Abstract

We extend proxies of several popular asset allocation approaches—U.S. and Global 60/40, Diversified Multi-Asset, Risk Parity, Endowment, Factor-Based, and Dynamic asset allocation—using long-run return data for a variety of sub-asset classes and factors to test their long-term performance. We use equity and debt assets, commodities, alternatives, and indices to reconstruct the returns on allocation portfolios from 1926 to the present, the entire period for which comprehensive asset pricing data are available. We contribute to the existing literature by developing a laboratory for testing the performance of popular asset allocation strategies in a wide range of scenarios. We also aim to test the importance of the behavioral aspect of investment decisions for portfolio outcomes. In our framework, Factor-Based portfolios exhibit the best traditionally measured risk-adjusted returns over the long run. However, Dynamic asset allocation is most likely to reduce the risk of abandonment of the strategy by an investor and selling the portfolio in panic when they experience losses over their tolerance threshold, because the dynamic strategy exhibits lower expected drawdowns, even during severe market downturns. Across all strategies, risk-tolerant investors who rely on a longer history to set their expectations, whether based upon actual or extrapolated data, experience significantly better outcomes, particularly if their investment horizon includes times of crisis. This study informs portfolio managers, investment analysts, and advisors, as well as investors themselves, of the impact of information, persistence, and properties of various portfolio allocation methods on investment returns.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Asset owners often fail to remain invested in a specific asset allocation for the entire duration of their investment horizon. They often abandon their selected strategy and liquidate or de-risk their portfolios during turbulent times (see for example Goetzmann et al. (2000), Dahiya and Yermack (2018), and Hoopes et al. (2022)). This behavior results in a significant gap between time-weighted and dollar-weighted returns as supported among others by the studies of Barber and Odean (2000), Dichev (2007), and Dalbar (2017) report.

One of the drivers of this behavior is a lack of information about the true risk associated with the selected asset allocation strategy. When making investment decisions, naïve investors are often unaware of the long-term history of asset returns. They may have never encountered it firsthand and/or may have been advised to ignore the long-run data. As a result of this limited awareness, investors face return downside surprises that lie beyond their risk tolerance. Unlike short-term data, extended history can inform investors about potential crash risks embedded in portfolios and prepare them to withstand significant downturns. In this study, we explore the effect of long-run information availability on investment returns for different categories of investors over a variety of investment horizons, using seven popular portfolio allocation strategies: U.S. 60/40, Global 60/40, Diversified, Risk Parity, Endowment, Factor-Based, and Dynamic allocation.

This research question is important for portfolio managers, investment advisers, and individual investors. Too often, they perceive the data from distant history as obsolete or irrelevant to practical investment decisions. Therefore, more recent events tend to shape the collective narrative regarding market performance and crash risk (Goetzmann et al. 2022). Goetzmann et al. show that in 1987, the collective memory of the stock market crash of 1929 was not invoked by journalists until the day after the October 19 crash. Similarly, before the Great Recession of 2008, events of a magnitude comparable to the Great Depression were not seriously considered likely to reoccur. Consequently, relatively recent historical data are most often presented as the most relevant or even as an exhaustive record of the performance of an investment strategy. As a result, investors select portfolios under the assumption that recent history accurately represents the complete set of probable investment outcomes. If there is no stress period in recent and available history, investors’ view of an investment strategy is likely to be overly optimistic, which makes them overconfident ex ante. When investors then face unexpected adversity in the market, they are likely to succumb to the fear of a substantial or total loss of wealth and sell their portfolio during or around the market trough, conditional on their risk tolerance and ex post assessment of the riskiness of their portfolio.

Following Weber et al. (2013), we argue that investors’ awareness of the prior long-run distribution of returns improves their tolerance of market downturns. Understanding the distribution of the population of returns informs investors and creates more realistic perceptions of investment risks and expectations of investment returns. Campbell and Thompson (2008) likewise show that a reduction in the length of observed history introduces significant bias in an investor’s beliefs about expected risks. Malmendier (2021) argues that living through an actual drawdown is not the same as reading about a simulated drawdown from the distant past. However, greater awareness of historical negative outcomes still reduces the likelihood of a surprise for the informed investor. Thus, theoretical knowledge of the true distribution of returns may still mitigate the potential for an abrupt abandonment of an investment strategy during an unfavorable period.

We begin an empirical exploration of this topic with a study of nearly a century of reconstructed historical performance for several common portfolio allocation methods mentioned above. We begin our study with data from 1926, when comprehensive data series for asset pricing first became available. While still limited, the data from this period provide a quite comprehensive laboratory to study the investment environment relevant to the present time. It covers the landscape of the financial system that is fairly similar to current conditions. It also includes periods of significant disturbance in the markets, such as the Great Depression, the time around World War II, the inflationary period of the 1970s–1980s, and the Great Recession. We show how the popular asset allocation frameworks differ in their risks and returns over the past century, especially concerning the most extreme losses (drawdowns). Many of the strategies diversify sources of return, rather than sources of risk. The growth in popularity of one or another strategy compared to the rest usually follows its periods of strongest performance. Information about each strategy’s potential maximum drawdowns over longer time frames (i.e., Risk Parity circa 2011) is often unavailable or disregarded.

We show that the Dynamic allocation strategy produces the most stable portfolios in periods of both extreme drawdowns and those of lower volatility. It promotes greater consistency and resilience in investor behavior. Some asset allocation strategies perform better than others depending on market conditions. However, during a significant market downturn, such as the one experienced during the Great Depression and, more recently, during the Financial Crisis of 2007–2009, most allocations undergo a synchronous decline. Significant downturns also lead to crashes in the popular factors, such as Momentum in 2009 (Daniel and Moskowitz 2016), and Value in 2020 (Samonov 2020, 2021). However, Factor-Based asset allocation is shown to be successful at reducing drawdowns during such periods, but its returns over the last 20 years have not performed as well as they did before that period. The extended underperformance of popular factors coincident with their rise in popularity raises the question of whether factors are reliable risk premia. If they are instead anomalies, and their returns are liable to disappear due to crowding, their betas are unreliable from the long-run asset allocation perspective.

