Abstract

The high technology (high-tech) industry of China has gained a key strategic position in the Chinese economic goals. In this positioning, foreign direct investment (FDI) and technological innovation have emerged as strong pillars of the high-tech industry. However, there are growing concerns of carbon emission from this industry which is still debatable. In this context, this study measures the effect of FDI and technology innovation on carbon emissions in the high-tech industry from 28 provinces of China. The study uses the provincial data for China over the period 2000–2018. In addition to examining unit root properties, structural breaks, and cointegration, this study uses quantile regression for estimating long-run relationships among study variables. The findings reveal the negative impact of FDI on carbon emissions. Technology innovation positively impacts in the initial three quantiles, whereas negatively impacts in the next six quantiles. These results indicate that FDI and technology innovation have shaped the energy intensity in the high-tech industry, which causes fluctuation in carbon emissions over time. After controlling the effects of urbanization, energy intensity, and economic growth, this study recommends that policymakers should emphasize on the heterogeneous effects of FDI and technology-lead emissions at different quantiles during the process of CO2 emission reduction.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The Paris Agreement, a worldwide agreement on global warming and climate change, announced by the USA in 2017 that the withdrawal of the agreement caused an uproar. As the largest developing country, China still adopts an active and stable carbon emission reduction routeFootnote 1 to cope with the unfavorable situation of high energy demand and overall backwardness of energy technology.

In 2012, the 18th National Congress of the Communist Party of China clearly stated that “scientific and technological innovation is strategic support for improving social productivity and comprehensive national strength and must be placed at the core position of the overall development of the country”. It is considered a major shift in economic growth mode, changing from the traditional labor-based and energy-resource drive to technological innovation. The adoption of high technology (high-tech) applicable technologies to transform and enhance the traditional production processing and modes in the industry and achieve a green development path that simultaneously looks at environmental performance and industrial competitiveness. This national strategic plan aims to achieve a contribution rate of science and technology more than 70% by 2020, constructing China an innovative-oriented nation. It also makes the weak position of China’s manufacturing at the low end of the global industrial chain fundamentally reversed and abandons the drawbacks of outstanding energy depletionFootnote 2.

According to Romer’s new economic growth theory, technological progress and technological innovation have become critical endogenous factors driving the growth. Energy consumption also plays one role in necessary inputs for resource-based development (Tang et al. 2016; Ahmad et al. 2016). The same direction of change between emission and growth is also reflected by the left side of the EKC (environmental Kuznets curve) inverted U-shaped (Dogan and Seker 2016; Ahmad et al. 2016). Yet, at this stage, the increase in income caused by economic growth still promotes the technology to affect emission reduction by indirect means such as attracting capital investment and promoting legal regulations (Andreoni and Levinson 2001). These theoretical assumptions have also been discussed in several contexts in recent years, including quantifying the effect of technical factors on environmental performance and exploring the nexus causality relationship with other critical variables such as energy consumption and economic growth (Zheng and Walsh 2019; Khan et al. 2020b). Moreover, China’s provincial regions show significant heterogeneity in economic and environmental performance (Cheong et al. 2019). In this context, this study finds the answer of research question that “how FDI and Technology Innovation mitigate CO2 emissions in high-tech industries of China?”.

Technology innovation promotes the culture of research and development (R&D) in the high-tech industry (Wei et al. 2019). It also induces more national and foreign investment. In recent years, China’s government has announced a series of policies to stimulate investment in high-tech industries, including expanding the entry threshold for foreign investment. The advantages of FDI spillover effects on promoting growth and adopting environmental friendly technologies will guide foreign investment into high-end manufacturing such as high-end smart and green manufacturing (Bano et al. 2019).

Due to China’s reform and opening up, the eastern region has taken advantage of the rise of geographical pluses, presenting the features of the industry and population agglomeration (Zheng and Walsh 2019). This urbanization process acceleration has been the trigger of high levels of (carbon dioxide) CO2 emissions. As per China Statistics Yearbook on High Technology Industry (2016), the high-tech industry, one catalog of the manufacturing, represents different distribution characteristics of “intensive-east and sparse-west.” In 2016, the main business income of high-tech industries in the eastern region accounted for 70.33%, besides the western region only 1.16%.Footnote 3 The investment amount accounted for 47.24% in the east and 17.80% in the west. The energy intensity in the eastern region is 0.4935 t of standard coal per 10,000 yuan, while that in the west is 0.7202 t of standard coal per 10,000 yuan; the eastern region bears most of the CO2 emissions with 4402.32 mt, while the western region accounts for 20.84% of the total, only 2338.70 mtFootnote 4. As China’s preferential policy toward the western has been tilted in recent years, investment has remarkably grown in this region, with an average annual growth rate of around 30% in the past 5 years. The unevenness of innovation input and environmental performance caused by regional differences has become a factor that cannot be ignored when analyzing and evaluating the role of innovation impact. Also, it illustrates the necessity of comprehensive analysis from the perspective of clustering.

The high-tech industry has always been the industry that the Chinese government emphasizes is no longer a separate development. The objective of the government has been to update the traditional industries to new advance level through the technology spillover and diffusion effects. Especially in the face of the disruptive impact of high uncertainty and social restructuring, endogenous innovation has become the engine. As such a carrier, the high-tech industry serves as a pioneer in adapting to the economical characteristics of the current stage to achieve innovation driven. From this perspective, reviewing the existing literature research, we have not found a discussion on the impact of China’s high-tech industry innovation on the overall environmental performance at the regional level, especially for CO2 emissions. The relationship is also unclear; therefore, the gap exists in assessing innovations for regional emissions and environmental policy benefits in high-tech industries. Considering the urgent practical significance of the development of high-tech industry, we analyzed whether China’s high-tech industry technology innovation is conducive to reducing regional CO2 emissions and summed up relevant conclusions to demonstrate whether the spillover effect of technological innovation in key industries has promoted the improvement of the overall industry and the achievement of overall emission reduction targets.

The contributions of this paper are summarized as follows: Even though an increasing number of studies have concentrated on the impact of FDI on the environment, there is still no agreement in the area, and the effect of FDI on environmental sustainability is still unclear. Furthermore, evidence from developing economies is insufficient. This article fills this gap in the current literature and takes China as the focus of research that faces extreme environmental pressure and rapid growth. This paper uses the CO2 emission data calculated by the Apparent Emission Accounting Approach (Shan et al. 2016) and discusses the relationship between high-tech industry innovation and long-term cointegration in 28 provinces from 2000 to 2018. FDI, urbanization, and energy intensity were included in the augmented function. Current manuscript investigates how do FDI and Technology Innovation mitigate CO2 emissions in high-tech industries of China. Secondly, the methodological contribution of this paper to apply second generation panel unit root CIPS and CADF tests in the presence of cross-section dependence. The method of Westerlund and Edgerton (2008) was used in the illustration of structural breaks in cointegration which is ignored by previous studies.

