Abstract

Energy Service Companies (ESCO) provide various services to their customers through Energy Performance Contracts (EPCs), including technical support, financial assistance, installation, maintenance, and insurance services. However, emerging risks during this extended process can lead to uncertainties for energy efficiency implementations, ESCOs, and their clients. Understanding of uncertain factors of such energy efficiency applications is therefore crucial. This study aims to evaluate the risks that emerge in the stages of EPC implementations in Türkiye. An expert survey was conducted to assess these risks, with participants consisting of energy managers, representatives from Turkish ESCOs, experts from the financial sector, academics, and decision-makers. Based on the survey responses, the Best–Worst Method (BWM), a multi-criteria decision-making approach, was employed to evaluate the risks in EPCs. Binary comparison vectors, indicating the relative importance of evaluated risk factors, were formulated using the BWM, enabling the calculation of risk weights and the analysis of response consistency. It is revealed that “Financial and Market Risks” is the most important, and “Technological Risks” is the least important risk criterion for EPCs in Türkiye. In the end, policy recommendations were developed to improve EPC applications in Türkiye.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Energy Performance Contracting (EPC) is a ‘creative financing’ form for capital improvement that allows funding energy upgrades from cost reductions. Within the framework of an EPC arrangement, an external entity referred to as an Energy Service Company (ESCO) undertakes a project to implement energy efficiency improvements or renewable energy projects. The financing of these projects is subsequently sourced from the revenue stream generated by the realized cost savings or renewable energy. The EPC approach is based on the transfer of technical risks from the client to the ESCO based on performance guarantees given by the ESCO. The amount of energy saved, or the quality of the energy service is a metric of performance in EPC, and ESCO remuneration is dependent on this performance. Institutions that lack capital resources, risk awareness, energy engineering experience, labor or management time, or technology knowledge can use EPC to upgrade their infrastructure (JRC, 2023). The energy efficiency service sector can be revitalized with EPCs today, where economic difficulties abound, and carbon reduction and energy efficiency practices have become mandatory.

Although it is seen as an excellent and creative tool, there are some barriers to EPC, such as lack of awareness and knowledge, legal, political, and market-related obstacles, lack of standardized procedures for energy savings measurement and verification (M&V), financial obstacles, lack of support mechanisms, risk perception, etc. (Akkoç et al., 2023; Vine, 2005). All these obstacles make it challenging to realize EPC-based projects and complicate establishing the necessary confidence environment for developing the energy service markets. Therefore, risk assessment is one of the crucial requirements in EPC applications. The success of EPC projects depends on their capacity to identify, prevent, mitigate, and manage risks. Risk management provides an effective structure for these requirements (Jahantigh et al., 2017; Xia et al., 2022).

The Turkish energy services market has been growing since 2009 but has not yet realized its full potential. Compared to the market, EPCs are significantly more recent and have fewer applications. A recent study showed that Türkiye’s low number of EPC implementations does not fully meet the EPC criteria and cannot go beyond ordinary energy efficiency implementation projects (Akkoç et al., 2023). By understanding and solving the risks of EPCs in Türkiye, improvement of EPC applications can be achieved. The growth and development of the energy service market and reaching an ideal market may be made simpler by the increase in the quality of EPC applications in Türkiye.

This study aims to determine the risk criteria and their weights in EPC applications in Türkiye and to develop suggestions for preventing the risks. For this purpose, an expert survey study was conducted specifically for Türkiye. The survey’s target group was energy managers, Turkish ESCOs (EVDs), financial experts, academics, and decision-makers/policymakers. Based on the detailed EPC risk literature, 5 main and 21 sub-risk criteria for EPCs were determined. Survey questions were prepared in accordance with the Best–Worst Method (BWM) to be used. Experts were asked first to determine the “Most Important” and “Least Important” risks among the 5 main risk criteria in EPC and then to perform pairwise comparisons of these risks with the other main risk criteria. Subsequently, they were asked to identify the “Most Important” and “Least Important” risks among the 21 sub-risk criteria, followed by pairwise comparisons with the other sub-risk criteria. 63 experts participated in the survey, including 9 experts from the financial sector, 5 decision-makers, 7 academics, 19 energy managers, and 23 representatives from EVD companies. Within the scope of the BWM, consistency analysis is conducted. According to consistency analysis, it was found that 7 experts provided inconsistent responses to the survey questions. Therefore, 7 responses were removed from the analysis.

Using the BWM, the weights of the main and sub-risk criteria of EPC in Türkiye were calculated, and the “Most Important” and “Least Important” risk criteria were determined based on experts’ opinions. This study will contribute to the literature as the EPC risk assessment is carried out for the first time in Türkiye. Besides, it is desired that this study can be a foundational framework for related energy service market participants to conduct EPC risk assessments and management.

Accordingly, the rest of the paper is organized as follows. The second section explains the EPC concept, and related legislation in Türkiye is summarized. Risk factors of EPC were presented in the third section. The methodology of the study is explained in the fourth section. Analysis of the study is detailed in the fifth section. The sixth section discussed the results, while the seventh section presented the overall conclusions and recommendations.

Energy performance contracts

According to the Energy Efficiency Directive (EED) by the European Parliament and the Council of the European Union (EU), an energy performance contract is defined as “an agreement between a beneficiary and a provider that regulates activities related to measuring, verifying, and monitoring energy efficiency improvement efforts”. This agreement specifies investment (implementation, supply, or service) financing based on changes in energy efficiency or other performance indicators, such as financial savings (European Parlement, 2023). The diversity in EPC is due to each country’s unique legislation and financial mechanisms. Guaranteed and shared energy savings contracts are among the most well-known types. Other contract types include Build-Operate-Transfer, Leasing, Fuel-Based Contracts (Chauffage), First-In-First-Out, and others. Figure 1 explains the EPC types (Bertoldi et al., 2006; Carbonara & Pellegrino, 2018; CERtuS n.d.; JRC, 2023; Liu et al., 2017; Qin et al., 2017).

Türkiye's energy efficiency legislation has been developing for many years. However, in the recent past, Energy Performance Contracts have started to have a significant place in the legislations.

Energy Efficiency Law No. 5627, accepted on April 18, 2007, and published in the Official Journal (OJ) with No. 26510 on May 2, 2007, set Türkiye’s fundamental legislative framework for energy efficiency. The purpose of the law is defined as “increasing efficiency in the use of energy resources and energy, preventing waste, reducing the burden of energy costs on the economy, and preserving the environment”. The law encompasses definitions and authorizations of stakeholders related to energy efficiency, principles of education, awareness and implementation, support, and administrative sanctions. In the law, Turkish ESCOs are named Energy Efficiency Consultancy Company (EVD), and EPC is defined as “a contract based on the principle of guaranteeing the energy-savings to be achieved after the implementation project and paying the expenditures with the savings that will occur as a result of the implementation” (Republic of Türkiye, 2007).

Following the law, EPC-related legislation has been published. In Presidential Decree No. 1, published in the OJ dated 10 July 2018 and numbered 30,474, the task of “providing consultancy and technical support for the realization of EE investments, including energy performance contracts” is specified (Presidency of Türkiye, 2018b). Article 77 of the “Law on Amendments to Tax Laws and Certain Laws and Decrees” gives a more comprehensive description, published on March 27, 2018, with OJ No. 7103. Consequently, it has been indicated that public institutions and organizations can enter into EPC agreements if the contract duration does not exceed 15 years. The payment for EPC will be made from the budget where energy procurement expenses are incurred, and the total annual payments will not exceed the guaranteed savings amount (Presidency of Türkiye, 2018a).

