Abstract

More recently, the COVID-19 pandemic outbreak has created massive economic policy uncertainty (EPU). EPU and its economic fallout have been a hot topic of study; however, the impact of EPU on CO2 emissions has been seldom addressed to date. This paper investigates the effects of the EPU on CO2 emissions. It elucidates the role of EPU in moderating the environmental regulation-CO2 emissions nexus at the national and regional levels using the panel data model and provincial panel data from 2003 to 2017 in China. The main empirical results are as follows. The EPU has a negative impact on carbon emissions; however, this relationship is non-significant even at the 10% level in the central and western region datasets. Environmental regulation positively increases the CO2 emissions implying that the green paradox occurs in the whole and western regions datasets. From the perspective of the moderating effect of uncertainty, EPU exerts a positive impact upon the environmental regulation-CO2 emissions nexus in the whole and western region datasets. The moderating effect is not significant in the eastern and central regions. The results demonstrate that the re-examination of the EKC hypothesis is inconclusive. Kuznets relationship between economic growth and CO2 emissions for the national, eastern, and central samples was confirmed. In contrast, CO2 emissions monotonically rise as GDP grows for western datasets. Based on the overall findings, some policy implications were put forward. We recommend that the local government should consider EPU to improve the institutional environment. Further, different regions should implement various environmental policies according to regional conditions maximizing the emission reduction potential.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Climate change due to global warming is one of the defining issues of our time. Global temperature has been in constant rise since the pre-industrial era. Its well-known reason is the steady climb of greenhouse gas (GHG) emissions, particularly carbon dioxide (CO2), which is now 50% higher than pre-industrial levels. The United Nations member states have agreed to limit the increase in the global average temperature to 1.5°C, which requires substantial worldwide commitments to achieve these goals. As the world’s largest carbon emitters, China has already committed to the Paris climate pact that China would cut its carbon emissions per unit of GDP by 60–65 per cent by 2030 from 2005 levels, increase non-fossil fuel sources in primary energy consumption to about 20 per cent, and peak its carbon emissions by 2030. Based on the above background, clarifying the mechanism behind carbon emissions is significant for China to achieve these goals.

A large body of literature has analyzed the driving forces of carbon emissions, such as economic growth (Alshehry and Belloumi 2017; Chiu 2012; Farhani et al. 2014; Grossman and Krueger 1991), industrial structure (Dong et al. 2020; Wang et al. 2016; Yu et al. 2018), foreign direct investment (FDI) (Demena and Afesorgbor 2020; Mahadevan and Sun 2020; Shahbaz et al. 2019; Tang and Tan 2015), and urbanization (Elliott and Clement 2014; Huo et al. 2020; Khan et al. 2019; Makido et al. 2012; Yao et al. 2018).

Obviously, studies on the driving forces of CO2 emissions are relatively mature; however, the macro factor such as economic policy uncertainty (EPU) has just aroused the research interest in the environmental field. Resembling the concept of risk, EPU refers to the inability of economic entities to forecast the timing, content, and potential economic consequences of policy decisions (Gulen and Ion 2015). Today, as the worldwide politics and economics changes, especially the pandemic outbreak of the COVID-19 has created massive economic uncertainty (Baker et al. 2020; Jordà et al. 2020), the importance of the EPU becomes increasingly visible. EPU has a dampening impact both at the macro-level, i.e., economic growth (Baker et al. 2013a; Baker et al. 2016; Baker et al. 2020), and at the micro-level, i.e., corporate investments (Akron et al. 2020; Gulen and Ion 2016), corporate innovation (He et al. 2020; Xu 2020), household consumption (Aaberge et al. 2017; Levenko 2020), and stock market (Arouri et al. 2016; Das et al. 2019). In all, uncertainty reshapes the environment in which the economic entities operate. Besides, when the external environment changes, the decision of economic entities that link to CO2 emissions is altered. To summarize, we speculate that EPU may have an impact on CO2 emissions.

Some scholars have already studied the nexus between EPU and CO2 emissions; however, the results are rather inconclusive. The first research stream suggested that EPU increased CO2 emissions. EPU depressed economic situation, resulting in industries inclining to choose traditional cheaper and dirty energy (such as coal and oil) for production, which increases CO2 emissions. Based on US sector data, Jiang et al. (2019) implement a novel parametric test of Granger causality to assess the impact of EPU on CO2 emissions and found a Granger causality running from the US EPU to CO2 emissions. Pirgaip and Dincergok (2020) employ a bootstrap panel Granger causality test to investigate the causal relationship between EPU and energy consumption and CO2 emissions in G7 countries. They argued that EPU has adverse effects on energy saving and emission reduction. Additionally, Adams et al. (2020) using data from economies characterized by resource-rich but crisis-prone demonstrate a significant association between geopolitical risk, EPU, energy consumption, economic growth, and CO2 emissions in the long run. This implies that higher levels of EPU adversely affect carbon abatement. This finding is consistent with the result of Anser et al. (2021). Azka and Eyup (2021) indicate that EPU has a positive economic effect on CO2 emissions in China. By constructing China’s provincial EPU index, Yu et al. (2021) suggest that China’s provincial EPU level significantly impacts manufacturing firms’ carbon emission intensity. The second research stream suggested that EPU reduced CO2 emissions. Adedoyin and Zakari (2020) examine the role of EPU played in the nexus between energy consumption, economic, and CO2 emissions in the UK. The results indicate that EPU plays a critical role in the effort of mitigating CO2 emissions. Moreover, Abbasi and Adedoyin (2021) suggest that economic policy uncertainty has an insignificant impact on China’s CO2 emissions.

