Abstract

In the present worldwide highly competitive markets, competition occurs among the supply chain members on behalf of organizations. In this way, partners of the supply chain try to apply effective coordination to increase market shares. Because of the significance and utilization of inventory decisions and pricing strategies on accepting a product in the current business scenario, in this study, decentralized channel coordination is generalized to increase the profitability of a two-echelon supply chain. Here, a one-manufacturer–one-retailer supply chain mechanism for the deteriorating product with a leader–follower relationship under price-dependent demand is developed. Up-stream member-manufacturer sells the on-hand item to the downstream member-retailer in which the retailer faces off the customer. This model considers the effect of the deterioration of the product, selling price of both the channel members, cycle duration, idle time, ordering lot size in a decentralized supply chain system. The Stackelberg game method has been used considering the retailer as a leader and manufacturer as a follower to optimize the sales price of channel members and time–length up to zero manufacturer inventory for maximum profit. Finally, a numerical example and sensitivity analysis are given to demonstrate the model. The result shows that manufacturer profit is far better than the retailer profit though the retailer’s selling price is higher than that of the manufacturer’s selling price. Also, a little change in the manufacturing cost is highly sensitive for the profit of the channel members, which encourages the manufacturer to reduce the manufacturing cost and increases supply chain profit as well as channel members profit.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the present competitive market scenario, enterprises have advanced the issues of inventory control in supply chain management. Market conditions vary for different periods; thus, it is very difficult for retailers and businessmen to attract and convince buyers to purchase a product. Many companies are facing a big challenge to survive in the market and maximize their profit. Pricing is considered as a significant marketing strategy. As a rule, the manners of customers are influenced by the pricing scheme of items. When products are acquired from external suppliers, it is likewise essential to manage inventory replenishment time for the best optimum choices. Inventory is the root of an enormous piece of an organization’s expenses, directly impacting the pricing and replenishment scheme. It is also very eminent when considered deterioration of the product. In real life, the impact of the deterioration in the decision-making process can not be ignored. Deterioration of different items is a characteristic event for production inventory that happens because of dryness, affliction, decay, etc. It additionally decreases the quality and amount of stock items. These phenomena of deterioration frequently occur in an inventory system and cause loss to the supply chain members. Ghare (1963) addressed the deterioration phenomena for the inventory, which is exponentially broken down. Due to different geographical locations, supply chain members individually manage their inventory levels.

The supply chain contains various key business schemes and a group of facilities that consecutively plays out the elements of acquiring basic resources, transforming basic resources to the finished items, and distributing products. The supply chain endeavors are attained by several entities called supplier, manufacturer, retailer, distributor, etc. The decision-making process of organizations, such as pricing, ordering lot size, replenishment time, etc., is characterized as centralized and decentralized. Under the traditional mechanism, supply chain members make their decisions individually based on their interests. Since supply chain individuals are influenced by one another, it is important to find the methodology that enhances channel members’ performance. In the decentralized strategy, each channel member autonomously picks their technique, and therefore the general framework effectiveness may not necessarily be optimized. Different supply chain follows various decentralized approaches. When the retailer acts as a leader and the rest of the channel members follow the retailer’s decision, this decentralized mechanism is the Retailer–Stackelberg game approach. Such a supply chain mechanism is called a pull-type framework which has the significance that there will be no abundance of stock that should be stored, consequently decreasing stock levels and expenses of storing and carrying products. Pull-type SCM is used comprehensively in cutting-edge enterprises. For example, Dell, HP, IBM, and Philips, are presently attempting to adjust this kind of strategy to react to the deft business world.

A two-echelon supply chain model is developed with the decentralized decision-making structure considering the Stackelberg game procedure. Both the channel members have their inventories of deteriorated products under price-sensitive demand. So, keeping in this mind, some of the previous research work towards the research objectives are provided in Sect. 2 “Literature Review”. The paper is arranged as follows. Section 3 is formed as “Fundamental assumptions and notations” with notations and assumptions. In Sect. 4, “Model formulation” with the inventory mechanism is constructed. Then in Sect. 5 the “Solution method” of the model is given. In Sect. 6, “Numerical result” and “Sensitivity analysis” is carried out. Lastly, the “Conclusion and Future scope” are presented in Sect. 7.

2 Literature review

Literature review of deteriorating items is categorized from two aspects—“Deteriorating inventory model with price-sensitive demand”, and “Supply chain coordination”.

