Abstract

The sharp rise in international cereal prices in 2007 and 2008 had a profound impact on food security at national levels for net importing countries, sharply raising the cost of imports. Domestic trade policies and government market interventions in a set of South Asian countries have been critical, however, in determining the effects of the international price shocks on domestic markets. While these price shocks are a sober reminder that reliance on international markets will not guarantee price stability, it is important that governments do not over-react to recent events and adopt policies that ultimately result in large costs in terms of slower economic growth and less poverty reduction. Instead, national policies should involve some combination of (1) national stocks to prevent very large price increases, (2) reliance on international trade to limit the need for government interventions in most years, (3) promotion of domestic production through investments in irrigation, research and extension that is economically efficient when evaluated at medium-term border prices, and (4) targeted (ideally cash-based) safety net programs to address the food security needs of poor households. The appropriate design and implementation of these broad food policy guidelines will necessarily vary according to individual country conditions; the need to avoid government interventions that ultimately have very high costs is universal.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The sharp rise in international cereal prices in 2007 and 2008 had a profound impact on food security at national levels for net importers, sharply raising the cost of food imports. Moreover, where these international prices were passed through to domestic markets, these price shocks adversely affected net cereal consumers especially in developing countries where levels of poverty were already high. Although the price transmission mechanisms varied, prices of wheat, rice and maize have nonetheless risen sharply in most developing countries, though in some cases (e.g. India), government controls on external trade to a large extent prevented large increases in domestic prices.

In light of these recent price shocks, many developing countries are rethinking their policies regarding public sector food stocks, reliance on international trade and national food security. Concerns about the dependability of world markets are especially high in countries for which imports account for a large share of cereal supply and for which national and household-level food security are crucial for economic growth and the welfare of the poor. The issues is especially critical for rice importers given the extremely large surge in rice prices in late 2007 and early 2008 that coincided with export bans placed by major rice exporters (India and Vietnam).

This paper discusses the implications of recent world price shocks on national strategies for food price stabilization, focusing on the roles of public food stocks and international trade. In examining national policies, the paper focuses on the countries of South Asia, a region in which major public sector interventions in cereal markets are common.Footnote 1 The “Price stabilization and public stocks: policy instruments and objectives” section provides a summary of alternative approaches to price stabilization and public sector cereal stocks, emphasizing the importance of clearly specifying policy instruments and objectives. The “Price movements in international cereal markets” section reviews recent international cereal price movements and their causes, and compares these price shocks with those in the early 1970s. The “Price stabilization and stock policies in South Asia” section describes country-specific price stabilization policies in India, Bangladesh, Pakistan and Afghanistan, and the mechanisms by which the recent surge in international prices have affected domestic markets and households. The final section offers a set of key considerations for the price stabilization and stock policies.

Price stabilization and public stocks: policy instruments and objectives

Prices of major food staples are major determinants of food consumption and welfare for consumers in developing countries, especially for the poor, for whom the budget shares of major staple foods (typically rice, wheat or maize) often account for 30% to 50% of total household expenditures.Footnote 2 At the same time, farm gate prices of these commodities are major determinants of incomes and incentives for production of small and large farmers. Government policy-makers are thus faced with a “food policy dilemma” of promoting high prices for producers or low prices for consumers, knowing that market interventions are not costless and could result in substantial government subsidies and efficiency losses (Timmer et al. 1983).

In addition, there is often a mismatch between objectives (producer and consumer price levels and stability, availability of grain for distribution programs, minimum stock levels, etc.) and policy instruments (procurement and sales prices, levels of government imports, etc.). In many cases, there are more objectives than instruments, making it impossible to meet all objectives with the number of policy instruments available. In other cases, the feasible policy options (e.g. levels of domestic procurement or distribution) are limited by fiscal constraints so that policy objectives (e.g. market price stabilization) cannot be met. Thus, there are typically major gaps between stated objectives, policy measures undertaken and policy objectives achieved.

In general, there are two broad approaches to price stabilization strategies to protect consumer interests: those with an explicit market price objective and those focusing on provision of rationed quantities at a subsidized price (Dorosh 2008).Footnote 3 For example, Indonesia generally followed the former approach in the 1970s and 1980s, using untargeted open market sales of rice by BULOG (the national logistics agency) to stabilize market prices (McCullough and Timmer 2008).

In contrast, market interventions to protect consumer interests in South Asia in most years have followed the latter approach, with quantities of subsidized sales or transfers determined mainly by targets or entitlements for public distribution systems. For example, India, Bangladesh and Pakistan all subsidized sales of public sector grain to households through ration shops in the 1970s and 1980s, a policy that has continued in India to the present. Ration shops were eliminated in reforms in the late 1980s in Pakistan and early 1990s in Bangladesh. Nonetheless, public foodgrain distribution continues in Bangladesh through targeted programs such as Food-for-Work and Vulnerable Group Development, and in Pakistan, there are large-scale subsidized sales of wheat to flour mills. Although market price stabilization may be a stated objective of these policies, the quantities sold or distributed are typically determined independently of the amount needed to achieve a particular target level of open market prices.

Concurrent with efforts at price stabilization for consumers, India, Pakistan and Bangladesh also intervene to support producers with purchases at fixed prices (e.g. the Minimum Support Price in India). Government procurement is not necessarily sufficient to maintain market prices at the government purchase prices (especially in Bangladesh). However, political pressures from farmer interest groups who benefit from direct procurement have led to increases in procurement prices, as well as levels of procurement, especially in India and Pakistan, and were a major cause of the surge in public stocks in India in the 1990s, as discussed below.

