Abstract

This study reviews research from 1970 through 2016 on developed country multinational enterprises (DMNEs) entering and competing in developing economies. To identify the current state of knowledge of this research and push it further, we review the literature using bibliometric and qualitative content analyses covering leading journals and books. We articulate frontier issues that are understudied yet critical to both theorization and practice of DMNEs in developing economies. We discuss the findings and conclusions from prior research along five key areas: (1) entering developing economies, (2) organizing local activities, (3) managing alliances and joint ventures, (4) competing in dynamic environments, and (5) dealing with institutions, governments and society. We offer prospective insights into future agenda that have important implications for MNE strategies and decisions, and propose frontier directions that encompass strategic localization, reverse transfer and adaptation, co-evolution with local business ecosystems, reorganizing and restructuring, and strategic responses to institutional and market complexity.

Résumé

Cette étude passe en revue les recherches menées de 1970 à 2016 sur les entreprises multinationales des pays développés (EMND) entrées et en concurrence dans les économies en développement. Pour identifier l’état actuel des connaissances sur cette recherche et le pousser plus loin, nous passons en revue la littérature à l’aide d’analyses de contenu bibliométrique et qualitatif couvrant des revues et ouvrages de référence. Nous formulons des problèmes futurs qui sont peu étudiés mais essentiels à la fois à la théorisation et à la pratique des EMND dans les économies en développement. Nous discutons des résultats et des conclusions de recherches antérieures dans cinq domaines clés: (1) l’entrée dans les économies en développement, (2) l’organisation des activités locales, (3) la gestion d’alliances et de coentreprises, (4) la concurrence dans des environnements dynamiques et (5) les relations avec les institutions, les gouvernements et la société. Nous proposons des connaissances prospectives sur le programme futur ayant des incidences importantes sur les stratégies et les décisions des EMN, et proposons des orientations frontalières englobant la localisation stratégique, le transfert inversé et l’adaptation, la co-évolution avec les écosystèmes d’affaires locaux, la réorganisation et la restructuration, ainsi que des réponses stratégiques à la complexité des institutions et des marchés.

Resumen

Este estudio revisa las investigaciones desde 1970 hasta el 2016 sobre las empresas multinacionales de países desarrollados que entran y compiten en economías en desarrollo. Para identificar el estado actual del conocimiento de esta investigación y llevarlo más lejos, revisamos la literatura usando un análisis de contenido bibliométrico y cualitativo cubriendo las principales revistas y libros. Articulamos los asuntos de frontera que están poco estudiados, aunque son críticos para la teorización y la práctica de las empresas multinacionales de países desarrollados en economías en desarrollo. Discutimos los hallazgos y las conclusiones de las investigaciones anteriores en cinco áreas clave: (1) la entrada a economías en desarrollo, (2) la organización de actividades locales, (3) la gestión de alianzas y joint ventures, (4) la competencia en entornos dinámicos, y (5) las relaciones con instituciones, gobiernos y sociedad. Ofrecemos puntos de vista prospectivos sobre la agenda futura que tiene implicaciones importantes para las estrategias y decisiones de las empresas multinacionales, y proponemos direcciones de frontera que engloban localización estratégica, transferencia y adaptaciones en reversa, co-evolución con ecosistemas empresariales locales, reorganización y re-estructuración, y respuestas estratégicas a la complejidad institucional y de mercado.

Resumo

Este estudo revisa pesquisas de 1970 até 2016 sobre empresas multinacionais de países desenvolvidos (DMNEs) que entram e competem em economias em desenvolvimento. Para identificar o estado atual do conhecimento desta pesquisa e ampliá-la, revisamos a literatura usando análises bibliométricas e de conteúdo qualitativo, abrangendo periódicos líderes e livros. Articulamos questões na fronteira que são pouco estudadas, mas essenciais tanto para a teorização quanto para a prática de DMNEs em economias em desenvolvimento. Discutimos as descobertas e conclusões de pesquisas anteriores em cinco áreas principais: (1) entrada em economias em desenvolvimento, (2) organização de atividades locais, (3) gestão de alianças e joint ventures, (4) concorrência em ambientes dinâmicos e (5) negociação com instituições, governos e sociedade. Oferecemos insights prospectivos sobre a agenda futura que têm importantes implicações para as estratégias e decisões de MNE, e propomos direções para a fronteira que abrangem localização estratégica, transferência reversa e adaptação, coevolução com ecossistemas de negócios locais, reorganização e reestruturação e respostas estratégicas para a complexidade de mercados e instituições.

摘要

本研究回顾了1970年至2016年发达国家跨国企业进入发展中国家投资的研究。我们采用涵盖主要期刊和书籍的文献计量以及定性内容分析的方法来审阅和推进这一领域的研究,并且阐述了对理论研究和企业实践都至关重要的前沿问题。我们将现有文献的研究结果分为五大主要领域:(1)进入发展中国家,(2)组织当地活动,(3)管理联盟和合资企业,(4)在动态环境中竞争,(5)应对制度、政府、社会。我们针对未来研究提出了前沿研究方向,包括战略本地化,逆向转移和适应,与当地商业生态系统的共同演化,重组和重建,以及对制度和市场复杂性的战略响应。这些前沿问题对跨国企业战略和决策具有重要意义。

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Developed country multinational enterprises (DMNEs) have been keenly entering, competing and operating in developing economies since World War II, and especially over the past four decades as those economies have grown. The unparalleled and continued growth of developing economies has revolutionized the global business landscape, generating massive opportunities along with a myriad of challenges facing DMNEs. To many of these DMNEs, developing economies are pivotal to their global success and sustained development (UNCTAD, 2017) as they pursue a multitude of strategic and economic motives (Beamish, 1993; Buckley, Clegg, & Tan, 2003; Luo & Peng, 1999; Makino, Beamish, & Zhao, 2004; Meyer, 2004; Tung, 1982). Correspondingly, international business (IB) scholars have shed considerable light regarding how DMNEs invest and compete in developing economies, producing over 692 articles published in leading IB and management journals during the last half-century, according to our survey.

We review the literature on DMNEs entering developing economies (emerging economies included), covering publications of 47 years from 1970 to 2016, for several purposes. First, despite a long and growing interest by the IB scholarly community in the process by which DMNEs enter developing economies, our cumulative understanding of this domain is highly fragmented, with no systematic review performed thus far. There is a calling for synthesized knowledge at a higher, broader and more collective level that provides a fuller picture of theorization and findings in this field. Second, a diversity of studied topics, mixed evidence, and various perspectives compel and inspire us to offer an integrative survey of the literature so as to identify conclusions, consensus, controversies and caveats. Third, the IB scholarly community has tackled a myriad of issues in this field from various lenses such as strategic management, organizational behavior, entrepreneurship, marketing, and human resources, among others, warranting a holistic illumination of prevalent themes and subthemes alongside with discussions of impactful views, logic, and conclusions under each theme and subtheme. Fourth, we need a dynamic or evolving view. Developing economies have been undergoing fundamental changes in macroeconomic, institutional and industrial environments, compelling many DMNEs to undertake organizational and strategic transformation. DMNEs have adopted such strategies as reverse innovation, increased localization, competence renewal, and restructuring. Some scholars (e.g., Luo, 2007a) have described the transformation of DMNEs investing in developing economies from being “foreign investors” to “strategic insiders.” Last, we intend to push the frontier forward by offering our own views and suggestions. We are generally optimistic toward these future prospects given the abundance of important and interesting issues that merit further exploration.

Using qualitative content analysis, our review surveys 692 articles from 14 leading IB and management journals and 21 highly-cited books published between 1970 and 2016. We follow the definition and list of “developed countries” (home countries of DMNEs) and “developing economies” (host countries of DMNEs) provided by the International Monetary Fund (IMF). We adopted a dynamic view in identifying whether a country is developed or developing based on the country’s development level in a focal year.1 Our review incorporates both established and nascent DMNEs as well as small, medium and large-sized DMNEs. Our content analysis elaborates the evolution of literature and encapsulates five major themes including: (1) FDI and entry strategies, (2) organizing and managing local activities, (3) building and managing international joint ventures or cooperative alliances, (4) competing, operating and localizing in developing economies, and (5) dealing with institutions, governments and society.

