Abstract

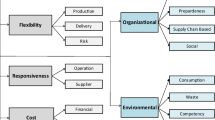

Since the financial crisis of 2008, financial resiliency has gradually become a crucial tools employed by supply chains worldwide to resist external risks and shocks. Risks and shocks sometimes creating a turbulent environment can vary in intensity and frequency and may be attributed to a system's internal or external factors. Resilience is defined as the capacity to withstand risks that are more significant, rapid recovery after risks, and reduced degradation by virtue of a certain number of hazards. Financial resiliency focuses on how an organization efficiently deploys the remaining financial resources and invests in maintenance and reconstruction strategies to accelerate the recovery process. This study aims to identify and classify the criteria for measuring supply chain financial resilience using the hybrid Fuzzy Delphi Method (FDM) and intuitive fuzzy DEMATEL technique with interval values (IVIF-DEMATEL). For this purpose, by reviewing the literature, 29 criteria of supply chain financial resiliency were identified, and after screening by FDM, 12 criteria were finalized. In the next step, the desired criteria were classified into two category, and the importance of each was determined.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Today's supply chain is subject to a diverse and changing environment, threatening them with shocks, risks and natural hazards. Threats sometimes creating a turbulent environment can vary in intensity and frequency and may be attributed to a system's internal or external factors [46]. Many factor have made organizations more vulnerable such as increasing complexity of transactions between supply chain partners, fierce competition, bargaining power of customers, dependence on suppliers, the constant demand for innovation, changes in regulatory conditions, new expectations of society and customers and changes in rules and regulations [3]. Natural disasters, terrorist attacks, recessions, and international economic sanctions are among the threats that could further jeopardize the organization's survival (S. [35, 65]. Therefore, in today age where changing and uncertainty play an important part, continuing the organization's life at the time of a hazard strike requires rapid recovery, getting back to the initial state, and learning from experience. The ability of an organization to mitigate vulnerability of threats, the ability to change itself and adapt to changes in the surrounding environment, and the ability to recover when a disaster strikes in the shortest time as possible are essential prerequisites referred in the literature as organizational resilience [23]. A resilient supply chain is ready to deal with shocks, hazards and risks and retain its performance under challenging conditions. Resiliency empower the supply chain to quickly return to their initial state after experiencing shocks [10, 11]. In addition, resiliency by increasing the capacity and capability of supply chain, can gain competitive advantage over time [55].

Financial resiliency refers to the ability of a supply chain to acquire financial resources in a timely manner in order to prevent or take advantage of uncertain events and seize valuable investment opportunities. The typical reasons for enterprises to reserve financial resiliency are to minimize the negative impacts of environmental uncertainty and financing constraints on enterprise survival and success [64]. However, an organization's ability to respond to various disorders depends on the organization's goals and maturity level in facing a risk [5]. Still, when an organization faces shocks and those affecting its financial crisis, organizational resilience is interpreted as financial resilience [31, 37]. As mentioned, financial resiliency focuses on how a supply chain efficiently deploys the remaining financial resources and invests in maintenance and reconstruction to accelerate recovery.

In the process of supply chain development, enterprises often face problems such as legality, information asymmetry, and difficulty in obtaining external resources, which will lead to severe environmental uncertainty and financing constraints. Therefore, enterprises need to reserve certain financial resiliency to prevent potential threats to their development and at the same time to improve their legitimacy and establishing competitive advantages. Therefore, how to obtain financial resiliency is one of the most important issues for supply chains. DeAngelo [19] provides the first research to systematically explain how corporations obtain financial resiliency, and to propose that the acquisition of financial resiliency should be examined and analyzed from three aspects: cash resiliency, debt resiliency, and equity resiliency. So far, research on financial resiliency has mainly focused on three aspects: the definition of financial resiliency [14, 21, 48], the impact of financial resiliency on corporate investment and financing [2], and the impact of financial resiliency on corporate performance or valuation [26, 30, 53].

For all organizations, financial resilience has become a necessity to maintain survival in today's unstable environment. Regarding the evaluation of supply chain financial resilience, the results in the literature have been inconsistent. Although the existing literature on organizational resilience has taken a prescriptive and normative position and emphasizes the need for further empirical research as well as the development of resilience measurement framework. In addition, few studies have specifically focused on the measurement criteria of supply chain financial resilience. In other words, it is worth mentioning that there is a gap in the existing literature on providing an approach to measure financial resilience. Hence, in this paper, we fill this important research gap. Therefore, this study aims to provide an approach to analyze the measuring criteria of supply chain financial resilience. The research questions as follows:

-

RQ1 What are the measurement criteria of supply chain financial resilience?

-

RQ2 How are the importance and effectiveness of the financial resilience measurement criteria of supply chain?

The remainder of this paper is structured as follows. Section 2 includes a summary of the literature on organizational resiliency, financial resiliency and financial resiliency measurement criteria. Section 3 discusses the research methods. The measurement criteria of supply chain financial resilience are modeled using multi criteria decision making (MCDM) techniques in Sect. 4. The results, managerial consequences, and limitations of the analysis are presented in Sect. 5.

