Abstract

Background

The Affordable Care Act takes a “patchwork” approach to expanding coverage: Medicaid covers individuals with incomes 138% of the federal poverty level (FPL) in expansion states, while subsidized Marketplace insurance is available to those above this income cutoff.

Objective

To characterize the magnitude of churning between Medicaid and Marketplace coverage and to examine the impact of the 138% FPL income cutoff on stability of coverage.

Design

We measured the incidence of transitions between Medicaid and Marketplace coverage. Then, we used a differences-in-differences framework to compare insurance churning in Medicaid expansion and non-expansion states, before and after the ACA, among adults with incomes 100–200% of poverty.

Participants

Non-elderly adult respondents of the Medical Expenditure Panel Survey 2010–2018

Main Measures

The annual proportion of adults who (1) transitioned between Medicaid and Marketplace coverage; (2) experienced any coverage disruption.

Key Results

One million U.S. adults transitioned between Medicaid and Marketplace coverage annually. The 138% FPL cutoff in expansion states was not associated with an increase in insurance churning among individuals with incomes close to the cutoff.

Conclusions

Transitions between Medicaid and Marketplace insurance are uncommon—far lower than pre-ACA analyses predicted. The 138% income cutoff does not to contribute significantly to insurance disruptions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

INTRODUCTION

The Affordable Care Act (ACA) dramatically reduced the uninsured rate through two insurance programs: the expansion of Medicaid to all non-elderly adults with household incomes below 138% of the federal poverty level and the creation of the state-based Health Insurance Marketplaces, which offer subsidized coverage to non-elderly adults with incomes between 138 and 400% of the poverty level. In states that expanded Medicaid, adults whose household incomes fluctuate across this 138% percent income cutoff may experience frequent changes in eligibility for the ACA’s insurance programs. While the ACA coverage expansions have led to unprecedented gains in insurance enrollment, this “patchwork” approach to broadening coverage may have also created the potential for enrollees to experience “churning” between Medicaid and subsidized Marketplace insurance.1

Prior to the passage of the ACA, several studies projected that large numbers of individuals would move between Medicaid and Marketplace insurance due to the use of income-based eligibility cutoffs.2,3,4 One pre-ACA study estimated that 28 million people per year would transition between Medicaid and Marketplace insurance under the ACA.3 Some experts were concerned that the cutoff was too low: one pre-ACA analysis suggested that increasing the cutoff from 138 to 200% of poverty would mitigate the insurance churning problem, because household incomes became more stable at higher income levels.5

Stability of health insurance coverage is a concern for patients and policymakers, as disruptions in coverage are associated with adverse health outcomes including delays in care, increased used of the emergency room, and decreased adherence to prescription medication.6,7,8 Such adverse outcomes have been observed not only when the disruptions result in a gap in coverage, but also in cases when an individual transitions from one insurance type to another.9 Coverage disruptions have been a persistent problem in Medicaid,10,11 and the associated administrative burden increases costs for states, health care providers, and Medicaid managed care organizations.12

Although prior work has shown that the Medicaid expansion decreased churning amongst those with incomes below the 138% cutoff,13,14 no post-ACA studies have examined the extent of churning between Medicaid and Marketplace insurance, nor has the effect of the 138% FPL income cutoff on coverage disruptions been examined. Therefore, the objectives of this study were to (1) measure the incidence of transitions between Medicaid and Marketplace coverage among U.S. adults and (2) assess whether the use of an income cutoff at 138% of FPL in expansion states is associated with increased insurance churning.

METHODS

State Policies

The ACA gave states the option to extend Medicaid eligibility to all adults with household incomes below 138% of the FPL. Twenty-five states adopted the expansion by January 1, 2014, while an additional seven states expanded Medicaid before the end of our study period in 2018 (see Appendix Table A). In these states, adults with incomes between 138 and 400% of the FPL are eligible for subsidized Marketplace coverage. In non-expansion states, subsidized Marketplace coverage is available to individuals with incomes between 100 and 400% of FPL. Income eligibility limits for Medicaid in non-expansion states vary widely across eligibility categories and states; the median income cutoff for Medicaid eligibility for parents is 41% of the FPL.15 Childless adults are generally not eligible for Medicaid in non-expansion states, although a few non-expansion states have extended limited eligibility for this group through state demonstrations.16

Data and Sample

We used the Medical Expenditure Panel Survey (MEPS) for the years 2010–2018. The MEPS is a nationally representative survey of approximately fifteen thousand households per year that contains information on monthly insurance enrollment, including insurance type, and on household income. Information is self-reported by survey participants, and all households are surveyed on five occasions over the course of two and a half years.17 In our analysis of Medicaid-Marketplace transitions, we examined all non-elderly adults of ages 19–64, regardless of income (N = 91,956) during the post-ACA period (2014–2018).

