Abstract

The green finance sector is key to accelerating the green transformation of economic structures and promoting green economic growth. However, understanding how to effectively combine green finance and green innovation is still in the exploratory stage. Using the implementation of the Green Credit Guidelines (hereinafter Guidelines) in 2012 as a quasi-natural experiment, we examine the causal relationship between green finance and green innovation. According to our findings, the green innovation performance of green credit-restricted industries improved significantly after the implementation of the Guidelines, although quality improvements of green innovation were not evident. This was a result of improved management efficiency and investment efficiency. Additionally, the Guidelines appear to have a more positive impact on green innovation for firms with lower levels of managerial short-termism or firms in regions with stronger environmental law enforcement. Green innovation can significantly enhance the environmental and social performance of a company.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

A total of 195 countries signed the Paris Agreement in 2015 in an effort to reduce climate change. Provided the agreement holds, global temperatures will not rise beyond 2 °C. Many countries are promoting green innovation to achieve these long-term goals. There has been considerable debate in academic economics concerning the factors that drive green innovations. Research has been conducted on various market characteristics, including environmental regulations (Pan et al. 2021; Song et al. 2020), industry competition (Aghion et al. 2020), and corporate governance (Amore and Bennedsen 2016; Asni and Agustia 2022). Another strand of research emphasized firm characteristics such as firm size (Lin et al. 2019), managerial concern (Tang et al. 2018), and financing constraints (Yu et al. 2021). Andersen (2017) showed that access to financial resources was the most essential characteristic. An important component of upfront costs is innovation investment (S. Liu et al. 2021). A higher upfront cost requires more external financing (Sutton 2007).

China’s enterprises are facing severe financing constraints and are eager for financial assistance (Chava et al. 2009). Thus, the Chinese government has implemented a series of policies to improve finance allocation efficiency for enterprises participating in green innovations, such as the green credit policy. In 2007, the China Banking Regulatory Commission (CBRC) issued “Guiding Opinions on Credit Granting for Energy Conservation and Emission Reduction.” Subsequently, the CBRC issued the “Green Credit Guidelines” in 2012, which outlined the framework for green credit and allocated resources to low-carbon, recycling, and ecological projects. According to the predicted statistics, 21 major banks would save more than 400 million tons of standard coal and reduce the carbon dioxide equivalent by more than 700 million tons each year by utilizing green credit funds. However, there is still a research gap regarding the integration of green finance policies and green innovation. It is uncertain whether this green credit policy will be effective in promoting green innovation. How would an effective green credit policy influence enterprises’ green innovation activities? To resolve these issues, we consider taking the implementation of the Green Credit Guidelines policy in 2012 as a quasi-natural experiment.

In accordance with the detailed regulations of the Green Credit Guidelines, green financing may have both an incentive and a restraint effect. According to the Green Credit Guidelines, the accessibility of finance is directly related to enterprises’ environmental performance; that is, if companies demonstrate better environmental risk management, environmental disclosure, environmental performance, and involvement in green projects, they are able to obtain larger, longer-term, and more affordable loans, but not vice versa. Thus, enterprises are motivated to improve their green innovations to obtain financial support. Nevertheless, in the context of principal-agency ownership structures, managers are responsible for affecting and implementing any business strategy (Hambrick 2007; Hambrick and Mason 1984). A firm’s agent with control over the firm’s resources will act in his or her own self-interest at the expense of the corporation (Jensen and Meckling 1976). Accordingly, whether green finance is able to improve green innovations depends on managers’ behavior. Monitoring mechanisms are capable of monitoring managers’ self-interest behavior (Rashid 2016). According to Jensen and Meckling (1976), banks and other institutional creditors play an important role in corporate governance activities (Nini et al. 2012). A strong supervision function of green credit leads managers to do a better job of ensuring that green innovation investments are enabled and that green development opportunities are captured (Tan et al. 2022). Additionally, bank credit plays an important signaling role for external investors, and shareholders motivate managers to innovate in a greener manner through a “reverse forcing” effect (Guan et al. 2019; Porter 1995). Therefore, the external and internal controlling functions of green finance can constrain the adverse selection and moral hazard behavior of managers to a certain extent (He et al. 2019), effectively alleviate credit constraints (Tolliver et al. 2021), and increase the efficiency of green investments (Hovakimian 2011). Enhancing management efficiency (reducing agency costs) and investment efficiency contributes to the advancement of green innovations. Empirical studies demonstrate that the Green Credit Guidelines influence the innovation behavior of enterprises by enhancing management efficiency and investment efficiency, although the quality of innovation is not significantly enhanced.

Time orientation theory in social psychology suggests that managers’ time cognition is short-term oriented and that they value the present (Kang et al. 2019; Laverty 1996). Generally, senior managers are compelled to engage in short-term strategies to satisfy a newly empowered short-termism shareholder base (Polsky and Lund 2013). In contrast, the green innovation phenomenon is a high-risk, long-term, and uncertain activity, and short-termism by managers has a negative impact on the motivation to participate. This paper explores managerial short-termism as a moderator of the relationship between green finance and green innovation. According to the empirical tests, the Green Credit Guidelines result in a significantly pronounced positive impact on innovation improvement for enterprises with lower managerial short-termism.

In accordance with the literature, the characteristics of firms influence green innovation; however, market factors, such as laws, regulations, and policies, have also been shown to have an impact on the innovation behavior of enterprises (Shao et al. 2020). As an example, strengthening environmental regulations can enhance the efficiency of green finance allocation (Su and Lian 2018). To influence enterprises’ innovation behavior, it is essential to allocate green finance efficiently. Accordingly, in this paper, we also explore the role of environmental regulation in moderating the relationship between green finance and green innovation. Empirical tests indicate that the stronger environmental regulations are, the greater the effect of the guidelines on promoting green innovation. In addition to verifying that the Green Credit Guidelines improve innovative behavior in enterprises, we examine whether they contribute to improving environmental and social performance. The results indicate that green innovation induced by the Guidelines has led to significant improvements in the performance of enterprises in terms of their environmental and social impacts.

