Abstract

This paper presents some evidence on the dynamics of population across Italian locations (municipalities and LLMs) over the period 1951–2011. We find that population shifted from initially smaller to relatively larger locations. The growth rate of very large urban areas was particularly intense in the post-war period, while it became slower in the last two decades. Population dynamics in the post-war period are related to structural change away from agriculture; sectoral diversification and—to a lesser extent—human capital represent an important determinant of city growth in the last two decades.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The aim of this paper is to provide some stylized facts on patterns of population growth of Italian cities over the medium/long run. We proceed in two steps. We first evaluate the relationship between growth and the initial levels of city population between 1951 and 2011. Then, we study the extent to which the observed population dynamics have been driven by the deep economic transformations that characterized the Italian economy in the last 60 years.

Our focus on population growth has two main reasons. The first is related to the deep connection between population dynamics and economic factors. While physical geography (mountains, coasts, rivers) may have played a crucial role in early settlements, in the long run, the evolution of the population across geographical locations is mostly led by economic motives.Footnote 1 The second refers to the fact that city level data on population are characterized by a good availability and higher quality. For this reason long run analyses in urban economics generally rely on population data, since other economic indicators are more likely to be affected by measurement errors and lack of comparability over time.

Testing Gibrat’s law is important for both its positive and normative implications. The size of a city is the result of a complex amalgam between centripetal and centrifugal forces. If the Gibrat’s law were confirmed, these two forces perfectly counterbalance in expectation and city size is simply determined natural advantages or geographical constraints; this basically imply that first-nature advantages are the only determinant of city size while the impact of second-nature advantages (agglomeration economies) is limited. In principle, this has relevant policy implications; if growth is random, irrespective of past productivity shocks, all policies aimed at improving the locational fundamentals would always be very effective since they could have may have permanent consequences on the spatial distribution of population and economic activities; if, instead, agglomeration economies play a relevant role, public policies would be effective only in the short run.

This is the first work, to the best of our knowledge, that studies population growth for all Italian locations over a relatively long time span. Italy represents an interesting case because of its great variability of economic conditions and regional imbalances over this period of time. Between 1951 and 2011 experienced distinct phases in its economic history, passing from decades of intense growth and industrialization (1951–1971) to marked economic and productivity slowdown (1991–2011). Our results show that Gibrat’s law is rejected over the period 1951–2011, irrespective of whether we consider administrative units (municipalities) or local labor markets (LLMs). In the last 60 years there was a remarkable shift of population. Very small locations consistently lost population over time, while cities of intermediate size grew more than average; the growth rate of very large cities changed over time. In the post-war period, very large locations grew more than average due to the strong urbanization process that took place in those years; in the subsequent decades, instead, growth for this kind of locations halted, suggesting a progressive decline in agglomeration economies or a rise in congestion costs. The rejection of the random growth leads to the second part of the paper in which we study the role economic factors in explaining such divergence; we focus, in particular, on the structural change away from agriculture (Michaels et al. 2012) that characterized all modern economies in the last 60 years. While agricultural activities are intensive in the use of land and have very limited returns from agglomeration, non-agricultural sectors rely much less on land and benefit more from higher density in economic activities.Footnote 2 This implies that structural change may have made relatively larger locations more economically attractive at the expenses of smaller ones. We also analyze the role of sectoral diversification and human capital. Larger cities are generally more diversified and more educated than smaller ones; this can—in part—explain population divergence considering the large evidence on the positive role of diversification and human capital for the absorption of negative sectoral shocks (Duranton 2007; Findeisen and Suedekum 2008; Glaeser and Gottlieb 2009) and, in general, in spurring local economic growth (Glaeser et al. 1992; Glaeser 1995; Henderson et al. 1995). Our results show that structural change, especially the one away from agriculture, plays an important role in describing population growth over locations. Structural change has instead a more limited role when we analyze the last two decades. The role of sectoral diversification was instead quite limited in the post-war decades and it became relevant in the period 1991–2011. Human capital, instead, provide a limited support to local growth; this result is in constrast with the international evidence.

The paper is organized as follows. Section 2 provides a brief review of the related literature, which is based on international evidence. Section 3 describes the data. Section 4 presents the test for random growth. Section 5 studies the possible determinants for population divergence. Section 6 concludes.

