Abstract

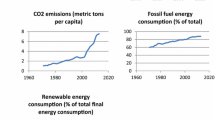

The purpose of this paper is to research the relation among environmental quality and renewable energy in the RECAI country group. The study used per capita CO2 emission, energy intensity, and Aggregate National Savings as a measure of environmental quality. Other variables used in the study are renewable energy consumption, fossil fuel consumption, GDP per capita, and foreign direct investments. In the study, three different models to see different environmental quality indicators by panel quantile method for 19202090–. According to the results obtained, unlike other models, renewable energy consumption in model 1 positively affects energy intensity in all quantiles. In other words, renewable energy consumption negatively affects environmental quality. In model 1 and model 3, the coefficients of fossil fuel consumption were positive and negative, respectively. Unlike model 2, the coefficient estimates of fossil fuel consumption in model 3 were predominantly negative. Fossil fuel consumption shows a positive effect on environmental quality, which is similar to model 1. Economic growth negatively affects environmental quality in all models. There is a one-way causal relationship from renewable energy consumption to energy intensity and energy intensity to growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Global warming and related climate change issues are among the top issues that occupy the world’s agenda today and in the near future. Minimizing the negative effects of climate change is closely related to the use of existing alternative energy resources without impairing the environmental quality. The consumption of renewable energy is extremely important for the sustainable development goals of countries, and in this context, countries increasingly give priority to renewable energy investments within the framework of changing investment models. Renewable energy generally refers to both traditional biomass (i.e., firewood, animal waste, and crop residues burned in stoves) and modern technologies based on solar, wind, biomass, geothermal, and small hydropower.

According to data, approximately 11% of the energy consumed for electricity, transportation, and heating purposes in the world is obtained from renewable energy sources. Considering the global climate conditions and the potential of existing primary energy resources, it becomes inevitable for countries to turn to renewable energy technologies and to produce policies accordingly, and states set recent targets to the enhancement proportion of renewable energy in their energy mixture. These targets set for a rad2019ical change in the energy mix around the world bring new investment opportunities for renewable energy markets. Ernest & Young, an international audit and consultancy services company operating in about 140 countries around the world, periodically publishes the Renewable Energy Country Attractiveness Index (RECAI). This index indicates the most efficient 40 countries’ markets in terms of renewable energy investment opportunities.

RECAI score is calculated according to the renewable energy investments and opportunities of the countries. The US ranks first in the list in terms of renewable energy investment opportunities. Investments in renewable energy technologies in the US have increased significantly in the last 15 years. Investments, which were $ 11.3 billion in 2005, reached $ 59 billion in 2019. The renewable market of the US has become an important market for green technology companies in terms of venture capital and private equity financing, with the effect of green incentive programs and tax exemptions for renewable energy investments. In addition, the US reached a global volume of $ 301.7 billion in 2019 in terms of investments in clean energy, largely focusing on small-scale solar energy and utility-scale renewable technologies (Jaganmohan 2020). On the other hand, China and India, which are among the leading countries of the world in terms of population and energy use, are at the top of the list of attractive countries in terms of renewable energy investments.

Atholia et al. (2020) state that the share of electricity generated from renewable energy sources in the total production in Australia in the last decade has increased to 20%. The study also emphasizes that the Renewable Energy Target (RET), which aims to generate an additional large-scale renewable electricity generation of 33,000 (GWh) by 2020, with the encouragement of the government’s policies on climate change, is determined as the main policy.

According to the RECAI November 2020 report, India, whose installed solar energy capacity has increased significantly in the last few years and exceeded 35GW, has set an installed renewable energy target of 510GW by 2030, increasing its economic attractiveness. Similarly, in South Korea, where the offshore wind sector has become very attractive for investors after the government announced the Green New Deal program, the target of reaching 20% of the production from renewable sources by 2030, in addition to the existing incentives, has an important place in increasing the attractiveness of the country. The announcement that renewable resources will be used instead of fossil fuels in energy investments in Portugal, and the record-breaking bids of the second state-run solar energy tender with a new capacity of 670 MW, setting the 80% target of renewable electricity installed by 2030 increases the attractiveness of the country.

