Abstract

What are the implications of adopting the various board governance practices that have been proposed as solutions to the conflict of interest between managers and shareholders? Agency theory suggests that board independence and incentive alignment will improve firm outcomes. Yet, the evidence so far has led to both disputes on their effectiveness and proposals that board member motivations and capabilities are important additional factors. As a result, the list of proposed governance practices is now so long that it is difficult to assess which practice does what. To address this question, a fruitful approach is to use data to describe how governance practices are associated with beneficial outcomes for the firm and its shareholders, and thus lay a foundation for theory building and causal research. Using algorithm supported induction, we examine the role of board reform governance practices for the performance of Canadian firms between 2001 and 2010. We find that only a small subset of practices is associated with firm value creation and distribution. Using interviews with board members, we gain further insight into the mechanisms driving these effects and propose theory for additional testing. Our work demonstrates that independence of directors and the alignment of their interests with those of the shareholders need to be complemented with practices that result in motivated and capable board members.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Agency theory is the dominant perspective in governance research and practice. It guides research on how boards are designed to address problems arising from the separation of ownership and control and how different designs affect firm outcomes (Jensen & Meckling 1976; Eisenhardt 1989; Fama 1980; Holmstrom and Milgrom 1989). Agency theory’s primary recommendations are that board members should be independent of management and aligned with shareholders. These recommendations are broadly accepted and intuitively appealing (Dalton and Dalton 2011; Sharma 2011). If one had robust evidence that firms with boards designed to solve the problems arising from the separation of ownership and control have better outcomes, especially for the owners, then this evidence would support agency theory’s continued use as a source of recommendations on board design and governance more generally.

However, the vast body of research testing agency theory models of governance provide decidedly mixed support (Dalton et al. 1998; Iyengar and Zampelli 2009). Consequently, scholars have begun to question whether agency theory is adequate for designing boards that protect shareholder interests (Boivie et al. 2021). Despite substantial attention to the relationship between board practices and firm outcomes, we are left with a gap between prevailing theoretical arguments and empirical results: one or both need to be adjusted. This is problematic given the frequent application of agency theory in teaching governance and designing board structures and processes in major corporations.

In addition, we currently face a body of research comprising complex, multi-level relationships, contradictory results, industry differences, difficulties comparing results across studies using different outcome measures and theoretical concerns that agency theory is insufficient, all of which generate more debates and questions than insights. Against this backdrop, more studies in the same vein as past work will do little to clarify the efficacy of agency theory to guide the design of boards. New approaches are required.

We employ an inductive approach using machine learning generated algorithms. This method allows discovery of “complex but interpretable patterns in data in a robust and replicable manner” (Shrestha et al. 2021:1) with the goal of building theory from data. To address debates about the agency theory models of governance, we are interested in the broad research question “Which governance practices affect firm outcomes?” We use data on the adoption of board practices in Canada between 2001 and 2010 and analyze the impact of 11 prominent board governance practices on three distinct measures: return on assets (ROA), total debt, and dividends per share. These practices were part of a movement aiming to achieve greater board independence from management and greater alignment between board members and shareholder interests. Our outcome measures capture some of the central concerns for shareholders. Return on assets reflect how well the total assets of the firm are utilized; debt influences risk assessments and hence determines the acceptable rate of return, and dividends per share reflect the distribution of firm earnings to its shareholders.

The findings are easy to summarize. Audit committee independence (e.g., Brown et al. 2017) helps increase ROA as one would expect, though the finding is surprisingly weak. Directors' share ownership and director evaluation were associated with an increase in total debt. Director evaluation was associated with an increase in dividends paid to shareholders. These findings suggest that agency theory models are relevant but should be enriched with concepts capturing board member motivations and capabilities. To better understand our findings, we conducted 23 interviews with corporate governance practitioners, which helped us identify underlying mechanisms and build arguments on why some practices had a clearer impact on firm outcomes than the others.

Our primary contribution is to show that, at least our sample, the preponderance of governance mechanisms implemented did not have measurable effects on firm outcomes, with a few exceptions. We also develop theory on the distinctive features of the governance mechanisms that are indeed effective across a broad range of outcomes. Our approach allows us to combine theoretical perspectives rather than explore single-theory predictions. In addition, we include agency theory logic, but go beyond it to propose a multi-theory model linking board practices to firm outcomes. This builds on past single-theory research that identifies specific practices but cannot compare, or consider combined, effects across theories. In addition to independence and alignment, board members should be capable and motivated. Although we caution that this type of machine-learning research should be done on multiple sets of firms across multiple legal regimes, our theoretical and empirical contributions will strengthen agency theory and governance research by focusing research efforts on the most impactful governance mechanisms. The practice of designing board structures and processes will become simplified and more effective. A secondary, but still important, contribution is the demonstration that machine-learning techniques can be a very effective sorting mechanism for theoretical predictions that translate into an abundance of behavioral recommendations. Other theories that have similarly multiplex translation into practice will also benefit from these procedures.

State of agency theory models of governance

While agency theory dominates corporate governance research, other theories have been used to develop alternative models, especially concerning the role or purpose of boards. For example, the resource-based view and resource dependency theory accounts suggest the purpose of boards is to provide access to resources (Hillman and Dalziel 2003), external relationships and legitimacy (Pfeffer and Salancik, 1978), or assist management with advice and strategic input (Boivie, et al 2021; Westphal and Frederickson 2001; Golden and Zajac 2001).

Nevertheless, agency theory models overshadow all other governance research (Sharma 2011; Dalton and Dalton 2011; Rowley et al. 2017). In their review of the field, Boivie et al. (2021) find that 95% of corporate governance research across disciplines rely on agency theory to build theoretical models. Consequently, any effort to contribute to the field must consider, if not build upon, the large body of agency theory models. Below, we begin by reviewing key tenets of agency theory, then review empirical research based on agency theory and finally expand the lens beyond agency theory models.

Review of key tenets

Agency theory addresses the problem of a principal hiring an agent to perform a task when the task outcome is visible to the principal. There is sufficient uncertainty in the generation of outcomes so that agent’s effort devoted to it is not visible (Arrow 1986). Solving the agency problem requires making the compensation of the agent conditional on the outcome through an incentive scheme. The agent cannot bear as much risk as the principal: the agent often derives its main source of income from being employed by the principal while the principal diversifies its investments across the number of different firms where it employs a number of different agents. Thus, the agent’s incentives have to be lower than proportional. The best solutions are those that balance the losses from risk bearing and low effort by the agent through optimal incentives and, when possible, ability of the principal to observe the agent’s effort.

Applied to corporate governance, agency theory typically addresses the problem of optimal contracting between owners and managers of the firm, although in principle any resource providers to the firm can be viewed as a principal or agent, with an accompanying contracting problem. The board of directors with its oversight and control of management is seen as crucial. In the words of the most-cited agency applied agency theory paper, “The role of the board in this framework is to provide a relatively low-cost mechanism for replacing or reordering top managers” (Fama 1980: 294). In other words, the primary board role is to monitor management, so board member expertise and alignment of their interests with those of shareholders is a prerequisite for effectively preventing management mischief and protecting shareholder interests (Fama and Jensen 1983). Modern versions of this theory cast its net wider and examine a broad set of mechanisms for generating better observability or incentives of the board by firm owners, or of the management by the board (e.g., Tirole 2010; Dalton and Dalton 2011; Sharma 2011). However, it is not known whether agency theory works “as intended” and whether there are tangible effects of board practices on the outcomes that investors care about.