A goal of 15% energy savings by the end of 2023 has been established for public buildings with an annual total energy consumption of 250 toe or above or an overall construction area of 10,000 square meters or above by Circular dated 15/08/2019 and numbered 2019/18 (Presidency of Türkiye, 2019). Following Article 1 of the Energy Efficiency Law, the “Presidential Decree on Principles and Procedures Regarding Public Energy Performance Contracts” was published in 2020 (Presidency of Türkiye, 2020). Based on the Decree, a communiqué was prepared in 2021. Within the framework of the communiqué, details regarding the implementation of EPC were explained, including the format of feasibility reports, specifications, and draft contracts. Additionally, a guide on how to implement EPC in the public sector, certification of measurement and verification experts provided by the Ministry of Energy and Natural Resources (MENR), and the Turkish International Measurement and Verification Protocol are also included in the annex of the regulation (Presidency of Türkiye, 2021).

The Ministry of Environment, Urbanization and Climate Change (MEUCC) has initiated the Energy Efficiency in Public Buildings (KABEV) project with the following objectives: (i) reducing fuel and electricity consumption through energy efficiency practices in public buildings; (ii) providing budget savings by reducing energy costs of public buildings, (iii) reducing greenhouse gas emissions as a result of energy saving, (iv) increasing the comfort conditions of personnel working in public buildings and citizens using the buildings, (v) increasing energy efficiency awareness among users of public buildings. The KABEV project is funded by the World Bank and implemented by the MEUCC General Directorate of Construction Works (YİGM) with the support of the MENR. Within the scope of the KABEV project, 500–700 public buildings are aimed to renew with energy efficiency.Footnote 1

Under the KABEV Project:

-

In 2021, a high school in Bursa province was selected as the first public building under the KABEV Project to achieve 80% energy efficiency on the school campus through EPC model.

-

In 2022, a tender was conducted for the Waste Flue Gas Electricity Generation for Sivas Compressor Station of Pipelines and Petroleum Transport Inc. (BOTAŞ). The project to be carried out within the scope of EPC aims to reduce the amount of waste heat by 95%, to meet the entire annual electricity need of Sivas Compressor Station and approximately 20% of the total annual electrical energy needed in other facilities of BOTAŞ.

-

In 2023, the first solar power plant, which has an area of 100 thousand square meters and an installed capacity of 5660 kW, was implemented in Van province through EPC model.

-

In 2024, the rooftop solar power plant project carried out in Izmir Tire Municipality with the EPC model, it is aimed to meet more than half of the electricity consumption of Tire Municipality with an investment of 29 million Turkish Liras without using public resources.

Although the main purpose of the KABEV project is to provide energy efficiency, most of the tenders and EPC applications have been renewable energy projects. If renewable energy projects are carried out after the full energy saving potential has been realized, the capacity to be installed and therefore the investment will be lower. Unfortunately, it is not checked whether these requirements are fulfilled in the actual applications.

The stated legislation and regulations seek to direct the energy service sector through EVDs and EPC projects. However, Türkiye’s energy service market and EPC applications are currently not at the desired level, and it need to be developed to include more energy efficiency projects.

Risk factors of energy performance contracts

EPC brings together investors and clients on the same common ground, intersecting at the point of energy efficiency. In this context, identifying, evaluating, and understanding the risks in energy efficiency projects will diversify the applications, enhance the transparency of savings potential, and increase investor confidence in project performance. Therefore, it is essential to leave no hidden points in energy efficiency projects within the scope of EPCs, carefully prepare the business plan, share management and operational risks, and perform risk assessment within the contract scope.

Risk assessment is the process of systematically identifying, analyzing, and evaluating risks to understand the potential effects of uncertainties. The ISO 31000:2018 standard defines this process as one of the key components of risk management (ISO, 2018). Risk matrices and SWOT analysis, commonly used risk assessment methods, support the evaluation of risks in various dimensions. These methods encourage evaluating risks by dividing them into more specific categories. Besides common methods, multi-criteria decision-making methods can be used for risk assessments.

By reviewing the literature, various studies that identify the critical risk factors influencing EPCs and propose effective measures and recommendations against these risks can be observed. The risks associated with EPCs are generally categorized into two main groups: “in-project” and “out-of-project” risks. Changes made within the scope of investment, such as the performance of installed equipment and implemented applications, directly affect the project and constitute in-project risks. Out-of-project risks encompass uncontrollable factors such as price fluctuations (Mills et al., 2006). On the other hand, more risk categories allow risks to be examined in detail and make it easier to develop customized intervention strategies for each type of risk (Aven & Renn, 2010). Also, multi-criteria decision-making methods require risks to be evaluated in different categories (Belton & Stewart, 2002). These methods enable risks to be analyzed in detail under various criteria in complex projects such as EPCs.

Upon detailed examination of the risks compiled from the literature, 21 sub-risk criteria, dependent on 5 main risk criteria, come to the forefront. The main risk criteria are environmental risks, managerial and operational risks, financial and market risks, technological risks, and client risks. Table 1 shows the main and sub-risk criteria for EPC compiled from the literature, along with their references. Following Table 1, the explanations of main and sub-risk criteria are given.

Environmental Risks

Government policies can change over time, which can result in risks for ESCOs. The absence of a robust market for ESCOs, the lack of consistent and detailed regulations, or economic instability pose risks for the long-term implementation of contracts. Natural conditions such as weather, hydrogeology, topography, and natural disasters can also affect energy-saving performance.

-

Political and Legal Risk

-

Political and legal risks can arise from factors such as changes in legislation, political instability, alterations in regulations, or transformations in government policies, potentially impeding the successful completion of the project or achieving the targeted energy savings. Changes in policy and legislation affecting the project can complicate its planning and execution. Particularly, modifications in legal regulations governing or impacting EPCs can influence the project's cost, duration, and scope. The instability of the political environment affecting the project can have adverse effects on its progress and success. Political conflicts, elections, or political uncertainties may affect the project's financing, permits, and operational processes. Government energy policies and incentives can impact the project's success. Policy changes such as energy efficiency incentives, renewable energy policies, or carbon taxes can affect the project's costs or returns. Legal uncertainties or disputes related to the project may hinder its progress and success.

-

Economic Risk

-

A decrease in general economic activity or periods of economic downturn can negatively affect the financing and demand for the project. Economic downturns can prolong the project's repayment processes and make financing more challenging to obtain. High inflation rates can increase the project's costs. Currency fluctuations can impact both the costs and revenues of the project. Changes in economic policies can affect the project's financing and demand. Changes in tax regulations or incentive policies can affect the project's cost structure and profitability.

-

Natural Environmental Risk

-

The natural environmental risk in EPC refers to the potential exposure of the project to adverse effects stemming from environmental factors. These risks can arise from factors such as the geographical location of the project area, climatic conditions, natural disasters, and environmental variables, and they can impede the successful completion of the project or the achievement of targeted energy savings.

Managerial and operational risks

Managerial and operational risks, problems related to the project team, decision-making errors, the ability to work on and control the project, risks arising from equipment and material procurement, and project-independent risks such as the age and location of the building fall into this group.

-

Completion of Project Team

-

The risk of incomplete project team formation in EPC refers to the situation where the project team is incomplete or inadequate to achieve the set objectives. This risk can hinder the project from being executed as planned and completed. The lack of expertise and skills among the members of the project team can make it challenging to complete the project. Insufficient personnel in the project team can make it difficult to distribute the workload and complete the project on time. Communication gaps or issues within the project team can hinder effective management and collaboration on the project. Staff turnover or changes during the project can affect its continuity and consistency. The integration process for new staff or the adjustment of existing team members can take time, impacting the progress of the project.

-

Decision Risk

-

The decision risk in EPC refers to the potential for decisions made during the project process to fail to achieve the expected outcomes or lead to undesired results. This risk can arise from various factors and may impede the successful completion of the project or the achievement of targeted energy savings. Insufficient information or analysis during the decision-making process can make it difficult to manage the project successfully. Uncertainties and variables affecting the project can complicate the decision-making process.

-

Ability Risk

-

The ability risk in EPC refers to the situation where there is a lack of or insufficient personnel possessing the necessary skills required to successfully execute the project. The absence of the required expertise and experience among the project team members can impede the effective management of the project and the achievement of objectives. Changes in the required expertise and skills throughout the project duration may necessitate continuous training and development for team members.

