Abstract

Recently some emphasis has been placed on measuring social and environmental intellectual capital. The major weight of current literature focuses on explaining its mediating role between corporate environmental and social responsibility and corporate financial performance. This mediation approach aims at overcoming the weaknesses of previous methodological frameworks, which recognized a direct casual relationship between corporate social and environmental responsibility and financial performance. This paper outlines a theoretical framework to comprehensively explain the interrelationship among some mediating components for corporate environmental and financial performance, such as social and environmental responsibility, intellectual capital, innovation and competitive advantage. The analysis falls into the knowledge-based view of firms and intellectual capital-based approach of firms and depends on some rational and deductive epistemological reflections which assist in overcoming some existing theoretical weaknesses in the field of corporate environmental and social management.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Recently a significant debate regarding the relationship between corporate social and environmental responsibility (CSER) and financial performance has taken place (Nikolaou and Evangelinos 2008). In order to clarify the basic findings of the current literature, it is divided into two areas of research: (a) theoretical frameworks and (b) empirical results. At a theoretical level, many scholars have proposed conceptual frameworks to describe a potential positive relationship between CSER and corporate financial performance (Stanwick and Stanwick 1998; Lopez et al. 2007; Lopez-Gamero et al. 2009). However, some weaknesses exist for such frameworks mainly because they use various terms for CSER, such as corporate social responsibility, corporate citizenship, corporate sustainability, corporate responsibility, environmental business, business ethics and triple bottom line (Carroll 1999; van Marrewijk 2003; Carriga and Mele 2004). The divergences of these terms are explained by either a single-dimension (e.g. only the environment) or a multiple-dimensional approach on various sustainability issues (Dahlsrud 2008). Other significant weaknesses of the current theoretical frameworks are their inability express of stakeholders’ expectations and CSER activities (O’Riordan and Fairbrass 2008) as well as the lack of an outline of the mediating role of intangible assets and intellectual capital (IC) (Gardberg and Fombrun 2006).

At an empirical level, the findings of current studies are inconclusive since they range from negative to positive (Aupperle et al. 1985; Freedman and Jaggi 1982; Waddock and Graves 1997; Preston and O’Bannon 1997; Roman et al. 1999). This vagueness seems to be associated with the lack of suitable measurement indicators (e.g. using traditional financial indicators—return on investment (ROI)and return on asset (ROA)—which only prove the overall corporate financial performance and does not deal with the consequences of CSER on financial performance separately the (absence of measuring intangible assets and uncertain causality of CSER and financial performance (e.g. CSER affects financial performance or the opposite) (Surroca et al. 2010).

To overcome the weaknesses of the theoretical and empirical literature, some approaches have been proposed to link CSER’s variables with competitive advantage and firms’ performance, for instance, the resource-based view (RBV) of a firm (Branco and Rodrigues 2006), intellectual capital (Chen 2008a; Surroca et al. 2010) and the knowledge-based view (KBV) of a firm (Siltaoja 2014). A well-known modified version of RVB for corporate environmental management has been introduced by Hart (1995) who indicates that environmental investments (e.g. pollution prevention, product stewardship and sustainable development) of firms assists in building a competitive advantage (tacit and explicit knowledge) and gains social legitimacy (e.g. transparency, stakeholder management and collaboration). Particularly, the resource-based thinking highlights the capability of firms to constitute tangible (e.g. physical and financial) and intangible resources (e.g. reputation, employees’ knowledge, IC). Corporate resources play a key role in building sustainable competitive advantage essentially by reason of (its) their internal capabilities, which are inimitable by competitors (Barney 1999) as a result of outstanding features of firms such as being path dependent, causally ambitious and socially complex (Colbert 2004).

Other scholars focus on green and social IC and KBV which is still in its infancy (Chen 2008a; Surroca et al. 2010; Siltaoja 2014). A limited number of studies have been carried out to shed light on different theoretical constructs through questionnaire-based research and accounting scoring and benchmarking techniques (Chen 2008a; Chang and Chen 2012; Polo and Vázquez 2008).

The existing literature offers helpful insights mainly for green IC without a concrete and robust theoretical background. The majority of current academic works provide methodologies to record certain relationships between CSER and intellectual capital; nevertheless, a theoretical approach to describe such relationships is lacking. In other words, the gap in the research suggests that organizational knowledge creation derived from CSEER project implication is evaluated without a concrete theoretical background. This paper suggests an overall theoretical framework to outline the prospective relationships between CSER and corporate financial performance by mediating the role of the social and environmental intellectual capital (S-EIC), innovation and competitive advantage. This analysis is made through KBV and the intellectual-based approaches which offer suitable conditions to revisit the roots of CSER and indicate the critical role of firms in the modern market environment. The proposed framework suggests four key interlinked components CSER, IC, innovation and sustainable competitive advantage.

The rest of the paper is organized as follows. The next section outlines the review objectives. In the “Conceptual Framework—Proposition Development” section, the framework model and propositions have been developed. Management implications have been developed in the “Implications for Corporate Social and Environmental Responsibility Management” section. The results and conclusion of the proposed framework model is presented in the “Conclusion” section.

Theoretical Underpinning

The IC is a very significant feature of corporate dominance (Bontis et al. 2000; Chen et al. 2005). A relevant consensus seems to exist regarding the content of IC which generally encompasses three elements such as human capital (e.g. skills and qualifications of staff), structural capital (e.g. copyrights, patents, software) and relational capital (e.g. customer and supplier relationships). The necessity of measuring these types of capital mainly arises from the new concepts of knowledge-based economy which requires new accounting techniques so as to overcome weaknesses of conventional accounting techniques (Petty and Guthrie 2000; Berzkalne and Zelgalve 2014). This implies that knowledge creation and quality of human resource capital play a critical role in the competitiveness of firms in modern globalized market conditions.

Considerable attention has been paid to evaluation techniques to estimate corporate IC and strategic management tools for managing and developing IC. Firstly, some popular accounting techniques for measuring IC are Human Resource Accounting, Economic Value Added (EVA), Balanced Score Card and Skandia Navigator (Bontis et al. 2000; Chen et al. 2004). The value of IC has been calculated as the gap between book and market values or as quantification of intangible assets. The empirical findings mainly show a positive relationship between IC, financial performance and shareholder value (Chen et al. 2005). Practically this means that the increase of IC expands the gap between market and book value (Ruta 2009; Maditinos et al. 2011). Secondly, strategic management tools play a critical role in designing well-fitting corporate strategies to encourage employees’ participation in knowledge creating procedures for creating tacit and explicit knowledge and strengthen the corporate capability so as to gain competitive advantage (Polanyi 1967). Tacit knowledge includes personal attributes easily transportable by employees when changing career. The explicit knowledge is restricted within firms’ boundaries through database, manuals and guidelines. This knowledge is considered an important asset of firms which is difficult to transfer. The creation of knowledge is a dialectic process between tacit and explicit knowledge within firms. The following sub-sections aim to analyse how the findings of general IC could be transferred to CSER and how such this experience could build a good foundation for developing a theoretical basis for green IC.