Lack of empirical support

The empirical findings from tests of these relationships do not match the definitiveness of the theoretical proposition (Bhagat and Bolton 2008; Rhoades 2007). Meta-analyses and theoretical reviews have suggested that there is no consistent set of findings in which board independence has a material effect on firm performance outcomes (e.g., Hillman and Dalziel 2003; van Essen et al. 2012). Indeed, an influential empirical study shows no (or even a negative) relationship between board independence and firm performance and suggests that past support for this relationship was a result of flawed empirical procedures (Wintoki et al. 2012). Dalton and Dalton (2011: 407) summarize these results by stating “there is no evidence of systematic relationships between board composition [independence] and corporate financial performance.”

Research examining the effects of splitting the CEO and board chair positions (versus allowing the CEO to occupy both positions simultaneously) on firm performance suffers a similar fate. Again, from an agency theory perspective the recommendation is obvious: splitting these roles is necessary because CEOs who are also chairs—leaders of boards—are unable to effectively monitor themselves, and indeed may seek to manipulate board processes to their favor (Tuggle et al. 2010). And, again, the collective results of studies examining the relationship between board leadership and firm outcomes provide no consistent evidence of such a relationship (Dalton, et al. 1998; Iyengar and Zampelli 2009).

Similarly, agency theory predicts that agents need less supervision if their incentives are aligned with those of the principals. The prediction is more conceptually informative than practical because even governance reforms that most directly address misaligned incentives, such as improving CEO bonus and stock option schemes, often do not produce the desired results (Bebchuk & Fried 2003). In sum, there remains much uncertainty regarding what board practices are worthwhile versus those that are theoretically endorsed but unnecessary, and hence only add costs to the firm governance processes.

Explanation of unsupportive results

These research findings have led many researchers to doubt agency models of governance. We organize the criticisms or explanations into three categories. First, some theoretical models suggest that agency theory accounts are not predictive and attack its core assumptions and claims. They argue against the primacy of independence and suggest that such directors also need domain expertise, bandwidth, and motivation to monitor management in order to avoid governance failures (Hambrick et al. 2015). Scholars alternatively postulate, for example, that the separation of chair and CEO roles can lead to inferior outcomes for firms low on complexity and for CEOs of low reputation (Faleye 2007). Boivie et al. (2021) ponder whether managers, on average, require extensive monitoring to pursue shareholder interests because CEOs are generally seen by directors as actually acting in the interests of the shareholders. These arguments propose that agency theory is focused on the wrong mechanisms and should not be the central perspective underlying governance models.

Second, other scholars are less willing to abandon agency theory, but they explicitly question whether oversight is the only mechanism through which boards affect firm outcomes. Thus, they see agency theory as necessary but not sufficient to generate useful predictions. For example, if management oversight is not the central board role, then independence is less important. If a board’s purpose is to provide resource access, external relationships, and legitimacy (Kor and Sundaramurthy 2009) or contribute to and support managerial decision-making (Kor and Misangyi 2008; Golden and Zajac 2001), then mixed empirical results between board independence and firm outcomes would not be surprising.

Hillman and Dalziel (2003) incorporate resource dependence theory to argue that agency theory thinking ignores board member capabilities: independent board members may be willing to fulfill their roles but may lack the ability to do so. Taking this thinking further, it could be the case that even the combination of independence and capabilities is not sufficient. These factors provide the freedom and skills, respectively, to fulfill the board role but do not motivate board members (Boivie et al. 2016). More generally, this thinking proposes that new work should move beyond agency theory dominated models. The question is, does the influence of independence (agency theory) only activate when board members are capable and held accountable (resource-based view)?

Third, others blame inconsistent and unsupportive results on the nature of the analyses. One issue is that several, and often diverging, performance and other outcome variables have been operationalized across different settings, complicating efforts to compare results. Similar problems are seen in the independent variables. The influence of board practices involves effects across multiple levels—individual, board, and firm—and should be modeled accordingly (Dalton and Dalton 2011). As Boivie et al. (2016) point out, inconsistent results could be driven by multiple group and individual level limitations (referred to as “board barriers”) that prevent directors from exercising effective control. Similarly, as mentioned above, the theoretical predictions could be driven by mediating or moderating relationships across levels of analysis. Capturing multiple effects that may interact in traditional studies is challenging, which may explain why governance research has produced unsupportive results so often.

In sum, the body of research on board practices across multiple levels, measurements, and settings, has generated debates and questions, but few systematic conclusions. The criticisms and guidance offered to explain the results suggest that a wider view of board roles and practices will improve governance models. New models should not only test independence but also include factors capturing board member capabilities, knowledge, accountability, and incentive variables. Few studies capture variables from multiple theoretical perspectives, making it difficult to compare or observe combined effects.

Our analytical approach

We opted for an inductive study of the relationship between governance and organizational outcomes using machine learning. This approach allows us to address analytical issues, simultaneously examine variables capturing independence, alignment, capabilities, and motives. Usually, inductive studies have been the realm of qualitative research where scholars collect facts from interviews, historical records, participant observation, or other methods, and then develop theory based on the patterns that they observe (Helfat 2007; Graebner and Eisenhardt 2004; Parker 2007; Joseph and Ocasio 2012). This theory can then be tested in follow-up deductive studies. Qualitative methods that rely on informant responses are likely unsuitable for examining the governance precursors of performance and related outcomes because respondents are subject to fundamental attribution errors and self-enhancement (Nisbett and Ross 1980) and cannot be fully relied on for accurate reports on the determinants of organizational outcomes.

Advances in machine learning as well as recent articles that provide a blueprint for algorithm-based induction show how one can simultaneously engage in theory development and theory testing using quantitative, archival data (Shrestha et al. 2021). Prior research (e.g., Finkelstein and D'Aveni 1994) indicates that success of one governance practice can be contingent on other practices (e.g., CEO not holding the chair position is effective only if the board is independent), making machine learning an attractive method because it looks for combinations of attributes. This allows machine-learning algorithms to identify whether practices individually or in combination have an impact on organizational outcomes without researchers imposing any ex ante functional form on these relationships.

In the sections that follow, we first describe the data and context, then engage in algorithmic supported induction whereby we first discover relations based on patterns in one part of the sample and then test these relations in another part of the sample. This way, we explicitly follow the blueprint of theorizing using algorithm-based induction provided by Shrestha et al. (2021). This involves identifying robust associations in one sample derived from our data, developing mechanisms explaining these associations, and then testing these associations in another sample. Analogously to qualitative research, the associations discovered in the first sample can be viewed as robust stylized facts that need to be explained (Helfat 2007). This approach also guards against drawing conclusions from a model over-fitted to data because the same model is tested again on different data. Replication of the associations on a different data helps us assess generalizability of these stylized facts. Subsequent theory development supported by interviews assists us understand why associations between constructs are observed in these stylized facts. The resulting patterns provide the basis for theory development in the discussion.

