Abstract

Developments in iron and steel production with low CO2 emissions and trends in global and regional coal and coke markets are analytically reviewed. Innovations in global coke production are noted. Prospects and challenges for coke production are considered.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The Eurocoke 2019 summit, organized by Smithers Apex (Britain and the United States), was held in Amsterdam, the Netherlands, on April 2–4, 2019, attended by 150 representatives of coal, coke, and steel producers and research organizations from around the world.

The plenary sessions featured 18 presentations on the following main themes:

—steel production with low CO2 emissions (the HIsarna project);

—global and regional markets for metallurgical coal, including India and South East Asia (China, Indonesia, and elsewhere), new market conditions, and Colombian coke;

—modernization of coke production, coke-battery operation with stamped charge coal at the Tata Steel plant, battery diagnostics and working life, and up-to-date coke machines;

—automated control of coke-battery heating;

—prospects and challenges for coke production up to 2030.

We now consider the most important contributions.

1 STEEL PRODUCTION WITH LOW CO2 EMISSIONS

As an example of steel production with low CO2 emissions, Tata Steel reported on experience at the Ijmuiden (Netherlands) pilot plant with HIsarna technology [1].

HIsarna coke-free technology permits hot-metal production with decrease in CO2 emissions by at least 20% or by at least 80% when CCS technology is used for CO2 capture. This technology employs no coke, is flexible in terms of the raw materials used (scrap may be used), yields hot metal with low phosphorus and sulfur content, and permits the capture of zinc from the dust formed.

The HIsarna system is one of four technologies developed within the European Community’s ULCOS project (begun in 2004), with the goal of 50% decrease in CO2 emissions in steel production. Since 2007, Tata Steel, Rio Tinto, and ULCOS have actively worked on this coal-based technology for hot-metal production. In 2010, a pilot plant developed in collaboration with ArcelorMittal, Thyssenkrupp, voestalpine, and Paul Wurth went into operation at Tata Steel’s Ijmuiden plant.

The project is financed under the EC’s Horizon 2020 program. Today, investment in new technology exceeds 75 million euro. In comparison with blast-furnace technology, the HIsarna process offers the following environmental benefits.

1. Lower emissions of CO2, SOx, NOx, and fine particulates.

2. No storage of slag and particulate waste.

3. Utilization of mining wastes.

4. Smelting of hot metal by means of low-cost raw materials, noncoking coal, and low-grade ore.

5. Return of scale, slag, and galvanized scrap to the production cycle.

6. Higher energy efficiency.

7. Lower production costs, on account of the lower sulfur and phosphorus content in the hot metal.

8. Lower capital costs for environmental measures.

In Fig. 1, we show the basic HIsarna process. In Fig. 2, we present the pilot plant.

The basic characteristics of the process are as follows.

1. Iron ore is injected into a cyclone for smelting in the presence of oxygen.

2. The CO-rich gaseous fuel ascending from the smelting reduction vessel (SVR) burns in the cyclone, thereby increasing the temperature and also melting and partially reducing the iron.

3. The molten iron forms a liquid film at the cyclone wall, and then iron droplets fall onto the slag bed in the retort.

4. Granulated coal is injected into the slag bed, completely reduces the iron ore to hot metal, and carburizes the hot-metal bath.

5. The CO gas formed on reduction partially burns in the presence of O2 between the upper surface of the slag bed and the bottom of the cyclone, generating heat.

6. The splashing and turbulence associated with injection transfer some of the heat to the slag and hot metal.

In 2017 and 2018, the research at the pilot plant was undertaken with the following goals:

—to demonstrate the possibility of decreasing the CO2 emissions by 35% without using CCS technology;

—to demonstrate the possibility of stable use of 40% biomass (caking low-density, low-ash residue injected through a coal sprayer) and 35% crushed and pressed scrap, introduced semicontinuously by means of gravity.

The use of scrap and biomass in different proportions confirms that the CO2 emissions (t/t of hot metal) are lower in the HIsarna process than for the blast furnace.

Improvements in the process continue. The results at the pilot plant are important for the development of European coke production. Note that the following measures permit decrease in coke consumption in the steel industry:

—coal-based technologies for hot-metal production (HIsarna, HIsmelt, Finex, and other processes);

—steel production on the basis of scrap (in electrical arc furnaces—EAF);

—the use of natural gas and hydrogen as reducing agents (in the production of direct reduced iron and hot-briquetted iron).

The HIsarna process is a breakthrough providing the basis for stable global steel production, with great economic and environmental benefits.

2 GLOBAL MARKET FOR METALLURGICAL COAL

Wood Mackenzie (United States) reviewed the global market for metallurgical coal [2].

Since September 2016, global spot prices (FOB) for metallurgical coal have been fairly high on account of problems with supplies from Australia and reforms in Chinese steel production: on average, $205/t. This figure corresponds to the mean monthly estimates for Australian coal with a low content of volatiles.

The state of the market is assessed in relation to the largest suppliers and consumers. For example, Australia, the main supplier of metallurgical coal, has had problems, but export growth by 10 million t is possible in 2019. (Its exports in 2018 amounted to 176 million t.)