In accordance with the content of our paper, our major contributions are as follows: First, we introduce green finance into the framework of determinants of green innovation and we examine whether green finance improves green innovation using the DID methodology, thereby filling a gap in the research on green finance and developing a new empirical approach to the topic. Second, we supplement the previous literature by examining possible mechanisms for upgrading green innovation through green finance. Several policy implications can be drawn from the results. Developing countries may also benefit from China’s successful green credit policy. A third contribution is to provide a microeconomic foundation for the literature on the finance-growth nexus through an examination of the causal effects of green finance on green innovation.

The remainder of the paper is organized as follows: The “Institutional background and literature review” section briefly summarizes the background of the Green Credit Guidelines in China, reviews the relevant literature, and develops hypotheses. The “Research design” section describes the research design, including the data sample, empirical model, and descriptive analysis. The empirical baseline results are presented in the “Empirical results” section. In the “Possible channels” section, we test the possible channels and perform robustness tests in the “Robustness test” section. In the “Further analysis” section, we provide heterogeneity tests and perform further analysis of the effects on environmental performance. The “Conclusion and policy implications” section summarizes the full text and offers policy recommendations.

Institutional background and literature review

Institutional background

To achieve the goal of limiting the upgrading in global temperature to below 2 °C, the majority of countries support enhancing green innovation (Acemoglu et al. 2016). A typical example is China. The Chinese government has been working hard to fight pollution. In 2020, China officially proposed the “dual carbon” commitment of striving to achieve a carbon peak in 2030 and carbon neutrality in 2060 ahead of schedule. To achieve the dual carbon goal, governments focus on the supporting and leading roles of green and low-carbon technological innovation actions. Carbon peaking and carbon neutralization are systematic, long-term projects. Deepening the structural reform of the financial supply side and developing green finance are inevitable requirements for achieving carbon peaking and carbon neutrality. Therefore, in addition to comprehensive regulations and administrative enforcement, green finance policies have been introduced and improved (D'Orazio 2022).

China is a country with a relatively complete green financial policy system. For the first time, the “overall plan for the reform of the ecological civilization system” proposed the overall goal of “establishing a green financial system” in 2015. In 2016, the “guiding opinions on building a green financial system” clearly presented key tasks and specific measures for building a green financial system and providing policy guarantees for the standardized development of green finance. In 2020, the Fifth Plenary Session of the 19th CPC Central Committee once again emphasized the “Development of Green Finance.” In 2021, the Central Committee of the Communist Party of China issued the “Opinions on Completely, Accurately, and Comprehensively Implementing the New Development Concept and Doing a Good Job in Carbon Peaking and Carbon Neutrality,” which required the active development of green finance, the establishment and improvement of a green financial standard system, and the need for financial support for carbon emissions. Work on peaking and carbon neutrality provide the basics to follow.

China’s green credit policy is the earliest, largest, and most mature part of China’s green finance field. In 2007, the former CBRC issued the “Guiding Opinions on Credit Granting for Energy Conservation and Emission Reduction.” In 2012, the CBRC issued the “Green Credit Guidelines.” They first outlined the framework for the green credit system and ensured that resources were allocated to low-carbon, recycling, and ecological projects. Since then, a series of green finance policies have been launched, including the “Energy Efficiency Credit Guidelines,” the “Green Credit Statistical System,” and the “Key Evaluation Indicators of Green Credit Implementation.” The policy system, including statistics, assessment and evaluation, and classified guidance, has been continuously improved, and banking institutions have been urged to develop green finance. As of the end of September 2021, the green credit balance of 21 major domestic banks reached 14.1 trillion yuan, accounting for 10.32% of all loans. Figure 1 reports that the green credit balance of large state-owned commercial banks and national joint-stock commercial banks has been continuously improved.

China’s green credit scale has ranked first in the world for many years, and its asset quality is generally good. The nonperforming loan ratio has remained below 0.7% in the past 5 years. According to the proportion of credit funds in the total investment in green projects, the green credit of 21 major banks can save more than 400 million tons of standard coal and reduce the carbon dioxide equivalent by more than 700 million tons each year.

The introduction of these policies has led to a remarkable improvement in green innovation in China. The 2021 China Green Technology Innovation Index Report shows that since 2008, China’s green technology innovation has grown rapidly. The annual index of green technology innovation increased from 1000 in the base period in 2008 to 4791.20 in 2021, an increase of nearly 4.8 times in 14 years with a compound annual growth rate of 11.84%. National green technology innovation grew rapidly during 2008–2021 (see Fig. 2).

National green technology innovation annual index from 2008 to 2021. Data source: https://baijiahao.baidu.com/s?id=1733079735940015884&wfr=spider&for=pc

Literature review and hypothesis development

The Green Credit Guidelines limit loans to industries with high levels of pollution, high levels of energy intensity, and overcapacity (THOS industries), while providing assistance to non-THOS industries (Tan et al. 2022). A dual incentive-restraint effect is created by the Green Credit Guidelines by guiding capital allocation. This incentive effect can be seen in its availability and convenience when enterprises receive credit, i.e., if companies perform better in managing environmental risks, the disclosure of environmental information, and environmental performance, they can obtain financial support and obtain larger, longer-term, and more affordable loans. Enterprises’ capabilities in green innovation are usually limited by financing constraints because green innovation is characterized by high uncertainty, high input, and a prolonged research and development (R&D) cycle (Beladi et al. 2021; Hall and Lerner 2010; Zhang and Guo 2019). Therefore, green finance is necessary to alleviate the financial constraints on green innovation and to drive the improvement of green innovation (Zhou and Du 2021).

