Abstract

The Children’s Savings Accounts (CSAs) program, an asset-building intervention, has gained increasing attention for its potential to elevate low-in families’ education expectations, college enrollment, and completion. Variations in program enrollment policy can lead to different levels of program participation among vulnerable populations. This paper examines the enrollment policy of one of the oldest CSA programs and explores program participation among a financially vulnerable group—welfare users. While welfare users were 43% less likely to expect their children to attend college, those who enrolled in the CSA program were about two times more likely to expect their children to go to college than welfare users who did not participate in the program. Findings shed light on research and policies that facilitate asset-building efforts among vulnerable populations and encourage visioning CSAs a potential drive for better financial inclusion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Children’s Savings Accounts (CSAs) programs are a policy intervention designed to facilitate saving towards post-econdary education through providing a saving structure (e.g., a savings account, incentives) with a population focus on low-to-moderate income (LMI) families. Education remains a robust pathway to achieve upward social and economic mobility (National Center for Education Statistics, 2016), yet costs of college education continue to rise beyond the affordability of low-income families. Past studies indicated that parents of lower socioeconomic status perceived college as a catalyst for social mobility but lacking resources and support to fully finance their children’s post-secondary education (Friedline et al., 2017). With tremendous concerns over rising college tuition and student debt, CSAs have gained popularity for their role in facilitating LMI families’ saving efforts towards education and promoting college education access. Indeed, CSAs have grown steadily over the last decade. As of 2019, there are 82 CSA programs with 707,000 child participants across 36 states and DC jumping, an increased rate of 55% (457,000) from 2018 (Prosperity Now, 2020).

The role of CSAs in facilitating savings and helping families cope with financial hardships was highlighted recently during the pandemic. The COVID-19 pandemic has had an unprecedented impact on families’ financial stability where job loss and financial hardships have disproportionately hit low-income families, as well as well people of color, youth, and parents (Office of Human Services Policy, 2021). The federal government enacted the Coronavirus Aid, Relief, and Economic Security (CARES) Act to mitigate financial disaster, yet many low-income families do not have a bank account for easy transfer of CARES ACT relief checks and therefore have had to wait for a long time to receive their relief checks. The economic fallout of COVID-19 and the government’s inadequate response together highlight the critical role that savings and financial access can play in protecting financially vulnerable groups when income shocks occur. While CSAs programs oftentimes stipulate savings gained towards education expenses, some CSA programs considered allowing emergency withdrawal in the early stage of the Covid-19 pandemic to help participating families cope with financial hardship (Prosperity Now, 2020). This emergency saving adjustment shows the potential role of CSA in helping families cope with income shock. Further, CSAs as a banking platform have the potential to meet banking needs and create greater access to financial resources (Chen & Elliott, 2020).

Despite CSAs’ demonstrated impact and potential for supporting the disadvantaged families (Sherraden et al., 2019), LMI family’s CSAs participation remains low. This is particularly the case among CSAs programs with application-based enrollment policy (also known as opt-in), which requires eligible children and families to apply in order to participate in the program. In fact, CSA programs that adopt opt-in enrollment often have participants who are disproportionately higher-income families, despite of various outreach and recruitment efforts targeting low-income families (Clancy & Sherraden, 2014; Loke et al., 2009). In contrast, the automatic enrollment (also known as opt-out) policy enrolls eligible participants and opens CSA accounts for participants without any action required from them or their parents or guardians. As of 2020, almost two-thirds (64%) of current CSA programs adopted opt-in enrollment, 34% were opt-out and 3% used a combination of opt-in and opt-out enrollment (Prosperity Now, 2020).

In this paper, we examine program participation among welfare user in the My Alfond Grant program in the state of Maine, one of a few state-wide CSA designed to address the educational achievement gap and to level the field of savings. The My Alfond Grant (MAG) program, funded by the Alfond Scholarship Foundation, started in 2008 and offered eligible children in Maine $500 towards postsecondary education. It also provided incentives (e.g., matching grants, tax deductions, financial education) to participating families for making contributions to saving accounts (Clancy & Lassar, 2010). At the beginning of the program, interested families need to meet requirements and apply to participate in the MAG, which is what opt-in enrollment prescribes. In 2014, however, the MAG program shifted from opt-in to opt-out enrollment granting all children born in Maine $500 at birth with no additional application required. This enrollment policy change aims for better program inclusivity and financial inclusion. As of January 2022, more than 130,000 Maine children now is participating in the MAG program (The Alfond Grant, 2022). In this paper, we were interested in understanding how this enrollment policy affected program inclusivity, especially among children from welfare user families.

