Abstract

Recent scholarship across various disciplines since the U.S. housing crisis of 2008 has deepened our understanding of racial wealth gaps, especially as it pertains to housing. This article focuses on two less-developed dimensions of Black and Latino home ownership, voting and immigration, respectively. The Black home ownership rate has fallen to 41% as of 2019, the lowest level since the 1968 Fair Housing Act. I contend that the continued decline of Black home ownership reduces voting turnout. A multivariate fixed effects analysis of state-level Black voter turnout in presidential elections since 2000 lends support to this contention. In contrast, the Latino home ownership rate has rebounded, climbing to nearly 48% in 2019. I argue that this rise is as much a mirage as sign of progress—an artifact of the deportation of millions of Latin Americans and the end of undocumented Mexican migration. Such changes inflate Latino ownership rates by reducing the denominator rather than increasing the numerator of homeowners. Examining state-level data, my multivariate analysis shows that the decline in the undocumented population and, to a lesser extent, the increase of DACA recipients explain the level and change in Latino ownership more than the change in the share of Latino citizens or documented non-citizens. I conclude that the color line has reinforced a new Black/non-Black divide in home ownership that undermines the social mobility and electoral representation of Black Americans. Meanwhile, a tri-racial divide by legal status and race stratifies Latino home ownership. Intra-Latino inequality masquerades as success because of the expulsion of vulnerable Latino immigrants and their US citizen children. The social consequences distort the home ownership rate calculation and pose another threat to multiracial democracy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the United States today, the wealth of the median Black household is 10% of median white household wealth and median Latino household wealth is just 13% (Lei et al. 2015; Maroto 2016). Home ownership remains the greatest source of wealth for American households, especially Black and Latino families (Salgado and Ortiz 2019). Scholarship since the 2008 housing crisis has further excavated the foundations of racial wealth gaps, including institutional histories (Baradaran 2017; Connolly 2014; Prasad 2013; Trounstine 2018), mortgage and student debt finance (Engel and McCoy 2011; Immergluck 2011; McMillan-Cottom 2017; Seamster and Charron-Chénier 2017), climate disasters (Gotham 2014; Howell and Elliott 2019), and housing discrimination (Desmond 2012; Faber 2013; Korver-Glenn 2018; Rothstein 2017; Rugh and Massey 2010; Sharkey 2013; Taylor 2019). In this article I focus on the implications of Black and Latino home ownership for two critical issues: voting and immigration. Voting rights and immigrant justice loom over the upcoming Supreme Court ruling on DACA and 2020 presidential election amidst an era of racial massacres, from Charleston and Charlottesville to Pittsburgh and El Paso, extrajudicial police killings, the demise of refugee entry, ending of asylum at the US-Mexico border, racialized deportations, and systematic voter disenfranchisement.

The Black home ownership rate has fallen to the lowest level since the 1968 Fair Housing Act, just under 41% as of mid-2019 (Fig. 1). Black Americans stand out as the only ethno-racial group to not recover from the housing crisis. Neither education, income, nor credit explain this Black/non-Black divide. Black college graduates remain less likely to own their homes than white Americans without a high school diploma (56% vs. 61%; see Choi 2019). I contend that the continued decline of Black home ownership reduces voting turnout. I examine the consequences of the persistent decline in Black home ownership since its peak in 2004 for Black voter turnout in presidential elections across states from 2000 to 2016 and uncover troubling implications.

By contrast, the Latino home ownership rate has rebounded, climbing from 45% in 2014 to 48% by 2019 (Fig. 2). I argue that this rise is as much a mirage as a sign of progress—an artifact of the deportation of millions of Latin Americans and the end of migration by undocumented and disadvantaged Latino populations. I dig deeper into what exactly is behind the recovery in ownership rates that began after 2013 and how it may be linked to changes in immigration policy and the legal status composition of the Latino population, which includes the native born, naturalized citizens, documented non-citizens, those in Temporary Protected Status (TPS), those benefiting from Deferred Action for Childhood Arrivals (DACA), and all other undocumented immigrants. My multivariate analysis of state-level data employing state-year fixed effects shows that declines in the undocumented population and the increase of DACA recipients are significantly associated with Latino ownership.

Black Americans and the Cumulative Wealth Disadvantage Cycle

Today, Black Americans comprise 13.4% of the U.S. population, yet hold only 2.6% of total wealth, little more than the 1% share post-emancipation (Baradaran 2017; Darity and Mullen 2020). Because recounting the 400-year history of (stolen) Black American wealth is beyond the scope of this article, I synthesize work on racial segregation and wealth as an ongoing feedback mechanism of social stratification (Desmond and Emirbayer 2016; DiPrete and Eirich 2006; Krysan and Crowder 2017; Massey and Denton 1993; Rugh et al. 2015; Sewell 2016; Takaki 2008; Taylor 2019), a framework I label the cumulative wealth disadvantage cycle (Fig. 3). I also choose to focus primarily on new scholarship published since the 2008 US housing crisis.

The foundation of the cycle rests on the colonial institutionalization of race, racism, and slavery. Historian Kendi (2016) argues that slavery was born of self-interest rather than hate, wherein racism is used as justification. Slavery robbed Black people of their wealth and was justified ex-post facto by racist ideologies that may never be eradicated, but, like a virus, mutate and persist today (Kendi 2016; Stevenson 2014). The emancipation of enslaved Black people and post-Civil War reconstruction were short-lived and marked neither the end of race-based slavery nor racism (Foner 2019). Instead, racism and slavery simply evolved during the Jim Crow era into new forms of wealth suppression: convict leasing, sharecropping, and debt peonage persisted into the 1940s, enforced by Supreme Court rulings and the lynching of thousands of Black Americans (e.g., Blackmon 2009; Equal Justice Initiative 2017).

Over the past decade, influential works by Ibram Kendi, Byran Stevenson, Nikole Hannah-Jones, and Ta-Nehisi Coates have broken through to mainstream America to show how racism threads to the present (Kendi 2016), through lynching and mass incarceration (Stevenson 2014), segregation (Hannah-Jones 2012, 2015), and, ultimately, a reckoning with collective repentance and reparations (Brown 2016; Coates 2014; Darity and Mullen 2020; Mock 2019). Ida B. Wells, W.E.B. Du Bois, and John Hope Franklin were three forerunners of this breakthrough work, yet their contributions were buried by white elites due to the same racism they uncovered (Faust 2015; Hunter and Robinson 2018; Morris 2017; Wright II 2017).

Whereas the first 250 years of disadvantage for Black Americans accumulated by way of slavery, lynching, and the denial of property, segregation curtailed wealth gains through cycles of exploitation and wealth destruction (Fig. 3). As Massey and Denton (1993) argue, the turn of the twentieth century and the Great Black Migration marked the genesis of American racial apartheid in housing, not its demise. Primarily via mortgage redlining and urban renewal, racial segregation and the suppression of black wealth was hard-wired into federal policy and deployed locally to create segregation even in places where it did not previously exist (Rothstein 2017; Sugrue 2014). Black-White segregation did not peak until 1980 and is higher than any time prior to 1940; Black Americans remain hyper-segregated in 21 metro areas, including Baltimore, Boston, Chicago, Detroit, and New York (Hwang et al. 2019; Kucheva and Sander 2018; Massey and Tannen 2015; Rugh and Massey 2014).

Segregation leads to the destruction of Black wealth-building institutions such as entrepreneurship, banks, and businesses (Oliver and Shapiro 1999). The violent 1921 massacre of the Black residents and destruction of Black-owned property in Tulsa, Oklahoma underlines how spatial segregation can lead to the demise of wealth-building institutions. Legal scholar Mehrsa Baradaran (2017) argues that the institution of black banking has never delivered on promises touted by boosters, from Lincoln to Obama. Such banks are doomed primarily due to housing segregation, and also by white plunder that stretches from the failure of the Freedman’s Bank to the 2008 crisis (Baradaran 2017). Historian Nathan Connolly (2014) uses the case of Jim Crow segregation in housing in South Florida to illustrate how class-based interests of white as well as Black property owners dictated the negotiated terms of segregation in ways that rationed access to public goods, private property, and wealth. The subprime crisis of 2008 supports Connolly’s (2014) thesis that segregation is and always will be profitable, including to Black interests operating under the strictures of racist white institutions (Ray 2019), such as mortgage brokers who exploit and erase the wealth of the wider Black community (Massey et al. 2016b; Steil et al. 2018).