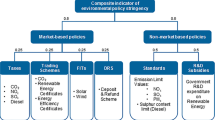

Economic policy uncertainty mainly stems from the frequent changes in macroeconomic policies and the unpredictability in policy implementation (Gulen and Ion 2015). In turn, EPU also affects policy-making. Guo et al. (2019a) contend that uncertainty has a significant effect on environmental policy-making. Lecuyer and Quirion (2019) argue that a high level of uncertainty has a positive incentive effect on renewable energy subsidies effectiveness. Meanwhile, in achieving green development and high-quality economic growth, environmental policies and regulations play a vital role. During the “Outline of the Thirteenth Five-Year Plan for National Economic and Social Development of the People’s Republic of China” (13th Five-Year Plan) periods, the Chinese government promulgated a series of policies (the environmental protection tax law, resource tax law, etc.) to strengthen environmental protection and build the ecological civilization. The relationship between environmental regulation and CO2 emissions has been fiercely debated in recent years. As evidence, although the field has accumulated well-developed literature, there is no uniform conclusion. According to the literature, there are two perspectives on this issue: the “green paradox” and “curbing effect.” The concept of the green paradox that is first put forward by Sinn (2008), which is defined as a myriad of measures launched by politicians aimed at alleviating CO2 emissions, eventually exacerbate the problem. Sinn attributes counter-productive policies to the psychological expectation that the environmental regulation will gradually be tightened, resulting in accelerating the exploitation of fossil energy. Other researchers ascribe the emergence of the green paradox to an unreasonable set of carbon taxes (Edenhofer and Kalkuhl 2011), support policies for alternative energy (van der Ploeg and Withagen 2012), policy’s implementation lags (Di Maria et al. 2012), and unilateral climate policies (Sen 2016). On the contrary, other scholars argue a significant positive correlation between environmental regulation and environmental pollution, also known as the “curbing effect” hypothesis. Zhang et al. (2017) and Zhao et al. (2015) indicate that environmental regulations positively affect reducing CO2 emissions. Nevertheless, some studies hold a more neutral viewpoint. Wang (2018) suggests an inverted U-shaped curve relationship between environmental regulation and CO2 emissions. Besides, some researchers confirmed that environmental regulations have indirect effects on carbon emission through transmission paths, such as industrial structure (Yang et al. 2020), energy structure (Wu et al. 2020), technological innovation (Cheng et al. 2017; Pei et al. 2019), and FDI (Wang et al. 2018). The influence mechanism, however, is paradoxical. Under the constraints of EPU, the direction and intensity of the effect of environmental regulations on CO2 emissions may change. In other words, EPU could also influence CO2 emissions via environmental regulations. Thus, the nexus between environmental regulations and CO2 emissions could be moderated by the level of uncertainty.

Based on the above background, the study’s objective is to clarify how EPU affects CO2 emissions and elucidate the role of EPU in moderating the environmental regulation-CO2 emissions nexus at the national and regional levels using the panel data model provincial panel data from 2003 to 2017 in China.

The present paper contributes to the previous literature as follows. First, although few studies have explored the impact of economic policy uncertainty on CO2 emissions, they mainly focused on the causal relationship between EPU, energy consumption, economic growth, and CO2 emissions using autoregressive distributional lag models (ARDL) (Abbasi and Adedoyin 2021; Anser et al. 2021) and Granger causality tests (Jiang et al. 2019; Pirgaip and Dincergok 2020). Most of them are based on the national level, without an in-depth exploration of the mechanism of the intrinsic influence of EPU on CO2 emissions. Our study investigates how EPU directly affects CO2 emissions and account for EPU in the environmental regulation-CO2 emissions nexus to examine the moderating effects of EPU. Understanding the impact of institutional factors behind CO2 emissions is of utmost significance to realize a low-carbon economy.

Second, we investigate the relevant issues in the Chinese context at the national and regional levels and consider the regional heterogeneity in China’s CO2 emissions. Most of the existing studies take developed countries, such as the USA (Jiang et al. 2019; Wang et al. 2020) and the UK (Adedoyin and Zakari 2020), as samples to explore the causal relationship between economic policy uncertainty and CO2 emissions, while China, as the largest developing country in the world, may have different findings due to various social backgrounds and economic systems.

Third, we use a more reasonable news-based index proxy developed by Davis et al. (2019) to capture China’s aggregate economic policy uncertainty level. Based on the South China Morning Post (SCMP), Hong Kong’s leading English-language newspaper, Baker et al. (2013b) develop a monthly EPU index for China, running from January 1995 to the present. Due to the publicly available and scientific measure of the uncertainty present in the economy, the BBD index is widely accepted. Moreover, a coherent body of empirical research on the topic of this index has been conducted. However, the index may have some limitations. For example, the Hong Kong-based newspaper may not overall picture the level of EPU in China, and only one newspaper in the sample may magnify measurement error that could induce a bias in empirical analysis. To conquer those shortcomings, following the BBD approach, Davis et al. (2019) (henceforth DLS) construct monthly indices of EPU for China by using two mainland Chinese newspapers: the Renmin Daily and the Guangming Daily. The DLS index selects representative and influential newspapers in mainland China as the sample can more effectively capture China’s aggregate economic policy uncertainty level. Therefore, the DLS index is superior to the EPU index. As a result, this study takes the DLS index as the benchmark indicator and examines the impact of uncertainty on CO2 emissions.

The paper is structured as follows: the “Theoretical background and hypothesis” section introduces the theoretical background and hypothesis of the study. The “Data and methods” section presents the data and methods. The “Results and discussion” section demonstrates the empirical results and discussions. The “Conclusions and policy implications” section concludes alongside policy implications.

Theoretical background and hypothesis

This section describes the mechanism by which EPU affects CO2 emissions and the theoretical background of the role of EPU in moderating the environmental regulation-CO2 emissions nexus.

Wang et al. (2020) suggest two effects (i.e., consumption effect and investment effect) of economic policy uncertainty on CO2 emissions. On the one hand, the EPU harms the whole economic and impedes recovery from the recession (Baker et al. 2016). A higher level of uncertainty can curb the consumption of energy-intensive products, leading to a reduction in CO2 emissions. The dampening effect of uncertainty on CO2 emissions is known as the consumption effect. With the economic condition changed, the demand for energy consumption will be affected. Jiang et al. (2019) indicate that EPU has an indirect economic demand effect on CO2 emissions. EPU causes economic depression, leading to changes in demand for energy consumption, thus affecting CO2 emissions. Traditional cheaper energy, for instance, coal and oil, would be chosen by more industries due to the sluggish economic situation (Yu et al. 2021). Undoubtedly, the more cheap and dirty fossil fuel energy consumed, the more CO2 emissions. In addition, the level of uncertainty has a certain degree of impact on energy prices, which could affect consumers’ energy choices, too. Balcilar et al. (2017) imply that EPU is an essential driver of oil price volatility, and there is an asymmetric connection between uncertainty and oil returns. Yang (2019) demonstrates that EPU significantly influences oil price shocks and the causality relationship between them intensifies as time scales increase. From the perspective of the consumption effect, the reduction in consumer production and living caused by the higher level of EPU has partly reduced CO2 emissions. At the same time, the use of more cheap and dirty energy increases CO2 emissions. The net effects are unclear.

