Abstract

This study examines links between Morgan and Stanley capital Investment (MSCI), foreign direct investment (FDI), renewable energy, urbanization, and trade openness on environmental degradation in (Brazil, Russia, India, China, South Africa) BRICS countries. In this study, generalized method of moment (GMM) estimation is applied on a data set ranging from 1993 to 2018. Results illustrate that stock market index price (MSCI) has negative relationship on CO2 emissions in India, China, Russia, and South Africa and has positive relationship in Brazil. One possible reason for this is strong environmental regulations and their enforcement by Brazilian government. The study also finds that trade openness, FDI, and urbanization have a significant positive relationship on environmental degradation. The impact of stock market development on environmental degradation varies among BRICS countries. Our outcomes have significant policy implications. For example, the policy makers have to initiate effective strategies to promote the renewable energy sources to meet the increasing demand for energy by replacing the use of conventional energy such as coal, gas, and oil. This will help to reduce the CO2 emissions from fossil fuel and ensure sustainable stock market development in the BRICS nations. BRICS countries who have taken the initiative and formulated policies for businesses to conserve the environment play a positive role compared to those who do not.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the last two decades, protecting natural environment has been one of the prominent global concerns. The increasing temperatures have become a significant threat to environmental degradation. The 1997 Kyoto protocol aims to reduce greenhouse gas (GHG) emissions which are major contributors to environmental degradation. Most of the GHG emissions come from fossils energy (Paramati et al. 2017b). Environment policymakers and energy economists urge to use renewable energy sources instead of fossil energy sources.

It is evident that renewable energy sources reduce carbon emissions (Hanif et al. 2019). Since renewable energies are harmless in environmental pollution as they decrease CO2 and other greenhouse gasses, their consumption is not limited. The ever-increasing energy demand for the development and expansion of renewable energies is necessary for developing countries’ sustainable development as an important factor. Although BRICS countries (Brazil, Russian, India, China, and South Africa) signed the Kyoto Protocol to control greenhouse gas emissions, there are still major environmental concerns given the region’s recent economic growth.

Other important factor that can be related to environmental improvement is stock market. Stock market is considered one of the leading economic indicators; its stock value determines future economic growth. The stock market is highly attractive for businesses (Sadorsky 2010), as it permits additional sources of funds and equity funding for entrepreneurs to expand their business. This enhanced activity helps businesses and investors diversify their risks, lower financing costs, optimize capital structure, and invest in new projects (Paramati et al. 2017b). This increased economic activity is anticipated with a high demand for energy.

A critical review of literature reveals that regardless of this theoretical link among economic activity, energy demand, and environmental degradation (Zhao and Yang 2020; Hanif et al. 2019; Paramati et al. 2017a, b; Tamazian et al. 2009), research related to MSCI, renewable energy conservation, and CO2 emissions is still unexplored.

Financial development is another factor that degrades the environment. As financial development increases economic growth, this economic growth attracts more foreign direct investment (FDI) and R&D investments and hence requires more energy consumption resulting in more CO2 emission (Tamazian et al. 2009). Additionally, literature illustrates that FDI boosts countries manufacturing production processes, expands its logistics and industrialization; requires more energy consumption, and leads to more CO2 emissions (Hanif et al. 2019). These advanced technologies enhance energy efficiency and environment-friendly production and reduce carbon emissions (Doytch and Narayan 2016). The link between FDI and carbon emission is worth investigating as previous studies have certain conflicts (Dasgupta et al. 2001; Ozturk and Acaravci 2013; Sadorsky 2010; Shahbaz et al. 2013).

Moreover, the literature reveals that trade openness of a country also impacts its environment. Trade openness leads to environmental degradation (Nasir and Ur Rehman 2011). Many other studies also confirm this impact on environmental degradation. For instance, Haq et al. (2016) showed that trade openness may have detrimental effects on the environment. However, if these traded commodities or their products are environmental-friendly, this openness may save the environment from degradation. Trade openness may lead to environmental degradation in three ways: first based on traded technique, second based on scale, and third through composite effect (Grossman and Krueger 1991, b). Trade openness may also decrease carbon emission levels as technology transfer across countries and diffusion of environmentally friendly production technologies reduces carbon emission levels.

