Abstract

In this paper, we use new data and modern time series econometrics to reassess the relationship between interest rates, prices and inflation in Britain across the two and a half centuries from 1750 to 2006 for which reliable data are available. We pay particular attention to monetary regimes that may lead to breaks in the relationship and to associated shifts in the stochastic structure of interest rates and prices. The behaviour of real interest rates is examined in detail and estimates of the expected real rate are calculated using a variety of methods to check for robustness.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

From Henry Thornton at the turn of the nineteenth century (Thornton (1802 [1978]), through Wicksell (1907), Fisher (1907, 1930) and Keynes (1930) in the early twentieth century and Friedman and Schwartz (1982) in the late twentieth century, to Alvarez et al. (2001) in the twenty-first century, the relationship between interest rates and prices, either in levels or changes (i.e., inflation), has provoked great interest and debate. In this paper, we use new data and modern time series econometrics to reassess this relationship across the two and a half centuries from 1750 to 2006 for which reliable British data are available. We pay particular attention to monetary regimes that may lead to breaks in the relationship and to associated shifts in the stochastic structure of interest rates and prices.

Section 2 thus introduces the data that we use and reports initial exploratory analysis using simple graphical and regression approaches. Section 3 looks explicitly at the Gibson Paradox, the relationship between the interest rate and the price level that was argued to have been found during the gold standard regime. The behaviour of the real interest rate—in particular, the long run stability of the expected real rate—is the concern of Sect. 4. Section 5 provides a summary and conclusions.

2 Initial data analysis

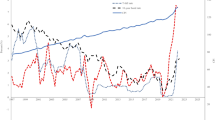

The price series that we use is the composite consumer price index of O’Donoghue et al. (2004, Table 1) for 1750 to 2003, updated to 2006. Denoting this series as P t , the logarithms p t = log (P t ) are plotted in Fig. 1 and the annual rate of inflation, π t = 100Δp t , is plotted in Fig. 2. The familiar pattern of British price movements are clearly seen in Fig. 1: an upward trend during the latter half of the eighteenth century, stability throughout the nineteenth century up to the outbreak of World War I, a sharp increase at the end of the war followed by a decline throughout the interwar period, and then a continued upward trend, with various degrees of steepness, till the end of the sample period. Inflation is very volatile until the mid-1800s, although it fluctuates around zero (the median rate of inflation between 1750 and 1860 is indeed zero). Inflation fluctuations tend to decline thereafter, albeit with bouts of volatility, but average inflation is markedly positive (post-1860 mean inflation is 3% per annum).

For the long interest rate we use the yield on Consols, taken from Mitchell (1998) and extended to 2006. This series, denoted R t , is shown in Fig. 3. For more than two centuries (1750–1960) the Consol yield fluctuated within the band 2.25−6%. From 1965 to 1997, the yield was consistently well above this band, reaching over 14% during the mid-1970s. From 1998, after the Bank of England became independent, it has once again been below 6%.

Figure 4 presents a scatterplot of R t on π t , with the ‘aberrant’ period from 1965 to 1997 highlighted, along with the two inflation outliers of 31.0% in 1800 and −26.4% in 1802. The 1965 to 1997 observations appear as a distinct cluster and a regression of R t on π t over this sub-period produces

Note the absence of autocorrelation and the highly significant positive coefficient on inflation (figures in parentheses are standard errors). In contrast, the corresponding regression for the remainder of the sample (1750–1964, 1998–2006) yielded

Accounting for the severe residual autocorrelation either by estimating with a first-order autoregressive error process or by first differencing reduces the t-ratio from 1.0 to 0.3. For example,

This confirms that, for the great majority of the two and a half centuries for which we have data, there was no contemporaneous linear relationship between R t and π t . Neither does including lags of Δπ t improve matters. Adding three lags of this regressor for the 1751–1964 period only increases the R 2 to 0.012.