Furthermore, the majority of previous research has used conditional mean (CM) methods, including autoregressive distributed lag (Sarkodie and Adams 2018), OLS (Jebli et al. 2016), fully modified OLS (Lau et al. 2019), dynamic OLS (Dong et al. 2018), and fixed effects regression (Nassani et al. 2017). CM analyses can only provide a mean estimate of the entire sample’s effects and cannot give a complete picture of emissions and their main related factors. These approaches are often unconcerned about the panel data’s heterogeneity, which may contribute to biased findings (Destek and Sarkodie 2019). The bootstrapped quantile regression assesses the coefficients at various quantiles and provides a clear picture of the entire sample. In comparison to these studies, we concentrate on the individual heterogeneity of the panel data by using bootstrapped quantile regression from three emission levels. Finally, this research result has significant policy implications for China and contributes to current literature on technology innovation and CO2 emissions.

Literature review

Technology innovation is an essential contributor to energy intensity reduction (Fisher-Vanden et al. 2004) and environmental quality improvement (Yu and Du 2019). The studies on measurements of the impact of technology innovation on environmental performance can be summarized as follows: at the point of the process of technological innovation, the following are two aspects: innovation input and output. The former mainly includes R&D with indigenous self-research, which primarily refers to innovation in specific units, such as countries or the sectors. Some research steam recently considered R&D as an indicator of technology innovation to discuss how it works against environmental degradation (Lee et al. 2015). We have conducted a detailed literature overview on this area. Technology innovation is indirectly realized through the introduction, purchase, imitation, and absorption of the vast number of developing countries and emerging economies. The spillover and diffusion effect of FDI and trade cooperation have also become critical drivers for innovation (Ahmad et al. 2016). Innovative outputs are reflected in patent licensing and applications, new technology revenues, and specific energy-saving technology applications. In the following, the existing research is briefly summarized, and the contribution of this paper is highlighted again.

With a standard structure method, Kong et al. (2016) revealed that high-tech industry in 25 emerging nations could greatly enhance pulp and paper technology to minimize energy consumption and CO2 emissions. Sgobbi et al. (2016) used the JRC-EU-TIMES model to evaluate the impact of technical progress on the use of the high-tech marine energy sector in European countries. The results showed that marine energy technology upgrades may obviously boost marine energy supply and reduce CO2 emissions. Wiebe (2016) has also researched the application of high-tech in the energy industry of European countries with the input output technique and has discovered that the high-tech sector might increase the power industry’s energy efficiency. This would greatly cut the energy industry’s coal use and CO2 emissions. In addition, Lee et al. (2017) studied the influence of high-tech environmental protection business on decrease of CO2 emissions in Asian countries. The results demonstrated that low-carbon, green vehicles and energy-saving technology were becoming more and more significant for reducing CO2 emissions. McDowall et al. (2018) examined the contribution of the emerging high-tech energy industries to European countries’ control of the fossil energy consumption and reduction of CO2 emissions. Using an environmentally expanded input-output model, they discovered that photovoltaic industry development has reduced the total CO2 emissions by 7%.

The widespread recognition of the new economic growth theory has made R&D closely linked to economic growth and environmental performance. In industries that are strictly related to energy consumption, increasing R&D investment and proper allocation of funds are also regarded as complementing the innovation dynamics of energy technologies that benefit environmental conditions (Inglesi-Lotz 2017). In recent years, Kahouli (2018) analyzed the two-way causality links between electricity, R&D stock, CO2 emissions, and economic growth in 18 Mediterranean economies, and the results show unidirectional causality among R&D stocks and economic growth as well as between R&D stocks and CO2 emissions. Besides, by ordinary least square (OLS) estimation, Fernández Fernández et al. (2018) discussed the influence of R&D on CO2 emission in the European Union EU (15), the USA, and China from 1990 and 2013, respectively. R&D indicates positive effects on carbon emissions in the EU and the USA, yet the opposite in China. Lee and Min (2015) investigated the link between green R&D and carbon emissions and reported positive link of them in the Japanese manufacturing firms during 2001–2010. Garrone and Grilli (2010) adopted a causality analysis method to explore the relationship between public energy R&D and carbon emissions per GDP (carbon intensity) at the country level in 13 advanced economies over the 1980–2004 period. However, their results did not show a significant impact on carbon emission. Zhang et al. (2017b) estimated that the innovation resources and knowledge innovation are conducive for carbon reduction in China’s 30 provinces in years of 2000–2013. Similarly, Yu and Du (2019) also discussed the impact of indigenous R&D and interregional R&D on overall Industrial CO2 intensity from 1999 to 2015 at the provincial level in China. Similar studies include but are not limited to Koçak and Ulucak (2019).

R&D activities play fundamental driving forces to energy technology patents which widely measure the innovation performance for emission abatement (Li and Lin 2016; Ponce and Khan 2021). Therefore, a patent is also applied as an indicator of technology innovation. Considering the availability and statistical consistency of the data and following Ang (2009), Tang and Tan (2013), and Samargandi (2017), we adopt the number of patents to indicate technology innovation. Some research discusses the environmental effect of FDI, and trade has placed it in the context of EKC to explore the nexus relationship between economic growth and environmental degradation. For example, Lau et al. (2014), taking Malaysia from 1970 to 2008, investigated the effect of FDI and trade openness on the EKC curve in the short and long term. It is also found that both FDI and trade lead to environmental degradation. Also, strong evidence of bi-directional causality exists between CO2 and economic growth and FDI and economic growth. Sapkota and Bastola (2017) used the time series data from 14 Latin American countries in 1980–2010 to estimate the effects of FDI and income on pollution emissions. The results show that the pollution haven hypothesis (PHH) and the EKC are tenable, and the effectiveness of PHH is still established in high- and low-income countries. Other studies deployed causality analysis applications to discuss the impact of FDI and trade as Sbia et al. (2014) examined the causality between FDI, clean energy, trade openness, carbon emissions, and energy demand in the United Arab Emirates utilizing the VECM granger approach. Similar studies in recent years have included Lee (2013), Baek (2016), Hille et al. (2019), and Bano et al. (2019).

