Abstract

This study aims to investigate the ecological efficiency of industry in Greece through a sector-wise framework using data envelopment analysis and considering three different types of environmental emissions. Through this quantification, it is possible to determine the degree of internalization of the environmental impact for each sector of the Greek economy. This fact supports the administrative decision-making process for the planning of sustainable industrial development. Subsequently, the effect of energy and transportation taxes on the eco-efficiency index is examined. It is shown that the revenues from the collection of environmental taxes in Greece have not been sufficiently used to improve eco-efficiency. This fact underlines the need to achieve long-term economic development that is compatible with environmental goals and social needs through appropriate strategic decisions and measures. It also highlights the need to create a well-designed tax system in order to reduce environmental pollution and improve environmental quality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Eco-efficiency is a term that refers to the goal of creating value, while simultaneously decreasing environmental impact (Huppes & Ishikawa, 2005). In other words, the term is defined as the ability of regions, economies, industries, or firms to produce more goods and services, having less environmental impacts and at the same time consuming fewer natural resources, connecting therefore both economic and ecological issues (Camarero et al., 2013).

Eco-efficiency is needed in order to satisfy both the rising consumption and the attainment of environmental quality and can be used as an instrument for sustainability (Huppes & Ishikawa, 2005). It can be applied at a regional and global level and to various sectors, while it can be used from enterprises as a decision-making tool, in order to improve sustainability (Liu et al., 2019). It can also be used as an internal tool to measure progress, as well as to communicate economic and environmental performance (Michelsen et al., 2006).

When environmental effects are decreased, as the value of economic outputs is increased or at least maintained, then eco-efficiency improves. However, the eco-efficiency coefficient measures the relative level of environmental pressure, in relation to the economic activity volume; therefore, an improvement of the coefficient does not guarantee sustainability (Picazo-Tadeo et al., 2011).

It is significantly important to measure eco-efficiency, since its improvement is sometimes the most cost-efficient way to reduce environmental pressures – even if a sustainable level of environmental pressure is not achieved, these options should be explored. At the same time, it is found that efficiency improvement policies are easier to adopt, compared to policies that restrict economic activity levels, which are difficult to implement unless there is convincing evidence on the inadequacy of symptomatic eco-efficiency solutions (Kuosmanen & Kortelainen, 2005).

Sustainability and sustainable development have been a part of most political agendas recently and the world is trying to establish a more sustainable path (Halkos & Gkampoura, 2021). The 17 Sustainable Development Goals, introduced by the United Nations in 2015, aim to promote sustainable growth that does not focus only on the economy, but cover major development areas at the same time; in the literature the positive sustainability elasticities and the synergetic nature of the spillovers effects of sustainable development have been confirmed (Taghvaee et al., 2022a, 2023c). Technology has been found to have a positive effect on weak and strong sustainability, suggesting the promotion of inflationary strategies when it comes to technology (Nasrollahi et al., 2020), while it is suggested that decision-makers should be investing in more efficient technologies, in countries where there is a positive relationship between economic complexity and environmental pollution (Wang & Taghvaee, 2023).

The eco-efficiency index determines the degree of efficiency of an economic activity in relation to the goods and services that nature offers us. Therefore, this indicator is a useful benchmarking tool for policy makers aiming at sustainable development through improved socio-economic and environmental performance. The development of the eco-efficiency index is largely influenced by fiscal policies, which are implemented through taxes and government spending.

Effective policy making is now crucial in terms of improving sustainability, and the interest of the academic community is focused on finding the optimal environmental policy, mainly focusing on the expenditure side of the government budget (provision of subsidies). In this context, Taghvaee et al. (2023a) implement pricing policy by focusing on estimating the demand elasticity of fossil fuels to determine the price levels that cause a reduction in fossil fuel consumption. Taghvaee et al. (2022b) and Taghvaee et al. (2023b) compare the effects of pricing policy (provision of fossil fuel subsidies) with the effects of energy efficiency in reducing the demand for fossil fuels. The comparison of the results shows that energy efficiency is superior to pricing policy, as it results in a greater reduction in demand for fossil fuels and a further improvement in the pillars of sustainable development.

This paper attempts to deepen the existing knowledge on the search for the optimal environmental policy by combining pricing policy and eco-efficiency to reduce environmental emissions. The study focuses on the part of environmental taxation where the innovation of this article lies. Specifically, a sectoral analysis is conducted using the Data Envelopment Analysis (DEA) to determine the level of eco-efficiency for all economic sectors of the Greek economy based on the NACE Rev. 2 classification. Subsequently, the impact of environmental taxes (energy and transport taxes) on the CH4-adjusted eco-efficiency index is examined by determining the long-term elasticity. As it turns out, the energy tax has a negative impact on ecological efficiency and therefore cannot be generalized as an environmental policy measure to reduce methane emissions. Conversely, the transport tax improves ecological efficiency. Therefore, at the same time as improving ecological efficiency, tax policy measures to reduce methane emissions per economic activity should be formulated on time to reduce environmental degradation and better promote sustainable development.