We form portfolios in each of the seven strategies with investment horizons ranging from five to forty years. The boundaries of the range may be associated with medium-term individual investments like saving for a significant consumption goal (five years) and saving for retirement (forty years). We focus on the investors who are expected to retire around the time of the Great Recession and start in 1970, 40 years before 2010. The paper presents summarized outcomes over five- through forty-year investment horizons in simulated portfolios for risk-averse, risk-neutral, and risk-tolerant investors with data availability ranging from the most recent ten years to the full scope of history available, starting in 1926.

Our study informs academics and practitioners regarding long-term performance of the allocation strategies and helps develop more accurate beliefs about return distributions. We show that availability of information is associated with a lower probability of early abandonment of a strategy and higher cumulative returns. Additionally, persistent investors avoids both losses related to exiting at the wrong time and the need to make a subsequent choice of time for re-entry. However, only risk-tolerant investors capture the full extent of the benefit of the information made available to them. In the end, all investors face drawdown risk, regardless of their selected asset allocation strategy. However, investment outcomes are better for more informed investors and those who choose to invest using Dynamic asset allocation.

This paper also includes a survey of the relevant literature, defines a model of an investor’s decision to exit their strategy, explains the construction of the asset allocation portfolios, discusses the empirical distributions of returns and risk metrics for the popular investment strategies, and demonstrates the implications of the availability of prior information about investment losses to the investors for their exit decisions and returns on investment.

Literature

A vast literature defines investors’ behavior as a significant determinant of investment outcomes. De Bondt and Thaler (1985) document substantial overreaction to dramatic news events and further confirm in De Bondt et al. (1987) that even seasonal trading anomalies are associated with the past performance of the asset returns that drive behavioral trading. Furthermore, De Bondt and Werner (1998) depict noise trading by naïve investors as suboptimal in many ways and Barberis and Thaler (2003) elaborate on how investors may not be fully rational. Finally, Dichev (2007) and Dichev and Yu (2011) argue that investors typically do not achieve expected buy-and-hold returns due to the disruptive timing of their investments, in agreement with Barber and Odean (2000), who previously highlighted the detrimental impact of active trading on investors’ wealth. Friesen and Sapp (2007) and Keswani and Stolin (2008) also show that the failure to achieve the possible buy-and-hold returns is a problem faced by institutional as well as retail investors.

The issue of wealth loss via the irrational active trading of individual investors reached a new level due to the greater availability of cheap and easy access to trading associated with the rise of new platforms like Robinhood (Barber et al. 2022). Additionally, Hoopes et al. (2022) confirm significant individual trading in response to bad news during the financial crisis of 2007–2009, highlighting the detrimental impact of frequent trading on individual wealth. Such behavior is consistent with Jorion and Goetzmann’s (2000) assertion that, during market crashes, investors may rationally doubt the comeback of their portfolio.

Misperception of the riskiness of a portfolio is one of the key reasons why investors fail to hold on to an asset allocation strategy. We concur with Weber et al. (2013) and Weber and Klement (2018), who decouple the pure attitudinal and generally static variable of the willingness to take risk from the dynamic component of risk-taking, which is driven by the perception of asset riskiness. In their framework, an investor’s perception of risk is a dynamic variable that changes with market conditions, resulting in unplanned buying and selling decisions.

Risk perception varies with the market cycle and, especially, deviates from its typical levels during rare and extreme downturn events (see Bogle’s (2008) explanation of the importance of black swan events, and Van Hemert et al.’s (2020) discussion of the relevance of various risk measures), so many investors do not have direct experience of living through extreme troughs. This renders them generally underinformed when forming their views and committing to an investment strategy. Recent studies of the long-term history of Factor-Based allocations highlight the relevance and value of distant history in asset-pricing research. Baltussen et al. (2021) find strong and unexplained global factor premiums in a sample that covers over 200 years, like Geczy and Samonov (2016), who show a persistence of momentum in a two-century-long history of performance in different classes of assets. Importantly, these studies highlight periodic large-factor crashes with frequencies unseen in post-1926 histories.

Conveying long-run information effectively to an investor at the time of the selection of an allocation strategy may be challenging. However, a growing body of literature suggests that a wealth-loss measure, such as drawdown, is an important risk measure. This illustrative measure of risk helps investors envision the bad, the worse, and the ugly of market correction events. Drawdown is an intuitive metric and may be more predictive of investor’s behavior and therefore their outcomes compared to other metrics traditionally used in the literature and asset allocation practice. An unpopular risk measure in the past (Chekhlov et al. (2004) is a rare example at the time), drawdowns seem to have gained popularity and appear in Gray and Vogel (2013), Goldberg and Mahmoud (2017), Rodosthenous and Zhang (2020), and Van Hemert et al. (2020) more recently. Harvey et al. (2019) employ drawdowns to explore making traditional asset allocation portfolios crash-proof, including Factor-Based and Dynamic approaches.

In the context of protection from drawdowns, the Dynamic asset allocation strategy stands out in multiple studies, including many of the most recent (see Perold and Sharpe 1988; Brennan and Xia 2002; Liu et al. 2003; Faber 2007; Blitz and van Vliet 2009; Keller et al. 2015; Giamouridis et al. 2017; Page 2020; and Ha and Fabozzi 2022, just to name a few). However, the Dynamic approach is still underappreciated relative to the traditional 60/40, Risk Parity (Chaves et al. 2011; Qian 2011; and Fabozzi et al. 2021), Endowment (Jacobs and Kobor 2021 and Lo et al. 2020), and Factor-Based allocations (Clarke, et al. 2020; Bessler et al. 2021; Kritzman 2021; Ilmanen 2022; Canner et al. 1994; and Campbell et al. 2002). The debate over the performance and risk of various asset allocation strategies is critical for understanding investment outcomes (see most importantly Sharpe 1992; Kandel and Stambaugh 1996; Ibbotson 2010; and more recently Bessler, et al. 2021), yet it is still underrepresented in the academic literature.