On the other hand, renewable and green energy’s investment would be postponed when EPU is higher, resulting in an increase in CO2 emissions, which is labeled as the investment effect. A plethora of works explores that the economic policy-related uncertainty depresses corporate investment (Chen et al. 2019; Dibiasi et al. 2018; Liu and Zhang 2020). Based on the real options theory, corporate investment projects are irreversible to varying degrees and usually costly; economic policy uncertainty increases the value of the waiting option, so firms become more cautious and prefer to delay investment until getting more information for decision-making, in the face of greater uncertainty (Bernanke 1983; Pindyck 1991). The investment of renewable energy industry, for example, hydropower, wind, and biomass, has a higher degree of irreversibility, which usually has the characteristics of a larger initial investment scale and longer investment return cycle. Renewable energy’s investment leads to higher sunk costs, and renewable energy enterprises inevitably delay investment when economic policy uncertainty increases. There is no doubt that the decrease in investment, especially in the renewable energy industry, has increased CO2 emissions. This argues for the investment effect.

Furthermore, according to signal theory, the increase of carbon information disclosure can effectively promote energy saving and reduce emission reduction (Connelly et al. 2011). However, Pan et al. (2020) find that policy uncertainty has a more significant inhibition effect on corporate environmental information disclosure by incorporating difference-in-difference (DID) estimation. Firms have more incentive to reduce the transparency of carbon information disclosure when the EPU is at a high level. Therefore, a reduction in carbon disclosure caused by EPU may increase carbon emissions.

Based on the previous analytic mechanisms commented, this study proposes the following hypothesis.

Hypothesis1a: The EPU index has a negative correlation with CO2 emissions.

Hypothesis1b: The EPU index has a positive correlation with CO2 emissions.

As briefly analyzed in the introduction, the influencing mechanism between environmental regulation and CO2 emissions is paradoxical. Undoubtedly, the unpredictability of policy changes, including environmental policies, is a major source of uncertainty (Pastor and Veronesi 2012). Jiang et al. (2019) indicate that EPU has a direct policy adjustment effect on CO2 emissions. With a high level of uncertainty, the attention on green development from the government will be distracted, resulting in environmental protection policies executed poorly. The governments’ determination to reduce emissions may be doubted, leading to the efforts for carbon abatement by enterprises relaxed, eventually increasing emissions. Different policy-makers may have different attitudes towards uncertainty, which will lead to different environmental regulations against EPU across other regions. We infer that EPU exerts moderation effects on the environmental regulation-CO2 emissions nexus. Guo et al. (2019a) contend that uncertainty has a significant impact on environmental policy-making. They argued that underestimating and overestimating uncertainties make against formulating a reasonable carbon mitigation design by policy-makers. Lecuyer and Quirion (2019) argue that a high level of uncertainty has a positive incentive effect on renewable energy subsidy effectiveness. These subsidies are not welfare-improving at the low level of uncertainty. Considering the forward-looking policy uncertainty, Contreras and Platania (2019) put forward a zero mean-reverting model to estimate the effectiveness of the London Environment Strategy. Against this backdrop, the EPU is a critical determinant in understanding the impact of environmental regulation on CO2 emissions.

Based on the discussion above, this study puts forward the following hypothesis:

Hypothesis 2: EPU plays an essential role in moderating the relationship between environmental regulation and CO2 emissions.

Data and methods

Methods

There is an extensive body of literature that analyzes the mechanism behind carbon emissions. Ehrlich and Ehrlich (1970) first propose the Impact = Population· Affluence· Technology (IPAT) framework to study environmental changes affected by anthropogenic driving forces. Dietz and Rosa (1994) reformulate the IPAT framework by considering nonproportional effects of driving forces, raising the stochastic version of this model, namely, STIRPAT (stochastic impacts by regression on population, affluence, and technology).

Furthermore, a considerable number of studies have investigated the nexus between CO2 emissions and economic growth. Grossman and Krueger (1991) develop environmental Kuznets curve (EKC) to emphasize this nexus. Resembling the Kuznets curve of inequality (Kuznets 1955), the EKC also postulates an inverted-U hypothesis. According to EKC, environmental pollution or CO2 emissions increase as the economic level grows at the beginning and then decrease after a specific turning point. Since then, with various datasets and complex econometric methods employed, the EKC has been tested extensively, but its validity is debatable. In the EKC framework, the nonlinear relationship can be explained by three effects: income, structural, and abatement effect (Jaunky 2011). The results verified in many previous studies often appear to be contradictory and inconclusive both theoretically and empirically. Empirical studies like Alshehry and Belloumi (2017), Chiu (2012), and Farhani et al. (2014) confirm the existence of the EKC. The empirical findings of Alshehry and Belloumi (2017), Baek (2015), Fernández-Amador et al. (2017), and Haq et al. (2016), however, fail to provide such positive support. Moreover, Rodríguez et al. (2016) show a monotonic and positive relationship between environmental quality indicators and income. As mentioned, no clear conclusion can be drawn.

The primary purpose of this paper is to shed light on the mechanisms of how uncertainty affects CO2 emissions and clarify the role of EPU in moderating the environmental regulation-CO2 emissions nexus. We establish the following models based on the STIRPAT model and EKC hypothesis. CO2 emissions were selected as the explanatory variable. Economic policy uncertainty and environmental regulation were the core explanatory variables. The explanatory variables considered are chosen because they were commonly found in previous literature.

Equation (1) is constructed to elucidate the effect of EPU on CO2 emissions. To ensure the linearity of the model and eliminate the heteroscedasticity phenomenon, logarithmic processing is carried out for all variables. Herein, lnCO2 means the CO2 emission per capita; lnGDP and lnGDP2 denote real gross domestic product per capita in logarithms and its squared term. The quadratic term of GDP is incorporated in the models to test the EKC hypothesis in the context of China. lnENC is energy consumption; lnER expresses environmental regulation; lnEPU represents economic policy uncertainty, where subscripts i and t denote the i-th province and the t-th year, respectively. α0 is the constant term; β1, β2…β5 are the evaluation coefficients, μi is the unobserved individual fixed effects, and εit is the independent and identically distributed residual error term.

Based on Equation (1), Equation (2) introduced the concept of EPUit ∗ ERit, namely, the interaction item of EPU and ER to ascertain the moderating role of EPU on the environmental regulation-CO2 emissions nexus. β5 and β6 are the focus of interest coefficients in this study. If β5 > 0 and β6 < 0, this suggests that a higher ER level harms CO2 emissions and that a green paradox occurs, but a higher level of EPU weakens that adverse effect. Conversely, if β5< 0 and β6 > 0, this implies that a higher ER level has a mitigating impact on CO2 emissions and that EPU reinforces that mitigating effect. If β5< 0 and β6 < 0, this suggests that a higher ER level reduces CO2 emissions and that EPU strengthens this effect. Finally, if β5 > 0 and β6 > 0, this implies that a higher ER level negatively impacts CO2 emissions and that a higher level of EPU exacerbates this adverse effect.