Countries have also differed widely in the degree of reliance on market mechanisms to implement either pure price stabilization or rationed quantity systems. At one extreme is complete reliance on market mechanisms for procurement (tenders) and distribution (open market sales at auction). At the other extreme is forced procurement or rationed sales at official prices. Most international experience (as well as economic theory) suggests that market mechanisms are generally more efficient over time in achieving price stabilization objectives (Byerlee et al. 2007). However, in exceptional years when international market prices are very high, they offer little help in stabilizing domestic prices without the use of government subsidies (Dorosh 2001).

Public stocks

Clarity on instruments and objectives is especially important with respect to public stocks. Typically, the same stocks can serve several purposes at the same time, i.e. they can function as working stocks for distribution programs, buffer stocks for price stabilization needs, or food security stocks for emergency relief. Nonetheless, it is not always possible to meet all three objectives with the same quantities of grain, as in the case when emergency relief needs require stocks to be drawn down so low that some normal distribution of grain is not feasible and must be postponed or cancelled.

Any government cereal market intervention involving purchases or sales necessitates creation of public stocks, if only as working stocks to guarantee adequate availability of grain at distribution points. The optimal size of these working stocks is determined mainly by the volume and timing of planned distribution, number of distribution points, and costs of storage and transport. In principle, calculations of working stocks are the most straightforward.

Estimating required buffer stocks for price stabilization, however, requires an assessment of risks of various shocks (e.g. production shortfalls and market demand shocks) and is thus subject to more uncertainty. Although complex dynamic programming models could be used to plan buffer stocks, their use is limited by institutional capacity and uncertainty regarding risk parameters and model specification, so simpler specifications and rules of thumb are most often used. For example, India sets minimum stock norms that provide a guideline to stock management at various points of the year.

A major conclusion from the considerable research that has been done on optimal price stabilization and buffer stock policy is that on average, some reliance on international trade can reduce costs of price stabilization substantially (Goletti 2000; Byerlee et al. 2007). This finding rests on the fact that holding stocks entails substantial cost,Footnote 4 and that in most countries typical shocks to domestic supply and demand (weather and pest-related production shortfalls, natural disasters, income shocks) are large relative to average supply and demand. Whether trade-based price stabilization policies are superior to holding national cereal stocks also depends on the degree of stability in international prices and availability.Footnote 5 For most of the three decades from 1975 to 2006, these international markets in fact had been relatively stable. In years of very high world prices (such as 2007 and 2008), though, international trade will not stabilize domestic markets (and may actually destabilize markets, as in the case of Pakistan described below).

Even in the absence of an explicit price stabilization policy or public distribution system objectives, most countries set minimum stock targets for a national security stock. The appropriate national security stock is not independent of other policies and instruments, however, and has been a contentious issue in many countries for decades (World Bank 2006b).

Price movements in international cereal markets

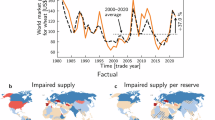

International market prices for major cereals surged in the second half of 2007 and the first half of 2008 to reach record levels in nominal US dollar terms, before falling again in the second half of 2008 (Fig. 1). Wheat prices in 2008 averaged 127% above their 1998–2007 average; rice and maize prices were 100% and 106%, respectively, above their 1997–2008 averages (Table 1). In real terms (using the IMF dollar price deflator), 2008 prices were still substantially above the 1998-2007 averages (by 72%, 107% and 64% for wheat, rice and maize, respectively (Table 1 and Fig. 2). Nonetheless, the 1974 price shock was significantly greater than that of 2008. Real prices for rice in 2008 were less than one half those in 1974. For wheat and maize, prices in 2008 were below their 1974 levels by 35% and 41%, respectively.

There are also major differences in the causes of the 1973–1974 and 2007–2008 price shocks. In 1973 and 1974, consecutive years of adverse weather contributed to production declines in many parts of the world. In addition, following its own national production decline, the Soviet Union chose to import cereals rather than cut back domestic feed and food consumption, leading to a major surge in international demand on world markets. Production shocks played a major role in 2007 and 2008, as well, though the increase in demand for maize as bio-fuel also contributed to the 54% increase in the international dollar price of maize between August 2006 and February 2007 that predated the surge in wheat prices triggered by poor wheat harvests in late 2007. World cereal market model simulations suggest that the effect of increased bio-fuel demand on maize prices is about three times larger than the effect on wheat prices (Rosegrant 2008).Footnote 6

Price stabilization and stock policies in South Asia

A shared colonial heritage—in terms of the food policies of British India institute in response to the 1943 Great Bengal famine (Ahmed et al. 2000)—continues to influence food stock policies in Bangladesh, India and Pakistan. Moreover, the food economies across South Asia are increasingly linked, directly and indirectly, through international trade, especially the rice markets of Bangladesh and India and the wheat markets of Pakistan and Afghanistan. In addition, because India’s trade policies have a major impact on international rice markets, there are indirect links between India and all the countries of the region.

In spite of a shared policy heritage, recent government interventions in cereal markets have varied markedly across South Asia. Pakistan and India both procure large shares of the national production of major cereals. From 2001 through 2007, Pakistan government agencies (provincial governments and PASSCO) procured an average of 19.2% of wheat production per year. India’s procurement was even higher: an average of 23.0% of wheat production and 25.7% of rice production (Table 2). These large scale interventions in domestic cereal markets help bring price stability, but come at high fiscal costs because of storage losses, costs of handling and transport and often subsidized sales or direct distribution of the grain. In contrast, Bangladesh has enjoyed similar price stability with substantially less procurement of cereals (an average of only 3.4% of rice production and 6.7% of wheat production.Footnote 7

Stock levels vary substantially across countries, as well, both in absolute levels and in per capita terms, reflecting differences in public distribution systems (and the need for working stocks), price stabilization objectives (and the need for buffer stocks), and perceptions of risk (and thus the need for emergency or reserve stocks). India’s stocks averaged 33.4 million tons (17.1 and 16.4 million tons of rice and wheat, respectively) over the 2001–2007 period, equivalent to 31.6 kg per person, the highest in the region. There have been substantial variations in stock levels over the period, however, due both to fluctuations in domestic production as well as changes in distribution policies (Fig. 3).

