Abstract

In this article, five in-depth illustrations of practical applications of various derivatives for risk control for asset management are provided. The illustrations are presented using stock index futures, interest-rate derivatives (Treasury futures and interest rate swaps), options, and equity swaps. The cases presented bridge the gap between theoretical finance and practical application, making it invaluable for those involved in risk management for portfolio managers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In this article, we present the following applications of derivatives for portfolio risk management:

-

The use of stock index futures and put options to hedge an equity portfolio.

-

The utilization of U.S. Treasury futures to modify the interest rate risk associated with a bond portfolio.

-

Controlling tail risk which involves rare but impactful investment outcomes, and demonstrates how options can be employed to hedge against this risk.

-

The use of equity swaps in active equity portfolio management.

-

How the treasurer of a credit union can use interest rate swaps to manage the interest rate risk of a consumer mortgage portfolio.

Hedging with stock index futures and put options

An equity portfolio manager is bullish on all the individual names included in the portfolio shown in Table 1Footnote 1, which were determined through bottoms up fundamental research. However, many of the names in the portfolio are high beta, and despite establishing a 5% allocation to cash, the portfolio beta relative to the benchmark, the S&P 500 index, is still 1.1525. Since the portfolio manager does not have a view on the broader market and being uncomfortable being essentially long 15% versus the benchmark, a decision is made to hedge the excess market exposure. Two approaches are being considered by the portfolio manager for hedging:

Futures approach Using the existing cash allocation as collateral for the futures position, sell index futures.

Options approach With a portion of the existing excess cash, buying a 20-delta index put option.

In both cases, the portfolio manager’s goal is to reduce exposure to the benchmark without changing the cash market positions. As of February 28, 2020, the S&P 500 index was valued at $2954.22, a March expiry e-mini future contract on the S&P500 was trading at $2951, and a 20-delta put with an expiration identical to the March futures contract was trading at $48.50 and had a strike price of $2660.

E-mini futures contracts on the S&P 500 have a multiplier of 50. Therefore, to size the correct number of futures to sell (denoted by Nfutures), the portfolio manager solves the following equation:

In our illustration we have

The negative sign means that the futures should be shorted. Note that because futures contracts do not have a beta of exactly 1, it is appropriate to use the futures price in the denominator. Additionally, the futures contract requires no initial cash outlay, so the portfolio manager’s cash position is unchanged at the time the hedge is put on.

Next, the portfolio manager evaluates the put option approach. Options on the S&P 500 have a contract multiplier of 100. The following equation is solved by the portfolio manager to determine the number of put options to purchase (Nputs):

The option delta in our illustration is − 0.20. Substituting this value and the other values for our illustration gives:

Note that the cash outlay to purchase these contracts is $1.9 million (387 \(\times \) $48.50 \(\times \) 100), which is easily covered by the $7.5 million cash position.

Now, which approach is better? The answer is, “it depends.” Both approaches reduce the effective equity exposure by the same amount at the onset of the trade. However, the futures approach is only exposed to one risk factor (the underlying) and the options approach is exposed to more risk factors (the underlying and the volatility of the underlying). As it turns out, February 28, 2020 was on the eve of one of the most severe sell-offs in stock market history due to the rapid global spread of the Covid-19 virus. Both these contracts expired on March 20, 2020, when the settlement price on the S&P500 was $2437.98.

Let’s compare the profit and loss (P&L) for each approach:

-

Futures Approach: − 155 × (2437.98 − 2951) × 50 = $3,975,905 or a + 2.65% contribution to portfolio return

-

Option approach: 387 × [max (2660 − 2437.98, 0) − 48.50] × 100 = $6,715,224 or a + 4.48% contribution to portfolio return

The option approach was much more attractive than the futures approach in this example because the realized move in the underlying was so large. In other words, the option was underpricing subsequent volatility. However, most of the time, options tend to trade at a premium, a phenomenon known as the “volatility risk premium” (VRP). One way to measure the VRP is to compare option implied volatility to subsequent realized volatility. Historically, this spread is significant and positive, meaning implied volatility is on average a few percentage points higher than historical realized volatility and regular purchasers of index options tend to lose money. Because futures contracts are not exposed to the VRP, they will tend to be less expensive hedging instruments than put options for the same amount of linear exposure reduction. Additionally, transaction costs on futures are far lower than transaction costs on options.

The moral of the story is that when evaluating linear hedges like futures versus non-linear hedges like options (or various combinations of options), portfolio managers should:

-

Evaluate apples-to-apples by comparing the net linear exposure of the option positions to the same exposure with futures.

-

Use options-based methods when they have a view or preference on risk factors only accessible via options (e.g., volatility).

Bond portfolio hedging with U.S. treasury futures

In this case study, we discuss how portfolio managers may apply U.S. Treasury futures to alter the interest-rate sensitivity of a bond portfolio.

Table 2 shows the details of a simple illustrative bond portfolio worth $133 million, yielding 4.55%, and comprised of all USD-denominated securities as of August 31, 2023. The portfolio is comprised of investment-grade securities, including U.S. Treasuries, agencies, supranationals, as well as corporate and financial sector debt instruments. While diversified bond portfolios typically contain a lot more securities than the 10 securities in this illustrative case, the hedging considerations and conclusions are not impacted by the choice of this easy-to-overview portfolio.

The portfolio’s overall effective duration, labeled as option-adjusted duration in the table is 5.31 years, and the individual securities’ time to maturity and durations fall in the ranges of 2.4–9.2 years and 2.2–7.4 years, respectively. Given the securities’ market values, we can also determine the portfolio’s DV01, i.e., dollar sensitivity with respect to 1 basis point yield change:

$132,967,763.90 × 5.31 × 0.0001=$70,600.94.

This means that our portfolio of $133 million would lose about $71,000, roughly 0.05% of the portfolio value.

Figure 1 illustrates the U.S. Treasury yield curve as of August 31, 2023. The yield curve at that point is inverted as the Federal Reserve (Fed) had hiked the Fed Fund rate multiple times to fight inflation, while the market is pricing in a change in the hawkish monetary policy toward an easing policy (i.e., lowering interest rates). Because market expectations are sensitive to inflation and job market reports, the portfolio manager is concerned about the market expecting easing to start too soon. Should these market expectations change, the yield levels would increase, and the yield curve could become less inverted.

Given these concerns, the portfolio manager decides to reduce the portfolio duration, and wants to initiate a 1 month horizon Treasury futures-based interest rate risk hedge at the end of August, by using the 2023 December Treasury futures contracts, the nearest actively traded month at that time that was practical for a one-month horizon hedge. Table 3 shows the 2 year, 5 year, and 10 year Treasury futures contracts’ key characteristics as of August 31, 2023.