-

Information Management Risk

-

The information management risk in EPC refers to the inadequate or incorrect management of information that could impact the success of the project. Failure to adequately collect or analyze the necessary information during the project process can make it difficult to make informed decisions. The reliability and accuracy of the information used during the project process can affect the success of the project. Misunderstood or misused information can lead to incorrect decision-making or hinder the achievement of objectives. Communication gaps or disruptions in information flow among the project team or stakeholders can impede effective project management.

-

Procurement Risk

-

The procurement risk in EPC refers to the potential problems that may arise in the procurement of materials, equipment, or services required for the project. This risk can stem from various factors such as disruptions in the supply chain, delays, or deficiencies in service quality, and it can impede the successful completion of the project or the achievement of targeted energy savings.

-

Construction Risk

-

The construction risk in EPC refers to the potential problems that may arise during the physical construction process of the project. Delays encountered during the construction phase, cost increases, quality issues, or safety risks due to factors such as weather conditions, supply chain issues, or technical difficulties can prevent the construction from being completed on time, negatively impacting the success of the project.

Financial and Market Risks

Financial and market risks for ESCOs primarily arise from market supply and demand conditions, price fluctuations, and access to suitable financing. Market demand, fluctuating prices, uncertainty in competition, and high-interest rates for small and medium-sized enterprises can lead to significant risks for ESCOs.

-

Risk of Market Competition

-

A competitive market environment can impact the costs and revenues of the project. The presence of other companies offering similar services or technologies can increase price competition and reduce the profitability of the project. Price competition in a competitive market environment can affect the project's costs. Other companies offering similar services at lower prices can diminish the project's competitive edge and decrease its profitability. Market share competition can affect the growth and development of the project.

-

Risk of Price Change

-

Unexpected increases in the prices of materials used in the project can increase its costs. Rises in the prices of raw materials can reduce the project's profitability and lead to budget overruns. Changes in the costs of labor employed in the project can affect its expenses. Increases or decreases in labor costs can impact the overall project cost and alter budget estimates. Increases in the prices of energy sources such as electricity, natural gas, or oil can raise the operational costs of the project and make it more challenging to meet energy-saving targets. Changes in exchange rates, particularly if materials or services used in the project are imported, can affect the project's costs. Depreciation of the local currency or volatility in exchange rates can alter cost forecasts for the project.

-

Risk of Market Demand

-

The demand for energy-saving or efficiency services offered in the project is lower than anticipated can impact its success. Additionally, the failure of the projected customer demand to materialize during the project planning phase can jeopardize its success. Factors such as economic downturns, sectoral changes, or technological innovations can influence the demand level of the project and create unforeseen challenges. Policy changes in the energy sector can affect market demand risk.

-

High-Interest Rate Risk

-

Small and medium-sized enterprises may encounter the problem of high-interest rates when seeking loans from banks. For medium and small-scale enterprises as well as emerging businesses, credit levels are relatively low, making it difficult to obtain commercial loans from banks. This can constrain the further development of the business.

Technological Risks

The lack of advanced and competitive technologies to increase energy efficiency, the absence of measurement and verification methods to assess energy-saving impacts, the lack of standards for implementing EPCs, and the challenge of accessing affordable equipment for countries importing technology are risks for the development of the ESCO industry.

-

Lack of Standards for Implementing EPC

-

The absence of a specific standard for EPC can create a lack of clarity regarding how contracts will be formulated, implemented, and monitored. The absence of standards may lead to disagreements or uncertainties between the parties involved in the contract, hindering the successful completion of the project, or achieving energy-saving goals. The lack of standards determining the technical specifications of the technology and equipment to be used and the non-application of existing standards also affect the quality of EPCs.

-

Advanced Technology and Equipment Risk

-

There is a risk that the advanced technology or equipment used in the project may be incompatible with the existing infrastructure or operational conditions. This could result in the technology not being effectively integrated or failing to deliver the expected performance. There is a risk that advanced technology and equipment may not achieve the expected efficiency and performance in real-world conditions. There is also a risk of encountering reliability issues with new technologies or equipment. This could lead to equipment failures, disruptions, or performance declines, adversely affecting the operational continuity of the project.

-

Project Quality Risk

-

The inadequacy or unsuitability of the design or engineering solutions used in the project can affect its quality. This could lead to technical errors or mismatches. The low quality of materials used or workmanship errors during the construction or implementation of the project can also affect its quality.

-

Energy-Saving Measurement and Verification Risk

-

The risk of measurement and verification of energy savings in EPC refers to the uncertainties surrounding the extent to which the energy savings objectives specified in the contract can be verified or measured. Challenges in measurement and monitoring, lack of standards and methodologies, data accuracy and reliability, variable conditions, and external factors can all affect energy savings.

Client Risks

Customer risks primarily consist of a lack of customer awareness and trust, inadequate contract risks stemming from overlooked issues in contracts, credit risk arising from the customer refusing to implement or pay for the contract, and business risks resulting from ineffective energy savings and low energy efficiency due to management errors.

-

Client Awareness Risks

-

Customer awareness risk is a risk arising from the customer's lack of sufficient knowledge about the energy-saving potential, the details of the contract, and its operation. This situation can make it difficult to successfully implement the contract and achieve the expected energy savings. Also, not knowing enough about EPCs and not being aware of their benefits may create resistance on the client side.

-

Contract Risks

-

Contract risk refers to the risks arising from disputes, uncertainties, or failures to fulfill commitments between the parties involved in the contract. Disputes or uncertainties may arise between the parties to the contract. For example, disagreements may occur regarding how and when a specific target will be achieved. Such situations can complicate the execution of the contract and jeopardize the success of the project. Failure to fully fulfill the commitments outlined in the contract can increase contract risk.

-

Credit Risk

-

In EPC, credit risk refers to the risk that the customer may not fulfill their financial obligations throughout the duration of the contract. This risk is a significant concern for financial institutions that provide financing for investments made under the contract. It is essential to assess whether the customer has the financial capability to cover the costs of energy-saving equipment or services. The customer's financial situation and credit history are crucial factors in evaluating credit risk. There is a risk that the customer may default on payments or experience delays in payment. Throughout the contract period, deterioration in the customer's financial condition or unexpected issues may arise, leading to difficulties in making payments.

-

Business Risk

-

In EPC, business risk refers to ineffective energy savings and low energy efficiency resulting from errors and improper practices in operational management. Inadequate or incorrect implementation of energy efficiency measures can hinder the project from achieving its targeted performance.

Methodology

This study aims to determine the weights of the main and sub-risk criteria of EPCs in Türkiye through an expert survey. The Best–Worst Method has been utilized in the survey to assess the risks in EPC. In this section, the stages of survey preparation, distribution, and data collection and the utilized methodology are explained.

Preparation of the Survey

A survey compatible with the selected method was prepared to evaluate the risk criteria determined through literature research. The survey consists of 28 questions in total.

The survey begins with 4 questions to get to know the participants. Survey participants were asked which expert category they are in (energy managers, EVDs, financial experts, academics, and decision-makers/policymakers), their EPC application experience (yes, no), how many years they have been working in energy efficiency (less than 10, 10–20, more than 20) and in which sector they are working (public, private).

After the expert identification questions, the survey flow continues with the assessment of the main risk criteria, followed by the evaluation of the sub-risk criteria. In the survey, definitions of the main and sub-risk criteria in EPC are given. Detailed instructions on how to conduct evaluations were given before each question, along with example evaluations.

According to the method, the survey proceeds in groups of 4 questions: selecting the most important criterion among the criteria, making a pairwise comparison of the selected criterion with other criteria, selecting the least important criterion, and making a pairwise comparison of the selected criterion with other criteria. In the risk assessment part of the survey, a total of 24 questions were asked, 4 questions for the evaluation of the main risk criteria and 4 questions for the evaluation of the sub-risk criteria of each main risk criterion.

