Abstract

This paper examined the impact of related deposit transactions on banks' risk-taking and financial stability by considering the ratio of related deposits over total deposits to capture banks' dependency on deposits from their related parties. Our sample consisted of 90 Indonesian banks and covered the period 2009–2019. Our finding showed that related bank deposits significantly increased the z-score. Our deeper investigation showed that the effect of related deposits when we split the sample based on size. We find that related deposits increase the z-score only for small banks. Our results provide insights and noteworthy policy implications for regulators to take into account related party transactions in deposits to have greater control over the behavior of bank's risk-taking and to maintain the soundness of the banks, and mitigate financial instability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The vast majority of literature on banks and their related parties has investigated the related party transactions in the form of lending. Banks' controlling shareholders tend to have a stake in non-financial firms that may potentially lead to a conflict of interest (Barry et al. 2011). Several studies have provided empirical evidence on how related party transactions can be harmful to minority shareholders or even taxpayers (Johnson et al. 2000; La Porta et al. 2003; Peng et al. 2011). Controlling shareholders also benefit themselves at the expense of minority shareholders or even taxpayers in the case of bailouts by conducting related party transactions. These transactions can take the form of "tunneling," where controlling shareholders undertake a wealth transfer, or the form of "propping," where the related party transactions are designed to save related firms during financial distress.

In the case of "tunneling," stakes in non-financial firms may prompt controlling shareholders to use their banks to lend money directly to their related parties. In most instances, these loans come with favorable terms such as lower interest rates, no collateral requirements, and longer maturity and grace periods compared to similarly risky loans granted to non-related parties (La Porta et al. 2003). Markets may also react negatively to a high volume of related party transactions when firms with high related party transactions are granted loans by banks, as minority shareholders are aware of the risk of expropriation (Bailey et al. 2011; Huang et al. 2012). Thus, loans granted are most likely based on a looting perspective instead of profit maximization that may reduce minority shareholders' wealth.

With the growing assets generated by business groups, banks' controlling shareholders have the ability to improve bank stability via related deposits. Excess cash in their business group can be a useful propping tool for improving banks' stability. Moreover, controlling banks' shareholders benefit from financing their related parties and take advantage of easy access to funding from their related parties. Deposits tend to be a shield for banks from bank-run risk; banks with higher deposits have less funding liquidity risk, which reduces market discipline, and leads to greater risk-taking (Khan et al. 2017).

On the other hand, banks with higher related deposits will have more incentive to take risks because they have enough funds, and they find it relatively easy to access funds from their related parties. Nys et al. (2015) found that politically connected banks are able to attract deposits more easily than their non-connected counterparts. However, holding a higher ratio of related deposits might not be good, especially for smaller banks, since the related depositors could withdraw their funds in a crisis or when they are in financial difficulty. Moreover, banks benefit from having easy access to related deposits during financial distress or a liquidity crisis to lower liquidity risk. Hence related deposits have the potential to be either harmful as it may encourage banks to take more risks or beneficial as related deposits can act as propping tools to improve banks' stability.

This study also examined the impact of related deposit transactions on banks' risk-taking and financial stability by considering the ratio of related deposits to total deposits to capture dependency on deposits from related parties. To the best of our knowledge, few papers have focused on examining the effect of related party transactions in the form of related deposits. Our sample consisted of 90 Indonesian banks during the period 2009–2019. Habib et al. (2017) argued that Indonesia offers an interesting setting in related party transactions due to its unique institutional features.

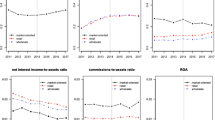

Our finding shows that variable related deposits scaled with total deposits (RDTD) and total assets (RDTA) significantly increase the z-score (denote as LnZROA). Our deeper investigation shows that when we split the sample based on size, we find that related deposits increase the z-score only for small banks. We also try to see whether market power could affect the relationship between related deposits and z-score. However, we find that no strong results showing market power affect the relationship between related deposits and stability.