Review Process

Our review covers articles from high-impact journals and books. We systematically searched for relevant articles in 14 leading journals, including six top management journals – Academy of Management Review (AMR), Academy of Management Journal (AMJ), Administrative Science Quarterly (ASQ), Strategic Management Journal (SMJ), Organization Science (OS), and Journal of International Business Studies (JIBS); five elite IB-focused journals – Journal of World Business (JWB), Global Strategy Journal (GSJ), Journal of International Management (JIM), Management International Review (MIR), and International Business Review (IBR); and three impactful management practice journals – Harvard Business Review (HBR), California Management Review (CMR), and MIT Sloan Management Review (SMR). These 14 journals have been used in previously published reviews in the IB and management literature (Bruton & Lau, 2008; DuBois & Reeb, 2000; Gomez-Mejia & Balkin, 1992; Griffith, Tamer Cavusgil, & Xu, 2008; Judge, Cable, Colbert, & Rynes, 2007; Podsakoff, MacKenzie, Bachrach, & Podsakoff, 2005; Tüselmann, Sinkovics, & Pishchulov, 2016; Werner, 2002; Xu & Meyer, 2013). Our review also incorporates impactful articles beyond the 14 selected journals and is extended to such journals as Journal of Management, Journal of Management Studies, and Journal of Operations Management. Finally, we include the 21 most cited books on DMNEs in developing economies.

Our review spans 47 years, 1970 to 2016. We chose 1970 as the starting point as it is the year in which JIBS was launched, when IB scholars began to examine many aspects of developing – and less developed – economies. We proceeded in two stages. First, we identified keywords by looking at extant literature reviews, then we searched our target publications with those keywords using the ABI/INFORM and EBSCO databases2. These steps yielded a final sample of 692 articles. Following prior studies (Bruton & Lau, 2008; Colquitt & Zapata-Phelan, 2007; Roth & Kostova, 2003; Xu & Meyer, 2013), we used both bibliometric methods and content analysis to review those articles. The bibliometric method (Ramos-Rodríguez & Ruíz-Navarro, 2004) has been used to conduct statistical and descriptive analyses of patterns that appear in publications, while content analysis has been used to identify prevalent research themes and sub-themes. The goal is to synthesize cumulative and collective insights in order to form a comprehensive picture of the research on DMNEs entering developing economies.

Bibliometric Findings

Journal and Year Distribution

Figure 1 displays the number of articles published on DMNEs entering developing economies. JWB with 157 articles and JIBS with 126 have the highest number by some margin among the top journals we surveyed. Figure 2 shows the distribution of publications year on year, clearly showing an upward trend. Our bibliometric results are similar to those of previous research in that we find three distinct phases. Research on developing economies was in an embryonic phase from 1970 to 1997 with 189 publications. In the second phase, 1998–2007, there were 196 articles, a 4% increase. In the third and current phase beginning in 2008, the number of articles markedly increased, to date 307, nearly 50% of the total sample. There was a small dip in 2010, but that there have been since more than 20 articles per year shows continued interest in this line of research.

Theories Used

The distinctive social, institutional, and economic nature of developing economies offers researchers an opportunity to extend and test existing theories. Table 1 shows theories used or developed in the studies we identified. Chief among them are the institution-based view and the resource-based view (including the knowledge-based view and dynamic capabilities). Also often used are FDI theory (including the liability of foreignness), organizational learning theory, transaction cost economics (TCE), social capital theory, internalization theory, and cultural theory (e.g., cultural distance). Our review shows that earlier studies used extensively TCE (e.g., Choi, Lee, & Kim, 1999; Delios & Henisz, 2000; Hoskisson, Lorraine, Lau, & Wright, 2000; Sohn, 1994), international trade theories (e.g., Lecraw, 1984; Murtha & Lenway, 1994; Swannack-Nunn, 1978), and conventional IB theories such as the eclectic paradigm (e.g., Makino & Delios, 1996; Pan & Chi, 1999; Schroath, Hu, & Chen, 1993). Later, as developing economies, and emerging economies in particular, became more important for DMNEs, more studies have used institutional theory and the institution-based view (e.g., Husted & Allen, 2006; Meyer, Estrin, Bhaumik, & Peng, 2009; Peng, 2003; Rodriguez, Uhlenbruck, & Eden, 2005), the resource-based view (e.g., Douma, George, & Kabir, 2006; Luo, 2002a; Meyer & Peng, 2005; Tsang, 2002), and organizational learning theory (e.g., Dhanaraj, Lyles, Steensma, & Tihanyi, 2004; Hitt, Dacin, Levitas, Arregle, & Borza, 2000) to examine the important role of institutions and capabilities in developing economies. Recent research has increasingly used theories from other fields such as relational ties from sociology (e.g., Chen, Chittoor, & Vissa, 2015; Li, Poppo, & Zhou, 2010; Sun, Mellahi, & Thun, 2010), real option theory from finance (e.g., Belderbos & Zou, 2009; Tong, Reuer, & Peng, 2008), and ecological perspectives from biology (e.g., Kuilman & Li, 2006; Zhou & Li, 2008).

We identified a number of theoretical contributions and, borrowing from Colquitt & Zapata-Phelan (2007), classified them according to whether they were theory building, extending, or testing. Theory building articles advance novel theories or frameworks, new constructs and relationships that are complete departures from extant theory. Theory extending articles contextualize extant theory, introduce new concepts, new moderators or new empirical settings. Theory testing articles examine extant theory in new empirical contexts or draw on extant theory to validate propositions. Only 54 of the articles in our sample can be classified as theory building, a mere 8%. Theory extending articles account for 37% (n = 259), an indication that the development of novel theories and perspectives on DMNEs in developing economies still falls short. Finally, theory testing articles (n = 379) dominate at 55%. Nearly 25% (n = 94) of those articles adopted a single theory, and 10% (n = 38) integrated two or more. Figure 3 shows changes in this regard over the past 47 years.

Developing Economies Studied

Table 2 shows which countries were studied over time. The results reveal that China is the most popular research context. Since 1995, there have been 217 studies on China, nearly a third of our total sample. The number of articles focusing on China correlates strongly with its rapid economic growth and pro-market reforms of the past two decades. After China, Central and Eastern European (CEE) countries are most often studied. Starting in 2010, research on DMNEs entering India and other Asian countries, Latin America, Africa, and the Middle East has intensified. There is also a sizable number of studies (n = 163) that examine multiple developing economies or use them as a general context (i.e. “developing economies in general”).

Methods Used

Table 3 provides a summary of the research methods and data sources used. The main method employed is quantitative, based mostly on surveys as the primary data source. Most likely this is due to the difficulty of obtaining valid archival data in many developing economies with low information transparency, especially in early years. Data availability has significantly improved in recent years. Among the 231 studies using archival data, 128 were published in the last 11 years (2006–2016). Regression analysis (n = 253) is the most commonly used statistical method, amounting to 71% of the 357 quantitative articles. Qualitative research is less common. Of the 692 articles in our sample, 163 (23.5%) were case or field studies, and 169 (24.4%) were theoretical or descriptive. Qualitative methods were used to generate new theories, test existing ones, and identify new phenomena (e.g., Cuervo-Cazurra, Andersson, Brannen, Nielsen, & Reuber, 2016; Eisenhardt & Graebner, 2007; Welch, et al., 2011).

Content Analysis

Literature Overview and Evolution

Research on DMNE investment in developing economies has evolved over the past four decades. Studies carried out in the 1970s and 1980s focused on the opening of Third World countries to Western investment (Das, 1981; Fagre & Wells, 1982; Root & Ahmed, 1978; Stoutjesdijk, 1970; Wright, 1984). Since the 1990s, there has been increased attention paid to emerging economies. In addition to the economic, social and political environment considered earlier, scholars have increasingly looked at the informal and formal institutions that characterize emerging economies (e.g., Meyer et al., 2009; Peng, 2003; Peng, Wang, & Jiang, 2008; Xu & Meyer, 2013). That work is reflective of the multiple, sometimes conflicting, institutions with which DMNEs must engage (Meyer & Peng, 2016; Stevens, Xie, & Peng, 2016). More recent studies examine the competitive landscape in developing and emerging economies and the role it plays in the DMNE global value chain and business ecosystem worldwide (Chang & Xu, 2008; Luo, 2007a; Luo & Zhao, 2004; Rangan & Drummond, 2004). FDI inflows into developing economies have increased local competition. That may have a negative impact on local firms, but at the same time local firms have benefited from positive spillovers (Chang & Xu, 2008; Spencer, 2008; Zhang, Li, Li, & Zhou, 2010). Moreover, DMNEs are seeing their operations in developing economies as crucial to increasing their global competitiveness (Immelt, Govindarajan, & Trimble, 2009; Santangelo, Meyer, & Jindra, 2016). Thus, it is important for DMNEs to integrate their activities in developing economies into their global value chains to enhance operational efficiency, capitalize on market opportunities, and stimulate innovation.

