Abstract

Purpose

Life cycle assessment (LCA) and life cycle costing (LCC) are state-of-the-art methods used to holistically measure the environmental and economic performance of industrial symbiosis networks (ISNs). Existing methodologies face a challenge in unifying LCA and LCC of an ISN in a single model that can disaggregate the network-level results to the entity and resource flow levels. This study introduces UM3-LCE3-ISN, a methodology for multi-level matrix-based modeling for life cycle environmental and economic evaluation of ISNs.

Methods

The UM3-LCE3-ISN methodology is designed to conduct a process-based LCA and LCC of any ISN scenario. The methodology constructs a single matrix-based model that represents the physical and monetary flows of an ISN across the entire life cycle. The demand and price vectors in the model can be manipulated to produce LCA and LCC results of an ISN at the levels of the entire network, individual companies, and specific resource flows. A formalism is provided that outlines the steps for model construction and multi-level analysis. Verification of the model constructed can be done by producing scaled technology and monetary matrices of an ISN. UM3-LCE3-ISN is tested through a case study of an urban agri-food ISN comprising five entities engaged in open and closed-loop recycling.

Results and discussion

The case study results demonstrated that UM3-LCE3-ISN can be used to compute the life cycle environmental impacts and net present value of ISNs at the three different stakeholder levels. Only one matrix model was required for each scenario to compute the LCA and LCC results for multiple stakeholders through one computation as opposed to several computations in multiple separate models. UM3-LCE3-ISN can produce granular LCA and LCC results regarding specific waste-to-resource conversion processes within an ISN and their contribution to the environmental and economic performance of specific entities. Overall, UM3-LCE3-ISN is able to unify potential conflicting assumptions and data used by different models and obtain more holistic LCA and LCC results that are harmonized for stakeholders across different levels.

Conclusion

The UM3-LCE3-ISN methodology can be applied in industrial symbiosis facilitation tools that allow diverse stakeholders such as policy-makers, urban planners, businesses, and product designers to operate on a common platform to determine the life cycle environmental and economic performance of an ISN from multiple perspectives of interest. This would allow diverse stakeholders to make holistic evidence-based decisions and strategies for developing ISNs in different sectors that enable a large-scale transition to a circular economy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The concept of the circular economy has been internationally recognized as a paradigm to achieve sustainable development by addressing a wide range of issues such as climate change mitigation, waste management, resource scarcity, and environmental degradation. To enable a transition to a circular economy, industrial symbiosis has been promoted as a scalable pathway for businesses and other organizations to pursue (Kirchherr et al. 2017; Kerdlap et al. 2019). Industrial symbiosis has been broadly defined as the collaboration between traditionally separate industries with the objective of physically exchanging materials, energy, water, and/or by-products to gain competitive advantages (Chertow 2000, 2007; Chertow and Park 2016). Over the past several years, information and communication technology tools have been developed to spur the growth of industrial symbiosis networks (ISNs) by identifying synergistic linkages among industrial processes and businesses (Raabe et al. 2017; Capelleveen et al. 2018; Low et al. 2018; Yeo et al. 2019). National industry networking programs and industrial symbiosis facilitation tools have advocated that the costs and benefits of waste-to-resource exchanges be quantified through indicators such as life cycle environmental impacts and economic performance (Laybourn and Lombardi 2007; Kerdlap et al. 2020b). Some waste-to-resource exchanges can be more detrimental to the environment (Mohammed et al. 2018) and could lead to burden shifts such as the circular economy rebound effect (Zink and Geyer 2017).

Life cycle assessment (LCA) and life cycle costing (LCC) are methods that have been widely used to holistically evaluate the environmental and/or economic performance of ISNs. In LCA, the environmental impacts of a product or service throughout all stages of its life cycle are measured starting with the extraction of raw materials, processing of materials, manufacturing of products, use of the products, reuse, repair, or recycle, and final disposal at the end of life (International Organization for Standardization 2006a, b). Similarly, LCC measures all monetary flows (costs and revenue) of a product or service throughout its life cycle (Swarr et al. 2011). Through a holistic approach, stakeholders at various levels of an ISN can better understand if a proposed technical solution applied locally results in the desired environmental benefits in a broader context. Over the past decade, many peer-reviewed LCA and LCC studies of ISNs have been conducted to holistically quantify the environmental and economic benefits and trade-offs of ISNs (Kerdlap et al. 2020a). Several methods for carrying out LCAs and LCCs specifically for ISNs already exist (Mattila et al. 2012; Dong et al. 2013; Gerber et al. 2013; Martin et al. 2015; Kerdlap et al. 2020b). Despite the plethora of methods and case studies of life cycle environmental and economic evaluations of ISNs, stakeholders operating at different ISN decision-making levels still lack the ability to conduct such assessments from multiple perspectives using a single model.

Three main technical issues exist with regard to unifying LCA and LCC modeling and analysis of ISNs. The first issue is that current methods that unify LCA and LCC modeling have been developed for the case of independent single product systems through matrix-based models (Heijungs et al. 2013; Moreau and Weidema 2015). Such methods have not been tested in cases with multiple product systems that are interconnected with each other through waste-to-resource exchanges, which is a typical characteristic of ISNs. The second issue is the method for representing fixed costs in a model for both LCA and LCC. In LCA, the environmental impacts of fixed costs such as equipment and capital goods are typically amortized where the impacts of equipment are distributed across its lifetime and the amount of product the equipment will produce. However, when conducting an LCC, the time value of money is often factored in and so the full cost of an equipment must be incurred in a specific time period and not amortized. The third issue is the lack of a method for disaggregating network-level LCA and LCC results to the levels of specific entities or product flows. This is important because without the ability to produce results at these different levels, the different stakeholders will not be able to acquire the information they need to benchmark their environmental and economic performance to ultimately decide if participating in an ISN adds value to their business and organizational goals. In an ISN, there can be resource flows with multiple origins (sources) and destinations (sinks). Due to waste-to-resource exchanges, a resource flow that is a cost for one entity could also be considered as revenue for another entity (Kerdlap and Cornago 2021). This presents another level of complexity when trying to use a single model to represent both physical and monetary flows of an entire ISN and disaggregate the results to the level of a single entity or product flow. Research in this area has been pursued for LCA (Martin 2015; Martin et al. 2015; Kerdlap et al. 2020b), but has not yet been explored in both LCA and LCC.

To address the aforementioned technical challenges, this study introduces a methodology for unified multi-level matrix-based modeling for life cycle environmental and economic performance evaluation of industrial symbiosis networks, hereby referred to as the UM3-LCE3-ISN methodology. The UM3-LCE3-ISN methodology is designed to analyze the life cycle environmental impacts and economic costs and revenue of an ISN at the network-level and disaggregate the results down to the entity and resource flow levels through manipulation of the demand vector. The UM3-LCE3-ISN methodology is tested through an ISN case study of a fictitious network of five urban agri-food production companies that participate in waste-to-resource exchanges among each other. This study concludes with a discussion about how the UM3-LCE3-ISN methodology overcomes the aforementioned technical challenges and future areas of research. The methodology was developed to support advancement of tools and software that give a wide range of ISN stakeholders with different interests the ability to operate on a single platform when measuring the environmental and economic performance of ISN options being considered and make decisions.

2 Methods

The UM3-LCE3-ISN methodology builds on the previous research completed by Kerdlap et al. (2020b) by adding multi-level LCC of ISNs as a new capability to the model constructed, which serves as the novelty of this study. Several parts of the UM3-LCE3-ISN methodology remain equal to the methodology presented in the previous paper by Kerdlap et al. (2020b) and are therefore presented again in this paper for the sake of readability. Specifically, the sections of this study that remained the same from the previous study are about the interventions matrix, representation of ISN scenarios, demand vector manipulation, and environmental evaluation.

