Abstract

Social dilemmas, in which individually selfish behavior leads to collectively deficient outcomes, continue to be an important topic of research because of their ubiquity. The present research with Japanese participants replicates, with slight modifications, public goods games previously run in the United States. In contrast to recent work showing profound cross-cultural differences, the results of two studies reported here show remarkable cross-cultural similarities. Specifically, results suggest that (1) as in the U.S., allowing incremental commitment to a public good is effective at eliciting contributions, (2) individual differences in trust affect contributions, (3) the distribution of player types in the U.S. and Japan are very similar, and (4) the dynamics of play in the public goods games used here are strikingly parallel. These results are discussed in the context of the relationship between cross-cultural differences and economic institutional environments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Social Dilemmas and Reciprocity

Cross-culturally, people often face a social dilemma in which their interests are pitted against the interest of the group. In such situations, if everyone behaves cooperatively, the group as a whole is better off. However, if people act selfishly, the group as a whole suffers (Dawes 1980; Komorita and Parks 1995; Liebrand and Messick 1996; Messick and Brewer 1983). Social dilemmas can be dyadic, involving only two players, or larger, involving groups of various sizes.

Because of the importance and ubiquity of social dilemmas, substantial theoretical (e.g., in evolutionary biology; Trivers 1971) and empirical (in experimental psychology; Komorita and Parks 1995) work has attempted to delineate the conditions under which people choose to act cooperatively and the strategies that people use when they are involved in repeated, or iterated, social dilemmas (e.g., Wilson and Sell 1997).

Reciprocity—responding to cooperation with cooperation and to defection with defection—has been a focal point of research (see, e.g., Kelley and Thibaut 1978; van Lange 1999). Reciprocity has been shown to be theoretically plausible from an evolutionary standpoint (Trivers 1971), successful in computer simulations (Axelrod 1984), and prevalent—indeed, universal—cross-culturally (Brown 1991; Gouldner 1960). In groups (N > 2), reciprocity is somewhat more complex than it is in dyads for two reasons, both of which we explore here. First, an individual playing reciprocally in an iterated social dilemma has an array of strategic options—cooperating, for example, only if the majority of others in the group cooperate. Many other strategic rules are possible. Second, recent evidence suggests that there are individual differences in reciprocity in at least some social dilemma settings (see below).

A standard method for investigating cooperation in groups, and the one used here, is the public goods game (Isaac et al. 1985). In a typical experiment, people in randomly assembled groups of four to eight people must decide how to divide money provided by the experimenter into two accounts. The private account yields a return of one to one, and money placed into it is kept by the investing individual. The group account has an interest rate (h > 1) known by all participants. Money placed in this account is increased by the interest rate and shared equally among all group members. For any given group size, h can be chosen so that investment in the group account increases the aggregate group payoff but decreases the investing individual’s payoff, generating a social dilemma (Dawes 1980). A player’s contribution to the group account is therefore an index of cooperation. Substantial evidence suggests that many people are willing to endure costs to benefit the group as long as other members of the group are doing so (Granovetter 1978; Schelling 1960).

Individual Differences and Group Dynamics

When public goods games are repeated, and players observe the total contribution by the group in previous rounds, a frequently replicated result is that the total contribution to the group account begins at roughly 50% of the total aggregate endowments but decreases from round to round. One explanation for this pattern is that players decrease their contributions over time because their trust that others will contribute is not fulfilled. Consider players who begin the game by contributing relatively large fractions of their endowments to the group account in early rounds because they believe others will do so. As they observe that others do not (i.e., are free riding), initially highly cooperative players decrease their contributions. This leads naturally to a spiraling down of contributions (e.g., Andreoni 1995; Ledyard 1995).

A crucial factor in understanding the dynamics of play in these games is individual differences. Recently, Kurzban and Houser (2005) developed a method to classify players into three types: free riders, who tend not to contribute to the public good independent of others’ contributions; cooperators, who contribute a great deal to the public good independent of others’ contributors; and lastly, the majority of their participants, reciprocators, who contribute as a positive function of others’ contributions. This set of types has previously been observed (Fishbacher et al. 2001). Crucial to the present discussion, the dynamics of contribution decisions can be extremely accurately predicted by the type composition of the group.

A rich understanding of cooperative group dynamics therefore requires attention to individual differences (Messick and McClintock 1968; van Lange and Semin-Goossens 1998). The experiments reported here investigate differences both within and between participant populations. In particular, we report data from Japanese participants that constitute a replication of two experiments first used in the United States (Kurzban and Houser 2005; Kurzban, McCabe, Smith, and Wilson 2001). Replicating these experiments is important for understanding whether the reciprocal strategies used in the West are idiosyncratic to that particular participant population or if there are important cross-cultural similarities. Although some evolutionary analyses imply that strategic similarity should be observed cross-culturally (e.g., Kurzban and Houser 2005), there are reasons to believe that cultural differences might have an important impact in these game environments (see below). The two experiments reported here show substantial cross-cultural similarity and what we take to be one important cross-cultural difference (in Study 2) which can be easily understood in the context of extant cross-cultural data.