In line with the above trends, the motivation for FDI in developing economies has fundamentally changed, mainly because of fast economic growth, a rapid rise in the number of middle-income consumers, and market transformation. For instance, FDI inflows toward less developed countries in the 1970s and 1980s were primarily motivated by the search for low-cost labor and natural resources. The products made by DMNEs in developing economies were not intended for the local market but for export to countries where costs were substantially higher (Dunning, 1998; Kumar, 1994; Leontiades, 1971). In addition to pointing to efficiency-seeking FDI in search of lower production costs, the IB literature emphasized the asset-exploitation motive of DMNEs that invested in less-developed countries to exploit firm-specific advantages such as technology and knowledge (Aydin & Terpstra, 1981; Caves, 1971; Hymer, 1976; Makino, Lau, & Yeh, 2002). Following the unprecedented rise of emerging economies beginning in the 1990s, an increasing number of studies have investigated the market-seeking and asset-seeking motives of DMNEs (e.g., Dong, Buckley, & Mirza, 1997). With their home markets and those of other developed countries becoming saturated, DMNEs have increasingly turned to emerging economies to seek opportunities for market growth (London & Hart, 2004; Luo, 2003). They have especially tried to acquire strategic assets and to coordinate the complementary assets owned by local firms in emerging economies (Luo, 2002a; Makino et al., 2002), and to bring innovative products developed in emerging economies to wealthier countries through reverse innovation and reverse transfer (Govindarajan & Ramamurti, 2011; Winter & Govindarajan, 2015).

The body of work we consider rich addresses fundamental features of developing economies where DMNEs invest. Those economies tend to have higher levels of environmental volatility, governmental intervention, and political instability than developed countries (Beamish, 1987; Hitt, Ahlstrom, Dacin, Levitas, & Svobodina, 2004; Luo, 2007b; Murtha & Lenway, 1994; Uhlenbruck & De Castro, 2000). DMNEs need to cope with those realities and to adapt their “home” strategies to be able to deal with institutional voids caused by a lack of specialized intermediaries, limited IPR protection, weak public services, and different regulatory systems (Khanna & Palepu, 1997; Khanna, Palepu, & Sinha, 2005). Informal or unregistered businesses can account for as much as half of the economic activities in developing economies and those businesses provide a livelihood for billions of people (La Porta & Shleifer, 2014; Webb, Tihanyi, Ireland, & Sirmon, 2009). The challenges posed by informal sector businesses may increase legitimacy building costs for DMNEs: for example, they might develop new products in order to distinguish themselves (McCann & Bahl, 2017). Local businesses in developing economies are also often characterized by complex corporate governance arrangements, for example business groups, that help fill institutional voids by facilitating the sharing of critical resources, information and experience among group members (Carney, Van Essen, Estrin, & Shapiro, 2017; Khanna & Palepu, 2000; Khanna & Yafeh, 2007). State-owned companies, family firms, and cross-shareholdings are pervasive features in developing economies, all of which raise the complexity of corporate governance and agency costs (Claessens & Yurtoglu, 2013). The bottom-of-the-pyramid with some four billion under-served inhabitants represents not only a largely untapped market segment for DMNEs but should also be a focal point of social entrepreneurship and social responsibility for them (Prahalad & Hart, 2002).

Extant research shows large regional diversity among developing economies. Central and Eastern Europe (CEE) and China are major economies in which there have been noteworthy pro-market reforms, although their paces and paths have differed greatly (Hitt et al., 2004; Peng, 2000). The CEE bloc is unique in its radical industrial privatization and democratic reforms, so much so that they have been called “shock therapy” or “big-bang” reforms, and have resulted in domestic industries being decimated by foreign entrants (Brouthers & Bamossy, 1997; Buck, Filatotchev, Nolan, & Wright, 2000; Meyer & Peng, 2005; White & Linden, 2002). In contrast, China’s “gradualist” and “go-slow” approach to reform, which has not meant significant democratization or privatizations, has all the same allowed managers to make and implement appropriate strategic and organizational changes (Buck et al., 2000; White & Linden, 2002). Developing economies also differ in population, historical background, natural resource endowments, infrastructure, political regimes, macroeconomic environment, and market size, with the result being huge differences in their level of competitiveness (Schwab, 2017). For example, Latin America and Africa offer good prospects in agriculture, minerals, and food and beverages, while information technology and IT-enabled services are competitive industries in India and the Philippines (UNCTAD, 2017). While many large, fast-growing emerging economies, such as those of China, Russia, India, and Brazil, have become top FDI destinations, FDI flows to smaller, slow-growing, structurally-weak developing economies have declined, particularly due to their limited market opportunities and slow economic growth (UNCTAD, 2017). This is not to say that economic transition has occurred at the same pace across large emerging economies. Even within China and India. pro-market reforms did not proceed at the same pace in all regions, and that has led to significant heterogeneity in subnational institutions (Banalieva, Eddleston, & Zellweger, 2015; Chan, Makino, & Isobe, 2010; Ma, Tong, & Fitza, 2013; Shi, Sun, Yan, & Zhu, 2017).

We also see from our review that FDI policies have evolved in developing economies. In the 1960s and 1970s, in order to support the development of indigenous firms, the governments of many developing economies introduced import substitution policies that restricted foreign firm imports (Bruton, 1998). Later, numerous countries (especially in Asia) embarked upon economic integration policies by which they hoped to attract foreign capital, technology, and managerial know-how (Das, 1981; Stoutjesdijk, 1970; Wright, 1984), even as most countries in Latin America continued to implement import substitution policies, some until the 1980s (Cuervo-Cazurra & Dau, 2009). Nonetheless, sweeping changes in many emerging economies in the 1980s ushered in market-friendly institutions and FDI liberalization that accelerated in the following decade (UNCTAD, 1992). There are many ways that developing economies can increase their FDI attractiveness, from offering tax incentives, to allowing the privatization of state-owned firms, to accommodating foreign personnel (Root & Ahmed, 1978; UNCTAD, 1992), but a great deal of care needs to be exercised as their market structures are often weak and their development needs are pressing (UNCTAD, 2003). host country governments are well aware of this and may seek to restrict foreign ownership or require DMNEs to work with local partners (Chen, Paik, & Park, 2010; Sachdev, 1978). As developing economies grow, the need to offer subsidies or protection from competition in order to attract FDI decreases (Stoever, 1982, 1985). Thus, we see that continued economic growth, structural transformation, and institutional development as well as WTO membership all bring about shifts in policy that affect DMNEs. The Chinese serve as a good example. Chinese policies have shifted from restricting the entry of foreign firms to intervening in their operations – be it through national-level or subnational-level regulation – to aligning the treatment of foreign firms with that of domestic ones (Luo, 2007a). Recently, most developing economies have adopted formal industrial development strategies that are intended to attract FDI, and at the same time improve FDI screening mechanisms, in order to achieve global value chain integration, upgraded capabilities, sustainable growth, and better positioning for the new industrial revolution (UNCTAD, 2018).

Five Major Themes

We identified several dominant research themes from the nearly 40-year period of research by first calculating the frequency of use of topical keywords in prior studies. These keywords suggested five major research themes. Categorization of those themes allows us to see the evolution of the literature. We consulted leading IB and developing economy scholars and experts in order to finalize our selection. The main themes and the number of articles addressing each are given in Figure 4.3 We summarize the main arguments and findings of those which have been cited 200 times or more in Tables 4, 5, 6, 7 and 8.4 Finally, the top 20 most-cited articles on DMNEs in developing economies are listed in an Appendix.