Barro (1987) argues that government spending impacts upon interest rates. Figure 5 shows the government spending ratio g t , defined as the ratio of government spending to GNP. The large spikes in g t associated with increased military spending during the Napoleonic and the twentieth century world wars are clearly seen, as well as the rising trend throughout the twentieth century. Including g t as a control variable produces the following regressions

The inclusion of the government spending ratio, although it enters significantly, has no impact on the strength and direction of the relationship between consol yields and inflation. However, is this evidence of no relationship a consequence of failing to distinguish between periods when Britain was on (1750–1796, 1822–1913, 1925–1931) and off the gold standard? Figure 6 suggests not and this is confirmed by the following regressions. For the gold standard sample, we obtain

For the periods when the gold standard was not in operation, we obtain

and

There continues to be no relationship between R t and π t in any of these periods and, indeed, no relationship between R t and g t except under the gold standard (the possible presence of residual autocorrelation indicated by the dw statistic in this regression does not affect this relationship: the coefficient on g t remains significant at less than the 0.005 level when HAC standard errors are used).

3 The Gibson Paradox

Consider now Fig. 7, which is the scatterplot of R t on the price level, p t , for the period 1750 to 1914, split (by examination of the data) into periods closely approximating the years when Britain was on and off the gold standard, i.e., 1750–1794, 1795–1820, 1821–1914. During the two ‘gold standard’ periods, there is clearly a positive relationship between the two variables, but there appears to be a negative relationship in the intervening years. The positive correlation between the long term interest rate and the price level is termed the ‘Gibson Paradox’, regarded by Keynes (1930, p. 198) as ‘one of the most completely established empirical facts in the whole field of quantitative economics’. For examples of quantitative evidence concerning the Gibson Paradox, see Sargent (1973), Shiller and Siegel (1977), Benjamin and Kochin (1984), Barsky and Summers (1988) and Mills (1990), while reviews of the theoretical explanations of the paradox may be found in Friedman and Schwartz (1982, Chap. 10) and Capie et al. (1991).

The impression obtained from Fig. 7 is confirmed by the following regressions

Note that π t and g t are both included as control variables and R t-1 is included to model any dynamics. Their joint inclusion fails to stop p t from remaining significant with the predicted signs. We can thus confirm the existence of the ‘traditional’ form of the Gibson Paradox, a positive relationship between interest rates and the price level, for the years of the gold standard before 1914. However, we also find that there is still a relationship between these two variables when the gold standard was suspended, albeit a negative one.

Not surprisingly, any relationship between interest rates and the price level completely disappears after 1914:

Although the residuals in this regression exhibit time varying heteroskedasticity, fitting a GARCH model to them produces little change to the coefficient estimates or their significance.

4 Modelling the real interest rate

The ex post, or realised, real interest rate is defined as

Following Rose (1988), for example, this definition of the realised real rate follows from the Fisher decomposition of the nominal interest rate as the sum of the ex ante real rate and expected inflation:

If expected inflation differs from observed inflation by a forecasting error,

then

This will lead to (1) if r e t = r t − η t + 1 , i.e., if the ‘forecast error’ in predicting real interest rates offsets the inflation forecast error. From (1) it would seem that the stochastic properties of r t will depend upon the stochastic properties of the observed R t and π t + 1 . Table 1 reports the conclusions on the level of integration of the respective series that we have drawn from subjecting them to a battery of unit root tests across a range of sample periods. The years from 1965 to 1997, already indicated above as ‘aberrant’, is the only period for which the variables are ‘balanced’ (Granger 1999, Chap. 1), i.e., the price level is I(2), inflation is thus I(1), interest rates are also I(1) and the observed real rate, being the difference between these series, is also I(1). For all other periods and, indeed, for the complete sample, interest rates are I(1) and inflation is I(0) but real rates are also I(0), whereas they should, in terms of balance, be I(1).