We contribute to the literature in several ways. First, we contribute to the literature on deposits by showing that banks may attract deposits from connected parties to bolster stability (Alamsyah et al. 2020; Ibrahim and Rizvi 2018; Martinez and Schmukler 2001; Nys et al. 2015b; Trinugroho et al. 2020). Secondly, to the best of our knowledge, this is the first paper to examine the role of related deposits. Our analysis, therefore, contributes to the literature of related party transactions providing evidence that related party transaction in the form of related deposit is regarded as beneficial where banks' ultimate owner may use it to prop up and bolster banks stability to maintain their soundness (Khanna and Yafeh 2010; Wang et al. 2019). Our evidences are of interest to policymakers and regulators in countries where related party transaction remains a concern. We provide insights and noteworthy policy implications for regulators to consider related party transactions in deposits to have better control over the behavior of banks' risk-taking, maintain the soundness of banks, and mitigate financial instability.

The rest of the paper is organized as follows. Section 2 presents related literature. Section 3 describes our sample and defines our variables of interest. Section 4 presents our empirical result. Section 5 discusses our result. Section 6 concludes the paper.

2 Literature review

2.1 Related party transactions

The literature has conflicting views on related party transactions. Related party transactions can be both good and bad for banks. A comprehensive literature review of related party transactions is needed to understand the conflicting views on related party transactions in the form of deposits on banks' stability. This is because the practice of related party transactions in banks is derived from related party transaction activities in companies.

According to International Accounting Standard 24.9, a related party transaction is a transfer of resources, services, or obligations between related parties, regardless of whether or not a price is charged (Habib et al. 2017). Specifically, related party transactions are all transactions with related entities such as shareholders, members of the board of directors, and affiliated companies (Kang et al. 2014). Most studies in related party transactions are conducted by using a sample of firms, and the results from these studies can be divided into two major categories. The first is based on the view that related party transactions could provide opportunities for the related party to extract cash from the firm. There are many cases in the world when a company sends cash to their institutional shareholder. For instance, in 2001, a state-owned company in China transferred the equivalent of USD 4 million in cash to their state-owned controlling shareholder for safekeeping and management (Cheung et al. 2009a, b). Another case was documented in Italy (Johnson et al. 2000). There was a French company called SARL Perronet, owned by the Perronet family. One day, the Perronet family established a new company called SCI. SCI subsequently bought some land and took out loans from banks to build a warehouse. SCI then leased the warehouse to SARL Perronet to repay the loan and expand the business. This case shows an expropriation from a majority (Perronet family) to a minority of SARL Perronet. This mechanism is called "tunneling" and highlights the "negative" effect of related party transactions to the firm.

The second is based on the fact that related party transactions can also be used to prop up firms, usually to support underperforming firms. This view suggests that related party transactions can be used within corporate groups (a firm and its related parties) as a way to reduce transaction costs and optimize the allocation of resources (Ge et al. 2010; Kang et al. 2014). There is an evidence that another Chinese state-owned firm received a USD 28 million loan and bank guarantees from its parent company (Cheung et al. 2009a, b). This "positive" effect of related party transactions is widely known as "propping". From these examples, we could define "tunneling" as the transfer of assets and profits out of firms for the benefit of those who control them (Johnson et al. 2000), whereas "propping" is a scenario whereby a controlling owner of a firm uses a firm's resources to manage an affiliate firm's earnings (Jian and Wong 2010).

A study by La Porta et al. (2003) is to the best of our knowledge the first empirical study to investigate "tunneling" and "propping" phenomena in the banking sector, although they use different terms, namely, information view for the former and looting for the latter. The main motivation for investigating related party transactions in the banking sector is based on the fact that a significant proportion of bank lending is often directed toward related parties, that is, bank shareholders, associates, and family, or subsidiaries (firms they control). This is in line with evidence in China (Cheung et al. 2009a, b). However, related lending, or lending to related parties, could have both positive or negative effects on a company (La Porta et al. 2003). On one hand, related lending can improve credit efficiency and reduce monitoring costs because the bank knows more about related borrowers than unrelated ones. In cases where the borrowers are institutional shareholders, directors indeed interact regularly with banks' managers at board meetings. Related lending is therefore good for both borrowers and lenders because it can reduce information asymmetry between them. In addition, from the banks' point of view, related lending could reduce monitoring costs that usually account for a significant proportion of the banks' expenses. However, on the other hand, because of the close ties between the borrowers and the banks, borrowers could allow insiders to divert resources from depositors or minority shareholders to themselves. Moreover, if a bank is protected by deposit insurance, the controlling shareholder could make loans to other firms that they manage, or in which they own shares. The shareholder understands that the government bears the cost of the risk taking by the shareholder.

