Abstract

Wind energy being one of the cheapest and easily available sources of energy is very important to meet increasing demand for green energy in India. Wind energy is a clean, eco-friendly, renewable resource having better spread across the country compared to most of the conventional energy sources. This review covers recent developments in the field of wind energy in the country and highlights progress in the areas of wind installation, production, and consumption actively supported by policy formulations, design, and implementation of incentive schemes, and monitoring the effective implementation of the policy frameworks. Further, this paper reviews existing drivers and bottlenecks and identifies future drivers of wind growth in India. It is found that financing of wind projects remains as one of the most important challenges, and the Ministry of New and Renewable Energy is constantly trying to overcome the same. It is anticipated that future wind power developments will be largely driven by the formation of Renewable Energy Act, successful implementation of Offshore Wind Energy Policy, and low-cost financing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

On the backdrop of increased global attention on Climate Change and Conference of Parties (COP21) agreement in Paris renewable energy is at the focal point to be near 2 °C scenario. In 2015, about 140 GW of renewable energy capacity came on stream and wind contributing 63 GW [1•], about 45 % of total renewable capacity additions. In 2015, wind achieved 22 % annual growth rate primarily due to unprecedented capacity addition in China. In 2015, total investments in the clean energy sector reached a record USD 329 billion from USD 316 billion in 2014 and registered a record of 4 % growth (http://www.bloombergcom/company/clean-energy-investment/form). Wind energy is getting a significant share of investment. International Energy Agency estimates that total investment in wind will be USD 3.6 trillion between 2014 and 2040. Further, another USD 7.1 trillion would be invested for expansion and enhancement of transmission and distribution networks.

In line with the global renewable expansion, India is making all kinds of efforts to increase the share of renewable energy. The share of renewable energy capacity installation reached 14.1 % in June 2016 (Table 1) from 12.4 % in February 2014 [3••]. The southern region is leading the renewable installation capacity whereas the eastern region is the least developed renewable market. Despite the growth of renewables, coal dominates electricity generation capacity in the country. Renewable energy, in general, and wind energy, in particular, produces much lower environmental impact compared to conventional fossil fuel-based energy sources. Therefore, renewable is showing steady progress and the sector is poised grow much faster than the conventional energy sources.

In India, importance of renewable energy was realized in the early 1970s. Thereafter, many large programs for renewable energy were designed and implemented. As a result of sustained efforts, several renewable energy systems and devices are now commercially available [4•]. The development of wind power in India started in the 1990s and received much-needed attention in the first decade of this century.

There are several factors, which include concerns for the environment, enactment of Electricity Act 2003, National Electricity Policy (NEP) 2005, and formulation of dedicated Renewable Energy Policy by States serve as drivers of renewable growth in the country. In addition, some other factors presented in Fig. 1 have been quite helpful to promote wind energy in the country. As a result, India becomes the second largest wind market in Asia and the fourth largest [1•] in terms of cumulative installations in the world (Fig. 2). India’s renewed interest in wind energy has been an outcome of the Prime Minister’s focus on green energy and environment protection. It is evidence from 2623 MW of wind capacity addition in 2015, which places India in the fifth position (Fig. 3) in terms of new capacity addition in 2015.

Section 86 of Electricity Act 2003 promotes production, distribution, and sales of renewable power. Electricity Act 2003 creates provision of setting up the Central Electricity Regulatory Commission (CERC) and State Electricity Regulatory Commission (SERC) having many important regulatory authorities including tariff determination and fixing minimum renewable energy purchase obligation. Further, Section 5.2.20 of NEP2005 promotes private participation in renewable energy (RE) developments. Section 5.12.1 of NEP targets capital cost reduction in RE through utilization of competition.

Based on the market factors, business environment, and competitive scenarios, the SERCs bring necessary regulations in line with CERC to make wind power competitive enough [3••]. As a result, wind power achieved grid parity in the country and it is today one of the cheapest sources of energy.