For our difference-in-differences analysis, we restricted our sample to non-elderly adults who had insurance for at least one month during the year and whose household incomes were between 100 and 200% of the federal poverty level (n = 23,546) for all study years (2010–2018). In non-expansion states, adults are eligible for Marketplace insurance subsidies if their household income is above 100% of the FPL. Therefore, adults in non-expansion states comprised the comparison group as they were not subject to the 138% FPL income cutoff. Our non-expansion state group included the nineteen states that had not expanded eligibility for Medicaid by 2018, listed in Appendix A. Expansion states were the twenty-five states and the District of Columbia that had expanded Medicaid programs by January 1, 2014. We excluded the seven states that expanded between January 2014 and December 2018, but performed sensitivity analyses that included these seven states.

Measures

Our first primary outcome, which we examined descriptively, was the annual proportion of adults who transitioned between Medicaid and Marketplace insurance. A transition was defined as having at least 1 month of Medicaid and of Marketplace coverage in the same year. Our second primary outcome, examined in a difference-in-differences analysis, was the annual proportion of individuals who experienced any coverage disruption. We defined a coverage disruption as moving between major insurance types (Medicaid, Marketplace, or employer-sponsored insurance (ESI)) or becoming uninsured over the course of a 1-year follow-up period. Secondary outcomes of the difference-in-differences analysis included the proportion of individuals who disenrolled from specific insurance types due to switching to a new insurance type or becoming uninsured. We examined disenrollment from Medicaid and ESI. We did not examine disenrollment from Marketplace in the difference-in-differences analysis, as no pre-ACA comparison is available for this insurance type.

Statistical Analysis

In our first analyses, we estimated the proportions of individuals who experienced a transition between Medicaid and Marketplace insurance. In our second analysis, we used a difference-in-difference approach to assess changes in churning rates in expansion versus non-expansion states before and after January 1, 2014. We employed linear probability models to facilitate interpretation of our difference-in-differences estimates.18 We examined the annual proportion of adults who experienced any coverage disruption, disenrolled from Medicaid, and disenrolled from ESI using the difference-in-differences framework, conditional on having had at least 1 month of insurance in a given year. In adjusted models, we included covariates for age, sex, race, employment status, birth outside of the U.S.A., family size, marital status, disability status (defined as receiving supplemental security income payments), presence of dependents in household, pregnancy status, and whether or not an individual reported a chronic disease, which included respiratory disease, cardiovascular disease, diabetes, joint disease, and cancer.

In a sensitivity analysis, we repeated the difference-in-differences analysis in the population of adults with incomes 100–200% of the FPL, regardless of insurance status (i.e., not conditional on having had insurance for at least 1 month). To explore the impact of restricting our study population to the narrow income range of 100–200% of the FPL, we performed another sensitivity analysis in which we repeated the difference-in-differences analysis in adults with incomes 50–250% of the FPL.

We graphed trends in insurance churning in expansion and non-expansion states during the pre-expansion years from 2010 to 2013. We also implemented “placebo tests” in which we re-estimated our primary difference-in-difference model restricting to pre-expansion years and testing falsified dates of the policy change in 2011, 2012, and 2013. Lastly, we created event studies showing the change in coverage disruption in expansion states vs. non-expansion states over time among adults with incomes 100–200% of the FPL, conditional on having any insurance. In these figures, the x-axis represents time elapsed since the ACA’s implementation in 2014. The y-axis represents yearly beta coefficients on the interaction between “time-to-policy change” and “Medicaid expansion status of the state of residence” in regressions for which the dependent variable was “coverage disruption.” All regressions were performed with SAS, version 9.4, and used survey-based procedures that accounted for the complex sample design and weights in the MEPS. This study was deemed non-human subjects research by the Boston University Institutional Review Board.

RESULTS

For the analysis of Medicaid-Marketplace transitions, our study population included 55,068 non-elderly adults in expansion states and 36,888 non-elderly adults in non-expansion states. In expansion states, an average of 0.7% (SE = 0.05) of adults transitioned between Medicaid and Marketplace insurance per year, representing a weighted average of 785,508 individuals (Table 1). In non-expansion states, an average of 0.25% (SE = 0.04) of adults or 198,429 adults per year transitioned between Medicaid and Marketplace coverage.