Welfare users in this study refer to individuals who participate in federally funded public assistance programs. Research has well documented that while savings and assets are instrumental to helping individuals cope with financial hardships (McKernan et al., 2010), asset building was discouraged for poor families participating in public assistance programs that are often mean-tested (McKernan et al., 2012). In fact, welfare users are among those who were least likely to participate in asset building programs such as 529 plans and retirement plans. As one of the oldest and most prominent college saving programs in the country, the MAG offers a rare opportunity to understand welfare users’ participation in an asset building program. This study examines welfare users’ program participation during the enrollment policy shift from opt-in to opt-out. Additionally, along with other low-income individuals, welfare users tend to have low educational expectations (Kim et al., 2013). Evidence has shown that CSAs participation was linked with higher educational expectation. Given that educational expectation is an interim outcome that is closely associated with college attendance and completion, we were interested in understanding the relationship between welfare users’ CSA participation and educational expectation. The following section reviews CSA literature and studies on the MAG program.

Literature Review

An Overview of Research on CSA Impact

As CSAs are becoming an increasingly prominent strategy to improve access to higher education and long-term financial security, research on CSA has grew exponentially in recent years (Markoff et al., 2018). A recent overview indicated that CSA effects were studied in four outcome areas including health and well-being, economic mobility, equity, and education (Markoff et al., 2018). For health and well-being, for instance, studies have linked CSAs with mother’s increased psychological well-being, positive parenting practice, and increased psychological and social-emotional well-being (Huang et al., 2014, Gray et al., 2012, Nam et al., 2016, Scalon & Adams, 2008). In terms of economic mobility, studies reported a positive association between having a CSA and increased savings and connection to mainstream financial institutions (Elliott & Lewis, 2015; Huang et al., 2013; Sherraden et al., 2011). CSA also seems to reduce disparities between the poor and nonpoor families in account holding and savings (Beverly et al., 2015; Buitrago & Mullany, 2017; Sullivan et al., 2016). Lastly, evidence on CSA’s impact on education focuses on savings for post-secondary education, educational expectations, academic achievement, and post-secondary enrollment and completion (Beverly et al., 2016; Kim et al., 2015; Long, 2016; Elloitt et al., 2011; Elliott et al., 2013, 2019). Given educational expectation is the focus of this study, we review this line of research in details below.

Educational Expectation and Children’s Savings Accounts

In and outside of the CSA field, the educational expectation has been linked to improved academic performance (e.g., Carolan & Wasserman, 2015), and become a routinely examined interim outcome to assess CSA program impact (Markoff et al., 2018). Findings from CSA studies indicated a positive association between educational expectation and CSA account holding. The most rigorous evidence comes from experimental studies on Saving for Education, Entrepreneurship, and Downpayment (SEED for Oklahoma Kids (SEED OK), a large CSA experiment in the state of Oklahoma, studies have showed that the CSA program had a positive impact on sustaining and increasing mothers’ educational expectations over a time period of 4 years (e.g., Kim et al., 2015). Using the same data, several other studies showed that educational expectations were significantly higher in treatment group than those in the control group, indicating CSA’s strong impact on educational expectation among average participants as well as vulnerable groups (Huang et al., 2019; Kim et al., 2017).

In addition to experimental research, a group of studies used secondary data to examine the relationship between college savings accounts and educational expectation. For example, Elliott (2009) used data from the Panel Study of Income Dynamics and found that children with a Children’s Development Account (CDA) were nearly twice as likely to expect to attend college than children without a CDA. Shanks and Destin (2009) reported similar findings with an African American subsample. Fang et al. (2018) used data from China Family Panel Studies and found that parental educational expectations are a partial mediator between family’s savings and children’s educational achievement in China.

Educational expectation has also been studied qualitatively and with mixed methods. A few qualitative studies indicated that participating children and youths in families that regularly communicated about savings and education had higher educational expectations (Blumenthal & Shanks, 2019; Chen & Elliott, 2020; Friedline et al., 2017). In a mixed method study by Blumenthal and Shanks (2019), for example, researchers investigated SEEK OK participants’ family communications about college, saving for college and found that families that held an account and communicated with children about accounts had higher educational expectations than families that did not have an account or communicate about the account.

CSA Enrollment Policy

The design and mechanism of CSAs are rooted in the institutional theory of saving, which describes that structural arrangements play a critical role in shaping saving behaviors, yet such arrangements are often absent in the financial lives of low-income individuals and families (Beverly & Sherraden, 1999; Sherraden, 1991, 1999). According to the theory, automatic enrollment is part of facilitation, expanding saving opportunities to low-income families (Curley et al., 2009). In the CSA field, enrollment policy varies to a great extent. To meet local priorities and best use available resources, CSA programs have used three different enrollment processes and yielded varied participation outcomes, savings engagement, and account accumulation (Markoff et al., 2018). Automatic enrollment (opt-out policy) and application-based enrollment (opt-in policy) are the two main enrollment policies in the CSA field. As of 2020, there were 82 publicly or privately run CSA programs in the USA, about 34% of existing programs had opt-out enrollment whereas 64% was opt-in (Prosperity Now, 2020). Compared to the opt-in policy, opt-out enrollment allows for all eligible children to participate in the program, therefore, ensure near-universal participation. A few CSAs used a combination of opt-in and opt-out enrollments. To date, few studies have taken a close look at CSA enrollment policy to understand the impact on program participation and outcome. Beverly et al. (2015) examined automatic enrollment of the SEED OK and found that the opt-out design eliminated virtually all variation by income, race, and other demographic characteristics in account holding. Using the same data source, Huang et al. (2019) further examined the impacts of SEED OK on TANF and the Head Start participants and indicated that universal access to CSA yielded positive impacts on financial and social-emotional development outcomes for TANF and Head Start mother and child participants. Data from San Francisco’s Kindergarten-to-College (K2C), a CSA for all kindergartens in the public school system, Elliott et al. (2017) found that school-level opt-out enrollment ensures better participation among low and moderate-income families. Findings from these studies converge to suggest that universal enrollment is better at facilitating vulnerable families’ access to asset building opportunities and improved outcomes on an array of social, emotional, and educational factors.

