Abstract

The main goal of this paper is to show that organizations and institutions play a relevant role in the economic growth process, both directly and indirectly. Human capital plays a direct role by facilitating the introduction and use of new technologies. A more indirect role is play by entrepreneurial activity in three ways: 1) supplying monetary funds; 2) creating an adequate social climate and 3) encouraging trust in the society. The hypotheses introduced are tested using the data on eleven countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Economists have been traditionally concerned with determining and studying the factors that enhance the economic growth process, an interest greatly intensified in moments of economic crisis. Due to the serious problems that arise in such circumstances, they are interested in determining the cause of the crisis in order to propose economic policies they consider adequate to alleviate the crisis and avoid similar future crises.

From a political economy point of view, the primary way to prevent an economic crisis and its ensuing problems is through economic growth. Through the economic growth process, the unemployment rate is reduced, more goods and services are supplied to the economy and, finally, the social welfare is improved.

On this theme, several studies have stressed the relevance of the role of organizations and institutions in supplying the necessary resources to increase such economic growth. The ways they do this can be quite diverse. For example they can supply monetary funds to be invested to improve fixed capital; or they can provide a venue to use or assimilate the new technologies that are essential to increase the competitiveness of the country.

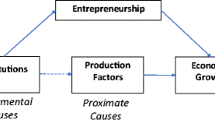

While their main role is to facilitate the activity of one or more factors that directly affect economic growth, many of their effects on economic growth are not direct. To examine this, we must consider particular factors that would directly impact economic growth and then analyze the effects of organizations and institutions on such factors. By doing so, we would be able to consider the direct and indirect effects on economic growth.

Taking into account this process and following the new theories of economic growth, we will consider that education organizations would have a positive direct effect on economic growth, and entrepreneurship activity would be the factor through which such organizations would have an indirect effect.

The main goal of this paper is to analyse the relevance of the role of organizations in the economic growth process. “The role of institutions in economic growth” focuses on this topic. “Entrepreneurship characteristics” examines the characteristics of entrepreneurship. In “Entrepreneurship and economic growth”, the relationship between entrepreneurship and economic growth is analyzed. In “Empirical estimation”, the empirical analysis is developed to test the hypotheses considered. The main conclusions follow.

The role of institutions in economic growth

As previously stated, economic growth is a relevant economic policy goal, as its improvement increases the social welfare of the country. Therefore, it is interesting to determine those factors that enhance economic growth to better design a strategy that would maintain the process, allowing the social benefits to be enjoyed by economic agents as long as possible.

In analyzing growth strategies, it is important to differentiate between igniting economic growth and sustaining it (Rodrick 2005). The former requires several reforms and the latter requires constructing a long-term institutional policy to facilitate the economy in resisting shocks and maintaining productive dynamism. Generally, this difference has not been considered. For example the policy principles of the Washington Consensus (Williamson 1990) were focused on trade and financial liberalization, fiscal discipline, competitive currencies, privatization and deregulation. The list was augmented at the end of the 1990s to include aspects related to institutions and “good governance.” (Rodrick 2005 p 974).

Considering the difference, two main groups of policies could be developed:

-

1.

To stimulate economic growth, economic group policies could be designed focusing on demand side or supply side. In this group it is very important to create, following the Stern’s concept (2001), an adequate “investment climate”. This means creating the appropriate behavioral environment to beneficially influence the risks and returns associated with investment. In this case, the improvement of human capital, social capital, and property rights, and the reduction of corruption, tax burden, inflation, and macroeconomic instability would be adequate principles to take into account. This is important in the case of transtion economies (Smallbone et al. 2010), to promote female entrepreneurship (Pardo-del-Val 2010), to support intrapreneurship (Alpkan et al. 2010) and to take into account the differences between entrepreneurs and small business owners (Wagener et al. 2010).

-

2.

To sustain economic growth, it is necessary to create and to improve appropriate institutions that facilitate and improve the market activity to avoid economic shocks (Acemoglu et al. 2002). These institutions could be, in general terms:

-

Political Environment (democracy): Parliament, Institutions of regulation and supervision.

-

Economic Environment: Central Bank, Fiscal institutions.

-

Entrepreneurial environment: Property rights, Institutions of supervision for correcting market failures, social capital

-

In the design of growth-enhancing economic policy, policy makers must consider, at least, two main aspects: first, the relationship between this goal and other economic policy objectives, and second, the instruments that facilitate the achievement of the goal. We will consider both aspects.

In the relationship between economic growth as a goal and other economic policy objectives, it is necessary to take into account the following aspects:

-

1.

