Abstract

Background

Patent expiries on leading biologics are creating new momentum in the market for biosimilars (copies of off-patent biologics), paving the way for their development. However, little is known about the factors influencing the competition between biosimilars and their reference products (REF).

Objectives

The aim of this study was to analyse key global erythropoietin (EPO) markets and factors affecting biosimilar EPO (BIOSIM-EPO) uptakes, and to identify countries where BIOSIM-EPOs have gained significant market shares.

Methods

Inclusion criteria for countries in the study were a biosimilar regulatory framework similar to the EU framework, and biological market value higher than US$2.5 billion. Factors evaluated included EPO market size, EPO retail/hospital distribution mix, national incentives to use biosimilars and BIOSIM-EPO/REF price differences. IMS Health provided EPO consumption in volumes, values, and EPO ex-manufacturer prices from 2007 to 2012.

Results

Japan: large-sized market, mixed retail/hospital distribution, no incentives, low BIOSIM-EPO uptake (6.8 % in 2012). France: large-sized market, dominant retail distribution, no incentives, low BIOSIM-EPO uptake (5.8 %). Spain and Italy: medium-sized market, dominant hospital distribution, no incentives, moderate BIOSIM-EPO uptakes (11.5 and 8.6 %). Germany: small-sized market, dominant retail distribution, presence of incentives, high BIOSIM-EPO uptake (30.4 %). UK: small-sized market, mixed retail/hospital distribution, no incentives, low BIOSIM-EPO uptake (2.0 %). BIOSIM-EPO/REF price differences play no role at a global level (−10.8 % in Germany and −26.9 % in Japan).

Conclusions

EPO markets have proven to be highly country-specific. EPO market sizes, EPO retail/hospital distribution mixes and BIOSIM-EPO/REF price differences may not be determining factors of BIOSIM-EPO uptakes. Prescription and substitution incentives to use BIOSIM-EPO appear to be determining factors in Germany. The heterogeneity of national EPO markets makes it impossible to outline country profile types with significant BIOSIM-EPO penetrations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Because ‘biosimilarized’ molecules belong to different therapeutic classes that all have their own scientific characteristics, the best approach to establish appropriate national policies on biosimilars seems to be the class-by-class approach. |

National measures to promote the use of biosimilars have to be carefully designed, taking into account the efficacy of the original policies implemented for their use, i.e (i) development of scientific guidelines; (ii) implementation of prescription incentives or quotas; (iii) substitution and (iv) price-cutting policies. |

Pending national health policymaker’s decisions on these points, by default, hospitals and regional health structures have to locally define the scientific and economic conditions for the inclusion of biosimilars in tenders, and to develop the regulatory framework for the substitution of a biosimilar for a reference product, or for the substitution of a biosimilar for a non-reference-branded product belonging to the same class. |

1 Background

During the last two decades, the use of costly biologics has increased sharply to meet the needs in a variety of chronic and debilitating conditions (e.g. anemia in renal failure, cancer, or rheumatoid arthritis) [1–3]. Global sales of biologics reached US$157 billion in 2011 [4]. Biologics represent substantial expenditures for healthcare systems and induce cost-cutting measures in other therapeutic areas, which generate inequities among patients [5].

The use of biosimilars (‘copies’ of off-patent biologicals) is a way to reduce spending [5]. Unlike small chemical molecules, biologicals are proteins produced by living organisms, which are generally 100–1,000 times larger than chemical molecules, inherently more variable and complex (microheterogeneity of the protein structure, different glycosylation profiles). While traditional generics are identical copies of off-patent chemical medicines, biosimilars are similar ‘copies’ of biotechnology-derived medicines produced by live cells [6–8]. They are similar enough that no significant clinical difference exists between them [7]. Even so, the regulatory framework for biosimilars is different to those for generics [8].

As the first to introduce scientific requirements for their approval in 2004, the EU has emerged as a testing ground for biosimilars [6–8]. Japan adopted a regulatory framework for biosimilars in 2009 [9–11]. The US lags behind: the US Congress authorized the FDA to approve biosimilars through the Biologics Price Competition and Innovation Act of 2009, enacted as part of the Patient Protection and Affordable Care Act of 2010 [12]. In 2012, the FDA issued draft guidelines on the development of biosimilars [13].

As of the end of 2012, three therapeutic classes have been ‘biosimilarized’, meeting strict European Medicines Agency (EMA) regulatory requirements or near-equivalents: human growth hormones (h-GHs), granulocyte-colony stimulating factors (G-CSFs), and erythropoietins (EPOs) [7, 8]. The h-GH market remains a niche market [14, 15] and is not considered here. G-CSF and EPO markets share some commonalities (high elasticity of demand [16] and intense competition between short- and long-acting products [17]), but also have different characteristics (e.g. more manufacturers and products on the EPO market [15]). Furthermore, these two classes have significant differences scientifically and medically: (i) non-systematic dose equivalences between short- and long-acting EPOs, unlike G-CSFs [18]; (ii) EPOs are glycosylated molecules, while G-CSFs are non-glycosylated molecules [19]; (iii) biosimilar EPOs (BIOSIM-EPO) have limited indications versus reference EPO (REF) at launch, whereas there are full indications for biosimilar G-CSFs (BIOSIM-G-CSF) versus their reference [20–23]; and (iv) because of immunogenicity concerns, some BIOSIM-EPO did not primarily get a market authorization (MA) for delivery through subcutaneous injection [24] and there is a history of pure red cell aplasia (PRCA) with REF, leading to patient deaths in the late 1990s [25, 26], whereas G-CSFs are not affected by these problems.

