Abstract

This paper uses the Global Malmquist-Luenberger Index (GMLI) based on directional distance function (DDF) super efficiency model to measure the urban green land use efficiency (UGLUE) of 108 cities in the Yangtze River Economic Belt (YREB) from 2007 to 2018, and it utilizes the spatial economic model to analyze the impact of land finance on the UGLUE and its mechanism of action. The results show that, firstly, the UGLUE in the YREB shows a steady development trend, the overall efficiency level is high, and there are spatial agglomeration characteristics. Secondly, the impact of land finance on the UGLUE presents “inverted U-shaped.” With the continuous expansion of the scale of land finance, the impact of land finance on the UGLUE in the city has changed from positive to negative. Thirdly, land finance has a spatial spillover effect. Land finance will inhibit the improvement of UGLUE in surrounding areas through the “peer effect.” With the continuous expansion of land finance scale, land finance will promote the improvement of UGLUE in surrounding cities through the “warning effect.”

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Land is not only the spatial material carrier of economic and social activities, but also important resource source and basic guarantee for urban development (Kuang et al. 2020). With the rapid development of China’s economy, the demand for urban construction land has continued to increase in recent years (Wang et al. 2018; Zhong et al. 2020). From 2006 to 2018, China’s urban construction land area increased from 31,765.70 to 56,075.90 km2. The rapid expansion of urban construction land has not only led to the loss of a large amount of arable land resources, but also caused a series of ecological problems such as the heat island effect and environmental pollution (Chen et al. 2018). For the purpose of solving these problems, the Ministry of Land and Resources of China issued the “Guiding Opinions on Implementing the Target of Decreasing Construction Land for Units Gross Domestic Product” in February 2012, which clearly requires land and resources departments at all levels to strengthen the intensive use of land. To a certain extent, it limits the extensive expansion of urban construction land. As the urban construction land resources become increasingly tight, the constraints of land resources on economic growth gradually emerge, especially in the eastern coastal areas (Ding and Lichtenberg, 2011). How to better promote economic growth under the constraints of land resources (that is, increasing UGLUE) has become a key issue in solving the contradiction between the shortage of land resources and economic growth (Yang et al. 2020).

The UGLUE is influenced by the level of economic development (Xie et al. 2018), the upgrading of industrial structure (Gao et al. 2020) and the technological level (Yu et al. 2019), globalization, marketization, decentralization and urbanization (Wu et al. 2017), and many other factors. Among these factors, the impact of land finance on UGLUE is particularly important (Wang et al. 2021b). Land finance refers to the behavior that local governments use land to obtain on-budget and off-budget revenue to win in regional competition (Qun et al. 2015). Since the reform of tax distribution system in 1994, local governments, which are increasingly short of financial resources, have increasingly relied on land finance to solve the financial constraints they are facing (Chen et al. 2002). After 1998, the scale of land transfer income in China showed a rapid growth trend as a whole. As shown in Fig. 1, China’s land transfer income increased significantly from 50.77 billion yuan in 1998 to 1,221.672 billion yuan in 2007 and reached 4,038.586 billion yuan in 2014 (with an average annual growth rate of 31.59%). The rising proportion of land transfer income in local government fiscal revenue makes land finance become the “second finance” of local government. The “land king” is constantly created. Rising land price and housing price make local governments take land transfer as the center of development has attracted much attention and doubt. It is undeniable that in the past 10 years, land finance revenue has been an important source of funds for local governments to carry out infrastructure construction and attract investment. So, what is the impact of land finance on UGLUE? How is it affected? Solving these problems is essential for realizing the effective use of land resources and achieving sustainable economic development.

The YREB is a giant basin economic belt with the largest population, industrial scale, and the most complete urban system in the world and runs through the eastern, central, and regions of China (Chen et al. 2017; Yang et al. 2021). The YREB covers an area of 2.05 million km2, accounting for 1/5 of the total land area of China (Jin et al. 2018). In 2019, the total GDP of YREB was 45.8 trillion yuan, accounting for 46.2% of the country’s GDP. The YREB supports rapid economic development with less land. Compared with other regions, the contradiction between the shortage of urban land resources and economic growth in the YREB is more prominent. Increasing the UGLUE of the YREB can not only solve the contradiction between the insufficient supply of land resources and economic growth in YREB, but also provide a reference for other cities to realize the efficient use of land.

Based on the above analysis, this paper firstly uses the GMLI based on the DDF super efficiency model to measure the UGLUE of 108 cities in the YREB. Secondly, through the Benchmark regression model and spatial economic model, it discusses the impact of land finance on UGLUE. Finally, from the perspective of land finance, it puts forward some policy recommendations on promoting the effective use of urban land.

The structure of the rest part in this paper is as follows: The second part describes the literature review. The third part puts forward the research hypothesis. The fourth part introduces the data and methods. The fifth part presents the results and discussion. The sixth part summarizes the empirical results and policy recommendations.

Literature review

As an input element of production, the use of land has attracted wide attention from scholars. Traditional urban land use efficiency is an important measurable indicator reflecting the relationship between land input and economic output (Du et al. 2016; Han et al. 2019). However, land is a complex economic, social-natural environment system. Traditional urban land use efficiency is only limited to the economic and social scope (Chen et al. 2018), ignoring the green concept of coordinated economic, social, and environmental development. UGLUE refers to maximizing economic benefits under the premise of reducing resource consumption and environmental pollution (Yu et al. 2020). With the deepening of the concept of green development, UGLUE has received widespread attention from scholars from all walks of life (Xie et al. 2019; Xie and Wang, 2015; Hu et al. 2018). Scholars have begun to use different methods to measure UGLUE in different regions. Lu et al. (2018) incorporated the environmental pollution index into the overall evaluation index system of urban land utilization and measured the overall evaluation of urban green land use in 31 provinces and cities of China from 2001 to 2014 by using SBM model. Zhao et al. (2018) used the super efficiency DEA model to measure the land ecological efficiency of 13 prefecture-level cities in the Beijing-Tianjin-Hebei region. Han and Zhang (2020) analyzed cultivated land use efficiency by using the minimum distance to strong efficient frontier (MinDS) model and the Malmquist index. In addition to DEA model, the SFA model can also be used. Liu et al. (2020) evaluated the green land use efficiency (GLUE) by using the one-stage SFA model and analyzed the influence of bad output on the GLUE and the improvement potential of urban GLUE. Based on SFA, Song et al. (2020) and Dong et al. (2020) studied the spatiotemporal patterns of logistics land use efficiency and urban land use efficiency in the YREB, respectively.