Prior Studies on the MAG Program

Since the MAG started in 2008, a few studies investigated program participation and outcome. There is no experimental data available; therefore, studies on the MAG program reviewed used cross-sectional, one-shot survey data. Clancy and Sherraden (2014) examined program participation and found that participation rates increased from 40% during the opt-in time period (2008–2013) to nearly 100% (opt-out in 2014 and after). In addition to participation, other studies have linked the MAG program to improved and persistent educational expectations. For instance, Chen et al. (2020) found that while there was no expectation difference between opt-in and opt-out parents, parents with a CSA were 2.7 times more likely than those without a CSA to expect their children to attend a 4-year college. Qualitatively, Elliott et al., (2018) as well as Chen and Elliott (2020) investigated the impact of CSA on parental educational expectations and program participants’ experiences. Elliott et al. (2018) found that most parents who had a CSA described positive educational expectations and developed a college-saver identity. Chen and Elliott (2020) suggested that having a CSA helped elevating parents’ educational expectations and increasing family financial socializations. To summarize, studies on the MAG program showed a promising link between having a CSA account and elevated educational expectation.

The MAG’s enrollment policy change from opt-in to opt-out is unique in the CSA field. With current participants enrolled through either opt-in and opt-out, the MAG program provides a rare opportunity to examine program participation and outcome by enrollment. Building on previous research, this study used data collected from Maine residents to examine program participation among welfare users and their educational expectation. We were interested in understanding how enrollment policy may affect low-income families, especially welfare user’s program participation. Along with other low-income individuals, welfare users tend to have low educational expectations (Kim et al., 2013). We were interested in exploring whether having a CSA affects this group’s educational expectation, given that one of the CSA aims was to provide access to educational attainment. The following sections provide details regarding the study design and findings.

Method

Data Collection

Data were collected using a random sampling method through Pan Atlantic Research, a market research and consulting firm in the state of Maine. The sampling pool was identified by the purchase of approximately 8000 phone records of parents with children born between 2008 and 2017. Participants were selected if (1) they were verified residents of Maine, and (2) had at least one child born between 2008 and 2017. A 63-item survey instrument was developed by several researchers who have expertise in household finance and asset building. The survey includes questions regarding qualifying criteria, educational expectation, health and education history of the child, household finances, college saving and child’s saving accounts, college cost, family relationships, and socio-demographic information. The average time to complete the survey was 16 min. Data collection began in September 2018 and ended in March 2019 and occurred in several stages. It started with 300 surveys collected through phone interviews, then 170 surveys collected through online survey, and another 300 surveys collected through phone interviews.

Measures

Educational expectation was the dependent variable and assessed by one question worded as “As things stand now, how far in school do you think the child will actually get?”. Respondents were asked to choose from nine optional answers including some high school, complete a high school diploma, GED or alternative high school credentials, complete a certificate program or diploma from a school that provides occupational training, some college, associate degree, a bachelor’s degree, some graduate school, Master’s Degree, and a Ph.D., MD, law school or other high-level professional degree. Because this study focuses on college education, the educational expectation variable was coded dichotomously (1 = bachelor’s degree or higher, 0 = less than a bachelor’s degree).

The key independent variable was welfare use and assessed with a question asking respondents if they participated in any of seven public assistance programs (i.e., Temporary Assistance for Needy Families, state welfare program, Special Supplement Nutrition Program for Women, Infants, and Children, state Medicaid, Children’s Health Insurance Program, Sect. 8) in the past 12 months. The welfare use variable was coded dichotomously indicating program participation in any of the seven public assistance programs listed. The other key independent variable of interest was CSA participation. This variable was dichotomously coded indicating whether respondents had a CSA account at the time of the survey (have a CSA account = 1, do not have CSA account = 0). Based on this variable, we further computed a variable that indicates enrollment policy: opt-in CSA and opt-out CSA. The opt-in CSA group composes of study participants who received the Alfond Grant during the opt-in policy period (2008–2013), whereas the No CSA group includes participants who did not apply for My Alfond Grant during this time period. The opt-out group consists of study participants who received the My Alfond Grant during the opt-out policy period (2014–2017). The group that without CSA (i.e., No CSA) was used as a comparison group in the analysis.