1.1 Related literature

The main contribution of this paper is the analysis of the Gibrat’s law for all Italian cities over a relatively long time span. Early papers on the topic tended to confirm the hypothesis that city growth is random. Eaton and Eckstein (1997) examined the growth patterns for 40 long-established cities in Japan between 1876 and 1990 and 39 cities in France between 1925 and 1985. For this highly-selected sample, they confirm the existence of parallel population growth (i.e. orthogonality between growth and initial conditions). This pattern is confirmed by Sharma (2003), for the size distribution of cities in India over a century, and Ioannides and Overman (2003), for US metropolitan areas in the 1990s.Footnote 3 More recently, the availability of larger datasets with population data for all locations over very long time-spans has questioned the empirical relevance of Gibrat’s law. Beeson and DeJong (2002) document that population growth by US states was more intense following their admission to the Union. Holmes and Lee (2010) find an inverted-U relation between growth and size from 1990 to 2000 for US locations. Dittmar (2011) shows that orthogonal growth across European cities emerged only in the modern period (after 1500). Desmet and Rappaport (2017), Giesen and Südekum (2014), and Sánchez-Vidal et al. (2014) documents episodes of convergence or divergence from a long-term perspective; however, Gibrat’s law generally emerge in the very long run, once the incidence of confounding factors like the age of the location and structural transformations gradually disappear.Footnote 4 Convergence across location is reported by Gonzalez-Val (2016) for a set of European cities from 1300 to 1800. Our results basically confirm the rejection of the Gibrat’s law for Italian cities in the period under consideration.

Our paper also analyzes the role of structural change on population dynamics. Michaels et al. (2012) study population growth for all US locations from 1880 to 2000 and document a strong positive correlation between population growth and initial size of the location. They interpret these results through the lens of structural transformation of the US economy away from agriculture. The intuition is that manufacturing and services benefit more from agglomeration economies; structural change increases the comparative advantage of larger locations (i.e. rising the returns to agglomeration) and create a positive correlation between growth and initial size. According to their estimates, structural change had a relevant impact on the departure from the Gibrat’s law especially for the areas (e.g. Southern States) and in the decades (1880–1960) in which the structural transformation of the US economy away from agriculture was more intense. Our results confirm for the Italian case the importance of structural transformations in explaining population divergence across locations; structural change away from agriculture is particularly important in the early stages of the modernization of the Italian economy.

Finally this paper also analyzes—for the Italian case—the role of other determinants like sectoral diversification and human capital on local growth. There is a widespread consensus on the positive impact of diversification (Glaeser et al. 1992; Henderson et al. 1995); this finding has been rationalized by Duranton and Puga (2001) in a theoretical model that shows that more diversified cities are more likely to foster the growth of new and innovative sectors. The concept of diversification has been more recently rephrased by Frenken et al. (2007) to accommodate the concept of related variety; for the Netherlands, they show that productivity growth was more intense in the areas in which diversification occurred among technologically close sectors. As for the impact of human capital, early literature on the topic (Glaeser et al. 1995) has emphasized the role of human capital for local growth; this evidence was extensively reviewed by Moretti (2004) and Glaeser and Gottlieb (2009). More recently, human capital was also portrayed as a major source of regional resilience during the recent European crises (Crescenzi et al. 2016). For Italy, Giffoni et al. (2017) has found a positive relationship between human capital endowment and population growth for the period 1981–2001. Our results partially confirm the international evidence. While the impact of sectoral diversification (especially, among related varieties) is in line with the results for other countries, the impact of human capital is more limited; population growth positively correlate with the level of education of local population only for the period 1991–2011 (a period that partially overlaps with Giffoni et al. 2017).

