Abstract

Banks accept deposits and often lend via commitments. It has been shown that there are synergies between transaction deposits and loan commitments; and that the volatility of bank stock returns declines when these two liquidity risks are taken together. We examine whether such deposit-lending synergies reflect on U.S. commercial bank profitability levels, and whether the synergies impact bank profitability levels differently around financial crises. Our results from panel regressions show that the deposit-lending synergies translate to increased profitability only for small publicly traded banks. However, pre-crisis deposit-lending synergies do not appear to lead to higher profitability during or after the crises.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Financial intermediation theory indicates that providing liquidity is an important reason why banks exist. Banks accept deposits and issue loans. They often lend via commitments reported as off-balance sheet activities.Footnote 1 Holmström and Tirole (1998) and Kashyap et al. (2002) show how banks can provide liquidity to borrowers using such off- balance sheet items. Diamond and Dybvig (1983) present a model where banks create liquidity by financing illiquid assets such as loans, with liquid liabilities such as deposits. They show that liquidity creation puts banks at risk to runs. Moreover, financial crises can also have negative effects on liquidity creation (e.g., Dell’Ariccia et al. 2008).

Kashyap et al. (2002) consider bank deposits as exogenous. They report a positive correlation between unused loan commitments and transactions deposits and posit that there may be synergies for banks in fulfilling their two primary roles: accepting deposits and issuing loans. Myers and Rajan (1998), however, show that holding liquid assets is costly. They state that “…increased liquidity can paradoxically be bad. Although more liquid assets increase the ability to raise cash on short notice, they also reduce management’s ability to commit credibly to an investment strategy that protects investors.” (p. 733).

Gatev et al. (2009) find that stock-return volatility declines when banks encounter the deposit-loan synergies described by Kashyap et al. (2002), and imply that the synergies hedge liquidity risk. Observing the relationship between risk and unused commitments for banks with high levels of transactions deposits and for banks with low levels of transactions deposits during the commercial paper crisis of 1998, they conclude that this hedging is more beneficial during crises.

Using data on U.S. commercial banks from 1985 to 2013, we investigate whether engaging in both deposit and lending activities translate to bank profitability, and whether the bank profitability levels differ around financial crises. This study contributes two empirical findings. The deposit-lending synergies shown to reduce the volatility of bank stock returns translate into higher bank profitability only for small publicly traded banks. However, our results do not provide enough evidence that the synergies affect the profitability level of these small publicly traded banks around financial crises.

The next section provides a brief summary of some related research and reviews the crises considered in this study, namely the five major crises that affected the U.S. financial market from 1986 to 2009. Section 3 describes the study sample and the main variables. Section 4 presents the empirical tests. We report and discuss the results in Section 5. Section 6 concludes.

2 Related literature

2.1 Banks as liquidity providers

Banks create liquidity by accepting deposits and issuing loans. They provide liquidity on demand not only to depositors, but also to borrowers via lines of credit and loan commitments. Borrowers can draw down on their line of credit at any time, as long as they don’t exceed the maximum set in the agreement. With loan commitment agreements, banks provide borrowers with a stated amount of funds during a specified amount of time. Gatev and Strahan (2006) explain that banks with a high level of loan commitments tend to increase lending and deposits when the market for commercial paper is tight. Diamond and Dybvig (1983) show that banks afford superior allocations as compared to arm’s-length securities markets with regard to taking deposits and extending loans. Their model describes how banks provide liquidity by financing loans with deposits. The profitability of bank intermediation is mainly based on loan pricing, which accounts for interest rate compensation, tangible cost of fund delivery and intangible cost of risk (uncertainty) bearing. Holmström and Tirole (1998) show that absent aggregate uncertainty, this financial intermediation contributes to the future liquidity needs of a firm, provided banks compensate the scarcity of liquidity with high leverage ratio and liquidity constraints on the firm.

Boot et al. (1993) and Billett et al. (1995) report that strong banks use these off-balance activities as a positive signal. Kashyap et al. (2002), hereafter KRS, show that banks with more demand deposits make more loan commitments. The KRS model supports that as long as the demand for liquidity through transaction deposits is not highly correlated with liquidity demand from loan commitments, a bank can reduce the costs of holding illiquid assets to insure provision of liquidity on demand.