Coal exports from the United States in the first half of 2018 were strong (54.6 million t, on average) but slowed somewhat in the second half of the year (to 48.6 million t). Much coal was used by local steelmakers on account of tariffs on imported coal. Consistently high market prices stimulated export growth from the United States, to a level of 50 million t, on average, but rail transportation proved a hindrance. Exports through New Orleans increased. Environmental regulations may curb future expansions in supply.

Thanks to China’s introduction of a 25% tariff on United States coal, the country’s exports fell significantly (almost fivefold) between February and December 2018. A bilateral agreement could eliminate such problems, especially in the light of relations between China and Australia. A complicating factor is that China monitors the radiation levels of some imported coal, including coal from the United States. China has banned the import of fuel coal from Australia and limits the import of metallurgical coal. In 2018, China imported 10 million t of metallurgical coal through Dalian; of that total, 9 million t came from Australia. Wood Mackenzie predicts that imports of metallurgical coal to China from Australia will fall by 4 million t in 2019. In 2018, China imported 39 million t of metallurgical coal from Australia and 8 million t from other countries.

With India’s adoption of the 2016 Insolvency and Bankruptcy Code, approaches to steel-plant operation have changed. It has resulted in the consolidation of 56% of steelmaking capacity and 85% of production capacity for rolled steel. The steel output of companies in bankruptcy between 2014 and 2018 was fairly high: their total capacity was around 22 million t. (Affected companies include Essar, Bhushan Power & Steel, Bhushan Steel, and Monnet Ispat.) Between 2015 and 2020, Indian demand for steel is expected to rise to ~90 million t (in sectors such as shipbuilding, manufacturing, construction, and the auto industry), with corresponding increase in steel output. Demand for pulverized coal in India is fairly high, and Wood Mackenzie predicts increase in imports from ~7 million t in 2019 to 34 million t in 2030. The leading companies are Tata, ISW, SAIL, and Bhushan. In future, with refinements in pulverized-coal injection, India’s imports will fall.

Overall, global demand for seaborne metallurgical coal will increase from 310 to 410 million t between 2018 and 2040. Much of that demand will be met by Australia, on account of the low cost of its coal and its relative proximity to India, which is one of the largest importers.

In conclusion, Wood Mackenzie predicted that prices for metallurgical coal will increase next year. They also noted the following.

1. Demand for coal in China may increase by 3%. With drop in demand, imports will be limited. However, broad import bans are not foreseen, since China needs high-quality imported coal (especially coking coal). Shortages will lead to high local prices in the first half of next year.

2. For India, another year of import growth may be expected: to 4 million t, with a large proportion of pulverized coal. Growth will be driven by private companies.

3. Australian exports of metallurgical coal will slowly increase in price. The United States will probably find new sources of coal with a high content of volatiles, in particular. Exports of United States coal will reach almost 55 million t, with the likelihood of growing deliveries through New Orleans.

4. Prices for metallurgical coal will fluctuate within the range $180–215/t, depending on short-term trends.

3 COAL DEMAND IN INDIA AND SOUTH EAST ASIA

The Jellinbach Group (Australia) made a presentation on the demand for metallurgical coal in India and South East Asia and its impact on global demand. [3].

3.1 India

India’s Steel Ministry has published the following figures for national steel output: 106 million t in 2018; 150 million t in 2020; and 300 million t in 2030. The key goals of national policy in 2017 were formulated as follows:

—to create globally competitive steel capacity of 300 million t/yr by 2030;

—to increase per capita steel demand to 160 kg by 2030, corresponding to total output of 246.1 million t of steel;

—to increase local coking-coal output so that imports fall to 50% of demand by 2030;

—to become a world leader in terms of the energy efficiency, labor safety, and environmental impact of steel production;

—to become a steel exporter by 2025.

In fact, steel output in 2018 was 106 million t, with the prospect of reaching 246 million t by 2030.

Obstacles to meeting the national goals include the following.

1. Limits on land use. Each farmer has the right to speak on this topic.

2. Logistical issues. While the iron ore is of high quality, extraction permits may be a problem, infrastructure improvements are necessary, and corruption is always a concern.

3. Deficient infrastructure, notably power-supply systems and railroads.

4. A lack of qualified staff. This problem may be resolved.

5. Limits on water supplies. This problem may also be resolved.

To cover 50% of the demand for metallurgical coal from local sources is impossible because of the poor coal quality. In addition, its use decreases the efficiency of steel production.

As of March 2016, India’s steel industry may be characterized as follows:

—steelmaking capacity of 50 million t on the basis of a blast furnace–oxygen converter chain, with 82% use of capacity;

—308 producers of iron sponge (including those using gas);

—1175 electrical arc and induction furnaces;

—1392 rolling mills producing wire rod.

The 2016 Insolvency and Bankruptcy Code on restored clarity to the steel industry. It protects the interests of small investors and solves the problem of inoperative shares. The Reserve Bank of India has recognized five large steel companies as insolvent; their total output is 22 million t. The most promising is the ISW group, whose predicted steel output is 45 million t/yr in 2025 and 60 million t/yr in 2030.