Study 1

We used the real-time public goods game first developed by Dorsey (1992) and extended by Kurzban et al. (2001). Under this method, players can continuously update their decisions in real time. Rounds last T seconds, where T is known to participants, and during the round summary or individual information about others’ contributions is continuously updated and displayed. The player’s allocation to the public good at time T, if any, is taken to be her contribution for the round. The real-time protocol is an appealing method for exploring reciprocity because it (1) allows players a range of reciprocal strategies, (2) permits easy manipulation of the information made available to participants, and (3) provides a look at group dynamics (Goren et al. 2003, 2004; Kurzban et al. 2001).

Note that when players can adjust their contributions upward and downward during the round, information about others’ contributions amounts to little more than “cheap talk”—unenforceable communication about one’s intentions. However, when players can only increase their contribution to the public account, they can commit, because once a player has raised his contribution to a particular level, he cannot reverse it. This mechanism enables players to make small commitments to the public good while allowing them to limit their commitments so they can control the extent to which they expose themselves to being taken advantage of. This fear of cooperating more than others appears to be a powerful motivation in these situations (e.g., Insko et al. 1990; Rapoport and Eshed-Levy 1989). Consistent with this hypothesis, Kurzban et al. (2001) demonstrated that players (American participants) contributed more in the increase-only (commitment) condition than in the increase/decrease (cheap talk) condition, in which people could not only increase but also decrease their contributions.

In addition to replicating a previous experiment (Kurzban et al. 2001), Study 1 investigates the role of trust in this public goods environment. Trust has become an increasingly important research topic (Fukuyama 1995; Ostrom and Walker 2003; Parks and Hulbert 1995). Trust, which has been variously defined, generally entails entering into arrangements—often exchanges of some type—in which one incurs a cost without the other already having done so, often with the expectation of the delivery of a reciprocal benefit (see, e.g., Kurzban 2003). Trust is valuable for any number of transactions, whether social or strictly economic, because it allows for mutually beneficial exchanges which otherwise could not take place. Even without guarantee mechanisms in place, for example, relatively anonymous bilateral transactions routinely occur through the Internet on such sites as eBay, presumably because buyers trust sellers to fulfill their part of the agreed-upon trade (Bolton et al. 2004).

Of course, extending trust is potentially costly. When interaction partners prove untrustworthy, one stands to lose the amount already invested in social or economic relationships, which can be considerable. If you trust me sufficiently to send me a check for $100, expecting that I will send you my vintage Mickey Mouse watch, and I prove untrustworthy and keep the watch, you are out $100.

The importance of trust is by no means limited to dyadic interactions. Indeed, trust has been found to be related to economic activity and growth at the level of national economies, with countries with higher levels of trust having higher rates of economic growth (Zak and Knack 2001). It is therefore not surprising that this topic has received a great deal of attention cross-culturally (e.g., Buchan et al. 2002), and the origins and consequences of differences in trust and trustworthiness are important research topics that cut across disciplines.

Study 1 implements the increase-only method in the real-time game described above. One purpose of the current study was to examine whether the increase-only mechanism would also be effective in Japan. As Yamagishi (2003:352) recently put it, research comparing the United States and Japan has repeatedly demonstrated that the level of general trust is much higher in American society (see also Yamagishi and Yamagishi 1994; Yamagishi et al. 1998). If levels of trust are lower in Japan than in the United States, and trust plays an important role in decision-making in these games (e.g., Parks and Hulbert 1995), it should be possible to detect systematic differences in behavior in group cooperation games.

Note, however, that Yamagishi (2003) has suggested that Japan has high levels of assurance. He argues that the Japanese are more trusting than their American counterparts if and only if there are institutional mechanisms in place that punish untrustworthy behavior. In this view, Japanese people tend to trust only when it is in their interest to do so because of the (institutional or social) costs associated with not trusting (Yamagishi 1988).

Individual differences in levels of trust may also be a crucial variable affecting behavior in these experimental games (Parks and Hulbert 1995). Hence, another purpose of Study 1 was to observe whether players’ different levels of trust would affect their contributions. In particular, participants were placed into groups based on their score on a self-report measure of trust (Yamagishi and Yamagishi 1994), affording a comparison of groups with high trusters with those with low trusters. If trust plays a significant role in public goods games, then differences should be observed under this sorting procedure.

The increase-only mechanism helps prevent players from being free ridden, providing them with a kind of assurance. If Yamagishi’s (2003) argument is correct, then the mechanism should be more effective among Japanese than among Americans. At the same time, the mechanism enables players to see immediately whether the other players behave reciprocally, letting them monitor whether their expectations for the other players’ cooperation are being fulfilled. Because high trusters are more likely to cooperate by expecting others’ cooperation, they can be predicted to contribute more than low trusters at the beginning of the game. Once their expectations are fulfilled, high trusters should be more prompt than low trusters in contributing reciprocally in order to induce other players to increase their contributions.

In sum, our predictions were that (1) Japanese participants would contribute more, on average, than American participants did in the previous study because of the assurance afforded by the increase-only mechanism, (2) groups consisting of high trusters would contribute more over time than groups consisting of low trusters, and (3) high trusters would show more reciprocal behavior than low trusters.

Method

Participants

Fifty Japanese undergraduates at Hokkaido University (six females and 44 males)Footnote 1 participated. They were prescreened based on average scores on the six-item, seven-point trust scale developed by Yamagishi and Yamagishi (1994). Half of the participants were high trusters, who scored 4.6 and above on the trust scale, and the others were low trusters, who scored 3.4 and under. Five groups of five high trusters and five groups of five low trusters participated in each session.