Gatev et al. (2009) argue that bank risk, as measured by stock return volatility, increases as unused loan commitments increase. However, they show that commercial banks with a high volume of unused loan commitments might be exposed to loan-liquidity risk only if they lack a high volume of transaction deposits. In other words, Gatev et al. (2009) provide evidence that the KRS deposit-lending synergies can be viewed as liquidity risk hedging, thus a risk-reducing strategy. They concur with Avery and Berger (1991) who find that loan commitments reduce risk exposure for banks.

2.2 Financial crises

Following Berger and Bouwman (2008), we consider two banking crises (the credit crunch of the early 1990s and the subprime lending crisis that became apparent in 2007) and three market-related crises (the 1987 stock market crash; the Russian debt crisis and the Long-Term Capital Management bailout in 1998; and the bursting of the dot.com bubble in the early 2000s).

The stock market crashed on “Black Monday”, October 19, 1987. On that day, the S&P 500 index dropped about 20.4% and the Dow Jones Industrial Average lost about 22.6% of its value. The crash was preceded by years of dramatic surge of the stock market. Potential causes of the crash include program trading, overvaluation, illiquidity, and market psychology.

Commercial and industrial lending declined in the early years of 1990s. Peek and Rosengren (1995) cite that this credit crunch was due to the fall in bank capital from loan losses of the late 1980s. Bernanke and Lown (1991) review the behavior of bank lending and also claim that reduced loan demand due to macroeconomic and regional recessions caused the crunch. Other authors (e.g., Hancock et al. 1995 and Thakor 1996) note that the credit crunch was related to the implementation of Basel I capital standards. The Basel I standards were mainly based on credit risk and the weighing of bank assets by their risk.

Long-Term Capital Management (LTCM), a leading U.S. hedge fund that used an arbitrage strategy referred to as market neutral, nearly collapsed in late 1998. When Russia devaluated its currency and defaulted on its sovereign debt on August 17, 1998, the U.S. stock market dropped by about 20%, while the European markets fell by about 35%. Investors fled to U.S. treasury bonds. As a result, by the end of August 1998, LTCM had lost about 50% of the value of its highly leveraged capital investments. To save the U.S. banking system, the Federal Reserve Bank of New York organized a $3.5 billion bailout by LTCM’s major creditors.

During the mid to late 1990s, many internet-based companies were founded. Most of these companies focused on increasing market share. These companies could raise money even if they had not earned substantial profits or revenues. On March 10, 2000, The Nasdaq composite index doubled its value of the year before. Several internet-based companies were acquired or filed for bankruptcy. The U.S. economy started to slow down and the stock market began to fall. Due to this bubble burst and later to the September 11, 2001 attacks, the economic slowdown amplified.

The Federal Reserve intervened in unprecedented ways in response to the subprime lending crisis that became apparent in 2007. Banks had difficulty in selling loans and seemed to be reluctant to provide credit to borrowers or to lend to each other. Risk premia increased. Some banks lost a major part of their capital. The Federal Reserve extended the safety net to financial institutions, lowered the discount rate, and started holding mortgage-backed securities and lending directly to investment banks.

Bank profitability is important for the stability of the banking industry. Moreover, the impact of the banking industry on the capital markets and the economy is well known. We examine whether the potential synergies from banks fulfilling of their two primary activities of taking deposits and issuing loans relate to profitability. We also investigate whether the synergies translate to profitability around the crises described in this section.

3 Sample and variable descriptions

We obtain quarterly data for U.S. commercial banks for the period 1985-Q1 to 2010-Q4 from the Federal Reserve of Chicago.Footnote 2 Data for the period 2011-Q1 to 2013-Q4 are from the Federal Financial Institutions Examination Council (FFIEC) Central Data Repository.Footnote 3

We define the study variables as follows:

-

Market-level control

-

Federal funds rate (FedRate) = Quarterly average of monthly federal funds rateFootnote 4

-

Economic condition control

-

NatEmpl = Quarterly rate of national employment growthFootnote 5

-

Bank-level controls

-

Size = Natural logarithm of total assets in 2013-Q4 dollars using the consumer price index as deflator.