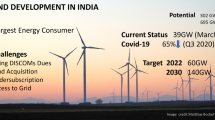

Wind Energy in India

India’s wind capacity growth is quite moderate over the last 13 years with an average capacity addition of 1913 MW. As of 31 March 2016, cumulative wind installation reached 26,777.45 MW from 1909 MW in March 2003. Compared our neighboring country China, India’s growth rate is quite slow. In 2015, China added 30,753 MW of capacity which is higher than India’s cumulative capacity over the last 15 years. India’s recent push for wind energy would certainly place among the top three wind markets in the world by 2022. Recently, National Institute of Wind Energy (NIWE) revised its earlier estimation of onshore wind potential at an 80-m height from 102 to 302 GW (Table 2). The NIWE suggests that the revised estimations are based on more realistic and practical assumptions, therefore could be closer to real potential. Considering the revised potential estimates, India’s onshore wind potential utilization is just about 9 %. At this point in time, states like Madhya Pradesh, Rajasthan, and Tamil Nadu have about 20–23 % of potential utilization. These three states certainly will lead future wind power growth in the country. Further, other high potential states like Gujarat, Maharashtra, Karnataka, and Andhra Pradesh are poised to grow faster.

Onshore Wind

Onshore wind is already one of the cheapest electricity generation options, and costs are continuing to decline due to many factors including increasing size and efficiency of turbines. Onshore wind installations in India have shown a steady progress (Fig. 4). The onshore wind development in the country has been reasonably successful compared to other renewable sources.

Cumulative onshore wind installation capacity in India (March 2009–March 2015) [7]

Wind potential map of India (Fig. 5) suggests that the wind as a resource has a greater presence in the states like Gujarat, Rajasthan, Maharashtra, Andhra Pradesh, Tamil Nadu, Karnataka, and Jammu & Kashmir. These states have enormous opportunities to capitalize on wind resources and optimize their energy mix. Further, these states can sale surplus wind energy to their neighboring states.

Wind power potential map in India [8]

Offshore Wind

Globally, compared to onshore wind, offshore wind is in very nascent stage of development and primarily region-centric. By the end of 2015, total cumulative offshore wind installation reached 12 GW, just about 2.8 % of the cumulative wind installations of 432.9 GW. In 2015, about 3.4 GW of offshore wind installations were added in Europe, China, Japan, and South Korea. Today, the UK remains the largest offshore wind market with 40 % contribution.

Relatively higher costs and installation complexity compared to onshore wind are big challenges for offshore wind development across the globe. A Study by E&Y indicates a steep reduction in levelized cost of electricity (LCOE) of offshore wind by 2030 [9]. Further, the introduction of higher capacity turbines with better energy capture and reliability with lower operating costs, leading to as much as a 9 % reduction in costs [10•]. India could gain from the learning from the European offshore wind market. Moreover, technology advancements will have a trickling effect on emerging markets like India and in the long run, the offshore wind developers in India would immensely benefits.

To promote offshore wind energy, in October 2015, India announced its first National Offshore Wind Energy Policy (NOWEP). The National Institute for Wind Energy (NIWE) is the nodal agency for implementing the policy and creating the necessary ecosystem for the sector. With the introduction of NOWEP, the government is attempting to replicate the success of onshore wind power development in the offshore wind power field. The NOWEP [11••] is developed with multiple objectives, and some of them are presented here:

-

Exploring and promoting deployment of offshore wind farms in the exclusive economic zone (EEZ) of the country, including those under public–private partnership

-

Encouraging indigenization of the offshore wind energy technology

-

Promoting research and development in the offshore wind energy sector

-

Creating skilled manpower and employment in the offshore wind energy sector

-

Facilitating the development of project EPC and operation and maintenance with regard to the offshore wind industry

-

Developing coastal infrastructure and supply chain to support heavy construction and fabrication work and the operation and maintenance activities.

As per the policy, NIWE would facilitate applications of offshore developers for clearances/no-objection certificates (NOCs) from various ministries/departments. Further, the policy creates a provision for creating Offshore Wind Energy Steering Committee (OWESC) under the chair of the Secretary, Ministry of New and Renewable Energy (MNRE) to (i) provide policy guidance and (ii) oversee the execution and effective implementation of specific offshore wind energy activities.

