Abstract

Do different types of innovation require distinct kinds of external knowledge search strategies? This paper explores this question using an original innovation survey of 385 KIBS firms in Ontario (Canada). Applying ordered regression analysis, we show that KIBS which conduct marketing innovation have higher degrees of external knowledge sourcing than those that engage in other types of innovation. KIBS that conduct product innovation have higher degrees of external partnering than those that focus more intensively on other types of innovation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The last decade has marked a growing interest in understanding and exploring the scope of open innovation (OI) in different industrial contexts (Bogers et al. 2017; West and Bogers 2017; Huizingh 2011; Dahlander and Gann 2010; van de Vrande et al. 2009; Chesborough 2007). Underlying the debate on OI, there is the presumption that openness to external knowledge can spur a firm’s innovation performance by providing access to complementary technology from external sources (Chesbrough 2017, p. 35). This has led to a growing empirical literature that investigates how the opening up of innovation processes affects a firm’s innovation performance (Laursen and Salter 2006; Tsai and Wang 2008; van de Vrande et al. 2009; Barge-Gil 2013).

Prior studies on OI usually take different open search strategies as their explanatory variable (Monteiro et al. 2017; Terjesen and Patel 2017; Ferreras-Méndez et al. 2016; Wang et al. 2015; Parida et al. 2012; Love et al. 2011) and focus on the conditions under which openness to external partners affects innovation performance. Extant studies have paid less attention, however, to the type of innovation that benefits most from OI strategies. This is an important lacuna since common sense suggests that different types of innovation require different kinds of knowledge inputs, and therefore need different knowledge management strategies.

In this paper, we contribute to the debate by exploring whether different types of innovation require distinct kinds of external knowledge search strategies by using a survey of 385 knowledge-intensive business service (KIBS) firms in Ontario (Canada). We aim to extend an emergent stream of research of OI strategies in services in general (Virlee et al. 2015; Mina et al. 2014), and in KIBS in particular (Janssen et al. 2018; Rodriguez et al. 2017; Doloreux and Shearmur 2013). We distinguish between two types of external knowledge search strategies: the degree to which a firm relies on different types of external knowledge sources; and the degree to which a firm forms different formal partnerships with external firms. Therefore, this research provides insights for KIBS trying to strategize their search for new ideas, faced with the choice of adopting open search strategies that involve the use of a wide range of external knowledge sources and a large set of potential partners.

The remainder of this article is organised as follows. Section 2 presents the literature review and engages in a review on open innovation in general and on OI in KIBS. Section 3 describes the research design, the variables and the analytical model. Section 4 contains the empirical part of the paper. Finally, Sect. 5 discusses the findings and elaborates on the implications of the findings.

2 Theory and evidence

2.1 Open innovation

The starting point of the OI story is that innovation cannot be regarded as a purely individual act. It depends on the use of a variety of external knowledge sources and inter-organisational collaborations (Roper et al. 2017; Brunswicker and Vanhaverbeke 2015; Mina et al. 2014). An implication of this conceptualisation is that the highly interactive and relational nature of innovation necessitates an OI model for a firm’s strategy. OI is defined as ‘the use of purposive inflows and outflows of knowledge to accelerate international innovation, and to expand the markets for external use of innovation, respectively’ (Chesbrough et al. 2006, p. 1).

Research on OI identifies two modes of OI (Bogers et al. 2017; West and Bogers 2017). The outbound mode involves internally developed technologies and ideas that are sold to external organisations often for commercialisation purposes. The inbound mode involves the use of purposeful inflows of knowledge to accelerate internal innovation either with immediate monetary compensation related to knowledge flow (pecuniary mode) or with no immediate compensation (nonpecuniary mode).

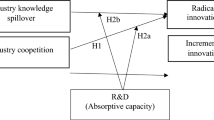

In this context, there is a consensus that a firm’s external knowledge sourcing strategy is a key factor in the development of innovation (Battisti et al. 2014; Brunswicker and Vanhaverbeke 2015; Clausen et al. 2013; Love et al. 2014). This is in contrast to the traditional view of innovation, which is essentially portrayed as a linear process where firms mainly rely on internal knowledge, usually through internal R&D and human capital accumulation (Rothwell 1991). Empirical studies on inter-organisational collaboration provide evidence that openness positively influences firms’ innovation activities and performance (Rodriguez et al. 2017; Drechsler and Natter 2012; Lazzarotti et al. 2011; Laursen and Salter 2006). Other studies provide evidence that OI is strongly associated with a firm’s absorptive capacity, which permits the company to identify, absorb and make use of external knowledge (Ferreras-Méndez et al. 2016).

The external knowledge sourcing view is complementary to the resource-based theory which suggests that firms require resources they cannot produce internally, so they acquire them from external partners. According to Wernerfelt (1984), the firm is a bundle of resources and is not self-sufficient. The most common motive to use and interact with external knowledge sources is, therefore, to complement internal resources to reduce uncertainty and access others’ resources. Whatever the role played by external knowledge and information, firms’ internal resources remain crucial, since without them firms lack the know-how and the capacity to absorb and exploit what is learnt from the outside. Scholars concur that firms with a high absorptive capacity raise not only their likelihood to collaborate, but also their ability to take better advantage of external knowledge (Kostopoulos et al. 2011). Absorptive capacity is considered as the level of expertise of firms and builds upon cumulative knowledge stock and knowledge flows (Cohen and Levinthal 1990). It enables firms to integrate knowledge from external sources by leveraging their ability to recognise, integrate, assimilate and apply new knowledge.