Our research contributes to the existing literature in multiple dimensions. First, it provides risk and return analysis of the long-term history of the most popular allocation strategies. Further, it tests the empirical outcomes of hypothetical investors with stationary risk aversion and time-varying perceptions of risk under various levels of prior information and over a range of investment horizons. Finally, the paper develops a framework that bridges traditional investment analysis and behavioral aspects of investment decisions. Thus, we extend and integrate the following strands: the literature on the failure to realize buy-and-hold returns due to irrational trading (selloff) decisions, the literature on extraordinarily long time series in investment analysis, and the literature on drawdown as an important risk measure. We build a model of investor behavior under the conditions of varying perceptions of risk and self-limited information and demonstrate empirically how risk-tolerant and well-informed investors fare best in achieving their maximum returns. We also show how the Dynamic model stands out among other allocation strategies in terms of risk and return performance during the past century.

Model

We model investors’ decisions to abandon their portfolios in a market crisis as a function of (1) ex ante information about the worst-case scenario that they may experience either through direct exposure or historical data; (2) their risk aversion; and (3) the ex post portfolio risk measured as drawdown (wealth loss from the level of initial investment) realized during the market downturn. The main assumptions of the model are as follows: (1) investors are rational with stationary risk aversion known ex ante; (2) there are no frictions in the markets, such as transaction costs, taxes, inflation, short-selling restrictions; (3) markets are highly efficient, all investors having equal access to all available information and the ability to choose the length of the data history that they use in their analysis when committing to an allocation strategy; (4) investor have unlimited access to all assets; (5) distributions of the returns are normal and stationary.

Investors commit to their portfolios with an ex ante understanding of the maximum possible loss for the type of allocation \(\theta_{ex - ante}\) that depends on two factors: the maximum drawdown observed in the historical data, D, to which the investor is exposed, and the stationary level of their risk aversion, τ

where To is the start of the investment period and To-n is the time n years before the start of the investment period. n is the length of the history that an investor chooses to include in their investment analysis.

Ex ante investors believe that they have perfect information about the possible future state of the market based on historically observed conditions; however, their actual perception of risk is time-varying in response to the dynamics of the fluctuating market environment, particularly for investors that use a shorter period of history for their analysis. When a crisis starts, risk perception (sentiment) φ is driven by the information on economic conditions Ei and market volatility \(\upsilon_{i}\), and possibly new information about returns distribution leading to an adjustment of the tolerable level of loss that becomes \(\theta_{ex - post}\).

When a shorter historical period is used for investment analysis at the time of commitment to a strategy, \(\theta_{ex - post}\) is more likely to be insufficient to withstand the crisis and trigger a decision to abandon the allocation strategy. Changing risk perception φ may lead to \(\theta_{ex - post} < \theta_{ex - ante}\) and exacerbate the issue, particularly for risk-averse and risk-neutral investors.

In this parsimonious model, we first focus solely on exit decisions and assume that investors do not re-enter the market after they exit in the downturn. Thus, the investor’s decision to sell is defined as follows:

where S is a dummy variable that represents the decision to sell on each day within the investor’s horizon. It is a function of \(\theta ex - post\), the actual drawdown threshold, defined above. Once an actual loss reaches \(\theta_{ex - post}\), the investor sells the portfolio (S=1).

At the time of commitment to an investment strategy, an investor is willing to accept a perceived return distribution based on the historical data for n years where \(E(R) \sim N(\overline{R} ,\sigma )\) and the maximum drawdown is \(D_{\max }\) that together with the level of risk tolerance defines \(\theta_{ex - ante}\). This perceived distribution is defined by the sample statistics of the historical data that the investor is willing to include in their analysis. However, during the downturn, the actual drawdown may exceed the historically observed maximum drawdown: \(D_{t} > D_{\max }\). As a result, the investor may sell early, and instead of the expected return over the entire investment horizon h, \(R_{h} = E(R) + \varepsilon\), realize return \(R_{r} = R_{t}\), where \(R_{r} < R_{h}\) is likely and results in a wealth loss represented by \(\theta_{ex - post}\).

As an extension to the standard framework, we recognize that after an early exit, an investor has the opportunity to improve their outcome by re-entering the market. In the augmented model, the investor re-enters once the market consistently surpasses the level of their exit point. Our investor in this case realizes an enhanced return \(R_{r + }\), where \(R_{r + } > R_{r}\) is likely.

Long-run data and portfolio construction methodology

In this study, we develop an extended historical data series to compare seven popular moderate-risk asset allocation frameworks: U.S. 60/40, Global 60/40, Diversified 60/40, Risk Parity, Endowment, Factor-Based, and Dynamic asset allocation. The portfolio allocation strategies are explained in detail in this section below and further in the Online AppendixFootnote 1. Of course, in practice, any asset allocator can decide to blend or tweak any of the above approaches. Our goal was to study simplified “corner cases” of moderate-risk approaches and create simple, yet generally accurate, versions of these allocation strategies.