Data and context

We examine the board practices of a set of Canadian corporations from 2001 to 2010, a period with significant variation of governance practices adoptions across the Canadian business landscape. Our data contain information on Toronto Stock Exchange Index (TSX) member firms. TSX is a representative sample of publicly traded firms in Canada. Reflecting the nature of Canadian economy, our dataset is dominated by companies in Metal Mining, Oil and Gas Extraction, Chemicals, Primary Metal Industries, Electronic Equipment Manufacturers, Communications, Electric, Gas and Sanitary Services, Financial Services and Business Services.

Starting in 2000, the Canadian Coalition for Good Governance, an advocacy group representing prominent institutional investors, recommended corporations adopt “board reform” practices that would strengthen boards oversight, risk management, and alignment among company and shareholder interests. In addition, it funded a rating system, the Board Shareholder Confidence Index (BSCI), which scored and compared board practices of Canadian firms comprising the TSX index. Each firm received an overall grade as well as individual points for each practice adoption. The Canadian Coalition for Good Governance used this rating system to ask corporations to adopt each practice or explain why they did not adopt. The practices we examine represent the core of the BSCI score. Furthermore, in 2005, Canadian government issued a corporate governance guideline NP 58–201. It stipulated the needs to have independent boards. However, this guideline was not prescriptive, thus firms clearly knew that adoption of these practices was demanded by external stakeholders. Firms still could choose whether to comply to the “board reform logic” that these practices were supposed to further by adopting all of them, some of them, or none.

We study the influence of 11 major practices concerning board structure, evaluation process, and share structure on firm-level outcomes. By adopting any of these 11 practices, firms would both change their governance mechanisms along the recommendations of the Canadian Coalition of Good Governance as well as the guideline NP 58–201. They will also score higher on the BSCI, thus raising in the public rating.

These practices are meaningful, and their choices have been evaluated by a series of prior studies. We know that adoption decisions are driven by past governance practices’ adoption and the attention to the company. Shipilov et al. (2010) showed that practices diffused in waves and adoption of earlier practices (e.g., director independence, CEO/chairman role split, independence of audit and compensation committees) made it more likely that the company buys into the board reform logic, therefore it is more likely to adopt more recent practices at the time, such as board and director evaluation. Rowley et al. (2017) show that firms which were targeted by criticism for their low adoption were subsequently less likely to adopt these practices while firms praised for their adoption were more likely to adopt going forward. Finally, Shipilov et al. (2019) showed that either good or bad publicity which firms received in business press (regardless of whether this publicity was related to governance) triggered the propensity to adopt these practices. However, all these studies share a common shortcoming in that they did not evaluate the impact of practices’ adoptions on firm outcomes.

These data allow construction of a firm-year dataset with significant variation in the dependent variables, annual updates of observations, and year lags for the independent variables.

Governance practices

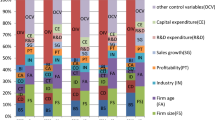

In Fig. 1, we describe each of the practices that have diffused in Canada between 2001 and 2010 and summarize the rationales offered to pressure or convince boards to adopt them.

Full definitions of practices in Fig. 1 are given elsewhere (Rowley et al. 2017; Shipilov et al. 2019); here we provide a brief summary. The first set of practices captures different dimensions of board member independence. (1) Board independence. The BSCI considered the board to be independent when at least two thirds of its directors were outsiders without connections to the firm’s management. Independence of (2) audit and (3) compensation committees. The BSCI coded each of the audit and compensation committees as independent if all its committee members were independent directors. (4) Board chair and CEO split, meaning that the CEO and chair positions were occupied by different individuals who did not have a kinship tie. The second set of practices are related to board and director performance and accountability. (5) Director evaluation was coded as 1 when the board had a peer-to-peer assessment process among board members; this practice instituted a level of accountability by highlighting each director’s performance. (6) Board evaluation was an indicator of formal board member assessments of key board processes, including the quality of board meetings and board information packages, the chair’s leadership, and committee reports.

The third set of practices in our data set captured alignment between board members (and their decisions) and shareholder interests. (7) Director stock ownership. The BSCI coded the company as having adopted this practice if the average value of share ownership by the company’s directors exceeded four times their annual retainer. (8) Dual share structure. BSCI viewed companies as not having a dual share structure, and thus as enabling the influence of common shareholders, when more than 50% of its equity controlled more than 50% of the votes. (9) Share dilution. This was viewed as a practice counter to shareholder interests. BSCI scored a company as diluting shareholders’ holdings if options granted to directors and managers (resp., CEO’s) constituted more than 10% (resp., 5%) of the company’s outstanding shares. (10) Option repricing. Like share dilution, option repricing was viewed as counter to shareholder interests, as more value would be allocated to other stakeholders. When a firm’s share value declines, the cost of exercising options could be greater than the cost of purchasing stock at market value. While detrimental to shareholder value, option pricing would benefit board members holding options valued below market value. BSCI scoring was based on whether the company lowered option exercise prices during any of the previous three years. (11) Alignment between CEO compensation and share price. Similar to the alignment measures, this evaluation captured whether the board linked the CEO’s pay to performance. BSCI coded a company to have proper alignment if CEO compensation did not increase by more than 25% following a year during which the firm’s share price decreased by more than 25%.1

Dependent variables

Our dependent variables capture firm value creation and value distribution (or capture). The foundational research on value based strategy (e.g., Brandenburger and Stuart 1996; Gans and Ryall 2017) note that understanding factors determining value creation and value capture is one of the fundamental issues in strategy. We use ROA and total debt as measures of value creation while dividends per share was a measure of value distribution. ROA is a measure of value creation as it reflects efficiency of the utilization of the firm’s assets. High debt corresponds to higher risk that the firm undertakes to create value. In their strategic role, boards oversee capital allocation, growth, and financing decisions. In determining the appropriate choices, a primary concern is the company’s risk exposure, which is increased with higher levels of debt financing. When financing growth strategies or capital investments, debt represents a faster but higher risk approach than equity. Boards can influence ROA by assessing management’s strategy and by questioning the management about asset utilization efficiency and cost controls. Controlling for net sales in some models allows us to interpret total debt as a measure of risk that the firm takes to create value. Finally, dividends per share represent a measure of the distribution of value among stakeholders including employees, board members and shareholders. When the company earns profit, it must decide the percentage allocated to fund business operations versus distributed to shareholders. Deciding dividend payouts is a key board function: higher dividends per share means that the firm distributes a higher proportion of the value to shareholders. In other words, all three measures—ROA, debt and dividends—are chosen because they are under the board’s control and therefore governance practices might be expected to have a link to them.

We acknowledge that dividends or debt are not directly capturing competitive or financial performance, but rather are more concerned with how value is allocated or the level of risk assumed to achieve a given level of performance. For example, board needs to approve taking on debt or paying out dividends. By contrast, the board does not approve the company’s share price. Thus, we would not expect shareholder-related metrics, such as TSR, to be influenced by the firm’s governance regime.

Debt reflects the aspect of value creation because it highlights the risk taken by the firm. If a company wishes to grow (and create more value) the board may decide to take more debt. However, this approach to value creation will be riskier, as opposed to growing organically or through an equity raise. In other words, an investor buying shares in a highly leveraged company will expect a higher return to compensate for additional risk compared to investing in low leverage company. Tirole (2010) highlights that a theory of corporate finance should reflect the role that corporate governance in general and boards in particular play in the firm’s value creation and capture. He also suggests that dividends represent an important mechanism of value capture whereas debt is used to discipline the management. On the one hand, debt is a measure of risk that the firm undertakes, on the other hand, debt brings in creditors as an additional source of governance control (because they can cause bankruptcy).