1.2 Data and descriptive statistics

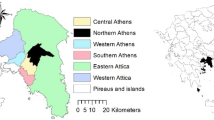

This paper uses population and employment data at city level for all decennial censuses from 1951 to 2011. The choice of the unit of observation is a critical issue. As explained by Cuberes (2011) both administrative and functional definitions of cities have advantages and disadvantages. For example, administrative boundaries are sometimes arbitrary and lack of economic content. Functional definitions of metropolitan areas, instead, have more economic meaning but they change over time; this makes them less suitable for long run comparisons. For this reason, we use both administrative and functional boundaries. As for the administrative units, we rely on the homogenization recently made available by the Italian Statistical Office (Istat) on the web portal http://ottomilacensus.istat.it/. Municipalities’ data are made comparable from 1951 to 2011. Table 1 presents the number of municipalities for each census year. As for the functional boundaries, we use the Istat definition of LLMs. Starting from 1981, Istat started surveying the commuting patterns across municipalities by Italian workers. This allowed constructing commuting matrixes among municipalities. The Istat LLM is a set of at least two contiguous municipalities characterized by self-contained commuting patterns (at least 75% of local population lives and works in the LLM). For the purposes of this paper, we use the LLMs map based on 1981 commuting patterns for all analyses between 1971 and 2011.Footnote 5

Table 2 presents a number of descriptive statistics for both municipalities and LLMs. Average population growth across cities between 1951 and 2011 is negative (− 8.8% in log points); this indicates the prevalence of a number of locations that lost population since in the same period total population in Italy grew by 22% (in log points). The great variability in growth rate is apparent by the standard deviation that is seven times the mean. Figures 1a, b show different population growth patterns according to different geographical zones: growth has been weaker for municipalities and LLMs located in internal mountainous areas, especially in the Apennines, than for those placed in coastal areas. The prevalence of small rural locations in 1951 can be also detected by the average high share of employees in agriculture (57%) that is larger than national figure at that time (41%). The standard deviation of the log population for municipalities was 1.040 in 1951 and 1.340 in 2011Footnote 6; this indicates an increasing dispersion in the city-size distribution suggesting the existence of a sigma-divergence across Italian location.

2 Random growth for Italian cities

2.1 Non parametric analysis

Gibrat’s law for population growth predicts the orthogonality between growth rates and initial conditions. We test this implication by using both parametric and non-parametric estimates.

Non-parametric estimates are obtained by the following regression:

where i indicates the city or the LLM; \(g_{i}\) is the standardized log growth rate of city i; standardized growth rate is the difference between the growth rate and the sample mean, divided by standard deviation. \(S_{i}\) is the log population of location i at the start of the period (Ioannides and Overman, 2003). The objective of this regression is to provide an approximation of the unknown relationship between growth and size using smoothing, without making parametric assumptions about the functional form of \(m\left( {S_{i} } \right)\). We denote the estimate of \(m\left( {S_{i} } \right)\) with \(\hat{m}\left( {S_{i} } \right)\) that is the local average of the dependent variable around \(S_{i}\). This local average smooths the value around \(S_{i}\) by using a kernel, that is a continuous weight function symmetric around \(S_{i}\). The kernel K used in the remainder of the paper will be an Epanechnikov kernel, with optimal bandwidth h as computed by Silverman (1986). In formula, the estimator is equal to:

Figure 2a presents the kernel estimation for the standardized growth rates of Italian cities between 1951 and 2011; Fig. 3a shows the same estimation for LLMs over the period 1971 and 2011. Both figures decisively reject the random growth hypothesis.Footnote 7 Over both time spans middle-size locations registered a positive standardized growth, while smaller location grew less than the average. The turning points are around 5000 inhabitants for cities and 20,000 for LLMs. Results for bigger municipalities (more than 200,000 inhabitants) are instead more tentative due to larger standard errors; it should be noted, however, that point estimates are lower than those registered by middle-sized locations. The other panels of Figs. 2 and 3 present a breakdown of the relationship between growth and size by splitting growth rates into three (for cities) or two (for LLMs) 20 years subperiods. This periodization is particularly meaningful for the Italian case. From 1951 to 1971 Italy experienced the fastest economic growth in its history (the so-called economic miracle); this period is characterized by a dramatic shift from a mostly agricultural to a manufacturing economy. In the same period Italy registered vast internal migrations from the countryside to urban centers and, in particular, from the North to the South. In the second period (1971 to 1991) Italy experienced lower but still vibrant economic growth; industrialization continued at fast pace, especially in some areas of the North East and the Center, with the rise of industrial districts.Footnote 8 Other cities of ancient industrialization like Milan and Genoa started instead to deindustrialize. The third period (1991–2011) is characterized by a marked economic slowdown and (especially in the second decade) and an intense deindustrialization.