For each asset class, we compare our proxy with the actual return data during the period for which both return series are available to ensure sufficient correlation. We rely on an extensive amount of data, including third-party data providers such as Global Financial Data (GFD), pre-computed data from Samonov and Geczy (2016), and data generated specifically for this study, as explained below. Our initial objective was to extend the essential sub-asset classes and factor portfolios back to January 1926, which allows for approximation and comparison. We choose 1926 as the start date because many of the data series from GFD and the Center for Research in Security Prices (CRSP) started at this time, and because this date conveniently precedes the Great Depression, a pivotal event that sets a conservative threshold for the maximum drawdown. Thus, we construct a dataset that provides a unique laboratory for testing the performance of modern asset allocation strategies in scenarios that have not occurred within the strategies’ actual history.

Our empirical work relies on current techniques in long-run data exploration, originally pioneered at the asset-class level by researchers like Schwert (1990), Dimson et al. (2002), Ibbotson and Goetzmann (2005), and Jordà et al. (2019), and by data providers like GFD. These techniques have been adopted and enhanced in much of the recent and growing literature extending popular factors, such as value and momentum (Asness et al. 2013; Geczy and Samonov 2016, 2017, 2019; and Baltussen et al. 2021).

A complete list of the extended asset classes, factors, and their proxies used in this study is given in Table 1, and detailed descriptions of the data sources and extrapolation methods are provided in the Online Appendix. In summary, we extend data for 23 sub-asset classes and 15 long-short factor portfolios. The word “custom” in Table 1 identifies all the extended time series that we construct specifically for this study, either from the underlying securities, using the bottom-up approach, or via statistical extrapolation beyond the standard splicing of existing indices.

The bulk of index-level data come from GFD. In addition to providing an excellent selection of third-party indices used in typical asset allocations, GFD also constructs proprietary indices that go much further back historically. GFD also provides centuries of returns and other data for individual stocks that have traded on US and UK exchanges. We are grateful for their work as it enables us to extend the starting period to the 1920s for most traditional asset classes.

The U.S. 60/40 allocation strategy is a simple combination of 60% U.S. Large Cap stocks and 40% U.S. Aggregate Bond Index, rebalanced monthly (Table 2). Most investors are familiar with this simple portfolio, and we use it as a starting point for our analysis. The Global 60/40 strategy uses a similar structure but consists of 60% Global Equities and 40% Global Aggregate Bond index, providing global diversification. The Diversified 60/40 strategy allocates 60% to high-level equity asset classes, distributing it among U.S. Large Cap (15%), and Small Cap (5%) stocks, Growth (5%), and Value (5%) stocks, REITs (5%), International Developed Stocks (10%), and Emerging Markets (10%). A remaining 34% is allocated to Fixed Income, with 8% in U.S. Government 10-year bonds, 8% in Munis, 8% in Investment Grade Corporate Bonds, 5% in International Bonds, and 5% in Emerging Market Bonds. The final 6% is allocated to Commodities. This mix represents a typical allocation, creating a representative diversified portfolio in which the primary risk comes from its equity allocation (see Brinson et al. 1986).

The Risk Parity approach became a popular alternative to traditional capital-weighted portfolios around 2011 (Qian 2011; Fabozzi et al. 2021). Instead of allocating capital weights, the Risk Parity approach proposes to allocate risk—portfolio variance—to different asset classes. This results in more balanced risk exposure across asset classes, solving the problem of over-concentrated exposure to equities in traditional capital-weighted portfolios. Our Risk Parity proxy allocates portfolio variance equally across U.S. Large Cap stocks (33.3%.), Government 10-Year Bonds (33.3%), and Commodities (33.3%), targeting the same ex post risk as the U.S. 60/40 portfolio (realized volatility: 11.4%). To achieve this volatility target, the portfolio requires leverage (57%), which we assume is financed at the 90-day T-bill borrowing rate. We have validated our proxy versus the HFR Institutional 10% Volatility Risk Parity Index, and the proxy demonstrates a high correlation (82%) and comparable drawdown metrics. Since the index’s inception in 2003, our proxy allocation generates 6.55% per year vs 6.15% for the HFR index. Furthermore, on the important metric of maximum drawdown, the proxy and the actual index perform similarly (25.6% drawdown for the proxy portfolio and 22.5% for the actual index). This gives us confidence that we have produced a reasonable proxy for the Risk Parity approach.

The Endowment strategy proxy employs high-level and sub-asset class weights from the 2020 NACUBO report, including allocations to various asset classes such as Public U.S. Equities, Private Equity, Venture Capital, Fixed Income, and Real Estate. By comparing returns to actual fiscal year returns reported in NACUBO, the proxy shows a 97.6% correlation since 2000, with slightly higher annualized returns and volatility comparable to actual endowments, resulting in very comparable Sharpe ratios of 0.47 for the proxy vs 0.44 for the actual Endowment allocation (for more detail, see Online Appendix).

The Factor-Based allocation combines 70% U.S. 60/40 with a 30% equally weighted 15 Factor Premia basket. We include this factor basket because it is uncorrelated with traditional asset classes and has lower volatility than the equity market, which results in meaningful downside-risk reduction. In practice, one might allow for leverage to scale up the volatility, introduce optimization across traditional and Factor-Based portfolios, and allow for greater diversification in the traditional asset classes. These may improve results, but the choice of parameters would be highly subjective. We prefer to remain as generic as possible without introducing too much customization, yet still capturing the main benefit of each approach.

The Dynamic portfolio can be constructed utilizing many combinations of factors (see, for example, Fama and French 1988; Vassalou and Xing 2003; Campbell and Thompson 2008; Harvey et al. 2018). However, in the spirit of “keeping things only as complicated as necessary,” we use a “vanilla” Dynamic asset allocation strategy with a combination of volatility targeting and momentum, following an approach described by Keller et al. (2015). Our proxy Dynamic portfolio divides allocation between U.S. Large Cap stocks and the U.S. Bond Aggregate and rebalances monthly using 5-year rolling covariance estimates to target the ex post volatility of the U.S. 60/40. The expected returns for the two asset classes are formed by using the trailing 11-month return, consistent with the literature on asset-class trends following Moskowitz et al. (2012). The quadratic mean–variance monthly optimization uses long-only weight constraints between 0 and 100% for each of the two asset classes, and a monthly turnover budget of 10%. This basic dynamic strategy is sufficient to demonstrate its potential to reduce drawdown.