In recent years, a large number of studies have focused on the factors affecting the use of urban land. Xie et al. (2018) found that the relationship between the per capita GDP and industrial land efficiency of urban agglomerations in the middle reaches of the Yangtze River is “N” type. Huang et al. (2017) found that China’s economic development zones can influence the land use efficiency through selection effect, factor accumulation effect, and agglomeration effect. Through regression analysis, Yu et al. (2019) found that the level of economic development, population density, and market openness had a significant impact on the land use efficiency. Yu et al. (2020) used GIS and machine learning methods to discuss the influencing factors of green utilization efficiency of urban construction land (GUEUCL). He found that population density, economic conditions, government investment attraction, and reasonable growth of urban space development were important indicators affecting GUEUCL. Based on a spatial regression model, He et al. (2020) found that urban form could affect land use efficiency. In addition, government intervention in the land market will also affect land use. This intervention is mainly reflected in two aspects: The one hand is the introduction of land-related policies, such as Du et al. (2016) found that the land pricing system could stimulate investment and business management to promote effective land use. The study of Tu et al. (2014) found that the central government’s policy of promoting the public transfer of industrial land at the end of 2006 did not reduce the use of idle land. The other hand is land finance. Wang et al. (2021b) used the panel threshold model to analyze the impact of land finance on land use efficiency, and empirical test found that there was an inverted “U” curve relationship between the two. Different from the study of Wang et al. (2021b) , Liu et al. (2018) did not use the panel threshold model but analyzed the land use performance of Chongqing by constructing a conceptual framework. The study found that the local government’s excessive dependence on land finance led to the rapid expansion of land use.

The above literatures provide inspiration for this paper, but there are still some shortcomings in the research on the relationship between land finance and UGLUE. Firstly, existing studies only evaluate the level of land use from an economic point of view, ignoring the evaluation from an ecological point of view. Secondly, the existing literatures are basically analyzed from the provincial level or the individual level of cities. However, there is a lack of research on the YREB. Thirdly, existing studies have not considered the spatial spillover effect of inter-city land finance. The neglect of such spillover effect may lead to biased or even invalid coefficient estimates of land finance on UGLUE.

The contributions of this study are as follows: Firstly, compared with previous studies that only consider economic factors, this paper incorporates five indicators of land, capital, labor, economy, and ecology into the evaluation system of UGLUE and uses the GMLI based on DDF super-efficiency model to measure the UGLUE in YREB. Secondly, this paper selects the panel data of 108 cities in the YREB from 2007 to 2018 as the research sample, which provides a new evidence for the research on the relationship between land finance and UGLUE. Thirdly, this paper analyzes the direct effect and spillover effect of land finance on UGLUE from both theoretical and empirical aspects, which enriches the researches on the role of land finance in efficient use of land.

Research hypothesis

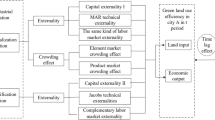

Land revenue has become the “rigid demand” for local governments to promote economic growth and affects the UGLUE and sustainable development level of cities. Based on the existing theoretical mechanism and empirical research, this paper draws Fig. 2 to analyze the mechanism of land finance on UGLUE and puts forward the following two hypotheses.

Under the dual incentive of financial decentralization and promotion tournament, local governments adopts the method of selling industrial land at low prices to promote local economic development and horizontally subsidize the cost of industrial land by selling commercial land at high prices. From the perspective of industrial land, the sale of industrial land at a low price can promote the employment level of the region by attracting foreign capital and introduce some high-tech industries, thereby generating knowledge spillover effects and promoting the improvement of UGLUE. However, with the continuous reduction of the cost of industrial land, a large number of low-efficiency enterprises with backward technology and equipment flood in. The high-tech industries facing higher land prices are crowded out, which leads to misallocation of resources and a reduction in the output efficiency (Cao et al. 2008; Du et al. 2016). From the perspective of commercial and residential land, the sale of commercial and residential land at high prices brings an increase in public infrastructure investment. The continuous improvement of public infrastructure promotes the industrial development, which will inevitably increase the output of land units and improve the UGLUE (Tian and Ma, 2009; Pan et al. 2015; Ye and Wu, 2014). However, the high price of commercial and residential land will also promote the rise of housing prices (Fang and Zi, 2012; Pan et al. 2015). Induced by the high profits of the real estate industry, enterprises will invest a large amount of funds into the real estate sector for arbitrage, resulting in a large outflow of capital and crowding out investment in high-tech sectors. This reduces the output efficiency and inhibits the improvement of UGLUE.

Therefore, Hypothesis 1 is proposed: Under the promotion competition mechanism of local governments, there is a positive relationship between land finance and UGLUE. However, with the continuous expansion of the scale of land finance, the relationship between land finance and UGLUE changes from positive to negative. The relationship between them is an inverted U-shaped.

Some important decisions of local government officials are not only based on their own conditions, but also affected by the decision-making of areas with similar levels of resource endowment and economic development. In this paper, the interaction effect between governments is divided into “peer effect” and “warning effect.” On the one hand, due to the existence of “promotion tournament” mechanism, local government officials are in the category of “the same group.” The decisions of local officials may not be made simply on their own situation, but by referring and imitating the behavior of other decision-makers in order to prove to the higher government that its efforts are not inferior to those of the surrounding cities. This is called the “peer effect.” When a city benefits from the land finance policy, the government officials in surrounding areas tend to blindly imitate and follow its land finance policy in the short term, which may cause excessive waste of land resources. On the other hand, facing the waste of land resources and unreasonable industrial structure caused by the excessive financial scale of land, the government of surrounding areas may be regarded as a “warning” because of the pressure of public opinion. Then, they can develop appropriate land fiscal policy according to their own actual situation to achieve green land use and sustainable economic development, which is called the “warning effect.”

Therefore, Hypothesis 2 is put forward: Land finance has spatial spillover effect, and the land finance in the area can affect UGLUE in the surrounding areas.

Data and methodology

The super-efficiency DDF model with unexpected output

The directional distance function (DDF for short) model adopted in this study is based on the research of Färe et al. (2007). Each city is regarded as an input–output system, in which the input vector is represented by x. The output vector is divided into good output y and bad output b. The production possibility set P can be defined as

The input vectors include capital (K), labor (L), and land (M) in the cities of the YREB. Good output is the GDP of each city, and bad output is the emission of industrial waste in each city. The DDF model assumes that the production feasibility set is a closed bounded convex set, which meets \(P\left(0\right)=\left\{0, 0\right\}\). At the same time, assuming that the good output and input are free to dispose. That is to say: ①If \(\left(y,b\right)\in P(x)\) and \(\left({y}^{^{\prime}},b)\le (y,b\right)\), then \(\left({y}^{^{\prime}},b\right)\subseteq P(x)\); ②If \(\left(y,b\right)\in P(x)\) and \({x}^{^{\prime}}\ge x\), then \(P({x}^{^{\prime}})\subseteq P(x)\).