Pakistan’s per capita wheat stocks have been on average less than half those of India (7.6and 16.2 kg/capita, respectively), and since Pakistan’s government no longer maintains rice stocks, total food grain stocks in Pakistan were on average less than one-quarter those of India on a per capita basis, reflecting in large part a difference in the volume of food grain offtake through their distribution systems. India’s offtake averaged 42.4 million tons per year in India from 2003–2004 to 2006–2007, ten times that of Pakistan—4.2 million tons per year).Footnote 8 Bangladesh stock levels have been by far the lowest of the three countries on a per capita basis.

Country responses to the 2007–2008 world price shocks

Given the differences in trade openness, composition of cereal consumption and other country characteristics, the 2007–2008 world price shocks posed varying levels of threat to food security across the countries of South Asia. Country response, in terms of price stabilization and stock policies also varied. Moreover, policy choices in India and Pakistan had major spillover effects on food security and prices in Bangladesh and Afghanistan.

Price stabilization and stock policies in India

The high levels of stocks in India relative to those elsewhere in South Asia are in part due to a recognition by India’s policy-makers that because of the country’s large population and total cereal demand, a surge in import demand by India could result in sizeable increases in world market prices.Footnote 9 (Indeed, the reduction in India’s export supply of rice in 2007–2008 had a significant effect on the 30 million ton per year world rice trade.)

India sets seasonal buffer stock norms as guidelines for procurement and offtake decisions, with the minimum stock norms varying from 5.2 to 12.2 million tons of rice and 4.0 to 17.1 million tons of wheat over the year. Stock levels have far exceeded the norms in recent years, however. Political pressures to rapidly raise minimum support prices and then procure the high volumes of rice and wheat offered for sale at these prices contributed to huge buildups in public stocks in the early 1990s and again from about 1999–2000 to 2002–2003. Procurement levels of foodgrain (mostly rice and wheat, but also small amounts of coarse cereals) rose rapidly, from 19.6 million tons in 1991–1992 to 42.6 million tons in 2001–2002.Footnote 10 Average procurement from 1999–2000 to 2007–2008 was 37.4 million tons, more than double that of the 1980–1981 to 1992–1993 period.

Because the volume of grain distribution through the Public Distribution grew at a much slower rate, government stocks increased from 15.8 million tons in 1990–2001 to 58.0 million tons in January 2002, far in excess of the (1999–2000) target stock norm of 18.8 million tons (Fig. 4). Consequently, there was a significant increase in the subsidy on buffer stocks as a percent of total food subsidy from 16% in the early 1990s to 41.5% in 2001–2002. Food Corporation of India (FCI) stocks were subsequently reduced to 21.7 million tons in January 2005, in large part through subsidized exports of 31 million tons of rice and wheat from 2000–2001 through 2003-04 (del Ninno et al. 2007), (Table 3). From 2004–2005 to 2007–2008, though, procurement and total offtake have been approximately balanced, as public distribution sales have been increased by nearly 9 million tons per year compared to 2002–2003 to 2003–2004.

Low levels of wheat stocks and domestic procurement of wheat in recent years were a major impetus behind the Government of India’s decision to import wheat in recent years and place restrictions on rice exports in 2007–2008. Successive years of relatively low domestic wheat procurement resulted in a July 1, 2006 wheat stock of only 8.2 million tons, less than half of the 17.1 million ton norm. In order to boost stocks, the government imported wheat and adjusted wheat offtake in 2006–2007, and in an effort to boost procurement in April–June 2007 (the 2007–2008 season), the government also raised the Minimum Support Price of wheat. However, procurement increased only slightly to 11.1 million tons (up from 9.2 million tons in 2006–2007), so that July 1, 2007 wheat stocks were still 4.2 million tons below the July 1 norm.

With wheat stocks relatively low and international wheat and rice market prices high, the government then took additional steps to boost rice procurement during the monsoon (kharif) season, raising the minimum support price (including bonus) for paddy. It also placed a ban on exports of non-basmati rice on October 9, 2007, though it lifted the ban on October 25, 2007 and allow exports at or above a minimum f.o.b. export price of $425 per ton. This minimum export price of non-basmati rice was subsequently raised to $500 per ton on December 31, 2007.Footnote 11 Note that the f.o.b. Bangkok price of comparable quality A1 Special Thai rice was only $297/ton in October 2007 and only $342/ton in December 2007. Thus, India’s minimum export price effectively made India’s exports of coarse varieties of non-basmati rice uncompetitive in international markets (at least until March 2008). International markets reacted strongly to these effective export bans by India since India had accounted for about one sixth of total world rice exports in previous recent years (about five million out of total world trade of 30 million tons), and the Thai price rose to $365/ton in January 2008, $431/ton in February, $522 in March and to more than $700/ton in April 2008.