Even if biosimilars may represent significant cost-saving opportunities, their market share is currently limited (US$4–6 billion in 2016, i.e. 2 % of the global biological market) [4]. To date, the factors influencing biosimilar uptakes are largely unknown [27]. Only a few authors have tried to construct economic models for biosimilars and these remain incomplete because they do not integrate the numerous variables influencing biosimilar uptakes [28–30].

Due to the lack of experience with biosimilars [17] and the heterogenicity of G-CSF and EPO markets, a recent European study suggests [31] that the best way to explore the biosimilar market is to provide a country-by-country analysis within the same therapeutic class. The study focused on BIOSIM-G-CSF and identified specific factors influencing their uptakes. Following a similar methodology, the present study focuses on BIOSIM-EPO. EPOs control red blood cell production and are used to treat anemia in patients undergoing dialysis or chemotherapy [32, 33].

2 Objectives

Our first objective was to allow for a descriptive analysis of the EU-5 (top five European pharmaceutical markets) and Japanese EPO markets, while our second objective was twofold: (1) to determine the factors influencing BIOSIM-EPO uptakes, particularly BIOSIM-EPO/REF price differences; and (2) to identify, if possible, country profiles where BIOSIM-EPO have taken significant market shares.

3 Methods

3.1 Data Source and Data Processing

Data on medicine volumes and values were derived from the IMS Health MIDAS database [15]. MIDAS brings together data obtained from IMS Health’s detailed audits of retail pharmacy and hospital sales. MIDAS provided information on sales by standard units (SU) and by monetary values (in current Euros) for EPOs. The SU used in the database was determined by taking the number of counting units sold divided by the SU factor, which is the smallest common dose of a product form. For EPOs, which are injectable forms, an SU is one prefilled syringe, pen, cartridge, or vial.

The market volumes are presented as millions of defined daily doses (DDD), and the market values as millions of Euros. The product DDD and the doses associated with each pack were collected from the WHO. The DDD is a statistical measure of drug consumption, defined by the WHO. It is used to standardize the comparison of drug usage between different drugs or between different healthcare environments, and is defined as the assumed average maintenance dose per day for a drug used for its main indication in adults (considered to be persons with a body weight of 70 kg) [34].

Data were analysed from January 2007 (the first year a BIOSIM-EPO was launched in the EU) until December 2012.

3.2 Selection of Countries and Medicines

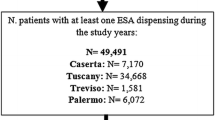

Inclusion criteria for countries in the study: Countries where the legal concept of biosimilars is homogeneous and the regulatory framework for biosimilars development is similar to the EU framework; countries where BIOSIM-EPO were marketed by the end of 2012 (Fig. 1).

Exclusion criteria for countries in the study: Countries with a biological market below a value of US$2.5 billion in 2010; countries where pharmaceutical firms do not always respect intellectual property (Fig. 1).

Table 1 summarizes the characteristics of EPOs marketed in countries studied over the 2007–2012 period. EPOα and EPOβ have different glycosylation and biologic properties [36]. First-generation EPOs (1Gα = REF, biosimilar of REF = BIOSIM-EPO, 1Gβ, and 1Gδ) are short-acting EPOs, unlike second-generation EPOs (2Gα and 2Gβ), which are long-acting EPOs (hyperglycosylated and polyethylene glycol EPOs, respectively).

Second-generation EPOs require less injections per week than first-generation EPOs: 2Gα is given once every 1–2 weeks and 2Gβ once or twice a month, whereas first-generation EPOs are given two or three times per week. 1Gδ has been excluded from the analysis (only marketed in the EU from 2007 to 2009 and very little consumed) [15]. In 2012, only 1Gα has been ‘biosimilarized’.

As Table 1 shows, in 2012, BIOSIM-EPO could have different International Nonproprietary Names (INNs). Historically, the WHO has assigned biosimilars INNs that are the same as those of the REF. However, a biosimilar MA holder could choose to use a Greek letter suffix to indicate differences in glycosylation of his BIOSIM-EPO compared to REF [37].

3.3 Analysis of the Erythropoietin (EPO) Markets

EPO retail market/hospital market distribution mixes have been characterized country-by-country with regard to EPO consumption in volume. Countries were classified into three categories, i.e. those with a dominant retail distribution (R), a dominant hospital distribution (H), and an equally-shared distribution between retail and hospital markets (R + H).

The market shares by DDD of each category of EPO (Table 2) were calculated by aggregating the sales of all presentations (pack) belonging to one of these categories.

In the EU, REF has been registered under a mutual recognition procedure [40], while other EPOs have been authorized centrally [41]. Regardless of the registration procedure, the same categories of EPOs have the same indications, dosages, and administration routes within EU countries. The same is true for Japan and the EU. Therefore, EPO consumption or price differences between countries cannot be attributed to this.

3.4 Comparison of EPO Prices

Prices were calculated by dividing market value by market volume. The data obtained from the IMS database were ex-manufacturing prices. They are better suited to make international comparisons because public prices are influenced by national policies and regulations such as distribution margins or patient co-payment. To ensure the reliability of the prices calculated, they were compared with those provided by national health authorities [42]. All available prices were comparable to calculated prices.

In order to assess the price differences between EPO categories, the prices of all presentations have been expressed as price per DDD and aggregated by category, computed as a weighted average price (WAP) calculated per year over the period 2007–2012 using the following formula:

where Q i is the annual sales volume for a product presentation, Q′ i is the number of doses per pack of the product, Pricei is the list price of the product, DDDi is the number of DDDs of the product.