Entering and investing in developing economies

There are three interrelated theoretical perspectives used to explain entry strategies, including transaction cost economics, the resource-based view, and institutional theory (e.g., Chen & Hu, 2002; Demirbag, Glaister, & Tatoglu, 2007; Douma, George, & Kabir, 2006; Hoskisson, Lorraine, Lau, & Wright, 2000; Meyer, 2001; Meyer & Peng, 2005). The extant literature shows that the mode, timing and location of DMNE entry are determined by numerous factors at both the corporate and the country level. Links have been shown between the resources, capabilities, experience and networks of DMNEs and their entry mode and country selection choices (Chang & Park, 2005; Chen & Chen, 1998; Dikova & van Witteloostuijn, 2007). This suggests that a high-commitment entry is positively associated with the parent company’s technological intensity and prior experience in the host country (Filatotchev, Strange, Piesse, & Lien, 2007a; Xia, Tan, & Tan, 2008). In addition, a DMNE may prefer a joint venture (JV) over a wholly owned subsidiary (WOS) when entering a developing economy because JVs often entail more resource sharing and cost-reducing opportunities (Beamish & Banks, 1987). DMNEs are also more likely to invest in JVs or locate subsidiaries where they have stronger economic and cultural links and historic ties (Barkema & Drogendijk, 2007; Guillen, 2002; Kuilman & Li, 2006).

The host country institutional, economic, cultural, and political context significantly shapes foreign market entry strategy (García-Canal & Guillén, 2008; Li, Lam, & Qian, 2001; Tsang & Yip, 2007; Uhlenbruck & De Castro, 2000). Extant research shows that firms in regulated industries tend to avoid investing where there are high levels of macroeconomic uncertainty, preferring locales with discretionary governmental policymaking capacities as they may be able to negotiate favorable entry conditions (García-Canal & Guillén, 2008). DMNEs employ more cooperative modes of entry when investing in developing economies with weak institutional frameworks, low market efficiencies, high political risk, or high cultural distance (Brouthers & Brouthers, 2001; London & Hart, 2004). Cooperative entry modes such as JVs and strategic alliances are better at reducing investment risk and accessing local resources than are greenfields or acquisitions (Demirbag, Tatoglu, & Glaister, 2008; Meyer et al., 2009; Xia, Boal, & Delios, 2009). DMNEs entering countries where corruption is prevalent may choose short-term contracting or a JV (Rodriguez et al., 2005; Uhlenbruck, Rodriguez, Doh, & Eden, 2006). The legitimization of DMNE subsidiaries is subject to legitimacy spillover in FDI communities coupled with the host country’s acceptance, which further influence entry strategies of DMNEs (Kuilman & Li, 2009; Li, Yang, & Yue, 2007).

Entry strategy is crucial to performance and survival in developing economies. Prior research has shown that early entrants grow faster and are more profitable than late movers (Luo, 1998), while late movers incur lower risks (Pan & Chi, 1999). A newcomer can learn from the experience of prior entrants while at the same time leveraging its own experience gained from previous entries elsewhere, which together can significantly increase performance and ultimately the chances of survival (Belderbos, Olffen, & Zou, 2011; Guillen, 2002; Perkins, 2014; Yang, Li, & Delios, 2015). DMNEs need specialized strategies to capitalize on market opportunities and other capabilities to deal with local environment dominated by informal institutions (London & Hart, 2004; Meyer & Estrin, 2001; Ramamurti, 2004). Prior research has shown that the choice of target country is an important determinant of foreign affiliate performance in developing economies (Chan, Isobe, & Makino, 2008; Makino, Isobe, & Chan, 2004).

Moreover, the level of institutional development and the heterogeneity of subnational regions in large developing economies are significant factors which can explain variations in foreign affiliate performance (Chan et al., 2010; Ma & Delios, 2010; Ma et al., 2013). Studies considering the positive and negative spillover effects from FDI in developing economies have found, among other things, that both the presence and the specific home country of foreign investors have a positive impact on the productivity of domestic firms (Buckley, Clegg, & Wang, 2002), particularly when the latter have strong absorptive capacities and when the technology gap between them and foreign investors is not too large (Meyer, 2004; Zhang et al., 2010). Nevertheless, foreign investors often pose a threat to domestic firms (Dau, Ayyagari, & Spencer, 2015; Meyer, 2004). The magnitude of crowding out effects is particularly strong if DMNEs and local firms target both lower- and middle-income customers or the same regional markets (Chang & Xu, 2008; Spencer, 2008). DMNEs can also capture spillover effects from local firms (Govindarajan & Ramamurti, 2011). Table 4 provides the main arguments made in the key DMNE entry strategy literature.

Organizing and managing in developing economies

There has been an increase in studies related to post-entry issues, including, but not limited to, how DMNEs organize and manage operations once they have entered a developing economy. This line of research has focused primarily on parent–subsidiary links, knowledge transfer, cultural intelligence, and global talent management. First, strong parent–subsidiary links are essential if DMNE subunits are to successfully compete locally. To curtail operational risks arising from uncertainty, DMNE subsidiaries need to manage their dependence on local resources, especially those that are government controlled, by exploiting parent-sourced resources (Child, Chung, & Davies, 2003; Luo, 2003; Robins, Tallman, & Fladmoe-Lindquist, 2002). Meanwhile, parent firms need to delegate some autonomy to subunits in order to be able to exploit new opportunities (Garnier, 1982; Luo, 2003). There is evidence that DMNEs with greater breadth and depth of related prior experience with emerging economies coupled with a larger pool of capabilities will achieve superior performance (Uhlenbruck, 2004). Parent–subsidiary links can serve as an important conduit for effective knowledge transfer within a DMNE’s global network, depending on the capacity and willingness of both parent and subsidiary to acquire and to transfer knowledge (Wang, Tong, & Koh, 2004; Zhao & Anand, 2009). An innovation or expertise adopted by a subsidiary in one developing or emerging economy can be transmitted to others or even developed economies (Govindarajan & Ramamurti, 2011; Meyer & Estrin, 2014).

Some prior work draws on the cross-cultural management literature to investigate how DMNEs can manage cultural differences. Research shows that DMNEs that follow the socio-cultural rules of the host country are more successful in managing their subsidiaries (Ghauri & Fang, 2001; Li et al., 2001). Investments in employee development, cross-cultural training, expatriate management programs, and top management incentive packages are needed to fill cultural voids while simultaneously encouraging greater collaboration and knowledge sharing (Fey & Björkman, 2001; Selmier, Kahindi, & Oh, 2015; Wong & Law, 1999). DMNEs need to pay particular attention to organizational justice, an important determinant of job satisfaction for local employees and expatriates alike (Chen, Choi, & Chi, 2002; Leung, Smith, Wang, & Sun, 1996; Leung, Zhu, & Ge, 2009). Global talent management research has also been extended to DMNEs in developing economies, as researchers recognize the importance of hiring local talent, of encouraging talent mobility, and of using social media networks in those processes. Human resources departments are addressing these issues with an eye towards balancing global integration and local responsiveness (Farndale, Scullion, & Sparrow, 2010; Hartmann, Feisel, & Schober, 2010; Iles, Chuai, & Preece, 2010). Table 5 provides the main findings of articles classified under this research theme.

Building and managing joint ventures and alliances in developing economies

International joint ventures (IJVs) and global strategic alliances are important cooperative strategies for DMNEs. Studies in the 1980s and 1990s approached this topic by examining IJV characteristics, motivations, partner selection processes, and ownership structure (Beamish, 1985; Hennart, 1988; Lee & Beamish, 1995; Luo, 1997; Pan, 1997; Yan & Gray, 1994). This line of research found that IJVs in developing economies experienced higher instability rates and more managerial dissatisfaction than those in developed countries, especially if one of the parents was from a developed country (Lane & Beamish, 1990; Lee & Beamish, 1995; Lyles & Baird, 1994; Sim & Ali, 1998). Researchers concluded that to improve IJV performance DMNEs should find local partners with complementary resources (i.e. local market knowledge and experience) and make use of their financial assets, technical capabilities, and other resources (Beamish, 1987; Luo, 1997). A good inter-partner fit, that is one characterized by shared organizational traits and common strategies, can increase the commitment of both partners and lead to superior IJV performance (Lane & Beamish, 1990; Lin & Germain, 1998). In contrast to ventures in developed countries in which foreign investors tend to prefer majority or equal ownership, most firms entering developing or emerging economies through IJVs elect to take a minority equity position because of government constraints and environmental uncertainty (Beamish, 1985; Franko, 1989; Makino & Beamish, 1998; Pan, 1997). Firms in developing economies are especially interested in partnering with firms in developed countries from which they can learn and acquire tacit, embedded knowledge (Lyles & Salk, 1996; Shenkar & Li, 1999).