In the field of innovation, the discussion about the nature of openness required by innovative firms goes back to the contributions by Laursen and Salter (2006) who developed the concept of breadth and depth as two key components of the openness of individual firms’ external search strategies. Search breadth is defined as ‘the number of different search channels that a firm draws upon in its innovative activities’ (Laursen and Salter 2006, p. 135). In contrast, search depth is defined in terms of the extent to which firms draw deeply from these different external sources or search channels (idem, pp. 135–136). Lately, a significant corpus of work has focused on knowledge search strategies at the level of the firm with the objective of capturing and investigating the impact of behaviour along the breadth and depth dimensions for a firm’s innovation performance (Ferreras-Méndez et al. 2016; Leiponen and Helfat 2010; Kang and Kang 2009). This work has recently been extended to examine the breadth and depth of collaborative relationships, where Laursen and Salter (2014) make the distinction between informal knowledge sources and formal partnerships. The former captures knowledge search through both formal and informal relations, while the latter captures the numbers of innovation-related cooperative partners.

To sum up, most scholars agree on the benefits of accessing external knowledge beyond the firm’s boundaries for its innovation performance, and there are still open questions regarding the extent to which different innovation types influence a firm’s external knowledge sourcing strategy. Thus, most of this literature focuses on the degree to which different knowledge sourcing strategies are associated with innovation. It offers several insights into the use of external knowledge sources and innovation processes; its limitation is that most contributions usually take different open search strategies as their explanatory variable. Compared to the literature on OI, this paper contributes to shedding new light in this area, by considering, as its dependent variable, the types of external knowledge search strategies adopted by KIBS firms.

2.2 Open innovation in KIBS

There are several distinctive features of innovation processes that make the adoption of OI strategies particularly attractive for KIBS. First, KIBS are establishments for which the primary activities depend on human capital, knowledge, and skills and their role consists of providing knowledge-intensive inputs to the business processes of other organisations (Muller and Doloreux 2009). In this sector, knowledge can be considered as the most important resource to increase new competencies and as a precondition for the generation of new services.

Second, innovation in KIBS can take many forms. It can involve the development of new services, new ways of producing and delivering services, new forms of interactions with clients, and new forms of commercialisation and marketing strategies (Amara et al. 2009). Service innovations require new knowledge or new knowledge combinations resulting from the acquisition, assimilation and exploitation of new knowledge (Muller and Doloreux 2009).

Third, innovation in KIBS results from a combination of in-house and external knowledge owned by various parties (Miles 2008). The cumulative nature of the exchange of knowledge occurs through informal and formal interactions and exchanges with clients and other organisations within the value chain (Shearmur and Doloreux 2015). The role of external actors in the innovation process is not limited to clients (Asikainen and Mangiarotti 2017). However, clients play an important role in the production of new services since the final service is often co-produced with clients and emerges through the interaction between KIBS and their clients (Muller and Doloreux 2009). Scholars refer to the notion of ‘co-production’ of knowledge to denote the way to produce and transform knowledge which relies on a client’s knowledge base and the pool of codified knowledge, and the way this intertwines with learning and innovation on one or both sides of the relationship (Bettencourt et al. 2002). With the exception of a few technology-oriented KIBS, new services are less the result of R&D than of the acquisition of new technologies and/or software (Doloreux et al. 2016) and service innovations remain difficult to legally protect (Chang and Chen 2016).

Taking these characteristics of innovation in KIBS into account, and considering the diversity of approaches adopted by KIBS to generate, assimilate and diffuse knowledge, scholars recognise that the key role of KIBS is “locating, developing, combining and applying various types of generic knowledge about technologies and applications to the local and specific problems, issues and contexts to their clients” (Miles 2005, p. 39). This has led to a flourishing new research stream that studies the various OI strategies that KIBS can adopt in their collaborative innovation efforts. Rodriguez et al. (2016) used Spanish data to explore the knowledge sourcing strategies of KIBS by examining the relationship between these strategies and two dimensions of innovativeness: the type of innovator and the degree of openness (reliance on internal versus external information sources). They found that different knowledge sourcing profiles exist across KIBS industries: independent innovators (i.e. firms with few external interactions, relying on R&D), Barras-type innovators (i.e. firms which innovate as a consequence of introducing new technology), balanced innovators (i.e. firms that rely on a variety of internal and external resources to innovate), and, highly cooperative innovators (i.e. firms that engage in innovation partnerships). Furthermore, they found that the degree of openness in OI strategies is not associated with a higher or lower propensity to innovate.

Trigo and Vence (2012) also investigated the scope and patterns of knowledge search in Spanish service firms. They identified three broad profiles: firms intensive in techno-scientific flows of information, firms intensive in interactions with clients, and the lonely innovators with low collaboration intensity. Their findings reveal that the relationship between cooperation behaviours and innovation is directly linked. Also, the profiles adopted by services is linked to different innovation performance: product innovation is linked to techno-scientific flow of innovation, process innovation is linked to collaboration with clients, and organisation innovation is associated with lonely innovators.

These results are in line with the works of Mina et al. (2014), who show that the UK business services collaborate intensely with clients, on the one hand, and universities and research organisations, on the other. However, they show that service firms attached more importance to scientific and technological knowledge than to market knowledge compared to manufacturing firms. This may be understood in the light of Shearmur and Doloreux (2016) exploration of Canadian KIBS on the nature of the OI process. They show that if market information, or rapidly outdated knowledge about preferences and trends, is a key input to a firm’s innovative activities, then the degree and type of openness that is required will differ from firms where innovation rests on more technological knowledge (often coupled with internal R&D capabilities). According to them, slow innovators will rely on non-market-sourced information and infrequent contacts with knowledge sources of innovations, including universities and research laboratories, and fast innovators will be relying on market-sourced information and frequent interactions.

On the basis of the literature review presented above, in the empirical part we analyse the extent to which a KIBS firm’s innovation type influences its external knowledge sourcing strategy. By doing so, the contribution of this article is twofold:

-

1.