Data

In the present study, considering the availability and completeness of the data, 30-provincial panel data from 2003 to 2017 in China are investigated. Given that the CO2 emissions are heterogeneous in different regions, these 30 provincial-level administration regions can be divided into three groups: eastern, central, and western regions, according to the level of economic and social development. The specific classification is shown in Table 10 in the Appendix. The three economic zones are at different stages of economic growth. Due to this, the subsequent analysis is conducted at both the national and regional levels.

CO2 emission

The CO2 emission data were collected from the China Emission Accounts and Datasets (CEADS) website. Sponsored by domestic and international professional bodies, research institutes like the National Natural Science Foundation of China, Science and Technology Research Council UK, and CEADs devoted to China’s emission accounting methods and applications (Liu et al. 2020). The carbon emission datasets published by CEADs are characterized by fully open access, have multi-scale coverage, and are free to download. In addition to the traditional database of carbon emissions from energy consumption, the CEADs database also covers the detailed data of carbon emissions from industrial processes, including cement production, lime production, glass, and so on. The emission data is accurate and most up-to-date, effectively avoiding measurement errors.

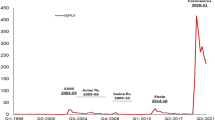

The regional difference in CO2 emissions can be clearly seen in Fig.1. The fluctuation trend of emissions is generally on the rise. National CO2 emissions increase roughly one and a half times throughout the study period. Due to superior resource endowment, CO2 emissions in the eastern region have been dominant in 2003–2017. The western region’s emission levels have exceeded those of the central region since 2013. Since 2011, the growth of CO2 emissions has become slower. CO2 emissions in China have been effectively controlled.

EPU index

Based on Baker et al. (2016), the BBD index is a weighted average of three components: the news-based component, the tax component, and the forecaster disagreement component. The weights are one-half, one-sixth, and one-third, respectively. BBD go to great lengths to verify that the BBD index is a reliable and accurate picture of EPU. According to the newspaper-based methods, the EPU indices have been constructed for major economies, including China. Following the BBD approach, Davis et al. (2019) build monthly indices of EPU for China. The two indices are compared in Fig. 2. Both indices look like a reasonable proxy for genuine policy-related economic uncertainty. In addition, the data shows that the EPU curve of China is not smooth, and the phenomena of considerable growth and the sharp decline occur alternately. They tend to move together with spikes around events that are ex-ante predictable to increase uncertainty, such as financial crises, stimulus package, and elections. Currently, these two indices rose to historical highs after the global pandemic. However, there are significant divergences between the two indices.

Environmental regulation

In this paper, we use cost-based environmental regulation indices as the proxy variable for the level of environmental regulations (Guo et al. 2019b; Hu and Wang 2020; Lanoie et al. 2008; Wang et al. 2019; Wu et al. 2020; Yang et al. 2020). We adopt the ratio of industrial pollution governance expenditures collected by each province to its industrial added value (denoted as ER) as the environmental regulation variable. It is easy to find that the cost-based index focuses on the expenditure (input) of pollution control in each province. There is a positive correlation between the cost-based index and the enforcement of government environmental regulation. The larger the value of the index, the greater the environmental regulation intensity. Therefore, pollution control expenditure or treatment investments can well reflect the environmental regulation intensity.

To eliminate the impact of price factors, all variables related to the price index, including environmental regulation, per capita GDP, are converted to the constant 2000 price. Energy consumption is expressed by the total energy consumption of each province at the end of the year. The monthly Chinese DLS EPU index is converted into the annual EPU index by the arithmetic average method to be consistent with the time horizon. The 30-province shares the same average EPU index. In addition, this study takes the Chinese BBD EPU index as the auxiliary index measuring the level of economic policy uncertainty to test results robustness.

The data sources are described in Table 1. Table 2 shows the descriptive statistics for all variables.

Results and discussion

Results

Table 3 presents the Pearson correlation matrix to capture the correlation between the variables and indicate no high correlations. As shown, both the EPU and the level of environmental regulation are positively and significantly correlated with CO2 emission, while the relationship between them is negative. Besides, energy consumption and environmental regulations are insignificantly related.

In this paper, 30-province panel data from 2003 to 2017 in China are employed. Usually, there are three types of estimation methods in terms of short panel data: pooled regression, fixed effects model, and random effects model. This paper performs the F-test and Hausman (1978) test to choose the most appropriate estimation method. The F-test is run to inspect individual-specific effects with the null hypothesis, all μi = 0. The lower the p value of the F-test statistic, the higher the significance level. The null hypothesis is rejected. The estimator of the fixed effects model estimator is more efficient than the pooled regression. The Hausman test is applied to determine whether to choose the fixed effects model or the random effects model. Similarly, the more considerable Hausman test value means that the corresponding p value is minor than preset significance levels. The null hypothesis should be rejected and a fixed-effects model established. Table 4 reports the F-test results. The empirical results of the Hausman test are shown in Table 5.

As shown in Table 4 and Table 5, the results of the F-test and the Hausman test implied that the null hypothesis was strongly rejected, suggesting that the fixed effects model should be selected to examine the effect of EPU on CO2 emissions for the whole nation and the three regions. Based on the above findings, two panel estimation methods were employed, namely, fixed effects (FE) and linear regression with Driscoll-Kraay standard errors (DK) (Driscoll and Kraay 1998).

Table 6 shows estimates of Equation (1) employing the above estimation methods for the whole dataset and the three regional datasets. Moreover, to verify the effectiveness of the estimator, we employed the modified Wald statistic for groupwise heteroskedasticity (Greene 2000), the Wooldridge test for autocorrelation (Wooldridge 2002), and the Pesaran test for cross-sectional dependence (Pesaran 2004). The empirical results are reported in Table 6, too. The results confirm that the whole and eastern region datasets showed autocorrelation and groupwise heteroscedasticity, and the central region dataset showed groupwise heteroscedasticity, besides the western datasets showed groupwise heteroscedasticity and cross-sectional dependence.

Therefore, the estimators of the DK model are more effective and robust. This method is robust to the panel data with the problems of groupwise heteroscedasticity, autocorrelation, and cross-sectional dependence. We mainly focus on the empirical results of the DK model.

As shown in Table 6, the columns present the results of the whole dataset and the three regional datasets, respectively. Due to the natural logarithmic form taken in this model, the coefficients of the explanatory variables could be directly explained as elasticities.