2 Literature review

Regarding the organizational resilience concept, researchers have offered many definitions, but despite the common elements, there are some discrepancies between them. After reviewing the definitions provided by previous researchers, it can be concluded that there are three main streams in conceptualizing organizational resilience: (1) resilience as a characteristic of the organization, (2) resilience as a result of the organization's activities and (3) resilience as a measure of the turmoil that an organization can withstand. They all have nearly the same meaning, emphasizing an organization's survival when facing shocks, risks, or changes [57]. Some researchers consider resilience as a necessity for organizations when coming across obstacles [13, 32]. Other researchers have defined organizational resilience as a function of specific capabilities or abilities [22, 23, 46] identified flexibility, adaptability, agility, and efficiency as the components of organizational resilience [23]. These capabilities are based on coping with changes, shocks, or environmental risks [45]. Defining resilience as a function of these characteristics indicates that resilience is a complex concept. Instead of defining it by focusing on what a resilient organization has, other researchers define resilience by highlighting what a resilient organization does. As an illustration, resilience is defined as "maintaining positive adjustments under challenging circumstances as the organization emerges stronger and more empowered" [66]. A resilient organization can return to its performance level after the disruption [58].

In addition, organization management literature has underlined the importance of organizational members to organizational resilience during crisis situations. Some researcher insisted that organizational members or employees must learn how to be resilient because they can then quickly design and implement positive adaptive behaviors that match the crisis. In the same vein, individual (i.e., organizational member) resilience within an organization can contribute to its organizational resilience, through the individual’s ability to employ emotions and to help the company quickly engage in creative and positive crisis communication [67]. Moreover, as internal publics [13], employees can have a “vested interest” in organizations’ crisis recovery by providing a recovery spotlight, unlike external publics and media. Furthermore, the vast majority of studies have indicated that resilience is most likely when employees have the relevant and specific knowledge necessary to make a decision and resolve a problem [36].

Financial resilience is defined as "the ability to access and attract accessible internal and external resources supporting financial constraints" [49]. An organization with financial resilience can cope with external financial shocks and subsequent recovery. Organizations can increase their financial resilience by using maneuverability and risk awareness, and they can respond effectively to these risks [57].

The financial resilience of supply chain reserves stems from environmental uncertainty and financing constraints. Environmental uncertainty requires enterprises to reserve financial resilience, to maintain the ability to minimize environmental threats, and to quickly mobilize funds to seize investment opportunities when they come. Financing constraints also require enterprises to reserve financial resilience to cope with financing bottlenecks caused by higher external financing costs than internal financing costs, and to provide certain financial resource guarantees to realize prevention and utilization capabilities [3]. The Modigliani–Miller theorem posits that the value of a firm is unaffected by how that firm is financed, assuming that the capital market is frictionless [14]. Regarding performance metrics, it is significant for supply chains to conduct financial resilience evaluation to facilitate the understanding of risk exposure in supply chains and to evaluate resilience and risk mitigation strategies [61]. Researchers have investigated the measurement of financial resilience by evaluating, for example, density [59], stock level [15], service level, lead time and costs [15]. However, studies on financial resilience measurement criteria remain scarce [17, 38, 62], as only a few research have discussed financial resilience measurement. Without understanding the level of financial resilience of a system, it would be difficult to assess the response and reaction of the supply chain during financial disruptions. According to [52], the potential of financial resilience measurements is stated as a valuable research stream that can offer essential knowledge of financial resilience and its outcomes.

Significant positive relationships exist among supply chain management capabilities, and business performance has been expounded in many extant studies [17, 52]. Capabilities are essential in the establishment of financial resilience and therefore improve the performance of supply chain when facing disruptive events [50]; at the same time, appropriate performance metrics are necessary for evaluating financial resilience performance to achieve further improvement. A systematic literature review by Hohenstein et al. [33] analyzed eight studies on financial resilience measurement and proposed a way to measure financial resilience through readiness, responsiveness and recovery. [52] developed a framework of measuring logistical capabilities based on pre- and post-disruption aspects. Chowdhury and Quaddus [17] extended the measurement to readiness, response and recovery capabilities specifically. It could be seen that financial resilience performance could be measured through specific capabilities [29].

Extant literature reviews have mainly focused on three perspectives. First is the analysis of financial resilience definition and identification of capabilities e.g. (A. [6, 33, 38, 40]. The second is the review on the evolution of financial resilience research and identification of future directions e.g. [7, 51]. The other perspective is the review of research methods, such as quantitative modelling methods applied in analyzing financial resilience e.g. [35, 54].There is a wide theoretical literature on what makes supply chain operate in the way that they do [24] Provide a survey of how these models of management have been used to analyze financial vulnerability, distress and survival. However, there is a substantial identification problem: the same findings (for example that supply chain facing financial risk appear to stay in operation) can be consistent with many different theories. Hence, the literature review indicated that no research has examined and evaluated the criteria of supply chain financial resilience so far. In general, this research's innovations are divided into three categories pertinent to the proposed hybrid approach are listed as follows:

-

(1)

Trying to determine the degree of relations' interaction with numerical points. It also utilizes a new multi-criteria decision-making method named Decision-Making Trial and Evaluation Laboratory (DEMATEL) with interval values intuitive fuzzy number (IVIF). Another superior feature of this decision-making method is that each element can affect all of its higher and lower levels.

