Abstract

This study examines the dynamics of consumer–brand identification (CBI) and its antecedents in the context of the launch of a new brand. Three focal drivers of CBI with a new brand are examined, namely: perceived quality (the instrumental driver), self–brand congruity (the symbolic driver), and consumer innate innovativeness (a trait-based driver). Using longitudinal survey data, the authors find that on average, CBI growth trajectories initially rise after the introduction but eventually decline, following an inverted-U shape. More importantly, the longitudinal effects of the antecedents suggest that CBI can take different paths. Consumer innovativeness creates a fleeting identification with the brand that dissipates over time. On the other hand, company-controlled drivers of CBI—such as brand positioning—can contribute to the build-up of deep-structure CBI that grows stronger over time. Based on these findings, the authors offer normative guidelines to managers on consumer–brand relationship investment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Examining consumers’ relationships with companies and brands has been an important theme in multiple streams of marketing research. Drawing from social identity theory (Tajfel and Turner 1985), a stream of research in B2B and B2C marketing proposes that customers may identify with companies (Ahearne et al. 2005; Bhattacharya and Sen 2003; Brown et al. 2005; Homburg et al. 2009; Maxham et al. 2008) and their brands (Donavan et al. 2006; Escalas and Bettman 2005; Kuenzel and Halliday 2008). This research stream is deeply rooted in the theme of “consumer identity” in consumer culture theory (Arnould and Thompson 2005), which posits that markets have increasingly become sources of symbols and social cues which help consumers pursue identity projects (Belk 1988; Holt 2002). Emerging from this stream of research is the concept of consumer–brand identification (CBI). We draw from social identity theory to define CBI as a consumer’s psychological state of perceiving, feeling, and valuing his or her belongingness with a brand. Previous research on CBI has provided useful insight into the field of relationship marketing by demonstrating that CBI is a powerful predictor of consumer behaviors such as repurchase intention, word-of-mouth, and symbol passing (Donavan et al. 2006; Kuenzel and Halliday 2008). However, there exist two limitations that warrant further investigation.

First, although prior research has provided useful insights into why identification occurs, we still know little about the dynamic process that emphasizes how identification takes place. The shift from understanding identification from a static perspective to a dynamic one is important, because it sheds light not only on how consumers incorporate attributes of the brand identity into their own self but also how identification evolves, fluctuates, and changes over time (e.g., Ashforth et al. 2008). Given the relationship between identification and various positive outcomes, understanding how identification changes over time has important managerial implications. To this end, new brands are particularly suitable for observing how CBI unfolds because the launch of a new brand serves as a critical event that all consumers are generally exposed to at the same time. Furthermore, firms entering an established market increasingly rely on new products’ brand identities to alter the competitive landscape, as well as exert profound impacts on an industry and its consumers (e.g., Amazon’s Kindle Fire in the tablet market, Google Droid and Apple iPhone in the cell phone market, McDonald’s McCafe in the coffee house market). A deeper understanding of how CBI with a new brand evolves over time will be useful for brand managers to capitalize on CBI at the right phase.

Second, little is known about the dynamics of CBI antecedents. With regard to firm-controlled antecedents, prior research highlights functional and symbolic types of brand associations as valuable constituents of consumers’ brand knowledge (e.g., Keller 1993; Park et al. 1986) that induces CBI formation. Research on brand personality also suggests that consumer traits, factors that are not controlled by the firm, should also play an important role in CBI formation. However, there is a lack of understanding about how the dynamics of these factors influence CBI evolution, especially CBI with a new brand. Such an understanding is important for brand management, even more so in the context of launching a new brand, because insights into the longitudinal influences of drivers that are controlled and not controlled by the firm on CBI growth trajectories will inform managers about how to allocate brand investment.

We aim to address these limitations in this study. Drawing from the consumer–company identification conceptual framework (Bhattacharya and Sen 2003) and the symbolic–instrumental framework in the attitude and branding literature (e.g., Katz 1960; Keller 1993; Park et al. 2009; Shavitt 1992), we propose and test a conceptual framework that focuses on three key CBI antecedents: (1) perceived quality, which is generally under the control of brand managers, (2) self–brand congruity, which is moderately under the control of brand managers (e.g., through positioning and marketing communications), and (3) consumer innate innovativeness, an individual trait that is beyond the control of manager.

Because perceived quality is defined as a consumer’s judgment about the superiority or excellence of a product (Zeithaml 1988), it represents an instrumental driver of CBI (Katz 1960; Mittal 2006; Swan and Combs 1976; Keller 1993 refers to this driver as “functional”). Self–brand congruity, defined as the perceived similarity of personality between the self and the brand (Sirgy 1982), is a symbolic driver of CBI (e.g., Bhattacharya and Sen 2003; Elliott and Wattanasuwan 1998; Katz 1960). Consumer innate innovativeness represents a consumer’s predisposition to buy new and different products and brands rather than sticking with previous choices and consumption patterns (Steenkamp et al. 1999). Together, these symbolic, instrumental, and consumer trait variables capture the multifaceted nature of consumer–brand relationships (Gardner and Levy 1955; Keller 1993; Sheth and Parvatiyar 1995; Swan and Combs 1976). Drawing from need-gratification theories (Agustin and Singh 2005; Herzberg 1966; Houston and Gassenheimer 1987; Swan and Combs 1976), we categorize these drivers of CBI into lower- and higher-order need-gratification mechanisms in order to predict their longitudinal effects on CBI. We test the conceptual framework using longitudinal survey data of 635 consumers over a one-year period during the launch of the iPhone in Spain.

Our study contributes to the literature on CBI and branding in several ways. First, we are among the first to not only provide a conceptual framework of the evolution of CBI as a dynamic process but also empirically demonstrate the longitudinal effects of CBI antecedents from brand introduction into initial growth stages. Second, we build on and extend CBI and customer-based brand equity research by highlighting the relative strengths of consumer–brand relationship drivers over time. Our findings provide insights into how companies can leverage both functional and symbolic brand associations over time to achieve differential effects and, consequently, optimally allocate brand investments. Third, our findings also shed light on the longitudinal effects of trait-based CBI drivers. These study findings provide important managerial implications on brand management and efficient allocation of marketing resources to fortify CBI, aiding managers in the pivotal brand strategy decisions made during the introductory and growth phases of a new brand (e.g., Park et al. 1986) and product life cycle (e.g., Golder and Tellis 2004).

We organize the paper as follows. First, we provide a brief review of the CBI construct and then present our hypotheses. Second, we present a longitudinal study on the evolution of CBI antecedents. The paper concludes with a general discussion of implications for theory, practice, and future research.

Consumer–brand identification

Consumer culture theorists have long been interested in how consumers use the symbolic resources of products and brands to develop a sense of self, construct their identities, and pursue self-representation goals (Belk 1988; Schau and Gilly 2003). Building on this research, recent studies have drawn from social identity theory (Tajfel and Turner 1985) and the consumer–company identification framework (Bhattacharya and Sen 2003) to explain how a consumer is attached to a brand that shares the same self-definitional attributes (Donavan et al. 2006). As mentioned earlier, we define CBI as a consumer’s psychological state consisting of three elements: perceiving, feeling, and valuing his or her belongingness with a brand. This conceptualization is in line with the original tripartite conceptualization in social identity theory (i.e., cognitive, affective, and evaluative aspects; see Tajfel and Turner 1985) and integrates the multidimensional perspective in recent research on organizational identification in applied psychology.

Empirical research on the consequences of customer–company identification has reported that identification with a company leads to both consumer in-role behaviors such as higher product utilization and extra-role behaviors such as word-of-mouth, collecting company-related collectibles, and symbol passing (Ahearne et al. 2005; Bagozzi and Dholakia 2006; Brown et al. 2005; Donavan et al. 2006). However, little is known about the longitudinal effects of the antecedents to CBI, especially in the context of a new brand.