This research contributes to the literature by four different points. With these contributions, the RECAI Index ranks the top 40 markets in the world in terms of the attractiveness of renewable energy investments and distribution opportunities. Because the rankings reflect the assessment of market attractiveness and global market trends, the examination of the possible interaction between environmental quality and renewable energy by taking this group of countries into consideration is of vital importance in terms of foreign capital investments and economic policies of that country. Another contribution of our study is that it analyzes with three different models, including 3 important environmental quality indicators used in different studies in the literature. The third important contribution of the study is method-oriented. This study uses a panel quantitative method which can present consistent coefficients instead of traditional regression approaches such as ordinary least squares based on mean estimation. The classic ordinary least squares assumptions are arbitrary terms with zero mean, constant variance, and normal distribution which are not easily met. Therefore, quantitative regression has an advantage for these hard assumptions. Panel quantitative regression can obtain robust results even when classical econometric assumptions are not met (Wang et al. 2018).

The continuation of the study includes in section two a summary of the literature, in section 3, the methodology is presented, the fourth section includes empirical results, while the last section covers the policy recommendation and conclusion part.

Literature review

The basic aim of the countries in the axis of sustainable development is to optimize the welfare level by using them effectively in the current period without reducing the welfare level of future generations. In other words, countries should make their development moves while preserving the environmental quality. Environmental quality is an indicator of not only the natural environment but also its effects on the health, well-being, and psychological state of the people living in that environment (including plants and animals). Since renewable energy investments are investments that require high financing, they are either carried out by the government or companies investing in this field are provided with various investment advantages. When evaluated from this aspect, whether there is relation among renewable energy depletion, economic improvement, and environmental quality and the direction of this relationship are of great importance in guiding the energy policies to be followed in countries where the state plays an active role in energy markets.

The concept of sustainable development was first discussed in the World Environment and Development Commission Brundtland Report (1987) with the theme “Our Common Future” in 1987. Grossman and Krueger (1991) found a relationship called the Environmental Kuznets Curve (EKC) hypothesis in their study on the relationship between environmental impacts of NAFTA and economic growth. Following this study, the verification of this hypothesis has been one of the main objectives in studies including many country examples such as Apergis and Ozturk (2015) for 14 Asian countries, Apergis (2016) for a panel of 15 countries, Ozcan et al. (2018) for Turkey, and Paramati et al. (2018) for developed and emerging market economies across the globe.

In the last 10 years, many studies have examined the relationship between CO2 emissions, renewable energy consumption, foreign direct investments, economic growth, and environmental quality, and different results have been obtained according to country groups. Azam et al. (2015) investigated the effect of total foreign direct investments on energy consumption and obtained results that support that foreign direct investments can lead to clean energy consumption by reducing energy demand. Bhattacharya et al. (2016) analyzed the relationship between renewable energy consumption and growth performances by using data for the period 1991–2012 for 38 countries included in the RECAI index and consuming more renewable energy in their energy mix. They found that in 57% of the countries included in the analysis, renewable energy consumption has a positive effect on the level of economic output.