India’s policies succeeded in stabilizing their domestic prices of rice and wheat, while contributing to a sharp rise in international prices. While the international rice price rose by 75% in dollar terms between October 2007 and March 2008, the wholesale price of (primal variety) rice in Delhi rose by only 14%, from 13.6 to 15.5 Rs/kg. (The Indian rice price then fell to 14.7 and in April 2008 as the rabi season rice and wheat harvests began, while the international rice price continued to surge upward in April before falling in May. The policies were not costless, however. India likely could have exported another two to three million tons of rice (as in normal years of about five million tons of exports).Footnote 12 Even at a price of only $300/ton (the approximate price in October 2007), this would have amounted to $600 to $900 million in export revenues. Selling this rice domestically at the APL (Above Poverty Line) sales price of common rice of 7.95 Rs/kg (equal to $115/ton at an exchange rate of $69 Rs/$), would generate $230 to $345 million. Relative to this alternative, the financial revenues foregone by not exporting the rice were $370 to $550 million (200 to 300 thousand tons at $185/ton).Footnote 13 In 2007–2008, this policy may well be deemed to have been worthwhile from India’s perspective, although the decision to curtail exports involved considerable negative externalities to rice consumers in other countries as result of the subsequent price surge in international rice markets.

Bangladesh rice stocks, private imports and price stabilization

Up until the early 1990s, the food policy of Bangladesh was similar to that of India, with government control of international trade and large-scale domestic procurement to help supply the public foodgrain distribution system (PFDS). Since the early 1990s, though, Bangladesh has liberalized its domestic and international trade, while retaining a reduced public foodgrain distribution system. As a result, private sector imports have played a major role in price stabilization, particularly following major domestic production shortfalls such as that following the massive 1998 floods.

Bangladesh is nearly self-sufficient in rice, importing an average of about 850 thousand tons per year from 1998–1999 to 2007–2008, equal to less than 5% of total net availability of rice. Levels of imports fluctuate depending on domestic supply and demand conditions (largely influenced by production levels) and the lowest cost import parity price (generally from India in recent years because of lower transport costs, as well as India’s rice policies). Following normal rice harvests in the mid-1990s, domestic market rice prices fell below import parity levels with India and private sector imports were essentially zero. After a shortfall in the monsoon season (aman) rice crop in 1997 and then again after a massive flood in mid-1998, domestic prices in Bangladesh rapidly rose to import parity levels, triggering large-scale private sector imports.Footnote 14 Bangladesh was able to promote price-stabilizing private sector trade even while expanding targeted distribution of rice and (mainly) wheat through measures designed to build confidence of the private sector, by avoiding imposition of anti-hoarding regulations, continuing dialogue between the government and traders, and eliminating trade taxes.Footnote 15

After the 1998 flood, Bangladesh rice production increased sharply, again reducing domestic prices below import parity levels, as calculated on the basis of wholesale market prices in India. However, imports surged again in 2002–2003 and 2003–2004 as India exported some of its excess stocks, releasing grain to exporters at the BPL (Below Poverty Line) sales price. Prices in Dhaka continued to track import parity (based on BPL prices) through early 2007 (Fig. 5), suggesting that rice exporters in India were able to obtain rice at the BPL price for export in much of this period.Footnote 16

Severe floods during July to September 2007 and a cyclone in November resulted in severe damage to the aman rice crop, limiting the harvest to only 9.7 million tons, 1.1 million tons below the harvest of the previous year. India restricted its exports, however, so that Bangladesh domestic prices moved substantially above import parity levels (calculated on the basis of BPL prices) from mid-2007. In October 2007, India announced a rice export ban, forcing Bangladeshi importers to turn to international prices where prices rose rapidly. Private sector imports, totaled about 950 thousand tons from January through April 2008, as Bangladesh domestic prices broadly tracked import parity prices from Bangkok. (Government of Bangladesh negotiated imports of about 500 thousand tons of rice from India did not arrive in large quantities until May 2008.) In all, private sector imports were substantial, totaling about 1.8 million tons in the period between the onset of the floods in July 2007 and the boro harvest the following April (2008).

The 45% rise in real prices of rice in Bangladesh from November 2007 to April 2008 with no change in availability in comparison with the previous year, suggests that private stock demand may have increased by an amount estimated at about 10% of total consumer food demand for the period, i.e. about 0.5 months of normal food consumption (about one million tons).Footnote 17 The above calculations suggest that additional injections of about 1 million tons into domestic markets would have been sufficient to prevent an increase in real rice prices during this period, and that additional injections of only about 0.5 million tons would have been sufficient to limit the increase in real rice prices to about 20–25%.Footnote 18 Thus, rice stocks (which averaged about 700 thousand tons for the 2002–2003 to 2007–2008 period, Table 4) would likely not have to be raised very much to enable timely government interventions to stabilize market prices.

Dhaka wholesale market prices dipped to 28 Tk/kg following the winter (boro) season harvest in April 2008, but hovered at about 30 Tk/kg throughout 2008, until finally falling to about 25 Tk/kg following the November/December monsoon season (aman) rice crop. Moreover, by October 2008, the international (Bangkok) rice price, which had risen sharply in April 2008, had fallen sharply so that Bangladesh domestic prices were approximately equal to import parity (Bangkok) levels by the end of 2008 (Fig. 5).

Pakistan wheat policy and the 2007–2008 price rise

Pakistan’s government intervenes heavily in domestic wheat markets. Provincial governments (mainly Punjab and to a lesser extent Sindh) and PASSCO (Pakistan Agriculture Storage and Supplies Corporation) procure about 20% of total wheat production each year. Large scale government wheat procurement offers little direct benefit to consumers of wheat flour, however, because almost all procured wheat is bought and then sold again to flour millers (at a financial loss to the government) in the same wheat marketing year. Most recently, millers have enjoyed quotas for purchase of government subsidized wheat at below-market prices and have thus been able subsequently to sell wheat flour at market-clearing prices. This has contributed to a large expansion in wheat mills, over-capacity in the milling industry and a large number of mills that operate only when subsidized wheat is available for purchase, as well as political pressure on the part of millers and others to maintain the current system.Footnote 19

In most years, sales of government wheat imports (to wheat millers) have supplemented domestic supplies, lowering domestic prices and benefiting net consumers of wheat. Since domestic prices of wheat have generally been below import parity levels, private commercial imports are minimal.

