Abstract

This paper investigates factors affecting firm performance. Using data from Business Environment and Enterprise Performance Surveys (BEEPS 2013–2014), findings indicate that the following have a positive effect on firm performance: (i) innovative activities; (ii) knowledge spillovers; (iii) foreign ownership; and (iv) the proportion of skilled workers in the workforce. The paper therefore argues that innovation activities are endogenously related to firm performance, and that the performance of firms is influenced by knowledge spillovers and innovation activities, among other firm characteristics. The paper contributes to the literature by identifying spillovers and innovation activities as causal variables of firm performance—a novel approach to investigating knowledge spillovers and innovation activities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Firm-performance is usually measured by indicators such as: profit, revenue, growth, productivity, efficiency, stock price, new markets, and export. There have been theoretical developments about this since the 1990s (Bhaskaran 2006; Leeuwen 2008; Verhees and Meulenberg 2004). Wolff and Pett (2006) suggested that performance indicators are consequential, related to growth and profit. Murphy et al. (1996) and Sohn et al. (2007) noted that firm-performance is a multidimensional concept, the indicators of which can be departmental, related to production, finance or marketing. Castany et al. (2005); Van Biesebroeck (2005); Pagés (2010); Geroski (1998) and Tybout (2000) concluded that firms which have better access to technology, managerial skills, finance, learning, flexible non-hierarchical structure perform better than the others. More recently, it has become progressively accepted that innovations and knowledge spillovers have an essential impact on firm-performance (Abazi-Alili et al. 2014; Fritsch and Franke 2004). We are interested in the impact of knowledge spillovers and innovation activities on firm-performance.

Knowledge is one of the most relevant source of competitive advantage of firms (Bascavusoglu-Moreau and Li 2013; Fernades et al. 2013; Rexhepi 2015) and plays an important role in increasing of the firm-performance. Knowledge can be from a different nature, like operational systems, local abilities, know-how and many others, that are necessary for solving the day-to-day problems in the firm (Alegrem et al. 2011). But only gaining a competitive advantage isn’t the end goal of the firms; they need to be sure that they have gained a sustainable competitive advantage (Mata et al. 1995; Rexhepi and Ibraimi 2011; Suklev and Rexhepi 2013). This can be achieved through continuous process of gaining knowledge. Knowledge inside the firm needs to be managed through knowledge management (KM), which represents a substantial source of sustainable competitive advantage (Alegrem et al. 2011). KM contributes the firms to improve the efficiency of their business processes, productivity and quality (Donate and Sánchez de Pablo 2015), and their innovation performance (Alegrem et al. 2011). The use of knowledge management depends from the leadership of the firm. Researchers point that knowledge-oriented leadership’s strong impact on KM, positively affects the innovation performance of the firms (Donate and Sánchez de Pablo 2015).

Firms nowadays have left the idea, that the generation of new knowledge is mostly considered as an internal process (Arora et al. 2001). The level of creating a new knowledge is not related only with the extent to which private firms and public institutions are able to generate new knowledge, but also from the level of gaining new knowledge from other firms (Acs et al. 2012; Fung 2003, 2005). But, as we can gain knowledge from others, other firms can gain knowledge from us, without having to pay in a normal market transaction (Acs et al. 1994; Bascavusoglu-Moreau and Li 2013; Bernstein and Nadiri 1988; de Clercq et al. 2008). The role of information spillovers via social networks, which are becoming more and more used, can be also very important in knowledge spillovers (Miguel and Kremer 2004). This process of gaining new knowledge from other firms beside ours is called knowledge spillover. It is created when firms combine its own knowledge with the others’ knowledge (Yang and Steensma 2014). Knowledge spillovers, can be defined also as the external benefits from “the creation of knowledge that accrue to parties other than the creator, occur at multiple levels of analysis, be it within or across organizations and networks” (Agarwal et al. 2010, p. 271). Spillovers can arise in multiple ways. They can be intentional on the part of the innovator, such as the publication of scientific papers, or can be disclosed in a patent as a quid pro quo for the granting of monopoly rights, or they can occur despite any desire of the inventor via the sales of the new product (Jaffe 1998). However, in order to recognize, access, adopt and benefit from these external sources of knowledge, via either market internalized transactions or by externalities, firms need to have a certain level of absorptive capacity. (Bascavusoglu-Moreau and Li 2013). The level of knowledge spillover or the level of knowledge that a firm can get, depends from the actual level of knowledge that it possess. The idea of knowledge spillover started from 1890, when Alfred Marshall developed this theory, which later was extended by Kenneth Arrow and Paul Romer (as cited in Benjamin 1961). In the beginning, the researches were oriented toward knowledge spillovers of firms in the same industry in a city, which helped knowledge to ‘travel’ among firms and facilitates innovation and growth (Benjamin 1961). Some others point that knowledge externalities are so important and forceful and there is no reason for a political boundary to limit the spatial extent of the spillovers (Blazseka and Escribano 2009).

Today, firms perform under a greater pressure than before. They are under pressure of competitive firms, that offer the same or similar product or service, or they are under the pressure of the customers who expect and require more and more from the product they consume or service that they use. In order to face with the new conditions and situations, firms are forced to continuously search for new ways of acting; they should continuously bring to the market innovations, namely to offer new products and services, or enhancing the existing ones (Lipit 2006; Ramadani et al. 2013a, b; Ratten 2016). Ferreira (2010), Huse et al. (2005) and McAdam and Keogh (2004) found out that the firms that innovate obtain higher competitive advantage. Ferreira et al. (2016, p. 3) noted that “effective implementation of innovation has come in for increasing recognition as a synonym for the construction of sustainable competitive advantage and therefore strengthening organisational performance levels”.

Much research has taken place in the West where performance has long been an important component of capitalism, and knowledge spillovers and innovation has been means to attain performance; however, less is known about the impact of knowledge spillovers and innovation on firm performance in the Balkans countries. Our objective is to apply a new approach on investigating knowledge spillovers and innovation activities, i.e., identifying them as determinants that affect firm performance. The data used for the empirical analysis of this study are recently released for transition economies (including the Balkans countries) by Business Environment and Enterprise Performance Surveys (BEEPS) for 2013–2014. Instrumental variables (IV) estimator is employed as appropriate method for controlling the endogeneity on the relationship between firm performance with knowledge spillovers and innovation activities.

Our findings reveal that the proportion of investments in R&D, knowledge spillovers, age, direct export, and skilled workers have a positive effect on firm performance—even in the Balkans countries, where neither innovation nor emphasis on performance have a long history. This contributes to the theory by showing that: (i) knowledge spillovers and innovation activities are endogenously related to firm-performance; and (ii) the firm-performance is influenced by knowledge spillovers and innovation activities and other firm characteristics.

The structure of the paper is as follows: In the second section is summarized the relevant literature review related to the transition economies and the Balkans context, knowledge spillovers, innovation and firm-performance, with main focus on the determinants of knowledge spillovers and innovation activity. Section three elaborates the methodology, sample and data used for the empirical analysis, i.e. BEEPS data for 2013–2014. Findings of the results are provided in section four. Discussion and conclusion sections end the paper.

Literature review

The context

Entrepreneurship in transition economies has become an important subject for research. Since the reforms of the 1980s, a very rich literature has emerged about entrepreneurship in transition countries across Asia where economies changed paths (Dana 2002). Among early studies of transition in China are Beamish (1993); Chau (1995); Chow and Tsang (1995); Dana (1999c); Dandridge and Flynn (1988); Fan et al. (1996); Lombardo (1995); Overholt (1993); Peng (2000); Shirk (1993); Siu and Kirby (1995); Wei (2001); and Williams and Li (1993); Brown and Zasloff (1999) pioneered research about transition in Cambodia. Dana (1995) focused on Laos. Dana (1994a, b) and Tan and Lim (1993) reported on Vietnam. Dana (1997a) focused on entrepreneurship in Kazakhstan, and Dana (2000a) on the Kyrgyz Republic. Dana (2002) also reported about entrepreneurship in Tajikistan, Turkmenistan and Uzbekistan. Comparative studies being uncommon, Lasch and Dana (2011) contrasted the context for entrepreneurship in the Kyrgyz Republic with that in Uzbekistan. Dana (2002) studied entrepreneurship in Myanmar.