Like patented products, depending on the country and the year, more than one BIOSIM-EPO can be launched. All BIOSIM-EPO prices were pooled and one WAP was calculated. This simplification was considered acceptable as the variance among the WAP of BIOSIM-EPO in each country was minor. This assumption was also made for the category of each patented product considering the small WAP variance among them. The BIOSIM-EPO/REF price differences were computed as the difference in percentages between the WAP of BIOSIM-EPO and the WAP of REF per year.

4 Results

France, Germany, Italy, Spain, the UK (75 % of the global EU biologicals market [43]), and Japan met the inclusion criteria (Fig. 1).

As Table 2 shows, there are size differences between EPO markets in 2012, with the two extremes being Japan (€818.77 million) and the UK (€112.52 million), both with a 50:50 R + H distribution mix. However, DDD per capita was 14.7 times greater in Japan than in the UK. France and Germany (€405.60 and €164.00 million) are both R markets, but DDD per capita in France was 3.3 times greater than in Germany. Italy and Spain (€500.24 and €215.88 million) are both H markets; nevertheless DDD per capita in Italy was 1.6 times greater than in Spain. Thus, there is no correlation between EPO distribution mixes and national EPO consumption levels.

As illustrated in Tables 3 and 4, EPO markets are different in terms of composition, and that probably affects BIOSIM-EPO uptakes. Depending on the country and on physicians’ prescribing practices, BIOSIM-EPO competes with first-generation EPOs, second-generation EPOs, or both.

In 2012, the global BIOSIM-EPO uptake in Germany was 30.4 % and only 5.8 % in France, while both have R markets. In Japan, it was 6.8 %, and in the UK it stands at 2.0 %, with the same distribution mix. Italy and Spain both have H markets with moderate BIOSIM-EPO uptakes (8.6 and 11.5 %). There seems to be no relationship between EPO distribution mixes, BIOSIM-EPO uptakes and EPO market sizes (e.g. Japan is the largest market with a low BIOSIM-EPO uptake and Germany is a small market with a high BIOSIM-EPO uptake).

Table 5 shows the EPO price dynamics over the 2007–2012 period. Significant differences appear between countries. In 2012, REF and BIOSIM-EPO were the most expensive in Italy. The highest WAPs for second-generation EPOs have been reported in Germany. Although BIOSIM-EPO/REF price differences were high in Japan (−26.9 %) and Italy (−22.2 %), the BIOSIM-EPO uptakes remained globally moderate (6.8 and 8.6 %). In Germany and in Spain, the BIOSIM-EPO/REF price differences were the lowest of all countries (−10.8 and −3.6 %); nonetheless, the BIOSIM-EPO uptake was the highest. Consequently, BIOSIM-EPO/REF price differences do not appear to be determining factors of global BIOSIM-EPO uptakes. Notwithstanding, the overall EPO price levels seem to have an impact on their market uptake; Germany and Spain are countries where EPOs are globally expensive and they have high BIOSIM-EPO uptakes.

5 Discussion

5.1 Japan

This R + H EPO market is the biggest among countries studied, even if EPO consumption per capita is lower than in Italy and France. The dialysis prevalence is higher than in the EU (1,945 persons per million of the population [pmp] vs. 550 pmp) [44]. This might explain the high DDD per capita in Japan, but would not explain why DDD per capita is higher in Italy and in France.

The only BIOSIM-EPO approved in November 2009 [45] has rapidly gained market shares in the retail market (10.3 % in volume in 2012), while it has been rarely included in drug formularies in hospitals (3.2 %—see Table 4). The high consumption of second-generation EPOs (68.0 % in the retail market and 78.3 % in hospitals) seems to limit its uptake. As with generics, physicians do not have any financial incentive to prescribe biosimilars [46]. National guidelines mention that the substitution of reference products for biosimilars by pharmacists should be avoided during the postmarketing surveillance period [11, 47]. The BIOSIM-EPO/REF price differences are the highest of all countries (−26.9 % in 2012), whereas the global BIOSIM-EPO uptake remains low (6.8 %—see Table 4).

5.2 France

The EPO market is 48 % smaller in value in France than in Japan. France ranks second among EU countries for EPO consumption per capita, behind Italy. Like Germany, France is a R market. EPOs are subject to a 1-year initial prescription by hospital physicians or home dialysis-unit practitioners [48] so as to better monitor patients and to limit their consumption. However, the prescribing habits of physicians may lead to EPO overmedication.

BIOSIM-EPO represented 7.0 % of the retail market in volume in 2012, while BIOSIM-EPO uptake was almost nil in hospitals (0.8 %—see Table 4). Due to the lack of experience with BIOSIM-EPO, the fear of the risk of PRCA, and indication differences between some BIOSIM-EPO and REF, BIOSIM-EPO are often not considered by hospital drugs committees as therapeutically equivalent to REF and are seldom included in tenders [49].

The high 2Gα consumption (49.9 % in the retail market and 68.6 % in hospitals) may explain why BIOSIM-EPO uptakes remain globally low (5.8 %—see Table 4). In 2012, no substitution was authorized and no incentive for physicians to prescribe biosimilars has been put in place [50].

With the first marketing of a biosimilar, the French Health Ministry applies a biosimilar discount of 20 % versus REF, which is decreased by approximately 10 % [51]. This is not a compulsory discount but is observed in practice. These price cuts gradually lead to a convergence between BIOSIM-EPO and REF prices [17, 52]. Since 2005, the French Government has implemented a reimbursement price cap for high-cost drugs in hospitals (i.e. the ‘responsibility tariff’, or RT) in order to limit the medicine expenditure increases [53]. Over the 2007–2012 period, all EPOs were included in this list, which means that pharmaceutical firms were not allowed to charge a price higher than this ceiling price [53]. BIOSIM-EPOs were included in this list at the same RT as other EPOs [51, 54]. Following the implementation of this policy, unlike branded drugs, hospitals have negotiated below the RT for generics [55] and biosimilars [52]. The BIOSIM-EPO/REF price differences amounted to −14.0 % in 2012.

