Abstract

Purpose

With increasing cancer care costs and greater patient cost-sharing in the USA, understanding access to medical care among cancer survivors is imperative. This study aims to identify financial, psychosocial, and cancer-related barriers to the receipt of medical care, tests, or treatments deemed necessary by the doctor or patient for cancer among cancer survivors age < 65 years.

Methods

We used data on 4321 cancer survivors aged 18–64 years who completed the 2012 LIVESTRONG Survey. Multivariable logistic regression was used to identify risk factors associated with the receipt of necessary medical care, including sociodemographic, financial hardship, debt amount, caregiver status, and cancer-related variables.

Results

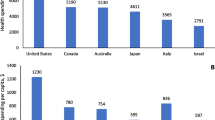

Approximately 28% of cancer survivors were within 1 year, and 43% between 1 and 5 years, since their last treatment at the time of survey. Nearly 9% of cancer survivors reported not receiving necessary medical care. Compared to survivors without financial hardship, the likelihood of not receiving necessary medical care significantly increased as the amount of debt increased among those with financial hardship (RRFinancial hardship w/< $10,000 debt = 1.94, 95% CI 1.55–2.42, and RR RRFinancial hardship w/≥ $10,000 debt = 3.41, 95% CI 2.69–4.33, p < 0.001). Survivors who reported lack of a caregiver, being uninsured, and not receiving help understanding medical bills were significantly more likely to not receive necessary medical care.

Conclusion

We identified key financial and insurance risk factors that may serve as significant barriers to the receipt of necessary medical care among cancer survivors age < 65 in the USA

Implications for cancer survivors

The majority of cancer survivors reported receiving medical care either they or their doctors deemed necessary. However, identifying potentially modifiable barriers to receipt of necessary medical cancer care among cancer survivors age < 65 is imperative for developing interventions to ensure equitable access to care and reducing cancer disparities.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

An estimated 15.5 million people were alive in the USA in 2016 who had received a cancer diagnosis (cancer survivors), with this number projected to reach more than 20 million by 2026 due largely to population changes and an increase in the number of older adults [1]. Advances in cancer therapy have led to significant improvements in survival for many patient populations [2]. However, costs of cancer care are expected to reach at least $158 billion by 2020 and are rising faster than other medical sectors [3, 4]. In conjunction with higher costs, out-of-pocket (OOP) expenses are increasing and have become a growing concern for patients and their families [5]. Although the number of uninsured Americans has decreased by 20.2 million since the enactment of Affordable Care Act (ACA) in 2010, approximately 24.4 million adults ages 18–64 years were uninsured in early 2016 [6] and others remained underinsured due to high cost-sharing requirements [7]. Since 2010, health plan deductibles for individuals increased by 66%, although wages only increased by 10% [8]. Meanwhile, cancer drugs account for some of the most expensive medications available, with a single cancer drug costing as much as $120,000 per year [9]. As a result, even insured patients with cancer may face annual OOP expenses of $25,000 or more for medical care [9]. Furthermore, prior studies indicate that nearly 30% of cancer survivors younger than 65 years of age experience material financial hardship (e.g., going into debt, filing for bankruptcy, or inability to cover medical care costs) [10] and approximately 13% of cancer survivors under age 65 who report financial hardship indicate incurring debt amounts of ≥ $50,000 [11]. The amalgamation of the increasing costs of cancer care and high patient cost-sharing burden, therefore, may adversely impact medical care utilization for many patients diagnosed with cancer.

Although studies have evaluated the influence of cost-sharing on treatment use and adherence among patients with cancer [12,13,14,15,16], a limited number of studies have examined a broader range of risk factors associated with the receipt of necessary medical care among patients in different phases of the cancer care continuum (e.g., in-treatment, post-treatment, survivorship, and surveillance care) [17,18,19,20,21,22]. Among these studies, only a handful have focused on necessary medical care use among cancer survivors who are not age-eligible for Medicare [19,20,21,22], despite more than one third of cancer survivors in the USA are age < 65 years [23]. Keegan et al. [21] found that, among adolescent and young adult cancer survivors, lack of health insurance and employment were barriers to receipt of necessary care. A recent study by Zheng et al. [20] found that cancer survivors aged 18–64 were more likely to change their prescription drug use for financial reasons, compared to their counterparts without a cancer history. Cancer survivors younger than 65 years are at greater risk for financial hardship from cancer [10] and may encounter unique challenges associated with access to medical care. Particularly, given the potential impact of cancer diagnosis and treatment on late or long-term effects, the ability to work and perform work-related tasks [24, 25], productivity losses [26], and the reliance on employment for health insurance coverage and as the key source of income. To address this gap in knowledge, we sought to conduct an assessment of the barriers to receipt of medical care, tests, or treatments deemed necessary by the doctor or patient for cancer among survivors younger than 65 years of age. These barriers can be broadly classified as sociodemographic, financial hardship, debt amount, employment, caregiver status, number of cancer diagnosis,s and time since cancer treatment.