In addition, the directional distance function also meets the zero-knot and the joint weak disposal of output. It means that good output is bound to be accompanied by bad output and reducing bad output will inevitably lead to the reduction of good output. That is to say: ①If \((y,b)\in P(x)\) and \(b=0\), then \(y=0\); ②If \((y,b)\in P(x)\) and \(0\le \theta \le 1\), then \(\left(\theta y,\theta b\right)\in P(x)\).

Based on the production possibility set P(x), the DDF model can be defined as the following equation:

\(g=({g}_{y},-{g}_{b})\) represents the direction vector. The maximum value of this function is \({\beta }^{*}={D}_{0}(x,y,b;g)\), which represents the maximum extent to which good outputs increase and bad outputs decrease when the output vector \(\left(y,b\right)\in P(x)\) of a decision unit moves to the boundary of the output possible set according to the direction vector g. β* is the embodiment of the production efficiency of each unit. The lower the production efficiency of the unit, the greater the β* is.

Global Malmquist-Luenberger index

When the data of the evaluated DMU is panel data containing a plurality of points in time, at multiple time points, the UGLUE will change at different time points. At this time, it is necessary to use the Malmquist index method to measure the dynamic change of UGLUE. Referred to Chung et al. (1997), this paper introduces Global Malmquist-Luenberger index (GMLI for short), which can measure the change of UGLUE including undesired output to facilitate dynamic analysis. The index from t period to t + 1 period is expressed as follows:

\(1+\overrightarrow{{D}_{G}^{T}}({x}^{t},{y}^{t},{b}^{t};{g}^{t})\) and \(1+\overrightarrow{{D}_{G}^{T+1}}({x}^{t},{y}^{t},{b}^{t};{g}^{t})\) are the distance function of DMU for comparing the t and t + 1 period with the production frontier surfaces of the same period, respectively. \(1+\overrightarrow{{D}_{G}^{T}}({x}^{t+1},{y}^{t+1},{b}^{t+1};{g}^{t+1})\) and \(1+\overrightarrow{{D}_{G}^{T+1}}({x}^{t+1},{y}^{t+1},{b}^{t+1};{g}^{t+1})\) are the distance function of DMU in t + 1 period and t period comparing the t period and t + 1 period with the production frontier surfaces of the mixing period, respectively. That is to say, the distance function between the DMU and front surface of mixing period. \({GMLI}^{t,t+1}>1\) indicates that the productivity is increasing.\({GMLI}^{t,t+1}<1\) indicates that the productivity is lowering. The GMLI index is further decomposed as follows:

\({GMLTECH}_{t}^{t+1}\) is the efficiency change index of urban green land use technology, which indicates the ability of decision-making unit (DMU) to utilize the current technology. If \({GMLTECH}_{t}^{t+1}\) is greater than 1, the technical efficiency of decision-making unit is improving and more and more approach to the production frontier. If \({GMLTECH}_{t}^{t+1}\) is less than 1, the DMU does not make full use of the existing technology to maximize its capacity \({GMLEFFCH}_{t}^{t+1}\) is the change index of urban green land use technological progress, which indicates the impact of production frontier on the efficiency of DMU. If \({GMLEFFCH}_{t}^{t+1}\) is more than 1, the technology of DMU’s environment is improving from t to t + 1. If \({GMLEFFCH}_{t}^{t+1}\) is less than 1, the technology of DMU’s environment is regressing from t to t + 1. The GMLI consists of technological efficiency and technological progress, which equals to the product of these two indicators.

Empirical models

Spatial autocorrelation test

First of all, this paper uses Moran’s I to test the global spatial correlation between UGLUE and land finance in 108 cities in the YREB. The formula is as follows:

S2 is the sample variance, \({w}_{ij}\) is a spatial weight matrix, and \(\sum \limits_{i=1}^{n}\sum \limits_{j=1}^{n}{w}_{ij}\) is the sum of all space weights. In general, the Moran’s I is valued between − 1 and 1. If I is greater than 0, there is a positive correlation of space. If I is less than 0, there is a negative correlation of space. If I is close to 0, it indicates that the spatial distribution is random. That is, there is no spatial autocorrelation.

Spatial econometric models

According to the first law of geography, all things are associated with other things, but the closer things are more relevant than the farther things (Tobler, 1970). Therefore, using a spatial econometric model to identify the interrelatedness between such regions is necessary. The existing spatial econometric models are mainly Spatial Autoregressive Model (SAR), Spatial Error Model (SEM), and Spatial Durbin Model (SDM).

SAR model mainly reflects the direct interaction of the explained variables by setting the lagged term of the explained variables (Zhang et al. 2018; Zhang et al. 2020). The expression is as follows:

SEM mainly reflects the interaction relationship of the explained variable due to the system by setting the hysteresis of the perturbation term (Elhorst, 2003; Guo et al. 2020). The expression is as follows:

SDM not only considers the spatial correlation of the explained variables, but also considers the spatial correlation of the explanatory variables (Wang et al. 2021a). The expression is as follows:

ε is a perturbation term; i and t represent the space and time, respectively; w is a spatial weight matrix, where the geographical inverse distance matrix is selected in this paper; δ is the spatial autoregressive coefficient, representing the influence of neighboring unit variables on the explained variable of the spatial unit;. ρ, ρ0 and ρ1 represent the influence coefficients of the observed values from other regions; α represents the coefficient of explanatory variable, and θ represents the coefficient of controlling variable; UGLUE is the explained variable. LF is the explanatory variable. Z is the control variable.

The choice of three models can be obtained by Wald test and likelihood ratio test (Elhorst, 2014; Zhong et al. 2021).

Variable selection and data source

Variable selection

-

(1)

Urban green land use efficiency (UGLUE): In this paper, the GMLI based on DDF super-efficiency model is used to measure the UGLUE of 108 cities in the YREB. According to the existing studies (Yang et al. 2020), the following core indicators of UGLUE evaluation are selected (Table 1). For input indicators, land factor input M, labor factor input L, and capital factor input K are mainly selected as input indicators. As for the output index, the added value of the secondary and tertiary industries in municipal district is selected as the expected output, and the GDP deflator is used to convert it into a comparable value. Meanwhile, the pollution indexes of industrial wastewater discharge, industrial sulfur dioxide discharge, and industrial smoke (powder) dust discharge are selected as the undesired output.

Land finance: Considering that local government still mainly use land transfer fees to increase local government revenue at the present stage, this paper uses land transfer income as a decision variable to measure the local government land transfer behavior. In order to eliminate the effect of dimension, it measures land finance by the per capita land transfer income and carries on the logarithmic processing to it.