-

(2)

Extraction of financial resilience measurement criteria, because in previous work, researchers had mentioned a small number of these indicators in their model.

-

(3)

Combining the methods used for the first time in a research project considers the advantages of each in different decision-making stages.

Moreover, according to the literature, a comprehensive investigate in financial resilience criteria of supply chain with a managerial approach has not been conducted. The criteria were obtained from literature described in Table 1.

3 Research methodology

The present study is an exploratory-descriptive study in terms of nature. The experts of this research consist of 10 persons with these specifications: powerful background and experience in the supply chain (at least 15 years), At least an M.A. or PhD degree, fully familiar with the financial resilience supply chain, and finally interested in participating in this research. The snowball method was used to select the experts. This number of samples is quite suitable for achieving the goal of the research and is even more than some similar researches done by using the IVIF-DEMATEL such as [1, 39, 43, 44], 68. Figure 1 illustrates the steps of conducting research.

3.1 Fuzzy Delphi method

The Fuzzy Delphi method (FDM) contains some steps that must be followed for expert approval. In addition, the FDM by applying Binary Terms rating ranges from 0 to 1, making this method faster and reducing the laps from Delphi's method. This method can reduce the number of rounds of surveys and experts can fully express their opinions, ensure perfection and provide consistent opinions. The FDM does not misinterpret the original opinion of the expert and illustrates their real reaction. Therefore, in this research, FDM was used to screen and identify the appropriate financial resilience criteria in the supply chain.

This technique’s implementation steps are as follows [28].

-

Step Identifying the research attributes.

In this step, based on the literature, the identified financial resilience criteria are illustrated in Table 1.

-

Step 2 Collect expert opinions using decision group.

After identifying criteria, n experts invited to determine the relation score of the identified attributes to the research problem through a questionnaire using linguistic variables presented in Table 2. This study uses fuzzy triangular numbers and a geometric mean model for evaluating the criteria and determining the experts’ group decisions.

Table 2 Linguistic scales -

Step 3 Identification of the most related criteria.

The final step in this method is identifying the most related criteria, which is done by comparing the score of each attribute with the threshold \(\tilde{S}\). The value of \(\tilde{S}\) is calculated by the average of all attributes scores. In this regard, we should set up the fuzzy triangular numbers (TFNs) \({\uptau }\). for each attribute as defined in (1).

$$\widetilde{{a_{ij} }} = \left( {a_{ij} ,b_{ij} ,c_{ij} } \right){\text{ for }}i = 1, \ldots ,n,{ }j = 1, \ldots ,m$$(1)$$\widetilde{{\tau_{j} }} = \left( {a_{j} ,b_{j} ,c_{j} } \right)$$(2)$$a_{j} = \min \left\{ {a_{ij} } \right\}$$(3)$$b_{j} = \left( {\mathop \prod \limits_{i = 1}^{n} b_{ij} } \right)^{\frac{1}{n}}$$(4)$$c_{j} = max\left\{ {c_{ij} } \right\}$$(5)where in this equations index, \(I\) referred to expert and index \(j\) referred to attribute. \(\widetilde{{a_{ij} }}\) Referred to the fuzzy value of each attribute obtained from each expert and \(\widetilde{{\tau_{j} }}\) referred to the fuzzy average value of each attribute.

Also, this fuzzy average value of each attribute defuzzified as follows:

After calculating mentioned values, if the crisp value of \(\widetilde{{\tau_{j} }} \ge \tilde{S}\) then attribute j is selected, and if the crisp value of \(\widetilde{{\tau_{j} }} < \tilde{S}, {\text{then attribute j}}\) is rejected.

3.2 IVIF-DEMATEL

The DEMATEL technique was first used at the BMI Institute in Switzerland in 1972 in a Geneva Research Center project [9]. DEMATEL methodology aims to calculate which criteria are more important in decision-making process. The biggest advantage of this model is generating impact relation map. Owing to this issue, the causality relationship between the items can be found Linguistic information is used in fuzzy sets with the aim of minimizing this problem in decision-making. However, making exact evaluation is sometimes very difficult in this process. For this situation, the results of linguistic evaluation are provided intuitive fuzzy number. Intuitive fuzzy steps with interval values are as follows:

-

Step 1 Collect phrases or verbal data from the new range of preferences. According to the number of experts and based on the verbal expressions of Table 3, the experts were asked to determine the effect of each factor on the other using the IVIF set.