Consistent with Bhattacharya and Sen’s (2003) conceptual framework, we contend that self–brand congruity and CBI are two distinct constructs. First, although self–brand congruity is an antecedent to CBI, it is not the only antecedent to CBI. Self–brand congruity reflects the notion of identity similarity that Bhattacharya and Sen (2003) conceptualize as an important antecedent to consumers’ identification with a marketing entity. This notion of identity similarity corresponds to the concept of person–organization fit in the marketing and industrial organization psychology literatures, which posits that people are attracted to organizations that share similar values (Donavan et al. 2004; Schneider 1987). Therefore, such person–organization fit is a necessary, but not sufficient, condition for people to develop identification with the organization or a social entity. Second, the concept of CBI, as defined here, is considered to be more gestalt than concepts akin to person–organization fit, or self–brand congruity. As a psychological state that goes beyond just the cognitive overlap between the brand and self, CBI also includes the affective and evaluative facets of psychological oneness with the brand. Thus, CBI is at a higher level of abstraction than the concrete self–brand congruity. Third, the empirical results we report suggest that in general, CBI follows an inverted-U growth trajectory, while self–brand congruity follows a U-shaped growth trajectory, providing supplementary evidence of (1) the discriminant validity between the two constructs and (2) the influence of other factors on CBI evolution in addition to self–brand congruity.

Research hypotheses

Figure 1 presents the conceptual framework. We focus on three predictors of CBI with a new brand: perceived quality, self–brand congruity, and consumer innate innovativeness.Footnote 1

Antecedents to the initial level of consumer–brand identification

Perceived quality as the instrumental driver

Previous research has suggested that perceived quality can be formed by a consumer’s perceptions about the functional attributes of a product and also by perceptions of more abstract and global attributes such as brand name (Dodds et al. 1991; Zeithaml 1988). In information economics, quality cues that consumers glean from strong brand names reduce their uncertainty about brand attributes (Aaker 1991; Erdem et al. 2006; Keller 1993). Consumers’ uncertainty, or perceived risk, about a new brand is particularly salient. High certainty about the quality of the new brand promises consumers that the brand will meet their instrumental goals, at least in the introduction phase. Such positive product knowledge in turn can affect self-knowledge (Walker and Olson 1991). In that sense, perceived quality represents an instrumental driver of how much consumers initially identify with a brand; that is, they identify with the new brand because they believe that the new brand is instrumental in achieving their functional needs (e.g., Katz 1960).

Additionally, there has been some empirical evidence that indirectly supports the positive relationship between perceived quality and identification. For example, Bhattacharya et al. (1995) find that satisfaction with the focal organization’s offerings is positively related to people’s identification with the focal organization. Kuenzel and Halliday (2008) also report a positive relationship between satisfaction and brand identification. Because perceived quality is an important driver of customer satisfaction, a high level of perceived quality initially formed when the new brand is introduced to the market place (i.e., the introductory phase) should also be positively related to the initial level of consumers’ identification. Therefore, we hypothesize:

-

H1:

Consumers who perceive the new brand to be of high quality during the introductory phase will have higher initial levels of CBI.

Self–brand congruity as the symbolic driver

The rich literature on employee–company identification has generally considered person–organization fit as one of the key drivers of identification (Dutton et al. 1994). This literature suggests that individuals are likely to associate with entities that coincide with abstract attributes they feel describe themselves to satisfy their needs for self-continuity or consistency of self-concept (e.g., Dukerich et al. 2002). Rousseau (1998, p. 227) echoes this claim by stating, “Sameness is not a required feature of identity; rather what is required is a sense of continuity.” Therefore, applying these insights into the brand domain, we posit that brand attributes can instill continuity, not by constancy but by having attributes of the brand remain attractive to the individual (e.g., Bhattacharya et al. 1995). Otherwise individuals will begin to disassociate with those entities. Along the same line, in the branding literature, self–brand congruity, a measure of the similarity between self and a brand, has been used in the past to predict brand loyalty (e.g., Sirgy 1982; Sirgy et al. 1991). Bhattacharya and Sen’s (2003) conceptual framework suggests that the relationship between self–brand congruity and consumer behavior is mediated by consumer–brand identification. In that sense, self–brand congruity represents a symbolic driver of consumer’s identification with a brand.

According to Hogg (2003, p. 473), in addition to the self-continuity and self-enhancement motivations, “social identity processes are also motivated by a need to reduce subjective uncertainty about one’s perceptions, attitudes, feelings, behaviors, and ultimately one’s self-concept and place within the social world. Uncertainty reduction, particularly about subjectively important matters that are generally self-conceptually relevant, is a core human motivation.” Because a brand provides a prototype that describes who its users are and distinguishes itself from other prototypes (e.g., Aaker 1997; Elliott and Wattanasuwan 1998), a new brand with high self–brand congruity will help consumers reduce self-expressive uncertainty. Therefore, we hypothesize:

-

H2:

Consumers who perceive the new brand as highly congruent with their self-image will have higher initial levels of CBI.

Consumer innate innovativeness

The innate innovativeness of a consumer is defined as his or her predisposition to buy new and different products and brands rather than remain with previous choices and consumption patterns (Steenkamp et al. 1999). There are two reasons why in the introduction phase, highly innovative consumers develop a higher initial level of identification with a new brand than non-innovative consumers. First, from an instrumental perspective, highly innovative consumers are more likely to be attracted to a new brand because the new brand generally has novel product features. Second, the new brand also provides symbolic meanings for these consumers. By matching a brand-user image of innovativeness with their own innovative self-concept, consumers satisfy their self-congruity needs. This self-congruity of being innovative is also guided by self-concept motives such as the need for self-esteem and self-consistency (Aaker 1997; Sirgy 1982). More formally, we hypothesize:

-

H3:

Consumers who are high on innate innovativeness will have higher initial levels of CBI with the new brand.

Longitudinal effects of consumer–brand identification antecedents

Longitudinal effect terminology

In developing our hypotheses about the longitudinal effects of CBI antecedents, we express CBI growth as a function of three elements: time, CBI antecedents, and the interaction between these antecedents and time. The growth rate of this growth function is its first derivative with respect to time. For a linear growth function, the growth trajectory is monotonically increasing or decreasing, with a constant growth rate. If the interaction between a CBI antecedent and the linear temporal term (t) in the linear growth function is significant, then its effect on CBI growth rate will be of the same sign as the coefficient of the interaction term, and constant or stable in magnitude. For polynomial growth trajectories of higher order n (where n > 1), the growth rate is also a function of time, i.e., CBI will grow at changing rates. For example, the first derivative of a quadratic CBI growth function represents the growth rate of CBI that is a linear function of time. In this case, it is important to see which CBI antecedents influence the coefficient of time in the growth rate, because such an effect (1) mathematically represents an interaction between those antecedents and time in the growth rate and (2) conceptually informs how a CBI antecedent accelerates or inhibits the growth of CBI over time. Therefore, the hypotheses about the longitudinal effects of CBI antecedents on its growth trajectories will have to be focused on how they influence the growth rate of CBI. We elaborate on this issue more formally when we describe the model specifications.

Need-gratification theories and points of parity among brands

We theorize that each CBI antecedent reflects various consumers’ needs that drive consumers’ identification with a brand, and these needs vary with time according to need-gratification and dual-factor motivation theories (Herzberg 1966; Maslow 1943; Wolf 1970). These theories suggest that individual needs can be broadly classified into two categories: (1) basic, lower-order, or hygiene needs and (2) growth, higher order, or motivator needs. Higher-order needs will fail to motivate goal pursuit (e.g., identification with the brand) until lower-order needs are fulfilled, but beyond a threshold of basic fulfillment, higher-order needs have an increasingly motivational effect on goal pursuit. In this state of lower-level fulfillment, the effect of lower-order needs becomes inconsequential for motivating goal pursuit. We build on this insight to propose that when abundant information about brands is available, such fulfillment of needs can be in the form of perceived or expected fulfillment (e.g., perceived quality), and we categorize CBI antecedents into lower- and higher-order needs.

In branding literature, Keller (1993, 2008) posits that brands have points of parity and difference. Points of difference reflect the advantages of a brand over competitors. Over time, symbolic-based points of difference among brands will likely remain distinct (e.g., brand personality) while other non symbolic-based points of difference may become points of parity (e.g., followers offer similar functional attributes to establish parity with market leaders). Combining these two related insights, we propose in the next section that CBI antecedents have differential effects on CBI over time due to (1) whether they are expected to satisfy consumers’ lower-order (e.g., instrumental) or high-order (e.g., symbolic, innovative) needs and (2) the likelihood that consumers have other substitute brands to achieve such gratification.