-

Liquid asset (LiqAssets) = (Cash plus Securities + Fed funds sold) divided by Total assets

-

Capital Adequacy (CapAdeq) = Total equity capital divided by Total assets

-

Access to Federal funds market (FedPool) = Fed funds purchased divided by Total assets

-

PubTraded is a (0, 1) dummy variable with the value of 1 if the bank or its highest parent bank holding company is publicly traded. We distinguish publicly traded banks from non-publicly traded banks as Holod and Peek (2007) posit that non-publicly traded firms are the most likely to face liquidity constraints. We use the CRSP-FRB Link dataset from the Federal Reserve Bank (FRB) of New York, which provides a link between regulatory entity codes and Center for Research in Security Prices (CRSP) permanent company codes for publicly-traded banks and bank holding companies that are listed on the NYSE, AMEX, or NASDAQ.

-

InBHC is a (0, 1) dummy variable with the value of 1 if the bank is part of a bank holding company and 0 otherwise.

-

Agri, Comm, Mort, Consu, and Other are (0, 1) dummy variables to control for line of business, with the value of 1 if the bank is specialized in agriculture, commercial, mortgage, consumer, or other lending, respectively, and 0 otherwise.

-

Small, Medium, and Large are (0, 1) dummy variables with the value of 1 if the bank is considered as small, medium, or large, respectively, and 0 otherwise. Berger et al. (2005) and KRS document differences between large and small bank portfolios. KRS use three bank size categories: large (top 100 banks based on average of total assets), medium (next 500 banks), and small (the remaining banks). For each quarter, we consider small banks (total assets < $100 Millions), medium banks ($100 Millions ≤ total assets ≤ $1 Billion), and large banks (total assets > $1 Billion).

-

Deposits

-

TransDep = Transactions deposits divided by Total assetsFootnote 6

-

BrokerDep = Brokered deposits divided by Total assets

-

LargeTimeDep = Total time deposits of $100,000 or more divided by Total assets

-

Bank profitability

-

Return on Equity (ROE) = Net income divided by Total equity capital

We opt to use ROE rather than return on assets (ROA) as the measure of profitability because net income and equity reflect both on-balance-sheet and off-balance-sheet bank activities. ROE reflects how effectively a bank is using its shareholders’ equity, thus, represents the shareholders’ interest in the business. Moreover, ROE is not asset-dependent, which allows for comparison of profitability of firms with different asset structures or different lines of business.

For example, Akhigbe and McNulty (2005) define a “profit efficiency” to compare small, medium, and large banks. They argue that, when normalized by equity (rather than assets), the profit efficiency is closer to ROE and better compares how well banks utilize their financial capital because large banks use more leverage than small banks.

-

Liquidity exposure

-

UnusedLoanCom = Unused commitments divided by Total assets, where

-

Unused commitments = Unused (Revolving, open end lines secured by 1–4 residential properties + Commercial, real estate, construction, and land development, secured by real estate + Commercial, real estate, construction, and land development, not secured by real estate + Securities underwriting + Commercial and similar letters of credit + Credit card lines) + Other unused commitments

For the sub-period 1986-Q1 to 1989-Q4, we use the total unused commitments (call report item RCFD3423) instead because prior to March 1990, components of unused commitments were not available on the call reports. KRS note that credit card lines do not provide as much liquidity as the other commitments, since most credit cards holders pay their balance monthly, and that only a small number of banks engage in the credit card business. Credit card banks are commercial banks with average managed assets (loans to individuals including securitizations) greater than or equal to 200 million dollars with minimum 50% of assets in consumer lending and 90% of consumer lending in the form of revolving credit. While KRS omit unused credit card commitments by excluding credit card banks, as well as banks with a ratio of credit card loans to total loans greater than 0.5, we opt not to exclude such banks..Footnote 7

We exclude foreign owned banks and banks not located in the 50 States, as well as banks with foreign offices. In addition, we leave out any bank-quarter observation in which a merger occurs, as well as the bank observation in the subsequent quarter. Finally, we eliminate observations with negative equity, observations with negative net income, as well as observations with ROE values that deviate by more than four standard deviations from the mean value of ROE in the quarter. The final sample includes a total of 678,769 observations, with each individual bank being primarily insured by the Federal Deposit Insurance Corporation (FDIC) and having at least four quarters of observations.