First, since most studies focusing on OI have dwelt upon manufacturing industries, this study provides insights into another industry (KIBS) and responds directly to a research gap in the literature where OI in services remains a poorly developed area of study (Mina et al. 2014; Miozzo et al. 2016).

-

2.

Second, it uses empirical information concerning whether the types of service innovation—product, process, management, and marketing—influence the external knowledge sourcing strategies (external knowledge sources and formal partnerships with external firms). Thus, we are not testing the benefits from openness to external knowledge on innovation performance of KIBS, but rather examine whether the development of different types of service innovation is more conducive to the adoption of distinct OI strategies. In the literature there is little structured empirical analysis on this question since the majority of studies on KIBS uses knowledge sourcing strategies as explanatory variables, and focuses on the relationship between knowledge sourcing and innovation.

3 Research methodology

3.1 Data source and sample

The data used in the quantitative analysis originate from a firm-level survey which was developed for the research project ‘Creating Digital Opportunity: Canada’s ICT Industry in Global Perspective.’ The aim of the survey was to study the characteristics and patterns of innovation activities in KIBS in the Canadian province of Ontario and to investigate whether the geographic location of KIBS establishments alters their propensity to innovate. The core questions in the questionnaire were inspired from Statistics Canada’s Survey of Innovation and Business Strategy, the Community Innovative Survey, and the third edition of the Oslo Manual of the Organisation for Economic Cooperation and Development (OECD). The rationale for undertaking a separate survey emanated from concerns over the coverage of existing KIBS surveys—which usually exclude establishments with less than 15 employees—and the lack of official statistics in Canada on KIBS disaggregated at the community level. Several academic articles that use similar approaches to study KIBS in Canada have now been published (Shearmur and Doloreux 2016; Doloreux and Shearmur 2012; Amara et al. 2009).

The survey was carried out between September 19, 2015 and May 4, 2016 through computer-assisted telephone interviews. The survey was addressed to the director of each establishment. Given their senior position and responsibilities, these individuals were considered to have a good understanding of their establishment’s innovation organisation. The primary data source for the survey population was Dun & Bradstreet’s Ontario directory (2015). An initial sample of 2000 KIBS establishments was randomly drawn from the entire population of firms available (5060 establishments). The sampling was restricted to computer services, legal services and management services. Firms with fewer than 5 and over 200 employees were not included in the sample. In this respect, we deviated from Industry Canada’ categorisation of SMEs (Industry Canada 2016) in service-based business given the fact that they define a small business as one that has fewer than 100 employees (if the firm is producing a goods-producing business) or fewer than 50 employees (if the firm is a service-based business). A minimum target of 350 participants was set. These calculations were based on a 5% margin of error and a 95% confidence level. Ultimately, we obtained valid responses from 392 establishments, representing a sample rate of 19.6%.Footnote 1

Two methodological concerns that are commonly raised in survey analysis are non-response bias and common method bias. To assess the non-response bias in our sample, we compared early respondents with late ones and found no significant differences in key demographic variables such as KIBS size and industries. This suggests that non-response would not likely bias our findings (Armstrong and Overton 1977). To minimise a potential common method bias effect, we ran Harman’s single factor test (Harman 1976) and found that the total variance for a single factor was less than 50%, suggesting that common method bias was not a serious problem in this study.

3.2 Dependent variable: open innovation strategy

We use two distinct dependent variables to measure a firm’s OI strategy. The first dependent variable measures ‘external sourcing’ by counting the number of types of external parties that provide relevant information to the firm and also taking into account the importance of these partners. For this purpose, we employed a survey question which asks: ‘during the 3 years, 2012–2014, how important to your establishment’s innovation activities was each of the following information sources?’ Respondents had to choose one of four answers: not used (coded 0), low importance (coded 1), medium importance (coded 2), and high importance (coded 3). Respondents could choose from 11 types of potential partners: clients; suppliers; competitors; others KIBS; universities and other higher education institutions; college and technical institutes; federal government research laboratories; provincial government research laboratories; conferences, trade fairs, and exhibitions; scientific and trade/technical publications; professional and industry association. Given 11 sourcing types and low–medium–high importance differentiation, the variable of external sourcing ranges from 0 to 33. Due to the categorical nature of our other variables, for parsimony we scaled this variable into three scales: low, medium, and high. Using equal sized intervals is vulnerable to outliers; therefore, we used a supervised discretisation method, namely Chiu et al. (1990) approach that maximises entropy over the discretised space.

The second dependent variable measures ‘external partnering’ by counting the number of types of external parties with which a focal firm cooperated. The survey asks: ‘did your establishment cooperate on any innovation activities other enterprises or institutes during the 3 years period 2014–2012?’ We included seven types of organisations for such cooperation: clients or customers; supplier; competitors; other KIBS; universities or higher education institutions; commercial laboratories or R&D institutes; government or public research institutes. The survey further specifies three possible geographical locations of these partners: regional within Ontario; Canada; and, all other countries. We calculated the external partnering variable by adding 1 for every organisation–location combination that respondents indicated. The seven types of collaborators and the three geographical locations were combined into a single measure, ranging from 0 to 21. Here again, we categorised providers into three ordinal levels of external partnering: low external partnering, medium external partnering and high external partnering using the Chiu et al. (1990) approach.