It is important to note that the DV01 of one futures contract is determined by the cheapest-to-deliver (CTD) bond, and is best estimated as

It is interesting to note that while the duration of the 5 year contract’s CTD bond is more than twice that of the 2 year contract, the DV01s of the 2 year and 5 year contracts are quite similar. The reason is that the 2 year contract’s size is twice that of the 5 year contract’s size.

If the portfolio manager wanted to reduce the portfolio’s duration by 1 year by using 5 year Treasury futures, then the aim would be to reduce the portfolio DV01 by 1 × $132,967,763 × 0.0001 = $13,297, and that could be achieved by selling $13,297/$43.33 = 307 of the 5 year Treasury futures contracts.

The portfolio manager, however, decides to fully hedge all the Treasury interest-rate sensitivity of the portfolio. That is the portfolio wants to reduce its DV01 of $70,600.94 to zero. The number of contracts to sell, depending on which futures the portfolio manager chooses, would be as follows:

-

2 year contract (TUH4): 70,600.94/39.33=1795, or

-

5 year contract (FVH4): 70,600.94/43.33=1629, or

-

10 year contract (TYH4): 70,600.94/66.52=1061 contracts.

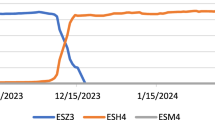

Figure 2 shows how the yield curve moved over the month of September, justifying the portfolio manager’s initial concerns. While the front end of the curve remained practically unchanged, the curve “bear steepened”, as the 2 year, 5 year, and 10 year rates have increased by 18 bps, 36 bps, and 46 bps respectively. Figure 3 shows the daily history of the Treasury yields, futures prices, and performance of the futures contracts over the month of September.

Table 4 shows the portfolio’s value and performance by the end of September 2023, without any derivative hedges. The portfolio’s value declined from about $133 million to $130 million, as the portfolio’s yield-to-worst increased by 42 basis points to 4.97%. The total monthly profit/loss (P/L) is -1.89%, or ($2,518,736) that includes a coupon payment of $398,000 for the Citibank bond, besides the overall market value change and coupon accruals.

Table 5 provides a comparison of how the hedges would have performed if the portfolio manager had utilized either the 2 year, 5 year, or 10 year contracts to hedge the portfolio. The column labeled “$ P/L on Bond Portfolio and Futures” displays the sum of the P/L on the short futures contract added to the ($2,518,736) overall negative performance of the bond portfolio. While all three futures transactions DV01 were set equal to the portfolio’s DV01, the 2 year contract obviously would have been the poorest choice. This is not surprising, since the yield curve did not shift up in parallel manner, but the front remained unchanged, and longer dated yields increased by more. The 2 year Treasury yield increased by 18 basis points in September, much less than the 42 basis points yield increase of the portfolio. The 5 year and 10 year Treasury rates’ increase of 36 basis points and 46 basis points were closer to the portfolio’s overall yield increase. In fact, if the par yield curve steepens, the forward rates underlying the Treasury futures price changes increase by even more.

Given the portfolio’s initial duration of 5.31 years, it is intuitive to expect that the 2 year Treasury futures would not be the most intuitive choice; the 5 year or 10 year contracts would be more natural choices—see their CTD bonds’ durations of 4.02 and 5.99 years in Table 3.

To explore this further, Table 6 displays the bonds portfolio’s key rate duration profile as of August 31. Based on this information, we can see that the portfolio’s overall DV01 $70,601 is mostly concentrated around the 5 year and 10 year key rates, based on Bloomberg’s Portfolio Administration tool. Instead of trading with only one of the available futures contracts, the portfolio manager could also determine a basket of 2 year, 5 year, and 10 year contracts such that they best match the portfolio’s key-rate DV01 profile, as shown in Table 7. By simultaneously shorting 100, 17, and 992 contracts of the 2 year, 5 year, and 10 year Treasury futures, the portfolio’s key rate DV01 profile could be closely match, resulting in an overall $561,188, or + 0.42% P/L net of hedge. While the portfolio manager could successfully eliminate the adverse impact of the yield curve change, could preserve the positive carry of the portfolio over September.

Using options for tail risk hedging

Options markets allow portfolio managers to efficiently shape the probability distribution of returns. In exchange for paying a premium to the seller of an option, the buyer of an option can create a contingent payoff for specific market events of interest. In this section, the use of options to hedge tail risks in financial markets is illustrated.

By tail risk we generally mean financial market outcomes that are rare, but whose consequence can be large. Since these events are rare, it is usually very difficult to make a prediction of when and how large such events will occur. However, this does not change the importance of having some securities or strategies in a portfolio that will perform well in such events to provide robustness to the overall portfolio. Tail risk hedging, by definition, is a “just in case” investment strategy as compared to “just in time” investment strategies which rely on responding to an adverse event as it occurs. In other words, using options for tail risk hedging provides a portfolio manager with the ability to plan in advance, rather than react to the adverse event as it is happening. Options markets are perfectly suited for such risk management applications.

Adverse events can be different for different portfolios.Footnote 2 For any adverse event, by committing a small amount of premium to asymmetric options-based strategies helps the underlying portfolio during the period of interest and provides both protection and the ability to take advantage of opportunities via option monetization and redeployment. Such hedging, of course, is not free. For the benefit of getting the protection, the investor normally must pay something (e.g., an option premium, either on a set schedule, or by committing capital for protective strategies for a fixed horizon in advance). It is important to realize that once the risk factors of interest are identified, then options on those systematic risk factors can be utilized to reduce the systematic tail risks. Identification and quantification of risk factor exposures is thus the logical first step in designing a tail hedge. For instance, one could use options on the S&P 500 or other market indices if the primary risk factor of interest is aggregate large cap equity beta, or other indices (e.g., options on the Nasdaq 100 index) if the risk is primarily technology sector exposure. Since options are time decaying assets, the potency of the hedge must be maintained by purchasing new options as old options expire.

When an adverse market event occurs, the options may rise significantly in value; portfolio managers can choose to do nothing if the view is that the hedge is still needed, or monetize it by selling it in the market, and redeploying the proceeds into the markets or other investments, or just using the cash flows to meet other liabilities. In other words, having options-based hedges during the event in question thus provides endogenous liquidity when such liquidity is valuable for the portfolio. A combination of both systematic and discretionary monetization strategies may be used to monetize the increase in value of the options.