Methods

Study population

We examined data from 4321 adults aged 18–64 years who responded to the 2012 LIVESTRONG Survey for People Affected by Cancer [27]. The online survey (available in English and Spanish) was designed to elucidate the needs of individuals diagnosed with cancer, both during and after their cancer treatment. Survey respondents were recruited through outreach efforts of the LIVESTRONG Foundation constituency (e.g., donors, participants at events or programs, advocates, and others in the community), social media, and partnering national and community-based organizations. We excluded respondents who did not have a personal history of cancer (e.g., family members, caregivers, and other respondents who had not survived cancer themselves), those who resided outside the USA or a US territory, and those who were aged ≥ 65 years at the time of the survey.

Measures

The 2012 LIVESTRONG survey used the same measures to assess financial hardship among cancer survivors as did the 2011 Medical Expenditure Panel Survey (MEPS) Experiences with Cancer Survivorship Survey [28]. All questions in the MEPS experiences with cancer survey were developed based on established survey items and refined through cognitive testing of a representative group of more than 50 cancer survivors. More details about the MEPS survey design, cognitive testing, and content are available elsewhere [28, 29].

Receipt of necessary medical care

Participant responses to the survey item “At any time since you were first diagnosed with cancer, did you get all of the medical care, tests, or treatments that you or your doctor believed were necessary?” was the dependent variable of interest. This item had potential responses of “yes” or “no” and was located in a section of the survey that asked participants about their medical care for cancer. We created a dichotomous variable, receipt of necessary medical care, based on participants’ responses (Yes = 1 or No = 0).

Potential barriers to the receipt of necessary medical care

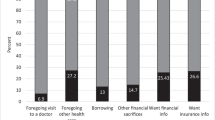

The independent variables included in our analysis were selected based on extant literature and previous research of factors associated with receipt of medical care among individuals diagnosed with cancer [16,17,18,19, 30, 31] and informed by the Andersen behavioral model of health care utilization [32] (Supplemental Table 1). Financial hardship associated with cancer was the primary independent variable of interest and was defined as previously reported [10] based on participants’ responses to four survey items: (1) Have you or has anyone in your family had to borrow money or go into debt because of your cancer, its treatment, or the lasting effects of that treatment? (2) Did you or your family ever file for bankruptcy because of your cancer, its treatment, or the lasting effects of that treatment? (3) Have you or your family had to make any other kinds of financial sacrifices because of your cancer, its treatment, or the lasting effects of that treatment? and (4) Have you ever been unable to cover your share of the cost of those visits? Participants who responded “Yes” to any (one or more) of the four financial hardship measures were defined as experiencing financial hardship associated with cancer. Participants who responded “No” to all four financial hardship measures were defined as not experiencing financial hardship.

We also included information on the amount of money borrowed/debt incurred, based on answers to the question “How much did you or your family borrow, or how much debt did you incur because of your cancer, its treatment, or the lasting effects of that treatment?”; presence of a caregiver, “Since the time you were first diagnosed with cancer, has any friend or family member provided care to you during or after your cancer treatment?”; and help understanding medical bills, “Did you ever receive help understanding health insurance or medical bills?” We measured change in employment as any extended leave (paid or unpaid) or switch to part time employment due to cancer. Cancer-related characteristics included the number of cancer diagnoses and time since the last cancer treatment. Sociodemographic characteristics collected at the time of the survey, included age, sex/marital status, race/ethnicity, annual household income, educational attainment, and health insurance status. Sex and marital status were combined in our analysis (male/married, male/not married, female/married, female/not married) based on our prior work, in which this combination was found to be a valid way to assess these variables among cancer survivors under age 65 years given that each stratum has been shown to have different distributions of financial burden [11]. Accordingly, this aligns with our reported conceptual model approach as presented in Supplemental Table 1.

Statistical analyses

We used a two-pronged approach to identify potential barriers to the receipt of necessary medical care. Our primary approach was to select a fixed set of independent variables based on existing scientific research regarding barriers to receipt of necessary medical care (conceptually driven approach) and analytic constraints due to sample size and frequency of responses to each measure [33]. Second, we applied signal detection methodology (data-driven approach) to identify additional potential barriers. For the data-driven approach, we included variables likely to be associated with receipt of necessary medical care but not selected for our conceptually driven model, as well as reconsidered optimal cut-points or groupings for categorical and composite variables included in the conceptually driven model. For example, instead of using the financial hardship measure only, we assessed the association of a composite variable that combined the amount of money borrowed/debt incurred measure with the financial hardship measure. Supplemental Table 1 describes the variables included in each model, using the conceptually driven and data-driven approaches.

Signal detection has been shown to be useful when analyzing data with highly collinear independent variables and potential interactions between independent variables and has been applied in a wide range of biomedical research projects [34,35,36]. Signal detection identifies and classifies variables by evaluating receiver operating characteristic (ROC) curves across all independent variables, as well as across all categorizations of the independent variables. The result is a decision tree that balances optimal sensitivity and specificity in discriminating between participants who do and do not have the outcome of interest. In our study, this led to the identification of variables that best distinguish between cancer survivors who did and did not receive necessary medical care. We examined variables presented in the data-driven approach in Supplemental Table 1. We used those empirically identified as stronger predictors (stopping rule of p < 0.05) than those included in the conceptually driven model to develop the final multivariable model.