2.1 Deteriorating inventory model with price-sensitive demand

Decision-maker utilizes price as a decision variable that should be advanced, and demand is likewise examined as price-sensitive. Since deterioration is a natural phenomenon, such price-dependent demand form directly co-relates with the deterioration of the inventory system. Hou (2006) discussed the inflation effect in a deteriorating inventory model where demand depends on selling price and stock. Min and Zhou (2009) developed a deteriorating EOQ model under variable backlogging rate imposing a ceiling on on-hand stock level. Hsieh and Dye (2010) investigated the replenishment and pricing strategy for an EOQ model of the deteriorating product. Wang and Li (2012) evaluated various pricing policies in a deteriorating inventory model to decrease the wastage of food and expand the systems’ profitability. Sarkar et al. (2020) developed an inventory model with time-varying deterioration and considered variable backlogging rate under stock-dependent demand. Maihami and Kamalabadi (2012) discussed the integrated decisions of pricing and inventory policy of non-instantaneous deteriorated EOQ models with price and time-sensitive demand patterns. Feng et al. (2015) discussed the joint decisions of a dynamic deteriorating inventory model with pricing and advertising strategy considering advertisement capacity constraints. Maihami and Karimi (2014) established a non-instantaneous deteriorating EOQ model under stochastic demand function with partially backlogged shortages to deal with pricing and replenishment strategies incorporating advertisement effort. Tiwari et al. (2018) developed a deteriorated EOQ model considering the trade-credit scheme with price-sensitive demand for partially backlogged shortages. Mashud et al. (2019) determined optimum cycle length, deteriorated time–length, and sales price of a deteriorated EOQ model considering trade credit policy for price-dependent demand. Wei et al. (2020) established an EOQ model with selling price and freshness of product-dependent demand to jointly optimize the pricing and inventory policy for the amount and quality loss of items. Khanna et al. (2020) optimized sales price and ordering lot size to maximize the profit of an EOQ model’s under price-sensitive demand. Cheng et al. (2020) established a deteriorating EOQ system to decide the order amount and sales price of products with a linear form of price-dependent demand. Kamna et al. (2021) addressed a sustainable production inventory model with linear price-sensitive-demand for an imperfect production system. Barman et al. (2021c) studied a multi-item deteriorated EOQ model under price-dependent demand considering shortages.

2.2 Supply chain coordination

The previous research articles discussed in Sect. 2.1 assume that single-decision makers perform various policies to optimize their decisions. The supply chain system consists of many members, including manufacturers and retailers. Some noteworthy works (Cachon 2003; Van der Veen and Venugopal 2005; Li and Liu 2006; Hou et al. 2009) have been acted in for organizations production network mechanism. In these papers, researchers have discussed various issues of coordination, mainly in a two-layer supply chain system. Chen (2011) proposed integrated and non-integrated policies to optimize selling price, lot size, and replenishment cycle. Wu (2011) developed a centralized supply chain structure incorporating price-sensitive demand. Sarkar (2013) minimized the system-related costs in a two-layered supply chain model inspecting probabilistic deterioration under constant demand. Cárdenas-Barrón and Sana (2014) discussed coordination schemes with the help of sales team initiatives in the manufacturer–retailer supply chain. Sana (2011) established a three-layer inventory supply chain model for perfect and imperfect goods with the constant demand to find the rate of production and replenishment ordering size. Pal et al. (2012) extended this model for production mechanism may go through an “out-of-control” condition from an “in-control” condition, with the same decision variables. Barman et al. (2021a) maximize the profitability of Sana (2011) model considering non-instantaneous deterioration. Giri and Bardhan (2012) discussed both manufacturer and retailer inventory with deterioration in a two-layered supply chain model. Cheaitou and Khan (2015) proposed a cost minimization problem for a sole product in a multiple sourcing supply chain model with constant demand. Rad et al. (2018) established a supply chain model for selling price-sensitive demand with imperfect production and shortage. Giri et al. (2017) used both deterministic and probabilistic price-dependent demand design to evaluate the integrated structure o the supply chain considering retail fixed mark-up policy. Kumar et al. (2016) developed a two-echelon supply chain system with a single manufacturer and single buyer and discussed centralized cases under fuzzy stochastic demand. Sarkar et al. (2020) maximized three echelon supply chains’ profit under a centralized structure for sales price and promotion effort-sensitive demand. Barman et al. (2020) differentiate the benefit of a centralized supply chain system under both linear and iso-elastic price-sensitive demand. Das et al. (2020) integrated a two-stage supply chain system in a competitive scenario with sales price and quality of product-dependent demand.

The game model has been seen as quite possibly the most extensive perspective to incorporate the communication among the supply chain members. Dong et al. (2008) investigated a decentralized case of a two-stage supply chain model for deteriorated items considering the competition between channel members. Xiao and Xu (2013) studied the Stackelberg game approach in a supplier–retailer supply chain with the deterioration of items to coordinate pricing and service level decisions. Taleizadeh and Noori-daryan (2016) used the Stackelberg–Nash equilibrium game model to evaluate the decentralized case of the supply chain for price-dependent demand. In addition Gautam et al. (2019), Bai et al. (2015) and Das et al. (2021) also applied the game model in their supply chain mechanism.

By now, various inventory model with deterioration of products considering price-dependent demand and supply chain coordination with the game-theoretic approach is frequently examined in the literature review section. Some literature with assumptions and objectives of the previous literature has been summarized to appreciate our model’s contribution in Table 1. This work extends the study of Sana (2011) and Pal et al. (2012) by comprising deterioration at the manufacturer and retailer inventory level, which fills the gap of coordination of supply chain with deteriorated products. Sana (2011) introduced a centralized production EOQ model in a three echelon supply chain under the perfect and imperfect quality of products. Pal et al. (2012) extends the study of Sana (2011) incorporating product reliability and reworking the defective items. In these studies, the demand is presumed to be consistent, and the main finding is replenishment lot size and production rate. This paper addresses the problem with the price-dependent demand rate and considers the product’s deterioration. The decision variables are the selling price of both the manufacturer and retailer and the time length of zero inventory of the manufacturer. The another study closest to our work is done by Barman et al. (2021b) and Mahmoodi (2020). In the study of Barman et al. (2021b) and Mahmoodi (2020), the supply chain manager aims to maximize the benefit of examining the problem formulation as a manufacturer–Stackelberg game. Other inventory costs (holding cost, deterioration cost, idle time cost) incurred at the manufacturer warehouse are ignored in these studies (Barman et al. 2021b; Mahmoodi 2020).