Control variables: For the control variable Z, the following variables are selected as the control variable Z (Table 2):

(1) Degree of land marketization (LM) (Mu and qian, 2018): The marketization of land transfer refers to the transfer of land by local governments in a higher degree of marketization, such as bidding, auction, and listing. The higher the degree of marketization of land transfer, the more land buyers compete through the open market (Cai et al. 2013). It can promote the realization of the best match between land resources and land users, thus improving the allocation of land resources and improving the UGLUE. Therefore, this paper selects the proportion of the transfer area of bidding, auction, and hanging to the total transfer area to express the degree of land marketization.

(2) The level of economic development (GDP) (Xie et al. 2018): The higher the economic development of a city, the higher the output of a city and the more we can improve the UGLUE. This paper selects Per capita GDP to express.

(3) Technology level (TEC) (Chen et al. 2012): The higher the scientific and technological level of cities, the more they can promote the utilization of input elements and the transformation of innovative achievements and improve the UGLUE. This paper selects the proportion of science and technology expenditure to fiscal expenditure to express.

(4) Infrastructure level (INF) (Xiong et al. 2018): The continuous improvement of infrastructure can save transportation costs, promote the optimal allocation of land elements, and improve the UGLUE. This paper selects the per capita road area to express.

(5) Financial scale (FS) (Sealey et al. 2018): When the financial scale is small, the financial sector can promote high-quality economic development by reducing the internal friction of economic operation and improving financial efficiency. However, there is “inherent instability” in the financial system. Excessive financial scale will make the economy “break away from reality to emptiness”, resulting in serious damage to the financial system, which is not conducive to the improvement of UGLUE. This paper uses the proportion of per capita deposits of financial institutions to GDP to express financial scale.

Data source

The data of land transfer income and land transfer area are from the Yearbook of Land and Resources Statistics in China. Other relevant indicators are all from China Urban Statistical Yearbook. In order to maintain the integrity of the data, this paper uses the average method to fill the vacancy value. In addition, due to the unavailability of the GDP deflator of each city, we use the GDP deflator of each province to deal with the relevant data, which comes from the National Bureau of Statistics.

Results

Temporal and spatial characteristics of UGLUE

Figure 3 shows the dynamic change trend of UGLUE in the YREB from 2007 to 2018. The GMLI value of UGLUE in the YREB fluctuates between 0.931 and 1.260, especially the GMLI values of 2009, 2011, 2013, 2014, and 2015 are less than 1. It indicates that the UGLUE is reduced by about 4.5%. From 2007 to 2008, the average value of GMLI is 1.065. The utilization degree of land input is relatively high. The overall UGLUE increases at an average annual rate of 6.5%, but declines after 2008. The average value from 2008 to 2015 is 0.973, and the UGLUE decreases at an average annual rate of 2.7%. From 2016 to 2018, the annual average value is 1.206, and the UGLUE shows an upward trend. At the same time, it finds that the fluctuations of GMLI values of UGLUE in the upper, middle, and lower reaches of the Yangtze River are between 0.934 and 1.160, 0.955 and 1.059, and 0.945 and 1.078, respectively. In particular, the mean value of UGLUE in the lower reaches of the Yangtze River is the lowest, which is 1.001. The mean value of GMLI in the middle reaches of the Yangtze River is 1.003. The mean value of GMLI in the upper reaches of the Yangtze River is the highest, which is 1.048. It indicates that the UGLUE in the three regions has increased to varying degrees.

It can be seen from Fig. 4 that the number of cities with GMLI value greater than 1 increases year by year from 2013 to 2017, which shows that UGLUE has grown in more and more cities, and UGLUE is gradually moving to the forefront of production.

Spatial autocorrelation

Firstly, this paper uses Moran’s I to test spatial autocorrelation. The statistical results show that the Moran indexes of UGLUE and land finance are significantly positive in general from 2007 to 2018, indicating that UGLUE and land finance exist an obvious spatial correlation (Table 3).

Secondly, it further examines the spatial autocorrelation of local areas by using local Moran’s I. Figure 5 reports the Moran scatter plots of UGLUE and land finance in 2007 and 2018. The Moran scatter plots are divided into four quadrants. Quadrants 1 and 3 represent positive spatial autocorrelation of observed values, while quadrants 2 and 4 represent negative spatial autocorrelation. As for UGLUE and land finance, we can see that most of the points are located in the first and third quadrants, which indicates that the UGLUE and land finance of each city present the characteristics of spatial agglomeration of “high-high” and “low-low.”

Benchmark regression analysis

Before performing spatial regression, this article uses a model that does not consider spatial factors to perform regression. Meanwhile, taking into account the potential impact of outliers on the results, this paper conducts a winsorization for the core variables at the 1.5% level.

As shown in Table 4, columns (1), (2), (3), (4), and (5) represent mixed OLS, individual fixed effect, time fixed effect, individual and time two-way fixed effect, and random effect models, respectively. The estimation results of F test and LM test prove that there is individual effect in the model. The estimated results of the joint significance test (year test) of all annual dummy variables strongly reject the null hypothesis of “no time effect” and believe that the model should include not only individual effect but also time effect. The results of Hausman test prove that, among the individual and time two-way fixed effect model and the random effect model, the individual and time two-way fixed effect model is the best model. Therefore, we choose the individual and time two-way fixed-effect model to explain the estimation results.

Regarding land finance, the estimated coefficients of land finance and its quadratic term are 0.157 and − 0.0111, respectively, which shows that land finance and UGLUE have an inverted U-shaped nonlinear relationship. The turning point occurs when the land finance (taking logarithm) is 7.07. When the land finance (taking logarithm) of a region is lower than 7.07, the land finance will significantly promote the improvement of UGLUE. When the land finance (taking logarithm) of a region is higher than 7.07, the land finance will obviously restrain the improvement of UGLUE. Among the 1296 sample points, 78% of the sample points are located in the downward part of the inverted U-shaped curve, which shows that land finance has significantly suppressed the increase of UGLUE.

Regarding the control variables, the estimated coefficient of land marketization level is 0.0517, and it passes the 10% significant level. The estimated coefficient of economic development level is 0.0533, and it passes the 5% significant level, which shows that the level of land marketization and the level of economic development have a positive impact on UGLUE. The estimated coefficient of infrastructure level is − 0.0647, and it passes the 1% significant level, which shows that the level of technology and infrastructure have a negative impact on UGLUE. The impact of technological level and financial scale on UGLUE is not significant.