In contrast, the restraint effect is evident in the higher thresholds for loan limits and transaction costs (Irfan et al. 2022). If a company emits high levels of pollution, the financial assistance it receives will be reduced (van Leeuwen and Mohnen 2017) or the financing costs will be increased. To obtain loans from banks, THOS industries need to engage in innovative green technology (Goetz 2019). Therefore, we propose Hypothesis H1.

-

Hypothesis H1: After the guidelines were published, the green innovation performance of enterprises with green credit restrictions in the guidelines was better.

A conflict of interest exists between managers and shareholders when agents have control over a firm’s resources and work for their own interests at the expense of shareholders (Jensen and Meckling 1976). A cost arising from the principle’s sacrifice of wealth and the potential costs associated with monitoring agents is known as the agency cost (Jensen and Meckling 1976). A higher agency cost indicates a lower level of managerial efficiency. It is possible to minimize the relative agency cost by implementing a number of monitoring mechanisms (Rashid 2016). The agency costs of companies can be reduced when external entities such as banks or other creditors monitor their operations, as Jensen and Meckling (1976) note. It is widely recognized that banks and some other institutional creditors are not merely observers of firm value until a default occurs; they participate in corporate governance activities (Nini et al. 2012). As banks provide financing for enterprises, they are responsible for supervising and controlling them (Yu et al. 2021). Furthermore, banks may adjust the terms of their bank loans in response to their concerns regarding agency problems. Therefore, green credit plays a clear supervisory role (Tan et al. 2022). Considering the strong supervision function of green credit, managers must work harder to ensure that green innovation investments are carried out and those green development opportunities are exploited (Zhang and Li 2022). In addition, bank credit plays an imperative signaling role for external investors as well as motivating managers to innovate through a “reverse forcing” effect (Guan et al. 2019; Porter 1995). Consequently, the control functions of bank credit can reduce the adverse selection and moral hazard behaviors of managers and increase management efficiency (He et al. 2019). Therefore, we propose Hypothesis H2a.

-

Hypothesis H2a: After the implementation of the guidelines, the managerial efficiency of green credit-restricted industries was significantly improved.

Stein (2003) has demonstrated that inefficiency in investment can be attributed to underlying agency issues such as empire building, overconfidence, career motives, herding behavior, and short-termism. Accordingly, enterprises deviate from their optimal investment amount due to agency conflicts, asymmetric information, and financing constraints, which results in low investment efficiency (Holmström 1999; Malmendier and Tate 2005). Studies have shown that debt financing plays a significant role in minimizing agency costs between management and shareholders and improving investment efficiency (Yan et al. 2022). Bank loans account for the majority of debt financing in China (Wang and Zhi 2016). Enterprise investment efficiency can be improved by the governance effect of bank loans (Jensen 1986; Stulz 1990). Through four internal mechanisms—delivering important information, reducing agency costs, easing financing constraints, and hardening budget constraints—bank credit can serve as the primary source of corporate debt financing, alleviating investment shortages and controlling overinvestment, which ultimately leads to improved investment efficiency (He et al. 2019). Furthermore, financial institutions oversee the financial operations of enterprises during the preloan, in-loan, and postloan processes, which improves investment efficiency (Yu et al. 2021). In terms of the Green Credit Guidelines, green credit can help relieve credit constraints (Tolliver et al. 2021). Higher green investment efficiency is enabled by lowering credit constraints (Hovakimian 2011). Thus, we propose Hypothesis H2b.

-

Hypothesis H2b: After the implementation of the guidelines, the investment efficiency of green credit-restricted industries was significantly improved.

Based on the upper echelon theory, the experiences, values, cognitions, and personalities of executives affect the firm’s strategy choices (Hambrick and Mason 1984). A company’s executive can have a significant influence on green innovation as the decision-maker. According to the time orientation theory in social psychology, managers perceive time as short-term and value the present (Kang et al. 2019; Laverty 1996). Accordingly, senior managers will usually be forced to engage in short-term strategies that prop up current share prices to satisfy the newly empowered short-termism shareholder base (Polsky and Lund 2013). They may lose ground to their competitors if they fail to do so, thereby increasing their likelihood of termination. Since green innovation involves considerable R&D expenditures and a high failure rate (Holmstrom 1989), managers prefer short-term investments to boost their reputation (Brauer 2013) or are concerned about job security, so they prefer short-term investments over long-term investments (Hirshleifer and Thakor 1992). As Brauer (2013) notes, chief executive officers (CEOs) are unlikely to reap the benefits of long-term measures due to their continuously short tenure (Marginson and McAulay 2008). Thus, the short-termism of managers can result in increased agency costs and inefficient investment decisions (Terry 2015). In contrast, we have demonstrated that bank credit can improve investment efficiency through four internal mechanisms (He et al. 2019). Thus, the lower the short-termism of managers, the higher the investment efficiency, and the greater the impact of guidelines on green innovation. In other words, managers with lower levels of short-termism are more likely to engage in green innovation after obtaining green financing. As a result, we propose Hypothesis H3a.

-

Hypothesis H3a: The lower the myopia of management is, the more significant the green innovation promotion effect of the guidelines.

An improvement in environmental regulations will enhance the investment efficiency of green credit (Berrone et al. 2013). It is important to note from the perspective of green finance that the effectiveness of green credit policies depends on the support of environmental protection policies and relevant laws and regulations (Shao et al. 2020). Thus, strengthening environmental regulations is helpful in increasing the efficiency of the allocation of green credit resources. Incorporating environmental damage, resource consumption, and ecological benefits into the economic and social development evaluation system, for instance, may significantly increase the support of local governments for a green economy, improve environmental protection laws, and strengthen environmental protection interviews (Su and Lian 2018). According to Song et al. (2018), environmental regulation intensity differs significantly in different industries, and this difference leads to a wide range of R&D efficiency between industries (Jiang et al. 2018). There is evidence that industries subjected to strict environmental regulations have higher input‒output ratios. Furthermore, according to institutional innovation theory, the stability of the policy system will affect the innovation process of enterprises (Chu et al. 2018). Therefore, we propose Hypothesis H3b.