Our use of a two-pronged approach in this study was possible given the availability of comprehensive survey data, which provided the opportunity to identify important factors associated with the receipt of medical care that may have otherwise been overlooked if we relied solely on conceptual models to frame the analysis. By integrating the conceptual and data-driven approaches to modeling, we increased efficiency and, more importantly, developed a more comprehensive model of healthcare burden in a population of cancer survivors younger than 65 years of age.

We calculated descriptive statistics for all measures included in the analysis. Logistic regression was used to estimate associations between the receipt of necessary medical care and the independent variables. We fit bivariate logistic regression models for each independent variable, as well as multivariable logistic regression models for the conceptually driven and final models. Comparisons between the conceptually driven and final multivariable models were made using a Vuong test with non-nested models and a likelihood-ratio test for nested models [37]. Adjusted risk ratios were calculated in order to facilitate interpretation and discussion [38]. All statistical tests assumed a two-sided alpha of 0.05. Analyses were conducted using a combination of SAS 9.4, Stata 13.1, and signal detection software publically available from Stanford University [35].

Results

Slightly less than half of the cancer survivors were ages 40–54 years (47%), 35% were ages 55–64 years, and 18% were ages 18–39 years (Table 1). The majority of cancer survivors were non-Hispanic white (88%), female (66%), and married (70%), and had a bachelor’s degree or higher (63%) and private health insurance (88%). Approximately 43% had an annual income ≥ $80,000, and 87% were employed. In addition, an estimated 89% of survivors had a caregiver and 75% had one lifetime cancer diagnosis only. About 28% of cancer survivors were within 1 year, and 43% between 1 and 5 years, since their last treatment at the time of survey. Overall, an estimated 9% of cancer survivors did not receive necessary medical care.

Results of the bivariate analysis of variables included in the conceptually driven and data-driven models are presented in Table 2. Not receiving necessary medical care was significantly more likely among survivors who experienced financial hardship (p < 0.001), had public insurance or were uninsured/other (p < 0.001), and were unemployed or employed at diagnosis and made work changes (p = 0.015), compared to those survivors who did not experience financial hardship, had private insurance, and were employed at diagnosis but did not make work changes. Further, female survivors (both married and non-married) (p = 0.005), those with ≥ 2 cancer diagnoses (p = 0.001) and those who did not have a caregiver (p = 0.018), were significantly more likely not to have received necessary medical care than married male survivors, those with only one cancer diagnosis, and those who had a caregiver. There was an inverse association between annual income and not receiving necessary medical care, such that compared to those in the highest income category (≥ $120,000), those with a lower income were more likely not to receive necessary medical care (p < 0.001). Based on the data-driven model, we identified two additional variables strongly associated with receipt of necessary medical care and included them in the final multivariable model: (1) the composite measure of experiencing financial hardship and amount of debt incurred and (2) receiving help understanding health insurance or medical bills (Table 2).

The final multivariable regression model results are presented in Table 3, including the risk factors identified in the data-driven approach in the final multivariable model improved model fit compared to the conceptually driven model, as measured by a likelihood-ratio test (χ 2 = 61.6, p < 0.001) (Supplemental Table 2). Among those experiencing financial hardship, the likelihood of not receiving necessary medical care significantly increased, in a stepwise manner, as the amount of debt increased. Specifically, compared to cancer survivors who did not experience financial hardship, survivors who experienced financial hardship and incurred debt <$10,000 were nearly twice as likely not to receive necessary medical care (RRFinancial hardship w/< $10,000 debt = 1.94, 95% CI 1.55–2.42, p < 0.001), and survivors who experienced financial hardship and incurred debt ≥ $10,000 were 3.4 times more likely not to receive necessary medical care (RRFinancial hardship w/≥ $10,000 debt = 3.41, 95% CI 2.69–4.33, p < 0.001). Survivors who were uninsured were more likely not to receive necessary care, compared to those with private insurance (RR = 1.70, 95% CI 1.27–2.28, p = 0.001), while the association for public insurance was attenuated in the fully adjusted model. Not having a caregiver was significantly associated with a greater likelihood of not receiving necessary medical care (RR = 1.44, 95% CI 1.11–1.87, p = 0.008), compared to survivors with a caregiver. Having two or more cancer diagnoses was associated with greater likelihood of not receiving necessary medical care (RR = 1.24, 95% CI 1.01–1.52, p = 0.040), compared to survivors with a single cancer diagnosis. Survivors who reported that they did not receive help understanding their health insurance or medical bills were more likely to not receive necessary medical care (RR = 2.17, 95% CI 1.68–2.81, p < 0.001), compared to those who reported receiving help.

