Abstract

Electric vehicles provide the ability to substantially reduce or eliminate greenhouse gas emissions from transportation. Electric vehicles utilize a fundamentally different powertrain technology compared to conventional vehicles based on the internal combustion of liquid fuels. In this issue of MRS Bulletin, materials challenges related to three key subsystems related to the powertrain of electric vehicles are discussed: batteries, power electronics, and permanent magnets. Given that electric vehicles currently occupy ~20% of the market share and are projected to rapidly rise, a cross-cutting challenge among these systems is the sustainability and resilience of the global supply chain of critical minerals to enable increased adoption of electric vehicles.

Graphical abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The world collectively produced about 85 million vehicles in 2022, including about 17 million in Europe and North America each and 50 million in Asia and Oceania.1 Most of these vehicles are powered by an internal-combustion engine (ICE) that utilizes petroleum-derived liquid fuels such as gasoline and diesel. As a result, ground transportation accounted for about 18% of global CO2 emissions in 2022, the third largest sector after power generation (39%) and industry (29%).2

Electrification, or the process of replacing the internal-combustion engine with electric powertrains, represents the most promising avenue to decarbonize the transportation sector. Because electricity can be produced from carbon-free sources, including wind, solar, hydroelectric, and nuclear power, electrification provides an avenue to bring that carbon-free electricity to transportation. Compared to vehicles with ICE, electric cars offer a lower environmental footprint, with the total greenhouse gas emissions roughly halved (including production and consumption).3 While the greenhouse gas emissions for a liter of a given combustion fuel are essentially constant, the continued adoption of renewable energy into the grid will continue to reduce the carbon intensity of electric vehicle operation and manufacturing. For this reason, governments around the world have set ambitious targets for the widespread adoption of electric vehicles and their associated infrastructure such as charging stations, manufacturing, and eventually recycling.3 Beyond their environmental benefits, electric vehicles offer additional advantages for the consumer from faster acceleration, increased comfort, fewer moving parts, lower maintenance, to lower cost of energy and lower energy price volatility.

A short history of electric vehicles

At the dawn of the automotive era in the late 1800s, many different powertrain systems were developed and used a variety of energy sources, including petroleum, steam, and electricity. Electric vehicles, powered by lead-acid batteries, held distinct appeal with easy startup and lack of toxic fumes. In contrast, early vehicles with internal-combustion engines required a hand crank starter and the manual changing of gears. Clara Ford, the wife of the automotive industrialist Henry Ford, preferred electric cars for their ease of operation.4 Thomas Edison was an early proponent of electric vehicles (Figure 1a), and sought to develop superior battery storage technology.

Historic electric vehicles. (a) Thomas Edison inspecting an electric vehicle in the early 1910s. (b) Sebring-Vanguard CitiCar from the mid-1970s after the first oil shock. (c) General Motors EV1 during the mid-1990s. (d) Modern Tesla Model S in the 2010s. Images from References 7,8,9,10; images in public domain (a) or creative common attribution license (b–d).

Technological and societal developments soon resulted in the demise of these early electric vehicles in this competitive market. In 1911, Charles Kettering patented an electric “engine starting device” that replaced the hand crank,5 which overcame one of the key shortcomings of combustion vehicles. Around the same time, mass-production methods popularized by Henry Ford substantially decreased the cost of gasoline-powered cars, such as the Model T. In addition, a network of refueling stations enabling internal-combustion vehicles to be driven over long ranges started being developed.6 The continued discovery of new petroleum sources in the interwar and postwar eras, including in the Middle East, provided a plentiful supply of liquid fuels for internal-combustion engines.