2.2 Related deposits

In market discipline mechanisms, depositors have a main role in monitoring banks. Depositors take action depending on the risk level of banks. Depositors may withdraw their money or require higher interest rates on deposits when banks' activities are riskier. Some studies also revealed that the strength of market discipline depends on the deposit insurance system in place (e.g., Hadad et al. 2011, Nys et al. 2015). Arguably, the more generous the deposit insurance system, the less the incentive for depositors to monitor banks. Some also argue that there is a different sensitivity among depositors during a crisis. Depositors are more careful regarding their funds during a crisis, therefore market discipline by depositors work more effectively during a crisis (Hasan et al. 2013).

Business groups can also conduct another type of related transactions, by depositing their money in their own related banks. This related deposit can arguably have two effects on the banks. Related party transactions in the form of deposits become a stabilization tool when a bank faces difficult times; it can act as a "propping" proxy to help a bank to maintain its soundness and stability. However, one might argue that related deposits can provide more incentives to banks to take excessive risk as it is a considerably cheaper source of funding. By having access to cheaper funds, banks can benefit from more profit. Hence, this paper examined the related deposit roles of banks, both the "propping" form and the "tunneling" form.

2.3 Institutional background

In most cases, problems of related party transactions are associated with the expropriation of a majority to minority shareholders. This expropriation usually happens in companies with concentrated ownership, particularly in Asia and specifically China (Bona-Sánchez et al. 2017; Cheung et al. 2009a, b) or Indonesia (Habib et al. 2017). Using the Indonesian context, related parties in this paper are defined according to the Institute of Indonesia Chartered Accountant's Statement of Financial Accounting Standards (Pernyataan Standar Akuntansi Keuangan—PSAK) No 7 of 1999. Related parties of companies include:

Companies that with one or more intermediaries are either controlling or being controlled or under joint control of the company;

Associated companies;

An individual who directly or indirectly has voting rights in the company and the close family of the individual;

Key employees, that is, people who have the authority and responsibility to plan, lead, and control the company, including boards of commissioners and managers and their immediate family; and.

Companies where substantial interest in the voting rights, directly or indirectly, of each person outlined in (3) and (4) have significant value to the company. This includes other companies owned by boards of commissioners, managers, or major shareholders of the company.

These characteristics are typically similar to the characteristics of related parties in Taiwan (Yeh et al. 2012) and China (Ge et al. 2010).

Related party transactions of banks in Indonesia are regulated under Peraturan Bank Indonesia No. 7/PBI/2005, which limits the related party lending maximum to 10% of the banks' equity. Moreover, listed banks are required to publicize those related party transactions that are likely to take the form of "tunneling" (such as loan to a related party) 2 days after the transactions have taken place. However, to the best of our knowledge, there is no regulation regarding related deposits. Banks can take advantage of related deposits as they can provide a cheaper source of funds and can be used to maintain stability and liquidity during financial stress and could be viewed as a proxy for "propping."

Related deposits in Indonesia are relatively high and tend to increase over time. Figure 1 shows the mean value of the portion of related deposits over total deposits. The highest proportion of a related deposits that banks possessed in their liabilities was 9.77% in 2016. We further analyzed the sample to understand the portion of related deposits by looking at banks' size. Figure 2 shows that banks that have smaller sizes have a higher proportion of related deposits while bigger banks have a significantly smaller proportion of related deposits. This shows that smaller banks perceive that related deposit is relatively cheaper compared to any other source of deposit. Therefore, it provides them an incentive to rely on internal group resources to maintain their soundness.