In our difference-in-differences analysis, which examined the effect of the 138% FPL cutoff, our study population included 9714 non-elderly adults residing in non-expansion states and 13,832 in expansion states. In the pre-ACA cohort (n = 5997 in expansion states; n = 4288 in non-expansion states), the study subjects were more likely to be Hispanic and Asian in expansion states and more likely to be Black in non-expansion states (Table 2). In expansion states, subjects were less likely to be employed or born in the U.S.A. and more likely to receive Supplemental Security Income (SSI), a marker of disability. The sociodemographic differences between our study groups changed only slightly in the post-ACA period compared to the pre-ACA period. The differences between our study groups in racial composition, family size, and birthplace outside the U.S.A. persisted in the post-ACA period, whereas the differences in rates of employment and receipt of SSI across study groups were no longer significant after the ACA.

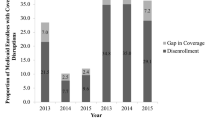

When examined graphically (Fig. 1), the annual proportion of individuals experiencing coverage disruptions followed a similar trend in expansion and non-expansion state groups during the pre-ACA period, and these trends persisted in the post-implementation period. The proportion of individuals who became disenrolled from Medicaid was consistently higher in the expansion state group compared to the non-expansion state group, both before and after the ACA, but the trends were similar (Fig. 2). Annual rates of Marketplace disenrollment averaged 1% per year in both expansion and non-expansion states in both study groups (Appendix Figure B1). Rates of ESI disenrollment showed no differences in trend with respect to the implementation of the ACA (Appendix Figure B2).

In our difference-in-differences analysis, the proportion of individuals who experienced a coverage disruption was higher during the pre-ACA period in expansion states compared to non-expansion states (18.1% in expansion states vs. 16.3% in non-expansion states) (Table 3). These rates did not change significantly in the post-ACA period. Medicaid disenrollment rates were higher in non-expansion states at baseline (23.5% in expansion states vs. 29.2% in non-expansion states), and disenrollment from Medicaid decreased by 3.6 percentage points in expansion states in the post-ACA period compared to non-expansion states (p = 0.03). In the analysis of ESI disenrollment, rates of transitions out of ESI were similar in both groups prior to the ACA and were relatively unchanged in the post-ACA period. In the sensitivity analysis in which we repeated these three difference-in-differences analyses on a population of adults with incomes 50–250% of the FPL, our results were unchanged (results not shown).

In the sensitivity analysis that including all adults, regardless of insurance status, the implementation of the ACA was not associated with significant changes in annual rates of coverage disruptions; coverage disruptions increased in both expansion and non-expansion states after implementation of the ACA (p = 0.88) (Appendix Table 3). Rates of Medicaid disenrollment did not change in expansion states compared to non-expansion states in the post-ACA period (p = 0.11). Consistent with our primary analysis, we did not identify differences between expansion and non-expansion states in ESI disenrollment before versus after ACA implementation.

Results of the sensitivity analysis, in which we repeated the difference-in-differences including the seven states that expanded after January 2014, were substantively unchanged (Appendix Table D). Our placebo analysis did not show evidence of differential pre-ACA trends in rates of coverage disruptions (Appendix Table E). The event studies, which depict graphically the change in coverage disruption in expansion states vs. non-expansion states over time, showed no change in the pattern of cover disruption relative to the implementation of the ACA in 2014 (Appendix Figure F).

DISCUSSION

In this study analyzing nationally representative data, we found evidence that rates of insurance transitions between Medicaid and Marketplace coverage are uncommon and were much lower than pre-ACA predictions. While Medicaid-Marketplace transition rates were higher in Medicaid expansion states compared to non-expansion states, overall less than 1% of the population experienced a transition in both expansion and non-expansion states. Furthermore, our difference-in-differences analysis did not show evidence that the use of a 138% FPL income cutoff between Medicaid and Marketplace eligibility was a driver of coverage disruption among individuals with incomes near the cutoff. Consistent with prior research showing that Medicaid expansion reduced insurance churning in the Medicaid-eligible population, we found that individuals with incomes close to the cutoff living in expansion states had a decreased risk of Medicaid disenrollment in the post-ACA period compared to those living in non-expansion states.