Ahmad et al. (2016) researched the relation among CO2, energy depletion, and improvement for the Indian economy in the period of 1971–2014, emphasizing that there is a co-integration relation among the variables and that the EKC is confirmed at aggregated and disaggregated levels. They also concluded that there is a positive relation among energy (total energy, gas, oil, electricity, and coal) depletion and CO2, a feedback effect among economic improvement and CO2. Shahbaz et al. (2017) examined the asymmetrical relation among energy depletion and economic improvement for the Indian economy in the period 1960–2015, and they found that only negative shocks for energy depletion had an impact on economic improvement. Danish et al. (2018) examines the interaction of energy production, economic improvement, and CO2 with reference to the Pakistan economy 1970–2011 data and emphasizes that the main reason for CO2 is energy production from fossil fuels and that there is a bidirectional causality among energy production and CO2 in the long term. On the other hand, it is stated that the energy to be produced from renewable energy sources will contribute to the environmental quality. Balsalobre-Lorente et al. (2018) studied the relation among economic improvement and CO2 for five major European countries (England, France, Germany, Spain, Italy) and emphasized that the interaction among commercial openness and economic improvement and renewable electricity depletion positively affects the environmental quality by creating a positive effect on CO2 emissions. Bekun et al. (2018) used 1996–2014 data for 16 EU countries to confirm that primary energy consumption and economic growth enhancement CO2, while renewable energy depletion makes smaller CO2.

Al Chandio et al. (2019) examined the relation among industrial oil, gas, electricity, renewable energy depletion, and economic improvement for the Pakistani economy and found that there is a relation among industrial energy depletion and growth and that industrial energy depletion has a significant effect on growth. Alola and Kirikkaleli (2019) analyzed the causal relation among CO2, renewable energy depletion, immigration, and health services for the US economy and concluded that there is a positive relation among variables at different scales.

Shahbaz et al. (2020) applied the DOLS and FMOLS non-heterogeneous causality approach for 38 countries consuming renewable energy for the period 1990–2018 and found that there was an important long-term relation among energy depletion and economic improvement. In addition, they found that renewable energy depletion has an impact on economic improvement for 58% of the countries included in the analysis. Ike et al. (2020) researched the relation among renewable energy use, energy prices, CO2, and trade volume for the G7 countries and concluded that energy prices exerted a negative pressure on CO2, while trade volume exerted a strong positive pressure on CO2. On the other hand, they emphasized that the EKC hypothesis is generally confirmed, but different results occur between countries in terms of the relation among renewable energy use and trade volume. The study also found that the use of renewable energy has an indirect effect on CO2 emissions through energy prices. Sharif et al. (2020) investigate the impact of renewable and non-renewable energy consumption on Turkey’s ecological footprint, applying QARDL approach for the period of 1965Q1-2017Q4. The findings indicate that for all quantile in the long-term balance link among ecological footprint and energy depletion in Turkey that had the return of a significant return and the negative error correction parameters confirming this was statistically significant. Zafar et al. (2020) examined the relation among renewable energy use, education, foreign direct investment, and growth for 27 OECD countries. They emphasized that in these countries, green technologies should be increased in order to generate lower carbon emissions through the encouragement of policies that attract foreign direct investments towards energy-efficient and clean technologies and practices such as tax reductions/additional financial incentives. With these policies, it is foreseen that governments’ approaches focused on protecting the natural resource pool through public-public-private partnerships can reduce fossil fuel consumption and carbon emissions can be reduced by encouraging organizations to benefit from renewable energy solutions.

Ansari et al. (2020) examined the effects of energy consumption, globalization, urbanization, and economic growth on environmental quality for a sample of countries consuming renewable energy for the period 1991–2016 and pointed out the existence of a long-term balance relationship between variables. Usman et al. (2020) examined the relationship between clean energy consumption and CO2 emissions using the non-linear ARDL approach for the Pakistani economy for the period 1975–2018. In the study, they obtained results confirming the existence of asymmetries regarding the connection between variables in the short and long run. Adedoyin et al. (2021) examined the energy-growth-CO2 relationship for 32 Sub-Saharan African countries for the period 1996–2014 and concluded that both real GDP and renewable energy use increase CO2 emissions as a result of the one-way GMM analysis.

Ullah et al. (2020) investigated the relationship between GDP growth volatility, inflation instability, and the environmental quality in Pakistan, for 1975–2018 by employing an asymmetric autoregressive distributed lag framework. They concluded that positive and negative shocks of inflation instability have different effects on environmental quality in Pakistan.