The rest of the paper is structured as follows. Section 2 presents a review of the existing relevant literature. Section 3 presents the data and the methodology used in each stage of the empirical analysis. Section 4 presents the empirical results of the analysis, while Sect. 5 discusses the empirical results. In the last section, the conclusions of the study are presented and some environmental tax reform measures are proposed to policy makers that can ensure a more environmentally efficient production process for the sectors of the Greek economy that can contribute to the achievement of sustainable development.

2 Literature review

Eco-efficiency can be measured in several ways, one of which is by using DEA. DEA is a non-parametric approach used to measure the relative efficiency of decision-making units, in cases where multiple inputs and outputs exist that can make the comparison more difficult (Boussofiane et al., 1991). DEA is used in a wide range of theoretical and methodological extensions (Emrouznejad, 2014; Zhu, 2014; Emrouznejad & Cabanda, 2015), since there is no need for predefined optimum values, and efficiency scores are estimated based on the existing decision-making units (Kyrgiakos et al., 2021). It can assist in the identification of sources of inefficiency, in the ranking of units by efficiency outcomes, and in the evaluation of public management policies and of the effectiveness of programs or policies, among others (Golany & Roll, 1989).

DEA has a wide range of application in the literature: some of the industries where DEA studies have focused on include banking, healthcare, agriculture, transportation, and education, while the applications in the sectors of finance and energy and the environment have seen significant growth (Liu et al., 2012). There is also a variety of studies in the literature that use DEA in order to assess eco-efficiency.

Korhonen and Luptacik (2004) presented two approaches that can be used to estimate eco-efficiency: In the first approach, technical efficiency and ecological efficiency are estimated separately, and the results of the models are used as output variables in a new DEA model, in order to provide the eco-efficiency indicator. In the second approach, different variants of DEA models are formulated that simultaneously take into consideration the inputs and the undesirable and desirable outputs.

There are some studies in the literature that have used DEA to assess eco-efficiency in country-level analyses. For example, Desli et al. (2021) conducted a country-level analysis for the years 1990–2017, in order to estimate an eco-efficiency index, taking into consideration the actual decision-making process of productive activity. They found that both the eco-efficiency index as well as the state of the environment suggest ecological inefficiency, while the recent practices are found to be less efficient, compared to those of the past. At the same time, it is found that counties that have almost perfect scores of technical efficiency, have extremely low eco-efficiency.

Madaleno et al. (2016) have used DEA to estimate the eco-efficiency of 26 European countries for the time period 2001–2012, finding that different input or output-oriented models can change economic and environmental estimates, in terms of years and technical efficiency versions. Moutinho et al. (2018) focused on 16 Latin American countries and used DEA to analyze eco-efficiency in a comparative way and the efficiency’s evolution, and evaluated the decoupling elasticity. Their findings suggest that the dominant influential factor of the optimal production frontier was the changes of technological scale in energy production, while CO2 emissions per capita are found to increase or decrease as a result of other economic and environmental factors, rather than the GDP growth rate.

Rashidi and Saen (2015) have examined the eco-efficiency of selected members of OECD, developing a DEA model and dividing inputs into energy and non-energy and outputs into good and bad ones. The authors identified five countries that were characterized as eco-efficient, while the rest of the examined countries were eco-inefficient. The findings also suggest that a higher use of energy inputs can lead to more undesirable outputs.

Halkos and Tzeremes (2014) have determined environmental efficiency levels, using conditional and unconditional DEA models, for 110 countries in 2007, in order to capture the effect that countries’ compliance with the Kyoto Protocol Agreement (KPA) had. The results indicate that there is a positive impact on the countries’ environmental efficiencies for the first 6 years after they signed the KPA. However, this turns into an immediate negative effect after that period, since the countries seem to avoid complying with the actions that the KPA imposed.

There are also studies that assess eco-efficiency at a regional level. For instance, Huang et al. (2014) investigated the dynamics of regional eco-efficiency in China, using data for the period 2000–2010. Rybaczewska-Błażejowska and Masternak-Janus (2018) examined eco-efficiency for the regions of Poland, combining DEA and Life Cycle Assessment (LCA). Bianchi et al. (2020) investigated regional eco-efficiency patters in Europe, using data from 282 European regions and for the years 2006–2014, while the technology and conditional efficiency gaps in the regions’ dominant territorial features are also estimated.

Camarero et al. (2013) conducted an analysis both at a country-level and an air-pollutant-specific level. More specifically, they have focused on the assessment of convergence in eco-efficiency, taking into consideration data from 22 OECD countries and computing eco-efficiency scores using DEA techniques. The results indicate that eco-efficiency has improved over the studied time period (1980–2008), while the most eco-efficient countries, as well as the worst eco-efficient countries, tend to form clubs of convergence. Similarly, Camarero et al. (2014) focused on European Union countries, finding that there are at least four convergence clubs, depending on the pollutant considered.

There is also a plethora of studies in the literature focusing on certain sectors and incorporating DEA to examine eco-efficiency. For example, Wang et al. (2019) and Shao et al. (2019) examined eco-efficiency of the industrial sectors in China, using a hybrid super-efficiency DEA model that combines hybrid DEA with super-efficiency DEA in the first study, and the directional distance function of network DEA in the second study. Both works indicate that eco-efficiency was improved during the studied time periods (2006–2015 and 2007–2016, respectively). Wang et al. (2019) suggest that acceleration is needed in technological progress concerning eco-efficiency improvement. At the same time, Shao et al. (2019) suggest that a win–win situation was achieved by China’s industries regarding the development of environmental protection and economic growth.

