italy and Croatia. The widespread distribution of oil and gas seepages offshore of Montenegro indicates the presence of an active petroleum system. These are connected with recent oil discoveries in northern Albania, such as the onshore Shpirag-2 reserve with over 5 billion barrels of oil. In addition, the Tertiary age sandstones in offshore Montenegro are considered highly prospective for biogenic gas. The biogenic gas play is prolific in the Po Basin of offshore northern Italy/Croatia, where over 30 TCFGIP have been discovered to date. The play has been proven in the Duresi basin offshore Albania and Italy, but to date only limited exploration drilling has been carried out in offshore Montenegro [20].

In May 2014, Energean submitted a bid in Montenegro’s First Round for Production Concession Contracts for offshore hydrocarbons exploration and exploitation. The company reached an agreement with the Ministry of Economy of Montenegro in June 2016, and 6 months later the agreement was ratified by the Montenegrin Parliament. In March 2017, Energean signed a Concession Agreement with the State of Montenegro for hydrocarbon exploration and exploitation in offshore blocks 4219-26 and 4218-30 (Fig. 7). The two blocks are located offshore at a water depth of 50–100 m, close to the Montenegrin coast near the town of Bar. Total investment will be US$19 million over an exploration phase of 7 years, including new 3D seismic survey, geophysical and geological studies, and the drilling of one well. According to the NSAI CPR, Energean’s combined prospective resources at Blocks 26 and 30 are estimated of 143.9 MMbbls of hydrocarbons liquids and 1,766.1 Bcf of gas [20].

Blocks 26 and 30 explored by Energean offshore of Montenegro in the Adriatic Sea (https://www.energean.com/operations/montenegro/montenegro/)

2.3 Italy

Offshore oil and gas production constitutes an important energy source of hydrocarbons in Italy. In 2012, offshore oil production in the EU totaled approximately 60 million tons produced in the continental shelves of different EU member states. For example, UK produces 75.38%, Denmark 17.17%, and Italy 0.83%. Additional considerable quantities of oil were extracted from the continental shelf of Norway. In 2012 offshore oil production in Norway was almost 78 million tons, more than 130% of the total European offshore oil production. In 2012 offshore natural gas production in EU-28 was approximately 63 million tons of oil equivalent with the UK and the Netherlands having a predominant role with 54.60% and 25.23%, respectively, and Italy 8.06% [22]. In Italy natural gas in 2017 was produced in the offshore zones A, B, C, D, and F totaling 3,754 million Sm3 while crude oil production in the offshore zones B, C, and F totaling 0.65 million tons [23].

The east coast of Italy in the Adriatic Sea is the location of the majority of oil and gas exploration and exploitation activities (Figs. 8 and 9). The majority of offshore rigs is located along the Northern and Central Adriatic coasts of Italy (in February 2018): 138 platforms and subsea wellheads, from them production platforms, 120; production support platforms, 10; and non-production platforms, 8. In addition Italy has three FPSO (Floating Production Storage and Offloading): Alba Marina, Firenze FPSO, and Leonis [23]. Several offshore platforms are located in the South Adriatic Sea, Ionian Sea, and Sicily Channel (Figs. 10 and 11).

Italian offshore oil and gas concessions and installations in the North and Central Adriatic Sea (http://unmig.sviluppoeconomico.gov.it/unmig/strutturemarine/carta%20impianti%20offshore%201di2.pdf)

Gas platform Annamaria B in the Adriatic Sea off the coast of Ravenna (Emilia-Romagna) (https://commons.wikimedia.org/wiki/File:Platform_Annamaria_B.jpg)

Italian offshore oil and gas concessions and installations in the South Adriatic Sea, Ionian Sea, and Sicily Channel (http://unmig.sviluppoeconomico.gov.it/unmig/strutturemarine/carta%20impianti%20offshore%202di2.pdf)

Oil platform Vega in the Mediterranean Sea off the coast of Pozzallo, Ragusa (Sicily) (https://commons.wikimedia.org/wiki/File:EDISON21.jpg)