3.3 Explanatory variables

3.3.1 Innovation types

Following the Oslo manual (2005), we define service innovation as the market introduction of services that are either ‘new to the firm’ or ‘new to the firm’s market’. Four different forms of innovation are considered. Product (service) innovation includes significant improvements in technical specifications, components and materials, software in the product, user friendliness, or other functional characteristics in the service. Process innovation includes significant changes in techniques, equipment, and/or software. Marketing innovation involves significant changes in product design or packaging, product placement, and product promotion or pricing. Organisational innovation is a new organisational method in business practices, workplace organisation, or external relations (OECD 2005). We created four dummy variables for each of these innovation types,Footnote 2 which is coded 1 if the establishment introduced an innovation, and 0 otherwise.

3.3.2 Innovation activities

Innovation activities were analysed by using two groups of variables. The first group of variables concerns the use of ICT applications that were examined based on the responses to the question ‘During the 3 years, 2012–2014, did your establishment use any of the following information and communication technologies (ICTs) in the reference year?’ We used seven ICT applications: (1) Internet-enabled mobile devices; (2) company-wide computer networks; (3) e-commerce platforms; (4) industry-specific software; (5) customer/supplier relationship management software; (6) cloud computing; and (7) video-conferencing. The seven ICT applications were accumulated to form a single ‘ICT use’ variable with the range of 0–7.

The second group captures information on innovation activities and describes ‘all scientific, technological, organisational, financial and commercial steps which actually lead, or are intended to lead, to the implementation of innovations. Some of these activities may be innovative in their own right, while others are not novel but are necessary to implementation’ (OECD 2005). Here, respondents were asked ‘During the 3 years, 2014–2012, did your establishment engage in the following innovation activities?’ We used five types of innovation activities: internal R&D; external R&D, acquisition of equipment and software; training; design. Each of these items was coded as a binary variable, 0 as ‘not applicable’ and 1 as ‘applicable’.

3.3.3 Control variables

A number of standard control variables were included to control for other factors that could be correlated with our dependent variables (Becheikh et al. 2006). We controlled for firm size by including the logarithm of an establishment’s number of employees in 2014. Second, we controlled for the age of the firm. Third, we controlled for export intensity by using a continuous variable measuring the percentage of sales obtained in international markets. Finally, we controlled for KIBS industries’ heterogeneity and create three dummy variables for KIBS industry: computer system designs and related services, legal services and management services.

3.4 Ordered logit model

Our empirical analysis studies the relation between a firm’s OI strategy (degree of external sourcing and degree of external partnering) and different types of innovation, controlling for key firm-specific factors and industry fixed effect. Since our dependent variables each consist of three ordinal scales, we rely on ordered logit estimation for our regression analysis, which estimates the odds of reaching a higher level of the dependent variable.

It is important to point out that our analysis by necessity is exploratory and is about association, not causality. It is not possible with the cross-sectional data at our disposal to establish cause and effect. Thus, we are unable to say whether firms adapted a specific open innovation strategy because they are more innovative, or whether they are innovative because they have adopted a specific open innovation strategy. Since adopting an open innovation strategy is a process occurring over time, it is likely that both causal directions apply and will be difficult to disentangle (if, indeed, they can be) without either detailed case histories or panel data: however, if significant associations between innovation and open innovation strategies are established, this will, in itself, provide new insights into innovation processes in KIBS establishments, insights that will call for further exploration.

4 Results

4.1 Univariate analysis

Table 1 presents univariate statistics for the means of the independent variables in each of our dependent variables’ ordinal categories. The left panel focuses on external sourcing, whereas the right panel centres on external partnering. A first result that can be derived from Table 1 is that establishments that adopt different OI strategies portray little variation in their propensity to conduct certain types of innovation. In Table 1, providers with high, medium, and low degrees of external sourcing have a highly similar propensity to conduct product innovation. That is, 69% of the KIBS with high degrees of external sourcing conduct product innovation, while this propensity is 65 and 70% for providers with medium and low degrees of external sourcing. There is slightly more variation in the propensity to conduct process and organisational innovation across external sourcing categories, but the relation is ambiguous. Establishments with high degrees of external sourcing are more likely to conduct process and organisational innovation than medium sourcers, but less likely than low sourcers.

We can make similar observations about external partnering. In Table 1, across external partnering categories, there is little variation in the average propensity to conduct organisational and marketing innovation (between 33 and 45% for the former, and between 33 and 39% for the latter). There is also an ambiguous relation in the propensity to conduct process innovation across external partnering categories, with KIBS that conduct medium levels of partnering (33%) having a lower propensity than KIBS that conduct low and high levels of partnering (53%).

Notwithstanding these similarities, there are also some important differences that emerge. One of the most striking results from Table 1 is that providers with high degrees of external knowledge sourcing are more likely to conduct marketing innovation than medium and low sourcers. Specifically, 48% of KIBS with high degrees of external sourcing conduct marketing innovation, whereas it is only 32% and 10% of KIBS with medium and low degrees of external sourcing that conduct marketing innovation, respectively. Table 1 suggests, then again, that the degree of external partnering seems to be more tightly related to product innovation. That is, 80% of KIBS with high degrees of external partnering conduct product innovation, whereas 69% and 60% of KIBS with medium and high degrees of external sourcing conduct product innovation, respectively.

Table 1 also shows that there is limited variation in the innovation activities across external sourcing and partnering categories, albeit with some exceptions. Regardless if we consider external sourcing or partnering categories, there is little or ambiguous variation in their propensity to use ICT, to conduct internal R&D, to obtain external R&D, or to conduct design. ICT usage varies between 3.2 and 4.7 (out of 7), internal R&D between 60 and 73%, external R&D between 35% and 50%, and design between 50 and 67%. For external sourcing, there is also limited disparity in the acquisition of equipment and software across external sourcing categories. For external partnering, then again, there is some evidence that KIBS with higher degrees of external partnering are more likely to acquire software. Finally, for both external sourcing and external partnering, there is evidence that KIBS with higher degrees of openness have a higher propensity to conduct training.