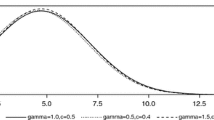

The nonstationarity of interest rates and the apparent stationarity of inflation and the real rate can also be observed in the spatial densities of the three series shown in Fig. 8 and the plot of the real rate itself in Fig. 9. The spatial density is a concept developed in Phillips (2001, 2005) and is a generalisation of the probability distribution to nonstationary time series. The spatial densities shown in Fig. 8 are kernel densities scaled by \({\sqrt{T}}\) (calculated using a gaussian kernel with bandwith T −0.2, as recommended by Phillips 2001) and have the interpretation of indicating the amount of time (the ‘sojourn’ time) spent by a series in the vicinity of a particular value. For a nonstationary series, the spatial density thus distributes soujourn time across space, whereas for a stationary series a conventional density estimate distributes probability across space. Phillips (2001) demonstrates that for a stationary series, the spatial density will be fairly smooth, have quite a narrow spatial support, and will have a single mode. For a nonstationary series, the spatial density will be irregular and show substantial variation in sojourn levels over a wide range of spatial values, providing information about the spatial points that the series has visited and the relative proportion of those visits to the full sample. The spatial densities in Fig. 8 show, first, that interest rates, although having a mode between 3 and 3.5%, also visit the regions [4.5, 5] and [8.5, 10.5] more frequently than surrounding regions, thus confirming that interest rates are nonstationary; and, second, that both inflation and real rates are concentrated in the region [0, 5], consistent with stationarity.

A resolution of the paradox is provided by the simulation experiment of Markellos and Mills (2001) and the theoretical analysis of Sun and Phillips (2004). This shows that, if the difference between an I(1) and an I(0) series is computed, a standard Dickey–Fuller test for a unit root would almost always reject the correct I(1) null if the variance of the I(0) series was much larger than the innovation variance of the I(1) series. The final column of Table 1 reports the values for the variance ratio λ = var ΔR/varπ. In most cases λ is extremely small, so that the variation in stationary inflation swamps the ‘I(1)-ness’ of interest rates so that real rates exhibit stationarity as well, which is clearly seen in Fig. 9.

We thus continue by assuming that real rates are stationary. However, both the conditional mean and variance of r t are autocorrelated, as seen from the sample autocorrelation functions in Fig. 10. Although Sun and Phillips (2004) argue that any long memory in interest rates would be swamped by the variation in inflation, it is hard to reconcile the sample autocorrelation function of r t with anything other than a short memory process. After some experimentation, the following AR(2)-EGARCH(1,2) model with generalised error (GED) innovations (see Nelson 1991) was found to adequately fit r t for the complete sample period.

This model has the following interpretation. The mean real rate is estimated to be 2.55% per annum, around which the real rate cycles stochastically (since the roots of the AR(2) component are complex: 0.28 ± 0.27i) with an average period of 8.2 years. However, this cyclical movement is rather volatile, being buffeted by drawings from a fat-tailed GED random variable (since the GED parameter is estimated to be less than 2) scaled by a time-varying σ t , whose evolution is plotted in Fig. 11. This is seen to be asymmetric, with rapid increases in volatility being followed by slower declines. Writing the asymmetric part of the EGARCH specification as

enables the ‘news impact’ curve to be defined as

Thus, ∂f/∂ɛt - 1 = 0.515 if ɛt - 1 > 0 and ∂f/∂ɛt - 1 = − 1.485 if ɛt - 1 < 0, showing the asymmetric response of volatility to innovations, i.e., ‘news’.

Given that we have earlier identified several sub-periods showing different statistical properties, models for the real rate process were also built for the periods 1750–1914, 1915–1964 and 1965–2005. For the first period, an AR(3)–EGARCH(1,2), again with GED innovations, provided a satisfactory fit

The stochastic properties of the real rate for the period up to 1914 are very similar to those for the complete period. The mean real rate is 2.87% per annum, around which the real rate cycles stochastically with an average period of 5.9 years (the roots of the AR(3) process are 0.35 ± 0.62i and −0.47). The GED innovation distribution has fatter tails than for the complete period, with its parameter, estimated to be 1.12, being insignificantly different from unity, which defines the double exponential, or Laplace, distribution. The news impact curve is

so that the asymmetry is even more marked in this subperiod than for the complete period.

Rather simpler models are required for the two later periods, being

and

The mean real rate is 1.94% per annum between 1915 and 1964, but is 2.87% from 1965 onwards. The cyclical pattern in the real rate has disappeared after 1915 and, from 1965, so has the fat-tailed GED innovations, being replaced by gaussianity. The asymmetry in the conditional variance has also disappeared after 1915, with ARCH(1) processes being all that is required in both sub-periods. Persistence in volatility also decreases over time, since the ARCH parameter is smaller in the final sub-period.