As per the NOWEP-2015, leasing of seabed and allocation of blocks would be made through an open International Competitive Bidding (ICB) process. The bidder could be a company, consortium, or a joint venture. The winning bidders will have to sign contracts with NIWE for exploration and exploitation of wind energy in the allocated blocks. Some of the important parameters of the contract will be as follows:

-

The time frame for completion of the installation and commissioning of the wind farm

-

Period of the contract

-

Committed Minimum Work Program (MWP) in terms of project capacity in the allocated block

-

Monitoring and inspection by MNRE/NIWE and decommissioning plan

-

Relinquishment of the lease and allocated blocks in case of failure to start commercial production within the stipulated time

Generally, evacuation and transmission of offshore wind power are big concerns. To address the bottlenecks of evacuation and transmission of offshore wind power, the central transmission utility (CTU) and/or state transmission utility (STU) will take the responsibility. The central government may provide support to state government for developing offshore wind power evacuation infrastructure. In addition, there is a provision for introducing bundling schemes with power from other sources and centralized procurement for making offshore wind power cost-effective.

The policy document envisions extending fiscal and financial incentives available to onshore wind farms to offshore wind farms, too. However, considering existing cost structure of offshore wind farms across the globe, the existing incentives applicable to onshore wind farms may not be adequate enough. Therefore, special incentive schemes may be introduced for rapid growth of offshore wind power development in the country.

Policies, Incentives, and Investment

This section is devoted to review and discuss policies and incentive schemes provided by the central government, state governments, and their agencies/regulatory bodies to promote wind energy. Also, current and future investment scenario is reviewed.

Central Level

In the past, with multiple objectives including broadening investor base, promoting actual wind power generation, attracting large independent power producers and foreign direct investment; schemes like generation-based incentive (GBI) was launched in December 2009. The scheme positively impacted not only installation but also the actual production of wind power in the country. Despite the considerable amount of success, the scheme was withdrawn in 2012. The wind industry expressed their concerns; therefore, in September 2013, the government extended the scheme until 31 March 2017 and the estimated budgetary support for the scheme was Rs.16364/crore [12]. As of April 30, 2016, under GBI-I (17 December 2009–31 March 2012) and GBI-II (1 April 2012–31 March 2017), capacity of 2031.38 and 5590.45 MW, respectively, were registered [13]. Including the demo stage, a total of 7670.73 MW of wind installations registered under GBI scheme. So far, the Indian Renewable Energy Development Agency (IREDA) released GBI incentives of Rs. 1267.53 crore. The government should continue the GBI scheme till 2022 to achieve higher generation oriented wind installation.

Another incentive scheme namely accelerated depreciation (AD) benefit introduced in 2003 was found to be helpful to the wind project developers. Earlier, under the scheme, wind projects were allowed up to 80 % of accelerated depreciation under the Income Tax Act. However, in the Union Budget 2016, the government put a capping of AD tax benefit at a maximum of 40 % from April 2017. Such a capping may impact the future growth of wind installation in the country. Wind producers and turbine manufacturers wish [14] that continuance of earlier AD tax benefit scheme would have helped to achieve 60 GW of wind installation by 2022. The finance minister may consider the suggestion and increase the capping up to 80 % in the next Union Budget.

Recently, the President of India sanctioned implementation of a scheme for setting up of 1000 MW Wind Power Projects connected to transmission network of CTU, through Solar Energy Corporation of India (SECI) [15]. Under the scheme, the Government targets to install 1000 MW wind power plants in 2016–2017.

The scheme intends to

-

1.

Facilitate the supply of wind power to the nonwindy states at a price discovered through a transparent bidding process;

-

2.

Encourage competitiveness through scaling up of project sizes and introduction of efficient and transparent e-bidding and e-auctioning processes

-

3.