Additionally, foreign trade interjects domestic market thus increasing domestic competition and domestic traders shift toward efficient techniques for production. Thus, it helps lessen CO2 emission. Also, trade openness increases a country’s production levels using its scarce natural resources ultimately increasing carbon emissions. Furthermore, ratio of exports to imports is called composition effect. As trade openness of a country shifts toward cleaner industries, this will result in low carbon emissions levels and in turn low environmental degradation. If trade openness prefers dirty industries as compared to cleaner industries, then this will lead toward environmental degradation. Therefore, the role of trade in literature is ambiguous as it may improve or degrade environment (Nasir and Ur Rehman 2011).

Urbanization is a global phenomenon that is also considered as a prime determinant of economic growth. Half of the world’s population lives in urban areas. Contrary to developing economies, this ratio is higher in developed countries (Seto et al. 2010; Sadorsky 2014). Usually, unemployed people from rural areas move toward urban areas for new learning and employment opportunities; this movement disrupts the environment and infrastructure in urban areas and cannot be controlled by law (Shahbaz et al. 2016). By providing employment opportunities, urbanization leads toward environmental degradation, poverty omissions, and disease spreads. Studies by Poumanyvong and Kaneko (2010), Zhang and Lin (2012), Al-Mulali et al. (2013), and Dogan and Turkekul (2016) show that urbanization increases demand for traditional fuel energy consumption and vehicles, among others (Katircioğlu and Katircioğlu 2018; Ali et al. 2019).

The impact of environmental degradation on urbanization can be positive and negative (Muhammad and Abdul 2014). Literature also reveals negative relationship between urbanization and carbon emissions (Fan et al. 2006; Sharma 2011; Muhammad and Abdul 2014), whereas urbanization also brings efficiency in scarce resources resulting in improvement of environmental quality (Capello and Camagni 2000; Gasimli et al. 2019). Additionally, urbanization can also help in improving environmental quality (Effiong 2016).

Hence, this study aims to examine the impact of annual stock market prices and renewable energy consumption on environmental degradation. The study also investigates the relationship between FDI, urbanization, and trade openness on environmental degradation. The study makes use of annual data from 1992 to 2018 in the BRICS countries by using econometric estimation. The study makes several contributions to the literature. First, this study investigates the relationship between annual stock market price, FDI, renewable energy, urbanization, and trade openness in BRICS countries. This study uses MSCI variable for stock market development that is missing in past studies. It also incorporates a variety of variables in single study like stock market development, FDI, urbanization, trade openness, renewable energy, and total energy consumption for a data set of 1993–2018.

To study the role of environmental degradation on stock markets in BRICS region in manifold, one major reason is the risks associated with its stock market development in terms of energy consumption safety and environmental degradation. The BRICS countries might be a giant group then G6 in less than 40 years, and by 2025, they could account for over half the size of G6 (Sachs 2003). To maintain the pace of economic growth, BRICS countries’ stock markets are under constant pressure by internal and external risks associated with environmental degradation.

Literature review

Environmental degradation and annual stock market price

Over the decades, studies have examined the link between financial development of stock markets, energy consumption, and environmental degradation around the globe. However, the results still are inconclusive. Either the financial development of a country increases energy consumption and hence environmental degradation (carbon emissions) or vice versa. Studies conducted on developed and developing markets showed that stock market indicators impact carbon emissions differently in developed and emerging markets. Stock market indicators of developed markets impacts carbon emissions significantly positive, whereas on emerging markets, their impacts are significantly negative, hence enhancing the support for environmental Kuznets curve (EKC) hypothesis, which says that stronger stock markets play a central role in minimizing carbon emissions. One reason for this phenomenon might be that developed stock markets have formulated effective policies against environmental degradation, and carbon emissions for listed firms, whereas emerging markets still lag.

Khan et al. (2020) studied the link between energy consumption, economic development, and CO2 emissions in Pakistan. Data from 1965 to 2015 was used. Results indicated that energy consumption and economic growth increases the CO2 emissions. One possible reason for these findings is the use of traditional energy sources such as coal, gas, and oil for increased demand of energy consumption instead of renewable energy sources. Işık et al. (2019) studied the impact of renewable energy, fossil energy, population, and real GDP on CO2 emissions by taking a sample of ten US states from 1980 to 2015. Five states (Florida, Illinois, Michigan, New York, and Ohio) showed support of the EKC hypothesis, i.e., renewable energy resources help in lowering environmental degradation (carbon emission), whereas fossil energy has negative impacts on CO2 emissions in Texas and other states.