-

Hypothesis H3b: The stronger the environmental regulation is, the more significant the green innovation promotion of the guidelines will be.

First, let us consider the direct effects of the Green Credit Guidelines. To reduce corporate risks and improve performance, the guidelines encourage clean investment and restrict polluting investment (Yao et al. 2021). The application of green innovation can reduce negative externalities associated with the environment and improve the sustainability and social performance of enterprises (Sachs et al. 2019). The second effect is the indirect effect of the Green Credit Guidelines. Porter and Linde (1995) suggest that environmental regulation can foster innovation and enhance competitiveness. On the basis of the literature (e.g., Cai and Tylecote 2008; Jiang et al. 2018) and this hypothesis, we expect green innovation to improve firm performance in China (Zhang et al. 2019). By obtaining high-quality green patents, firms are able to enjoy faster growth and gain more economic benefits. An increase in firm performance leads to an increase in environmental and social performance. Therefore, we propose Hypothesis H4.

-

Hypothesis H4: After the implementation of the guidelines, green innovation can improve the environmental and social performance of enterprises.

Research design

Data

We obtained data from the China Securities Markets and Accounting Research (CSMAR) database for 2007 to 2017, which is a source of financial data for A-share listed companies. We then eliminate the following companies from the sample: financial and insurance companies, companies with asset-liability ratios between 0 and 1, and listed companies without data. From the China Research Data Service Platform (CNRDS), we obtain patent classification numbers for all A-share listed companies’ invention patents. We further divide patents into green and nongreen according to the “Green List of International Patent Classification” issued by the World Intellectual Property Organization (WIPO).

Variables

Green innovation

A number of approaches to technology innovation have been proposed, including research and development (R&D) (Zhang et al. 2017), patents (Wu et al. 2021), and total factor productivity (TFP). It is difficult to penetrate the segmented technology areas with R&D data and green productivity indicators (Wang 2017), a small delay in patent applications (Griliches et al. 1986), and a large amount of micro information included in patents (Dechezleprêtre and Martin 2010), which explains why we prefer patents. Furthermore, the audit of patent grants is more stringent than the audit of patent applications, so this paper focuses on green patents to measure green innovation. Many scholars consider the number of utility patents granted as a measure of quantity. The number of invention patents granted is considered a measure of the quality of innovation (Hu and Jefferson 2009; Bronzini and Piselli 2016). It has been shown that invention patents are more inventive and technologically advanced than utility model patents (Fu et al. 2022). Therefore, following Fu et al. (2022), this study measures the quantity of green technology innovation through the number of granted green utility model patents and the quality of green technology innovation through the number of granted green invention patents. In this study, the dependent variable is the logarithm of one plus the number of patents granted for green inventions.

Other variables

On the basis of the literature, we also control the following variables.

First, we control the size of the firm. The government, the media, and nongovernmental organizations exert greater pressure on large-scale companies. It is believed that larger companies are motivated to participate in corporate social responsibility (CSR) initiatives (Udayasankar 2008) and are discouraged from engaging in irresponsible behavior (Liu and Anbumozhi 2009). Furthermore, larger companies have easier access to a variety of resources, which encourages the development of green innovations (Lin et al. 2019). The size of the firm is determined by the logarithm of the number of employees (size).

Based on a resource-based perspective, green innovation requires substantial financial resources, of which profitability is an essential component (Li et al. 2017). Profitability enables a company to invest in more eco-friendly technologies and management systems (Dean and Brown 1995). Profitability is calculated as the ratio of net profit to total assets (ROA).

Li (2018) documented that companies with high financial leverage have a high asset-liability ratio, as a result of which these companies are forced to take measures to meet the demands of stakeholders for sustainable development, such as green innovation. The ratio of total debt to total assets is used to calculate leverage (leverage).

A number of studies have demonstrated that managerial ability can improve certain aspects of corporate operations (Chen et al. 2015). First, more able managers are more likely to be trusted by shareholders and other stakeholders (Baik et al. 2011; Demerjian et al. 2013). Thus, able managers are less likely to be discouraged from investing in risky innovation projects within the context of career concerns (Narayanan 1985). Additionally, a higher level of trust results in lower financing costs, which facilitates investments in innovation. By creating the best framework for research staff to maximize their creative capacity, more capable managers can influence innovative outcomes. Thus, skilled managers are more likely to be able to turn patented ideas into commercially successful products. In this study, we use the measure of managerial ability (MA score) developed by Demerjian et al. (2012) to assess managerial ability (MB).

The productivity of a firm is positively correlated with its profits (Foster et al. 2008; Chandra et al. 2016), size, and growth (Balk 2001; Wagner 2002; Koellinger 2008; Harrison et al. 2013). Thus, firms with higher TFPs are more able to bear the higher costs associated with green innovation. In this study, we estimate TFP using the method proposed by Levinsohn and Pertrin (2003) (TFP).

The theory of upper echelons suggests that managerial short-termism will affect an organization’s strategy and investment practices. Ridge et al. (2014) reported that temporal myopia results in a focus on current strategies rather than long-term strategies. A short-termism manager tends to focus on short-term financial performance at the expense of the enterprise’s long-term interests. Green innovation involves long cycles and high risks (Holmstrom 1989). Consequently, short-term-oriented managers reduce green innovation capital expenditures. Following Liu (2022), we use text analysis (Li 2010) and machine learning methods (Mikolov et al. 2013) to construct the managerial short-termism index (Myopia).

Yin et al. (2022) suggested that older firms often have well-established external relationships that provide access to resources necessary to produce innovation (Withers et al. 2011). Knowledge and experience are also essential to a firm’s innovation (Cohen and Levinthal 1990; Sørensen and Stuart 2000). The experience and knowledge gained from previous experiments can lead to innovation achievements in the future (Miyazaki 1994; Withers et al. 2011). Consequently, older firms are more likely to be involved in green entrepreneurial activities because they have more experience and knowledge, which are essential to producing green innovations. A firm’s age is determined by its years since incorporation (Westman and Thorgren 2016; Huang and Boateng 2013; Ke 2008). Following Huang and Li (2017), firm age is assessed by the number of years from the firm’s founding date.