Five control variables were included in the analysis including the child’s age and gender, respondent’s marital status, income, and their report of the child’s academic performance. The selection of control variables was based on the literature and availability of the data. All but one control variables were dichotomized for analysis. The child’s gender was coded 1 if male, 0 if female. Marital status was coded 1 if married, 0 otherwise. Household income was coded 1 if it was reported above $55,000, 0 if $55,000 or below. Parent-rated academic performance was coded 1 if respondents reported their child’s GPA or overall school performance last year was above average or excellent, 0 if it was average, below average, or very poor. Age was coded continuously.

Data Analysis

Descriptive and bivariate analyses were conducted to compare sample characteristics of the full sample with that of the welfare recipient subsample. Descriptive statistics were computed to examine welfare user participation under the opt-in and opt-out enrollment policy. Bivariate tests were conducted to examine group difference between welfare use and CSA groups. Then a logit regression model with a listwise deletion method was conducted to assess the relationship between welfare use and educational expectation. Finally, we examined the relationship between CSA participation and educational expectation among welfare users, with the same set of control variables included. Odd ratios were computed for all variables included in the models.

Results

Table 1 shows sample characteristics of the full sample and the subsample of welfare users. The full sample consisted of 770 Maine residents, 47% (n = 370) were self-identified welfare users. The sample consisted of mostly white (97%), married adults (76%). Over a half of the sample was college educated (61%) with an annual household income of above $55,000 (64%). About 58% of respondents had a female child; 72% of the respondents reported their child had above average GPA. The mean age of children reported by respondents was 7 years old. Overall, the demographic distribution of the welfare recipient subsample aligns with the full sample except household income. The percentage of respondents with an annual household income of up to $55,000 in the welfare subsample was 9% higher than the percentage in the full sample (44.99% versus 35.61%).

Most respondents reported that they expected their children to go to college (78% of the full sample, 73% of the welfare user subsample). Approximately, a quarter of the sample did not have a CSA account (27% of the full sample, 24% of the welfare user subsample). About the same percentage (46%) of respondents in the full sample and in the welfare user subsample received CSA account under the opt-in policy, while the percentage of respondents in the welfare user subsample received CSA through opt-out policy was higher than the percentage of respondents in the full sample received CSA through opt-in policy (29.33% versus 26.61%, respectively).

Table 2 shows the distribution of welfare users in the three policy groups: No CSA group consisted of participants did not apply for Alfond Grant during the opt-in policy, Opt-in CSA group included participants who applied and received a CSA during the opt-in policy, whereas Opt-out CSA group consisted of participants received a CSA during the opt-out policy through automatic enrollment. As seen in Table 2, welfare users accounted for about 48% of the full sample as well as of the Opt-in CSA group. In the Opt-out CSA group, the percentage of welfare users was 7% larger than the portion of non-welfare users (53% and 46%, respectively). When comparing the portion of welfare users with CSA by enrollment policy, data showed that the Opt-out CSA group has a larger percentage of welfare users than the Opt-in CSA group (53% versus 48%). Results of chi-square tests showed that there was no welfare use difference among the three CSA groups. Table 3 shows sample characteristics by CSA enrollment policy. As shown in this table, compared to the opt-in CSA group, the opt-out CSA group had significantly fewer married participants (72.22% versus 80.17%) and fewer participants with a household income of $55,000 and above (55.90% versus 72.64%).

Findings from Logit Regression Analysis

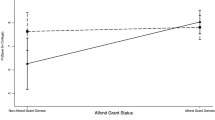

Table 4 shows results from two multivariate regression models in which educational expectation was regressed on welfare use and CSA participation, with six control variables. Specifically, to examine the relationship between welfare use and educational expectation, logit regression was used with a listwise deletion method with a working sample size of 692. Results indicated a negative association between welfare use and educational expectation (OR = 0.57, z = −2.77, p < .01). In other words, respondents who participated in public assistance program were less likely to expect their children to go to college than those who did not receive public assistance. CSA participation showed no significant relationship with education expectation. Most control variables included were not significantly associated with educational expectation. Academic performance was the only control variable that was found positively associated with educational expectation (OR = 1.68, z = 2.45, p < .05). This suggests that those parents who had the higher self-reported academic performance of their children were more likely to expect their children to attend college.

With the same set of control variables, a logit regression with the welfare user subsample was estimated to assess the relationship between CSA participation and educational expectation. Results revealed a positive association between CSA participation and educational expectation (OR = 2.28, z = 2.68, p < .01). This suggests that welfare users who participated in CSA were 2.28 times more likely to expect their children to attend college. Among all control variables included in the model, academic performance was the only variable which showed a significant relationship with the dependent variable educational expectation. Specifically, welfare recipients who reported their child had over-average academic performance were 2 times more likely to expect their child to go to college (OR = 2.13, z = 2.58, p < .05).