5.3 Italy

The EPO market is equivalent in volume to the French market, but is a H market, like in Spain. EPO consumption per capita is the highest of all countries. In Italy, the hospitals also provide EPOs to outpatients (double distribution system via hospitals typically undertaken by regions to reduce pharmaceutical expenditure) [16]. In 2012, some regions (Campania, Molise, Piemonte, Toscana, Trentino, Veneto) have enacted the principle of using a biosimilar first for naïve patients, leading to local high BIOSIM-EPO uptakes [56, 57]. There is a high consumption of REF in hospitals corresponding to prescription practices. Thus, Italy is often portrayed as the largest European biosimilar-accessible market [43], even when the global BIOSIM-EPO uptake remains moderate (8.6 %—see table 4). There is no national incentive to stimulate demand for biosimilars. Italy applies the same pricing policy as France (i.e. discounts of 20 % and 10 % price cuts for the REF) [58]. In 2012, the BIOSIM-EPO/REF price difference in Italy was the highest among all EU countries (−22.2 %), but BIOSIM uptake remains fairly low.

5.4 Spain

Similar to the Italian system, this EPO market has an exclusively H distribution. The hospitals also provide EPOs to outpatients [16]. The market is 73.6 % smaller in value than in Japan and 46.8 % smaller than in France, likely as a result of tenders in hospitals. In 2012, Spain ranked second among countries in terms of global BIOSIM-EPO uptake (11.5 %—see Table 4), in spite of offering the lowest BIOSIM-EPO/REF price differences of all countries (−3.6 %). The financial crisis in Spain has prompted the government to seriously decrease medicines prices and to promote the use of biosimilars [16]. The REF market share did not change when BIOSIM-EPO entered the market, while the 2Gα market share decreased after their launch [59]. This might indicate that BIOSIM-EPO take market shares away from 2Gα.

5.5 Germany

Like France, this is a R EPO market, but it is 59.6 % smaller in value than in France. The EPO consumption per capita is 69.9 % lower than in France. The EPO market is the oldest and the market on which BIOSIM-EPO penetrate the most among EU countries (30.4 % globally—see Table 4), likely due to several factors: strong presence of the generics industry, biosimilar prescription incentives [60, 61], and implementation of quotas and guidelines at a regional level to encourage their use [62, 63]. Since October 2011, a short list of ‘bioidenticals’ (i.e. products whose production processes are considered identical) can be substituted for reference products [61]. Germany is the only country in those studied to give such incentives [5, 61–63]. BIOSIM-EPO uptake in hospitals is the highest of all countries, probably because there is less skepticism about therapeutic equivalence between BIOSIM-EPO and REF [59] and due to heavy discounting of BIOSIM-EPO [16].

Individual health insurance funds (Krankenkassen) have a strong influence on local BIOSIM-EPO market access since a law passed in 2007 allows manufacturers, hospitals, and health providers to negotiate rebates directly with the health insurance funds [58]. BIOSIM-EPO/REF price differences have diminished (−30.3 % in 2007 vs. −10.8 % in 2012) because of acute REF price declines.

A reference pricing system (RPS), which applies to a list of medicines, including EPOs, is in place in Germany [16]. The RPS groups clinically similar drugs together in one cluster and sets a maximum reimbursement price for all drugs in the cluster. The benefit of introducing this reimbursement system in terms of price competition is still being discussed [64–68].

5.6 UK

This R + H EPO market is by far the smallest of all countries. The fact that oncology has developed from radiology in the UK, as in the Scandinavian countries, seems to lead physicians to use less EPO by comparison to other EU countries where oncology has a medical descent [44]. The EPO consumption per capita is much lower than other countries (nearly 93.0 % smaller than Japan and France), mainly because the National Institute for Health and Care Excellence (NICE) recommends against the use of EPO in cancer, given the relatively modest and controversial impact of EPO treatment on survival and other objective endpoints [69].

This policy has resulted in very low BIOSIM-EPO uptakes (2.0 % globally in 2012—see Table 4). Another explanation of the low BIOSIM-EPO uptake is that some BIOSIM-EPO do not primarily obtain renal subcutaneous indication in dialysis [20, 21], whereas the NICE prefers subcutaneous over intravenous use [70]. Therefore, Primary Care Trusts (PCTs) and hospitals often do not include BIOSIM-EPO in their therapeutic formulary.

Like in Italy, REF consumption is high in hospitals, which might suggest that if hospitals endorse the therapeutic equivalence between BIOSIM-EPO and REF in the future, BIOSIM-EPO could quickly get a larger market share in hospitals. In the retail market, the 2Gα consumption is high, which represents a major obstacle to BIOSIM-EPO market access.

The BIOSIM/REF price discount of −11.6 % seems lack incentives for PCTs and budget holders who tend to strictly follow the NICE reimbursement guidelines. In 2012, the English Health and Social Care Act set up a central contracting system for specialist services, which includes patients with cancer. This system is made up of clinical commissioning groups (CCGs), which are National Health System (NHS) organizations, which negotiate some of the prices of medicines used in the treatment of cancer [71]. This could significantly impact EPO prices in the near future.

5.7 General Discussion

Each EPO market is highly country-specific; there are different market sizes, compositions, and distribution mixes due to national specificities of oncology and dialysis patient management. No link was found between BIOSIM-EPO uptakes, EPO market distribution mixes, and EPO consumption. Conversely, it has been shown that the more G-CSF hospital distribution dominates in a country, the lower the G-CSF consumption is and the higher BIOSIM-G-CSF uptake is [31]. The market access of BIOSIM-G-CSF takes place at decentralized levels, particularly in hospitals where pharmacists practice substitution indirectly, which retail pharmacists are statutorily not allowed to do [31, 52]; however, this is not the case for BIOSIM-EPOs.