Model specification

To test the effect of green finance on green innovation, we build a difference-in-difference (DID) model:

where \({\mathrm{Patent}}_{it}\) denotes firm i’s performance of green innovation in year t. In line with the literature, we adopt the number of green utility model patents to measure innovation quantity and the number of green innovation patents to measure innovation quality. In line with the literature, green utility model patents are used as a measure of quantity, and green innovation patents are used as a measure of quality. To remove right-skewed distributions of green patent applications, we take the logarithm of 1 plus the number of applications. The dummy variable T represents the time period before and after the Guidelines were implemented. During the period after implementation (2012 and later), it is 1; prior to implementation (before 2012), it is 0. In 2012, the former China Banking Regulatory Commission formulated the “Green Credit Guidelines” to guide green credit policy implementation. Environmental and social risks were clarified in the guidelines by the former CBRC. We check whether A-share listed companies are in industries with environmental and social risks of category A to determine whether they are green credit restricted. There are 9 industries in class A: nuclear power generation, hydropower generation, water conservation, inland river port engineering and construction, coal mining and washing, oil and gas mining, ferrous metal mining and dressing, nonferrous metal mining and dressing, nonmetallic mining and dressing, and other mining. If the company belongs to one of the above 9 industries, it is considered a green credit restricted industry (treatment group) with D = 1; otherwise, it is considered a nongreen credit restricted industry (control group) with D = 0. The interactive item “D × T” indicates the impact of green innovation in green credit-restricted industries and nongreen credit-restricted industries before and after the implementation of the Guidelines. If \(\beta_{1}\) is significantly greater than 0, it indicates that the Guidelines have significantly promoted green innovation in industries restricted by green credit; otherwise, it has no significant promoting effect. \(X\) is the control variable vector including MB, calculated by employing the two-step approach developed by Demerjian et al. (2012); Size is calculated as the natural logarithm of the employment number; ROA is calculated as the ratio of net profit to total assets; leverage is calculated by the ratio of total debt to total assets; TFP is calculated by using the OP approach; myopia is calculated by the text analysis approach. We winsorize processing by 1% on the main continuous variable real quantities. \({\delta }_{i}+{\varphi }_{t}+{\eta }_{c}\) \({\delta }_{i}\), \({\varphi }_{t}\), \({\eta }_{c}\), and \(\varepsilon\) are company fixed effects, year fixed effects, province effects, and residual error, respectively. Company fixed effects are used to capture differences between individuals that do not vary over time and can be used to overcome the problem of missing variables. Province-fixed effects absorb time-invariant systematic differences in the intercity economy. Time-fixed effects exclude the shocks of the macroeconomic environment that all provinces faced, which might have triggered the effect of the Green Credit Guidelines and thus take the time-varying factors into account.

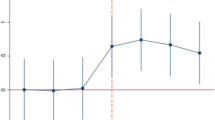

Prior to 2012, the time trend of green patent applications of the treatment group and control group was basically the same, but after 2012, the average applications of the treatment group were significantly higher than those of the control group (see Fig. 3). Therefore, we can preliminarily determine that the Guidelines have a positive effect on green patent applications, making the DID model suitable for identifying causal effects. Furthermore, the double-difference method can help avoid endogeneity problems, such as mutual causality.

Descriptive analysis

Table 1 presents the summary statistics for the main variables. The T-test result shows that there is a significant difference between the two groups, including management ability, firm size, and profitability. For example, for the treatment group, the mean firm size (Size) is 8.21, while it is 7.95 for the control group. The t-value is significant at the 1% level.

Empirical results

Baseline results

The green credit restriction industries included in the treatment group are not picked at random. Hence, we adopt the propensity score matching method (PSM) (Caliendo and Kopeinig 2008) to match individuals in the treatment and control groups as similar as possible to alleviate selection bias issues. The results of the balance hypothesis tests are presented in Table 2 when we conduct 1:1 nearest matching. The results show that the differences in covariates after matching are all insignificant.

Table 3 shows the results of the association between green finance and green innovation by adopting DID approaches. In column 1, after controlling for firm fixed effects, year fixed effects, and province fixed effects, the coefficient of the interactive term “\(D\times T\)” is 0.4781, which is significant at the 1% level. This indicates that the Green Credit Guidelines enhance green innovation patents. We further include other control variables and rerun specification (1). The coefficient of the interactive term “\(D\times T\)” presented in column (2) is 0.4808, which also passes the 1% level of significance. The robustness results confirm that the Green Credit Guidelines play a positive role in promoting green innovation. In terms of green innovation quality, we replace the dependent variable with the natural logarithm of green utility model patents plus one. The results in column (3) show that the coefficient of the interactive term “\(D\times T\)” is 0.1553, but it does not pass the statistical significance test. Therefore, the Green Credit Guidelines do not affect the quality of green innovation. Taking other variables into account, we rerun Formula 1 and obtain consistent results in column 4.

Our results show that the quantity of green innovation has increased significantly in banned industries since the implementation of the Green Credit Guidelines. However, the quality of green innovation is not affected.

Parallel trend test

The validity of the DID approach depends on the parallel-trend assumption. We test the parallel trend assumption in an event study framework (e.g., Beck et al. 2010) by developing the following specification:

where \(\mathrm{time}\) as a dummy variable is equal to 1 when the year is \(2012 + k\); otherwise, \(\mathrm{time}\) is equal to 0. The definition of the remaining variables is identical to that in Eq. (1).

The results in Fig. 4-A suggest that there is no change in green innovation prior to the publication of the Green Credit Guidelines and a significant change in green innovation occurs only after the guidelines are published. In this way, the treatment group and the control group would have continued to follow the previous trend if the guidelines were not published. Thus, Fig. 4-A demonstrates that it is the Green Credit Guidelines that cause the difference in green innovation.