Empirical results of spatial econometric model

Through the above theoretical analysis, this paper finds that there is a spatial interaction between local governments. That is to say, local governments do not make decisions completely based on their own situation, but are influenced by the decisions of surrounding areas. Therefore, this paper uses spatial econometric model to further analyze the impact of land finance on UGLUE in the YREB. The estimated results are shown in Table 5.

The spatial lag coefficient of UGLUE is significantly positive at the 10% level, indicating that UGLUE has a spillover effect. In order to determine which spatial econometric model is the most appropriate among the three models, this paper uses the Wald and LR test to analyze whether the SDM model can be simplified into SAR and SEM model. Moreover, it applies Hausman test to identify which of the fixed effect or random effect is more appropriate. The results show that the fixed effect is more appropriate. From the results of the Wald and LR test, the original hypothesis (H0: γ = 0; H0: γ + ρβ = 0) are rejected, indicating that the SDM model cannot be simplified to SAR or SEM model. Therefore, we should choose the SDM model of individual and time fixed effect for performing analysis.

Regarding land finance, similar to the estimation results of the above-mentioned benchmark regression, the land finance and its quadratic regression coefficients are 0.189 and − 0.0135, respectively, and both pass the 1% significance level, which is in line with the Hypothesis 1 of this article. Land finance and UGLUE have an inverted U-shaped nonlinear relationship. Land finance can promote the improvement of UGLUE. However, as the scale of land finance continues to expand, the impact of land finance on UGLUE will turn from positive to negative, inhibiting the improvement of UGLUE.

Regarding the spatial spillover effects of land finance, the spatial lag coefficients of land finance and its quadratic terms are − 0.760 and 0.0482, respectively, and both pass the 5% significance level, which is in line with the Hypothesis 2 of this article. It shows that the land finance in the surrounding areas will have a negative impact on UGLUE in this area, and the “peer effect” has a significant effect. With the continuous expansion of the scale of land finance, the impact of land finance in surrounding areas on UGLUE in the region has changed from negative to positive, and the “learning effect” is significant.

Among the control variables, the estimated coefficient of land marketization level is 0.0367, and it passes the 10% significance level. It shows that when the government improves the marketization level of land transfer and increases the proportion of bidding, auction and listing transfers, the UGLUE of the city will also increase accordingly. On the one hand, the higher land acquisition price increases the production cost of enterprises. Enterprises have the incentive to invest more capital or labor to obtain a higher level of output. On the other hand, land buyers compete in the open market to promote the best match between land resources and land users, so as to improve the allocation of land resources. The estimated coefficient of economic development level is 0.0568 and passes the 5% significant level; the improvement of economic development level can increase economic output, thereby increasing UGLUE. The estimated coefficients of technological level are − 0.0143 and pass the 5% significant level. This may be because China’s R&D investment is used more for production technology advancement rather than emission reduction technology advancement (Shao et al. 2019). Increased environmental pollution makes UGLUE decline. The estimated coefficient of infrastructure level is − 0.0605, and it passes the 1% significance level. Excessive road maintenance costs increase transportation costs and restrict the circulation of various elements in the region, thereby inhibiting the increase of UGLUE.

In addition, according to LeSage and Fischer (2008), we report the marginal effect of land finance on UGLUE. The direct effect, indirect effect, and total effect of land finance are shown in Table 6. The direct effect reflects the impact of land finance on UGLUE in the region. The indirect effect reflects the impact of land finance in the surrounding area on UGLUE in the area, and the total effect is the sum of the direct effect and the indirect effect. Regarding land finance, the direct effect (0.187) is significantly positive at the 1% level, while the indirect effect (− 0.990) is significantly negative at the 5% level. Regarding the quadratic term of land finance, the direct effect (− 0.0134) is significantly negative at the 1% level, while the indirect effect (0.0626) is significantly positive at the 5% level, which is similar to the estimated results in Table 6. It is worth noting that the indirect effect of land finance are significantly greater than its direct effects, indicating that the impact of land finance in surrounding areas on UGLUE is more important. According to the “Promotion Championship,” the promotion of government officials largely depends on local performance. In order to increase the probability of promotion, local governments will pay close attention to the decision-making behaviors of surrounding area governments in land finance, rather than just making decisions based on their own conditions.

Among the control variables, the direct effect, indirect effect, and total effect of land transfer marketization are all positive, indicating that when the government increases the level of land transfer marketization, UGLUE in the region and surrounding areas will also increase accordingly. The direct effect, indirect effect, and total effect of the road infrastructure level are significantly negative, indicating that the level of road infrastructure in a region has a negative impact on the UGLUE of the region and its surrounding areas. It is worth noting that the indirect effect of financial scale is significantly positive. According to the law of diminishing marginal returns of capital, the marginal rate of return of financial capital in developed areas continues to decline, and some funds begin to flow to the surrounding areas, promoting the economic development and the improvement of UGLUE in surrounding areas.

The impact of land finance on the UGLUE in different regions

According to the natural geographical location and the level of development level, this paper divides the nine provinces and two cities of the YREB into three regions: the upper reaches, the middle reaches, and the lower reaches.

The historical development foundation, geographical location conditions, and national policies of the upper, middle, and lower reaches of the YREB are different. Firstly, from the perspective of historical development foundation, the YREB spans the three major tiers of China’s topography, with the climate from dry to relatively humid and the solid from relatively barren to relatively fertile. Therefore, the early development began in the lower reaches of the Yangtze River, and it leads to its relatively rapid development, while the middle and upper reaches of the region developed behind the lower reaches because of their natural environment, economic foundation, and cultural level. Secondly, from the perspective of geographical location conditions, cities in the upper reaches of the Yangtze River develop in isolation and lack of communication and cooperation with other cities, resulting slow overall economic development in the upper reaches of the Yangtze River. While the lower reaches of the Yangtze River in the eastern coast have both the dual advantages of riverside and coastal areas. They are the frontier of China’s opening to the outside world. Finally, from the point of national policy, the state has been inclined to the lower reaches of the Yangtze River and neglected the development of the middle and upper reaches of the Yangtze River since the 1980s. As a result, the overall industrial development, human capital, and education level of the upper and middle reaches of the Yangtze River are relatively backward.

This paper uses the SDM model to estimate the impact of land finance on UGLUE in the upper, middle, and lower reaches of the Yangtze River. The estimation results (Table 7) are highly consistent with the spatial measurement model estimation results (Table 5). This further illustrates the impact of land finance on UGLUE is inverted U-shaped. It is worth noting that compared with the middle and lower reaches of the Yangtze River, land finance in the upper reaches of the Yangtze River has the greatest impact on UGLUE. The reasons may be that the cities in the upper reaches of the Yangtze River have a strong willingness to catch up and surpass the development. Compared with the cities in the middle and lower reaches of the Yangtze River, the financial sources in the upper reaches of the Yangtze River are more insufficient. Therefore, there is greater demand for using land finance to increase fiscal revenue and create development conditions.