As the German case illustrates, the implementation of national prescription and substitution incentives seem to be determining factors of BIOSIM-EPO uptakes, but these measures have not been able to ensure BIOSIM-G-CSF uptake in Germany [17, 31]. Depending on the country and the class ‘biosimilarized’, the incentives introduced to encourage the use of biosimilars could be effective or not, and must be adapted.

As demonstrated with BIOSIM-G-CSF/REF price discounts, BIOSIM-EPO/REF price differences do not globally influence their uptakes [31]. As for G-CSF, whatever the country concerned, whether in retail markets or in hospital markets, the second-generation of EPO products generally dominate the market. These offer significant convenience and quality advantages to patients, and lower administration costs for providers. Table 5 shows that their price in Euros per DDD is comparable with the price of REF and BIOSIM-EPO. This may partly explain why the utilization of second-generation products dominates. In fact, the prices of BIOSIM-EPO and REF appear to be not low enough to enable them to gain a market share.

Unlike the other countries studied, in the German and Japanese retail markets BIOSIM-EPO market shares are high compared to the REF shares. It may be because of the incentives in place in Germany to encourage the use of biosimilars, but also because of medical practice differences across countries. In the countries included in this study, BIOSIM-EPO/REF price differences were globally modest in 2012. REF prices have declined significantly in many countries for several years (more than 40 % in Germany between 2007 and 2012). Presumably, this is also why biosimilar uptakes remain globally low. Concomitantly, the prices of second-generation EPOs have declined but less so.

It seems that there is one distribution model for BIOSIM-G-CSF with specific factors influencing their uptakes [31], while there are several distribution models for BIOSIM-EPO with other factors affecting their uptakes. These results make clear the validity of a class-by-class approach to analyse the biosimilar market. Analysing it globally would be nonsense. The heterogeneity of the national EPO markets considered makes it impossible to outline country profile types with significant BIOSIM-EPO penetrations.

5.8 Limitations of the Study

The prices used in this study are ex-manufacturing prices. Retail or hospitals discounts and claw-back mechanisms have not been taken into account. The accuracy of the IMS Health MIDAS database varies across countries, particularly in relation to the hospital market. Retail prices in hospitals are, by default, list prices, i.e. ex-manufacturing prices. This means that EPO WAPs in the hospital market, calculated using list prices, might be substantially higher than the real transaction prices due to the usual discounts offered by pharmaceutical companies following tenders [52].

6 Conclusions

To date, substitution decisions are largely handled by hospitals or local purchasing structures at a local level [18, 31], based on a similar principle to the US, where decisions are made at State level [12, 72], or as in Canada where decisions are made at provincial level [73]. Pending the position of national health policymakers on the subject, by default it is the sole responsibility of hospital physicians, hospital pharmacists, and regional health structures to define the scientific and economic conditions for the inclusion of biosimilars in tenders and to develop the framework of the substitution within them [31, 44, 74]. It is up to hospitals and local purchasing structures to identify their therapeutic needs within their geographical area of competence and to define the selection procedure for the inclusion of biologics (biosimilars, reference products, and second-generation products) in their respective drug formularies (prices, scientific requirements, requirements related to the quality of the products).

Biosimilars and generics follow two distinct economic models. Generics are distribution products with a right of substitution for pharmacists, and follow a pure and perfect competition model. However, biosimilars are prescription products without any right of substitution, and follow a monopolistic competition model [12, 29]. Unlike generics, the biosimilar market is not a low-cost commodity market based on price deals with retail pharmacists [31].

The scientific differences between ‘biosimilarized’ molecules should be taken into account when developing national policies promoting biosimilar prescriptions (incentives, quotas) or the substitution of reference products for biosimilars (e.g. guidelines specifying the requirements for a biosimilar to be regarded as a substitute for a reference product, or positive restricted list of biologics considered as therapeutically equivalents).

In the future, a class-by-class approach and a targeted substitution between reference products and biosimilars must be encouraged, especially since these issues are becoming increasingly important with the arrival, in 2015, of the first biosimilar monoclonal antibodies in Europe [30].

Today, increasing biosimilar versus reference product price discounts in the retail markets should be seen as a first step, rather than an end in itself, of a policy to reduce medicine expenditures. The strong competition that second-generation products represent suggests that it would be more coherent to pursue the same pricing policy within the same therapeutic class.

Regarding the issue of the substitution, the decision of whether biosimilars are substitutable is taken by individual Member States in Europe [7, 17]. Except in France, where pharmacists have been allowed, by a national law, to substitute a biosimilar for a reference product since January 2014 (but only when the patient initiates a course of treatment and if the biosimilar belongs to the same ‘similar biologic group’) [75], EU countries are currently opposed to automatic substitution [7]. Nevertheless, the decree implementing this French law is awaiting publication [75].

References

Surveying tomorrow’s biopharma landscape—the NASDAQ Biotech Index up close evaluate pharma, June 2012. http://info.evaluatepharma.com/rs/evaluatepharmaltd/images/EvaluatePharma_NBI_Up_Close_2012.pdf. Accessed 12 Feb 2014.

Befrits G. The case for biosimilars: a payer’s perspective. Generics Biosimilars Initiat J. 2013;2(1):12.

Roger SD. Biosimilars: how similar or dissimilar are they? Neprology (Carlton). 2006;11(4):341–6.