Table 3 Preference criteria in IVIF-DEMATEL [1] -

Step 2 Calculate each decision maker's weight: Each decision-makers weight is calculated using Table 4 and Eq. 7.

$$E\left( A \right) = \frac{1}{n}\mathop \sum \limits_{i = 1}^{n} \left[ {\frac{{2 - \left| {{\upmu }_{i}^{{\text{L}}} \left( x \right) - {\upnu }_{i}^{{\text{L}}} \left( x \right)} \right| - \left| {{\upmu }_{i}^{{\text{U}}} \left( x \right) - {\upnu }_{i}^{{\text{U}}} \left( x \right)} \right| + {\uppi }_{{\text{i}}}^{{\text{L}}} \left( x \right) + {\uppi }_{{\text{i}}}^{{\text{U}}} \left( x \right)}}{{2 + \left| {{\upmu }_{i}^{{\text{L}}} \left( x \right) - {\upnu }_{i}^{{\text{L}}} \left( x \right)} \right| + \left| {{\upmu }_{i}^{{\text{U}}} \left( x \right) - {\upnu }_{i}^{{\text{U}}} \left( x \right)} \right| + {\uppi }_{{\text{i}}}^{{\text{L}}} \left( x \right) + {\uppi }_{{\text{i}}}^{{\text{U}}} \left( x \right)}}} \right]$$(7)Table 4 Preference criteria for calculating the weight of decision-makers [1] -

Step 3 Consolidate the decision-makers 'preferences: Using Eq. 8, we combine the decision-makers' preferences to arrive at a final IVIF expression.

$$\left( {\left[ {1 - \mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {1 - {\upmu }_{{\text{j}}}^{{\text{L}}} } \right)^{{{\uplambda }_{{\text{j}}} }} ,1 - \mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {1 - {\upmu }_{{\text{j}}}^{{\text{U}}} } \right)^{{{\uplambda }_{{\text{j}}} }} } \right],\left[ {\mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {{\upnu }_{{\text{j}}}^{{\text{L}}} } \right)^{{{\uplambda }_{{\text{j}}} }} ,\mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {{\upnu }_{{\text{j}}}^{{\text{U}}} } \right)^{{{\uplambda }_{{\text{j}}} }} } \right]} \right)$$(8)$$\left( {\left[ {\mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {1 - {\upmu }_{{\text{j}}}^{{\text{U}}} } \right)^{{{\uplambda }_{{\text{j}}} }} - \mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {{\upnu }_{{\text{j}}}^{{\text{U}}} } \right)^{{{\uplambda }_{{\text{j}}} }} ,\mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {1 - {\upmu }_{{\text{j}}}^{{\text{L}}} } \right)^{{{\uplambda }_{{\text{j}}} }} - \mathop \prod \limits_{{{\text{j}} = 1}}^{{\text{n}}} \left( {{\upnu }_{{\text{j}}}^{{\text{L}}} } \right)^{{{\uplambda }_{{\text{j}}} }} } \right]} \right)$$ -

Step 4 We also calculate the initial direct relations/matrix's definite values using the IVIF entropy calculator given in Eq. 7. The initial direct matrix, which is calculated by the intuitive fuzzy method with values of intervals, is the first step of the DEMATEL method, which is performed according to [1].

4 Findings

This section focuses on the evaluation for financial resilience criteria of supply chain. In this study, it is aimed to find the important criteria in the effectiveness of the supply chain. For this purpose, IVIF-DEMATEL is considered. In the literature, there are many approaches, which aim to weight the criteria, such as analytic hierarchy process (AHP) and analytic network process (ANP). The main reason of selecting DEMATEL technique is that it can create impact relation map for the criteria [60]. This situation provides an opportunity to make causality analysis for these factors [39, 56].

The main benefit of hesitant fuzzy sets is accepting similar opinions as common decisions (B. [34]. This issue is quite beneficial when not all decision makers have the same opinion (W. [69]. Moreover, intuitive fuzzy number provide more accurate fuzzification in the evaluation process [27]. Additionally, this proposed model includes a hybrid MCDM methodology. In other words, two different MCDM techniques are considered in both screening and weighting the criteria. When the model is not hybrid, only one MCDM method is used with the aim of ranking the alternatives [4]. Hence, it is obvious that considering hybrid model provides more appropriate results because of making objective evaluations [25].

In order to confirm the indicators of financial resilience, 29 criteria obtained from the literature (Table 1) were placed in the FDM questionnaire. Afterward, the linguistic variables were converted into fuzzy triangular numbers, and then, the average of the experts' opinions in the first stage was calculated. In the next step, the experts' average opinions were defuzzified. Then the difference between the crisp value of each expert and the aggregate defuzzy value of the expert was calculated. This is because there was no consensus between the experts' opinions. The average value of the opinions was more than (0.2), i.e., the threshold. Afterward, the FDM continued in the second stage to reach a consensus. In the second stage, in order to check the agreement between the experts, the questionnaire of the first stage was resent to the panel members after making the necessary changes along with the defuzzy value of the average opinions of the experts and the opinion of each expert. They were also asked to review the answers and reconsider their opinions and judgments if necessary. After the initial feedback was given to the experts and the second stage of FDM took place, the experts' corrected opinions were obtained. Besides, in the second stage, the experts' average opinions were calculated. In addition, at this stage, the average of the opinions was defuzzified. Then, the difference between the defuzzy value of each expert's and the average defuzzy value was calculated. After calculating the difference between the defuzzy values of the experts' opinions in the two stages, a consensus has been reached because the opinion difference of the experts between the two stages was less than the threshold. Thereby, the FDM process was stopped, and the results were presented in Table 5. According to the [28], the threshold in the study is 0.7.