Perceived quality and CBI over time

Consistent with the hygiene (lower-order) role in need-gratification theories (Agustin and Singh 2005; Herzberg 1966; Houston and Gassenheimer 1987; Swan and Combs 1976), we conceptualize perceived quality as a need-fulfilling mechanism for instrumental or basic needs in a market-based exchange. We propose that because consumers’ initial perception of quality of the new brand reflects consumers’ expectation of satisfying lower-order needs, and the likelihood that these needs can be met by other brands having parity with the new brand in terms of perceived quality becomes higher over time, this instrumental driver of CBI does not contribute to the growth of CBI in the long run.

Two possible scenarios lead to this prediction. For consumers who initially believe the new brand is capable of satisfying consumers’ basic core needs for quality, need-gratification theory suggests that perceived quality will have decreasing effects on consumers’ identification with the new brand over time. This happens because beyond the point of hygiene need gratification, consumers will place more emphasis on higher-order needs, such as their self-expressive needs, than they will place on lower-order needs (Agustin and Singh 2005; Swan and Combs 1976). For consumers who have an unfavorable initial belief about the new brand’s quality, they will be motivated to fulfill their lower-order needs from brands that they trust will outperform or perform equally as well as the new brand shortly after the introductory phase. In other words, consumers who initially perceive the new brand as less attractive than other brands in terms of quality will not be motivated to maintain a strong identification. The likelihood that consumers can learn about these substitute brands grows stronger over time. Either way, as the new brand moves past the introductory phase, the effect of initially formed perceived quality on the CBI growth rate will likely remain stable, if not decrease, over time. Thus, we hypothesize:

-

H4:

Consumers who initially perceive the new brand to be of higher quality will exhibit stable growth rates of CBI over time.

Self–brand congruity and CBI over time

Because the development of social bonds and relationships in market exchanges creates a mechanism that enhances relational benefits, we conceptualize self–brand congruity as a growth or higher-order need (Agustin and Singh 2005; Herzberg 1966; Vargo and Lusch 2004). We propose that because self–brand congruity satisfies consumers’ higher-order needs, and the likelihood that these needs may otherwise be met by other brands is low, self–brand congruity exerts a positive effect on the CBI growth rate.

First, we mentioned above that beyond the point of hygiene need fulfillment, consumers will place more emphasis on higher-order needs, such as their self-expressive needs, than on lower-order needs (Agustin and Singh 2005; Swan and Combs 1976). This insight suggests that self–brand congruity as the symbolic driver of CBI will become more and more important in motivating CBI. Second, because brand personality represents brand imagery associations that are a point of difference rather than a point of parity among brands (e.g., Keller 1993, 2008), self–brand congruity with the new brand is unique and not easily substitutable by congruity with another brand. Finally, when consumers see a brand as sharing similar identity attributes that are not otherwise available in other brands, they are motivated to generate an increasingly biased yet favorable attitude because positive perceptions of these brands reinforce the continuity of their own self-identity attributes (e.g., Belk 1988; Kleine et al. 1995; Kunda 1990). Therefore, we hypothesize:

-

H5:

Consumers who initially report higher levels of self–brand congruity with a new brand will exhibit higher growth rates of CBI over time.

Consumer innate innovativeness and CBI over time

We conceptualize consumer innate innovativeness also as a higher-order need that creates an identity bond between consumer and brand. In addition to the higher-order need fulfillment provided by self–brand congruity, a brand viewed as innovative satisfies select consumers’ needs for newness, both instrumentally and symbolically. However, unlike self–brand congruity, which partially relies on the brand personality traits and brand positioning––two elements that are not easily imitated by competitors––the innovativeness of a new brand can be a paradox: it can ignite consumers’ intense initial interests, but it is also vulnerable to competitive disruptions to become a point of parity later on (Keller 2008; Mick and Fournier 1998). More specifically, due to their intrinsic need for change, consumers high on innovativeness have a decreased tendency to stick to the same purchase response over time (Baumgartner and Steenkamp 1996).

After the initial period of brand introduction, target brand features can be perceived as less innovative as other competing brand attribute offerings become available. Consumers high on the innovativeness trait are less likely to associate with the previously chosen brand attributes that may have lost their innovative appeal. Additionally, as perceived risk is lowered due to abundant and verified information, consumers will be less likely to rely on the peripheral information about the corporate image of being innovative (Gürhan-Canli and Batra 2004). Innately innovative consumers will likely transition into identifying with a newer innovation on the market to stay true to their self-concept of being innovative. Consequently, the decreased perception of brand innovativeness will lower the importance of the brand’s innovativeness; the consumers’ innate need to be seen as innovative will not be adequately satisfied, causing higher-order needs to become unfulfilled. These arguments suggest that the positive effect of the innovativeness trait on CBI will diminish over time, which in turn slows down the growth rate of CBI among highly innovative consumers.

-

H6:

Consumers who have higher levels of innate innovativeness will exhibit lower growth rates of CBI over time.

Method

Research context and data collection

The iPhone’s initial launch in Spain provided a suitable research context for the study for several reasons. First, the brand was new to all Spanish consumers, creating a radical change to consumers’ perceptual map and a natural starting point to study CBI evolution. Second, the reputation of the iPhone brand and the publicity surrounding its launch were unprecedented. When the iPhone was introduced for the first time in the United States in 2007, it was named the innovation of the year by Time magazine. Well before the launch in Spain, most consumers in Spain were exposed to abundant information about the parent company’s personality (Apple Inc.) and the quality of the iPhone. Finally, the new brand was also positioned as highly functional (i.e., many new features) and symbolic.

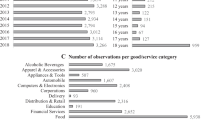

A large European online panel research company allowed us to track a subset of its panel in Spain. We developed the initial questionnaire in English and then had it translated into Spanish by a professional translation service. Two native Spanish speakers completed and checked the wording of the questionnaire. The questionnaire was then revised, back translated, and finally programmed in Spanish. Prior to the launch of the survey, we conducted pretests of the scales to make sure that they were well behaved. Links to the online survey were then sent to panel members for a total of five waves of surveys. We conducted the first wave two months before the launch of the iPhone in Spain. Screening questions in the first wave ascertained whether the panel members owned a cell phone as well as their awareness of the launch of the iPhone. We removed those who were not aware of the iPhone (less than 3 on a seven-point Likert scale) from the survey. The other four waves were carried out at two-month intervals, with the second wave launched approximately 10 days after the actual launch. Each wave was “live” for approximately 2 weeks. To enhance the response rates, we entered panel members into a raffle if they completed all of the waves.

We were able to monitor 708 cell phone users over the entire duration of the study. Our primary purpose was to examine the effects of various antecedents on CBI and to ensure that each consumer had enough repeated measures to fit polynomial growth models for the entire dataset. Therefore, we removed 73 consumers who did not complete all of the five waves of the survey from the sample. The final dataset included 635 usable responses with a balanced design (i.e., each consumer had five waves of data) and a socio-demographically diverse background: 39% were female, 84% lived in an urban area, 56% were under the age of 30, 85% were employed, 48% were married, and 88% held a bachelor’s degree.

Measures

Dependent variable

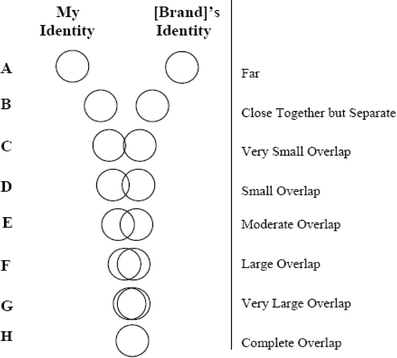

We measured CBI using six items. The cognitive dimension consists of two items (Bergami and Bagozzi 2000). Originating from the interpersonal relationship literature (Levinger 1979), the first item for this scale is a Venn diagram that shows the overlap between consumer identity and brand identity, such that the overlap represents the extent to which a consumer identifies with the brand. This item has a full explanation on what identity means and how to respond to the Venn diagram. The second item, proposed by Bergami and Bagozzi (2000) to cross-validate the Venn diagram item, is a verbal item that describes the identity overlap in words rather than visually. We measured consumers’ affective identification with the brand using two items that are part of the well-cited organizational identification scale (Mael and Ashforth 1992). For the evaluative dimension, two items were used to assess whether the consumer thinks the psychological oneness with the brand is valuable to him or her individually and socially. These items were adapted from Bagozzi and Dholakia (2006).Footnote 2 Following Bagozzi and Dholakia’s (2006) tripartite conceptualization of identification and Tajfel and Turner’s (1985) original definition of social identification, we conceptualized CBI as a formative construct, with three reflective first-order dimensions. In each wave, we placed the cognitive dimension of CBI at the beginning and the other two at the end of the survey.