All the returns mentioned above are computed on a pre-transaction cost basis. While transaction costs historically have been significant, their impact has been reduced in recent times. Thus, we disregard transaction costs to estimate forward-looking insights of risk and return based on historical data.

Results

Long-run performance of the allocation strategies

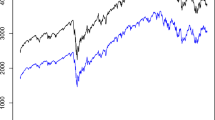

Figure 1 shows that the Endowment portfolio is the apparent leader in total returns, yet this style of allocation is not easy to replicate for the average investor or even portfolio manager because it requires a large scale, a stable funding base, and access to unique investment opportunities. Also, while the Endowment strategy outperformed all others in terms of cumulative returns, it exhibits periods of pronounced volatility, often at a greater magnitude than the others. Moreover, when we add the dimension of risk-adjusted performance via the Sharpe ratio, as shown in Table 3, we find that the Endowment approach is no longer the top performer. Even the classic US 60/40 produces competitive returns compared to other allocation strategies in this study, but the Factor-Based allocation is the most efficient from the standpoint of realized risk-return, followed by the Dynamic allocation. Dynamic allocation is the second-best performer on returns, and, unlike Factor-Based allocations, it performed well during the past quarter-century.

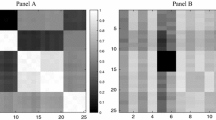

Further, when risk is measured as a drawdown, the relative attractiveness of the approaches changes once again. As noted, an important feature of nearly all the portfolios except the Factor-Based and Dynamic is their synchronous decline in value during major stock market downturns, such as the Great Depression, World War II, the stock market crash of the early 1970s, the Black Monday crisis in 1987 and, finally, the Great Recession. The maximum drawdown is as deep as 62% for the U.S. 60/40, and it can take nearly seven years to recover and reach the pre-crisis wealth level (Table 4). In fact, wealth losses of 15% or more occurred more than ten times over the past century in all portfolios except the Factor-Based and the Dynamic. Figure 2 shows how similar most portfolios are in terms of the frequency of drawdowns because of their response to crises.

These results may be surprising, unless one knows that the main risk associated with most of the portfolios comes from their allocations to stocks, which causes a correlated response to stock market crashes. Despite significant diversification in the dollar proportions of funds among various asset classes, there is little diversification in the source of risk. Dynamic allocation stands out sharply among the rest of the popular investment strategies, with only eight drawdowns of 15% or more, and just two of 25% or more, and a maximum drawdown of 26%. This is a very impressive result compared to the next lowest maximum drawdown, that of the Factor-Based portfolio at 44%. Dynamic allocation significantly reduces drawdown risk compared to all other allocations; however, this only becomes clear upon examining their complete long-run histories. In the next section, we explore how the possession of long-run versus only short-run data impacts investors’ behavior.

Wealth-loss tolerance and investment outcomes

Having examined the performance of various allocation strategies during mild and severe market downturns, we use the data to test our model of investor behavior empirically and illustrate how investors’ preparedness may improve investment outcomes across all the allocation strategies. Preparedness is proxied by the level of information (length of the chosen asset-allocation history sample) an investor considers when selecting their allocation strategy.

Our simulations include four levels of investor preparedness: the “least informed investor” sees only the 10 years immediately preceding the start of the investment period. This timeframe is commonly used by financial advisers when presenting the performance of a strategy. The “more informed” and “further informed” investors rely on a 25-year and 50-year history, respectively, and the “most informed” use the maximum available history. We also define three types of risk aversion: “risk-tolerant” investors do not sell their portfolios until (unless) the losses hit the maximum drawdown level observed in the historical data (i.e., the investor’s original threshold of tolerance); “risk-neutral” and “risk-averse” sell when losses hit 75% and 50% of the maximum observed drawdown, respectively.

We conduct tests for a range of investment horizons, including 5-, 10-, 20-, and 40-year rolling periods, starting in 1970 and ending in 2020. Each scenario in our analysis represents a unique combination of factors across four dimensions: the length of the observed history of portfolio returns, risk aversion, investment horizon, and the start year. Examples of simulated US 60/40 portfolios invested in 1970 for 40 years are explained in the Online Appendix for risk-tolerant, risk-neutral, and risk-averse investors with full and 10-year histories.

When we look at the range of the portfolios and the array of outcomes, we discover significant differences in each scenario based on the different levels of information available coupled with the investors’ risk aversion. The summaries for most strategies are provided in Tables 5, 6, 7, 8, and 9, and the data for the Global 60/40 and the Diversified allocation are available in the Online Appendix. The tables show averages for the following metrics: maximum observed drawdown from historical sample preceding the start year of investment; full-period buy-and-hold cumulative and annual returns, threshold drawdown that triggers exit, and actual, realized cumulative and annual returns for each combination of history length, investment horizon, and type of risk aversion within each strategy. Full-period returns serve as a benchmark for the actual investor’s return in each scenario. Ex ante, investors accept the observed levels of possible wealth loss as inferred from the available historical data. However, when exposed to significant drawdowns approaching the investor-specific threshold of tolerance, on average, across all portfolios, risk-tolerant investors with long-run information are most likely to realize the full-period buy-and-hold returns. Among allocation strategies, the best average performance for both long- and short-term investors is associated with the Endowment strategy, followed by the Dynamic allocation and the Risk Parity portfolios.