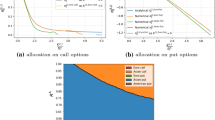

In this illustration, we provide a typical structure of a tail hedging program for hedging equity risk. We consider the problem of a portfolio manager who owns equities and wants to hedge out downside risk. Let’s consider a portfolio manager overseeing a $100 million investment in the S&P 500 index, via an exchange-traded fund such the SPDR S&P 500 ETF Trust (SPY) or the iShares Core S&P 500 ETF (IVV). Assume also that the portfolio manager (1) seeks a strategy that allows the portfolio itself (without the hedge) to absorb the first 20% of potential losses within their portfolio, (2) requires protection against any further decline if the portfolio’s value drops below $80 million within a year, and (3) desires a dependable tail hedge mechanism, one that is highly likely to activate and compensate for losses if the S&P 500 index decreases by 20% or more. This scenario assumes that the portfolio manager prefers not to sell or decrease the portfolio’s market holdings as a means to mitigate risk. This stance by the portfolio manager may be due to optimism that the market will rebound, fearing that exiting now could mean missing out on future gains, and/or selling the investments could result in taxable events on unrealized gains, presenting an additional financial burden. To implement this hedging strategy, the portfolio manager can look to buy an out of the money put option on the S&P 500 index. The portfolio manager has other choices, such as options on the SPY ETF itself, or even options on the S&P 500 index futures. The portfolio manager can also create a custom over-the-counter (OTC) option if the portfolio manager has a relationship with a prime broker or OTC derivative counterparty. Finally, the portfolio manager can create less reliable but potentially cheaper hedges using related instruments in other related markets. This cheapening of cost, however, comes with increased basis risk, so in this illustration we will not discuss such indirect hedges (Bhansali, 1).

As a first example of a reliable tail hedge with minimal basis risk, assume that the price of the S&P 500 index is 5150.82 (price as of March 8, 2024). Assume that the portfolio manager wants to hedge the downside risk with a 20% out-of-the-money European style put option with 90 days to expiration. This is a short-dated option which is usually suitable if the portfolio manager expects a sharp and steep market shock like the one that occurred during the COVID-19 crisis.

Using the Black-Scholes formula with 5150.82 as the current price, implied volatility of 26.36%, dividend yield of 1.412% for the S&P 500, interest rates of 5.31% and strike of 4120.50 (all data from Bloomberg as of March 8, 2024), the price of this put option is 9.24 S&P 500 points, which, in percentage terms is 0.17% or 17 basis points (9.24/5151.84 = 0.17%). In addition, the delta of the option is -0.033 (-3.3%), the gamma is 0.5581, the vega is 1.87, and the theta is − 0.27 (these numbers use the conventions that Bloomberg uses and can be used to compute the change in the value of the option for small changes in the variables that drive the price of the option). The option also has higher-order Greeks such as the rate of change of delta with respect to time (called “Charm” or delta decay) which come into play when managing the risks of options over time.

So, a portfolio manager can hedge a $100 million portfolio for 0.17% of $100 million (i.e., for a dollar price of $170,000. Since this is a European option, which can only be exercised at expiration, the portfolio manager is paid one for one for any decline beyond the 20% strike level if the market falls below the 20% strike level. Note that since the delta is 3.3%, locally the exposure is as if the portfolio manager is short $3.3 million equivalent of the stock market. But this delta changes rapidly as the market declines or volatility increases, which tends to happen together since market declines result in increases in implied volatility.

Thus, the real potency of the hedge comes from the convexity of the option. For example, if the S&P 500 drops 20%–4120.66 the value of the hedge will increase by a large multiple of its initial cost. If we assume that the volatility remains unchanged, then because of the change in the level of the S&P 500 and the gamma of the put option, the value of the put option will increase to 4.7%, which is a 21-fold increase in value.Footnote 3 But the value of options is also very responsive to the level of volatility, which we assumed above to be unchanged. It is difficult to forecast what the level of volatility is going to be for all future paths, but broadly speaking volatility rises sharply when the equity markets fall.Footnote 4 If we assume conservatively that for each 10% fall in the market results in a 10-point increase in volatility, then increasing the implied volatility by 20% results in the value of the option increasing to 8.6%, which is a 39-fold increase in its value from its purchase price. Thus, while this selloff in the market results in a loss in the underlying portfolio of 20%, the increase in the option price would cushion a good portion of the losses, thereby providing a tail-hedge.

Using a simple Black-Scholes calculator and assumptions for the change in the underlying, the portfolio manager can calculate other scenario payoffs and see if they mitigate the risks as desired or not. For illustration, if we use a 35% decline and 80% volatility level, the new option price would be 30%, which is a whopping increase of 112 times the initial value of the option. This is how options can hedge “crash” risk, and indeed were able to do so during the COVID-19 pandemic. For other events, such as the gradual but protracted decline in the market in the 2007–2008 Global Financial Crisis, options with longer maturity would be more valuable since they give longer exposure and do not decay as quickly. In practice, portfolio managers can combine options with different strike prices and maturities. For example, suppose a portfolio manager is looking for a hedge that is maintained over time and has a 1 year horizon, and resets its strike prices partially as the market changes. The portfolio manager can buy a ladder of options of different maturities (e.g., 3 month, 6 month, 9 month, and 12 month options) each with one quarter of the notional using quarterly options expiration dates and replace expiring options with new 12 month options.

An important thing to remember is that there is a price for the convexity of these options. In the world of option trading, the convexity is known as “gamma”, and price is the time decay or “theta”. In essence, if the market status quo is maintained (meaning there are no significant changes in market levels or the volatility term structure), the value of the option will decrease over time, along with its effectiveness. So, if one month has elapsed then the price of the same option will fall to close to half its value (0.09%). Part of this change in value comes from the smaller time left to expiry, and part of the change comes from the implied volatility changing. The “potency” or the delta also decays as time passes (this is the effect of the higher-order Greek “charm” mentioned above). For example, after one month, the delta falls to only −0.02 or −2%, so now the equivalent market short position is only $2 million on this option. This is why to maintain a tail hedge a portfolio manager has to commit new capital periodically to extend the hedge. This is not dissimilar to renewal of an insurance policy where periodic premiums are needed to maintain coverage. Of course, at expiration if the market is not below the strike price, the value of the option is exactly zero, or the insurance/hedge will have expired worthless.

The difference between the implied volatility of at-the-money options and the out-of-the money options is called the “volatility skew”. When this illustration was created, the 20% out-of-the-money put volatility was almost twice the implied volatility for at-the-money options. Thus, another alternative to hedging with puts is to use a put-spread. In a put-spread the portfolio manager buys a higher strike put option and sells a lower strike put option. For example, the portfolio manager could buy a 5% out-of-the-money put for 0.95% premium (i.e., almost $950,000), and sell a 10% out-of-the-money put for 0.475% (i.e., $475,000) for a difference of approximately 0.475%. Note that the delta of the 5% out-of-the-money put is − 21, and the delta of the 10% out-of-the-money put is − 10, so the total delta of the put-spread is − 11. In other words, to obtain the same delta as the original 20% out-of-the-money put the portfolio manager only has to invest in roughly a third (to obtain the same delta as the original) notional in the put-spread, thus reducing the cost for the put-spread to 0.16% (0.475%/3), which is quite close but not the same as the price of the put.Footnote 5 However, the put-spread has a much different payoff profile than the put and can have very different sensitivities (“Greeks”). For instance, if the market falls a large amount within a short period and does not bounce back, the portfolio manager would have been better off buying a put rather than a put-spread. On the other hand, if the market falls only by a moderate amount between the upper and lower strikes of the put-spread then the portfolio manager would do better with a put-spread than with a put. Options traders run scenario shocks to quantify the difference between such structures and optimize their decisions to ensure that the desired outcome is achieved at the lowest price.