Discussion

In this study, we identified significant barriers to the receipt of necessary medical care in a large sample of adult cancer survivors less than 65 years of age in the US survivors experiencing financial hardship from cancer were most likely to report not receiving medical care either they or their doctors deemed necessary. The likelihood of not receiving necessary medical care increased as the amount of debt increased. Specifically, cancer survivors experiencing financial hardship with debt < $10,000 were 1.9 times more likely to not receive necessary medical care, and survivors in financial hardship with ≥ $10,000 of debt were 3.4 times more likely to not receive necessary medical care than survivors who did not experience financial hardship. With prior studies showing that nearly 1 in 3 cancer survivors experiences financial hardship [11, 18, 39] and that more than half of cancer survivors in debt incur amounts over $10,000 [11, 40], our findings underscore the importance of identifying cancer survivors who may be at greatest risk for financial hardship from cancer because of the negative influence of financial burden throughout the care continuum.

A growing body of evidence indicates that cancer survivors who experience financial hardship or face high OOP costs are more likely to delay or forgo both general and cancer-related medical care, have longer times to initiation of therapy, have delays in therapy initiation, and are more likely to discontinue recommended regimens [12,13,14,15, 20, 41]. Furthermore, as trends point to increasing costs of cancer care [5] and a shift toward greater patient cost-sharing for medical care, cancer patients may face a choice between optimal care or care they can afford [42, 43]. In scenarios where medical care is interrupted or abandoned due to affordability issues, patients may not receive the fullest potential health benefit and, instead, may experience higher rates of disease progression [12], adverse events [44], premature death [45], and higher overall health care expenditures due to preventable emergency room visits [46] and hospitalizations [14, 45, 47]. If the burden of financial hardship from cancer is not addressed, the consequent impact on medical care access and utilization may lead to poor health outcomes among individuals diagnosed with cancer and exacerbate disparities across a wide range of patient characteristics, including race/ethnicity and socioeconomic status.

Insurance status was also found to be significantly associated with the receipt of necessary medical care in our study. Extensive research shows the impact of the lack of health insurance and the type of health insurance on reduced access to medical care [48,49,50,51,52]. Our findings provide further support, showing that uninsured cancer survivors are 70% more likely to not receive necessary medical care than those survivors with private insurance. Although the future of health reform is uncertain, recent findings on the effects of the ACA show that more than 20 million US adults age 18–64 gained health insurance [53], which will also increase the proportion with access to medical care [54]. Yet, achieving the full benefit of health insurance coverage among newly and continuously insured individuals may require additional support for individuals who struggle to understand their insurance benefits and medical bills. As shown in our study, cancer survivors who did not receive help understanding their health insurance or medical bills were more than twice as likely to report not receiving necessary medical care. Consequently, cancer survivors may require greater support to better understand their health insurance and medical bills during the time period around diagnosis and treatment, when the use of medical care is high and bills start to accumulate.

Among other factors included in our analysis of cancer survivors, we found that having a caregiver was significantly associated with the receipt of necessary medical care. Individuals with cancer face a plethora of challenges throughout the cancer care trajectory related to late and long-term effects of treatment, psychological and emotional distress, financial hardship, and managing and coordinating medical care [55,56,57,58,59,60,61]. Our findings that cancer survivors without a caregiver were significantly more likely not to receive necessary medical care support prior studies reporting that the presence of a caregiver may lead to improved outcomes for cancer patients, including management of care [62, 63]. We also found that having a higher number of cancer diagnoses was associated with greater likelihood of not receiving necessary medical care. This may be related to greater total costs of care associated with multiple rounds of treatment or the long-term effects of treatment.

Identifying barriers to receipt of necessary medical cancer care among cancer survivors is imperative in developing interventions that ensure equitable access to care across populations [64]. A common thread among the barriers found to be significantly associated with receipt of necessary care in our final multivariable model is their relationship to patient cost of care (financial hardship/debt amount, health insurance, help understanding health insurance, and medical bills). It is now well-established that patients face significant financial hardship from cancer, its treatment, and the late/lasting effects of treatment [10,11,12, 14, 18, 26, 39,40,41, 65,66,67,68,69,70,71,72,73,74,75,76,77,78,79], with population-based estimates indicating that approximately one in every five cancer survivors report material (e.g., unable to cover medical care costs) or psychological financial hardship (e.g., worry about paying medical bills because of cancer) [10]. Yet, to date, there are no prospective studies evaluating the impact of interventions to prevent financial hardship from cancer [80]. Efforts to mitigate financial hardship from cancer and limit the impact on access and utilization of medical care will require the collection of patient financial information (e.g., examining patients’ debt-to-income ratio, or information on assets and debts), as well as improved coordination and communication between patients and their health care team. First, early education of patients about their cost-sharing responsibilities for impending medical care may help them prepare for and engage in the steps necessary to manage the associated finances. Second, it is essential that physicians and other members of the health care team (e.g., nurse, medical assistant, social worker) engage in conversations about the costs of medical care, so that they become aware of their patient’s financial capability and can help identify resources (e.g., institutional medical financial assistance programs, pharmaceutical co-pay assistance programs, or third-party non-profit organizations) or cost-saving strategies [81]. Third, given that an individual’s financial capability is dynamic over time, ensuring that the aforementioned information about the costs of medical care is available and “financial check-ins” occur throughout the care continuum, from the time of diagnosis through survivorship or end of life, may ensure that patients are receiving necessary care.