There is a clear disparity in the performance of more and less risk-tolerant investors, especially during times of deep crisis. Figure 3 helps illustrate the difference. It presents short-term (5-year) and long-term (40-year) portfolios by start year for risk-averse and risk-tolerant investors. On each graph, the solid line represents full-period buy-and-hold returns, the light-colored bars show actual returns for investors with prior beliefs based on the full history of returns, and the dark-colored bars show the actual returns for investors who use only short history. The contrast is stark for the performance of the most informed (maximum history used in developing priors) versus the least informed (only 10 years of history) and for risk-tolerant versus risk-averse investors. As we can see, regardless of risk tolerance levels, it is better to be informed. However, informed and risk-tolerant investors are most likely to enjoy the full benefit of the complete holding period. Informed investors do significantly better in all investment strategies because a longer history helps develop more realistic prior beliefs. The effect appears to be most critical for the Risk Parity and Dynamic portfolios (only Dynamic is presented in this paper to conserve space; data analogous to that in Fig. 3 for all other strategies are available in the Online Appendix). Finally, even the most risk-tolerant investors tend to fail to stay with the strategy when they have limited information.

Effect of information on the outcomes of investors: dynamic. Top-row charts show outcomes for the 5-year horizon while the bottom - for the 40-year horizon. Left-column charts show results for risk-averse investor while right-column chart show results for risk-tolerant investor. Each chart shows three data points over time: dark bar shows least informed investors total return; light bar shows the most informed investors total return, and dark line shows the full period possible total return

Discussion

Our simple model of investor behavior proves powerful when tested empirically. It shows how a lack of understanding of investment strategy upfront turns into a lack of commitment and leads investors to abandon their strategy. With an early exit at the time of a market trough, investors fail to realize their potential buy-and-hold returns over the entire investment horizon. Our model is based on the drawdown, an intuitive measure of risk that represents wealth loss. For empirical testing, we construct a unique dataset of returns for seven popular asset-allocation strategies and show how the use of a long history is important for understanding return distributions. Our study shows that risk-tolerant and well-informed investors are best equipped to navigate market downturns. It also revealed Dynamic allocation to be a low-risk high-performer. Our empirical results support the theoretical proposition of the negative impact of information withdrawal on wealth creation. The findings support those of Dichev (2007) and Dichev and Yu (2011) regarding the failure to achieve buy-and-hold returns. Our findings are also consistent with Hoopes et al. (2022) and Barber et al. (2022) regarding the detrimental impact of trading in response to stressful news. Like Harvey et al. (2019) and Van Hemert et al. (2020), we find the drawdown a very useful risk measure for a study of investor behavior. Finally, we agree with Baltussen et al. (2021) regarding the importance of long data series because they include rare but important events (Bogle 2008) that may be omitted when shorter histories are employed.

We recognize the limitations of this model, and in the next evolution, investors have an option to re-enter the market after withdrawal, once market conditions return to acceptable levels. We pilot-test the effect of re-entry on the outcome, assuming that investors reinvest once tolerable conditions persist. We define the time of reentry as the day when the 30-day moving average value of the portfolio surpasses the value of the portfolio at the time of exit and test the model using Dynamic portfolios. The results are provided in Table 10, and the evidence is overwhelmingly positive. Our findings support the value of re-entry. In most cases, on average, both cumulative and annualized returns are better than if investors do not re-enter, even though some periods include deep financial crises after re-entry. However, returns with temporary exits never surpass full-period returns, which underlines the importance of adherence to the originally chosen investment strategy.

However, we cannot assume with certainty that investors strictly follow the presumed threshold. Nor can we draw specific boundaries for a drift in risk/return expectations due to exposure to market sell-off close to the bottom level observed by investors, which may result in changes in the withdrawal threshold. We expect that exploration of the uncertainty of the withdrawal and re-entry thresholds with Monte-Carlo simulations will be valuable. It can be done in future research, assuming the actual threshold \(\theta_{ex - post} \sim N(\theta_{ex - ante} ,\sigma )\) for the risk-neutral investor, and \(\theta_{ex - post} \sim SN(\theta_{ex - ante} ,\sigma )\) for risk-tolerant (skew<0) and risk-averse (skew>0) investors. We also recognize the impact of economic and market conditions Ei and \(\upsilon_{i}\) on investors’ risk perception and assume that the impact is constant for the portfolios in the cross section. However, empirical testing of the impact over time is of interest and contributes to the development of the results obtained in this study.

Conclusions

In this paper, we aim to examine the effect of limited historical knowledge of asset allocation strategy performance when making investment decisions on investment outcomes. To achieve this goal, we build a unique dataset of returns on various classes of assets over the past century and reconstruct the performance of the prevalent asset allocation strategies for the period 1926–2020. Most strategies are prone to deep, frequent, and prolonged downturns in portfolio value (drawdowns) in the event of market crashes, which occur several times during the observed period. Only Factor-Based allocation offers a significant improvement over the others when it comes to a large-scale loss of wealth when markets approach their trough. Downturn events are infrequent, and thus, limited history often produces a skewed view of the actual distribution of returns. Thus, we find significant value in the long-term history of returns.

We also explore the performance of different strategies across different investors’ risk-tolerance levels and investment horizons. We use drawdowns as a risk measure and focus on the length of the history considered by the investors at the time of commitment to a strategy. Our findings show that risk-tolerant and well-informed investors achieve significantly better cumulative returns, and this success is attributed to the consideration of an extended historical sample when developing their prior beliefs about possible investment outcomes. On the contrary, investors who exhibit risk-neutral or risk-averse behavior, as well as those who rely on shorter-term history in developing their investment beliefs, more easily exit and lose out on returns. Furthermore, the performance of the Risk Parity and Dynamic portfolios relies most heavily on the extent of information available to investors across all investment horizons and regardless of risk tolerance. Thus, we successfully argue that reliance on extended historical data is associated with more accurate prior beliefs, which result in a lower probability of an early abandonment of allocation strategy and higher cumulative returns. However, only risk-tolerant investors are likely to capture the full benefit of long-run information.