Further, urbanization is closely related to economic growth, accompanied by the transfer of labor from primary agriculture to industry-clustered urban. Therefore, urbanization is also an essential factor in causing environmental pressure (Wang et al. 2016c; Parveen and Ahmad 2020). Recently, research has focused on exploring the relationship between urbanization and carbon emission from an international perspective. Zhang et al. (2017a) found an inverted U-shaped relationship between urbanization and carbon emissions among the OECD countries, and the inverted point was 73.8% on urbanization. Sadorsky (2014) examined the effects of urbanization on CO2 emissions in 16 emerging countries during 1971–2009, and the results reflect statistically non-significant outcomes in most estimated specifications. Similar studies include: (Martínez-Zarzoso and Maruotti 2011; Al-mulali et al. 2013) used China's provincial panel data combined with the STIRPAT model. It is concluded from the regional level that urbanization in the central region contributes more to the CO2 emissions than it works in the eastern region. Similar conclusions have been supported by Wang et al. (2016a), and it validated the relevant arguments of the urban environmental transition theory with panel data from 1990 to 2012 in China. The results also show evidence that the eastern region with high urbanization has a more negligible impact on energy consumption and CO2 emissions than the western and central regions.

In summary, this article looks at China’s high-tech industries and uses patent data to explore the impact of technological innovations in specific critical industries on overall CO2 emissions. To a certain extent, it is regarded as a positive complement to relevant research. Simultaneously, according to the characteristics of high-tech industry in attracting foreign investment and industrial layout, FDI and urbanization are introduced as significant explanatory variables in this paper, and a comprehensive attempt is made for the environmental benefits of investigating technology innovation.

Methodology and data

This present study examines the effect of technology and FDI on carbon emissions by controlling China’s urbanization, energy intensity, and economic growth. Carbon emissions are considered the main greenhouse gas responsible for global warming, as previously indicated. Our main interest variables are FDI and the technology innovation that affects carbon emissions. We used patents as a technological innovation proxy. The following long-term carbon emission model is used in this study:

The model variables are log-transformed for empirical estimation so that data sharpness is reduced, and variables have improved distributional properties. The natural logarithmic conversion helps in the removal of autocorrelation and heteroskedasticity problems from data. The results obtained from log-transformed models are more robust and efficient than those obtained from linear transformations (Majeed et al. 2013, 2021; Xiaoman et al. 2021). The following is the log-linear form of augmented carbon emissions:

where φ2, φ3 , φ3, and φ5 are the coefficients of foreign direct investment (FDI), income (GDP), urbanization (URB), technology (Tech), and energy intensity (EI). Table 1 indicates the variables employed in this research, along with their data sources.

Econometric methodology

We start our analysis by checking cross-sectional dependence and unit root properties. Then we check the panel cointegration with structural breaks. In the end, we employ bootstrapped panel quantile regression to examine the long-run associations.

Cross-sectional dependence (CD)

Before testing the stationarity properties and the long-run association between the variables, we incorporate a cross-sectional dependence (CD) analysis that has been introduced by Pesaran (2004). Because the panel data typically display CD, provinces are interconnected at the country and regional level. If the research findings do not evaluate CD, the estimation methods would be inconsistent and bias (Phillips and Sul 2003; Paramati et al. 2017). Thus, the CD must be examined in the panel data. In this analysis, we used the CD test formed by Pesaran (2004). The below equation for the CD assay is given as:

where sample size is signified by N, time is shown by T, and ρij demonstrates the cross-sectional error correlation estimation of province i and j.

Unit root tests

In the energy economics literature, the second-generation panel unit root tests have gained popularity for the reason that the outcomes of the first-generation unit root analysis are unreliable in the existence of CD (Zafar et al. 2019). Thus, this research used cross-sectional-augmented IPS and cross-sectional-augmented ADF, also known as CIPS and CADF, to examine the stationarity of the variables. Besides, the credibility of the analyses improves by utilizing the appropriate unit root checks within a panel data in the existence of CD. Pesaran (2007) developed the following equation of the IPS cross-section augmented to evaluate the unit root:

where difference operator is denoted by Δ, evaluated variable shown by xi, t, individual intercept expressed by α, time trend represented by T, and error term explained by εit. The Schwarz Information Criterion approach defines the lag length. For both measures, the null hypothesis is that neither variable is stationary against the alternative hypothesis; within a time series of panel data, at least one individual is stationary.

Panel cointegration test

Before estimating the long-term parameters, we confirm that cointegration persists or not between the variables. As the panel cointegration tests of the first and second generation cannot jointly cope with structural breaks and CD, i.e., (McCoskey and Kao 1998); (Pedroni 2004); (Larsson et al. 2001); (Westerlund 2005); (Westerlund 2007). According to Phillips and Sul (2003), traditional cointegration techniques give deceptive and unreliable findings when the model endures from CD and heteroscedasticity. Therefore, this article employed the Durbin Hausman group mean (DHGM) cointegration measure developed by Westerlund and Edgerton (2008), an advanced method and robust not only for CD but also incorporates multiple structural breaks. Westerlund and Edgerton (2008) approach examine the series through the structural break and regime shift. Westerlund and Edgerton (2008) cointegration analysis presume that under null hypotheses indicate no cointegration against the alternative hypothesis of long-term relationships among variables. Thus, this analysis should first employ (Westerlund and Edgerton 2008) the panel cointegration method before obtaining a long-run estimate. The equation for the (Westerlund and Edgerton 2008) cointegration analysis is described as:

Quantile regression

The quantile regression (QR) technique was initially presented by Koenker and Bassett (1978). This approach helps take maximum advantage of the data sample to conduct regression examination based on distinct quantile points. Therefore, QR can also employ a conditional quantile approximation, in which each function defines the performance of every particular aspect in the conditional probability distribution. The QR technique has been one of the primary research directions for econometrics in the past few years. It has been extensively employed in economics and environmental fields (Zhu et al. 2016; Xu and Lin 2016). As a result, this analysis uses a QR model to show the different effects of the driving factors on the real distribution of carbon emissions by the high-tech (H-T) industry. The standard equation for panel data assessment is as shown in:

where y represents the independent variable, x is a vector of the explanatory variables, and μ signifies a random disturbance, in which conditional quantile distribution is identical to zero. Quantθ(Yi| Xi) implies the θth quantile of the response variable y. The QR method helps one assess the impacts of covariates at various positions in disseminating the independent variables. The θth QR estimation is βθ, which is the formula for the following equations:

By linear programming, the above equation acquires the solutions. A specific case of QR is the median regression and is accessed by presuming θ 0.5. By setting diverse θ values, we can get the various quantiles. In order to extract the relations among the independent variables and the distinct conditional distribution of the explanatory variables, we can set 0.1th, 0.2th, 0.3th, 0.4th, 0.5th, 0.6th, 0.7th, 0.8th, and 90th quantiles. We employ the bootstrap approach suggested by Buchinsky (1995) to achieve a standard deviation of the QR variables. Due to its consistency and robustness, QR is an incredibly important estimation technique, particularly when the error term is not a normal distribution and has a heteroscedasticity problem.