Level of employment. Economic growth would lead to higher income per capita, which would, in turn, lead to higher levels of consumption. From a Keynesian perspective, this would have positive effects on employment levels. However, growth also implies rapid changes in the production process, introducing new technologies. If people cannot improve their skills, their jobs may be replaced by machines.

-

2.

Income distribution. If incomes rise, government can possibly favor shifting incomes from the rich to the poor. However, several mechanisms could influence this relationship: the introduction of new technology (Lin et al. 2010) and the slow process of skill improvement could generate job losses or lower wages for the unskilled workers (Juhn et al. 1993; Piketty 1997); credit market restrictions that reduce the investment possibilities of less rich people (Tsiddon 1992; Saint-Paul and Verdier 1992; Galor and Zeira 1993; Banarjee and Newman 1993); and the role of the lobbies that reduce the effectiveness of the measures designed by policy makers (Persson and Tabellini 1994)

-

3.

Macroeconomic difficulties. Higher income would lead to a higher demand, which could generate inflation and balance of payment problems due to an increase in imports of goods. An increase in production would circumvent this problem, and meet individuals’ needs.

-

4.

Environmental resources. The relationship between economic growth and environment is not clear (Selden and Song 1994; Magnani 2000; Andreoni and Levinson 2001; Heerink et al. 2001; Eriksson and Persson 2003). Some literature states that as individuals become richer, they are more preoccupied with the environment. Higher education facilitates this process. However, economic growth would use greater amounts of resources, some of them non-renewable. In this case, improvement of scientific knowledge (Lindblom and Tikkanen 2010) is necessary to avoid this problem. Higher consumption derived from economic growth also generates higher levels of pollution and waste.

-

5.

Welfare and happiness. From the previous points, it can be concluded that by avoiding some costs (mainly distribution and environmental problems), economic growth leads to a higher level of social welfare and finally to increased happiness. However, some controversies have developed in this field. Ethical claims have appeared recently stating that “the more people have, the more they want” and for this reason more consumption may not increase their happiness and social welfare. It may, rather, only lead the individuals to a more materialistic, selfish and less caring society. Such a society sees increased violence, crime, divorce and suicides. (Friedman 2005. On happiness and economy, see e. g. Frey and Stutzer 2002; Easterlin 2005. On franchise associations see Gámez-González et al. 2010).

In the case of the factors that enhance economic growth, the traditional literature has focused on private capital, public capital and human capital. However, recent literature has also included entrepreneurship activity (Amagoh 2009). Its characteristics are analyzed in the following section.

Entrepreneurship characteristics

The main difficulty in entrepreneurship analysis is its delimitation, as there is not a generally accepted definition of this concept. Wennekers and Thurik (1999), following the ideas exposed by Herbert and Link (1989), Bull and Willard (1993) and Lumpkin and Dess (1996), define it as the manifested capacity and desire of the individuals to create new business opportunities—that is, new products, new organization forms, new production methods—and to introduce their ideas in the markets confronting uncertainty and other obstacles, adopting decisions on localization and on the use of resources. These decisions could be adopted individually or in networks included or not in institutions.

Following this definition, several characteristics can be considered (Galindo et al. 2010, p. 133):

-

1.

The definition takes into account the economic agents’ behavior. For this reason, entrepreneurship doesn’t mean an occupation but an activity that considers the different circumstances and aspects of a person.

-

2.

Entrepreneurships must consider uncertainty and obstacles inherent in the business creation process.

-

3.

They must have information or ideas about efficient production processes, as well as new organizational forms. This doesn’t mean entrepreneurs had to have attended special academic courses about management. They must have the idea and they can ask information or advice from experts to execute the idea.

-

4.

The entrepreneurs can be also encountered in big firms. In this case, they are named “entrepreneurs’” or “corporate preneurs.” (Arendt and Brettel 2010).

The modern perspective defines different types of entrepreneurships:

-

a)

Innovator, following Schumpeter’s (1950, 1911) thesis. Schumpeter considers that entrepreneurship activity implies innovation in the introduction of a new product, organization or process, generating a destruction process. He creates new industries and for this reason he causes relevant structural changes in the economy. Entrepreneurs cannot be considered as inventors because they adopt the inventions created by others. When an entrepreneur gives up innovation, he loses his entrepreneur condition. For this reason the Schumpeterian vision implies that the entrepreneur is an innovator that destroys the existing structures. From a more modern and general point of view, entrepreneurship entails the creation of a new firm, but doesn’t imply that the entrepreneur must create new products. He/she can generate a new business without being an innovator in the Schumpeterian sense and assimilate the technological advances.