This paper investigates a two-layer supply chain model containing two participants: a manufacturer and a retailer dealing with a single product for price-dependent demand. Items have deteriorated continuously in both manufacturer and retailer warehouses. Also, at the manufacturer and retailer level, pricing decisions and inventory strategies are built. The decision model is analyzed for decentralized channel interactions in which the decentralized case has been studied under the Stackelberg game approach. The main issue is to coordinate pricing and inventory strategies across the whole supply chain to expand the overall benefit of the system.

3 Fundamental assumptions and notations

3.1 Notations

The following notations are used to establish the model.

Decision Variables

- \(p_m\) :

-

Selling price of the manufacturer (per unit)

- \(p_r\) :

-

Selling price of the retailer (per unit)

- \(t_1\) :

-

Time length up to zero inventory level of the manufacturer

Parameters

- \(I_m(t)\) :

-

Inventory level at time t of manufacturer, \(0< t < t_1\)

- \(I_{r}(t)\) :

-

Inventory level at time t for retailer, \( 0< t < T\)

- Q :

-

Ordering lot of the manufacturer

- T :

-

Duration of the cycle of retailer

- \(\theta \) :

-

Deterioration rate

- k :

-

Deterioration cost (per unit time)

- \(A_m\) :

-

Set up cost of the manufacturer (per cycle)

- \(h_m\) :

-

Holding cost of the manufacturer (per unit time)

- \(I_m\) :

-

Cost per unit idle time of manufacturer (per cycle)

- c :

-

Manufacturing cost of the manufacturer (per unit)

- \(\varPi _m\) :

-

Profit of the manufacturer

- \(A_r\) :

-

Set up cost of the retailer (per cycle)

- \(h_r\) :

-

Holding cost of the retailer (per unit time)

- \(D_r\) :

-

Demand rate of the retailer

- \(D_c\) :

-

Demand rate of the customer

- \(\varPi _r\) :

-

Profit of the retailer

- \(\varPi \) :

-

Total profit

3.2 Assumptions

-

1.

A two-level supply chain including one manufacturer and one retailer is considered. The supply chain framework deals with a single item/product.

-

2.

The available stock of the item is deteriorated per unit time as a consistent deteriorating rate \(\theta \), \((0< \theta < 1)\).

-

3.

The demand rates of both the retailer and customer are linearly depends on the selling price. We assume the demand rate of retailer as \(D_r= a_1-b_1 p_m\) and demand rate of customer as \(D_c= a_2-b_2 p_r\) where \(b_1, b_2 > 0\) and \(a_1, a_2\) are basic demand which indicates the potential of customers in a particular market. The basic demand also refers to the maximum sales volume of any given item in a market before it reaches market saturation. \(b_1, b_2\) are price elasticity parameters of demand which shows the impact of change in the price of products on the variation in its amount demanded. Price elasticity is the degree to which the purchaser’s purchasing behavior fluctuates with the adjustment in the item’s cost. In the market circumstance, a higher sales price generally disperse the purchasers, which originated a decrease in demand of the item. The management needs to set a reasonable price that will attract the customers, and the benefit line is additionally preserved.

-

4.

The shortage is not permitted. The demand rate of the retailer is always more than that of customer demand.

-

5.

The cost for idle times at the manufacturer level is appraised.

-

6.

Lead time is negligible.

4 Model formulation

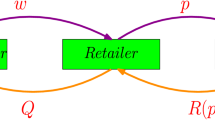

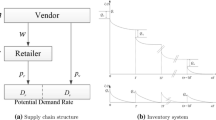

This model examines a two-stage supply chain containing one manufacturer and one retailer dealing with a deteriorated product depicted in Fig. 1. The manufacturer faces a price-dependent demand from the retailer and supplies the finished product to the retailer. Retailer deals directly with the buyers and delivers the item to them according to buyers demand. The inventory level of both the supply chain members is subject to a constant deterioration rate over time.

As indicated by the previously mentioned notations and assumptions, the inventory levels of the supply chain follow the pattern presented in Fig. 2. The manufacturer meets the retailer’s demand at a demand rate \(D_r\) up to time \(t_1\), \(0< t_1 < T\) with a deterioration rate \(\theta \). During time period \((0, t_1)\), the retailer builds up inventory level at a rate \((D_r-D_c)\) in which some items deteriorate at a constant rate \(\theta \) and the accumulated inventory during this time satisfies the customers demand \(D_c\) for time-interval \((t_1, T)\). Also some items are deteriorated during the period \((t_1, T)\) at a constant deterioration rate \(\theta \). Consequently, the differential equations that prompt the status of inventory of the manufacture and retailer are as follows.

4.1 Manufacturer individual average profit

The following differential equations can depict the manufacturer inventory level at time t.

with the boundary condition \(I_m(t_1)=0 \).

Using the boundary condition, the following inventory level is obtained by solving the differential equation (1):

Hence the manufacturer’s ordering lot size can be given by

Now, the components of manufacturer profit per unit time in the manufacturer inventory cycle are given by:

-

1.

Set up cost It is also termed as the ordering cost of the manufacturer. When a supplier gives the information to the manufacturer regarding the quality of the product, product quantity, then this cost has been experienced. Vendors continuously attempt to use a smart strategy as their order strategy. Subsequently, the ordering process is done so rapidly with lower investment. Here set up cost of the manufacturer is considered as \(A_m\).

-

2.

Manufacturing cost By investing in a production setup, the apparatus can be prepared to deal with various groups of products. By contributing one’s time, the yield throughout the whole process duration and the next time can be acquired. It is the fundamental expense of beginning a business and running it productively. Depending upon the developed set up the production process upgraded at a fast pace. Here, total purchasing cost of the manufacturer

$$\begin{aligned}&= cQ\nonumber \\&= c\frac{a_1-b_1p_m}{\theta } \Big [ e^{\theta t_1}-1 \Big ] \end{aligned}$$(4) -

3.

