Abstract

The benchmark system to establish iron ore prices was abandoned after many years in 2010. Instead, the use of spot prices has increased and new systems based on indexes have been introduced. It seems as if iron ore prices in the first year after the discontinuation of benchmark negotiations were largely determined on the one hand by the cost of production of Chinese iron ores or concentrates and the price for imported ores on the other. These two are mainly influenced by (1) the increasing production costs of Chinese iron ore mines and (2) the general economic situation in both China and the rest of the world. The prices of iron ore, like many other raw materials and commodities, have been fluctuating widely since a few years. They have, in particular in recent times, been increasing. To understand the various mechanisms behind this development, four aspects will be discussed: Firstly, the evolution of the mechanisms to establish iron ore prices worldwide; secondly, the costs of producing saleable iron ore or concentrates as they are delivered to the iron and steel industry; thirdly, the important and growing role of China and finally, the present situation and future trends.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Iron ore price mechanisms worldwide

It is clear that in the end of the first decade of the twenty-first century, there was an interesting change in the way of fixing iron ore prices: during a long period prices were agreed by annual negotiations between the main steel companies and the major iron ore miners, what was known as the “benchmark system”. Although some mining companies are trying to stick to an annual fixed price FOB, this system is disappearing. It seems to be replaced by a negotiation of prices based on various, more or less established indexes based on spot prices. It is hence important to remember that part of the iron ore trade is made based on spot prices.

The evolution of iron ore prices between 2005 and 2011 is shown in principle in Fig. 1. This figure has been constructed by using the prices during the last years of the benchmark system (i.e. FOB) and adding an estimate of the average freight cost for fines at about 65 % Fe from Brazil to the Far East. After the discontinuation of the benchmark system, estimates of spot prices for Indian 62 % Fe delivered to China have been used. The benchmark price is also indicated in Fig. 1.

Evolution of iron ore prices delivered to the Far East (daily average price, USD/dry tonne). Published with permission from World Steel Dynamics. Source: World Steel Dynamics (2011)

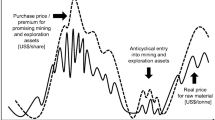

This estimate can be compared to studies by World Steel Dynamics (World Steel Dynamics 2011) and reproduced in Figs. 2 and 3. Figure 2 confirms our estimates in Fig. 1. Figure 3 is more interesting in that it explains how iron ore prices are moving. There are two major facts to keep in mind when studying this figure. Firstly, China is by far the largest iron ore importer. In 2009, according to UNCTAD (UNCTAD 2010 iron ore statistics), it imported 628 Mt out of a world total of 937 Mt. Secondly, China is also relying on domestic production. It is, as we know from our visits and meetings in China,Footnote 1 costly because it is based on many relatively small and, often, difficult deposits of low-grade ores which necessitates costly preparation and beneficiation, depending on the nature of the deposits and the structure of the crude ores. As a consequence, iron ore export prices to China varied between 150 and 200 USD/t of fines with a grade between 62 and 65 % Fe in the beginning of 2011. In this region, the market seemed to be in a kind of equilibrium between the imported ores and the ores from domestic producers.

Iron ore prices in China, domestic and imported ores. Published with permission from World Steel Dynamics. Source: World Steel Dynamics (2011).

Production costs of iron ore

At this point, it is important to have some general ideas about the production costs of iron ore. In a study published in Les Techniques de l’Ingénieur (Astier 2011), an up-to-date simplified model was developed. The results are shown in Table 1. The range of production costs for high-grade fines or concentrates as delivered to the iron and steel industry vary widely mainly depending on two parameters:

-

Type of mine, from the easy and relatively cheap extraction in large-scale open pits with limited over burden via mines with higher strip ratios to smaller operations and underground mines with highest costs.

-

Type of ores, similarly a wide range from natural, high-grade direct shipping ores (DSO) to lower grades but easy to concentrate to complex ores difficult to process.

It is clear that the large-scale, efficient operations in Australia and Brazil are on the left part of this table. This is in good agreement with Fig. 4. At the other end of the cost curve are Chinese mining and processing operations at the right end part of Table 1. This table emphasises the wide range of costs of production of iron ores worldwide, especially between the large open-pit operations based on naturally high-grade ores and the more difficult, smaller mining and processing facilities. From Table 1 and Fig. 4, it can be estimated that the major exporting mines of Brazil and Australia have operating costs of around 10 USD/t of fines FOB or 15 US cents (USc)/dmtuFootnote 2 also FOB. If general administrative expenses and transport costs are added, we estimate that the production cost is between 20 and 30 USD/tFootnote 3 of fines CIF China or 30–45 USc/dmtu again CIF China.

Estimated cost curve sinter fines, Q2 2011. Source: Burrai (2011)

The Chinese mines and processing plants are probably among the smaller mining and processing facilities with highest operating costs. Assuming low or negligible transport costs, it can be estimated that the Chinese production costs are between 100 and 150 USD/t of fines at steel works or 150–225 USc/dmtu or even higher than indicated in Table 1.

The complete curve for the capacity of Chinese mines and processing plants as a function, at a given time, of the costs is not known but can be estimated from available information as shown in Fig. 5. This figure is based on the following assumptions:

-

The various curves are not steep but flat as we assume that most Chinese mines are faced with similarly difficult conditions; as for example, small- or medium-sized operations, difficult and low-grade iron ores which need costly processing facilities.

-

The production data are from UNCTAD, see Table 2. In this table, it also included our estimates of annual price levels for Chinese fines or concentrates.

Table 2 Main characteristics of Chinese iron ore production

It must be underlined that Fig. 5 is indicative and does not give precise figures. It does however give two clear trends.