At the national level, the empirical results of the DK model estimation show that all the explanatory variables are statistically significant. The EPU negatively increases carbon emissions. A 1% increase in uncertainty would decrease emissions by 0.033% in China when other variables remain constant. The estimated results contradict the findings of previous studies (Adams et al. 2020; Pirgaip and Dincergok 2020). They argued that EPU has adverse effects on emission reduction. Thereby, hypothesis 1a was verified. Our results show that environmental regulation was positively correlated with CO2 emissions, implying that the green paradox occurs. For the control variables, the elasticity of energy consumption is the greatest (0.840), indicating that a 1% increase in energy consumption level would lead to 0.840% increase in CO2 emissions. GDP growth rate is positively associated with CO2 emissions. By judging from the quadratic term of per capita GDP, the regression coefficients are negative at the significance level of 1%. In other words, the environmental Kuznets curve (EKC) theory holds.

Considering the typical regional differences in China, the relationship between considered variables may also have regional heterogeneity characteristics. Thus, we should analyze the effects of the EPU upon emissions at the regional level. Compared with the national aggregate case, the eastern region almost has similar findings. The influences of variables appear to be greater due to the high economic intensity and population density in this region. All the independent variables are statistically significant in the eastern region, except environmental regulation, while it is statistically significant at the 10% level in FE model estimation. The EPU index has a significant role in inhibiting eastern CO2 emissions, taking the value of −0.063. The elasticity of energy consumption is 0.480, which is the lowest in the sample selected.

In the central region, the elasticity of EPU is −0.003, while it is non-significant in both the FE model and DK model. Environmental regulation passes t-test with an elasticity of −0.046 in FE model estimation resembling the eastern region. For every 1% increase in environmental regulations, carbon emissions fall by 0. 046%. This implies that environmental regulation was negatively correlated with CO2 emissions, and environmental regulation tools meet the basic emissions reduction requirements in the eastern region. Through a forced mechanism, environmental regulation improvement is conducive to mitigating emissions, meeting the basic needs of emissions reduction. The elasticity of energy consumption is the highest (0.965), owing to the fast urbanization and industrialization process.

As shown in column 6, the western region is quite different. It is worth noting that all explanatory variables are non-significant even at the 10% level except energy consumption, while GDP and environmental regulation are statistically significant at the 10% level and 5% level in FE model estimation. One possible explanation is that the heterogeneity of sample distribution causes insignificance of most variables. Energy consumption is the most significant element with an elasticity of 0.843, followed by uncertainty.

The variable GDP per capita presents a positive and significant effect on emissions for all regions (GDP is statistically significant at the 10% level for the western region). In the eastern region, the coefficient of GDP per capita is the largest (0.840), which is much higher than other samples. It suggests that there is a strong link between economic growth and CO2 emissions. The coefficient of the quadratic term of GDP per capita is negative and statistically significant in the eastern and central regions, while it is statistically non-significant in the western regions. This means that the results in the eastern and central regions are in line with the theory of EKC; however, the inverted U-shaped relationship between economic growth and emissions cannot hold any more in the western regions.

Furthermore, this paper uses the interactive term (EPU*ER) to capture the effect of uncertainty on the functional mechanisms of environmental regulation. Table 7 shows estimates of Equation (2) employing the FE and DK estimation methods for the whole sample and three regional datasets. At the national and western regions, the signs of environmental regulation are positive, indicating that environmental regulations have significantly promoted CO2 emissions and that a green paradox occurs. The symbols of the interactive term are positive and statistically significant, implying that EPU exerts a positive impact upon the environmental regulation-CO2 emissions nexus. Therefore, hypothesis 2 is verified.

Environmental regulations are statistically significant in the eastern and central regions at 5% level with the elasticity of −0.051 and −0.047 in the FE model. It indicates that the increase of environmental regulations’ intensity is conducive to improving carbon emission reduction, while they are not significant in the DK model. From the perspective of the moderating effect of uncertainty, the coefficient of the interaction term between EPU and environmental regulation is positive yet insignificant, indicating that uncertainty may increase CO2 emissions from environmental regulation. The findings suggest that environmental regulation can effectively mitigate CO2 emissions without consideration of uncertainty. However, when the EPU was considered, environmental regulation significantly positively affected CO2 emissions, leading to an unintended increase in emissions.

Robustness test

To alleviate the interference of endogeneity problem, i.e., omitted variables, the auxiliary economic policy uncertainty variable developed by Baker et al. (2016) is used for the robustness test. We also use the panel instrumental variable two-stage least squares estimation (IV-2SLS) for further robustness testing. Considering the strong linkage of macroeconomic policies between China and the USA, this paper selects the US EPU index as the instrumental variable. Besides, the first-year lag of uncertainty level is applied as another instrumental variable of lnEPU. We employ the Davidson-MacKinnon test for exogenous tests. As shown in Table 9, all models passed the endogeneity test except model 2 for the western region, suggesting that the estimation results of OLS and IV-2SLS are consistent. This further demonstrates that the findings of this paper are reliable. In the correlation test of the instrumental variables, the Anderson canon. corr. LM statistic is used for the underidentification test, the P values of that are all less than 0.1, rejecting the null hypothesis of insufficient identification of instrumental variables, the Cragg-Donald Wald F statistic is employed to perform the Weak identification test, and F-statistics are all greater than the corresponding Stock-Yogo critical value of 16.38, rejecting the null hypothesis of weak instrumental variables; Sargan statistic is applied to test overidentification. The test results of these three tests indicate that the instrumental variables are appropriately selected. The results of the robust test are shown in Table 8 and Table 9. The sign and significance of these variables’ coefficients have seldom changed. Overall, the findings are consistent with the results of Table 6 and Table 7. Therefore, it can be concluded that the results mentioned above of empirical analysis are relatively robust.

Discussion

Our panel estimation results yield several interesting conclusions:

-

(1)

The EPU has a negative impact on carbon emissions; however, this relationship is non-significant even at the 10% level in the central and western regions datasets.

The empirical results show that the positive effect of EPU on emission reduction is greater than the adverse effect. The consumption effect caused by uncertainty dominates (Wang et al. 2020). A higher level of uncertainty can curb the consumption of energy-intensive products, leading to a reduction in CO2 emissions. Besides, economic policy uncertainty disrupts the economic situation, resulting in a setback for the actual industry and inhibiting household consumption. The decline in household consumption leads to a decrease in CO2 emissions, too. Compared with the central and western regions, the national and eastern regions have a complete economic structure and economic system. They also have a perfect social responsibility system for market information disclosure, exhibiting greater flexibility in responding to uncertainty. Due to the imperfect economic system structure, the central and western regions have a slower response to the uncertain changes of economic policies. The response effect is not apparent, which eventually leads to the less significant relationship between EPU and CO2 emissions.

-

(2)

Environmental regulation positively increases the CO2 emissions implying that the green paradox occurs in the whole and western region datasets. While environmental regulation is negatively correlated with CO2 emissions in the eastern and central regions datasets, this relationship is statistically significant at the 10% level in FE model estimation.