A firm’s size, age, and export propensity is related to its OI strategy. KIBS with a higher degree of external knowledge sourcing tend to be larger in size, even though no such relation exists between size and degree of external partnering. KIBS with a higher degree of external partnering tend to be older and more export oriented, even though no such relation between external sourcing, age and percentage of international sales. This latter result may be because it takes time for a KIBS to set up formal partnerships and since partnerships are required to develop export relations.

Finally, there is some variation in degrees of external sourcing and partnering across KIBS sectors. Table 1 shows that 38% of management service providers have high degrees of external sourcing, whereas it is 31% and 30% for legal service and computer system design establishments, respectively. In Table 2, the opposite pattern emerges. 40% of computer system design establishments have high degrees of external partnering, compared to 33% for legal services KIBS and 26% for management services.

This univariate analysis highlights both similarities and differences across OI strategies that need to be verified with multivariate analysis. The next section presents the results of the multivariate analysis.

4.2 Multivariate analysis

To verify the robustness of these results, we next proceed with a multivariate analysis. Table 2 reports the means, standard deviation, and correlations among all the variables. Pearson correlations indicate the absence of a multicollinearity problem and an internal consistency of the selected independent variables. Next, we verify for potential multicollinearity using variance inflation factors (VIFs) to eliminate the risk of suppressor effects (Hair et al. 2007). VIF indexes measure the extent to which the variance of an estimated regression coefficient is increased because of collinearity. In all the tests, the VIF indexes are well below the usually recommended cutoff score of 10 (Neter et al. 1996). The VIF scores range from 2.37 to 6.6.

Given the absence of multicollinearity, we conduct ordered logistic regression to estimate the effects of our independent variables on two dependent variables.Footnote 3 Since our dependent variable is ordinal, we chose ordered logistic regression to explore the relationship between external sourcing and external partnering and different types of innovation. Given relatively small sample size and many single-scale variables, other more complex models with recursive linkages such as in structural equation modelling usually show poor performance (Reinartz et al. 2009). Therefore, provided the parsimony of the model, while we control for a number of factors, we do not include any recursive linkages.

Before conducting the regressions, we test the assumptions of the ordered logistic regression model by conducting Brant test, which indicates that we have not violated the proportional odds assumption (p > χ2 0.316). All our regressions include the various control variables that we have described above and include industry fixed effects to control for variations across KIBS industries.

Table 3 presents the results of the analysis. Both regressions indicate good model fit (χ2 below 0.05). Column 1 presents the results for external sourcing, whereas column 2 shows the results for external partnering. The results in column 1 confirm that KIBS that conduct marketing innovation have a significantly higher degree of external sourcing than firms which do not conduct marketing innovation (but may conduct other types of innovation). Specifically, it reports a significant positive effect of marketing innovation on external sourcing with a coefficient value of 0.57, which suggests that KIBS that conduct marketing innovation are more likely to have higher degrees of external sourcing than similar firms which do not conduct marketing innovation. Similar to the univariate analysis, no significant relations are detected between the other types of innovation and external sourcing. This result suggests that external sourcing is a particularly common OI strategy for KIBS which conduct marketing innovation.

The remainder of the results in column 1 of Table 3 suggest that the various innovation activities have little relation with the choice of external sourcing strategy, with none of the coefficients obtaining significance. The acquisition of equipment and software is found to have a positive and significant effect on the external knowledge sourcing whereas firm size has a negative coefficient. In contrast to the univariate analysis, this suggests that larger providers are less likely to adopt higher degrees of external sourcing once other control variables are taken into account.

The findings in column 2 of Table 3 confirm the univariate result that KIBS which conduct product innovation have a significantly higher degree of external partnering than firms which do not conduct product innovation. In particular, it shows a significant positive effect of product innovation on external partnering with a coefficient value of 0.73, which suggests that KIBS which conduct product innovation are more likely to have higher degrees of external partnering than similar firms with no product innovation. No significant relations are detected between the other types of innovation and external partnering. This finding implies that external partnering is a particularly common OI strategy for KIBS which conduct product innovation.

Similar to external sourcing, we find limited evidence in column 2 of Table 3 that different innovation activities have a relationship with the choice of external partnering strategy. The sole exception is design, which has a positive coefficient. Similar to the univariate analysis, we find that KIBS with a higher export propensity are more likely to adopt a high degree of external partnering.

4.3 Robustness test

To check the robustness of our results, we have split our full sample into two commonly used categories—Technological T-KIBS (Computer services) and Professional P-KIBS (Legal and management services)—and we have re-run our regression analysis on each subsample. T-KIBS provide services in the field of information technologies and professional and technical-computer related services, while P-KIBS provide services based on specialised knowledge of administrative system and social affairs (Coombs and Miles 2000).

The results presented in Table 4 provide further evidence that our main results are robust to different specifications. Overall, the results tend to support those found in the ordered logic regressions for the total sample of KIBS (Table 3). We find that for both types of KIBS marketing innovation consistently has a positive and significant association with external sourcing, and product innovation has a positive relationship with external partnering. At the same time, the more disaggregated analysis shows additional nuances in the relationship between innovation types and a firm’s external knowledge search strategy. In the case of T-KIBS, those providers which conduct process innovation have a higher degree of external sourcing. In the case of P-KIBS, those firms which conduct organisational innovation have a higher degree of external partnering.Footnote 4

With respect to innovation activities, the analysis shows additional nuances. The results show that—with the exception of the acquisition of equipment and software—innovation activities have different relationships with the open strategy adopted by P-KIBS and T-KIBS. For T-KIBS, internal R&D and training is closely related to external knowledge strategy, whereas, the use of ICT, external R&D and design is closely related to external partnering strategy. In contrast, for P-KIBS only the use of ICT is associated with external sourcing and only training is associated with external partnering strategy. These results suggest two things: first, that some of these innovation activities may become the inputs upon which the external knowledge search strategies build and develop; second, it shows the heterogeneity of innovation approaches across KIBS firms in the sense that they could develop different activities to pursue similar strategies.