Results and discussion

The empirical evaluation starts with the check of the CD in the model. The assessment of CD has become the key focus of the current literature. The failure to manage the CD could generate biased outcomes (Ahmed et al. 2020). The outcomes of the CD are described in Table 2. The findings are significant at the 1% significance level and confirm the rejection of the null hypothesis. The findings of Table 2 verify the existence of CD. The existence of the CD allows the use of second-generation unit root assessments to analyze the integration order of the variables. For such a reason, CADF and CIPS panel unit root tests are employed, and Table 3 summarizes the findings of both tests. The CIPS test’s empirical outcomes show that urbanization (U) and EI have a unit root at the level. These variables have no unit root in the first difference, and they are integrated at I (1). The CADF panel unit root test findings reveal the existence of unit root at the level, and all variables are stationary at the first difference.

The long-run cointegration relationship was assessed by employing Westerlund and Edgerton cointegration technique. The significant test statistics of τ and ϕ imply a long-term relation between independent and dependent variables in Table 4, no shift, level shift, and regime shift. Table 5 presents the structural breakpoints of each province. The findings found many structural breaks. In particular, we have observed multiple structural break periods that are 2002, 2003, 2004, 2005, 2006, 2007, 2008, 2010, 2011, 2012, 2013, and 2014. These breaks influence both country shocks and local shocks for each selected province. In this study, we applied the bootstrap QR technique to contemplate the limitation of the conditional mean regression approach.

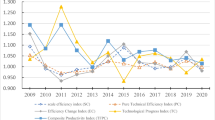

The heterogeneous effects of FDI, GDP, U, technology, and EI on CO2 emissions are presented in Table 6 and Fig. 1. The distribution characteristics of CO2 emissions can be completely expressed in each quantile, and the QR can visually show the marginal impact of the independent variable on distinct CO2 emissions quantiles. Thus, this study presents the QR findings of CO2 emissions in the H-T industry in China. We selected nine representative quantiles (i.e., 0.1th, 0.2th, 0.3th, 0.4th, 0.5th, 0.6th, 0.7th, 0.8th, and 90th) to apply the QR. The effect of FDI on carbon emission is heterogeneous. The regression findings in Table 5 demonstrate an upsurge in FDI corresponds with a decrease in carbon emission. This result matches with the result of Cheng et al. (2019). Yet again, the effects are asymmetric, and the values of the coefficients are marginally lower at 0.1th to 0.3th quantiles and then increase to 0.445 to 0.636 in the 04th to 06th quantile and soar subsequently. In the beginning, the adverse effects of FDI decrease marginally, then escalate to the 0.8th quantile, and reduce from the 0.9th quantile. Furthermore, the coefficients are statistically significant at low emissions, medium emissions, and high emissions. FDI inflow serves as the pool of capital for China’s economic growth (GDP) and helps promote domestic technology through the spillover effect.

This, in essence, speeds up the growth of the economy, which is seen as the fundamental source of growth in the economy. China has become a significant market for FDI as an attractive hub in the foreign investment network, even as it has produced a globally famous “China miracle” (Zhu et al. 2019). The findings demonstrate that augmented FDI can minimize environmental degradation, indicating the “pollution halo hypothesis.” Therefore, consistent with the halo effect, our results prove that FDI enhances environmental quality by incorporating clean technologies and skills, thus delivering significant benefits (Zhang and Zhou 2016; Doytch and Uctum 2016; Sun et al. 2017). The practical implementation of foreign capital is also good for sustainable government development. So, the halo pollution hypothesis claims that FDI offers advanced production technologies and management expertise to developing nations, helping them achieve sustainable and environmentally friendly production and enhancing global and regional environmental quality competencies (Liu et al. 2017). Some research backs up the pollution halo hypothesis (Zhang and Zhou 2016; Hao et al. 2020), while some others have backed the pollution haven hypothesis (Jiang 2015; Sun et al. 2017).

Technology has a significant effect in 0.1th quantile while insignificant on 0.2th and 0.3th quantile. Further, it has a significant effect on CO2 emission from 0.4th to 0.9th quantile in medium and high emissions. The strongest driver for GDP is technology. The government of China has initiated a “market for technology” policy since the 1980s, aiming to switch to the latest technology brought by FDI with a massive global marketplace, thereby pushing the current level of technology in China. This finding endorses the results of Hao and Liu (2015). Therefore, technology increases the productivity of the resources, promotes the production and use of renewable energy, and reduces environmental degradation (Lin and Zhu 2019; Khan et al. 2020a). The explanation why FDI can minimize environmental emissions by advanced technology may be that FDI relates to the spillover impact that can be accomplished via workers stream, market exposition, competitive pressures, and imitation of learning (Liu et al. 2017; Zhu et al. 2019; Ponce et al. 2020a, b). Further, the H-T industry attracts foreign capital, such as FDI, attracting a significant number of skilled and professional workers, increasing labor efficiency, and decreasing carbon emissions. At the same time, H-T companies gather at shared locations such as electric power stations, waste treatment facilities, pollution treatment, and other facilities to lessen CO2 emissions. The knowledge spread of the H-T industry is advantageous to creativity and the development and dissemination of new technology. H-T industry congregation offers a strong external framework for businesses to use emerging technology, new processes, and new management techniques. H-T industries reduce CO2 emissions by using modern resource-saving technologies.

The execution of the reforms and opening-up strategy has significantly supported Chinese GDP. The primary objective of all economies is to increase GDP. Therefore, the impacts of GDP on carbon emission in the medium and high emissions from 0.4th to 0.8th quantiles are higher and significant than other quantiles (Lin and Xu 2017). It indicates that GDP is a substantial factor in increasing carbon emissions. The predicted outcome is compatible with the results of Wang et al. (2016b). The findings indicate that GDP shows a major role in the development of carbon emissions. GDP upsurges CO2 emissions in China primarily via two channels, first, investment in fixed assets in the H-T industry. It is well established that the three primary driving forces of GDP are fixed asset investment, domestic demand, and exports (Xu and Lin 2017). Investment in fixed assets is the most significant factor of GDP in China for a long time. Investment in fixed assets consumes tons of iron and steel and cement products, consumes plentiful coal, and emits large-scale carbon emissions (Xu and Lin 2018).