As mentioned in the introduction, the main reasons for the emergence of the green paradox in the country and the western region are unreasonable environmental policies and policy implementation lags. Given the actual conditions of China, the Chinese style fiscal decentralization is the primary source of policy’s implementation lags. Besides, local governments have autonomy in regional development to some extent, so that the GDP-oriented performance evaluation mechanism makes local governments weaken the implementation of environmental regulations. On the other hand, current legal and supervision systems on environmental protection have been adequate with various regulations and promulgated measures in the eastern and central regions. These tools meet the basic requirements of emissions reduction through a forced mechanism. Moreover, these regions have a high degree of information disclosure system perfection and green innovation development.

-

(3)

From the perspective of the moderating effect of uncertainty, EPU exerts a positive impact upon the environmental regulation-CO2 emissions nexus in the whole and western region datasets. However, the moderating effect is not significant in the eastern and central regions.

The possible reasons EPU exerts a positive impact upon the environmental regulation-CO2 emissions nexus is that the priority for governments is economic stability rather than environmental conservation or other environmental policies under high uncertainty, resulting in the standards of environmental policy implementation being relaxed and CO2 emissions increased (Azka and Eyup 2021; Jiang et al. 2019).

-

(4)

The results demonstrate that the re-examination of the EKC hypothesis is inconclusive. Kuznets relationship between economic growth and CO2 emissions for the national, eastern, and central samples was confirmed. In contrast, CO2 emissions monotonically rise as GDP grows for western datasets.

In this paper, we find that the EKC curve has apparent heterogeneity. Although the EKC hypothesis was confirmed in the national eastern and western samples, the shape and turning point of the EKC curve are quite different due to the difference between economic development and resource endowment. Due to the lower level of economic development, the western region clusters many energy-intensive industries to pursue economic growth, leading to high energy consumption. Inevitably, CO2 emissions monotonically rise as GDP grows.

Despite the informative findings yielded, this study has some limitations that are worth noting. First of all, this study employs the same set of EPU indices as a proxy for Chinese provinces uncertainty level, which is not in line with reality. To better estimate the impact of economic policy uncertainty on CO2 emissions, more rational uncertainty accounting for the Chinese provinces level is expected in future studies. Moreover, economic policy uncertainty could affect CO2 emissions through many channels. This paper only considers the elements of environmental regulation, and other factors such as energy consumption and foreign direct investment would be studied in future research. Third, the cost-based environmental regulation indices only reveal one aspect of environmental governance. Therefore, a more reasonable and comprehensive index to fully reflect the level of environmental regulations would become increasingly important. Furthermore, this study only employed a conventional econometric method; further research would consider spatial spillover effects. The exploration of spatial spillover effects is conducive to the in-depth analysis of the driving forces behind CO2 emissions (Feng et al. 2020; Hu and Wang 2020; Meng et al. 2017).

Conclusions and policy implications

Using panel data of 30 provinces of China from 2003 to 2017, this study empirically analyzes the impact of the EPU on CO2 emissions and elucidates the role of EPU in moderating the environmental regulation-CO2 emissions nexus at the national and regional levels. The main conclusions can be summarized as follows.

The EPU has a negative impact on carbon emissions; however, this relationship is non-significant even at the 10% level in the central and western regions datasets. Environmental regulation positively increases the CO2 emissions implying that the green paradox occurs in the whole and western region datasets. From the perspective of the moderating effect of uncertainty, EPU exerts a positive impact upon the environmental regulation-CO2 emissions nexus in the whole and western region datasets. The moderating effect is not significant in the eastern and central regions. Moreover, the results demonstrate that the re-examination of the EKC hypothesis is inconclusive. Kuznets relationship between economic growth and CO2 emissions for the national, central, and eastern samples was confirmed. In contrast, CO2 emissions monotonically rise as GDP grows for western datasets.

Given the main results we obtained, the related policy implications can be drawn. First and foremost, this study demonstrated that economic policy uncertainty exerts a positive impact upon mitigating emissions and a positive effect on the environmental regulation-CO2 emissions nexus. For this reason, the government should do their best to maximize the positive effects of uncertainty and minimize the adverse effects of uncertainty. An unexpected spike in the level of economic policy uncertainty could not affect the credibility of the government. At this stage, the negative impact of COVID-19 on the global economy continues. The government must stabilize the economic development and reduce the adverse effects of uncertainty facing such a complex international economic situation. The determination to environmental conservation and emission abatement of government would not be shaken even under high levels of uncertainty. Necessary supportive measures should be considered to decrease uncertainty and maintain the transparency and stability of policies.

Besides, environmental regulations play an essential role in emission abatement. The intensity of environmental regulations must be appropriate. An overly restrictive emission-reduction policy would be counter-productive. Moreover, the environmental regulations should not be one size fits all due to the discrepancies of economic development and energy resource endowments. Therefore, different regions should implement different environmental policies according to regional conditions. In the eastern and central regions, local governments should further ensure the scientific rationality of environmental policies and maximize their policy effect of energy conservation and emission reduction. We should avoid falling into the backward development concept of “pollution before treatment” in the western region. The government should strengthen the construction of environmental pollution infrastructure, provide more technical support and help for production enterprises, and then promote the formation of the internal driving force of local green production. Moreover, these regulations should be applied without hampering policy stability since economic policy uncertainty goes against the effectiveness of environmental regulations and the achievement of carbon mitigation targets.

Last but not least, the empirical findings uncovered the adverse effect of energy consumption on CO2 emissions. Accordingly, the government should promote renewable energy or clean energy, such as nuclear power, hydropower, and wind power, to optimize energy consumption structure and reduce fossil fuel energy dependence. Meanwhile, the government should increase the financial support and stimulate capital investment for low-carbon technologies innovation to improve energy efficiency, decoupling economic growth from environmental pollution. In addition, environmental protection is not just a matter for the government. The role of public participation and supervision should be emphasized. Residents should improve their awareness of energy conservation and a low-carbon lifestyle. Furthermore, there is a need to strengthen the interregional cooperation and communication on carbon reduction experiences and practices to maximize technology spillovers effects. All regions should work hand in hand to tackle the issue.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Aaberge R, Liu K, Zhu Y (2017) Political uncertainty and household savings. J Comp Econ 45:154–170

Abbasi KR, Adedoyin FF (2021) Do energy use and economic policy uncertainty affect CO2 emissions in China? Empirical evidence from the dynamic ARDL simulation approach. Environ Sci Pollut R 28:23323–23335

Adams S, Adedoyin F, Olaniran E, Bekun FV (2020) Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Econ Anal Policy 68:179–190

Adedoyin FF, Zakari A (2020) Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Sci Total Environ 738:140014