Starting in the 1970s, three societal drivers led to renewed calls to challenge the reign of internal-combustion engine vehicles. First, the oil shocks of the 1970s showed a critical weakness in nations that rely on petroleum from volatile international markets. This dependence became a reminder of the need for energy security and diversification. Second, tailpipe emissions became a primary source of smog and other air pollution in dense urban areas in both the developed and developing world. Finally, there was a growing realization that the burning of fossil energy results in increased atmospheric CO2 concentrations—a primary driver of climate change. As a result, electric cars were developed by several companies, including the CitiCar, the most widely produced electric vehicle in North America between 1945 and 2010 (Figure 1b).

In the late 1990s, several automakers, including General Motors and Toyota, started to reintroduce electric vehicles in part to meet regulatory demands by the California Air Resource Board. While vehicles such as the GM EV1 (Figure 1c) and Toyota RAV4 electric gained popularity with early adopters, their short driving ranges, long charging times, and high initial costs were directly linked to the shortcomings of the lead-acid and nickel-metal hydride batteries that were used to power them. These models were eventually scrapped as automakers and regulators looked to other means to reduce tailpipe emissions and improve fuel efficiency, including the hybrid electric vehicle first introduced in the Toyota Prius in 1997. In parallel, in the early 2000s automakers and governments started to also explore the implementation of hydrogen fuel cell electric vehicles. An article11 and a more comprehensive book12 on electric vehicles were written by C.C. Chan in the early years of the millennium.

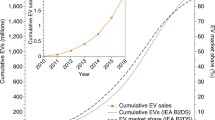

The most recent push for electric vehicles occurred after 2000, driven by rising oil prices, concerns about energy security, and climate change. Around the same time, the Li-ion battery gained increased technological maturity and lower costs, driven by its widespread use in portable electronics since the debut of the Sony Camcorder in 1991. Around 2010, both established automakers and newer entrants such as Tesla (USA) and BYD (China) started to introduce fully electric and plug-in hybrid electric vehicles, powered by Li-ion batteries (Figure 1d). Prices of electric vehicle batteries have fallen substantially, enabling rapid increases in adoption (Figure 2). In 2023, the global market share of these vehicles reached around 20%, including more than 35% in China and 25% in Europe.13 Although the mass adoption of electric vehicles is widely considered an overall benefit for society and a critical step for climate change mitigation, it also introduces significant challenges, particularly in managing the complex supply chains required for their production and effectively addressing the growing volume of “dead” batteries at the end of their lifespans (second use and recycling). Developing efficient and environmentally friendly recycling processes for these batteries will be crucial to ensure the long-term sustainability of the electric vehicle development.

Recent trends in (a) electric vehicle adoption and (b) battery pack price. Data from the Electric Vehicle Outlook Report from the Bloomberg New Energy Foundation.13

Materials challenges for electric vehicles

Automobiles are one of the most complex mass-produced products and utilize a global supply chain. The key differences between electric and petroleum-powered vehicles reside in the powertrain. Figure 3 provides a scheme of the power conversion processes in the powertrain of an electric vehicle. It consists of three subsystems—batteries, power electronics, and permanent magnet motors—each is of critical importance and is covered in the dedicated articles of this issue.

The battery module is responsible for storing the electrical energy that powers the vehicle. Both Li-ion and post-Li-ion batteries and the design of their components have been the subject of intense research in recent decades. Power electronics convert currents and voltages for both grid-to-battery charging and battery-to-motor propulsion. While traditionally such electronics were based on silicon, there has recently been substantial research and deployment of wide-bandgap materials that yield higher performance. Permanent magnet motors transfer the electrical energy stored in batteries to mechanical energy to propel the car.

Development of the next-generation electric vehicles (EVs) requires continuous innovation in the interdisciplinary areas of materials and components that constitute and define performance characteristics of each of these subsystems. The goal of this issue is to introduce readers to key concepts related to electric vehicles by explaining both existing and emerging technologies, overviewing their advantages and drawbacks, and illustrating how these technologies work together. We hope that it will provide researchers in the respective fields a more comprehensive understanding of the other systems and materials challenges that are highly relevant for next-generation electric vehicles.