-

b)

Taking advantage of profit opportunities (Kirzner 1973, 1999). Kirzner agrees with Schumpeter that an entrepreneur tries to take advantage of profit opportunities, but contrary to Schumpeter’s view, Kirzner says the entrepreneur learns from past mistakes and tries to correct them, driving the market toward equilibrium. From his point of view, there is a relationship between institutions and entrepreneurships that enhances economic progress, due to two factors. First, institutions facilitate the competitiveness level that entrepreneurships need. Second, they also facilitate the incentives structure that encourages entrepreneurships to develop their activity.

-

c)

Uncertainty (Knight 1921). Knight distinguished between risk and uncertainty. The former is insurable because it refers to recurrent events, the relative frequency of which is known from experience; the second is not insurable because it relates to events the probability of which is only subjectively estimated. Knight considered uncertainty as an important factor considered by entrepreneurs. They have to take it into account and adopt decisions in an uncertain world. Their profits are a reward for bearing this uncertainty.

The entrepreneurship differentiation defended by Baumol (1990), ranking them between “productive” and “non productive”. From his point of view, entrepreneurs are creative and ingenious, searching the more appropriate means to increase their wealth, power and prestige. The existing environment around them has an important influence on their decisions. For this reason it is possible to find different kinds of entrepreneurships.

It is also relevant to consider the sociological point of view. Max Weber’s (1978, 1988) contribution is one of the most relevant to be considered in this group.Footnote 1 According to Swedberg (2000), we can consider at least three main characteristics:

-

1.

Charisma. Weber considered that an entrepreneur is a kind of person who understands that other people want to follow him. However, Weber also recognizes that this charisma is not so relevant in a capitalistic society as in the early stages of mankind. In a capitalistic society, the main factor for entrepreneurship is taking advantage of market opportunities.

-

2.

Religious. In his celebrated The Protestant Ethic and the Spirit of Capitalism, Weber considered a certain form of religion that he called “ascetic Protestantism” favored the development of a positive attitude towards moneymaking which facilitated the change in attitude towards the entrepreneur.

-

3.

Bureaucracy. In some writings, Weber also counterpoised entrepreneur to bureaucrat. From his point of view, in a more rationalized society, bureaucracy becomes more relevant, both within enterprises and within the state. And the entrepreneur not only is the person who can keep the bureaucrat in his place, but also has better knowledge of the firm.

Entrepreneurship and economic growth

Entrepreneurship activity, in general terms, positively impacts economic growth because it is necessary to have a group of persons willing to assume risk, using their funds to generate new firms and business. This is the best way to achieve a sustainable economic growth.

Probably, Schumpeter is one of the first authors to consider the relevant role of entrepreneurship in the economic growth process. In his article entitled “Theoretical problems of economic growth,” published in 1947 (Schumpeter 1947), he shows that the literature has considered different factors that enhance economic growth: physical environment, social organization, institutions, and technology. (Schumpeter pp. 2-3). However, from his point of view, all these factors are not enough to explain the economic growth process, because “economic growth is not autonomous, being dependent upon factors outside of itself, and since these factors are many, no one-factor theory can ever be satisfactory.”(p. 4). However, at the end of the article, he concludes that “…since creative response means, in the economic sphere, simply the combination of existing productive resources in new ways or for new purposes, and since this function defines the economic type that we call the entrepreneur, we may reformulate the above suggestions by saying that we should recognize the importance of, and systematically require into, entrepreneurship as a factor of economic growth”(p. 8).

Taking into account this view, two topics must be considered. First, which are the factors that influence entrepreneurship? And second, how does entrepreneurship promote economic growth?

Considering the first question, Schumpeter states that an entrepreneur is a leader, and “leads” the means of production into new channels (Schumpeter 1911 p. 89) She or he is not necessarily “a genius or benefactor to humanity” (p. 90 ff). An entrepreneur has some expectation of a profit return as a precondition for decisions to innovate. From his point of view, entrepreneurial profit “is a surplus over costs [that is] the difference between receipts and outlay in a business” (p. 128). And in this situation, those entrepreneurs who have a better situation would have higher profits. That is, an improvement of the product involves a better position for the entrepreneur with the possibility to achieve higher profits. And innovation plays this role. For this reason, the innovation process enhances both growth and profits.

Therefore, in the Schumpeterian perspective, profits are an income derived from monopoly power positions (Oakley 1990 p. 139). And these positions are obtained through the innovation process.