Since 2000, the focus of research has shifted towards studying the management of these IJVs, especially the relative bargaining power of the parents, parent control of the IJV, knowledge transfer, and partner opportunistic behavior (Hitt et al., 2000; Krishnan, Martin, & Noorderhaven, 2006; Lane, Salk, & Lyles, 2001; Luo, 2007b; Tong et al., 2008). It is the relative bargaining power of partners that affects the pattern of management control, which in turn influences IJV performance and parent satisfaction (Luo, Shenkar, & Nyaw, 2001; Steensma, Tihanyi, Lyles, & Dhanaraj, 2005). An imbalance in management control increases the likelihood of conflict, and hence the chance of IJV failure, or its conversion into a wholly owned subsidiary (Barden, Steensma, & Lyles, 2005; Steensma, Barden, Dhanaraj, Lyles, & Tihanyi, 2008; Steensma & Lyles, 2000).

Prior studies have looked at the transfer of technological and managerial knowledge from foreign parents to the IJV (e.g., Dhanaraj et al., 2004; Steensma & Lyles, 2000), although relatively little research has been done on knowledge transfer in the other direction, that is from JVs to foreign parents (Tsang, 2002). Drawing on organizational learning and economic sociology, scholars have found that absorptive capacity and relational embeddedness play important roles in knowledge transfer between IJV partners (Dhanaraj et al., 2004; Lane et al., 2001). Subsequent research suggests that the capacity of partners to jointly learn is just as important in reducing JV instability as their absorptive capacity (Fang & Zou, 2010). Partner opportunism is often an issue in managing IJVs in developing economies as such economies are frequently characterized by drastic change and overall environmental volatility (Luo, 2007b). Contractual and structural (managerial governance) constraints as well social ones have been shown to be effective in curtailing opportunism (Gong, Shenkar, Luo, & Nyaw, 2007; Luo, 2002b), particularly when social mechanisms lead to on-going relationships built on personal attachment, social ties, trust, and shared values (Dhanaraj et al., 2004; Krishnan et al., 2006; Luo, 2001, 2005).

More recent IJV studies have adopted several nuanced approaches. Gu & Lu (2014) studied how firm reputation, an intangible resource, affects the formation of IJVs. Chen, Park, & Newburry (2009) noted that the use of different control types in an IJV is influenced by the resource contributions of its parent firms. Also, greater attention has been paid to IJV/alliance portfolio management, organization, and configuration (e.g., Andrevski, Brass, & Ferrier, 2016; Lavie & Miller, 2008; Wassmer, 2010). Despite these efforts, overall research output on IJVs in developing economies has decreased since 2010 (see Table 6).

Competing and localizing in developing economies

Research on how DMNEs compete in developing economies has received relatively little attention compared with other themes. Yet, considerable research has been done on the importance of coping with constantly shifting competitive and regulatory environments and also on how DMNEs can effectively change dominant strategies, build capabilities, and establish robust local and global value chains after market entry (Buckley, 2009; Luo, 2002a; Luo & Peng, 1999). A consensus seems to have been reached that DMNEs operating in developing economies face intense competition – not only from other DMNEs but also from local rivals that possess distinct market response and cost advantages (Chang & Xu, 2008; Pan & Tse, 1996; Rangan & Drummond, 2004). DMNEs suffer from a liability of foreignness because they are unfamiliar with the institutional and economic environments in which they operate (Gao, Murray, Kotabe, & Lu, 2010; Li, Poppo, & Zhou, 2010; Zhao, Park, & Zhou, 2014), and they also have a notable competitive disadvantage when attempting to fit into the host country because they lack ties with business and political stakeholders and hence face greater challenges obtaining tacit knowledge from host country actors (Li et al., 2010; Li, Poppo, & Zhou, 2008; Zhou, Poppo, & Yang, 2008). DMNEs attempt to compensate for those weaknesses by making an effort to augment their local knowledge and bolster their experience skillsets by collaborating with local firms, exploiting and building their own capabilities, and adopting a strategic orientation (e.g., analyzer orientation) well suited to the dynamic and complex emerging economy context (Luo, 2002a; Luo & Park, 2001; Luo & Peng, 1999; Makino & Delios, 1996). To compete in developing countries, DMNEs need to determine the optimal price–performance mix, make product adaptations, find ways to meet mass but low-income consumer demand, and improve capital efficiency (Prahalad & Lieberthal, 1998).

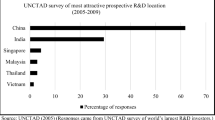

DMNEs are attempting to shift their status from “foreign investor” to “strategic insider” as they become increasingly aware of the fact that their success in developing economies is a key part of their overall corporate competitiveness (Khoury, Cuervo-Cazurra, & Dau, 2014; Luo, 2007a). A number of functions that in the past were almost invariably located in the DMNE’s home country are being relocated in host countries, and this includes critical upstream and downstream value chain activities such as R&D, branding, procurement, and training (Chen, McQueen, & Sun, 2013; Dou, Li, Zhou, & Su, 2010). DMNEs can strengthen their global competitiveness by building good relationships with local suppliers and distributors (Zhou & Xu, 2012), using upstream technical and knowledge-intensive business services in the host country (Manning, Ricart, Rosatti Rique, & Lewin, 2010), and developing local managerial competence (Corredoira & McDermott, 2014; Li & Scullion, 2010).

One significant trend is for DMNEs to increasingly use non-ownership, cooperative strategies, i.e. co-production, services outsourcing, franchising, licensing, and other types of contractual relationships by which the DMNE coordinates the local activities of host country firms without itself owning a stake in them (UNCTAD, 2011). Extant research shows that offshore outsourcing has become a popular competitive strategy for DMNEs seeking to achieve business renewal and corporate transformation, and that developing economies have become increasingly attractive offshore locations (Javalgi, Dixit, & Scherer, 2009; Zaheer, Lamin, & Subramani, 2009). Outsourcing goods and services to developing economies allows DMNEs to reduce production costs, improve cycle times, and increase innovation capabilities (Farrell, 2005; Kulkarni, 2008; Lewin, Massini, & Peeters, 2009), but at the same time they need to adopt integration processes and control mechanisms that are task-appropriate and to ensure effective monitoring and coordination of the activities performed by their offshore providers (Jayaraman, Narayanan, Luo, & Swaminathan, 2013; Jensen, 2012; Luo, Wang, Zheng, & Jayaraman, 2012).

Extant literature shows that DMNE offshore outsourcing also benefits developing economies as it contributes to host country exports, employment, and GDP, creates positive knowledge spillovers, and provides access to global value chains (Bunyaratavej, Hahn, & Doh, 2008; Manning et al., 2010). Developing economies eager to tap into such benefits are attempting to increase their attractiveness as services and production offshoring locations by bolstering their investment in human capital, infrastructure, and cluster capabilities, and by improving the overall business environment (Bunyaratavej et al., 2008; Contractor & Mudambi, 2008; Manning et al., 2010; Zaheer et al., 2009). Despite the potential benefits and the eagerness of developing economies to make the most of them, there are concerns that DMNEs are using outsourcing as a way to circumvent their domestic social and environmental standards and that developing economies are locked into low-value-added activities and are overly dependent on technologies owned or controlled by DMNEs and on their global value chains (UNCTAD, 2011). Table 7 provides a summary of key contributions to this research theme.