Procedure

The procedure was identical to that used in the increase-only-and-lowest-contribution-information condition in the real-time public goods game conducted by Kurzban et al. (2001, Study 2). Each participant was seated in front of a computer in a booth in a laboratory room so they could not see one another. The entire procedure was computerized. On the computer screen, participants were instructed that their task was to engage in ten decision-making rounds and that they would receive cash depending on points they earned in these ten rounds. In each round, participants were given 50 points and had to divide them between a personal account and a group account. Participants were told that their earnings would be determined by the number of points they placed in the personal account plus one-third of the sum of points placed by them and any members of their group in the group account.

Each round started with 50 points in the personal account and 0 points in the group account. Participants could only increase their contribution to the group account during the round, which lasted 90 s. Points placed in the group account during a round could not be taken out and returned to the player’s personal account.

During each round, the current lowest contribution to the group account was displayed in the center of the computer screen and updated as this value changed. The time left in the round was also displayed. When each round finished, participants received feedback about the total contribution to the group account and how many points they had earned. When all members indicated that they were ready to proceed, the next round started. After the ten rounds, participants were asked to complete a questionnaire exploring their beliefs about the game.

Because pretesting showed that participants had difficulty understanding that contributions to the group account increased their payoff, participants were told that the sum of points in the group account was multiplied by 5/3 first and then divided equally among members. The incentive structure here is thus equivalent to the previous study (Kurzban et al. 2001), but explained slightly differently.

Results

Trust and contribution levels

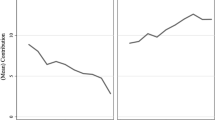

We conducted a 2 (levels of general trust) × 10 (round) repeated measures analysis of variance (ANOVA) on participants’ final contribution to the group account at the end of each round. There was a significant main effect of trust (F 1, 48 = 4.79, p < 0.05). High trusters contributed more than low trusters to the group account (means = 29.5 vs. 21.2). The ANOVA also revealed a significant main effect of round (F 9, 432 = 5.10, p < 0.0001). The trust by round interaction was not significant (F 9, 432 = 1.44, p > 0.15). As seen in Fig. 1, contributions in both groups did not decline over the course of rounds, replicating the results of Kurzban et al. (2001). Moreover, contributions by high trusters always exceeded those by low trusters and increased somewhat over the course of the game. This stands in stark contrast to typical public goods results in which contributions are lower, and decrease over time (Ledyard 1995).

Average contributions to the group account over the ten rounds of the experiment (Study 1)

To evaluate differences in contribution levels between high and low trusters, we also analyzed contributions during the course of rounds. Three groups that showed high levels of contributions (two high-trusters groups and one low-trusters group) achieved complete cooperation in at least one round. As seen in Fig. 2, and observed in Kurzban et al. (2001), a “ratchet” effect appeared because all members adjusted their contributions given the information of the lowest contribution, providing at least 1 point to the group account very shortly after the information was updated. This suggests that, at least for some groups, participants are sensitive to the lowest contribution and provide points to the group account gradually, keeping their contributions close to the value of the lowest current contribution.

Data from one group in the current study (top) showing contributions over time, illustrating the ratchet effect by which players increase their contributions gradually, contributing slightly more than the lowest current contribution to the group account. The data from US participants (bottom) are reprinted with permission (Kurzban et al. 2001: Fig. 4)

A straightforward prediction is that those who are high on the trust scale should be sensitive to the lowest contribution and willing to increase their contributions faster than their less-trusting counterparts. To test the prediction that high trusters increased their rates of cooperation faster during the course of a round, we looked at the lowest contribution at the end of each 10-s interval (10, 20, …, 90 s) in each round and conducted a 2 (trust) × 9 (time) × 10 (round) repeated measures ANOVA. There was a significant main effect of trust (F 1, 80 = 4.21, p < 0.05). The lowest contribution level was higher in high trusters than in low trusters (means = 14.0 vs. 9.36). Moreover, the level increased over time (F 8, 640 = 106.6, p < 0.0001). Importantly, the Trust × Time interaction was also significant (F 8, 640 = 4.40, p < 0.0001), with the lowest contribution increasing faster for high trusters. These interactions are illustrated in Fig. 3.

Questionnaire results indirectly indicated that high trusters behaved more reciprocally than low trusters. High trusters were more likely than low trusters to think that their contribution to the group account encouraged other people’s contributions (mean = 5.60 vs. 4.16 on a seven-point scale in which 1 = didn’t think at all, 7 = strongly thought; F 1, 48 = 10.98, p < 0.005). High trusters were also more likely than low trusters to think that other people also thought that their contributions to the group account encouraged other people’s contributions (means = 5.40 vs. 4.56 on a seven-point scale; F 1, 48 = 4.31, p < 0.05).

Cultural differences in contribution levels

To understand potential cross-cultural differences in contribution levels, we compared the Japanese data with the American data in Kurzban et al. (2001, Study 2).