2.1 Overview of UM3-LCE3-ISN methodology

The UM3-LCE3-ISN methodology is designed to conduct process-based LCAs and LCCs of any ISN scenario with or without waste-to-resource exchanges. This includes a prospective ISN, an optimized ISN, or different types of reference scenarios following the typologies by Aissani et al. (2019). UM3-LCE3-ISN uses a matrix-based model to enable high clarity and representation of processes, high level of detail, and computation simplicity for carrying out LCAs and LCCs (Suh and Huppes 2005). Cradle-to-gate is the system boundaries of the UM3-LCE3-ISN methodology. This methodology excludes activities during the use and end-of-life treatment stages of all final products or services made in an ISN (i.e., the functional unit). The system boundary is drawn here because the methodology assumes that the final products are consumed and treated at their end-of-life outside of the ISN (i.e., secondary networks/systems). The downstream processes the methodology includes are end-of-life treatment of all wastes generated in the foreground and background systems of an ISN.

The methodology defines a matrix A with dimension n × n that represents physical flows between processes across all life cycle stages. The value “n” refers to the total number of rows or columns in a matrix or vector. Matrix A will be referred to as the technology matrix following the nomenclature by Heijungs and Suh (2002) for matrix-based LCA models. The methodology uses process-based data to construct the model. In the technology matrix, columns represent processes and rows represent input and output resource flows. Next, the methodology defines a matrix B with dimension m × n to represent environmental and economic interventions of each process in the technology matrix. The value “m” refers to the total number of columns in a matrix when it is not equal to “n.” Matrix B will be referred to as the interventions matrix as stated by Heijungs and Suh (2002). An environmental intervention represents the direct impacts to the environment from a unit process such as emissions of carbon dioxide, sulfur dioxide, and other substances or the extraction of resources such as fossil fuels, water, and metals. An economic intervention in matrix B represents the monetary marginal value of each process. The total environmental impacts and net economic value are computed by using Eqs. 1, 2, and 3 as introduced by Heijungs and Suh (2002).

In this methodology, “j” represents the row number and “k” represents the column number of a value in a matrix. For example, B2,5 refers to the value at row 2 (j = 2) and column 5 (k = 5) in interventions matrix B.

Demand vector f is defined as a n × 1 column vector and represents the functional unit. Equation 2 is used to compute scaling vector s which is used to scale the technology matrix to the functional unit specified in demand vector f. If a resource flow in the technology matrix is not a final product or service included in the functional unit of an ISN, then the resource flow has to be consumed by a sink process such as another production process or a process for treating waste. For economic evaluation, price vectors ⍺ and β are introduced to control which monetary flows are to be included. Price vector ⍺ is a n × 1 column vector used to represent the monetary value per unit of a flow in the model. Price vector β is an n × 1 column vector use to represent the present value of a monetary value per unit of a flow in a defined time period.

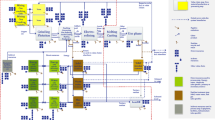

Figure 1 illustrates the general structure of the matrix-based model constructed. The steps for constructing this matrix-based model are provided in a formalism that is illustrated in Fig. 2. Figure 3 illustrates a formalism that lists the steps for multi-level analysis of the model constructed to produce LCA and LCC results at the network, entity, and flow-levels. Table 1 summarizes the notations that are used for the methodology. This methodology defines an entity as an individual company or organization participating in an ISN that provides a desired good or service.

The following sections explain how the matrix-based model is constructed and analyzed.

2.2 Model construction

Technology matrix A is constructed through three stages that build on top of each other which are (1) primary, (2) expanded, and (3) allocated. In the first stage, the primary matrix is constructed to represent all the entities that participate in an ISN and resource flows they produce and consume within the boundary of an ISN. In the second stage, the expanded matrix is formed by adding columns and rows to the primary matrix to represent background system processes that supply resources to the entities (sources) and processes that treat wastes (sinks) in an ISN. In the third stage, the allocated matrix is formed by splitting columns in the expanded matrix with multiple valuable outputs and by splitting rows for resource flows with multiple sources and sinks. The allocated matrix constructed represents the final technology matrix A that is used in the computations. By following the steps shown in the first three stages of the UM3-LCE3-ISN formalism for model construction (Fig. 2), the final technology matrix A will be square and non-singular. Therefore, technology matrix A can be inverted and be used with interventions matrix B to compute the LCA and LCC results following Eqs. 1, 2, and 3. More specific details and visuals about each stage of constructing technology matrix A are provided in Section 1.1 of the supplementary information.

In the fourth stage of model construction, interventions matrix B is constructed by creating a matrix that contains the same number of columns in technology matrix A. In interventions matrix B, a row is created for every direct environmental flow being considered in the scope of the study (e.g., carbon dioxide, sulfur dioxide, methane). A positive value is set for environmental flows produced in the process, and a negative value is set for environmental flows consumed by a process. Another row is added to interventions matrix B to represent the monetary marginal values for each column which is used in the economic analysis. In this row, monetary marginal values should only be inserted for columns that represent processes that take place within any entity in an ISN. Monetary marginal values for all other columns should be set to zero. For example, a monetary marginal value should be set in interventions matrix B for the process of manufacturing a computer component in a factory. However, for the column representing the cradle-to-gate production of electricity used to manufacture the computer component, the monetary marginal value in interventions matrix B should be set to zero. For “primary” columns that have direct environmental flows and were split during multi-product allocation, the values of the environmental flows for each of the split columns are determined based on the physical relationship with the valuable output flow or the allocation method selected. Section 1.3 of the supplementary information provides additional details regarding the construction of interventions matrix B.

2.3 Model analysis parameters

The model constructed by UM3-LCE3-ISN comprises four parameters that can be adjusted to conduct multi-level environmental and economic analysis which are:

-

1.

Demand vector f

-

2.

Price vector ⍺

-

3.

Time t

-

4.

Interest rate i

Demand vector f is used to represent the functional unit of an ISN. Thus, the values set for the flows in demand vector f must reflect the functional unit of the ISN being analyzed. The functional unit of an ISN scenario should represent the total output of all entities in an ISN during a defined time period (Mattila et al. 2012). Although the model constructed for each scenario represents a different type of ISN, functional equivalence needs to be maintained when comparing LCA and LCC results. Therefore, to maintain functional equivalence, the values used in demand vector f should be the same in each scenario modeled.

Price vectors ⍺ and β are used to compute the monetary marginal value of each process at a given time and interest rate. The monetary marginal values of each process are used to compute the net present value (NPV) to conduct an LCC. The user can choose what values to set in price vector ⍺ to control which monetary flows are to be included in the LCC for economic performance evaluation. Price vector ⍺ is used to represent the monetary value of a flow per unit. Price vector β converts the value in price vector ⍺ into the present value during a defined time period which is required for carrying out an NPV analysis. For price vector ⍺, an n × 1 column vector is defined with the same number of rows in the final technology matrix A. The values for price vector ⍺ must be set as the monetary value per unit of flow and can either be positive or negative. Table 2 shows the rules for the signs and numerical values to use in price vector ⍺.