Facilitate fulfillment of non-solar Renewable Purchase Obligation (RPO) requirement of nonwindy states

In addition, incentive schemes have been implemented to promote “Small Wind Energy and Hybrid system (SWES)” wherein both the solar and wind energy is effectively utilized for power generation in the remote areas by installing hybrid system consisting of both solar photovoltaic and aero generator/small wind turbine technologies. Under the scheme, central financial assistance of Rs 1, 00,000/KW ($1494) is provided for community users [16]. Under SWES, the total installed capacity as of 31 March 2016 stood at 2.69 MW [17]. There are six small wind turbine manufacturers and nine models empaneled under this program. Successful implementation of such a program would vastly improve availability and accessibility of clean energy in the rural and remote areas.

State Level

In addition to the incentives provided by the central government, the state governments offer many incentives to promote installation, generation, and distribution of wind power. Electricity being in the concurrent list of the Constitution of India, both the central government and the state governments have jurisdictions over the matter. Therefore, the state-level policies could play a critical role in promoting renewable energy in their states. Many states have developed dedicated Renewable Energy Policy which highlights the incentives offered to wind project developers, especially the onshore wind projects. Table 3 presents a summary of state-level incentives offered to eligible wind developers.

In Rajasthan, due to well-developed policy guidelines and incentives, 12 developers have commissioned projects of about 4000 MW [18] and Jaisalmer district contributes 80 % of the projects.

As per the provisions, most of the SERCs set preferential tariff for renewable energy including the wind and the basis for tariff determination is cost-plus. The CERC RE Tariff Regulations 2012 has recommended a normative CUF in the range of 22–30 % for the 200–400 W/m2 wind power density zone and most of the SERCs follow the guidelines set by CERC.

Investment

The government has set an ambitious target of 175 GW of renewable energy capacities by 2022, out of which 60 GW would be from wind power. Achieving this target require a capital outlay of US$160 billion including equity of US$40 billion. In addition, a considerable amount of investment is required for developing additional transmission infrastructure and upgrading existing grid system. To meet the additional investment, all banks, nonbanking financial companies (NBFCs), and other private investors would play an important role in providing low-cost and long-term funding to renewable project developers. A significant progress is being made in this area. During February 2015–March 2016, about Rs. 71,201.54 crore sanctioned by banks and NBFCs to finance various renewable energy projects [19]. Already, Rs. 29,529.57 crores released against the sanctioned amount, which indicates the funding agencies posing much-needed trust on renewable sector. Loans sanctioned by the banks and foreign investors for RE projects are 18.63 % of commitments made at RE-Invest 2015. Despite all efforts, there are concerns over meeting fund requirements of the renewable sector.

The government has been constantly striving to ensure availability of low-cost funding to the developers. If the renewable ecosystem operates efficiently and the financing agencies are paid back timely then more investment would flow. Investors and project developers constantly look out for better returns to their capital employed. If the renewable sector takes care of timely return on their capital, the financing would take care of itself. Otherwise, the government would have to intensify initiatives to attract low-cost capital to meet desired capital for renewable capacity expansion.

Future Drivers of Wind Power Growth

Decarbonization of power sector in India heavily rests on the growth of renewable energy installation and production. Government’s target of wind contributing about 34 % of installed renewable capacity by 2022 remains central to go green plan. Factors driving future growth of wind power in India include Renewable Energy Act, dedicated wind policy implementation in wind resource rich states, attracting investment, wind-solar hybrid projects, nonsolar RPO, and repowering of old wind farms.

The government is in the process of enacting “Renewable Energy Act” which would provide much-needed legal power to promote renewable energy. Further, the said Act is expected to create an enabling environment for the growth of renewable energy including wind energy.

Development and implementation of dedicated wind policy in resource-rich states would fast track growth of wind power. To attract higher investment wind policies should provide incentives to wind power developers as well component manufacturers.

In the lines with solar parks, efforts are being made for setting up of wind–solar hybrid parks for harnessing solar energy having exploitable potential at the site. This requires a fresh look at the tariff mechanism for power produced from wind–solar hybrid parks. This initiative would certainly prove as a driving force to future wind growth.