Much has also been written about the entrepreneurship in the former Soviet Union and its satellite Warsaw Pact countries, where transition was even more pronounced because it involved political as well as economic change; in Europe, economies changed hands (Dana 2010). Early works include research about Bulgaria (Dana 1999b), the Czech and Slovak Republic (Rondinelli 1991), the Czech Republic (Sachs 1993), Estonia (Liuhto 1996), Hungary (Hisrich and Fulop 1995; Hisrich and Vecsenyi 1990; Noar 1985), Latvia (Peng 2000), Moldova (Dana 1997b), Poland (Arendarski et al. 1994; Sachs 1993; Zapalska 1997), Russia (Ahmed et al. 2001; Bruton 1998; Hisrich and Gratchev 1993), Slovakia (Dana 2000b; Ivy 1996), and the Ukraine (Ahmed et al. 1998).

Yet, there is not an abundance of literature about the unique scenario of transition in Balkan countries outside the Soviet sphere. The Journal of Small Business Management published one study about small business the Perseritje model of Albania (Dana 1996). Bosnia in transition was the focus on Dana (1999a). Franicevic (1999) and Martin and Grbac (1998) wrote about Croatia. Macedonia was the focus of Dana (1998), but there was little to complement this until the recent contributions of Ramadani (2013); Ramadani et al. (2013a, b); Ramadani and Schneider (2013); and Dana and Ramadani (2015). Our objective is to further contribute to this lacuna.

Knowledge spillovers and firm-performance

The role of knowledge spillovers is strongly related with the improvement of teh firm-performance (Acs et al. 2012; Coe and Helpman 1995; Hashi and Stojcic 2012; Jaffe et al. 1993). Knowledge spillovers are an important source of economic growth of firms (Saito and Gopinath 2011). Knowledge spillover tend to be interesting also on innovation and collaboration in science and technology parks (Sanchez et al. 2011) and on productivity spillovers, including those across country borders (Coe and Helpman 1995; de Clercq et al. 2008; Kneller and Pisu 2007) and trade (Rod et al. 2004). The existence of knowledge is equated with its automatic spillover, yielding endogenous growth (Acs et al. 2012). Knowledge spillover is related with endogenous growth theory according to which the economic growth depends from endogenous forces rather the external forces. A country’s economic growth stems from the endogenous development of knowledge through spillover effects across economic actors (Romer 1986). Endogenous forces that create this growth are related with human capital, innovation and knowledge. This theory focuses also on positive externalities and spillovers’ effect of these forces. This means, knowledge that is created in one particular country, firm or region increasingly after entering new markets, contributes to the productivity growth of other geographic areas, and also it reduces duplication of the research efforts (Bascavusoglu-Moreau and Li 2013). The spillover effect helps the growth of the economy in an indirect way—through the firms’ operation in a particular economy. They help every firm in the economy but particularly micro, small and entrants, which do not have the needed resources to innovate (Hashi and Stojcic 2012), whereas in mature firms, external knowledge spillovers may be less important (Acs et al. 1994). De Clercq et al. (2008) identifies four steps how spillovers occur across country borders, specifically with respect to the case of inward FDIs:

-

1.

Market access spillovers occur through commercial links between foreign multi-national enterprises (MNEs) and local suppliers,

-

2.

A demonstration or imitation effect prompts domestic firms to copy foreign MNEs’ organizational practices, in a formal or informal way,

-

3.

When local employees gain important skills while working for a foreign MNE, a training effect will transfers those skills to other organizations.

-

4.

Foreign entrants may increase local competition by, for example, infusing new technologies into the local market and acting as competitive catalysts

Furthermore, according to endogenous growth theory, technological innovation is important to the “sustained” growth of an economy (Lucas 1988; Romer 1986).

Many authors have managed to confirm the value‐relevance of R&D activities and their influence on firm performance (Di Vito et al. 2010; Gentry and Shen 2013; Fung 2003; Lee and Habte-Giorgis 2004; Mudambi and Swift 2014). R&D play a crucial role in creating competitive advantage and knowledge spillover, and that is why having a right strategy regarding R&D activities represents a very important issue for the firms (Hill and Jones 2009; Lejarraga and Martinez-Ros 2008; Rexhepi 2015). In the cases, when innovation produced by a particular firm influences and increases the productivity of other firm, then we say that this firm generates an R&D spillover (Blazseka and Escribano 2009). Research suggest that each firm is converging to its own capacity of productivity growth rate, which is related with the firm’s R&D efforts and its capacity to gain from intra-industry spillovers (Fung 2005). If we assume that technology followers and leaders invest equally in R&D activities, then followers will be able to catch up with the leaders thanks to knowledge spillovers that they will receive from the latter (Fung 2005). R&D capacity of a firm influences its capacity to gain knowledge spillovers and absorptive capacity (Aghion and Jaravel 2015).

De Clercq et al. (2008) argue that the proportion of export-oriented new ventures represents in the same time an outcome and a source of knowledge spillovers. Knowledge of multinational firms spills over to domestic firms of the host country which means that, exports represent a source of knowledge spillovers (Kneller and Pisu 2007), as well as inward FDIs (de Clercq et al. 2008). Knowledge spillover, as was pointed earlier, influence the firm productivity as well. A study reports that exporting firms’ productivity are for 8.3, respectively 11.4 % higher than non-exporting firms, measured by total factor productivity (TFP) or labor productivity, respectively. (Bascavusoglu-Moreau and Li 2013). With respect to exports diversification, manufactured trade generates more spillover effects than primary commodity trade and so more positive externalities (Herzer and Nowak-Lehmann 2006). Hashi and Stojcic (2012) had proved that stronger participation in international markets leads to higher quality of exported products, which is proxied by the relative export unit value.

Productivity growth of a firm depends from knowledge and skills of workers (Benjamin 1961). Knowledge spillover sees human capital as main component of productivity growth (Benjamin 1961). The importance of human skills in achieving a knowledge spillover effect is very high (Munteanu 2015). Acs et al. (2009) point that the ability to transform new knowledge into economic opportunities involves a set of skills, aptitudes, insights and circumstances that is neither uniformly nor widely distributed in the population. Employment of skilled workers is a key channel through which knowledge is transmitted. Results show that firms’ productivity from spillovers increases with its skills’ intensity (Saito and Gopinath 2011). Another research point that U.S. manufacturing plants’ productivity increases by 0.6–0.7 % as the share of college graduates in a region increases by one percent (Moretti 2004). In order to use this value or its materialization it is required an appropriate strategy that will transform individual capabilities into value (Rexhepi 2014).

Knowledge spillovers can be of domestic or international origin. International knowledge spillovers enable firms to access the knowledge accumulated by others and to catch up with them by using their knowledge. In this context, the presence in foreign markets and technology transfer channels, such as foreign direct investment or licensing of foreign technology, may be of crucial importance (Hashi and Stojcic 2012). Foreign direct investments (FDI) are considered as a channel of knowledge spillovers, both from investing firms to indigenous firms and from indigenous firms to investing firms (Branstetter 2006). The presence of FDI has a positive impact on domestic firms (Chang and Xu 2008; Globerman et al. 2000). The stronger presence of multinationals and FDIs produces learning externalities (Hashi and Stojcic 2012). With the use of knowledge production function, the rate of return only from firms’ own R&D capacity has been estimated to be around 12–20 %, whereas external knowledge ranges between 15 and 35 % (Bascavusoglu-Moreau and Li 2013). Even though some studies do not show a strong positive influence of FDIs (Aitken and Harrison 1999; Haddad and Harrison 1993; Konings 2001), still majority of studies prove a strong effects of the existence of FDI on knowledge spillovers (Chang and Xu 2008; Globerman et al. 2000).