The legacy of Black-White segregation powerfully shapes racial divides in wealth and democracy today (Trounstine 2018). Alexandra Killewald and colleagues document that the annual return to black home ownership is 48% of the return to white ownership (Killewald and Bryan 2016); and grandparental wealth, not just parental wealth, determines racial patterns of wealth endowments, accumulations, and unequal rates of social mobility that widen racial wealth gaps (Pfeffer and Killewald 2017). Patrick Sharkey (2013) finds that the persistent Black/White divide in household fortunes in the post-Civil Rights era derives from the entrenched deficit in neighborhood fortunes that Black Americans inherited after the end of the Great Black Migration.

In the most racially segregated state of Michigan, also battered by a prolonged housing foreclosure crisis, Black voter turnout declined in 2012 and 2016, periods that coincided with the rise of racialized emergency management that disproportionately disenfranchised predominantly Black cities (Breznau and Kirkpatrick 2018; Seamster 2018). When I applied the change in voter turnout from 2012 to 2016 to the cities found in Seamster (2018), I find that voter turnout declined by − 9.5% in the mostly majority-black cities under emergency management, compared to − 3.5% in majority-white cities similarly distressed, but not under state control, and − 2.9% among other cities and towns in the Southeast Michigan-Detroit region. White advantage and isolation are equally important as Black disadvantage and segregation. Jessica Trounstine (2018) shows how relative whiteness (white racial isolation) of neighborhoods in 1970 remains a robust predictor, net of several confounders, of cumulative neighborhood racial advantage in terms of public goods and private wealth, as well as Republican vote shares, nearly 50 years later.

Although most Black and White Americans inherited hard-wired racial segregation, it is no longer universal (Kucheva and Sander 2018; Sharkey 2014). In more integrated cities where most housing was built after the 1968 Fair Housing Act, such as Las Vegas, Nevada, Phoenix Arizona, and San Diego, California, Black Americans have in fact attained greater equality (Sander 2018). Nevertheless, despite income advantages, many Black middle-class pioneers in more integrated cities are fewer in number and hold little wealth, still devastated by the 2008 housing crash (Raymond et al. 2016). For instance, from 2000 to 2018, metro area Black home ownership rates in Las Vegas dropped from 40 to 28%; in Phoenix, from 45 to 34%, and in San Diego, from 32 to 27%. Following a panel of over 11,000 homeowners in the hard-hit, yet more integrated region of Orlando, Florida, I find that experiencing foreclosure corresponds to a 4% reduction in voter activity for White voters and a 7–14% reduction among Black and Latino voters, net of age, marital status, income, and other confounders (Rugh 2019a).

Thus, even when Black Americans achieve exceptional racial integration, their precarious hold on wealth is eroded by the effect of three recent forces: first, predatory products and discriminatory practices; second, the worst local home price crashes of the most devastating housing crisis since the Great Depression; and, third, a belated and flawed government response to homeowner mortgage distress that likely widened, rather than narrowed, racial wealth gaps (Fraser and Oakley 2015; Immergluck 2015; Rugh 2019b; Schuetz et al. 2015). In sum, as Elizabeth Korver-Glenn (2018, p. 628) argues, “compounding inequalities” perpetuate the cycle of lost housing wealth (Fig. 1), from algorithmic racial bias, appraisal, marketing, searching, mortgage lending, foreclosure, relocation, and home price changes (Benjamin 2019; Besbris et al. 2015; Hwang 2019; Immergluck et al. 2019; Krysan and Crowder 2017; Raymond et al. 2016; Rugh et al. 2015; Sewell 2016; Squires 2017; Sharp and Hall 2014; Steil et al. 2018; Sullivan 2017; Noble 2018).

Race, Immigration, and the New Latino Homeowner Middle Class

Today, Latino Americans are the nation’s largest ethno-racial minority, at 18.3% of the U.S. population. Most of the increase in the Latino population has occurred in the post-Civil Rights era and, more recently, in new immigrant destinations such as the U.S. South (Armenta 2017; Jones 2019). The Latino population is increasingly diverse, and the Latino-white wealth gap varies by nationality, skin tone, immigrant generation, and legal status (e.g., McConnell and Akresh 2013; Painter and Qian 2016; Rugh 2019a). Partly as a result of Latino growth and diversification, the historical Black/White color line has morphed into a more complex tri-racial divide wherein the (non-Hispanic) “white” category shrinks numerically but retains hegemony while the “honorary white” and “collective black” strata expand (Bonilla-Silva 2002, 2017; Flores-González 2017; Gans 2012; Huante 2019; Vargas 2015). The honorary white category has expanded to absorb upper status, often lighter-skinned Cuban American and Puerto Rican suburbanites who are protected from deportation, and documented immigrants from South America, who enjoy high levels of home ownership and home equity (Cahill and Franklin 2013; McConnell and Akresh 2013) and low levels of foreclosure (Rugh 2019a). The collective black category envelopes Latino immigrants to the extent that undocumented status is racialized because it is criminalized, locking in intra- and intergenerational disadvantage through social and residential stratification, what Jones (2018, p.1) deems “reverse incorporation” (Asad and Rosen 2018; Bean 2016; Bean et al. 2015; Golash-Boza 2015; Hall and Rugh 2019; Hamilton et al. 2019; Massey 2013; Rugh 2019a; Rugh and Hall 2016).

Despite the rise of the Mexican American middle class, the largest minority middle class in the U.S. today, Latino homeowners face unique risks (Keister et al. 2019; Rugh 2015; Vallejo 2012). Two chief risks to wealth accumulation for Latinos are residence in mixed status families with undocumented members (Dreby 2015; Golash-Boza 2015; Gonzales 2016; López 2015; Zayas 2015; Zhou and Gonzales 2019) and the frequent remittance of earnings to home countries (Brown 2007; Vallejo 2012). Indirectly, racialized immigration enforcement programs such as local 287(g) agreements and the deportation of Latino workers have been linked to the reduction of income in mixed status families (Capps et al. 2015) and the destruction of wealth through foreclosure (Rugh and Hall 2016). It is well-documented that middle-class Black Americans confront greater discrimination due to their class status—not in spite of it (Anderson 2011; Cose 2009; Faber 2013). The racial experience of the Latino middle class tends to vary by ethnicity, class, generation, and legal status (Vallejo 2012; Vargas 2015), though arguably responses to discrimination along racial ideological grounds vary more than the experience itself (Dowling 2014; Huante 2019).

Like the Black American middle class, the new Latino middle class has lower wealth than the White middle class (Keister et al. 2015). The median White householder who only completed high school has greater wealth ($100,600) that the median Latina/o college graduate ($73,910) and the median Black college graduate ($68,300) (Author’s calculations based on the 2017 Survey of Consumer Finances). This intergenerational wealth disadvantage among Latinos has occurred primarily among the children and grandchildren of racially segregated Puerto Ricans, Mexican Americans, and undocumented Mexican immigrants (Bean et al. 2015; Flores-González 2017; Keister et al. 2015; Salgado and Ortiz 2019; Telles and Ortiz 2008). For the children of Mexican immigrants, homeowner wealth is reduced due to the prevalence of undocumented status, which at impedes parental wealth accumulation and intergenerational transfers (Flippen 2019). Similar to Black Americans, Salgado and Ortiz (2019) report that Mexican Americans rely on home equity as the primary source of household wealth, counting on very little or zero parental intergenerational financial support. Recently, affluent Puerto Ricans in more racially integrated settings such as suburban Florida may be on track for honorary white status, taking advantage of residential mobility, home ownership, and greater housing wealth (Duany 2010; Duany and Rodríguez 2006; Kuebler and Rugh 2013; Rugh 2019a; see Huante 2019 and Vallejo 2012 regarding Mexican Americans who cross, but do not shift, group racial boundaries). In review, since the 2008 housing crisis, the Black and Latino middle classes remain fragile, under the strain of student loan debt and obligations to family and co-ethnics facing incarceration, deportation, foreclosure, and eviction—all of which destroy wealth (Desmond 2012; Faber and Rich 2018; Goldrick-Rab 2016; Heflin and Pattillo 2006; Pattillo 2013; Massey and Rugh 2018; McMillan-Cottom 2017; Seamster 2019; Seamster and Charron-Chénier 2017; Sullivan 2017; Vallejo 2012).

The Recovery of Latino Home Ownership: Progress or Mirage?

Notwithstanding the perils faced by Black and Latino homeowners, while the Black home ownership continues to decline per the historical cycle of disadvantage, the Latino rate of ownership has rebounded rapidly since 2014. Unlike Black households, the Latino home ownership rate is higher today than in 2000. To illustrate the relationship to undocumented Latino immigration, Fig. 4 documents the Latino home ownership rate and the share of the Latino population that is undocumented from 2000 to 2019, divided into the boom (2000–2007), bust (2008–2012), and recovery (2013–2019) periods.