Across time, heterogeneity arises especially with respect to larger locations. City level data show that during the most intense period of industrialization and economic growth in the post-war years (1951–1971) the relationship between growth and initial size is almost monotonically increasing. In this period, indeed, larger cities grew more than all other locations; this is probably attributable to the fact that this period was characterized by a strong rural–urban migration that determined the spatial concentration of individuals in the larger urban centers in a period in which congestion costs were still low. In the following four decades (from 1971 to 2011), the relationship between growth and initial size is hump-shaped for both municipalities and LLMs. In these decades, population growth was relatively more intense for cities between 3000 and 60,000 inhabitants and for LLMs between 20,000 and 450,000 people; above and below these thresholds relative growth was negative. These patterns indicate that the strong urbanization in the period 1951–1971 dramatically lowered the net benefits of agglomerations (benefits minus congestion costs) for larger locations thus hampering their growth in the last two subperiods; Accetturo and Mocetti (2019) provide evidence on the steep rise in housing costs and traffic congestion in larger Italian location from 1970s.

2.2 Parametric analysis

Despite the presence of a large number of observations, non-parametric tests are generally quite sensitive to the presence of outliers (Tibshirani and Efron 1993). For this reason we also perform parametric tests. We first estimate the basic relationship:

where—as before—i indicates the city or the LLM; \(g_{i}\) is the standardized log growth rate of city i. \(\tilde{S}_{i}\) is the standardized log population of location i at the start of the period. f() is either a linear or quadratic function of \(\tilde{S}_{i}\).Footnote 9

Table 3 presents the results. In the upper panel, the first two columns are for cities (period 1951–2011) and the second two are for LLMs (1971–2011). The first and the third columns present the results when f() is linear; the second and the fourth show the estimates when it is quadratic. In all cases random growth is rejected: linear coefficients are always positive and significant, and in the second column shows also a negative and significant quadratic coefficient, thus confirming the hump-shaped relationship between growth and size. Estimates for subperiods (lower panels) confirm the heterogeneity over time. For municipalities, the estimated parabola is convex for the period 1951–1971; this basically confirms that smaller municipalities relatively grew less in this period and very large locations grew comparatively more (remind that coefficient are standardized). The estimated curve becomes instead concave in the subsequent four decades; this confirms the fact that in the last decades net benefits of agglomeration declined, thus hampering their growth. Results for LLMs confirm the previous ones since for both subperiods 1971–1991 and 1991–2011, the estimated second order polynomial is negative and significant thus implying that larger LLMs grew relatively less than intermediate-sized ones.

In Appendix we also show the results on a generalized test on Gibrat’s law in which we use log population density instead of log population. This is an important robustness check because location surfaces might be different and densities might be able to better capture the presence of agglomeration/congestion forces. Estimation results are quite similar to the ones obtained by using log population.

2.3 Relocation of population within LLMs

Previous sections have shown that between 1951 and 2011, smaller locations consistently lost population in favor of intermediate-sized ones; larger municipalities, instead, grew more intensively in the 50 s’ and the 60 s’, while they slowed down in the subsequent decades. These patterns seem to indicate that in all subperiods a relevant relocation process occurred within larger urban zones. To investigate this issue, we run the following regression:

where \(D_{{i,{\text{main}}}}\) is a dummy equal to one if the municipality i is the main city in the LLM and \(D_{\text{LLM}}\) is a set of LLM dummies.

Table 4 presents the results. All specifications, for all subperiods, still confirm that relocation of population from smaller to larger municipalities even within LLMs. The behavior of the main city, instead, changes over time. The main city within the LLM grew relatively more than the other municipalities until 1971; in the last two decades, instead, the coefficient becomes negative and significant thus indicating a process of suburbanization within LLMs.

3 Structural change, sectoral diversification, and human capital

3.1 Detecting the effects

Gibrat’s law is consistently rejected for Italian locations over a long time span. In order to explain this feature, we focus on the role played by some economic transformations that characterized the Italian economy over the last 60 years.

As explained in Sect. 2, Michaels et al. (2012) show that the shift from agricultural to non-agricultural activities partially explains the rejection of the Gibrat’s law for US counties from 1880 to 2000 in the US. The shift away from agriculture dramatically modifies the growth potential of each location. Smaller locations (with a comparative advantage in agriculture, due to their land abundance) are likely to lose, while more populated areas are more able to exploit agglomeration economies and, hence, are more likely to register economic (and population) growth. The characteristics of Italian structural change are described in Table 5. In 1951 40% of Italian workers were employed in agriculture; the corresponding share for manufacturing was 32%. From 1951 to 1971 agricultural share more than halved, while manufacturing share rose by 12 percentage points reaching its historical peak (44% in 1971). Starting from 1971, the share of industrial workers started to decrease, with a more intense fall in the period 2001–2011.