Our finding that the Medicaid-Marketplace transition rate was low, and that ACA’s 138% income cutoff did not drive coverage disruptions, contradicts several pre-ACA predictions that the ACA’s “patchwork” approach to insurance expansion would have the unintended consequence of creating large increases in insurance churning.2,3 Several factors may have attenuated the impact of the 138% FPL income cutoff on coverage disruptions. First, it is possible that individual’s incomes may have fluctuated less in the post-ACA period than predicted. However, this explanation is unlikely as post-ACA survey data shows that income volatility, defined as an income change of 25% or more, has affected one third of American households during the post-ACA period and is more common among lower-income families.19

Other explanatory factors include the broadening of the income range (up to 138% of poverty) within which Medicaid-enrolled adults’ incomes could fluctuate before losing eligibility. This may have decreased the likelihood of Medicaid loss. Increased outreach efforts may have improved retention for both Medicaid and Marketplace plans. Additionally, the ACA created several regulations that ease the impact of income fluctuations on coverage disruption. ACA rules prevent states from requiring individuals to submit redetermination applications for Medicaid enrollment more often than once every 12 months.20 States are directed to use internal sources of income data, such as data from the Supplemental Nutrition Assistance Program (SNAP), to make determinations about Medicaid renewal before contacting individuals. States may disenroll individuals if loss of eligibility due to income rise is detected through internal sources of income data, but the state must first contact the individual to request additional information.15 Although little evidence is available on the degree of individual states’ implementation of these regulations, these rules may have been effective in mitigating the potentially adverse consequences of the ACA’s 138% FPL income cutoff.

Our study finds that just under 1 million adults per year experienced a transition between Medicaid and Marketplace insurance. Although this figure is low compared with pre-ACA predictions, it still represents a non-trivial number of individuals. Additional policies may smooth transitions among those whose income fluctuations trigger changes in insurance eligibility. Raising the income cutoff to 200% of the poverty level may reduce coverage switching between Medicaid and Marketplace by up to 4%.5 The introduction of a public option with broad eligibility to those in Marketplace and Medicaid could also improve continuity of coverage21,22 by enabling individuals to stay enrolled in the public option continuously rather than transition between Medicaid and Marketplace coverage as their incomes fluctuate. However, increasing eligibility limits for the Medicaid expansion population or introducing a public option would represent an increase in federal and state spending. The median per capita annual expenditures for the Medicaid expansion population was $6709 in 2019,23 while data from 2015 found that the administrative cost of one cycle of churn ranged from approximately $460 to $700 per enrollee (accounting for inflation).24 Policymakers must weigh these trade-offs between increased cost vs. better access to health care when considering policies to reduce churning. Medicaid 12-month continuous eligibility policies, which allow enrollees to maintain coverage for a year coverage regardless of income changes, may decrease Medicaid churning among non-elderly adults by 30% according to a 2015 analysis.25 Twelve-month continuous eligibility policies may prove to have benefits in terms of cost-effectiveness as prior work has shown that average monthly Medicaid costs fall the longer a beneficiary is enrolled within the year.26

Our analysis has several limitations. We assessed our primary outcomes of coverage transitions and disruptions as an annual measure. A 1-year follow-up period may fail to capture those who had a coverage disruption over longer time periods; however, several previous studies have used 1-year follow-up periods to produce valid estimates of insurance churning.13,14 With regard to the difference-in-difference analysis, we assessed income as a percentage of FPL once annually, whereas incomes may fluctuate within the year. This may have resulted in including some enrollees in our 100–200% FPL study sample whose incomes fluctuated out of this range during the year and were therefore were less likely to be exposed to the cutoff. Additionally, we conducted this analysis in a narrow income band, but those outside of the 100–200% FPL range may also have experienced income fluctuations that resulted in eligibility changes. Thus, our findings may not be generalizable to the entire income distribution affected by ACA coverage expansions. However, the sensitivity analysis in which we expanded the income band to 50–250% yielded nearly identical results. Another limitation of our study is that insurance type is self-reported. However, previous validation studies have demonstrated that MEPS respondents report their insurance type accurately in a large majority of cases: reporting of enrollment Medicaid and private insurance was found to be 82%27,28 and 97%29 accurate, respectively. Finally, it is possible that changes in our sample composition over the course of the study period as more individuals gain insurance could bias our findings. However, the differences in sociodemographic characteristics between study groups remained largely consistent in the pre- vs. post-ACA period (Table 2), making compositional change unlikely to explain our findings.