Table 1 presents the predicted steel output of individual plants up to 2030.

Tata Steel, whose steel output is 12 million t/yr, intends to produce 30 million t/yr by 2025. Table 2 summarizes the expected output by plant.

The Steel Authority of India (SAIL) operates five integrated steel plants. In 2017, they produced 15.7 million t of steel. The predicted steel output in 2023 is 23.5 million t. In 2017, SAIL plants consumed 15 million t of metallurgical coal and 1.5 million t of pulverized coal. The demand for pulverized coal is expected to rise to 2.5 million t by 2019.

The presentation by the Jellinbach Group included the following information regarding SAIL plants.

1. RINL (Vizag Steel) expects to produce 7.5 million t of steel in 2019, with the use of 4.7 million t of high-coking coal; in 2022, pulverized-coal consumption of 1.35 million t is expected.

2. The National Mineral Development Corporation (NMDC) expects to introduce a new plant with capacity of 3 million t/yr in 2019.

3.2 South East Asia

South East Asia is a rapidly developing region. Table 3 summarizes the data for the region.

We now present information regarding steel production in some individual countries for 2017.

Vietnam. In 2017, the capacity of the Formosa Plastics Vietnam integrated steel plant was 7 million t/yr. The plan is to increase that to 22 million t/yr. However, government support is weak on account of the plant’s severe environmental problems. Annually, the plant consumes 4 million t of hard coking coal; 1 million t of pulverized coal; and 0.2 million t of local anthracite.

In 2017, Hoa Phat steel plant produced 2.8 million t of steel and around 1.1 million t of pig iron. The prediction is steel output of 8.0 million t in 2020.

Malaysia. Each year 6 million t of steel is imported. Alliance Steel expects to produce 3.2 million t per year. Built as part of China’s Belt and Road Initiative, it is expected to go on line by early 2019. It will consume 1.7 million t of coking coal and 0.5 million t of pulverized coal each year.

Indonesia. In January 2014, the Indonesian government banned the export of all raw materials. Previously, 50% of China’s nickel imports had been from Indonesia. Indonesia intends to enrich its ore locally so as to create production capacity and jobs. Recently, four large Chinese companies have built plants for the production of nickel pig iron (NPI) from nickel ore in rotary-kiln electrofurnaces (RKEF technology).

Morowali Industrial Park. Located on the southeastern shore of Central Sulawesi province, this park is dominated by Tsingshan Steel, which produces NPI by the RKEF technology in 20 furnaces. PT Dexin Steel is expected to soon go into production, with an annual output of 3.5 million t steel and 1.3 million t coke and inputs of 1.6 million t of coking coal and 0.6 million t of pulverized coal. Tsingshan Steel owns 43% of the shares in PT Dexin Steel.

Table 4 summarizes the predicted consumption of coking coal and pulverized coal in India and South East Asia.

4 ADAPTING TO NEW CONDITIONS IN THE COKING-COAL MARKET

The presentation by XCoal Energy and Resources (United States), which produces coking coal and fuel coal, focused on the new conditions in the coking-coal market [8]. In 2018, Xcoal produced 70% coking coal and 30% fuel coal. Its goal is to reach a 50 : 50 balance. It supplies coal to China, India, Japan, South Korea, Europe, and North and South America.

4.1 Factors Responsible for High Prices

In the past three years, prices for seaborne coking coal and thermal coal have remained high on account of high demand and low supply. Most of the increased demand is for coking coal. Because of the trade war, tariffs on United States coal have increased, affecting business with China and Turkey (although the latter does not affect overall demand). However, only the direction of trade has changed. The United States was responsible for 30% of the increase in coking-coal sales in 2018.

Table 5 presents the main exporters of coking coal.

In 2017 and 2018, investments in coal extraction were low. That limited supplies and slowed the increase in output from the major producers (Australia, the United States, Canada, and Russia). Coal exports from the United States were the most stable: they doubled between 2016 and 2018. That suggests that the United States may be regarded as a reliable future exporter.

4.2 Possible New Supplies

Most coal producers tend to take profits from their shares, rather than reinvesting the capital. That introduces market stresses on the supply side. Producers who have creditors must always reach agreement with them on the best expenditures. In the United States, coal suppliers are short of funds.

In the presentation, XCoal described major projects for expanding coal supplies in Australia. However, as was noted, many of them exist only on paper at present.

4.3 Trade Wars

As yet, trade wars have not affected coal demand. Globally, the most significant developments were the increase in tariffs on United States coal by Turkey (by 13.7%) and China (by 28%). Turkish importers continued to acquire coal from the United States in parallel with the negotiations. Coal imports from the United States to China are more important to the United States than to China and have fallen significantly.

The demand for coal depends on rates of economic growth, which are slowing globally. The exceptions are China and India with expected growth in GDP of 6.2 and 7.2% in 2019 (as against 3.3% for the world as a whole). However, that does not compensate for the overall decline in global growth rate. It remains to be seen how the trends in the global economy will affect the demand for coking coal.