Innovation depends on the exchange of ideas among individuals, which by economists is called as knowledge spillovers (Carlino 2001). Growth theory explained that innovation is fundamental, it is endogenous to the economic environment and it is assumed that there are positive externalities from knowledge that will be delivered through innovation (Aghion and Jaravel 2015). Successful innovation is depended from the development and integration of new knowledge in the innovation process, especially the external one (Cassiman and Veugelers 2001). Innovation is a process of transforming the new ideas, new knowledge into new products and services (Rexhepi et al. 2013a, b). It is an efficient use of the scarce resource knowledge (Czarnitzki and Kraft 2007). The more innovation the more new knowledge will be created and consequently more knowledge spillover. While assessing spillovers, it is important to distinguish between incoming spillovers, which affect the rate of innovation of the firm, and appropriability, which affects the ability of the firm to appropriate the returns from innovation (Cassiman and Veugelers 2001).

Today, there is a deficiency of studies that have analyzed the effect of size in knowledge spillover (Acs and Audretsch 1991; Rosenbusch et al. 2011). Some superficial studies have shown no relationship between firm size and knowledge spillover. Results also show that differences between how large firms and SMEs enact KM might be negligible in the case of high-tech SMEs (Alegrem et al. 2011).

Innovation and firm-performance

UK Department of Trade and Industry (2003) defines innovation as a process of successful exploitation of new ideas which involves investments in new products, processes or services and in new ways of doing business. Lionnet (2003) defines innovation as a dynamic technical, economic and social process -involving the interaction of people coming from different horizons, with different perspectives and different motivations—by which a novel idea is brought to the stage where it eventually produces money. Ramadani and Gërguri (2011) define innovations as a process of creating a new product or service, new technologic process, new organization, or enhancement of existing product or service, existing technologic process and existing organization. Based on the last definition, innovations can be classified as follow: product innovations—development or enhancement of a specific product; services innovations—offering new or enhancing of existing services; process innovations—finding of new ways of organizing and combining inputs in the process of production of specific products or services; and organisational innovations—creating new ways of organizing business resources.

Based on Leeuwen (2008), the most common measures used in the literature for analysing the process of innovation are as follows: i) a measure of the inputs into the process of innovation, for example, R&D expenditure, ii) an intermediate output, such as the number of inventions which have been patented, and iii) a direct measure of innovative output, new product or new process. These proxy measures for the innovation process have their limitations. Not all R&D expenditures end in innovation output since this measure reflects only the resources committed to producing innovative output, but not the innovative process. The number of patents does not indicate whether this output has a positive economic value or whether it has successfully been introduced in the market. Whereas the new product and/or process is acknowledged as a proxy that directly quantifies the effect of innovation and its success in the market.

R&D activities are expected to be a major factor leading to a new product and process and, therefore, R&D intensity has been used by the majority of studies (Crepon et al. 1998; Damijan et al. 2008; Falk 2008; Hashi and Stojcic 2012). Becheikh et al. (2006) conclude that 80 % of the studies find that R&D investment has a positive and significant effect on innovation activities. Acs and Audretsch (1991) find that firms increase the number of innovations with increased R&D expenditures, but at a decreasing rate.

Export intensity of the firm may stimulate innovation for some reasons: (i) exporting firms can benefit more from the knowledge abroad (learning-by-exporting) for their innovation activities than non-exporting firms; (ii) they are exposed to more intense foreign competition which requires continuous upgrading of their products and processes; and (iii) they will gain more profit by introducing the innovative product to foreign markets. The empirical evidence reports a positive relationship between export intensity and the incentive to innovate (Alvarez and Robertson 2004; Damijan et al. 2008; Lööf and Heshmati 2006).

There is evidence in the empirical literature that skilled labour force facilitates and induces innovation activities of firms (Kanter 1983). Studies investigating the relationship between human capital factors and innovation conclude that the ability of firms to innovate depends on the employees’ level of education (Gupta and Singhal 1993; Kanter 1983). Acs and Audretsch (1991) noted a positive and statistically significant impact of skilled labour force on innovation output. Similar results were found by Fernandes et al. (2011) and Roura (2009).

Foreign direct investments (FDIs) are also an important factor that can foster innovations (Kurtishi-Kastrati et al. 2016). According to Cheung and Lin (2004, p. 28–29), the impact of FDIs on innovations of the domestic firms can be summarised as follow: i) local firms can learn about the designs of the new products and technology, through reverse engineering for example, and then improve upon them to come up with new innovations; ii) FDIs can cause spillovers to local firms through labour market turnover whereby skilled workers who once worked for the FDI firms move to local firms; iii), FDI can generate a “demonstration effect”, respectively the mere presence of foreign products in domestic markets can stimulate local firms’ creative thinking and thus help generate blueprints for new products and processes.

Different studies found the positive effects of innovation on firm-performance (Bowen et al. 2010; Damanpour et al. 2009; Fernades et al. 2013; Ratten 2014; Sok and O’Cass 2011; Subramanian and Nilakanta 1996). Price et al. (2013, p. 1) noted “that firms that engage in developing innovative products and services are positioned to compete more successfully through the development of new products and processes, before competitors in first-mover advantage, increasing market share, return on investment (ROI), and overall firm success”. Rosenbusch et al. (2011), applying meta-analyses techniques to aggregate prior empirical research on the innovation–performance relationship (42 empirical studies on 21,270 firms), have found that innovation has a positive effect on the firm-performance. Their research was focused on small and medium sized enterprises (SMEs) and were identified several factors that impact the innovation-performance relationship:

-

Fostering an innovation orientation has more positive effects on firm-performance than creating innovation process outcomes, such as patents, innovative products or services. They highlighted that entrepreneurs focusing only on creating innovative products and services miss essential value’s dimensions that innovation can offer to firms (such as higher brand equity, obtaining better collaboration partners, and attracting highly skilled employees).

-

Comparing the performance effects of devoting more resources to innovation process inputs, for example R&D spending, with innovation process outcomes, it is found that innovation process outcomes lead to a greater increase of firm-performance. This finding emphasizes the significance for entrepreneurs to manage the innovation process thoroughly.

-

Innovation has a greater impact in younger firms than in more established firms. This result indicates that new firms possess unique capabilities to create and appropriate value through innovations and advocates that the liability of newness of younger firms can be an asset for new firms.

-

Innovation has stronger positive impact in the firm-performance in cultures characterized by collectivism (for example, in some Asian countries), in comparison with cultures characterized by individualism (for example, United States).

Regarding the innovation-performance relationship of firms, Tiwari and Buse (2007) developed a model, known as BCF model (better, cheaper and faster) which means that innovations make firms to produce better products and services (B-better), with lower costs (C-cheaper) and faster (F-faster). Those companies that succeed to produce products with better quality, with lower costs and place them on the market faster than the others increase the possibility to build better competitive position in the market, to increase its profitability and to strengthen its stability. So, all this enables firms to enhance their overall performance. Eurostat’s (2008) research on innovations has concluded that the most important benefits rising from innovations are: better quality, more choice and higher turnover. The findings reveal that 38 % of the innovative firms considered “improved quality in goods and services” a highly important effect, followed by “increased range of goods and services” and ‘“entered new markets or increase market share” scored 34 % and 29 % respectively. In addition, up to 25 % of the innovative firms classified as highly important benefits concern the internal organisation of the firm, whereas “improved flexibility of production/service provision” may lead to better development of the firm’s performance. The same benefit can be seen from the “increased capacity of production/service provision”. Bearing in mind that if more is produced, more can be sold, firms can replace old by new and through highly productive machinery. The following benefits: met regulation requirements, reduced labour costs per unit output, reduced environmental impacts or improved health and safety, reduced materials and energy per unit output, were chosen as highly important by under 20 % of the innovative firms. The main reason why these benefits are not as important because they are forced by regulatory requirements or they are considered more or less positive collateral benefits of innovation.

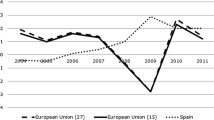

Innovation Union Scoreboard (IUS) and Knowledge-Intensity of the Economy (KIE) in the Balkan countries

The comparative analysis of research and innovation performance in Europe are delivered through the Innovation Union Scoreboards which helps countries and regions to recognize the areas they need to address. The Innovation Union Scoreboard within the measurement framework apprehends in total 25 different indicators which are differentiated between three main types of indicators and 8 innovation dimensions. The Enablers through the three innovation dimensions: Human resources; Open, excellent and attractive research systems as well as Finance and support, are the main drivers of innovation performance external to the firm. Firm activities seize innovation efforts at the level of the firm through the innovation dimensions Firm investments, Linkages and entrepreneurship and Intellectual assets; and finally Outputs through two innovation dimensions: Innovators and Economic effects captures the effects of firms’ innovation activities (Hollanders et al. 2015).