During the boom, Latino home ownership rose to a peak of 50% by 2007 and the undocumented immigrant population also peaked, at 20% of the Latino population. As I have argued (Rugh 2015), the housing boom was fueled by the influx of undocumented immigrants who helped build the homes, a younger bilingual generation who benefited as real estate sellers and buyers, and risky low/no documentation mortgages that required little or no verification of income to capture market share in the heavily Latino booming metros. I find that the incidence of such low/no doc loans could be explained by other factors for Black, White, and Asian American borrowers, but not for Latinos (Rugh 2015). The strategy of pooling income of documented and undocumented household members paid off—until the housing market crashed.

The façade of rising ownership physically and socially constructed using vulnerable undocumented labor concealed enormous racial risks for Latinos during the housing bust. Starting in 2007, lenders changed their lending standards, often overnight, to exclude income from undocumented immigrants, even when it could be documented (Guelespe 2013; Jones 2019; Schueths 2015; Author’s examination of SEC filings for Rugh 2015). To make matters even worse, the Bush and Obama administrations ramped up the deportation of undocumented immigrants to record levels. Millions of immigrants were expelled from 2007 to 2013; 85% were employed Latino men whose contributions to household mortgage and rent payments vanished (Golash-Boza and Hondagneu-Sotelo 2013; Rugh and Hall 2016). Using data from Pedroza (2019) and based on a quasi-experimental difference-in-difference model, along with Matthew Hall, I report that local 287(g) immigration enforcement is strongly associated with Latino foreclosure rates from 2005–2012, but not the rates of Black, White, or Asian households (Rugh and Hall 2016).

The final period, the current 2013–2019 mirage recovery, presents a new puzzle. Whereas immigration and ownership trended in tandem during the boom and bust, during the recovery this relationship reverses—the decline in the undocumented population now correspond to increases, rather than decreases, in Latino home ownership. To address this puzzling reversal, I first draw on the insight of Yu and Myers (2010, p. 2636) regarding the two sides to the homeownership rate calculation:

Research findings underscore that the current homeownership measure, defined as the percentage of households that are owners, is a deficient, if not flawed, indicator of access to owner-occupied housing in the US. A rise in that indicator can reveal two contradictory trends—either success in the ownership society, or the elimination of households from the housing market.

Complicating frames of a “wave of Hispanic buyers” reported in outlets like The Wall Street Journal (Kusisto and Eisen 2019) that focus on the numerator of homeowners, the insight of Yu and Myers points to the opposite possibility: a falling denominator of Latino households. If a tri-racial divide is emerging among Latinos in the U.S., both processes could be co-occurring and mutually reinforcing (Rugh 2019a); for example, native born and documented Latinos could be buying homes vacated by mixed status and undocumented families, many of whom may have left the US or made moves into more racially isolated Latino neighborhoods (Hall and Rugh 2019).

The “mirage recovery” argument also builds on analysis by Becky Pettit (2012) in her book, Invisible Men: Mass Incarceration and the Myth of Black Progress, where she shows that mass incarceration severely distorts indicators of Black American progress, such as educational attainment and voter turnout. As Pettit shows, these rates are inflated by the removal of Black men from the denominator of these calculations. Restoring them properly to the denominator reduces and, in some cases, erases a generation of (illusory) progress in the contradictory post-Civil Rights era of mass incarceration. In my analysis here, the removal of Latinos, mainly men, has a similar effect, but is perhaps even more likely to go unnoticed: While these men have likewise been detained and incarcerated due to racially discriminatory practices (Armenta 2017), they are now expelled from the U.S. entirely. In many ways, these men who were deported, along with their partners and families (including U.S. citizens) are out of sight and out of mind when we conceive of recent Latino “progress.” The end of Mexican net migration to the U.S. includes the forced and voluntary settlement of over 600,000 U.S. born “American Mexican” children in Mexico since 2009 (Jacobo and Jensen 2018). For a decade now, these children no longer age into adulthood or form new, mainly renter, households in the U.S. In sum, during the recovery, the deportation of millions of Latino immigrants (Golash-Boza 2015) and the end of undocumented Mexican immigration (Massey et al. 2016a; Passel and Cohn 2019) together inflate the Latino home ownership rate to make progress more of an artifact of these migration trends than a real increase in ownership.

As a preliminary test of my premise, Fig. 5 presents the Latino home ownership rate under three scenarios: (1) the actual 2017 rate of 47.3%; (2) the simulated 2017 rate of 45.8% when actual 2017 rates by legal status (see note) are applied to population shares when deportations and migration was akin to what existed circa 2010, including the absence of a DACA category; and (3) a final hypothetical 2017 rate of 44.5% when actual 2017 rates by legal status are applied strictly to 2007 legal status population shares, including the absence of DACA. These three scenarios show how changes in the legal status profile of the Latino population may explain potentially half (1.5 points) to all (3.2 points) of the recovery in Latino home ownership during the housing recovery that began in 2013. For the sake of parsimony, this rough estimate generously assumes that the current rates of ownership by legal status are unaffected by changing population shares. The inclusion of nearly 700,000 DACA recipients after 2012 and the growth in TPS populations are important because they have a similar effect (despite opposite reasons) as the removal of over 1.5 million established Latinos from the U.S. interior by Immigration and Customs Enforcement: both DACA/TPS and deportation remove householders from the all other undocumented category, which has the lowest ownership rate among all status categories.

Latino Home Ownership Rates in 2017 Under Three Scenarios. Note The legal status categories (and corresponding estimated 2017 Latino home ownership rates) are as follows: Naturalized citizens (61%), Native Born (49%), Documented Non-citizen/Legal Permanent Resident/Visa Holder (49%), Temporary Protected Status (TPS) (33%), DACA Households (29%), and All Other Undocumented Householders (12%). These estimates are based on analysis of McConnell and Marcelli (2007), Ruggles et al. (2019), Rugh (2019a), Rugh and Allen (2015), Warren and Kerwin (2017), Wong et al. (2017), and population data from the Congressional Research Service, US Citizen and Immigration Services, and the US Census Bureau. All known estimates are plugged into an equation that solves for the DACA household rate (including mixed legal status couples where the DACA recipient’s partner is a US citizen or documented immigrant) using the other known rates and all the known current population estimates (See Appendix, Table 3 for more details)

Summary of Key Arguments

In review, I have made two key arguments. First, I contend that the unrelenting decline in Black home ownership continues a historical cycle of lost wealth and may lead to consequences such as lower voter turnout (as I reported for Michigan and Florida), reflecting a persistent Black/non-Black color line. Second, I maintain the recent recovery in Latino home ownership is an artifact of the changing legal profile of the Latino population wherein undocumented Latino immigrants have been either (1) granted racialized, legally disputed, and increasingly precarious statuses such as TPS and DACA; (2) deliberately deported; (3) no longer arriving in similar numbers; or (4) voluntarily returned to Mexico and, to a lesser extent, the rest of Latin America. This “mirage recovery” supports the emergence of a tri-racial divide that stratifies Latinos primarily along legal status lines that intersect with national origin, race, and class.

Data and Methods

To test these two key arguments about the implications of Black and Latino home ownership trends, I analyze state-level data (including the District of Columbia) from 2000 to 2018 for my variables of interest: Black ownership rates and Black voter turnout as a percent of Black adult citizens age 18 or older in presidential election years, and Latino ownership rates and immigrant composition by legal status in even years. These indicators are defined using data from the U.S. Census Bureau, Ruggles et al. (2019), the Pew Research Center (for undocumented migrants), Congressional Research Service (for migrants holding TPS), and U.S. Citizenship and Immigration Services (for DACA recipients).

State-level data were chosen to ensure sufficient sample sizes of Black respondents in the Current Population Survey (CPS) Voter Supplement and because annual estimates of the undocumented immigrant population and total DACA recipients are only available at the state-level. While an analysis of larger metropolitan areas is planned for future analyses, my principal aim in this article is to examine sub-national units (states) that make up the total share of the population in my descriptive analysis and the vast share in my multivariate analysis. (The 40 most populous states for Black and Latino residents plus DC are home to 99.6% Black Americans and 99.2% of Latino Americans, respectively.)

In my analyses, I estimate weighted and ordinary least squares models using year, state, and state-year fixed effects. For the models of Black voter turnout as a function of Black home ownership, I include a set of control variables that include state-level racial segregation at the tract-level, time-varying indicators of election laws according to the National Conference of State Legislatures for voter photo ID (strict vs. non-strict/none: strict ID currently in Georgia, Indiana, Kansas, Mississippi, Tennessee, Virginia, and Wisconsin) and same day voter registration, and swing state status in the current presidential election year.