According to the above discussion, there is no causal effect of the guidelines on the quality of green innovation. Figure 4-B confirms the result.

Placebo test

To keep the results robust, we conduct placebo tests of all significant outcomes in Table 4. We assume that the publication of the Green Credit Guidelines occurred in 2011 rather than in 2012. We reestimate Eq. (1). Table 4 shows that none of the placebo test results is significant, thus proving the robustness of the main results.

Possible channels

According to the previous research assumptions, we start the analysis with management efficiency and investment efficiency.

First, to test hypothesis H2a, we replace the explained variable of green innovation with managerial efficiency (MF), which is measured by employing the managerial efficiency index developed by Qiu and Yu (2020). The larger the value is, the lower the managerial efficiency. Second, to test hypothesis H2b, we replace the explained variable green innovation with investment efficiency (IF).

Following Richardson (2006), we first use the following steps to measure the expected investment:

Second, we calculate the expected investment expenditure of companies based on Eq. (3). Finally, we obtain the residual error, which equates to the difference between actual investment expenditure minus expected investment expenditure. The larger the absolute value of the residual error is, the lower the investment efficiency.

In columns (1) and (2) of Table 5, coefficients of the interactive term “\(D\times T\)” are significantly negative at the significance level of 1%, indicating that after the publication of the Green Credit Guidelines, green management efficiency is significantly enhanced. In columns (3) and (4), the coefficients of the interactive term “\(D\times T\)” are significantly positive at the significance level of 1%, which indicates that the implementation of the Green Credit Guidelines significantly improved investment efficiency.

Robustness tests

First, considering the left-truncated characteristics of patent data, we adopt double Tobit regression to perform a robustness test. The results are listed in columns (1) to (2). In column (1), the dependent variable is the quantity of green patents, and the coefficient of \(D\times T\) is positive and significant at the 1% significance level. However, the coefficient of \(D\times T\) is not significant when the dependent variable is the quality of green patents. This is consistent with the regression results in Table 2.

Second, according to the “Key Evaluation Indicators of Green Credit Implementation,” in addition to category A, category B, including construction, production, and business activities, has adverse environmental and social consequences. Category B customers with insufficient mitigation measures for environmental and social risks are still included in the list of significant environmental and social risks. Therefore, we expand the scope of green credit-restricted industries to 34 industries. Columns (3) and (4) of Table 6 report the empirical results. The coefficients of \(D\times T\) confirm the robustness results.

Further analysis

High management short-termism vs. low management short-termism

With reference to Francois Brochet et al (2015a, b), we use a text analysis approach to calculate the management short-termism indicator. We divide the sample into two subsamples: higher short-termism (> median) and lower short-termism (< median). Table 7 shows the results. Panel A of Table 7 displays the impact of the Green Credit Guidelines on green innovation for companies with lower short-termism. The coefficients of \(D\times T\) in columns (1) to (4) are all significantly positive, at least at the 5% level. The results show that the impact of the Guidelines on the quantity and quality of green innovation are both significantly positive.

Panel B of Table 7 displays the impact of the Green Credit Guidelines on green innovation for companies with higher short-termism. The coefficients of \(D\times T\) in columns (1) and (2) are all significantly positive, at least at the 1% level. However, the coefficients of \(D\times T\) in columns (3) and (4) are all significantly negative, at least at the 1% level. The results show that the impact of the Green Credit Guidelines on the quantity of green innovation is significantly positive. However, the impact on the quality of green innovation is significantly negative.

Weak environmental regulation vs. strong environmental regulation

To the best of our knowledge, the effectiveness of the guidelines requires the support of environmental laws and regulations. In other words, the strengthening of environmental regulation can effectively improve the resource allocation efficiency of green credit (Yang et al. 2022). For example, “incorporating resource consumption, environmental damage, and ecological benefits into the economic and social development evaluation system” can significantly increase local government’s support for the green economy, improve environmental protection law enforcement, and strengthen environmental protection interviews. From the actual effect of pollution prevention and control, strict environmental regulation drives good performance.

Panel A of Table 8 displays the impact of the Green Credit Guidelines on green innovation for companies with stronger environmental regulations. The coefficients of \(D\times T\) in columns (1) and (2) are all significantly positive, at least at the 1% level. However, the coefficients of \(D\times T\) in columns (3) and (4) are all significantly negative, at least at the 1% level. The results show that the impact of the Green Credit Guidelines on the quantity of green innovation is significantly positive. However, the impact on the quality of green innovation is insignificantly negative. Panel B of Table 8 displays the impact of the Green Credit Guidelines on green innovation for companies with weaker environmental regulations. The coefficients of \(D\times T\) in columns (1) to (4) are all insignificantly negative.

The economic effect of promoting green innovation

In this section, we further document whether the upgrading of green innovation generates an economic effect. We employ CSR performance and Es indicators to represent the environmental and social performance of a company. Specifically, the CSR indicator is measured by CSR performance data from the Rankins CSR Ratings (RKS) database, which covers overall environmental management information, pollution information, mitigation, and adaptation to climate change. Therefore, the CSR score better reflects the environmental and social performance of enterprises.

The second variable, Es is environmental protection rewards, referring to the practice of Klassen and McLaughlin (1996). We consider whether the company has obtained environmental recognition for measurement; that is, if the company has obtained environmental recognition or other positive evaluations, the value is 1; otherwise, it is 0.

Table 9 reports the results. In columns (1) and (2), the coefficients of \(D \times T\) are all significantly positive at the 1% level, indicating that the green innovation induced by the Guidelines significantly improved CSR performance. In columns (3) and (4), the coefficients of \(D \times T\) are all significantly positive at the 1% level, indicating that the green innovation induced by the Guidelines significantly improved environmental protection rewards.