Another factor to be considered is the social environment. In such a variable, Schumpeter includes the reaction of the social group to the entrepreneurial activity, including the innovation process. He considers the existence of legal or political impediments, the culture, and could include the rule of law and the role of institutions. On the other hand, Schumpeter states that it would be possible to find some social opposition to the innovation process, in which case the entrepreneur would find it difficult to find the necessary cooperation. While such resistance was more relevant in the beginnings of capitalism, it is still effective nowadays (Schumpeter 1911 p. 87).

In this sense, Schumpeter is not sufficiently clear in designing the variables that affect such a social environment. In general terms, they would include the democracy level and especially income distribution. Income inequality reduction (a better distribution of the results from the innovation process) would reduce the social stress and the opposition to innovation. If we accept this supposition, there are possibilities to design redistributive fiscal policies.

Considering the second question, Schumpeter takes into account five cases that promote economic development (Schumpeter 1911, p. 66): “(1) The introduction of a new good (…) or a new quality of a good. (2) The introduction of a new method of production (…). (3) The opening of a new market (…). (4) The conquest of a new source of supply of raw materials or half-manufactured goods (…). (5) The carrying out of the new organization of any industry, like the creation of a monopoly position (…) or the breaking up of a monopoly position.”

All these activities must be led by a group of people with a particular talent, namely, the entrepreneurs. Therefore, entrepreneurship is the main factor to promote economic growth and the entrepreneur’s instrument to effect such growth is innovation. There is an important recent literature analising this topic (see Baregheh et al. 2009; Sundbo 2009; Toivonen and Tuominen 2009; Huang et al. 2010; Zhang and Duan 2010; Abreu et al. 2010; Mas-Verdu et al. 2010; Meliá et al. 2010; Romero-Martínez et al. 2010; Rubalcaba et al. 2010, among others)

We have shown before that the primary motivation behind innovation is to increase profits (although this requires an adequate social climate). It is also necessary to take into account that credit is the key variable to funding the innovations, which necessitates an adequate level of savings in the society. The interest rate plays an important role in this process. Again, however, the most relevant variable in the process is profit, because when “no profit is generated, no credit is required and no interest is paid.” (Oakley 1990 p 108). In this sense, credit institutions must not constrain credit, and they must respond to entrepreneurships’ credit requirements.

All in all, from Schumpeter’s point of view, entrepreneurship is the most relevant factor to promote economic growth. She or he is profit seeking and needs an adequate social environment to develop the activity. In the next section we will test some of Schumpeter’s ideas.

However, it is also necessary to take into account the indirect effect shown by Holcombe (1998, 2007). From his point of view, the behavior of a certain entrepreneurship not only encourages other entrepreneurs to follow his/her example but also creates new opportunities that can be taken advantage of by third persons.

Therefore, following the ideas shown above, entrepreneurship activity plays a relevant role in the economic growth process. And for this reason, it is necessary to create an adequate environment or social climate to facilitate the activity and favor the achievement of the process. In this sense, organizations and institutions play a relevant role because they facilitate the funds and the resources that entrepreneurships need to carry out their activities.

Given this, organizations and institutions would play a direct role in economic growth through human capital because they supply the necessary formation to economic agents facilitating the use of new technologies. Through human capital and an adequate social climate, entrepreneurships are able to innovate and to introduce new innovations.

But there are also indirect effects through entrepreneurship activity. For instance, the provision of adequate funds to invest makes the role of monetary institutions relevant. The social climate is also a relevant condition. A climate conducive to economic growth is achieved through income distribution. To this end, fiscal policy, that is a government instrument, is the main instrument to reduce income inequalities. Finally, social capital is also a relevant element in the process and it would include social networks and lager norms related to such networks that create value in both individual and collective ways (Putnam and Gross 2003 p 14). In this concept, not only institutions are considered, but also economic agents’ behavior in the society, taking into account the cooperation among them. In this sense, different topics and values must be included such as honesty and mutual agreement that enhance productivity and finally economic growth. Then social capital implies an increase in trust and cooperation among individuals (Wu et al. 2009), building a more prosperous society, facilitating education transmission, and the acceptation and assimilation of new technologies. In many instances, families and even some associations transfer financial resources to their members, obtaining in this way funds to finance their knowledge acquisitions or their investments (Putnam 1993; Fukuyama 1995; Woolcock and Narayan 2000; Woolcock 2001).