The history of offshore oil and gas exploration in Italy goes back to the mid-1950s when the first offshore seismic survey was conducted in the northern part of the Adriatic Sea. In 1959, the drilling of the well Gela-21, the first offshore well drilled in Europe, was highlighting further exploration possibilities. The largest gas discovery was Agostino-Porto Garibaldi which occurred in 1968 in the Northern Adriatic Sea. It is a biogenic gas giant field of about 600 MMboe of recoverable reserves [24]. Starting from 2007, the level of exploration drilling dropped to under ten wells per year with investments also reaching an historical minimum. That year was also the starting point of the decline of the Italian E&P industry. This negative trend was confirmed in 2014, when no onshore exploratory wells were drilled. The situation is even worst for the offshore drilling, where the last well was realized in 2008. One of the causes of this decline is certainly the exploration maturity of the biogenic gas play together with the heavy bureaucratic process to obtain exploration authorizations which has discouraged further investments. In addition, during 2010, potential investors faced a new federal law permanently banning the E&P activities within 12 miles from the Italian coast. Additionally, there is increasing general opposition of a large part of the Italian population to any kind of petroleum related domestic activities both onshore and offshore [24].

Since 2013, new drilling is prohibited in the Tyrrhenian Sea, in the marine protected areas, and in the waters within 12 nautical miles from the coast, but the concessions approved before 2013 may continue until all of the resources are extracted. A referendum on oil and natural gas drilling was held in Italy on 17 April 2016, which concerned the proposed repealing of a law that allows gas and oil drilling concessions extracting hydrocarbon within 12 nautical miles of the Italian coast to be prolonged until the exhaustion of the useful life of the fields. Although 86% voted in favor of repealing the law, the turnout of 31% was below the minimum threshold required to validate the result [25].

2.4 Croatia

The first gas field was discovered in Croatia in 1917 and first oil field in 1941. Intense onshore exploration and exploitation of oil and gas in Croatia has occurred over the last 60 years and has had an important value for economy growth of the country. During the last 40 years, Croatia has explored and exploited hydrocarbon deposits in the North Adriatic Sea. Since 1999 Croatia has produced gas in the north part of the Adriatic Sea. Today it holds 60 exploration fields of hydrocarbons; 3 of them are offshore (Fig. 12) [26].

Exploration blocks and exploitation concessions offshore Croatia in the North Adriatic Sea (https://www.azu.hr/media/1461/karta-more-data-room-eng-novo.jpg). Copyright © 2014 Esn

Exploration offshore of Croatia started in the North Adriatic in 1968 with the acquisition of 2D seismic data. In 1973 the Ivana gas field was discovered spurring further exploration in the region. Six more major discoveries (Ika, Ida, Annamaria, Ksenija, Koraljka, and Irma) resulted from surveys made in 1978–1993. The largest offshore oil discovery Elsa 1 was made in 1992. The most recent discovery was made in 2008 with the Monte Della Crescia gas discovery in the Italian Sector. The region has over 90 producing fields. Exploration in the Southern Durres Basin area has been much reduced due to a lack of data. There are currently 11 onshore and 5 offshore discoveries in the area. Many structures are still unexplored in the central and western part of the basin, where gas-generating conditions are more favorable, increasing the possibilities for new discoveries [26].

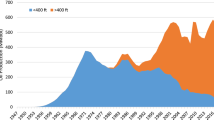

Until recently 15 offshore gas platforms were active in the North Adriatic Sea, 14 of them produced gas with natural drive, and on one compression facilities are being installed. The gas field Marica is being produced from two platforms. The maximum annual production of gas was achieved between 2007 and 2010, and it reached a total production of about 1.8 billion m3 of gas. Another significant production peak, significantly lower than maximum, was achieved in 2012, and it reached approximately 1.1 billion m3 of gas. Since then, it continuously decreases, and gas field production will probably end by 2040 [27].

2.5 Israel

The Tamar gas field (Fig. 13) was discovered by Noble Energy in January 2009 in Levantine Basin and is the company’s largest find to date. Noble Energy owns 36% in Tamar and is the operator of the field. The Levantine Basin covers about 83,000 km2 of the eastern Mediterranean region offshore Israel, Lebanon, and Syria. The US Geological Survey (USGS) estimates that the entire Levantine Basin holds a mean approximation of 1.7 billion barrels of recoverable oil and about 122 tcf of recoverable gas. According to estimates, the Tamar gas field has reserves of 10 tcf of gas. First production from Tamar was achieved in April 2013, and full production capacity was reached by the end of July 2013. Gas is produced through five subsea wells tied back to the Tamar platform. The wells are linked to the platform through 150 km long flowlines. The platform is installed at a depth of 800 ft. and has a processing capacity of 1.2 bcf per day of natural gas [28].