For the models of Latino home ownership as a function of the undocumented Latino population share, I include the non-citizen share, the share with DACA status (in models of later years), the ratio of median home values to median Latino household incomes, and a suite of time-varying indicators of state immigration laws according to the National Conference of State Legislatures. These laws include whether driver’s licenses are permitted for undocumented immigrants (California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, New Mexico, (New Jersey in 2021), New York, Nevada, Utah, Vermont, Washington, and DC), strict E-verify policy for all employees, and a trichotomous indicator of no in-state tuition for undocumented students vs. in-state tuition vs. in-state tuition and state financial student aid.

Black Home Ownership and Black Voter Turnout

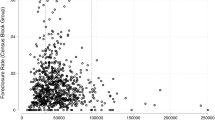

Figure 6 summarizes in a scatterplot the moderate and highly statistical significant bivariate correlation (r = 0.47, p < 0.001) between change in Black home ownership rates from 2006 to 2016 and the change in Black voter turnout since the previous election for the 2004–2008, 2001–2012, and 2012–2016 periods. While smaller states display larger variation partly due to sampling error in the CPS, the pattern each presidential year and over time is clear: In states where Black homeownership declines less/gains more, Black voter turnout decreases are reduced and increases are amplified. Likewise, the clustering of states that moves left and downward across the graph by election year demonstrates that Black ownership declined in nearly every state, with accompanying declines in Black voter turnout, especially between 2012 and 2016.

Figure 7 presents a line path of Black voter turnout as a function of Black home ownership rates from 2004 to 2016 in select swing states from 2012 (Colorado, Florida, Virginia) and 2016 (Florida, Michigan, Pennsylvania, Wisconsin). The hook-shaped pattern that shoots upward from 2004 to 2008 and then descends leftward shows how Black voter turnout helped elect the nation’s first Black president in 2008, but then slipped in 2012, and plummeted in 2016 across states, except Colorado and Virginia. The leftward drift means that Black home ownership (x-axis) has declined across all years and all states after the 2008 housing crisis. Colorado, Florida, Michigan, and Wisconsin are highlighted in Fig. 7 to show both the contrast of rising turnout in Colorado as well as the steep drop in turnout in Wisconsin—even if the decline were half as large in the population of Black voters as in the CPS sample, it would clearly be the most dramatic drop-off in a state where, among other things, a new strict voter ID law was also enacted. In all states except Colorado, Black voter turnout in 2016 was lower than in 2008; in the pivotal states of Florida, Michigan, and Wisconsin, Black voter turnout in 2016 was well below 2004 levels.

Table 1 presents the weighted (by Black sample size) least squares estimates of state-level Black voter turnout as percentage of adult citizens in the 2004 to 2016 U.S. presidential elections under various models of Black home ownership as the explanatory variable of interest. The analysis sample excludes states with fewer than 50 observations and thus includes 40 states plus DC that are home to 99.6% of all Black Americans as of 2016. In column (1), a straightforward model of the level of turnout and ownership is estimated with state fixed effects and the control variables and 74% of the variance is explained. The coefficient on Black home ownership (b = 0.905, p < 0.01) means that for every 10-point difference in Black homeownership in the cross-section of states, Black voter turnout is 9.05 points higher.

In column (2), both the outcome and explanatory variables are lagged to benchmark them to the previous election year and better isolate the effect of a change in ownership over the past 4 years on the change in turnout. The results indicate that for each 10-point increase in Black ownership, Black turnout rises by 1.93 points. Thus, so far, the relationship between ownership and voting is stronger between states than it is within states over time. However, column (3) removes the 2004–2008 period to focus on the change since the election of the first Black president, which occurred (not merely coincided) with housing and financial crisis of 2008. In this model, the relationship between the lagged rate of ownership 4 years earlier and the current turnout rate is slightly stronger (b = 0.225 vs. b = 0.193 in column (2), p = 0.05), even after accounting for election year effects, i.e., the substantial effect of the absence of the Obama candidacy in 2016 (b = − 8.275, p < 0.001).

In column (4), state fixed effects are re-introduced and the outcome variable is now measured as the change in Black voter turnout versus 4 years earlier, again from 2008 to 2016, and the explanatory variable of interest is the corresponding change in Black ownership during the past four years. The magnitude of the coefficient of interest is greater, albeit marginally statistically significant (b = 0.541, p < 0.09), implying that Black voter turnout rises by 5.41 points for each 10-point increase in Black ownership, net of state effects that do not vary with time and the time-varying control variables. In column (5), an otherwise identical model is estimated except that the explanatory variable of interest is now the 8-year lagged change in Black ownership, to probe whether the effects of declining ownership take longer to manifest. This possibility receives qualified support; net of state and year fixed effects, and time-varying covariates, a 10-point increase in Black home ownership over the previous 8 years is associated with a 7.03-point increase that is marginally statistically significant (p = 0.09) but suggestive given the limited statistical power of the sample size of state-years (n = 123).

Column (6) presents a final model of the level of 2016 Black voter turnout, controlling for 2012 turnout, with the 2012 level of Black home ownership as the explanatory variable of interest. Interestingly, in 2016, the model documents the strongest association between lagged ownership and turnout (b = 0.327, p < 0.03)—the association between ownership and turnout was thus much steeper in 2016. For every 10-point increase (decrease) in ownership, turnout rose (fell) by 3.27 points, compared to 1.93 points for 2004–2016 and 2.25 points for the 2008–2016 periods as shown in columns (2) and (3), respectively.

In summary, by 2016, the cumulative, continuing shift in Black home ownership rates to record low levels since 1968 manifested a stronger effect on state-level Black voter turnout. While prior descriptive and multivariate analysis shows that this relationship between depressed Black ownership (wealth) and voter turnout (democratic participation) first emerged in 2012, the much stronger association in 2016 combined with the effect of 2016 (i.e., Obama absence) to help explain (other factors also clearly at play) why states like Michigan, Pennsylvania, and Wisconsin tipped an extremely close election.

Latino Home Ownership and Immigrant Legal Status

Figure 8 combines data from various sources to show the growth and remarkable transformation in the Latino immigrant population by legal status from 2000 to 2018. During the housing boom from 2000 to 2007, the naturalized citizen share barely budged, by 0.5%, while the share of documented non-citizens fell from 28 to 21%, the undocumented share grew from 43 to 49%, the TPS fraction rose from 0.6 to 1.8%, and DACA did not yet exist. During the 2007 to 2018 crash and recovery, far more dramatic changes occurred: although the documented non-citizen share only edged up from 21 to 22%, the naturalized citizen share increased from 28 to 37%, and the undocumented share plummeted from 49 to 36%, with part of that incredible decline owing to TPS and especially the launch of DACA in 2012, which caused the share of undocumented with conditional work authorization to nearly triple, from 1.8 to 5.1%. In summary, whereas half the Latino immigrant population was undocumented without protections in 2007, today that share is approaching one-third, with the remaining two-thirds exhibiting much higher rates of home ownership and wealth (McConnell and Akresh 2013; Rugh 2019a).

US Latino Immigrant Population by Legal Status, 2000–2018. Data sources: U.S. Census Bureau, Ruggles et al. (2019), Pew Research Center (Undocumented), Congressional Research Service (TPS), U.S. Citizenship and Immigration Services (DACA), Author’s Calculations

Figure 9 presents the bivariate relationship between Latino home ownership and the undocumented Latino population share in states where Latino immigrants make up a majority of the undocumented, pooled across 2006, 2010, 2014, and 2018 (r = 0.55, p < 0.001). In states like Arizona (AZ), the decline in the undocumented Latino population share fell dramatically, from 23% in 2006 to 11% in 2018, while the Latino homeownership rate initially edged up from 56% in 2006 to peak at 57% in 2008, only to decline steeply to 49% in 2014 and then recover equally rapidly to 54% by 2018. California, Florida, Illinois, Nevada, Texas, and Utah follow a similar, though less volatile, pattern of decline and recovery in ownership (y-axis) as the undocumented share falls over time (x-axis). From 2006 to 2018, Latino home ownership climbed from 41 to 47% and undocumented Latino population share dropped from 47 to 30% in Georgia, where immigrant deportations led to dramatic declines in the Latino immigrant population and Mexican in-migration came to a halt. The strong recovery of Latino ownership in Arizona and Georgia hints that “progress” may in fact be attributable to the expulsion of vulnerable, mostly non-criminal, migrants in earlier years that shifted the Latino population composition.