Despite the strengths of our innovative analytic approach with a large national sample containing detailed measures about financial hardship, our study had several limitations. First, cancer survivors responding to the LIVESTRONG online survey were recruited from multiple sources, and thus, our national study sample was not population-based. Accordingly, our findings are most generalizable to study populations with characteristics similar to the study sample, namely, cancer survivors 18–64 years of age who are predominantly non-Hispanic whites, female, married, employed, and have high educational attainment, relatively high annual incomes, and Internet access. However, preliminary studies suggest that even if prevalence estimates differ between population-based probability samples and non-probability samples, associations between patient factors and outcomes, such as those between financial hardship and receipt of necessary care presented here, are similar [82]. Second, our study data were based on self-reported information and are subject to recall bias and misclassification. Third, the findings are based on a prevalent sample of cancer survivors and those diagnosed with more lethal cancers. Fourth, those who died as a result of suboptimal care were not included in the sample. Fifth, we did not have information on specific clinical characteristics, such as stage of cancer at diagnosis, presence of comorbid conditions, and whether subsequent cancers represented recurrence for survivors with a primary diagnosis or two separate cancers. Lastly, given the cross-sectional study design, we were not able to explore the temporal pathway between the identified barriers and receipt of necessary medical care.

Conclusion

In a large sample of adult cancer survivors younger than 65 years of age in the USA, we identified several factors that may serve as significant barriers to the receipt of necessary medical care. Survivors who experience financial hardship and incur large amounts of debt related to their cancer may be at greatest risk for not receiving necessary medical care. Additionally, providing support to cancer survivors who need help understanding the complexities of insurance or medical bills may improve both access to and receipt of necessary medical care. With trends in the US health care system pointing to increased costs of cancer care and greater patient cost-sharing, it is of paramount importance to identify and better understand barriers and facilitators to the receipt of necessary medical care throughout the cancer care continuum. Our findings will help inform the development of interventions by identifying individuals diagnosed with cancer who have the greatest need for education about the financial aspects of cancer care, health insurance benefits, the presence of a caregiver, and medical bills; these efforts may reduce the likelihood of disruption in high-quality cancer care provision and lead to improved health outcomes.

References

Miller KD, Siegel RL, Lin CC, Mariotto AB, Kramer JL, Rowland JH, et al. Cancer treatment and survivorship statistics, 2016. CA Cancer J Clin. 2016;66(4):271–89.

Howlader N, Noone AM, Krapacho M, Garshell J, Miller D, Altekruse SF, et al. SEER Cancer Statistics Review, 1975–2012 Bethesda, MD: National Cancer Institute; 2015 [Available from: http://seer.cancer.gov/csr/1975_2012/, based on November 2014 SEER data submission, posted to SEER website, April 2015.

Institute of Medicine (IOM). Ensuring patient access to affordable cancer drugs: workshop summary. Washington, DC: The National Academies Press; 2014.

Mariotto AB, Yabroff KR, Shao Y, Feuer EJ, Brown ML. Projections of the cost of cancer care in the United States: 2010–2020. J Natl Cancer Inst. 2011;103(2):117–28.

American Society of Clinical Oncology. The state of cancer Care in America, 2016: a report by the American Society of Clinical Oncology. J Oncol Pract. 2016;12(4):339–83.

Office CB. Congressional Budget Office: Insurance Coverage Provisions of the Affordable Care Act: CBO’s March 2015 Baseline Washington, D.C.: Congressional Budget Office; 2015 [Available from: https://www.cbo.gov/sites/default/files/51298-2015-03-ACA.pdf.

Collins SR, Rasmussen PW, Beutel S, Doty MM. The problem of underinsurance and how rising deductibles will make it worse. Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2014. Issue Brief (Commonw Fund). 2015;13:1–20.

Kaiser Family Foundation. Health Research & Education Trust. Employer health benefits. In: Annual survey. Merlo Park: Henry J. Kaiser Family Foundation; 2015.

Tefferi A, Kantarjian H, Rajkumar SV, Baker LH, Abkowitz JL, Adamson JW, et al. In support of a patient-driven initiative and petition to lower the high price of cancer drugs. Mayo Clin Proc. 2015;90(8):996–1000.

Yabroff KR, Dowling EC, Guy GP Jr, Banegas MP, Davidoff A, Han X, et al. Financial hardship associated with cancer in the United States: findings from a population-based sample of adult cancer survivors. J Clin Oncol. 2016;34(3):259–67.

Banegas MP, Guy GP Jr, de Moor JS, Ekwueme DU, Virgo KS, Kent EE, et al. For working-age cancer survivors, medical debt and bankruptcy create financial hardships. Health Aff (Millwood). 2016;35(1):54–61.

Dusetzina SB, Winn AN, Abel GA, Huskamp HA, Keating NL. Cost sharing and adherence to tyrosine kinase inhibitors for patients with chronic myeloid leukemia. J Clin Oncol. 2014;32(4):306–11.

Goldman DP, Jena AB, Lakdawalla DN, Malin JL, Malkin JD, Sun E. The value of specialty oncology drugs. Health Serv Res. 2010;45(1):115–32.

Kaisaeng N, Harpe SE, Carroll NV. Out-of-pocket costs and oral cancer medication discontinuation in the elderly. J Manag Care Spec Pharm. 2014;20(7):669–75.