The outcome of U on carbon emissions, except for 0.1 and 0.2 quantiles, is statistically significant in all other quantiles. U effect on carbon emissions shows a growing pattern in all listed quantities. U has a more substantial impact on carbon emissions at the higher quantiles. For all countries, U is a critical step in modern social growth. China’s U has grown steadily in recent years, and the rate of U rose from 36.2 percent in 2000 to 56.1 percent in 2015. U leads to a rapid expansion of the urban population and a rapid rise in household income. On the other hand, the growing urban population would demand a lot of resources. On the other side, growing incomes allow urban residents to buy and use motor vehicles that would eventually utilize large fossil fuels and emit many carbon emissions (Mi et al. 2016; Lin and Xu 2017;Yu et al. n.d.).

Several research scholars have utilized EI to investigate the effect of technological advances on carbon emissions (Lin and Xu 2017; Nathaniel and Khan 2020). EI shows an insignificant negative impact on CO2 in low emissions. It indicates that the EI of the H-T industry is steadily decreasing with the advancement of manufacture and energy-saving technologies (Lin and Xu 2017). The effect of EI on carbon emissions is positive and significant in medium and high emissions quantiles. The positive coefficient of EI in the upper quantiles shows that innovations for environmental conservation and energy usage are minimal and did not perform an integral part in lowering carbon emissions (Du et al. 2012). It is primarily due to research and development financing and research and development human resources investments. Improvements in environmental conservation and energy use technology require a lot of investment in research and development. Firstly, a significant gap in the funding of new products for research and development contributes to different energy consumption technologies (Ponce et al. 2020a, 2021). Any technological and scientific advancement needs large-scale support for research and development to minimize carbon emission (Filipescu et al. 2013). Figure 1 describes the impact of independent variables on CO2 emissions is heterogeneous in various quantiles.

Limitation

Due to data limitations, this article only looks at the connection between FDI, technological innovation, and carbon emissions at the regional level. It does not employ data from cities or industries. When using data at the city or industry level, empirical examination of FDI, technological innovation, and carbon emissions can be more detailed and reliable. We used the only available data of patents to represent technology innovation.

Conclusion

China has become the world’s leading CO2 emitter. Furthermore, CO2 emissions in China tend to grow due to the country’s rapid urbanization and industrialization. As a result, actively evolving technological innovation is an unavoidable option for reducing CO2 emissions now and in the future. The majority of the current literature examines the effect of the high-tech industry on pollution reduction from a broad perspective. Only a few studies have examined the differences among the various provinces of China. The current study uses the provincial data for China over the period 2000–2018. This study investigates the impact of technology and FDI on emissions intensity by controlling the role of urbanization, energy intensity, and economic growth in the high-tech industry. To achieve the study objective, we perform second-generation panel unit root and cointegration analyses to examine the stationary properties and long-run relationship between the variables. The panel bootstrapped quantile regression is used to estimate the varying relationships over distinct quantiles Table 6.

The results report the negative impact of FDI on carbon emissions. FDI inflows can help to build managerial and specialized technical skills and developments in production techniques in high-emission countries; such technologies can also be indirectly transferred through backward or forward ties to domestic firms. In these high-emission regions, multinational corporations will also have more sophisticated technologies than their competitors. They may prefer to disseminate cleaner technology that will be less detrimental to the environment. Therefore, a rise in FDI in high-emission areas increases the environmental efficiency of the regions. It shows that the halo effect hypothesis is true in China’s high-emission provinces. We recommend carrying on FDI inflows in the high-tech industry.

Technology innovation has levered the economic growth of China amid the high competition around the globe. Technology has a positive effect on the first three quantiles, while the next six quantiles negatively affect. Policymakers need to focus urgently on optimizing the impact of ecological innovation to promote the natural environment. Governments should support technological initiatives to encourage green policies to mitigate environmental and social problems. In order to define green standards for innovations that can enhance environmental efficiency, it is also necessary to set benchmarks. Innovation relevant to the world creates a consumer forum that helps businesses to share innovations and benefits while cultivating deep synergies.

The foregoing results have significant political ramifications. In order to speed up the construction of low-carbon economies, the central government should adopt significant measures to encourage the development of the high technology industry. First, the high-tech industry has direct links to energy consumption and CO2 emissions in high-speed trains and new energy-powered cars, new energy, resource utilization, and environmental protection high-tech industries. In addition, China is now facing several obstacles in developing a new, high-tech energy industry, such as inadequate economic policy incentives, an unsatisfactory mechanism for market protection, and a flawed technical service system. Governments at all levels should therefore set up specific funds to promote new high-tech energy industries and to advise and encourage social capital to invest in new high-tech energy companies and to encourage qualifying companies to enter the bond market. Second, governments of all levels should encourage and support inhabitants for the purchase, use, and promotion of low carbon lifestyles of high technology products. Low-carbon living signifies a lifestyle with low CO2 emissions, cheap energy usage, and low cost. Local governments should therefore encourage inhabitants to buy and use solar water heaters, new energy vehicles, and public transport for new energy purposes. Third, specific steps should be taken by government to support and fund the transformation of traditional high-tech equipment industries. The local governments, on the one hand, should speed up high-tech industrial park construction and further increase the impact of high-tech industrial parks at the national and provincial levels in order to alter traditional industries. On the other side, the government should encourage and support the use of industrial robots, clean-fuel engines, and technology for recycling carbon dioxide (e.g., iron and steel, equipment, and petrochemical) to reduce energy consumption and CO2 emission levels.

Further, from the standpoint of the industrial system, the government must progressively adapt to a transforming industry sector with a large proportion of high-tech firms by adjusting technological innovation. China should encourage the development of tertiary industry via technological innovation, FDI, and urbanization approach to meeting the material needs of growth in the economy while also achieving a low-carbon economy. In light of the recent issues raised regarding the environment, the Chinese government should continue implementing greenfield investment and high-technology that address environmental concerns. The Chinese government, in particular, should establish and enact policies that require Chinese firms to obtain FDI to use and share environmental-friendly technologies (Zhang and Zhou 2016).

Future research may analyze this impact through other proxies, which may potentially affect CO2 emissions. Similarly, the contribution of human capital in this linkage may be analyzed for improved recommendations. Furthermore, CO2 emissions are just one component of human activities that have an impact on the environment. Water, soil, biological, and climate resources are all part of the ecological environment. As a consideration, the effect of FDI and technological innovation on the ecological environment, such as water and land footprints, can be explored in the future.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Change history

29 December 2022

A Correction to this paper has been published: https://doi.org/10.1007/s11356-022-25007-z

Notes

Energy Development Strategic Action Plan 2014–2020 http://www.nea.gov.cn/2014-12/03/c_133830458.htm

The State Council issued the “Outline of National Innovation Driven Development Strategy” http://www.gov.cn/xinwen/2016-05/19/content_5074812.htm.

The results based on the relevant data of China Statistics Yearbook on High Technology Industry. The yearbook has provided classifications of eastern, central, and western regions.