Notes

The Online Appendix can be found at https://nonnasorokinaphd.org/century-crash-risk.

References

Asness, Clifford S., Tobias J. Moskowitz, and Lasse Heje Pedersen. 2013. Value and momentum everywhere. The Journal of Finance 68 (3): 929–985.

Baltussen, Guido, Laurens Swinkels, and Pim van Vliet. 2021. Global factor premiums. Journal of Financial EcoNomics 142 (3): 1128–1154.

Barber, Brad M., Xing Huang, Terrance Odean, and Christopher Schwarz. 2022. Attention-induced trading and returns: Evidence from Robinhood users. The Journal of Finance 77 (6): 3141–3190.

Barber, Brad M., and Terrance Odean. 2000. Trading is hazardous to your wealth: The common stock investment performance of individual investors. The Journal of Finance 55 (2): 773–806.

Barberis, Nicholas, and Richard Thaler. 2003. A survey of behavioral finance. Handbook of the Economics of Finance 1: 1053–1128.

Bessler, Wolfgang, Georgi Taushanov, and Dominik Wolff. 2021. Factor investing and asset allocation strategies: A comparison of factor versus sector optimization. Journal of Asset Management 22 (6): 488–506.

Blitz, David, and Pim van Vliet. Dynamic strategic asset allocation: Risk and return across economic regimes. Available at SSRN 1343063 (2009).

Bogle, John C. 2008. Black Monday and black swans. Financial Analysts Journal 64 (2): 30–40.

Brennan, Michael J., and Yihong Xia. 2002. Dynamic asset allocation under inflation. The Journal of Finance 57 (3): 1201–1238.

Brinson, Gary P., L. Randolph Hood, and Gilbert L. Beebower. 1986. Determinants of portfolio performance. Financial Analysts Journal 42 (4): 39–44.

Campbell, John Y., Luis M. Viceira, and Luis M. Viceira. Strategic asset allocation: Portfolio choice for long-term investors. Clarendon Lectures in Economic (2002).

Campbell, John Y., and Samuel B. Thompson. 2008. Predicting excess stock returns out of sample: Can anything beat the historical average?. The Review of Financial Studies 21 (4): 1509–1531.

Canner, Niko, N. Gregory Mankiw, and David N. Weil. An asset allocation puzzle. NBER Working Paper No. 4857. National Bureau of Economic Research (1994).

Chaves, Denis, et al. 2011. Risk parity portfolio vs. other asset allocation heuristic portfolios. The Journal of Investing 20 (1): 108–118.

Chekhlov, Alexei, Stanislav Uryasev, and Michael Zabarankin. Portfolio optimization with drawdown constraints. Supply Chain and Finance, 209–228 (2004).

Clarke, Roger, Harindra de Silva, and Steven Thorley. 2020. Risk management and the optimal combination of equity market factors. Financial Analysts Journal 76 (3): 57–79.

Dahiya, Sandeep, and David Yermack. Investment returns and distribution policies of non-profit endowment funds. No. w25323. National Bureau of Economic Research (2018).

Dalbar (2017) Quantitative analysis of investor behavior, 23rd Annual. Advisor Edition.

Daniel, Kent, and Tobias J. Moskowitz. 2016. Momentum crashes. Journal of Financial Economics 122 (2): 221–247.

de Bondt, Werner FM., and Richard Thaler. 1985. Does the stock market overreact?. The Journal of Finance 40 (3): 793–805.

Dichev, Ilia D. 2007. What are stock investors’ actual historical returns? Evidence from dollar-weighted returns. American Economic Review 97 (1): 386–401.

Dichev, Ilia D., and Gwen Yu. 2011. Higher risk, lower returns: What hedge fund investors really earn.". Journal of Financial Economics 100 (2): 248–263.

Dimson, Elroy, Paul Marsh, and Mike Staunton. Long-run global capital market returns and risk premia. Available at SSRN 299335 (2002).

Faber, M. T., A quantitative approach to tactical asset allocation. Journal of Wealth Management (2007).

Fabozzi, Francesco A., Joseph Simonian, and Frank J. Fabozzi. 2021. Risk parity: The democratization of risk in asset allocation. The Journal of Portfolio Management 47 (5): 41–50.

Fama, Eugene F., and Kenneth R. French. 1988. Dividend yields and expected stock returns. Journal of Financial Economics 22 (1): 3–25.

Friesen, Geoffrey C., and Travis R. A. Sapp. 2007. Mutual fund flows and investor returns: An empirical examination of fund investor timing ability. Journal of Banking & Finance 31 (9): 2796–2816.

Geczy, Christopher, and Mikhail Samonov. Two centuries of multi-asset momentum (equities, bonds, currencies, commodities, sectors and stocks). Available at SSRN 2607730 (2017).

Geczy, Christopher, and Mikhail Samonov. Two centuries of commodity futures premia: Momentum, value and basis. Value and Basis (2019).

Geczy, Christopher C., and Mikhail Samonov. 2016. Two centuries of price-return momentum. Financial Analysts Journal 72 (5): 32–56.

Giamouridis, Daniel, Athanasios Sakkas, and Nikolaos Tessaromatis. 2017. Dynamic asset allocation with liabilities. European Financial Management 23 (2): 254–291.

Goetzmann, William N., Massimo Massa, and K. Geert Rouwenhorst. Behavioral Factors in Mutual Fund Flows. INSEAD (2000).

Goetzmann, William N., Dasol Kim, and Robert J. Shiller. Crash Narratives. No. w30195. National Bureau of Economic Research (2022).