According to the main findings of the Innovation Union Scorecard 2015 on their average innovation performance across 25 indicators (Table 1), the countries can be divided into four groups: a) Innovation leaders—these countries show innovation performance well above that of the EU average; b) Innovation followers—these countries show innovation performance above or close to that of the EU average; c) Moderate innovators—these countries show innovation performance below that of the EU average; and d) Modest innovators—these countries show innovation performance well below that of the EU average.

In Table 1 are presented only the data that are related to the Balkans countries. From the data in this table, it can be seen that Slovenia is performing very well, where in four dimensions, Slovenia is performing above the EU average (human resources; firm investments; linkages and entrepreneurship; and intellectual assets). Comparing to the previous reports, Slovenia is showing an improved performance in most dimension. Strong declined performance is shown only in non-R&D innovation expenditures (−12 %). Slovenia is the only country from the Balkans that belongs in innovation followers. Croatia, Greece and Serbia are moderate innovators, which mean that they show innovation performance below that of the EU average. Croatia shows good performance in non R&D innovation expenditures (139), new doctorate graduates (128) and international scientific co-publication (125). Greece is performing well in international scientific co-publication (171), while Serbia in non-R&D innovation expenditures (412). Bulgaria, Romania, Macedonia and Turkey belong to modest innovators with innovation performance well below that of the EU average. None Balkan countries belongs to innovation leaders group—countries with innovation performance well above that of the EU average. Albania, Bosnia and Herzegovina, Kosovo and Montenegro are not covered in this Innovation Union Scoreboard 2015 and for this reason they are not discussed in this section.

According to Research and innovation performance in the EU report (2014), the knowledge-intensity of the economy indicator “focuses on the economy’s sectoral composition and specialization and shows the evolution of the weight of knowledge-intensive sectors and products” (p. 21). It is a composite indicator that includes R&D, skills, sectoral specialization, international specialization and internationalization sub-indicators. This indicator in the Balkan countries (those included in this report) is as follow: Bulgaria 33.5; Greece 31.6; Romania 27.5; Slovenia 50.3; and Turkey 19.5. The EU value of knowledge-intensity of the economy indicator is 51.2. Slovenia, again, is in the best position in comparison with other Balkan countries, while Turkey in the worst position. Other countries aren’t included in this report.

Methodology

Sample and data

World Bank/EBRD’s Business Environment Enterprise Performance Surveys (BEEPS) firm-level data conducted in 2013–2014 are employed for the empirical analysis of this paper. Out of the overall BEEPS dataset we make use of the data on eleven Balkan countries. Since there are European Union member countries, we are able to provide comparative analysis on undertaking innovation activities between countries that recently joint EU (list of four EU countries (alphabetic order): Bulgaria, Croatia, Romania and Slovenia) and those in South-eastern Europe (list of seven South- East European countries—SEE (alphabetic order): Albania, Bosnia and Herzegovina, Kosovo, Macedonia FYR, Montenegro, Serbia and Turkey).Footnote 1 The major advantage to be emphasized for this dataset is that it provides large number of observations comparable for Balkan countries for 2013–2014 having the final sample consisted of 4,596, as presented in Table 2.

The BEEPS questionnaire consists of questions which allow us to specify the variables of our interest by following the theory. Furthermore, the 2013–2014 round consists of special module on innovation. Table 3 gives the description of the variables employed in the model.

We now provide the descriptive statistics of the data for 2013–2014. Two separate tables, Tables 4 and 5 are generated to show the descriptive statistics for different types of the variables: (i) continuous and (ii) dichotomous, respectively.

Dependent variable

The dependent variable in the first model is dummy variable of firms undertaking innovation activities. The available variable in the dataset is based on two questions: ‘In the last 3 years, has this establishment introduced new products or services?’ and ‘In the last 3 years, has this establishment introduced new production/supply methods?. Innov_act is equal to one if the answer to either question is ‘yes’ and zero otherwise. According to the survey data, 33.3 % of firm respondents have undertaken innovation activities. The dependent variable in the second model is productivity. It is measured as sales to number of employee’s ratio. For the empirical analysis we take the logarithmic values. According to the survey data, the average of lnProd is 12.19, with a minimum of −3.4 and a maximum of 23.95.

Regression analysis

In order to explain the extent of innovation activity in EU and non-EU transition countries, we empirically investigate the relationship between firm’s innovation and labour productivity. A major problems that arises in the literature investigating the relationship between innovation activities and firm performance is endogeneity (Peters 2008). Considering the endogeneity problem, innovation activities and firm performance are determined simultaneously, i.e. innovation activities are endogenous. This implies that endogeneity should be taken into account when investigating the relationship between innovation activities and firm performance. Endogeneity appears in equations where there is correlation between an independent variable and the disturbance term.Footnote 2 When there is endogeneity among the variables, Baltagi et al. (2003a) show that there is substantial bias in OLS and the random effect estimators and both yield misleading inference.

One solution to the problem is the use of instrumental variables (IV), which is consistent and has a large-sample normal distribution (Baum 2006). Satisfactory instruments with meaningful economic rationale are not always easy to find, especially not valid ones that satisfy the two key properties—that it must be uncorrelated with the error term but correlated with the independent variable. The simple IV estimator assumes the presence of independent and identically distributed (i.i.d.) errors.

We apply instrumental variables (IV) estimator, as one of the solutions of the problem (Green 2012). The empirical estimations of the innovation-performance relationship are generated in two steps. The first model presents the probability of firms to innovate (probit model) which reveals the importance of individual factors on firms’ innovation activity with special emphasis on knowledge spillovers. The second estimations present a semi-logarithmic specification of the productivity model, which incorporates the predicted values of the first regression in conjunction with other firm characteristics.

The general model we will refer to can be written as follows:

The impact of individual factors, such as invested in R&D, knowledge spillovers, direct exports, changes on logistic, changes on management and marketing organization, on the probability to innovate of a firm ‘i’ in period ‘t’ are examined. The dependent variable of the first model (Innov_activity) present product and/or process innovation.

In order to ensure that the results are robust, we employ a dummy variable for whether the firms have invested in R&D or not (the specification reported in Table 6) and estimate the specification on 2,482 number of observations. The regression coefficients and corresponding p-values of the probit model regression of the probability to innovate together with the empirical results of productivity model are presented in Table 7.

Following the methodological approach applied in the literature, in the next step, the predicted values of the above innovation regressions are inserted as innovation activities variable into the labour productivity model. Table 6 displays the regression coefficients and corresponding p-values of the productivity model. The inserted model, apart from the determinants of productivity, allows for investment in R&D, direct export, and other source of knowledge input such as knowledge spillovers and skilled workers on labour productivity.

Before going to the interpretation of the coefficient, the diagnostics of the regressions are provided. The obtained results indicate that we have insufficient evidence to reject null hypothesis that the model has correct functional form at 5 % level of significance. The diagnostic tests suggest that there is insufficient evidence to accept the null hypothesis that the residuals have normal distribution. Furthermore, there is insufficient evidence to reject null hypothesis of homoscedasticity in the model. Considering the instrumental variable regression, the validity test of the instruments employed, F-test, shows that they are jointly significantly different from zero. The statistics of 77.63 indicates the strength of the instruments.

Findings

Investments in R&D variable, in the regression analysis, appears to have positive and significant relationship with innovation activities. The coefficient of the innovation on logistics (new logistical or business support processes introduced over last 3 years) is significant and positively related to the decision to innovative. The regression results show positive significant impact of direct export on innovation activities.

After generating the probit model for innovation activities we calculated the marginal effects coefficients. We found significant coefficients for investments in R&D, innovation in logistic, knowledge spillover, innovation in management and marketing, direct export, internet connection, EU members, age and age square, which can be interpreted as follows:

-

The coefficient of the investment in R&D is positive and statistically significant. This indicates that those firms that invest in R&D are 38 % more likely to undertake innovation activities compared to those that do not invest.