At this stage, financial resilience criteria were classified using an IVIF-DEMATEL technique. According to the experts, the experts determined each criteria effect on another. In the next step, each expert's weight was calculated using the mentioned preferences in the IVIF-DEMATEL, the results of which are given in Table 6.

The decision makers' preferences were aggregated and obtained as a final IVIF expression in the next step. In the following step, each cell's definite value of the initial direct relation matrix was calculated using the IVIF entropy calculator, as shown in Table 7.

After normalizing the initial direct relation matrix, the total relation matrix (T) was calculated. This matrix represents the direct and indirect effects of the matrix elements on each other, as shown in Table 8.

After calculating the total relation matrix, the importance and effectiveness of each criterion were determined, which can be seen in Fig. 2.

In order to determine the network relations map, the threshold must be calculated. In this study, the T-matrix's average values have been calculated to determine the value of the threshold in the IVIF-DEMATEL. The calculated threshold value is 0.1783. The partial relationships can be omitted, and a network of significant relationships can be drawn this way. According to Table 9 and Fig. 3, merely the relationships whose values in the T matrix are greater than or equal to the threshold value are shown in the network relationship map. All the matrix T values that are smaller than the threshold are zero (i.e., they are not considered in causal relations).

5 Conclusions

Supply chains are often affected by financing and environmental uncertainty, so they need to actively fulfill their performance. Previous studies focused on the impact of financing capacity from the perspectives of environmental uncertainty, financing costs, and corporate performance. Our work researches the measurement criteria on financial resilience from the perspective of resiliency. The financial sector's importance further highlights the need to pay attention to the stability of this sector confronted with various shocks. Although financial resilience has been considered in the literature, general measurement criteria for measuring it have not been defined and presented. Given Iran's financial structure and the severe impact of various shocks in the domestic sector, financial resilience was defined as the difference between resilience and vulnerability (with respect to the analysis stating that an increase in the level of vulnerability reduces the strength of financial resistance to various shocks).

For this purpose, a review of the literature was conducted, and 29 criteria were identified for criteria of financial resilience in supply chain. Afterward, the FDM was used, and 10 experts were asked to determine how much each of the 29 criteria affects finances resiliency. After calculating the difference between the defuzzy values of the experts' opinions in the two stages of the FDM, a consensus was reached because the difference of opinion between the experts in the two stages of the survey was less than the threshold. Therefore, the survey process was stopped. Finally, 12 criteria of financial resilience were selected. Thus, the first goal of the research was achieved. In order to achieve the second goal, the IVIF-DEMATEL was used. Another advantage of this method, in addition to structuralism, which determines the compliance of the criteria, is that it measures the effects of each criterion and determines the importance by identifying cause and effect diagram. The criteria, including visibility, risk awareness, technological capability, risk management culture, redundancy, and demand management, were identified as the influential indicators (cause), among which visibility is the most influential. Besides, indicators of flexibility, speed, research, development, financial strength, adaptability, and trust were identified as influential (disabled) indicators, among which flexibility is the most influential. In this method, the numerical value and position of each criterion in terms of importance are specified as follows: (R11 < R6 < R1 < R7 < R5 < R3 < R12 < R9 < R8 < R4 < R10 < R2).

5.1 Managerial implications

The results of the study clearly emphasize the importance of the redundancy (as the most crucial index) and visibility (as the most effective compared to other indicators) in financial resilience. Accordingly, it is suggested that organizations use these criteria as a serious factor of achieving to financial resilience, consider self-financing, and increase the likelihood of success in managing each of the indicators by adopting appropriate organizational leadership strategies and practices and applying key capabilities.Resilience systems need to be developed, as well as resilience labor. Everything in companies must be well prepared to deal with any disruption. Thus, resiliency and return to acceptable performance are undeniable and must be considered in corporate plans. Now, in order to achieve better and more resilient results in the field of finance, supply chains can put resilient measures on their agenda, which can be mentioned as follows:

-

(1)

Establishing a financial risk management unit in the organization to delegate responsibilities related to the investigation of disorders

-

(2)

Encouraging the teamwork to achieve a culture of continuous risk management learning

-

(3)

Implementing integrated and accessible information systems to be aware of financial changes and fluctuations in order to be prepared to deal with and make the right decisions

-

(4)

Identifying financial, technological changes and trying to align programs and actions with them

Though financial economists have argued that financial resilience might be used to hurt shareholders, investor activists have campaigned to force supply chains to decrease cash holdings and increase leverage, and the private equity industry has made the reduction of financial resilience intrinsic to its business model, these results should remind us that financial resilience is also a key risk management tool. However, this tool does not come for free. Future research should help us understand better how to value the downside of financial resilience to help shareholders and managers to trade off the benefits and costs of financial resilience more effectively.