Despite the trade wars, China still needs high-quality United States coking coal. Both buyers and sellers understand that they face higher costs on account of the higher tariffs. Coal is a key topic in the trade talks and a means of decreasing the trade deficit. Regardless of the outcome of the talks, China may switch from Australia to the United States as a supplier of coking coal and fuel coal.

The main factors that require close monitoring in 2019 are as follows: the state of the global economy; the policies of the Chinese government; China’s steel market; coal supplies from Australia; stresses in world trade; exchange rates; iron-ore prices; freight costs; strikes; and weather conditions.

5 COKING-COAL PRODUCTION IN THE UNITED STATES

The presentation by CORSA (United States), a producer of high-quality metallurgical coal, focused on the current production of coking coal in the United States [4]. In 2019, CORSA plans to sell 2.0–2.4 million t of coal.

Its coal is purchased by steel and coke plants in the United States, Asia, South America, and Europe.

Between 2010 and 2017, annual exports of metallurgical coal from the United States have oscillated between 55–70 and 40–55 million t. They increased from 55 million t in 2017 to 61 million t in 2018. In the United States market, annual sales are 19–22 million t.

In 2018, the breakdown of US exports by destination was as follows: Europe 44.2%; Asia 27.2%; South America 14.8%; North America 8.9%; Africa 3.6%; the Middle East 1.0%; Central America 0.3%. These markets remain stable. However, growth in exports to India and Brazil is observed.

In the next ten years, growth in steel output and demand for coking coal is expected on account of continuing urbanization around the world. The expected levels in 2030 are 40% in India, 69% in China, 86% in the United States, and 97% in Japan.

However, increase in the global output of metallurgical coal is slow. This may be attributed in part to more careful monitoring of the situation by risk-averse producers, investors, and bankers and to stricter enforcement of environmental and labor standards. Since 2012, capital investments in metallurgical coal have decreased globally by 70%.

In the United States, there are difficulties in ensuring adequate levels of technology and staffing. Capital for expansion of output is scarce. Investors require rapid returns on their expenditures. That leads to the following conclusions.

1. The growth in supplies of metallurgical coal in the United States will be limited.

2 Although it’s a profitable business, new infusions of capital are problematic.

3. Prices for hard coking coal will be stable ($150–200/t).

4. Much will depend on the political situation in the United States and production decisions.

6 METALLURGICAL COKE FROM COLOMBIA

Carbocoque (Colombia) made a presentation on one of the newest suppliers of metallurgical coke: Colombia [5].

Colombia is a center of consolidated fuel-coal production by major global companies. Last year, Colombia, with exports of 82 million t, was the world’s fourth largest exporter of fuel coal. At the same time, in 2018, Colombia exported ~2 million t of metallurgical coal, mainly to Brazil, Mexico, and Turkey. Colombia is the only Latin American country with reserves of high-quality metallurgical coal. About 25% of the available territory has already been worked. In addition, Colombia is the world’s third greatest supplier of commercial coke, after China and Poland. Its high-quality coke is exported to the main global steelmakers. In 2018, exports amounted to 3 million t.

Colombia, with a population of 45.5 million, occupies an area of 1.14 million km2. Its per capita GDP is $7301. In 2018, foreign investment amounted to $11 billion.

The untapped reserves of metallurgical coal in the center of the country totaled 2651 million t in 2018. Colombia is one of the few regions of the world where coal of three types is mined: coal with low, medium, and high content of volatiles. In 2018, coal output was ~7 million t. The coal is transported to ports in 35-t trucks over a distance of about 900 km.

The coal is found in complex geological conditions. The bed thickness is 0.8 m, with an inclination of 40°–65°. Levels of mechanization are low; 85% of the mines are small and underground. Colombian coal with medium content of volatiles has the following components: 8.0% moisture; 9.5% ash; 0.9% sulfur; 0.035% phosphorus; 27.0% volatiles; and 63.5% fixed carbon. The free-swelling index is 8.0%; and the maximum Arnu dilation is +60%.

Table 6 presents the mean characteristics of Colombian coke.

Colombia’s exports of metallurgical coke were as follows (million t): 1.916 in 2015; 1.772 in 2016; 2.521 in 2017; and 3.098 in 2018. Destinations include Brazil, Mexico, Britain, and Japan. At present, various projects for the expansion of coal production are under consideration in Colombia. In the past 15 years, Colombia has been a competitive, reliable, and long-term supplier of metallurgical coke.

7 MODERNIZATION OF THE GIJON COKE SHOP

In Spain, ArcelorMittal operates the Asturias plant, which has two coke shops: the shop at the Aviles site, which is active; and the shop at the Gijon site, which is in cold idling status. Its plenary presentation discussed the modernization of the Gijon coke shop [6].

To maintain coke output, after economic analysis, the company decided to partially reconstruct the byproduct shop at the Aviles shop and to completely restore coke production at the Gijon plant, which has not operated since 2013. The two existing coke batteries are capable of producing coke at a rate of 1.1 million t/yr.