This illustration highlights several other important aspects of tail risk hedging using options. First, the selection of the instrument and sizing must match the underlying and the objectives must be specified. The objectives can be encapsulated in terms of the underlying (here the S&P 500), the “attachment point” (here the strike of 20%), the expiry (here 3 months), and the budget (here the premium spent of 0.17% per quarter). Since the prices of options vary highly with market conditions, one must solve for these three input variables simultaneously; under certain market conditions, it might not be possible to meet all the objectives. For instance, if one is budgeting only 0.50% per annum, and the desired attachment point is 10% for one year, it might be close to impossible to find a reliable hedge. In such conditions, the portfolio manager might have to compromise by either changing the expiry of the hedge, the strike of the hedges, the mix of hedges (to include indirect hedges, which introduce basis risk) or resorting to timing of the hedges. These all create the possibility of the hedge not performing as originally desired.

Another important aspect of tail hedging arises because the value of options goes up sharply when either markets fall, or volatility rises. As discussed above, the value of a hedge can go up a 100 fold if there is a very sharp fall in the market and a shock to volatility. In such events, a portfolio manager can monetize the options fully or partially and redeploy the monetization proceeds back into the markets. By doing so, the portfolio manager can generate liquidity to purchase assets when they are cheap.Footnote 6 Consequently, tail hedging cannot only protect but also result in systematic rebalancing with new liquidity that is very valuable to the portfolio manager. Thus, the cost of the tail-hedge must account for the opportunity it provides when such adverse events occur, and whether such opportunity can enhance long-term returns.

While options exist in many markets and there are essentially an infinite variety of combinations of instruments that a portfolio manager can use to hedge exposures, normally it makes sense to stick to liquid markets where hedges can be quickly monetized with low transactions cost. Also counterparty risk should be kept low because financial market distress is correlated with increased stress on counterparties. For this reason, listed options markets which are traded and cleared on exchanges have become popular for large institutional hedging programs. For instance, if the underlying equity index is the S&P 500, then using listed options on the S&P 500 index are appropriate to use for tail hedging. These options markets are quite popular, and options come in many expiration dates and strike prices. The quarterly expiry options are especially popular and liquid which expire on the third Friday of the expiration month. They are “European” style, so they can only be exercised on the expiration date, and trading on these options ceases on the business day before the option expiry. For these options, the multiplier is $100, meaning that the price of the option is multiplied by $100 to obtain the total premium per option contract. Purchasers of options with expiries less than 9 months must pay the full option premium at purchase. For each expiration date, many strike prices are listed, with strike prices spaced out every five S&P 500 points for the near months, and 25 points for far months. These options trade between 8:30 a.m. to 3:15 p.m. central time, and other “extended” and “curb” times. Finally, these options are cash-settled, which means that once the exercise settlement value (SET) is computed using the opening prices in the market for each component of the S&P 500 index, the exercise settlement amount paid to the buyer of the option is the difference between the exercise-settlement value and the exercise price of the option, multiplied by $100. The options prices are provided in real-time by many pricing services so portfolio managers can see in real-time what the value of their hedges is at the moment and how the total portfolio is doing in aggregate.

Finally, many options markets provide investors with a lot of different types of structures that can be used to reduce the premium cost. However, given the efficiency of the options markets, this cost reduction via creative structuring is rarely free, and investors should ensure that in order to obtain cost reduction they are not creating scenarios where they might not have a reliable hedge, or be obligated to meet capital calls or be exposed to unwanted risks. At the end of the day, the hedge itself should be designed to be cost effective, reliable, transparent, and add to the robustness of the underlying portfolio it is hedging.

Use of equity swaps

In a very general sense, a swap is an over-the-counter contract for one party to pay the economic value of owning a specified asset in exchange for the contract counterparty agreeing to pay the economic value of owning a different asset, over a specified time period. It is a seemingly simple contract that can, however, be modified extensively to include different assets, financing arrangements, settlement conditions, and time spans. Presented below is a discussion of a particular form of swap called an equity swap. The discussion includes an explanation of what they are, their applications, how are they priced and traded, and a real-world example.

How investors use equity swaps

At a glance, an equity swap is a financial derivative contract between two parties to exchange two sets of cash flows over a defined period. One cash flow is based on the performance of specific assets, like an equity index, a customized basket of equities, or even a single stock. The second cash flow is typically a fixed financing payment.

Equity swaps can be customized to suit the specific needs and investment objectives of the involved counterparties, including the choice of the equity index or specific equities, the type and tenor of the interest rate, and the period over which of the swap is in effect. Swaps are widely used by corporations, institutional investors, and hedge funds. Given such flexibility, equity swaps can be used for several purposes.

Speculation Speculators use equity swaps to bet on the future performance of a stock, or basket of stocks, without having to own the stocks. If an investor believes stock values will rise, they can enter a long swap position to receive equity performance and pay a fixed financing cost. If an investor believes stock values will fall, they can enter a short swap position to pay equity performance and receive a fixed financing rate of return.

Hedging Investors can use equity swaps to hedge against potential losses in their positions. If an investor holds a position in a particular stock and is concerned about a short-term decline in market value, they can enter a short equity swap position. The investor would be responsible for paying the equity performance. In return, they would receive the fixed financing payments. If the asset price falls, then the short swap position would receive both the financing payments and the absolute value of the stock’s decline. Given that they are hedging a preexisting investment, the use of the swap would be the economic equivalent of temporarily selling out of their existing stock investment. When the term of the swap is complete, it would then be the economic equivalent of buying the stock investment back. In this example, the swap is used to temporarily sell out of the equity investment, without actually doing so.

Asset Allocation Investors can use equity swaps to adjust their portfolio’s asset allocation without actually buying or selling the underlying securities. This can be particularly useful for large institutional investors looking to rebalance their portfolios efficiently or to temporarily change their exposure to certain asset classes.

Leverage Equity swaps can be used to achieve leverage in an investment portfolio. Swap investors often do not need to provide 100% of the capital for their swap investment value. They might only be asked to provide $2.5 million for a $10 million position, for example. This means that investors can gain a larger exposure to the equity markets than their capital investment would normally allow. This can amplify both gains and losses, making it a strategy with higher risk but potentially higher return.