-

The relationship between innovation activities and age is found to be statistically significant and non-linear, in particular innovation activities initially fall with age and reaches a minimum at the age of 6 (the turning point is calculated using the approach of Wooldridge (2002)).Footnote 3 Amongst those aged 6 or more the effect of age is positive.

-

Firms that have gone through some innovation logistics are 1.16 % more likely to undertake innovation activities that those that do not and this finding is statistically significant. Furthermore, firms with innovations in marketing and management are 0.27 % more likely to undertake innovation activities that those that do not and this finding is statistically significant.

-

Innovation activities are significantly and positively associated with knowledge spillovers. In other words, firm that spend on acquisition of new knowledge .25 % higher probability to undertake innovation activities.

-

Firms that export directly are .004 % more likely to undertake innovation activities.

-

The variable indicating the EU membership is significant indicating that Balkan countries that are EU members are 0.42 more likely to undertake innovation activities.

The interpreted coefficients are statistically significant at 1 % level of significance, offering evidence that the Ho hypothesis, (θ it = 0) can be rejected for these cases. According to chi2 statistics the explanatory variables are jointly significant (since Prob>chi2 = 0.000) at 1 % level of significance, therefore the null hypothesis that all regressors are jointly insignificant may be rejected.

Productivity model regression is estimated using instrumental variable techniques (instruments used for innovation activities are (i) innovation in management and marketing, (ii) time given to employees for innovation, (iii) changes on innovation logistic and (iv) invested in R&D). The results show positive and statistically significant impact of instrumented variable, undertaken innovation activities, on firm performance. This impact confirms our hypothesis that more innovative firms tend to perform better. The EU membership dummy variable is positive and significant, showing that EU member state firms perform better than the ones that operate in non-EU countries. Summarizing these findings it is evident that the firms in Balkan Countries have improved their performance during the transition period. Since improved performance of firms in the transition period are due to factors such as innovation activities, R&D investment, knowledge spillovers, EU membership, etc. one can highlight the need for policies to assist these firms to improve their products and services and those that are not EU members to foster their accession.

Concluding and discussion

This paper is focused on knowledge spillovers and innovation activities and their impact on the firm-performance of the Balkans countries, namely Albania, Bulgaria, Bosnia and Herzegovina, Croatia, Kosovo, Macedonia FYR, Montenegro, Romania, Serbia, Slovenia, and Turkey. This study extends and critically reviews the empirical literature with respect to the incentives of firms to undertake innovation activities and knowledge spillovers and to investigate how these changes affect firm-performance. Our findings (using BEEPS 2013–2014 in the Balkans countries) show that investments in R&D, knowledge spillovers, age, direct export, and skilled workers are significant and positively related to firm innovation activities. We further examine the impact of (the predicted values of) innovation activity model on performance and thus conclude positive and significant relationship. Additional to the impact that arises from the innovation model, we conclude that knowledge spillovers and skilled workers have positive and statistically significant impact on performance. Summarizing these findings it is evident that the firms in Balkan countries have improved their performance.

Thus, this paper makes important contributions to the literature in terms of finding empirical evidence of the relationship of innovation activities, knowledge spillovers and firm- performance in the Balkan countries. Firstly, it argued that innovation activities are endogenously related to firm-performance, and secondly, firm- performance is influenced by knowledge spillovers and innovation activities and other firm characteristics.

Out of these results we come to the recommendation that investments in R&D should be supported by the government through mechanisms, such as innovation vouchers, matched funding of R&D expenditure, tax credit for R&D spending, etc. Other ways of fostering R&D may be through getting businesses to work more closely with universities and research institutions and helping researchers, innovators and businesses bring together specific knowledge, skills, technical resources. Since R&D intensity is higher in EU member economies, they should be a leading example for other non-EU Balkan countries. Whenever there is a lack of knowledge to bring changes in the firm, our model suggest that spending on acquisition of new knowledge will have positive effect on innovation activities and additionally on firm-performance. Another recommendation is that policies for improving the education system should be created to support new generations of skilled workers, ensuring a sufficient supply of individuals with science and engineering skills by making education more relevant, change the system from the traditional rote learning method to methods encouraging independent thinking, etc. The positive and significant findings of the foreign ownership variable on firm-performance, emphasize the importance of foreign direct investments. Based on these findings we suggest that Balkan countries should work on some improvements on the institutional framework, specifically the ownership rights, and investments in infrastructure, which will encourage foreign investments that will further stimulate the innovativeness of firms and thus improve performance.

Implications and future research suggestions

It is imperative for researchers, entrepreneurs and managers to harness the potential of knowledge spillovers and innovations for firm-performance. This article has demonstrated the role of knowledge spillovers and innovation activities for researchers, entrepreneurs and managers in their business context and environment. This is helpful to utilize the changes occurring over a time period to see the increased emphasis on knowledge and innovation in the Balkans countries, considering that the knowledge-based economy is becoming more vital day-by-day (Gërguri et al 2015). As more entrepreneurs and mangers focus on the relationship between knowledge spillovers and innovation activities and firm-performance, it is decisive that they inspire an atmosphere that is favorable to knowledge and innovation.

This paper underlined the Balkans countries, which will be helpful to manage institutional constraints with international market regulations (Dana and Ramadani 2015; Gërguri et al 2015). This article offers practical relevance to the pursuit of knowledge spillovers and innovation by considering how they enhance firm-performance and competitiveness. This article clarifies which knowledge, innovation and performance variables are more valuable for the Balkans countries. A focus on these settings enables firms to understand how knowledge spillovers and innovation shape and facilitate the Balkan countries.

One of the recommendations for future research is to place more emphasis on the investigation of innovation activates undertaken by firms during the transition period, especially in the context of restructuring. One suggestion for future research is to apply the CDM model, which investigates the stages of the innovation process. The CDM requires CIS-type data. With the EU accession, the non EU Balkan countries might become part of CIS and thus enable the investigation of innovation activities with CDM model using CIS data. Another suggestion related to this topic is further research on finding better ways of measuring innovation, R&D activity and intangible capital, such as knowledge spillover. The Balkan countries will be more likely to encourage innovation activities and knowledge spillovers if they are able to measure them more effectively and document their role in the firm-performance. Generally, the suggestion for further research requires gathering primary data. The publicly available data are very scarce in the Balkans. The governments should aim at creating policies that would encourage the institutions with access to data to provide more transparency and easier access for researchers and other interested parties. This will promote further research, especially at firm-level.

Notes

For Greece there were no data on BEEPS dataset.

The violation of the zero-conditional-mean-assumption (E[u| x] = 0) can also arise for two other causes than endogeneity: omission of relevant variables and measurement error in regressors.

In the estimated equation with B>0 and B 2 <0, the turning point is always achieved at the coefficient on x over twice the absolute value of the coefficient on X2. X* = |B 1 /(2B 2 )|.

References

Abazi-Alili, H., Ramadani, V., & Gërguri-Rashiti, S. (2014). Determinants of innovation activities and their impact on the entrepreneurial businesses performance: empirical evidence from Central and South Eastern Europe. Proceedings of REDETE Conference, Banja Luka: University of Banja Luka. http://redete.org/doc/confrence-proceedings-2014.pdf. Accessed 01 January 2016.

Acs, J. Z., & Audretsch, B. D. (1991). Innovation and small firms. Massachusetts: MIT Press.

Acs, Z. J., Audretsch, D. B., & Feldman, M. (1994). R&D spillovers and recipient firm size. The Review of Economics and Statistics, 76(2), 336–340.

Acs, Z. J., Braunerhjelm, P., Audretsch, B. D., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32, 15–30.

Acs, J. Z., Brooksbank, J. D., O’Gorman, C., Pickernell, D., & Terjesen, S. (2012). The knowledge spillover theory of entrepreneurship: an application to foreign direct investment. International Journal of Entrepreneurship and Small Business, 15(2), 237–261.

Agarwal, R., Audretsch, D., & Sarkar, M. (2010). Knowledge spillovers and strategic entrepreneurship. Strategic Entrepreneurship Journal, 4, 271–283.

Aghion, P., & Jaravel, X. (2015). Knowledge spillovers, innovation and growth. The Economic Journal, 125, 533–573.