Following the good March-April 2006 harvest and with prospects of a good March–April 2007 wheat harvest, Pakistan prices fell to export parity levels and the government permitted about 500 thousand tons of exports to international markets in early 2007 (in addition to exports to Afghanistan). However, when international market prices rose very sharply in mid-2007, the government quickly placed a ban on wheat exports to stem the flow of exports and prevent domestic prices from rising along with (export parity) international prices, which rose from about 12.0 Rs/kg to 19.0 Rs/kg (about 60%) between June and September, 2007 (Fig. 6).

The government of Pakistan also banned private sector exports of wheat flour to Afghanistan in January, 2008, allowing only government exports to Afghanistan. It should be noted, though, that exports of wheat flour to Afghanistan (typically in the range 0.5 to 1.0 million tons) is equivalent to only about 2% to 5% of Pakistan’s net wheat availability (before exports). Thus, the effect of these exports on the domestic wheat price is small, raising domestic prices by perhaps 5% to 15% ceterus paribus.Footnote 20

Nonetheless, domestic prices in Pakistan rose by about 40% in late 2007 and remained at levels of about $280/ton (Lahore, wholesale markets), suggesting that the April–May 2007 domestic wheat harvest may have been overestimated. Moreover, prices remained high even after the April/May 2008 wheat harvest, which was estimated at 21.5 million tons, 1.8 million tons (8%) less than 2007/08. Nonetheless, the continued ban on private sector exports meant that domestic prices remained far below export parity levels (Fig. 6).

Afghanistan: wheat policy and links with Pakistan’s wheat markets

Since at least 2000, prices of wheat and wheat flour in Kabul and northeast Afghanistan have essentially been driven by the price of imported wheat flour from Pakistan. These prices are highly correlated and co-integration analysis of wheat prices for January 2002 through June 2005 indicated that wheat prices in Lahore and Kabul moved together in the long-run and also were linked with the prices in other major Afghan cities (Chabot and Dorosh 2007). This link has taken place despite food aid inflows because of large volumes of private wheat imports from Pakistan (through Jalalabad to Kabul, as well as some trade through Quetta to Kandahar). Thus, private trade in wheat (flour) remained profitable in spite of food aid (Table 5).

Through mid-2007, this close link through trade with Pakistan stabilized wheat prices in Afghanistan (Fig. 7). The situation changed, however, with the rise in world wheat prices in 2007, with Pakistan’s ban on wheat exports in 2007 designed to prevent Pakistan’s domestic wheat prices from continuing to rise along with export parity levels. This policy had very adverse consequences for consumers in Afghanistan, particularly when the ban was extended to cover Pakistan’s wheat exports to Afghanistan in January 2008.

With increased restrictions on Pakistan’s exports, Afghanistan’s (Kabul) wheat prices increased dramatically from $325/ton in November 2007 to $465/ton in January 2008. When Afghanistan’s own May 2008 domestic wheat harvest fell short of its 2007 levels by 1.5 million tons, prices rose further to $782/ton in May 2008. Wheat prices in Kabul subsequently fell to $560/ton in December 2008 as increased food aid flows helped increase supplies, but domestic prices throughout 2008 remained far above the estimated import parity price of wheat from Pakistan (about $300/ton), indicating that Pakistan’s export restrictions were extremely effective in limiting wheat flows to Afghanistan.Footnote 21 Note that even at the peak of international wheat prices in March 2008 ($528/ton import parity Lahore), unrestricted trans-shipment of wheat from international markets through Pakistan could have reduced Afghanistan’s domestic prices (which peaked at $782/ton in May 2008).Footnote 22

This experience illustrates the critical importance for Afghanistan of maintaining unrestricted private imports of wheat and wheat flour from Pakistan. Though food aid inflows provide important additional supplies, private sector imports have proven to be highly effective in stabilizing Afghanistan’s wheat markets when these imports are unrestricted. This requires clear signals to be given to the private sector regarding trade policies (zero or minimal restrictions on wheat trade), food aid plans and government sales prices of wheat (if the government chooses to conduct open market sales) that reflect full costs of imports. Moreover, in the medium term, it is important to provide adequate investments in irrigation, adaptive agricultural research and extension to enable Afghanistan's farmers to increase wheat productivity.Footnote 23

Policy guidelines and conclusions

Several broad policy guidelines emerge from this review of recent world price movements and policies adopted in South Asian countries regarding food price stabilization, public stocks and promoting food security in the short- and long-term.

Promotion of domestic and international trade

International trade (and especially private sector trade) can provide price stabilization at low cost as long as international prices are not higher than government policy targets for domestic prices. The Bangladesh experience following the 1998 floods shows that given appropriate incentives the private sector trade can react quickly to changes in market conditions (in this case, extensive damage to the forthcoming monsoon season rice crop), and stabilize domestic markets through private sector imports from India. Similarly, imports from neighboring Pakistan helped stabilize wheat supplies and prices in Afghanistan. Moreover, it is possible simultaneously to hold stocks, conduct targeted food distribution programs and promote private sector trade (again, as Bangladesh did in 1998–1999). Promotion of private sector trade, however, greatly reduces the costs of price stabilization, since it reduces the size of necessary public stocks and spares government the handling and marketing costs involved in any imports.