Hanif (2018) examined the relationship between economic growth, urbanization, renewable energy consumption, fossil fuels, and solid fuels on CO2 emission. A sample for this study was taken from 1995 to 2015 of Saharan Africa. The results from the GMM model illustrated that CO2 emissions has positive relationship with fossil fuels and solid fuels. Bhat (2018) also examined the association between energy consumption and economic growth on CO2 emission from 1992 to 2016. Findings showed that renewable energy resources negatively impact CO2 emissions, whereas nonrenewable energy resources positively impact CO2 emissions. One reason for high CO2 emissions in developing countries as compared to developed markets is well illustrated by study conducted by Sinha and Shahbaz (2018). Shifting from traditional energy sources to renewable energy sources demands a high cost of the initial investment. Developing countries showed reluctance for this initial stage high cost to convert their traditional energy consumption to renewable energy sources, hence contributing more in environmental degradation to emitting more CO2. Promoting renewable energy sources in underdeveloped countries might lead to economic distress in the short run.

Their study also supports the findings of Inglesi-Lotz and Dogan (2018), suggesting that varying technological and economic conditions impact the choice of varying energy structures among developing and developed countries. Due to the reason, shifting on renewable energy sources from ancient traditional energy sources is a far big challenge for developing countries.

Dasgupta et al. (2001) also studied the impact of developed stock markets on environmental degradation by selecting a US sample and Canadian markets. By implementing environmental-friendly policies and practices for listed companies, efficient capital markets play a role in improving environmental performance. Dasgupta et al. (2001) studied the same link in the developing markets of Argentina, Chile, Mexico, and Philippines. The results showed that several disclosure mechanisms elevated environmental performance. Some more noteworthy studies with their findings are listed in Table 1.

Environmental degradation and urbanization

A brief review of the literature showed that the effect of urbanization could be positive or negative on environmental degradation. Gasimli et al. (2019) study the relationship in Sri Lanka between energy, trade urbanization, and environmental degradation for a time series sample of 1971 to 2006. Findings illustrate that long-run and short-run energy consumption have significant positive relations with carbon emission. Trade openness also has a significant positive relation with carbon emission, as more and more trade leads toward carbon emission in atmosphere.

On the other hand, urbanization was found to be significantly negatively associated with carbon emissions. Shahbaz et al. (2014) study the relationship between urbanization and carbon emissions in UAE. Quarter frequency data for a period of 1975–2011 was taken and found a long-run relationship between economic growth, electricity consumption urbanization, and carbon emissions. Also, urbanization has a significantly positive effect on carbon emission.

The same findings of the link between urbanization and carbon emissions were reported by Katircioğlu and Katircioğlu (2018) on a Turkey economy sample. As rapid development in urbanization leads to the use of traditional sources of energy consumption, it positively affects carbon emissions. Al-Mulali and Ozturk (2015) examine the environmental degradation factors in MENA (Middle East and North African region). Data was taken from 14 MENA countries for a period of 1996–2012. The results showed that energy consumption, urbanization, trade openness, and industrial development lead to higher environmental degradations.

Whereas Wang et al. (2017) and Wang et al. (2019) studied the link within China, the results showed that in the western region, urbanization impacts significantly positive to carbon emissions, while in eastern regions where there is rapid urbanization development taking place, it did not affect carbon emissions.

Saidi and Mbarek (2017) study the impact of financial development, income trade openness, and urbanization on carbon emissions for 19 countries for a period of 1990–2013. An inverted U-shaped relationship was found between income and environmental degradation. Financial development was found to be abating environmental degradation as the link between financial development and carbon emissions was significantly negative. The rationale for this finding is the financial reforms for listed companies as they imply financial development. Urbanization was found to be reducing carbon emissions. Hence, a suggestion for these countries’ policymakers is to impart the knowledge to slow the rapid urbanization increase.