5 Discussion and conclusion

The purpose of this paper has been to investigate the impact of different types of innovation on the external knowledge search strategies adopted by KIBS firms. The empirical analysis was based on a firm-level survey that examined KIBS firms in the province of Ontario (Canada). The current study provides evidence that different types of innovation are critical in explaining knowledge search strategies.

The paper provides a number of key findings. First, we show a positive direct relationship between innovation type and openness, be it in terms of external sourcing or external partnering strategies. The study reveals that marketing innovation entails significantly higher external knowledge sourcing than any other types of innovation, while product innovation entails higher external partnering than any other types of innovation. KIBS that conduct marketing innovation seem to seek external knowledge from more sources and at higher intensity, perhaps reflecting their recognition that it is information that has higher strategic value for developing significant changes in product placement, product promotion, or pricing. Such result showing that marketing innovation is driven by more informal knowledge search efforts is in line with Shearmur and Doloreux’s (2016) and Shearmur’s (2015) observations, whilst marketing innovation strongly relies on diverse information and knowledge sources which lose value rapidly and therefore firms tend to interact more frequently on an informal base with these sources to engage in innovation. On the other hand, KIBS which develop product innovation seem to more likely opt for high degrees of external partnering, perhaps suggesting that significant improvements in technical specifications, components and materials requires formal partnerships with other clients and organisations. Such result is commensurate with Hipp et al. (2015) and Mina et al. (2014), who suggest that product innovation is driven by collaborative efforts to find or develop new ways to create value with service beneficiaries (e.g. customer, supplier, other KIBS, etc) through the integration of resources and know-how exchanges and service exchange and delivery.

Second, the performance of the control variables measuring innovation activities was disappointing. Most variables did not contribute to explaining variations in either external knowledge sourcing or external partnership strategies. The only exception is “acquisition of equipment and software”, which was positively related to a firm’s degree of external sourcing in the overall sample, and which was positively related to both external sourcing and external partnering in the subsamples of T-KIBS and P-KIBS. In line with the univariate analysis, it suggests that in most cases, there might be no observable difference between individual KIBS, with respect to the types of innovation activities that they mobilise to develop these strategies. This result is surprising: it has been acknowledged that a firm’s absorptive capacity is strongly associated with OI strategy (Rodriguez et al. 2017; Ferreras-Méndez et al. 2016; Monteiro et al. 2017). This implies that firms engaging in external knowledge acquisition and collaboration should not overlook the effect of their internal technological capabilities: on the one hand, a certain absorption capacity is needed to benefit from external knowledge (Cohen and Levinthal 1990). On the other hand, appropriability also plays an important role, leading to what Laursen and Salter (2014) called the “the paradox of openness”, that is, although openness can be important to develop innovations, once these are going to be commercialised, protection becomes necessary. The appropriation strategy has not been addressed in this article. However, it is an issue that has been under-explored in KIBS and more scholarly work is required, as suggested by Freel and Robson (2017), to verify the effect of knowledge openness on the internal capabilities of firms and appropriation mechanisms adopted by them.

Third, among the firm-level characteristics associated with OI, the results of the study show with confidence that size matters when KIBS opt for external knowledge sourcing strategies. The results also show that export KIBS are more likely to engage in external partnerships. Finally, the age of the KIBS was not related to any form of OI strategies, hence suggesting that a KIBS’ OI strategy was independent of its degree of maturity.

What do these results suggest regarding the management of OI strategies in KIBS? First, the structural differences that we have observed in this study between external sourcing and external partnering indicate that the adoption of these strategies may be driven by differing underlying motivations. The empirical evidence has shown that, in spite of the presence of pervasive business interactions, innovation-related knowledge is exchanged in a rather uneven and selective way. More concretely, the results of this study suggest that developing innovation strategies that require access to external knowledge are diverse in view of becoming more innovative. For managers, this is an important observation, suggesting that strategies should be tailored to each firm’s strengths to fully benefit from an OI strategy.

As in all research, a number of limitations of this study should be borne in mind. The cross-sectional nature of the data means that we have to be careful in interpreting any causal relation between the OI strategies adopted by KIBS. This research highlights associations between different determinants and OI strategies, and should be seen as a first step in obtaining a better understanding of the causal processes at play. Such an exploratory step is crucial, however, to guide data collection and case study work designed to examine such causal processes. A related shortcoming is that the two OI strategies that have been measured in this paper are quite broad in nature. Finer-grained measures of knowledge sourcing modes may be identified and empirically measured within each broad strategy. The data do not allow us to identify how OI strategies change over time, nor to trace the effects of these changes on firm innovation performance.

While this study is on KIBS in the province of Ontario, it does not represent all KIBS or service industries equally. We encourage future studies to extend our work by focusing on individual KIBS sectors or other service industries, as these sectors could differ in their innovation patterns. Moreover, the findings of this study are limited to a single industrial context. Of course, future research could also focus on other contexts, thereby testing for the generalisability of our findings across different locations. Nevertheless, we believe this study makes an interesting contribution to innovation research in the KIBS sector.

Notes

The sample comprises both innovative and non-innovative KIBS. This approach allows to gather information on a large variety of aspects related to innovation, including its activities, sources, and determinants. If the potential group is restricted to innovating KIBS only, the effects can be underestimated, because the innovation status of a KIBS can change from non-innovative to innovative and vice versa. It is possible that the 3-year backward looking window on innovation outputs limits to capturing all KIBS establishment-level innovations that can be attributed to the adoption of open innovation strategies over the period. At the same time, having in the same the firms that did not introduce innovations in this 3-year period increases variance and helps to better establish the relationships between innovation patterns and external sourcing and external partnering.