The identified main risk criteria were “Environmental Risks, Managerial and Operational Risks, Financial and Market Risks, Technological Risks, and Client Risks.” Experts were asked first to choose the “Most Important” risk criterion from the main criteria and then compare it pairwise with the other main criteria. After selecting the “Most Important” risk criterion, respondents were asked to rate how important the selected criterion was compared to the others, using a 1 to 9 evaluation scale. A rating of “1” indicated equal importance, while “9” indicated the highest level of importance. The process was then repeated to select the “Least Important” risk criterion and its comparison with the others. However, in the pairwise comparison part of the least important criterion, it is requested to evaluate how important the other criteria are compared to the selected least important criterion.

Before evaluating the sub-risk criteria, explanations were provided to indicate which main risk criterion each sub-criterion belonged to. The same selection and pairwise comparison process used for the main risk criteria were also applied to sub-risks.

Survey distribution and data collection

The survey’s target audience consisted of Turkish ESCOs (EVDs), Energy Managers, Academics, Decision Makers/Policy Makers, and experts from the Finance sector in Türkiye.

All authorized 56 EVD’s information is publicly available on the MENR website. By legislation, industrial facilities consuming 1000 toe/annual and more energy and commercial and service buildings consuming 500 toe/annual and more energy are required to have an energy manager (Republic of Türkiye, 2011). According to MENR, there are around 2,000 active energy managers in the market. EVDs and energy managers working independently or in a facility are registered to the Energy Efficiency and Management Association (EYODER) of Türkiye (Akkoç et al., 2023).

The survey was conducted between March and April 2023. It was distributed online to members of the EYODER, all authorized EVDs, academics working in the field, experts from the MENR, employees of provincial governorships with energy management units (Istanbul, Bursa, Edirne, Konya, Kocaeli, Sakarya), and sector participants accessible through LinkedIn. All participants were informed that their responses to the survey would be used anonymously for academic research purposes. No personal or tracking data was collected from any participant.

A total of 63 experts participated in the survey. However, when the consistency analysis of the evaluations was conducted within the scope of the BWM, it was found that 7 experts provided inconsistent responses to the survey questions. Therefore, analysis was conducted with 56 consistent responses from experts from various fields, including 8 experts from the financial sector, 5 decision-makers, 7 academics, 13 energy managers, and 23 representatives from EVD companies.

The best–worst method

Decision-making can be defined as the process of selecting the most suitable option from among the available alternatives. Different criteria emerge in the process of identifying and making decisions regarding these alternatives. Multi-criteria decision-making methods (MCDM) are employed to analyze these criteria properly. MCDM methods create criteria by utilizing expert opinions, previous research, and relevant perspectives in line with a specific objective. MCDM rationalizes the decision-making process after a detailed analysis, aiding in making optimal decisions (Karabasevic et al., 2016). Various methods, either classical or fuzzy logic-based, are employed by researchers to solve problems known as MCDM problems in the literature. Some of these MCDM methods include BWM, VICOR, AHP, ANP, PROMETHEE, ELECTRE, TOPSIS, AHS, MACBETH, and GAIA (Ishizaka & Nemery, 2013). Among MCDM methods, Best Worst Method (BWM) yielded consistent and reliable results. Preparing a pairwise comparison matrix in other MCDM methods can be time-consuming. BWM requires fewer pairwise comparisons than other MCDM methods, making it advantageous. Additionally, BWM can be combined with other MCDM methods. Consequently, difficulties in maintaining focus and potential inconsistencies in results may arise, and BWM was developed to address these issues (Rezaei, 2015).

BWM is applied to various types of studies such as mobile phone selection (Rezaei, 2015), investigating the social sustainability of supply chains (Ahmadi et al., 2017), evaluating the research and development performance of small and medium enterprises (Salimi & Rezaei, 2018), designing wearable technological products (Gözde & Akçakaya, 2021), disaster risk reduction planning (Bozkurt & Çiçekdağı, 2022), evaluating urban rail transportation systems (Görçün & Küçükönder, 2022). It is evident that at least three expert evaluations are necessary for applying this method (Ahmadi et al., 2017; Bozkurt & Çiçekdağı, 2022; Görçün & Küçükönder, 2022; Gözde & Akçakaya, 2021; Rezaei, 2015; Salimi & Rezaei, 2018). BWM was applied in these studies, and experts evaluated the identified risk factors. Due to its advantages and diversity in applications, the BWM is selected for this study.

The BWM method was proposed by Dr. Jafar Rezaei (2015). In this method, the decision-maker identifies the best (most important, most desired) and worst (least important, least desired) criteria. Then, the identified best and worst criteria are compared pairwise with the other criteria. This method involves \(2n-3\) comparisons for n criteria. This process is illustrated in Fig. 2. The decision-maker assigns values to criterion pairs based on the comparisons made. Throughout these steps, the optimal weights of the criteria are determined, and the consistency of the results is evaluated. Criterion weights should fall within the range of \([0, 1]\). BWM is a vector-based method that requires fewer pairwise comparisons and leads to less inconsistency. As consistency value increases, the consistency ratios in comparisons are weak and less reliable, while as it approaches zero, consistency ratios are high and more reliable. Thus, the importance levels of the criteria are determined accurately (Rezaei, 2015).

The BWM method consists of six steps and they are explained below (Rezaei, 2015).

Step 1. Defining a Set of Criteria. The criteria influencing the decision problem ({c1, c2, …., cn}) are determined.

Step 2. Defining the Best and Worst Criteria.

The decision-maker is asked to designate two or more criteria from the set of n criteria as the best (most desired, most important) and worst (least desired, least important). At this stage, the decision-maker identifies the best and worst criteria without comparing. Only the criteria’ identities are considered, not their values.

Step 3. Determining the Importance of the Best Criterion Compared to Others.

In this step, the preference of the best criterion over the other criteria is established using a 1 to 9 evaluation scale which is provided in Table 2. Experts’ assessments are conducted based on this scale.

Here, 1 signifies equal importance among the criteria, while 9 indicates that the best criterion is significantly more important than the considered criterion. As a result, the comparison vector for the other criteria concerning the best criterion is derived, as shown in Eq. 1:

Each aBj in the AB vector in Eq. 1 indicates how much more important the best criterion B is than the jth criterion. Also, aBB = 1 signifies a comparison of the criterion with itself.

Step 4. Determining the Importance of Other Criteria Compared to the Worst Criterion.

Similar to the previous step, in this step, the decision-maker is asked to indicate their preference levels for the other criteria relative to the worst criterion, using the 1 to 9 evaluation scale. This time, the superiority of the other criteria over the worst criterion is established, creating the Aw vector. The comparison vector for the other criteria concerning the worst criterion is obtained as shown in Eq. 2:

Each ajW in the Aw vector in Eq. 2 indicates how much more important the jth criterion is than the worst criterion (W), and its value is determined as an integer between 1 and 9 according to Table 2. Additionally, aWW = 1 signifies a comparison of the criterion with itself.

Step 5. Determining the Optimal Solution.

In this step, the optimal weights for the criteria (W1*, W2*, …., Wn*) are determined. To determine the optimal weights of the criteria, the maximum absolute difference \(\left|\frac{{w}_{B}}{{w}_{j}}-{a}_{Bj}\right|\),\(\left|\frac{{w}_{J}}{{w}_{W}}-{a}_{jw}\right|\) should be minimized for all j criteria. Considering the total weight condition and the non-negativity constraint, the following function arises.

When Eqs. 3, 4, and 5 are linearized, Eqs. 6, 7, 8, 9, and 10 are obtained.

Objective Function:

Constraints:

The linear programming model in Eqs. 6–10 is solved to obtain the optimal criterion weights (W1*, W2*, …, Wn*) and the value of the optimal objective function ξ*.

Step 6. Calculating the Consistency Ratio.

Consistency indexes from Table 3 are employed to assess the consistency of comparisons and to determine the consistency ratio of the solved problem. The consistency ratio value of the problem is determined. If all j criteria satisfy the equation \({a}_{Bj}*{a}_{jw}={a}_{Bw}\) the comparisons are completely consistent.