Akron S, Demir E, Diez-Esteban JM, Garcia-Gomez CD (2020) Economic policy uncertainty and corporate investment: Evidence from the US hospitality industry. Tour Manag 77:104019

Alshehry AS, Belloumi M (2017) Study of the environmental Kuznets curve for transport carbon dioxide emissions in Saudi Arabia. Renew Sust Energ Rev 75:1339–1347

Anser MK, Apergis N, Syed QR (2021) Impact of economic policy uncertainty on CO2 emissions: evidence from top ten carbon emitter countries. Environ Sci Pollut R 28:29369–29378

Arouri M, Estay C, Rault C, Roubaud D (2016) Economic policy uncertainty and stock markets: long-run evidence from the US. Financ Res Lett 18:136–141

Azka A, Eyup D (2021) The role of economic policy uncertainty in the energy-environment nexus for China: evidence from the novel dynamic simulations method. J Environ Manag 292:112865

Baek J (2015) Environmental Kuznets curve for CO2 emissions: the case of Arctic countries. Energy Econ 50:13–17

Baker SR, Bloom N, Davis SJ (2013a) Measuring economic policy uncertainty. Working Paper, 21633

Baker SR, Bloom N, Davis SJ, Wang X (2013b) Economic policy uncertainty in China, University of Chicago. Working Paper, 1–40

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131:1593–1636

Baker SR, Bloom N, Davis SJ, Terry SJ (2020) COVID-induced economic uncertainty.Working Paper, 26983

Balcilar M, Bekiros S, Gupta R (2017) The role of news-based uncertainty indices in predicting oil markets: a hybrid nonparametric quantile causality method. Empir Econ 53:879–889

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98:85–106

Chen PF, Lee CC, Zeng JH (2019) Economic policy uncertainty and firm investment: evidence from the US market. Appl Econ 51:3423–3435

Cheng Z, Li L, Liu J (2017) The emissions reduction effect and technical progress effect of environmental regulation policy tools. J Clean Prod 149:191–205

Chiu YB (2012) Deforestation and the environmental Kuznets curve in developing countries: a panel smooth transition regression approach. Can J Agric Econ 60:177–194

Connelly BL, Certo ST, Ireland RD, Reutzel CR (2011) Signaling theory: a review and assessment. J Manag 37:39–67

Contreras G, Platania F (2019) Economic and policy uncertainty in climate change mitigation: the London Smart City case scenario. Technol Forecast Soc Chang 142:384–393

Das D, Kannadhasan M, Bhattacharyya M (2019) Do the emerging stock markets react to international economic policy uncertainty, geopolitical risk and financial stress alike? N Am J Econ Financ 48:1–19

Davis SJ, Liu D, Sheng XS (2019: Economic policy uncertainty in China since 1949: the view from mainland newspapers. Working Paper, 1-35

Demena BA, Afesorgbor SK (2020) The effect of FDI on environmental emissions: evidence from a meta-analysis. Energy Policy 138:111192

Di Maria C, Smulders S, van der Werf E (2012) Absolute abundance and relative scarcity: environmental policy with implementation lags. Ecol Econ 74:104–119

Dibiasi A, Abberger K, Siegenthaler M, Sturm JE (2018) The effects of policy uncertainty on investment: evidence from the unexpected acceptance of a far-reaching referendum in Switzerland. Eur Econ Rev 104:38–67

Dietz T, Rosa EA (1994) Rethinking the environmental impacts of population, affluence, and technology. Hum Ecol Rev 1(2):277–300

Dong B, Ma X, Zhang Z, Zhang H, Chen R, Song Y, Shen M, Xiang R (2020) Carbon emissions, the industrial structure and economic growth: evidence from heterogeneous industries in China. Environ Pollut 262:114322

Driscoll J, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent data. Rev Econ Stat 80:549–560

Edenhofer O, Kalkuhl M (2011) When do increasing carbon taxes accelerate global warming? A note on the green paradox. Energy Policy 39:2208–2212

Ehrlich PR, Ehrlich AH (1970) Population, resources, environment: issues in human ecology. Freeman, San Francisco

Elliott JR, Clement MT (2014) Urbanization and carbon emissions: a nationwide study of local countervailing effects in the United States. Soc Sci Q 95:795–816

Farhani S, Mrizak S, Chaibi A, Rault C (2014) The environmental Kuznets curve and sustainability: a panel data analysis. Energy Policy 71:189–198

Feng T, Du H, Lin Z, Zuo J (2020) Spatial spillover effects of environmental regulations on air pollution: evidence from urban agglomerations in China. J Environ Manag 272:110998

Fernández-Amador O, Francois JF, Oberdabernig DA, Tomberger P (2017) Carbon dioxide emissions and economic growth: an assessment based on production and consumption emission inventories. Ecol Econ 135:269–279

Greene WH (2000) Econometric analysis. Prentice Hall, Upper Saddle River, New Jersey

Grossman GM, Krueger AB (1991) Environmental impacts of a North American Free Trade Agreement 8(2):223–250

Gulen H, Ion M (2016) Policy uncertainty and corporate investment. Rev Financ Stud 29(3):523–564

Guo J-X, Tan X, Gu B, Qu X (2019a) The impacts of uncertainties on the carbon mitigation design: perspective from abatement cost and emission rate. J Clean Prod 232:213–223

Guo Q, Zhou M, Liu N, Wang Y (2019b) Spatial effects of environmental regulation and green credits on green technology innovation under low-carbon economy background conditions. Int J Environ Res Public Health 16(17):3027

Haq I, Zhu S, Shafiq M (2016) Empirical investigation of environmental Kuznets curve for carbon emission in Morocco. Ecol Indic 67:491–496

Hausman JA (1978) Specification tests in econometrics. J Econ Soc 46:1251–1271

He F, Ma Y, Zhang X (2020) How does economic policy uncertainty affect corporate Innovation?–evidence from China listed companies. Int Rev Econ Financ 67:225–239

Hu W, Wang D (2020) How does environmental regulation influence China’s carbon productivity? An empirical analysis based on the spatial spillover effect. J Clean Prod 257:120484

Huo T, Li X, Cai W, Zuo J, Jia F, Wei H (2020) Exploring the impact of urbanization on urban building carbon emissions in China: evidence from a provincial panel data model. Sustain Cities Soc 56:102068

Jaunky VC (2011) The CO2 emissions-income nexus: evidence from rich countries. Energy Policy 39:1228–1240

Jiang Y, Zhou Z, Liu C (2019) Does economic policy uncertainty matter for carbon emission? Evidence from US sector level data. Environ Sci Pollut Res Int 26:24380–24394

Jordà Ò, Singh SR, Taylor AM (2020) Longer-run economic consequences of pandemics. Federal Reserve Bank of San Francisco, Working Paper Series, 01-16