Batteries

The battery is a critically enabling technology for electric vehicles that enables the storage of electrical energy that can be carried on a vehicle. Early iterations of electric vehicles before the year 2000 used lead-acid and nickel-metal hydride batteries. At the time, lead-acid and nickel-metal hydride were more mature, but suffered from low energy densities of below 100 Watt-hour per kilogram (Wh/kg),14 limiting the range of those vehicles to <200 km. Since 2000, nearly all modern electric vehicles have adopted lithium-ion batteries whose energy densities already exceed 250 Wh/kg,14 leading to electric vehicles with ranges exceeding 500 km.

Lithium-ion batteries function based on the electrochemical migration, or intercalation, of lithium between two materials, the negative electrode (anode) and the positive electrode (cathode).15 In the discharged state, lithium would reside in the positive electrode, which is typically a lithium transition-metal oxide such as LiCoO2. To charge the battery, an electrical current is applied to move electrons from the positive to the negative electrode, which is often graphite. At the same time, an equal molar quantity of positively charged lithium ions would also migrate from the positive to the negative electrode through the liquid electrolyte to maintain charge balance. The electrochemical reaction moving lithium from the cathode to the anode yields a positive enthalpy and a positive Gibbs free energy; as a result, electrical energy, or work, must be done on the battery device. During discharge, the reaction reverses; electrical work is extracted from the battery and can be ultimately converted to mechanical work. For this reason, batteries enable the electrochemical storage of energy through the process of shuttling lithium between the positive and negative electrodes. By using nonaqueous organic electrolytes, Li-ion batteries have a much wider electrochemical stability window compared to aqueous batteries and can achieve nearly 4 V; this high voltage is largely responsible for the much higher energy density compared to lead-acid and nickel-metal hydride batteries.

The rapid proliferation and resulting reduction in cost for Li-ion batteries have been the primary factor enabling the reduction in cost for electric vehicles in recent years. However, many challenges and research opportunities remain in this field. One challenge is to further improve the energy density by using different materials. Substantial improvements can be achieved by replacing the graphite anode (300 milliamp-hour per gram, mAh/g) with alloy anodes such as Si or even lithium metal (each ~4000 mAh/g).16 Two approaches are employed: alloy or lithium-metal battery in liquid electrolyte,17 or the solid-state battery18 with a lithium19 or alloy20 anode. Both have been subject to immense research. By replacing the flammable liquid electrolyte with a solid electrolyte, it could also create a safer battery; however, even solid-state batteries can present safety challenges.

Another overarching challenge is to maintain a reliable supply chain of critical minerals for batteries. Demand for minerals such as lithium, nickel, cobalt, graphite, and copper is expected to increase substantially due to the widespread adoption of electric vehicles.21 Although it is unlikely that any of these minerals will be depleted, their geographic concentration may lead to insufficiently resilient supply chains. For example, about 70% of cobalt is mined in the Democratic Republic of the Congo, while about one-half of lithium is mined in Australia.3 One possible solution is to substitute rarer minerals with more earth-abundant and geographically dispersed materials, which will also reduce cost. LiFePO4 would replace nickel and cobalt metals with iron and has shown substantial increases in market shares in recent years. Sodium-ion batteries would further replace lithium with sodium; at the same time, it would replace the copper current collectors with aluminum. New research could reduce the performance gap between these newer chemistries compared to established Li-ion batteries based on layered oxide cathodes. Another solution would be to use recycling to extract these minerals from spent batteries.22 Although more than 99% of lead-acid batteries are recycled,23 one of the highest recycling rates for a consumer product, less than 10% of Li-ion batteries were recycled in 2018.24 Li-ion batteries are much more difficult to recycle due to both the larger number of materials and the more complex manufacturing. Identifying effective materials and processes for recycling batteries is an important topic for R&D.