Institutions, society and business-government relationships

The influence of political, social, and economic variables on DMNE investments in developing economies has been of interest to scholars as far back as the 1970s, so much so that the second largest number of articles by theme falls into this category (see Figure 4). Among the important findings of that body of research is that the level of corporate tax, political stability, and economic development are critical determinants of whether a country is attractive – or unattractive – to foreign investors (Keegan, 1979; Levis, 1979; Root & Ahmed, 1978). Studies in the 1980s focused on the bargaining models of DMNEs and their relationships with host country governments. Those studies found that the resources a DMNE brings determine its relative bargaining power vis-à-vis the host government, which in turn influences the equity ownership of its subsidiaries (Fagre & Wells, 1982; Lecraw, 1984; Simon, 1984). Ramamurti (2001) developed a two-tier, multi-party bargaining model in which bargaining between the governments of host and home countries influences the institutional environments for micro-level negotiations between individual DMNEs and host country institutions. While bargaining processes and negotiations between DMNEs and host country governments can affect the legitimacy of firms, the cognitive and normative institutions present a particular challenge to DMNEs (Ajami, 1980; Kim, 1988; Kostova & Zaheer, 1999). The consensus is that DMNEs in developing economies must contend with high uncertainty and high complexity due to differences in host country institutions and government intervention (Kostova & Zaheer, 1999; Poynter, 1982; Simon, 1984).

The trend towards marketization, liberalization, and privatization in developing countries since the 1990s has led to the development of market-supporting institutions which in turn have reduced the importance of JVs as an entry mode (Meyer, 2001; Meyer et al., 2009). A two-phased model developed by Peng (2003) suggests that, as developing economies become less relationship-based and more impersonal, a market-focused strategy should be adopted. Research also suggests that pro-market reforms enhance DMNE profitability by reducing firm-wide agency costs (Cuervo-Cazurra & Dau, 2009), and that stable institutional environments encourage DMNEs to employ a long-term strategy in developing economies (Hitt et al., 2004). There has also been considerable research on corruption in emerging economies. Recent research suggests that an increase in the perception of corruption reduces the propensity of DMNEs to cooperate with host governments or to make philanthropic contributions, and also increases short-term contracting and participation in corrupt activities (Cuervo-Cazurra, 2008; Cuervo-Cazurra & Genc, 2008; Luo, 2006; Rodriguez et al., 2005; Spencer & Gomez, 2011; Uhlenbruck et al., 2006). Along with the industry- and resource-based views, institutions can be seen as one leg of the “strategy tripod”. The institution-based view has been extensively used to explain how institutions influence DMNE strategies and performance in emerging economies (Peng et al., 2008; Stevens et al., 2016).

The societal impact of DMNEs on developing economies can be either positive or negative. Some DMNEs have introduced modern technology or environmentally friendly production processes to the developing economies where they invest, others use outdated technology or take advantage of the less stringent environmental regulations in what has been called pollution havens, in an environmental standards “race to the bottom” (Meyer, 2004). There are studies that stress the positive spillover effect of DMNEs in improving host country labor standards and wages (Caves, 1996), and studies that show that hosts eager to attract FDI compromise their standards (Scherer & Smid, 2000). Over the past decade, questions on business ethics have been high on the research list. Corporate social responsibility (CSR) has gained traction with interest in both formal and informal institutional DMNE settings. The motivation, process, quality, and outcomes of DMNE CSR activities in developing economies are being examined in closer detail. Research in this area has shown that, in general, DMNEs focus more on CSR and ethical issues overall when they are faced with complex institutional pressure, such as conflicting demands from global and local stakeholders or between their ethical standards and those of their host countries (Husted & Allen, 2006; Luo, 2006; Zhang & Luo, 2013). Hence, the evidence is mixed on whether CSR activities help DMNEs gain institutional legitimacy or government support in developing economies. This suggests that rewards for successful CSR management are contingent upon the particular industry or host country, and on the CSR undertaken (Li, Fetscherin, Alon, Lattemann, & Yeh, 2010; Selmier et al., 2015; Wiig & Kolstad, 2010). Table 8 synthesizes the main results of this theme.

Frontier Issues and Future Research

As developing economies have become more diverse, scholarly interest in these economies has grown concomitantly. The complexity and dynamism of developing economies and the evolutionary nature of DMNEs that themselves differ in origin, type, and capabilities, has many theoretical and practical implications. The global reach of new MNEs originating in developing and emerging economies has recently received considerable attention by IB scholars (see review by Luo and Zhang, 2016). Yet, we believe that a renewed endeavor is also needed to continue research on DMNEs that are active in competing in developing and emerging economies.

We identified frontier issues based on four criteria. First, the research agenda we propose requires a dynamic point of view. DMNEs must make adjustments in their global and local strategies as time goes by, because host countries are themselves changing, and because DMNEs learn experientially. Second, with emerging economies playing an increasingly significant role, many DMNEs are recognizing the need to co-develop and co-evolve and are adopting reverse innovation and reverse transfer policies. Thus, the idea of change resonates throughout many of our suggestions for future research. Third, digital globalization is compelling DMNEs to revamp their business models – both those for local markets and for global ones. We see this reflected in the economics of DMNEs offshoring operations to developing economies, in the reshoring of certain activities, and in DMNEs reconfiguring their global value chains (Tallman, Luo, & Buckley, 2018). In addition, DMNEs are integrating their operations in developing economies into their global ecosystem. Indeed, a number of our research agenda proposals have to do with the impact of the new global reality on DMNE strategies. Fourth, developing economies are complex. Far from abating, complexity has been heightened in some areas: for instance, the impact of informal institutions and that of impact of local competition is more and more difficult to anticipate. Thus, many of the research questions that we believe need to be answered have to do with complexity and how DMNEs can respond to it.

Strategic Localization and Insiderization

We believe additional light needs to be thrown on the strategies pursued by DMNEs after they enter developing economies, notably in the area of strategic localization and insiderization. Extant research suggests that, as DMNEs increasingly compete in large developing economies, they are shifting their strategic focus away from local adaptation towards insiderization (Luo, 2007a). Ohmae (1989) views insiderization as an essential element in understanding local market demand and thereby achieving commercial success in foreign markets. Insiderization activities are characterized by value chain localization, adaptive diversification and local competence building. DMNEs typically rely on their previous successes or failures in large developing economies to redefine and reorganize their strategies. Restructuring activities are often hub-and-spoke centered in key emerging economies, taking place across subunits in geographically dispersed locations. The goal is expansion of critical upstream and downstream activities to ultimately achieve global value chain integration. This insiderization process has not been sufficiently studied to date. This process entails DMNEs being proactive in (1) identifying and acting upon market opportunities, (2) localization and adaptation, and (3) bolstering organizational legitimacy and reputation. Insiderization is not an isolated act, it is evolutionary, and thus requires longitudinal analysis of the external and internal forces. This does not mean that DMNEs need to localize all critical processes. On the contrary, determining which activities and functions should be localized (and what should not) and what level of corporate support is needed to underpin them are critical. As is true of the process, the consequences of insiderization have not yet received adequate attention. For instance, DMNEs expending greater resources to counteract liabilities of foreignness accrue higher initial costs, but after insiderization is complete, is the continuous investment worth the gains in improved legitimacy? A number of promising avenues of research might compare DMNEs that have achieved insiderization with indigenous firms. One in particular would be to gauge learning over time. Insiderization requires coordination with corporate headquarters and with other DMNE subsidiaries. Future research should use a more integrated and interactive framework to study how insiderization affects global and local mandates. Lastly, the field would benefit from a more nuanced understanding of organizational behaviors that foster insiderization in R&D, marketing, supply chain management, distribution, e-commerce, and human resources management, among others.

Reverse Transfer and Reverse Adaptation

Knowledge acquisition is not a one-way street. Just as it is transferred from DMNE to host economy, so can it flow from a host developing country to the home country of a DMNE, notably through reverse transfer. As it applies to DMNEs, reverse transfer is a process whereby an innovation or knowledge originates in a developing or emerging economy where a DMNE has operations, and is then later transferred to the DMNE home country or to other developed or developing economies (Govindarajan & Ramamurti, 2011). Innovations often originate in emerging markets and are transferred by DMNEs globally. Some DMNEs have subsidiaries that serve as global innovation incubators. How reverse transfer is structured, coordinated and executed, and what levels of corporate support or organizational infrastructure (e.g., global mindset, corporate culture, data flows, parent–subsidiary links, reward schemes, etc.) are required to underpin it, has yet to be unpacked. Future research may explore which measures, programs, and policies at the parent level and at the subsidiary level would encourage reverse transfer. How a DMNE’s global integration strategy should incorporate reverse transfer also remains largely unstudied. The transnational approach, that is, conducting reverse transfer within a DMNE’s centrally planned, globally coordinated, and locally adapted transfer system, appears to be the most viable of the currently employed reverse transfer strategies. It would be valuable to the field to determine if that is indeed the case or if other strategies are more effective, and, if so, under what conditions.