Empirical methods

Model

The aim of this study is to investigate the relationship between three variables and renewable energy, which is a measure of environmental quality. Per capita, CO2 emission (CO2), energy intensity (enu), and Aggregate National Savings (AS) are included in the model as three variables indicating environmental quality and three different models are created. The main model used in the study was created by Salahuddin and Gow (2019), Twerefou et al. (2017), and Salahuddin et al. (2020) as follows:

In Eq. 1, n = 1, 2, 3 means CO2, enu and AS variables, which are three indicators of environmental quality, respectively. L1i denotes the country-specific time-invariant fixed effects. HSt shows the heterogeneous factor loadings that capture both time-variant heterogeneity and cross-sectional dependence, δi stands for the unobserved common factors, and εit represents the random error term (Salahuddin et al. 2020). I and t show the group of countries (32 countries) and the observation period (1990–2020), respectively.

Data and measurement of variables

In this study, 32 RECAI countries were examined during the 1990–2020 observation period (RECAI 2020). The countries that make up the panel group are as follows: Germany, Argentina, Australia, Brazil, Chile, China, Denmark, Philippines, Finland, France, South Africa, India, Spain, Israel, Italy, Japan, Canada, South Korea, Mexico, Egypt, Morocco, Netherlands, Norway, Pakistan, Portugal, Sweden, Switzerland, Thailand, Turkey, UK, USA, and Greece. The data of 8 of the RECAI countries (Taiwan, Belgium, Poland, Ireland, Jordan, Vietnam, Kazakhstan, Austria) consisting of 40 countries were not included in the study because they were not suitable for the balanced panel. The variables and their abbreviations used in the study and included in Eq. 1 are shown in Table 1. All variables used in the study were used by taking their natural logarithm and first difference.

Estimation procedures

Unit root test

It is the basic rule that the variables used in the research are stationary at the level or in the first difference. Unit root and cross-sectional dependencies of variables used in the study were investigated using the cross-sectional augmented IPS (CIPS) (Pesaran 2007) analysis method. CIPS basic equality is as follows:

where fit is the variable in the time t; i = 1, 2…..N; t = 1, 2 …. T is a K×1 vector of regression, q is a K×1 parameter vector, and ρi indicates that time-invariant individual distress parameters. In Eq. 2, eit means that the alternative hypothesis is cross-sectional dependency and the null hypothesis is independent.

-

H0: gib = gbi = cov(hit, hbt)= 0 for i≠b,

-

H1: gib = gbi ≠ 0 for the same i≠b, where gib is the product-moment correlation disturbance and is given by;

where k increases with the number of possible pairings, (git , gbt) (Shahbaz et al. 2020).

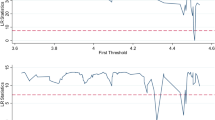

Panel quantile approach

Panel quantile regression analysis method gives more reliable results than traditional regression prediction methods. Because unlike traditional methods, the panel quantile method ignores the average effects when analyzing coefficient (Binder and Coad 2011). On the other hand, non-Gaussian variations and heterogeneity are not seen in this coefficient prediction method. Coefficients are more reliable in low, medium, and high quantile in coefficient estimates without heterogeneity (Dogan et al. 2020). Koenker and Bassett (1978) developed the quantile method. The panel quantile method used by Koenker (2004), Lamarche (2010), and Galvao (2011) in panel data studies is expressed as follows:

In Eq. 2, i denotes country groups and t refers to the observation period. The symbol c indicates the dependent variable and the y symbol indicates all variables in the equation. The j symbol symbolizes quantiles (0 < j < 1). β fixed effects on the model. Equation 2 allows y variables to be associated with j quantiles, but βi does not show fixed effects. Koenker (2004) solved the minimization problem that may occur in more than one quantile with the following equation;

Koenker and Bassett (1978) defines oaq = a (z – I (a < 0)) in Eq. 3 as the linear quantile loss function. The relative weight of the quantiles μ on the estimation of the parameters θsis controlled by Zl. On the other hand, Koenker (2004) suggests that individual effects should be directed towards a common value. This proposition is called the quantile penalty method in the literature and is expressed as follows;

where T(θ) = \( {\sum}_{i=0}^n\mid {\theta}_s\mid \)is the penalty considered.