Holding cost The holding cost yields a fundamental inventory as well as a functioning supply chain management. All manufactured products are stored through this type of investment. So, holding cost of the manufacturer can be calculated as

$$\begin{aligned}&= h_m \int _{0}^{t_1} I_{m}(t) dt\nonumber \\&= \frac{h_m (a_1-b_1p_m)}{\theta } \Big [ \frac{e^{\theta t_1}}{\theta }-t_1-\frac{1}{\theta } \Big ] \end{aligned}$$(5) -

4.

Deterioration cost Raw materials and manufactured products are deteriorated at the manufacturer warehouse at a constant rate. For this phenomenon, the manufacturer loses some money. This cost faces by the manufacturer is more if the cycle duration is lengthier as a result profit is reduced. The deterioration cost is given by

$$\begin{aligned}&= k \theta \int _{0}^{t_1} I_{m}(t) dt\nonumber \\&= k (a_1-b_1p_m) \Big [ \frac{e^{\theta t_1}}{\theta }-t_1-\frac{1}{\theta } \Big ] \end{aligned}$$(6) -

5.

Total sales revenue It is also called gross sales, is the combined estimation of products and enterprises a business conveys to its clients during a particular period of time. Total sales revenue of the manufacturer is evaluated as

$$\begin{aligned}&= p_m \int _{0}^{t_1} D_r dt\nonumber \\&= p_m (a_1-b_1p_m) t_1 \end{aligned}$$(7) -

6.

Cost for idle time The expense of idle time is incorporated as either direct work or manufacturing overhead and is an important part of \(= I_m (T-t_1)\)

Therefore, assimilating all the costs, the average profit per unit time of the manufacturer (\(\varPi _m\)) during the cycle can be calculated by

4.2 Retailer individual average profit

The following differential equations can depict the retailer inventory level at time t

with the boundary condition \( I_{r_1}(0)=0\) and \(I_{r_2}(T)=0\).

Using boundary conditions, the following inventory levels of the retailer are acquired by resolving the differential equations (9) and (10):

Now from the Eqs. (11) and (12), we have

Now, the elements of retailer benefit per unit time in the retailer inventory cycle are described by:

-

1.

Set up cost of the retailer It is also known as ordering cost, experienced every time when place an order from manufacturer. Here, set up cost of the retailer is considered as \(A_r\).

-

2.

Purchasing cost The inventory cost includes the purchasing cost of the products, less discounts that are taken as well as any duties and transportation costs paid by the

$$\begin{aligned}&= p_m D_r t_1\nonumber \\&= p_m (a_1-b_1p_m) t_1 \end{aligned}$$(14) -

3.

Holding cost It is a fundamental factor in the expense brought about by the purchaser. It is not to say that the items from the retailer to the customer will be sold immediately, thus it is important to store them. This kind of cost is essential for buyer satisfaction and attraction. The holding cost of the retailer is formulated as

$$\begin{aligned}&= h_r \Big [ \int _{0}^{t_1} I_{r_1}(t) dt + \int _{t_1}^{T} I_{r_2}(t) dt \Big ]\nonumber \\&= h_r \frac{(a_1- a_2)+(b_2p_r-b_1p_m)}{\theta } \Big [ \frac{e^{-\theta t_1}}{\theta }+t_1-\frac{1}{\theta } \Big ] \nonumber \\&\quad - h_r \frac{(a_2-b_2p_r)}{\theta } \Big [ T-t_1+\frac{1}{\theta }-\frac{e^{\theta (T-t_1)}}{\theta } \Big ] \end{aligned}$$(15) -

4.

Deterioration cost When products are stored at the retailer warehouse, the products are also deteriorated due to various phenomenon. Retailer looses some money due to deterioration. The deterioration cost incurs at retailer warehouse is

$$\begin{aligned}&= k \theta \Big [ \int _{0}^{t_1} I_{r_1}(t) dt + \int _{t_1}^{T} I_{r_2}(t) dt \Big ] \nonumber \\&= k \Big [(a_1- a_2)+(b_2p_r-b_1p_m) \Big ] \Big [\frac{e^{-\theta t_1}}{\theta }+t_1-\frac{1}{\theta } \Big ] \nonumber \\&\quad - k (a_2-b_2p_r) \Big [T-t_1+\frac{1}{\theta }-\frac{e^{\theta (T-t_1)}}{\theta } \Big ] \end{aligned}$$(16) -

5.

Total sales revenue of the retailer Retailer total amount of income occurred by the sales of products or service related to company’s primary operation and it is defined as

$$\begin{aligned}&= p_r \Big [ \int _{0}^{t_1} D_c dt + \int _{t_1}^{T} D_c dt \Big ] \nonumber \\&= p_r (a_2-b_2p_r) T \end{aligned}$$(17)

Therefore, assimilating all the costs, the average benefit per unit time of the retailer (\(\varPi _r\)) during the cycle can be evaluated by

5 Solution methodology

The Stackelberg game (RSC) has considered the retailer a leader and the manufacturer a follower to solve the problem. In this situation, the manufacturer yields his reaction on his selling price and time length up to zero inventory for observing retailer selling price. Based on the manufacturer’s reaction, the retailer optimizes his profit concerning his selling price. The manufacturer evaluates his profit function \(\varPi _m\) first with respect to \(p_m\) and \(t_1\) for given \(p_r\).