In general, flows that are valuable are set as positive (+ ve) values, whereas valueless flows such as waste are set as negative (− ve) values. For waste flows, the negative value must represent the cost of disposing each unit of waste. Taxes are considered as negative values because an entity does not gain any financial value (loses money) from the payment of taxes. Subsidies are considered as positive values because an entity benefits financially (gains money) from receiving a subsidy. A value of zero (0) in price vector ⍺ means that the flow does not incur any monetary value for the producer or the consumer. These sign rules for the values of flows in price vector ⍺ were designed to work with the direction of the different types of flows represented in technology matrix A. For example, capital good flows are negative values in the technology matrix because an entity consumes them while waste flows are positive values because they are outputs of an entity. When following these sign rules, eventually, the consumption of capital goods and treatment of waste flows will have negative monetary values because they are expenses for the entities, which must be represented as negative monetary flows in the computation of the monetary marginal values of each process. Price vector β is an n × 1 column vector with the same number of rows as in the final technology matrix A. Each number in price vector β is the present value of the corresponding number in price vector ⍺ at a given time (t) and interest rate (i). Each present value in price vector β is calculated using Eq. 4.

2.4 Representing ISN scenarios in technology matrix A

The model construction steps provided in the formalism in Fig. 2 are agnostic to the type of ISN scenario whether valuable wastes or by-products are exchanged between entities. The user is free to choose how the reference scenario or alternative scenarios are defined. When following the formalism to construct the model for a scenario, the entities in the matrix, background production processes, waste treatment processes, and the sources and sinks of all the flows in an ISN should reflect the conditions of the defined scenario. In a scenario where there are no waste-to-resource exchanges, all the entities in the model would represent traditional linear production. All input resources would come from virgin sources and all wastes produced would be sent for waste treatment. There would not be any entities consuming a by-product or valuable waste flow from another entity in technology matrix A.

In an ISN, there are many types of conditions that can occur such as open-loop recycling, closed-loop recycling, entities with a product consumed by multiple sinks, and the consumption of capital goods such as equipment and infrastructure. The way to represent these different conditions in technology matrix A are described in further detail in Section 1.2 of the supplementary information.

2.5 Representing interventions in matrix B

2.5.1 Environmental interventions

In interventions matrix B, a row can be added for any type of environmental intervention. For example, if there are three types of emissions such as carbon dioxide, sulfur dioxide, and nitrous oxide, a row is added for each emission factor. The value of the emission factor should be normalized to the amount of output represented in the same column of technology matrix A. Alternatively, the rows for environmental interventions can be represented as characterized emission factors for each process that are usually presented in units such as kg CO2-eq (climate change), kg oil-eq (fossil depletion), or kg 1,4-dichlorobenzene-eq (ecotoxicity). For example, if there are four impact categories such as climate change, water use, ecotoxicity, and metal depletion, four rows should be placed in intervention matrix B. The value of the characterized emission factor inserted should be normalized to the unit of output represented in the column.

2.5.2 Economic interventions

To conduct LCC through the UM3-LCE3-ISN methodology, the monetary marginal value for each process column must be computed and placed in the economic row of interventions matrix B. This is done through six steps which are as follows:

-

Step 1: Set values in price vector ⍺

-

Step 2: Compute present values in price vector β

-

Step 3: Construct matrix Diag(β)

-

Step 4: Construct monetary matrix (Amonetary = Diag(β)A)

-

Step 5: Compute the marginal present value for all columns

-

Step 6: Placement of marginal present values in interventions matrix B

A detailed explanation of each step with visual examples is provided in Section 1.4 of the supplementary information. During the final step of constructing interventions matrix B, monetary marginal values should only be placed for columns that represent processes that take place within the boundary of any entity in an ISN. This rule exists so that during model analysis, interventions matrix B can be used for both LCA and LCC. Including the monetary marginal value for columns that represent processes that take place only within the boundaries of an entity in the network ensures that the LCC results reflect only the direct cash flows of the network or specific entity of interest. However, should the scope of an LCC study seek to examine the economic flows across the whole supply chain at steps that take place beyond the boundary of and ISN, the monetary marginal values for the other processes could be added to interventions matrix B.

2.6 Multi-level analysis

As previously discussed, the model constructed by UM3-LCE3-ISN comprises four parameters that can be adjusted to conduct multi-level environmental and economic analysis. These are (1) demand vector f, (2) price vector ⍺, (3) time t, and (4) interest rate i. By turning on and off certain values in demand vector f and price vector ⍺, the user can acquire aggregated and disaggregated LCA and LCC results regarding the ISN. Fully aggregated results would be those at the level of the entire network. Disaggregated results would be those that represent specific entities, product flows, or specific processes such as recycling.

2.6.1 Environmental evaluation

The demand vector can be manipulated to analyze each modeled scenario at different levels as shown in Fig. 3 in the model analysis component of the formalism. To analyze the life cycle environmental impacts of the entire network, demand vector f should be set for all final products and services in the functional unit. This represents the total amount of all output flows, without sink entities, that the network produces during the analysis period of interest. For example, if six valuable products are made in an ISN in one year, the values in the demand vector for those six resource flows should be set to the amount that is produced within one year.

The network-level results can be broken down to analyze the environmental impacts of one entity in the network. This is done by setting the values in the demand vector only to the amount of valuable output flows from the entity of interest during the period of analysis. To analyze one specific resource flow in the model, only the value for the resource flow of interest in the demand vector should be given a value. An example of flow-level analysis is computing the environmental impacts of a waste-to-resource conversion process. In this case, the demand vector would be set to amount of output from the waste-to-resource conversion process that is required as a reference flow to the functional unit of the ISN.

2.6.2 Economic evaluation

The UM3-LCE3-ISN methodology follows Moreau and Weidema (2015) in defining LCC as the sum of the net profit over the life cycle, which is consistent with LCA and cradle-to-gate assessments in particular. To produce LCC results at the network, entity, and flow levels, the same analysis steps discussed previously can be followed. Before those analysis steps are followed, the parameters for monetary flows (price vector), time, and interest rate must be set. The time period of interest has to be defined in terms of years. Next, the interest rate for the period of interest has to be defined. Finally, the prices in price vector ⍺ must be defined for all monetary flows considered in the period of analysis. The monetary value should be set to the price per unit of the flow in technology matrix A and the sign (positive or negative) should be set according to the rules stated in Table 2.

For flows that represent a fixed cost such as a capital good, the value entered in price vector ⍺ must be set as the price of the capital good multiplied by its total lifetime (i.e., years). This modification of the price is done because consumption of capital goods is represented in the columns of technology matrix A as the amount consumed per unit of valuable output produced based on a defined capacity and lifetime. In an LCC, the cost of a capital good is completely incurred in a specific year, whereas in LCA, the environmental impacts of a capital good consumed are amortized and distributed over the total amount of products the capital good produces over its entire lifetime. Therefore, this rule for setting the monetary value of the capital good in price vector ⍺ allows for the full cost of the capital good to be incurred all at once in a specific time period of interest without having to modify technology matrix A, interventions matrix B, or the values defined in the demand vector. This is explained in further detail in Sections 1.2.4 and 1.4 of the supplementary information. Once the values in price vector ⍺, time period, and interest rate are set, the monetary marginal values can be calculated and inserted into the economic interventions row in matrix B.

In an LCC, the analysis usually takes place over multiple years depending on the goal and scope of the study. For each year of interest, the value set for time t has to be adjusted accordingly so that the LCC results computed represents the present value in a given time period and defined interest rate. For years that a capital good is not purchased, the monetary value for the capital good in price vector ⍺ should be set to zero. Similarly, if there is no cost or revenue for other flows in a specific year, the monetary value of those flows should also be set to zero.