Collapsing across levels of trust among the Japanese and comparing with the American data,Footnote 2 a 2 (culture) × 10 (round) repeated measures ANOVA on contributions showed a significant main effect of culture (F 1, 73 = 4.06, p < 0.05). Contributions were larger among Japanese (mean = 25.4) than among Americans (mean = 18.8). The interaction between culture and round was also significant (F 9, 657 = 3.17, p < 0.001). This interaction is driven by the fact that the increase in contributions over the course of rounds was larger in Americans than in the Japanese.

We also conducted a 2 (culture) × 9 (time) × 10 (round) repeated measures ANOVA on the lowest contribution to the group account at the end of each 10-s interval. No effects—not even culture—were significant. This implies that there were no cultural differences in the increase in the lowest contribution over time.

We also looked for potential cross-cultural differences in how players responded to others’ contributions by looking at the differences between each player’s contribution and the information they observed. To examine this, the difference between each member’s contribution and the lowest contribution at each second was computed. The averaged value for each round was used as a dependent measure. We conducted a 2 (culture) × 10 (round) repeated measures ANOVA. There was a significant main effect for culture (F 1, 130 = 31.98, p < 0.0001). The value was much smaller for the American sample (mean = 2.74) than for the Japanese sample (mean = 6.92). This suggests that Americans were more likely than Japanese to adjust their contribution levels to the current lowest contribution.

Discussion

The current study demonstrates that when people can incrementally increase their contributions to a public good without the possibility of removing them and can observe the current lowest contribution, contributions to public goods were elicited among Japanese participants in a way that parallels the effect shown among American participants (Kurzban et al. 2001). In contrast to typical results (Ledyard 1995), contributions were sustained over the course of ten rounds. This suggests that this mechanism, perhaps by virtue of its ability to allay contributors’ fears that they are being taken advantage of, can sustain cooperation even in very different cultures (Triandis 1995).

Although this mechanism generated relatively high levels of contributions for Japanese participants independent of their level of trust, self-reported high trusters did contribute more, on average, than low trusters. This difference in contributions was apparent from the beginning rounds of the game and gradually increased. Moreover, the lowest contributor in the high-trust group contributed more than the lowest contributor in the low-trust group. The finding that the lowest contribution increased faster for high trusters suggests that they were more sensitive than low trusters to other people’s contributions and were more willing to increase their contributions depending on others’ contributions. This provides indirect evidence that high trusters behaved more reciprocally. Results from the questionnaire were consistent with this suggestion.

Contributions among Japanese participants were somewhat larger than they were among the Americans in the previous study (Kurzban et al. 2001). These higher levels of contribution imply either greater cooperation in general among the Japanese participants or that the commitment mechanism was more effective. In light of arguments about the role of assurance in Japan (Yamagishi et al. 1998; Yamagishi and Yamagishi 1994), it is plausible that the commitment mechanism among Japanese was effective because of its ability to limit the extent to which individuals who cooperate are taken advantage of by less-cooperative individuals. The limitation on free riding might provide the type of institutional structure that fits with Japanese preferences regarding cooperation (Yamagishi 1988).

The lack of a decline in contributions over the course of the ten rounds of play contrasts with the standard result and with the result in the American sample, in which contributions increased significantly over rounds. So, while the increase-only/low-information condition does lead to behavior different from that typically observed in the simultaneous version of the voluntary contribution mechanism, the effect differs in terms of the between-round dynamics observed in the US. Our measures of reciprocity also show US–Japanese differences, particularly with respect to variation in within-round reciprocity. Broadly, these findings indicate differences in reciprocal behavior—both within and between rounds of play—which point to important directions for future research.

Specifically, the relatively flat curve in contribution levels (Fig. 1) for Japanese participants reflects a tendency to maintain a given rate of contribution throughout the course of the session. This might explain the greater variation in the differences between observed information and contribution decisions among Japanese participants compared with American participants. That is, Japanese participants might be behaving, broadly, less reciprocally within a round (Cook et al. 2005).

Study 2

Study 1 revealed close correspondence between the behavior of American and Japanese participants. One possible reason for this is the strength of the institutional mechanism; perhaps the increase-only/low-information game elicits behavior that will be similar across contexts in the same way that, for example, price mechanisms operate cross-culturally. That is, it is not surprising that both Japanese and Americans buy less of a good as the price of that good increases because people across cultures share the ability to execute the relevant cost/benefit computations. The mechanism in Study 1 might evoke homogeneity in behavior for essentially the same reason: the underlying computations, a willingness to contribute at a level slightly above that of the least-cooperative member of a group, are the same cross-culturally.

Study 2 investigates whether similar results can be obtained in a different environment, but it differs importantly from Study 1 in two key respects. First, Study 2, replicating Kurzban and Houser (2005), uses a circular public goods game instead of the real-time game. In the circular game, participants simultaneously decide how many points of their endowment to invest in the group exchange. Each game has a number of rounds after this initial decision. In each round, one participant in each group is given an opportunity to change the number of points invested in the group exchange. In making a decision, participants are allowed to view the current aggregate contribution to the group exchange. The game ends at a predetermined random point. Contributions to the group fund at the point that the game ends determine the payoffs for that game. Participants are informed of neither the number of rounds each game has nor the number of opportunities they will have to change their contributions. Each player is told that she will be given at least one opportunity to change her contribution to the group exchange in each game. The circular game might be a weaker mechanism—for example, the increase-only restriction is not implemented in this game. This leaves open the possibility that participants in Japan will play the game very differently from the participants in the US.