The studies conducted by Picazo-Tadeo et al. (2011), Pang et al. (2016), Rybaczewska-Błażejowska and Gierulski (2018), Coluccia et al. (2020) and Pishgar-Komleh et al. (2021), are only a few examples of studies assessing eco-efficiency in the agricultural sector. For instance, Picazo-Tadeo et al. (2011) assessed farming eco-efficiency, using a sample of Spanish farmers and finding that they are quite eco-inefficient, while this eco-inefficiency is related to technical inefficiencies in inputs management. Pang et al. (2016) focused agricultural eco-efficiency in China provinces, finding that only four out of the 31 provinces in China were relatively efficient and highlight as well that agricultural eco-efficiency is affected by technical efficiency. Rybaczewska-Błażejowska and Gierulski (2018) examined the eco-efficiency performance of agriculture in the EU, using a joint application of LCA and DEA techniques, and finding that 18 out of the 28 member states’ agricultural sectors are eco-inefficient, meaning that the consumption of natural resources and the use of fertilizers are excessive and that the amount of airborne emissions produced is significant. Pishgar-Komleh et al. (2021) focused also on the agricultural sector of the European Union and used a Window Slack-Based Measurement DEA model, finding that 4 out of the 27 countries were the most eco-efficient, with a score higher than 0.90, and that old EU members obtained greater scores of eco-efficiency performance. Coluccia et al. (2020) focused on agricultural eco-efficiency in Italy, finding that the country’s capacity for sustainable management of agricultural resources is good; however, there is still space for improvement.

Chen et al. (2023) and Tan et al. (2023) focused on forestry eco-efficiency. More specifically, Chen et al. (2023) applied a three-stage DEA model with the DEA-Malmquist approach, in order to examine forestry eco-efficiency in China’s regions, finding that absolute and conditional convergence of forestry eco-efficiency exists in the whole China and in six regions, will it is highlighted that the progress of forestry eco-efficiency is related to an excellent environment, as well as to efficient internal management. Tan et al. (2023) focused also on China provinces’ forestry eco-efficiency, adopting a super-efficient DEA model and finding that forestry eco-efficiency’s average value was at a low level (0.504), while they also identified some of the main factors affecting forestry eco-efficiency in the different regions. Zhang and Xu (2022), using a joint LCA and time-series DEA methodology, focused on the eco-efficiency of complex forestry enterprises, suggesting that it is significantly important that environmental management is merged into the daily business of a corporate and that eco-efficiency in complex forestry enterprises can be enhanced by increasing the positive effect with carbon sink rich resources and by minimizing negative effect with more reasonable key inputs.

Pais-Magalhães et al. (2021) concentrated on eco-efficiency of the waste sector in Europe, examining the environmental efficiencies of 15 European countries that result from waste generation. They found that Luxembourg was the most efficient country based on 2001–2015 data, highlighting that countries that include a variety of waste treatments in their waste management are more efficient compared to the ones where landfilling is the principal form of waste disposal. Amaral et al. (2022) and Llanquileo-Melgarejo and Molinos-Senante (2021) evaluated the economic and environmental impacts of municipal and solid waste services (MSW) in Portugal and Chile, indicating the importance of promoting joint organization of MSW management systems in an efficient and sustainable manner.

The studies conducted by Monastyrenko (2017), Tenente et al. (2020), Henriques et al. (2022) and Gouveia et al. (2023) are examples of studies focusing on eco-efficiency of the electricity sector. More specifically, Tenente et al. (2020) examined eco-efficiency of the electricity sector in 28 EU countries and identified the countries that were efficient across all chains, those that presented increased efficiency scores, and those that remained inefficient, concluding that countries’ potential when it comes to eco-efficiency was enhanced by the efficient investment on renewable energy deployment and the replacement of fossil fuels. Henriques et al. (2022) focused also on the electricity sector in the 28 EU countries, assessing the eco-efficiency of the production and supply chains and finding that richer Western European countries are the highest performers when it comes to eco-efficiency, while low-income and mid-income countries in the Eastern Europe have the most eco-inefficient electricity systems, suggesting improvements in their environmental performance.

Gouveia et al. (2023) focused also in the 28 EU countries and on the eco-efficiency changes in their electricity and gas sector production and consumption chains, finding that the catch-up effect across all chains was the main driver of productivity gains, while a decrease in the number of countries achieving productivity gains was observed. Monastyrenko (2017) used DEA and the Malmquist-Luenberger productivity index, in order to address the effects that mergers and acquisitions had on the eco-efficiency of electricity producers in Europe, finding that average eco-efficiency presented a decreasing trend, as well as that domestic horizontal M&As have no impact, while vertical domestic M&As have a negative impact in the short-run and that vertical international M&As reduce eco-efficiency 2 years after they are completed.

Vaičiukynas et al. (2022) conducted a cross-sector and cross-regional study, in order to evaluate the socio-eco-efficiency of high-tech companies. More specifically, the authors used data for the years 2010–2016 and performed DEA, while using the NACE classification system to perform a deeper cross-sectoral analysis. Quintano et al. (2021) based their research on the NUTS2 levels and NACE codes and used data of 24 European ports to examine their eco-efficiency.