To optimize the overall profit of the system, it is necessary to demonstrate that the overall profit function is concave. The overall benefit of the supply chain contains the manufacturer’s overall benefit and the retailer’s overall benefit. Here, \(p_m\) and \(t_1\) are decision variables of \(\varPi _m\), \(p_r\) is a decision variable of \(\varPi _r\).

Lemma 1

For any given time length up to zero inventory of manufacturer \(t_1\), \(\varPi _m\) is concave in manufacturer selling price \(p_m\).

Proof

For any given \(t_1\), the second order partial derivative of Eq. (8) with respect to \(p_m\) is given by

so the unit time overall benefit of the manufacturer is strictly concave in \(p_m\). □

Lemma 2

For any given selling price of manufacturer \(p_m\), \(\varPi _m\) is concave in time length up to zero of manufacturer \(t_1\).

Proof

Taking the \(2{\mathrm{nd}}\) order partial derivative of Eq. (8) with respect to \(t_1\) is given by

so the unit time overall benefit of the manufacturer is strictly concave in \(t_1\). □

Objective function of the manufacturer is Max \(\varPi _m (p_m,t_1)\) subject to \(p_m > c\) and \(t_1> 0\) . Assuming interior solutions, for any given retailer selling price \(p_r\), the reaction functions of the manufacturer \(p_m\) and \(t_1\) should satisfy

i.e.

Lemma 3

\(\varPi _m\) has maximum at (\(p_m^*, t_1^*\)) if

holds otherwise it is a saddle point.

Proof

To confirm the optimality of solutions in (21) and (22), we evaluate the Hessian matrix for the manufacturer optimization problem

where \(\frac{\partial ^2 \varPi _m}{\partial p_m^2}\) and \(\frac{\partial ^2 \varPi _m}{\partial t_1^2}\) are shown in (19) and (20) and

For given \(p_r\), the negative definite matrix condition regarding \(H_m\) are \(\bigtriangleup _1= -\frac{2b_1 t_1}{T}< 0\) and \(\bigtriangleup _2\) is given in “Appendix 1”. □

Following manufacturer decisions retailer determines his selling price \(p_r\). Now putting the value of \(p_m^*\) and \(t_1^*\) and \(T=t_1+\frac{1}{\theta } log[1+(\frac{a_1-b_1p_m}{a_2-b_2p_r})(1-e^{\theta t_1})]\) in the benefit function of the retailer \(\varPi _r \), we get

Now the objective function of the retailer is Max \(\varPi _r (p_r) \) subject to \(p_r > p_m^*\), \(t_1^*> 0\) and \(T >t_1^*\)

Lemma 4

Taking into the manufacturer reaction function, the profit function of the retailer is concave with respect to retailer selling price \(p_r\).

Proof

See ‘Appendix 1’. □

6 Numerical results

This section gives the numerical outcomes to justify the theoretical (RSC) problem, and computational experiments were conducted to evaluate the mathematical model in terms of the objective function to find the optimal solutions. The value of \(a_1\), \(a_2\), \(b_1\), \(b_2\), k, \(\theta \) and other parameter values are taken from Pal et al. (2012) (there are a supplier, a manufacturer, a retailer) shown in Table 2. The model is coded in software MATHEMATICA to find out the optimal solutions. The proposed mechanism is more realistic due to the consideration of selling price dependent demand, selling price, and cycle duration of the manufacturer as a decision variable which helps a firm administrator to settle on fitting choices to proceed with their business effectively in a difficult business condition. This mechanism suggests the management that when and how much order quantities of the manufacturer and the retailer would be placed and help the upstream as well as downstream channel members of the chain to settle their selling price in “leader–follower” situation. To accomplish significant insights into the model, we now examine the sensitivity of some key parameters on the optimal solutions.

Figure 3 demonstrates the concavity of \(\varPi _m\) in (\(p_m, t_1\)) and Fig. 4 shows the concavity of \(\varPi _r\) in (\(p_r\)), employing the suggested solution methodology the result of our (RSC) model is shown in Table 3. The eigenvalues of the Hessian matrix are \(\frac{\partial ^2 \varPi _m}{\partial p_m^2}=-39.15 < 0\), \(\frac{\partial ^2 \varPi _m}{\partial t_1^2}=-8769.77 < 0\) and \(\bigtriangleup _2=8.32>0\); also the value of \(\frac{\partial ^2 \varPi _r}{\partial p_r^2}=-2.563<0\). If the manufacturer sells the product at (\(p_m =\$ 126.607\)) and time–length up to zero inventory is (\( t_1 = 0.923\)) weeks then the manufacturer achieve its highest profit. Following the manufacturer, the retailer sold the product at (\(p_r=\$ 133.719\)) and obtained its highest profit. The retailer cycle duration (\(T=0.943\)) weeks is longer than the manufacturer cycle duration.

The result from Table 3 shows that the benefit of the manufacturer is higher than compared to the profit of the retailer in our proposed RSC decentralized model. In the RSC mechanism, the retailer screens the manufacturer strategies first, and afterward, he modifies with his strategy. Therefore, the manufacturer sets his selling price and stock out time first; after that retailer optimizes his profit with respect to his selling price \(p_r\) by addressing the manufacturer’s reaction on \(p_m\), \(t_1\) for a given duration of cycle T. The retailer benefit may not be satisfactory in the RSC model.