Environmental degradation and foreign direct investment

FDI is another environmental degradation element (Grossman and Krueger 1991, b). To date, no consensus exists in the literature that either FDI helps in lowering environmental degradation or elevating the levels in the host country.

Two main streams of literature go parallel. Pollution haven hypothesis states that strict environmental policies countries prefer to invest in weak environmental policies countries to fulfill the need of investment projects which might lead toward higher environmental degradation in host countries (Sarkodie and Strezov 2019; Balsalobre-Lorente et al. 2019; Harris, 2008; Liu et al. 2017; Hanif et al. 2019; Gago-de-Santos and Abbas 2019). Whereas Azam et al. (2019), Sarkodie and Strezov (2019), Sarkodie et al. (2019), and Liobikienė and Butkus (2019) studies are in conjunction with pollution halo hypotheses which states that host countries overcome these environmental degradation activities through FDI by introducing smart/advanced technology transfer, better management, and environmental innovations.

Caglar 2020 examines nine countries identified as highest by Climate Change Performance Index 2018 (CCPI) to examine the link between renewable energy, non-renewable energy, foreign direct investment, economic growth, and carbon emissions. The results demonstrated a significant positive long-term relationship in some countries between foreign direct investment renewable energy and economic growth, whereas results were different for nine countries on short-term basis. The stated rationale for this was the difference in policy implications for all nine countries for CO2 emissions. Some other studies are listed in Table 2.

Environmental degradation and trade openness

Boutabba (2020) investigates the role of financial development, economic growth, energy consumption, and trade openness in mitigating carbon emissions in India. The results showed that financial development reduces environmental degradation as financial development has long-run positive effect on carbon emissions.

Maji and Habibullaha (2015) study the link between trade openness and environmental quality in Nigeria through deforestation for a period from 1981 and 2011. Results showed that trade flow and economic growth were significantly associated but had an indirect relationship. For instance, both variables will help in the reduction of deforestation and turn will reduce environmental quality. The population was significantly positive in relation to deforestation, whereas the impact of energy was insignificant.

Ali et al. (2020) examine the relationship between trade openness, FDI, and institutional performance on environmental degradation in OIC countries. The results showed that trade openness, FDI, and urbanization have a significant positive relationship with environmental quality, but significant negative relationship between institutional performance and ecological footprints. The results suggest that OIC countries should incorporate green technologies, clean production, and improved institutions for sustainable and improved environmental quality.

Study conducted by (Alola 2019a) in the USA revealed that monetary policy, immigration, and trade are the hurdles to environmental sustainability. In another study, Alola (2019b) observed environmental degradation factors in the USA from 1990 to 2018. The short-run results showed a significant positive impact on CO2 emissions, whereas positive relation was found between migration and CO2 emissions.

Environmental degradation and renewable energy

Alola et al. (2019) study the relationship between renewable energy and environmental degradation in three European countries (France, the UK, and Germany). Robustness test also confirmed the reported relationship.

Sharif et al. (2020) study the link between renewable energy utilization and environmental degradation from 1990 to 2017 monthly. The sample was selected from the top 10 polluted countries of the world. The results revealed that renewable energy consumption is negatively associated with environmental degradation in China, the USA, Japan, Canada, Brazil, South Korea, and Germany, in contrast to India, Russia, and Indonesia. To lower ecological degradation, the government should implement policies of green energy as a substitute for old traditional energy sources.

Ben and Ben (2015) examine the relationship between trade openness and green and non-green energy under EKC hypothesis in Tunisia. Moreover, they found a unidirectional link between carbon emissions and green energy utilization. This link was unidirectional respectful of import and export-oriented variables.

Aggregate correlation

The trend of the correlational relationship of each variable with CO2 emission is reported in Figs. 1, 2, 3, 4, 5, 6, and most of the relationship patterns are important here. The previous theoretical literature suggests that the positive/negative relationship between our explanatory variables and CO2 emission could arise for several reasons, including policy and non-policy measures for economy-boosting’s productivity effects.