Conclusions and policy implications

Conclusions

In accordance with finance theories, financial tools are necessary to achieve the goal of carbon peaking and carbon neutralization. There have been a number of green finance policies and green innovation regulations issued by the Chinese government. However, few studies combine green finance and green innovation effectively. This paper analyzes the effect of green finance on green innovation using data from listed companies in China from 2007 to 2017. Based on the baseline and a series of robustness tests, the following conclusions can be drawn.

First, the green credit restriction industry in the Guidelines performs better in terms of green innovation. After the Guidelines are implemented, improving management efficiency and investment efficiency are the primary paths to promoting green innovation in enterprises. However, the Guidelines do not truly make a difference in the quality of green innovation.

Second, we also find that managerial short-termism has a moderating effect on the relation between green finance and green innovation. This shows that the innovation-drive effect of green finance is stronger for firms with lower managerial short-termism. In addition, environmental regulation plays a moderating role in the relation between the two. This indicates a positive correlation between the two in areas where environmental regulation is strong.

Third, the implementation of the Guidelines enhanced the environmental and social performance of enterprises. In addition to enhancing green innovation, it also increased enterprises’ environmental and social performance.

Policy implications

According to the above conclusions, we propose the following policy implications:

First, the implementation of the Green Credit Guidelines should be strengthened. In the implementation process, green projects are identified rather than business types. Enterprises that pollute and invest in the environment should be given special attention. They should be provided with financial support to facilitate the completion of green transformation.

In addition, the guiding effect of green credit policy should be more relevant to enterprise heterogeneity. Government policies should be flexible and dynamic to account for firm characteristics. The government should optimize financial resources based not only on previous environmental performance but also on management efficiency and investment efficiency. In addition to maximizing first-tier city environmental governance capacity, non-first-tier cities should improve their policy sensitivity to green credit, unblock the financial system’s policy transmission, and stimulate enterprises’ enthusiasm for green initiatives. Higher agency costs should be given more attention by the government.

Finally, green credit policies benefit enterprises by fostering innovation in green technologies. By strengthening the criteria for green governance in the assessment standards of managers, improving the efficiency of green credit funds, and mobilizing the enthusiasm of stakeholders to oversee the decision-making process for the environmental protection of enterprises, we are able to improve green innovation among enterprises.

Limitations

In comparison with R&D and TFP, patents are the most reliable indicator of green innovation. Patents, however, cover only patentable and patented inventions. For example, updating pollution-producing equipment and processes can also contribute to green innovation but cannot be quantified by green patents. Due to the lack of specific data on enterprise factories, green patents can only be used to measure green innovation (Zhu et al. 2019). We hope to develop indicators for measuring green innovation more accurately in the future.

Second, the sample period includes major Olympic events from Beijing. Olympic events may have some impact on this paper’s results, but due to technical reasons, they cannot be included. The Olympic Games can only be excluded if some samples are deleted from the robustness test. It is hoped that a specific model can be built in the future to exclude Olympic impacts.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author upon reasonable request.

References

Acemoglu D, Akcigit U, Hanley D, Kerr W (2016) Transition to clean technology. J Polit Econ 124(1):52–104

Aghion P, Bénabou R, Martin R, Roulet A (2020) Environmental preferences and technological choices: is market competition clean or dirty? National Bureau of Economic Research

Amore MD, Bennedsen M (2016) Corporate governance and green innovation. J Environ Econ Manag 75:54–72

Andersen DC (2017) Do credit constraints favor dirty production? Theory and plant-level evidence. J Environ Econ Manag 84:189–208

Asni N, Agustia D (2022) Does corporate governance induce green innovation? An emerging market evidence. Corporate Governance, ahead-of-print

Beck T, Levine R, Levkov A (2010) Big bad banks? The winners and losers from bank deregulation in the United States. J Financ 65(5):1637–1667

Berrone P, Fosfuri A, Gelabert L, Gomez-Mejia LR (2013) Necessity as the mother of ‘green’inventions: institutional pressures and environmental innovations. Strateg Manag J 34(8):891–909

Brauer MF (2013) The effects of short-term and long-term oriented managerial behavior on medium-term financial performance: longitudinal evidence from Europe. J Bus Econ Manag 14(2):386–402

Brochet F, Loumioti M, Serafeim G (2015a) Speaking of the short-term: disclosure horizon and managerial myopia. Social Science Electronic Publishing

Brochet F, Loumioti M, Serafeim G (2015b) Speaking of the short-term: disclosure horizon and managerial myopia. Rev Acc Stud 20(3):1122–1163

Caliendo M, Kopeinig S (2008) Some practical guidance for the implementation of propensity score matching. J Econ Surv 22(1):31–72

Chava S, Livdan D, Purnanandam A (2009) Do shareholder rights affect the cost of bank loans? Rev Financ Stud 22(8):2973–3004

Chen Y, Podolski EJ, Veeraraghavan M (2015) Does managerial ability facilitate corporate innovative success? J Empir Financ 34:313–326

Demerjian P, Lev B, McVay S (2012) Quantifying managerial ability: a new measure and validity tests. Manage Sci 58(7):1229–1248

Dean TJ, Brown RL (1995) Pollution regulation as a barrier to new firm entry: initial evidence and implications for future research. Acad Manag J 38(1):288–303

D’Orazio P (2022) Mapping the emergence and diffusion of climate-related financial policies: evidence from a cluster analysis on G20 countries. International Economics 169(C):135–147

Fu L, Yi Y, Wu T, Cheng R, Zhang Z (2022) Do carbon emission trading scheme policies induce green technology innovation? New evidence from provincial green patents in China. Environ Sci Pollut Res

Goetz MR (2019) Financing conditions and toxic emissions

Guan T, Zhang A, Liu L (2019) On appropriately sequencing in China’s financial opening up around the “three-in-one”. In The Fundamental Dynamic Effect on Reform and Opening in China (pp. 329–355). Brill