Access to Restricted Markets Equity swaps can provide investors with exposure to markets or securities that are otherwise difficult to access due to regulatory restrictions, high entry costs, or other barriers. By entering into a swap with a counterparty that has access to these markets, investors can gain exposure to the returns of the desired assets without directly acquiring them.

Tax Efficiency In some jurisdictions, equity swaps can offer tax advantages. For example, using equity swaps can sometimes defer or reduce capital gains taxes compared to directly buying and selling the underlying equity. This is a more complex use of swaps that is beyond the scope of this discussion.

Income Generation Investors can use equity swaps to generate income by receiving regular interest payments. If an investor owns a basket of equities, they can enter into a short swap agreement as the interest rate owner, where the reference asset is the equity basket that they currently own. They now receive steady interest payments and avoid the volatility associated with their equity portfolio. This example has the same effect as the hedging transaction but is done with an income objective.

Operational Risk Management and Efficiency Portfolio managers can buy or sell a swap to improve operational efficiency. Equity swaps are frequently based on broad equity baskets or indices. Portfolio managers can transact in a single instrument (the swap) with a single price that is tied to the market value of a more complex and comprehensive basket of securities, rather than buying or selling and managing potentially hundreds of individual securities. Investing in an index directly could mean significant operational responsibilities in terms of accounting systems, risk systems, ongoing corporate action monitoring, ongoing index monitoring, and ongoing general maintenance. By entering into a swap, portfolio managers can rely on the trade execution infrastructure of a large, well-resourced trading counterparty such as major money-center bank or investment bank. If properly overseen by the portfolio manager, this can both reduce transaction costs and limit the scope for a trade being mishandled in the process of execution, booking, or maintenance. Maintenance of large stock positions, particularly when shorting a large basket of stocks, can be onerous and time consuming in that they require ongoing accounting adjustments associated with such things as stock splits and equity dividend payments.

Return Enhancement One use of swaps, to control operational risk while enhancing returns, is related to securities lending. Securities lending occurs when the owner of a stock (or other securities) temporarily lends it to a borrower. Financial institutions, such as hedge funds or investment banks, will typically borrow stocks for the purpose of selling them short, covering a failed trade, or hedging a long position. In return for lending out their securities, the owner of the stock receives a securities lending fee, which can enhance their overall returns for their investment portfolio.

Securities lending, however, introduces additional risks including counterparty risk and additional operational risk to name a few. Counterparty risk is introduced due to the possibility of a borrower defaulting on their obligation to return the borrowed securities. Operational risk occurs due to potential failures in processes, systems, or controls within the securities lending program such as errors in record-keeping, mismanagement of collateral, or failures in the management of corporate actions on the lent securities.

By making use of a swap to own the stock, rather than buying it directly, one can transfer the operational risks associated with securities lending to the swap counterparty, in exchange for sharing in some of the securities lending revenues. This allows for some degree of return enhancement from securities lending while eliminating much of the operational risk.

What is a swap: a deeper dive

The structure of an equity swap typically involves two legs, an equity leg and an interest rate or financing leg. It is, however, possible but less common, that both legs involve equities. For a typical example of an equity swap, see Figure 4.

The equity leg is tied to the return of a specific equity or basket of equities. The returns include both the capital gains or losses due to price appreciation or depreciation, and dividends from the underlying equity or equity basket. The investor in this leg of the swap benefits from the performance of the selected equities, receiving the returns as if they owned the underlying assets directly.

The interest rate or financing leg is typically linked to an interest rate that may be fixed or floating. The cash flows on this leg are determined by applying the agreed-upon interest rate to a notional principal amount, i.e., the dollar value of the selected equity or equity basket at the start of the contract. The interest rate is typically tied to a benchmark rate such as the Secured Overnight Funding Rate (SOFR) or the Federal Funds rate, but it could, in rarer cases, be tied a longer maturity fixed income asset. The investor in this leg of the swap typically receives a cash flow based on the principal value of the equity asset and the applicable interest rate. Note a longer duration fixed-income reference asset could produce a capital loss for the owner of this leg if interest rates were to move higher. Similarly, if interest rates are negative then the owner of the interest rate leg would have a negative cash flow.

At the heart of an equity swap is the exchange of these two sets of cash flows without the need for either party to hold the underlying assets. This allows swap investors to gain exposure to, or hedge against, the performance of equity markets, manage interest rate risk, or achieve specific financial objectives without the complexities and costs associated with direct investment or additional financing arrangements.

Swaps: nomenclature and mechanics

The acronym “ISDA” stands for the International Swaps and Derivatives Association (ISDA), which is a trade organization that was founded in 1985 to represent participants in the derivatives market, including banks, investment managers, government and supranational entities, insurance companies, and corporations. The organization, known as ISDA, is most famous for its role in creating standardized contracts for derivatives transactions, such as the ISDA Master Agreement, typically referred to as “the ISDA,” which is used globally to govern over-the-counter (OTC) derivatives transactions, such as equity swaps.

The two primary documents governing a swap transaction are the ISDA Master Agreement and the Schedule and Credit Support Annex (CSA).

The ISDA Master Agreement is a standardized document that outlines the terms and conditions between two parties engaging in an OTC derivatives swap transaction. This agreement aims to reduce legal and credit risk by providing a comprehensive legal and documentation framework. The key components and important terms of the ISDA Master Agreement include:

-

Definitions and Interpretations This section provides precise definitions of terms used throughout the agreement, ensuring clarity and consistency in interpretation.

-

Representations and Warranties Both parties make certain representations and warranties regarding their legal capacity, authority, and compliance with laws and regulations to enter into transactions.

-

Covenants These are the ongoing obligations of the parties during the life of the agreement, such as the obligation to provide timely notice of certain events.

-

Events of Default and Termination Events This crucial section lists conditions under which one party may terminate the agreement due to the other party’s failure to perform its obligations or other specified events, such as bankruptcy or failure to pay.

-

Closeout and Netting This portion of the agreement provides mechanisms for calculating and netting off obligations in the event of a termination. This process reduces credit risk by allowing the non-defaulting party to offset positive and negative exposures to the defaulting party.

-

Transfer and Assignment Terms under which parties may or may not assign their rights and obligations under the agreement to third parties.

-

Governing Law and Jurisdiction Specifies the law governing the agreement and the jurisdiction for resolving disputes.

-

Taxation Outlines the parties’ responsibilities concerning the withholding and payment of taxes.

-

In addition to the Master Agreement, parties typically complete a schedule that specifies additional terms, elections, and amendments to the Master Agreement to tailor it to their specific transaction that is known as the Schedule and Credit Support Annex (CSA). The CSA defines such items as eligible collateral, collateral valuation, and daily margin guidelines.