3 Case study

To test the UM3-LCE3-ISN methodology, a case study was carried out that conducts an LCA and LCC of a fictitious urban agri-food ISN that comprises five entities that produce food at different scales. The five entities include a soil farm, a hydroponics farm, a brewery, an egg farm, and a fish farm. The case study compares the life cycle environmental and economic performance of an ISN before and after waste-to-resource exchanges. The functional unit of this LCA and LCC is the total food items produced by all five entities over a period of 10 years. The system boundary of the LCA and LCC is cradle-to-gate. All products from each entity are assumed to be delivered to a general market. All entity production processes take place within Singapore. Wastes generated from each entity’s cradle-to-gate production processes are sent to an incinerator in Singapore if they are not converted into resources.

The design of the two scenarios in this case study (before and after waste-to-resource exchanges) was based on real food production volumes and manufacturing processes in Singapore as well as waste valorization technologies being explored. Interviews with the relevant food production entities in Singapore and secondary data from the literature served as the basis for modeling the activities in both scenarios of the case study. Section 2 of the supplementary information provides all the data and assumptions used to model each entity in both case study scenarios. Table S2-1 in Section 2 of the supplementary information lists the reference flows of each entity in the defined functional unit on an annual basis.

The environmental impact categories used in the LCA were climate change on a 100-year time horizon, cumulative energy demand, and water depletion. These three impact categories were selected to measure the balance in the food-energy-water nexus which is relevant to the context of Singapore, a resource-scarce nation that has a goal to produce 30% of its food requirements by 2030 (Singapore Food Agency 2019). In the impact categories of climate change and water depletion, characterization factors from the ReCiPe method (Huijbregts et al. 2017) for midpoint indicators from a hierarchal perspective were used. In the economic evaluation, LCC was used to measure the NPV of the entire network and each entity over a period of 10 years. The NPV analysis was used to measure the change in profitability of the entire ISN and its participating entities when waste-to-resource exchanges are implemented. The NPV analysis included all capital (fixed) and operation (variable) costs and revenue. The interest applied was 8.88% (DBS Bank 2021) to factor in the time value of money in the economic evaluation. The case study assumes that all capital expenses (CAPEX) can be salvaged at 10% of the original price at the end of 10 years. The CAPEX for all entities in the ISN were estimated as overall bulk costs. The monetary data used in this case study are listed in the Sect. 2.3 of the supplementary information.

3.1 Scenarios

The reference scenario (REF) represents business-as-usual where all entities produce their goods independently and do not participate in any waste-to-resource exchanges. Thus, all wastes are sent to an incinerator in Singapore. Since wastes are not converted into resources, all five entities consume virgin resources to meet their annual production demand. The industrial symbiosis scenario (ISN) represents a fictitious situation where the chicken manure, spent grains, organic agriculture waste, and wastewater are converted into resources that are consumed by other entities in the ISN. The conversion of valuable wastes into resources and their movement from different sources to sinks are illustrated in Fig. 4.

Five waste-to-resource exchanges exist. The brewery gives its spent grains as chicken feed to the egg farm and to a facility that uses black soldier flies to convert spent grains into alternative fishmeal. The alternative fishmeal is used in fish feed production for the fish farm. The egg farm sends a portion of its manure to an anaerobic digester to produce electricity. The electricity generated is able to meet the total annual electricity demand of the egg farm itself as well as the hydroponics and soil farms. The electricity from the anaerobic digester is sold to those entities at a price 10% lower than the cost of electricity from the grid. The organic waste at the hydroponics farm is given to the soil farm to use as compost. Similarly, the wastewater from the hydroponics farm is given to the soil farm for reuse. The life cycle inventory (LCI) data used to model all five entities and the waste-to-resource exchanges in the LCA and LCC are provided in full detail in Section 2.2 of the supplementary information.

3.2 Modeling and analysis

To conduct the LCA and LCC, the UM3-LCE3-ISN methodology was used to construct and analyze matrix-based models for the REF and ISN scenarios. Only two matrix-based models were constructed for the two scenarios by following the methodological steps outlined in the model construction formalism shown in Fig. 2. The number of columns and rows and values in each technology matrix constructed were different depending on the conditions of each scenario which are described and illustrated in detail in Section 2.4 of the supplementary information. To analyze the LCA and LCC results at the network, entity, and flow levels for the REF and ISN scenarios, the annual production output values listed in Table S2-1 in the supplementary information were used in the demand vector. For the LCC, values in price vector ⍺ were given a value if the cost or revenue of a flow (row) was incurred during the period of analysis. The different values used in the demand vector for network-level, entity-level, and flow-level analyses are provided in Table S2-11 in the supplementary information.

4 Results

4.1 Environmental evaluation

4.1.1 Overall results

The life cycle environmental impacts of the REF and ISN scenarios are presented on an annual basis in Fig. 5. Although the case study’s goal and scope specified a 10-year time frame, the trends and conclusions drawn from the LCA results on an annual basis remain valid because it was assumed that the activities in the network are the same each year. In this case study, there is a large difference in annual production volumes among the entities. Therefore, the LCA results at the network and entity levels were presented in two ways. The graphs on the left side of Fig. 5 show the absolute LCA results of the ISN over a period of one year. These results help show how much each entity contributes to the total environmental impacts of the entire network. The graphs on the right side of Fig. 5 show the LCA results per kilogram of food item for each entity. These graphs better illustrate the change in total environmental impacts for each entity in terms of a single unit of food product, which is seen less clearly in the graphs on the left side of Fig. 5. The subsequent sections explain the LCA results at the network, entity, and flow-levels.

4.1.2 Network-level results

In Fig. 5, the network-level results are shown on the left side of the red dotted lines in each graph. The results were generated through UM3-LCE3-ISN by setting the values of the demand vector to be the total annual production volume of leafy vegetables from the hydroponics and soil farms, beer, eggs, and fish. At the network level, the waste-to-resource exchanges reduced the life cycle environmental impacts by 1.7–2.1% in comparison to the REF scenario (business-as-usual). Most of the reductions in environmental impacts occurred as a result of converting 95% of the chicken manure produced in Singapore into electricity instead of sending it to the incinerator which occurred in the REF scenario. Although the life cycle environmental impacts of the ISN at the network-level decreased in all impact categories, certain entities increased in their total environmental impacts after the waste-to-resource exchanges.

4.1.3 Entity-level results

On the right side of the dotted lines in the graphs in Fig. 5, the life cycle environmental impacts of each entity are shown. These results were computed through the UM3-LCE3-ISN methodology by setting a value in the demand vector for the specific entity of interest while all other values in the demand vector were set to zero. For example, to analyze the life cycle environmental impacts of the brewery, the demand vector was set to 200,000,000 liters; the total beer produced in one year. The same process of manipulating the demand vector was done to analyze the environmental impacts of each entity in both scenarios. In the supplementary information, Table S2-11 shows the demand vector values used to analyze each entity.

At the entity level, depending on the impact category, each entity either increased or decreased in environmental impacts when the waste-to-resource exchanges are implemented as shown in Table 3.

Only the brewery and egg farm decreased in total impacts whereas the soil, hydroponics, and fish farms increased in impacts. The brewery and egg farms decreased in impacts because they reduced the amount of waste (manure and spent grains) sent to the incinerator. The egg farm showed a decrease in environmental impacts in all three impact categories. This is because the egg farm was able to avoid sending 95% of the manure produced in Singapore to the incinerator and sent it to an anaerobic digester where it was converted into electricity. The brewery had a small decrease in impacts in the ISN scenario because less than half (45%) of the spent grains was used as a resource. The entities that generally increased in total impacts after waste-to-resources were the soil, hydroponics, and fish farms. This is because these entities inherited the impacts of the process for converting the wastes (manure and spent grains) into valuable resources (electricity and alternative fishmeal).