The results based on the relevant data of China energy statistics yearbook, China Statistical Yearbook.

References

Ahmad A, Zhao Y, Shahbaz M, Bano S, Zhang Z, Wang S, Liu Y (2016) Carbon emissions, energy consumption and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96:131–143. https://doi.org/10.1016/j.enpol.2016.05.032

Ahmed Z, Zafar MW, Ali S, Danish (2020) Linking urbanization, human capital, and the ecological footprint in G7 countries: an empirical analysis. Sustain Cities Soc 55:102064. https://doi.org/10.1016/j.scs.2020.102064

Al-mulali U, Fereidouni HG, Lee JYM, Sab CNBC (2013) Exploring the relationship between urbanization, energy consumption, and CO2 emission in MENA countries. Renew Sust Energ Rev 23:107–112. https://doi.org/10.1016/j.rser.2013.02.041

Andreoni J, Levinson A (2001) The simple analytics of the environmental Kuznets curve. J Public Econ 80:269–286. https://doi.org/10.1016/S0047-2727(00)00110-9

Ang JB (2009) CO2 emissions, research and technology transfer in China. Ecol Econ 68:2658–2665. https://doi.org/10.1016/j.ecolecon.2009.05.002

Baek J (2016) A new look at the FDI–income–energy–environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91:22–27. https://doi.org/10.1016/j.enpol.2015.12.045

Bano S, Zhao Y, Ahmad A, Wang S, Liu Y (2019) Why did FDI inflows of Pakistan decline? From the perspective of terrorism, energy shortage, financial instability, and political instability. Emerg Mark Financ Trade 55:90–104. https://doi.org/10.1080/1540496X.2018.1504207

Buchinsky M (1995) Estimating the asymptotic covariance matrix for quantile regression models a Monte Carlo study. J Econ 68:303–338. https://doi.org/10.1016/0304-4076(94)01652-G

Cheng C, Ren X, Wang Z, Yan C (2019) Heterogeneous impacts of renewable energy and environmental patents on CO 2 emission - evidence from the BRIICS. Sci Total Environ 668:1328–1338. https://doi.org/10.1016/j.scitotenv.2019.02.063

Cheong TS, Li VJ, Shi X (2019) Regional disparity and convergence of electricity consumption in China: a distribution dynamics approach. China Econ Rev 58:101154. https://doi.org/10.1016/j.chieco.2018.02.003

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Dogan E, Seker F (2016) An investigation on the determinants of carbon emissions for OECD countries: empirical evidence from panel models robust to heterogeneity and cross-sectional dependence. Environ Sci Pollut Res 23:14646–14655. https://doi.org/10.1007/s11356-016-6632-2

Dong K, Sun R, Dong X (2018) CO2 emissions, natural gas and renewables, economic growth: assessing the evidence from China. Sci Total Environ 640–641:293–302. https://doi.org/10.1016/j.scitotenv.2018.05.322

Doytch N, Uctum M (2016) Globalization and the environmental impact of sectoral FDI. Econ Syst 40:582–594. https://doi.org/10.1016/j.ecosys.2016.02.005

Du L, Wei C, Cai S (2012) Economic development and carbon dioxide emissions in China: provincial panel data analysis. China Econ Rev 23:371–384. https://doi.org/10.1016/j.chieco.2012.02.004

Fernández Fernández Y, Fernández López MA, Olmedillas Blanco B (2018) Innovation for sustainability: the impact of R&D spending on CO2 emissions. J Clean Prod 172:3459–3467. https://doi.org/10.1016/j.jclepro.2017.11.001

Filipescu DA, Prashantham S, Rialp A, Rialp J (2013) Technological innovation and exports: unpacking their reciprocal causality. J Int Mark 21:23–38. https://doi.org/10.1509/jim.12.0099

Fisher-Vanden K, Jefferson GH, Liu H, Tao Q (2004) What is driving China’s decline in energy intensity? Resour Energy Econ 26:77–97. https://doi.org/10.1016/j.reseneeco.2003.07.002

Garrone P, Grilli L (2010) Is there a relationship between public expenditures in energy R&D and carbon emissions per GDP? An empirical investigation. Energy Policy 38:5600–5613. https://doi.org/10.1016/j.enpol.2010.04.057

Hao Y, Liu YM (2015) Has the development of FDI and foreign trade contributed to China’s CO2 emissions? An empirical study with provincial panel data. Nat Hazards 76:1079–1091. https://doi.org/10.1007/s11069-014-1534-4

Hao Y, Wu Y, Wu H, Ren S (2020) How do FDI and technical innovation affect environmental quality? Evidence from China. Environ Sci Pollut Res 27:7835–7850. https://doi.org/10.1007/s11356-019-07411-0

Hille E, Shahbaz M, Moosa I (2019) The impact of FDI on regional air pollution in the Republic of Korea: a way ahead to achieve the green growth strategy? Energy Econ 81:308–326. https://doi.org/10.1016/j.eneco.2019.04.004

Inglesi-Lotz R (2017) Social rate of return to R&D on various energy technologies: where should we invest more? A study of G7 countries. Energy Policy 101:521–525. https://doi.org/10.1016/j.enpol.2016.10.043

Jebli MB, Youssef SB, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831. https://doi.org/10.1016/j.ecolind.2015.08.031

Jiang Y (2015) Foreign direct investment, pollution, and the environmental quality: a model with empirical evidence from the Chinese regions. Int Trade J 29:212–227. https://doi.org/10.1080/08853908.2014.1001538

Kahouli B (2018) The causality link between energy electricity consumption, CO2 emissions, R&D stocks and economic growth in Mediterranean countries (MCs). Energy 145:388–399. https://doi.org/10.1016/j.energy.2017.12.136

Khan SAR, Yu Z, Belhadi A, Mardani A (2020a) Investigating the effects of renewable energy on international trade and environmental quality. J Environ Manag 272:111089. https://doi.org/10.1016/j.jenvman.2020.111089

Khan SAR, Yu Z, Sharif A, Golpîra H (2020b) Determinants of economic growth and environmental sustainability in South Asian Association for Regional Cooperation: evidence from panel ARDL. Environ Sci Pollut Res 27:45675–45687. https://doi.org/10.1007/s11356-020-10410-1

Koçak E, Ulucak ZŞ (2019) The effect of energy R&D expenditures on CO2 emission reduction: estimation of the STIRPAT model for OECD countries. Environ Sci Pollut Res 26:14328–14338. https://doi.org/10.1007/s11356-019-04712-2

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46:33. https://doi.org/10.2307/1913643

Kong L, Hasanbeigi A, Price L (2016) Assessment of emerging energy-efficiency technologies for the pulp and paper industry: a technical review. J Clean Prod 122:5–28. https://doi.org/10.1016/j.jclepro.2015.12.116