Power electronics

While batteries can store electrical energy in chemical bonds, they require power electronics both for charging and for use in electrical motors because the voltage and frequency of the battery may be different from that of the grid and the motors. These power electronic circuits require power transistors, which act as electrical switches, alongside passive components such as resistors, capacitors, and inductors. The key material innovation has come in the power transistors. The key metrics for power transistors are to have a lower ON resistance for the current passing through the channel of the power electronic device. Materials with wider bandgap generally have much higher dielectric breakdown fields; as a result, for the same rated breakdown voltage, the channel can be thinner and therefore lower resistance.

Historically, power electronics have used silicon (Si, 1.1 eV) due to its ubiquity in the microelectronics industry with well-established processing methods. More recent developments have replaced Si with wide-bandgap materials such as silicon carbide (SiC, 3.3 eV) and gallium nitride (GaN, 3.4 eV), which has about 10× the dielectric breakdown field of Si.25 There is presently substantial research on future generations of “ultrawide-bandgap” with bandgaps above 5 eV, such as aluminum nitride, gallium oxide, germanium oxide, and diamond.26 However, there exists a substantial challenge with processing these materials and using them to develop next-generation power electronics.

Permanent magnets

The final subsystem in this issue is the permanent magnet motors that convert the electrical energy from the batteries (via power electronics) to mechanical energy to propel the vehicle. In electric vehicles, rotational torque is generated from the magnetic repulsion of two magnets, a stationary one inside the rotor and a rotating one outside the rotor. In induction motors, both magnets are electromagnets generated by passing a current through a coil of wire via induction. In permanent magnet motors, the rotating outside electromagnet is replaced with permanent magnets that can maintain a magnetic field without the need to pass a current. For this reason, permanent magnet motors are more efficient at converting electrical energy into torque and mechanical energy for vehicle propulsion.

Although permanent magnet motors are more efficient than induction motors, they are composed of rare earth elements, particularly neodymium–iron–boron. This material was first discovered in Japan in the 1980s27 and showed significantly larger magnetic energy density compared to previous ferrite or AlNiCo permanent magnets.28 Due in part to the geographic concentration in the production of rare earth element magnets, there is substantial interest in using earth-abundant materials for new types of high-performing magnets. Nitride-based magnets such as iron nitride present one possible solution, but the synthesis of such materials has been challenging.29

Preview of the articles

The five articles in this theme issue are written by a diverse group of authors and institutions. They are intended to present an overview of the three key materials challenges with electric vehicles: batteries, power electronics, and permanent magnets.

The first article by Promi et al. introduces the global landscape of lithium-ion batteries from the materials science perspective, examining both the functionality of batteries and the challenges associated with design of cathode and anode materials.30 Recognizing the current geopolitical landscape, the authors emphasize the importance of sustainable and resilient supply chains for the critical minerals used in these batteries. This analysis is crucial for researchers and engineers developing next-generation electric vehicles.

Focusing on sustainability and supply chain resilience, the second article by Akbari et al. discusses current and emerging approaches for end-of-life batteries, thereby targeting the separation and extraction of critical minerals such as Li, Co, Ni, Mn, and Cu from the battery waste.31 This article starts by reviewing hydrometallurgical and pyrometallurgical approaches using strong acids and high temperatures, before diving deeper into more sustainable and emerging pathways based on more benign organic acids.

The third article explores the potential of solid-state batteries for next-generation EVs. By replacing the flammable liquid electrolyte with a solid ion-conducting electrolyte, solid-state batteries can potentially yield batteries with higher energy densities and safety. Kazyak and García-Méndez present an overview of the materials and manufacturing challenges of solid-state batteries.32

The fourth article by Gupta and Ahmadi overviews consideration for wide-bandgap material designs that are necessary for both the charging of electric vehicles and the conversion of battery power to electric motor power.26 Gupta and Ahmadi first present the half-bridge, a representative DC–DC power conversion circuit that illustrates the requirements for efficient power electronics. They then introduce how wide-bandgap materials such as silicon carbide, gallium nitride, and gallium oxide can enable significantly higher efficiency, and reduced thermal losses, compared to traditional silicon-based power electronics. This can be potentially translated into substantial advancements for EV charging infrastructure and the conversion of battery power to propel the vehicle’s electric motors.