Tanin and Karish gas fields and blocks 12, 21, 22, 23, and 31 explored by Energean Israel as well as other gas fields offshore Israel (https://www.energean.com/operations/israel/israel/)

In December 2010, gas was discovered in the Leviathan Gas Field (Fig. 13), 135 km off the coast of Israel, with an estimated volume of 16 tcf of gas (approximately 453 million m3) [7]. Noble Energy obtained approval for the plan of development (POD) from the Ministry of National Infrastructure, Energy and Water Resources of Israel in June 2017. The company signed a gas sales and purchase agreement (GSPA) to provide natural gas from the Leviathan field to National Electric Power Company (NEPCO) for a period of 15 years. In August 2017 a contract was signed to drill two wells and complete four production wells in the Leviathan Gas Field [8]. The Leviathan gas field is scheduled to come online in late 2019. The Leviathan gas field’s natural gas reserves are estimated to be 18 tcf. Besides natural gas, the field is said to contain 600 million barrels of oil beneath the gas layer [29].

Energean Israel is the operating the Karish and Tanin leases offshore Israel (Fig. 13). Both fields were discovered by Noble Energy in the Levantine Basin in 2011 and 2013. The Karish and Tanin fields are world-class assets with 2,2 TCF of natural gas and 31.8 million barrels of light hydrocarbon liquid 2P reserves. The Karish Main Development envisages drilling three wells, using a new Floating Production Storage and Offloading (FPSO) unit that will be installed approximately 90 km offshore, with 800 mmscf/day capacity. First gas is expected in 2021. The Tanin Development will follow the development of Karish and envisages drilling six wells, connected to the same FPSO that will serve Karish Development. In December 2017 Energean was successfully awarded five offshore exploration licenses within the Israeli Exclusive Economic Zone (EEZ). The licenses awarded comprise blocks 12, 21, 22, 23, and 31 and are located near the currently producing Tamar gas field and the Karish and Tanin gas fields (Fig. 13) which are currently under development by Energean [20].

2.6 Palestine

The Gaza Marine natural gas field (Fig. 14) was discovered in 2000 by British Gas 36 km offshore the Gaza coast (depth 610 m) in waters under the control of the Palestinian National Authority. British Gas holds a 90% interest in the field [30]. Energean is ready to purchase a 45% stake in the offshore Gaza Marine gas field, pending approval by Palestinian and Israeli authorities. The Palestine Investment Fund (PIF) is currently the field’s sole owner looking for an operator and buyer for the 45% stake. Under current plans, the gas would go to Israel’s Ashkelon natural gas terminal and from there to a Palestinian power plant in Jenin in the West Bank. Palestinian political disputes and conflict with Israel, as well as economic factors, have delayed plans to develop the gas field, which possesses estimated reserves of over 1 tcf of natural gas, the equivalent of Spain’s consumption in 2016 [30, 31].

Oil and gas fields in the southeastern Mediterranean (http://www.connection-mag.com/?p=5333)

Development of the Gaza field is expected to benefit both Israel and the Palestinian National Authority. The Gaza gas field is expected to supply for 10% of the energy requirement of Israel. The country currently relies on Egypt for its gas supplies. Steadily growing economy calls for access to newer sources of energy for Israel. The country is planning to purchase the gas produced by the Gaza field to reduce its dependence on Egyptian gas [30, 31].

2.7 Cyprus

In the last decade, there have also been significant exploration activities off the coast of Cyprus (Figs. 1 and 2), following the development of new technologies to assess and reach previously inaccessible reserves, worth an estimated $131 billion [9].

The Aphrodite gas field was discovered in December 2011. It lies approximately 160 km south of Limassol offshore of the Republic of Cyprus in the Eastern Mediterranean Sea (Figs. 13 and 14). The gas field is located 30 km northwest of the Leviathan gas field in Block 12 of the Cypriot Exclusive Economic Zone (EEZ). The field covers an area of 120 km2, and it was the first gas discovery to be made in the Cypriot EEZ. The owners of Block 12 are Noble Energy International (35%), BG Cyprus (35%), Delek Drilling Limited Partnership (15%), and Avner Oil Exploration Limited Partnership (15%). The Aphrodite gas field is jointly owned by Delek Drilling (30%), Noble Energy (35%), and Shell (35%) [32].