Streeter SB, Schwartzberg L, Husain N, Johnsrud M. Patient and plan characteristics affecting abandonment of oral oncolytic prescriptions. J Oncol Pract. 2011;7(3 Suppl):46s–51s.

Zafar SY, Peppercorn JM, Schrag D, Taylor DH, Goetzinger AM, Zhong X, et al. The financial toxicity of cancer treatment: a pilot study assessing out-of-pocket expenses and the insured cancer patient’s experience. Oncologist. 2013;18(4):381–90.

Nipp RD, Zullig LL, Samsa G, Peppercorn JM, Schrag D, Taylor DH, Jr., et al. Identifying cancer patients who alter care or lifestyle due to treatment-related financial distress. Psychooncology. 2015;25(6):719–25.

Kent EE, Forsythe LP, Yabroff KR, Weaver KE, de Moor JS, Rodriguez JL, et al. Are survivors who report cancer-related financial problems more likely to forgo or delay medical care? Cancer. 2013;119(20):3710–7.

Weaver KE, Rowland JH, Bellizzi KM, Aziz NM. Forgoing medical care because of cost: assessing disparities in healthcare access among cancer survivors living in the United States. Cancer. 2010;116(14):3493–504.

Zheng Z, Han X, Guy GP Jr, Davidoff AJ, Li C, Banegas MP, et al. Do cancer survivors change their prescription drug use for financial reasons? Findings from a nationally representative sample in the United States. Cancer. 2017;123(8):1453–63.

Keegan TH, Tao L, DeRouen MC, Wu XC, Prasad P, Lynch CF, et al. Medical care in adolescents and young adult cancer survivors: what are the biggest access-related barriers? J Cancer Surviv. 2014;8(2):282–92.

Potosky AL, Harlan LC, Albritton K, Cress RD, Friedman DL, Hamilton AS, et al. Use of appropriate initial treatment among adolescents and young adults with cancer. J Natl Cancer Inst. 2014;106(11). https://doi.org/10.1093/jnci/dju300.

Society AC. Cancer treatment & survivorship facts & figures 2016–2017. American Cancer Society: Atlanta; 2016.

Foundation L. Survivors’ experiences with employment. LIVESTRONG Foundation: Austin; 2013.

Foundation L. Survivors’ experience with finances and insurance. Austin: LIVESTRONG Foundation; 2014.

Zheng Z, Yabroff KR, Guy GP, Jr., Han X, Li C, Banegas MP, et al. Annual medical expenditure and productivity loss among colorectal, female breast, and prostate cancer survivors in the United States. J Natl Cancer Inst. 2016;108(5). https://doi.org/10.1093/jnci/djv382.

LIVESTRONG Foundation. LIVESTRONG Surveys. 2016. [Available from: https://www.livestrong.org/what-we-do/livestrong-surveys.

Yabroff KR, Dowling E, Rodriguez J, Ekwueme DU, Meissner H, Soni A, et al. The Medical Expenditure Panel Survey (MEPS) experiences with cancer survivorship supplement. J Cancer Surviv. 2012;6(4):407–19.

Agency for Healthcare Research and Quality. Summary of Recommendations from Round 1 Cognitive Testing of the MEPS Cancer SAQ. AHRQ, Rockville. [Available from: http://meps.ahrq.gov/mepsweb/survey_comp/hc_survey/2011/MEPS_Cancer_SAQ_R1_Results.htm.

Zullig LL, Peppercorn JM, Schrag D, Taylor DH, Lu Y, Samsa G. Financial distress, use of cost-coping strategies, and adherence to prescription medication among patients with cancer. J Oncol Pract. 2013;9(6 SUPPL):60s–3s.

Veenstra CM, Regenbogen SE, Hawley ST, Griggs JJ, Banerjee M, Kato I, et al. A composite measure of personal financial burden among patients with stage III colorectal cancer. Med Care. 2014;52(11):957–62.

Andersen RM. Revisiting the behavioral model and access to medical care: does it matter? J Health Soc Behav. 1995;36(1):1–10.

Peduzzi P, Concato J, Kemper E, Holford TR, Feinstein AR. A simulation study of the number of events per variable in logistic regression analysis. J Clin Epidemiol. 1996;49(12):1373–9.

Kiernan M, Kraemer HC, Winkleby MA, King AC, Taylor CB. Do logistic regression and signal detection identify different subgroups at risk? Implications for the design of tailored interventions. Psychol Methods. 2001;6(1):35–48.

Andreescu C, Mulsant BH, Houck PR, Whyte EM, Mazumdar S, Dombrovski AY, et al. Empirically derived decision trees for the treatment of late-life depression. Am J Psychiatry. 2008;165(7):855–62.

Thanassi W, Noda A, Hernandez B, Newell J, Terpeluk P, Marder D, et al. Delineating a retesting zone using receiver operating characteristic analysis on serial QuantiFERON tuberculosis test results in US healthcare workers. Pulm Med. 2012;2012:291294.

Vuong QH. Likelihood ratio tests for model selection and non-nested hypotheses. Econometrica. 1989;57(2):307–33.