Khan K, Su C-W, Tao R, Hao L-N (2019) Urbanization and carbon emission: causality evidence from the new industrialized economies. Environ Dev Sustain 22:7193–7213

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45:1–28

Lanoie P, Patry M, Lajeunesse RJJoPA (2008) Environmental regulation and productivity: testing the porter hypothesis. J Prod Anal 30(2):121–128

Lecuyer O, Quirion P (2019) Interaction between CO2 emissions trading and renewable energy subsidies under uncertainty: feed-in tariffs as a safety net against over-allocation. Clim Pol 19:1002–1018

Levenko N (2020) Perceived uncertainty as a key driver of household saving. Int Rev Econ Financ 65:126–145

Liu G, Zhang C (2020) Economic policy uncertainty and firms’ investment and financing decisions in China. China Econ Rev 63:101279

Liu Z, Ciais P, Deng Z, Davis SJ, Zheng B, Wang Y, Cui D, Zhu B, Dou X, Ke P, Sun T, Guo R, Zhong H, Boucher O, Bréon FM, Lu C, Guo R, Xue J, Boucher E et al (2020) Carbon monitor, a near-real-time daily dataset of global CO2 emission from fossil fuel and cement production. Sci Data 7:392

Mahadevan R, Sun Y (2020) Effects of foreign direct investment on carbon emissions: evidence from China and its Belt and Road countries. J Environ Manag 276:111321

Makido Y, Dhakal S, Yamagata Y (2012) Relationship between urban form and CO2 emissions: evidence from fifty Japanese cities. Urban Clim 2:55–67

Meng B, Wang J, Andrew R, Xiao H, Xue J, Peters GPJEE (2017) Spatial spillover effects in determining China’s regional CO2 emissions growth: 2007–2010. Energy Econ 63:161–173

Pan Y, Chen Q, Zhang P (2020) Does policy uncertainty affect corporate environmental information disclosure: evidence from China. Sustain Account Manag Policy J 11:903–931

Pastor L, Veronesi P (2012) Uncertainty about government policy and stock prices. J Financ 67:1219–1264

Pei Y, Zhu Y, Liu S, Wang X, Cao J (2019) Environmental regulation and carbon emission: the mediation effect of technical efficiency. J Clean Prod 236:117599

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. Working Paper 1229

Pindyck RS (1991) Irreversibility, uncertainty, and investment. J Econ Lit 29:1110–1148

Pirgaip B, Dincergok B (2020) Economic policy uncertainty, energy consumption and carbon emissions in G7 countries: evidence from a panel Granger causality analysis. Environ Sci Pollut Res Int 27:30050–30066

Rodríguez M, Pena-Boquete Y, Pardo-Fernández JC (2016) Revisiting environmental Kuznets curves through the energy price lens. Energy Policy 95:32–41

Sen P (2016) Unilateral emission cuts and carbon leakages in a dynamic North-South trade model. Environ Resour Econ 64:131–152

Shahbaz M, Gozgor G, Adom PK, Hammoudeh S (2019) The technical decomposition of carbon emissions and the concerns about FDI and trade openness effects in the United States. Int Econ 159:56–73

Sinn H-W (2008) Public policies against global warming: a supply side approach. Int Tax Public Financ 15:360–394

Tang CF, Tan BW (2015) The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Energy 79:447–454

van der Ploeg F, Withagen C (2012) Is there really a green paradox? J Environ Econ Manag 64:342–363

Wang M (2018) Spatial effect of environmental regulation on carbon emissions. Meteorol Environ Res 9:57–61

Wang S-H, Song M-L, Yu T (2016) Hidden carbon emissions, industrial clusters, and structure optimization in China. Comput Econ 54:1319–1342

Wang Y, Zuo Y, Li W, Kang Y, Chen W, Zhao M, Chen H (2018) Does environmental regulation affect CO2 emissions? Analysis based on threshold effect model. Clean Techn Environ Policy 21:565–577

Wang YA, Zuo YH, Li W, Kang YQ, Chen W, Zhao MJ, Chen HB (2019) Does environmental regulation affect CO2 emissions? Analysis based on threshold effect model. Clean Techn Environ Policy 21:565–577

Wang Q, Xiao KF, Lu Z (2020) Does economic policy uncertainty affect co2 emissions? Empirical evidence from the United States. Sustainability-Basel 12(21):9108

Wooldridge JM (2002) Econometric analysis of cross section and panel data. The MIT Press, Cambridge, Massachusetts

Wu H, Xu L, Ren S, Hao Y, Yan G (2020) How do energy consumption and environmental regulation affect carbon emissions in China? New evidence from a dynamic threshold panel model. Resour Policy 67:101678

Xu Z (2020) Economic policy uncertainty, cost of capital, and corporate innovation. J Bank Financ 111:105698

Yang L (2019) Connectedness of economic policy uncertainty and oil price shocks in a time domain perspective. Energy Econ 80:219–233

Yang Y, Tang D, Zhang P (2020) Double effects of environmental regulation on carbon emissions in China: empirical research based on spatial econometric model. Discret Dyn Nat Soc 2020:1–12

Yao X, Kou D, Shao S, Li X, Wang W, Zhang C (2018) Can urbanization process and carbon emission abatement be harmonious? New evidence from China. Environ Impact Assess Rev 71:70–83

Yu Y, Deng Y-r, F-f C (2018) Impact of population ageing and industrial structure on CO 2 emissions and emissions trend prediction in China. Atmos Pollut Res 9:446–454

Yu J, Shi X, Guo D, Yang L (2021) Economic policy uncertainty (EPU) and firm carbon emissions: evidence using a China provincial EPU index. Energy Econ 94:105071

Zhang K, Zhang Z-Y, Liang Q-M (2017) An empirical analysis of the green paradox in China: from the perspective of fiscal decentralization. Energy Policy 103:203–211

Zhao X, Yin H, Zhao Y (2015) Impact of environmental regulations on the efficiency and CO2 emissions of power plants in China. Appl Energy 149:238–247

Acknowledgements

Funding from the National Natural Science Foundation of China (No.72003180) is gratefully acknowledged.

Funding

This research is funded by the National Natural Science Foundation of China (No.72003180). The National Natural Science Foundation of China provided the necessary financial support for the research.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by YL and ZPZ. The first draft of the manuscript was written by ZPZ, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible editor: Eyup Dogan

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Liu, ., Zhang, Z. How does economic policy uncertainty affect CO2 emissions? A regional analysis in China. Environ Sci Pollut Res 29, 4276–4290 (2022). https://doi.org/10.1007/s11356-021-15936-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15936-6