The robustness of these results is examined by fitting two alternative models to the real rate. The first is a two-state Markov switching process in which both the mean and the variance depend on the state (see Garcia and Perron 1996; Mills and Wang 2003, 2006, for previous applications to real interest rates and details of estimation and hypothesis testing). The fitted model is

This model categorises the real rate as falling into one of two states every year: a high mean(μ (S t = 1) = 3.07%), high variance (σ(S t = 1) = 8.331) regime, and a low mean (μ(S t = 2) = 2.40%), low variance (σ(S t = 2) = 2.294) regime. The transition probabilities associated with the two states are p 11 = 0.96, p 12 = 0.04, p 21 = 0.02 and p 22 = 0.98, where p ij is the probability that S t = j given that S t-1 = i, i,j = 1, 2. The expected duration of being in state i is given by (1 − p ii )−1, so that the expected durations are 27 and 42 years respectively. Thus, once the real rate enters a particular state, it tends to stay in that state for a considerable length of time, so that the expected real rate is extremely stable. This is shown in Fig. 12, which plots the (smoothed) probability of being in state 1 (high mean, high variance). On the assumption that a probability in excess of 0.5 categorises the year as being in state 1, then this state occurs throughout the period 1750 to 1858, apart from the years 1786 to 1792, while state 2 occurs throughout the subsequent period, apart from the years 1914 to 1921 and 1939.

Figure 13 superimposes a nonparametric trend onto the real rate series obtained using a Nadaraya–Watson kernel estimator (see Mills 2003, Chap. 5.3). This trend is smoothly and slowly varying and may be interpreted as an estimate of the underlying expected real rate. This is 2.75% at the beginning of the period in 1750 and slowly increases to 3.5% during the 1820s. It then declines to 1.5% by 1950 before increasing again to stand at 2.15% by 2005.

The Markov switching model and the nonparametric trend, although neither can effectively deal with the conditional volatility that is a major feature of the observed real rate, do lend support to the perception obtained from the set of volatility models that the expected real rate is rather stable, only slowly varying through a maximum range of 1.5 to 3.5% per annum. Indeed, from the GARCH models a strong claim can be made that, apart from the period from the outbreak of World War 1 to the mid-1960s, when the expected real rate was just under 2%, the expected real rate was constant at 2.86%.

5 Conclusions

Throughout the last two and a half centuries, long interest rates in Britain, as measured by the Consol yield, have been generated by a nonstationary, I(1) process. The price level, on the other hand, has been stationary or nonstationary depending upon the monetary regime. Typically it has been I(1), so that innovations (or shocks) to the price process are permanent and inflation—the stationary transformation of the price level—is the appropriate measure to analyse. During the gold standard era from 1820 to 1914, however, the price level was stationary, so that shocks have only a temporary impact and prices revert in time back to an underlying equilibrium level. In stark contrast, from the start of the stagflation era, 1965, to the beginning of Bank of England independence in 1997, the price level was I(2). This implies that inflation was nonstationary and that shocks to inflation were permanent and the price process was characterised by permanent shocks to both its level and slope. Consequently, pinning down the relationship between interest rates, prices and inflation has been difficult. The Gibson Paradox, that there is a relationship between interest rates and the price level, is confirmed to hold during the gold standard, even when controlling for inflation and government spending and allowing for dynamics. Interest rates and inflation are positively related during the 1965 to 1997 period but there is no relationship between them during any other period. The changing integration properties of the price level over the complete period perhaps suggests that long memory models of the type fitted by Baillie et al. (1996) to inflation and extended by Gil-Alana (2007) may be a useful extension to the approach taken here.

The real interest rate is stationary, even though the nominal rate is nonstationary, a consequence of the excessive volatility of inflation compared to that of nominal rates. It also exhibits volatility, having an asymmetric conditional volatility process driven by fat-tailed innovations, i.e., that increases in volatility are more rapid than falls and these movements are driven by innovations drawn from a distribution for which the probability of obtaining large (absolute) values is much greater than for a normal distribution. The extent of this asymmetry and ‘fat-tailed’-ness appears to have dissipated during the twentieth century. The expected real rate has been very stable across the entire period, being around 2.9% except between 1915 and 1964, when it was about one per cent lower. Alternative models produce estimates of the expected real rate that are consistent with this. Given the evidence of shifting volatility, an interesting extension of the models fitted here would be to the switching ARCH (SWARCH) class of models introduced by Cai (1994) and Hamilton and Susmel (1994): see Abramson and Cohen (2007) for recent references and developments.