6.1 Sensitivity analysis

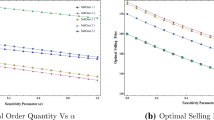

In this subsection, sensitivity analysis of some key parameters \(\theta , k, h_m, h_r, c, A_r, A_m\) is carried out by varying one parameter once keeping other parameters fixed. Table 4 summarizes the result, and Figs. 5, 6, 7, 8, 9 and 10 gives some managerial insights for the proposed supply chain structure of deteriorating items.

-

(1)

Sensitivity analysis of deterioration rate \(\theta \) As the deterioration rate \(\theta \) increases at both manufacturer and retailer inventory under RSC decentralized scenario, Table 4 and Figs. 6, 8, 10 show that only \(p_r\) increases and \(p_m\), \(t_1\), T, Q, \(\varPi _m\), \(\varPi _r\), \(\varPi \) decrease. For a higher deterioration rate manufacturer stocks less amount to stimulate the retailer’s demand and sells the product at a low selling price with a short time length. In addition, although the deterioration rate increases, the retailer sets its sales price with a little change to satisfy the customer demand at a shorter duration of the cycle. Finally, a high deterioration rate plays a negative role in the profit of the manufacture, retailer, and overall supply chain.

-

(2)

Sensitivity analysis of deterioration cost k From Table 4 and Figs. 5, 7, 9, under the RSC decentralized scenario, as deterioration cost k increases, \(p_m\), \(p_r\) increases while \(t_1\), T, Q, \(\varPi _m\), \(\varPi _r\) , \(\varPi \) decrease. For a higher deterioration cost, both manufacturer and retailer tend to increase the selling price. This implies that when k is relatively high, the ordering lot size of the manufacturer has reduced. Due to lack of stock and higher selling price, both customer and retailer demands are also reduced, and fewer products are sold out in a short time. This also plays a negative role in manufacturer, retailer, and supply chain profit.

-

(3)

Sensitivity analysis of holding cost of manufacture and retailer \(h_m\), \(h_r\) As seen from Table 4 and Figs. 5, 6, 7, 9 in the RSC decentralized scenario, when the unit inventory holding cost of the manufacturer increases, \(p_m\), \(p_r\) increases , whereas \(t_1\), T, Q, \(\varPi _m\), \(\varPi _r\), \(\varPi \) decrease. While the manufacture has to pay high holding costs \(h_m\), the manufacturer is inclined to keep away from a lot of stock by decreasing the ordering amount. Manufacturer increase it’s selling price to avoid low order amounts, but this phenomenon damages the manufacturer’s profit. Accordingly, the retailer could gain more benefits by setting a relatively higher retail cost. But, contrary to retailer expectations, the profit will decrease. Finally, a high holding cost of the manufacturer causes loss in the benefit of the manufacturer, retailer, and the whole supply chain.

When the unit inventory holding cost of the retailer increases, \(p_r\) increases, whereas T, \(\varPi _m\), \(\varPi _r\), \(\varPi \) decreases. Otherwise \(p_m\), \(t_1\), Q remain unchanged. When the retailer invests higher holding costs, he sets relatively higher sales prices and sells the product as soon as possible, which shortened the duration of the cycle. Manufacturer selling price, ordering lot size and replenishment time remain unchanged for increasing holding cost of the retailer, but the manufacturer gains benefits because of reducing idle time cost and shorter duration of the full cycle. Finally, a high holding cost of the retailer causes a loss in the benefit of the retailer and overall supply chain profit.

-

(4)

Sensitivity analysis of manufacturing cost c Under RSC decentralized scenario, Table 4 and Figs. 6, 8, 10 shows that when manufacturing cost of the manufacturer increases, \(p_m\), \(p_r\) increases, whereas \(t_1\), T, Q, \(\varPi _m\), \(\varPi _r\), \(\varPi \) decreases. From an economic viewpoint, when unit manufacturing cost increases, the manufacturer prefers to raise its selling price to chase the most extreme benefits, alongside higher retail costs charged by the retailer, which prompts a lower demand. Meanwhile, the order amount drops. This prompts to reduction in manufacturer profit, retailer profit, and overall supply chain profit.

-

(5)

Sensitivity analysis of ordering cost \(A_m, A_r\) From Table 4 and Figs. 5, 7, 8, 9, 10 under RSC decentralized scenario, as ordering cost of the retailer \(A_r\) increases, \(p_r\), T increase, whereas \(\varPi _m\), \(\varPi _r\), \(\varPi \) decreases and \(p_m\), \(t_1\), Q insensitive. A higher ordering cost gives the retailer more initiatives to increase the retail price. Moreover, increasing retail price lengthen the full duration of the cycle, resulting in lower unit time total profit for the manufacturer, the retailer, and overall supply chain profit. Hence the selling price of the manufacturer, replenishment time of manufacture, and order amount almost remain unchanged.

When ordering cost of the manufacturer \(A_m\) increases, \(\varPi _m\), \(\varPi \) decreases and \(p_m\), \(p_r\), \(t_1\), T, Q, \(\varPi _r\) insensitive . A high ordering cost drops down the manufacturer’s profit, which also damages total supply chain profit. Meanwhile, the selling price of manufacture, selling price of the retailer, replenishment time of manufacturer, total cycle duration, order amount, and total profit of retailer remain unchanged.

From the above sensitivity analysis Table 4, the manufacturing cost of the manufacturer is highly sensitive. A small change in the manufacturing cost significantly impacts the overall system profit. Manufacturing cost and supply chain profit are inversely proportional, i.e., reducing manufacturing cost increases the supply chain profit. The optimal decisions, channel members’ profit, and total supply chain profit are not so sensitive with the changes of deteriorate rate, holding cost of the manufacturer, ordering cost of the manufacturer, and retailer. All these parameters are inversely proportional to the supply chain profit. Therefore, the reduction of these costs is beneficial for any industry. The impact of changes of deterioration cost and holding cost of the retailer on the optimum solutions and supply chain profit is negotiable, but reducing these costs is also a little benefit for the industry.