Discussion and Implications

This study examines how enrollment policy affects participation among welfare users and investigates the relationship between CSA participation and educational expectations. Using data collected from 770 Maine residents, we compared welfare users’ enrollment and educational expectation in three groups: opt-in CSA, no CSA, and opt-out CSA group. We found that under the opt-out policy, the portion of welfare user participants was larger than the portion of non-welfare users, although there was no statistical difference between welfare use and the CSA group. However, when comparing CSA opt-in and opt-out group, we found the opt-out group had significantly more lower-income participants than the opt-in group. This finding is not surprising given that the opt-out enrollment policy was designed to have the maximum inclusivity. Past studies have shown that the inclusiveness of a CSA program depends on the types of enrollment policy. With the My Alfond Grant (MAG) program, researchers noted a low participation rate when it had opt-in enrollment: Only 40% of eligible children participated in the MAG program under the opt-in policy. Furthermore, the participation was disproportionately skewed towards children from families with higher levels of education and financial asset holding (Clancy & Sherraden, 2014; Huang et al., 2013). Low program participation rates among low-income families were also seen in other CSA programs. For example, The Saving for Education, Entrepreneurship, and Downpayment (SEED) program, a CSA program in the city of Detroit with a target population of Head Start participants, witnessed a 62% opt-in participation rate after putting in considerable outreach efforts (Marks et al., 2009). Existing studies on program participation suggested that opt-in enrollment has inherent barriers that deter socially and economically disadvantaged groups from participating in asset building opportunities. For the MAG program, past studies showed that paperwork requirements and enrollment timeline were participation barriers (Chen & Elliott, 2020). Echoing other CSA studies (Beverly et al., 2015; Chen & Elliott, 2020), findings from this study suggest that automatic enrollment likely removes participation barriers for lower-income families and likely others who tend not to participate in asset building opportunities due to various program-specific barriers (Chen & Elliott, 2020).

We also found a negative association between welfare use and educational expectations, which is consistent with previous studies indicating that compared to high-income families, lower-income families had lower expectations for their children’s educational future (McKernan et al., 2010; O’Brien, 2008). However, among the welfare users, we found that CSA participation had a strong, positive association with educational expectation. This finding is consistent with prior studies that examined this relationship among vulnerable households including low-income families, racial minorities, and welfare users (Elliott, 2009; Rauscher et al., 2017; Huang et al., 2019; Rauscher et al., 2017). The current study contributes to the literature by focusing on a vulnerable population and showing having a CSA could potentially elevate welfare users’ educational expectations.

In addition, the study showed the potential progressive impact of CSA on vulnerable populations. Findings showed no significant relationship between CSA participation and educational expectation with the full sample but identified a strong association among the welfare user subsample. Additionally, the association between CSA participation and educational expectation was stronger among welfare users than it was for the average MAG participant found by Chen et al. (2020)’s study. This implies that CSA’s potential role of leveling the field of savings by having a possibly larger impact on welfare users in terms of improving educational expectation. While experimental data are needed to pin down the causal relationship, this study builds on previous studies suggesting CSA’s larger-than-average impact among welfare users. These findings, if confirmed by experimental data, call for an automatic enrollment policy among CSA programs and other asset building programs that aim to level the saving field for financially vulnerable populations.

Implications

The economic crisis triggered by the COVID-19 pandemic has exposed a financial vulnerability that many low-income American families have lived in for years. While the Coronavirus Aid, Relief, and Economic Security (CARES) Act has distributed money to millions of bank accounts, there were still 14 million Americans whose stimulus checks arrived slowly and with higher fees. Those unbanked households were concentrated among lower-income, less-educated, younger, Black and Hispanic households, the groups that many CSA programs aim to reach (Chen & Friedline, 2022). As CSA shows the impact on improving educational outcomes (Huang et al., 2014), its potential to bridge the banking gap remains veiled. Recent studies have suggested that integrating a CSA with social services such as Head Start and TANF (Huang et al., 2019), this study builds on this vision by showing a universal CSAs’ potential in granting welfare users access to asset building opportunities. Given that CSA programs often provide bank accounts, these CSA accounts can serve as a banking platform that enables unbanked families to not only save for college education but also access basic financial services. At a time like the Covid pandemic crisis, CSA could be a channel to deliver stimulus checks to people who do not have access to traditional banking accounts. In addition, savings in CSA accounts can serve as a financial cushion to cope with economic crises, and this function can be critical to the financial well-being of lower-income individuals, the group that have been disproportionately affected by the Covid-19 crisis (Prosperity Now, 2020). In fact, some CSA programs considered allowing emergency withdrawals during the pandemic, although account withdrawal is still restricted by the majority of CSA programs (Prosperity Now, 2020). It is beyond the scope of this study to examine how CSAs are used during the pandemic crisis; however, findings of this study carry relevance within the context of the covid-induced economic downturn. The study focus on welfare users and findings from this study, along with the existing practice of using CSA as emergency savings offer an opportunity to envision CSA as a platform that beyond a savings account for educational advancement but banking inclusion and financial security among financially vulnerable populations (Sherraden et al., 2018).