Therefore, taking into account the previous considerations, the hypotheses to be tested are:

-

Hyp. 1: Human capital and entrepreneurship have a positive effect on economic growth

-

Hyp. 2: Social climate, that is, income distribution, has effects on entrepreneurship

-

Hyp. 3: Monetary funds have effects on entrepreneurship

-

Hyp. 4: Social capital has a positive effect on entrepreneurship

Empirical estimation

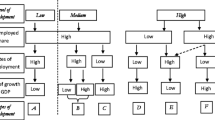

To test the previous hypotheses, the empirical estimations were developed. Utilizing the previous model, we considered the following countries: Denmark, Finland, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, the United Kingdom and the United States of America, for the period 2000-2005. We have only data for some variables for these years and for the countries listed.

All models are estimated by pooling data from the 11 countries mentioned above over the period 2000-2005 in a panel format using a total of 66 observations. The estimation method is Ordinary Least Squares and, whenever necessary, country specific factors are accounted for by including dummy variables in the estimation procedure.

-

Hypothesis 1: Human capital and entrepreneurship have a positive effect on economic growth

In this sense the equation to estimate is:

Equation 1 is the GDP equation, where y is gross domestic product (GDP), PE denotes public expenditure, I denote private investment, KHU denotes human capital and TEA denotes entrepreneurship. The expected signs are positive in the cases of I, KHU and TEA. The sign of PE is ambiguous. Some authors state that fiscal policy has a negative impact on private investment, thanks to the crowding-out effect, and finally on economic growth (e.g. Bertola 1993; Perotti 1993; Alesina and Rodrik 1994; Persson and Tabellini 1994, among others). However, there are also opposite studies (Bénabou 1996a, 1996b; Bourguignon and Verdier 2000), concluding that a redistributive policy will have positive effects on investment through different ways, such as increasing public investment (Saint-Paul and Verdier 1993) or reducing credit market imperfections or liquidity restrictions that have a negative impact on investment in physical and human capitals (Galor and Zeira 1993; Perotti 1993; Banarjee and Newman 1993; Piketty 1997; Aghion and Bolton 1992).

For entrepreneurship, we use the Total Entrepreneurship Activity, TEA, created by Global Entrepreneurship Monitor, GEM. Every year, GEM carries on a research program that estimates the national entrepreneurial activity in each country that participates in the survey, estimating the TEA index. The source of the remaining variables is the World Bank.

The results are shown in Table 1

As one can see, the signs are positive and the variables are significant. Therefore, entrepreneurship and human capital both have a positive effect on income. Organizations, through their formation and education activities, would have a positive effect on economic growth.

A second equation tests the rest of the hypothesis:

Equation 2 is an entrepreneurship equation (ϕ) that includes social capital (SK), income distribution (λ), and money supply (ms). In the case of income distribution, we have used the Gini index and for social capital we will use the data supplied by the World Values Survey.

The results are shown in Table 2

-

Hypothesis. 2: Social climate, that is, income distribution has effects on entrepreneurship

There is a controversy about the adequate sign of income distribution. Some authors (e.g. Kaldor 1956; Kelly and Williamson 1968; Cook 1995) consider that must be positive, because savings is related to income. Therefore, if we need more funds to finance investments or entrepreneurships activities, it is necessary to use a redistribute fiscal policy that shifts income from poorer to richer, who have a higher propensity to save.

As we can see in Table 2, the sign of this variable is positive. So, it is advisable to develop a redistributive fiscal policy as just noted.

However, this possibility could create some social tensions that would affect negatively on entrepreneurship activity. The differents channels that could arise such negative effect are (Perotti 1996 pp. 150-154; Aghion et al. 1999 pp 1621-1630):

-

1.

Fiscal channel. In an unequal society, poor voter will vote for those fiscal programs that promise a better income distribution through taxation or public expenditure. That implies the fiscal redistribution must be financed by distortionary taxation that distorts economic decisions, and discourages investment and finally economic growth (Alesina and Rodrik 1994; Bertola 1993. On the public capital effects, see Alfranca and Galindo 2003).

-

2.

Socio-political problem. Some literature (Perotti 1996; Benabou 1996a; b) has stressed the impact of income inequality on political instability and social tensions. These problems will increase uncertainty that leads to a lower investment and economic growth.

-

3.

Education (Becker, Murphy and Tamura 1990; Saint-Paul and Verdier 1993; Sylwester 2000). The empirical evidence shows that there is a positive effect of education on economic growth. In the case of income inequality, higher inequality implies higher underinvestment in the education when credit markets are imperfect.