Ahmed, Z. U., Dana, L.-P., Anwar, S. A., & Beidyuk, P. (1998). The environment for entrepreneurship and International Business in the Ukraine. Journal of International Business and Entrepreneurship, 6(2), 113–130.

Ahmed, Z. U., Robinson, B. R., & Dana, L.-P. (2001). A U.S. entrepreneur in Moscow. International Journal of Entrepreneurship and Innovation, 2(1), 51–58.

Aitken, J. B., & Harrison, E. A. (1999). Do domestic firms benefit from direct foreign Investment? Evidence from Venezuela. American Economic Review, 89(3), 605–618.

Alegrem, J., Sengupta, K., & Lapiedra, R. (2011). Knowledge management and innovation performance in a high-tech SMEs industry. International Small Business Journal, 31(4), 454–470.

Alvarez, R., & Robertson, R. (2004). Exposure to foreign markets and plant level innovation: evidence from Chile and Mexico. Journal of International Trade and Economic Development, 13(1), 57–87.

Arendarski, A., Mroczkowski, T., & Sood, J. (1994). A study of the redevelopment of private enterprise in Poland: conditions and policies for country growth. Journal of Small Business Management, 32(3), 40–51.

Arora, A., Fosfuri, A., & Gambardella, A. (2001). Markets for technology: Economics of innovation and corporate strategy. Cambridge: MIT Press.

Baltagi, B. H., Song, S. H., & Koh, W. (2003). Testing panel data regression models with spatial error correlation. Journal of Econometrics, 117, 123–150.

Bascavusoglu-Moreau, E., & Li, C. (2013). Knowledge spillovers and sources of knowledge in the manufacturing sector” the future of manufacturing: A new era of opportunity and challenge for the UK Project Report. London: The Government Office for Science.

Baum, C. F. (2006). An introduction to modern econometrics using Stata. Texas: Stata Press.

Beamish, P. (1993). The characteristics of joint ventures in the People’s Republic of China. Journal of International Marketing, 1(2), 29–48.

Becheikh, N., Landry, R., & Amara, N. (2006). Lessons from innovation empirical studies in the manufacturing sector: a systematic review of the literature from 1993–2003. Technovation, 26, 644–664.

Benjamin, C. (1961). Contrasts in agglomeration: New York and Pittsburgh. Papers and Proceedings of the American Economic Association, 51, 279–89.

Bernstein, J. I., & Nadiri, M. I. (1988). Interindustry R&D spillovers, rates of return, and production in high-tech industries. American Economic Review, 78(2), 429–434.

Bhaskaran, S. (2006). Incremental innovation and business performance: small and medium-size food enterprises in a concentrated industry environment. Journal of Small Business Management, 44(1), 64–80.

Blazseka, S., & Escribano, A. (2009). Knowledge spillovers in U.S. patents: A dynamic patent intensity model with secret common innovation factors, Working paper 09-89. Madrid: Departamento de Economía.

Bowen, F. E., Rostami, M., & Steel, P. (2010). Timing is everything: a meta-analysis of the relationships between organizational performance and innovation. Journal of Business Research, 63(11), 1179–1185.

Branstetter, L. (2006). Is foreign direct investment a channel of knowledge spillovers? Evidence from Japan’s FDI in the United States. Journal of International Economics, 68(2), 325–344.

Brown, M., & Zasloff, J. J. (1999). Cambodia confounds the peacemakers, 1979–1998. Ithaca: Cornell University Press.

Bruton, G. D. (1998). Incubators and small business support in Russia. Journal of Small Business Management, 36(1), 91–94.

Carlino, J. (2001). Knowledge spillovers: cities’ role in the new economy. Business Review, 4, 17–26.

Cassiman, B., & Veugelers, R. (2001). R&D cooperation and spillovers: Some empirical evidence from Belgium. Available at: http://web.iese.edu/bcassiman/aerversion-final.pdf. Accessed 15 January 2016.

Castany, L., López-Bazo, E., & Moreno, R. (2005). Differences in total factor productivity across firm size: A distributional analysis. Barcelona: University of Barcelona.

Chang, J. S., & Xu, D. (2008). Spillovers and competition among foreign and local firms in China. Strategic Management Journal, 29, 495–518.

Chau, S. S. (1995). The development of China’s private entrepreneurship. Journal of Enterprising Culture, 3(3), 261–270.

Cheung, K.-Y., & Lin, P. (2004). Spillover effects of FDI on innovation in China: evidence from the provincial data. China Economic Review, 15(1), 25–44.

Chow, K. W. C., & Tsang, W. K. E. (1995). Entrepreneurs in China: development, functions and problems. International Small Business Journal, 1, 63–77.

Coe, D., & Helpman, E. (1995). International R&D spillovers. European Economic Review, 39(5), 859–887.

Crepon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation, and productivity: an econometric analysis at the firm level. The Economics of Innovation and New Technology, 7, 115–158.

Czarnitzki, D., & Kraft, K. (2007). Spillovers of innovation activities and their profitability, Discussion Paper No. 07-073. Centre for European economic research. Available at: ftp://ftp.zew.de/pub/zew-docs/dp/dp07073.pdf. Accessed 15 January 2016.

Damanpour, F., Walker, R. M., & Avellaneda, C. N. (2009). Combinative effects of innovation types and organizational performance: a longitudinal study of service organizations. Journal of Management Studies, 46(4), 650–675.

Damijan, J. P., Kostevc, C., & Polanec, S. (2008). From innovation to exporting or vice versa: Causal link between innovation activity and exporting in Slovenian Microdata. Leuven, Belgium: Katholieke Universiteit.

Dana, L.-P. (1994a). A Marxist mini-dragon? Entrepreneurship in today’s Vietnam. Journal of Small Business Management, 32(2), 95–102.

Dana, L.-P. (1994b). Economic reform in the New Vietnam. Current Affairs, 70(11), 19–25.

Dana, L.-P. (1995). Small business in a non-entrepreneurial society: the case of the Lao People’s Democratic Republic (Laos). Journal of Small Business Management, 33(3), 95–102.

Dana, L.-P. (1996). Albania in the twilight zone: the Perseritje model and its impact on small business. Journal of Small Business Management, 34(1), 64–70.

Dana, L.-P. (1997a). Change, entrepreneurship and innovation in the Republic of Kazakhstan. Entrepreneurship, Innovation, and Change, 6(2), 167–174.

Dana, L.-P. (1997b). Stalemate in Moldova. Entrepreneurship, Innovation, and Change, 6(3), 269–277.

Dana, L.-P. (1998). Waiting for direction in the Former Yugoslav Republic of Macedonia (FYROM). Journal of Small Business Management, 36(2), 62–67.

Dana, L.-P. (1999a). Business and entrepreneurship in Bosnia-Herzegovina. Journal of Business & Entrepreneurship, 11(2), 105–118.

Dana, L.-P. (1999b). Bulgaria at the crossroads of entrepreneurship. Journal of Euromarketing, 8(4), 27–50.

Dana, L.-P. (1999c). Entrepreneurship as a supplement in the People’s Republic of China. Journal of Small Business Management, 37(3), 76–80.

Dana, L.-P. (2000a). Change and circumstance in Kyrgyz markets. Qualitative Market Research, 3(2), 62–73.

Dana, L.-P. (2000b). The hare and the tortoise of Former Czechoslovakia: small business in the Czech and Slovak Republics. European Business Review, 12(6), 337–343.

Dana, L.-P. (2002). When economies change paths: Models of transition in China, the Central Asian Republics, Myanmar, and the Nations of Former Indochine Francaise. Singapore: World Scientific.

Dana, L.-P. (2010). When economies change hands: A survey of entrepreneurship in the emerging markets of Europe from the Balkans to the Baltic States. New York: Routledge.

Dana, L.-P., & Ramadani, V. (2015). Family businesses in transition economies. Cham: Springer.

Dandridge, T. C., & Flynn, D. M. (1988). Entrepreneurship: environmental forces which are creating opportunities in China. International Small Business Journal, 6(3), 34–41.

de Clercq, D., Hessels, J., & Van Stel, A. (2008). Knowledge spillovers and new ventures’ export orientation. Small Business Economics, 31(3), 283–303.