Reverse transfer also applies to the deploying of key personnel (Luo, 2016). In contrast to local adaptation, which typically is unidirectional nationals from developed countries learning about and adapting to a developing or emerging country culture and environment, there is a burgeoning trend of personnel movement in the other direction. Often, it entails employees of a foreign subsidiary receiving training on the DMNE’s vision and competences so that they might be deployed wherever the firm needs them worldwide. The new paradigm reverses the notion of adaptation from “foreign to local” to that of “local to foreign”. The kinds of reverse transfer we have described are key components of knowledge flow within a DMNE. They are critical to the creation and exploitation of innovation and to learning, as reverse transfer and reverse adaptation both facilitate the dissemination of new ideas from large developing host countries to other countries, including developed ones.

Probing how reverse adaptation and cultural diversity work together to generate the highest level of benefits for a DMNE should be the next step in research of reverse adaptation evolutionary process. Reverse adaptation, if effective and extensive enough, can ultimately result in greater cultural diversity for DMNEs, which in turn appreciates and reconciles cultural differences. It can also create culturally diverse management teams that can better understand the implications of headquarters decisions in various foreign markets and can better reflect the breadth of the DMNE’s geographic footprint. To date, DMNEs seem to have intuitively understood that diversity is good for business, but they struggle to convert that into action. Reverse adaptation can help stimulate this conversion. Also, future research should address how reverse adaptation aligns with global strategy. DMNE managers need to invest in a global personnel program that prioritizes the development of indigenous talent and train them to become global talent. Extant research has found that sharing core cultural values, mindsets and ideologies is an essential, and one of the most effective, mechanisms to solidify a DMNE’s global integration and knowledge transfer processes (Bartlett & Ghoshal, 1989). DMNEs that maintain a high rate of knowledge and capability transfer across regions, businesses, and functions tend to have a greater breadth and depth of reverse adaptation capability. Likewise, organizations that engage in cross-border mergers, acquisitions and strategic alliances bolster reverse adaptation to foster cooperation and fluid post-acquisition integration.

Co-evolution with Local Business Ecosystems

According to the co-evolution perspective, firms and societies evolve together; thus, firms must adapt to the environment and the environment is impacted by the actions of firms (Lewin, Long, & Carroll, 1999; Lewin & Volberda, 1999), in other words, they co-evolve. This suggests that firms should seek to balance shifting competitive and institutional dynamics with their own evolving strategies. Applying this to DMNEs and the environments in which they do business, there has been much recent discourse regarding local adaptation, but markedly less about co-evolution with local business ecosystems, i.e., horizontal (local rivals and other foreign rivals), vertical (suppliers, distributors, users and consumers), and diagonal partners (specialized service vendors, industrial designers, financial service providers, local banks, and regulatory and government agencies). DMNEs also have robust internal ecosystems that, by orchestration and integration, effectively delegate power to subunits in developing economies. Co-evolution with both external and internal ecosystem partners is intentional and deliberate, and its success depends on how effectively structural, operational or organizational architecture can forge the connections that govern the evolution and stability of the ecosystem.

Future research might address co-evolution in several ways. First, most developing economies are characterized by shifting institutional and market environments and by an underdeveloped industrial environment (Luo, 2007a). This means that DMNE may have opportunities to bring about, or take part in, evolutionary processes in the ecosystems which they have entered, perhaps influencing industrial standards or regulatory policies. Determining the circumstances under which DMNEs might initiate, direct, or accelerate a co-evolution process would make a valuable contribution to the field, and equally valuable would be determining the value-capture strategies they could employ to capitalize on the improved conditions they have helped to create. Second, DMNEs often seek long-term growth opportunities in the markets they enter; thus, their long-term strategies are often contingent upon competitive and institutional dynamics that co-evolve with them. There are abundant win–win opportunities for firms when conditions improve. DMNEs that successfully compete in emerging economies often see themselves as participants in an evolving system wherein the synergetic or collaborative value of an industry ecosystem is greater than the sum of the parts. One critical research question is how MNEs can work towards common benefits without losing their centrality or keystone positions (Zahra & Nambisan, 2012). Extant literature has identified other risks DMNEs face in building and utilizing such an ecosystem: initiative risk, interdependence risk, and integration risk (Adner, 2006). We believe that the field would benefit from future research that investigates in more detail how DMNEs might harness returns from co-evolution without at the same time creating new and powerful rivals and losing control as the ecosystem is extended. Third, DMNE subunits in developing economies are simultaneously co-evolving with their corporate partners in other countries. Previously, these subunits catered to the emerging market, but are now shifting toward serving the world market. DMNEs need to know which bottlenecks (technological or organizational) are likely to inhibit the transition of their emerging economy subsidiaries from local players to global contributors.

Reorganizing and Restructuring

We see considerable scope for future IB research on the reorganization and restructuring of DMNE investment and operations in developing economies and the processes behind it. DMNEs have been reorganizing and consolidating their operations since the late 1990s, for which there are at least two major reasons. First, there is a general trend away from production-centric strategies towards more localized value chain activities. DMNEs are terminating unprofitable subunits and those that simply no longer fit their revised foreign-country, business-competence portfolios. Second, in the early days, many DMNEs established numerous subunits in a given host country and tried out different strategies in different locations within them (Meyer & Su, 2015). That approach meant that they later had to integrate activities if they were to be cost-effective. Now, DMNEs are beginning to carry out that integration and are consolidating functions under host country umbrella subsidiaries in a bid to streamline procurement, manufacturing, R&D, training, distribution, public relations, IT, financing, and taxation.

Extant research shows a trend towards sell-offs and spin-offs, ownership restructuring, leadership change, subunit consolidation, and early IJV termination (Dhanaraj & Beamish, 2004; Li & Li, 2010; Meschi, 2005; Steensma et al., 2008). One issue we would like to see on the research agenda is how DMNEs are carrying those out, that is, by which forms and processes, and under what conditions one or another is best. Researchers might consider the factors behind the trend itself, taking into consideration both local ones, such as disappointing subunit performance, revised downward projections for long-term growth in a host country, and increased rivalry from indigenous firms, as well as global ones, like a decline in the importance to a DMNE of a host country market and overall change in a DMNE’s geographic portfolio. Another issue that merits attention is how DMNEs coordinate the efforts of individual subunits in a host country and at the same time across other countries. Yet another issue of interest is the role that a hub in a large emerging economy such as China might play in DMNE reorganizing and restructuring, given that such a hub may be in an ideal position to provide feedback on local trends. Research in this area may reveal which global integration functions are likely to be handled at the national host country level and which are more likely to be performed in regional hubs.

McKinsey (Bughin, Lund, & Manyika, 2015) have projected that the unprecedented increase in DMNE profits from investments in emerging economies over the past two decades is drawing to a close. Current geopolitics, especially growing tensions in trade and investment between major developed economies (USA in particular) and leading developing countries (China in particular), further complicates the prospect for DMNEs. These MNEs will have to become more efficient, more resilient, and develop new capabilities if they are to remain competitive vis-à-vis powerful local rivals. Future research might address how reorganization and restructuring processes have resulted in improved efficiency and capability-building and have bolstered competitiveness. A real options logic, which holds that firms are adaptive systems that need to balance refinements of existing processes and explorations of new market conditions and opportunities (Kogut & Kulatilaka, 2001; McGrath, Ferrier, & Mendelow, 2004), might serve as a basis for a better understanding of the motives, processes, and consequences of restructuring and reorganization. As DMNEs continue to engage in co-evolution with local business ecosystems, it becomes even more important for them to match their capabilities to the environment. A real options heuristic allows a firm to gauge the value of particular paths of exploration in evolving environments. Future theorization could possibly unpack how real options methods work specifically in the context of DMNE reorganization in developing economies. Perhaps even more important to the growth of DMNEs is to determine which distinctive capabilities will allow them to make the most of opportunities they may have in the future, a premier notion in the real options theory framework (Bowman & Hurry, 1993).