Some General Thoughts for KBV

Knowledge is a vital asset for the business community in particular and economy in general. Teece (2000) points out that corporate competitive advantage is inextricably tied up with its ability to create, diffuse, use and maintain difficult-to-imitate knowledge assets. Such assets are internally built up by firms where ‘know-how’ and ‘learning-by-doing’ personal capabilities of employees are developed. Grant (1996a) supports that the integration of knowledge is a crucial feature for a business to build a sustainable competitive advantage. He identifies three basic characteristics for businesses which achieve knowledge integration: (a) the ability of business to integrate knowledge among its employees, (b) the well-defined scope of integration for creating useful types of knowledge which is difficult for competitors to imitate and (c) the flexibility of integration.

The knowledge assets are traditionally discussed by RBV and KBV. RBV explains how internal resources of firms can generate sustainable competitive advantage (Eisenhardt and Martin 2000). Barney (1991) defines resources as all firms’ capabilities, organizational procedures, information and knowledge which assist firms in designing efficiency and effectiveness strategies. The resources could be classified in three general categories: physical capital resources (e.g. technology and equipment), human capital resources (e.g. experience, intelligence) and organizational capital resources (e.g. coordinating system, planning system). The sustainable competitive advantage of firms remains when they have the ability to construct heterogeneous organizational resources which are difficult-to-imitate, valuable, rare and non-substitutable (Barney 1991). The valuable resources facilitate firms to design essential strategies to effectively and efficiently exploit opportunities. Rationally, these resources might be managed by firms in a special way because of employees’ unique talent (rare resources) and thus create a competitive advantage over other competitors. These particularities of resources (rareness and value) offer basic conditions of firms to build a sustainable competitive advantage since they are imperfectly imitable. The imperfect imitable features of resources are based on historical conditions (e.g. historical conditions are a determinant of business performance and competitiveness), causally ambiguous (e.g. the relationship between resources and competitive advantage of firms is poorly understood) and socially complex (e.g. resources are socially complex such as a firm’s culture, reputation).

The RBV considers knowledge as a distinctive resource, among others, which is made within a firm’s boundaries owing to employees’ experience, skills and abilities. Chuang (2004) examines, through RBV, the way in which knowledge assists firms in creating a sustainable competitive advantage. This tendency supposes that external knowledge provides the necessary information for firms to operate but their capability to transform this into a new and unique knowledge creates an opportunity to build sustainable competitive advantage (Gold et al. 2001). Meso and Smith (2000) use RBV to explain the paths of knowledge creation and essential circumstances (e.g. socio-technical perspective) which are necessary in order for firms to be able to create a competitive advantage.

The KBV is sometimes considered an extension of RBV (Hoskisson et al. 1999) and sometimes it is considered a separate theoretical approach to understand firms and their procedures (Nonaka 1994; Grant 1996b). Nonaka et al. (2000a) (point out that knowledge is not simply a separate resource among a set of others, but it also offers essential circumstances for companies to gain a competitive advantage. They support that knowledge is a key resource for creating sustainable competitive advantage and very difficult to imitate as a result of the tacit characteristics of some types of knowledge and distinctive organizational capabilities of firms. Nonaka (1994) describes this type of firm as a knowledge-creating entity where a suitably shaped place (a ‘ba’ in Nonaka terminology) exists for creating new knowledge. Nonaka et al. (2000a) provide a model for the knowledge-creating process (socialization, externalization, combination, internalization (SECI) model) where different combinations of tacit and explicit knowledge are achieved in the daily process of firms which offer perspectives for new knowledge.

Similarly, Grant (1996b) points out the necessity for the distinction between RBV and KBV not only thanks to the key role of knowledge resources in building a firm’s competitive advantage, but also because it would address certain primary topics of the existing theory of firms such as ‘coordination within the firm, organizational structure, the role of management and the allocation of decision-making rights, determinants of firm boundaries and theory of innovation’ (p. 110). Sveiby (2001) considers KBV very important because of the fact that people are true agents within firms who can design strategies for the development of firms.

Knowledge, IC and KBV

A number of issues need to be clarified prior to an analysis of IC. Some of them are as follows: what does the term knowledge mean? How is knowledge created within firms? What are the basic elements of IC? How can IC go hand-in-hand with KBV? Certainly, the basis of KBV is knowledge and the first responsibility is its clarification. Diakoulakis et al. (2004) reveal the ambiguities associated with the term knowledge owing to its identical use with the terms data and information. Essentially, the term knowledge enclosed social and humanistic characteristics which need an explicit framework to facilitate the transformation of information to knowledge (Nonaka et al. 2000b). Furthermore, knowledge created inside firms should have some specific characteristics such as transferability (e.g. the capability of knowledge to be transferable within a firm), capacity for aggregation (e.g. to add new knowledge to recent knowledge) and appropriability (e.g. to create new value for firms) (Grant 1996a).

A typical classification of knowledge has been made between tacit and explicit knowledge (Polanyi 1967; Nonaka 1994). The former type includes private knowledge of employees, and the latter type implies formal knowledge such as patents, manuals and mathematical formulas. A literature’s main concern is the ways in which these types of knowledge benefit firms. Nonaka et al. (2000a) state that an interaction between these types of knowledge is a key factor for creating new knowledge, innovations and conditions for competitive advantage. Similarly, Gold et al. (2001) suggest a strategic management tool for knowledge creation by mixing knowledge content (tacit and explicit knowledge) and knowledge capability (process and infrastructure) to outline a portfolio of knowledge opportunities (e.g. mining, growth, codification and integration). A primary purpose of firms is to design the necessary ways to translate knowledge into IC and financial value (Edvinsson and Sullivan 1996). This stems from the perspective that IC is an important strategic asset which assists firms in improving their financial performance (Belkaoui 2003). This implies the need for a better knowledge creating process. To delineate knowledge procedures, Hussi (2004) proposes a combination of Nonaka’s knowledge creating model (SECI model) and IC principles in an effort to convert static into dynamic processes.

Another important issue is the relationship between knowledge and IC. The concept of IC was introduced by John Kenneth Galbraith in 1996. Ever since, much ink has been spent to clarify its content which mainly consists of three elements: (a) human capital, (b) structural capital and (c) relational capital (Bontis 1998; Johnson 1999). The first element encompasses knowledge, skills, talents, experience, know-how and abilities of employees to create new products, management procedures and cooperation within firms. The second element covers organizational routines, cultures, databases, manuals, copyrights and patents. The final element pertains external relationships between firms with consumers, suppliers and innovation units.

Many tools have been designed to evaluate IC through KBV such as knowledge asset map and knowledge asset dashboard (Mar et al. 2004). Reed et al. (2006) consider KBV and IC as two separate views which they emphasize on in different topics in an effort to clarify dynamic relationships between knowledge and firms’ values. The KBV examines the capability of firms to create new knowledge, while the IC view examines how knowledge created by firms improves the value of firms. Essentially, IC could play a critical role in helping KBV to be a complete theory of strategic management since it could facilitate the connection between knowledge creations with sustainable competitive advantage.