4.1.4 Flow-level results

Through flow-level analysis, more granular information about the life cycle environmental impacts of a waste-to-resource conversion process can be acquired. This helps determine how much a specific waste-to-resource conversion process contributes to the total impacts of the entity that consumes the recycled product. Figure 6 shows the entity-level results and isolates the impacts of the waste-to-resource exchange flows. The total impacts of each entity in the graphs in Fig. 6 are presented per kilogram of food product. Similar to Fig. 5, the impacts in Fig. 6 are presented per kilogram of food product to more clearly illustrate the comparison in environmental performance of all entities on a single graph. The numerical values for the life cycle environmental impacts of each waste-to-resource exchange process on an annual basis are provided in Table S3-4 in the supplementary information.

In the category of cumulative energy demand, the results for the soil and hydroponics farms were negative in the ISN scenario for two reasons. First, these two entities consumed electricity generated by the anaerobic digester, and second, the sludge co-produced with electricity from the anaerobic digester was sent to the incinerator with energy recovery, which avoids additional electricity production from the national grid. In the REF scenario, any manure from the egg farm or sludge from the anaerobic digester was sent to an incinerator with energy recovery. The soil and hydroponics farms did not have negative results for cumulative energy demand because they consumed electricity from the Singapore grid instead of the anaerobic digester that would have resulted in sludge. In-depth explanations are provided in Section 3.1.2 in the supplementary information about why each entity increased or decreased in impacts to climate change, cumulative energy demand, and water depletion after waste-to-resource exchanges. Through the use of flow-level analysis, the user can isolate the impacts of specific waste-to-resource exchanges and quantify how much they contribute to the overall environmental performance of specific entities.

4.2 Economic evaluation

4.2.1 Overall results

Table 4 presents the NPV of the whole network and the individual entities after 10 years in the REF and ISN scenarios.

The economic evaluation results were generated through UM3-LCE3-ISN by setting values in the demand vector, the price vector, the specific years for the time variable, and the interest rate (8.88%). Similar to the environmental evaluation, the demand vector values were set to the total food items produced by all five entities annually. In price vector ⍺, monetary values were set for all flows that incur a cost or revenue during the time period of interest. This means that at year zero, the monetary value for all flows that are operational costs were set to zero and the monetary values for all capital goods were set to their price per unit multiplied by the capital goods’ assumed lifetime of 10 years. In years 1–10, a monetary value was set for all flows that are operational costs and revenue, while the monetary values of all capital goods were set to zero. Finally, in year 10, a monetary value was set for all capital goods that could salvaged at 10% of the original price. The interest rate was set to 8.88% for all 10 years.

4.2.2 Network-level results

As shown in Table 4, the overall network NPV in the ISN scenario was higher than that of the REF scenario. Figure 7 illustrates the present value of the entire network in the REF and ISN scenarios from years 0 to 10. The present value starts off negative in year zero for both scenarios because of the initial cost of investing in capital goods for all entities. From years 1 to 10, the present value shows profitability. Each year, the ISN scenario has a slightly higher profitability than the REF scenario by about 0.6–0.8% as a result of waste-to-resource exchanges. The improvement in profitability is due to the reductions in annual costs of all the entities, which can be explored through entity-level analysis.

4.2.3 Entity-level results

Similar to Fig. 7 above, NPV graphs can be created at the entity level. Figures S3-1 to S3-5 in the supplementary information show the growth in NPV of each entity from years 0 to 10. The process for generating the economic evaluation results at the entity-level was similar to that of the network-level. The only difference is that for the entity-level results, the demand vector was set to the amount of food items produced annually by the entity of interest. The numerical values used to produce the NPV graphs for each entity are provided in Section 3.2.2 of the supplementary information.

The entity-level results show that all the entities were able to have higher profits after waste-to-resource exchanges. Some entities were able to gain higher profits annually than others. The egg farm had a significant increase in profitability each year due to waste-to-resource exchanges. The other entities also improved in economic performance after waste-to-resource exchanges, but only by a small amount. The fish farm improved in annual profitability by about 3–7%, whereas the brewery, hydroponics, and soil farms improved in annual profitability by less than 1%.

The reason all the entities were able to improve in profitability in the ISN scenarios was that the waste-to-resource exchanges allowed the entities to reduce their annual costs. The breakdown of the annual costs for each entity in the REF and ISN scenarios are compared in the graphs in Fig. 8. The values of the annual cash flows, both revenue and costs, are provided in Section 3.2.2 of the supplementary information. The breakdown of the costs for each entity was generated through producing a scaled monetary matrix. Detailed explanations regarding how all five entities were able to reduce their annual costs in the ISN scenarios can be found in Section 3.2.3 of the supplementary information.

5 Discussion

5.1 Methodological contributions

5.1.1 Technical issues in multi-level LCAs and LCCs of ISNs

In Section 1, there were three issues mentioned regarding the state-of-the-art of methodologies used to conduct multi-level LCAs and LCCs of ISNs. The first issue is that existing methods that use a matrix-based model to unify LCA and LCC have been applied to single product systems, but not multi-product systems that are linked by waste-to-resource exchanges which is often the case for ISNs. The second issue is how to represent fixed costs in a model that is used for both LCA and LCC. The environmental impacts of capital goods in LCA are typically amortized and are distributed across the equipment’s lifetime and number of products that are produced within the capital good’s lifetime. On the contrary, in an LCC, the full monetary cost of a capital good is incurred once during a specific time period. A model that unifies LCA and LCC of ISNs needs to be able to satisfy these two aforementioned conditions. The last issue is the lack of a method for disaggregating network-level LCA and LCC results of an ISN to the levels of specific entities or product flows.

5.1.2 Addressing the technical issues

The UM3-LCE3-ISN methodology uses a matrix-based model that unifies LCA and LCC to address the aforementioned challenges. By following the formalism for model construction and analysis as shown in Figs. 2 and 3, the UM3-LCE3-ISN methodology can consistently construct a square and invertible technology matrix that can disaggregate multi-product systems. To address the first challenge, the UM3-LCE3-ISN methodology unifies LCA and LCC by creating matrices that represent both the physical and monetary flows that occur across the life cycle stages of an ISN. Steps are provided at each stage of constructing a technology matrix (see Fig. 2) that represents the physical flows of the system. The model construction formalism states rules about the number of columns to create in the technology matrix to represent the entities, waste-to-resource conversion processes, intermediary production processes for raw materials, and waste treatment processes. The methodology’s formalism also states rules regarding the number of rows to create in the technology matrix and how additional rows should be added when there are flows with multiple sources and sinks. To translate the physical flows to monetary flows in the model, price vectors ⍺ and β are defined which are used to construct a monetary matrix. The monetary matrix represents the physical flows of the technology matrix in terms of the monetary values specified in price vectors ⍺ and β. Thus, the same model can be used to represent both physical and monetary flows. An interventions matrix is defined to represent the environmental impacts of a process (column) as well as the monetary marginal value. The monetary marginal values for each process are computed from the monetary matrix, which are used to compute the NPV of an ISN at multiple levels.