Larsson R, Lyhagen J, Löthgren M (2001) Likelihood-based cointegration tests in heterogeneous panels. Econ J 4:109–142. https://doi.org/10.1111/1368-423x.00059

Lau LS, Choong CK, Eng YK (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: DO foreign direct investment and trade matter? Energy Policy 68:490–497. https://doi.org/10.1016/j.enpol.2014.01.002

Lau LS, Choong CK, Ng CF, Liew FM, Ching SL (2019) Is nuclear energy clean? Revisit of Environmental Kuznets Curve hypothesis in OECD countries. Econ Model 77:12–20. https://doi.org/10.1016/j.econmod.2018.09.015

Lee JW (2013) The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55:483–489. https://doi.org/10.1016/j.enpol.2012.12.039

Lee KH, Min B (2015) Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J Clean Prod 108:534–542. https://doi.org/10.1016/j.jclepro.2015.05.114

Lee K-H, Min B, Yook K-H (2015) The impacts of carbon (CO2) emissions and environmental research and development (R&D) investment on firm performance. Int J Prod Econ 167:1–11. https://doi.org/10.1016/j.ijpe.2015.05.018

Lee CT, Hashim H, Ho CS, Fan YV, Klemeš JJ (2017) Sustaining the low-carbon emission development in Asia and beyond: sustainable energy, water, transportation and low-carbon emission technology. J Clean Prod 146:1–13. https://doi.org/10.1016/j.jclepro.2016.11.144

Li K, Lin B (2016) Impact of energy technology patents in China: evidence from a panel cointegration and error correction model. Energy Policy 89:214–223. https://doi.org/10.1016/j.enpol.2015.11.034

Lin B, Du K (2013) Technology gap and China’s regional energy efficiency: a parametric metafrontier approach. Energy Econ 40:529–536. https://doi.org/10.1016/j.eneco.2013.08.013

Lin B, Xu B (2017) Which provinces should pay more attention to CO2 emissions? Using the quantile regression to investigate China’s manufacturing industry. J Clean Prod 164:980–993. https://doi.org/10.1016/j.jclepro.2017.07.022

Lin B, Zhu J (2019) Determinants of renewable energy technological innovation in China under CO2 emissions constraint. J Environ Manag 247:662–671. https://doi.org/10.1016/j.jenvman.2019.06.121

Liu Y, Hao Y, Gao Y (2017) The environmental consequences of domestic and foreign investment: evidence from China. Energy Policy 108:271–280. https://doi.org/10.1016/j.enpol.2017.05.055

Majeed A, Naveed F, Sohaib M et al (2013) Learning environment of manufacturing and service sectors of Pakistan: a comparison. Int J Manag Organ Stud 2:55–61

Majeed A, Wang L, Zhang X, Muniba, Kirikkaleli D (2021) Modeling the dynamic links among natural resources, economic globalization, disaggregated energy consumption, and environmental quality: fresh evidence from GCC economies. Res Policy 73:102204. https://doi.org/10.1016/j.resourpol.2021.102204

Martínez-Zarzoso I, Maruotti A (2011) The impact of urbanization on CO2 emissions: evidence from developing countries. Ecol Econ 70:1344–1353. https://doi.org/10.1016/j.ecolecon.2011.02.009

McCoskey S, Kao C (1998) A residual-based test of the null of cointegration in panel data. Aust Econ Rev 17:57–84. https://doi.org/10.1080/07474939808800403

McDowall W, Solano Rodriguez B, Usubiaga A, Acosta Fernández J (2018) Is the optimal decarbonization pathway influenced by indirect emissions? Incorporating indirect life-cycle carbon dioxide emissions into a European TIMES model. J Clean Prod 170:260–268. https://doi.org/10.1016/j.jclepro.2017.09.132

Mi Z, Zhang Y, Guan D, Shan Y, Liu Z, Cong R, Yuan XC, Wei YM (2016) Consumption-based emission accounting for Chinese cities. Appl Energy 184:1073–1081. https://doi.org/10.1016/j.apenergy.2016.06.094

Nassani AA, Aldakhil AM, Qazi Abro MM, Zaman K (2017) Environmental Kuznets curve among BRICS countries: spot lightening finance, transport, energy and growth factors. J Clean Prod 154:474–487. https://doi.org/10.1016/j.jclepro.2017.04.025

Nathaniel S, Khan SAR (2020) The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. J Clean Prod 272:122709. https://doi.org/10.1016/j.jclepro.2020.122709

Paramati SR, Mo D, Gupta R (2017) The effects of stock market growth and renewable energy use on CO2 emissions: evidence from G20 countries. Energy Econ 66:360–371. https://doi.org/10.1016/j.eneco.2017.06.025

Parveen R, Ahmad A (2020) Public behavior in reducing urban air pollution: an application of the theory of planned behavior in Lahore. Environ Sci Pollut Res 27:17815–17830. https://doi.org/10.1007/s11356-020-08235-z

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economic Theory 20:597–625. https://doi.org/10.1017/S0266466604203073

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. SSRN Electron J 1229. https://ssrn.com/abstract=572504

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312. https://doi.org/10.1002/jae.951

Phillips PCB, Sul D (2003) Dynamic panel estimation and homogeneity testing under cross section dependence. Econ J 6:217–259. https://doi.org/10.1111/1368-423x.00108

Ponce P, Khan SAR (2021) A causal link between renewable energy, energy efficiency, property rights, and CO2 emissions in developed countries: a road map for environmental sustainability. Environ Sci Pollut Res 28:37804–37817. https://doi.org/10.1007/s11356-021-12465-0

Ponce P, López-Sánchez M, Guerrero-Riofrío P, Flores-Chamba J (2020a) Determinants of renewable and non-renewable energy consumption in hydroelectric countries. Environ Sci Pollut Res 27:29554–29566. https://doi.org/10.1007/s11356-020-09238-6

Ponce P, Oliveira C, Álvarez V, Del Río-Rama M d l C (2020b) The liberalization of the internal energy market in the European union: evidence of its influence on reducing environmental pollution. Energies 13. https://doi.org/10.3390/en13226116

Ponce P, Del Río-Rama M d l C, Álvarez-García J, Oliveira C (2021) Forest conservation and renewable energy consumption: an ARDL approach. Forests 12. https://doi.org/10.3390/f12020255

Sadorsky P (2014) The effect of urbanization on CO2 emissions in emerging economies. Energy Econ 41:147–153. https://doi.org/10.1016/j.eneco.2013.11.007