Strategic Responses to Institutional and Market Complexity

Developing economies differ among themselves in their competitive and institutional environments but also in their heterogeneity and complexity. Large developing economies are characterized by intense market complexity that is manifested in geographic segmentation, sectorial heterogeneity, new consumerism, institutional unpredictability, and fierce competition. There has yet to be a thorough analysis in the IB literature of how DMNEs cope – or should cope – with that complexity. It seems more implausible than ever that DMNE home country executives, or even those in faraway regional locations, can decipher trends, diagnose problems, or react with ubiquitous heterogeneity within a host country. Developing country markets are segmented by levels of economic development, industrialization policies, local culture, purchasing power, consumer behavior, and distribution networks (Luo, 2007a). Their industrial structures have moved towards multiplicity, dissimilarity and heterogeneity because of governmental industrial policies that have put varying entry barriers in different sectors (Meyer, 2004). Another example is how new consumerism has challenged the ability of DMNEs to meet consumer demand as consumers in some developing markets leapfrog their developed country counterparts in the use of digital products. The level of consumption is on the rise across developing economies, facilitated by electronic purchasing and delivery. The new consumers in developing economies have already changed the nature of the luxury goods market, with the internet making it possible for them to purchase global brands in a way unimaginable a decade ago.

We caution against mistakenly treating developing economies in the simple aggregate, because large developing economies are a conglomeration of a variety of segmented markets, and thus, when considering strategic responses of DMNEs in these larger economies, within-country and cross-sector variations must be taken into account. There is an extant body of research that examines in detail country-level issues including economic, institutional, and cultural influences in developing economies, but less attention has been paid to within-country variations in demand, consumers, and sector-level actors.

There is widespread belief that developing economies are characterized by institutional voids, an absence of specialized intermediaries, and a lack of contract-enforcing mechanisms. While there is some truth to such notions, institutional complexity represents a much greater challenge. It is not so much that developing economies are lacking in regulations and institutions, but that there are too many of them (Greenwood, Raynard, Kodeih, Micelotta, & Lounsbury, 2011; Luo, Wang, & Zhang, 2017; Shi et al., 2017). The bureaucracy underpinning each formal institution and regulatory agency exerts sometimes contradictory pressures. Institutional complexity depicts the extent to which a DMNE encounters not only multiplicity but multi-directionality (some institutional forces are improved but others worsened), heterogeneity (DMNEs confront institutional constituents that require differently coercive, normative or cognitive standards), instability (institutional requirements constantly change and are difficult to predict), and ambiguity (tedious processes, dubious rules, and poor enforceability) of different requirements from a plurality of institutional forces in a large emerging economy. This complexity amplifies costs of processing information, of making decisions, and even of handling routine operations.

However, prior research does not provide an adequate understanding of DMNEs’ responses to institutional complexity. This shortfall is even more striking from decidedly interactive, evolutionary, and longitudinal perspectives. Institutional complexity dissuades investment, and in some cases has even caused large, well-established DMNEs to downsize or exit developing economies. It would be particularly useful to examine how DMNEs, individually or collectively, push institutional innovations at national, subnational and industrial levels of developing economies, in a process of co-evolution with local institutions, so as to reduce future institutional complexity. Of particular interest would be whether DMNEs obtain better results if they deal with institutions one-on-one or as part of a group comprising numerous DMNEs with shared interests, and, if so, in what ways. Efforts to change local institutions are often undertaken with local competitors, resulting in both collaboration and competition with the latter. Local rivals generally have a better understanding of the local environment (Luo & Child, 2015). However, cooperation with local rivals in both host country and global markets also warrants attention, especially concerning the forms of cooperation, co-learning processes and conditions under which co-opetition unfolds and evolves.

Conclusion

Prior research in early years largely focused on DMNEs’ entry into developing economies and treated DMNEs as “foreign investors”. More recent research shows that DMNEs have been evolving from “foreign investors” into “strategic insiders”, who conduct a large array of value chain activities in developing economies. Our review of the literature from 1970 through 2016 identifies key theoretical insights and empirical findings and shows that there has been considerable progress in the last four plus decades towards consensus on a number of issues. We undertook this study in order to advance our understanding of topics as diverse as entry strategies, IJV formation and management, the organization of host country operations, local market adaptation, and the management of social and institutional interactions.

The literature on DMNE investing in developing economies has enhanced our understanding of key theoretical lenses in international business. Extant research suggests that developing economies are not just a market for DMNEs but a critical source of global competence and global innovation. The concepts of reverse innovation and reverse transfer, for instance, have significantly changed the dominant views toward capability development, deployment, and diffusion. The literature sheds new light on the global integration–local responsiveness framework because it shows that many functions once performed by corporate headquarters have become much more decentralized and are now often performed in part by flagship hubs located in key emerging economies. The literature further changes our view toward global planning and decision-making theory. Many DMNEs have shifted away from a traditional top–down approach, where developing market subsidiaries in the past were mere implementers of global initiatives, to a bottom–up one where they are responsible for global initiatives. An increasing number of DMNEs have now established regional headquarters and global competence centers in large cities in developing countries.

Furthermore, the literature offers a nuanced understanding of the institutional perspective, and further enriches the evolutionary view of MNEs by providing insights on how MNEs co-evolve with host country competitive and institutional environments in recursive, iterative and interactive steps (e.g., Meyer, 2004; Ramamurti, 2004). This is possible because of the transitional nature of these economies at national, subnational and industrial levels. The literature also deepens our understanding of MNE evolution and strategic change, raising new questions as to how such evolutions may reshape existing MNE theories, such as internalization, ownership-specific advantages, and the liability of foreignness. Dynamic capabilities may be a viable lens to handle some of these issues, but it still needs to embrace organizational evolutions in this theory.

There are several research areas that could deepen our understanding of the co-development of DMNEs and developing economies. To this end, we identified five key areas that we think warrant greater attention: strategic localization, reverse transfer and reverse adaptation, co-evolution with local business ecosystems, reorganization and restructuring, and strategic responses to institutional and market complexity. Today, MNEs are continuously proactive in tapping potentials in developing economies despite daunting challenges and new global geopolitics they face. Opportunities also abound for IB scholars to contribute to the broadly defined body of work we have revealed and to offer nuanced approaches to understanding how DMNEs and developing economies co-evolve.

Notes

-

1

For instance, we identified some newly industrialized economies (NIEs) (e.g., Hong Kong, Taiwan, Singapore, and South Korea) as developed economies from 1998, and defined them as developing economies before 1998. Since 1998, the IMF and the CIA World Factbook began to list these NIEs as advanced economies. Similarly, the United Nations’ human development index (HDI) indicated that these four NIEs have reached a relatively high level of human development score as developed economies in 1998.

-

2

To decide on keywords, we looked at 10 highly-cited developing economy literature reviews: Bruton & Lau (2008); Kirkman, Lowe & Gibson (2006); Lu (2003); Luo & Zhang (2016); Marquis & Raynard (2015); Nicholls-Nixon, Castilla, Garcia & Pesquera (2011); Pisani (2008); Roth & Kostova (2003); Tsui, Schoonhoven, Meyer, Lau & Milkovich (2004); and Xu & Meyer (2013). We formed two sets of keywords: the first having descriptive terms relating to developing economies and the second relating to MNEs. We used the two sets to guide the literature search using the ABI/INFORM Complete-ProQuest and the EBSCO/host Business Source Premier databases. Each time we used a keyword from set one and also from set two, and ensured that each keyword from one set was pairwise searched together with a keyword from the other. We selected only full-length original research articles, excluding dissertation abstracts, book reviews, and introductory short notes.

-

3

Articles dealing with two research themes were coded as two. This explains why the cumulative number of articles shown in Figure 4 is larger than our 692 sample size.

-

4

We used the Google Scholar citation count of August 30, 2018.

References