The consistency ratio is calculated by comparing the computed ξ* value with the CI value provided in:

where CR represents the consistency ratio, and CI represents the consistency index. A consistency ratio approaching zero in Eq. 11 is interpreted as consistent while approaching 1 is considered less consistent. Consistency is generally deemed sufficient for values significantly smaller than one (Rezaei, 2015). Generally, a consistency ratio below 0.1 indicates the acceptability of the vector (Demir & Bircan, 2020).

Analysis and results

This section provides the analysis results. First, the experts’ profile who responded to the survey is summarized. Then, the results of the BWM analysis of survey responses in which experts evaluated EPC risk factors are presented.

63 experts from various fields participated in the online survey, including 9 experts from the finance sector, 5 decision-makers, 7 academicians, 19 energy managers, and 23 representatives from EVD companies. Among the experts, 7.9% have over 20 years of experience, 38.1% have between 10 and 20 years of experience, and 54% have between 1 and 10 years of experience in energy efficiency initiatives. Regarding practical experience with EPC, 54% of the participants have implemented EPC, while 46% have not. Furthermore, 27% of the participants work in public institutions, while 73% work in the private sector.

Following the identification questions for the experts, inquiries were directed towards the pairwise comparison of risk criteria. First, the evaluation of the main risk criteria and, subsequently, the evaluation of sub-risk criteria were requested. As an example, the assessment results for Expert-1 are provided in Table 4.

Through the assessments of Expert 1 regarding the main risk criteria, Eqs. 12–21 have been established, resulting in the development of a linear programming model. Since 5 main risk criteria were used in the application, there are,

, which is

constraints. According to Expert-1’s evaluation of the 5 main risk criteria, the objective function and constraints are as follows:

Using the responses’ numerical equivalents, this model’s solution was obtained, and the weights of the main risk criteria and the ξ* value were calculated using the Microsoft Excel Solver add-in. The results are presented in Fig. 3.

The ξ* value calculated based on Expert-1’s answers to the main risk criteria, and the consistency ratio calculated according to the consistency indices shown in Eq. 11, have been determined as follows: CR = ξ* / CI, CR = 0.159 / 4.47, CR = 0.035. A value of CR ≤ 0.1 indicates that the obtained vector is acceptable.

The weights of the sub-risk criteria, ξ* value, and consistency ratios for Expert-1 were similarly calculated using Microsoft Excel Solver, and the results of the analyses are shown in Table 5.

Considering Expert-1’s responses, the consistency ratio being very close to zero indicates that the answers are consistent. The same evaluations as those for Expert-1 were repeated for the other 62 experts who participated in the survey, and all stages of the BWM were applied. When the consistency ratios of the responses from the 63 experts who participated in the survey were checked, it was observed that 2 experts gave inconsistent answers to all questions, and 5 experts gave inconsistent answers to some questions. Therefore, to maintain the survey flow, the responses of a total of 7 experts were removed from the evaluation. Consequently, the evaluations were conducted with 56 experts’ responses.

The average weights of the evaluated main and sub-risk criteria are called local weights. Since sub-risk criteria are influenced by main risk criteria, the local weight of each sub-risk criterion was multiplied by the local weight of its corresponding main risk criterion. With this multiplication, overall weights were determined.

In this way, according to the BWM, local weights for both the main and sub-criteria of EPC, as well as the overall for all sub-criteria, were shown in Table 6. In addition, the local weights of the main and sub-risk criteria are shown in parentheses next to the relevant criterion in Table 6.

According to the BWM analysis, when examining the five main risk criteria in Table 6, “Financial and Market Risks (FMR)” is identified as the most important risk criterion, followed by “Managerial and Operational Risks (MOR)”, “Client Risks (CLR)”, and “Environmental Risks (ER)”, respectively. “Technological Risks (TR)” is the least important risk criterion.

Upon reviewing the evaluation results of the 21 sub-risk criteria with their respective local weights in Table 6, the most significant sub-risk criterion is “Economic Risk (ER2)” followed by “Political and Legal Risk (ER1)”, “Measurement and Verification Risk of Energy Savings (TR4)”, “Risk of Price Change (FMR2)”, and “Contractual Risk (CR2)” sub-risk criteria, respectively. The least important sub-risk criteria are identified as “Construction Risk (MOR6)” followed by “Complete Project Team Risk (MOR1)” and “Procurement Risk (MOR5)”. The local weight distributions of all sub-criteria in EPC are also graphically represented in Fig. 4.

Table 6 shows the results of the combined evaluation of the 21 sub-risk criteria with their respective overall weights. Upon examination, the most significant sub-risk criterion is identified as “Risk of Price Change (FMR2)” followed by the “Risk of Market Demand (FMR3)” and “Economic Risk (ER2)”. On the other hand, the least important sub-risk criteria are “Advanced Technology and Equipment Risk (TR2)” followed by “Project Quality Risk (TR3)”, and “Construction Risk (MOR6).” The graphical representation of the overall weight distributions for all sub-risk criteria in EPC can be found in Fig. 5.

Identifying the underlying causes of risks in EPC will directly impact the success of solution efforts. Therefore, a fishbone diagram has been constructed for the risks in the EPC sector in Türkiye, and it is shown in Fig. 6. This diagram has been created using the data from the overall weight distributions of all sub-risk criteria in EPC. With the obtained data, it becomes easier to visualize the positions of the risk criteria in the bigger picture of EPC. Upon examining the diagram, it is evident from the responses provided by the participating experts in Türkiye that the most significant obstacle to EPC implementations is “Financial and Market Risks (FMR)” with a percentage of 29%. This risk criterion is followed by “Managerial and Operational Risks (MOR)” at 24.1%, “Client Risks (CLR)” at 16.9%, “Environmental Risks (ER)” at 16.2%, and “Technological Risks (TR)” at 13.8%. When all sub-risk criteria are collectively evaluated, the three most important sub-risk criteria are identified as “Risk of Price Change (FMR2)”, “Risk of Market Demand (FPR3)” and “Economic Risk (ER2), respectively.

Discussion

In 2006, at a time when the energy service market was beginning in the EU, energy efficiency projects were perceived as investment decisions under uncertainty. Although energy efficiency projects were like ordinary investment projects, uncertainty in the valuation of projects in quantifying energy savings and financial appropriation of the resulting value. To overcome the uncertainty, it is stated that appropriate measurement and verification standards and tools were needed (Bertoldi and Kromer 2006). With the EU’s increased efforts and programs, significant growth, including more companies/projects, increased market volume, developed market structure, more institutions’ availability, and wider market coverage, was recorded in almost all energy service markets of European countries. However, this growth, brought with it new issues such as legal and political barriers, institutionalization and project tools problems, financial barriers, and market problems (Bertoldi and Boza-Kiss 2017). EPCs have come to the fore as a new creative tool aimed at eliminating these barriers and uncertainties in energy service markets. Although it is hoped that EPC will solve the problems of the energy service market, it also brings its own risks.

In this study, risk factors of EPC in Türkiye were evaluated for the first time by taking experts’ opinions. The expert survey was tried to be delivered to a wide audience through different channels, and 63 responses to the survey were collected within 2 months. The fact that only 54% of the survey participants have EPC implementation experience supports that EPCs are a new tool for Türkiye.