3 Methodology

3.1 Data

To conduct our research, we use hand-collected data on deposits from related parties from banks' financial reports for the period 2009–2019. The financial reports were obtained from the banks' websites. We start the period of investigation from 2009 as related deposit data is available in Indonesia since 2009, in which all firms consistently report all related party transactions. We combined related deposits with other bank-level data from BvD Bankscope and BankFocus. We calculated all the ratios and winsorized extreme values at 1% and 99% levels. Our final sample comprised 603 observations from 90 banks in Indonesia.

3.2 Dependent variable: z-score

We use the z-score as a primary proxy for banks' financial stability or risk-taking. This measure is very popular in empirical banking studies because it only uses accounting data and provides an easy interpretation. Based on earlier studies (Beck 2013b; Fu et al. 2014; Moudud-Ul-Huq 2019), the z-score was therefore calculated as follows.

where ROA is return on assets, EQTA is equity to total assets, and SDROA is the standard deviation of ROA. The z-score measures the number of the standard deviation by which the bank return has to diminish in order to deplete equity (Fu et al. 2014; Schaeck and Cihak 2014). Therefore, the higher the value of the z-score, the higher the bank's stability or, the lower its risk-taking behavior. Following Fu et al. (2014), we also take a logarithm value of the z-score (LnZ).

3.3 Main independent variable: related deposits

The proportion of related deposits over total deposits was used as proxy activities for related depositors (RDTDit). For an alternative, we also used RDTAit, the ratio of bank related deposits over total assets. In related party transactions, we had conflicting views which were either efficient or abusive related party transactions activities. On the one hand, the related deposits could be beneficial for bank risk when banks needed short-term funding to settle their obligations. In particular, during a financial crisis, the related deposits could be used to maintain the soundness of the bank. On the other hand, one might also argue that the higher share of related deposits could encourage banks to take more risk and therefore lower their stability. This is because the related deposits could be perceived as a cheap source of funding and encourage banks to take an excessive risk (Khan et al. 2017).

3.4 Control variables

In this paper, we also considered controls on the bank level known to affect the risk behavior of banks. We introduced the Lerner index to measure market competition, as there was a large amount of literature that investigated the competition-stability nexus (Beck et al. 2013a; Berger et al. 2009; Fiordelisi and Mare 2014; Schaeck and Cihak 2014). The Lerner index is the markup on the price of a banking product over its marginal costs.

Price is the ratio of total revenue (sum of total interest income and total non-interest operating income) to total assets, while Marginal Cost is obtained from the translog cost function (Meslier et al. 2017). A higher value of the Lerner index indicates higher market power or lower market competition because banks are able to set the price above the marginal cost in less competitive markets (Meslier et al. 2017). Our computation in Eq. (2) follows Fu et al. (2014). The value of the Lerner index ranges between 0 (low market power/more competitive market) and 1 (high market power/less competitive market). However, the Lerner index can also be negative for inefficient banks. Banks with high market power could be a result of a non-competitive market. How competition influences bank risk is still debated in the literature with a mixed empirical result; we, therefore, do not predict whether competition will positively or negatively impact bank stability.

Other controls were also employed in this study. We considered the logarithm of total assets (LogTA) as a proxy for bank size. The relationship between bank size and risk-taking is also unclear and for that reason in the further analysis we take into account this issue. In the case of "too big to fail," larger banks could have a greater incentive for taking excessive risk (Beck and Laeven 2006). Conversely, larger banks could also have a greater ability to diversify their earnings and therefore have less risk (Distinguin et al. 2013). Also, to proxy credit risk, we used the ratio of loan loss provision to total loan (LLRGL) following (Soedarmono et al. 2013). We also used some characteristics that are commonly used in the literature: cost to income ratio (CIR) for bank efficiency and GLTA (gross loan to total assets) as a proxy for bank liquidity (Khan et al. 2017). We also use EQTA (the ratio of total equity to total asset) to proxy bank solvency.

3.5 Econometric specification

In this research, in order to investigate the impact of related deposits on the stability of Indonesian banks, we developed the following equation:

where i and t refer to a bank and time index. To estimate Eq. (3), we use a fixed effects method to identify unobservable banks' characteristics that could not be captured in the model. We used time fixed effects or time trend to take into account changes on a macroeconomic level. Standard errors in the estimation were adjusted at a bank-level to eliminate heteroscedasticity and autocorrelation issues. Regarding the related deposit and bank risk relationship, it might also be argued that when a bank is exposed to high risk, according to a market discipline theory, the related party of the banks will be reluctant to add or keep their funds in the bank. This mechanism causes a decrease in related party deposits, because of the escalation in bank risk.