S-EIC

The terms green and social IC have recently been introduced in the literature of corporate environmental and social responsibility management (Claver-Cortes et al. 2007; Chen 2008b). A popular justification of the use of IC is the mediating role it plays among corporate social responsibility strategies, corporate financial performance and competitive advantage. To date, many terms have been utilized to express IC such as ‘sustainable’, ‘green’, ‘environmental’ and ‘social’ ICs.

The variety of IC terms could be explained simply by the different considerations of each term. Some terms emphasize more on environmental issues, particularly on the feedback between environmental management systems and IC (Chen 2008a; Lopez-Gamero et al. 2009). Others focus on a triple-bottom-line approach and CESR (Wasiluk 2013; Chang and Chen 2012). In general, S-EIC is an adjustment to classic components of IC and is consistent with the requirements of corporate environmental management, corporate sustainability and corporate social responsibility (CSR). Chen (2008a) considers that green IC consists of three components: green human capital, green structural capital and green relational capital. Correspondingly, Lopez-Gamero et al. (2009) describe sustainable IC as sustainable human capital, sustainable structural capital and sustainable relational capital. The first component, human capital, implies mainly the contribution of human resources to create corporate sustainable value. The second component, structural capital, includes organizational and technological parts such as culture, organizational learning, ecological products, and cleaner production technologies. Finally, relational capital implies relationships between firms and their stakeholders. Baharum and Pitt (2009) emphasize that the integration of environmental concerns into corporate strategy might assist in creating corporate green IC and green knowledge capital by strengthening green human knowledge, green customer knowledge and green structural knowledge. Chang and Chen (2012) contented that CSR practices are associated positively with green IC of firms. Finally, a part of the literature sought to draw suitable information regarding CSR, sustainability and IC through accounting techniques (Pedrini 2007; Polo and Vázquez 2008). Essential information regarding IC could be identified through sustainable and intellectual reports (Polo and Vázquez 2008). Cordazzo (2005) considers that IC reports encompass, to a great extent, environmental and social information. Guthrie et al. (2007) suggest an extension of existing performance reports by incorporating CSR and IC issues.

Conceptual Framework—Proposition Development

KBV–S-EIC

An important theoretical explanation of CSER is made through the business case view where firms expect financial benefits and sustainable competitive advantage. The drivers are classified mainly as internal (e.g. outstanding resources) and external (e.g. suppliers, consumers). From an internal point of view, Hart (1995) points out that an environmental management strategy is likely to strength the tacit knowledge of employees. Boiral (2002) notes that corporate environmental management could assist in creating essential tacit knowledge to solve environmental issues and build particular cultural characteristics in the working environment which facilitates knowledge exchange. Similarly, Preuss and Co’rdoba-Pachon (2009) support that knowledge management might equip firms with essential tools to face environmental and social externalities.

A limitation of RBV is highlighted when trying to explain the linkage between CSER and knowledge creation, as this approach places knowledge creation as a standalone component among various corporate resources. Siltaoja (2014) supports that CSER is likely to strengthen the corporate knowledge capital. Her approach relies on a combination of the corporate social performance model of Wood (1991) and the knowledge creating business model of Nonaka (1994). It aims to create a solid bond between CSER and KBV. Similarly, Preuss and Co’rdoba-Pachon (2009) utilize the KBV approach as a suitable and necessary context to modify the conventional processes of firms to play a more productive (position role within society). Specifically, they develop a (3 × 2) matrix for CSR knowledge processes to provide a gradual conversion of CSR to new knowledge and identify benefits for firms (e.g. advance of stakeholder dialogue). Guadamilas-Gomez and Donate-Manzanares (2011) recognize positive relationships between ethical treatment of employees and innovations. Essentially, they point out that the adoption of CSER might enhance the possibilities of creating intangible assets useful both for corporate financial performance and for human resource management. CSER undoubtedly creates new knowledge within firms’ boundaries whether tacit or explicit knowledge (Boiral 2002).

Based on the aforementioned analysis, a rational proposition is:

Proposition 1: The corporate CSER will shape essential processes for creating tacit and explicit knowledge.

Scholars assume that new knowledge creation as a result of CSER might offer an essential background to well-designed CSER and IC (Boiral 2002; Daily and Huang 2001). This highlights the particular role of human resources in the successful implementation of CSER, corporate competencies and IC creation (Boiral 2002; Daily and Huang 2001; Jabbour and Santos 2008). Analogous effects could be identified on corporate structural capital (e.g. environmental patents, manuals, and management routines) and relational capital (e.g. consumers, suppliers, employees, society and investors).

Some rational propositions are as follows:

Proposition 2.1: The adoption of CSER assists firms in creating environmentally and socially responsible human capital.

Proposition 2.2: The adoption of CSER assists firms in creating environmentally and socially responsible structural capital.

Proposition 2.3: The adoption of CSER assists firms in creating environmentally and socially responsible relational capital.

S-EIC and Competitive Advantage

The empirical studies have shown that green IC might engender a favourable setting for the business community to build a competitive advantage (Saeidi et al. 2015). The building of IC is not an inherent function of firms without certain conditions and capabilities. The creation of IC needs two basic capabilities such as the combination and the exchange of knowledge. The former process concerns the utilization of existing knowledge to create new knowledge for solving problems and exploiting new opportunities. The latter process focuses on the effective and efficient exchange of knowledge among different groups of employees. The literature emphasizes the necessity of essential conditions to encourage employees to participate in the knowledge creating processes. Nahapiet and Ghoshal (1998) provide some conditions for IC creation: the straightforward access of employees to knowledge processes, the confidence of employees that they work in a well-designed strategy, the benefits of employees from their participation in this process and, finally, the capability of employees to create new knowledge.

The largest body of literature illustrates that the knowledge created from CSER is useful mainly to successfully achieve its goals rather than improve the core business strategies (e.g. product and operation) and consequently to gain competitive advantage (Gond et al. 2011; Wagner 2013). Hart (1995) assumes that pollution prevention strategies might offer pollution and cost-saving benefits. A common ground in general management, entrepreneurship and corporate environmental management literature indicates that a corporate competitive advantage could be gained either as cost reduction (e.g. pollution reduction, energy savings, fewer materials uses) or product differentiation (e.g. eco-friendly products) (Reinhardt 1998). A comprehensive justification of the association of CSER and the core business strategy is lacking. An automatic correlation is not certainly self-evidenced because of various substantial barriers which are empirically and theoretically presented. For example, game theorists examine the effect of CSER on product differentiation and make certain assumptions under which CSER can cultivate a fertile ground for firms to gain a competitive advantage (Amacher et al. 2004; Clemenz 2010). Possibly in order to prove the contribution of CSER to competitive advantage, its connection with the core business strategy needs to be clarified. This logic recommends that CSER are able to create tacit and explicit knowledge not only to address environmental and social issues but also to offer financial benefits though cost reduction and product differentiation.