Finally, dividends reflect value distribution. The value of dividends to shareholders is disputed because value retained rather than given out as dividends should in principle be reflected in increased share values. Yet, regular dividend issue is widely viewed as a goodwill gesture, and more importantly, as a disciplining device against withholding too much of firm profits, enabling investors to earn faster returns.

Control variables

We strove for the optimal number of control variables to make sure that our algorithms had enough power on the relatively small dataset in our possession. We controlled for the BSCI Score, which ranged from zero to 100 with higher values indicating that the firm had more of the beneficial governance practices. Firms had different embeddedness in the network of board interlocks. Embeddedness is important to control because it offers access to information that can influence performance (Haunschild 1994) and inform governance norms (Davis and Greve 1997). We calculated the number of shared directors that each firm had with other firms in our sample, then normalized it by the maximum value within each year and obtained the metric of N-degree. Higher values meant that a firm had more interlocking relationships with other firms. We accounted for the passage of time by recording the Year in which we observed our data point. This variable captured trends in the effects of governance practices. In the early analysis, we also experimented with adding Log Net Revenues but discovered that its inclusion complicated the machine-learning. This variable might be interesting because it controls for the company size, so following Shrestha et al. (2021: 867), we omit it from the initial estimation to facilitate the modeling but bring it back as a robustness check for Sample 2 analyses.

The firms are from different industries with different levels of ROA, dividends per share and debt, for operational or institutional reasons. For example, unlike growing technology companies, which are expected to re-invest earnings to foster innovation, banks are expected to pay high dividends. To control for these differences and other stable factors such as headquarter locations and business culture we estimated models with firm fixed effects. This was achieved by first computing firm means on each variable and then subtracting these firm-specific averages from the value of the variable in each observation, including categorical variables that reflected adoptions of individual practices. This approach is automated in standard regression packages (stata xtreg, fe does exactly that), but we did not have the automated option available in python. Hence, all values in our dataset were deviations from the firm’s own means, which took care of industry and location fixed effects as well as all other sources of firm-specific time-constant unobserved heterogeneity. Since our demeaned indicators are continuous variables, in some models we observe quadratic terms. However, interpretations of these quadratic indicators were meaningless, so we focused on the main effects.

Analysis

Our approach to develop theory from data using machine learning follows the procedures of Shrestha et al. (2021). We started by randomly splitting our data into two samples. Sample 1, the training sample, was employed for pattern detection by algorithmically supported induction. Sample 2, the holdout sample, was used for re-testing the out-of-sample fit of the model derived from Sample 1. We identified comprehensible and robust associations within Sample 1, which allowed us to formulate hypotheses that were then tested in Sample 2. This sequence allowed us to detect overfitting of the models derived from Sample 1 and adjust the models and interpretation accordingly. Our dataset had a total of 1913 observations, so it was on the smaller side of “big data”. Therefore, we experimented with different splits in sizes between the training sample and the holdout sample. The tradeoff between these was that a larger training sample would learn better, but because the holdout sample was its complement, the relations drawn from the training sample needed to be tested against a smaller dataset. We chose to keep a 50/50 split in all analyses, except for the analysis with dividends in which constructed a 66% and 33% split between Samples 1 and 2, respectively, because an even split produced unstable Lasso models. In separating our data into Sample 1 and 2, we did 1000 splits with different random seeds. For our analyses, we kept the random seed that resulted in a split into Sample 1 and 2 that minimized the mean squared error in Sample 1.

Next, we identified robust associations within Sample 1. To allow for possible non-linearities while keeping interpretable results, we followed a two-stage sequence of decision-trees using a random forest algorithm to give us the most important features that predicted our target, and then used LASSO (least absolute shrinkage and selection operator) regression to narrow down the subset of these predictors for interpretability of associations between predictors and our target. Random forest is a machine-learning algorithm that learns regression relations by forming decision-trees that select the most important variables, followed by averaging across the decision-trees to gain stable estimates of effect sizes while avoiding overfitting.2 Our random forest algorithm used 50 iterations with a k-fold cross-validation (k = 5) for tuning hyperparameters. When tuning in Sample 1, we tried many different value combinations of hyperparameters and evaluated the performance of each by cross-validation to find a set of hyperparameters that minimize the sum of prediction errors in different holdout samples. After tuning, our hyperparameters included the number of decision-trees in the forest, the number of levels in a tree, the number of samples required to split a node, and the number of samples required to be at each leaf node.

We set the random grid for the following conditions and searched for the best set of parameters. For the number of trees in the forest (n_estimators) we tried the following values: 50, 100, 200, 300, 400. A higher number of trees may increase the model performance but also complexity. By including a range from 50 to 400, we explored a variety of ensemble sizes to find the optimal balance between model complexity and computational efficiency. For the maximum number of levels in tree (max_depth) we used the following values: 1,2,3,4,5,6,7,8,9,10. A shallow tree might underfit the model, while a deep tree might overfit it. The inclusion of a range from 1 to 10 allowed our model to capture different levels of feature interactions. For the minimum number of samples required to split an internal node (min_samples_split) we used the following values: 2, 4, 6, 8, 10. Similar to the max_depth, a lower value can result in more complex trees, potentially leading to overfitting, while a higher value can lead to overly simplified trees. For the minimum number of samples required to be at each leaf node (min_samples_leaf), similar to min_samples_split, a lower value allows more granularity in the leaves but may lead to overfitting. The range of 3 to 5 provided a moderate exploration for finding an appropriate value. Other parameters were set to default. For example, we used bootstrap samples when building trees in the forest. Bootstrapping introduces randomness and diversity among the trees by training each tree on the different subset of the data we have, which eventually helps us create a more robust and generalizable model. Online Appendix A6 provides graphic visualization of MSE levels at the different parameter choices.

Random forest identifies important variables that explain our dependent variable without imposing strong interpretability or functional form restrictions. We calculate the feature importance estimators to identify how much the model depends on each variable. A plot of permutation importance for the ROA models shows that the first variable contributes the most and the following 3 variables lead to accuracy improvement (Fig. 2; see also Online Appendix Fig. SA2a and b for the models with Debt, and Dividends as dependent variables).

We created a model with all possible degree 2 terms—two-way interactions and quadratic terms—based on the variables extracted from the random forest algorithm. For example, in a model with ROA as a dependent variable we had 9 terms in total: 3 linear, 3 quadratic, and 3 two-way interactions. Then, we applied the LASSO algorithm to this model to narrow the list to a subset of variables having strong effects. LASSO solves a least square estimation problem (or other forms of regressions) subject to the constraint that all variables remaining were above a minimal effect strength specified by the analyst. This approach allowed discovery of parsimonious models while retaining all variables with sufficiently strong effects. Coefficients of variables with small effects became zero and these variables were eliminated from the model.