The plan calls for the construction of two more coke batteries producing coke at a rate of 1.1 million t/yr; each will consist of 45 coke ovens. The characteristics of the coke ovens are as follows: height 6.5 m; length 15 m; mean width 420 mm; coking period 16.6 h; mean temperature in heating wall 1275°C; wall thickness 90 mm. The compound ovens are designed for heating by coke-oven gas and mixed gas, supplied at the bottom. Each battery is served by two sets of coke machines, a quenching tower of height 40 m; and a 2000-t coal tower.

The coke batteries are equipped with a dust-free coke discharge system and a heating system designed with low NOx emissions (below the current EC limits). The gas collector is on the machine side.

The design includes a new shop for biological water treatment and also breakdown of H2S and NH3, with the production of sulfur by means of a Claus system and the removal of naphthalene. The biological wastewater treatment will employ nitrification/denitrification processes. The system will include a cold-water unit, pipelines for collecting the emissions, and leak-free discharge of the residue from the decanters.

The byproduct shop at Aviles will be modernized. The planned improvements include replacement of the coke-oven gas by natural gas at the steel plant in Aviles and the injection of coke-oven gas into the blast furnace. Documentation is being developed by a group of 30 specialists at ArcelorMittal. The first coke production is planned for October 2019, with the start-up of a second battery in March 2020. The presentation detailed the permitted atmospheric emissions (CO, SO2, NOx, particulates, etc.) and water emissions.

For example, the permitted NOx emissions from different sources are 500 mg/m3 (5% O2), 450 mg/m3 (5% O2), and 200 mg/m3 (3% O2). (The last figure corresponds to a gas-fueled steam boiler.)

The furnace-heating design (structure of the heating walls, target temperatures) must ensure the generation of less than 400–500 mg/m3 NOx (5% O2) on heating by mixed gas.

Shutdown of the coke batteries at Gijon when the shop at Aviles is operating will permit its modernization at lower cost. The investment in modernizing a coke battery of capacity 1.1 million t/yr corresponds to the costs in constructing a new coke shop of capacity 700 000 t/yr. On the basis of a Karl Steel design, with the support of ArcelorMittal and Paul Wurth specialists, the company has been able to eliminate the defects in the original design of the Gijon facility.

8 OPTIMIZATION OF COAL STAMPING

The presentation by Tata Steel Jamshedpur focused on optimization of the energy consumption in stamping of the coal charge so as to obtain the required characteristics of the coal cake [6].

Tata Steel Jamshedpur operates seven coke batteries with annual coke production of 3.0 million t from 4.3 million t of coal; a special system permits ramming of the coal batch. In the coal-preparation shop, coal intake (by a system for tippling rail cars) is followed by dosing batch, crushing, wetting of coal, and its storage in a bunker. The age of the coke batteries is 3–22 years. Each one contains 30–88 coke ovens with 36–79 discharges per day. Their capacity is 900–2900 t/day.

Tata Steel is a pioneer in the successful operation of ramming systems. Between 2010 and 2018, the following systems were introduced at the plant:

—a system for trapping emissions at furnace charging and coke discharge;

—sulfur removal from coke-oven gas (a Claus system);

—an improved wet-quenching system with the prevention of emissions;

—water cleaning of the doors at high pressure;

—automatic combustion of the surplus coke-oven gas;

—an improved heating system with decreased NOx and SOx emissions;

—dry-quenching of the coke at coke batteries 10–11.

In addition, the ramming system was improved as follows.

1. Online monitoring of the density of rammed coal cake by ultrasound analysis. Two configurations of the ultrasound sensors are considered: a setup for measurements when necessary with guides for emergency discharge of the coal cake (Fig. 3); and constant measurements by sensors in the ramming chamber (Fig. 4).

2. Optimization of the coking period by measuring the exhaust-gas temperature in the standpipe.

3. An online temperature-monitoring system in the heating wall. The system is based on a single optical-fiber IR pyrometer for temperature measurement at several points over the length of the heating wall. Special glass-fiber lenses are installed in the heating channels. In Fig. 5, we show the basic system and its components.

9 COST-CONSCIOUS COAL-BLENDING

Ternium (Brazil) discussed a philosophy of coal-blending for lowering the cost of the hot metal produced [9]. Two specific examples were employed: the Ternium Argentina (TX ARG) and Ternium Brazil (TX BR) plants. Table 7 presents the characteristics of those plants.

To establish the annual procedure for coal purchases, covering the period from April to March, a group of specialists in blending methodology was convened. At each plant, the procedure employed is different. At TX BR, the batch includes coal with high (≥32%), medium (20–32%), and low (<20%) content of volatiles and also low-cost alternative materials such as petroleum coke, soft coking coal, or coking coal with high sulfur content. The sources of the batch materials are the United States, Australia, Canada, Mozambique, and Brazil (petroleum coke). Between the 2011 and 2019 financial years, CSR was 66.3–69.1%.

In selecting the batch materials, factors such as their availability, characteristics, cost, and stored reserves and the coke quality are carefully assessed. Ternium has developed a special method for assessing the batch composition and the sequence of changes in the coking conditions. The goal is to obtain hot metal in different cost ranges.