Second, in Study 2 we make a stronger prediction than in Study 1. Kurzban and Houser (2005) used an algorithm (see Type Classification, below) to separate players in this game into three types: Strong Cooperators, Free Riders, and Reciprocators. Based on evolutionary game theory and simulations, they suggested that there might be an observable mix of types. This implies that a similar distribution of types can be expected among Japanese participants. This would be particularly interesting in the context of the possibility that groups in different places might equilibrate at similar distributions of these types.

However, given the possibility that Japanese participants are less likely to be trusting without an institutional enforcement mechanism, the relatively limited number of strong cooperators found in the American sample might not be observed in the Japanese sample because Japanese participants can be expected to give their trust unilaterally less frequently.

Method

Sixty Japanese undergraduates at Hokkaido University (11 females and 49 males; see note regarding sex differences) participated in this study. The games were run with five groups of 12 people. The procedure was identical to that used in Kurzban and Houser (2005). Each participant was seated in front of a computer in a booth in a laboratory. Except for the instructions, the entire procedure was computerized. Participants were told that the study was concerned with individual and group investment behaviors. They were informed that each participant would be assigned to a group consisting of four people, and that their task was to divide 50 points between an individual exchange and a group exchange. Participants were told that they would earn 1 yen per point from the individual exchange, whereas each participant in the group would earn 0.5 yen per point from the group exchange. There were ten games in the study, though the participants were not told the number of games. Participants were randomly shuffled and reassigned to a different group of four people in every game.

The circular game was implemented as described above. The numbers of rounds in the ten games (excluding the initial decision stage) were as follows: 16, 7, 23, 32, 32, 34, 4, 17, 31, 8. When each game finished, participants received feedback about the total contribution to the group exchange and how many points they had earned. When all members indicated that they were ready to proceed, the next game started with new groups of four people. After all ten games were complete, participants were asked to complete a questionnaire, paid, and dismissed.

Results

Aggregate contributions

Final aggregate contributions to the group exchange in each round were averaged. As shown in Fig. 4, the mean contributions decreased over the course of rounds from about 70% to about 30%. Kurzban and Houser (2005) found the same pattern in the US.

Average contributions to the group exchange in Study 2

Type classification

Kurzban and Houser classified behaviors of participants into three types (free riding, unconditional cooperation, and conditional cooperation) by using each participant’s linear conditional-contribution profile (LCP). In order to compute each participant’s LCP, they regressed her/his contribution decisions to the group exchange on the aggregate contribution that s/he could see in making the decision. They defined each participant’s LCP as the outcome of the regression. Because the intercept can be considered an index of willingness to contribute regardless of contributions the other members made, it should be low among free riders but high among unconditional cooperators. Moreover, because the slope of this regression indicates how responsive an individual was to other members’ contributions, it should be positive among conditional cooperators. Kurzban and Houser classified a participant as a free rider if her/his LCP was everywhere below 25, which means that her/his contribution was always less than half of the other members’ contributions to the group exchange. On the other hand, a participant was classified as an unconditional cooperator if her/his LCP was everywhere above 25. Finally, a participant was classified as a conditional cooperator if her/his LCP had a positive slope and was both above and below 25. We used the same procedures to classify participants into the three types based on their behavior in the first seven games (see below). As a result, 15 of 60 participants (25%) were classified as free riders, 2 (3%) as unconditional cooperators, and 43 (72%) as conditional cooperators. Replicating Kurzban and Houser (2005), the number of conditional cooperators was the largest, while the number of unconditional cooperators was the smallest. The number of free riders fell between the two groups. However, the proportion of unconditional cooperators differed marginally significantly from that in the American sample (11 out of 84 participants, 13%; \(\chi _1^2 = 3.45\), p < 0.10).

In order to check whether group contributions were significantly different among the three types, we conducted a median test on the median contributions per game and found a significant difference (\(\chi _2^2 = 6.55\), p < 0.05). The median group contributions of free riders, conditional cooperators, and unconditional cooperators were 0, 30, and 50 points, respectively. We also conducted a median test on the median earnings per game among the three types. In spite of substantial differences in the group contributions, there was no significant difference in their earnings (\(\chi _2^2 = 2.32\), n.s). The median earnings of free riders, conditional cooperators, and unconditional cooperators were 72.5, 70, and 50 points, respectively. The standard deviation of the earnings for free riders, conditional cooperators, and unconditional cooperators were 21.9, 20.0, and 22.3 points, respectively. These patterns were identical to those found by Kurzban and Houser (2005) in the US.

We used the classification based on only the first seven games to investigate whether these individual differences were stable across the entire experimental session. We refer to these first seven games as in-sample because they were used to assign players to types. We use the in-sample games to see if the information derived from them can be used to predict play in the last three games, which we refer to as out-of-sample. If play is stable across the experimental session, then the dynamics observed in the first seven games should resemble the dynamics of play in the last three, using the type composition of groups as the unit of analysis.