In conclusion, we found low rates of insurance churning between Medicaid and Marketplace coverage, with an average of 984,000 adults per year, across all 50 states, transitioning between Medicaid and Marketplace plans. We further found that the introduction of a 138% FPL insurance eligibility cutoff between Medicaid and Marketplace coverage options did not substantively contribute to insurance churning in expansion states among those most likely to be exposed to the cutoff.

References

Sommers B. The perils of a patchwork system. The Boston Globe. https://www.bostonglobe.com/2019/12/16/opinion/perils-patchwork-system/?p1=BGSearch_Overlay_Results. Accessed May 29, 2021.

Graves JA, Curtis R, Gruber J. Balancing coverage affordability and continuity under a basic health program option. N Engl J Med. 2011;365(24):e44. https://doi.org/10.1056/NEJMp1111863

Sommers BD, Rosenbaum S. Issues In Health Reform: How Changes In Eligibility May Move Millions Back And Forth Between Medicaid And Insurance Exchanges. Health Affairs. 2011;30(2):228-236. https://doi.org/10.1377/hlthaff.2010.1000

Buettgens M, Nichols A, Dorn S. Churning under the ACA and State Policy Options for Mitigation. Robert Wood Johnson Foundation, Timely Analysis of Immediate Health Policy Issues. Published online June 14, 2012. http://www.urban.org/UploadedPDF/412587-Churning-Under-the-ACA-and-State-Policy-Options-for-Mitigation.pdf

Hwang A, Rosenbaum S, Sommers BD. Creation Of State Basic Health Programs Would Lead To 4 Percent Fewer People Churning Between Medicaid And Exchanges. Health Affairs. 2012;31(6):1314-1320. https://doi.org/10.1377/hlthaff.2011.0986

Banerjee R, Ziegenfuss JY, Shah ND. Impact of discontinuity in health insurance on resource utilization. BMC Health Serv Res. 2010;10:195. https://doi.org/10.1186/1472-6963-10-195

Olson LM, Tang S, Fong S, Newacheck PW. Children in the United States with Discontinuous Health Insurance Coverage. N Engl J Med. 2005;353(4):382-391. https://doi.org/10.1056/NEJMsa043878

Rimsza ME, Butler RJ, Johnson WG. Impact of Medicaid Disenrollment on Health Care Use and Cost. Pediatrics. 2007;119(5):e1026-e1032. https://doi.org/10.1542/peds.2006-2747

Sommers BD, Gourevitch R, Maylone B, Blendon RJ, Epstein AM. Insurance churning rates for low-income adults under health reform: lower than expected but still harmful for many. Health Affairs. 2016 Oct 1;35(10):1816-1824.

Ku L, Ross DC. Staying Covered: The Importance of Retaining Health Insurance for Low-Income Families. Commonwealth Fund, Task Force on the Future of Health Insurance. Published online December 12, 2002.

Klein K, Glied S, Ferry D. Entrances and exits: Health insurance churning, 1998-2000. Issue Brief. 2005 Sep 1;855:1-2. https://www.commonwealthfund.org/sites/default/files/documents/___media_files_publications_issue_brief_2005_sep_entrances_and_exits__health_insurance_churning__1998_2000_klein_855_entrancesexits_ib_pdf.pdf. Accessed March 1, 2022.

Solomon J.Medicaid: Compliance With Eligibility Requirements. Center on Budget and Policy Priorities; 2019. Accessed May 29, 2021. https://www.cbpp.org/sites/default/files/atoms/files/js-testimony-10-30-19.pdf

Goldman AL, Sommers BD. Among Low-Income Adults Enrolled In Medicaid, Churning Decreased After The Affordable Care Act. Health Aff (Millwood). 2020;39(1):85-93. https://doi.org/10.1377/hlthaff.2019.00378

Gordon SH, Sommers BD, Wilson I, Galarraga O, Trivedi AN. The Impact of Medicaid Expansion on Continuous Enrollment: a Two-State Analysis. J GEN INTERN MED. 2019;34(9):1919-1924. https://doi.org/10.1007/s11606-019-05101-8

Sugar S, Peters C, Lew ND, Sommers BD. Medicaid Churning and Continuity of Care: Evidence and Policy Considerations Before and After the COVID-19 Pandemic. US Department of health & human services. Retrieved June. 2021 Apr 12;10:2021. Accessed March 1, 2022.