Independent variables

We measured perceived quality with three items adapted from Netemeyer and colleagues (2004). These items focus on the functional utility of the brand, and we placed them in the middle of the survey. We operationalized self–brand personality congruity as the reverse-coded Euclidean distance between brand personality and consumer personality (Sirgy et al. 1991). To avoid survey fatigue, we measured these brand and consumer personality traits using a brief version of Aaker’s (1997) brand personality scale. Mathematically, this score was calculated as follows:

where BP = brand personality, SP = self personality, and i = 1–5. We measured perceived quality and self–brand congruity for both the iPhone and cell phone brands consumers were currently using because competing activities such as an association with and a positive attitude toward the incumbents can impair the development of CBI with the new brand (e.g., Bhattacharya et al. 1995). We measured consumer innate innovativeness with a scale adapted from Steenkamp and Gielens (2003) in the first wave of the study.

Control variables

We included consumer demographic variables, namely age, income, gender. We also controlled for consumers’ prior use of Apple’s products (as a dummy) because such prior use can gravitate consumers to identify with Apple’s new brands. In addition, it can be argued that firms that launch new brands tend to do a great deal of communications (e.g., advertising, sales promotion) initially and then cut back on these marketing expenses later on. Such practice may artificially force CBI to follow an inverted-U trajectory. Besides, word-of-mouth and the improvements that the new brand underwent may also influence CBI trajectories. Therefore, we also controlled for three time-varying covariates: promotion of the iPhone (two items), the extent of word-of-mouth about the iPhone (four items), and brand improvements of the new brand (three items) for each wave.Footnote 3 To test whether brand image and perceived quality are related to one another, we also measured perceived reputation and brand uniqueness using two items for each construct. Consistent with Keller (1993) who posits that brand image includes both brand reputation and brand uniqueness, we averaged the four items to create a score for brand image. Empirically, these four items also loaded onto the same construct in the exploratory factor analysis. Because we distributed the measures of these various constructs in a non-causal manner (i.e., measuring antecedents first, then CBI), order effects should not be a major concern. Appendix presents the scale measures of the focal constructs and control variables.

Analytical strategy

Data structure

The data have two levels: Level 1 consists of repeated measures nested within individuals, and Level 2 contains between-individual variables. We used hierarchical multivariate linear modeling (HMLM, Raudenbush and Bryk 2002) to test the hypotheses. Briefly, the Level 1 regression captures within-individual growth of CBI as a function of time, time-varying covariates (the new brand’s promotion, word-of-mouth, and improvements for each time period). We clocked time such that the first wave of the survey, which was immediately before the launch of the new brand, represents the start of the growth process (Time 0). Level 2 equations express the Level 1 intercept and slopes as a function of between-individual predictors (consumer innate innovativeness, perceived quality and self–brand congruity with the iPhone and with the brand the consumer was currently using and sociodemographic covariates) and random effects, if any.

Model specification

We chose the quadratic function because the exploratory and baseline analyses (see below) suggest that such trajectories best capture the phenomenon. The full HMLM model, with all predictors and covariates, is as follows:

-

Level 1:

$$ {\text{CB}}{{\text{I}}_{\text{ti}}} = {{\pi }_{{0{\text{i}}}}} + {{\pi }_{\text{1i}}}{\text{t}} + {{\pi }_{\text{2i}}}{{\text{t}}^{{2}}} + {{\pi }_{\text{3i}}}\left( {{\text{PRO}}{{\text{M}}_{\text{ti}}}} \right) + {{\pi }_{\text{4i}}}\left( {{\text{WO}}{{\text{M}}_{\text{ti}}}} \right) + {{\pi }_{\text{5i}}}\left( {{\text{NE}}{{\text{W}}_{\text{ti}}}} \right) + {{\text{e}}_{\text{ti}}}. $$(1)

-

Level 2:

$$ {{\pi }_{{0{\text{i}}}}} = {{\beta }_{{00}}} + {{\beta }_{{0{1}}}}\left( {{\text{GENDE}}{{\text{R}}_{\text{i}}}} \right) + {{\beta }_{{0{2}}}}\left( {{\text{AG}}{{\text{E}}_{\text{i}}}} \right) + {{\beta }_{{0{3}}}}\left( {{\text{INCOM}}{{\text{E}}_{\text{i}}}} \right) + {{\beta }_{{0{4}}}}\left( {{\text{APUS}}{{\text{E}}_{\text{i}}}} \right) + {{\beta }_{{0{5}}}}\left( {{\text{INNO}}{{\text{V}}_{\text{i}}}} \right) + {{\beta }_{{0{6}}}}\left( {{\text{IQU}}{{\text{A}}_{\text{i}}}} \right) + {{\beta }_{{0{7}}}}\left( {{\text{ISB}}{{\text{C}}_{\text{i}}}} \right) + {{\beta }_{{0{8}}}}\left( {{\text{BQU}}{{\text{A}}_{\text{i}}}} \right) + {{\beta }_{{0{9}}}}\left( {{\text{BSB}}{{\text{C}}_{\text{i}}}} \right) + {{\text{r}}_{{0{\text{i}}}}}. $$(2)$$ {{\pi }_{\text{1i}}} = {{\beta }_{{{1}0}}} + {{\beta }_{{{11}}}}\left( {{\text{APUS}}{{\text{E}}_{\text{i}}}} \right) + {{\beta }_{{{12}}}}\left( {{\text{INNO}}{{\text{V}}_{\text{i}}}} \right) + {{\beta }_{{{13}}}}\left( {{\text{IQU}}{{\text{A}}_{\text{i}}}} \right) + {{\beta }_{{{14}}}}\left( {{\text{ISB}}{{\text{C}}_{\text{i}}}} \right) + {{\beta }_{{{15}}}}\left( {{\text{BQU}}{{\text{A}}_{\text{i}}}} \right) + {{\beta }_{{{16}}}}\left( {{\text{BSB}}{{\text{C}}_{\text{i}}}} \right) + {{\text{r}}_{\text{1i}}}. $$(3)$$ {{\pi }_{\text{2i}}} = {{\beta }_{{{2}0}}} + {{\beta }_{{{21}}}}\left( {{\text{APUS}}{{\text{E}}_{\text{i}}}} \right) + {{\beta }_{{{22}}}}\left( {{\text{INNO}}{{\text{V}}_{\text{i}}}} \right) + {{\beta }_{{{23}}}}\left( {{\text{IQU}}{{\text{A}}_{\text{i}}}} \right) + {{\beta }_{{{24}}}}\left( {{\text{ISB}}{{\text{C}}_{\text{i}}}} \right) + {{\beta }_{{{25}}}}\left( {{\text{BQU}}{{\text{A}}_{\text{i}}}} \right) + {{\beta }_{{{26}}}}\left( {{\text{BSB}}{{\text{C}}_{\text{i}}}} \right) + {{\text{r}}_{\text{2i}}}. $$(4)$$ {{\pi }_{\text{3i}}} = {{\beta }_{{{3}0}}} + {{\text{r}}_{\text{3i}}}. $$(5)$$ {{\pi }_{\text{4i}}} = {{\beta }_{{{4}0}}} + {{\text{r}}_{\text{4i}}}. $$(6)$$ {{\pi }_{\text{5i}}} = {{\beta }_{{{5}0}}} + {{\text{r}}_{\text{5i}}}. $$(7)

where CBI = consumer–brand identification, PROM = promotion of iPhone, WOM = word-of-mouth about the iPhone; NEW = brand improvements of the iPhone; these variables are time-varying. Measured at t = 0 are: INNOV = consumer innate innovativeness, APUSE = prior use of Apple products (prior to the launch of the iPhone), IQUA = perceived quality of the iPhone at t0, ISBC = self–brand congruity with the iPhone at t0, BQUA = perceived quality of the current brand at t0, BSBC = self–brand congruity with the current brand at t0, t = 0–4, i = 1,…, 635.