Granger causality (Wald) test

After the regression estimates, Granger’s (1969) Wald test is used to investigate the existence of causality between variables. The method developed by Granger (1969) is as follows:

I and t in Eq. 5 denote the country group and the observation period, respectively, while x and v denote the stationary variables. Again, m denotes the lag in Eq. 5. \( {\alpha}_i^{(c)} \) expresses the autoregressive parameters and \( {\beta}_i^{(c)} \)means that slopes of coefficients. If the lagged values of the v variable improve the coefficient estimates of the x variable, it is accepted that there is a causal relationship from v to x.

Empirical results

As the first step of econometric application, it is necessary to investigate the stationary of the variables at the level or the first difference. It is seen in Table 2 that with the CIPS unit root analysis method, and all variables are stationary at the first difference and there is no cross-sectional dependency.

After investigating the unit root stationarity of the variables, regression analysis with panel quantities can be started. Tables 3, 4, and 5 show model 1, model 2, and model 3 regression estimates, respectively.

In model 1, energy intensity (ENU)-dependent variable and other variables (REC, FFC, FDI, GDP) are independent variables. Renewable energy consumption has an unexpected effect on energy intensity in model 1. A positive and statistically significant relationship was determined between renewable energy and energy intensity. Salahuddin et al. (2020) determined that the relationship between the two variables is negative. In this case, renewable energy has a negative effect on environmental quality. On the other hand, fossil fuel consumption has an unexpectedly positive and negative effect on energy intensity. However, for the most part the effect appears to be negative. Both negative and positive effects in low, medium, and high quantiles make it difficult to comment. Considering the coefficients as a whole, fossil fuel consumption has an unexpectedly decreasing effect on energy intensity. Similar to fossil fuel consumption, foreign direct investments have both negative and positive effects on environmental quality. However, the direction of the relationship between FDI and environmental quality is predominantly positive. RECAI countries are generally composed of developed economies, in this case, countries where foreign investors invest. FDI has a reducing effect on environmental quality. This situation supports the race to the bottom hypothesis. The relationship between GDP and environmental quality is seen as positive in all quantiles. In this case, it is seen that economic growth negatively affects the environmental quality.

Table 4 shows model 2 where CO2 is the dependent variable. Renewable energy consumption coefficients are seen as negative and significant in all quantiles. In this case, it is seen that renewable energy has a positive effect on environmental quality. Results are consistent with recent studies (Nathaniel and Iheonu 2019; Acheampong et al. 2019; Hu et al. 2018; Apergis et al. 2018; Aslan and Oguz 2016. On the other hand, fossil fuel consumption has a negative impact on environmental quality as expected. The fossil fuel consumption coefficient is positive and significant in all quantiles. The relationship between fossil fuel and CO2 is consistent with the studies of Hanif et al. (2019) and Moner-Girona et al. (2018). Contrary to model 1, there is a negative relationship between FDI and CO2 in model 2. In this case, foreign investments have a positive contribution to a clean environment. As expected, gdp shows a positive effect on CO2 in all quantiles.

Table 5 shows the regression estimates for model 3, where AS is the dependent variable. AS in model 2, renewable energy consumption has a positive effect on the increase of environmental quality in all quantiles. The relationship between fossil fuel consumption and environmental quality shows both positive and negative effects as in model 1. However, the direction of the relationship between the two factors is predominantly positive. FDI also shows both positive and negative effects on environmental quality, similar to the results in model 1. However, it can be seen from the regression results in Table 5 that the positive effect is dominant. When looking at the GDP coefficients, it is positive and significant as in model 1 and model 2. As a result, economic growth negatively affects environmental quality.