The Cyprus A-1 discovery well discovered gas reserve with estimation of a gross resource range from 5 to 8 tcf. Aphrodite’s Cyprus A-2 appraisal well was drilled in 2013 (6.4 km to the northeast of the Cyprus A-1) and resulted in an estimate of the gross resources of the field between 3.6 and 6 tcf of gas [32].

First gas from the field is expected after 2023 following the identification of a suitable export option. The Cypriot Government has signed an energy cooperation agreement with the Egyptian Government to examine the option of exporting gas from Aphrodite field to Egypt. A technical study was conducted by the Egyptian Natural Gas Holding Company and the Cyprus Hydrocarbons Company in 2015 to design a possible gas connecting route from the Aphrodite gas field to Egypt. It is planned that the processed gas from the FPSO will be transported through pipelines to a proposed onshore natural gas liquefaction plant. The proposed onshore plant will include three LNG production units with a capacity of five million tonnes per annum (Mtpa) each. It will also include a power plant, supporting and auxiliary services, an operation and control center, as well as two LNG storage containers with a capacity of 180,000 m3 each [32].

The development of the Aphrodite gas field is expected to enable Cyprus achieve energy independence and help the country minimize air pollution while strengthening businesses, employment opportunities, and the overall economy of the country. According to Noble Energy, a total gross unrisked deep oil potential is 3.7 billion barrels, and the field has a gross mean average of 7 tcf of natural gas [32].

2.8 Egypt

In the last decade, there has been serious development of offshore gas and oil fields along the Mediterranean coasts of Egypt (Figs. 1, 2, and 14), where the most active companies are BP, BG, IEOC, EGAS, Total, RWE Dea, and Dana Gas. BG is active in five concessions. Dana Gas, a regional company, has about ten producing fields. In September 2013, BP announced a significant gas discovery in the East Nile Delta named Salamat. The Salamat discovery is located around 75 km north of Damietta city and only 35 km to the North West of the Temsah offshore facilities. The Atoll gas field was discovered by BP in March 2015 by drilling the Atoll-1 deepwater exploration discovery well 15 km north of Salamat discovery. In August 2015, Eni announced the discovery of the Zohr gas field 150 km from Egypt’s north coast. The reserve is estimated as 30 trn scfd of natural gas, making it the largest in the Mediterranean. This discovery seems to increase the Egypt’s total gas reserves by about 40% [11].

The Atoll gas field is a significant discovery lying in the North Damietta Concession offshore Egypt in the East Nile Delta (Fig. 14). BP announced the Atoll discovery in March 2015. The field was developed by BP, which has a 100% equity in the discovery, and on 12 February 2018, BP announced start of gas production [33]. The field development was approved by BP in collaboration with Egyptian Natural Gas Holding Company (EGAS) on 20 June 2016. It was decided that Atoll would be developed as a fast-track project after the heads of agreement was signed in November 2015 between BP and the Egyptian Minister of Petroleum and Mineral Resources. BP has also signed a number of agreements for transportation and processing arrangements related to the field development. Pharaonic Petroleum Co. (PhPC), BP’s joint venture with EGAS and Eni, will execute and operate the project [33].

The Atoll field was discovered by BP in March 2015 by drilling the Atoll-1 deepwater exploration discovery well to a depth of 923 m and is expected to be Egypt’s deepest well ever drilled. The drilling site is located 15 km north of Salamat discovery, 80 km north of the city of Damietta, and 45 km to the northwest of Temsah offshore facilities. The exploration well was drilled to a depth of 6,400 m and encountered approximately 50 m of gas pay in high-quality sandstones. The field is estimated to contain approximately 1.5 tcf of natural gas and 31 million metric barrel (mmbl) of condensates. The gas and the liquids produced from the field are processed onshore at the existing West Harbour gas processing facility, which currently processes 280 mmscfd from Ha’py and 265 mmscfd from Taurt fields [33].

The Zohr gas field (Figs. 1, 2, and 14) is located within the 3,752 km2 Shorouk Block, within the Egyptian Exclusive Economic Zone (EEZ), in the southeastern part of the Mediterranean Sea. The field is situated more than 150 km from the coast of Egypt. Eni owns a 100% stake of the Shorouk license through IEOC Production, and the property is operated by Belayim Petroleum Company (Petrobel), a joint venture between IEOC and Egyptian General Petroleum Corporation (EGPC) [34]. Eni was granted approval for the Zohr Development Lease by the Egyptian Natural Gas Holding Company (EGAS) in February 2016. Production at the deepwater gas field has started by the end of 2017 and will reach full production capacity in 2019 [34].