In selecting the model specification that fits the data best and is parsimonious while taking into account the longitudinal nature of the data, we estimated various models with unrestricted, homogeneous, heterogeneous, and first-order autoregressive error structures (for details, see Raudenbush and Bryk 2002). We compared the deviance statistics, which is a model fit index, and also used Akaike’s Information Criterion (AIC) and Bayesian Information Criterion (BIC) indexes of these models to select the most parsimonious model (AIC = -2LL + 2 K, BIC = -2LL + K*ln(n) where -2LL is the deviance statistic, K is the number of parameters being estimated, and n is the sample size). These comparisons, which we report together with the estimation results (Table 2), suggest that the model with the unrestricted error structure fit the data the best.

Parameter interpretation

The parameters of the CBI growth trajectories consist of an initial level and its growth parameters such as the velocity and acceleration. In this HMLM model, the first derivative with respect to time t, π1i + 2π2it, reflects the velocity of CBI trajectory (e.g., the growth rate). Acceleration in the growth rate of CBI is captured by the second derivative with respect to time t, 2π2i, and it is also the change in the velocity of the growth of CBI. In turn, π2i is a function of prior use, consumer innate innovativeness, self–brand congruity with the new brand and the current brand, and perceived quality of the new brand and the current brand––all measured at time t0. This temporal order of the antecedents and CBI should lend some empirical evidence of causality. Note that we also measured self–brand congruity and perceived quality in each wave and used these time-varying data of the focal antecedents to show empirical evidence of antecedent growth patterns in the additional analysis section.

To test H1 through H3, the coefficients of interest are the beta coefficients in Eq. 2, which shows the influence of these predictors on the initial level of CBI (the intercept at time t = 0). We tested hypotheses H4 through H6 by focusing on the beta coefficients in Eqs. 3 and 4, which show the influence of these predictors on CBI growth rate (π1i and π2i). However, for a trajectory with a quadratic temporal term, the growth rate is also a function of time (π1i + 2π2it) where the effect of the quadratic temporal term (π2i) will take over the effect of the linear temporal term (π1i) as time elapses. Therefore, although a statistical test of the longitudinal effects of CBI antecedents is on the growth rate (the first derivative), such a test should focus on what variables influence the coefficient of the quadratic temporal term of the trajectory (π2i) and the sign of such influence. Customers who are high on variables that have a negative (positive) influence on π2i will have a growth rate that is lower (faster) than those who are low on those variables as time elapses.

Measurement models

We first ran an exploratory factor analysis for all of the constructs. All items for the reflective constructs exhibited strong loading patterns on their intended factors. Results from the confirmatory factor analysis showed that all of the scale items loaded significantly on their intended constructs, providing evidence of convergent validity. The zero-order correlation between perceived quality and brand image was .80 (p < .01), suggesting that the two constructs were closely related to each other, which is consistent with prior research. We therefore included only perceived quality in the HMLM model. Discriminant validity was established for all of the other constructs since the variance shared between any two constructs was less than the average variance extracted by the constructs.

We examined the validity of the formative construct CBI using partial least squares analysis. Results showed that all three dimensions had significant path weights that formed the CBI construct. Each of the CBI dimensions had high inter-item correlations, providing evidence of convergent validity within each dimension. Path weights and factor loadings of each first-order dimension of CBI appear in the Appendix. Table 1 reports the descriptive statistics, reliability indexes, average variance extracted, and the correlation matrix of the focal constructs. We created composite scores of each construct to estimate the growth models. As a side note, the aggregate means of CBI across individuals appear to be deceptively stable over time; these averages are not indicative of the heterogeneity in how within-individual processes unfold and balance each other out over time.

Results

Exploratory analyses

As an exploratory step, we first plotted the CBI growth trajectories (Fig. 2) of a random sample of 25 consumers using smoothing lines. While an inverted-U pattern emerged from the overall assessment, the individual consumer plots exhibited significant heterogeneity, indicating that there are differences between individuals that are explained by causes other than the passage of time. Next, we proceeded with the formal data analysis by first running a null model without predictors. This analysis revealed that 33% of the total variance in CBI growth resided within-individuals (over time), and 67% of the total variance resided between consumers.

Growth trajectories

Baseline growth model

We first specified a null model without any predictor and a random intercept at Level 2 of the model. We found that there was significant between-consumer heterogeneity in the CBI intercept (χ 2 (634) = 9525.42, p < .01). Adding a fixed linear term to the Level 1 equation improved model fit significantly (∆χ 2 (1) = 9.38, p < .01), and adding a fixed quadratic term further improved model fit (∆χ 2 (1) = 4.72, p < .05). When we contrasted nested models of fixed versus random temporal terms, we found that there were significant random effects in the linear (∆χ 2 (2) = 356.91, p < .01) and quadratic (∆χ 2 (5) = 95.13, p < .01) temporal terms. In the model with unrestricted error structure using time and time squared as predictors, the linear temporal term was positive (β = .07, p < .01) while the quadratic temporal term was negative (β = –.012, p < .05). In other words, on average, the CBI growth trajectory followed an inverted-U shape, but there was significant heterogeneity across consumers.

Full model

To build toward the full model, we sequentially added the covariates and predictors into the model. When time is set to zero, the combined Level 1 and Level 2 equation represents the predictors of the initial level of CBI. To test the hypotheses about the longitudinal effect of perceived quality, self–brand congruity, and consumer innate innovativeness, we added these variables as predictors of the linear and quadratic temporal effects at Level 2. Essentially, the coefficients of these variables in predicting the linear (Eq. 3) and the quadratic trend (Eq. 4) represent the interaction between them and the corresponding temporal terms. A comparison of model fit indexes also showed that the model with an unrestricted error structure fit the data best. In the full model, the intercepts of the linear and quadratic temporal terms at Level 2 should be interpreted in tandem with the other predictors in the Eqs. 3 and 4. These predictors jointly capture the heterogeneity in the coefficient of the linear and quadratic temporal terms of the growth trajectory. We used the results of the full model appear in Table 2 to report our test of the hypotheses.

We first report the results for testing the hypotheses about the initial level of CBI. Consistent with hypotheses H1 through H3, we found that consumers will have higher initial levels of CBI when they perceived the quality of the new brand during its introductory phase more positively (H1, β = .172, p < .01), perceived higher level of self–brand congruity (H2, β = .117, p < .05), and have a high level of innate innovativeness (H3, β = .201, p < .01). Therefore, H1, H2, and H3 are all supported. It should be noted that prior use of Apple products also contributed positively to the initial level of CBI with the iPhone (β = .169, p < .05) whereas elderly consumers tended to have lower initial level of CBI with the new brand (β = –.075, p < .05). Self–brand congruity with the incumbents (β = .067, not significant [n.s.]) and how consumers perceived the quality of these incumbents (β = –.027, n.s.) did not appear to have any significant influence on the initial level of CBI with the new brand.

We now turn to the between-individual longitudinal hypothesis tests. We found that the interaction between consumers’ initial perception of quality of the new brand and their self–brand congruity with the new brand did not interact with the linear temporal term. Because consumers’ initial perception of quality of the new brand did not interact with the quadratic temporal term either (H4, β = –.001, n.s.), H4 is supported. However, the interaction between self–brand congruity with the iPhone and the quadratic temporal term was significant and positive (H5, β = .015, p < .05). This suggests that consumers’ initial perception about self–brand congruity with the new brand makes CBI grow faster over time, in support of H5. In support of H6, we found that consumer innate innovativeness appears to slow down CBI growth rate, as evident by its negative interaction with the quadratic temporal term (H6, β = –.009, p < .10, two-tailed test). Note that the interaction between consumer innate innovativeness with the linear temporal term was significant and positive (β = .039, p < .05). This suggests that highly innovative consumers had higher initial levels of CBI that grew fast at first, but as time elapsed, this growth rate lost steam faster than it did for those who were not highly innovative.

With respect to the effects of competing brands, the results also showed that the interaction between the quadratic temporal term and consumers’ perceived quality of the incumbents at the time of the new brand launch was negative and significant (β = –.016, p < .00) and that between the quadratic temporal term and self–brand congruity with the incumbents was also negative and significant (β = –.012, p < .05). These effects support self-consistency theory, which predicts that cognitive consistency biases consumers to favor incumbents at the cost of the new brand (e.g., Lecky 1945; Tellis 1988).