In the paper, we do not study whether the various types of innovation are themselves correlated—the principal objective of the paper is to examine whether different types of innovation require distinct kinds of external knowledge search strategies. But as Amara et al. (2009) have shown, KIBS that implement one type of innovation often implement other types of innovations. This should be borne in mind when interpreting the results.

We removed seven outliers using a decision tree algorithm (John 1995). The final number of observations in our sample is 385.

All the new models show good model fit except for the T-KIBS and external sourcing, which suffers from a poorer model fit. At the same time, using other statistical techniques (e.g. operationalizing the dependent variable as low–high sourcing and using probit model) yields similar coefficients, which again, points to the robustness of the results.

References

Amara N, Landry R, Doloreux D (2009) Patterns of innovation in knowledge-intensive business services. Serv Ind J 29(4):407–430

Armstrong JS, Overton TS (1977) Estimating nonresponse bias in mail surveys. J Mark Res 14:396–402

Asikainen A-L, Mangiarotti G (2017) Open innovation and growth in IT sector. Serv Bus 11(1):45–68

Barge-Gil A (2013) Open strategies and innovation performance. Ind Innov 20(7):585–610

Battisti G, Gallego J, Rubalcaba L, Windrum P (2014) Open innovation in services: knowledge sources, intellectual property rights and internationalization. Econ Innov New Technol 24(3):223–247

Becheikh N, Landry R, Amara N (2006) Lessons from innovation empirical studies in the manufacturing sector: a systematic review of the literature from 1993–2003. Technovation 26(5–6):644–664

Bettencourt LA, Ostrom AL, Brown SW, Roundtree RI (2002) Client co-production in knowledge-intensive business services. Calif Manag Rev 44(4):100–128

Bogers M, Zobel A-K, Afuah A, Almirall E, Brunswicker S, Dahlander L et al (2017) The open innovation research landscape: established perspectives and emerging themes across different levels of analysis. Ind Innov 24(1):8–40

Brunswicker S, Vanhaverbeke W (2015) Open innovation in small and medium-sized enterprises (SMEs): external knowledge sourcing strategies and internal organizational facilitators. J Small Bus Manag 53(4):1241–1263

Chang Y-C, Chen M-N (2016) Service regime and innovation clusters: an empirical study from service firms in Taiwan. Res Policy 45(9):1845–1857

Chesborough HW (2007) Why companies should have open business models. MIT Sloan Manag Rev 48(2):22–28

Chesbrough H (2017) The future of open innovation: IRI Medal Address The future of open innovation will be more extensive, more collaborative, and more engaged with a wider variety of participants. Res Technol Manag 60(6):29–35

Chesbrough H, Vanhaverbeke W, West J (eds) (2006) Open innovation: researching a new paradigm. Oxford University Press on Demand

Chiu DKY, Cheung B, Wong AKC (1990) Information synthesis based on hierarchical entropy discretization. J Exp Theor Artif Intell 2:117–129

Clausen TH, Korneliussen T, Madsen EL (2013) Modes of innovation, resources and their influence on product innovation: empirical evidence from R&D active firms in Norway. Technovation 33(6–7):225–233

Cohen WM, Levinthal D (1990) Absorptive capacity: a new perspective on learning and innovation. Adm Sci Q 35:128–152

Coombs R, Miles I (2000) Innovation, measurement and services: the new problematique. In: Metcalfe JS, Miles I (eds) Innovation systems in the service economy. Springer, Berlin, pp 85–103

Dahlander L, Gann DM (2010) How open is innovation? Res Policy 39(6):699–709

Doloreux D, Shearmur R (2012) Collaboration, information and the geography of innovation in knowledge intensive business services. J Econ Geogr 12(1):79–105

Doloreux D, Shearmur R (2013) Innovation strategies: are knowledge-intensive business services just another source of information? Ind Innov 20(8):719–738

Doloreux D, Shearmur R, Rodriguez M (2016) Determinants of R&D in knowledge-intensive business services firms. Econ Innov New Technol 25(4):391–405

Drechsler W, Natter M (2012) Understanding a firm’s openness decisions in innovation. J Bus Res 65(3):438–445

Ferreras-Méndez JL, Fernández-Mesa A, Alegre J (2016) The relationship between knowledge search strategies and absorptive capacity: a deeper look. Technovation 54:48–61

Freel M, Robson PJ (2017) Appropriation strategies and open innovation in SMEs. Int Small Bus J 35(5):578–596

Hair Jr JF, Anderson RE, Tatham RL, Babin BJ, Black WC (2007) Multivariate data analysis (6th International ed). Dorling Kindersley (India) Pvt. Ltd, Delhi

Harman HH (1976) Modern factor analysis. University of Chicago press, Chicago

Hipp C, Gallego J, Rubalcaba L (2015) Shaping innovation in European knowledge-intensive business services. Serv Business 9(1):41–55

Huizingh EKRE (2011) Open innovation: state of the art and future perspectives. Technovation 31(1):2–9

Industry Canada (2016) Key small business statitics - June 2016- SME research and statistics, Ottawa. https://www.ic.gc.ca/eic/site/061.nsf/vwapj/KSBS-PSRPE_June-Juin_2016_eng-V2.pdf/$file/KSBS-PSRPE_June-Juin_2016_eng-V2.pdf

Janssen MJ, Castaldi C, Alexiev AS (2018) In the vanguard of openness: which dynamic capabilities are essential for innovative KIBS firms to develop? Ind Innov 25(4):432–457