When examining the literature on the Turkish energy service market, it can be seen that the risks tried to be determined are not directly EPC-focused but generally market-focused. Since this study is the first to examine EPC risks in Türkiye, the barriers in the past research conducted on the Turkish energy service market were examined to understand whether the study results are compatible with the market realities of Türkiye. In the Turkish energy service market, which has been growing and developing since 2009, financial barriers have been the most important ones. Economic instability (Okay et al., 2008), capital inadequacy (Akman et al., 2013), financing difficulties of ESCOs by finance companies/banks, disbelief in government funding energy efficiency programs, taxation rules (Dursun & Bertoldi, 2015), economic fluctuations, dependency on imported energy-efficient technologies, high investment costs due to high exchange rates, insufficient capacity of financing institutions, and lack of project financing and other requirements for EPCs (Acuner et al., 2021). Besides financial barriers, energy efficiency evaluation-related issues also exist in monitoring, measurement, and verification especially in long-term energy efficiency projects (Acuner et al., 2021). Although the awareness in the energy service markets increases over time, a new uncertainty and lack of awareness may arise for a tool like EPC that enters the market later. Issues related to awareness, such as lack of knowledge about EPCs, and a lack of understanding of the structure of EPCs (risks, interests, and credit conditions), come to the fore among the reasons why energy service market stakeholders do not prefer EPCs. Moreover, a lack of accepted standards for EPC, a lack of independent auditor structures (arbitration committee), and the inadequacy of current legislation are factors among the stakeholders who said they would not prefer EPC in the future (Akkoç et al., 2023).

When examining the analysis results of this study, the most important risk to EPC applications is the “Financial and Market Risks”, like they have been since the beginning of the Turkish energy service market. Experts’ opinions reflect the uncertainties in Türkiye’s current economic situation, as evident from the research findings. The fact that energy efficiency technologies are mostly imported, and fluctuations in exchange rates pose a significant barrier to energy efficiency investments. Additionally, the absence of a special credit code for energy efficiency, lack of incentives for energy efficiency for banks, and insufficient financial capacity of EVD companies constitute risks for EPC implementations. The absence of a risk assessment structure in EPC applications in Türkiye also restricts the progress of energy efficiency implementations.

Since China has the largest ESCO market and most of the EPC risk literature, it is necessary to pay attention to the results of these studies. Jinrong and Enyi (2011) explore the EPC risks in China and list them as political and legal, market, technology, management, financial, project quality, and client risks (Jinrong & Enyi, 2011). Lee et al. (2015) identify the top three significant risks in EPC projects in China as payment default risk (non-compliance with debt payment) under the financial risks category, fundamental measurement uncertainty under the measurement and verification risks category, and increasing installation costs under the economic risks category (Lee et al., 2015). In a similar survey study to this study conducted in China with 9 participants, the most prominent risk factor hindering EPC development is technological risks. Under the technological risk, advanced technology risk has the most risk weight (Wang et al., 2019). The prominence of advanced technology risks in EPC applications is attributed to China’s leading position in energy efficiency technologies and the growing development of the global ESCO market. Unlike China, the fact that energy efficiency technologies in Türkiye are generally imported may have left advanced technology risk behind. The rapid displacement of old technology with new can also necessitate the updating or upgrading of generally imported technology. This can affect the costs and energy performance of the projects. Therefore, it may be important for EPCs in Türkiye to contain provisions on how energy-efficient technology updates will be handled. In China, under technological risks, measurement and verification risk has the second most risk weight (Wang et al., 2019). This shows that the risks regarding measurement and verification in China have remained significant for many years. In this study, although the technological risks are the least significant main criterion, measurement and verification risks have the most weight under technological risk in Türkiye. There is also a need for further development in measurement and verification in Türkiye.

In a comprehensive study conducted in Russia, regulatory, financial, and market aspects significantly contribute to the risk level of private-sectors’ EPC projects. Under these aspects, lack of tax exemptions for EPC or ESCOs, delayed energy-saving payments from clients, and high interest rates for bank or third-party lending have the most risk weight. On the other hand, for the public sector of Russia, financial and client risks come to the fore. Under these risks, lack of long-term funding without a governmental or third-party guarantee for a loan, difficulties of an ESCO to get payback achieved from energy savings from the governmental budget, and fluctuation in client's energy consumption have the most risk weight (Garbuzova-Schlifter & Madlener, 2016). When looking at the overall weights of sub-risk criteria in this study, the top five sub-risks with the highest risk weight belong to the financial and environmental risks categories. Although environmental risks are the fourth significance among the main risk criteria, the overall prominence of the two sub-risks they cover (economic risk and political and legal risk) requires special attention to these risks. Similar to Russia, the fourth and fifth sub-risks have the most risk weights are high interest rates and political and legal risk in Türkiye.

To mitigate some of the financial, technological, and operational risks, Koutsandreas et al. (2022) suggest an insurance option as an alternative strategy, and they stated that risk-sharing mechanisms like that could further facilitate the bankability of energy efficiency projects (Koutsandreas et al., 2022). Also, Wan et al. (2023) state that energy-efficiency/performance insurance could mitigate financial risks for ESCOs by transferring risks to insurance companies (Wan et al., 2023). Töppel and Tränkler (2019) defined both energy-saving guarantees and energy efficiency insurances as risk-transfer contracts. They found that if the premiums of the insurance option are not fair, only energy-saving guarantees will work better. On one hand, it is advantageous to transfer the risk to insurance companies since they transfer it to large reinsurance companies. On the other hand, generally, risk-transfer contracts must insure levels just below expected energy savings, and this leads to a need for risk-transfer contracts with high risk-bearing capacity (Töppel & Tränkler, 2019).

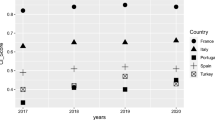

In this study, the analysis was conducted with 56 experts from various fields, including 8 experts from the financial sector, 5 decision-makers, 7 academics, 13 energy managers, and 23 representatives from EVD companies. Of the experts, 7.9% have more than 20 years of expertise, 38.1% have ten to twenty years, and 54% have one to ten years of experience in the energy efficiency sector. Moreover, 73% of participants are employed in the private sector, compared to 27% who work for public entities. To better see the evaluations of different expert groups, a radar chart was prepared (Fig. 7).

Figure 7 shows that “financial and market risks” is the most significant risk in the implementation of EPC perceived by the EVDs and decision-makers/policymakers participating in the survey. It is also the second significant risk category according to other expert groups. Under the “financial and market risks”, EVDs perceive the most significant sub-risk is “Risk of price change” and decision-makers/policymakers think that “high interest-rate” is the most significant sub-risk. EPC projects are subject to interest rates when being financed using credit or loans. An increase in interest rates can raise the overall project costs and extend the payback period. For companies engaged in international projects, exchange rate fluctuations can pose a substantial risk. Exchange rate fluctuations can also increase project costs or decrease revenues. The financing of EPC projects may be contingent on market values of energy prices or energy-saving measures. Changes in market values can affect the profitability of the project.

The most important EPC risk perceived by academics, energy managers and finance sector experts is “managerial and operational risks”. It is also the second significant risk for EVDs, and third for decision-makers. Under the “managerial and operational risks”, “information management risk” is the most significant sub-risk for academics and energy managers. According to finance sector experts, “decision risk” is the most significant sub-risk. Issues related to property rights for buildings or equipment used during the project can arise, impacting the sustainability and financing of the project. Project delays, financial overruns, and operational problems can result from errors made by the team or organization managing the project throughout planning, monitoring, and implementation. EPC projects are frequently technically complicated, and technical failures or equipment breakdowns may have an impact on the project’s outcome. It is essential to measure and monitor energy performance accurately. Correct operation and regular maintenance of the equipment or systems installed in EPC projects are very important. Mistakes and errors in operation and maintenance processes may cause a decrease in the planned energy savings or an increase in energy costs. Therefore, the success of the project depends on the effective management and operational capabilities of the relevant employees. A lack of qualified workforce can pose risks to project management and operation. Additionally, errors or omissions in data collection and monitoring processes can lead to project failures. Also, project data collection and tracking systems may have cybersecurity vulnerabilities. Such deficiencies can lead to data security risks.

Unlike other expert groups that consider “financial and market risks” and “managerial and operational risks” in the first two significant main risk criteria, decision-makers see “client risks” as the second most important risk in the implementation of EPC. Under the “client risks”, “contract risk” is the most significant sub-risk for almost all expert groups including decision-makers. The client is obligated to fulfill commitments throughout the contract period. The clients’ financial status can impact their ability to fulfill contractual obligations. Additionally, a complex or poorly understood contract between parties can create uncertainty and doubt. Parties may not fully understand their rights. The client’s business conditions, energy needs, or operations can change. These changes can affect the success of the project and increase risks.