Table 1 presents descriptive statistics of the variables for publicly and non-publicly traded banks. We classify a bank to have high transaction deposit if its transaction deposit value is at or above the variable median of each year. Similarly, a bank has high unused loan commitments if its unused loan commitments value is at or above the variable median of each year. On average, ROE is higher across banks with both high transaction deposits and high unused loan commitments (HH), suggesting that the KRS diversification synergies from combining these two liquidity risks translate into better profitability. The positive relationship between HH and profitability is consistent across the three size categorization for both publicly traded (in Panel A) and non-publicly traded banks (in Panel B).

4 Empirical tests

First, to examine whether there is a broader benefit from the KRS deposit-lending synergies, we estimate bank profitability as a function of liquidity exposure, transaction deposits ratio and other deposits ratios, as well as market-level, economic conditions, and other bank-level characteristics. We posit the first null hypothesis to test as:

-

Hypothesis 1: Deposit-lending synergies do not translate to increased profitability (ROE).

We model the profitability of bank i in quarter q as follows:

We include four lagged values of the federal funds rate to control for market fluctuations and four lagged values of national employment growth to control for economic conditions. We allow for bank fixed effects to control for omitted bank characteristics. The effect of the deposit-lending synergy is the coefficient of the interaction of unused loan commitments and transaction deposits (β5). We expect β5 to be positive. That is, the higher the unused loan commitments, the greater (more positive) the effect of transaction deposits on ROE. Similarly, the higher the transaction deposits, the greater (more positive) the effect of unused commitments on ROE.

Next, to study the effect of transaction deposits and unused loan commitments on profitability during and after each of the five crises observed in this study, we focus on the behavior of individual banks rather than the banking sector as a whole. Our second null hypothesis to test is as follows:

-

Hypothesis 2: Pre-crisis deposit-lending synergies do not translate to increased profitability during a crisis, as well as after a crisis.

We estimate bank profitability during, as well as after each crisis as a function of pre-crisis liquidity exposure, deposit ratios, and other market-level and bank-level characteristics. For each bank, we consider the averaged values of these variables over the pre-crisis period (eight or five quarters before the crisis), during the crisis, and over the post-crisis period (eight or five quarters after the crisis, except for the last crisis).Footnote 8

We model the profitability of bank i around crisis j as follows:

5 Results and discussion

5.1 Do the deposit-lending synergies affect bank profitability?

Gatev et al. (2009) show that large publicly traded banks experience a reduced liquidity risk when the synergies exist. As shown in Panel A of Table 2, the coefficient on the interaction term (UnusedLoanCom × TransDep) is positive (0.065) and statistically significant at the 10% level for publicly traded banks and negative (−0.048) and statistically significant at the 1% level for non-publicly traded banks. These results imply that deposit-lending synergies translate to increased profitability only for publicly traded banks. For non-publicly traded banks, on one hand, an increase in either transaction deposits or unused loan commitments (but not both) results in an increase in profitability. Specifically, a 1% point increase in non-publicly traded bank transaction deposits, as percentage of total assets, is associated with an increase of about 4% points in ROE. Similarly, a 1% point increase in unused loan commitments is associated with an increase of 4.1% points in ROE. However, a higher combination of transaction deposits and unused loan commitments has a highly statistically significant (1% level) negative effect on profitability.

Gatev et al. (2009) report that loan commitments are related to size. In Panel B of Table 2, a closer look at publicly traded banks reveals that small publicly traded banks are the ones that benefit in term of profitability from the synergies. While the coefficient on the interaction term is positive across the publicly traded banks, the coefficient (0.192) is statistically significant only for small banks. This finding is in tune with small banks being more focused on the traditional banking activities of deposit taking and lending.