Table 2 reports the ordinary least squares estimates of state-level Latino homeownership rates biennially (even years) from 2004 to 2018. The analysis sample is restricted to the 40 most populous Latino states plus DC that are home to 99.2% of the total U.S. Latino population as of 2016; the ten excluded states (see notes to Table 2) do not have data on unauthorized immigrants (Pew) or DACA (USCIS). The first model in column (1) documents that each 10-point difference in the percentage of undocumented Latinos across states and over time is associated with a − 2.33% point difference in Latino home ownership (p < 0.001), net of an array of covariates, but without yet incorporating year or state fixed effects. Critically, this first model also incorporates the non-citizen (citizen) share of the Latino population and finds that this effect is insignificant, suggesting that the deportation, voluntary return, and reduced in-migration of undocumented immigrants specifically are more likely drivers of ownership trends than the rise of the citizen share, including the well-known increase in the percent native born.

Because I have argued that the relationship between ownership and undocumented immigrant shares has become increasingly negative in the housing recovery that began around 2012, I split the sample and estimate a model of the change in ownership rates by for 2000–2010 in column (2) and 2012–2018 in column (3), and incorporate state fixed effects. As expected, prior to 2012, neither the undocumented share nor the non-citizen shares are statistically or substantially related to the biennial change in Latino ownership in the model reported in column (2). In contrast, the results in column (3) suggest that every 10-point increase in the state-level undocumented share is associated with a − 1.85% point decrease (p < 0.03) in Latino ownership since 2012. In column (4), I confine the analysis to the 2012–2018 period to estimate the effect of the ratio of Latin American DACA recipients to the state Latino non-citizen population. Expressed as a percentage during the 2012–2018 period, the DACA ratio or share ranges from 3 to 4% in Connecticut, Florida, Louisiana, Massachusetts, and Pennsylvania to 11–13% in California, Illinois, Indiana, New Mexico, Oregon, and Wisconsin. Given the inclusion of year and state fixed effects and the limited variance in the explanatory variable and years of complete annual DACA data, the results in column (4) remain highly suggestive, despite the marginal statistical significance (p < 0.08). For each 5-point increase (+ 2 S.D.) in the DACA share of the non-citizen population, the Latino home ownership rate rises by 0.63 points.

In column (5) and column (6), I estimate the model for all years from 2000 to 2018 but split the sample this time by the state-level proportion of undocumented immigrants that are Latin American using a cut-off just above the median, of 70%. I expect a negative association with undocumented Latino immigration in states above the 70% cut-off, but not in the states below the cut-off, where fluctuations are more likely to be undocumented immigrants from other regions, especially Asia, which should not directly affect Latino ownership rates. Column (5) reports the anticipated result: for every 10-point increase (decrease) in the Latino undocumented share, Latino ownership declines (rises) by 1.32 points (p < 0.01). Column (6) also bears out the expected null finding that changes in undocumented immigrant shares in states where more are from Asia, Africa, Canada, and Europe have no significant association with Latino home ownership (b = − 0.038, p = 0.77). Finally, column (7) presents an important falsification lead model that helps check for reverse causality. When the future change in the percent undocumented over the next 2 years is entered into the model, it is not statistically significantly associated (p = 0.36) with past changes in the Latino home ownership rate. Overall, the results from Table 2 support the argument that Latino home ownership is significantly associated with changes in undocumented Latino immigration, and in ways that shifted during the post-2012 housing recovery and rise of the DACA category.

Conclusion

Declining Black ownership and voter turnout along with the sharpening of intra-Latino stratification in ownership by legal status pose serious threats to our increasingly fragile multiracial democracy. The results of this analysis call attention to the implications of yet another Black/non-Black divide in home ownership. Whereas Black and Latino ownership rates were equal in 2000, since 2008 a new Black-Latino ownership gap widened to reach 7 points (Fig. 10).

Sources Census/CPS HVS and Ruggles et al. (2019) (Asian only category)

Home ownership by race/ethnicity, 2000 to 2019 (latest).

The persistent, seemingly unstoppable decline in Black ownership does not merely confirm a historical cycle of institutional racism, segregation, and destroyed wealth, it also undermines electoral participation. I find that a decline in Black ownership of 10 points, quite common in many states, is associated with a 3.3-point drop in Black voter turnout net of other trends like the presence or absence of Obama on the ballot and the proliferation of strict voter ID laws. I conclude that the color line has reinforced yet another new Black/non-Black divide in home ownership that further impedes the social mobility and undermines the electoral representation of Black American voters.

As this Black/non-Black divide deepens, a growing tri-racial divide among Latinos by legal status, race, and nationality stratifies home ownership (Fig. 11). The undocumented proportion of the Latino population plummeted from 20% in 2007 to 12% by 2019 (Passel and Cohn 2019; Author’s calculations) while the Latino ownership rate first plummeted from 50% in 2007 to 45% in 2014, only to rise again to 48% by 2019. In this article, I find that the recovery in Latino ownership after 2012 has been as much a mirage as a sign of success. We have effectively stumbled into the current Latino housing “recovery” by way of racialized Latino exclusion, which echoes the illusion of Black progress under mass incarceration (Pettit 2012). Rather than increasing the numerator of homeowners, the mirage recovery is belied by the end of Mexican migration and the mass deportation and self-expulsion of millions of Mexican and Central American immigrants and their families.

Estimated Latina/o home ownership by legal status. These estimates are based on analysis of McConnell and Marcelli (2007), Ruggles et al. (2019), Rugh (2019a), Rugh and Allen (2015), Warren and Kerwin (2017), Wong et al. (2017), and population data from the Congressional Research Service, US Citizen and Immigration Services, and the US Census Bureau. All known estimates are plugged into an equation that solves for the DACA household rate (including mixed legal status couples where the DACA recipient’s partner is a US citizen or documented immigrant) using the other known rates and all the known current population estimates. See Appendix Table 3 for further details

As shown in Fig. 11, the recovery in Latino ownership also stems from the tremendously successful, yet racially and legally endangered TPS and DACA liminal statuses (Abrego and Lakhani 2015; Gonzales et al. 2020; Kendi 2018; Menjívar 2006; Patler et al. 2019). The increasingly precarious fate of DACA will be decided by the U.S. Supreme Court in 2020. Encouragingly, in the short period of 2012–2016, the average state-level ratio of Latino DACA recipients to Latino non-citizens rose from 0 to 8%; an 8-point rise corresponds to a an increase in Latino homeownership of 2.1 points according to my estimates reported here (95% CI − 0.27, + 4.27). In states like California, Illinois, Oregon, and Wisconsin, where the DACA-to-non-citizen ratio rises as high as 13%, DACA may potentially exert a greater impact on Latino ownership. Notwithstanding the imprecision of this estimate, it is an invitation to use larger samples to explore how DACA improved life chances and standards of living, including increases in home ownership and mixed status and DACA household wealth (Gonzales et al. 2019; Kuka et al. 2018; Patler and Pirtle 2018; Wong et al. 2017).

The failure of the Bush and Obama administrations to intervene effectively in the housing crisis and their responsibility for the mass deportation regime clearly betrayed and battered Black and Latino homeowners. The Black and Latino middle class remain closely embedded in communities and linked to family and co-ethnics in the U.S. and abroad who have little to zero wealth, face poverty, student loan debt, incarceration, eviction, and deportation. To close racial wealth gaps, Black and Latino Americans, along with new cross-racial allies, have begun to demand a pathway to citizenship for undocumented immigrants, the de-criminalization of migration, re-enfranchisement of former felons, the repeal of voter suppression laws, and even reparations to Black American descendants of generations of slavery and redlining. Although reparations remain a distant lodestar on the horizon, when coupled with systemic antiracist reform of housing and other policies, they seem most likely to end the cycle of cumulative disadvantage.

Ironically, Latino immigrants and their upwardly mobile children have already proven an astounding three times—from the Silva letters of the 1970s (Vallejo 2012) to the 1986 IRCA amnesty and the rise of DACA today (Gonzales et al. 2019)—that the main obstacle holding back Latinos is the institutional racial deprivation of full citizenship (Massey et al. 2016a). A clear pathway to citizenship would undoubtedly narrow the Latino-White wealth gap. It seems equally certain that reparations for Black Americans will not arrive before that pathway materializes. However, to become reality, reparations may hinge on the support of Latinos at greatest risk of legal exclusion, who may not be allowed to remain, let alone vote.