According to academics, decision-makers, and energy managers, “environmental risks” are the third most significant risk criteria in the implementation of EPC. Under the “environmental risks”, academics and energy managers think that “economic risk” is the most significant sub-risk, while decision-makers see that the most significant sub-risk is “political and legal risk”. Changes and uncertainties in the general economic conditions can impact the project’s profitability and financing. Political and legal risks in EPC processes can affect the success of projects and harm results. Changing regulations could increase project costs or change energy savings targets. Environmental regulations and standards can affect the success and sustainability of the project. Also, climate change-related factors can affect the energy efficiency performance of projects.

Although the “technological risks” is the least significant risk criterion for almost all expert groups, all expert groups perceive the most significant sub-risk under the “technological risks” as the “energy-saving measurement and verification risk”. Appropriate measurement and verification mechanism is crucial for EPC implementations to see whether the targeted energy savings in EPC have been achieved or not.

As a result of all these evaluations, it is seen that even when different risks come to the fore from different groups, the causes and solutions of these risks are associated mostly with finance.

Conclusion and policy recommendations

This study evaluates risk factors of EPC applications in Türkiye for the first time. An expert survey specific to Türkiye was conducted within the scope of the study.

Based on the findings, among the five main risk criteria, “Financial and Market Risks” was selected as the most important, followed by “Managerial and Operational Risks”, “Client Risks,” and “Environmental Risks”. “Technological Risks” was selected as the least important risk criterion.

When all sub-risk criteria were evaluated together, the top five most important sub-risk criteria were identified as “Risk of Price Change”, “Risk of Market Demand”, “Economic Risk”, “High-Interest Rate Risk”, and “Political and Legal Risk”. The five least important sub-risk criteria were “Advanced Technology and Equipment Risk”, “Project Quality Risk”, “Construction Risk”, “Business Risk”, and “Natural Environmental Risk”.

As mentioned, financial issues have always been an important barrier in the energy service market in Türkiye. As expected, as a result of this study, it emerged as the most important risk factor in EPC applications. To mitigate financial and market risks in Türkiye, energy efficiency financing mechanisms can be improved to provide end-users with government-subsidized credit opportunities, such as favorable-rate loans, interest rate reductions, VAT reductions, and energy bill discounts. To mitigate risks arising from exchange rate fluctuations, exchange rates can be fixed in energy efficiency projects, or a special credit code can be created and list energy-efficient equipment eligible for credit. A guarantee and risk fund or proper insurance services can be established for EPC projects. Instead of leaving all risks to EPC contractors, sharing risks can help reduce financial and market risks in EPC applications and pave the way for third-party financial institutions with limited technical expertise to support energy efficiency projects. Also, research and development investment for domestic production of energy efficiency technologies can be an alternative to imported technology. Moreover, collaboration between energy-efficiency equipment suppliers and ESCOs can be enhanced.

Financial institutions, prioritizing their impact on the climate and the environment, may require carbon footprint measurement or sustainability reporting for the projects they finance. Obtaining green certificates or sustainability certificates for projects can reduce environmental risks and demonstrate that the project is being carried out with consideration for its environmental impacts. Since energy efficiency practices are a significant tool in reducing carbon emissions, companies in need of financing for project development can be inclined towards energy efficiency investments, taking these conditions into account for both newly planned projects and ongoing activities. The environmental impacts of materials used during the project can influence environmental risks. Proper material selection and effective waste management can enhance environmental sustainability.

To eliminate contract risks, EPCs should be prepared as simple, clear, understandable, and user-friendly as possible. Contracts should not lead to any contradictions. The primary responsibilities of the parties should be defined in the main text, and details such as technical parts can be included in appendixes.

Looking ahead, in terms of developing the energy service market in Türkiye and evaluating existing energy-saving potentials, EPC stands out as an important tool. The ESCO structure is of critical importance for developing energy markets like Türkiye and existing EVD companies play a key role in the responsibilities of an ESCO. For this, a sufficient number of EVDs should reach ESCO standards.

Besides the current literature and the results of this study, some inspiration should be taken from the European Union EED Recast legislation for developing policies on the energy service market and EPCs for Türkiye.

According to the new EED, the energy service sector is demand-driven. It is crucial to continue developing the market for energy services to ensure the availability of both the demand and the supply of energy services. Transparency is an important issue for this. It helps stimulate demand and increase trust in energy service providers through lists of certified energy services providers and available model contracts, the exchange of best practices and guidelines. To mitigate the market demand, contract, and operational risks in Türkiye, ensuring transparency is essential. To reduce the financial risks, there is a need to increase the effort to remove regulatory and non-regulatory barriers to the use of EPC and third-party financing arrangements. Those barriers include accounting rules and practices that prevent capital investments and annual financial savings resulting from energy efficiency improvement measures from being adequately reflected in the accounts for the whole life of the investment (European Parlement, 2023).

The number and awareness of EPCs in Türkiye increased with the legislation enacted specifically for public buildings. As the EED says, it should continue to support the public sector in the adoption of EPC in Türkiye by (i) providing model contracts for EPC that take into account the existing European or international standards; (ii) providing information on best practices for EPC, including, if available, a cost–benefit analysis using a life cycle approach; and (iii) promoting and making publicly available a database of implemented and ongoing EPC projects, including projected and achieved energy savings. Moreover, to mitigate legal risks, it should be established an individual mechanism or designated ombudspersons to ensure the efficient handling of complaints and out-of-court settlement of disputes arising from energy services and EPCs (European Parlement, 2023).

All in all, conducting risk assessments to eliminate gaps in EPC projects through all stages stands out as a key management practice. It is desired that the identification of risk factors and the provision of risk mitigation measures obtained in this study will facilitate the implementation of EPC projects in Türkiye. Since this study is the first to assess EPC risks in Türkiye, literature was taken as the basis for determining risk factors, and an overall assessment was made for the entire EPC market. For further studies, a more comprehensive risk analysis study can be conducted for Türkiye by comparing different sectors, contract types, and stakeholder groups. Additionally, more in-depth sector research can be conducted to investigate whether there are hidden risk factors specific to Türkiye.

Data Availability

The data supporting the findings of this study are available upon request from the corresponding author.

Notes

KABEV Project: https://www.kabev.org/proje-hakkinda/

Abbreviations

- BWM:

-

Best–worst method

- CLR:

-

Client risks

- EPC:

-

Energy performance contract

- ER:

-

Environmental risks

- ESCO:

-

Energy service company

- EVD:

-

Energy efficiency consulting companies

- EYODER:

-

Energy efficiency and management association

- FMR:

-

Finance and market risks

- IRR:

-

Internal rate of return

- MCDM:

-

Multi Criteria Decision Making methods

- MENR:

-

Ministry of energy and natural resources

- MOR:

-

Managerial and operational risks

- NPV:

-

Net present value

- TR:

-

Technological risks

- aBj :

-

Significance the best criterion over the j-th criterion

- ajw :

-

Significance of the j-th criterion over the worst criterion

- j:

-

(1,2,…..,n)

- EbaR:

-

Energy budgets-at-risk

- VaR:

-

Value-at-risk

- WB :

-

Weight of the best criterion

- Wj :

-

Weight of the j-th criterion

- WW :

-

Weight of the worst criterion

- ξ* :

-

Optimum objective function value

References

Acuner, E., Cin, R., & Onaygil, S. (2021). Energy service market evaluation by Bayesian belief network and SWOT analysis: case of Turkey. Energy Efficiency, 14(6), 62. https://doi.org/10.1007/s12053-021-09973-w

Ahmadi, H. B., Kusi-Sarpong, S., & Rezaei, J. (2017). Assessing the social sustainability of supply chains using Best Worst Method. Resources, Conservation and Recycling, 126, 99–106. https://doi.org/10.1016/j.resconrec.2017.07.020

Akkoç, H. N., Onaygil, S., Acuner, E., & Cin, R. (2023). Implementations of energy performance contracts in the energy service market of Turkey. Energy for Sustainable Development, 76, 101303. https://doi.org/10.1016/j.esd.2023.101303

Akman, U., Okay, E., & Okay, N. (2013). Current snapshot of the Turkish ESCO market. Energy Policy, 60, 106–115. https://doi.org/10.1016/j.enpol.2013.04.080

Aven, T., & Renn, O. (2010). Risk management and governance: Concepts, guidelines and applications. Springer Science & Business Media

Bertoldi, P., & Boza-Kiss, B. (2017). Analysis of barriers and drivers for the development of the ESCO markets in Europe. Energy Policy, 107, 345–355. https://doi.org/10.1016/j.enpol.2017.04.023

Belton, V., & Stewart, T. (2002). Multiple criteria decision analysis: an integrated approach. Springer Science & Business Media.