Using Snijders and Bosker’s (1999, p. 180) formulae, we calculated that the within- and between-individual predictors explained 33% of within-individual variation and 39% of between-individual variation. For illustration purposes, we plotted the significant interactions in Fig. 3a, which describes the interaction between self–brand congruity and time, and Fig. 3b, which depicts the interaction between consumer innate innovativeness and time. These figures also illustrate that although the effects of consumer traits are very strong when it comes to identification with new brands, their effects are fleeting. On the contrary, the smaller effect of self–brand congruity with the new brand at the initial stage gains momentum over time.

Additional analysis

Based on need-gratification theories, we theorized that the longitudinal effects of initial perceived quality and self–brand congruity are due to the extent to which each CBI driver satisfies different levels of needs. In order to give credence to our theory, we estimated two growth models with perceived quality and self–brand congruity over the five waves of the survey as the dependent variables. The results show that, for perceived quality, the coefficient of the linear term (β = –.05, s.e. = .043, n.s.) and quadratic temporal terms (β = .006, s.e. = .01, n.s.) were not significant, suggesting that initial perceived quality remained stable over time. In contrast, in the growth trajectory for self–brand congruity, the coefficient of the linear temporal term was significant (β = –.238, s.e. = .07, p < .01), and the coefficient of the quadratic temporal term was also significant and positive (β = .05, s.e. = .016, p < .01). As our theory would predict, these results suggest that consumers do in fact experience growth in their self–brand congruity and that they are increasingly attracted to the new brand due to its symbolic values (self–brand congruity) rather than its instrumental attributes (e.g., initial perceived quality). Finally, we also tested whether initially formed perceived quality interacted with higher-order temporal terms. However, we found that its interaction with a cubic temporal term was not significant. This analysis provides additional support for H4.

General discussion

To the best of our knowledge, this is the first longitudinal study to examine antecedents to CBI. While the body of consumer behavior research on traits is voluminous, our study is also among the first to adopt a dynamic perspective on consumer traits. Our findings provide useful insights into consumer–brand relationships from a social identity theory perspective, with important implications for strategic brand management.

Summary of findings and theoretical implications

Our study contributes to the literature on identification with social entities and with new brands. On a broader scope, our findings resonate with consumer culture theory, which posits that “consumers actively rework and transform symbolic meanings encoded in advertisements, brands, retail settings, or material goods to manifest their particular personal and social circumstances and further their identity and lifestyle goals” (Arnould and Thompson 2005, p. 871). In doing so, we enrich the understanding of not only consumers’ multiple motivations to engage in relationships with a brand (Sheth and Parvatiyar 1995) but also the dynamics of those motivations (Keller and Lehmann 2006).

CBI with a new brand

Prior research on identification in both the marketing and management literature has generally focused on identification with an existing social entity. There have been very few studies on the formation and evolution of organizational identification, and most of these are qualitative in nature (Pratt 2000). The heterogeneity of people’s motivation to identify with social entities has also received scant attention. We build on and extend this literature by offering theoretically grounded predictions and empirical evidence on individuals’ identification with a new brand as it evolves over time. Our empirical findings shed light on the evolution of CBI in three aspects: (1) the initial level of CBI with a new brand is determined not only by instrumental but also by symbolic and trait-based drivers, (2) CBI with a new brand exhibits an invert-U shaped growth trajectories in general, and (3) there exists heterogeneity across individuals’ growth trajectories.

Dynamics of CBI antecedents

We believe our study is the first to provide empirical evidence of the longitudinal effects of CBI antecedents. More specifically, the effect of the instrumental driver of CBI (e.g., perceived quality) appears to be stable over time. In contrast, the symbolic driver (e.g., self–brand congruity) makes CBI grow stronger over time. Thus we reconcile mixed findings in prior research on symbolic and instrumental drivers of identification. For example, Bhattacharya et al. (1995) findings suggest that symbolic drivers appear to be a stronger predictor of identification than instrumental drivers (standardized coefficients: .39 versus .13, respectively) while Kuenzel and Halliday’s (2008) findings suggest that instrumental drivers have a stronger effect over symbolic drivers (standardized coefficients: .46 versus .21, respectively). Although these differences can be attributable to different measures of identification and the product category (e.g., functional, symbolic, experiential, or hybrid; see Park et al. 1986), our findings seem to suggest that the role of the symbolic and instrumental drivers of CBI changes over time, in accordance with need-gratification theories and the dynamics of points of parity/difference.

The empirical findings also seem to suggest that shortly after the introduction, the downward side of CBI growth trajectories results from the tug of war between the upswing effect of self–brand congruity and the downswing effects jointly created by consumer innate innovativeness and incumbents’ factors (e.g., perceived quality of incumbents, consumers’ self–brand congruity with incumbents). Note that consumer innate innovativeness has a positive effect on the initial level of CBI. Taken together, these findings not only reinforce the notion of points of parity and differences between incumbent brands and the new brand in the capability to satisfy consumers’ lower-order and high-order needs, but they also underscore the paradoxical effect of consumer traits that has not been examined in the literature.

Toward a broader conceptualization of CBI antecedents

At a broader level, our findings provide empirical evidence for the notion of two types of identification in the social identity theory literature (Rousseau 1998). While situated identification is interest based and cue dependent, deep structure identification stems from the embodiment of characteristics of the identified target into one’s self-concept. Our empirical findings imply that although consumers’ initial perception of the quality is important in predicting the initial level of CBI, perceived quality appears to be a situated CBI driver: its effect does not seem to help with sustaining CBI over time. In addition, the results also suggest that certain individual traits drive situated CBI because their effects dissipate over time (e.g., innate innovativeness) whereas certain personality traits drive deep structure CBI because their effects grow stronger over time (e.g., the extent to which a consumer’s personality overlaps with the brand’s personality). Much more research is needed to identify the drivers of situated and deep-structure CBI.

Managerial implications

Our findings suggest that for new brands, what sizzles at the initial stage of consumer– brand relationships may turn brittle––much like a fling (Fournier 1998). Given that in a relationship, “maturity is never better than build-up and is often marginally inferior” (Jap and Anderson 2007, p. 271), a comprehension of what drives CBI with new brands during the build-up phase is substantively important. Based on the findings, we derive a number of normative guidelines for brand managers on how to effectively allocate brand investment to build stronger CBI and extend the life of new brands.

First, to maintain and extend the growth phase of new brands, brand managers should invest in activities that enhance consumers’ perceived quality and self–brand congruity. This is because these instrumental and symbolic drivers of CBI help with building the initial level of CBI and do not interfere with the process of creating stronger CBI over time. While the role of perceived quality in driving brand equity has been widely recognized in the literature, our findings seem to indicate that it plays an important role only in “setting the stage,” i.e., it influences only the initial level of CBI but not CBI growth. More importantly, brand managers who manage new brands should shift investment priority from instrumental drivers such as quality to symbolic drivers such as self–brand congruity at the later stages of the brand life cycle. This strategy is more effective because after the introductory phase, the return on investment from symbolic drivers in the form of creating stronger CBI and extending the CBI growth phase is much higher than that from instrumental drivers.

Second, prior research on consumer traits tends to inform brand managers that these traits have either a positive or negative influence on consumer behavior. The majority of research on consumer innate innovativeness also suggests that innovative consumers are more likely to adopt new brands and products, leaving open the issue of its longitudinal repurcursions. Here, we provide both theoretical and empirical evidence that the very consumer traits that draw consumers to the brand at the introduction stage may actually detach them from the brand at a later stage of the product life cycle. This type of CBI driver is a double-edged sword. Although managers do not have control over consumer traits, the understanding of the longitudinal effects of these variables is still important for strategic planning. Because the effects of these consumer traits on CBI at the introduction of the brand are strong but ephemeral, a brand manager should engage in other marketing activities such as sales promotion and expansive distribution to facilitate consumers in these segments to engage in purchasing behavior before their initial identification with the brand starts to lose steam.

Finally, the empirical findings also suggest that while non-innovative consumers are less likely to identify with a new brand, brand managers can still build CBI among these consumers by focusing on other drivers of CBI such as perceived quality and self–brand congruity. In that light, brand managers should be aware that although the perceived quality and self–brand congruity of incumbents do not appear to influence consumers’ initial level of CBI with the new brand, these competitive factors contribute to the dissipation in the growth rate of CBI with the new brand in the long run.