Di Vito, J., Laurin, C., & Bozec, Y. (2010). R&D activity in Canada: does corporate ownership structure matter? Canadian Journal of Administrative Sciences, 27(2), 107–121.

Donate, J. M., & Sánchez de Pablo, D. J. (2015). The role of knowledge-oriented leadership in knowledge management practices and innovation. Journal of Business Research, 68, 360–370.

Eurostat (2008). Science, technology and innovation in Europe. Brussels: European Commission.

Falk, M. (2008). Effects of foreign ownership on innovation activities: Empirical evidence for 12 European countries. Wien: Austrian Institute of Economic Research.

Fan, Y., Chen, N., & Kirby, D. (1996). Chinese peasant entrepreneurs: an examination of township and village enterprises in Rural China. Journal of Small Business Management, 34(4), 72–76.

Fernades, C., Ferreira, J., & Raposo, M. (2013). Drivers to firm innovation and their effects on performance: an international comparison. International Entrepreneurship and Management Journal, 9(4), 557–580.

Fernandes, C., Ferreira, J., & Marques, S.C. (2011). Knowledge spillovers and knowledge intensive business services: An empirical study, MPRA Paper. https://mpra.ub.uni-muenchen.de/34751/. Accessed 25 December 2015.

Ferreira, J. (2010). Corporate entrepreneurship and small firms’ growth. International Journal of Entrepreneurship and Small Business, 10(3), 386–409.

Ferreira, J., Fernandes, C., & Ratten, V. (2016). Entrepreneurship, innovation and competitiveness: what is the connection?. International Journal of Business and Globalisation. Forthcoming: http://www.inderscience.com/info/ingeneral/forthcoming.php?jcode=ijbg.

Franicevic, V. (1999). Political economy of the unofficial economy: The state and regulation. In E. L. Feige & K. Ott (Eds.), Underground economies in transition: Unrecorded activity, tax, corruption and organized crime (pp. 117–137). Aldershot: Ashgate.

Fritsch, M., & Franke, G. (2004). Innovation, regional knowledge spillovers and R&D cooperation. Research Policy, 33(1), 245–255.

Fung, M. (2003). To what extent are R&D and knowledge spillovers valued by the market? Pacific Accounting Review, 15(2), 29–50.

Fung, M. (2005). Are knowledge spillovers driving the convergence of productivity among firms? Economica New Series, 72(286), 287–305.

Gentry, R. J., & Shen, W. (2013). The impacts of performance relative to analyst forecasts and analyst coverage on firm R&D intensity. Strategic Management Journal, 34(1), 121–130.

Gërguri, S., Ramadani, V., Abazi-Alili, H., Dana, L.-P., & Ratten, V. (2015). ICT, innovation and firm performance: the transition economies context. Thunderbird International Business Review. doi:10.1002/tie.21772.

Geroski, P. (1998). An applied econometrician’s view of large company performance. Review of Industrial Organization, 13(3), 271–294.

Globerman, S., Kokko, A., & Sjoholm, F. (2000). International technology diffusion: evidence from Swedish patent data. Kyklos, 53, 17–38.

Green, W. H. (2012). Econometric analysis (7th ed.). New Jersey: Prentice-Hall.

Gupta, A., & Singhal, A. (1993). Managing human resources for innovation and creativity. Research Technology Management, 36(3), 8–41.

Haddad, M., & Harrison, A. (1993). Are there positive spillovers from direct foreign investment? Evidence from panel data for morocco. Journal of Development Economics, 42(1), 51–74.

Hashi, I., & Stojcic, N. (2012). The impact of innovation activities on firm performance using a multi-stage model: evidence from the community innovation survey 4. Research Policy, 42(2), 353–366.

Herzer, D., & Nowak-Lehmann, D. (2006). What does export diversification do for growth? An econometric analysis’. Applied Economics, 38(15), 1825–1838.

Hill, C. W., & Jones, G. R. (2009). Strategic management theory: An integrated approach (9th ed.). Mason: South-Western Cengage Learning.

Hisrich, D. R., & Fulop, G. (1995). Hungarian entrepreneurs and their enterprises. Journal of Small Business Management, 33(3), 88–94.

Hisrich, D. R., & Gratchev, M. V. (1993). The Russian entrepreneur. Journal of Business Venturing, 8(6), 487–497.

Hisrich, D. R., & Vecsenyi, J. (1990). Entrepreneurship and the Hungarian transformation. Journal of Managerial Psychology, 5(5), 11–16.

Hollanders, H., Es-Sadki, N., & Kanerva, M. (2015). Innovation union scoreboard 2015. Belgium: European Union.

Huse, M., Neubaum, O. D., & Gabrielsson, J. (2005). Corporate innovation and competitive environment. International Entrepreneurship and Management Journal, 1(3), 313–333.

Ivy, R. L. (1996). Small scale entrepreneurs and private sector development in the Slovak Republic. Journal of Small Business Management, 34(4), 77–83.

Jaffe, A. B. (1998). The importance of ‘spillovers’ in the policy mission of the advanced technology program. The Journal of Technology Transfer, 23(2), 11–19.

Jaffe, A., Trajtenberg, M., & Henderson, R. (1993). Geographical localization of knowledge spillovers as evidenced by patent citations. Quarterly Journal of Economics, 108(3), 577–599.

Kanter, R. M. (1983). The change masters: Innovation for productivity in the American corporation. New York: Simon & Schuster.

Kneller, R., & Pisu, M. (2007). Industrial linkages and export spillovers from FDI. The World Economy, 30(1), 105–134.

Konings, J. (2001). The effects of foreign direct investment on domestic firms: evidence from firm-level panel data in emerging economies. Economics of Transition, 9(3), 619–633.

Kurtishi-Kastrati, S., Ramadani, V., Dana, L-P., & Ratten, V. (2016). Do foreign direct investments accelerate economic growth? The case of the Republic of Macedonia. International Journal of Competitiveness, 1(1), forthcoming.

Lasch, F., & Dana, L.-P. (2011). Contrasting contexts for entrepreneurship: capitalism by Kyrgyz Decree compared to gradual transition in Uzbekistan. Journal of Small Business and Entrepreneurship, 24(3), 319–327.

Lee, J., & Habte-Giorgis, B. (2004). Empirical approach to the sequential relationships between firm strategy, export activity, and performance in U.S. manufacturing firms. International Business Review, 13, 101–129.

Leeuwen, V.G. (2008). Innovation and performance: A collection of microdata studies. Netherlands: Proefschrift Technische Universiteit Delft.

Lejarraga, J., & Martinez-Ros, E. (2008). Comparing small vs large firms’ R&D productivity through a dual process perspective, Academy of Management Proceedings, Meeting Abstract Supplement No. 1–6.

Lionnet, P. (2003). Innovation: The process. Lisbon: ESA Training.

Lipit, M. (2006). Patterns in innovation: goals and organization life cycle. Human Resource Planning Society Journal, 73–77.

Liuhto, K. (1996). The transformation of the enterprise sector in Estonia. Journal of Enterprising Culture, 4(3), 317–329.

Lombardo, G. A. (1995). Chinese entrepreneurs: strategic adaptation in a transitional economy. Journal of Enterprising Culture, 3(3), 277–292.

Lööf, H., & Heshmati, A. (2006). On the relationship between innovation and performance: a sensitivity analysis. Economics of Innovation and New Technology, 5(4/5), 317–344.

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22, 3–42.

Magnus, B. (1986). Foreign investment and productive efficiency: the case of Mexico. Journal of Industrial Economics, 35(1), 97–110.

Martin, J. H., & Grbac, B. (1998). Smaller and larger firms’ marketing activities as a response to economic privatization: marketing is alive and well in Croatia. Journal of Small Business Management, 36(1), 95–99.

Mata, F., Fuerst, W., & Barney, J. (1995). Information technology and sustainable competitive advantage: a resource-based analysis. MIS Quarterly, 19(4), 487–505.

McAdam, R., & Keogh, K. (2004). Transitioning towards creativity and innovation measurement in SMEs. Creativity and Innovation Management, 13(2), 126–141.