This study has potential limitations that can be addressed in future research. First, the measurement methods of financial resilience, environmental uncertainty, and financing constraints in the literature have been inconsistent. The problem of selection bias also exists in this research. In future studies, more accurate measurement methods should be sought. Secondly, although we found that financial resiliency has different substitution effects on cash flexibility and liability flexibility, it has not carried out in-depth empirical research on its mechanism of action, and further research is also the next step.

Data availability

The data that support the findings of this study are available from the corresponding author, upon reasonable request.

References

Abdullah, L., Zulkifli, N., Liao, H., Herrera-Viedma, E., Al-Barakati, A.: An interval-valued intuitionistic fuzzy DEMATEL method combined with Choquet integral for sustainable solid waste management. Eng. Appl. Artif. Intell. 82, 207–215 (2019)

Agha, M., Faff, R.: An investigation of the asymmetric link between credit re-ratings and corporate financial decisions:“Flicking the switch” with financial flexibility. J. Corp. Financ. 29, 37–57 (2014)

Ahrens, T., Ferry, L.: Financial resilience of English local government in the aftermath of COVID-19. J. Public Budget. Account. Financ. Manag. (2020). https://doi.org/10.1108/JPBAFM-07-2020-0098

Akincilar, A., Dagdeviren, M.: A hybrid multi-criteria decision making model to evaluate hotel websites. Int. J. Hosp. Manag. 36, 263–271 (2014)

Alharthy, A. A. M.: The role of knowledge creation process in enhancing organizational resilience and performance (2018)

Ali, A., Mahfouz, A., Arisha, A.: Analysing supply chain resilience: integrating the constructs in a concept mapping framework via a systematic literature review. Supply Chain Manag. Int. J. (2017). https://doi.org/10.1108/SCM-06-2016-0197/full/html

Ali, I., Gölgeci, I.: Where is supply chain resilience research heading? A systematic and co-occurrence analysis. Int. J. Phys. Distrib. Logist. Manag. (2019). https://doi.org/10.1108/IJPDLM-02-2019-0038

Annarelli, A., Nonino, F.: Strategic and operational management of organizational resilience: current state of research and future directions. Omega 62, 1–18 (2016)

Arab, A., Sahebi, I.G., Modarresi, M., Ajalli, M.: A Grey DEMATEL approach for ranking the KSFs of environmental management system implementation (ISO 14001). Calitatea 18(160), 115 (2017)

Barbera, C., Jones, M., Saliterer, I., & Steccolini, I.: European local authorities’ financial resilience in the face of austerity: a comparison across Austria, Italy and England (2014)

Boin, A., Van Eeten, M.J.G.: The resilient organization. Public Manag. Rev. 15(3), 429–445 (2013)

Briguglio, L., Cordina, G., Farrugia, N., & Vella, S.: Economic vulnerability and resilience: Concepts and measurements (Research Paper No. 2008/55). In Helsinki, Finland: The United Nations University World Institute for Development Economics Research (UNU-WIDER) (2008)

Burnard, K., Bhamra, R.: Organisational resilience: development of a conceptual framework for organisational responses. Int. J. Prod. Res. 49(18), 5581–5599 (2011)

Byoun, S.: Financial flexibility and capital structure decision. Available at SSRN 1108850 (2011)

Cabral, I., Grilo, A., Cruz-Machado, V.: A decision-making model for lean, agile, resilient and green supply chain management. Int. J. Prod. Res. 50(17), 4830–4845 (2012)

Carmeli, A., Markman, G.D.: Capture, governance, and resilience: Strategy implications from the history of Rome. Strateg. Manag. J. 32(3), 322–341 (2011)

Chowdhury, M.M.H., Quaddus, M.: Supply chain readiness, response and recovery for resilience. Supply Chain Manag. Int. J. (2016). https://doi.org/10.1108/SCM-12-2015-0463/full/html

Courtney, H., Kirkland, J., Viguerie, P.: Strategy under uncertainty. Harvard Bus. Rev. 75(6), 66–79 (2000)

DeAngelo, H., & DeAngelo, L.: Capital structure, payout policy, and financial flexibility. Marshall School of Business Working Paper No. FBE, 2–6 (2007)

Demmer, W.A., Vickery, S.K., Calantone, R.: Engendering resilience in small-and medium-sized enterprises (SMEs): a case study of Demmer Corporation. Int. J. Prod. Res. 49(18), 5395–5413 (2011)

Denis, D.J., McKeon, S.B.: Debt financing and financial flexibility evidence from proactive leverage increases. Rev. Financ. Stud. 25(6), 1897–1929 (2012)

Dubey, R., Gunasekaran, A., Papadopoulos, T., Childe, S.J., Shibin, K.T., Wamba, S.F.: Sustainable supply chain management: framework and further research directions. J. Clean. Prod. 142, 1119–1130 (2017)