Finally, Rom et al.’s article discusses motors that rely on permanent magnets to enable the efficient transduction of electrical energy (supplied by batteries and converted to AC using power electronics) to mechanical energy.33 Traditionally, these magnets are composed of rare earth metals such as neodymium–iron–boron and samarium–cobalt. This article first overviews these traditional materials before focusing on challenges and opportunities for earth-abundant permanent magnets, such as iron nitride and iron nickel alloys.

Perspective

The ongoing transition from internal-combustion vehicles to electric vehicles has been one of the more successful technological changes to reduce fossil fuel consumption and mitigate climate change. This success has in part been enabled by materials developments in batteries, magnets, and power electronics. Previous R&D has overcome the initial challenges that enable the functionality, scale-up, manufacturing, and deployment of electric vehicles. Such advancements in the performance of critical subcomponents have led to a rapid increase in adoption of electric vehicles across personal vehicles.

While most previous research has focused on performance with regard to the vehicle range, rate of charging, and the expected lifetime of a vehicle, there are new challenges related to mineral abundance, sustainable manufacturing, and supply chain resilience. In many cases, these sustainability and supply chain challenges must compete against vehicle performance metrics. For example, high-energy–density Li-ion batteries would use more cobalt and nickel compared to sodium-ion batteries that use more earth-abundant materials. More complex batteries are also more difficult to recycle. Some of the higher-performing materials for power electronics (Ga) and rare earth magnets (Nd) have geographically limited global productions. The balance of performance with sustainability and supply chain resilience provide new opportunities for materials research for electric vehicles.

References

International Organization of Motor Vehicle Manufacturers, World Motor Vehicle Production (International Organization of Motor Vehicle Manufacturers, 2023). https://www.oica.net/wp-content/uploads/By-country-region-2022.pdf

Z. Liu, Z. Deng, S. Davis, P. Ciais, Nat. Rev. Earth Environ. 4, 205 (2023)

Z. Yang, H. Huang, F. Lin, Adv. Energy Mater. 12, 2200383 (2022)

1914 Detroit Electric Model 47 Brougham, Personal Car of Clara Ford—The Henry Ford (n.d.). https://www.thehenryford.org/collections-and-research/digital-collections/artifact/209957/

C.F. Kettering, Engine-starting device, US Patent 1150523A (1915). https://patents.google.com/patent/US1150523A/en

The History of the Electric Car (US Department of Energy, Washington, DC, 2014). https://www.energy.gov/articles/history-electric-car

Photo of Thomas Edison with an electric car, 1913, Wikimedia Commons (n.d.). https://commons.wikimedia.org/wiki/File:EdisonElectricCar1913.jpg

K. Nahr, Late 6HP CitiCar electric car at the America on wheels auto museum, Wikimedia Commons (2010). https://commons.wikimedia.org/wiki/File:1976_Citicar_6HP.jpg

R. Rowen, Frontal view GM EV1, Wikimedia Commons (2008). https://commons.wikimedia.org/wiki/File:EV1_(6).jpg

Vauxford, 2018 Tesla Model S 75D taken in A464, Priorslee Road, Shifnal, Wikimedia Commons (2019). https://commons.wikimedia.org/wiki/File:2018_Tesla_Model_S_75D.jpg

C.C. Chan, Proc. IEEE 90 (2002), p. 247

C.C. Chan, K.T. Chau, Modern Electric Vehicle Technology (Oxford University Press, Oxford, 2001)

C. McKerracher, Electric Vehicle Outlook Report 2023 (Bloomberg New Energy Foundation). https://about.bnef.com/electric-vehicle-outlook/