Following the essential principles of KBV (Nonaka 1994; Grant 1996a), it seems that additional conditions are necessary for creating S-EIC and corporate competitive advantage. Given the SECI model of Nonaka (1994), it could be said that the conversion of knowledge should made connection between CSER (tacit and explicit knowledge) with core business strategy. This is similar to the ‘knowledge vision’ supported by Nonaka et al.’s (2000b) which is necessary to synchronize an entire firm’s knowledge and determine the responsibility of top management to express the knowledge vision of firms.

Given the previous analysis, some rational propositions are as follows:

Proposition 3.1: The new knowledge created by CSER will be aligned with the core business strategy.

Proposition 3.2: The processes of knowledge creation will strengthen the dialogue between socially and environmentally responsible knowledge and core business knowledge.

Many internal factors have been examined regarding the reasons for corporate competitive advantage such as value creation, rareness, limitability and essential procedures (Barney 1995; Ndlela and du Toit 2001). The primary aim of knowledge management programs is the mining of rare and special knowledge which are apt to come up especial features for firms in relation to their competitors. The possibility of long-run profitability to remain sustainable seems to be higher when the new knowledge created is inimitable. Another considerable reason for a thriving bond between knowledge creation and competitive advantage is the quality of corporate IC (Marti 2001). The effects of CSER on IC might be the result of staff training programs, eco-patents and manuals and improved relationships with stakeholders (Chen 2008b). The positive effect on human capital means that new skills have been created which is useful for CSER performance and competitive advantage. Empirical findings have shown the significant role of human resources in CSER implementation and IC creation (Fenwick and Bierema 2008; Garavan and McGuire 2010). Additionally, similar effects of CSER on structural capital have been identified such as environmental patents, new manuals and software plays a critical role in new product, process and organizational innovations (Rennings 2000). Finally, the empowerment of relational capital from CSER should be the most widespread standpoint in CSR literature (Dawkins and Lewis 2003).

Given the previous analysis, some rational propositions are as follows:

Proposition 3.3: The CSER can create S-EIC and consequently new innovations.

Proposition 3.4: The CSER innovations will outline a fundamental setting to build corporate sustainable competitive advantage.

Environmental and Financial Performance: a Mediating Role of S-EIC

There have been efforts in different scholarly fields to determine essential ways to link CSER and corporate financial performance (McWilliams and Siegel 2001; Waddock and Graves 1997; Husted and de Jesus Salazar 2006). The ambiguity of findings is explained through the different (CSER and financial) variables utilized, the causality problem (financial performance affect CSER or vice versa) and the absence of mediating variables such as IC. The role of IC in corporate competitive advantage has lately gained significant attention (Kamukama et al. 2011; Saeidi et al. 2015). The new valuable, rare and difficult to imitate knowledge arisen from CSER seems to be useful for firms to build IC, competitive advantage and better financial performance.

This analysis leads to the following rational propositions:

Proposition 4.1: The corporate competitive advantage as a result of CSER will positively influence corporate financial performance.

This implies that sound application of CSER assists firms in improving financial performance through reduction of pollutant and resources consumption (Lopez-Gamero et al. 2009). A noteworthy matter which remains regarding the relationship between CSER and financial performance is who are responsible for what. A common answer focuses on forward relationship where sound implementation of CSER affects corporate financial performance. However, the reverse relationship exists which implies that improved financial performance offers adequate financial resources in order for firms to adopt CSER and thus to improve CSER performance.

Some rational propositions are as follows:

Proposition 4.2: Sustainable competitive advantage and CSER innovations will positively influence corporate environmental and social performance.

Proposition 4.3: Improved financial performance offers increased financial capital for firms to invest in CSER.

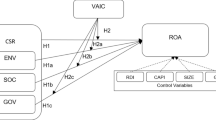

Conceptual Framework Creation

Figure 1 depicts a conceptual framework regarding the influences of CSER on corporate financial and CSER performance. It consists of five main stages which firms should take into account to exploit financial benefits from CSER. The first stage includes CSER undertaken by firms. This entails well-designed, prepared and implemented business projects which align environmental and social expectations of various stakeholders with core business strategy and mainly with the knowledge vision of firms (as pointed out by Nonaka 1994). This means that CSER should go hand in hand with core business strategy and not be viewed as a separate strategy which seeks to temporarily proffer public relation benefits. This goes beyond the view arisen from NRBV (natural resource-based view of firms) regarding the relationship between environmental management practices and corporate resources development (automatic and self-evident relationship) as well as the unilateral connection of CSER projects with stakeholders’ relations (Hart 1995; Clark 2000).

The proposed framework suggests that CSER should be placed in the core business strategy to create new knowledge through continual feedback routines between each other (Proposition 3.1—P.3.1) and focus on a modern sustainability business model (Stubbs 2008). Additionally, the design and accomplishment of CSER might outline suitable conditions for creating new knowledge to address environmental and social business matters (Proposition 1—P.1). As an evidence, Boiral (2002) outlines some specific ways to illustrate cases of creating tacit and explicit knowledge from CSER. Siltaoja (2014) also suggests a sophisticated conceptual framework to indicate knowledge development prospects from CSER. A well-defined relationship between CSER, knowledge creation and IC is lacking. The capability of firms to create new knowledge is based on existing corporate knowledge processes and knowledge management procedures such as knowledge combination and diffusion between employees. It is important to note that a coordination process is necessary to complete the business environment for knowledge creation. Essentially, this means the crucial linkage of knowledge creation with core business strategy (Proposition 3.1—P.3.1).

The combination process reinforces the capabilities of human capital to create new knowledge (Proposition 2.1—P.2.1), and the diffusion process offers motivation to employees to exchange knowledge with each other and identifies a common place for creating novel knowledge. It is worth noting that the knowledge processes can also enforce social capital and promote new culture models among employees. The success of these procedures also requires adequate capabilities of employees in top management, the R&D department and the staff in each department. CSER seems to have positive effects on the structural capital of firms (Propositions 2.2—P.2). Lately, many patents seem to be vested regarding CSER either on production or on the management phase (Rennings 2000). Some large firms have also suggested certain techniques to improve their environmental and social profile such as BASF technique to select the more eco-efficient products and body shop patents to produce environmentally friendly products (Shonnard et al. 2003). A number of certified management procedures (e.g. ISO 14001, EMAS, ISO 26000, and GRI) and product-based procedures (e.g. EU flower eco-label) used by firms to meet socially and environmentally responsible expectations of stakeholders through identifiable and third party (independent) certification systems (to strengthen legitimacy and accountability) are suggested. These projects create new explicit knowledge such as new manuals (e.g. ten general principles for corporate energy, audit energy guidelines, software) (Abdelaziz et al. 2011).

Another considerable influence of CSER is on relational capital (Proposition 2.3—P.2.3). A large part of the literature places emphasizes on corporate efforts to meet stakeholders’ expectations and create essential circumstances to operate in harmony with local societies (e.g. licence to operate, legitimacy, accountability). It is known that different groups of stakeholders such as consumers, investors and suppliers play different roles in firms’ viability. Some stakeholders need safe opportunities (risk avoidance) and others desire profitable opportunities (profit seeking). The former type of stakeholders seeks to eliminate their exposure to risky investment through firms prone to environmental accident and litigation risks. The latter type of stakeholders focuses on exploiting new opportunities from investments in ethically and environmentally friendly firms.