Limitations

One limitation of this study lies in its use of cross-sectional data, which does not allow for making robust observations on the relationship between CSA participation and educational expectation. The research design determines the found relationship between CSA participation and educational expectation is correlational. Another limitation of this study is the racial makeup of the sample. The majority of the sample is White. While the sample seems to reflect the racial composition of the residents in the state of Maine (Census Bureau, 2020), the association between CSA participation and expectation may change when the study sample has a more racially diverse composition. In addition, the educational attainment of the sample was slightly higher than the average Maine residents (55.85% of the sample had a college degree or higher while 32.5% of the Maine residents had a college education or higher, Census Bureau, 2020). Therefore, the study sample is not representative of the Maine resident population; therefore, findings may not be generalizable to all Maine residents. Finally, the data were collected through a mix of online surveys and phone interviews. It is possible that data collected through online surveys could be subjected to selection bias and social desirability bias when it comes to reporting educational expectation. Parent study participants who participated in the study may be more likely to have a higher educational expectation, and participants may have felt it is desirable to report that they had a high educational expectation of their children.

Conclusion

This paper examines welfare user participation in one of the oldest, state-wide Children’s Savings Account program and its implications participants’ educational expectation. Our findings suggest that universal enrollment policy (i.e., opt-out policy) can reach greater inclusivity, such inclusivity can be significant and meaningful among vulnerable populations such as welfare users. Additionally, our study implies that CSA as a policy tool could potentially enhance educational expectation among welfare users as well as other disadvantaged groups. Additional analysis should be considered to assess CSA’s long-term impacts among other disadvantaged groups with a more generalizable population. As CSAs continue to grow in numbers, findings from this study suggest envisioning CSA not only for elevating educational expectation but also a channel for bridging the banking gap among those who are outside the mainstream financial system. This vision is particularly relevant during the COVID-19 pandemic when millions of Americans who didn’t have a bank account had to wait a long time to receive pandemic stimulus benefits. Our study calls for further exploration of the inclusiveness of CSAs and other asset building programs with more representative samples and rigorous research designs to draw causal conclusions.

References

Beverly, S. G., & Sherraden, M. (1999). Institutional determinants of saving: Implications for low-income households and public policy. Journal of Socio-Economics, 28, 457–473.

Beverly, S. G., Clancy, M. M., & Sherraden, M. (2016). Universal accounts at birth: Results from SEED for Oklahoma Kids (CSD Research Summary No. 16–07). St. Louis, MO: Washington University, Center for Social Development.

Beverly, S. G., Kim, Y., Sherraden, M., Nam, Y., & Clancy, M. (2015). Can child development accounts be inclusive? Early evidence from a statewide experiment. Children and Youth Services Review, 53, 92–104. https://doi.org/10.1016/j.childyouth.2015.03.003

Blumenthal, A., & Shanks, T. R. (2019). Communication matters: A long-term follow-up study of child savings account program participation. Children and Youth Services Review, 100, 136–146.

Buitrago, K., & Mullany, L. (2017). Building brighter futures: Children’s savings accounts in Illinois. Heartland Alliance. Retrieved December 20, 2020, from https://financialinclusionforall.org/wp-content/uploads/2017/08/CSA_Report_FINAL2.pdf

Carolan, B. V., & Wasserman, S. J. (2015). Does parenting style matter? Concerted cultivation, educational expectations, and the transmission of educational advantage. Sociological Perspectives, 58(2), 168–186. https://doi.org/10.1177/0731121414562967

Census Bureau. (2020). Quick facts Maine. Retrieved December 10, 2020, from https://www.census.gov/quickfacts/ME

Chen, Z., & Elliott, W. (2020). Saving for college: Perspectives from participants in a universal children’s savings program. Journal of Children and Poverty, 17(2), 1–16.

Chen, Z., & Friedline, T. (2022). Make the invisible underbanked visible: Who are the underbanked? Journal of Financial Counseling and Planning, 33(2), 160–170.

Chen, Z., Elliott, W., Wang, K., Zhang, A., & Zheng, H. (2020). Examining parental educational expectations in one of the oldest children’s savings account programs in the country: The Harold Alfond College Challenge. Children and Youth Services Review, 108, 104582.

Clancy, M., & Lassar, T. (2010). College savings plan accounts at birth: Maine’s statewide program. Washington University.

Clancy, M., & Sherraden, M. (2014). Automatic deposits for all at birth: Maine’s Harold Alfond College Challenge. St Louis, MO: Center for Social Development Research. Retrieved December 15, 2020, from https://doi.org/10.7936/K7X63MGJ

Curley, J., Ssewamala, F., & Sherraden, M. (2009). Institutions and savings in low-income households. The Journal of Sociology & Social Welfare, 36(3), Article 2.