Ensuring timely implementation of nonsolar RPO, especially wind RPO across all states irrespective of the availability of wind resources, may prove crucial to the growth of wind energy. Possibly SERCs should introduce wind RPO to promote wind power in resource-rich states. Further, to increase production and consumption of renewable energy, Renewable Energy Certificate (REC) has been introduced. As on 15 July 2016, a total of 596 wind projects with a cumulative installation capacity of 2290.5 MW have been registered with the Renewable Energy Certificate Registry of India (RECRI). One REC is equivalent to 1 MWh which can be traded CERC approved exchange. The CERC fixed floor price of Rs.1500/REC and forbearance of Rs.3300/REC under the nonsolar category (i.e., wind) [20].

Global experience suggests that wind turbines completing 12–14 years of service life demand repowering or replacement with new and more efficient turbines [21]. Several studies have estimated that over 25 % of the turbines in India have a rating below 500 kW which offer bigger scope for repowering in India [22]. Repowering would certainly increase installation capacity and enhance capacity utilization and productivity. IREDA-WinD Force in the study on “Repowering of Wind Projects, 2014” highlighted issues and challenges to “Repowering” in India. Some of the important challenges include signing new power purchasing agreement (PPA), disposal of turbines, lack of incentives, absence of relevant policy package, and grid augmentation [23]. Research reports suggest that repowering was well incentivized in Denmark and Germany [24]. The MNRE is in the process of finalizing the draft guidelines on “Developing onshore wind projects” [25] which include repowering. The repowering would enhance efficiency and spur the future growth of wind power in India.

Conclusion

Wind energy is one of the cheapest sources of electricity in India. Compared to estimated potentials of 302 GW of onshore wind and average actual utilization is just about 9 %. This means that about 80 % of onshore potential remains untapped and offshore wind potential is yet to be assessed and exploited. In the last 5 years, Indian policy makers possibly increased their attention towards solar leaving behind the wind. In the recent years, the Government expressed renewed interest to revitalize the wind power market. Setting an ambitious target of 60 GW cumulative wind installations by 2022 indicates the strategic intent of the government. Necessary policy initiatives and regulatory changes are underway. The introduction of National Offshore Wind Policy, 2015, is a big step forward to assess potential and devise strategies to fully exploit the offshore wind potential of the country.

At this point in time, important incentive schemes like GIB and ADB offered by the central government are valid until 2017. To achieve the ambitious target the government should announce the extension of such effective schemes until 2022. Early announcements may help the investors to continue investing in wind power projects.

Abbreviations

- ADB:

-

Accelerated depreciation benefit

- CERC:

-

Central Electricity Regulatory Commission

- COP:

-

Conference of Parties

- CTU:

-

Central transmission utility

- EEZ:

-

Exclusive economic zone

- GBI:

-

Generation-based incentive

- IREDA:

-

Renewable energy development agency

- LCOE:

-

Levelized cost of electricity

- MNRE:

-

Ministry of New and Renewable Energy

- NBFCs:

-

Nonbanking financial companies

- NEP:

-

National electricity policy

- NIWE:

-

National Institute of Wind Energy

- NOCs:

-

No-objection certificates

- NOWEP:

-

National offshore wind energy policy

- PPA:

-

Power purchasing agreement

- REC:

-

Renewable Energy Certificate

- RECRI:

-

Renewable Energy Certificate Registry of India

- RPO:

-

Renewable Purchase Obligation

- SERC:

-

State Electricity Regulatory Commission

- STU:

-

State transmission utility

References

Papers of particular interest, published recently, have been highlighted as: • Of importance •• Of major importance

Global Wind Energy Report 2015. GWEC. http://www.gwec.net/wp-content/uploads/vip/GWEC-Global-Wind-2015-Report_April-2016_22_04.pdf. Accessed 12 July 2016. This is an important reference as it presents global wind energy developments.

GoI, CEA (2016) http://cea.nic.in/reports/monthly/installedcapacity/2016/installed_capacity-06.pdf. Accessed 14 July 2016.

Kar SK, Sharma A. Wind power developments in India. Renew Sust Energ Rev. 2015;48:264–75. This paper presents comprehensive analysis of wind market developments in India and could serve as a valueable reference material for readers and researchers.