After regression estimates for three variables and three models, which are the measure of environmental quality, the existence of a causal relationship between variables should be investigated. Table 6 shows Granger causality analysis results. The variables on the horizontal axis show the equation variables, and the variables on the vertical axis show the excluded variables.

It is concluded that a two-way causal relationship is valid between energy intensity and FDI. No bidirectional causal relationship is determined between CO2 and AS, which is the other environmental quality criterion other than energy intensity, and any variable. There is a one-way causal relationship from renewable energy consumption to energy intensity, from FDI to AS, from fossil fuel consumption and growth to CO2. On the other hand, one-way relationships from energy intensity to growth, from AS to FFC, from CO2 to FDI have been determined. While there is a one-way relationship from renewable energy consumption to FDI, there is a two-way relationship between GDP and renewable energy. A one-way causal relationship from fossil fuel consumption to renewable energy consumption, from GDP to FDI has been determined.

Policy recommendation and conclusion

In this study, three variables were used as environmental quality measures. These are CO2 emissions, AS, and energy intensity. These three variables were included in the equation as dependent variables in three different models, respectively, and their relationship with renewable energy consumption was tested in RECAI countries. As control variables GDP, fossil fuel consumption and FDI were used. In the study, panel quantile method as coefficient estimation method and Granger causality analysis method were used to investigate causality. In the study, 32 RECAI countries constitute the panel group in the 1990–2020 observation period.

The relationship between renewable energy consumption and environmental quality is surprisingly negative in model 1. In model 1, where the energy density is the dependent variable, the coefficients in all quantiles were determined as negative. As expected in model 2 and model 3, renewable energy consumption positively affects the environmental quality. The reason for the unexpected negative relationship seen in model 1 is the limited renewable energy consumption. In these economies, which are mostly composed of developed economies, clean energy may be preferred in individual usage areas. In order for renewable energy to have a positive effect on the environment, its usage area must be very wide. It is quite surprising to find different results in the same panel countries. However, model 2 and model 3 once again demonstrated the importance of renewable energy for a clean environment, as expected. A similar relationship between renewable energy and clean environment is seen between fossil fuel consumption and environmental quality. In model 1 and model 3, the coefficients of fossil fuel consumption are seen as both negative and positive. In model 2, the coefficient of fossil fuel consumption is positive for all quantiles. In this case, it is seen in model 2 that fossil fuel consumption clearly reduces environmental quality. In model 3, mainly the coefficients of fossil fuel consumption are seen as positive. As expected, fossil fuel consumption negatively affects environmental quality. The surprising results are seen in model 1. According to model 1 regression estimates, fossil fuel consumption has a decreasing effect on energy intensity. Therefore, it contributes positively to a clean environment.

Looking at the results of the research, growth in all three models has a negative effect on environmental quality. This effect is observed in the regression estimates of all three models, without exception, in all quantiles. On the other hand, FDI, which is one of the most important factors of growth, has a negative effect on environmental quality in models except model 2. The vast majority of RECAI countries are developed economies. They are highly preferred by investors thanks to their developed markets and developed banking systems. It seems quite difficult for the observation countries to eliminate this negative effect of economic development on environmental factors. However, this problem can be reduced with technological advancement and increased use of renewable energy sources.

According to causality analysis, there is a causal relationship from renewable energy consumption to energy intensity only. A causal relationship from renewable energy to CO2 and AS variables has not been determined. On the other hand, a causal relationship was not determined between the variables CO2, ENU, and AS. A unidirectional causality from GDP and fossil fuel consumption to CO2 emission was determined. On the other hand, a one-way causal relationship from foreign investments to ENU and AS variables has been determined.