Goldberg, Lisa R., and Ola Mahmoud. 2017. Drawdown: From practice to theory and back again. Mathematics and Financial Economics 11: 275–297.

Gray, Wesley R., and Jack Vogel. Using maximum drawdowns to capture tail risk. Available at SSRN 2226689 (2013).

Ha, Seokkeun, and Frank J. Fabozzi. 2022. Dual momentum: Testing the dual momentum strategy and implications for lifetime allocations. The Journal of Portfolio Management 48 (4): 282–301.

Harvey, Campbell, Edward Hoyle, Russell Korgaonkar, Sandy Rattray, Matthew Sargaison, and Otto van Hemert. 2018. The impact of volatility targeting. The Journal of Portfolio Management 45 (1): 14–33.

Harvey, Campbell, Edward Hoyle, Sandy Rattray, Matthew Sargaison, Dan Taylor, and Otto van Hemert. 2019. The best of strategies for the worst of times: Can portfolios be crisis proofed?. The Journal of Portfolio Management 45 (5): 7–28.

Hoopes, Jeffrey L., et al. 2022. Who sells during a crash Evidence from tax return data on daily sales of stock. The Economic Journal 132 (641): 299–325.

Ibbotson, Roger G., and William N. Goetzmann. History and the Equity Risk Premium. Available at SSRN 702341 (2005).

Ibbotson, Roger G. 2010. The importance of asset allocation. Financial Analysts Journal 66 (2): 18–20.

Ilmanen, Antti. Investing amid low expected returns: Making the most when markets offer the least. Wiley (2022)

Jacobs, Kathleen E., and Adam Kobor. 2021. Strategic asset allocation for endowment funds. The Journal of Portfolio Management 47 (5): 114–127.

Jordà, Òscar., Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. 2019. The rate of return on everything, 1870–2015. The Quarterly Journal of Economics 134 (3): 1225–1298.

Jorion, Philippe, and William Goetzmann, A century of global stock markets. NBER Working Paper No. w5901, (2000).

Kandel, Shmuel, and Robert F. Stambaugh. 1996. On the predictability of stock returns: An asset-allocation perspective. The Journal of Finance 51 (2): 385–424.

Keller, Wouter J., Adam Butler, and Ilya Kipnis. Momentum and Markowitz: A golden combination. Available at SSRN 2606884 (2015).

Keswani, Aneel, and David Stolin. 2008. Which money is smart? Mutual fund buys and sells of individual and institutional investors. The Journal of Finance 63 (1): 85–118.

Kritzman, Mark. 2021. The role of factors in asset allocation. The Journal of Portfolio Management 47 (5): 58–64.

Liu, Jun, Francis A. Longstaff, and Jun Pan. 2003. Dynamic asset allocation with event risk. The Journal of Finance 58 (1): 231–259.

Lo, Andrew W., Egor Matveyev, and Stefan Zeume. The risk, reward, and asset allocation of nonprofit endowment funds. MIT Sloan School of Management (2020).

Malmendier, Ulrike. 2021. FBBVA lecture 2020 exposure, experience, and expertise: Why personal histories matter in economics. Journal of the European Economic Association 19 (6): 2857–2894.

Moskowitz, Tobias, Yao Hua Ooi, and Lasse H. Pedersen. 2012. Time series momentum. Journal of Financial Economics 104 (2): 228–250.

Page, Sebastien. Beyond diversification: what every investor needs to know about asset allocation. McGraw Hill Professional, 2020.

Perold, Andre F., and William F. Sharpe. 1988. Dynamic strategies for asset allocation. Financial Analysts Journal 44 (1): 16–27.

Qian, Edward. 2011. Risk parity and diversification. The Journal of Investing 20 (1): 119–127.

Rodosthenous, Neofytos, and Hongzhong Zhang. 2020. When to sell an asset amid anxiety about drawdowns. Mathematical Finance 30 (4): 1422–1460.

Samonov, Mikhail, Value Investing, Even Longer History, 2020, Two Centuries Investments.

Samonov, Mikhail, UK Value Factor–The 200+ Year View, 2021, Two Centuries Investments.

Schwert, G. William. (1990). Indexes of US stock prices from 1802 to 1987. Journal of Business, pp. 399–426.

Sharpe, William F. 1992. Asset allocation: Management style and performance measurement. Journal of Portfolio Management 18 (2): 7–19.

van Hemert, Otto, et al. 2020. Drawdowns. The Journal of Portfolio Management 46 (8): 34–50.

Vassalou, Maria, and Yuhang Xing. Equity returns following changes in default risk: New insights into the informational content of credit ratings. Available at SSRN 413905 (2003).

Weber, Elke U., and Joachim Klement. Risk tolerance and circumstances. CFA Institute Research Foundation, 2018.

Weber, Martin, Elke U. Weber, and Alen Nosić. 2013. Who takes risks when and why: Determinants of changes in investor risk taking. Review of Finance 17 (3): 847–883.

Acknowledgments

Special thank you to Brad Barber for feedback and guidance, to Mihail Velikov for the helpful discussion of the topic, to Penn State BSB colloquium participants, conference session participants at the Financial Management Association 2023 Annual Meeting and Southern Finance Association 2023 Annual Meeting for their comments and suggestions, to Pawan Madhogarhia and Dean Ryu for their thoughtful discussions and recommendations, to Prescott Smith for the invaluable research assistantship, to Rebecca Jackson for editorial assistance, and to the Global Financial Data for making their data available.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Samonov, M., Sorokina, N. A century of asset allocation crash risk. J Asset Manag 25, 383–406 (2024). https://doi.org/10.1057/s41260-024-00355-2

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-024-00355-2

Keywords

- Behavioral finance

- Risk aversion

- Investment outcomes

- Dynamic asset allocation

- Risk parity

- Factor investing

- Endowment model

- Market downturn

- Drawdown