There are studies in the literature that aim to assess eco-efficiency and incorporate environmental taxes in the analysis. More specifically, Moutinho et al. (2017) used DEA to estimate the efficiency of 26 European Countries, and used a quantile regression technique and variables such as environmental taxes revenues, in order to explain the different efficiency scores. They found that environmental tax revenues have a negative influence on more eco-efficient countries, while the effects are found to be negatively stronger in less efficient countries. Martínez (2013) applied also DEA to examine eco-efficiency in the Swedish service sector, incorporating panel data techniques in the study and finding that energy taxes can lead to higher energy efficiency.

Lacko and Hajduová (2018) relied on DEA to estimate environmental efficiency in the European Union, and proposed three regression models, finding that environmental taxes can increase efficiency in countries with higher efficiency, but could lead to a fall in efficiency in less efficient countries. He et al. (2019) used DEA to estimate energy efficiency in 32 OECD countries, and a panel Logit model to assess the impact that energy taxes can have on energy efficiency. They found that energy tax collection can impact significantly energy consumption efficiency, while it is also suggested that energy taxes have a double dividend.

After a review of the current literature and, to the best of our knowledge, there is currently no other study that examines eco-efficiency of economic activities in Greece, while taking into consideration the NACE classification system. Thus, through the sectoral analysis we apply, we attempt to fill this gap in the literature by examining, first, the impact of environmental taxes on eco-efficiency for all sectors and, second, the need for environmental tax reform in Greece.

3 Data and methodology

In this study, a sectoral analysis is carried out using the DEA method to determine the eco-efficiency index of the Greek industry treating each sector as a separate decision-making unit (DMU). The survey data for the period from 2014 to 2019 are based on the classification system NACE (Table 1).

For each DMU, Table 2 presents some descriptive statistics of the variables used in our analysis,. Specifically, the variables considered are: employment (EMPT), energy (ETU), industry gross value added (GVA), environmental emissions (CO2, CH4, SOx), and environmental taxes (ET, TT).

3.1 Determining the indices of technical efficiency (TE), environmentally adjusted technical efficiency (TEadj) and Eco-efficiency (ECOEFF)

Table 3 shows the inputs and outputs for each production frontier and the formula for calculating the eco-efficiency index for different types of pollutants.

In this study, the output-oriented DEA models are used under both CRS and VRS assumptions.

3.1.1 Output oriented CCR model

The CCR mathematical model proposed by Charnes et al. (1978), based on DEA, is fractional programming that aims to measure the efficiency of each DMU. The objective function of the model is to maximize a ratio between the weighted sum of outputs and that of inputs under the constraint that the ratio for each DMU is at most one.

The fractional programming model for evaluating the level of relative efficiency of “p” DMU that works under CRS, can be expressed as follows:

where \(y_{rj}\) = the number of output r produced by the jth DMU, \(x_{sj}\) = the number of input s utilized by the jth DMU, \(v_{r}\) = the variable weight given to output r, \(u_{s}\) = the variable weight given to input s.

Model (1) can be transformed into a linear programming problem if the denominator of the ratio is set to one, as shown in Eq. (2). Therefore the maximization linear programming problem for constant inputs can be written as follows:

3.1.2 Output oriented BCC model

The BCC model developed by Banker et.al. (1984) is used for analyzing VRS cases. Taking into consideration that an increase in inputs’ level may not lead to a proportional increase in output level, the output oriented BCC model can be formulated as follows:

where h* = the optimal solution,

\(\frac{1}{h}\) = the technical efficiency,

DMUo = the DMU under evaluation, xio the ith input for DMUo, yro the rth output for DMUo, \(\sum\limits_{j = 1}^{n} {\lambda_{j} x_{ij} }\) = the inputs of DMUj, \(\sum\limits_{j = 1}^{n} {\lambda_{j} y_{rj} }\) = the outputs of DMUj, λj = the weight values.

3.2 Long-run elasticities of ECOEFF with respect to ET and TT

In order to estimate the long-run, from 2014 to 2019, elasticities of eco-efficiency of aggregated industries in Greece with respect to energy taxes and transport taxes, we calculate the elasticities \(\frac{d(\log ECOEFF)}{{d(\log ET)}}\) and \(\frac{d(\log ECOEFF)}{{d(\log TT)}}\) at the means of the independent variables and more specifically from the marginal effects \(\frac{dECOEFF}{{dET}}\) and \(\frac{dECOEFF}{{dTT}}\), by using the chain rule:

Because \(\frac{d(\log ET)}{{dET}} = \frac{1}{ET}\) and \(\frac{d(\log TT)}{{dTT}} = \frac{1}{TT}\) we have

where: log = the natural logarithm (Nodehi et al., 2022), ECOEFF = the prediction function, ET and TT = the independent variables in the regression. The results obtained from this procedure are presented in Table 8 below.