Bertoldi, P., & Kromer, S. (2006). Risk Assessment in Efficiency Valuation-Concepts and Practice. https://www.aceee.org/files/proceedings/2006/data/papers/SS06_Panel12_Paper02.pdf. Accessed 25 March 2024.

Bertoldi, P., Rezessy, S., & Vine, E. (2006). Energy service companies in European countries: Current status and a strategy to foster their development. Energy Policy, 34(14), 1818–1832. https://doi.org/10.1016/j.enpol.2005.01.010

Bozkurt, Ö., & Çiçekdağı, H. İ. (2022). Criteria Prioritization with the Best-Worst Method (BWM) in Risk Reduction Investments After the Provincial Disaster Risk Reduction Plans (IRAP) (in Turkish). Afet ve Risk Dergisi, 5(1), 109–121. https://doi.org/10.35341/afet.1060488

Carbonara, N., & Pellegrino, R. (2018). Public-private partnerships for energy efficiency projects: A win-win model to choose the energy performance contracting structure. Journal of Cleaner Production, 170, 1064–1075. https://doi.org/10.1016/j.jclepro.2017.09.151

CERtuS. (n.d.). Energy Performance Contract Models. http://certus-project.eu/portfolio-items/build-own-operate-transfer-boot/?lang=it. Accessed 20 July 2023

Da-li, G. (2009). Energy service companies to improve energy efficiency in China: barriers and removal measures. Procedia Earth and Planetary Science, 1(1), 1695–1704. https://doi.org/10.1016/j.proeps.2009.09.260

Demir, G., & Bircan, H. (2020). Comparison of BWM and FUCOM Methods of Criteria Weighting Methods and An Application (in Turkish). Cumhuriyet Üniversitesi İktisadi Ve İdari Bilimler Dergisi, 21(2), 170–185. https://doi.org/10.37880/cumuiibf.616766

Dogan, E., & Seker, F. (2016). Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renewable Energy, 94, 429–439. https://doi.org/10.1016/j.renene.2016.03.078

Dursun, E., & Bertoldi, P. (2015). ESCO market in Turkey: Challenges and opportunities. In 2015 IEEE 15th International Conference on Environment and Electrical Engineering (EEEIC) (pp. 150–155). IEEE. https://doi.org/10.1109/EEEIC.2015.7165532

European Parlement. (2023). Directive (EU) 2023/1791 of the European Parliament and of the Council of 13 September 2023 on energy efficiency and amending Regulation (EU) 2023/955 (recast). Official Journal. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=OJ%3AJOL_2023_231_R_0001&qid=1695186598766. Accessed 23 Mar 2024.

Garbuzova-Schlifter, M., & Madlener, R. (2016). AHP-based risk analysis of energy performance contracting projects in Russia. Energy Policy, 97, 559–581. https://doi.org/10.1016/j.enpol.2016.07.024

Garbuzova-Schlifter, M., & Madlener, R. (2017). Risk analysis of energy performance contracting projects in Russia: an analytic hierarchy process approach. In Operations Research Proceedings 2015: Selected Papers of the International Conference of the German, Austrian and Swiss Operations Research Societies (GOR, ÖGOR, SVOR/ASRO), University of Vienna, Austria, September 1–4, 2015 (pp. 683–690). Springer. https://doi.org/10.1007/978-3-319-42902-1_92

Görçün, Ö. F., & Küçükönder, H. (2022). Comparative Analysis of Transportation Performances of Cities with BWM and CoCoSo Methods (in Turkish). İDEALKENT, 13(36), 824–856. https://doi.org/10.31198/idealkent.1028556

Gözde, K., & Akçakaya, E. D. U. (2021). Evaluation of Factors Effective in the Design of Wearable Technological Products Using the Best-Worst Method (BWM) (in Turkish). Bilecik Şeyh Edebali Üniversitesi Fen Bilimleri Dergisi, 8(1), 136–150. https://doi.org/10.35193/bseufbd.847791

Hill, D. R. (2019). Energy Efficiency Financing: A review of risks and uncertainties. In Energy Challenges for the Next Decade, 16th IAEE European Conference. Ljubljana, Slovenia: Energy Challenges for the Next Decade, 16th IAEE European Conference. https://iaee2019ljubljana.oyco.eu/download/contribution/fullpaper/77/77_fullpaper_20190606_123412.pdf. Accessed 15 Aug 2023.

Ishizaka, A., & Nemery, P. (2013). Multi-criteria decision analysis: Methods and software. John Wiley & Sons. https://doi.org/10.1002/9781118644898

ISO. (2018). ISO 31000:2018. Risk management — Guidelines. International Organization for Standardization (ISO). Accessed 25 May 2024

Jahantigh, F. F., Malmir, B., & Avilaq, B. A. (2017). Economic risk assessment of EPC projects using fuzzy TOPSIS approach. International Journal of Industrial and Systems Engineering, 27(2), 161–179. https://doi.org/10.1504/IJISE.2017.10007101

Jinrong, H., & Enyi, Z. (2011). Engineering risk management planning in energy performance contracting in China. Systems Engineering Procedia, 1, 195–205. https://doi.org/10.1016/j.sepro.2011.08.032

JRC. (2023). Energy Performance Contracting. https://e3p.jrc.ec.europa.eu/articles/energy-performance-contracting. Accessed 15 August 2023

Karabasevic, D., Zavadskas, E. K., Turskis, Z., & Stanujkic, D. (2016). The framework for the selection of personnel based on the SWARA and ARAS methods under uncertainties. Informatica, 27(1), 49–65. https://doi.org/10.15388/Informatica.2016.76

Koutsandreas, D., Kleanthis, N., Flamos, A., Karakosta, C., & Doukas, H. (2022). Risks and mitigation strategies in energy efficiency financing: A systematic literature review. Energy Reports, 8, 1789–1802. https://doi.org/10.1016/j.egyr.2022.01.006

Lee, P., Lam, P. T. I., & Lee, W. L. (2015). Risks in energy performance contracting (EPC) projects. Energy and Buildings, 92, 116–127.

Liu, P., Zhou, Y., Zhou, D. K., & Xue, L. (2017). Energy Performance Contract models for the diffusion of green-manufacturing technologies in China: A stakeholder analysis from SMEs’ perspective. Energy Policy, 106, 59–67. https://doi.org/10.1016/j.enpol.2017.03.040

Mills, E., Kromer, S., Weiss, G., & Mathew, P. A. (2006). From volatility to value: analysing and managing financial and performance risk in energy savings projects. Energy Policy, 34(2), 188–199. https://doi.org/10.1016/j.enpol.2004.08.042

Okay, E., Okay, N., Konukman, A. E. Ş, & Akman, U. (2008). Views on Turkey’s impending ESCO market: Is it promising? Energy Policy, 36(6), 1821–1825. https://doi.org/10.1016/j.enpol.2008.02.024

Presidency of Türkiye. (2018a, March 27). Law on Amendments to Tax Laws and Certain Laws and Decrees. Official Journal. https://www.mevzuat.gov.tr/MevzuatMetin/1.5.7103.pdf