Figure 1 is showing the relationship between MSCI and CO2 emission for a cross section of 5 countries. The aggregate relationship suggests a negative relationship between MSCI and CO2 emission since countries with a higher level of stock market performance have a significant lower CO2 emission rate. We can say that each additional unit increase in MSCI is associated with − 0.21 points decrease in CO2 emission. This estimated point is statistically significant at a 1% level, whereas the stock market performance level explains 58% of cross-country variance of CO2 emission.

Figure 2 shows the relationship between trade openness and CO2 emission for a cross section of 5 countries. The aggregate relationship suggests a positive relationship between trade openness and CO2 emission since countries with a higher level of trade openness have a significantly higher CO2 emission rate. We can say that each additional one percent increase in trade openness is associated with a 0.09-point increase in CO2 emission. This estimated point is statistically significant at a 1% level, whereas the level of trade openness explains 58% of cross-country variance of CO2 emission.

Figure 3 shows the relationship between GDP per capita growth and CO2 emission for a cross section of 5 countries. The aggregate relationship suggests a negative relationship between economic development and CO2 emission since countries with a higher economic development level have a significantly lower CO2 emission rate. We can say that each additional one percent increase in GDP per capita growth is associated with a 0.13-point decrease in CO2 emission. This estimated point is statistically significant at a 1% level, whereas the economic development level explains 67% of cross-country variance of CO2 emission.

Figure 4 shows the relationship between FDI growth and CO2 emission for a cross-section of 5 countries. The aggregate relationship suggests a positive relationship between FDI and CO2 emission since countries with a higher level of foreign direct investment have a significantly higher CO2 emission rate. We can say that each additional one percent increase in FDI is associated with 0.23-point increase in CO2 emission. This estimated point is statistically significant at 1% level, whereas the FDI level explains about 54% of cross-country variance of CO2 emission.

Figure 5 is showing the relationship between technology growth and CO2 emission for a cross section of 5 countries. The aggregate relationship suggests a positive relationship between technology and CO2 emission since countries with higher level of technological use have a significant higher CO2 emission rate. We can say that each additional one percent increase in technology is associated with 0.37-point increase in CO2 emission. This estimated point is statistically significant at 1% level, whereas the FDI level explains about 73% of cross-country variance of CO2 emission.

Figure 6 is showing the relationship between urbanization growth and CO2 emission for a cross section of 5 countries. The aggregate relationship suggests a negative relationship between urbanization and CO2 emission since countries with higher level of urbanization have a significant lower CO2 emission rate. We can say that each additional 1% increase in urbanization is associated with 0.07-point decrease in CO2 emission. This estimated point is statistically significant at 1% level, whereas the FDI level explains about 62% of cross-country variance of CO2 emission.

Materials and method

Data source and description of variables

To access the impact on environmental degradation of stock market, foreign direct investment, renewable energy consumption, and trade openness accompanied by urbanization, we use data for BRICS countries (Brazil, Russia, India, China, and South Africa) for a period of 1993 to 2018. This period is chosen based on data availability from data-stream. As data for China was available from 1993, all other countries variables are set to this year. For environmental degradation, data was collected from Enerdata. Burning of fossil fuels emits carbon dioxide in a process called “combustion”; this emission of CO2 is taken as a proxy for environmental degradation (MtCO2). Proxy for stock market development is named as MSCI, for which data was collected from DataStream. Data for GDP, foreign direct investment, renewable energy consumption, urbanization, and trade openness were collected from World Development Indicators available at the World Bank database (website www.wdi.com). GDP was measured as GDP (constant 2010 US$); renewable energy consumption was proxied by energy consumption, which is measured as total energy consumption (MTOE). Foreign direct investment is proxied by net of imports and exports (as a percent of GDP). Trade openness is measured as the sum of export and imports as a percent of GDP. Urbanization is measured as the urban population as a percent of total population. The relationship between the stock market prices and CO2 emissions is depicted in Fig. 7. China showed inverse relationship between CO2 emissions and stock price, i.e., as CO2 emission increases the stock prices decrease. In this scenario, the CO2 emissions affect the growth of stock market due to traditional energy sources such as coal, gas, and oil for increased demand of energy consumption and affect the environment. The same behavior was observed for other countries except Brazil, where the stock prices increase as CO2 emission decreases. Hence, Brazil stock market plays a significant role in minimizing carbon emissions. One possible reason for these findings might be effective government policies against environmental degradation, i.e., CO2 emissions and renewable energy sources to fulfill the increasing demand of energy (Table 3).