We estimate the following equation:

where \(g_{i}\) and \(\tilde{S}_{i}\) denote the same variables explained in the previous section. \({\text{s}}\widetilde{{{\text{h}}\_{\text{ag}}}}{\text{r}}_{i}\) and \({\text{s}}\widetilde{{{\text{h}}\_{\text{ma}}}}{\text{n}}_{i}\) are, respectively, the (standardized) share of agriculture and the share of manufacturing in location i at the start of the period. These two variables are aimed at capturing the role of structural change on population growth (Michaels et al. 2012); we use of the start-of-the-period figures (rather than changes over time) to reduce the impact of simultaneity biases in first differenced regressions (Baum-Snow and Ferreira 2015).

Parameter \(\beta\) represents the conditional correlation between initial size and growth; it is equal to zero when population growth is random, while it is positive (negative) in case of divergence (convergence). In order to keep relatively simple the interpretation of the coefficient we just insert the linear term of \(S_{i}\) despite the fact that the relationship between growth and size is generally concave.

Vector \(X_{i}\) includes controls for alternative explanations for population growth. We concentrate on two main determinants. The first is the role of sectoral diversification. Duranton (2007) and Findeisen and Suedekum (2008) show that sectoral diversification has an impact on city-level population and economic cycles. If an urban area is diversified enough, negative idiosyncratic shocks in some industries could be compensated by the growth of other sectors, thus leaving employment, income levels, and population unchanged (Glaeser et al. 1992; Henderson et al. 1995; Duranton and Puga 2001); moreover, diversification also induces inter-sectoral knowledge spillovers with relevant impact on productivity (and, hence, population) growth. Frenken et al. (2007) operationalize this idea by showing that sectoral diversification can be decomposed in a within-sector diversification (so-called related variety that captures the technological effects) and a between-sector component (so-called unrelated variety that accounts for the portfolio diversification argument).Footnote 10 In practice we use the economic censuses from 1951 to 1991; these data (provided by Istat) contain information on the number of employees for each municipality at 4-digit Nace level. Unrelated variety is measured as an entropy index across sectors at 2-digit level:

where g indexes 2-digit sectors and \(P_{{g_{i} }}\) is the share of employment in sector g in location i. \({\text{UV}}_{i}\) captures the degree of diversification in an area across technologically distant sectors. Diversification across technologically close sectors is captured instead by the related variety index:

where

\(p_{ji}\) is the share of subsector (4-digit) j belonging to macro-sector (2-digit) g over total employment. \({\text{RV}}_{i}\) captures the degree of diversification across subsectors belonging to the same 2-digit macro-sector.

The second control we include is a measure of human capital endowment at local level. A large literature on urban growth has shown that human capital is a major determinant for economic growth, especially in the most recent decades (Glaser et al. 1995; Moretti 2004; Glaeser and Gottlieb 2009). We use the share of individuals with at least a secondary-school diploma since this is the only measure that is consistently available from 1951. Finally, we include a dummy for southern locations.Footnote 11

4 Results

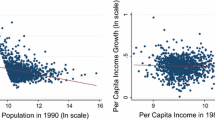

Estimation results of Eq. (5) for municipalities are reported in Table 6a shows the estimates for the entire period (1951–2011). The first column reports the simple correlation between growth and initial population controlling for the dummy South only; the coefficient is positive confirming the population divergence we observed in the previous section. An increase of a standard deviation in local population is associated with a rise in the relative population growth of 28% points. The second column adds controls for agriculture: initial share is negatively correlated with population growth. This fact confirms the effects of structural change on population dynamics (Michaels et al. 2012). The third column includes controls for manufacturing. The positive effect of the initial industrial share is quite smallFootnote 12: this is not surprising considering that the period between 1951 and 2011 is characterized by opposing waves of industrialization and deindustrialization. In the fourth column we include diversification indexes (related and unrelated varieties); as shown by Frenken et al. (2007), diversification in related varieties has a stronger impact on population growth (Glaeser et al. 1992; Henderson et al. 1995; Duranton 2007). Column five adds human capital. Quite unexpectedly, the sign is negative; as we will see, this is driven by a specific period of time (1971–1991).