The S-EIC could be translated firstly in new innovations and secondly in competitive advantage (Proposition 3.3—P.3.3). CSER (has to) offers challenges for short-term and long-term value creations through potential innovations (Dangelico and Pujari 2010). Carrillo-Hermosilla et al. (2010) highlight eight key points for environmental innovation: component, sub-system, system, user development, user acceptance, product-service deliverable, product-service process and governance. Similarly, Rexhepi et al. (2013) offer models to identify CSER innovations for products and management systems which encompass certain principles against crime, towards environmental friendly and design criteria. Hart and Milstein (2003) highlight the weak relationship between CSER and innovations as a poor value creation of products. Additionally, Russo and Fouts (1997) have pointed out that the most important barrier of firms, in the long-term period, do not come from institutional environment (e.g. environmental regulations), but are caused by the absence of internal innovation capabilities to achieve cost (saving solutions).

The outcome of environmental and social innovations mainly focuses on corporate capability to reduce operational and production costs or to differentiate products (Proposition 3.4—P.3.4). On the one hand, cost saving is a significant reason for firms to participate in CSER. For instance, Weber (2008) provides many empirical and theoretical findings with emphasis on cost saving as a key factor for firms to adopt CSER. On the other hand, product differentiation is another crucial factor in order for firms to adopt CSER since they seek to discover a new niche market with specific types of environmental sensitive consumers who look for products and firms with CSER attributes. Social and environmental innovations might play an important role for firms in improving their CSER performance (Proposition 4.2—P.4.2).

Innovations facilitate firms to gain a competitive advantage and exploit financial benefits (Proposition 4.1—P.4.1). The relationship between competitive advantage and corporate financial performance may follow two paths. On the one hand, the product differentiation through CSER can create sustainable competitive advantage and abnormal returns under persistence, long-term plan and enduring loyalty (McWilliams and Siegel 2010). This demystifies the mechanical and automatic connection between CSER and reputation and signals the need for marketing strategies to make such differentiations known (McWilliams and Siegel 2010). The effects of CSER on reputation need long-run processes in order to fill the information gap with consumers (Sirsly and Lvina 2016). On the other hand, the adoption of CSER might encourage firms to gain a competitive advantage either by decreasing pollution or by eliminating potential environmental barriers for future growth of firms (Hart 1995).

CSER is generally associated with improved corporate environmental performance (Epstein and Roy 1998; Stanwick and Stanwick 1998). Obliviously, corporate environmental and social innovations offer improvements in financial, environmental and social performance (P.4.2). Wagner (2009) points out the significant influences of environmental management and innovation on corporate environmental performance. The relevant academic debate focuses either on a linear relationship from better CSER performance to better financial performance (Wagner and Shaltegger 2004; Wagner 2005) or on backward relationship (Orlitzky et al. 2003). Waddock and Graves (1997) consider that there is a virtuous cycle between corporate social performance and corporate financial performance. Realistically, this means that adequate financial capital is necessary in order for firms to be able to finance CSER. Undoubtedly, financial capital is considered a significant barrier for firms, mainly for SMEs (small and medium sized enterprises), to spend in CSER (Murillo-Luna et al. 2011).

Implications for Corporate Social and Environmental Responsibility Management

The proposed theoretical framework aims to provide an alternative view to explain why firms adopt CSER projects on a voluntary basis and to describe the relationship between CSER adoption and firms’ performance. Some current and popular theories, such as the stakeholder-based view, the resource-based view and the legitimacy theory, use strategic management to examine the possible reasons why firms adopt sustainability and social responsibility management policies (O’Riordan and Fairbrass 2008; Branco and Rodrigues 2006; Beddewela and Fairbass 2016). Such theories focus on providing some theoretical explanations as to why firms invest in CESR projects. They suggest that managers choose to invest in CSER projects mainly to tackle external challenges (e.g. regulatory and economic requirements), to mimic strategies of other homogenous firms (institutional theory), to meet the needs of stakeholders (stakeholder theory) and to legitimize their operation (legitimacy theory). These theories are more suited to larger firms (multinational corporations), which operate in different counties with diversified institutional requirements. This implies that firms implement CSER projects depending mainly on the capability (strength and power) of firms to avoid complying with institutional requirements (Yang and Rivers 2009). Similar explanations have been given for the stakeholder theory and the legitimacy theory, which are associated with stakeholders’ power to change a firm’s behaviour (Spitzeck and Hansen 2010).

McWilliams and Siegel (2011) consider that such theories have been limited to the flexibility of firms with regard to external requirements and that a theory which links CSER projects and the bottom line could be more favourable for managers. On the other hand, Lozano et al. (2015) point out that the use of theories from the management field focuses mainly on firms’ economic and management activities and less on sustainability issues. It operates in a different environment, thus proposing a sustainability-oriented theory of firms. Actually, this is a very interesting approach as it suggests that the weakness of previous theories is the lack of theories proposed to link management principles with basic ideas of sustainable development (e.g. strong sustainability, carrying capacity and safe minimum standards). However, for a firm to achieve sustainability goals, whether in the short term or long term, requires adequate knowledge so as to improve their competitiveness (financial and social aspects for sustainability) and achieve the goals of sustainable development (e.g. environmental thresholds). Therefore, it is extremely difficult to make a new a theory for sustainable firm without taking into account the core principles of business’ operation (Lozano et al. 2015). The proposed theoretical framework adds to the field by linking the external and internal incentives of firms to achieve sustainability goals with the core business strategy through knowledge creation and knowledge creating assets. The proposed theoretical framework adds to the field by linking external and internal factors which assists in incorporating corporate sustainability goals into business strategy through knowledge creation and knowledge creating assets. Firstly, this improves current assumptions of internal based theories (e.g. RBV) which consider voluntary implementation of CSER projects to be a critical factor in assisting firms in building new capabilities and resources that are not easily duplicated by rivals (Hart 1995). Actually, the proposed theoretical framework demonstrates that the adoption of CSER projects creates new knowledge which under some conditions could play a crucial role for firms in their efforts to build sustainable competitive advantage. Secondly, this places the knowledge in the centre of a firm’s strategy since knowledge (employee’s knowledge, interests and stakes) could play a catalytic role in developing new resources (Branco and Rodrigues 2006) and adequately addressing sustainability issues (Malovics et al. 2008).