References

Abramson A, Cohen I (2007) On the stationarity of Markov-switching GARCH processes. Econom Theory 23:485–500

Alvarez F, Lucas RE Jr, Weber WE (2001) Interest rates and inflation. Am Econ Rev 91:219–225

Baillie RT, Chung C-F, Tieslau MA (1996) Analysing inflation by the fractionally integrated ARFIMA–GARCH model. J Appl Econom 11:23–40

Barro RJ (1987) Government spending, interest rates, prices, and budget deficits in the United Kingdom, 1701–1918. J Monetary Econ 20:221–247

Barsky RB, Summers LH (1988) Gibson’s Paradox and the gold standard. J Polit Econ 96:528–550

Benjamin DK, Kochin LA (1984) War, prices and interest rates: a martial solution to Gibson’s Paradox. In: Bordo MD, Schwartz AJ (eds) A retrospective on the classical gold standard 1821–1931. University of Chicago Press, Chicago, pp 587–604

Cai J (1994) A Markov model of switching regime ARCH. J Bus Econ Stat 12:309–316

Capie FH, Mills TC, Wood GE (1991) Money, interest rates and the great depression: Britain from 1870 to 1913. In: Foreman-Peck J (ed) New perspectives on the Late Victorian economy. Cambridge University Press, Cambridge, pp 251–284

Fisher I (1907) The rate of interest. Macmillan, New York

Fisher I (1930) The theory of interest. Macmillan, New York

Friedman M, Schwartz AJ (1982) Monetary trends in the United States and the United Kingdom. University of Chicago Press, Chicago

Garcia R, Perron P (1996) An analysis of the real interest rate under regime shifts. Rev Econ Stat 78:111–125

Gil-Alana LA (2007) Fractional integration and structural breaks at unknown periods of time. J Time Ser Anal (in press)

Granger CWJ (1999) Empirical modeling in economics: specification and evaluation. Cambridge University Press, Cambridge

Hamilton JD, Susmel R (1994) Autoregressive conditional heteroskedasticity and changes in regime. J Econom 64:307–333

Keynes JM (1930) A treatise on money. Macmillan, London

Markellos RN, Mills TC (2001) Unit roots in the CAPM? Appl Econ Lett 8:499–502

Mills TC (1990) A note on the Gibson Paradox during the gold standard. Explor Econ Hist 27:277–286

Mills TC (2003) Modelling trends and cycles in economic time series. Palgrave Macmillan, Basingstoke

Mills TC, Wang P (2003) Regime shifts in European real interest rates. Weltwirtsch Archiv 139:66–81

Mills TC, Wang P (2006) Modelling regime shift behaviour in Asian real interest rates. Econ Model 23:952–966

Mitchell BR (1998) International historical statistics: Europe, 1750–1993, 4th edn. Macmillan, Basingstoke

Nelson DR (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59:347–370

O’Donoghue J, Goulding L, Allen G (2004) Consumer price inflation since 1750. Econ Trends 604:38–46

Phillips PCB (2001) Descriptive econometrics for non-stationary time series with empirical illustrations. J Appl Econ 16:389–413

Phillips PCB (2005) Econometric analysis of Fisher’s equation. Am J Econ Sociol 64:125–168

Rose AK (1988) Is the real interest rate stable? J Finance 43:1095–1112

Sargent TJ (1973) Interest rates and prices in the long run: a study of the Gibson Paradox. J Money Credit Bank 5:383–449

Shiller RJ, Siegel JJ (1977) The Gibson Paradox and historical movements in real interest rates. J Polit Econ 85:891–907

Sun Y, Phillips PCB (2004) Understanding the Fisher equation. J Appl Econom 19:869–886

Thornton H (1802 [1978]) An enquiry into the nature and effects of the paper credit of Great Britain. Augustus M. Kelley, Fairfield, NJ

Wicksell K (1907) The influence of the interest rate on prices. Econ J 17:213–220

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mills, T.C. Exploring historical economic relationships: two and a half centuries of British interest rates and inflation. Cliometrica 2, 213–228 (2008). https://doi.org/10.1007/s11698-007-0023-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-007-0023-3