The gas field was discovered in August 2015 by drilling the Zohr 1X NFW well at a water depth of approximately 1,450 m. The exploration well was drilled to a total depth of 4,131 m and encountered 630 m layer of hydrocarbon column. The field was successfully appraised in February 2016 by drilling the Zohr 2X appraisal well, approximately 1.5 km southeast of the exploration well. It was drilled to a total depth of 4,171 m, encountering 455 m layer of continuous hydrocarbon column. Phase I of the project envisages the development of six production wells to produce an initial 1bcf/d of gas in 2018 and is expected to reach its peak production capacity of 2.7 bcf/d by 2019. The project will involve the construction and installation of an offshore control and production platform, which will further be connected to an onshore processing plant by means of subsea pipelines. The full field development plan entails the drilling of 254 wells over the field’s production life. The gas produced from the field is expected to be distributed within Egypt, while the excess will be exported to overseas markets [34].

2.9 Libya

In 1974, the Italian oil company Eni S.p.A signed a Production sharing agreement (PSA) awarded by the state-owned National Oil Corporation (NOC) of Libya for onshore and offshore exploration in areas near Tripoli. Two years later, the Eni’s subsidiary company Agip Oil announced discovery of the offshore Bouri field at a depth of 2,700 m in the Gulf of Gabes (Fig. 15). The Bouri field is jointly operated by Eni (30%) in partnership with state-owned NOC (70%), with the two partners jointly setting up Mellitah Oil and Gas Company to manage the field. The Bouri Offshore Field is part of Block NC-41, which is located 120 km north of the Libyan coast in the Mediterranean Sea. Its reserves are estimated to contain 4.5 billion barrels in proven recoverable crude oil and 3.5 tcf of associated natural gas with an annual production potential of 6 billion m3. The Bouri field is considered the largest producing oilfield in the Mediterranean Sea [35].

Offshore oil and gas fields in Libya and Tunisia (https://www.energy-pedia.com/news/tunisia/sonde-resources-updates-152743)

Production from the field started in 1988 through two production platforms and Sloug floating storage and offloading (FSO) vessel. In 2006, Eni reported that the Bouri field was producing about 60,000 barrels of oil per day. In 2012, it was announced that the existing FSO will be replaced by a new FSO named Gaza. Built at a cost of $424.78 m, the new vessel reached the Libyan field in May 2016 [35].

The Western Libyan Gas Project is a 50/50 joint venture between Eni and NOC which came online in October 2004. This project transports natural gas from Bouri and other Eni fields through the 520 km long Greenstream underwater pipeline. Currently, 280 Bcf of natural gas per year is exported from a processing facility at Melitah, on the Libyan coast, via Greenstream to southeastern Sicily in Italy. From Sicily, the natural gas goes to the Italian mainland and then onward to Europe [35].

The Bouri field is situated in the Djeffara-Pelagian Basin Province (also known as the “Pelagian Basin”). The Province is primarily an offshore region of the Mediterranean, located off eastern Tunisia and northern Libya (northwest of the Sirte Basin) and extending slightly into Italian and Maltese territorial waters (Fig. 15). The Pelagian Basin contains over 2.3 billion barrels of total recoverable petroleum liquids, consisting of about 1 billion barrels of recoverable oil reserves and approximately 17 tcf of natural gas [35].

3 Conclusions

Until recently, the Mediterranean Sea was not known as an important region for offshore oil and gas exploration and production, unlike the Gulf of Mexico, the North Sea, and the Caspian Sea. This was with the exception of offshore activities in the Adriatic Sea by Italy since the 1950s, in the Aegean Sea by Greece since the 1970s, and in the Gulf of Gabes by Italy and Libya in the 1970s–1980s. However 10 years ago the situation significantly changed with the discovery of a series important gas fields in waters of Israel, Palestine, Cyprus, and Egypt, which in the near future will change completely the gas market in this region of the Mediterranean.

In 2015, Israel produced over 8.5 billion cubic meters (bcm) of natural gas a year, while its proven reserves are estimated as 199 bcm. Future production at the Tamar and Leviathan gas fields is seen as an opportunity for Israel to become a major energy player in the Middle East. As of 2017, even by conservative estimates, Leviathan field holds enough gas to meet Israel’s domestic needs for 40 years ahead. The offshore gas fields of Zohr, Salamat, Atoll, North Alexandria, and Nooros are among the most important offshore projects that will increase natural gas production in Egypt and will contribute to natural gas self-sufficiency by the end of 2018. Today oil and gas exploration or production also takes place off the coasts of Algeria, Spain, Libya, Tunisia, Malta, and Turkey.