The global use of medicines: outlook through 2016. IMS Health for Healthcare Informatics Report, July 2012. http://www.imshealth.com/deployedfiles/ims/Global/Content/Insights/IMS%20Institute%20for%20Healthcare%20Informatics/Global%20Use%20of%20Meds%202011/Medicines_Outlook_Through_2016_Report.pdf. Accessed 16 Mar 2014.

Haustein R, de Millas C, Hoër A, et al. Saving money in the European healthcare systems with biosimilars. Generics Biosimilars Initiat J. 2012;1(3–4):120–6.

Schellekens H. How similar ‘biosimilars’ need to be? Nat Biotechnol. 2004;22(11):1357–9.

What you need to know about biosimilar medicinal products: process on corporate responsibility in the field of pharmaceuticals access to medicines in Europe. European Commission. Consensus Information Paper, 2013. http://ec.europa.eu/enterprise/sectors/healthcare/files/docs/biosimilars_report_en.pdf. Accessed 17 Mar 2014.

Bocquet F, Paubel P. Les aspects juridiques du développement des médicaments biosimilaires [in French]. Revue de Droit Sanitaire et Social. 2012;1:121–33.

Guidelines for the quality, safety and efficacy assurance of follow-on biologics, PFSB/ELD notification no. 0304007, MHLW, 4 March 2009. http://www.pmda.go.jp/english/service/pdf/notifications/PFSB-ELD-0304007.pdf. Accessed 28 Mar 2014.

Biosimilar development and regulation in Japan. Generics Biosimilars Initiat J. 2013;2(4):207–8.

Jakovljevic MB, Nakazono S, Ogura S. Contemporary generic market in Japan: key conditions to successful evolution. Expert Rev Pharmacoecon Outcomes Res. 2014;14(2):181–94.

Grabowski H, Long G, Mortimer R. Implementation of the biosimilar pathway: economic and policy issues, Seton hall law review. 2011;41(2). Article 2. http://erepository.law.shu.edu/shlr/vol41/iss2/2. Accessed 10 Mar 2014.

Kowalchyk K, Crowley-Weber C. Biosimilars: impact of differences with Hatch-Waxman. Pharm Pat Anal. 2013;2(1):29–37.

Aggarwal S. What’s fueling the biotech engine 2009–2010. Nat Biotechnol. 2010;28(11):1165–71.

IMSHealth. MIDAS database. La Défense: IMS Health; 2013.

Biosimilars: How much entry and price competition will result? Office of Health Economics Report based on the proceedings of an OHE Conference held on 2 June 2009, edited by Mattison N, Mestre-Ferrandiz J, Torse A, Dec. 2010. http://www.ohe.org/publications/article/biosimilars-how-much-entry-and-pricecompetition-will-result-13.cfm. Accessed 28 Jan 2014.

Grabowski H, Guha R, Salgado M. Biosimilar competition: lessons from Europe. Nat Rev. 2014;13(2):99–100s).

Bocquet F, Paubel P, Fusier I et al. Biosimilar hematopoetic growth factors in the public hospitals of Paris: trade-offs between economic goals and evidence based medicine [abstract no. PCASE5 plus poster]. International Society for Pharmacoeconomics and Outcomes Research 15th Annual European Congress; 3–7 Nov 2012, Berlin.

Power DA. Licensing and prescribing biosimilars in Australia. Generics Biosimilars Initiat J. 2013;2(3):152–4.

European public assessment reports for Binocrit® (epoetin alfa), European Medicines Agency (EMA), 2014. http://www.ema.europa.eu/docs/en_GB/document_library/EPAR_-_Scientific_Discussion/human/000725/WC500053615.pdf. Accessed 26 Jan 2014.

Product information for Binocrit® (epoetin alfa). http://www.ema.europa.eu/docs/en_GB/document_library/EPAR_-_Product_Information/human/000725/WC500053680.pdf. Accessed 26 Jan 2014.

European public assessment reports for Zarzio® (filgrastim), European Medicines Agency (EMA), 2014. http://www.ema.europa.eu/docs/en_GB/document_library/EPAR_-_Public_assessment_report/human/000917/WC500046528.pdf. Accessed 26 Jan 2014.

European public assessment reports for Ratiograstim® (filgrastim), European Medicines Agency (EMA), 2014. http://www.ema.europa.eu/docs/en_GB/document_library/EPAR_-_Public_assessment_report/human/000825/WC500047793.pdf. Accessed 26 Jan 2014.

Safety study for subcutaneous epoetin alfa biosimilar Binocrit/Epoetin alfa Hexal /Abseamed suspended. Generics Biosimilars Initiative Online; Oct. 2009. http://www.gabionline.net/Biosimilars/News/Safety-study-for-subcutaneous-epoetin-alfa-biosimilar-Binocrit-Epoetin-alfa-Hexal-Abseamed-suspended. Accessed 12 Jan 2014.

Schellekens H, Jiscoot W. Eprex-associated pure red cell aplasia and leachates. Nat Biotechnol. 2006;24(6):613–4.

Hermeling S, Schellekens H, Crommelin DJ, et al. Micelle-associated protein in epoietin formulations: a risk factor for immunogenicity? Pharm Res. 2003;20:1903–7.

Bocquet F, Paubel P, Fusier I, et al. To what extent can biosimilars compete with brand name biologics? A EU-5 granulocyte-colony stimulating factors markets analysis. Value Health. 2013;16(7):A455.

Chauhan D, Towse A, Mestre-Ferrandiz J. The market for biosimilars: evolution and policy options, OHE Briefing No. 45, Office of Health Economics, London. 2008. http://www.ohe.org/publications/article/the-market-for-biosimilars-evolution-and-policy-options-35.cfm. Accessed 11 Jan 2014.