Important features of an ISDA

The ISDA Master Agreement governs the exchange of cash flows between parties, typically covering issues related to the performance of an equity investment (like a stock or a basket of stocks) versus a fixed or floating interest rate. Important considerations specific to equity swaps might include:

-

Equity Definitions The agreement might include specific definitions related to equity swaps, such as how dividends and stock splits are treated.

-

Valuation and Payment Dates The agreement will specify how and when the equity and interest components of the swap are valued and when payments are due.

-

Termination and Early Termination Conditions under which the equity swap can be terminated early, and how the termination amount is calculated.

The ISDA Master Agreement and its associated documents provide a robust framework that helps manage the potentially complex risks associated with equity swaps. Now let’s consider a real-world example.

Swap example

A portfolio manager (PM) wishes to capture exposure to the MSCI Daily Total Return Gross Small Cap World USD. This index is created by investment index provider MSCI. MSCI maintains numerous indices by identifying ordinary and preferred shares, share equivalents, and real estate investment trusts that are investable, accessible to global investors, and sufficiently liquid, and then creates identifiable indexes that investors can analyze, track, and invest in. Their indexes can be broadly based or categorized into geographies, sizes, sectors, industries, themes, or combinations thereof. In this example, the PM wishes to capture the total return of global small cap equities. There are about 4150 securities in the index covering the 85th–99th percentiles of free float market capitalization in 23 developed global markets. The index is denominated in US dollars. The index is theoretical and not directly investable. An investor can attempt to capture the index performance by purchasing and managing the 4150 index constituents directly or by purchasing a mutual fund, ETF, or derivative instrument that aims to track the index.

In the example presented below, a PM enters a swap transaction with a broker dealer (BD) whereby the BD agrees to pay the performance of the index (the equity, i.e., floating leg) and the PM agrees to pay a financing cost (the interest rate, i.e., fixed leg). Simply put, the PM gets long an equity index, in this case the MSCI World Small Cap Total Return Index and does so through the use of a swap.

The swap agreement that’s entered into is governed by two key documents, an ISDA and an associated CSA. The details of these contracts are negotiated prior to initiating the investment and include the specification of an equity index, a financing benchmark, a financing spreadFootnote 7, index pricing, execution fees, initial and variation margin, and the duration of the agreement.

The case presented in Table 8 is a sample real-world swap investment that was initiated on August 31, 2022, and closed on September 30, 2022. The initial (opening) terms and pricing are shown in the section titled “TRADE OPEN.” The closing details of the swap investment are presented under “TRADE CLOSE.” In both cases there is a trade date (when the transaction occurred), a settlement date (when all relevant transfers of assets are completed), and all transactions costs and pricing information.

In the section titled “TRADE LIFECYCLE,” the details are provided concerning all of the various required cash flows related to the initiation, maintenance, and closure of the swap. Cash flows related to the maintenance of the swap will depend on the ongoing performance of the swap. In very simple terms, if the swap is profitable then the BD will send money to the investor, if it is unprofitable then the PM will send more money (post more collateral) to the BD.

Finally, toward the end of the TRADE LIFECYCLE section, the calculation of the net returns of the investment is presented.

In this example, the PM sustained a loss of approximately $2.35 million. Let’s hope this was a hedging transaction!

Portfolio application

This sample application makes use of an equity swap to augment an equity portfolio that replicates the S&P 500 Total Return Index, by introducing a small-cap factor tilt while respecting a specified tracking error relative to the S&P 500 Total Return Index. An investor might choose to do this if, for example, they believe that the introduction of the so-called Fama-French risk factor “Size” will serve to improve their returns and help them systematically beat their S&P500 benchmark over time. In this example, the manager wishes to use the MSCI World Small Cap Total Return Index as a proxy for small cap stocks. As noted above however, this index includes some 4150 different stocks across 23 global markets, so the manager decides to use an equity swap to make the allocation more operationally tractable.

Our portfolio manager is, however, assumed to be bound by a decision that requires that the resulting portfolio not vary too substantially from a specified strategic benchmark.

The degree of variation of the portfolio, relative to its benchmark, is assumed to be capped and quantified by its “tracking error.” The tracking error for an S&P 500 Total Return portfolio, augmented by an allocation to the MSCI World Small Cap Total Return Index, relative to its S&P 500 Total Return benchmark would be given by:

where \({w}_{1}\) and \({w}_{2}\) are the respective portfolio weights, \({w}_{1}\ge 0 \text{and } {w}_{2}\ge 0\), \({w}_{1}+{w}_{2}=1\), and \(SP500TR\) and \(MSCWTR\) are the respective daily returns of the two equity indices.

The tracking error of a portfolio relative to its benchmark is therefore the standard deviation of the differences between the daily returns of the newly created portfolio and the daily returns of the benchmark.

In this application, the portfolio manager wishes to cap the tracking error at 5%. The tracking error constraint is enforced by the inequality: \(0.05-TE\ge 0\). This ensures that the tracking error of the newly created portfolio does not exceed 5%, thereby maintaining close performance relative to the SP500TR. In the online supplement, code is provided that solves for \({w}_{1} \text{and} {w}_{2}\), that makes use of an optimizer.

The result of this optimization is a portfolio where approximately 92% of it remains allocated to the S&P500TR, while approximately 8% is allocated to a global small cap index. The resulting portfolio can now theoretically benefit from a factor tilt toward a well-documented risk factor exposure while maintaining an acceptable degree of tracking error relative to a strategic asset allocation decision. The manager of the portfolio makes use of an equity swap to simplify a potentially operationally complex asset-allocation decision.

Consumer mortgage portfolio hedging with interest rate swaps

This case study demonstrates how the treasurer of a banking institution, specifically a credit union, may choose to hedge the fair value of the institution’s mortgage loan portfolio with interest rate swaps, and thereby mitigate interest rate risk arising from mismatched asset and liability durations for the overall balance sheet. The credit union for which this case study is written is Star One Credit Union based out of Sunnyvale, California.

Table 9 provides modeled durations for the various assets, liabilities, and equity of Star One Credit Union as of December 31, 2018.