-

Hypothesis 3: Monetary funds have effects on entrepreneurship

-

As we can see in Table 2 the sign of money supply is negative. The expected one would be positive, because it would reduce the interest rate, encouraging the investment decisions. However, as we have shown in the previous hypothesis, if savings are necessary, one way to encourage them is increasing the interest rate. And to achieve this goal it is necessary to decrease money supply although it would have a negative effect on entrepreneurship. Anyway, the estimation shows that this factor is not significant.

-

Hypothesis 4: Social capital has a positive effect on entrepreneurship

Table 2 shows a positive sign in the social capital case. Therefore, as stated previously, increased social capital means an increase in trust and cooperation among individuals, building a more prosperous society, facilitating education transmission and the acceptance and assimilation of new technologies. Families and even associations transfer financial resources to their members, financing knowledge acquisition or investments.

Conclusions

In this paper we have considered the roles of organizations and institutions in the economic growth process. Their effects on economic policy could be direct and indirect. Human capital is the key factor in the first case, because organizations supply the formation and education necessary to assimilate, introduce and use in an efficient way the new technologies.

In considering indirect effects, we have looked as entrepreneurship as the variable to enhance economic growth. Behind entrepreneurs are institutions and organizations that encourage such activity by facilitating monetary funds and resources, creating an adequate social climate and creating the adequate trust that encourages the cooperation and the transmission of the positive effects of the other variables considered.

Considering the empirical analysis developed, the results show that organizations have a relevant role in the economic growth process and encourage the building of a more prosperous society. If they fail to cooperate facilitating the resources, confidence is reduced, and it is more difficult to design a sustainable economic growth.

Notes

We have included Weber’s approach in the sociologist group. However, according to Swedberg (1998), he must be considered as an economist sociologist.

References

Abreu, M., Grinevich, V., Kitson, M., & Savona, M. (2010). Policies to enhance the ‘hidden innovation’ in services: evidence and lessons from the UK. Service Industries Journal, 30(1), 99–118.

Acemoglu, D., Johnson, S., & Robinson, A. (2002). The colonial origins of comparative development. An empirical investigation. American Economic Review, 91(5), 1369–1401.

Aghion, P., & Bolton, P. (1992). Distribution and growth in models of imperfect capital markets. European Economic Review, 36, 603–611.

Aghion, P., Caroli, E. & Garcia-Peñalosa, C. (1999). Inequality and economic growth: The perspective of the new growth theories. Journal of Economic Literature, XXXVII, 1615–1660.

Alesina, A., & Rodrik, D. (1994). Distribution policies and economic growth? Quarterly Journal of Economics, 109, 465–490.

Alfranca, O. & Galindo, M. A. (2003). Public capital, income distribution, and growth in OECD countries. International Advances in Economic Research, 9, 133–139.

Alpkan, L., Bulut, C., Gunday, G., Ulusoy, G., & Kilic, K. (2010). Organizational support for intrapreneurship and its interaction with human capital to enhance innovative performance. Management Decision, 48(5), 732–755.

Amagoh, F. (2009). Leadership development and leadership effectiveness. Management Decision, 47(6), 989–999.

Andreoni, J., & Levinson, A. (2001). The simple analytics of the environmental Kuznets curve. Journal of Public Economics, 80, 269–286.

Arendt, S., & Brettel, M. (2010). Understanding the influence of corporate social responsibility on corporate identity, image, and firm performance. Management Decision, 48(10), 1469–1492.

Banarjee, A. V., & Newman, A. F. (1993). Occupational choice and the process of development. Journal of Political Economy, 101, 274–298.

Baregheh, A., Rowley, J., & Sambrook, S. (2009). Towards a multidisciplinary definition of innovation. Management Decision, 47(8), 1323–1322.

Baumol, W. J. (1990). Entrepreneurship: productive, unproductive and destructive. Journal of Political Economy, 80, 893–921.

Becker, G., Murphy, K. M. and Tamura, R. (1990). Human capital, fertility, and economic growth. Journal of Political Economy, 98(5) S12–S37.

Bénabou, R. (1996a). Unequal societies. NBER Working Paper 5583.

Bénabou, R. (1996b). Inequality and growth. NBER Macroeconomic Annual 1996, Cambridge: MIT Press, pp. 11–74.

Bertola, G. (1993). Factor shares and savings in endogenous growth? American Economic Review, 83, 1184–1198.

Bourguignon, F., & Verdier, T. (2000). Oligarchy, democracy, inequality, and growth. Journal of Development Economics, 62, 285–313.