Black and Latino Americans are leading a new interracial alliance to combat ongoing racial exclusion that destroys wealth and disenfranchises voters (Abrams 2019; Brown and Jones 2016; Jones 2019; Rugh 2020; Zepeda-Millán 2017). The efforts of leaders like Stacey Abrams, who chooses to fund voter registration and voting rights reforms instead of running for president, epitomize this new alliance. It insists on the undiminished right to full participation to foster social mobility and fulfill unrealized constitutional promises. Abrams, along with an increasing number of Black, Latina/o, White, Asian and Native American leaders and everyday citizens, fight for voting rights and immigrant rights not just as a matter of justice, but for the very survival of multiracial democracy itself.

References

Abrams, S. Y. (2019). Identity politics strengthens democracy. Foreign affairs (pp. 160–163) (March/April 2019). https://www.foreignaffairs.com/articles/2019-02-01/stacey-abrams-response-to-francis-fukuyama-identity-politics-article. Accessed 2 Jan 2020.

Abrego, L. J., & Lakhani, S. M. (2015). Incomplete inclusion: Legal violence and immigrants in liminal legal statuses. Law & Policy,37(4), 265–293.

Anderson, E. (2011). The cosmopolitan canopy: Race and civility in everyday life. New York: W.W. Norton.

Armenta, A. (2017). Protect, serve, and deport: The rise of policing as immigration enforcement. Berkeley, CA: University of California Press.

Asad, A. L., & Rosen, E. (2018). Hiding within racial hierarchies: How undocumented immigrants make residential decisions in an American City. Journal of Ethnic and Migration Studies,45(11), 1857–1882.

Baradaran, M. (2017). The color of money: Black banks and the racial wealth gap. Cambridge, MA: Harvard University Press.

Bean, F. D. (2016). Ethnoracial diversity: Toward a new American narrative. The American prospect. https://prospect.org/civil-rights/ethnoracial-diversity-toward-new-american-narrative/. Accessed 2 Jan 2020.

Bean, F. D., Brown, S. K., & Bachmeier, J. D. (2015). Parents without papers: The progress and Pitfalls of Mexican American Integration. New York: Russell Sage Foundation.

Benjamin, R. (2019). Race after technology: Abolitionist tools for the new jim code. Medford, MA: Polity Press.

Besbris, M., Faber, J. W., Rich, P., & Sharkey, P. (2015). Effect of neighborhood stigma on economic transactions. Proceedings of the National Academy of Sciences, 112(16), 4994–4998.

Blackmon, D. A. (2009). Slavery by another name: The re-enslavement of Black Americans from the Civil War to World War II. New York: Anchor Books.

Bonilla-Silva, E. (2002). We are all Americans!: The Latin Americanization of racial stratification in the USA. Race & Society,5(2), 3–16.

Bonilla-Silva, E. (2017). Racism without racists: Color-blind racism and the persistence of racial inequality in America (5th ed.). New York: Rowman & Littlefield.

Breznau, N., & Kirkpatrick, L. O. (2018). Urban fiscal crisis and local emergency management: Tracking the color line in Michigan. https://doi.org/10.31219/osf.io/k9ve7

Brown, H., & Jones, J. A. (2016). Immigrant rights are civil rights. Contexts,15(2), 34–39.

Brown, L. (2016). Rationale for the omnibus American reparation and restitution bill. Baltimore Sun. https://www.baltimoresun.com/citypaper/bcp-020316-reparations-lawrence-brown-20160202-story.html. Accessed 2 Jan 2020.

Brown, S. K. (2007). Delayed spatial assimilation: Multigenerational incorporation of the Mexican-origin Population in Los Angeles. City & Community,6(3), 193–209.

Cahill, M. E., & Franklin, R. S. (2013). The minority homeownership gap, foreclosure, and nativity: Evidence from Miami-Dade County. Journal of Regional Science,53(1), 91–117.

Capps, R., Koball, H., Campetella, A., Perreira, K., Hooker, S., & Pedroza, J. M. (2015). Implications of immigration enforcement activities for the well-being of children in immigrant families. Washington, DC: Urban Institute and Migration Policy Institute.

Choi, J. H. (2019). Black-white homeownership gap: A closer look across MSAs. Urban institute data talk: Black homeownership gap: Research trends and why the growing gap matters (July 16, 2019). https://www.urban.org/sites/default/files/black_homeownership_data_talk_slides.pdf. Accessed 2 Jan 2020.

Coates, T.-N. (2014). The case for reparations. The Atlantic (May 21, 2014). https://www.theatlantic.com/features/archive/2014/05/the-case-for-reparations/361631/. Accessed 2 Jan 2020.

Connolly, N. D. B. (2014). A world more concrete: Real estate and the remaking of Jim Crow South Florida. Chicago: University of Chicago Press.

Cose, E. (2009). The rage of a privileged class: Why do prosperous blacks still have the blues? Harper Collins.

Darity, W. A. Jr., Mullen, & A. K. (2020). From here to equality: Reparations for black Americans in the twenty-first century. Chapel Hill, NC: University of North Carolina Press. https://uncpress.org/book/9781469654973/from-here-to-equality/. Accessed 2 Jan 2020.

Desmond, M. (2012). Eviction and the reproduction of urban poverty. American Journal of Sociology,118(1), 88–133.

Desmond, M., & Emirbayer, M. (2016). Race in America. New York: W.W. Norton.

DiPrete, T. A., & Eirich, G. M. (2006). Cumulative advantage as a mechanism for inequality: A review of theoretical and empirical developments. Annual Review of Sociology,32, 271–297.

Dowling, J. (2014). Mexican Americans and the question of race. Austin, TX: University of Texas Press.

Dreby, J. (2015). Everyday illegal: When policies undermine immigrant families. Berkeley, CA: University of California Press.

Duany, J. (2010). The Orlando Ricans: Overlapping identity discourses among middle-class Puerto Rican immigrants. Centro Journal,22(1), 85–115.

Duany, J., & Rodríguez, F. V. M. (2006). Puerto Ricans in Orlando and Central Florida (Vol. 1, No. 1). New York: Centro de Estudios Puertorriqueños, Hunter College (CUNY).

Engel, K. C., & McCoy, P. A. (2011). Subprime virus: Reckless credit, regulatory failure, and next steps. Oxford: Oxford University Press.

Equal Justice Initiative. (2017). Lynching in America: Confronting the legacy of racial terror. 3rd edition. https://eji.org/reports/lynching-in-america. Accessed 2 Jan 2020.

Faber, J. W. (2013). Racial dynamics of subprime mortgage lending at the peak. Housing Policy Debate,23(2), 328–349.

Faber, J. W., & Rich, P. M. (2018). Financially overextended: College attendance as a contributor to foreclosures during the great recession. Demography, 55(5), 1727–1748.

Faust, D. G. (2015). John Hope Franklin: Race and the meaning of America. New York Review of Books 2015:97–99. https://www.nybooks.com/articles/2015/12/17/john-hope-franklin-race-meaning-america/. Accessed 2 Jan 2020.

Flippen, C. A. (2019). The uphill climb: A transnational perspective on wealth accumulation among Latino immigrants in Durham, NC. Journal of Ethnic and Migration Studies. https://doi.org/10.1080/1369183X.2019.1592873.

Flores-González, N. (2017). Citizens but not Americans: Race and belonging among Latino Millennials. New York: New York University Press.

Foner, E. (2019). The second founding: How the civil war and reconstruction remade the constitution. New York: W.W. Norton.

Fraser, J., & Oakley, D. (2015). The neighborhood stabilization program: Stable for whom? Journal of Urban Affairs,37(1), 38–41.

Gans, H. J. (2012) ‘Whitening’ and the changing American racial hierarchy. Du Bois Review: Social Science Research on Race,9(2), 267–279.

Golash-Boza, T. M. (2015). Deported: Immigrant policing, disposable labor and global capitalism. New York: New York University Press.

Golash-Boza, T., & Hondagneu-Sotelo, P. (2013). Latino immigrant men and the deportation crisis: A gendered racial removal program. Latino Studies,11(3), 271–292.

Goldrick-Rab, S. (2016). Paying the price: College costs, financial aid, and the betrayal of the American dream. Chicago: University of Chicago Press.

Gonzales, R. G. (2016). Lives in limbo: Undocumented and coming of age in America. Berkeley, CA: University of California Press.

Gonzales, R. G., Camacho, S., Brant, K., & Aguilar, C. (2019). The long-term impact of DACA: Forging futures despite DACA’s uncertainty, findings from the National UnDACAmented Research Project (NURP). Cambridge, MA: Immigration Initiative at Harvard University.

Gonzales, R. G., Kristina, B., & Benjamin R. (2020). DACAmented in the age of deportation: Navigating spaces of belonging and vulnerability in social and personal life. Ethnic and Racial Studies, 43(1), 60–79.