The members’ equity line item is the value of assets less the value of liabilities (for both book and fair values. That is,

Total Assets − Total Liabilities = Members’ Equity

The members’ equity ratio is members’ equity divided by total assets; that is,

Members’ Equity/Total Assets = Members’ Equity Ratio

The estimated effective duration of equity is the difference between the assumed change in assets less the assumed change in liabilities as shown below:

(Duration of Assets \(\times \) Fair Value of Assets) − (Duration of Liabilities \(\times \) Fair Value of Liabilities)/Members Equity = Estimated Effective Duration of Equity

Star One’s balance sheet, as shown in Table 9, demonstrates liability sensitivity as of year-end 2018. Liability sensitivity refers to the shorter modeled duration of liabilities relative to assets; hence, liabilities are primed to reprice faster than assets given any degree of interest rate movement, and ultimately, the change in fair value will be less for liabilities than it will for assets under the assumptions that led to the durations in Table 9. Alternatively, if the duration of assets were shorter than the duration of liabilities, then we would refer to the balance sheet as asset sensitive. Given Star One’s interest rate risk profile shown in Table 9, a 100 basis-point increase in interest rates would result in a decrease of the fair value of equity of 3.49%.

The fair value of liabilities is often difficult to conceptualize. In an up-interest rate scenario with the objective of maximizing members’ equity, one would prefer larger liability durations relative to assets, which means the fair value of liabilities would decline faster than the fair value of assets, thus increasing members’ equity. The decline in fair value of liabilities suggests that the institution owes less than the implied book balance of liabilities from an economic perspective. In an alternative down rate scenario, a relatively larger overall liability duration means the fair value of liabilities (what is owed from a fair value perspective) increases faster than the fair value of assets, and therefore reduces the members’ equity position.

The reason why the treasurer of a depository institution may aim to keep relatively short asset durations is the sensitivity of the balance sheet to assumptions made for the non-maturing deposit portion of liabilities (members’ shares in Table 9), specifically, prepayment risk. As the regional banking turmoil of early 2023 demonstrated, non-maturing deposit liabilities may come due much earlier than expected and therefore demonstrate much shorter liability durations than may have been modeled under various assumptions. The estimated duration for member shares is very much based on how the institution’s depositors have behaved relative to prior interest rate moves; however, extreme interest rate moves, such as those observed in 2022 and 2023 provide a true test of assumed depositor behavior.

For the purpose of this case study, we may assume that Star One held no interest rate swaps as of December 31, 2018, and observe the impact of their hedge as of January 1, 2019. Table 10 shows the composition of Star One’s loan portfolio as of December 31, 2018.

Adjusting the duration of consumer mortgages with interest rate swaps

Star One uses the interest rate swaps to hedge the fair value of a significant portion of their fixed residential mortgage portfolio. Under Accounting Standards Update (ASU) 2017-12 (Derivatives and Hedging), Star One may pursue the direct hedging of specified fixed rate mortgage pools with the intent to mitigate interest rate risk of long-term, fixed real estate loans. As shown in Table 10, Star One held a consumer mortgage portfolio of $3.2 billion as of year-end 2018, and of this $3.2 billion, approximately $2.4 billion were fixed rate loans with maturities greater than 15 years.

The implementation of ASU 2017-12 provided significant flexibility with hedge accounting, and in Star One’s case, the Credit Union may assume perfect hedge effectiveness. Under the last-of-layer method of determining the hedged portfolio, Star One can identify a portion of its fixed rate mortgage portfolio “without having to incorporate the risks arising from prepayments, defaults, and other factors affecting the timing and amount of cash flows into the measurement of the hedged portfolio” according to prevailing financial accounting rules (FASB, 2).

Star one credit union policy targets

Credit unions engaging in derivatives transactions are expected to operate according to well documented policies and procedures commensurate with the risk profile of the activity and the institution.Footnote 8 Star One maintains two policy targets for its derivatives positions.

Hedge Ratio: A range of 80–100% with a target of 90%.

The hedge ratio is defined as hedging instruments (defined as borrowings and derivatives with the expressed intent of hedging long-term fixed rate loans) plus equity divided by total fixed real estate loans with original terms 15 years or greater and 10 years or lower from origination date.

Average Life Ratio: A range of 70–90% with a target of 80%.

The average life ratio is defined as the hedging instrument average life including equity (which is assumed to have an average life equal to that of real estate loans) divided by total fixed real estate loans average life.

Let’s assume Star One’s interest rate risk profile takes the form of that shown Table 9. With a total asset duration of 3.02 years exceeding the total liability duration of 2.94 years, the resulting duration of equity is 3.49 years. Hence, the fair value of equity will decline by 3.49% for a 100-basis point increase in interest rates. Alternatively, a 100-basis point decrease in interest rates would result in an increase in the fair value of equity of 3.49%. The risk to equity in this case is clearly in a rates-up environment.

Treasurers and those responsible for interest rate risk in depository institutions will typically acknowledge that their job is not to guess the change in interest rates, but rather, manage the assets and liabilities of the institution in a way that mitigates undue risk to owners’ equity. For this example, let’s assume that the duration of equity of 3.49% is too high for the institution’s risk appetite and needs to be adjusted downward to reduce equity volatility. One of the options available to Star One’s treasurer is to enter into pay fixed interest rate swaps, which essentially convert fixed assets to floating rate assets, thereby shortening the overall asset duration.

Given the preferred accounting treatment discussed previously, Star One seeks to hedge 30% to 40% of its long, fixed rate mortgage portfolio—the assumption being that 30–40% of loan production in any given period will last to maturity, and therefore, satisfy the “last of layer” accounting treatment.

Let’s assume that on January 1, 2019, Star One enters into $955 million of pay fixed swaps with an average duration of 6.0 years for the fixed leg to match the duration of the mortgage assets being hedged. The receive floating leg resets quarterly against the Secured Overnight Financing Rate (SOFR), and the resulting duration is very short, approximately 0.25. With 40% of the long duration, fixed rate mortgages swapped to floating rate, loan portfolio and balance sheet durations take the form of those shown in Table 11.

The iteration of duration adjustments due to the added swap positions is as follows:

-

1.

The long-dated, fixed rate mortgage portfolio duration is reduced from 6.0 to 3.67 years against a fair value balance of $2.1 billion; this reduces the total mortgage portfolio duration from 5.3 to 3.6 years against a fair value balance of $2.9 billion.

-

2.

The reduction in mortgage portfolio duration reduces overall loan portfolio duration from 4.71 to 3.34 years.

-

3.

The lower overall loan portfolio duration results in total weighted average asset duration of 2.42 years versus the pre-swapped asset duration of 3.04 years.

-

4.

The total asset duration of 2.42 years is now less than the total liability duration of 2.94 years, and the resulting net members’ equity duration is (0.70) years. Thus, a change in interest rates will result in a materially reduced impact on the fair value of equity.

The $955 million of pay fixed swaps placed against long duration, fixed rate mortgage assets reduce equity duration from 3.49 years to (0.70) years. The risk to equity given interest rate volatility has been significantly reduced, and the institution transitions from a liability sensitive position to an asset sensitive position.

The previous example assumed Star One entered into the $955 million of notional swap positions as of a single point in time, but in practice, Star One enters into new pay fixed contracts quarterly depending on the amount of long duration, fixed rate mortgage production as well as the overall change in the cash flow characteristics of the mortgage portfolio.