Miguel, E., & Kremer, M. (2004). Worms: identifying impacts on education and health in the presence of treatment externalities. Econometrica, 72(1), 159–217.

Moretti, E. (2004). Workers’ education, spillovers, and productivity: evidence from plant-level production functions. American Economic Review, 94, 656–690.

Mudambi, R., & Swift, T. (2014). Knowing when to leap: transitioning between exploitative and explorative R&D. Strategic Management Journal, 35, 126–145.

Munteanu, A.-C. (2015). Knowledge spillovers of FDI. Procedia Economics and Finance, 32, 1093–1099.

Murphy, G. B., Trailer, J. W., & Hill, R. C. (1996). Measuring performance in entrepreneurship research. Journal of Business Venturing, 36(1), 15–23.

Noar, J. (1985). Recent small business reforms in Hungary. Journal of Small Business Management, 23(1), 65–72.

Overholt, W. H. (1993). The rise of China: How economic reform is creating a new superpower. New York: Norton.

Pagés, C. (2010). The age of productivity. New York: Palgrave Macmillan.

Peng, M. W. (2000). Business strategies in transition economies. Thousand Oaks: Sage.

Peters, B. (2008). Innovation and firm performance: An empirical investigation for German firms. Heidelberg: Springer.

Price, P. D., Stoica, M., & Boncella, J. R. (2013). The relationship between innovation, knowledge, and performance in family and non-family firms: an analysis of SMEs. Journal of Innovation and Entrepreneurship, 2(1), 1–20.

Ramadani, V. (2013). Entrepreneurship and small business in Republic of Macedonia. Strategic Change, 22(7/8), 485–501.

Ramadani, V., & Gërguri, S. (2011). Innovations: principles and strategies. Strategic Change, 20(3/4), 101–110.

Ramadani, V., & Schneider, C. R. (Eds.). (2013). Entrepreneurship in the Balkans. Heidelberg: Springer.

Ramadani, V., Dana, L.-P., Gerguri, S., & Tašaminova, T. (2013a). Women entrepreneurs in the Republic of Macedonia: waiting for directions. International Journal of Entrepreneurship and Small Business, 19(1), 95–121.

Ramadani, V., Gerguri, S., Rexhepi, G., & Abduli, S. (2013b). Innovation and economic development: the case of FYR of Macedonia. Journal of Balkan and Near Eastern Studies, 15(3), 324–345.

Ratten, V. (2014). Behavioral intentions to adopt technological innovations: the role of trust, innovation and performance. International Journal of Enterprise Information Systems, 10(3), 1–13.

Ratten, V. (2016). Female entrepreneurship and the role of customer knowledge development, innovation outcome expectations and culture on intentions to start informal business ventures. International Journal of Entrepreneurship and Small Business, 27(2/3), 262–272.

Research and innovation performance in the EU Report (2014). Innovation Union progress at country level. Brussels: European Commission.

Rexhepi, G. (2014). Use the right strategy and grow. ACRN Journal of Entrepreneurship Perspectives, 3(1), 19–29.

Rexhepi, G. (2015). Entering new markets: Strategies for internationalization of family businesses. In L.-P. Dana & V. Ramadani (Eds.), Family businesses in transition economies (pp. 293–303). Cham: Springer.

Rexhepi, G., & Ibraimi, S. (2011). Do strategies emerge? Procedia-Social and Behavioral Sciences, 24, 1624–1629.

Rexhepi, G., Ibraimi, S., & Veseli, N. (2013a). Role of intellectual capital in creating enterprise strategy. Procedia-Social and Behavioral Sciences, 75, 44–51.

Rexhepi, G., Kurtishi, S., & Bexheti, G. (2013b). Corporate Social Responsibility (CSR) and innovation–the drivers of business growth? Procedia-Social and Behavioral Sciences, 75, 532–541.

Rod, F., Neil, F., & David, G. (2004). Imports, exports, knowledge spillovers and growth. Economics Letters, 85(2), 209–221.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94(5), 1002–1037.

Rondinelli, D. A. (1991). Developing private enterprise in the Czech and Slovak Federal Republic. Columbia Journal of World Business, 26, 26–36.

Rosenbusch, N., Brinckmann, J., & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of Business Venturing, 26(2011), 441–457.

Roura, J. (2009). Towards new European peripheries? In C. Karlson, B. Joahansson, & R. Stough (Eds.), Innovation, agglomeration and regional competition: New horizons in regional science. Cheltenham, UK: Edward Elgar Publishing.

Sachs, J. (1993). Poland’s jump to the market economy. Cambridge: MIT.

Saito, H., & Gopinath, M. (2011). Knowledge spillovers, absorptive capacity, and skill intensity of Chilean manufacturing plants. Journal of Regional Science, 51(1), 83–101.

Sanchez, M. A., Ortiz-de-Urbina-Criado, M., & Mora-Valentin, M. E. (2011). Effects of knowledge spillovers on innovation and collaboration in science and technology parks. Journal of Knowledge Management, 15(6), 948–970.

Shirk, S. (1993). The political logic of economic reform in China. Berkeley: University of California Press.

Siu, W.-S., & Kirby, A. D. (1995). Marketing in Chinese small business: tentative theory. Journal of Enterprising Culture, 3(3), 309–342.

Sohn, S. Y., Joo, Y. G., & Han, H. K. (2007). Structural equation model for the evaluation of national funding on R&D project of SMEs in consideration with MBNQA Criteria. Evaluation and Program Planning, 30, 10–20.

Sok, P., & O’Cass, A. (2011). Achieving superior innovation-based performance outcomes in SMEs through innovation resource–capability complementarity. Industrial Marketing Management, 40(8), 1285–1293.

Subramanian, A., & Nilakanta, S. (1996). Organizational innovativeness: exploring the relationship between organizational determinants of innovation, types of innovations, and measures of organizational performance. Omega, 24(6), 631–647.

Suklev, B., & Rexhepi, G. (2013). Growth strategies of entrepreneurial businesses: Evidence from Macedonia. In V. Ramadani & R. C. Schneider (Eds.), Entrepreneurship in the Balkans (pp. 77–87). Heidelberg: Springer.

Tan, C. L., & Lim, T. S. (1993). Vietnam: Business and investment opportunities. Singapore: Cassia.

Tiwari, R., & Buse, S. (2007). Barriers to innovation in SMEs: Can the internationalization of R&D mitigate their effects? Proceedings of the First European Conference on Knowledge for Growth: Role and Dynamics of Corporate R&D (CONCORD 2007), October 8–9, 2007, Seville, Spain.

Tybout, J. R. (2000). Manufacturing firms in developing countries: how well do they do and why. Journal of Economic Literature, 38(1), 11–44.

UK Department of Trade and Industry. (2003). Innovation report. London: Ministry for Science and Innovation.

Van Biesebroeck, J. (2005). Firm size matters: growth and productivity growth in African manufacturing. Economic Development and Cultural Changes, 53(3), 545–583.

Verhees, F. J. H. M., & Meulenberg, M. T. G. (2004). Market orientation, innovativeness, product innovation and performance in small firms. Journal of Small Business Management, 42(2), 134–154.

Wei, L. (2001). Incentive systems for technical change: the Chinese system in transition. International Journal of Entrepreneurship and Innovation Management, 1(2), 157–177.

Williams, E. E., & Li, J. (1993). Rural entrepreneurship in the People’s Republic of China. Entrepreneurship, Innovation, and Change, 2(1), 41–54.

Wolff, J. A., & Pett, T. L. (2006). Small firm performance. Journal of Small Business Management, 44(2), 268–284.

Yang, H., & Steensma, H. K. (2014). When do firms rely on their knowledge spillover recipients for guidance in exploring unfamiliar knowledge? Research Policy, 43(9), 1496–1507.

Zapalska, A. (1997). A profile of woman entrepreneurs in Poland. Journal of Small Business Management, 35(4), 76–82.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ramadani, V., Abazi-Alili, H., Dana, LP. et al. The impact of knowledge spillovers and innovation on firm-performance: findings from the Balkans countries. Int Entrep Manag J 13, 299–325 (2017). https://doi.org/10.1007/s11365-016-0393-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-016-0393-8