Gotham, K. F. (2014). Racialization and rescaling: Post-Katrina rebuilding and the Louisiana road home program. International Journal of Urban and Regional Research,38(3), 773–790.

Guelespe, D. M. (2013). Second class families: The challenges and strategies of mixed-status immigrant families. Dissertations. Paper 668. Chicago: Loyola University Chicago. http://ecommons.luc.edu/luc_diss/668. Accessed 2 Jan 2020.

Hall, M., & Rugh, J. S. (2019). The impact of immigrant deportations on latino segregation. Paper presented at the Annual Meeting of the Population Association of America, Austin, Texas (April 11, 2019).

Hamilton, E. R., Patler, C. C., & Hale, J. M. (2019). Growing up without status: The integration of children in mixed‐status families. Sociology Compass 13(6). https://doi.org/10.1111/soc4.12695

Hannah-Jones, N. (2012). Living apart: How the government betrayed a landmark civil rights law (Vol. 21). ProPublica. https://www.propublica.org/article/living-apart-how-the-government-betrayed-a-landmark-civil-rights-law. Accessed 2 Jan 2020.

Hannah-Jones, N. (2015). The problem we all live with. This American Life. https://www.thisamericanlife.org/562/the-problem-we-all-live-with-part-one. Accessed 2 Jan 2020.

Heflin, C. M., & Pattillo, M. (2006). Poverty in the family: Race, siblings, and socioeconomic heterogeneity. Social Science Research,35(4), 804–822.

Howell, J., & Elliott, J. R. (2019). Damages done: The longitudinal impacts of natural hazards on wealth inequality in the United States. Social Problems,66(3), 448–467.

Huante, A. (2019). A lighter shade of brown? Racial formation and gentrification in Latino Los Angeles. Social Problems. https://doi.org/10.1093/socpro/spz047.

Hunter, M. A., & Robinson, Z. (2018). Chocolate cities: The black map of American Life. Oakland, CA: University of California Press.

Hwang, J. (2019). Racialized recovery: Postforeclosure pathways in Boston neighborhoods. City & Community, 18(4), 1287–1313.

Hwang, J., Roberto, E., Stephens, S. I., & Rugh, J. S. (2019). Integrating or segregating? Gentrification, black exceptionalism, and the changing structure of segregation. In Paper presented at the annual meeting of the American Sociological Association, August 13, 2019, New York, NY.

Immergluck, D. (2011). Foreclosed: High-risk lending, deregulation, and the undermining of America’s Mortgage Market (2nd ed.). Ithaca, NY: Cornell University Press.

Immergluck, D. (2015). Preventing the next mortgage crisis: The meltdown, the federal response, and the future of housing in America. Lanham, MD: Rowman & Littlefield.

Immergluck, D., Earl, S., & Powell, A. (2019). Black homebuying after the Crisis: Appreciation patterns in fifteen large metropolitan areas. City & Community,18(3), 983–1002. https://doi.org/10.1111/cico.12436.

Jacobo, M., & Jensen, B. (2018). Schooling for US-Citizen students in Mexico. Los Angeles: UCLA Civil Rights Project. https://tinyurl.com/yxcaynrx. Accessed 2 Jan 2020.

Jones, J. A. (2018). From open doors to closed gates: Intragenerational reverse incorporation in new immigrant destinations. International Migration Review. https://doi.org/10.1177%2F0197918318791982

Jones, J. A. (2019). The browning of the new south. Chicago: University of Chicago Press.

Keister, L. A., Vallejo, J. A., & Paige Borelli, E. (2015). Mexican American mobility: Early life processes and adult wealth ownership. Social Forces,93(3), 1015–1046.

Keister, L. A., Vallejo, J. A., & Smith, P. B. (2019). Investing in the homeland: Cross-border investments and immigrant wealth in the US. Journal of Ethnic and Migration Studies. https://doi.org/10.1080/1369183X.2019.1592875.

Kendi, I. X. (2016). Stamped from the beginning: the definitive history of racist ideas in America. New York: Random House.

Kendi, I. X. (2018). The heartbeat of racism is denial. The New York Times SR:1. https://www.nytimes.com/2018/01/13/opinion/sunday/heartbeat-of-racism-denial.html. Accessed 2 Jan 2020.

Killewald, A., & Bryan, B. (2016). Does your home make you wealthy? The Russell Sage Foundation Journal of the Social Sciences,2(6), 110–128.

Korver-Glenn, E. (2018). Compounding inequalities: How racial stereotypes and discrimination accumulate across the stages of housing exchange. American Sociological Review,83(4), 627–656.

Krysan, M., & Crowder, K. (2017). Cycle of segregation: Social processes and residential stratification. New York: Russell Sage Foundation.

Kucheva, Y., & Sander, R. (2018). Structural versus ethnic dimensions of housing segregation. Journal of Urban Affairs,40(3), 329–348.

Kuebler, M., & Rugh, J. S. (2013). New evidence on racial and ethnic disparities in homeownership in the United States from 2001 to 2010. Social Science Research,42(5), 1357–1374.

Kuka, E., Na'ama, S., & Kevin, S. (2018). Do human capital decisions respond to the returns to education? Evidence from DACA. NBER Working Paper No. w24315. National Bureau of Economic Research. https://www.nber.org/papers/w24315. Accessed 2 Jan 2020.

Kusisto, L., & Eisen, B. (2019). Wave of hispanic buyers shores up U.S. housing market. Wall Street Journal. https://www.wsj.com/articles/wave-of-hispanic-buyers-boosts-u-s-housing-market-11563183000. Accessed 2 Jan 2020.

Lei, S., Signe-Mary, M., Caroline, R., Steuerle, C. E., Quakenbush, C., & Emma, K. (2015). Nine charts about wealth inequality in America. Urban Institute. https://apps.urban.org/features/wealth-inequality-charts/. Accessed 2 Jan 2020.

López, J. L. (2015) ‘Impossible Families’: Mixed‐citizenship status couples and the law. Law & Policy,37(1–2), 93–118.

Maroto, M. (2016). Growing farther apart: Racial and ethnic inequality in household wealth across the distribution. Sociological Science,3, 801–824.

Massey, D. S. (2013). Immigration enforcement as a race-making institution. In D. Card & S. Raphael (Eds.), Immigration, poverty, and socioeconomic inequality (pp. 357–381). New York: Russell Sage Foundation.

Massey, D. S., & Denton, N. A. (1993). American apartheid: Segregation and the making of the underclass. Cambridge, MA: Harvard University Press.

Massey, D. S., Durand, J., & Pren, K. A. (2016a). Why border enforcement backfired. American Journal of Sociology,121(5), 1557–1600.

Massey, D. S., & Rugh, J. S. (2018). The great recession and the destruction of minority wealth. Current History,117(802), 298–303.

Massey, D. S., Steil, J., Albright, L., & Rugh, J. S. (2016b). ‘Riding the stagecoach to hell:’ A qualitative analysis of racial discrimination in mortgage lending. City & Community,15(2), 118–136.

Massey, D. S., & Tannen, J. (2015). A research note on trends in black hypersegregation. Demography,52(3), 1025–1034.

McConnell, E. D., & Akresh, I. R. (2013). Home equity of new legal immigrants in the United States: An evaluation of three key theoretical perspectives. International Migration Review,47(3), 686–729.

McConnell, E. D., & Marcelli, E. A. (2007). Buying into the American dream? Mexican immigrants, legal status, and homeownership in Los Angeles county. Social Science Quarterly, 88(1), 199–221.

McMillan-Cottom, T. (2017). Lower Ed: The troubling rise of for-profit colleges in the new economy. New York: The New Press.

Menjívar, C. (2006). Liminal legality: Salvadoran and guatemalan immigrants' lives in the United States. American Journal of Sociology,111(4), 999–1037.

Mock, B. (2019). Are reparations baltimore’s fix for redlining, investment deprivation? Citylab (February 14, 2019). https://www.citylab.com/equity/2019/02/reparations-baltimore-redlining-segregation-fix-race/582760/. Accessed 2 Jan 2020.

Morris, A. (2017). The scholar denied: W.E.B. Du bois and the birth of modern sociology. Oakland, CA: University of California Press.

Noble, S. U. (2018). Algorithms of oppression: How search engines reinforce racism. New York: New York University Press.

Oliver, M. L., & Shapiro, T. M. (1999). Black wealth/white wealth. New York: Routledge.

Painter, M. A., & Qian, Z. (2016). Wealth inequality among immigrants: Consistent racial/ethnic inequality in the United States. Population Research and Policy Review,35(2), 147–175.