Hambrick DC, Mason PA (1984) Upper echelons: the organization as a reflection of its top managers. Acad Manag Rev 9(2):193–206

He L, Zhang L, Zhong Z, Wang D, Wang F (2019) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372

Hirshleifer D, Thakor AV (1992) Managerial conservatism, project choice, and debt. Rev Financ Stud 5(3):437–470

Holmstrom B (1989) Agency costs and innovation. J Econ Behav Organ 12(3):305–327

Huang J-W, Li Y-H (2017) Green innovation and performance: the view of organizational capability and social reciprocity. J Bus Ethics 145(2):309–324

Kang S, Chung CY, Kim D-S (2019) The effect of institutional blockholders’ short-termism on firm innovation: evidence from the Korean market. Pac Basin Financ J 57:101188

Klassen RD, McLaughlin CP (1996) The impact of environmental management on firm performance. Manage Sci 42(8):1199–1214

Laverty KJ (1996) Economic “short-termism”: the debate, the unresolved issues, and the implications for management practice and research. Acad Manag Rev 21(3):825–860

Li F (2010) Textual analysis of corporate disclosures: a survey of the literature. Social Science Electronic Publishing, 29

Li D, Zheng M, Cao C, Chen X, Ren S, Huang M (2017) The impact of legitimacy pressure and corporate profitability on green innovation: evidence from China top 100. J Clean Prod 141:41–49

Lin W-L, Cheah J-H, Azali M, Ho JA, Yip N (2019) Does firm size matter? Evidence on the impact of the green innovation strategy on corporate financial performance in the automotive sector. J Clean Prod 229:974–988

Liu S, Xu R, Chen X (2021) Does green credit affect the green innovation performance of high-polluting and energy-intensive enterprises? Evidence from a quasi-natural experiment. Environ Sci Pollut Res 28(46):65265–65277

Liu X, Anbumozhi V (2009) Determinant factors of corporate environmental information disclosure: an empirical study of Chinese listed companies. J Clean Prod 17(6):593–600

Liu X (2022) Managerial myopia and firm green innovation: based on text analysis and machine learning. Front Psychol 13

Marginson D, McAulay L (2008) Exploring the debate on short-termism: a theoretical and empirical analysis. Strateg Manag J 29(3):273–292

Mikolov T, Sutskever I, Chen K, Corrado G, Dean J (2013) Distributed representations of words and phrases and their compositionality. Adv Neural Inf Proces Syst 26

Pan X, Cheng W, Gao Y, Balezentis T, Shen Z (2021) Is environmental regulation effective in promoting the quantity and quality of green innovation? Environ Sci Pollut Res 28(5):6232–6241

Porter ME (1995). Linde, Cvd (1995). Green and competitive: ending the stalemate. Harvard Bus Rev 73(5): 120–134

Qiu LD, Yu M (2020) Export scope, managerial efficiency, and trade liberalization: evidence from Chinese firms. J Econ Behav Organ 177:71–90

Richardson S (2006) Over-investment of free cash flow. Rev Acc Stud 11(2):159–189

Sachs JD, Woo WT, Yoshino N, Taghizadeh-Hesary F (2019) Importance of green finance for achieving sustainable development goals and energy security. In Handbook of Green Finance (pp. 3–12). Springer

Shao S, Hu Z, Cao J, Yang L, Guan D (2020) Environmental regulation and enterprise innovation: a review. Bus Strateg Environ 29(3):1465–1478

Song M, Wang S, Zhang H (2020) Could environmental regulation and R&D tax incentives affect green product innovation? J Clean Prod 258:120849

Su D, Lian L (2018) Does green credit policy affect corporate financing and investment? Evidence from publicly listed firms in pollution-intensive industries. J Financ Res 12(12):123–137

Tan X, Yan Y, Dong Y (2022) Peer effect in green credit induced green innovation: an empirical study from China’s Green Credit Guidelines. Resour Policy 76:102619

Tang M, Walsh G, Lerner D, Fitza MA, Li Q (2018) Green innovation, managerial concern and firm performance: an empirical study. Bus Strateg Environ 27(1):39–51

Tolliver C, Fujii H, Keeley AR, Managi S (2021) Green innovation and finance in Asia. Asian Econ Policy Rev 16(1):67–87

Udayasankar K (2008) Corporate social responsibility and firm size. J Bus Ethics 83(2):167–175

van Leeuwen G, Mohnen P (2017) Revisiting the Porter hypothesis: an empirical analysis of green innovation for the Netherlands. Econ Innov New Technol 26(1–2):63–77

Yang Y, Su X, Yao S (2022) Can green finance promote green innovation? The moderating effect of environmental regulation. Environ Sci Pollut Res 1–14

Yao Q, Zeng S, Sheng S, Gong S (2021) Green innovation and brand equity: moderating effects of industrial institutions. Asia Pac J Manag 38(2):573–602

Yin C, Salmador MP, Li D, Lloria MB (2022) Green entrepreneurship and SME performance: the moderating effect of firm age. Int Entrep Manag J 18(1):255–275

Yu C-H, Wu X, Zhang D, Chen S, Zhao J (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255

Funding

This work was supported by the Zhejiang Provincial Philosophy and Social Science Planning Project (22NDJC015Z; 20NDJC225YB) and the Zhejiang Provincial Soft Science Project (2022C35080; 2022C35088; 2021C35020) and the Zhejiang Provincial Education Department (Y202250353).

Author information

Authors and Affiliations

Contributions

Xiaohui Xu contributed to the study’s conception and design. Material preparation, data collection, and analysis were performed by Xiaohui Xu. The first draft of the manuscript was written by Xiaohui Xu who commented on previous versions of the manuscript. Xiaohui Xu revised the manuscript and read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Xu, X. Does green finance promote green innovation? Evidence from China. Environ Sci Pollut Res 30, 27948–27964 (2023). https://doi.org/10.1007/s11356-022-24106-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-24106-1