Following Kurzban and Houser (2005), we attempted to distinguish groups by using an index of cooperativeness score. In order to compute a group cooperative score, Kurzban and Houser assigned 0 to each free rider in a group, 1 to each conditional cooperator, and 2 to each unconditional cooperator, and then summed the scores of the four members in each group. We used the same procedure and obtained group scores ranging from 1 to 5. Because participants were randomly matched in every game, by chance there was neither a group which included only free riders nor a group which included more than one unconditional cooperator. Final aggregate contributions to the group exchange for the first seven (in-sample) games and the last three (out-of-sample) games in each cooperativeness score are plotted in Fig. 5. Final aggregate contributions for both samples increased as a function of cooperativeness scores. This suggests that cooperativeness scores predict not only final aggregate contributions in-sample, but also contributions out-of-sample. Moreover, as shown in Fig. 5, out-of-sample aggregate final contributions were within two standard errors of the in-sample aggregate final contributions. The tendency was also seen when final contributions over the course of rounds are plotted (Fig. 6). Consistent with Kurzban and Houser (2005), we found a predictable relationship between temporal patterns of group cooperation and the makeup of groups. That is, the dynamics of play obtained from the first seven (in-sample) games replicated themselves to a substantial extent when similar groupings were formed in the last three (out-of-sample) games. This finding suggests that participants were relatively consistent in their play across the ten games, leading to similar dynamics within each arrangement of the three types within a group.

Discussion

A similar distribution of free riders, reciprocators, and unconditional cooperators was found in the Japanese sample. This distribution was free to vary and has essentially no bounds, so the observation of such similarity might be taken to support the view that there are similar mixed equilibria of types across populations, though there are of course many different possible avenues by which such equilibria might come to pass (Kurzban and Houser 2005). Additional work in still other cultural contexts would be very valuable to see if the close correspondence of types in the US and Japan is coincidental, or something more robust.

Further, as in the US sample, player strategies were sufficiently consistent over the course of multiple games that when individuals were placed into new groups, the dynamics of play could be accurately predicted from the dynamics of similarly-composed groups in the first seven games. This suggests that participants in both the US and Japan chose a strategy and used it throughout the session.

The very small number of unconditional cooperators in Japan—two in a sample of 60—is suggestive. Though contributing independent of others’ contributions is not identical to Yamagishi’s (2003) suggestion that there is a cultural difference in the amount of trust given in the absence of assurance, the paucity of players who are unwilling to cooperate independent of others’ willingness is interesting in this regard. Of course, given the marginal significance of this result, it should be interpreted with appropriate caution.

General Discussion

The work reported here complements the growing interest in how people across cultures respond to behavioral economics environments (e.g., Roth et al. 1991), with recent research in a very wide variety of human cultures (Henrich et al. 2005, 2006). Broadly, this recent work, based primarily on the ultimatum game, has shown profound between-group differences. Cross-cultural variability in cooperation versus selfishness is not new. A number of psychologists have argued, for example, that collectivism and individualism characterize Eastern and Western societies, respectively (Triandis 1995), and that this has important implications for propensities toward cooperative versus selfish behavior (Smith, Dugan and Trompenaars 1996; Wagner 1995), with those in collectivist societies expected to be more cooperative than those in individualist societies. Recently, however, it has been proposed that the dimension of collectivism versus individualism is neither strong nor systematic (e.g., Oyserman et al. 2002).

We found some evidence for such a cultural difference in Study 1 in the form of differences in cooperation rates between Japanese and American participants. However, this difference was quantitatively small and the general patterns of results were similar, as were the dynamics of play. We also observed a ratchet effect, suggesting a similar underlying use of behavioral strategies in the two populations. Study 2 illustrated similar cross-cultural patterns, including in the dynamics of play. These observations lead naturally to the question of why some researchers find profound differences (e.g., Yamagishi 1988), while we find similarities.

Henrich et al. (2005) have suggested one source for a possible explanation: the ambiguities of behavioral economics experiments, which are, by design, conducted with minimal context to limit the impact of framing effects (e.g., Batson and Moran 1999). As a result, the stylized setting of these experiments might lead to a certain degree of confusion (Andreoni 1995; Houser and Kurzban 2002; Kurzban 2001), causing participants to try to map the unfamiliar and somewhat unusual experimental procedures presented to them onto something with which they are familiar. If this is the case, the more stripped of meaning the experimental context, the more the experiment is really addressing the way that participants map the experiment onto something familiar, and the less the experimenter is asking the same question about the preferences and strategies of people in different cultural environments.

A second possibility, alluded to above, is that the between-culture similarities observed here result from a stronger pull of economic incentives. In the trivial case in which contributions to the public good are transparently a net gain for participants, it is reasonable to suspect that behavior would be homogeneous, as the alignment of individual and group incentives would lead to universal or nearly universal contributions (Isaac and Walker 1988). The institutional mechanism implemented in Study 1 is richer than an ultimatum game and simultaneously changes the incentive structure depending on the priors of the participants: if players believe that others will contribute at levels just above the lowest current contributor, and believe that others believe this, pure self-interest will generate the observed ratchet pattern. In this case, the similarity derives from the relatively straightforward preference for pursuit of self-interest in both populations. This argument is more difficult to sustain in the context of Study 2, though there is no clear, objective metric for characterizing the strength of institutional arrangements.