The second issue of representing fixed costs (e.g., capital goods, equipment) in a unified model for LCA and LCC is addressed through amortizing the amount of capital goods a process consumes in the technology matrix and adjusting the monetary value set in price vector ⍺ for the fixed cost. In Section 1.2.4 of the supplementary information, an example is provided about how to compute the amount of capital goods an entity in an ISN consumes per unit product. The monetary value of the capital good inserted into price vector ⍺ must be set as the price of the capital good multiplied by its total lifetime. This ensures that the full cost of the capital good is completely incurred in the time period of interest without having to modify technology matrix A. Following the multi-level analysis formalism in Fig. 3, the monetary value of the capital good will only be turned on in price vector ⍺ in the year the cost is incurred. The present value computed for the network or an entity in the specified time period will include the full cost of the capital good. This method was tested in the case study, and the bulk capital costs for each entity were correctly computed in the LCC for the NPV analysis.

The UM3-LCE3-ISN methodology addresses the third technical issue through a method for constructing a model that uses demand vector f and price vector ⍺ to disaggregate the network-level LCA and LCC results to the levels of specific entities or product flows. In the multi-level analysis formalism (see Fig. 3), rules are provided about how to set price vector ⍺ to include the monetary flows that take place in an ISN during a specified time period. To analyze the results at the different stakeholder levels, rules are provided in the multi-level analysis formalism about how to set the demand vector to generate LCA and LCC results at either the network, entity, or flow levels. In the UM3-LCE3-ISN methodology, waste-to-resource conversion processes are represented in the technology matrix as columns with row values that represent flows that come from one or more entity columns and/or flows that are sent to one or more entities in an ISN. In waste-to-resource exchanges, entities or processes (columns) will have multiple valuable output flows since they produce the main product(s) and valuable waste flows. The formalism for UM3-LCE3-ISN states rules in the multi-product allocation stage of matrix construction regarding how the column for an entity or process with multiple valuable output flows should be split for each product. In terms of economic analysis, rules are established with regard to how the values in price vector ⍺ should be set to reflect the revenue and costs of a waste-to-resource exchange from the perspectives of the entities involved. This capability of disaggregating the network-level results to the levels of the entities and specific product flows was demonstrated in the case study through the computation of LCA and LCC results for the entire network as well as each of the five entities as shown in Figs. 5 to 8.

5.2 Advantages

The case study demonstrated several advantages of using the UM3-LCE3-ISN methodology to conduct multi-level LCAs and LCCs of ISNs.

5.2.1 Multi-level analysis in a single model

The first advantage is that unified modeling and analysis allows the user to use a single model for each scenario to analyze both the life cycle environmental impacts and economic costs and revenue simultaneously. In the case study, only one matrix model was needed for each scenario and only one computation was required to construct the model as opposed to several computations in multiple separate models. Through manipulation of the demand and price vector, the model can compute the LCA and/or LCC results of the whole network, which can be broken down to the individual entities or their specific output flows in the case of multi-output entities. Using traditional approaches, the user would need to construct multiple separate process-based LCA models to represent the perspective of each entity, each waste-to-resource exchange, and combine the results to get the perspective of the whole network (Kerdlap et al. 2020a). Representing both the foreground and background systems of an ISN in just one model avoids the need to do separate computations in each system that is modeled. Furthermore, the UM3-LCE3-ISN methodology can conduct a more detailed LCA and LCC of waste-to-resource conversion processes within an ISN and determine their contribution to environmental and economic performance of specific entities. Through this multi-level approach, LCA and LCC results can be generated for stakeholder groups with different interests regarding the environmental and economic performance of an ISN. Network-level results would be of interest to policy makers and industrial estate planners, whereas entity-level results would be of interest to the individual companies operating in an ISN. Although LCAs and LCCs of ISNs can be done by constructing more than one model, the use of a single model reduces the amount of time needed to analyze the different stakeholder perspectives.

5.2.2 Traceability

When modeling the physical and monetary flows of an ISN across the entire life cycle, the user must be able to check if the physical and monetary flows simulated in the model represent reality. This means that the user should be able to know the absolute amounts of physical and monetary flows being modeled and trace their respective sources and sinks. Verification of the model constructed by the UM3-LCE3-ISN methodology can be done by producing the scaled technology and monetary matrices. The scaled technology matrix can be used to verify all the physical flows of an ISN across the entire life cycle. This is done by taking technology matrix A and multiplying it by the diagonal matrix of scaling vector s (ADiag(s)) to produce a new technology matrix that is scaled to the functional unit defined by demand vector f. In the scaled technology matrix, the total inputs and outputs of the system are computed. The scaled monetary matrix can be used to verify all the monetary flows of an ISN across the entire life cycle. Similar to producing the scaled technology matrix, the scaled monetary matrix is produced by taking the monetary matrix (Amonetary) and multiplying it by it by the diagonal matrix of scaling vector s (AmonetaryDiag(s)). The scaled monetary matrix serves an account balance sheet where the user can view all the costs and revenue of each column and identify where the cash flows move to and from in the system modeled. By analyzing the scaled technology and monetary matrices, the user can determine the physical and monetary relationships between the entities in an ISN based on how the resource and waste flows move from their source to production and recycling processes and become inputs to other entities in the network. The scaled technology and monetary matrices can be adjusted accordingly based on the values set in the demand vector. The use of the scaled technology and monetary matrices are explained in further detail in Section 1.5 of the supplementary information.

5.2.3 Consistency in physical and monetary flows and assumptions

Using the UM3-LCE3-ISN methodology helps ensure consistency between the systems used to conduct the LCA and LCC of an ISN. This is achieved through a single model that represents both the monetary and physical systems as opposed to relying on two or more separate models for environmental and economic evaluation. The premise is that with one matrix model, the UM3-LCE3-ISN methodology is able to unify potential conflicting assumptions and data used by different models and obtain more holistic LCA and LCC results that are harmonized for stakeholders across the different levels. Using separate models for the LCA and LCC would require more time to construct and analyze the models and check to make sure the assumptions in the different models are consistent with each other.

5.2.4 Time-based resolution

The UM3-LCE3-ISN methodology was designed to include a time parameter to factor in the time value of money in the LCC. The model therefore computes the results for different snapshots of time. This is necessary because some activities, such as the purchase of capital goods, occur during specific time periods and are not repeated over several years. Therefore, the user can compute the life cycle environmental impacts and NPV for a given time period. With this in mind, the technology matrix could be modified to reflect a change that occurs in the system during a given period (e.g., improvement in energy efficiency, reduction in virgin resource consumption, reduction in waste). Thus, the user can use the same model to represent an ISN at different time periods and make modifications in the inputs and outputs for processes (columns) in the technology matrix. Users can design the model to represent taxes or incentives and use price vector ⍺ to control which time periods those monetary flows should occur in and how these changes affect the economic evaluation results.

5.3 Limitations

One of the challenges encountered during the development of the methodology was the need for mass balancing of processes with flows that have multiple sources and sinks. In the formalism, this occurs during the multi-product allocation stage of matrix construction with a rule that states “…The value of the flow in each ‘split’ row should be proportional to the amount coming from the different sources and/or going to different sinks.” The need for mass balancing often occurs during a waste-to-resource exchange process when an entity consumes a resource from a virgin or recycled source or when an entity produces waste with a portion that is recycled and another portion that is disposed. Mass balancing in the technology matrix is needed so that the LCA and LCC results generated are an accurate representation of the ISN. Currently, the mass balancing is done manually outside the matrix-based model and the values for the flows are inserted into the technology matrix accordingly.

Although providing LCA and LCC results in snapshots of time is useful for exploring variations in activities during different time periods, the methodology has a limitation with LCC specifically. The methodology currently requires the user to compute the LCC results in multiple iterations depending on the number of time periods of interest. In essence, the user must change the time parameter to generate LCC results for each year. This is in contrast to just entering the maximum time period once and generating the final LCC results. Typically, this type of LCC is done through a summation equation with all the LCC parameters defined and the total costs and revenue are computed from the start to the end time period defined (Swarr et al. 2011; Reddy et al. 2015). Although using a summation equation for LCC provides the ease of computing the LCC results by entering the maximum time period, such an approach may not be compatible for multi-level LCA and LCC (Kerdlap et al. 2020a).