Elliott, W. (2009). Children’s college aspirations and expectations: The potential role of children’s development accounts (CDAs). Children and Youth Services Review, 31(2), 274–283.

Elliott, W., & Lewis, M. (2015). Student debt effects on financial well-being: Research and policy implications. Journal of Economic Surveys, 29(4), 614–636.

Elliott, W., Choi, E. H., Destin, M., & Kim, K. H. (2011). The age-old question, which comes first? A simultaneous test of children’s savings and children’s college-bound identity. Children and Youth Services Review, 33(7), 1101–1111.

Elliott, W., Chowa, G., Ellis, J., Chen, Z., & O’Brien, M. (2019). Combining children’s savings account programs with scholarship programs: Effects on math and reading scores. Children and Youth Services Review, 102, 7–17. https://doi.org/10.1016/j.childyouth.2019.04.024

Elliott, W., Lewis, M., O’Brien, M., Licalsi, C., Brown, L., Tucker, N., & Sorensen, N. (2017). Kindergarten to College Contribution Activity and Asset Accumulation in a Universal Children’s Savings Account Program Kindergarten to College Contribution Activity and Asset Accumulation in a Universal Children’s Savings Account Program. University of Michigan Center on Assets, Education, and Inclusion.

Elliott, W., Song, H., & Nam, I. (2013). Small-dollar accounts, children’s college outcomes, and wilt. Children and Youth Services Review, 35(3), 535–547. https://doi.org/10.1016/j.childyouth.2012.12.001

Elliott, W., Starks, B., Seefeldt, K., & Ellis, J. (2018). Children’s savings account programs enable parents to plan and talk about college with children and others. Sociology Mind, 8(4), 345–365. https://doi.org/10.4236/sm.2018.84022

Fang, S., Huang, J., Curley, J., & Birkenmaier, J. (2018). Family assets, parental expectations, and children educational performance: An empirical examination from China. Children and Youth Services Review, 87, 60–68.

Friedline, T., Rauscher, E., West, S., Phipps, B., Kardash, N., Chang, K., & Ecker-Lyster, M. (2017). “They will go like I did”: How parents think about college for their young children in the context of rising costs. Children and Youth Services Review, 81, 340–349. https://doi.org/10.1016/j.childyouth.2017.08.027

Gray, K., Clancy, M., Sherraden, M. S., Wagner, K., & Miller-Cribbs, J. (2012). Interviews with mothers of young children in the SEED for Oklahoma Kids college savings experiment. Washington University in St Louis Center for Social Development.

Huang, J., Beverly, S. G., Kim, Y., Clancy, M. M., & Sherraden, M. (2019). Exploring a model for integrating Child Development Accounts with social services for vulnerable families. Journal of Consumer Affairs, 53(3), 770–795.

Huang, J., Nam, Y., & Sherraden, M. S. (2013). Financial knowledge and Child Development Account policy: A test of financial capability. Journal of Consumer Affairs, 47(1), 1–26. https://doi.org/10.1111/joca.12000

Huang, J., Sherraden, M., Kim, Y., & Clancy, M. (2014). Effects of Child Development Accounts on early social-emotional development: An experimental test. JAMA Pediatrics, 168(3), 265–271. https://doi.org/10.1001/jamapediatrics.2013.4643

Kim, Y., Huang, J., Sherraden, M., & Clancy, M. (2017). Child development accounts, parental savings, and parental educational expectations: A path model. Children and Youth Services Review, 79, 20–28.

Kim, Y., Sherraden, M., & Clancy, M. (2013). Do mothers’ educational expectations differ by race and ethnicity, or socioeconomic status? Economics of Education Review, 33, 82–94. https://doi.org/10.1016/j.econedurev.2012.09.007

Kim, Y., Sherraden, M., Huang, J., & Clancy, M. (2015). Child development accounts and parental educational expectations for young children: Early evidence from a statewide social experiment. Social Service Review, 89(1), 99–137.

Loke, L., Clancy, M. & Zager, R. (2009). Account monitoring research at Michigan SEED. St Louis, MO: Center for Social Development Research.

Long, B. T. (2016). The impact of parent engagement on student outcomes: Analysis of the FUEL Education Model. Inversant.

Markoff, M., Loya, R., & Santos, J. (2018). Quick guide to CSA research: An overview of Evidence on Children’s Savings Accounts. Retrieved December 20, 2020, from https://prosperitynow.org/resources/quick-guide-csa-research-overview-evidence-childrens-savings-accounts

Marks, E. L., Rhodes, B. B., Engelhardt, G. V., Scheffler, S., & Wallace, I. F. (2009). Building assets: An impact evaluation of the MI SEED children’s savings program. Research Triangle Park, NC: RTI International.

McKernan, S. M., Ratcliffe, C., & Nam, Y. (2010). The effects of welfare and Individual Development Account (IDA) program rules on asset holdings. Social Science Research, 39(1), 92–110.