The negative effect of higher combination of transaction deposits and unused loan commitments on ROE is mainly true for non-publicly traded medium and large banks. Being less transparent than publicly traded banks, non-publicly traded banks may encounter other risks that the deposit-lending synergies cannot hedge, thus relatively affecting negatively their profitability.

As a robustness check, we repeat the previous tests only for “healthy” banks (with capital adequacy of 6% or more) and obtain similar results (not reported). Following Gatev et al. (2009), we also repeat the analyses without controlling for broker deposits and large time deposits. We report the results from the latter analyses in Table 3.

The evidence that deposit-lending synergies translate to increased profitability only for publicly traded banks still holds as reported in Table 3. In addition, we find evidence that holding liquid assets is indeed costly, supporting Myers and Rajan (1998). From Table 3, a 1% point increase in liquid assets is associated on average with 1.8% point decrease in profitability at the 1% level of statistical significance. It is also worth noting that from all our previous tests, on average, capital adequacy has a highly statistically significant negative effect on profitability.

Next, we examine how the transaction deposits and unused loan commitments for publicly traded banks fluctuate around each of the five crises described in Section 2. Hereafter, we limit the sample to the publicly traded small banks because our prior analyses show that an increase in deposit-lending synergy translates to an increase in profitability only for these banks.

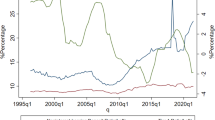

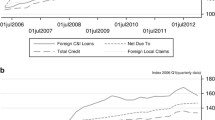

As shown in Fig. 1, both transaction deposits and unused loan commitments tend to grow before the stock market crash of 1987 (Crisis 1). Afterwards, while unused loan commitment levels continue to rise, there is a continuous perceivable decline in transaction deposit levels. However, each of the three market crises (Crisis 1, 3, and 4) displays some surge in transaction deposits, probably illustrating a “flight to quality”.

Figure 2 shows that banking crises reflect a stagnant level (Crisis 2) or a severe decline (Crisis 5) of unused loan commitments. The illustrations support the premise that these crises are related to lending issues. After the 2007–2009 crisis, transaction deposits incurred a tangible increase whereas, the amounts of unused loan commitments basically stayed at the same lower level than before the crisis.

The coefficients on the interaction (Average TransDep × Average UnusedLoanCom), though positive across Table 4, are not statistically significant at the conventional levels. Thus, we do not find enough evidence on whether any increase of pre-crisis deposit-lending synergies translates to increased profitability either during or after a crisis. The exception is for the bursting of the dot.com bubble followed by the September 11, 2001 attacks (Crisis 4). On average, for publicly traded small banks, either a higher level of transaction deposits or a higher level of unused loan commitments (not both) before Crisis 4 translates into a statistically significant increase in profitability during the crisis. However, the statistically significant negative coefficient (−0.257) on the interaction variable implies that a higher combination of both liquidity risks has a negative effect on profitability during that crisis.

6 Conclusion

The main contribution of this study is to further examine another potential value of the KRS deposit-lending synergies model. Gatev et al. (2009) find a positive effect of the synergies by showing that large publicly traded banks experience a reduced liquidity risk when the synergies exist. We investigate how these synergies reflect on bank profitability.

First, we find that the deposit-lending synergies translate into increased profitability measured by ROE, only for publicly traded banks, specifically the smaller ones. For the less transparent non-publicly traded banks, highly combining these two liquidity risks appears to have a negative effect on profitability.

Second, we analyze the effect of the synergies on bank profitability at the individual publicly traded small bank level. We do not find significant evidence on whether the banks benefit in term of profitability from the synergies during or after the crises considered in this study. However, on average, a 1% point increase in the interaction of transaction deposits with unused loan commitments before the bursting of the dot.com bubble followed by the 2001 attacks is related to about 26% point decrease on profitability during the crisis.