4 Results

4.1 Descriptive statistics

Table 1 provides descriptive statistics on all the variables we used in this research. We also provide an explanation of each variable. As explained earlier, to proxy stability, we use the z-score following Beck et al. (2013b); Cihák and Hesse (2007) as a main variable (LnZ). In this paper, related deposits were scaled with total deposits (RDTD) and total assets (RDTA). The mean of RDTD and RDTA was 7.5% and 5.4%, respectively. The Lerner index's average value was 0.309, implying that Indonesian banks, on average, could set the price of their banking products 30% higher than their marginal costs. This also confirmed that the Indonesian banking sector is less competitive, possibly because the market is dominated by only five banks (Risfandy et al. 2019). Bank efficiency was proxied by the cost to income ratio (CIR), which had an average value of 17.5%. On average, Indonesian banks had a 2% ratio of loan loss reserves over the gross loan and a 6% ratio of loans over total assets.

4.2 Correlation matrix

In order to make sure that our model did not have a multicollinearity problem, we tested the correlation coefficient between independent variables. Table 2 summarizes the results. As can be seen, there was no multicollinearity problem because the correlation coefficient between the independent variables was less than 0.5. In addition, we also tested for multicollinearity using variance inflation factors. Because all of the VIF scores were less than 10, there was no need to worry about multicollinearity issues (Table 3).

4.3 Empirical results

In this final sub-section we provide the results of our estimation. Our main research question was whether related deposits increased or decreased bank stability. The results we obtained from our analysis seem to support the positive impact of related deposits. Table 4 summarizes the results and demonstrates that variable RDTD and RDTA significantly increased the z-score (LnZ). It meant that higher related deposits were associated with greater bank stability. Our result was strong because RDTD and RDTA exhibited similar results, and the results were also robust in fixed effects and random effects techniques. This evidence suggests a positive impact of related deposits on the bank stability. We further analyzed our sample based on banks' size (market power) and then performed a regression separately on low and high bank's size (market power) based on the median.

We find that large banks might find it easier to withstand economic shock and have greater shock absorbance capacity compare to their small counterpart, as depicted in Table 5. Thus, large banks' dependency to related deposit especially propping from related parties is lower and most likely to not have any significant impact. Furthermore, as large bank tends to be systematically important, government and regulator are less likely to allow large banks to fail due to their complex nature with regards to resolution in the case of bankruptcy and their possession of systematic risk, providing incentives for the government to provide preferential treatment such as bailout. Hence, their reliance on related deposit is lower and are more likely to shift the cost of stabilizing the bank to the taxpayer instead of internal group resources.

In contrast, smaller banks are less likely to have strong shock absorbance and are more sensitive towards economic shocks. Smaller banks also tend to be easier to resolve in the case of bankruptcy, while at the same time, they might find it difficult to obtain aids from the government. Hence their reliance on related deposit will be stronger as it will be a cheaper source of funds comparing to obtained externally. Our results are therefore consistently showing that related deposit is significant only for the smaller bank rather than larger bank indicating smaller bank strong reliance on the internal group resources to maintain their soundness. Our results are also consistent with different measurements for related deposits and different estimation techniques.

Regarding market power, we hypothesize that banks with higher market power tend to have better access to non-deposit short-term funding resulting in less reliance on deposits compare to their low market power counterpart (Sudrajad and Hübner 2019). Furthermore, banks with higher market power will be able to find a cheaper source of funds compare to banks with lower market power. Hence, banks with lower market power are more likely to rely on related deposits as the cost of obtaining can be lower compare to obtaining from external. However, as shown in Table 6, we do not observe any robust evidence when we split it based on the market power. Therefore, our results hold independently from banks' level of market power.