The similarities in the findings reported here, compared with the surprising variation in the ultimatum game results reported by Henrich et al. (2005), point up the usual difficulties in evaluating differences in cross-cultural research. The fact that we observe here striking similarities in games more complex than the ultimatum game in what have historically been considered very different cultures should alert us to the possibility that cross-cultural differences in behavior might mask important underlying similarities. Our intent is not to minimize cultural differences, but rather to emphasize the importance of careful consideration of inferences that can be drawn from cross-cultural research (Burnham and Kurzban 2005). Cross-cultural differences can come from many sources, including noise, translation problems, methodological variation, and, of course, differences in underlying concepts and preferences. Similarities, however, while plausibly having different causal antecedents, are potentially more informative because they speak to the likelihood of underlying similarity in psychological processes (Brown 1991). In this case, the close resemblance in distributions of types in Study 2 opens up intriguing possibilities regarding the equilibration of different strategic types across different cultural contexts.

More generally, Japan represents an appealing country for replicating behavioral economics experiments. Because of its technological sophistication, many experiments can be run in Japan that would be difficult or impossible in settings in which computer technology is less pervasive. At the same time, Japan has received a great deal of attention because of large and purportedly important differences compared with the West (Benedict 1946). As such, additional collaborative work between the East (e.g., Japan, China, and Korea) and West using the relatively clean methods of behavioral economics might be extremely useful in mapping the details of individual and cross-cultural differences in social preferences.

Notes

Collapsing levels of trust and comparing them with American data is potentially problematic because Japanese participants were not randomly selected, as American participants were. While aware of this difficulty, we nonetheless conducted the analysis because it is potentially informative regarding potential cross-cultural differences in behavior in public goods games.

References

Andreoni, J. (1995). Cooperation in public goods experiments: Kindness or confusion? American Economic Review, 85, 891–904.

Axelrod, R. (1984). The evolution of cooperation. New York: Basic Books.

Batson, C. D., & Moran, T. (1999). Empathy-induced altruism in a prisoner’s dilemma. European Journal of Social Psychology, 29, 909–924.

Benedict, R. (1946). The chrysanthemum and the sword: Patterns of Japanese culture. Boston: Houghton Mifflin.

Bolton, G. E., Katok, E., & Ockenfels, A. (2004). Trust among internet traders: A behavioral economics approach. Analyze and Kritik, 26, 185–202.

Brown, D. E. (1991). Human universals. New York: McGraw-Hill.

Buchan, N., Croson, R., & Dawes, R. (2002). Swift neighbors and persistent strangers: A cross-cultural investigation of trust an reciprocity in social exchange. American Journal of Sociology, 108, 168–206.

Burnham, T., & Kurzban, R. (2005). On the limitations of quasi-experiments. Behavior and Brain Sciences, 28, 818–819.

Cook, K. S., Yamagishi, T., Cheshire, C., Cooper, R., Matsuda, M., & Mashima, R. (2005). Trust building via risk taking: A cross-societal experiment. Social Psychology Quarterly, 68, 121–142.

Dawes, R. (1980). Social dilemmas. Annual Review of Psychology, 31, 169–193.

Dorsey, R. E. (1992). The voluntary contributions mechanism with real time revisions. Public Choice, 73, 261–282.

Fishbacher, U., Gächter, S., & Fehr, E. (2001). Are people conditionally cooperative? Evidence from a public goods experiment. Economics Letters, 71, 397–404.

Fukuyama, F. (1995). Trust: The social virtues and the creation of prosperity. New York: Free.

Goren, H., Kurzban, R., & Rapoport, A. (2003). Social loafing vs. social enhancement: Public good provisioning in real time with irrevocable commitments. Organizational Behavior and Human Decision Processes, 90, 277–290.

Goren, H., Rapoport, A., & Kurzban, R. (2004). Revocable commitments to public goods provision under the real-time protocol of play. Journal of Behavioral Decision Making, 17, 17–37.

Gouldner, A. (1960). The norm of reciprocity: A preliminary statement. American Sociology Review, 25, 161–178.

Granovetter, M. (1978). Threshold models of collective behavior. American Journal of Sociology, 83, 1420–1443.

Henrich, J., Boyd, R., Bowles, S., Camerer, C., Fehr, E., Gintis, H., et al. (2005). Economic man in cross-cultural perspective: Behavioral experiments in 15 small-scale societies. Behavior and Brain Science, 28, 795–855.

Henrich, J., McElreath, R., Barr, A., Ensimger, J., Barrett, C., Bolyanatz, A., et al. (2006). Costly punishment across human societies. Science, 312, 1767–1770.

Houser, D., & Kurzban, R. (2002). Revising kindness and confusion in public goods games. American Economic Review, 92, 1062–1069.

Insko, C. A., Schopler, J., Hoyle, R. H., Dardis, G. J., & Graetz, K. A. (1990). Individual-group discontinuity as a function of fear and greed. Journal of Personality and Social Psychology, 58, 68–79.

Isaac, R. M., McCue, K. F., & Plott, C. R. (1985). Public goods provision in an experimental environment. Journal of Public Economics, 26, 51–74.

Isaac, R. M., & Walker, J. M. (1988). Communication and free-riding behavior: The voluntary contribution mechanism. Economic Inquiry, 26, 585–608.

Kelley, H. H., & Thibaut, J. W. (1978). Interpersonal relations: A theory of interdependence. New York: Wiley.

Komorita, S. S., & Parks, C. D. (1995). Interpersonal relations: mixed-motive interaction. Annual Review of Psychology, 46, 183–207.