Several measures can be taken to promote a competitive private sector trade that can enhance market efficiency and price stability. Allowing private sector storage is one necessary condition. Anti-hoarding laws, designed to prevent speculative storage actually destabilize markets by encouraging all market actors (farmers, millers, traders and consumers) to hold additional (and if necessary, secret) stocks. (Liberalization of trade and release of government stocks as part of clearly announced policy is a more effective way of reducing speculative market behavior.) Transparency of policy is also crucial. To accomplish this, governments can hold open discussions with private sector to understand their concerns and to communicate policy decisions. Sharing of information regarding market prices, international trade and government stocks also builds confidence. Governments can also disseminate analysis of current market conditions, including analysis of price movementsFootnote 24, assessments of net availability per capita (which has not declined sharply in south Asia) and prospective government measures. Monitoring markets through comparisons of movements in import (or export) parity with domestic prices, volumes of impending imports as indicated by letters of credit and other measures can build confidence of key policy makers and the public.

Public stocks and government market interventions

However, at times of very high world prices, as in 2007–2008, private trade by a net importing country will not stabilize domestic market prices below the very high import parity prices. To reduce prices below these levels requires sale or distribution of government stocks (sourced either from previous domestic procurement or imports). The arguments in favor of stocks are especially strong in the case of rice, for which international markets remain relatively thin—about 30 million tons traded annually, equivalent to only 7% of world rice production (as compared to 12% and 17% ratios of trade to production for maize and wheat, respectively, Table 6).

Nonetheless, great care must be taken with public stock policies, since stocks can entail substantial costs, both in terms of financial costs (implicit interest, (hidden) quality losses, physical storage losses and transactions costs of stock rotation) as well as efficiency costs through disincentives to (generally more efficient) private sector storage and trade. If government stocks are used to reduce seasonality of prices, they eliminate some of the incentives for private stock-holdings. In the limit, a government policy of using stocks to keep prices equal throughout the year would completely eliminate any incentive for private storage since the costs of storage could not be recouped in subsequent sales.

Setting appropriate stock targets for minimum buffer stocks can help avoid excessive costs. These minimum buffer stock levels should take into account the level of national consumption, variability of domestic production, costs of storage, size of the country relative to the international market, other factors influencing domestic prices, and the risks to poor households and the overall economy of price spikes.Footnote 25 Stocks per capita or as a share of total consumption, with appropriate adjustments when there are two major harvests per year, offer a useful guideline. India’s buffer stock norms of 4.0 million tons of wheat (April 1) and 5.2 million tons of rice (December 1) total approximately 9 kg/capita. Average annual stock norms are higher—about 17 million tons of rice and wheat combined, equivalent to about 17 kgs/capita. However, average (January 1) stock levels in recent years were double that amount (33.6 kgs/capita). By contrast, Bangladesh stabilized its prices with average (rice and wheat combined) stock levels of only 5.5 kgs/capita; Pakistan’s average (wheat) stock level was only 7.6 kgs/capita.

In general, though, the biggest costs of stocks come not from the level of stocks per se, but from the mechanisms used to rotate the stocks and from disincentives to private sector trade. In principle, the most efficient mechanism for rotating stocks is through the market, procuring by tender and selling at auction so as to minimize financial costs. In countries with public distribution systems (Bangladesh and India), however, stock rotation is done largely as part of the normal procurement and offtake of the distribution system. In this case, costs of holding stocks and stock rotation are less apparent, but holding additional stock entails additional costs of distribution (offtake) and procurement for stock rotation, thus linking levels of stock to the size of the distribution program and to the fiscal deficit.Footnote 26

Regional stocks (such as the regional stock of the South Asian Association for Regional Cooperation, SAARC) are one option for risk pooling and overall cost reduction. However, terms of re-imbursement or purchase of these stocks need to be clearly specified in advance of a food crisis and ultimately must be to the advantage of the potential user of the stocks if they are to be useful in times of shortage.Footnote 27

Medium-term agricultural policy

National agricultural policies should be reviewed in light of the surge and subsequent fall in international cereal and energy prices. To the extent these swings in international prices are passed on to domestic markets, private sector farmers could face major changes in both output and input (fertilizer) prices. Whether overall incentives for production increase and whether supply is responsive to these changes will vary for each crop depending on production technology options (including whether the crop is fertilizer intensive and whether opportunities exist for area expansion). It is critically important to consider the likelihood of these price shocks to persist, so as to avoid over-reacting to short-term price movements with strategies that may not be economically efficient at medium-term international prices (e.g. national food self-sufficiency or costly irrigation schemes). Here, an assessment of the causes of international price movements is important to distinguish between the effects of long-term factors (such as long-term steady increases in demand for energy) and short-term factors (such as weather-induced crop production shortfalls).

Safety nets and social protection

Protecting poor consumers from the adverse effects of food price increases need not involve subsidizing food; cash transfers or public employment schemes can also be used to increase household purchasing power and therefore their access to food. In general, these transfers are more efficient than food transfers because they do not involve public sector costs of food distribution. Targeted cash programs transfers do not necessarily eliminate the need for government interventions to add to domestic food availability, however, especially when the total size of the transfer required to ensure food security is large relative to national income and would thus lead to significant additional increases in market prices of food (or a large volume of imports at high international prices). In this case, combining price stabilization measures (increasing food availability) with cash transfers to increase food access by the poor is likely to be most effective.