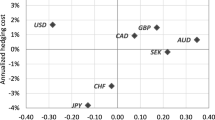

Table 12 shows historical trends for Star One’s fixed mortgage hedging program inclusive of interest rate swaps. The hedge ratioFootnote 9 and the average life ratio are shown in bold. Figure 5 shows how well the fair value of Star One’s interest rate swap positions move opposite of like duration U.S. Treasury yields, a proxy for the offsetting fair value decline of Star One’s fixed mortgage portfolio. Similarly, Figure 6 shows the fair value of Star One’s interest rate swap positions relative to the value of the Bloomberg U.S. Mortgage-Backed Security (MBS) Index.

Under the accounting treatment discussed previously, there is no mark-to-market impact on Star One’s income statement since the hedge is assumed to be perfectly effective, and the net mark between the derivatives and the assets is assumed to be zero. However, the net coupon spread between the pay fixed and receive floating legs of the swaps do run through the income statement with an adjustment to loan interest income. Star One’s consistent and systematic hedging of its long duration, fixed residential mortgage portfolio helped to protect a large portion of its net interest income when interest rates rapidly increased in 2022 and 2023.

Figure 7 shows the high-level income statement impact of the net swap coupon spread relative to total net interest income. As funding costs rose significantly in 2022 and 2023, Star One benefited from the floating leg of the swaps since the coupon rose right along with short-term interest rates (see the Receive Floating Interest Rate Column in Table 12 for 2022 and 2023). As of Q4 2023, the net coupon spread income from Star One’s interest rate swaps provided approximately 66.7% of Star One’s net interest income. Without the swap positions, Star One’s net interest income would have struggled to remain positive in the latter half of 2023. This income benefit is a direct realization of the adjusted balance sheet durations because of the interest rate swaps. The ability to reprice assets faster in the rising rate environment helped to offset higher funding costs on the liability side of the balance sheet.

Most financial institutions continue to grapple with much higher funding costs while unable to reprice long-duration assets originated during the historically low interest rate environment. Institutions such as Star One have been able to navigate the uncertainty with much more flexibility due to their consistent and prudent risk management of interest rate risk. Although hedging reduces upside opportunity while also reducing downside risk, Star One’s hedge program provides an excellent example of how prudent risk management over the long run helps to ensure an institution remains a going concern through volatile economic environments.

Summary

In this article, we provide strategic uses of derivatives to control and mitigate portfolio risks. The first shows the application of stock index futures and put options for hedging equity. This includes a detailed example where an equity portfolio manager employs futures and options to balance portfolio beta relative to a benchmark index, illustrating how derivatives can be tailored to specific portfolio needs while reducing market exposure.

The second illustration involves U.S. Treasury futures to adjust the interest-rate risk of bond portfolios. The methodologies for employing Treasury futures to manage duration and interest-rate sensitivity provides a practical guide for portfolio managers to align their portfolios with interest-rate expectations.

The application of options for tail risk hedging is then demonstrated. How options can protect against rare but severe market movements, thus adding a layer of security to investment strategies is explained. This application highlights the flexibility of options in portfolio management, allowing for customized risk management approaches based on specific portfolio characteristics and risk tolerance.

The use of equity swaps in active equity portfolio management is then covered. The mechanics of equity swaps and their use in gaining exposure to market indices or specific sectors without direct investment, thus enhancing portfolio diversification and managing specific equity risks effectively is demonstrated.

The final illustration focuses on how treasurers of credit unions can employ interest-rate swaps to hedge against the interest-rate risk of consumer mortgage portfolios. This case is particularly insightful as it lays out a scenario where a credit union might use swaps to stabilize income from interest payments by exchanging payments on a variable-rate basis for payments on a fixed-rate payment basis. This strategy is crucial for managing the financial stability of institutions that have significant exposures to loans with fluctuating interest rates, ensuring consistent income regardless of market volatility.

Notes

The hypothetical portfolio used in this mini-case is based on the top 50 names of a T. Rowe Price portfolio as of February 28, 2020, renormalized to have a market value of $150 MN. Additionally, a 5% cash allocation was added to facilitate the illustration. Betas were estimated using historical data between 2016 and February 28, 2020 using historical returns. Futures prices come from Bloomberg and option pricing is from OptionMetrics.

For instance, during the 2008-2010 financial crisis, portfolio managers who had overweight credit exposure suffered when credit spreads widened. On the other hand, when inflation suddenly increased in 2021 and 2022, portfolio managers who had been relying on bond markets to diversify their portfolios suffered from sharply rising bond yields. During the COVID-19 pandemic, the sudden decline in equity markets, especially in March 2020, created a significant adverse tail event for equity markets in general.

During the COVID-19 crisis, the S&P 500 dropped from approximately 3400 to a low of 2200, an almost 35% decline from peak to trough in approximately one month from the middle of February 2020 to the middle of March 2020.

For example, during the one month from February 2020 to March 2020, implied volatility as measured by the CBOE Volatility Index (VIX) rose sharply from 20 to 80, a four-fold increase.

We should emphasize that the delta of deeply out of the money options can be quite sensitive to the inputs and the model that is used, and especially for tail-hedging applications, many of the assumptions underlying the Black-Scholes model are violated, such as the assumption that the returns are normally distributed. So, care is required in the use of the models for such applications.

For instance, during the COVID-19 crisis, any monetization performed in the middle of March 2020 could be redeployed into the equity markets. As the Federal Reserve provided massive amounts of liquidity and purchased assets, the market rallied sharply and resulted in substantial gains.

Typically, when an interest rate is specified, the holder of the equity leg pays that interest rate plus some additional amount known as the spread, for example SOFR plus 50 basis points.

Code of Federal Regulations. (2024, February 1). 12 CFR 703.106—Operational support requirements. https://www.ecfr.gov/current/title-12/part-703/section-703.106.

As of this writing, Star One’s hedge ratio target range is 80% to 100%; however, this range has evolved over time and had at one time been 70% to 90%.

References

Bhansali, V. 2014. Tail Risk Hedging: Creating Robust Portfolios for Volatile Markets, McGraw-Hill, New York

Financial Accounting Standards Board. (2017). Accounting Standards Update No. 2017-12—Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not necessarily reflect the official policy or position of any other agency, organization, employer, or company, including the authors’ employer in the asset management industry. The information provided in this article is for general informational purposes only and should not be construed as legal, tax, investment, financial, or other professional advice.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bhansali, V., Fabozzi, F.J., Harlow, R. et al. Applications of derivatives for portfolio risk management. J Asset Manag (2024). https://doi.org/10.1057/s41260-024-00365-0

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41260-024-00365-0