4 Results

4.1 Annual and sector average performance of TE, TEadj and ECOEFF

In Tables 4 and 5, we obtain the indices of annual and sectoral averages of TEadj for different types of pollutants under the CRS and VRS assumptions. We then rely on the results of these tables and apply the formula described in Table 3 to calculate the annual and sectoral average of the eco-efficiency index for different types of pollutants (Table 6 and 7).

As shown in Table 7, DMUs A, C, D, and H mainly focus on maximising the efficiency of their economic activities through the GVA index and show low sensitivity to their ecological impacts in terms of CO2, CH4, and SΟx gases. Therefore, their ecological performance index receives a value of less than one (< 1).

In the case of DMU B, the TEadj index (Table 4) shows satisfactory values for the ecological impacts related to CO2 (TEadj of CO2 at CRS = 0.72981, TEadj of CO2 at VRS = 0.83697) and SΟx (TEadj of SΟx at CRS = 0.68436, TEadj of SΟx at VRS = 0.74864) gases. A similar picture is obtained in the case of DMU F, where the TEadj index for all three types of pollutants ranges from 0.42 to 0.72 under the CRS and VRS assumptions. In these cases, the ECOEFF index takes values above 1 (> 1). This is an indication of a more environmentally efficient production process that can contribute to the achievement of sustainable development.

A high ECOEFF index (see DMU E, G for CO2 gas and DMU I-U for CO2 and CH4 gases) indicates similar interest and attention to the two types of efficiency, but may also indicate poor management and lack of political will.

As shown in Table 6 and 7, the eco-efficiency index related to CH4 has on average the lowest values for constant and variable returns to scale compared to the eco-efficiency indices for CO2 and SOx.

4.2 Elasticities and marginal effects of ECOEFF with respect to ET and TT

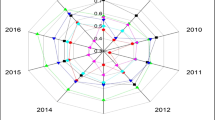

According to Figs. 1 and 2 the trends of the ECOEFF indices for CO2, CH4, and SOx behave similarly under the CRS and VRS assumptions. It is noteworthy that the ECOEFF index for CH4 lags behind the other two indices in 6 of the 9 DMUs (Figs. 1 and 2), namely DMU A, DMU C, DMU D, DMU E, DMU F, and DMU G.

Based on this observation, we decided to investigate the impact of energy and transport taxes on the CH4 eco-efficiency index in a second level of analysis, both to investigate specific aspects of the tax policies pursued and to provide policy makers with ways to improve the specific index in the short run (ECOEFF of CH4 = 1) and in the long run (ECOEFF of CH4 > 1).

It is worth noting that methane is an extremely potent greenhouse gas, storing much more heat in the atmosphere than carbon dioxide. Therefore, reducing methane emissions would have a more direct impact on current global warming.

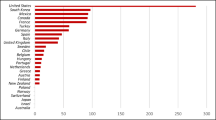

Figure 3 shows the relative evolution of the ET and TT indices. In all DMUs except DMU H, the ET index is lower than the TT index, with the largest difference in DMUs E and F. However, for energy taxes compared to transport taxes (Figs. 4 and 5), both the average sectoral tax and the average annual tax are much higher.

4.2.1 .

According to the results arising from Table 8, which are based on “NACE Rev.2” aggregated data for the main industries in Greece, it appears that during the period under review, the long run elasticity of the adjusted to CH4 eco-efficiency in regard to energy taxes, is negative. In this case, for every unit increase in energy taxes, we expect a 0.6227602 unit decrease in the level of eco-efficiency. On the other hand, the long run elasticity of the adjusted to CH4 eco-efficiency, with respect to transport taxes, is between 0 and 1 (0.5826438) for a period spanning from 2014 to 2019. In this case, the growth rate of eco-efficiency is lower than the growth rate of transport taxes.

5 Discussion

In order to ensure the sustainable use of resources and the protection of the environment, it is necessary to quantify the current situation on the basis of efficiency indicators and to pursue an appropriately designed fiscal policy. In this study, the research interest focuses on the Greek industry and the identification of ecological efficiency indicators for different types of pollutants, with a focus on methane emissions. Subsequently, the impact of Greek environmental taxes (energy taxes and transportation taxes) on the level of ecological efficiency is examined.

This feedback framework aims to strengthen the fiscal policy toolkit to ensure that prices reflect the full social cost of air pollution from methane emissions. Therefore, creating a well-designed tax system is crucial for reducing environmental emissions and improving environmental quality.

This study underlines the need to introduce an environmental taxation that is fully in line with the environmental goal of transforming Greece into a climate-neutral economy. The results show that a more thorough analysis is possible if the environmental tax is split into an energy tax and a transportation tax. This makes fiscal policy more targeted and better aligned with this goal.

The results show that for both constant and variable returns to scale, the adjusted to CH4 eco-efficiency index has the lowest overall average compared to the other two pollutant types (Tables 6 and 7). Moreover, the relative evolution of the adjusted to CH4 eco-efficiency index for the DMU A, DMU C, DMU D, DMU E, DMU F and DMU G sectors is lower than that of the other two pollutant types (Fig. 1), which is why the regulating role of the fiscal policy practiced in Greece needs to be further investigated.

Looking at the relative evolution of environmental taxes in the individual sectors of the Greek economy (Fig. 3), it becomes clear that in all sectors except DMU H, the relative evolution of the ET index lags behind the relative evolution of the TT index, with the greatest deviation being recorded in the DMU E and DMU F sectors. In addition, both the average sectoral and the average annual energy tax are far higher than the corresponding transport taxes (Figs. 4 and 5).