Moreover, the proposed theoretical framework goes beyond the classical KBV of a firm by linking its basic assumptions with classical components of intellectual capital theory. Actually, this aims to make KBV more practical and measurable. Although, the KBV is built on the general assumption of creating new knowledge from an implementing strategy, the IC view assists KBV in translating theoretical construct into practical implications. This is an important task for the CSER literature; managers and owners are required to justify effectively and convincingly each dollar which they transfer from the primary strategies (e.g. operation and production issues) to spend on secondary strategies (e.g. philanthropic strategies). There are many contradictory positions regarding the CSER projects which could be classified in two general categories: positive (supporters) and negative (resistant). The former suggests that CSER projects assist firms in improving their reputation and attracting social and environmental sensitive consumers (Lii and Lee 2012), while the reluctant managers consider CSER projects a waste (sacrificing) of money (Reinhardt et al. 2008). By attempting to contribute to the former body of literature, the proposed framework outlines the key channels for creating, diffusing, and sharing knowledge within a firm’s context in order to indicate potential links between the CSER projects and the economic performance of firms. Essentially, the proposed theoretical framework provides an answer to the question raised in corporate social responsibility/corporate sustainability literature regarding the relationship between CESR projects and firms’ economic performance. In particular, a question often raised in the literature is how the implementation of CSER projects could positively influence firms’ economic performance (Waddock and Graves 1997; Weber 2008). The question is if the good CSER performance is the result of the good economic performance of firms or good CSER performance is a factor for which firms improve their economic performance. To this sense, the proposed framework also contributes to clarify how CSER projects facilitate firms to advance their economic performance.

The analysis of this paper contributes to general management since sustainability issues through KBV and core business strategy provide a new perspective for firms and management. The belief that knowledge creation for CSER should be explicitly linked to the core strategies of firms paves the way for a new business and management sustainability model, which would replace the general management strategy rather than operate parallel with it as is currently the case. The problem today is that social and environmental issues operate separately from the core strategy of firms, and many market and society actors dispute their results.

Conclusions

The proposed framework provides an approach to connect CSER with financial performance though the view of KBV and IC. This implies many factors which play a critical role between CSER and corporate financial performance. It overcomes the traditional view of a direct and automatic relationship between CSER and corporate financial performance by inserting some mediating factors such as IC, innovations and competitive advantage. This approach is based on the business case for CSER which justifies the adoption of CSER as the primary goal of firms to improve financial performance. The contribution of this framework is the connection of CSER with KBV where firms are constituted certain places to create essential knowledge for business viability. The knowledge creation assists firms in exploiting innovation opportunities and competitive advantages in relation to their competitors. These business assets could be associated with better financial performance under essential circumstances.

The traditional frameworks aim to explain the relationship between CSER and financial performance as a result of resource development inside firms through certain capabilities of employees. This relationship is overcome through well-organized knowledge creation processes inside firms which assist in developing new products and management procedures. The success of firms is associated with their efforts to organize such procedures and make specific marketing strategies to promote CSER findings. The creation of IC is very important and plays a critical role in firms operation since it assists in designing new knowledge useful for innovative products and management procedures. The emphasis on human capital, structural capital and relational capital plays a critical role in providing incentives for employees to utilize their talents for corporate aims.

The conceptual frameworks also provide insights that help in overcoming problems in empirical research when direct connections between CSER and financial performance have been identified. The absence of essential variables between CSER and financial performance (e.g. IC, innovations) seems to underestimate or overestimate the results of empirical research and explain the existence of unequivocal findings of current studies. Additionally, the proposed knowledge procedures and the connection with core business strategy are necessary features for knowledge creation and assist firms in creating essential knowledge for exploiting new opportunities.

Additionally, proposition development could play a critical role in future research. Future research would be useful to confirm these propositions in a number of different industries in order to be suitable for theory development. This could provide a basis for a range of models and diagnostic conceptual tools for knowledge management of CSER. Finally, a lot of work has been done regarding the connection of CSER knowledge and core strategy of firms and real problems of society and the environment under the concept of strong sustainability.

References

Abdelaziz, E. A., Saidur, R., & Mekhilef, S. (2011). A review on energy saving strategies in industrial sector. Renewable on Sustainable Energy Reviews, 15, 150–168.

Amacher, G. S., Koskela, E., & Ollikainen, M. (2004). Environmental quality competition and eco-labelling. Journal of Environmental Economics and Management, 47, 284–304.

Aupperle, K. E., Carroll, A. B., & Hatfield, J. D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal, 28(2), 446–463.

Baharum, M. R., & Pitt, M. (2009). Determining a conceptual framework for green FM intellectual capital. Journal of Facilities Management, 7(4), 267–282.

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Barney, J. (1995). Looking inside for competitive advantage. Academy of Management Executive, 9(4), 49–61.

Barney, J. (1999). How a firm's capabilities affect boundary decisions. Sloan Management Review, 40(3), 137–146.

Beddewela, E., & Fairbass, J. (2016). Seeking legitimacy through CSR: institutional pressures and corporate response of multinationals in Sri Lanka. Journal of Business Ethics, 136(3), 503–522.

Belkaoui, A. R. (2003). Intellectual capital and firm performance of US multinational firms: a study of the resource-based and stakeholder views. Journal of Intellectual Capital, 4(2), 215–226.

Berzkalne, I., & Zelgalve, E. (2014). Intellectual capital and company value. Procedia-Social and Behavioural Sciences, 110, 887–896.

Boiral, O. (2002). Tacit knowledge and environmental management. Long Range Planning, 35(3), 291–317.

Bontis, N. (1998). Intellectual capital: an exploratory study that develops measures and models. Management Decision, 36(2), 63–76.

Bontis, N., Keow, W. C. C., & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1), 85–100.

Branco, M. C., & Rodrigues, L. L. (2006). Corporate social responsibility and resource-based perspectives. Journal of Business Ethics, 69, 111–132.

Carriga, E., & Mele, D. (2004). Corporate social responsibility theories: mapping the territory. Journal of Business Ethics, 53(1/2), 51–71.

Carrillo-Hermosilla, J., del Rio, P., & Konnola, T. (2010). Diversity of eco-innovations: reflections form selected case studies. Journal of Cleaner Production, 18, 1073–1083.

Carroll, A. B. (1999). Corporate social responsibility: evaluation of definitional construct. Business & Society, 38(3), 268–295.

Chang, C.-H., & Chen, Y.-S. (2012). The determinants of green intellectual capital. Management Decision, 50(1), 74–94.

Chen, Y.-S. (2008a). The positive effect of green intellectual capital on competitive advantages of firms. Journal of Business Ethics, 77, 271–286.

Chen, Y.-S. (2008b). The driver of green innovation and green image—green core competence. Journal of Business Ethics, 81(3), 531–543.

Chen, J., Zhu, Z., & Xie, H. Y. (2004). Measuring intellectual capital: a new model and empirical study. Journal of Intellectual Capital, 5(1), 195–212.

Chen, M.-C., Cheng, S.-J., & Hwang, Y. (2005). An empirical investigation of the relationship between intellectual capital and firm’s market value and financial performance. Journal of Intellectual Capital, 6(2), 159–176.

Chuang, S. H. (2004). A resource-based perspective on knowledge management capability and competitive advantage: an empirical investigation. Expert Systems with Applications, 27, 459–465.

Clark, C. E. (2000). Difference between public relations and corporate social responsibility: an analysis. Public Relations Review, 26(3), 363–380.

Claver-Cortes, E., Lopez-Gamero, M. D., Molina-Azorin, J. F., & Zaragoza-Saez, P. D. C. (2007). Intellectual and environmental capital. Journal of Intellectual Capital, 8(1), 1781–1182.