7 Conclusion and future scope

The joint economic lot-sizing issue is developing an interest in supply chain management. Many researchers concentrated on a coordinated vendor-buyer inventory model and joint optimization problem to maximize the overall profitability of the chain. The joint effort between individuals from a supply chain includes attentiveness to durable cooperation, cost-sharing, and even shared profit. As the market of businesses turns out to be increasingly competitive, the supply chain has a great influence on the inventory control problem. In this paper, a two-layer supply chain involving a manufacturer and a retailer is studied. It is assumed that products have deteriorated, and also the cycle duration is equal at each stage. The supply chain cost also contains the cost of the idle time of the manufacturer. The inventory lots of manufacturers are sent to downstream channel member-retailer. The average profit of the whole supply chain is maximized by considering the retailer as a leader and the manufacturer as a follower. A numerical example is presented to illustrate the model, and sensitivities of the major parameters are examined to assist the organizations in making appropriate choices on their procedures.

The numerical result shows that total supply chain profit is optimized along with the selling price of both manufacturer and retailer, time–length up to zero inventory of manufacturer by which both the channel members individually and securely invest for a deteriorating product. The RSC decentralized structure reveals that manufacturer profit is better than that of retailer profit. The proposed model can have many potential implications in the area of supply chain management. Through the proposed mechanism, the selling price, delivery quantities, the timing can be evaluated optimally in cooperation with down/upstream members of the supply chain to achieve a maximum profit. Many industries such as the IC manufacturing industry, TFT-LCD panel manufacturing industry, agricultural industries supply chain suffer inventory management with costly deterioration rates. The proposed Stackelberg approach contributes to a significant profit maximization among the members of the supply chain.

The new major contribution of the proposed model are price-dependent demand rate, product deterioration, time–length of the cycle compared to the existing literature. The proposed model applies to industries of textile, automobile, electronics accessories, etc. The above-mentioned product demand is mainly dependent on price. The items are sold through retail shops, directly to customers, showrooms, etc. The market choices of those items are controlled by the channel individuals together or separately, as shown by their importance, particular advantage, and association.

In this model, constant deterioration at each stage is considered, which is very common in this direction; different deterioration rates could be considered, including time-dependent deterioration. Another limitation of this model is that the production rate at the manufacturer stage is ignored. The model may establish for a multi-stage supply chain also the model extends under shortage, various supply chain contracts like buyback policy, revenue sharing contract, etc. Future research should consider the other game-theoretic approach to maximize profit.

References

Bai QG, Xu XH, Chen MY, Luo Q (2015) A two-echelon supply chain coordination for deteriorating item with a multi-variable continuous demand function. Int J Syst Sci Oper Logisti 2(1):49–62

Barman A, Das R, De PK (2020) An analysis of retailer’s inventory in a two-echelon centralized supply chain co-ordination under price-sensitive demand. SN Appl Sci 2(12):1–15

Barman A, Das R, De PK (2021a) An analysis of optimal pricing strategy and inventory scheduling policy for a non-instantaneous deteriorating item in a two-layer supply chain. Appl Intell. https://doi.org/10.1007/s10489-021-02646-2

Barman A, Das R, De PK (2021b) Optimal pricing and greening decision in a manufacturer retailer dual-channel supply chain. Mater Today Proc 42:870–875

Barman A, Das R, De PK (2021c) Optimal pricing, replenishment scheduling and preservation technology investment policy for multi-item deteriorating inventory model under shortages. Int J Model Simul Sci Comput 2150039

Cachon GP (2003) Supply chain coordination with contracts. Handb Oper Res Manag Sci 11:227–339

Cárdenas-Barrón LE, Sana SS (2014) A production–inventory model for a two-echelon supply chain when demand is dependent on sales teams initiatives. Int J Prod Econ 155:249–258

Cheaitou A, Khan SA (2015) An integrated supplier selection and procurement planning model using product predesign and operational criteria. Int J Interact Des Manuf (IJIDeM) 9(3):213–224

Chen TH (2011) Coordinating the ordering and advertising policies for a single-period commodity in a two-level supply chain. Comput Ind Eng 61(4):1268–1274

Cheng MC, Hsieh TP, Lee HM, Ouyang LY (2020) Optimal ordering policies for deteriorating items with a return period and price-dependent demand under two-phase advance sales. Oper Res 20(2):585–604

Das R, De PK, Barman A (2020) Co-ordination of a two-echelon supply chain with competing retailers where demand is sensitive to price and quality of the product. In: Mathematical modeling, computational intelligence techniques and renewable energy: proceedings of the first international conference, MMCITRE 2020. Springer

Das R, De PK, Barman A (2021) Pricing and ordering strategies in a two-echelon supply chain under price-discount policy: a Stackelberg game approach. J Manag Anal. https://doi.org/10.1080/23270012.2021.1911697

Dong JF, Shao-Fu D, Yang S, Liang L (2008) Competitive pricing and replenishment policies in distributed supply chain for a deteriorating item: a game approach. Asia Pac Manag Rev 13(2):497–512

Feng L, Zhang J, Tang W (2015) A joint dynamic pricing and advertising model of perishable products. J Oper Res Soc 66(8):1341–1351

Gautam P, Kishore A, Khanna A, Jaggi CK (2019) Strategic defect management for a sustainable green supply chain. J Clean Prod 233:226–241