Kleinman LC, Norton EC. What’s the risk? A simple approach for estimating adjusted risk measures from nonlinear models including logistic regression. Health Serv Res. 2009;44(1):288–302.

Jagsi R, Pottow JA, Griffith KA, Bradley C, Hamilton AS, Graff J, et al. Long-term financial burden of breast cancer: experiences of a diverse cohort of survivors identified through population-based registries. J Clin Oncol. 2014;32(12):1269–76.

Shankaran V, Jolly S, Blough D, Ramsey SD. Risk factors for financial hardship in patients receiving adjuvant chemotherapy for colon cancer: a population-based exploratory analysis. J Clin Oncol. 2012;30(14):1608–14.

Guy GP Jr, Yabroff KR, Ekwueme DU, Virgo KS, Han X, Banegas MP, et al. Healthcare expenditure burden among non-elderly cancer survivors, 2008-2012. Am J Prev Med. 2015;49(6 Suppl 5):S489–97.

Young RA, DeVoe JE. Who will have health insurance in the future? An updated projection. Ann Fam Med. 2012;10(2):156–62.

Shankaran V, Ramsey S. Addressing the financial burden of cancer treatment: from copay to Can't pay. JAMA Oncol. 2015;1(3):273–4.

Tamblyn R, Laprise R, Hanley JA, Abrahamowicz M, Scott S, Mayo N, et al. Adverse events associated with prescription drug cost-sharing among poor and elderly persons. J Am Med Assoc. 2001;285(4):421–9.

Hsu J, Price M, Huang J, Brand R, Fung V, Hui R, et al. Unintended consequences of caps on Medicare drug benefits. N Engl J Med. 2006;354(22):2349–59.

Chandra A, Gruber J, McKnight R. Patient cost-sharing and hospitalization offsets in the elderly. Am Econ Rev. 2010;100(1):193–213.

Swartz K. Cost-sharing: Effects on spending and outcomes. The Robert Wood Johnson Foundation; 2010. http://www.rwjf.org/en/library/research/2011/12/cost-sharing--effects-onspending-and-outcomes.html.

Hargraves JL, Hadley J. The contribution of insurance coverage and community resources to reducing racial/ethnic disparities in access to care. Health Serv Res. 2003;38(3):809–29.

Shi L, Stevens GD. Vulnerability and unmet health care needs. The influence of multiple risk factors. J Gen Intern Med. 2005;20(2):148–54.

Donelan K, DesRoches CM, Schoen C. Inadequate health insurance: costs and consequences. Med Gen Med. 2000;2(3):E37.

Siminoff LA, Ross L. Access and equity to cancer care in the USA: a review and assessment. Postgrad Med J. 2005;81(961):674–9.

Mayberry RM, Mili F, Ofili E. Racial and ethnic differences in access to medical care. Med Care Res Rev. 2000;57(Suppl 1):108–45.

Office of the Assistant Secretary for Planning and Evaluation. Health insurance coverage and the affordable care act. Washington, D.C.: Office of the Assistant Secretary for Planning and Evaluation; 2015.

Sommers A, Cunningham PJ. Medical bill problems steady for U.S. families, 2007–2010. Track Rep. 2011;(28):1–5.

Hewitt ME, Bamundo A, Day R, Harvey C. Perspectives on post-treatment cancer care: qualitative research with survivors, nurses, and physicians. J Clin Oncol. 2007;25(16):2270–3.

Armes J, Crowe M, Colbourne L, Morgan H, Murrells T, Oakley C, et al. Patients’ supportive care needs beyond the end of cancer treatment: a prospective, longitudinal survey. J Clin Oncol. 2009;27(36):6172–9.

McInnes DK, Cleary PD, Stein KD, Ding L, Mehta CC, Ayanian JZ. Perceptions of cancer-related information among cancer survivors: a report from the American Cancer Society’s studies of cancer survivors. Cancer. 2008;113(6):1471–9.

Beckjord EB, Arora NK, McLaughlin W, Oakley-Girvan I, Hamilton AS, Hesse BW. Health-related information needs in a large and diverse sample of adult cancer survivors: implications for cancer care. J Cancer Surviv. 2008;2(3):179–89.

Stein KD, Syrjala KL, Andrykowski MA. Physical and psychological long-term and late effects of cancer. Cancer. 2008;112(11 Suppl):2577–92.

Hanratty B, Holland P, Jacoby A, Whitehead M. Financial stress and strain associated with terminal cancer—a review of the evidence. Palliat Med. 2007;21(7):595–607.

Harrison JD, Young JM, Price MA, Butow PN, Solomon MJ. What are the unmet supportive care needs of people with cancer? A systematic review. Support Care Cancer. 2009;17(8):1117–28.

Kim Y, Carver CS. Recognizing the value and needs of the caregiver in oncology. Curr Opin Support Palliat Care. 2012;6(2):280–8.

Glajchen M. The emerging role and needs of family caregivers in cancer care. J Support Oncol. 2004;2(2):145–55.

Zafar SY. Financial toxicity of cancer care: It’s time to intervene. J Natl Cancer Inst. 2015;109(5):djv370.