The signs of the correlations are roughly confirmed across sub-periods. The initial agriculture share impacts negatively during all the 20-years sub-periods and its effect is stronger in the first two decades (1951–1971, panel (b)); the effect of the initial manufacturing share is not significant for the first 20 years, while it becomes strongly positive and significant in the subsequent periods, especially over the period 1971–1991 (panel (c)). Human capital is not significant in the first 20 years while it has a negative effect in the 1971–1991 decades when the industrialization of the North-Eastern and Central Italy took place (industrial districts); this is not surprising since the knowledge spillovers in industrial districts were not based on formal education but rather on learning by doing. de Blasio and Di Addario (2005) confirm this hypothesis by estimating negligible returns to education in industrial districts. The impact of human capital is instead positive and significant in the last 20 years, in a period of strong tertiarization of the Italian economy.Footnote 13

We calculate the impact of each component in explaining population divergence by looking at the sensitivity of the coefficient of initial population across specifications. In particular, we analyze the role of structural change and diversification in reducing the estimate of \(\beta\); we compare the third, the fourth, and the fifth columns with the first one. For the entire period (1951–2011) structural change impacts for almost 40% (= (0.2827–0.1723)/0.2827) of the observed population divergence; diversification accounts, instead, for roughly 13% (= (0.1723–0.1351)/0.2828). The relative importance of structural change and diversification changes over time. The role of structural change is particularly relevant in the first two decades as it explains almost 50% of total divergence (= (0.3117–0.1567)/0.3117), while it accounts for roughly one-quarter of divergence in the following four decades. Diversification, instead, does not impact on divergence in the 50 s’ and 60 s’ while its relevance raises to more than 50% in the period 1991–2011 (= (0.1993–0.0585)/0.2681). As we said, human capital explains divergence only in the last decades; however, its impact is quite limited (4% = (0.0565–0.0469)/0.2681).

Results for LLMs (Table 7) basically confirm these findings. From 1971 to 2011 population divergence across LLMs was relevant, with a standardized coefficient of 0.338 (panel (a), first column). Over this period, the impact of structural change played on divergence was significant (18%), although quantitatively smaller than the one computed for cities. Analyses by sub-periods do not show much heterogeneity: the impact of both structural change and diversification is quite constant in both sub-periods.

5 Concluding remarks

In this paper we present some evidence on the dynamics of population across all Italian locations (municipalities or LLMs) over the period 1951–2011. Our aim is to detect whether Gibrat’s law holds for Italy over a relatively long (and quite diversified) period of time. We find that random growth is consistently rejected. From 1951 to 2011, population shifted from initially smaller to relatively larger locations; the growth rate of very large urban areas was more intense in the post-war period and it slowed down in the subsequent decades. We interpret this result by analyzing the relative roles of structural change and diversification. We find that structural change away from agriculture and, to a lesser extent, industrialization had a big role in explaining population divergence across locations. The effect was particularly strong until 1971, while it weakened in the last two decades. Diversification had also an effect in explaining divergence: its role became more relevant in the last 20 years.

In interpreting these results two things should be kept in mind.

First, we just show conditional correlations, in which problems of omitted variables or reverse causality might be pervasive. While we think that a good description of data is important for a primer in analyzing economic issues, we are aware that detecting causality is important when we derive policy implications. We leave this problem to future research.

Second, the structural change and diversification interpretations for population dynamics have recently become quite popular. In our estimates we find that they able to explain an important part of the observed divergence (50% in the ‘50 s and the ‘60 s, almost one-third in subsequent decades). However, observed divergence is still robust across locations, even in the most recent decades. A possible explanation, that we leave for future research, is linked to the path dependence in the location of population. Individuals may react quite slowly (and with several lags) to local economic shocks; this implies that “old” systems of cities may perpetuate over time despite the fact that some locations have completely lost their locational advantages. This might have strong aggregate effects as shown by Michaels and Rauch (2017) in their comparison between the French and the British urban systems.