Erol, O., Mansouri, M., & Sauser, B.: A framework for enterprise resilience using service oriented architecture approach. In 2009 3rd Annual IEEE systems conference, 127–132(2009)

Espadinha-Cruz, P.: Lean , agile , resilient and green supply chain management interoperability assessment methodology. Supply Chain Manag. Int. J. 140 (2012)

Esteban, A., Zafra, A., Romero, C.: Helping university students to choose elective courses by using a hybrid multi-criteria recommendation system with genetic optimization. Knowledge-Based Syst. 194, 105385 (2020)

Gamba, A., Triantis, A.: The value of financial flexibility. J. Financ. 63(5), 2263–2296 (2008)

Gupta, P. K., & Muhuri, P. K.: Multi-objective Linguistic optimization: extensions and new directions using 2-tuple fuzzy linguistic representation model. In 2017 IEEE international conference on fuzzy systems (FUZZ-IEEE), 1–6 (2017)

Habibi, A., Jahantigh, F.F., Sarafrazi, A.: Fuzzy Delphi technique for forecasting and screening items. Asian J. Res. Bus. Econ. Manag. 5(2), 130–143 (2015)

Hald, K.S., Mouritsen, J.: The evolution of performance measurement systems in a supply chain: a longitudinal case study on the role of interorganisational factors. Int. J. Prod. Econ. 205, 256–271 (2018)

Hayward, M., Caldwell, A., Steen, J., Gow, D., Liesch, P.: Entrepreneurs’ capital budgeting orientations and innovation outputs: evidence from Australian biotechnology firms. Long Range Plan. 50(2), 121–133 (2017)

Hendrick, R.: The role of slack in local government finances. Public Budg. Financ. 26(1), 14–46 (2006)

Hilton, J., Wright, C., & Kiparoglou, V.: Building resilience into systems. In 2012 IEEE International Systems Conference SysCon 2012, 1–8 (2012)

Hohenstein, N.-O., Feisel, E., Hartmann, E., Giunipero, L.: Research on the phenomenon of supply chain resilience: a systematic review and paths for further investigation. Int. J. Phys. Distrib. Logist. Manag. (2015). https://doi.org/10.1108/IJPDLM-05-2013-0128

Hosseini, B., Kiani, K.: A big data driven distributed density based hesitant fuzzy clustering using apache spark with application to gene expression microarray. Eng. Appl. Artif. Intell. 79, 100–113 (2019)

Hosseini, S., Ivanov, D., Dolgui, A.: Review of quantitative methods for supply chain resilience analysis. Transp. Res. Part E Logist. Transp. Rev. 125, 285–307 (2019)

Jafarnejad Chaghooshi, A., Arab, A., Ghasemian Sahebi, I.: Providing a mathematical model for evaluating resilient suppliers and order allocation in automotive related industries. J. Ope. Res. Appl. Lahijan Azad Univ. 16(4), 55–72 (2019)

Jones, M., & Steccolini, I.: UK municipalities’ financial resilience under austerity: facing crises and looking ahead (2014)

Kamalahmadi, M., Parast, M.M.: A review of the literature on the principles of enterprise and supply chain resilience: major findings and directions for future research. Int. J. Prod. Econ. 171, 116–133 (2016)

Kaya, R., Yet, B.: Building Bayesian networks based on DEMATEL for multiple criteria decision problems: a supplier selection case study. Expert Syst. Appl. 134, 234–248 (2019)

Kochan, C.G., Nowicki, D.R., Sauser, B., Randall, W.S.: Impact of cloud-based information sharing on hospital supply chain performance: a system dynamics framework. Int. J. Prod. Econ. 195, 168–185 (2018)

Limnios, E.A.M., Mazzarol, T., Ghadouani, A., Schilizzi, S.G.M.: The resilience architecture framework: four organizational archetypes. Eur. Manag. J. 32(1), 104–116 (2014)

Macuzić, I., Tadić, D., Aleksić, A., Stefanović, M.: A two step fuzzy model for the assessment and ranking of organizational resilience factors in the process industry. J. Loss Prev. Process Ind. 40, 122–130 (2016)

Mahdiraji, H.A., Zavadskas, E.K., Arab, A., Turskis, Z., Sahebi, I.G.: formulation of manufacturing strategies based on an extended swara method with intuitionistic fuzzy numbers: an automotive industry application. Transf. Bus. Econ. 20(2), 346 (2021)

Mahdiraji, H.A., Zavadskas, E.K., Skare, M., Kafshgar, F.Z.R., Arab, A.: Evaluating strategies for implementing industry 4.0: a hybrid expert oriented approach of BWM and interval valued intuitionistic fuzzy TODIM. Economic Research-Ekonomska Istraživanja 33(1), 1600–1620 (2020)

Martin-Breen, P., & Anderies, J. M.: Resilience: a literature review (2011)

McManus, S., Seville, E., Vargo, J., Brunsdon, D.: Facilitated process for improving organizational resilience. Nat. Hazard. Rev. 9(2), 81–90 (2008)