Examination of the long-run elasticity of the adjusted to CH4 eco-efficiency index shows that it is i. negative with respect to energy taxes and ii. positive with respect to transport taxes, which, however, have a higher growth rate than the growth rate of efficiency. This result could be an indication that the revenues from the collection of environmental taxes in Greece have not been sufficiently used to improve eco-efficiency and offset pollution costs. It would therefore be interesting to thoroughly investigate the macroeconomic and sectoral effects of the introduction of environmental taxes in Greece in further studies. In particular, it should be investigated whether the additional revenue generated are used to reduce the tax burden on labor or to reduce public debt.

6 Conclusions and policy implications

This study focuses, on the one hand, on the determination of the eco-efficiency levels of the Greek economic sectors according to the classification system "NACE Rev.2" and, on the other hand, on the impact of environmental taxes (energy and transport taxes) on the CH4 eco-efficiency index of the Greek economy.

As it turns out, the ECOEFF index has no upper limits, since it ranges from zero to infinity. Therefore, it can be continuously improved and allows monitoring the progress of a DMU as well as the comparative assessment of all DMUs. In this context, this indicator can be a tool for policy makers aiming to ensure the necessary conditions for sustainable development in the Greek industrial sectors.

In the context of Greek policy, special consumption taxes on energy products and electricity represent the largest share of revenues from environmental taxes and charges, but as the previous analysis has shown, they do not contribute to improving the eco-efficiency of economic activities in Greece.

To change this situation, it is important that policy makers make a focused and systematic effort to introduce an environmental tax reform that complements existing corporate taxes by taxing environmentally harmful activities (e.g. methane taxes in the mining sector—DMU B).

By introducing a new structure of tax rates, the ecological tax reform can help create the necessary financial resources that will contribute to the green transition efforts in Greece through tax disincentives on greenhouse gas emissions and tax incentives for the use of clean energy and energy savings.

At the same time, it should be explored how the costs of pollution can be fiscally allocated to products and services to avoid adverse market effects. In an internationalized economy, environmental taxes can only be an appropriate means of implementing the "polluter-pays" principle if they are introduced in a way that is revenue neutral and protects business competitiveness.

Given the difficulties in monitoring emissions, policymakers could also be directed to a system of fees and subsidies (feebates) for activities involving higher and lower carbon intensity products, respectively.

The biggest challenge in calculating eco-efficiency indicators is the limited data at the company level of an industry. However, data limitations have not hindered the sectoral analysis, which, based on the specificities of Greek industry, has led to targeted sectoral priorities that are directly linked to the mitigation of environmental degradation and thus to sustainable development. The theoretical and empirical significance of the present study can be extended to European industry and its individual sectors by examining the impact of the tax on greenhouse gases used in industry, which have a high global warming potential, on ecological efficiency.

Data availability

Data will be made available on request.

References

Amaral, C., Isabel Pedro, M., Cunha Ferreira, D., & Cunha Marques, R. (2022). Performance and its determinants in the Portuguese municipal solid waste utilities. Waste Management., 139, 70–84.

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science, 30, 1078–1092.

Bianchi, M., del Valle, I., & Tapia, C. (2020). Measuring eco-efficiency in European regions: Evidence from a territorial perspective. Journal of Cleaner Production, 276, 123246.

Boussofiane, A., Dyson, R. G., & Thanassoulis, E. (1991). Applied data envelopment analysis. European Journal of Operational Research, 52(1), 1–15.

Camarero, M., Castillo, J., Picazo-Tadeo, A. J., & Tamarit, C. (2013). Eco-efficiency and convergence in OECD countries. Environmental and Resource Economics, 55(1), 87–106.

Camarero, M., Castillo-Giménez, J., Picazo-Tadeo, A. J., & Tamarit, C. (2014). Is eco-efficiency in greenhouse gas emissions converging among European Union countries? Empirical Economics, 47, 143–168.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the inefficiency of decision-making units. European Journal of Operational Research, 2(6), 429–444.

Chen, Y., Ma, L., Miao, J., & Hui, X. (2023). Does Chinese forestry eco-efficiency converge? A three-stage DEA-Malmquist approach. European Journal of Forest Research, 5, 1–19.

Coluccia, B., Valente, D., Fusco, G., De Leo, F., & Porrini, D. (2020). Assessing agricultural eco-efficiency in Italian Regions. Ecological Indicators, 116, 106483.

Desli, E., Gkoulgkoutsika, A., Sdrolia, E., & Zarotiadis, G. (2021). Eco-efficiency: A methodological framework and assessment. Cleaner Environmental Systems, 3, 100049.

Hellenic Statistical Authority ELSTAT. (2023). Statistics: “economy, indices” and “environment and energy”. https://www.statistics.gr/statistics. Accessed 07 Feb 2023.

Emrouznejad, A. (2014). Advances in data envelopment analysis. Annals of Operations Research, 214(1), 1–4.