Notes

The most known example is Detroit, whose decline in population coincided with a severe downturn in manufacturing activity. In Italy, similar dynamics were experienced in cities like Trieste or Naples.

This is confirmed by Eeckhout (2004) for all US cities in the 1990 s.

Rappaport and Sachs (2003) find that the increasing population density in the coastal areas of the United States is partly driven by the fact that those areas are characterized by a higher productivity; however, in more recent decades, population divergence is also explained by quality of life.

There are two main sources of arbitrariness. The first is the use of 1971 as a staring year, despite the fact that commuting patterns were registered in 1981. The second is the use of 1981-LLMs for the following years, despite the fact that we know that LLMs changed over time. It should be noted, however, that our results are quite robust to the change of the initial year or the change of the definition of LLMs. Results are available upon request.

The difference between the two figures is statistically significant.

Note that these figures (for the entire period and for subperiods) are quite similar to those shown by Desmet and Rappaport (2015) for the period 1940-2000.

This area was subsequently called “Third Italy” with the aim to distinguish it from the already industrialized North-West and the still lagging South.

The constant is omitted from this regression since both dependent and explanatory variables are standardized.

Caragliu et al. (2016) employ these measures in a cross-sectional analysis on EU regions.

A dummy for Southern locations is necessary to control for the divergent pattern that experienced the Italian economy since the national unification in the 1860s. It also aims at capturing the stark differences between the two macro-areas under several dimensions (geography, economic development, infrastructure human and social capital). However, all results are confirmed is we remove this dummy; results available upon request.

This result is in contrast with Glaeser et al. (1995) which find that specialization in manufacturing is negatively correlated with economic growth. It should be noted, however, that—compared with the US—manufacturing still plays a very relevant role in the Italian economy.

This is consistent with the evidence by Giffoni et al. (2017) that shows that tertiary education is a good predictor of population growth in Italian LLMs in the period 1981–2001.

This is, for instance, the measure of urbanization used by Michaels et al. (2012).

References

Accetturo, A., & Mocetti, S. (2019). Historical Origins and Developments of Italian cities. Forthcoming Italian Economic Journal.

Baum-Snow N. and F. Ferreira (2015): “Causal inference in urban economics,” in G. Duranton, J. V. Henderson, and W. Strange (eds.) Handbook of Regional and Urban Economics, vol. 5.

Beeson, P. E., & DeJong, D. N. (2002). Divergence. Contributions in Macroeconomics, 2(1)

Breschi, S., & Lissoni, F. (2001). Knowledge spillovers and local innovation systems: a critical survey. Industrial and Corporate Change, 10(4), 975–1005.

Caragliu, A., de Dominicis, L., & de Groot, H. L. (2016). Both Marshall and Jacobs were right! Economic Geography, 92(1), 87–111.

Crescenzi, R., Luca, D., & Milio, S. (2016). Resistance to the crisis in Europe: macroeconomic conditions, regional structural factors and short-term economic performance. Cambridge Journal of Regions, Economy and Society, 9, 13–32.

Cuberes, D. (2011). Sequential city growth: empirical evidence. Journal of Urban Economics, 69(2), 229–239.

de Blasio, G., & Di Addario, S. (2005). Do workers benefit from industrial agglomeration? Journal of Regional Science, 45(4), 797–827.

Desmet, K., & Rappaport, J. (2017). The settlement of the United States, 1800–2000: the long transition towards Gibrat’s law. Journal of Urban Economics, 98, 50–68.

Dittmar, J. (2011). Cities, markets, and growth: the emergence of Zipf’s law. Institute for Advanced Study.

Duranton, G. (2007). Urban evolutions: the fast, the slow, and the still. American Economic Review, 97(1), 197–221.

Duranton, G., & Puga, D. (2001). Nursery cities: urban diversity, process innovation, and the life cycle of products. American Economic Review, 91(5), 1454–1477.

Duranton, G., & Puga, D. (2004). Micro-foundations of urban agglomeration economies. In Handbook of regional and urban economics (Vol. 4, pp. 2063-2117). Elsevier.

Eaton, J., & Eckstein, Z. (1997). Cities and growth: theory and evidence from France and Japan. Regional Science and Urban Economics, 27(4–5), 443–474.

Eeckhout, J. (2004). Gibrat’s law for (all) cities. American Economic Review, 94(5), 1429–1451.