Samargandi N (2017) Sector value addition, technology and CO 2 emissions in Saudi Arabia ☆. Renew Sust Energ Rev 78:868–877. https://doi.org/10.1016/j.rser.2017.04.056

Sapkota P, Bastola U (2017) Foreign direct investment, income, and environmental pollution in developing countries: panel data analysis of Latin America. Energy Econ 64:206–212. https://doi.org/10.1016/j.eneco.2017.04.001

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601. https://doi.org/10.1016/j.scitotenv.2018.06.320

Sbia R, Shahbaz M, Hamdi H (2014) A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ Model 36:191–197. https://doi.org/10.1016/j.econmod.2013.09.047

Sgobbi A, Simões SG, Magagna D, Nijs W (2016) Assessing the impacts of technology improvements on the deployment of marine energy in Europe with an energy system perspective. Renew Energy 89:515–525. https://doi.org/10.1016/j.renene.2015.11.076

Shan Y, Liu J, Liu Z, Xu X, Shao S, Wang P, Guan D (2016) New provincial CO2 emission inventories in China based on apparent energy consumption data and updated emission factors. Appl Energy 184:742–750. https://doi.org/10.1016/j.apenergy.2016.03.073

Sun C, Zhang F, Xu M (2017) Investigation of pollution haven hypothesis for China: an ARDL approach with breakpoint unit root tests. J Clean Prod 161:153–164. https://doi.org/10.1016/j.jclepro.2017.05.119

Tang CF, Tan EC (2013) Exploring the nexus of electricity consumption, economic growth, energy prices and technology innovation in Malaysia. Appl Energy 104:297–305. https://doi.org/10.1016/j.apenergy.2012.10.061

Tang CF, Tan BW, Ozturk I (2016) Energy consumption and economic growth in Vietnam. Renew Sust Energ Rev 54:1506–1514. https://doi.org/10.1016/j.rser.2015.10.083

Wang Q, Wu S, Zeng Y, Wu B (2016a) Exploring the relationship between urbanization, energy consumption, and CO2 emissions in different provinces of China. Renew Sust Energ Rev 54:1563–1579. https://doi.org/10.1016/j.rser.2015.10.090

Wang S, Li Q, Fang C, Zhou C (2016b) The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Sci Total Environ 542:360–371. https://doi.org/10.1016/j.scitotenv.2015.10.027

Wang Y, Li L, Kubota J, Han R, Zhu X, Lu G (2016c) Does urbanization lead to more carbon emission? Evidence from a panel of BRICS countries. Appl Energy 168:375–380. https://doi.org/10.1016/j.apenergy.2016.01.105

Wei Z, Han B, Han L, Shi Y (2019) Factor substitution, diversified sources on biased technological progress and decomposition of energy intensity in China’s high-tech industry. J Clean Prod 231:87–97. https://doi.org/10.1016/j.jclepro.2019.05.223

Westerlund J (2005) New simple tests for panel cointegration. Aust Econ Rev 24:297–316. https://doi.org/10.1080/07474930500243019

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69:709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Westerlund J, Edgerton DL (2008) A simple test for cointegration in dependent panels with structural breaks. Oxf Bull Econ Stat 70:665–704. https://doi.org/10.1111/j.1468-0084.2008.00513.x

Wiebe KS (2016) The impact of renewable energy diffusion on European consumption-based emissions. Econ Syst Res 28:133–150. https://doi.org/10.1080/09535314.2015.1113936

Xiaoman W, Majeed A, Vasbieva DG, Yameogo CEW, Hussain N (2021) Natural resources abundance , economic globalization , and carbon emissions: advancing sustainable development agenda:1–12. https://doi.org/10.1002/sd.2192

Xu B, Lin B (2016) A quantile regression analysis of China’s provincial CO2 emissions: where does the difference lie? Energy Policy 98:328–342. https://doi.org/10.1016/j.enpol.2016.09.003

Xu B, Lin B (2017) What cause a surge in China’s CO2 emissions? A dynamic vector autoregression analysis. J Clean Prod 143:17–26. https://doi.org/10.1016/j.jclepro.2016.12.159

Xu B, Lin B (2018) Investigating the role of high-tech industry in reducing China’s CO2 emissions: a regional perspective. J Clean Prod 177:169–177. https://doi.org/10.1016/j.jclepro.2017.12.174

Yu Y, Du Y (2019) Impact of technological innovation on CO2 emissions and emissions trend prediction on ‘New Normal’ economy in China. Atmos Pollut Res 10:152–161. https://doi.org/10.1016/j.apr.2018.07.005

Yu Z, Tianshan M, Khan SAR Investigating the effect of government subsidies on end-of-life vehicle recycling. Waste Manag Res 0:0734242X20953893. https://doi.org/10.1177/0734242X20953893

Zafar MW, Shahbaz M, Hou F, Sinha A (2019) From nonrenewable to renewable energy and its impact on economic growth: the role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J Clean Prod 212:1166–1178. https://doi.org/10.1016/j.jclepro.2018.12.081

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sust Energ Rev 58:943–951

Zhang N, Yu K, Chen Z (2017a) How does urbanization affect carbon dioxide emissions? A cross-country panel data analysis. Energy Policy 107:678–687. https://doi.org/10.1016/j.enpol.2017.03.072

Zhang Y-J, Bian X-J, Tan W, Song J (2017b) The indirect energy consumption and CO2 emission caused by household consumption in China: an analysis based on the input–output method. J Clean Prod 163:69–83. https://doi.org/10.1016/j.jclepro.2015.08.044

Zheng W, Walsh PP (2019) Economic growth, urbanization and energy consumption — a provincial level analysis of China. Energy Econ 80:153–162. https://doi.org/10.1016/j.eneco.2019.01.004

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248. https://doi.org/10.1016/j.econmod.2016.05.003

Zhu L, Hao Y, Lu ZN, Wu H, Ran Q (2019) Do economic activities cause air pollution? Evidence from China’s major cities. Sustain Cities Soc 49:101593. https://doi.org/10.1016/j.scs.2019.101593

Acknowledgement

Dr. Abdul Majeed acknowledges financial support from the ILMA University under the ILMA research grant program.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not for profit sectors.

Author information

Authors and Affiliations

Contributions

ZW, LG, ZW, and IA: conceptualization, data curation, formal analysis, project administration, and software. AM: writing (original draft), methodology, validation, writing (review and editing), funding acquisition, and was a major contributor in writing the manuscript. All authors read and approved the final manuscript.

Corresponding authors

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, Z., Gao, L., Wei, Z. et al. How FDI and technology innovation mitigate CO2 emissions in high-tech industries: evidence from province-level data of China. Environ Sci Pollut Res 29, 4641–4653 (2022). https://doi.org/10.1007/s11356-021-15946-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15946-4