Limitations and further research

The results of this study should be interpreted with its limitations in mind. First, we conducted the empirical study on a single brand (iPhone) of a widely-recognized company (Apple Inc.), in one product category. The empirical context is fairly unique in that the new brand enjoyed unprecedented publicity and encountered minimal competition within the time frame of the study. While this sample controls for noise such as industry characteristics and provides a natural setting for testing our hypotheses, this may have compromised the generalizability of the findings to other product categories and other types of new brand introduction. However, given the high level of innovation in today’s markets and the rapid pace of technological improvements in many industries, more brands are falling into the “innovative” category. Moreover, since the iPhone was mostly appealing to younger generations during its introductory phases and we surveyed an online consumer panel, our sample was generally young (56% below 30) and university educated (88%). Future research may study new products that appear innovative to people in various demographic categories in order to examine whether there are differences in terms of CBI formation over time across demographic groups. Additionally, the results imply that innately innovative consumers have additional avenues (i.e., quality, self–brand congruity) to form CBI, even with a non-innovative brand.

We conjecture that our results about the longitudinal effects of instrumental and symbolic drivers of CBI still hold for non-innovative but symbolic brands. Without the innovativeness of these brands as a motivation, consumers will still need to rely on situational cues such as the instrumental drivers (e.g., initial perceived quality) more heavily in their CBI formation, but as the brands become more mature and perceived risk decreases, the effect of perceived quality will be less important than that of the symbolic drivers. For non-innovative brands that are less symbolic, the effect of perceived quality on CBI may grow over time because in these cases, the brands are positioned as purely functional and their functionality then becomes the central cue. In other words, the product category may be a Level 3 moderator that we have controlled for by using a single brand, but it can be easily captured in further research using multiple product categories and including category dummies as Level 3 moderators. Nevertheless, we believe this longitudinal approach to CBI is promising, and the notion of deep-structure versus situated CBI deserves more empirical marketing research.

Second, we did not measure brand attachment (Park et al. 2010) and cannot empirically show the discriminant validity between CBI and brand attachment. However, there are conceptual distinctions between the two constructs. Conceptually, Park et al. (2010) posit that brand attachment is a reflective construct with two dimensions: (1) self–brand connection, which refers to “the cognitive and emotional connection between the brand and the self,” and (2) prominence, which “reflects the salience of the cognitive and affective bond that connects the brand to the self” (Park et al. 2010, p. 2). These authors further propose that self–brand connection can occur because the brand represents who consumers are (an identity basis) or because “it is meaningful in light of goals, personal concerns, or life projects.” It is evident that Park et al. (2010) integrate identity theory that is primarily concerned with the private self (Stryker 1968) and brand concepts (e.g., self–brand connection, Escalas and Bettman 2005) to conceptualize the construct of brand attachment. Our theoretical foundation for CBI is social identity theory (Tajfel 1982; Tajfel and Turner 1985), which is more concerned with the social self and is also the backbone of Bhattacharya and Sen’s (2003) consumer–company identification framework. In social identity theory (Tajfel 1982, p. 2), the original definition of identification is multidimensional, including cognitive, affective, and evaluative; this is the definition we adopt in our conceptualization of CBI. In social identity theory and the literature that stems from it such as organizational identification research, identity salience is a function of either the importance of the identified identity to the individual (which we believe is similar to the prominence dimension in Park et al.’s (2010) conceptualization of brand attachment) or the social context (Ashforth and Johnson 2001; see also Oyserman 2009; Reed 2004; Shavitt et al. 2009). Based on these theoretical backgrounds, it appears that CBI has conceptual overlap with brand attachment, but CBI conceptualization does not treat salience as an inherent part of the concept, while brand attachment does not include the evaluative component that CBI does. Further research that examines how these two constructs are related will be useful.

Third, the scale that we used to measure CBI includes two items for each dimension. Because this scale has been validated in prior research (Bagozzi and Dholakia 2006) and passed all the necessary validity tests in our data, we do not think the parsimony seriously impairs the validity of the findings. However, the parsimony of the scale limits us from exploring the growth trajectories of the specific CBI dimensions over time. To achieve this goal, future research is needed to develop more items for each of the dimensions. In this regard, the marketing literature seems to concur that the cognitive dimension of CBI is best measured by the two items we adapted from Bergami and Bagozzi (2000). The affective and evaluative dimensions of CBI need further scale development and refinement based on research in the marketing and psychology literatures (e.g., Henry et al. 1999; Park et al. 2010). Furthermore, future research on CBI may also explore the role of CEOs in driving CBI. For example, consumers’ identification with Steve Jobs (i.e., interpersonal identification) can induce them to identify with any new brands that Apple has in its portfolio. How does this effect vary between the U.S. and the other countries? Similarly, with the loss of Steve Jobs, will consumers maintain their strong CBI with the new brand?Footnote 4

Finally, we were able to track consumers over the course of about a year. While this duration maintains a reasonable temporal contiguity between the antecedents and CBI (Rindfleisch et al. 2008) and it is a reasonable time frame for purchase decisions for the product we were studying (e.g., cell phone), it is possible that studies with a longer duration may unravel further insight into the evolution of the consumer–brand relationships. For example, competition during the time frame of the study was minimal, but may have intensified afterward. It will be useful to conduct further research on CBI with other less unique brands over longer time frames.

Notes

While image and reputation are often examined as antecedents to identification in the management literature, we do not use them in our framework for two reasons. First, as Bhattacharya and Sen (2003) state, “the notion of customer-company identification is conceptually distinct from consumers’ identification with a company’s brands, its target markets, or, more specifically, its prototypical consumer.” Using image or reputation can often capture firm-based perceptions rather than brand perceptions that we are trying to capture. Second, prior research in marketing has suggested that perceived quality is closely related to the external cues such as brand image and brand reputation (e.g., Dodds et al. 1991; Keller 1993; Zeithaml 1988), suggesting the two to be interrelated. Given brand management literature that has supported brand prestige (Kuenzel and Halliday 2008) as an antecedent to brand identification, it would be redundant to include both perceived quality and brand image in the conceptual framework. Third, such redundancy also produces multicollinearity in the empirical model.

It might be argued that consumers may have difficulty in answering some of these questions without actual use. We believe this is not the case for our research context. First, brand identification is not contingent on actual use. For example, a consumer can identify with a luxury brand without being able to afford it. Second and most important, the survey questions captured the state of the customer–brand relationship in the respective time period.

These time-varying covariates can also be modeled in the same way as we did for CBI antecedents to show how their effects interact with time from the initial stage. However, the effects of these variables are not the focus of our study. In addition, such specification will increase the number of parameters to be estimated, thus less parsimonious than the model we chose.

We thank an anonymous reviewer for pointing this out.

References

Aaker, D. A. (1991). Managing brand equity. New York: The Free Press.

Aaker, J. L. (1997). Dimensions of brand personality. Journal of Marketing Research, 34, 347–356.

Agustin, C., & Singh, J. (2005). Curvilinear effects of consumer loyalty determinants in relational exchanges. Journal of Marketing Research, 52, 96–108.

Ahearne, M., Bhattacharya, C. B., & Gruen, T. (2005). Antecedents and consequences of customer-company identification: expanding the role of relationship marketing. Journal of Applied Psychology, 90, 574–85.

Arnould, E. J., & Thompson, C. J. (2005). Consumer Culture Theory (CCT): twenty years of research. Journal of Consumer Research, 31, 868–882.

Ashforth, B. E., Harrison, S. H. & Corley, K.G. (2008). Identification in organizations: an examination of four fundamental questions. Journal of Management, 34, 325–374.

Ashforth, B. E., & Johnson, S. A. (2001). Which hat to wear? The relative salience of multiple identities in organizational contexts. In M. A. Hogg & D. J. Terry (Eds.), Social identity processes in organizational contexts (pp. 31–48). Philadelphia: Psychology Press.

Bagozzi, R. P., & Dholakia, U. M. (2006). Antecedents and purchase consequences of customer participation in small group brand communities. International Journal of Research Marketing, 23, 45–61.

Baumgartner, H., & Steenkamp, J. B. E. M. (1996). Exploratory consumer buying behavior: conceptualization and measurement. International Journal of Research in Marketing, 13, 121–137.

Belk, R. W. (1988). Possessions and the extended self. Journal of Consumer Research, 15, 139–168.

Bergami, M., & Bagozzi, R. P. (2000). Self-categorization, affective commitment, and group self-esteem as distinct aspects of social identity in the organization. British Journal of Social Psychology, 39, 555–577.

Bhattacharya, C. B., & Sen, S. (2003). Consumer–company identification: a framework for understanding consumers’ relationships with companies. Journal of Marketing, 67, 76–88.