A topic that has been discussed widely in the literature in LCA of ISNs is allocation of the environmental impacts of co-products and waste-to-resource exchange processes between entities (Mattila et al. 2012; Martin et al. 2015; Kim et al. 2018). There is not a correct method to solve this problem. Rather, the allocation method chosen should be consistent with the methodological choices of the study (Guinée et al. 2004). The three methods that have been used for allocation are 100–0 (also referred to as cutoff allocation), 0–100 (also referred to as substitution), and 50/50, which can be summarized as follows.

-

100–0 method: All the credits for avoided resource requirements are given to the company that produced the by-product that could be used as a resource for the receiving company.

-

0–100 method: The company that receives the by-product gets the credit for avoided resource use.

-

50/50 method: The credits are evenly split between both companies involved in the waste-to-resource exchange.

LCA case studies of ISNs by Vigano et al. (2020), Hildebrandt et al. (2019), Kim et al. (2018), and Martin et al. (2014) have shown that the results can be different depending on how the environmental impacts of wastes, by-products, and conversion processes are allocated. In the UM3-LCE3-ISN methodology, users can decide how to allocate the inputs and outputs of multi-product entities during the third stage of constructing the technology matrix (see Fig. 2). With regard to waste-to-resource conversion processes (e.g., recycling, upcycling), the UM3-LCE3-ISN methodology currently treats the conversion processes as a production process where the entity that consumes a recycled or upcycled product will incur the environmental impacts of converting the waste into a resource. However, the user can isolate the environmental impacts of the waste-to-resource conversion process by setting the demand vector to the amount of recycled product and distribute the impacts according to the allocation method suitable to the goal and scope of the study.

5.4 Future work

There are several opportunities for future work to push the boundaries in this field of research. One area of future research is enabling optimization of ISNs in the UM3-LCE3-ISN methodology. The methodology is currently designed as an analytical model for exploring what-if scenarios depending on the user’s interests. Optimization would be helpful for users who have a specific objective (e.g., achieve lowest or highest environmental impacts, maximize profitability, minimize virgin material use) and produce multi-level LCA and LCC results. Enabling optimization would entail setting rules on how the parameters of the optimization problem should be defined and how they would affect parts of the technology matrix such as the scaling vector values. The feasibility of optimizing ISNs based on LCA results could be limited by the high variability of LCA results caused by several factors such as the choice of the life cycle impact assessment method or use of different datasets for background processes.

Another future area of research is enabling dynamic modeling in the UM3-LCE3-ISN methodology. In the methodology’s current state, a different model needs to be constructed for each ISN scenario because the processes in the technology matrix are different depending on the amounts of flows going to and from different sources and sinks in a scenario. The UM3-LCE3-ISN methodology could be improved to construct a single matrix for all scenarios and include a parameter for turning on and off specific waste-to-resource exchange connections in the technology matrix. This would help enable more dynamic analyses that can be done in a step-wise fashion.

More research could be done to apply the UM3-LCE3-ISN methodology to broader circular economy applications. As the scope of the methodology was limited to cradle-to-gate as the system boundary, the methodology can be expanded to include the use and end-of-life stages of the products in the functional unit. Future case studies could be done to broaden the methodology’s application to circular economy systems where the downstream activities of products in an ISN are included. The products made in an ISN could be recycled or reused in other production systems that exist in the ISN. More rules would need to be included in the formalism with regards to the number of rows and columns that must be added to the matrix and how the values in the technology matrix, demand vector, and price vector should be set.

There is potential for applying the UM3-LCE3-ISN methodology in software tools that assist industrial symbiosis stakeholders in making decisions. Examples of these stakeholders include policy makers, urban planners, ISN facilitators, companies, researchers, product designers, and logistics service providers. Each of these stakeholders requires environmental and economic performance information at either the network, entity, or resource flow levels, which the UM3-LCE3-ISN methodology can provide. To apply the methodology in software tools, future work could be done to create a dashboard system that improves the visualization of the LCA and LCC results of an ISN generated by the methodology. This would help improve communication of the LCA and LCC results to the different types of stakeholders who lack technical expertise in LCA and LCC, but still need to make decisions regarding the development of an ISN.

6 Conclusions

This study introduces UM3-LCE3-ISN, a methodology designed to conduct multi-level life cycle environmental and economic performance evaluations of any type of ISN. This methodology is able to construct a single matrix-based model that represents an ISN and can produce LCA and LCC results at the network, entity, and flow levels. A formalism is provided that outlines steps for constructing a multi-level model and analyze it at different levels through manipulation of the demand and price vectors and the parameters for time and interest rate. UM3-LCE3-ISN is designed to be generic to any type of ISN and is able to consistently construct a square invertible matrix that can represent both physical and monetary flows that are produced from multiple sources and consumed by multiple sinks. The model is able to produce LCA and LCC results at different snapshots of time depending on the period of interest specified in the time variable.

To test the UM3-LCE3-ISN methodology, a case study was carried out that evaluates the life cycle environmental and economic performance of a fictitious urban agri-food production ISN in Singapore over a period of 10 years. The network comprised five entities that produce leafy vegetables, beer, eggs, and fish and exchange valuable wastes that are used as resources in each other’s supply chains. This case study had both products and wastes with multiple sources and sinks. The methodological steps outlined in the formalism were followed to construct a square and invertible technology matrix that disaggregates multi-product systems in this case study. Only a single matrix-based model was required to represent the foreground and background systems of each scenario examined instead of having to construct multiple separate models for each entity in the network. Each model constructed was able to compute the life cycle environmental impacts and economic costs and benefits from the perspectives of the network, each entity, and different flows of interest. This was done by manipulating the values in the demand vector, price vector, and parameters for time and interest rate as stated in the methodological steps outlined in the formalism (Figs. 2 and 3). For economic evaluation, the values in the price vector were turned on and off depending on whether the flow was considered a cost or revenue during the time period of interest in the analysis. Through following these steps, the life cycle environmental impacts and NPV were calculated for the REF and ISN scenarios to compare the environmental and economic performance before and after waste-to-resource exchanges from the perspectives of different stakeholders.

The UM3-LCE3-ISN methodology developed can be applied to industrial symbiosis facilitation tools and software. This would allow policy-makers, urban planners, businesses, and product designers to operate on a single platform to make holistic evidence-based decisions in the development of ISNs with regard to environmental and economic performance. Through the use of a single model that unifies LCA and LCC of ISNs, stakeholders at different levels can align on a common system when conducting multi-level analysis to acquire the information they need that suits their unique set of goals and objectives.

Data availability

All data generated or analyzed during this study are included in this published article and the electronic supplementary information file.