5 Discussions

Our empirical evidence shows that related party transactions in the form of deposits shape financial stability within banks. The increasing trend of holding related deposits indicates that deposits from related parties have become a tool for maintaining stability. We found that holding more deposits from related parties was associated with higher stability and lower risk. The evidence suggests that related deposits act implicitly similar to equity. Thus, banks with higher related deposits tend to act more carefully in their decisions on risk-taking as they put more equity-like funds in their bank. Related deposits are used by banks as a sort of last resort to access funds in illiquid situations. We also argue that related deposits are mostly needed in financial crises as "propping tools."

We also considered the contrasting views regarding related party transactions in the form of deposits. In a financial crisis, when most banks are vulnerable, holding a relatively higher proportion of related deposits could be bad. We need to understand that related deposits are unique in the sense of information asymmetry. Since related deposits are from related parties, they are regarded as more preferable depositors compared to third-party depositors as they have more and deeper information on the banks. Thus, during financial crises, when there is a higher probability of default, related depositors have a strong incentive to exercise their benefits from having better information to withdraw their deposit from the banks and thus will decrease the stability of the banks. As illustrated in related party transactions, majority shareholders can take benefits over minority shareholders. However, in our study, we did not observe this phenomenon. Our results show that related deposits are good for bank stability.

We also discussed how related deposits affected the stability of banks based on their size. Our evidence showed that the related deposit effect is more pronounced in smaller banks rather than large banks. These smaller banks are less likely to receive preferential treatment from the government. Therefore, smaller banks rather rely on internal group resources or their connected parties for cheap sources and easy access to funds as a part of maintaining their stability.

6 Conclusion and recommendation

We investigated the effect of the proportion of related deposit transactions on bank risk-taking and financial stability by considering the ratio of related deposits over total deposits to examine dependency on deposits from their related party. Our sample consisted of 90 Indonesian banks during the period 2009–2019. We gathered data from banks' financial reports, BvD Bankscope, and BankFocus.

Our findings reveal that bank related deposits are mostly used by banks to improve their stability and thus reduce their risk. A deeper investigation shows that the positive effect of related deposit on risk is concentrated in smaller banks. Larger banks tend to be systematically important and complex to resolve providing them a bargaining power to receive preferential treatment from the government or any other external source of fund. In addition, larger banks tend to be more resilient towards economic shock as they have greater shock absorbance due to their size and available resources. Conversely, smaller bank may be more sensitive towards economic shock, while less likely to receive treatment especially when regulators view smaller bank is less complex and less costly from economic and political perspective to resolve during crisis. Our results therefore provide insights and noteworthy policy implications for regulators to take into account related party transaction in the form of deposits in order to understand the nature of related deposit and to have better control over the behavior of banks' risk-taking and to maintain the soundness of banks as well as mitigate financial instability.

References

Alamsyah, H., Ariefianto, M. D., Saheruddin, H., Wardono, S., & Trinugroho, I. (2020). Depositors’ trust: Some empirical evidence from Indonesia. Research in International Business and Finance, 54(May), 101251. https://doi.org/10.1016/j.ribaf.2020.101251

Bailey, W., Huang, W., & Yang, Z. (2011). Bank loans with Chinese characteristics: Some evidence on inside debt in a state-controlled banking system. Journal of Financial and Quantitative Analysis, 46(6), 1795–1830. https://doi.org/10.1017/S0022109011000433

Barry, T. A., Lepetit, L., & Tarazi, A. (2011). Ownership structure and risk in publicly held and privately owned banks. Journal of Banking and Finance, 35(5), 1327–1340. https://doi.org/10.1016/j.jbankfin.2010.10.004

Beck, T., & Laeven, L. (2006). Resolution of failed banks by deposit insurers cross-country evidence. In World Bank Policy Research Working Paper (Vol. 3920)

Beck, T., De Jonghe, O., & Schepens, G. (2013a). Bank competition and stability: Cross-country heterogeneity. Journal of Financial Intermediation, 22, 218–244. https://doi.org/10.1016/j.jfi.2012.07.001

Beck, T., Demirgüç-Kunt, A., & Merrouche, O. (2013b). Islamic vs. conventional banking: Business model, efficiency and stability. Journal of Banking & Finance, 37(2), 433–447