At TX ARG, the blend includes coking coal with low (<22%) and medium (20–24% with fluidity >3000 ddpm and 22–28% with fluidity >5000 ddpm) content of volatiles; semihard coking coal with low content of volatiles (20–25% with fluidity <100 ddpm); and petroleum coke. The sources of the blend materials are the United States, Australia, and Colombia.

Advanced blending technique has decreased costs by 16.83% at TX BR and 9.0% at TX ARG.

10 INFLUENCE OF MINERAL PARTICLES ON COKE QUALITY

Teck, a member of the Canadian Carbonization Research Association, addressed the influence of the type and size of mineral particles on coke quality [11]. The company’s research permits better prediction of the CSR and CRI values of coke. The presentation included description of an experimental procedure and digital data, with a detailed list of the mineral particles observed in coal and their influence on coke rheology and quality.

11 DESIGNS FOR COKE OVEN MACHINES

Paul Wurth (SMS Group) gave examples of digital systems for slag-granulation systems, charging devices for blast furnaces, and coke-making machines [11]. By modeling and optimization of the process (with monitoring and prediction of the state of the equipment), the performance of the equipment may be improved, and repair operations may be facilitated.

The system is based on observation and information collection by means of precise sensors and on information transfer and processing to obtain recommendations, alarm signals, electronic messages, and so on. It permits rapid response to warning signals, improvement in equipment monitoring, increased flexibility, and reliable equipment operation.

For example, the system collects information regarding door-opening machines: their position, their deflection, their operating time, their speed, and so on; and information from the active wall regarding the coke’s exit path, the contact time, the temperature of the heating walls, and so on.

An innovation is absolute positioning of the coke oven machines, by means of special cameras. In contrast to traditional systems, the machine is first approximately positioned and then precisely positioned by means of an infrared camera, which functions independently of the local illumination. The attainable precision is ≤3 mm with the oven door open and ≤1 mm with the door closed. Besides positioning, the system permits the following:

—identification of the oven number (as a cross check);

—collection of information regarduing deposits at the door frames;

—measurement of the floor level in the coking chamber.

12 COMPLETELY AUTOMATED COKE OVEN MACHINES

John M. Henderson Machines (Britain) made a presentation on manless coke oven machines [12].

The main topics were as follows:

—the human factor in coke production;

—preconditions for the use of fully automated coke-making machines;

—examples of their operation and their influence on overall coke production.

In considering the human factor, the primary considerations are health and safety and occupational risks. Strict requirements are imposed on worker safety in coke shops. The presentation included examples of best available techniques (BAT): smoke-free furnace charging; dust-free coke discharge; gas-tight doors; effective cleaning systems for the coke-oven doors and doorframes; and automated production.

The company regards the introduction of completely automatic control systems in already-operating coke shops as feasible, with the complete elimination of the human factor.

Projects completed by the company include the following:

1. Automation of two electric locomotives for quenching cars that had been operating for 40 years at a British plant, with the removal of 50 workers from a zone with problematic working conditions.

2. Engineering, manufacture, and startup of 15 new coke batteries and 45 modernized coke-making machines, including new machines for coke ovens of height 6.7 m, at a plant in South Korea.

These projects meet the requirements of complete automation of all the coke-making machines and remote monitoring of their operation. Automated operation of the door-removing machine decreased the frequency of operational accidents, with financial savings of $3.3 million per year. Staff requirements were decreased from 40 to 14, with a further saving of $3.12 million per year. The operating cycle was shortened from 14.36 to 11.38 min, thereby increasing output, with an additional economic benefit of $1.47 million per year.

Overall, productivity is increased by 29%; energy consumption is decreased by 8%; disruption of operation is decreased by 3%; and staff is decreased by 60%.

13 EAGLECOKETM THERMAL CONTROL SYSTEM FOR COKE BATTERIES

Lotus Wireless (India) offered a presentation on the EAGLECOKETM system for thermal control of coke batteries [13].

The system was introduced at coke battery 6 of the Rourkela steel plant. In 2016, the company began to develop the system software. In 2017, an order was placed for the system at coke battery 6 and, in 2018, it went into operation. Tests were completed in 2019.

The battery was designed by MECON, with consultation by CET. The coke battery has a capacity of 768 000 t/yr. It consists of 67 coke ovens, with a mean chamber width of 400 mm and height of 7 mm, and 5–2 pushing cycle. The coal is charged by gravitation. The ovens are of compound type with twin heating flues and bottom gas supply. Heating is by means of coke-oven gas, alone or in a mixture with blast-furnace gas. The calorific value of the mixture is 950–1150 kcal/m3. Other initial data are as follows:

—normal gas consumption in heating 67 000–75 000 m3/h (with occasional dips to 60 000 m3/h);

—normal pressure of the heating gas 50–75 mbar (with occasional dips to 35 mbar on account of fluctuations in blast-furnace pressure);

—calorific value of blast-furnace gas 950–1020 kcal/m3, with an assumed value of 1050–1120 kcal/m3 (constant regulation is required);

—oven discharge 90–93 times per day (permissible fluctuation ±5).