Robustness test

Considering that only using the geographic distance weight matrix in the empirical study may make the estimation results unrepresentative, this article replaces the geographic distance weight matrix with the spatial adjacent weight matrix. At the same time, the SAC model is also used for robustness test. As shown in Table 8, similar to previous estimates, the impact of land finance on UGLUE is inverted U-shaped, which shows that the estimation results are robust.

Endogenous problem

Logically speaking, there are endogenous problems between land finance and UGLUE. Although this paper analyzes the internal mechanism of the influence of local government’s land finance scale on UGLUE, it omits the control variables such as relevant land policies. The introduction of relevant land policies will affect land use (Wang et al. 2018), thereby affecting the UGLUE. Due to the existence of missing variables, there will be endogenous problem between land finance and UGLUE.

This paper uses the instrumental variable method to make an estimation in order to avoid the impact of endogenous problem on the research conclusion. According to the idea and logic of instrumental variable method, the instrumental variable to be constructed in this paper should satisfy the principle of “correlation” and “exclusivity,” that is, exogenous variables that are only intrinsically related to land finance but not directly related to UGLUE. Saiz (2010) used the proportion of land with slopes higher than 15 degrees as an explanatory variable and found that the steeper the land, the higher the housing price. Zhang and Yu (2019) used the interaction term of average land slope and economic growth target of each city as the instrumental variable of land transfer income.

This paper firstly uses the lagging period of land finance as an instrumental variable. In addition, this paper also uses the interaction term between the land slope and year (LPY) as an instrumental variable to perform a two-stage least squares regression. As natural geographical feature, terrain conforms to the characteristics of instrumental variables. The estimation results are shown in Table 9. Columns (1), (2), (4), and (5) report the first-phase regression results of land finance and LPY as an instrumental variable, respectively. Among them, the coefficients of the main variables (lnLF, lnLF*lnLF) are significant, which meets the requirements of instrumental variable correlation. F statistic is greater than 10, indicating that there is no weak instrumental variable problem. Columns (2) and (6) report the first-lagged regression results of land finance and the second-stage regression results of LPY as instrumental variables, respectively. Among them, the coefficient of the first-order term of land finance is still significantly positive, and the coefficient of the quadratic term is still significantly negative, indicating that the endogenous deviation in the impact of land finance on UGLUE is not serious.

In the test results of instrumental variables, Kleibergen-Paap rk LM statistic rejects the null hypothesis of insufficient identification of instrumental variables, indicating that there is no problem of insufficient identification of instrumental variables. The Cragg-Donald Wald F statistic is greater than the 10% critical value of the Stock-Yogo bias critical value, which indicates that there is no weak instrumental variable problem.

Discussion

From the perspective of direct effect, there is an inverted U-shaped relationship between land finance and UGLUE. Land finance can promote the improvement of UGLUE. However, with the continuous expansion of land finance scale, the impact of land finance on UGLUE turns from positive to negative, which is consistent with the Hypothesis 1 of this paper. Local governments selling industrial land at low prices can attract foreign investment to expand employment, and selling commercial land at high prices can promote industrial development by increasing infrastructure investment, thereby increasing UGLUE. However, the continuous expansion of the scale of land finance will also cause excessive rises in housing prices and the outflow of a large amount of capital and labor, thereby reducing the productivity of the entire society and lowering UGLUE. According to statistical data, the land transfer income of 108 prefecture-level cities in the YREB accounted for 72.1% of their budgetary income in 2007. In 2016, although the proportion of land transfer income to its budgetary income decreased slightly (58.3%), the land finance scale is still at a high level. This will significantly inhibit the improvement of urban UGLUE.

From the perspective of indirect effect, land finance will inhibit the increase of UGLUE in the surrounding areas. With the expansion of land finance scale in the region, the UGLUE of the surrounding areas will increase, which is in line with Hypothesis 2 of this paper. Because of the existence of “peer effect” and “warning effect,” when a city benefits from the land finance policy, the government officials in the surrounding areas tend to blindly imitate and follow its land finance policy in the short term, which may cause excessive waste of land resources. On the other hand, facing the area where land resource cost and industrial structure are unreasonable caused by excessive financial scale of land, the surrounding areas will learn from the experience and lessons of the area and rationally formulate land finance policies according to their own actual conditions, so as to realize the green use of land and sustainable development of economy.

On September 9, 1987, Shenzhen transfer the land use right by agreement (land price was 200 yuan/square meter, totaling 1,064 million yuan, the land can be used for 50 years) for the first time. It is the first paid and timely transfer of the right to use land, marking the formal start of the reform of urban land use system in China. On April 29, 1990, the State Council promulgated the Provisional Regulations on the Assignment and Transfer of State-owned Land in Cities and Towns, which is an important legal guarantee to push the reform of the right to use right of state-owned land in towns and cities from pilot projects to the whole country. In 2004, the Ministry of Land and Resources formulated the Decision on Deepening Reform and Strict Land Management, stipulating that industrial land should also create conditions for industrial land to be gradually transferred by bidding, auction, or listing, and the transfer price shall not be lower than the minimum price standard. In 2006, the State Council issued the Notice on Strengthening the Macro management of Land. The minimum price standard for the transfer of industrial land shall not be lower than the sum of the cost of acquiring land, developing land in the early stage and the related fees collected according to regulations. Under this system, local governments have the right to pursue their own political and economic interests through the transfer of land use rights. Driven by economic and political interests, local governments began to rely more and more on land finance to achieve their own political promotion. Land finance can promote the development of the economy and the improvement of public infrastructure. Meanwhile, the continuous expansion of land finance will also lead to excessive rise in housing prices and the outflow of a large number of capital and labor force, thus reducing the production of the whole society and efficiency of green land use. Therefore, local governments should actively seek other sources of land financial funds, optimize the structure of fiscal expenditure, and formulate reasonable land fiscal policies in combination with their own development conditions, which are of great significance to promote the effective allocation of land resources and achieve sustainable economic development.

Conclusion and policy recommendations

This paper uses the GMLI based on DDF super efficiency model to measure the UGLUE of 108 cities in the YREB from 2007 to 2018. By using the panel data regression model and spatial economic model, it examines the influence of land finance on the UGLUE and its action mechanism. The results show that, firstly, the UGLUE in the YREB shows a steady development trend, the overall efficiency level is high, and there are spatial agglomeration characteristics. Secondly, for the city, the impact of land finance on the UGLUE is inverted U-shaped. With the continuous expansion of the scale of land finance, the impact of land finance on the UGLUE in the city has changed from positive to negative. Thirdly, land finance has spatial spillover effect. Land finance will inhibit the improvement of UGLUE in surrounding areas through the “peer effect.” With the continuous expansion of land finance scale, land finance will promote the improvement of UGLUE in surrounding cities through “warning effect.” Based on these conclusions, this paper puts forward some policy suggestions to improve the UGLUE in the YREB from the perspective of land finance.