McWilliams, A., Siegel, D.: Corporate social responsibility and financial performance: correlation or misspecification? Strateg. Manag. Res. 3, 247–254 (2001)

Mensah, Y.M., Werner, R.: Cost efficiency and financial flexibility in institutions of higher education. J. Account. Public Policy 22(4), 293–323 (2003)

Muir, K., Reeve, R., Connolly, C., Marjolin, A., Salignac, F., & Ho, K.-A.: Financial resilience in Australia 2015 (2016)

Pettit, T.J., Croxton, K.L., Fiksel, J.: Ensuring supply chain resilience: development and implementation of an assessment tool. J. Bus. Logist. 34(1), 46–76 (2013)

Pettit, T.J., Croxton, K.L., Fiksel, J.: The evolution of resilience in supply chain management: a retrospective on ensuring supply chain resilience. J. Bus. Logist. 40(1), 56–65 (2019)

Ponomarov, S.Y., Holcomb, M.C.: Understanding the concept of supply chain resilience. Int. J. Logist. Manag. (2009). https://doi.org/10.1108/09574090910954873

Rapp, M.S., Schmid, T., Urban, D.: The value of financial flexibility and corporate financial policy. J. Corp. Finan. 29, 288–302 (2014)

Ribeiro, J.P., Barbosa-Povoa, A.: Supply chain resilience: definitions and quantitative modelling approaches–a literature review. Comput. Ind. Eng. 115, 109–122 (2018)

Robb, D.: Building resilient organizations resilient organizations actively build and integrate performance and adaptive skills. OD Practitioner 32(3), 27–32 (2000)

Roy, M., Sen, P., Pal, P.: An integrated green management model to improve environmental performance of textile industry towards sustainability. J. Clean. Prod. 271, 122656 (2020)

Ruiz Martin, C.: A framework to study the resilience of organizations: a case study of a nuclear emergency plan. Carleton University (2018)

Shefi, S., Tarapore, P.E., Walsh, T.J., Croughan, M., Turek, P.J.: Wet heat exposure: a potentially reversible cause of low semen quality in infertile men. Int. Braz. J. Urol. 33, 50–57 (2007)

Smith, C.S., Puckett, B., Gittman, R.K., Peterson, C.H.: Living shorelines enhanced the resilience of saltmarshes to Hurricane Matthew (2016). Ecol. Appl. 28(4), 871–877 (2018)

Song, W., Zhu, Y., Zhao, Q.: Analyzing barriers for adopting sustainable online consumption: A rough hierarchical DEMATEL method. Comput. Ind. Eng. 140, 106279 (2020)

Soni, U., Jain, V., Kumar, S.: Measuring supply chain resilience using a deterministic modeling approach. Comput. Ind. Eng. 74, 11–25 (2014)

Spiegler, V.L.M., Naim, M.M., Wikner, J.: A control engineering approach to the assessment of supply chain resilience. Int. J. Prod. Res. 50(21), 6162–6187 (2012)

Starr, R., Newfrock, J., Delurey, M.: Enterprise resilience: managing risk in the networked economy. Strateg. Bus. 30, 70–79 (2003)

Suryaningtyas, D., Sudiro, A., Eka, T.A., Dodi, I.W.: Organizational resilience and organizational performance: examining the mediating roles of resilient leadership and organizational culture. Acad. Strateg. Manag. J. 18(2), 1–7 (2019)

Vallascas, F., Keasey, K.: Bank resilience to systemic shocks and the stability of banking systems: small is beautiful. J. Int. Money Financ. 31(6), 1745–1776 (2012)

Vogus, T. J., & Sutcliffe, K. M.: Organizational resilience: towards a theory and research agenda. In 2007 IEEE international conference on systems, man and cybernetics, 3418–3422 (2007)

Wei, C.: Does the stock market react to unexpected inflation differently across the business cycle? Appl. Financ. Econ. 19, 1947–1959 (2009). https://doi.org/10.1080/09603100903282622

Zhang, S., Liu, S.: A GRA-based intuitionistic fuzzy multi-criteria group decision making method for personnel selection. Expert Syst. Appl. 38(9), 11401–11405 (2011). https://doi.org/10.1016/j.eswa.2011.03.012

Zhang, W., Deng, Y.: Combining conflicting evidence using the DEMATEL method. Soft. Comput. 23(17), 8207–8216 (2019)

Acknowledgements

The authors wish to express their gratitude to the esteemed reviewers for their valuable comments in improving the quality of this research work.

Funding

None.

Author information

Authors and Affiliations

Contributions

IGS performed material preparation, data collection and analysis. SPT wrote the first draft of the manuscript. GK and SG verified the analytical methods and editing the final version. All authors provided critical feedback and helped shape the research, analysis and manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Sahebi, I.G., Toufighi, S.P., Karakaya, G. et al. An intuitive fuzzy approach for evaluating financial resiliency of supply chain. OPSEARCH 59, 460–481 (2022). https://doi.org/10.1007/s12597-021-00563-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-021-00563-z