In the presentation, the control model for battery heating was described, with listing of the input parameters (for the coal blend and heating gas, as well as operational characteristics). The model algorithm includes the following sequence of calculations:

—the coking period;

—the heat consumption in coking;

—the temperature in heating flues;

—the final coking temperature;

—the calorific value of fuel gas;

—the air consumption in heating;

—the volume of combustion products (heat losses).

The heating characteristics are corrected on the basis of the actual temperatures in the heating flues and the coke cake if their fluctuation is excessive. Correction involves the following:

—change in consumption and pressure of the heating gas;

—adjustment of the pause in heating;

—modification of the calorific value of the heating gas.

In tests, the guaranteed characteristics were maintained over seven days. The contract limits fluctuations in temperature of the coke cake to ~17°C; in fact it is ~14°C. Likewise, the decrease in heat consumption must be no less than 1% for each 10°C decrease in temperature of the coke cake; in fact, it is 1.8%.

14 DIAGNOSTICS AND WORKING LIFE OF COKE BATTERIES

14.1 A. Presentation by POSCO

POSCO’s presentation focused on the company’s approach to the diagnostics of coke batteries and prediction of their working life at their plants in Pohang and Gwangyang [14].

Table 8 summarizes the main characteristics of POSCO coke batteries.

Multiple-stage gas supply is used in 59% of the coke batteries, so as to decrease NOx formation and ensure more uniform combustion in the vertical channels. To meet more stringent standards in the future, POSCO plans to reconstruct the heating systems of the other coke batteries.

The company’s development strategy for coke production over the next 50 years includes the following:

—repair of the coke batteries and construction of new batteries requiring fewer repairs;

—shutdown of small coke batteries (height 5.15 m);

—renewal of the stock of coke ovens in the light of the balance of coke and coke-oven gas at the company;

—compliance with environmental standards (in terms of NOx, SOx, and smokestack gases).

The company uses a plot of the oven condition against operating time and has a method of assessing the state of various coke-battery components. On the basis of the monitoring data, the remaining working life of the battery is predicted. The most important battery components (refractory lining, anchorage system) are monitored individually and repaired accordingly. To ensure effective control of the coke ovens, a special data-collection system has been developed for real-time diagnostics and analysis.

The development strategy for coke production at POSCO calls for the construction of 23 new coke batteries and the replacement of 28 batteries at the Pohang plant, followed by 38 batteries at the Gwangyang plant.

14.2 B. Presentation by TKIS

Thyssenkrupp Industrial Solutions (TKIS) discussed assessment of coke-battery life the basis of process data [15].

TKIS has developed the following analysis of coke production today.

1. Most coke batteries have been operating for more than 30 years.

2. Environmental standards are becoming more stringent.

3. Many coke batteries require replacement or relining, but current investment does not meet that need.

4. Therefore, it is of great interest to maximize battery life.

Prolonging battery life is associated with both benefits and risks. Decisions of great economic significance must be made. Monitoring of the state of coke batteries assumes a critical role here. TKIS has a proprietary monitoring system focused on the refractory lining; it employs visual inspection and also automated systems, endoscopy, and other technologies. However, the number of defects may far exceed those that are visible. Therefore, more complete process data must be employed.

This is especially important in terms of lining defects (such as invisible cracks), through which gas may leak.

The first signs of such defects are changes in composition of the combustion products at the smokestack (traces of CO2, O2, sulfur compounds, and hydrocarbons). Accordingly, the composition of the combustion products is measured in samples at all the gas-exhaust valves. The source of each gas detected is identified.

The procedure for the heating walls is analogous. It takes around a day to determine the composition of the combustion products. On the basis of semiautomatic assessment of the results, the condition of the coke battery is mapped and measures are taken to eliminate the defects. In parallel, data are collected regarding the battery’s operating conditions, with a view to their subsequent adjustment.

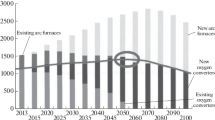

15 PREDICTIONS FOR 2030

In their plenary presentation, H&W Worldwide Consulting (Australia) discussed challenges facing coke production between now and 2030 [16].

The primary themes were as follows.

1. Challenges and problems.

2. The development of steelmaking over the next ten years. Will electrosmelting dominate? Will the use of scrap decrease the demand for coke?

3. The prospects for coking coal up to 2030. Who will supply the raw materials for coke production?

4. Analysis of the foreseeable future.

Challenges facing the steel industry and the coke industry include the following: stricter enforcement of environmental standards and the need to decrease emissions; economic issues associated with battery aging and the availability of raw materials; and labor shortages. The expansion of renewable energy threatens the future of the coal industry. A particular concern is the emission of carbon dioxide. New steelmaking technologies with low carbon emissions are under development (reductive smelting, HIsarna, the use of biomass and hydrogen for reduction, etc.).