Bull, I., & Willard, G. E. (1993). Towards a theory of entrepreneurship. Journal of Business Venturing, 8, 183–195.

Cook, C. J. (1995). Saving rates and income distribution: further evidence from LDCs. Applied Economics, 27, 71–82.

Easterlin, R. A. (2005). Building a better theory of well-being. In L. Bruni & P. L. Porta (Eds.), Economics and happiness (pp. 29–64). Oxford: Oxford University Press.

Eriksson, C., & Persson, J. (2003). Economic growth, inequality, democratization and the environment. Environmental and Resource Economics, 25, 1–16.

Frey, B. S., & Stutzer, A. (2002). Happiness and economics. Princeton: Princeton University Press.

Friedman, B. M. (2005). The moral consequences of economic growth. New York: Knopf.

Fukuyama, F. (1995). Trust: The social virtues and the creation of prosperity. New York: Free.

Galindo, M. A., Mendez, M. T., & Alfaro, J. L. (2010). Entrepreneurship, income distribution and economic growth. International Entrepreneurship Management Journal, 6, 131–141.

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. Review of Economic Studies, 60(1), 35–52.

Gámez-González, J., Rondan-Cataluña, F. J., Diez-de Castro, E. C., & Navarro-Garcia, A. (2010). Toward an international code of franchising. Management Decision, 48(10), 1568–1595.

Herbert, R. F., & Link, A. N. (1989). In search of meaning of entrepreneurship. Small Business Economics, 1, 39–49.

Heerink, N., Mylatu, A., & Bulte, E. (2001). Income inequality and the environment: aggregation bias in environmental Kuznets curves. Ecological Economics, 38, 359–367.

Holcombe, R. (1998). Entrepreneurship and Economic Growth. The Quarterly Journal of Austrian Economics, 1, 45–62.

Holcombe, R. G. (2007). Entrepreneurship and economic progress. London: Routledge.

Huang, J. Y., Chou, T. C., & Lee, G. G. (2010). Imitative innovation strategies: understanding resource management of competent followers. Management Decision, 48(6), 952–975.

Juhn, C., Murphy, K., & Pierce, B. (1993). Wage inequality and the rise in returns to skill. Journal of Political Economy, 101(3), 410–442.

Kaldor, N. (1956). Alternative theories of distribution. Review of Economic Studies, 23(2), 83–100.

Kelly, A. C. & Williamson, J. G. (1968). Household savings behaviour in developing country: The Indonesian case. Economic Development and Cultural Change, 16(3), 385–403.

Kirzner, I. M. (1973). Competition & entrepreneurship. Chicago: University of Chicago Press.

Kirzner, I. M. (1999). Creative and/or alertness: a reconsideration of the Schumpeterian entrepreneur. The Review of Austrian Economics, 11, 5–17.

Knight, F. (1921). Risk, uncertainty, and profit. New York: Houghton Mifflin.

Lumpkin, G. T., & Dess, G. G. (1996). Clarifying the entrepreneurial orientation construct and linking it to performance. Academy of Management Review, 21, 135–172.

Lin, E., Lin, T. M. Y., & Lin, B. W. (2010). New high-tech venturing as process of resource accumulation. Management Decision, 48(8), 1230–1246.

Lindblom, A., & Tikkanen, H. (2010). Knowledge creation and business format franchising. Management Decision, 48(2), 179–188.

Magnani, E. (2000). The environmental Kuznets curve: environmental protection policy and income distribution. Ecological Economics, 32, 431–443.

Mas-Verdu, F., Soriano, D. R., & Dobon, S. R. (2010). Regional development and innovation: the role of services. Service Industries Journal, 30(5), 633–641.

Meliá, M. R., Pérez, A. B., & Dobón, S. R. (2010). The influence of innovation orientation on the internationalisation of SMEs in the service sector. Service Industries Journal, 30(5), 777–791.

Oakley, A. (1990). Schumpeter´s theory of capitalist motion. Aldershot: Edward Elgar.

Pardo-del-Val, M. (2010). Services supporting female entrepreneurs. Service Industries Journal, 30(9), 1479–1498.

Perotti, R. (1993). Political equilibrium, income distribution and growth. Review of Economic Studies, 60, 755–776.

Perotti, R. (1996). Growth, income distribution and democracy: What the data say. Journal of Economic Growth, 1, 149–187.

Persson, T., & Tabellini, G. (1994). Is inequality harmful for growth? American Economic Review, 84, 600–621.