M. Winter, B. Barnett, K. Xu, Chem. Rev. 118, 11433 (2018)

M.S. Whittingham, Chem. Rev. 104, 4271 (2004)

N.J. Dudney, MRS Bull. 43(10), 752 (2018)

B. Liu, J.-G. Zhang, W. Xu, Joule 2, 833 (2018)

H. Wang, C.S. Ozkan, H. Zhu, X. Li, MRS Bull. 48(12), 1221 (2023)

P. Albertus, S. Babinec, S. Litzelman, A. Newman, Nat. Energy 3, 16 (2018)

D.H.S. Tan, Y.-T. Chen, H. Yang, W. Bao, B. Sreenarayanan, J.-M. Doux, W. Li, B. Lu, S.-Y. Ham, B. Sayahpour, J. Scharf, E.A. Wu, G. Deysher, H.E. Han, H.J. Hah, H. Jeong, J.B. Lee, Z. Chen, Y.S. Meng, Science 373, 1494 (2021)

E.A. Olivetti, G. Ceder, G.G. Gaustad, X. Fu, Joule 1, 229 (2017)

L. Gaines, K. Richa, J. Spangenberger, MRS Energy Sustain. 5, E14 (2018)

Vault Consulting, National Recycling Rate Study (Battery Council International, 2023). https://batterycouncil.org/resource/national-recycling-rate-study/

J. Mao, C. Ye, S. Zhang, F. Xie, R. Zeng, K. Davey, Z. Guo, S. Qiao, Energy Environ. Sci. 15, 2732 (2022)

G. Iannaccone, C. Sbrana, I. Morelli, S. Strangio, IEEE Access 9, 139446 (2021)

G. Gupta, E. Ahmadi, MRS Bull. 49(7) (2024). https://doi.org/10.1557/s43577-024-00750-5

M. Sagawa, S. Fujimura, N. Togawa, H. Yamamoto, Y. Matsuura, J. Appl. Phys. 55, 2083 (1984)

O. Gutfleisch, M.A. Willard, E. Brück, C.H. Chen, S.G. Sankar, J.P. Liu, Adv. Mater. 23, 821 (2011)

S. Bhattacharyya, J. Phys. Chem. C 119, 1601 (2015)

A. Promi, K. Meyer, R. Ghosh, F. Lin, MRS Bull. 49(7) (2024). https://doi.org/10.1557/s43577-024-00749-y

P. Akbari, A.E. Strohmeyer, D.T. Genna, J.I. Feldblyum, MRS Bull. 49(7) (2024). https://doi.org/10.1557/s43577-024-00745-2

E. Kazyak, R. García-Méndez, MRS Bull. 49(7) (2024). https://doi.org/10.1557/s43577-024-00740-7

C. Rom, S. Dugu, S. O’Donnell, R. Smaha, S. Bauers, MRS Bull. 49(7) (2024). https://doi.org/10.1557/s43577-024-00743-4

Acknowledgments

The image of the electric car in the graphical abstract was generated by the Image Generator DALL-E 3 under the prompt “Please generate an image of an electric vehicle charging.” No other parts of this manuscript, including both text and image, were generated by large language models or other artificial intelligence tools.

Funding

Maria R. Lukatskaya’s contribution to this work was supported by the Schweizerischer Nationalfonds zur Förderung der Wissenschaftlichen Forschung, TMSGI_218234, and Yiyang Li was supported by the University of Michigan, College of Engineering.

Author information

Authors and Affiliations

Contributions

Both authors jointly wrote and edited this article.

Corresponding authors

Ethics declarations

Conflict of interest

The corresponding authors state that there is no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, Y., Lukatskaya, M.R. Materials challenges for electric vehicles. MRS Bulletin 49, 691–696 (2024). https://doi.org/10.1557/s43577-024-00738-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1557/s43577-024-00738-1