Sharma A, Srivastava J, Kar SK, Kumar A. Wind energy status in India: a short review. Renew Sust Energ Rev. 2012;16:1157–64. It presents review of wind power developments in India till 2012.

http://niwe.res.in/department_wra_100m%20agl.php. Accessed 11 July 2016.

http://mnre.gov.in/file-manager/UserFiles/State-wise-wind-power-potential-utilized.pdf. Accessed 11 July 2016.

http://www.inwea.org/installedcapacity.htm. Accessed 14 July 2016.

NISE http://niwe.res.in/assets/Docu/Wra_100m%20agl%20map.pdf. Accessed 14 July 2016.

Global Wind Energy Report 2015. GWEC. P.47. http://www.gwec.net/wp-content/uploads/vip/GWEC-Global-Wind-2015-Report_April-2016_22_04.pdf. Accessed 12 July 2016.

Offshore wind in Europe. http://www.ewea.org/fileadmin/files/library/publications/reports/EY-Offshore-Wind-in-Europe.pdf. Accessed on 13 July 2016. It highlights offshore wind power developments in Europe.

National Offshore Wind Energy Policy. The Gazette of India. PART II—Section 3—Sub-section (i). October 06, 2015. New Delhi. This policy document sets direction for future offshore wind power developments in India.

http://mnre.gov.in/file-manager/grid-wind/gbi-scheme.pdf. Accessed 11 July 2016.

http://www.ireda.gov.in/forms/contentpage.aspx?lid=744. Accessed 11 July 2016.

http://www.business-standard.com/budget/article/budget-2016-wind-sector-to-take-a-hit-as-accelerated-depreciation-tax-benefit-capped-at-40-116022900591_1.html. Accessed 12 July 2016.

http://mnre.gov.in/file-manager/grid-wind/Wind-1000-MW-Scheme.pdf. Accessed 11 July 2016.

PIB. Harnessing of solar and wind energy in rural areas. 2016.

PIB. Small Wind Solar Hybrid System to provide electricity to un-electrified areas. 2016. http://pib.nic.in/newsite/erelease.aspx?relid=147052. Accessed 13 July 2016.

RRECL. Status of wind power projects commissioned. http://www.rrecl.com/PDF/Total%20Wind%20Power%20Projects%20Commissioned%20(Developerwise).pdf. Accessed 14 July 2016

PIB. Over Rs. 71,200 crore Sanctioned & Rs. 29,500 crore disbursed for renewable energy sector by banks & NBFCs since February, 2015. 2016. http://pib.nic.in/newsite/erelease.aspx?relid=147052. Accessed 13 July 2016.

https://www.recregistryindia.nic.in/index.php/general/publics/faqs. Accessed 15 July 2016.

Datta A. Re-wind—repower the old wind projects. Indian Wind Power. 2015;1(2). http://www.indianwindpower.com/pdf/Indian%20Wind%20Power%20Magazine%20-%20Feb.-March%202015%20Issue.pdf. Accessed 12 July 2016.

Gomathinayagam S. Repowering of wind farms: issues and proposals in India. Indian Wind Power. 2015;1(2).

IREDA-WinDForce. Study of repowering of wind power projects. 2014. http://www.ireda.gov.in/writereaddata/IREDA%20Repowering%20Study.pdf. Accessed 12 July 2016.

http://www.nrel.gov/docs/fy15osti/63591.pdf. Accessed 12 July 2016.

http://mnre.gov.in/file-manager/UserFiles/Draft-Guidelines-for-Development-of-Wind-Power-Projects.pdf. Accessed 12 July 2016.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The author declares that he has no competing interests.

Human and Animal Rights and Informed Consent

This article does not contain any studies with human or animal subjects performed by any of the authors.

Additional information

This article is part of the Topical Collection on Regional Renewable Energy

Rights and permissions

About this article

Cite this article

Kar, S.K. A Short Review of Wind Energy Progress in India. Curr Sustainable Renewable Energy Rep 3, 92–100 (2016). https://doi.org/10.1007/s40518-016-0053-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40518-016-0053-1