Ghare P (1963) A model for an exponentially decaying inventory. J Ind Eng 14:238–243

Giri BC, Bardhan S (2012) Supply chain coordination for a deteriorating item with stock and price-dependent demand under revenue sharing contract. Int Trans Oper Res 19(5):753–768

Giri B, Roy B, Maiti T (2017) Coordinating a three-echelon supply chain under price and quality dependent demand with sub-supply chain and RFM strategies. Appl Math Modell 52:747–769

Hou KL (2006) An inventory model for deteriorating items with stock-dependent consumption rate and shortages under inflation and time discounting. Eur J Oper Res 168(2):463–474

Hou J, Zeng AZ, Zhao L (2009) Achieving better coordination through revenue sharing and bargaining in a two-stage supply chain. Comput Ind Eng 57(1):383–394

Hsieh TP, Dye CY (2010) Pricing and lot-sizing policies for deteriorating items with partial backlogging under inflation. Expert Syst Appl 37(10):7234–7242

Kamna K, Gautam P, Jaggi CK (2021) Sustainable inventory policy for an imperfect production system with energy usage and volume agility. Int J Syst Assur Eng Manag 12(1):44–52

Khanna A, Gautam P, Hasan A, Jaggi CK (2020) Inventory and pricing decisions for an imperfect production system with quality inspection, rework and carbon-emissions. Yugoslav J Oper Res 30(3):339–360

Kumar RS, Tiwari M, Goswami A (2016) Two-echelon fuzzy stochastic supply chain for the manufacturer–buyer integrated production–inventory system. J Intell Manuf 27(4):875–888

Li J, Liu L (2006) Supply chain coordination with quantity discount policy. Int J Prod Econ 101(1):89–98

Mahmoodi A (2020) Pricing and inventory decisions in a manufacturer–Stackelberg supply chain with deteriorating items. Kybernetes 107:2411–2502

Maihami R, Kamalabadi IN (2012) Joint pricing and inventory control for non-instantaneous deteriorating items with partial backlogging and time and price dependent demand. Int J Prod Econ 136(1):116–122

Maihami R, Karimi B (2014) Optimizing the pricing and replenishment policy for non-instantaneous deteriorating items with stochastic demand and promotional efforts. Comput Oper Res 51:302–312

Mashud AHM, Uddin MS, Sana SS (2019) A two-level trade-credit approach to an integrated price-sensitive inventory model with shortages. Int J Appl Comput Math 5(4):121

Min J, Zhou YW (2009) A perishable inventory model under stock-dependent selling rate and shortage-dependent partial backlogging with capacity constraint. Int J Syst Sci 40(1):33–44

Pal B, Sana SS, Chaudhuri K (2012) Three-layer supply chain—a production–inventory model for reworkable items. Appl Math Comput 219(2):530–543

Rad MA, Khoshalhan F, Glock CH (2018) Optimal production and distribution policies for a two-stage supply chain with imperfect items and price-and advertisement-sensitive demand: a note. Appl Math Modell 57:625–632

Sana SS (2011) A production–inventory model of imperfect quality products in a three-layer supply chain. Decis Support Syst 50(2):539–547

Sarkar B (2013) A production–inventory model with probabilistic deterioration in two-echelon supply chain management. Appl Math Modell 37(5):3138–3151

Sarkar B, Omair M, Kim N (2020) A cooperative advertising collaboration policy in supply chain management under uncertain conditions. Appl Soft Comput 88:105948

Taleizadeh AA, Noori-daryan M (2016) Pricing, manufacturing and inventory policies for raw material in a three-level supply chain. Int J Syst Sci 47(4):919–931

Tiwari S, Cárdenas-Barrón LE, Goh M, Shaikh AA (2018) Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits in supply chain. Int J Prod Econ 200:16–36

Van der Veen JA, Venugopal V (2005) Using revenue sharing to create win-win in the video rental supply chain. J Oper Res Soc 56(7):757–762

Wang X, Li D (2012) A dynamic product quality evaluation based pricing model for perishable food supply chains. Omega 40(6):906–917

Wei J, Liu Y, Zhao X, Yang X (2020) Joint optimization of pricing and inventory strategy for perishable product with the quality and quantity loss. J Ind Prod Eng 37(1):23–32

Wu D (2011) Joint pricing–servicing decision and channel strategies in the supply chain. Cent Eur J Oper Res 19(1):99–137

Xiao T, Xu T (2013) Coordinating price and service level decisions for a supply chain with deteriorating item under vendor managed inventory. Int J Prod Econ 145(2):743–752

Acknowledgements

This first author gratefully acknowledge the MHRD, Govt. of India for financially supporting her with a junior research fellowship.

Funding

Not applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1

Appendix 1

Proof of Lemma 3

Second order principal minor follows

If,

which implying the concavity of \(\varPi _m\) with respect to \(p_m\) and \(t_1\). □

Proof of Lemma 4

Taking the first order derivative of retailer profit function, we get

where,

Due to complexity of (A.3), we can not analytically obtained the value of \(p_r\) but the numerical simulation is done in Sect. 6 has also shown the numeric value of \(\frac{\partial ^2 \varPi _r}{\partial p_r^2}< 0\) . □

Rights and permissions

About this article

Cite this article

Das, R., Barman, A. & De, P.K. Integration of pricing and inventory decisions of deteriorating item in a decentralized supply chain: a Stackelberg-game approach. Int J Syst Assur Eng Manag 13, 479–493 (2022). https://doi.org/10.1007/s13198-021-01299-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-021-01299-1