Garfield R, Orgera K, Damico A.The Coverage Gap: Uninsured Poor Adults in States That Do Not Expand Medicaid.; 2021. Accessed May 29, 2021. https://www.kff.org/medicaid/issue-brief/the-coverage-gap-uninsured-poor-adults-in-states-that-do-not-expand-medicaid/

Agency for Healthcare Research and Quality. Medical Expenditure Panel Survey: MEPS-HC Panel Design and Data Collection Process [Internet]. Rockville (MD): AHRQ; [cited March 1, 2002]. Available from: https://meps.ahrq.gov/survey_comp/hc_data_collection.jsp

Karaca‐Mandic P, Norton EC, Dowd B. Interaction terms in nonlinear models. Health services research. 2012 Feb;47(1pt1):255-274.

Elmi S, Currier E, Key C.How Income Volatility Interacts With American Familieshe Household Intervi. The Pew Charitable Trusts; 2017. Accessed May 29, 2021. https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2017/03/how-income-volatility-interacts-with-american-families-financial-security

Medicaid and CHIP Payment and Access Commission. Eligibility, Enrollment, and Renewal: Case Study Findings.; 2018. Accessed May 29, 2021. https://www.macpac.gov/publication/eligibility-enrollment-and-renewal-case-study-findings/

Gondi S, Song Z. Expanding Health Insurance through a Public Optiontionbility-enrollment-and Trade-offs JAMA Health Forum. 2021;2(3):e210305. https://doi.org/10.1001/jamahealthforum.2021.0305

Cole MB, Shafer PR, Gordon SH. What the New Biden Administration May Mean for Medicaid. JAMA Health Forum. 2021;2(1):e201497. https://doi.org/10.1001/jamahealthforum.2020.1497

Centers for Medicare and Medicaid Services. Medicaid Per Capita Expenditures [Internet]. Washington (DC): CMS; [cited March 1, 2002]. Available from: https://www.medicaid.gov/stateoverviews/scorecard/how-much-states-spend-per-medicaid-enrollee/index.html

Young K, Rouhani S, Garfield R, January 28, 2015. Medicaid Per Enrollee Spending: Variation Across States. KFF. Published January 28, 2015. Accessed January 17, 2022. https://www.kff.org/medicaid/issue-brief/medicaid-per-enrollee-spending-variation-across-states/

Swartz K, Short PF, Graefe DR, Uberoi N. Reducing Medicaid Churning: Extending Eligibility For Twelve Months Or To End Of Calendar Year Is Most Effective. Health Affairs. 2015;34(7):1180-1187. https://doi.org/10.1377/hlthaff.2014.1204

Ku L, Steinmetz E, Bysshe T. Continuity of Medicaid Coverage in an Era of Transition. Working Paper. Published online November 1, 2015. http://www.communityplans.net/Portals/0/Policy/Medicaid/GW_ContinuityInAnEraOfTransition_11-01-15.pdf

Lynch V, Resnick D.Misreporting Health Insurance Status: Medicaid Enrollees in the Medical Expenditure Panel Survey, 2003.; 2009.

State Health Access Data Assistance Center. Research Project to Understand the Medicaid Undercount: The University of Minnesota’s State Health Access Data Assistance Center, National Center for Health Statistics, Department of Health and Human Services Assistant Secretary for Planning and Evaluation, Agency for Healthcare Research and Quality, Centers for Medicare and Medicaid Services, and U.S. Census Bureau [Internet]. Minneapolis (MN): SHADAC; [cited March 1, 2002]. Available from: https://www.shadac.org/sites/default/files/publications/SNACC_Phase_VI_Full_Report.pdf

Hill SC. The Accuracy of Reported Insurance Status in the MEPS. INQUIRY: The Journal of Health Care Organization, Provision, and Financing. Published online November 1, 2007. https://doi.org/10.5034/inquiryjrnl_44.4.443

Acknowledgements

The authors would like to thank Michael Barnett for providing comments on the manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Disclosures

Sarah Gordon is a senior advisor on health policy in the Office of the Assistant Secretary for Planning and Evaluation at the Department of Health and Human Services. However, this article was conceived and drafted while Dr. Gordon was employed at Boston University, and the findings and views in this article do not reflect the official views or policy of the Department of Health and Human Services.

Conflict of Interest

The authors report no conflicts of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

ESM 1

(DOCX 36 kb)

Rights and permissions

About this article

Cite this article

Goldman, A.L., Gordon, S.H. Coverage Disruptions and Transitions Across the ACA’s Medicaid/Marketplace Income Cutoff. J GEN INTERN MED 37, 3570–3576 (2022). https://doi.org/10.1007/s11606-022-07437-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11606-022-07437-0