Piketty, T. (1997). The dynamics of the wealth distribution and interest rates with credit rationing? Review of Economic Studies, 64(2), 173–189.

Putnam, R. D. (1993). The prosperous community. American Prospect, 13, 35–42.

Putnam, R. D., & Gross, R. (2003). Introducción. In R. D. Putnam (Ed.), El declive del capital social (pp. 7–34). Barcelona: Galaxia Gutenberg.

Rodrick, D. (2005). Growth strategies. In P. Aghion & S. N. Durlauf (Eds.), Handbook of economic growth (a, Vol. 1, pp. 968–1014). Amsterdam: North-Holland.

Romero-Martínez, A. M., Ortiz-de-Urbina-Criado, M., & Soriano, D. R. (2010). Evaluating European Union support for innovation in Spanish small and medium enterprises. Service Industries Journal, 30(5), 671–683.

Rubalcaba, L., Gallego, J., & Hertog, P. D. (2010). The case of market and system failures in services innovation. Service Industries Journal, 30(4), 549–566.

Saint-Paul, G., & Verdier, T. (1992). Historical accidents and the persistence of distributional conflicts. Journal of Japanese and International Economics, 6, 406–422.

Saint-Paul, G., & Verdier, T. (1993). Education, democracy and growth. Journal of Development Economics, 42(2), 399–407.

Schumpeter, J. A. (1911). The theory of economic development. New York: Oxford University Press.

Schumpeter, J. A. (1947). Theoretical Problems of Economic Growth. The Journal of Economic History, 7(Supplement), 1–9.

Schumpeter, J. A. (1950). Capitalism, socialism and democracy. New York: Harper & Brother.

Selden, T. M., & Song, D. (1994). Environmental quality and development: is there a Kuznets curve for air pollution emissions? Journal of Environmental Economics and Management, 27(2), 147–162.

Smallbone, D., Welter, F., Voytovich, A., & Egorov, I. (2010). Government and entrepreneurship in transition economies: the case of small firms in business services in Ukraine. Service Industries Journal, 30(5), 655–670.

Stern, N. (2001). A strategy for development. Washington: World Bank.

Sundbo, J. (2009). Innovation in the experience economy: a taxonomy of innovation organizations. Service Industries Journal, 29(4), 431–455.

Swedberg, R. (1998). Max Weber and the idea of economic sociology. Princeton: Princeton University Press.

Swedberg, R. (2000). The social science view of entrepreneurship. In R. Swedberg (Ed.), Entrepreneurship. The social science view (pp. 7–44). Oxford: Oxford University Press.

Sylwester, K. (2000). Income inequality, education expenditures, and growth. Journal of Development Economics, 63, 379–398.

Toivonen, M., & Tuominen, T. (2009). Emergence of innovations in services. Service Industries Journal, 29(7), 887–902.

Tsiddon, D. (1992). A moral hazard trap to growth. International Economic Review, 33, 299–321.

Wagener, S., Gorgievski, M., & Rijsdijk, S. (2010). Businessman or host? Individual differences between entrepreneurs and small business owners in the hospitality industry. Service Industries Journal, 30(9), 1513–1527.

Weber, M. (1978). Economy and society, 2 vols. Berkeley: University of California Press.

Weber, M. (1988). The protestant ethics and the spirit of capitalism. Gloucester: Peter Smith.

Wennekers, A. R. M., & Thurik, A. R. (1999). Linking Entrepreneurship and economic growth. Small Business Economics, 13, 27–55.

Williamson, J. (1990). What Washington means by policy reform. In J. Williamson (Ed.), Latin American adjustment: How much has happened? Washington: Institute for International Economics.

Woolcock, M. (2001). The place of social capital in understanding economic and social outcomes. Canadian Journal of Policy Research, 2(1), 11–17.

Woolcock, M., & Narayan, D. (2000). Social capital: implications for development theory, research and policy. World Bank Research Observer, 15(2), 225–249.

Wu, L. Y., Wang, C. J., Tseng, C. Y., & Wu, M. C. (2009). Founding team and start-up competitive advantage. Management Decision, 47(2), 345–358.

Zhang, J., & Duan, Y. (2010). The impact of different types of market orientation on product innovation performance: evidence from Chinese manufacturers. Management Decision, 48(6), 849–867.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nissan, E., Galindo Martín, MÁ. & Méndez Picazo, MT. Relationship between organizations, institutions, entrepreneurship and economic growth process. Int Entrep Manag J 7, 311–324 (2011). https://doi.org/10.1007/s11365-011-0191-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-011-0191-2