Bhattacharya, C. B., Rao, H., & Glynn, M. A. (1995). Understanding the bond of identification: an investigation of its correlates among art museum members. Journal of Marketing, 59, 46–57.

Brown, T. J., Barry, T. E., Dacin, P. A., & Gunst, R. F. (2005). Spreading the word: investigating antecedents of consumers’ positive word-of-mouth intentions and behaviors in a retailing context. Journal of the Academy of Marketing Science, 33, 123–38.

Dodds, W. B., Monroe, K. B., & Grewal, D. (1991). Effects of price, brand, and store information on buyers’ product evaluations. Journal of Marketing Research, 28, 307–319.

Donavan, T. D., Janda, S., & Suh, J. (2006). Environmental influences in corporate brand identification and outcomes. Journal of Brand Management, 14, 125–136.

Donavan, T. D., Brown, T. J., & Mowen, J. C. (2004). Internal benefits of service-worker customer orientation: job satisfaction, commitment, and organizational citizenship behaviors. Journal of Marketing, 68, 128–46.

Dukerich, J. M., Golden, B. R., & Shortell, S. M. (2002). Beauty is in the eye of the beholder: the impact of organizational identification, identity, and image on the cooperative behaviors of physicians. Administrative Science Quarterly, 47, 507–533.

Dutton, J. E., Dukerich, J. M., & Harquail, C. V. (1994). Organizational images and member identification. Administrative Science Quarterly, 39, 239–63.

Elliott, R., & Wattanasuwan, K. (1998). Brands as symbolic resources for the construction of identity. International Journal of Advertising, 17, 131–144.

Erdem, T., Swait, J., & Valenzuela, A. (2006). Brands as signals: a cross-country validation study. Journal of Marketing, 70, 34–49.

Escalas, J. E., & Bettman, J. R. (2005). Self-construal, reference groups, and brand meaning. Journal of Consumer Research, 32, 378–89.

Fournier, S. (1998). Consumers and their brands: developing relationship theory in consumer research. Journal of Consumer Research, 24, 343–373.

Gardner, B. B., & Levy, S. J. (1955). The product and the brand. Harvard Business Review, 33, 33–39.

Golder, P. N., & Tellis, G. J. (2004). Growing, growing, gone: cascades, diffusion, and turning points in the product life cycle. Marketing Science, 23, 207–218.

Gürhan-Canli, Z., & Batra, R. (2004). When corporate image affects product evaluations: the moderating role of perceived risks. Journal of Marketing Research, 51, 197–205.

Henry, K. B., Arrow, H., & Carini, B. (1999). A tripartite model of group identification: theory and measurement. Small Group Research, 30, 558–581.

Herzberg, F. (1966). Work and the nature of man. Cleveland: World Publishing Company.

Hogg, M. A. (2003). Social identity. In M. R. Leary & J. P. Tangney (Eds.), Handbook of self and identity (pp. 462–479). New York: The Guilford Press.

Holt, D. B. (2002). Why do brands cause trouble? A dialectical theory of consumer culture and branding. Journal of Consumer Research, 29, 70–90.

Homburg, C., Wieseke, J., & Hoyer, W. D. (2009). Social identity and the service-profit chain. Journal of Marketing, 73, 38–54.

Houston, F., & Gassenheimer, J. (1987). Marketing and exchange. Journal of Marketing, 51, 3–18.

Jap, S. D., & Anderson, E. (2007). Testing a life-cycle theory of cooperative interorganizational relationships: movement across stages and performance. Management Science, 53, 260–275.

Katz, D. (1960). The functional approach to the study of attitudes. Public Opinion Quarterly, 24, 163–204.

Keller, K. L. (2008). Strategic brand management: Building, measuring, and managing brand equity (3rd ed.). Upper Saddle River: Pearson/Prentice Hall.

Keller, K. L. (1993). Conceptualizing, measuring, and managing customer-based brand equity. Journal of Marketing, 57, 1–22.

Keller, K. L., & Lehmann, D. R. (2006). Brands and branding: research findings and future priorities. Marketing Science, 25, 740–759.

Kleine, S. S., Kleine, R. E., III, & Allen, C. T. (1995). How is a possession “me” or “not me”? Characterizing types and antecedents of material possession attachment. Journal of Consumer Research, 22, 327–43.

Kuenzel, S., & Halliday, S. V. (2008). Investigating antecedents and consequences of brand identification. Journal of Product and Brand Management, 17, 293–304.

Kunda, Z. (1990). The case for motivated reasoning. Psychological Bulletin, 108, 480–98.

Lecky, P. (1945). Self-consistency: A theory of personality. New York: Island Press.

Levinger, G. (1979). Toward the analysis of close relationships. Journal of Experimental Social Psychology, 16, 510–44.

Mael, F., & Ashforth, B. E. (1992). Alumni and their alma mater: a partial test of the reformulated model of organizational identification. Journal of Organizational Behavior, 13, 103–123.

Maslow, A. H. (1943). A theory of human motivation. Psychological Review, 50, 370–396.

Maxham, J. G., III, Netemeyer, R. G., & Lichtenstein, D. R. (2008). The retail value chain: linking employee perceptions to employee performance, customer evaluations, and store performance. Marketing Science, 27, 147–167.

Mick, D. G., & Fournier, S. (1998). Paradoxes of technology: consumer cognizance, emotions, and coping strategies. Journal of Consumer Research, 25, 123–143.

Mittal, B. (2006). I, me, and mine: how products become consumers’ extended selves. Journal of Consumer Behaviour, 5, 550–62.

Netemeyer, R. G., Krishnan, B., Pullig, C., Wang, G., Yagci, M., Dean, D., Ricks, J., & Wirth, F. (2004). Developing and validating measures of facets of customer-based brand equity. Journal of Business Research, 57, 209–224.

Oyserman, D. (2009). Identity–based motivation: implications for action-readiness, procedural-readiness, and consumer behavior. Journal of Consumer Psychology, 19, 250–260.

Park, C. W., Jaworski, B. J., & MacInnis, D. J. (1986). Strategic brand concept-image management. Journal of Marketing, 50, 135–45.

Park, C. W., MacInnis, D. J., & Priester, J. R. (2009). Research directions on strong brand relationships. In D. J. MacInnis, C. W. Park, & J. R. Priester (Eds.), Handbook of brand relationships (pp. 379–91). Armonk: M.E. Sharpe.

Park, C. W., MacInnis, D. J., Priester, J. R., Eisingerich, A. B., & Iacobucci, D. (2010). Brand attachment and brand attitude strength: conceptual and empirical differentiation of two critical brand equity drivers. Journal of Marketing, 74, 1–17.

Pratt, M. G. (2000). The good, the bad, and the ambivalent: managing identification among Amway distributors. Administrative Science Quarterly, 45, 456–93.

Raudenbush, S. W., & Bryk, A. S. (2002). Hierarchical linear models: Applications and data analysis methods. Thousand Oaks: Sage.

Reed, A. (2004). Activating the self-importance of consumer selves: exploring identity salience effects on judgments. Journal of Consumer Research, 31, 286–295.

Rindfleisch, A., Malter, A. J., Ganesan, S., & Moorman, C. (2008). Cross-sectional versus longitudinal survey research: concepts, findings, and guidelines. Journal of Marketing Research, 45, 261–279.

Rousseau, D. (1998). Why workers still identify with organizations. Journal of Organizational Behavior, 19, 217–233.

Schau, H. J., & Gilly, M. C. (2003). We are what we post? Self-presentation in personal web space. Journal of Consumer Research, 30, 385–404.

Schneider, B. (1987). The people make the place. Personnel Psychology, 40, 437–53.

Shavitt, S., Torelli, C. J., & Wong, J. (2009). Identity-based motivation: constraints and opportunities in consumer research. Journal of Consumer Psychology, 19, 261–266.

Shavitt, S. (1992). Evidence for predicting the effectiveness of value-expressive versus utilitarian appeals: a reply to Johar and Sirgy. Journal of Advertising, 21, 47–51.

Sheth, J. N., & Parvatiyar, A. (1995). Relationship marketing in consumer markets: antecedents and consequences. Journal of the Academy of Marketing Science, 23, 255–271.

Sirgy, M. J. (1982). Self-concept in consumer behavior: a critical review. Journal of Consumer Research, 9, 287–300.