Advani PS, Reitzel LR, Nguyen NT, Fisher FD, Savoy EJ, Cuevas AG, et al. Financial strain and cancer risk behaviors among African Americans. Cancer Epidemiol Biomark Prev. 2014;23(6):967–75.

Bestvina CM, Zullig LL, Rushing C, Chino F, Samsa GP, Altomare I, et al. Patient-oncologist cost communication, financial distress, and medication adherence. J Oncol Pract. 2014;10(3):162–7.

Bona K, Dussel V, Orellana L, Kang T, Geyer R, Feudtner C, et al. Economic impact of advanced pediatric cancer on families. J Pain Symptom Manag. 2014;47(3):594–603.

Bradshaw M, Ellison CG. Financial hardship and psychological distress: exploring the buffering effects of religion. Soc Sci Med. 2010;71(1):196–204.

Davidoff AJ, Erten M, Shaffer T. Out-of-pocket health care expenditure burden for Medicare beneficiaries with cancer. Cancer. 2013;119(6):1257–65.

de Boer A, Moffatt S, Noble E, White M. Addressing the financial consequences of cancer: qualitative evaluation of a welfare rights advice service. PLoS One. 2012;7(8):e42979.

de Souza JA, Yap BJ, Hlubocky FJ, Wroblewski K, Ratain MJ, Cella D, et al. The development of a financial toxicity patient-reported outcome in cancer: the COST measure. Cancer. 2014;120(20):3245–53.

Ekwueme DU, Yabroff KR, Guy GP Jr, Banegas MP, de Moor JS, Li C, et al. Medical costs and productivity losses of cancer survivors—United States, 2008-2011. MMWR Morb Mortal Wkly Rep. 2014;63(23):505–10.

Guy GP Jr, Ekwueme DU, Yabroff KR, Dowling EC, Li C, Rodriguez JL, et al. Economic burden of cancer survivorship among adults in the United States. J Clin Oncol. 2013;31(30):3749–57.

Guy GP Jr, Yabroff KR, Ekwueme DU, Smith AW, Dowling EC, Rechis R, et al. Estimating the health and economic burden of cancer among those diagnosed as adolescents and young adults. Health Aff (Millwood). 2014;33(6):1024–31.

Howard DH, Molinari NA, Thorpe KE. National estimates of medical costs incurred by nonelderly cancer patients. Cancer. 2004;100(5):883–91.

Nekhlyudov L, Walker R, Ziebell R, Rabin B, Nutt S, Chubak J. Cancer survivors’ experiences with insurance, employment and personal finances: results from a multi-site study. J Clin Oncol. 2015;33(Suppl):Abstract 9574.

Pisu M, Kenzik KM, Oster RA, Drentea P, Ashing KT, Fouad M, et al. Economic hardship of minority and non-minority cancer survivors 1 year after diagnosis: another long-term effect of cancer? Cancer. 2015;121(8):1257–64.

Ramsey S, Blough D, Kirchhoff A, Kreizenbeck K, Fedorenko C, Snell K, et al. Washington state cancer patients found to be at greater risk for bankruptcy than people without a cancer diagnosis. Health Aff (Millwood). 2013;32(6):1143–52.

Zafar SY, McNeil RB, Thomas CM, Lathan CS, Ayanian JZ, Provenzale D. Population-based assessment of cancer survivors’ financial burden and quality of life: a prospective cohort study. J Oncol Pract. 2015;11(2):145–50.

PDQ® Adult Treatment Editorial Board. PDQ Financial Toxicity and Cancer Treatment. National Cancer Institute, Bethesda; updated 05/03/17. Available from: https://www.cancer.gov/about-cancer/managing-care/financial-toxicity-hp-pdq.

Hunter WG, Zhang CZ, Hesson A, Davis JK, Kirby C, Williamson LD, et al. Discuss to reduce out-of-pocket costs? Analysis of cost-saving strategies in 1,755 outpatient clinic visits. Med Decis Mak. 2016;36:900–10.

Liu B, Chowdhury S, De Moor J, Kent E, Machlin S, Nutt S, et al. Evaluation of Strategies to Improve Utility of Estimates From a Non-probability Based Survey. Federal Committee on Statistical Methodology Research Conference; December 1–3, 2015. https://www.westat.com/aboutus/presentations/2015-federal-committee-statistical-methodology-fcsm-statistical-policy.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

This article does not contain any studies with human participants performed by any of the authors. Informed consent was obtained from all individual participants included in the study.

Conflict of interest

The authors declare that they have no conflicts of interest.

Additional information

The findings and conclusions in this report are those of the authors and do not necessarily represent the official position of the American Cancer Society, Centers for Disease Control and Prevention, National Cancer Institute, or the Department of Health and Human Services.

Electronic supplementary material

ESM 1

(DOCX 40 kb)

Rights and permissions

About this article

Cite this article

Banegas, M.P., Dickerson, J.F., Kent, E.E. et al. Exploring barriers to the receipt of necessary medical care among cancer survivors under age 65 years. J Cancer Surviv 12, 28–37 (2018). https://doi.org/10.1007/s11764-017-0640-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11764-017-0640-1