References

Aissani L, Lacassagne A, Bahers J-B, Le FS (2019) Life cycle assessment of industrial symbiosis: A critical review of relevant reference scenarios. J Ind Ecol 23:972–985. https://doi.org/10.1111/jiec.12842

Capelleveen G Van, Amrit C, Yazan DM (2018) A literature survey of information systems facilitating the identification of industrial symbiosis. In: Otjacques B, Hitzelberger P, Naumann S, Wohlgemuth V (eds) From science to society. Springer International Publishing, pp 155–169

Chertow M, Park J (2016) Scholarship and practice in industrial symbiosis: 1989–2014 BT — taking stock of industrial ecology. In: Druckman A (ed) Clift R. Springer International Publishing, Cham, pp 87–116

Chertow MR (2000) Industrial symbiosis: literature and taxonomy. Annu Rev Energy Environ 25:313–337. https://doi.org/10.1146/annurev.energy.25.1.313

Chertow MR (2007) “Uncovering” industrial symbiosis. J Ind Ecol 11:11–30

DBS Bank (2021) DBS new business loan. https://www.dbs.com.sg/sme/business-loan99sme.page?pk_source=google&pk_medium=organic&pk_campaign=seo. Accessed 1 Mar 2021

Dong L, Fujita T, Zhang H et al (2013) Promoting low-carbon city through industrial symbiosis: a case in China by applying HPIMO model. Energy Policy 61:864–873. https://doi.org/10.1016/j.enpol.2013.06.084

Gerber L, Fazlollahi S, Maréchal F (2013) A systematic methodology for the environomic design and synthesis of energy systems combining process integration, Life Cycle Assessment and industrial ecology. Comput Chem Eng 59:2–16. https://doi.org/10.1016/j.compchemeng.2013.05.025

Guinée JB, Heijungs R, Huppes G (2004) Economic allocation: examples and derived decision tree. Int J Life Cycle Assess 9:23–33. https://doi.org/10.1007/BF02978533

Heijungs R, Settanni E, Guinée J (2013) Toward a computational structure for life cycle sustainability analysis: unifying LCA and LCC. Int J Life Cycle Assess 18:1722–1733. https://doi.org/10.1007/s11367-012-0461-4

Heijungs R, Suh S (2002) The computational structure of life cycle assessment. Springer, Netherlands

Hildebrandt J, O’Keeffe S, Bezama A, Thrän D (2019) Revealing the environmental advantages of industrial symbiosis in wood-based bioeconomy networks: an assessment from a life cycle perspective. J Ind Ecol 23:808–822. https://doi.org/10.1111/jiec.12818

Huijbregts MAJ, Steinmann ZJN, Elshout PMF et al (2017) ReCiPe2016: a harmonised life cycle impact assessment method at midpoint and endpoint level. Int J Life Cycle Assess 22:138–147. https://doi.org/10.1007/s11367-016-1246-y

International Organization for Standardization (2006a) ISO 14040:2006 Environmental management — life cycle assessment — principles and framework. https://www.iso.org/standard/37456.html. Accessed 15 Nov 2019

International Organization for Standardization (2006b) ISO 14044:2006 Environmental management — life cycle assessment — requirements and guidelines. https://www.iso.org/standard/38498.html. Accessed 15 Nov 2019

Kerdlap P, Cornago S (2021) Life cycle costing: methodology and applications in a circular economy BT — an introduction to circular economy. In: Ramakrishna S (ed) Liu L. Springer Singapore, Singapore, pp 499–525

Kerdlap P, Low JSC, Ramakrishna S (2019) Zero waste manufacturing: a framework and review of technology, research, and implementation barriers for enabling a circular economy transition in Singapore. Resour Conserv Recycl 151:104438. https://doi.org/10.1016/j.resconrec.2019.104438

Kerdlap P, Low JSC, Ramakrishna S (2020a) Life cycle environmental and economic assessment of industrial symbiosis networks: a review of the past decade of models and computational methods through a multi-level analysis lens. Int J Life Cycle Assess. https://doi.org/10.1007/s11367-020-01792-y

Kerdlap P, Low JSC, Tan DZL et al (2020b) M3-IS-LCA: a methodology for multi-level life cycle environmental performance evaluation of industrial symbiosis networks. Resour Conserv Recycl 161:104963. https://doi.org/10.1016/j.resconrec.2020.104963

Kim H-W, Ohnishi S, Fujii M et al (2018) Evaluation and allocation of greenhouse gas reductions in industrial symbiosis. J Ind Ecol 22:275–287. https://doi.org/10.1111/jiec.12539

Kirchherr J, Reike D, Hekkert M (2017) Conceptualizing the circular economy: an analysis of 114 definitions

Laybourn P, Lombardi DR (2007) The role of audited benefits in industrial symbiosis: the U.K. National Industrial Symbiosis Programme Meas Control 40:244–247. https://doi.org/10.1177/002029400704000809

Low JSC, Tjandra TB, Yunus F, et al (2018) A collaboration platform for enabling industrial symbiosis: application of the database engine for waste-to-resource matching. In: Procedia CIRP

Martin M (2015) Quantifying the environmental performance of an industrial symbiosis network of biofuel producers. J Clean Prod 102:202–212. https://doi.org/10.1016/j.jclepro.2015.04.063

Martin M, Svensson N, Eklund M (2015) Who gets the benefits? An approach for assessing the environmental performance of industrial symbiosis. J Clean Prod 98:263–271. https://doi.org/10.1016/j.jclepro.2013.06.024

Martin M, Svensson N, Fonseca J, Eklund M (2014) Quantifying the environmental performance of integrated bioethanol and biogas production. Renew Energy 61:109–116. https://doi.org/10.1016/j.renene.2012.09.058

Mattila T, Lehtoranta S, Sokka L et al (2012) Methodological aspects of applying life cycle assessment to industrial symbioses. J Ind Ecol 16:51–60. https://doi.org/10.1111/j.1530-9290.2011.00443.x

Mohammed F, Biswas WK, Yao H, Tadé M (2018) Sustainability assessment of symbiotic processes for the reuse of phosphogypsum. J Clean Prod 188:497–507. https://doi.org/10.1016/j.jclepro.2018.03.309

Moreau V, Weidema BP (2015) The computational structure of environmental life cycle costing. Int J Life Cycle Assess 20:1359–1363. https://doi.org/10.1007/s11367-015-0952-1

Raabe B, Low JSC, Juraschek M, et al (2017) Collaboration platform for enabling industrial symbiosis: application of the by-product exchange network model. In: Procedia CIRP. Elsevier B.V., pp 263–268

Reddy VR, Kurian M, Ardakanian R (2015) Life-cycle cost approach for management of environmental resources: a primer, 1st edn. Springer, Cham

Singapore Food Agency (2019) Food farming. https://www.sfa.gov.sg/food-farming. Accessed 20 Feb 2020

Suh S, Huppes G (2005) Methods for life cycle inventory of a product. J Clean Prod 13:687–697. https://doi.org/10.1016/j.jclepro.2003.04.001

Swarr TE, Hunkeler D, Klopffer W et al (2011) Environmental life cycle costing: a code of practice. Society of Environmental Toxicology and Chemistry, Pensacola

Viganò E, Brondi C, Corngao S, et al (2020) The LCA modelling of chemical companies in the industrial symbiosis perspective: allocation approaches and regulatory framework. In: Simone M, Brondi C (eds) Life cycle assessment in the chemical product chain. Springer, pp 75–98

Yeo Z, Masi D, Low JSC et al (2019) Tools for promoting industrial symbiosis: a systematic review. J Ind Ecol 23:1087–1108. https://doi.org/10.1111/jiec.12846

Zink T, Geyer R (2017) Circular Economy Rebound J Ind Ecol 21:593–602. https://doi.org/10.1111/jiec.12545

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Communicated by Monia Niero.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Kerdlap, P., Low, J.S.C., Tan, D.Z.L. et al. UM3-LCE3-ISN: a methodology for multi-level life cycle environmental and economic evaluation of industrial symbiosis networks. Int J Life Cycle Assess 29, 1409–1429 (2024). https://doi.org/10.1007/s11367-022-02024-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11367-022-02024-1