The variables used in the LASSO algorithm had the highest explanatory power across all decision-trees within the subsamples of Sample 1 and were used to build a complete model with linear and squared effects as well as all pairs of interactions. We used k-fold cross-validation for tuning the hyperparameter for regularization (i.e., alpha). Specifically, we selected the alpha that minimized the mean squared error which was estimated through cross-validation of across multiple subsets of Sample 1 (Fig. 3 for a model with ROA as a dependent variable, Online Appendix Fig. SA3 a, b for models with Debt, and Dividends as dependent variables, respectively). Continuing the example of a model with ROA as a dependent variable, LASSO identified 5 terms (i.e., Audit Committee, Director Evaluation, Option Repricing, Audit Committee^2, Option Repricing^2) out of 9 as the most important and robust predictors. These five variables were also robust predictors across bootstrap subsamples, which showed that the results were robust to sampling errors (Fig. 4, Online Appendix Fig. SA4 a, b for heatmaps with Debt and Dividends).

For a final presentation of the results, we estimated OLS with firm-clustered standard errors in Sample 2 using the predictors identified by LASSO in Sample 1. This analysis produced point estimates and standard errors of associations between our predictors and a focal dependent variable. OLS was appropriate because all our models had a continuous dependent variable. From analyzing Sample 1, we picked theoretically meaningful effects with low firm-clustered standard errors and developed an inductive theoretical model about their effect on the dependent variable. We tested hypotheses by estimating the same variables into an OLS model in Sample 2.

To reach a final interpretation for theory development, after we have formulated the hypotheses based on Sample 1 analysis, we supplemented this model with qualitative insights from interviews that we conducted in the summer of 2021 with participants of board member education programs on corporate governance. These participants were experienced board members (including chairs) who joined the program to further their governance education. We interviewed 23 participants for a total of 460 min. The interviews comprised two sets of open-ended questions. First, participants were asked to identify characteristics, practices, or processes that related to effective or ineffective board oversight based on their experiences before they saw our results from Sample 1. Second, they were shown our preliminary quantitative results and asked to comment on these results. Finally, to uncover whether participants had insights on underlying mechanism they were asked why they expected some of the results that were consistent with their experience. For example, why did audit committee independence lead to specific outcomes? As a check of whether their comments were based on conjecture or their experiences, they were asked to describe specific examples. Online Appendix Table SA5 describes these participants. Respondents were spread across West, Central and Eastern Canada. Most of them were aged between 45 and 65 years, and they had a mean of 14 years of board experience across public and private companies. Twelve of them had audit committee experience and they had a mix of independent and inside director roles.

Data pre-processing

Because the dependent variables have missing values in different observations, the data for each of the four analyses have slightly different correlation tables. Table 1 is the correlations table illustrating associations for the ROA analyses.

The other two are in Online Appendix . It has moderate to high correlation among BSCI score and many practices and between director and board evaluation and year. The correlation of BSCI with practices is not surprising because one gets a higher score when adopting more practices, so information contained in BSCI was already in the data. Board and director evaluation practices tend to be adopted together (Shipilov et al. 2010) while year is correlated with average net sales due to the growth of the Canadian economy. Moderate to high correlations between variables (e.g., x1 and x2) means that they can substitute each other in predicting Y, so many linear combinations of x1 and x2 where one substitutes in part x1 for x2 would work similarly well as predictors.3 This results in unstable results across different runs because LASSO recognizes that any one of the highly correlated pair of variables has weak effects when both are included, but will choose a different variable to drop depending on the subsample. Therefore, as a part of our data pre-processing, we dropped BSCI score, board evaluation and year from the analyses. Next, we dropped observations with missing values and computed z-scores for all variables. Our analyses did not drop any outliers and we did not winsorize the variables. We re-analyzed our data with different algorithms selected automatically to deal with collinearity without manually dropping variables (Online Appendix Alternative Models using Data Robot).

Research question 1: what governance practices affect ROA?

As noted above, we do regression analysis three times, first on Sample 1 and then twice on Sample 2. The second analysis of Sample 2 regressions is a robustness test that includes the net sales/revenue variable that we dropped because it complicated the LASSO regression. Our regression analyses are reported in Table 2a-b.

Return on assets is a staple measure of firm performance. It reflects firm profitability and is monitored by many stakeholders (e.g., Rowley et al 2017). Model 1 in Table 2a shows that Audit Committee Independence (b = 0.080, SE = 0.047, p = 0.092) is a potential candidate for practices that affect ROA. This and other models for the subsequent research questions did not retain theoretically interesting interaction terms between pairs of practices. Thus, following the approach proposed by Shrestha et al (2021), we formulate the following:

Hypothesis 1: There is a positive association between audit committee independence and ROA

This analysis suggests it is the combination of board member independence and capabilities, not independence alone, that generates positive financial outcomes (Golden and Zajac 2001). Board members need to have capabilities beyond independence to perform their various roles—management oversight, resource access and advice. These capabilities include expertise, experience, knowledge of the business (Hillman and Dalziel 2003). Kor and Misangyi (2008) find evidence among entrepreneurial firms that having board members with industry-specific experience or knowledge is effective for overcoming the information gap disadvantaging many board members. Relative to management, many board members lack industry and organizational knowledge. Audit committees are responsible for a comprehensive set of duties, such that audit committee members develop a valuable (knowledge) capability. Audit committees are required to ensure financial statement accuracy (Brown et al. 2017), oversee management statements to investors and shareholders (e.g., the Management Discussion and Analysis section in disclosed financial statements), provide financial insights to board meetings, evaluate financial performance, and monitor risks (Carscallen and Newton, 2022: 19, 42). In addition, audit committees often scrutinize capital allocation options and oversee whistle-blower programs.

To perform these tasks, audit committee members engage with external and internal auditors, the ethics and compliance department. They also meet more frequently with the CEO and CFO than other board members, and more fully engage in discussions about strategic plans and the competitive landscape. Consequently, audit committee members build a knowledge capability, overcoming information asymmetry obstacles better than other board members.

Our interviewees echoed this idea and suggested that knowledge, and thus capabilities, are unevenly distributed across board members. One CEO commented that “Most [board] meetings are just updates for the board. I spend most of time getting them [the board] up to speed… They don’t know enough to be strategic. My audit [committee] chair is good though. He knows my business well and I will actually call him for insights. He can see blind spots.” Similarly, one board member we interviewed argued, “unless you dig into the business, sit on the audit committee or maybe the investment committee, you can’t add much. You can make sure the company is compliant [with regulations], but it’s tough to be in the know.” Finally, a board chair we interviewed mentioned that the audit committee members “have the ear of the entire board…they talk and others listen”.

This finding also suggests that independence matters too, as it ensures that those board members, who develop capabilities by virtue of their audit committee members, are not beholden to management, are willing to argue their true positions on issues, and can fully address moral hazard issues related to management–shareholder misalignment. One interviewee, a CEO, summarized independence in this way: “It’s a no-brainer to have an independent audit committee. How could you trust the financial statements if the audit committee was all insiders [managers]? Sometimes I don’t like the extra work of convincing them…I will admit that these are directors that have the best insights. They challenge me.”