Grabowski HG, Ridley DB, Schulman KA. Entry and competition in generic biologicals. Manag Decis Econ. 2007;28(4–5):439–45.

Farfan-Portet M-I, Gerkens S, Lepage-Nefkens I. Are biosimilars the next tool to guarantee cost-containment for pharmaceutical expenditures? Eur J Health Econ. 2014;15:223–8.

Bocquet F, Paubel P, Fusier F. Biosimilar granulocyte colony-stimulating factor uptakes in the EU-5 markets: a descriptive analysis. Appl Health Econ Health Policy. 2014;12(3):315–26.

Beusterien KM, Nissenson AR, Port FK, et al. The effects of recombinant human erythropoietin on functional health and well-being in chronic dialysis patients. J Am Soc Nephrol. 1996;7(5):763–73.

Pashos CL, Larholt K, Fraser KA, et al. Outcomes of erythropoiesis-stimulating agents in cancer patients with chemotherapy-induced anemia. Support Care Cancer. 2012;20(1):159–65.

WHO Collaborating Centre for Drug Statistics Methodology, 2009. http://www.whocc.no/ddd/definition_and_general_considera. Accessed 21 Jan 2014.

Abraham I, MacDonald K. Clinical efficacy and safety of HX575, a biosimilar recombinant human erythropoietin, in the management of anemia. Biosimilars. 2012;2:13–25.

Storring PL, Tiplady RJ, Gaines Das RE, et al. Epoetin alfa and beta differ in their erythropoietin isoform compositions and biological properties. Br J Haematol. 1998;100(1):79–89.

The biosimilar name debate. What’s at stake for public health. GaBi J. 2014;3(1):10–2.

Eurostat, demography—national data—population, 2013. http://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&init=1&plugin=1&language=fr&pcode=tps00001. Accessed 5 Jan 2014.

The World Bank, data, population (total), 2013. http://data.worldbank.org/indicator/SP.POP.TOTL. Accessed 5 Jan 2014.

Directive 2004/27/EC of the European Parliament and of the Council of 31st March 2004 amending Directive 2001/83/EC on the Community code relating to medicinal products for human use. Off J Eur Union L 136:34–57. http://eur-lex.europa.eu/en/index.htm. Accessed 29 Jan 2014.

Regulation (EC) No 726/2004 of the European Parliament and of the Council of 31 March 2004 laying down Community procedures for the authorisation and supervision of medicinal products for human and veterinary use and establishing a European Medicines Agency. Off J Eur Union L 136:1–33. http://eur-lex.europa.eu/en/index.htm. Accessed 29 Jan 2014.

WHO National Medicine Price Sources, 2010. http://www.who.int/entity/medicines/areas/access/sources_prices/National_Medicine_Price_Sources.pdf. Accessed 31 Mar 2014.

IMS. Biosimilar accessible market: size and biosimilar penetration, prepared for EFPIA-EGA-EuropaBio, April 2012. http://ec.europa.eu/enterprise/sectors/healthcare/files/docs/biosimilars_imsstudy_en.pdf. Accessed 25 Feb 2014.

Black book—blood feud. The coming battle for the $11 billion global EPO market. European EPO market: less EPO, more competition. In: Bernstein Global Wealth Management; 2006. pp. 107–28.

Ian Haydock. Biosimilar EPO and novel antidiabetics lead raft of Japanese approvals. Scrip News. Scrip intelligence; 21 Jan 2010. http://www.scripintelligence.com/researchdevelopment/Biosimilar-EPO-and-novel-antidiabetics-lead-raft-of-Japanese-approvals-186811. Accessed 2 Feb 2014.

Japan. Generics and Biosimilars Initiative Online; 2012. http://www.gabionline.net/layout/set/print/content/view/full/1676. Accessed 31 Mar 2014.

Bogaert P. et al. Biosimilar regulation: important considerations and global developments. Cross-border Life Sciences Handbook. Practical Law Company. http://www.practicallaw.com/3-500-9862#null. Accessed 3 Feb 2014.

Agence nationale de sécurité du médicament et des produits de santé, Répertoire des spécialités pharmaceutiques, 2014 [in French]. http://agence-prd.ansm.sante.fr/php/ecodex/index.php. Accessed 31 Mar 2014.

Bocquet F, Paubel P, Fusier I et al. Biosimilar hematopoetic growth factors in the public hospitals of Paris: trade-offs between economic goals and evidence based medicine [abstract no. PCASE5 plus poster]. International Society for Pharmacoeconomics and Outcomes Research 15th Annual European Congress; 2012 Nov 3–7; Berlin.

Moreau A, Demolis P, Cavalié C. Les médicaments biosimilaires - Etat des lieux. ANSM Report, Sep 2013 [in French] http://www.ansm.sante.fr/var/ansm_site/storage/original/application/6187b427efca64d2a15e496ff691158e.pdf. Accessed 3 Feb 2014.

L’assurance maladie, Base des médicaments et informations tarifaires, BdMIT, 2014 [in French]. http://www.codage.ext.cnamts.fr/codif/bdm_it/index.php?p_site=AMELI. Accessed 12 Mar 2014.

Karouby D, Vallet C, Bocquet F, et al. Comparative study of the cost of erythropoietic factors, original medicines and biosimilars in French care facilities. DSL-005. Eur J Hosp Pharm. 2013;20 Suppl 1:A1–238.

Financing of Social Security Act for 2004 of 18 December 2003 [in French], loi no. 2003–1199. J Officiel de la République Française 2003 Dec 19;293:21641.

Bensadon AC et al. Pertinence d’une intégration du montant des agents stimulant l’érythropoïèse dans les tarifs de dialyse. Inspection Générale des Affaires Sociales, Jul 2010 [in French]. http://www.ladocumentationfrancaise.fr/var/storage/rapports-publics/104000477/0000.pdf. Accessed 4 Apr 2014.