McKernan, S. M., Ratcliffe, C., & Shanks, T. W. (2012). Is poverty incompatible with asset accumulation. PN Jefferson, The Oxford Handbook of the Economics of Poverty, 463–493.

Nam, Y., Wikoff, N., & Sherraden, M. (2016). Economic intervention and parenting: A randomized experiment of statewide Child Development Accounts. Research on Social Work Practice, 26(4), 339–349. https://doi.org/10.1177/1049731514555511

National Center for Education Statistics. (2016). Fast facts: Income of young adults. Retrieved December 20, 2020, from https://nces.ed.gov/fastfacts/display.asp?id=77

O’Brien, R. (2008). Ineligible to save? Asset limits and the saving behavior of welfare recipients. Journal of Community Practice, 16(2), 183–199.

Office of Human Services Policy. (2021). The impact and implications of COVID-19 on household arrangements. Retrieved December 20, 2021, from https://aspe.hhs.gov/reports/joint-household-formations-during-covid-19

Prosperity Now. (2020). The movement reaches new heights. Retrieved December 18, 2021, from https://prosperitynow.org/sites/default/files/PDFs/CSAs/The_Movement_Reaches_New_Heights.pdf

Rauscher, E., Elliott, W., O’Brien, M., Callahan, J., & Steensma, J. (2017). Examining the relationship between parental educational expectations and a community-based children’s savings account program. Children and Youth Services Review, 74, 96–107.

Scanlon, E., & Adams, D. (2008). Do assets affect well-being? Perceptions of youth in a matched savings program. Journal of Social Service Research, 35(1), 33–46. https://doi.org/10.1080/01488370802477048

Shanks, T. R. W., & Destin, M. (2009). Parental expectations and educational outcomes for young African American adults: Do household assets matter? Race and Social Problems, 1, 27–35.

Sherraden, M. (1991). Assets and the poor. Armonk, NY: M. E. Sharpe, Inc. Sherraden, M. (1999). Key questions in asset building research, revised. St. Louis, MO: Center for Social Development, Washington University.

Sherraden, M., Clancy, M., Nam, Y., Huang, J., Kim, Y., Beverly, S., Mason, L. R., Williams Shanks, T. R., Wikoff, N. E., Schreiner, M., & Purnell, J. Q. (2018). Universal and progressive Child Development Accounts: A policy innovation to reduce educational disparity. Urban Education, 53(6), 806–833. https://doi.org/10.1177/0042085916682573

Sherraden, M., Huang, J., & Zou, L. (2019). Toward universal, progressive, and lifelong asset building: Introduction to the special issue on inclusive child development accounts. Asia Pacific Journal of Social Work and Development, 29(1), 1–5. https://doi.org/10.1080/02185385.2019.1575272

Sherraden, M. S., Johnson, L., Guo, B., & Elliott, W. (2011). Financial capability in children: Effects of participation in a school-based financial education and savings program. Journal of Family and Economic Issues, 32(3), 385–399. https://doi.org/10.1007/s10834-010-9220-5

Sullivan, L., Meschede, T., Shapiro, T., Asante-Muhammed, D., & Nieves, E. (2016). Equitable investment in the next generation: Designing policies to close the racial wealth gap. Retrieved December 10, 2020, from https://heller.brandeis.edu/iasp/pdfs/racial-wealth-equity/racial-wealth-gap/equitable-investments.pdf

The Alfond Grant. (2022). About the Alfond Scholarship Foundation. Retrieved December 18, 2021, from https://www.myalfondgrant.org/about-the-alfond-scholarship-foundation/

Author information

Authors and Affiliations

Contributions

Dr. Zibei Chen developed the study concept and hypothesis, conducted the statistical analyses, reviewed the literature, and wrote the first and subsequent drafts of the manuscript. Dr. Megan O’Brien managed data collection, contributed to the interpretation of the results, assisted in writing the manuscript, and provided feedback with particular expertise on the population of this study. Ms. Sophia Nielsen contributed to the writing of literature review and interpretation of the results. Mr. Haotian Zheng contributes to the writing of literature and results. Ms. Briana Starks assisted with writing the manuscript and contributed towards literature review and interpretation of the findings. All authors contributed to and have approved the final manuscript.

Corresponding author

Ethics declarations

Ethics Approval

The authors acknowledge the project is in full compliance with ethical standards.

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This is to confirm that this paper (or closely related research) has not been published or accepted for publication elsewhere. Further, it is not simultaneously under consideration at another journal and, if accepted, will not be published elsewhere.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chen, Z., O’Brien, M., Nielsen, S. et al. A Cross-Sectional Examination of Educational Expectation Among Welfare Users in an Asset Building Program. Glob Soc Welf (2023). https://doi.org/10.1007/s40609-023-00263-0

Accepted:

Published:

DOI: https://doi.org/10.1007/s40609-023-00263-0