Different types of offshore platforms are used for oil and gas exploration and production in the sea [36]. These activities pose a serious threat to the marine and coastal zone environment, the seabed, and sea-bottom habitats and species (Fig. 16), since oil contamination can persist in the marine environment for many years, depending on the oil type, the location of a spill, and the area in which the contamination occurs [36, 37]. Today, accidental spills from offshore platforms in different parts of the World Ocean represent only about 1–3% of total amount of petroleum discharged in the sea. In the Mediterranean Sea, this share should be even less than 1% of total oil pollution as the number of offshore oil and gas platforms and production is small in comparison with other regions of the World Ocean.

Sources of oil inputs from offshore oil and gas installations. Source: OSPAR Quality Status Report 2010, Fig. 7.1, page 65 [38]

In the Mediterranean Sea, there is contradictory information about the total number of oil and gas platforms operating in the sea. According to Statista [18] as of January 2018, there were only 26 rigs operating in the sea, while according to Ministry of Economic Development of Italy in February 2018, Italy alone had 138 offshore platforms. On the other hand, again according to Statista [18] in the North Sea and the Gulf of Mexico (United States), 184 and 175 offshore rigs were located, respectively, as of January 2018, and globally, the number of oil platforms was expected to rise from 389 units in 2010 to 500 in 2017. This number corresponds to the weekly updated information given by Petrodata Weekly Rig Count [39] which for October 2018 shows 77 offshore rigs in the Gulf of Mexico, 38 in South America, 91 in Northwest Europe, 60 in West Africa, 175 in Middle East, 86 in Southeast Asia, and in total 766 worldwide. Unfortunately this database does not provide information about offshore rigs located in the Mediterranean Sea. The discrepancy may be explained by unclear terminology when, for offshore rigs, only oil platforms are counted.

Following the Deepwater Horizon accident in the Gulf of Mexico in April 2010, the European Commission launched an assessment of safety of offshore oil and gas exploration activities as well as production activities in European waters [40]. The investigation concluded that while a number of best practices already existed in the European Union (EU) member states in relation to safety, preparedness, and response, the divergent and fragmented regulatory framework, along with current industry safety practices, did not provide adequate protection from risks of offshore accidents. These conclusions are all the more relevant in light of the transformation of the European oil and gas industry in response to the progressive depletion of “easy” reservoirs. Exploration is moving toward more complex environmental conditions characterized by high-pressure/high-temperature reservoirs, deeper waters and/or extreme climate conditions, and weather events that may complicate the control of subsea installations and incident response [21].

At the same time, production facilities in maturing fields are ageing and often taken over by specialist operators with smaller capital bases. The study concluded that while risks could not be totally eliminated in the offshore hydrocarbon industry, the safety and integrity of operations and assurances of maximum protection of people and the environment needed to be guaranteed [40]. Following this examination, the European Parliament issued the European Offshore Safety Directive (Directive 2013/30/EU) in 2013 [41]. It aims to reduce, as far as possible, major accidents relating to offshore oil and gas operations and to limit their consequences, increase the protection of the marine environment and coastal economies against pollution, establish minimum conditions for safe offshore exploration and exploitation of oil and gas, and improve the response mechanisms in case of an accident. Each EU member state had to transpose the directive into national legislation [21].

References

Kostianoy AG, Kosarev AN (eds) (2005) The Caspian Sea environment. The handbook of environmental chemistry Springer, Berlin, 271 pp

Zhiltsov SS, Zonn IS, Kostianoy AG (eds) (2016) Oil and gas pipelines in the Black-Caspian Seas Region. Springer International Publishing AG, Cham, p 288

CGG (2015) Aegean 2015 seepage study. https://www.cgg.com/data/1/rec_docs/3079_15FY-NP-341-V1_Aegean_Seep_2015_300.pdf

Laubier L (2005) Mediterranean Sea and humans: improving a conflictual partnership. In: Handbook of environmental chemistry, vol. 5, Part K, pp 3–27. Doi: https://doi.org/10.1007/b107142