Towards an optimal food price policy

The surge in international and domestic food prices in 2007–2008 caused substantial hardship for millions of poor consumers and rightly concerned national policy-makers throughout the world. While this price shock is a sober reminder that reliance on international markets will not guarantee price stability, it is important that governments do not over-react to recent events and adopt policies that ultimately result in large costs in terms of slower economic growth and less poverty reduction. Thus, countries should avoid placing restrictions on private trade and damaging the extent of private sector market development earlier achieved. Instead, national policies should involve some combination of (1) national stocks to prevent very large price increases, (2) reliance on international trade to limit the need for government interventions in most years, (3) promotion of domestic production through investments in irrigation, research and extension that is economically efficient when evaluated at medium-term border prices, and (4) targeted (ideally cash-based) safety net programs to address the food security needs of poor households. The appropriate design and implementation of these broad food policy guidelines will necessarily vary according to individual country conditions; the need to avoid government interventions that ultimately have very high costs is universal.

Notes

For example, the total budget share for rice and wheat in Bangladesh was 42% (Bangladesh Bureau of Statistics, 2000).

Food stamp programs that entitle holders to purchase a range of private market commodities through private shops (where the private shop is then reimbursed by the government) and direct cash transfers are other common alternative means of subsidizing household consumption.

For example, estimates from Bangladesh for 2000/01 (Dorosh et al. 2004) suggest that storage losses for rice were only about Tk 0.26/kg ($4.80/ton at 2000/01 exchange rates), of which the value of losses in quality were estimated at Tk 1.73/kg ($32.10/ton). Assuming that as much as 20% of total marketing and establishment costs of Tk 2.00/kg ($37.1/ton) were costs of storage (interest, warehousing and management), then the total cost of holding stocks was about 2.4 Tk/kg ($44.3/ton). Only in years when import parity prices are in excess of target domestic prices by more than about $44/ton, would it be less costly in economic terms for government to have held stocks for a year rather than to simply subsidize commercial imports.

For example, Goletti et al. (1991) and Goletti (2000) emphasized the importance of clarifying the major objectives of holding stocks in Bangladesh (e.g. price stabilization or working stocks for the public distribution) and that lowest costs for the PFDS could be achieved by holding rice stocks mainly for rice price stabilization and lower cost wheat for public distribution system.

Maize prices began to increase substantially in 2006, more than a year before substantial price increases for wheat (driven largely by poor harvests).

The average procurement for wheat masks wide variations in procurement. From 2000 to 2006, Bangladesh procured almost no wheat from domestic markets.

India’s stock to distribution ratio (0.74 for wheat and rice combined) was nearly three times higher than Pakistan’s (0.27) highlighting the India’s excessive stock levels in the 2001 to 2003 period. For 2003–2004 to 2006–2007 India’s stock to distribution ratio was only 45 percent (more than double that of Pakistan (20%) in this period.

Concerns with the unreliability of world markets date back at least to the mid-1960s when political considerations reduced U.S. food aid deliveries to India (del Ninno et al. 2007).

Most of the benefits of procurement policies accrue to farmers in the few states in which procurement is highly concentrated: Punjab, Haryana and Uttar Pradesh for wheat, and Punjab, Haryana and Andhra Pradesh for rice (World Bank 2004).

Government of India (2008), India Economic Survey, 2007–2008, pp. 177.

Figures on India’s total non-basmati rice exports in 2007–2008 are unavailable, though Bangladesh import data suggest the total was at least 1.8 million tons.

In 2007/2008, the total economic cost of rice was 13.71 Rs/kg (weighted average of common grade and fine varieties) and 15.73 Rs/kg for wheat, far above the respective Above Poverty Line (APL) prices of wheat (Rs 6.10/kg) and common grade rice (Rs 7.95/kg). Thus, sales at the APL price resulted in subsidies of about 61% for wheat and 42 percent for rice; (subsidies for Below Poverty Line and other distribution programs were much larger). The Government of India does not publish data on the cost of stock-holding, however.

In all, 2.4 million tons of rice were imported by the private sector from India, most of this by truck after the 1998 floods.

Following the 1998 flood, the Government of Bangladesh explored the possibility of drawing grain from the regional stock of the South Asian Association for Regional Cooperation (SAARC). Ultimately, however, this option was not taken because the price at which India’s rice stocks were offered exceeded India’s open market price at which the Bangladesh private sector was importing rice.

Figure 5 shows three different import parity prices based on alternative sources of supply (rice priced at India’s Below Poverty Line sales price, rice in the wholesale market in Delhi, and rice exported from Bangkok). In general, in any given period, only the lowest of these prices is relevant for the private trade, which seeks the lowest cost source of supply. However, in 2007 and 2008 when India banned private market exports, neither the import parity from BPL sources nor that from wholesale markets in Delhi resulted in actual trade to Bangladesh.

The above calculation assumes an own-price elasticity of demand of rice of about −0.2, similar to earlier analysis of rice demand in Bangladesh following the 1998 flood (Dorosh 2001).

If stabilizing rice market prices had diminished the increase in private stock demand, the size of the net injections required would have been correspondingly less.

These calculations are base on an own-price elasticity of demand in the range of −0.3 to −0.5. For further discussion of the impacts of wheat flour exports to Afghanistan on Pakistan’s prices, see Dorosh and Salam (2008).

Although the border between Afghanistan and Pakistan is highly porous in terms of movements of small amounts of goods and people, shipment of the hundreds of thousands of tons of grain required to significantly offset the 1.5 million ton production shortfall is not possible on mountain paths and small roads.

Transport costs to Kabul in 2005 were estimated at about $20/ton (Chabot and Dorosh 2007). Total milling, transport and marketing cost from wholesale grain Lahore to retail flour Kabul averaged $50/ton (July 2006 to June 2007).

Note that poppy cultivation takes up only about 1% of cultivated land, so that the tradeoff of wheat versus poppy is not in terms of competition for land, but competition for labor, since poppy is a very labor intensive crop. See World Bank (2006a).