Berger, A. N., Klapper, L. F., & Turk-Ariss, R. (2009). Bank Competition and Financial Stability. Journal of Financial Services Research, 35(2), 99–118. https://doi.org/10.1007/s10693-008-0050-7

Bona-Sánchez, C., Fernández-Senra, C. L., & Pérez-Alemán, J. (2017). Related-party transactions, dominant owners and firm value. BRQ Business Research Quarterly, 20(1), 4–17. https://doi.org/10.1016/j.brq.2016.07.002

Cheung, Y. L., Jing, L., Lu, T., Rau, P. R., & Stouraitis, A. (2009a). Tunneling and propping up: An analysis of related party transactions by Chinese listed companies. Pacific Basin Finance Journal, 17(3), 372–393. https://doi.org/10.1016/j.pacfin.2008.10.001

Cheung, Y. L., Qi, Y., Raghavendra Rau, P., & Stouraitis, A. (2009b). Buy high, sell low: How listed firms price asset transfers in related party transactions. Journal of Banking and Finance, 33(5), 914–924. https://doi.org/10.1016/j.jbankfin.2008.10.002

Cihák, M., & Hesse, H. (2007). Cooperative banks and financial stability. IMF Working Papers, 07(2), 36. https://doi.org/10.5089/9781451865660.001

da Wang, H., Cho, C. C., & Lin, C. J. (2019). Related party transactions, business relatedness, and firm performance. Journal of Business Research, 101(January), 411–425. https://doi.org/10.1016/j.jbusres.2019.01.066

Distinguin, I., Kouassi, T., & Tarazi, A. (2013). Interbank deposits and market discipline: Evidence from Central and Eastern Europe. Journal of Comparative Economics, 41(2), 544–560. https://doi.org/10.1016/j.jce.2012.07.005

Fiordelisi, F., & Mare, D. S. (2014). Competition and financial stability in European cooperative banks. Journal of International Money and Finance, 45, 1–16. https://doi.org/10.1016/j.jimonfin.2014.02.008

Fu, X., Lin, Y., & Molyneux, P. (2014). Bank competition and financial stability in Asia Pacific. Journal of Banking & Finance, 38, 64–77.

Ge, W., Drury, D. H., Fortin, S., Liu, F., & Tsang, D. (2010). Value relevance of disclosed related party transactions. Advances in Accounting, 26(1), 134–141. https://doi.org/10.1016/j.adiac.2010.02.004

Habib, A., Muhammadi, A. H., & Jiang, H. (2017). Political connections and related party transactions: Evidence from Indonesia. International Journal of Accounting, 52(1), 45–63. https://doi.org/10.1016/j.intacc.2017.01.004

Hadad, M. D., Agusman, A., Monroe, G. S., Gasbarro, D., & Zumwalt, J. K. (2011). Market discipline, financial crisis and regulatory changes: evidence from Indonesian banks. Journal of Banking and Finance, 35, 1552–1562

Hasan, I., Jackowicz, K., Kowaleski, O., & Kozlowski, L. (2013). Market discipline during crisis: Evidence from bank depositors in transition countries. Journal of Banking and Finance, 37, 5436–5451

Huang, W., Schwienbacher, A., & Zhao, S. (2012). When bank loans are bad news: Evidence from market reactions to loan announcements under the risk of expropriation. Journal of International Financial Markets, Institutions and Money, 22(2), 233–252. https://doi.org/10.1016/j.intfin.2011.09.004

Ibrahim, M. H., & Rizvi, S. A. R. (2018). Bank lending, deposits and risk-taking in times of crisis: A panel analysis of Islamic and conventional banks. Emerging Markets Review, 35, 31–47. https://doi.org/10.1016/j.ememar.2017.12.003

Jian, M., & Wong, T. J. (2010). Propping through related party transactions. Review of Accounting Studies, 15, 70–105

Johnson, S., Porta, R. La, Lopez-de-silanes, F., & Shleifer, A. (2000). Tunneling. American Economic Review, 90(2)

Kang, M., Lee, H. Y., Lee, M. G., & Park, J. C. (2014). The association between related-party transactions and control-ownership wedge: Evidence from Korea. Pacific Basin Finance Journal, 29, 272–296. https://doi.org/10.1016/j.pacfin.2014.04.006