-

(1)

Improve the government assessment mechanism and fiscal and taxation systems. Firstly, the central government should change the official assessment system of “judging hero by GDP,” weaken the proportion of GDP in the assessments of officials, and increase the proportion of public services such as education and health care in the assessment of officials, so as to reduce the behavior of short-term blind land transfer by local governments. Secondly, land transfer income is the main source of local government land finance at present. Because the income of land transfer is unsustainable, local governments will face tremendous financial pressure after the completion of land transfer. Therefore, it is necessary to actively seek other sources of land finance, such as property tax, so as to ensure the sustainability of local government land finance. Finally, the government should build a mechanism for coordinating interests and organically combine “self-interest” with “altruism,” thus promoting the effective use of land in the surrounding areas and achieve win–win situation.

-

(2)

Optimize the expenditure structure of local government. The reasonable allocation of land transfer income is the key to improve the UGLUE. Therefore, local governments should reduce local expenditure and increase expenditure on public services such as education, health, science, and technology. At the same time, the serious separation of local government financial authority and administrative power is an important reason for local government to rely on land transfer income. Therefore, it is necessary to rationally divide the expenditure responsibilities between local and central governments and reduce the motivation of the government to pursue additional income. The central government should mainly undertake the global and inclusive expenditures on people’s livelihood, such as medical insurance and social security. The local government should mainly responsible for the expenditure of public goods such as quarantine and fire protection.

-

(3)

Implement different land finance policies and measures according to local conditions. For the lower reaches of Yangtze River with a high level of economic development, the government should gradually reduce the role of land finance and standardize the transfer of bidding, auction, and listing. At the same time, it is necessary to increase the transparency of operation of primary land market to reduce rent-seeking space and corruption in the process of land supply. For areas with relatively backward economic development, the government should intervene in land appropriately while strengthening supervision, give full play to the government’s guiding and regulating role in macroeconomic operation, and maximize land output by intervening in land transfer.

Data availability

The data that support the findings of this study are available from [www.cnki.net], but restrictions apply to the availability of these data, which were used under license for the current study, and so are not publicly available. Data are however available from the authors upon reasonable request and with permission of [www.cnki.net].

References

Cai H, Henderson JV, Zhang Q (2013) China's land market auctions: evidence of corruption? The Rand journal of economics 44(3):488–521

Cao G, Feng C, Tao R (2008) Local “land finance” in China’s urban expansion: challenges and solutions. Chin World Econ 16:19–30

Chen K, Hillman AL, Gu Q (2002) Fiscal re-centralization and behavioral change of local governments: from the helping hand to the grabbing hand. China Econ Q 2:111–130

Chen X, Huang H, Khanna M (2012) Land-use and greenhouse gas implications of biofuels: role of technology and policy. Climate Change Econ 3:1250013

Chen Y, Zhang S, Huang D, Li B-L, Liu J, Liu W, Ma J, Wang F, Wang Y, Wu S (2017) The development of China’s Yangtze River Economic Belt: how to make it in a green way. Sci Bull 62:648–651

Chen W, Shen Y, Wang Y, Wu Q (2018) The effect of industrial relocation on industrial land use efficiency in China: a spatial econometrics approach. J Clean Prod 205:525–535

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. J Environ Manage 51:229–240

Ding C, Lichtenberg E (2011) Land and urban economic growth in China. J Reg Sci 51:299–317

Dong Y, Jin G, Deng X (2020) Dynamic interactive effects of urban land-use efficiency, industrial transformation, and carbon emissions. J Clean Prod 270:122547

Du J, Thill J-C, Peiser RB (2016) Land pricing and its impact on land use efficiency in post-land-reform China: A case study of Beijing. Cities 50:68–74

Elhorst JP (2003) Specification and estimation of spatial panel data models. Int Reg Sci Rev 26:244–268

Elhorst JP (2014) Matlab software for spatial panels. International Regional Science Review 37(3):389–405

Färe R, Grosskopf S, Pasurka Jr CA (2007) Environmental production functions and environmental directional distance functions. Energy 32(7):1055–1066

Fang L, Zi S (2012) Theory study and empirical research about impact of land finance on housing price. Resource Dev Market 29:136–140

Gao X, Zhang A, Sun Z (2020) How regional economic integration influence on urban land use efficiency? A case study of Wuhan metropolitan area. China. Land Use Policy 90:104329

Guo A, Yang J, Xiao X, Xia J, Jin C, Li X (2020) Influences of urban spatial form on urban heat island effects at the community level in China. Sustainable Cities and Society 53:101972

Han H, Zhang X (2020) Static and dynamic cultivated land use efficiency in China: a minimum distance to strong efficient frontier approach. Journal of Cleaner Production 246:119002

Han W, Zhang Y, Cai J, Ma E (2019) Does urban industrial agglomeration lead to the improvement of land use efficiency in China? An empirical study from a spatial perspective. Sustainability 11:986

He S, Yu S, Li G, Zhang J (2020) Exploring the influence of urban form on land-use efficiency from a spatiotemporal heterogeneity perspective: evidence from 336 Chinese cities. Land Use Policy 95:104576

Hu B, Li J, Kuang B (2018) Evolution characteristics and influencing factors of urban land use efficiency difference under the concept of green development. Econ Geogr 38:183–189

Huang Z, He C, Zhu S (2017) Do China’s economic development zones improve land use efficiency? The effects of selection, factor accumulation and agglomeration. Landsc Urban Plan 162:145–156

Jin G, Deng X, Zhao X, Guo B, Yang J (2018) Spatiotemporal patterns in urbanization efficiency within the Yangtze River Economic Belt between 2005 and 2014. J Geog Sci 28:1113–1126

Kuang B, Lu X, Zhou M, Chen D (2020) Provincial cultivated land use efficiency in China: empirical analysis based on the SBM-DEA model with carbon emissions considered. Technol Forecast Soc Chang 151:119874

LeSage JP, Fischer MM (2008) Spatial growth regressions: model specification, estimation and interpretation. Spatial Economic Analysis 3(3):275–304

Liu Y, Fan P, Yue W, Song Y (2018) Impacts of land finance on urban sprawl in China: the case of Chongqing. Land Use Policy 72:420–432