Emrouznejad, A., & Cabanda, E. (2015). Introduction to data envelopment analysis and its applications. In A. L. Osman, A. L. Anouze, & A. Emrouznejad (Eds.), Handbook of research on strategic performance management and measurement using data envelopment analysis (pp. 235–255). IGI Global.

Golany, B., & Roll, Y. (1989). An application procedure for DEA. Omega, 17(3), 237–250.

Gouveia, M. C., Henriques, C. O., & Dias, L. C. (2023). Eco-efficiency changes of the electricity and gas sectors across 28 European countries: A value-based data envelopment analysis productivity approach. Socio-Economic Planning Sciences, 87, 101609.

Halkos, G., & Gkampoura, E. C. (2021). Where do we stand on the 17 sustainable development goals? An overview on progress. Economic Analysis and Policy, 70, 94–122.

Halkos, G. E., & Tzeremes, N. G. (2014). Measuring the effect of Kyoto protocol agreement on countries’ environmental efficiency in CO2 emissions: An application of conditional full frontiers. Journal of Productivity Analysis, 41(3), 367–382.

He, P., Sun, Y., Shen, H., Jian, J., & Yu, Z. (2019). Does environmental tax affect energy efficiency? An empirical study of energy efficiency in OECD countries based on DEA and Logit model. Sustainability, 11(14), 3792.

Henriques, C. O., Gouveia, C. M., Tenente, M., & da Silva, P. P. (2022). Employing value-based DEA in the eco-efficiency assessment of the electricity sector. Economic Analysis and Policy, 73, 826–844.

Huang, J., Yang, X., Cheng, G., & Wang, S. (2014). A comprehensive eco-efficiency model and dynamics of regional eco-efficiency in China. Journal of Cleaner Production, 67, 228–238.

Huppes, G., & Ishikawa, M. (2005). Eco-efficiency and its terminology. Journal of Industrial Ecology, 9(4), 43–46.

Korhonen, P. J., & Luptacik, M. (2004). Eco-efficiency analysis of power plants: An extension of data envelopment analysis. European Journal of Operational Research, 154(2), 437–446.

Kuosmanen, T., & Kortelainen, M. (2005). Measuring eco-efficiency of production with data envelopment analysis. Journal of Industrial Ecology, 9(4), 59–72.

Kyrgiakos, L. S., Vlontzos, G., & Pardalos, P. M. (2021). Ranking EU agricultural sectors under the prism of alternative widths on window DEA. Energies, 14(4), 1021.

Lacko, R., & Hajduová, Z. (2018). Determinants of environmental efficiency of the EU countries using two-step DEA approach. Sustainability, 10(10), 3525.

Liu, J. S., Lu, L. Y., Lu, W. M., & Lin, B. J. (2012). A survey of DEA applications. Omega, 41(5), 893–902.

Liu, X., Guo, P., & Guo, S. (2019). Assessing the eco-efficiency of a circular economy system in China’s coal mining areas: Emergy and data envelopment analysis. Journal of Cleaner Production, 206, 1101–1109.

Llanquileo-Melgarejo, P., & Molinos-Senante, M. (2021). Evaluation of economies of scale in eco-efficiency of municipal waste management: An empirical approach for Chile. Environmental Science and Pollution Research, 28(22), 28337–28348.

Madaleno, M., Moutinho, V., & Robaina, M. (2016). Economic and environmental assessment: EU cross-country efficiency ranking analysis. Energy Procedia, 106, 134–154.

Martínez, C. I. P. (2013). An analysis of eco-efficiency in energy use and CO2 emissions in the Swedish service industries. Socio-Economic Planning Sciences, 47(2), 120–130.

Michelsen, O., Fet, A. M., & Dahlsrud, A. (2006). Eco-efficiency in extended supply chains: A case study of furniture production. Journal of Environmental Management, 79(3), 290–297.

Monastyrenko, E. (2017). Eco-efficiency outcomes of mergers and acquisitions in the European electricity industry. Energy Policy, 107, 258–277.

Moutinho, V., Fuinhas, J. A., Marques, A. C., & Santiago, R. (2018). Assessing eco-efficiency through the DEA analysis and decoupling index in the Latin America countries. Journal of Cleaner Production, 205, 512–524.

Moutinho, V., Madaleno, M., & Robaina, M. (2017). The economic and environmental efficiency assessment in EU cross-country: Evidence from DEA and quantile regression approach. Ecological Indicators, 78, 85–97.

Nasrollahi, Z., Ms, H., Bameri, S., et al. (2020). Environmental pollution, economic growth, population, industrialization, and technology in weak and strong sustainability: Using STIRPAT model. Environment, Development and Sustainability, 22, 1105–1122. https://doi.org/10.1007/s10668-018-0237-5

Nodehi, M., Arani, A. A., & Taghvaee, V. M. (2022). Sustainability spillover effects and partnership between East Asia & Pacific versus North America: Interactions of social, environment and economy. Letters in Spatial and Resource Sciences, 15(3), 311–339. https://doi.org/10.1007/s12076-021-00282-5

Pais-Magalhães, V., Moutinho, V., & Marques, A. C. (2021). Scoring method of eco-efficiency using the DEA approach: Evidence from European waste sectors. Environment, Development and Sustainability, 23, 9726–9748.