Degrassat-Théas A, Bensadon MC, Rieu C. Hospital reimbursement price cap for cancer drugs. The French experience in controlling hospital drug expenditures. Pharmacoeconomics. 2012;30(7):565–73.

Menditto E, Cammarota S, Putignano D et al. Consumption of biosimilar drugs in Campania region in the years 2009–2012 [abstract no. PHP25 plus poster]. International Society for Pharmacoeconomics and Outcomes Research 16th Annual European Congress; 2013 Nov 2–6; Dublin.

Walsh K. Biosimilars’ utilization and the role payers do play in driving uptake in Europe: an industry perspective. Biosimilar Medicines 11th European Generic Medicines Association (EGA) International Symposium, April 2013. http://sandoz-biosimilars.com/cs/www.sandoz-biosimilars.com-v3/assets/media/shared/documents/presentations/Ken%20Walsh%20EGA%20Annual%20Meeting%202013.pdf. Accessed 5 Apr 2014.

Rovira J, Espín J, García L et al. The impact of biosimilars’ entry in the EU market. Andalusian School of Public Health Report for the European Commission (Directorate-General for Enterprise and Industry), Jan 2011. http://ec.europa.eu/enterprise/sectors/healthcare/files/docs/biosimilars_market_012011_en.pdf. Accessed 5 Apr 2014.

Hurtado P, Vieta A, Espinós B, Badia X. Market access barriers for biosimilars in Spain and Germany: epoetin alfa example. Value Health. 2011;14(7):A336.

Shaping the biosimilars opportunity: a global perspective on the evolving biosimilars landscape. IMS Health Whitepaper, Dec 2011. http://www.imshealth.com/ims/Global/Content/Home%20Page%20Content/IMS%20News/Biosimilars_Whitepaper.pdf. Accessed 6 Apr 2014.

Godman B. Editorial: health authority perspective on biosimilars. Generics Biosimilars Initiat J. 2013;2(1):10–1.

Declerck P, Simoens S. A European perspective on the market accessibility of biosimilars. Biosimilars. 2012;2:33–40.

Blackstone EA, Fuhr JP. The future of competition in the biologics market. Temple J Sci Technol Environ Law. 2012;31:L.1.

Galizzi MM, Ghislandi S, Miraldo M. Effects of reference pricing in pharmaceutical markets: a review. Pharmacoeconomics. 2011;29(1):17–33.

Garuoliene` K, Godman B, Gulbinovic J, Wettermark B, Haycox A. European countries with small populations can obtain low prices for drugs: Lithuania as a case history. Expert Rev Pharmacoecon Outcomes Res. 2011;11(3):343–9.

Puig-Junoy J. Impact of European pharmaceutical price regulation on generic price competition: a review. Pharmacoeconomics. 2010;28(8):649–63.

Danzon P, Ketcham J. Reference pricing of pharmaceuticals for Medicare: evidence from Germany, the Netherlands and New Zealand. Cambridge: National Bureau of Economic Research; 2004.

Puig-Junoy J. The impact of generic reference pricing interventions in the statin market. Health Policy. 2007;84(1):14–29.

National Institute for Health and Care Excellence, Appraisal Consultation Document - Erythropoietin for anemia induced by cancer treatment, Mar 2010. http://www.nice.org.uk/guidance/index.jsp?action=article&r=true&o=34940 Accessed 6 Apr 2014.

Bernstein Research. Biosimilars: quo vadis—a snapshot of the biosimilar industry halfway through its formation. In: Bernstein Global Wealth Management; 2011. pp. 1–73.

National Health Service Commissioning Board, October 2012. http://www.england.nhs.uk/wp-content/uploads/2012/09/fs-ccg-respon.pdf. Accessed 22 Mar 2014.

US state legislation on biosimilars substitution. Generics Biosimilars Initiat J. 2013;2(3). doi:10.5639/gabij.2013.0203.040.

Kaya J, Feagan BG, Guirguisc. Health Canada/BIOTECanada summit on regulatory and clinical topics related to subsequent entry biologics (biosimilars), Ottawa, Canada, 14 May 2012. Biologicals. 2012;40:517–27.

Lucio SD, Stevenson JG, Hoffman JM. Biosimilars: implications for health-system pharmacists. Am J Health Syst Pharm. 2013;70:2004–17.

Financing of Social Security Act for 2014 of 23 December 2013 [in French], Art 47, loi no. 2013–1203. J Officiel de la République Française 2013;298:21034.

Acknowledgments

No sources of funding were used to conduct this study. Data were kindly provided by IMS Health France. The authors are grateful to Stéphane Sclison and Yapi Anon for their assistance in collecting data from the IMS Health MIDAS database, and to Gary Stewart for editing the manuscript. The authors have no conflicts of interest that are directly relevant to the content of this article, and the opinions expressed are those of the authors. All authors have participated sufficiently to take responsibility for the entire content of the article. François Bocquet conceived and planned the work, analysed and interpreted the data, wrote the manuscript, and is responsible for the work as a whole. Pascal Paubel, Isabelle Fusier, Anne-Laure Cordonnier, Martine Sinègre and Claude Le Pen made significant contributions to the conception of the work, the analysis and the interpretation of the data, the revision of the manuscript, and approved the final submitted version.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bocquet, F., Paubel, P., Fusier, I. et al. Biosimilar Versus Patented Erythropoietins: Learning from 5 Years of European and Japanese Experience. Appl Health Econ Health Policy 13, 47–59 (2015). https://doi.org/10.1007/s40258-014-0125-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40258-014-0125-6