Liu S, Xiao W, Li L, Ye Y, Song X (2020) Urban land use efficiency and improvement potential in China: a stochastic frontier analysis. Land Use Policy 99:105046

Lu X, Kuang B, Li J (2018) Regional difference decomposition and policy implications of China’s urban land use efficiency under the environmental restriction. Habitat Int 77:32–39

Mu Y, Qian Z (2018) Will the marketization level of primary land market be upgraded by land financial dependence: based on the test of a provincial—level panel data in China from 2003 to 2015. China Land Sci 32:8–13

Pan J-N, Huang J-T, Chiang T-F (2015) Empirical study of the local government deficit, land finance and real estate markets in China. China Econ Rev 32:57–67

Qun W, Yongle L, Siqi Y (2015) The incentives of China’s urban land finance. Land Use Policy 42:432–442

Saiz A (2010) The geographic determinants of housing supply. Q J Econ 125:1253–1296

Sealey KS, Binder P-M, Burch RK (2018) Financial credit drives urban land-use change in the United States. Anthropocene 21:42–51

Shao S, Zhang K, Dou J (2019) Effects of economic agglomeration on energy saving and emission reduction: theory and empirical evidence from China. Management World 35:36–60 (In Chinese)

Song Y, Yeung G, Zhu D, Zhang L, Xu Y, Zhang L (2020) Efficiency of logistics land use: the case of Yangtze River Economic Belt in China, 2000–2017. J Transp Geogr 88:102851

Tian L, Ma W (2009) Government intervention in city development of China: a tool of land supply. Land Use Policy 26:599–609

Tobler WR (1970) A computer movie simulating urban growth in the Detroit region. Econ Geogr 46:234–240

Tu F, Yu X, Ruan J (2014) Industrial land use efficiency under government intervention: evidence from Hangzhou, China. Habitat Int 43:1–10

Wang J, Lin Y, Glendinning A, Xu Y (2018) Land-use changes and land policies evolution in China’s urbanization processes. Land Use Policy 75:375–387

Wang H, Cui H, Zhao Q (2021a) Effect of green technology innovation on green total factor productivity in China: evidence from spatial durbin model analysis. J Clean Prod 288:125624

Wang P, Shao Z, Wang J, Wu Q (2021b) The impact of land finance on urban land use efficiency: A panel threshold model for Chinese provinces. Growth and Change 52(1):310–331

Wu C, Wei YD, Huang X, Chen B (2017) Economic transition, spatial development and urban land use efficiency in the Yangtze River Delta, China. Habitat Int 63:67–78

Xie H, Wang W (2015) Exploring the spatial-temporal disparities of urban land use economic efficiency in China and its influencing factors under environmental constraints based on a sequential slacks-based model. Sustainability 7:10171–10190

Xie H, Chen Q, Lu F, Wu Q, Wang W (2018) Spatial-temporal disparities, saving potential and influential factors of industrial land use efficiency: a case study in urban agglomeration in the middle reaches of the Yangtze River. Land Use Policy 75:518–529

Xie H, Chen Q, Lu F, Wang W, Yao G, Yu J (2019) Spatial-temporal disparities and influencing factors of total-factor green use efficiency of industrial land in China. J Clean Prod 207:1047–1058

Xiong C, Beckmann V, Tan R (2018) Effects of infrastructure on land use and land cover change (LUCC): the case of Hangzhou International Airport. China Sustainability 10:2013

Yang K, Zhong T, Zhang Y, Wen Q (2020) Total factor productivity of urban land use in China. Growth Chang 51:1784–1803

Yang B, Wang Z, Zou L, Zou L, Zhang H (2021) Exploring the eco-efficiency of cultivated land utilization and its influencing factors in China’s Yangtze River Economic Belt, 2001–2018. J Environ Manag 294:112939

Yao Y, Zhang M (2015) Subnational leaders and economic growth: evidence from Chinese cities. J Econ Growth 20:405–436

Ye L, Wu AM (2014) Urbanization, land development, and land financing: evidence from Chinese cities. J Urban Aff 36:354–368

Yu J, Zhou L-A, Zhu G (2016) Strategic interaction in political competition: evidence from spatial effects across Chinese cities. Reg Sci Urban Econ 57:23–37

Yu J, Zhou K, Yang S (2019) Land use efficiency and influencing factors of urban agglomerations in China. Land Use Policy 88:10414

Yu H, Song G, Li T, Liu Y (2020) Spatial pattern characteristics and influencing factors of green use efficiency of urban construction land in Jilin province. Complexity 2020:1–12

Zhang S, Yu Y (2019) Land lease, resource misallocation and total factor productivity. J Financ Econ 02:73–85 (In Chinese)

Zhang L, Xiong L, Cheng B, Yu C (2018) How does foreign trade influence China’s carbon productivity? Based on panel spatial lag model analysis. Struct Chang Econ Dyn 47:171–179

Zhang J, Zhang K, Zhao F (2020) Research on the regional spatial effects of green development and environmental governance in China based on a spatial autocorrelation model. Struct Chang Econ Dyn 55:1–11

Zhao Z, Bai Y, Wang G, Chen J, Yu J, Liu W (2018) Land eco-efficiency for new-type urbanization in the Beijing-Tianjin-Hebei region. Technol Forecast Soc Chang 137:19–26

Zhong Y, Lin A, He L, Zhou Z, Yuan M (2020) Spatiotemporal dynamics and driving forces of urban land-use expansion: a case study of the Yangtze River economic belt. China Remote Sensing 12:287

Zhong S, Li J, Zhao R (2021) Does environmental information disclosure promote sulfur dioxide (SO2) remove? New evidence from 113 cities in China. J Clean Prod 299:126906

Funding

We sincerely thank the following project for their support on the study: Special Project of Philosophy and Social Science Research in Heilongjiang Province (20GLD235) and General Project of Philosophy and Social Science Research in Heilongjiang Province (17GLB024).

Author information

Authors and Affiliations

Contributions

Shen Zhong: Conceptualization, resources, supervision. Xiaona Li: Methodology, software, data curation, investigation. Jun Ma: Formal analysis.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

This study involves the macro data of human economy and society. All the data are from the Statistical Yearbook. The data collection process is in line with the ethical and moral standards. The research method of this study is spatial econometric method, and there is no need for ethical approval and animal experiment content. The author guarantees that the process, content, and conclusion of this study do not violate the theory and moral principles.

Consent of publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhong, S., Li, X. & Ma, J. Impacts of land finance on green land use efficiency in the Yangtze River Economic Belt: a spatial econometrics analysis. Environ Sci Pollut Res 29, 56004–56022 (2022). https://doi.org/10.1007/s11356-022-19450-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19450-1