Kurzban, R. (2001). Are experimental economists behaviorists, and is behaviorism for the birds. Behavior and Brain Sciences, 24, 420–421.

Kurzban, R. (2003). Biological foundations of reciprocity. In E. Ostrom, & J. Walker (Eds.), Trust, reciprocity, and gains from association: Interdisciplinary lessons from experimental research (pp. 105–127). New York: Sage.

Kurzban, R., & Houser, D. (2005). Experiments investigating cooperative types in humans: A complement to evolutionary theory and simulations. Proceedings of the National Academy of Sciences, 102, 1803–1807.

Kurzban, R., McCabe, K., Smith, V. L., & Wilson, B. J. (2001). Incremental commitment and reciprocity in a real-time public goods game. Personality and Social Psychology Bulletin, 27, 1662–1673.

Ledyard, J. (1995). Public goods: A survey of experimental research. In J. Kagel, & A. Roth (Eds.), Handbook of experimental economics (pp. 111–194). Princeton: Princeton University Press.

Liebrand, W. B. G., & Messick, D. M. (Eds.) (1996). In Frontiers in social dilemmas research. Berlin: Springer.

Messick, D. M., & Brewer, M. B. (1983). Solving social dilemmas: A review. Review of Personality and Social Psychology, 4, 11–44.

Messick, D. M., & McClintock, C. G. (1968). Motivational basis of choice in experimental games. Journal of Experimental Social Psychology, 4, 1–25.

Ostrom, E., & Walker, J. (2003). Trust & reciprocity. New York: Sage.

Oyserman, D., Coon, H. M., & Kemmelmeier, M. (2002). Rethinking individualism and collectivism: Evaluation of theoretical assumptions and meta-analyses. Psychological Bulletin, 128, 3–72.

Parks, C. D., & Hulbert, L. G. (1995). High and low trusters responses to fear in a payoff matrix. Journal of Conflict Resolution, 39, 718–730.

Rapoport, A., & Eshed-Levy, D. (1989). Provision of step-level public goods: Effects of greed and fear of being gypped. Organizational Behavior & Human Decision Processes, 44, 325–344.

Roth, A. E., Pracnikar, V., Okuno-Fujiwara, M., & Zamir, S. (1991). Bargaining and market behavior in Jerusalem, Ljubljana, Pittsburgh, and Tokyo: An experimental study. American Economic Review, 81, 1068–1095.

Schelling, T. (1960). The strategy of conflict. Cambridge: Harvard University Press.

Sell, J. (1997). Gender, strategies, and contributions to public goods. Social Psychology Quarterly, 60, 252–265.

Simpson, B. (2003). Sex, fear, and greed: A social dilemma analysis of gender and cooperation. Social Forces, 82, 35–52.

Smith, P. B., Dugan, S., & Trompenaars, F. (1996). National culture and the values of organizational employees: A dimensional analysis across 43 nations. Journal of Cross-Cultural Psychology, 27, 231–255.

Triandis, H. C. (1995). Individualism and collectivism. Boulder: Westview.

Trivers, R. L. (1971). The evolution of reciprocal altruism. Quarterly Review of Biology, 46, 35–57.

Van Lange, P. A. M. (1999). The pursuit of joint outcomes and equality in outcomes: An integrative model of social value orientation. Journal of Personality and Social Psychology, 77, 337–349.

Van Lange, P. A. M., & Semin-Goossens, A. (1998). The boundaries of reciprocal cooperation. European Journal of Social Psychology, 28, 847–854.

Wagner, J. A. (1995). Studies in individualism and collectivism: Effects on cooperation in groups. Academy of Management Journal, 38, 152–172.

Wilson, R. K., & Sell, J. (1997). “Liar, liar...”: Cheap talk and reputation in repeated public goods settings. Journal of Conflict Resolution, 41, 695–717.

Yamagishi, T. (1988). The provision of a sanction system in the United States and Japan. Social Psychology Quarterly, 51, 32–42.

Yamagishi, T. (2003). Cross-societal experimentation on trust: A comparison of the United States and Japan. In E. Ostrom, & J. Walker (Eds.), Trust and reciprocity: Interdisciplinary lessons from experimental research (pp. 352–370). New York: Sage.

Yamagishi, T., Cook, K., & Watabe, M. (1998). Uncertainly, trust, and commitment formation in the United States and Japan. American Journal of Sociology, 104, 165–194.

Yamagishi, T., & Yamagishi, M. (1994). Trust and commitment in the United States and Japan. Motivation and Emotion, 18, 129–166.

Zak, P. J., & Knack, S. (2001). Trust and growth. Economic Journal, 111, 295–321.

Acknowledgments

The research reported in this paper was supported by a grant to the first author from the Japan Society for the Promotion of Science. We thank members of the Hokkaido University Center of Excellence Program on “Cultural and Ecological Foundations of the Mind” for their support in carrying out this work. The second author acknowledges the generous support of the University of Pennsylvania University Research Foundation and thanks Toshio Yamagishi for stimulating discussions related to this project.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ishii, K., Kurzban, R. Public Goods Games in Japan. Hum Nat 19, 138–156 (2008). https://doi.org/10.1007/s12110-008-9034-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12110-008-9034-4