References

Acheampong AO, Adams S, Boateng E (2019) Do globalization and renewable energy contribute to carbon emissions mitigation in sub-Saharan Africa? Sci Total Environ 677:436–446

Adedoyin FF, Ozturk I, Agboola MO, Agboola PO, Bekun FV (2021) The implications of renewable and non-renewable energy generating in sub-Saharan Africa: the role of economic policy uncertainties. Energy Policy 150:112115

Ahmad A, Zhao Y, Shahbaz M, Bano S, Zhang Z, Wnag S, Liu Y (2016) Carbon emissions, energy consumption and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96:131–143

Alola AA, Kirikkaleli D (2019) The nexus of environmental quality with renewable consumption, immigration, and healthcare in the US: wavelet and gradual-shift causality approaches. Environ Sci Pollut Res 26:35208–35217

Ansari MA, Haider S, Masood T (2020) Do renewable energy and globalization enhance ecological footprint: an analysis of top renewable energy countries? Environ Sci Pollut Res 28:6719–6732. https://doi.org/10.1007/s11356-020-10786-0

Apergis N (2016) Environmental Kuznets curves: New evidence on both panel and country-level CO2 emissions. Energy Econ 54:263–271 ISSN 0140-9883

Apergis N, Ozturk I (2015) Testing Environmental Kuznets Curve hypothesis in Asian countries. Ecol Indic 52:16–22 ISSN 1470-160X

Apergis N, Ben Jebli M, Ben Youssef P (2018) Does renewable energy consumption and health expenditures decrease carbon dioxide emissions? Evidence for sub-Saharan Africa countries. Renew Energy 127:1011–1016

Aslan A, Oguz O (2016) The role of renewable energy consumption in economic growth: evidence from asymmetric causality. Renew Sust Energ Rev 60:953–959

Atholia T, Flannigan G, Lai S (2020) Renewable Energy Investment in Australia. Reserve Bank of Australia

Azam, M., Khan, A.Q., Zaman, K., & Ahmad,M. (2015). Factors determining energy consumption: evidence from Indonesia, Malaysia and Thailand. Renew Sust Energ Rev, 42, 1123-1131.

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Bekun FV, Alola AA, Sarkodie SA (2018) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029

Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S (2016) The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl Energy 162:733–741

Binder M, Coad A (2011) From Average Joe’s happiness to Miserable Jane and Cheerful John: using quantile regressions to analyze the full subjective well-being distribution. J Econ Behav Organ 79(3):275–290

Brundtland GH (1987) World commission on environment and development, our common future, report. Oxford University Press, Oxford

Chandio AA, Rauf A, Jiang Y, Ozturk I, Ahmad F (2019) Cointegration and causality analysis of dynamic linkage between ındustrial energy consumption and economic growth in Pakistan. Sustainability 11:4546. https://doi.org/10.3390/su11174546

Danish, Zhang B, Wang Z, Wang B (2018) Energy production, economic growth and CO2 emission: evidence from Pakistan. Nat Hazards 90:27–50

Dogan E, Madaleno M, Altinoz B (2020) Revisiting the nexus of financialization and natural resource abundance in resource-rich countries: new empirical evidence from nine indices of financial development. Res Policy 69:101839

Galvao AF (2011) Quantile regression for dynamic panel data with fixed effects. J Econ 164(1):142–157

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424

Grossman GM, Krueger AB (1991) Environmental impacts of a North American Free Trade Agreement. NBER Working Papers 3914, National Bureau of Economic Research, Inc

Hanif I, Faraz Raza SM, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy. 171:493–501

Hu H, Xie N, Fang D, Zhang X (2018) The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: evidence from 25 developing countries. Appl Energy 211:1229–1244

Ike GN, Usman O, Alola AA, Sarkodie SA (2020) Environmental quality effects of income, energy prices and trade: the role of renewable energy consumption in G-7 countries. Sci Total Environ 721:137813

Jaganmohan M (2021) Renewable energy investments in the U.S. 2004–2019. Statista Country Reports. https://www.statista.com/statistics/186818/north-american-investment-in-sustainable-energy-since-2004/

Koenker R (2004) Quantile regression for longitudinal data. J Multivar Anal 91(1):74–89