Clemenz, G. (2010). Eco-labeling and horizontal product differentiation. Environmental and Resource Economics, 45, 481–497.

Colbert, B. A. (2004). The complex resource-based view: implications theory and practice in strategic human resource management. Academy of Management Review, 29(3), 341–358.

Cordazzo, M. (2005). IC statement vs environmental and social reports. Journal of Intellectual Capital, 6(3), 441–464.

Dahlsrud, A. (2008). How corporate social responsibility is defined an analysis of 37 definitions. Corporate Social Responsibility and Environmental Management, 15, 1–13.

Daily, B. F., & Huang, S.-C. (2001). Achieving sustainability through attention to human resource factors in environmental management. International Journal of Operations & Production Management, 21(12), 1539–1552.

Dangelico, R. M., & Pujari, D. (2010). Mainstreaming green product innovation: why and how companies integrate environmental sustainability. Journal of Business Ethics, 95, 471–486.

Dawkins, J., & Lewis, S. (2003). CSR in stakeholder expectations: and their implication for company strategy. Journal of Business Ethics, 44(2), 185–193.

Diakoulakis, I. E., Georgopoulos, N. B., Koulouriotis, D. E., & Emiris, D. M. (2004). Towards a holistic knowledge management model. Journal of Knowledge Management, 8(1), 32–46.

Edvinsson, L., & Sullivan, P. (1996). Developing a model for managing intellectual capital. European Management Journal, 14(4), 356–364.

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: what are they? Strategic Management, 21, 1105–1127.

Epstein, M., & Roy, M.-J. (1998). Managing corporate environmental performance: a multinational perspective. European Management Journal, 16(3), 284–296.

Fenwick, T., & Bierema, L. (2008). Corporate social responsibility: issues for human resource development professionals. International Journal of Training and Development, 12(1), 24–35.

Freedman, M., & Jaggi, B. (1982). Pollution disclosures, pollution performance, and economic performance. Omega, 10(2), 167–176.

Garavan, T. N., & McGuire, D. (2010). Human resource development and society: human resource development’s role in embedding corporate social responsibility, sustainability and ethic in organizations. Advances in Developing Human Resources, 12(5), 487–507.

Gardberg, N. A., & Fombrun, C. J. (2006). Corporate citizenship: creating intangible assets across institutional environments. Academy of Management Review, 31(2), 329–346.

Gold, A. H., Malhotra, A., & Segars, H. (2001). Knowledge management: an organizational capabilities perspective. Journal of Management Information Systems, 18(1), 185–214.

Gond, J.-P., Igalens, J., Swaen, C., & El Akremi, A. (2011). The human resources contribution to responsible leadership: an exploration of the CSR-HR interface. Journal of Business Ethics, 98, 115–132.

Grant, R. M. (1996a). Prospering in dynamically—competitive environments: organizational capability as knowledge integration. Organization Science, 7(4), 375–387.

Grant, R. M. (1996b). Toward a knowledge-based theory of the firm. Strategic Management Journal, 17, 109–122.

Guadamilas-Gomez, F., & Donate-Manzanares, M. J. (2011). Ethics and corporate social responsibility integrated into knowledge management and innovation technology. Journal of Management Development, 30(6), 569–581.

Guthrie, J., Cuganesan, S., & Ward, L. (2007). Extended performance reporting: evaluating corporate social responsibility and intellectual capital management. Issues in Social and Environmental Accounting, 1(1), 1–25.

Hart, S. L. (1995). A natural-resource-based view of the firm. The Academy of Management Review, 20(4), 986–1014.

Hart, S. L., & Milstein, M. B. (2003). Creating sustainable value. Academy of Management Executive, 17(2), 56–67.

Hoskisson, R. E., Hitt, M. A., & Yiu, D. (1999). Theory and research in strategic management: swings of a pendulum. Journal of Management, 25(3), 417–456.

Hussi, T. (2004). Reconfiguring knowledge management—combining intellectual capital, intangible assets and knowledge creation. Journal of Knowledge Management, 8(2), 36–52.

Husted, B. W., & de Jesus Salazar, J. (2006). Taking Friedman seriously: maximizing profits and social performance. Journal of Management Studies, 43(1), 75–91.

Jabbour, C. J. C., & Santos, C. J. C. (2008). Relationship between human resource dimensions and environmental management in companies: proposal model. Journal of Cleaner Production, 16(1), 51–58.

Johnson, W. H. A. (1999). An integrative taxonomy of intellectual capital: measuring the stock and flow of intellectual capital components in the firm. International Journal of Technology Management, 18(5–8), 591–603.

Kamukama, N., Ahaiauzu, A., & Ntayi, J. M. (2011). Competitive advantage: mediator of intellectual capital and performance. Journal of Intellectual Capital, 12(1), 152–164.

Lii, Y.-S., & Lee, M. (2012). Doing right leads to doing well: when the type of CSR and reputation interact to affect consumer evaluations of the firm. Journal of Business Ethics, 105(1), 69–81.

Lopez, V. M., Garcia, A., & Rodriguez, L. (2007). Sustainable development and corporate performance: a study based on the Dow Jones Sustainability Index. Journal of Business Ethics, 75(3), 285–300.

Lopez-Gamero, M. D., Molina-Aeorin, J. F., & Claver-Cortes, E. (2009). The whole relationship between environmental variables and firm performance: competitive advantage and firm resources as mediator variables. Journal of Environmental Management, 90, 3110–3121.

Lozano, R., Carpenter, A., & Huisingh, D. (2015). A review of ‘theories of the firm’ and their contributions to corporate sustainability. Journal of Cleaner Production, 106, 430–442.

Maditinos, D., Chatzoudes, D., Tsairidis, C., & Theriou, G. (2011). The impact of intellectual capital on firms’ market value and financial performance. Journal of Intellectual Capital, 12(1), 132–151.

Malovics, G., Csigene, N. N., & Kraus, S. (2008). The role of corporate social responsibility in strong sustainability. The Journal of Socio-Economics, 37, 907–918.

Mar, B., Schiuma, G., & Neely, A. (2004). Intellectual capital—defining key performance indicators for organizational knowledge assets. Business Process Management Journal, 10(5), 551–569.

Marti, J. M. V. (2001). ICBS—intellectual capital benchmarking system. Journal of Intellectual Capital, 2(2), 148–165.

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: a theory of the firm perspective. Academy of Management Review, 26(1), 117–127.

McWilliams, A., & Siegel D. S. (2010). Creating and capturing value: strategic corporate social responsibility, resource-based theory and sustainable competitive advantage. Journal of Management, in press.

McWilliams, A., & Siegel, D. S. (2011). Creating and capturing value: strategic corporate social responsibility, resource-based theory, and sustainable competitive advantage. Journal of Management, 37(5), 1480–1495.

Meso, P., & Smith, R. (2000). A resource-based view of organizational knowledge management systems. Journal of Knowledge Management, 4(3), 224–234.