John GH (1995) Robust decision trees: removing outliers from databases. In: KDD, pp 174–179

Kang KH, Kang J (2009) How do firms source external knowledge for innovation? Analysing effects of different knowledge sourcing methods. Int J Innov Manag 13(01):1–17

Kostopoulos K, Papalexandris A, Papachroni M, Ioannou G (2011) Absorptive capacity, innovation, and financial performance. J Bus Res 64(12):1335–1343

Laursen K, Salter A (2006) Open for innovation: the role of openness in explaining innovation performance among U.K. manufacturing firms. Strateg Manag J 27(2):131–150

Laursen K, Salter AJ (2014) The paradox of openness: appropriability, external search and collaboration. Res Policy 43(5):867–878

Lazzarotti V, Manzini R, Pellegrini L (2011) Firm-specific factors and the openness degree: a survey of Italian firms. Eur J Innov Manag 14(4):475–495

Leiponen A, Helfat CE (2010) Innovation objectives, knowledge sources, and the benefits of breadth. Strateg Manag J 31(2):224–236

Love JH, Roper S, Bryson JR (2011) Openness, knowledge, innovation and growth in UK business services. Res Policy 40(10):1438–1452

Love JH, Roper S, Vahter P (2014) Dynamic complementarities in innovation strategies. Res Policy 43(10):1774–1784

Miles I (2005) Knowledge intensive business services: prospects and policies. Foresight 7(6):39–63. https://doi.org/10.1108/14636680510630939

Miles I (2008) Patterns of innovation in service industries. IBM Syst J 47(1):115–128

Mina A, Bascavusoglu-Moreau E, Hughes A (2014) Open service innovation and the firm’s search for external knowledge. Res Policy 43(5):853–866

Miozzo M, Desyllas P, Lee H, Miles I (2016) Innovation collaboration and appropriability by knowledge-intensive business services firms. Res Policy 45(7):1337–1351

Monteiro F, Mol M, Birkinshaw J (2017) Ready to be open? Explaining the firm level barriers to benefiting from openness to external knowledge. Long Range Plan 50(2):282–295

Muller E, Doloreux D (2009) What we should know about knowledge-intensive business services. Technol Soc 31(1):64–72

Neter J, Kutner MH, Nachtsheim CJ, Wasserman W (1996) Applied linear statistical models, vol 4. Irwin, Chicago

OECD. (2005). Oslo manual: Guidelines for collecting and interpreting innovation data (3rd ed.). Oslo Manual

Parida V, Westerberg M, Frishammar J (2012) Inbound open innovation activities in high-tech SMEs: the impact on innovation performance. J Small Bus Manag 50(2):283–309

Reinartz Werner, Haenlein Michael, Henseler Jörg (2009) An empirical comparison of the efficacy of covariance-based and variance-based SEM. Int J Res Mark 26(4):332–344

Rodriguez M, Doloreux D, Shearmur R (2016) Innovation strategies, innovator types and openness: a study of KIBS firms in Spain. Serv Bus 10(3):629–649

Rodriguez M, Doloreux D, Shearmur R (2017) Variety in external knowledge sourcing and innovation novelty: Evidence from the KIBS sector in Spain. Technovation 68(C):35–43

Roper S, Love JH, Bonner K (2017) Firms’ knowledge search and local knowledge externalities in innovation performance. Res Policy 46(1):43–56

Rothwell R (1991) External networking and innovation in small and medium-sized manufacturing firms in Europe. Technovation 11(2):93–112

Shearmur R (2015) Far from the madding crowd: slow innovators, information value, and the geography of innovation. Growth Change 46(3):424–442

Shearmur R, Doloreux D (2015) Knowledge-intensive business services (KIBS) use and user innovation: high-order services, geographic hierarchies and internet use in Quebec’s manufacturing sector. Reg Stud 49(10):1654–1671

Shearmur R, Doloreux D (2016) How open innovation processes vary between urban and remote environments: slow innovators, market-sourced information and frequency of interaction. Entrep Reg Dev 28(5–6):337–357

Terjesen S, Patel PC (2017) In search of process innovations: the role of search depth, search breadth, and the industry environment. J Manag 43(5):1421–1446

Trigo A, Vence X (2012) Scope and patterns of innovation cooperation in Spanish service enterprises. Res Policy 41(3):602–613

Tsai KH, Wang JC (2008) External technology acquisition and firm performance: a longitudinal study. J Bus Ventur 23(1):91–112

van de Vrande V, de Jong JPJ, Vanhaverbeke W, de Rochemont M (2009) Open innovation in SMEs: trends, motives and management challenges. Technovation 29(6–7):423–437

Virlee J, Hammedi W, Parida V (2015) Open innovation implementation in the service industry: exploring practices, sub-practices and contextual. J Innov Manag 3(2):106–130

Wang CH, Chang CH, Shen GC (2015) The effect of inbound open innovation on firm performance: evidence from high-tech industry. Technol Forecast Soc Chang 99:222–230

Wernerfelt B (1984) A resource-based view of the firm. Strateg Manag J 5:171–180

West J, Bogers M (2017) Open innovation: current status and research opportunities. Innovation 19(1):43–50

Acknowledgements

This research was made possible by financial support from the Social Sciences and Humanities Research Council for the project called ‘Creating Digital Opportunity: Canada’s ICT Industry in Global Perspective (CDO)’. The authors benefited from valuable comments from the coordinator of the project, David Wolfe of the University of Toronto. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Doloreux, D., Turkina, E. & Van Assche, A. Innovation type and external knowledge search strategies in KIBS: evidence from Canada. Serv Bus 13, 509–530 (2019). https://doi.org/10.1007/s11628-018-00393-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11628-018-00393-y