Trabucco B, Maggi C, Manfra L, Nonnis O, DiMento R, Mannozzi M, Lamberti CV (2012) Monitoring of impacts of offshore platforms in the Adriatic Sea (Italy). In: El-Megren H (ed) Advances in natural gas technology, chapter 11, IntechOpen, pp 285–300

Kostianoy AG, Carpenter A (2018) History, sources and volumes of oil pollution in the Mediterranean Sea. In: Carpenter A, Kostianoy AG (eds) Oil pollution in the Mediterranean Sea: part I – the international context. Hdb Env Chem, Springer

Galil B, Herut B (2011) Marine environmental issues of deep-sea oil and gas exploration and exploitation activities off the coast of Israel. IOLR Report H15/2011, Annex II. http://www.sviva.gov.il/subjectsEnv/SeaAndShore/MonitoringandResearch/SeaResearchMedEilat/Documents/IOL_deep_sea_drilling_Israel2011_1.pdf

Offshore Technology (2017) Noble energy hires Ensco’s drillship for offshore work in Israel. Offshore-Technology Com, Bews 22 Aug 2017. https://www.offshore-technology.com/news/newsnoble-energy-hires-enscos-drillship-for-offshore-work-in-israel-5907504/

Pappas J (2013) Mediterranean Sea plays offer new opportunities. Offshore Mag 73(7). https://www.offshore-mag.com/articles/print/volume-73/issue-7/offshore-mediterranean/mediterranean-sea-plays-offer-new-opportunities.html

Offshore Staff (2018) Energean, BP extend offtake agreement for the Prinos oil field offshore Greece Offshore Magazine, February 2018. https://www.offshore-mag.com/articles/2018/02/energean-bp-extend-offtake-agreement-for-the-prinos-oil-field-offshore-greece.html

Oxford Business Group (2018) New discoveries for Egyptian oil producers. https://oxfordbusinessgroup.com/overview/fresh-ideas-new-discoveries-have-oil-producers-optimistic-about-future. Accessed 13 Oct 2018

Kostianoy AG, Lavrova OY (eds) (2014) Oil pollution in the Baltic Sea. The handbook of environmental chemistry. Springer, Berlin, p 268

Carpenter A (ed) (2016) Oil pollution in the North Sea. The handbook of environmental chemistry, vol 41. Springer International Publishing, Cham, p 312

Carpenter A (2018) Oil Pollution in the North Sea: the impact of governance measures on oil pollution over several decades. Hydrobiologia, North Sea open science conference proceedings (Published online 12 March 2018). https://doi.org/10.1007/s10750-018-3559-2

Tansel B (2014) Propagation of impacts after oil spills at sea: categorization and quantification of local vs regional and immediate vs delayed impacts. Int J Disaster Risk Reduct 7:1–8. https://doi.org/10.1016/j.ijdrr.2013.11.001

Kingston PF (2002) Long-term environmental impacts of oil spills. Spill Sci Technol Bull 7(1–2):55–61

Transportation Research Board and National Research Council (2003) Oil in the sea III: inputs, fates, and effects. The National Academies Press, Washington, DC. https://doi.org/10.17226/10388

Statista (2018) https://www.statista.com/statistics/279100/number-of-offshore-rigs-worldwide-by-region/. Accessed 13 Oct 2018

Types of Offshore Oil and Gas Structures. NOAA Ocean Explorer: Expedition to the Deep Slope. 15 December 2008. https://oceanexplorer.noaa.gov/explorations/06mexico/background/oil/media/types_600.html. Accessed 12 Oct 2018

Energean (2018) https://www.energean.com/. Accessed 13 Oct 2018

Berenguel-Anter A (2018) Improving the safety of oil production in Greece. EBRD, 30 Apr 2018. https://www.ebrd.com/news/2018/improving-the-safety-of-oil-production-in-greece.html. Accessed 13 Oct 2018

Offshore Oil and Gas Production in Europe (2012) Joint Research Centre. EU Offshore Authorities Group – Web Portal. https://euoag.jrc.ec.europa.eu/node/63. Accessed 16 Oct 2018

Ministry of Economic Development of Italy (2018) http://unmig.sviluppoeconomico.gov.it/unmig/strutturemarine/elenco.asp. Accessed 16 Oct 2018

Cazzini FF (2018) The history of the oil and gas exploration in Italy. Search and Discovery Article #30545. AAPG International Conference and Exhibition, London, October 15–18, 2017. http://www.searchanddiscovery.com/documents/2018/30545cazzini/ndx_cazzini.pdf. Accessed 16 Oct 2018