Futures contracts, especially for wheat and maize, can be used to reduce uncertainty regarding the price of potential grain imports. To date, most governments have been reluctant to use futures contracts in part because they essentially function as an insurance policy, with no “payoff” in years when there is no need for imports or when international market prices are below the contracted forward delivery price.

Basic inventory control models with exogenous prices or more complex dynamic programming models with endogenous market demand and prices exist to calculate optimal stock levels and price stabilization strategies (e.g. Goletti 2000); these provide guidance in setting the overall policy framework (e.g. international trade combined with national stocks is a more effective strategy than pure self-reliance), but in practice, actual decisions regarding monthly or annual stocks typically are based on less formal analysis.

In the mid-1980s, in order to finance the costs of holding a rice buffer stock as total imports (and therefore sales and financial earnings) declined, Indonesia included an explicit line item in the budget.

According to the regulations of the SAARC Food Security Reserve, established November 4, 1987, each member was entitled to draw on the foodgrain reserves in an emergency. However, the price and other conditions of repayment were not specified beforehand, but were to be “the subject of direct negotiations between the member countries concerned”. (Article IV.3.). (SAARC 1987). Steps to modify the system and create a SAARC Regional Food Bank began at the 12th SAARC Summit in 2004, and a formal document endorsed at the 14th summit in 2006. Although the document was scheduled to be ratified by July 2007, only four countries had ratified the document by July 2008 and the SAARC Regional Food Bank was still not in place at the end of 2008.

References

Ahmed R, Haggblade S, Chowdhury TE (2000) Out of the shadow of famine: evolving food markets and food policy in Bangladesh. Johns Hopkins University Press, Baltimore, Maryland

Bangladesh Bureau of Statistics (2000) Household income and expenditure survey 2000. Dhaka, Bangladesh

Byerlee D, Jayne TS, Myers RJ (2007) Managing food price risks and instability in a liberalizing marketing environment: overview and policy options. Food Policy 31(4):275–287

Chabot P, Dorosh PA (2007) Wheat markets, food aid and food security in Afghanistan. Food Policy 32(3):334–353

del Ninno C, Dorosh PA, Subbarao K (2007) Food aid, domestic policy and food security: contrasting experiences from South Asia and sub-Saharan Africa. Food Policy 32(3):413–435

Dorosh PA (2001) Trade liberalization and national food security: rice trade between Bangladesh and India. World Dev 29(4):673–689

Dorosh PA (2008) Food price stabilization and food security: the international experience. Bull Indones Econ Stud 44(1):93–114

Dorosh PA, Salam A (2008) Wheat markets and price stabilization in Pakistan: an analysis of policy options. Pak Dev Rev 44(1):71–88

Dorosh PA, Farid N, Shahabuddin Q (2004) Price stabilization and food stock policy. In: Dorosh P, del Ninno C, Shahabuddin Q (eds) The 1998 floods and beyond: towards comprehensive food security in Bangladesh. International Food Policy Research Institute and University Press Ltd, Dhaka, Bangladesh

Goletti F (2000) Price stabilization and management of public foodgrain stocks in Bangladesh. In: Ahmed R, Haggblade S, Chowdhury T (eds) Out of the shadow of famine: evolving food markets and food policy in Bangladesh. IFPRI and Johns Hopkins University Press, Baltimore

Goletti F, Raisuddin, Chowdhury N (1991) Optimal stock for the public foodgrain distribution system in Bangladesh. Food Policy in Bangladesh Working Paper 4. International Food Policy Research Institute, Washington, DC

Government of India (various years). India Economic Survey. Ministry of Finance. New Delhi.

Jayne TS, Zulu B, Nijhoff JJ (2006) Stabilizing food markets in Eastern and Southern Africa. Food Policy 31:328–341

McCullough N, Timmer CP (2008) Rice policy in Indonesia: a special issue. Bull Indones Econ Stud 44(1):33–44

Rashid S, Gulati A, Cummings R Jr (2008) From Parastatals to private trade: lessons from asian agriculture. Johns Hopkins University Press, Baltimore, MD

Rosegrant M (2008) Biofuels and grain prices: impacts and policy responses. Brief written as testimony to the US Senate Committee on Homeland Security and Governmental Affairs, 7 May 2008, International Food Policy Research Institute (IFPRI).

South Asian Association for Regional Cooperation (SAARC) (1987) Agreement on establishing the SAARC Food Security Reserve.” www.slmfa.gov.lk/saarc/ images/agreements/saarc_food_security_reserve_1987.pdf (downloaded January 18, 2009)

Timmer PC, Falcon WP, Pearson SR (1983) Food policy analysis. Johns Hopkins University Press, Baltimore MD

United States Department of Agriculture (USDA) (2008) Grain: world markets and trade. Circular FG 04-08. Washington, DC

World Bank (2004) India: re-energizing the agricultural sector to sustain growth and reduce poverty, published for the World Bank by Oxford University Press, New Delhi.

World Bank (2006a) Enhancing food security in Afghanistan; South Asia human development discussion paper. World Bank, Washington, DC

World Bank (2006b) Managing food price risks and instability in an environment of market liberalization. Agriculture and Rural Development Department. World Bank, Washington, DC

World Bank (2007) Pakistan: promoting rural growth and poverty reduction. Report No. 39303-PK. World Bank, Washington, DC

World Food Programme (2008) Wheat price increase and urban programming in Afghanistan, January 2008, Rapid assessment mission report

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dorosh, P.A. Price stabilization, international trade and national cereal stocks: world price shocks and policy response in South Asia. Food Sec. 1, 137–149 (2009). https://doi.org/10.1007/s12571-009-0013-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12571-009-0013-3