Murillo-Luna, J., Garces-Ayerbe, C., & andd Rivera-Torres P. (2011). Barriers to the adoption of proactive environmental strategies. Journal of Cleaner Production, 19(13), 1417–1425.

Nahapiet, J., & Ghoshal, S. (1998). Social capital, intellectual capital and the organizational advantage. The Academy of Management Review, 23(2), 242–266.

Ndlela, L. T., & du Toit, A. S. A. (2001). Establishing a knowledge management programme for competitive advantage in an enterprise. International Journal of Information Management, 21, 151–165.

Nikolaou, E. I., & Evangelinos, K. I. (2008). The opportunities for a general definition of corporate sustainability. International Journal of Green Economics, 2(4), 392–410.

Nonaka, I. (1994). A dynamic theory of organizational knowledge creation. Organization Science, 5, 14–37.

Nonaka, I., Toyama, R., & Konno, N. (2000a). SECI, Ba and leadership: a unified model of dynamic knowledge creation. Long Range Planning, 33, 5–34.

Nonaka, I., Toyama, R., & Nagata, A. (2000b). A firm as a knowledge-creating entity: a new perspective on the theory of the firm. Industrial and Corporate Change, 9(1), 1–19.

O’Riordan, L., & Fairbrass, J. (2008). Corporate social responsibility (CSR): models and theories in stakeholder dialogue. Journal of Business Ethics, 83, 745–758.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: a meta-analysis. Organization Studies, 24(3), 403–441.

Pedrini, M. (2007). Human capital convergences in intellectual capital and sustainability reports. Journal of Intellectual Capital, 8(2), 346–366.

Petty, R., & Guthrie, J. (2000). Intellectual capital literature review. Journal of Intellectual Capital, 1(2), 155–176.

Polanyi, M. (1967). The tacit dimension. London: Routledge and Kegan Paul.

Polo, F. C., & Vázquez, D. G. (2008). Social information within the intellectual capital report. Journal of International Management, 14, 353–363.

Preston, L. E., & O’Bannon, D. P. (1997). Research note: The corporate social-financial performance relationship: a typology and analysis. Business & Society, 36(4), 419–429.

Preuss, L., & Co’rdoba-Pachon, J.-R. (2009). A knowledge management perspective of corporate social responsibility. Corporate Governance, 9(4), 517–527.

Reed, K. K., Lubatkin, M., & Srinivasn, N. (2006). Proposing and testing an intellectual capital-based view of the firm. Journal of Management Studies, 43(4), 867–891.

Reinhardt, F. L. (1998). Environmental product differentiation: implications for corporate strategy. California Management Review, 40(4), 43–73.

Reinhardt, F. L., Stavins, R. N., & Vietor, R. H. K. (2008). Corporate social responsibility through an economic lens. Review of Environmental Economics and Policy, 2(2), 219–239.

Rennings, K. (2000). Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecological Economics, 32, 319–332.

Rexhepi, G., Kurtishi, S., & Bexheti, G. (2013). Corporate social responsibility (CSR) and innovation—the drivers of business growth? Procedia-Social and Behavioral Sciences, 75, 532–541.

Roman, R. M., Hayibor, S., & Agle, B. R. (1999). The relationship between social and financial performance. Business and Society, 38(1), 109–125.

Russo, M. V., & Fouts, P. A. (1997). A resource-based perspective on corporate environmental performance and profitability. Academy of Management Journal, 40(3), 534–559.

Ruta, C. D. (2009). HR portal alignment for the creation and development of intellectual capital. International Journal of Human Resource Management, 20(3), 562–577.

Saeidi, S. P., Sofian, S., Saeidi, P., Saeidi, S. P., & Saaeidi, S. A. (2015). How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of Business Research, 68, 341–350.

Shonnard, D. R., Kicherer, A., & Saling, P. (2003). Industrial application using BASF eco-efficiency analysis: perspectives on green engineering principles. Environmental Science and Technology, 37(23), 5340–5348.

Siltaoja, M. E. (2014). Revising the corporate social performance model—towards knowledge creation for sustainable. Business Strategy and the Environment, 23, 289–302.

Sirsly, C.-A. T., & Lvina, D. S. (2016). From doing good to looking even better: the dynamic of CSR and reputation. Business & Society, 1–33.

Spitzeck, H., & Hansen, E.G., (2010). Stakeholder governance: how stakeholders influence corporate decision making, Corporate Governance: The International Journal of Business in Society, 10(4), 378-391.

Stanwick, P. A., & Stanwick, S. D. (1998). The relationship between corporate social performance, and organizational size, financial performance, and environmental performance: an empirical examination. Journal of Business Ethics, 17, 195–204.

Stubbs, W. (2008). Conceptualizing a “sustainability business model”. Organization & Environment, 21(2), 103–127.

Surroca, J., Tribo, J. A., & Waddock, S. (2010). Corporate responsibility and financial performance: the role of intangible resources. Strategic Management Journal, 31(5), 463–490.

Sveiby, K.-E. (2001). A knowledge-based theory of the firm to guide in strategy formulation. Journal of Intellectual Capital, 2(4), 344–358.

Teece, D. J. (2000). Strategies for managing knowledge assets: the role of firm structure and industrial context. Long Range Planning, 33, 35–54.

Van Marrewijk, M. (2003). Concepts and definitions of CSR and corporate sustainability: between agency and communication. Journal of Business Ethics, 49, 95–105.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance-financial performance link. Strategic Management Journal, 18(4), 303–3319.

Wagner, M. (2005). How to reconcile environmental and economic performance to improve corporate sustainability: corporate environmental strategies in the European paper industry. Journal of Environmental Management, 76(2), 105–118.

Wagner, M. (2009). Innovation and competitive advantages from the integration of strategic aspects with social and environmental management in European firms. Business Strategy and the Environment, 18, 291–306.

Wagner, M. (2013). ‘Green’ human resource benefits: do they matter the determinants of environmental management implementation? Journal of Business Ethics, 114(3), 443–456.

Wagner, M., & Shaltegger, S. (2004). The effect of corporate environmental strategy choice and environmental performance on competitiveness and economic performance: an empirical study of EU manufacturing. European Management Journal, 22(5), 557–572.

Wasiluk, K. L. (2013). Beyond eco-efficiency: understanding CS through the IC practice lens. Journal of Intellectual Capital, 14(1), 102–126.

Weber, M. (2008). The business case for corporate social responsibility: a company-level measurement approach for CSR. European Management Journal, 26, 247–261.

Wood, D. J. (1991). Corporate social performance revisited. Academy of Management Review, 16(4), 691–718.

Yang, X., & Rivers, C. (2009). Antecedents of CSR practices in MNC’s subsidiaries: a stakeholder and institutional perspectives. Journal of Business Ethics, 86, 155–169.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nikolaou, I.E. A Framework to Explicate the Relationship Between CSER and Financial Performance: an Intellectual Capital-Based Approach and Knowledge-Based View of Firm. J Knowl Econ 10, 1427–1446 (2019). https://doi.org/10.1007/s13132-017-0491-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-017-0491-z