Italian Oil Drilling Referendum (2016) https://en.wikipedia.org/wiki/Italian_oil_drilling_referendum,_2016. Accessed 16 Oct 2018

Croatian Hydrocarbon Agency (2018) https://www.azu.hr/en/about-us/. Accessed 16 Oct 2018

Overview on Oil and Gas in Croatia (2017) https://eurogeologists.eu/wp-content/uploads/2018/01/Overview-on-oil-and-gas-in-Croatia-Final-Ratko-01.12.2017-1.pdf. Accessed 16 Oct 2018

Offshore Technology (2018) Tamar natural gas field. https://www.offshore-technology.com/projects/tamar-field/. Accessed 20 Oct 2018

Offshore Technology (2018) Leviathan gas field, Levantine Basin, Mediterranean Sea. https://www.offshore-technology.com/projects/leviathan-gas-field-levantine-israel/. Accessed 20 Oct 2018

Offshore Technology (2018) Gaza marine gas field. https://www.offshore-technology.com/projects/gaza-marine-gas-field/. Accessed 20 Oct 2018

Energean to buy 45% stake in Gaza Marine field. Egypt Oil and Gas. 8 July 2018. https://egyptoil-gas.com/news/energean-to-buy-45-stake-in-gaza-marine-field/. Accessed 16 Oct 2018

Offshore Technology (2018) Aphrodite gas field. https://www.offshore-technology.com/projects/aphrodite-gas-field/. Accessed 20 Oct 2018

Offshore Technology (2018) Atoll gas field, North Damietta Offshore Concession, East Nile Delta. https://www.offshore-technology.com/projects/atoll-gas-field-north-damietta-offshore-concession-east-nile-delta/. Accessed 20 Oct 2018

Offshore Technology (2018) Zohr gas field. https://www.offshore-technology.com/projects/zohr-gas-field/. Accessed 20 Oct 2018

Offshore Technology (2018) Bouri Field, Mediterranean Sea. https://www.offshore-technology.com/projects/bouri-field-mediterranean-sea/. Accessed 20 Oct 2018

World Ocean Review 3. Chapter 1: oil and gas from the sea. https://worldoceanreview.com/wp-content/downloads/wor3/WOR3_chapter_1.pdf. Accessed 20 Oct 2018

Oceana. Offshore Oil Exploration in the Mediterranean Sea and impact on the marine ecosystem and on Cetaceans’ life. http://www.csun.edu/~dorsogna/nodrill/OffshoreExplore.pdf. Accessed 20 Oct 2018

OSPAR Commission (2010) The quality status report 2010. OSPAR Commission, London. http://qsr2010.ospar.org/en/index.html. Accessed 20 Oct 2018

Petrodata Weekly Rig Count (2018) https://ihsmarkit.com/products/offshore-oil-rig-data.html. Accessed 20 Oct 2018

European Commission Joint Research Centre (2016) Safety of offshore oil and gas operations: lessons from past accident analysis. JRC Scientific and Policy Reports Luxembourg: Publications Office of the European Union, 2012. http://publications.jrc.ec.europa.eu/repository/bitstream/JRC77767/offshore-accident-analysis-draft-final-report-dec-2012-rev6-online.pdf. Accessed 27 Oct 2018

European Parliament and Council (2013) Directive 2013/30.EU of the European Parliament and of the Council of 12 June 2013 on safety of offshore oil and gas operations and amending Directive 2004/35/EC. Off J Eur Union L 178/66 of 28.6.2013. https://euoag.jrc.ec.europa.eu/files/attachments/osd_final_eu_directive_2013_30_eu1.pdf. Accessed 27 Oct 2018

Acknowledgments

The research by A.G. Kostianoy was partially supported by the framework of the Shirshov Institute of Oceanology RAS budgetary financing (Project N 149-2018-0003).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Kostianoy, A.G., Carpenter, A. (2018). Oil and Gas Exploration and Production in the Mediterranean Sea. In: Carpenter, A., Kostianoy, A. (eds) Oil Pollution in the Mediterranean Sea: Part I. The Handbook of Environmental Chemistry, vol 83. Springer, Cham. https://doi.org/10.1007/698_2018_373

Download citation

DOI: https://doi.org/10.1007/698_2018_373

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-12235-5

Online ISBN: 978-3-030-12236-2

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)