Findeisen, S., & Suedekum, J. (2008). Industry churning and the evolution of cities: evidence for Germany. Journal of Urban Economics, 64(2), 326–339.

Frenken, K., Van Oort, F., & Verburg, T. (2007). Related variety, unrelated variety and regional economic growth. Regional Studies, 41(5), 685–697.

Giesen, K., & Suedekum, J. (2014). City age and city size. European Economic Review, 71, 193–208.

Giffoni, F., Gomellini, M., & Pellegrino, D. (2017). Human capital and urban growth in Italy, 1981-2001. Temi di discussione della Banca d’Italia (No. 1127). Working Paper

Glaeser, E. L., & Gottlieb, J. D. (2009). The Wealth of the Cities: agglomeration Economies and Spatial Equilibrium in the United States. Journal of Economic Literature, 47(4), 983–1028.

Glaeser, E. L., Kallal, H. D., Scheinkman, J. A., & Shleifer, A. (1992). Growth in cities. Journal of Political Economy, 100(6), 1126–1152.

Glaeser, E. L., Scheinkman, J., & Shleifer, A. (1995). Economic growth in a cross-section of cities. Journal of Monetary Economics, 36(1), 117–143.

González‐Val, R. (2016). Historical urban growth in Europe (1300–1800). Papers in Regional Science.

Henderson, V., Kuncoro, A., & Turner, M. (1995). Industrial development in cities. Journal of Political Economy, 103(5), 1067–1090.

Holmes, T. J., & Lee, S. (2010). Cities as six-by-six-mile squares: Zipf’s law?. In Agglomeration Economics (pp. 105-131). University of Chicago Press.

Ioannides, Y. M., & Overman, H. G. (2003). Zipf’s law for cities: an empirical examination. Regional Science and Urban Economics, 33(2), 127–137.

Michaels, G., & Rauch, F. (2017). Resetting the urban network: 117–2012. The Economic Journal, 128(608), 378–412.

Michaels, G., Rauch, F., & Redding, S. J. (2012). Urbanization and structural transformation. The Quarterly Journal of Economics, 127(2), 535–586.

Moretti E. (2004). Human Capital Externalities. Handbook of Regional and Urban Economics.

Rappaport, J., & Sachs, J. D. (2003). The United States as Coastal Nation. Journal of Economic Growth, 8, 5–46.

Sánchez-Vidal, M., González-Val, R., & Viladecans-Marsal, E. (2014). Sequential city growth in the US: does age matter? Regional Science and Urban Economics, 44, 29–37.

Sharma, S. (2003). Persistence and stability in city growth. Journal of Urban Economics, 53(2), 300–320.

Silverman, B. W. (1986). Density estimation for statistics and data analysis. Routledge.

Tibshirani, R. J., & Efron, B. (1993). An introduction to the bootstrap. Monographs on Statistics and Applied Probability, 57, 1–436.

Acknowledgements

We wish to thank the Editor (Federico Revelli), two anonymous referees, Alberto Dalmazzo, Paolo Sestito, and the participants to the Bank of Italy – Urban economics workshop (Rome, December 2015), ERSA 2016, and AIEL 2016 conferences for useful comments. The usual disclaimers apply. Further, the views expressed are the author’s own and do not necessarily reflect those of the Bank of Italy.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Results on densities

Appendix: Results on densities

In this appendix we report and briefly comment the results of the main estimates of the paper when the main dependent variable, i.e. city size, is defined not as the absolute population of a territory but as its population density, namely the ratio between its population and its area.Footnote 14

Table 8 shows the counterpart of Table 3 when we use log population density instead of log population as main variable of interest. For both municipalities and LLMs Gibrat’s law is again rejected. For municipalities the estimated parabola is now convex instead of concave; this is driven by the period 1951–1971 when population growth was more intense more dense locations. In subsequent decades, the estimates are remarkably similar to the ones presented in Table 3.

In Tables 9, 10 we have results of the estimation of Eq. (6); even in this case results of Tables 6 and 7 are confirmed.

Rights and permissions

About this article

Cite this article

Accetturo, A., Cascarano, M. & de Blasio, G. Dynamics of urban growth: Italy, 1951–2011. Econ Polit 36, 373–398 (2019). https://doi.org/10.1007/s40888-019-00155-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-019-00155-7