In sum, the combination of high transaction deposits and unused loan commitments tends to have a positive role in the management of small publicly traded banks. However, such synergies do not appear to help banks weather financial crises.

Notes

Off-balance sheet activities: https://www.fdic.gov/regulations/safety/manual/section3-8.pdf

Call reports are available at https://www.chicagofed.org/banking/financial-institution-rBeginning Maeports/commercial-bank-data

Beginning on March 31, 2011, the banks’ call reports are available from the FFIEC Central Data Repository’s Public Data Distribution at https://cdr.ffiec.gov/public/

Monthly federal funds rates are available on the website of the Board of Governors of the Federal Reserve System at http://www.federalreserve.gov

Employment data are from the website of the Bureau of Labor Statistics at http://www.bls.gov

As Holod and Peek (2007) suggest, scaling by assets allows a clearer interpretation of relative responses to changes.

Including or excluding unused credit card commitments lead to similar results in our study.

We reduce to 5 quarters the post-crisis period of the Russian debt /LCTM bailout crisis, as well as the pre-crisis period of the bursting of the dot.com bubble crisis to insure that these periods are not contaminated by crisis proximity.

References

Akhigbe A, McNulty J (2005) Profit efficiency sources and differences among small and large U.S. commercial banks. J Econ Finan 29(3):289–299

Avery R, Berger A (1991) Loan commitments and bank risk exposure. J Bank Financ 15:173–192

Berger AN, Bouwman CHS (2008) Financial crises and bank liquidity creation (This is an OLD WP that has been split into 2 parts: (1) How does capital affect bank performance during financial crises (JFE, July 2013); and (2) Bank liquidity creation, monetary policy, and financial crises (WP 2012)). https://doi.org/10.2139/ssrn.1231562. Accessed 3 Jan 2016

Berger AN, Miller NH, Petersen MA, Rajan RG, Stein JC (2005) Does function follow organizational form? Evidence from the lending practices of large and small banks. J Econ Finan 76(2):237–269

Bernanke BS, Lown CS (1991) The credit crunch. Brook Pap Econ Act 2:205–248

Billett MT, Flannery MJ, Garfinkel JA (1995) The effect of lender identity on a borrowing firm’s equity return. J Financ 50:699–718

Boot AWA, Greenbaum SI, Thakor AV (1993) Reputation and discretion in financial contracting. Am Econ Rev 83:1165–1183

Dell’Ariccia G, Detragiache E, Rajan RG (2008) The real effects of bank crises. J Financ Intermed 17:89–112

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econ 91(3):401–419

Gatev E, Strahan PE (2006) Banks’ advantage in hedging liquidity risk: theory and evidence from the commercial paper market. J Financ 61:867–892

Gatev E, Schuermann T, Strahan PE (2009) Managing bank liquidity risk: how deposit-loan synergies vary with market conditions. Rev Fin Stud 22(3):995–1020

Hancock D, Laing AJ, Wilcox JA (1995) Bank balance sheet shocks and aggregate shocks: their dynamic effects on bank capital and lending. J Bank Financ 19:661–677

Holmström B, Tirole J (1998) Public and private supply of liquidity. J Polit Econ 106(1):1–40

Holod D, Peek J (2007) Asymmetric information and liquidity constraints: a new test. J Bank Financ 31:2425–2451

Kashyap AK, Rajan RG, Stein JC (2002) Banks as liquidity providers: an explanation for the coexistence of lending and deposit-taking. J Financ 57(1):33–73

Myers SC, Rajan RG (1998) The paradox of liquidity. Q Rev Econ Financ 113(3):733–777

Peek J, Rosengren ES (1995) The capital crunch: neither a borrower nor a lender be. J Money Credit Bank 27(3):625–638

Thakor AV (1996) Capital requirements, monetary policy, and aggregate bank lending: theory and empirical evidence. J Financ 51:279–324

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Arthur, B.R., Rabarison, M.K. Deposit-lending synergies and bank profitability. J Econ Finan 42, 710–726 (2018). https://doi.org/10.1007/s12197-017-9414-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-017-9414-x