Consequently, we suggest that independent audit committees are positively correlated with ROA because of the combination of two attributes: these board members are well informed and more capable to contribute and are free to provide unbiased, unfiltered feedback to the CEO to improve decisions. Individual directors who are members of audit committees gain deeper knowledge and greater capabilities to add value as compared to other members of the board. Those increased capabilities are realized for the benefit of firm performance only if those directors are independent from management. These performance impacts are associated with the increased profitability and/or efficiency in utilizing the firms’ assets, lowering the risk of these assets’ misuse and ultimately increasing profitability. Hence, we propose that there is a positive association between audit committee independence and firm’s return on assets.

This association is tested in Sample 2, and the results are shown in Model 2. There, we observe that the effect of Audit Committee Independence on ROA is indeed positive (b = 0.051, SE = 0.032, p = 0.114). Hence, the coefficient suggests support of Hypothesis 1, though at a lower level of significance than the p < 0.1 cutoff (Bettis 2012). Model 3 shows a slightly weaker effect (b = 0.05, SE = 0.032, p = 0.124).

Research question 2: what governance practices affect debt?

We applied a similar procedure to identify practices that affect firm debt. As noted earlier, debt (financial leverage) increases risk because the principal and interest must be repaid in installments regardless of the current cash flow levels or other cash needs. There is a positive relationship between risk of a firm and its financial leverage (e.g., Breen and Lerner 1973; Huffman 1989), thus governance practices that have a positive effect on debt should be either indicative of the firms’ willingness to increase risk or their lower cost of servicing debt (Lorca et al. 2011). The point estimates of the main terms and their interactions are reported in Model 3 of Table 2a. We find two such effects. The regression analyses show that there is a positive relationship between Director Share Ownership and the amount of total debt incurred by a firm (b = 0.171, SE = 0.085, p = 0.046). Likewise, Director Evaluation has a positive association with debt (b = 0.163, SE = 0.051, p = 0.001). Hence, we can propose the following hypotheses for testing in Sample 2:

Hypothesis 2a: There is a positive association between director share ownership and firm debt.

Hypothesis 2b: There is a positive association between director evaluation and firm debt.

Our interviewees were not surprised by the result indicating a relationship between director share ownership and debt levels. Managers are often attracted to debt financing as it is cheaper and faster than equity financing, allowing them to grow faster and achieve short-term bonus targets. A board member we interviewed stated “Equity is messy—negotiating with new investors and getting approval from existing shareholders. Complicated, slow, and leading to bad feelings. Debt is faster and cleaner”.

In addition, when issuing new equity existing shareholders’ financial positions are often partially diluted, and new equity usually comes with rights granted to the new shareholders. Directors with no or low shareholdings will be less concerned about the potential negative impact of new equity or existing shareholders, but directors with share ownership will be sensitive to this tradeoff. One interviewee who believed that directors should own shares acknowledged the downside, stating that once directors think about themselves as shareholders they tend to “think about how they can monetize their own positions.” Another experienced board member and CEO we interviewed argued that “You have to remember that shareholders are not equal…When a new shareholder class is added to the cap[ital] table, existing shareholders are sometimes disadvantaged.” Several interviewees indicated that new equity issues often receive liquidation preferences or special dividends, which dilute the value of the [current] shareholders. Another interviewee summarized this same argument by stating “If you are a rational shareholder, then you do not want to be diluted by new equity unless there is the possibility of a big return.” He went on to mention that “debt financing looks more attractive to you [even if expensive].” We note that shareholders’ preferences for debt should not be considered as purely self-serving because debt issues help avoid dilution of all current shareholders. Thus, we propose that there is a positive association between directors’ share ownership and a firm’s debt. As noted earlier, Lorca et al. (2011) showed that director share ownership was negatively related to the cost of debt. This finding is consistent with our result: the cost of debt is negatively correlated with risk level. So, their finding suggests director share ownership leads to lower risk, makes debt more attractive, and, thus, motivates relatively higher debt levels.

We struggle to interpret the Director Evaluation potential finding using only agency theory. Peer-to-peer evaluations are intended to provide individual performance feedback to each board member. The practice introduces accountability: board members are less likely to free-ride the efforts of fellow board members. Greater accountability should lead to more diligent efforts to fulfill board duties, perhaps motivating board members to be more knowledgeable, and willing to develop and apply their capabilities (e.g., Finkelstein and Mooney 2003).

One explanation of the positive association of director evaluation with debt is that such board members are more likely to understand strategic plans and are better able to assess appropriate risk and, therefore, debt levels. Evaluation practices motivate the board members to engage in active service, as opposed to merely rubber-stamping management decisions. This explanation suggests that boards with motivated board members are better able to properly assess strategic plans and assess when more debt is appropriate. We suspect that less motivated boards are more conservative, less willing to add risk, even if appropriate, when they lack understanding of the business. This narrative is consistent with the argument that greater knowledge or confidence increases willingness to take risks (Schumacher et al. 2020). This finding is based on existing research going beyond agency theory models, suggesting that motivations, in our setting stemming from the accountability of board member evaluations and feedback, are important dimensions for predicting when board members add value to shareholders.

Analysis of Sample 2 in Model 4 Table 2a shows that the Directors’ Share Ownership is positively correlated with total debt (b = 0.068, SE = 0.020, p = 0.001). Hence, Hypothesis 2a is supported. Hypothesis 2b is also supported, as the effect of Director Evaluation is precisely estimated in Sample 2 (b = 0.097, SE = 0.023, p = 0.000).

Research question 3: what governance practices affect dividends per share?

We next identified practices that affect firms’ dividends per share. Dividend policies and payouts require formal approval from the board, which typically asks for input from management. These decisions are based on whether the board believes shareholder interests would be best served by investing free cash flow in the company or distributing it back to shareholders. Thus, the relationship between governance practices and dividend payout decisions is a meaningful indicator of how well the board represents shareholder interests. Point estimates of different main terms and their interactions in Sample 1 are reported in Model 3 of Table 2b. The regression analysis shows that there is a positive relationship with Director Evaluation (b = 0.136, SE = 0.056, p = 0.016) and a negative relationship with Director Independence (b = -0.075, SE = 0.045, p = 0.094). Online Appendix Table 1b in Online Appendix shows descriptive statistics and correlations when our DV is dividends per share. Online Appendix Fig. SA2b describes the importance of features with this DV, Online Appendix Fig. SA3b shows the selection of cross-validation for LASSO Hyperparameter selection while Online Appendix Fig. SA4b shows identified associations with dividends per share in 80% bootstrap samples from Sample 1. Thus, we propose the following hypotheses:

Hypothesis 3a: There is a positive association between director evaluation and dividends per share.

Hypothesis 3b: There is a negative association between director independence and dividends per share.

Paying suitably high dividends to shareholders is the least ambiguous part of the board performance. As mentioned above, a director evaluation practice may be a mechanism for motivating board members to fulfill their responsibilities; by evaluating, and providing feedback about, their performance, board members are incentivized to discharge their duties. It follows that board members who are motivated are less likely to free-ride, more likely to build knowledge and other capabilities and thus become effective. Importantly, informed, active, and committed directors would be comfortable in their ability to either discipline or explicitly work as sparring partners with management (Boivie et al 2021). And such directors are more willing to assess future cash requirements that need to remain in the business versus what can be paid out in dividends. In contrast to such board members, managers, who face short-term performance pressure and yearly bonus targets, are likely to prefer smaller dividend payments, reserving more cash for their future plans.