Khan, M. S., Scheule, H., & Wu, E. (2017). Funding liquidity and bank risk taking. Journal of Banking and Finance, 82, 203–216. https://doi.org/10.1016/j.jbankfin.2016.09.005

Khanna, T., & Yafeh, Y. (2010). Business Groups in Emerging Markets: Paragons or Parasites? The Oxford Handbook of Business Groups, 45(2), 331–372. https://doi.org/10.1093/oxfordhb/9780199552863.003.0020

La Porta, R., Lopez-de-Silanes, F., & Zamarripa, G. (2003). Related Lending. The Quarterly Journal of Economics, 118(1), 231–268. https://doi.org/10.1162/00335530360535199

Martinez, M. S., & Schmukler, S. L. (2001). Do Depositors Punish Banks for " Bad " Behavior?: Market Discipline, Deposit Insurance, and Banking Crises. The Journal of Finance, 56(3), 1029–1051. https://doi.org/10.1111/0022-1082.00354

Meslier, C., Risfandy, T., & Tarazi, A. (2017). Dual market competition and deposit rate setting in Islamic and conventional banks. Economic Modelling, 63, 318–333. https://doi.org/10.1016/j.econmod.2017.02.013

Moudud-Ul-Huq, S. (2019). Banks’ capital buffers, risk, and efficiency in emerging economies: Are they counter-cyclical? Eurasian Economic Review, 9(4), 467–492. https://doi.org/10.1007/s40822-018-0121-5

Nys, E., Tarazi, A., & Trinugroho, I. (2015). Political connections, bank deposits, and formal deposit insurance. Journal of Financial Stability, 19, 83–104. https://doi.org/10.1016/j.jfs.2015.01.004

Peng, W. Q., Wei, K. C. J., & Yang, Z. (2011). Tunneling or propping: Evidence from connected transactions in China. Journal of Corporate Finance, 17(2), 306–325. https://doi.org/10.1016/j.jcorpfin.2010.08.002

Risfandy, T., Trinarningsih, W., Harmadi, H., & Trinugroho, I. (2019). Islamic Banks’ market power, state-owned banks, and Ramadan: Evidence from Indonesia. The Singapore Economic Review, 64(2), 423–440. https://doi.org/10.1142/S0217590817500229

Schaeck, K., & Cihak, M. (2014). Competition, efficiency, and stability. Financial Management, 43(1), 215–241

Soedarmono, W., Machrouh, F., & Tarazi, A. (2013). Bank competition, crisis and risk taking: Evidence from emerging markets in Asia. Journal of International Financial Markets, Institutions & Money, 23, 196–221. https://doi.org/10.1016/j.intfin.2012.09.009

Sudrajad, O. Y., & Hübner, G. (2019). Empirical evidence on bank market power, business models, stability and performance in the emerging economies. Eurasian Business Review, 9(2). https://doi.org/10.1007/s40821-018-0112-1

Trinugroho, I., Pamungkas, P., Ariefianto, M. D., & Tarazi, A. (2020). Deposit structure, market discipline, and ownership type: Evidence from Indonesia. Economic Systems, 44(2). https://doi.org/10.1016/j.ecosys.2020.100758

Yeh, Y. H., Shu, P. G., & Su, Y. H. (2012). Related-party transactions and corporate governance: The evidence from the Taiwan stock market. Pacific Basin Finance Journal, 20(5), 755–776. https://doi.org/10.1016/j.pacfin.2012.02.003

Funding

This paper was funded by Lembaga Penjamin Simpanan/LPS (Indonesia Deposit Insurance Corporation) with the contract no. PKS-1/DRSP/2017 under the LPS Call for Research 2017. The views expressed in this paper are the authors’ only and do not necessarily reflect those of Indonesia Deposit Insurance Corporation. All errors, of course, remain with us.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Achsanta, A.F., Risfandy, T., Pamungkas, P. et al. Related bank deposits: Good or bad for stability?. Eurasian Econ Rev 11, 735–751 (2021). https://doi.org/10.1007/s40822-021-00184-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-021-00184-3