Passel, J. S., & Cohn, D’. (2019). Mexicans decline to less than half the US unauthorized immigrant population for the first time. Pew Research Center. https://www.pewresearch.org/fact-tank/2019/06/12/us-unauthorized-immigrant-population-2017/. Accessed 2 Jan 2020.

Patler, C., Hamilton, E., Meagher, K., & Savinar, R. (2019). Uncertainty about DACA may undermine its positive impact on health for recipients and their children. Health Affairs,38(5), 738–745.

Patler, C., & Pirtle, W. L. (2018). From undocumented to lawfully present: Do changes to legal status impact psychological wellbeing among latino immigrant young adults? Social Science & Medicine,199, 39–48.

Pattillo, M. (2013). Black picket fences: Privilege and peril among the black middle class. Chicago: University of Chicago Press.

Pedroza, J. M. (2019). Where immigration enforcement agreements stalled: The location of local 287(g) program applications and inquiries (2005–2012). SocArXiv. January 4. https://doi.org/10.31235/osf.io/2a8kz

Pettit, B. (2012). Invisible men: Mass incarceration and the myth of black progress. New York: Russell Sage Foundation.

Pfeffer, F. T., & Killewald, A. (2017). Generations of advantage: Multigenerational correlations in family wealth. Social Forces,96(4), 1411–1442.

Prasad, M. (2013). Land of too much: American abundance and the paradox of poverty. Cambridge, MA: Harvard University Press.

Ray, V. (2019). A theory of racialized organizations. American Sociological Review,84(1), 26–53.

Raymond, E., Wang, K., & Immergluck, D. (2016). Race and uneven recovery: Neighborhood home value trajectories in Atlanta before and after the Housing Crisis. Housing Studies,31(3), 324–339.

Rothstein, R. (2017). The color of law: A forgotten history of how our government segregated America. New York: Liveright Publishing.

Ruggles, S., Sarah, F., Ronald, G., Josiah, G., Erin, M., Jose, P., & Matthew, S. (2019). IPUMS USA: Version 9.0 . Minneapolis, MN: IPUMS. https://doi.org/10.18128/D010.V9.0

Rugh, J. S. (2015). Double jeopardy: Why Latinos were hit hardest by the US foreclosure crisis. Social Forces,93(3), 1139–1184. https://doi.org/10.1093/sf/sou107.

Rugh, J. S. (2019a). Vanishing wealth, vanishing votes? Latino homeownership and the 2016 election in Florida. Journal of Ethnic and Migration Studies. https://doi.org/10.1080/1369183X.2019.1592877.

Rugh, J. S. (2019b). Subprime lending/foreclosure crisis. The Wiley-Blackwell Encyclopedia of Urban and Regional Studies. Malden, MA: Wiley-Blackwell.

Rugh, J. S. (2020). Housing segregation and the forgotten Latino American story. In N. O. Kwate (Ed.) American inequality: A photographic field guide in the streets of Camden. Camden, NJ: Rutgers University Press.

Rugh, J. S., Albright, L., & Massey, D. S. (2015). Race, space, and cumulative disadvantage: A case study of the subprime mortgage collapse. Social Problems, 62(2), 186–218.

Rugh, J. S., & Hall, M. (2016). Deporting the American dream: Immigration enforcement and Latino foreclosures. Sociological Science,3, 1053–1076. https://doi.org/10.15195/v3.a46.

Rugh, J. S., & Massey, D. S. (2010). Racial segregation and the American Foreclosure Crisis. American Sociological Review,75(5), 629–651.

Rugh, J. S., & Massey, D. S. (2014). Segregation in post-civil rights America: Stalled integration or end of the segregated century? Du Bois Review: Social Science Research on Race,11(4), 205–232.

Rugh, J. S., & Ryan, A. (2015). Using original data to uncover pathways to Latino disparities in foreclosure. Paper presented at the Meeting of Urban Affairs Association, Miami, FL (April 9, 2015).

Salgado, C. D., & Ortiz, V. (2019). Mexican Americans and wealth: Economic status, family and place. Journal of Ethnic and Migration Studies. https://doi.org/10.1080/1369183X.2019.1592878.

Sander, R. H. (2018). Moving toward integration: The past and future of fair housing. Cambridge, MA: Harvard University Press.

Schueths, A. M. (2015). Life and love outside the citizenship binary: The lived experiences of mixed-status couples in the United States. In A. M. Schueths & J. M. Lawston (Eds.), Living together, living apart: Mixed status families and US immigration policy (pp. 23–36). Seattle, WA: University of Washington Press.

Schuetz, J., Spader, J., Buell, J. L., Burnett, K., Buron, L., Cortes, A., et al. (2015). Investing in distressed communities: Outcomes from the neighborhood stabilization program. Cityscape,17(2), 279–306.

Seamster, L. (2018). When democracy disappears: Emergency management in benton harbor. Du Bois Review: Social Science Research on Race,15(2), 295–322.

Seamster, L. (2019). Black debt, white debt. Contexts,18(1), 30–35.

Seamster, L., & Charron-Chénier, R. (2017). Predatory inclusion and education debt: Rethinking the racial wealth gap. Social Currents,4(3), 199–207.

Sewell, A. A. (2016). The racism-race reification process: A mesolevel political economic framework for understanding racial health disparities. Sociology of Race and Ethnicity,2(4), 402–432.

Sharkey, P. (2013). Stuck in place: Urban neighborhoods and the end of progress toward racial equality. Chicago: University of Chicago Press.

Sharkey, P. (2014). Spatial segmentation and the black middle class. American Journal of Sociology,119(4), 903–954.

Sharp, G., & Hall, M. (2014). Emerging forms of racial inequality in homeownership exit, 1968–2009. Social Problems,61(3), 427–447.

Squires, G. D. (Ed.). (2017). The fight for fair housing: Causes, consequences, and future implications of the 1968 Federal Fair Housing Act. New York: Routledge.

Steil, J., Albright, L., Rugh, J. S., & Massey, D. S. (2018). The social structure of mortgage discrimination: A qualitative analysis. Housing Studies,33(5), 759–766.

Stevenson, B. (2014). Just mercy: A story of justice and redemption. New York: Spiegel & Grau.

Sugrue, T. J. (2014). The origins of the urban crisis: Race and inequality in postwar detroit-updated edition. Princeton: Princeton University Press.

Sullivan, E. (2017). Displaced in place: Manufactured housing, mass eviction, and the paradox of state intervention. American Sociological Review,82(2), 243–269.

Takaki, R. (2008). A different mirror: A history of multicultural America (2nd ed.). New York: Little, Brown, and Company.

Taylor, K.-Y. (2019). Race for profit: How banks and the real estate industry undermined black homeownership. Chapel Hill, NC: University of North Carolina Press.

Telles, E. E., & Ortiz, V. (2008). Generations of exclusion: Mexican-Americans, assimilation, and race. New York: Russell Sage Foundation.

Trounstine, J. (2018). Segregation by design: Local politics and inequality in American cities. New York: Cambridge University Press.

Vallejo, J. A. (2012). Barrios to burbs: The making of the Mexican-American middle class. Stanford, CA: Stanford University Press.

Vargas, N. (2015). Latina/o whitening? Which Latina/os self-classify as white and report being perceived as white by other Americans? Du Bois Review: Social Science Research on Race,12(1), 119–136.

Warren, R., & Kerwin, D. (2017). A statistical and demographic profile of the US temporary protected status populations from El Salvador, Honduras, and Haiti. Journal on Migration and Human Security,5(3), 577–592.

Wong, T. K., Rosas, G. M., & Luna, A. (2017). DACA recipients' economic and educational gains continue to grow. Center for American Progress.

Wright II, E. (2017). The First American School of Sociology: W.E.B. Du Bois and the Atlanta Sociological Laboratory. New York: Routledge.

Yu, Z., & Myers, D. (2010). Misleading comparisons of homeownership rates when the variable effect of household formation is ignored: Explaining rising homeownership and the homeownership gap between blacks and Asians in the US. Urban Studies,47(12), 2615–2640.

Zayas, L. H. (2015). Forgotten citizens: Deportation, children, and the making of American exiles and orphans. New York: Oxford University Press.

Zepeda-Millán, C. (2017). Latino mass mobilization: Immigration, racialization, and activism. Cambridge University Press.

Zhou, M., & Gonzales, R. G. (2019). Divergent destinies: Children of immigrants growing up in the United States. Annual Review of Sociology,45, 383–399.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Table 3.

Rights and permissions

About this article

Cite this article

Rugh, J.S. Why Black and Latino Home Ownership Matter to the Color Line and Multiracial Democracy. Race Soc Probl 12, 57–76 (2020). https://doi.org/10.1007/s12552-019-09275-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12552-019-09275-y