Many interviewees suggested this empirical relationship was evidence of boards performing their role effectively. One interviewee, who was formerly a CEO, but moved into Chair positions, reflected that “CEOs want to re-invest earnings back into their companies…They believe in their plans and their own abilities…[But] sometimes the best thing is to give profits back to shareholders.” Several interviewees agreed that managers face a conflict of interest: an interviewee argued that “CEOs want to over-invest in themselves… boards must be the rational ones.” Consequently, boards must be motivated to take the lead to evaluate the opportunity cost of re-investing into the company to achieve stock appreciation against giving cash (dividends) back to shareholders to investments elsewhere.

A negative association between director independence and dividends per share might be explained by the preference of independent directors to reinvest profits into their business. If management is eager to reinvest the earnings back into the business in order to ensure future growth, and perhaps achieve their bonus targets, then independent directors could be open to such reasoning. Indeed, independent directors may be less concerned with appearing beholden to management than non-independent directors for dividend decisions, making independent directors an easier target for proposals to reinvest them. Although this explanation is possible, the finding still seems puzzling.

Model 3 in Table 2b is estimated on Sample 2 and shows there is indeed a positive association between director evaluation practices and dividends per share (b = 0.079, SE = 0.020, p = 0.000), including in the final model with net sales/revenues added. This supports Hypothesis H3a. At the same time, there is no support for the association with director independence, so we conclude that the relationship between dividends and director interdependence in Sample 1 was likely spurious. Thus, the estimates on Sample 2 retains the finding that has a solid theoretical interpretation and removes the finding that was harder to explain.

Table 3 provides a summary for all the associations we derived and their effects (parenthesis) in the holdout sample. The findings are striking. Out of 11 adopted practices, only three—audit committee independence, director share ownership, and director evaluation—had consistently measurable effects across two samples. This suggests a more limited role of board mechanisms in governing firms than the rhetoric around these institutions has advocated.

Causality vs. association

Machine-learning methods are inherently based on associations, but they can play a role in establishing causality (Davis and Heller 2017, p. 548; Athey and Wager 2019, p. 20). We introduced firm fixed effects, and we lagged our independent variables, which helps to rule out time invariant confounding factors. Still, in principle, causality can go both ways. That is, governance practices can improve firm outcomes, yet better performing firms might be more likely to incorporate governance practices as compared to worse performing firms. However, should an outside observer look for board-level correlates of superior performance without knowing ex ante what the performance of a firm was, then governance practices, such as the independence of the audit committee, appear to provide a useful indication of such performance irrespective of the direction in which causality between governance practices and firm performance is going. Should an outside observer look for higher dividend payouts, then this person should look for firms that require board members to own shares and perform director evaluations. The data firmly establish these associations.

Replication with different algorithms

As with other statistical methods, machine-learning approaches rely on certain assumptions, and each choice of method(s) has different strengths and weaknesses depending on how well these are met in a specific dataset. The combination of random forest and Lasso is frequently used and known to be robust, but it has two potential weaknesses. One is that collinear variables contribute redundant information into the model, so the ML algorithms fluctuate between assigning high weights in the model to one variable or the other depending on the randomization step of each iteration. In our hypothesis development and testing, we mitigated this by dropping some control variables either because they strongly correlated with our practices (e.g., BSCI score) or with dependent variables (e.g., Net Revenues). The other is that this sequence of algorithms will always yield less information than what the analyst would get from a more complete algorithm selection. The arsenal of machine-learning methods comprises dozens of different algorithms, some of which are designed to handle collinearity between variables. Following the advice of Chouduhry et al. (2021: 54), we re-analyzed our data using different ML algorithms in order to confirm whether the relationships between independent and dependent variables which we identified actually held. To do so, we used automatic algorithm selection by DataRobot platform. Results of this analysis are available in Online Appendix . Our results were replicated with different algorithms for variable selection, indicating that they were not dependent on the choice of the common sequence of random forest and Lasso.

Discussion and conclusion

There is a substantial body of governance research on the effects of board practices on firm outcomes, but clear answers on their effects remain obscure or contested (e.g., Hillman and Dalziel 2003; Dalton and Dalton 2011; Boivie et al. 2016). This is problematic because agency theory predictions on which governance structures are best for shareholders—board independence from management and alignment with shareholder interests—dominate theoretical arguments but are not supported empirically. Theoretically the reasoning is sound, but there are many different types of practices, and their effects are difficult to disentangle, or even detect (Dalton et al 2003). Adopting and investing in various governance practices purported to be antecedents to desired firm or shareholder outcomes requires substantial resources and time, and it may not be necessary. Instead, it is possible that adopting a selected subset of these practices will be more beneficial than wholesale adoption.

We have utilized machine-learning to explore relationships between a broad set of governance practices and the firm outcome of return on assets, along with firm decisions on debts and dividends. This approach has multiple benefits. First, traditional analytical frameworks impose restrictions on the functional form of the relation from a governance practice to an outcome that may not be justified—especially the unrealistic assumption that it is independent of other practices unless there is a theoretical reason to posit otherwise. Machine-learning examines all potential interdependencies up to the level of interaction allowed by the researcher. Second, although multiple governance practices spread across Canadian companies, it is unrealistic that all have effects, and it is not apparent which ones do impact the outcome variables of interest when other practices are considered. Having data on the adoption over time of all practices greatly facilitates testing and comparing the effects of each one. Importantly, following the machine-learning approach of entering all into the initial analysis and pruning variables that do not show effects avoids the risk of omitted-variable bias that can happen in analysis that enters some, but not all, of the relevant governance practices into a model.

The findings are easy summarize. First, contrary to the rhetoric promoting the adoption of many governance practices, our findings indicate that most practices do not have effects that are measurable with a dataset of our size. Larger datasets might produce more findings, but this would be because a large dataset allows measurement of substantively weak effects. Second, exactly one governance practice appears to affect value creation by providing greater return on assets—an independent audit committee—though this finding was just barely “insignificant” in the holdout sample and thus need additional testing. Membership in the audit committee requires directors to build expertise on the firm, resulting in better insights for supporting and monitoring management’s use of assets and profitability. In addition to this capability, audit committee independence means its members are free from conflicts of interests that might bias or dampen their efforts to protect shareholder interests. Thus, the combination of knowledge and independence—the two underlying attributes of independent audit committees—potentially leads to the outcomes sought by those promoting governance practices.

Third, we found positive effects of director evaluation and share ownership on debt. While debt can be considered a driver for the company growth in the short-term, it is also a long-term risk, and investors will require higher earnings from a company challenged by greater financial leverage. A company with high leverage has greater financial constraints (and higher bankruptcy risk) compared to a company with low leverage. Higher debt means that more cash must be allocated to principal and interest re-payment and, thus, less to strategic investments. High debt may discipline management, preventing them from having slack resources for vanity projects. Thus, companies with directors who are aware that their actions will be scrutinized by the peers and those who own shares might be using debt as a way to discipline management.

Fourth, the dividend payout was more favorable to shareholders when directors were undergoing regular evaluation. This is the most straightforward finding because it matches the view that director accountability (and hence, motivation) is necessary to activate the agency theoretic effect. Perhaps we should not be surprised that this was the cleanest finding, as the “correct” decision from the viewpoint of shareholders is more obvious than for total debt. Also, although ROA is to some degree a product of firm decisions, it is also a noisy variable for which the firm CEO and the board can make excuses, and these excuses would at least partly hold true. Dividends are central and easily observable signs of the board working for the shareholders.