Steel will remain fundamental to economic growth. However, steelmaking is very energy-intensive. The combination of the blast furnace and oxygen converter is a major source of CO2 and greenhouse gases. The task is to make the steel industry environmentally friendly. Globally, arc furnaces are widely used for steel production. They are integral to the production chain for the direct reduction of iron. By 2030, the annual steel output of EAF is expected to be 70–75 million t, and the technology will have been improved.

Steel scrap is used in oxygen converters (25–35%) and in EAF. The availability of scrap of adequate quality in adequate quantities is a problem. The main sources of scrap in the future will be the United States, Japan, China, and South Korea. The volume of scrap worldwide is expected to be ~270 million t by 2030. (After 2023, China’s contribution will be 200 million t.) The use of scrap in oxygen converters is expected to increase by 16% after 2023, with corresponding decrease in the smelting of hot metal. By 2025, the consumption of coking coal is expected to fall by 100 million t. However, the demand for coke in steelmaking will continue to grow.

By 2030, the main suppliers of coking coal will be Australia (58%), Canada (12%), the United States (8%), Russia (7%), Indonesia (5%), Mozambique (5%), and elsewhere (5%). Each source has its risks and problems (investment, infrastructure, etc.). Coal production in the United States is falling. Production in Mozambique, Indonesia, and Russia (in the Far East) will rise.

By 2030, the combined population of China and India will be 3 billion. The Chinese economy will dominate, with India in second place. Growth rates in the steel industry will slow in China and rise in India. The Indian government intends to increase steelmaking capacity to 300 million t by 2030, with actual output of 250 million t/yr.

Today, annual coke production in China exceeds 550 million t, with a figure of 12 million t for India. By 2030, China’s annual output will be less than 400 million t, while India’s will be 15 million t. Coke ovens of slot type (height >7 m) are appearing in China. Larger furnaces of that type will be introduced in India, along with ramming technology. In 2030, China will still be the major exporter. India is a potential exporter. The world’s population will continue to increase. It is reasonable to expect 45% increase in the demand for steel by 2030 and 100% increase by 2040. The per capita demand for steel will also increase.

16 CONCLUSIONS

Steel will continue to be fundamental to world economic development. However, steelmaking is very energy-intensive and a major source of CO2 emissions. Other problems relate to battery aging, the availability of raw materials, and decrease in the coke consumption in hot-metal production. Therefore, alternatives to the blast furnace, especially coke-free processes, are of great interest. Improvements are being made to steel production in arc furnaces, often with the use of scrap. However, the demand for coke in steelmaking will continue to grow. In the future, the major coke suppliers will be China, Poland, and Colombia.

There are stresses in the global market for metallurgical coal on account of problems with the supply from Australia, reforms in China’s steel industry, trade wars, and other factors. In the near future, prices of metallurgical coal will rise, but global demand will continue to increase, especially for seaborne coal. South East Asia (India, Indonesia, Vietnam, etc.) will have the greatest influence on global demand for metallurgical coal.

The main suppliers of coking coal will be Australia, Canada, the United States, Russia, Indonesia, and Mozambique.

The restoration of old and outdated coke batteries and equipment continues, with corresponding improvement in performance. Given inadequate investments in upgrading of the available coke batteries, it is important to improve monitoring and diagnostic systems and to develop measures for extending battery life.

Improvements in coke oven machines include the development of automated control systems permitting operation of manless machines. Automated thermal control systems have been introduced for coke batteries. Improvements have been made in procedures for raw coal selection for coking blends, and research on coal with a view to predicting coke quality has expanded.

REFERENCES

van Boggelen, J., et al., HIsarna: Demonstrating low CO2 ironmaking at pilot scale, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Truman, J., Global metallurgical coal market outlook, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Urzaa, K., Indian and South East Asian demand, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Cushmore, F., US coking coal industry status, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Sanchez, J., Colombia. The silent Met Coke supplier, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Honnart, F., Arcelor Mittal Gijon-modernization at the coke plant, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Kumar, S., Stamping energy optimization for desired coal cake characteristics in stamped coke oven operations, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Porco, D., Adjusting to the “new normal” in coking coal, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Jaccard, A.P., A case study: blending philosophy at Ternium to reduce the cost of hot metal, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Halco, J., Effect of mineral type and size on coke quality, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Hoffman, M., Smart solutions for cokemaking machines, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Niculita, O., Manless coke oven machines, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Singh, M., EAGLECOKEтм system: overview & case study, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Lee, W., Coke oven Diagnosis and Life Prolongation in POSCO, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Neumann, M., et al., Process data based lifetime assessment of coke oven batteries, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Bristow, N., Challenges to 2030. Will there steel be a need for coke in 2030, Proc. 2019 Eurocoke Summit, April 3–4, 2019, Amsterdam.

Author information

Authors and Affiliations

Corresponding authors

Additional information

Translated by Bernard Gilbert

About this article

Cite this article

Rudyka, V.I., Soloviov, M.A. & Malyna, V.P. Innovations in Coke Production, Market Trends: Insights from the Eurocoke 2019 Summit. Coke Chem. 62, 267–279 (2019). https://doi.org/10.3103/S1068364X1907010X

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.3103/S1068364X1907010X