Firstly, during the years 2000–2010, costs increased considerably partly due to increasing technical difficulties and partly to inflation driven by, among other factors, Chinese wages not being fully matched by productivity increases. Further, the prices and costs are expressed in US dollars, but the Chinese yuan has appreciated significantly vis-à-vis the dollar during the period shown. Secondly, this cost increase continues also in the future.

Development of the Chinese iron and steel industry

To understand the evolution of iron ore prices, it is necessary to review the impressive development of the Chinese iron and steel industry on the one hand and the mining and processing of ores on the other. The period after the revolution in 1949 can be divided into three: first developments from 1950 to 1973, evolution from 1974 to 2000 and recent achievements from 2000 to 2010.

First developments from 1950 to 1973

It must be remembered that the Chinese iron and steel industry started to develop from zero based on its own resources and relying entirely on the available domestic iron ores. Table 3 summarises the main data for this period. Steel production reached 25 Mt in 1973 and pig iron 25 Mt. Not only was the production based on domestic ores but also all other raw materials and resources needed were of Chinese origin. If we compare the official Chinese data (two last columns in Table. 3) with a Fe balance based on the need of Fe units to produce the pig iron reported, the figures fairly well with each other. There is a small excess of Fe units produced over what is needed, but this could be explained by the loss of Fe units during the processing of crude ores.

Evolution from 1974 to 2000

In the 1970s, during study trips to China, it was clear that the Chinese authorities were well aware of the high costs of mining and processing of their domestic ores with low grades and complex composition. The authorities were also aware of the large quantities of easily available, cheap, high-grade iron ores on the world market. Thus, as illustrated in Table 4, the Chinese steel industry started to import larger and larger amounts of high-grade ores mainly from Australia and Brazil. Production of steel increased up to 131 Mt in 2000, and China became the most important steel and pig iron-producing country in the world. It should be noted that during this period, the expansion was more and more based on imported ores. China also became one of the leading importing countries. This is shown by the ratio of imported ore to total Fe needs: 15 % in 1990, 26 % in 1995 and 35 % in 2000.

Recent achievements from 2000 to 2010

Since the year 2000, the growth of the Chinese steel industry has been impressive as shown in Tables 5 and 6. The import dependence has however increased further and reached 70 % in 2010. It means that Chinese production of concentrates is more and more difficult and costly (UNCTAD).

Possible evolution of iron ore prices

It is clear from the the preceeding tables and figures and supported by various statistical data and comments, especially from the Trust Fund on Iron Ore Information (UNCTAD, the iron ore market 2009–2011, 2010), that the world iron ore market is now dominated by China (see Table 5) and Chinese iron ore imports are and will continue to play a paramount role in this trade and particularly in determining iron ore prices. Considering the cost curves from Fig. 5, it can be suggested, based on Fig. 6, that from the present situation (curve in black), there are two possibilities:

-

If price increases, the trend upwards and to the right will prevail where it will be possible for a number of Chinese mines to continue operating profitably or even some to re-open and a decrease of Chinese iron ore imports would follow. Such a development would be welcomed by Chinese miners, but steel producers in China, and elsewhere, would complain.

-

If price decreases, the arrow downwards and to the left indicates that an additional number of Chinese mines would get into a difficult situation and would probably have to close their operations and an increase of iron ore imports would take place. This development would be welcomed by steel producers in China and elsewhere but Chinese miners and other high-cost producers would complain.

In other words, the present situation appears to be fairly stable, unless an increase of production costs with general inflation or for other reasons moves the curve upwards and results again in a trend to increase iron ore prices. To summarise:

-

A lower export iron ore price would benefit the steel industry worldwide and the major iron ore producers could manage such a situation without serious problems, but it would further decrease Chinese iron ore production.

-

A higher iron ore export price would benefit Chinese mines, which would become more competitive and produce more ore and decrease Chinese imports at least in the short run. This is not an advantage for the iron ore-exporting countries. It would further not be appreciated by steel producers which have serious problems to transfer such a price increase to their customers.

-

Finally, the decrease of the production rate of steel in China, the growing inflation and the present economic crisis could lead to a lowering of iron ore demand when new projects will increase supply (Östensson 2011) and thus point to a decrease in iron ore prices after 2012 rather than an increase.

Notes

The author has travelled widely in all Asia, including India and China, since the 1950s.

Dry metric ton unit = 10 kg of iron content in dry ore.

10–20 USD/t transport might be a bit low but adding another 10 USD in freight cost does not alter the continued discussion.

References

Astier J (2011) Aspects géographiques et économiques des minerais de fer. Les Techniques de l’Ingénieur M 7041 Paris

Burrai V (2011) Cost structure of producing iron ore Presentation Metal Bulletin 17th International Iron Ore Symposium Geneva

Feng S (2011) Safeguarding the sustainable development of the iron ore industry Presentation Metal Bulletin 17th International Iron Ore Symposium Geneva

Östensson O (2011) New projects and project restarts: who, where and when? Will there be overcapacity? Presentation Metal Bulletin 17th International Iron Ore Symposium Geneva

UNCTAD, Trust Fund Project on Iron Ore Information (2010) Iron ore statistics, New York and Geneva

UNCTAD, Trust Fund Project on Iron Ore Information (2010) The iron ore market 2009-2012, New York and Geneva

World Steel Association (2011) Pig iron statistics, Brussels

World Steel Dynamics (2011) Iron & Steel Technology, p 23

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Astier, J. Evolution of iron ore prices. Miner Econ 28, 3–9 (2015). https://doi.org/10.1007/s13563-015-0068-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-015-0068-x