Taken together, these results help us formulate a model of corporate governance that goes beyond the applications of the agency theory. It is summarized in Fig. 5. Specifically, agency theory would assume that independence of the board members and their alignment with the shareholders would be sufficient for firm outcomes to materialize. However, our findings suggest that one needs to also consider both board member motivations and capabilities. Evaluation practices increase board member motivation to carry out monitoring duties and this is translated into higher dividend payouts and higher debt (which in turn could either finance more of the dividends, future business growth opportunities approved by the board or discipline the management by lowering the free cash flow). The effect of independent audit committee on ROA suggests that board member capabilities also matter: board members who are members of audit committees gain valuable capabilities in the form of deeper knowledge. Such capabilities help directors understand the strategy of the company as well as its financial conditions. As a result, these board members are able to better monitor management decisions and also provide advice, all of which improve firm profitability and asset utilization.

One implication of this theoretical model is that future research on the relationship between governance and firm outcomes should pay more attention to motivations and capabilities of directors, as opposed to merely examining the extent to which they are independent from the management or aligned with shareholder interests. Even though we deduced the role of the director motivation from the positive association between evaluation measures and firm outcomes, director motivation can be affected in different ways. For example, some companies might attract more scrutiny from outside stakeholders than the others. Directors in companies under more scrutiny should be more motivated to exercise their monitoring responsibilities than directors whose companies are less scrutinized. If the company belongs to the major stock market index (e.g., TSX, NYSE, and NASDAQ), its activities are more likely to be monitored by external stakeholders than mid-cap companies that can potentially fly “under the radar”. Thus, our model would suggest that the higher the scrutiny, or visibility, of the firm, the stronger the relationship between governance practices and outcomes in this firm, and this effect is driven by higher director motivation in the highly scrutinized firms.

One can also think of director capabilities in different ways. While independence of the audit committee is a correlate of its members’ superior capabilities, director industry experience can also proxy for their capabilities. If board members possess more experience in the company’s industry, then one should expect a stronger association between governance practices and organizational outcomes. Directors may also possess professional experience that matter. For example, those with CEO experience could be especially effective monitors and mentors: these board members are uniquely capable of providing experiences and insights valuable to management as well as being able to detect attempts by management to “game the system” and act in their own interests. Thus, the higher the number of directors with the CEO experience or other management-level experience on the board, the stronger the relationship between its governance practices and firm outcomes. These are all promising venues for future research.

This model speaks to Dalton and Dalton’s (2011) work which showed that board composition and board chair leadership do not predict firm financial performance. They suggest that scholars need to turn to multilevel research (i.e., incorporate insights into directors’ personal characteristics or organizational context) to understand why this might be the case. We confirm their finding in general but do discover that a board composition practice (audit committee independence) mattered for a single financial outcome (i.e., ROA). We also discovered effects of other practices on other outcomes. Thus, based on our insights, in addition to looking at the multilevel aspects of governance, one should also recognize that governance practices are heterogeneous in nature, they can be more or less motivated by the key tenets of agency theory, and they can impact different performance outcomes.

Our finding that independent audit committee may influence firm value creation seems to contradict the findings of Boivie et al. (2021: 1683) suggesting that some directors view audit committees as “only important for carrying out necessary, tactical activities, and checking the boxes needed for regulatory compliance”. While directors as a whole might indeed have this perception, audit committees are small groups that meet more frequently than the board, and they hold deep expertise and clearly defined mandates. These characteristics might help independent audit committees to overcome multiple barriers for the quality of monitoring, such as large size of the board, low frequency of meetings, and dissimilarity and complexity of job demands (Boivie et al. 2016). Thus, independent audit committees might be an underappreciated feature of well performing boards that requires further investigation. Our findings on this are far from conclusive, so we strongly encourage more research on audit committee effects.

We also contribute to studies that highlight the importance of board processes for organizations (e.g., Finkelstein and Mooney 2003) by showing that these practices matter for some, but not for all performance outcomes. While board evaluation did not seem to matter, director evaluation impacted both the total debt and dividends per share. Coupled with the effects of audit committee independence on ROA, we conclude that the link between board practices and performance is conditional upon the specific performance objective that the firm wants to maximize. However, unlike Finkelstein and D'Aveni (1994) we do not find any bundles of practices that would affect firm outcomes. These should have manifested themselves through interactions between practices, but none were observed in our analyses even though machine-learning algorithms are made to effectively detect any that exist in the data. Hence, we cannot conclude from our analysis that non-structural practices amplify or diminish the effects of structural ones.

The notion that director motivations and capabilities are necessary complements to director independence is consistent with the “quad model” for identifying director potential for corporate monitoring developed by Hambrick et al. (2015). We complement Hambrick et al (2015) in two ways. First, we provide empirical testing of hypotheses that inform our model while their study exclusively focuses on theory development. Second, our results imply that different facets of governance might lead to different organizational outcomes. For example, our model implies that board member capabilities coupled with director independence are likely to lead to improved financial performance. However, board member motivations are likely to lead to increased dividend payouts or higher debt. By contrast, Hambrick et al (2015) were primarily focused on the governance failures as the outcomes of interest.

Finally, we contribute to the debate in agency theory research about the role of corporate governance for dividend payouts. Sharma (2011) showed that director independence was associated with increased dividend payouts, because this way independent directors return value to the shareholders as well as signal their own competence. We did not find effects of director independence on dividend payout in the analysis of the holdout sample, but instead found the positive effects of director evaluation on this outcome. It could be that our study is too small to discover an effect of director independence on dividends, or the effect itself might be small. However, we do suggest that internal board processes, which were not discussed in Sharma (2011), might play a more important role in dividend distribution than director independence.

Our methodological contribution lies in illustrating on firm-level data how machine learning can help identify effects of multiple practices on multiple outcomes, thereby facilitating inductive theory building using quantitative methods. Ideally, it should be combined with interviews to uncover the underlying mechanisms, as we did. We believe that machine-learning techniques to test performance claims is a necessary step for researchers who are interested in examining theoretically motivated new practices such as different approaches to firm market positioning, capability accumulation or institutional practices. One merit of doing so is that it allows testing of the theory underlying practices. A second merit is that the performance effect is of specific interest to management practice, so this type of testing is exactly how researchers generate theoretically relevant research that also has immediate substantive implications.

At the end, the general implication of our findings is that creating structures that put capable and motivated independent directors in the position of power can help advance the performance enhancing agenda of stakeholders. These people have to bridge the information gap between different stakeholders and have an unbiased mind. At the same time, when multiple practices are imposed on firms to further the same agenda, one needs to be prepared that some of these practices might actually be ineffective.

Data availability

Data and code are available from the authors upon reasonable request.

References

Arrow KJ (1986) Rationality of self and others in an economic system. J Bus, S385-S399.

Athey S, Wager S (2019) Estimating treatment effects with causal forests: an application. Observ Stud 5(2):37–51

Bebchuk LA, Fried JM (2003) Executive compensation as an agency problem. J Econ Perspect 17:71–92