Pang, J., Chen, X., Zhang, Z., & Li, H. (2016). Measuring eco-efficiency of agriculture in China. Sustainability, 8(4), 398.

Picazo-Tadeo, A. J., Gómez-Limón, J. A., & Reig-Martínez, E. (2011). Assessing farming eco-efficiency: A data envelopment analysis approach. Journal of Environmental Management, 92(4), 1154–1164.

Pishgar-Komleh, S. H., Čechura, L., & Kuzmenko, E. (2021). Investigating the dynamic eco-efficiency in agriculture sector of the European Union countries. Environmental Science and Pollution Research, 28(35), 48942–48954.

Quintano, C., Mazzocchi, P., & Rocca, A. (2021). Evaluation of the eco-efficiency of territorial districts with seaport economic activities. Utilities Policy, 71, 101248.

Rashidi, K., & Saen, R. F. (2015). Measuring eco-efficiency based on green indicators and potentials in energy saving and undesirable output abatement. Energy Economics, 50, 18–26.

Rybaczewska-Błażejowska, M., & Gierulski, W. (2018). Eco-efficiency evaluation of agricultural production in the EU-28. Sustainability, 10(12), 4544.

Rybaczewska-Błażejowska, M., & Masternak-Janus, A. (2018). Eco-efficiency assessment of Polish regions: Joint application of life cycle assessment and data envelopment analysis. Journal of Cleaner Production, 172, 1180–1192.

Shao, L., Yu, X., & Feng, C. (2019). Evaluating the eco-efficiency of China’s industrial sectors: A two-stage network data envelopment analysis. Journal of Environmental Management, 247, 551–560.

Taghvaee, V. M., Arani, A. A., & Agheli, L. (2022a). Sustainable development spillover effects between North America and MENA: Analyzing the integrated sustainability perspective. Environmental and Sustainability Indicators, 14, 100182. https://doi.org/10.1016/j.indic.2022.100182

Taghvaee, V. M., Arani, A. A., Soretz, S., et al. (2022b). Comparing energy efficiency and price policy from a sustainable development perspective: Using fossil fuel demand elasticities in Iran. MRS Energy & Sustainability, 9, 480–493. https://doi.org/10.1557/s43581-022-00024-0

Taghvaee, V. M., Arani, A. A., Soretz, S., et al. (2023b). Diesel demand elasticities and sustainable development pillars of economy, environment and social (health): Comparing two strategies of subsidy removal and energy efficiency. Environment, Development and Sustainability, 25, 2285–2315. https://doi.org/10.1007/s10668-021-02092-7

Taghvaee, V. M., Nodehi, M., Arani, A. A., et al. (2023c). Sustainability spillover effects of social, environment and economy: Mapping global sustainable development in a systematic analysis. Asia-Pacific Journal of Regional Science, 7, 329–353. https://doi.org/10.1007/s41685-022-00231-0

Taghvaee, V. Μ, Nodehi, M., Arani, A. Α, Rishehri, M., Nodehi, S. E., & Shirazi, J. Κ. (2023a). Fossil fuel price policy and sustainability: Energy, environment, health and economy. International Journal of Energy Sector Management, 17(2), 371–409. https://doi.org/10.1108/IJESM-09-2021-0012

Tan, J., Su, X., & Wang, R. (2023). Exploring the measurement of regional forestry eco-efficiency and influencing factors in China based on the super-efficient DEA-tobit two stage model. Forests, 14(2), 300.

Tenente, M., Henriques, C., & da Silva, P. P. (2020). Eco-efficiency assessment of the electricity sector: Evidence from 28 European Union countries. Economic Analysis and Policy, 66, 293–314.

Vaičiukynas, E., Andrijauskienė, M., Danėnas, P., & Benetytė, R. (2022). Socio-eco-efficiency of high-tech companies: a cross-sector and cross-regional study. Environment, Development and Sustainability, 25, 12761.

Wang, F., & Taghvaee, V. M. (2023). Impact of technology and economic complexity on environmental pollution and economic growth in developing and developed countries: Using IPAT and STIRPAT models. Environmental Science and Pollution Research, 30, 73349–73360. https://doi.org/10.1007/s11356-023-27569-y

Wang, X., Ding, H., & Liu, L. (2019). Eco-efficiency measurement of industrial sectors in China: A hybrid super-efficiency DEA analysis. Journal of Cleaner Production, 229, 53–64.

Zhang, X., & Xu, D. (2022). Assessing the eco-efficiency of complex forestry enterprises using LCA/time-series DEA methodology. Ecological Indicators, 142, 109166.

Zhu, J. (2014). Envelopment DEA models. In M. Ch (Ed.), Quantitative models for performance evaluation and benchmarking. International series in operations research and management science. Cham: Springer. https://doi.org/10.1007/978-3-319-06647-9_2

Funding

Open access funding provided by HEAL-Link Greece. The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Ethical approval

This article does not have any studies with human participants executed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bampatsou, C., Halkos, G. & Gkampoura, EC. Environmentally adjusted technical efficiency and the impact of energy and transport taxes on the eco-efficiency index of Greek industry. J. Ind. Bus. Econ. 51, 73–97 (2024). https://doi.org/10.1007/s40812-023-00292-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40812-023-00292-y