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46(1):33

Lamarche C (2010) Robust penalized quantile regression estimation for panel data. J Econ 157(2):396–408

Moner-Girona M, Solano-Peralta M, Lazopoulou M, Ackom EK, Vallve X, Szabó S (2018) Electrification of Sub-Saharan Africa through PV/hybrid mini-grids: reducing the gap between current business models and on-site experience. Renew Sust Energ Rev 91:1148–1161

Nathaniel SP, Iheonu CO (2019) Carbon dioxide abatement in Africa: the role of renewable and non-renewable energy consumption. Sci Total Environ 679:337–345

Ozcan B, Apergis N, Shahbaz M (2018) A revisit of the environmental Kuznets curve hypothesis for Turkey: new evidence from bootstrap rolling window causality. Environ Sci Pollut Res 25:32381–32394. https://doi.org/10.1007/s11356-018-3165-x

Paramati SR, Alam MS, Apergis N (2018) The role of stock markets on environmental degradation: a comparative study of developed and emerging market economies across the globe. Emerg Mark Rev 35:19–30 ISSN 1566-0141

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

RECAI (2020) Renewable energy country attractiveness Index, Issue: 56. https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/top

Salahuddin M, Gow J (2019) Effects of energy consumption and economic growth on environmental quality: evidence from Qatar. Environmental Science and Pollution

Salahuddin M, Habib MA, Al-Mulali U, Ozturk I, Marshall M, Ali MI (2020) Renewable energy and environmental quality: a second-generation panel evidence from the Sub Saharan Africa (SSA) Countries. Environ Res 110094

Shahbaz M, Hoang THV, Mahalik MK, Roubaud D (2017) Energy consumption, financial development and economic growth in India: new evidence from a nonlinear and asymmetric analysis. Energy Econ 63:199–212

Shahbaz M, Raghutla C, Chittedi KR, Jiao Z, Vo XV (2020) The effect of renewable energy consumption on economic growth: evidence from the renewable energy country attractive index. Energy 118162

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from Quantile ARDL approach. Sustain Cities Soc 57:102138

Twerefou DK, Kwadwo DM, Godfred AB (2017) The environmental effects of economic growth and globalization in Sub-Saharan Africa: a panel general method of moments approach. Res Int Bus Financ 42:939–949

Ullah, S., Apergis, N., Usman, A., Chishti M.Z. Asymmetric effects of inflation instability and GDP growth volatility on environmental quality in Pakistan. Environ Sci Pollut Res 27, 31892–31904 (2020). https://doi.org/10.1007/s11356-020-09258-2

Usman A, Ullah S, Ozturk I, Chisti MZ, Zafar SM (2020) Analysis of asymmetries in the nexus among clean energy and environmental quality in Pakistan. Environ Sci Pollut Res 27:20736–20747

Wang N, Zhu H, Guo Y, Peng C (2018) The heterogeneous effect of democracy, political globalisation, and urbanisation on PM2.5 concentrations in G20 countries: evidence from panel quantile regression. J Clean Prod 194(2018):54–68

Zafar MW, Shahbaz M, Sinha A, Sengupta T, Qin Q (2020) How renewable energy consumption contribute to environmental quality? The role of education in OECD countries. J Clean Prod 268:122149

Funding

The authors received no financial support for the research, authorship, and/or publication of this article.

Author information

Authors and Affiliations

Contributions

Writing—original draft, conceptualization: ND; writing—original draft: AA; data curation: BO; supervision, project administration: AA. The authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable.

Conflict of interests

The authors declare that they have no conflict of interests.

Availability of data and materials

Not applicable

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Aslan, A., Ozsolak, B. & Doğanalp, N. Environmental quality and renewable energy consumption with different quality indicators: evidence from robust result with panel quantile approach. Environ Sci Pollut Res 28, 62398–62406 (2021). https://doi.org/10.1007/s11356-021-15181-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15181-x