Econometric methodology

Panel unit root test

To determine the stationarity of panel data variables, unit root tests were run for reliable estimates. Following Danish et al. (2018), the test was divided into two: first-generation panel unit root test and second-generation unit root test. As Levin Lin Chu (LLC) and Hadri, the Breitung tests comprise first-generation unit root tests but do not address cross-sectional dependence. As second-generation unit root tests are based on the assumption of homogeneity and cross-sectional dependence, second-generation panel root tests are suitable for this study. According to Danish (2019) and Wang et al. (2018), the problem of homogeneity is reduced by second-generation tests like the IM Pesaran Shin test, Fisher ADF test, and Fisher PP. Apart from these, Pesaran (2007) introduces tests like CIPS and CADF, which comprise the second generation unit root test. These tests address cross-sectional dependence as the CO2 emission level varies significantly among BRICS countries.

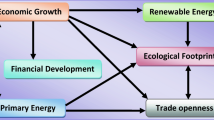

Generalized method of moment model

This study investigates the link between stock exchange development, FDI, renewable energy, trade openness, urbanization, and environmental degradation. The study treats environmental degradation as outcome variable, while stock exchange development, FDI, renewable energy, trade openness, and urbanization are treated as predictor variables.

Endogeneity and simultaneity biases results in the presence of correlation among disturbance term and endogenous variables. So, in this situation, applying ordinary least squares regressions lead toward biased and unreliable estimates, resulting in a violation of one of the classical linear regression models’ assumptions. Similarly, long-run panel data estimation methods are also unsuitable to use. To get reliable and precise analysis, we employ a generalized method of moment approach. Arellano and Bond (1991) introduce the GMM approach. In support of this approach, he argues that in the dynamic panel model, using the orthogonal condition between the lag value of the dependent variable and the error term, an additional instrument can be achieved. Hence, this new instrument eliminates the correlation between independent variable and the disturbances. Following Halkos (2003), Danish (2019), Ahmad et al. (2019), we use the GMM estimator in this study. Using orthogonal conditions between lag value of dependent variable and error term, the possibility of endogeneity of predictor variables can be controlled. Applying first-order differentiation through this approach helps counter cross-country effects. As a result, estimation is reliable and consistent.

Results analysis

Table 4 provides the statistics summary of all variables of the study. Urbanization was found to be the least volatile of all variables. There is not any considerable difference between MSCI and TO and FD and GDP. These 4 were less volatile than CO2 and GDP2. On the other hand, GDP2 appears to have the highest volatility, approximately 2 times higher than all variables.

Table 4 shows the correlation matrix among variables. Tec shows highest positive correlation with a value of .9726, whereas GDP2 positively correlates 0.7017, GDP = 0.6980, FD = 0.5700, and EOP =0.3736. On the other hand, MSCI and URB correlate negatively with a value of − .5750 and − .1854 respectively.

Preliminary analysis

Panel unit root tests

Among BRICS countries, as variable levels vary significantly, a group of second-generation panel unit roots test is suitable. The results showed that variables under consideration are not stationary at level but become stationary after taking the first difference. Hence, CO2, MSCI, TO, GDP, FD, TEC, and URB are integrated at the first order I (1); we can go on to regression estimates (Table 5).

GMM estimation results

This study uses the GMM approach to get regression coefficients. The study takes environmental degradation (CO2 emissions) as outcome variable, with MSCI, renewable energy, FDI, urbanization, and trade openness as predictor variables. As some variable shows strong positive correlation in the correlation table, which restricts the use of OLS regression, we use the GMM estimation for regression coefficients to avoid endogeneity biases. The results are reported in Table 6. Table 6 shows that the coefficient of MSCI is significant positive in 5 models and negative in 2 models, suggesting that the MSCI effect on carbon emissions from fossil fuels is not stable in all models. By adding FD, URB, and TEC, the stock market coefficient becomes negative in models 6 and 7. This may be due to encouragement through governmental policies toward economic development but less focus on conserving environment as there are more emissions of CO2 with respect to economic development. The relationship between trade openness and carbon emissions from fossil fuels is significantly positive, suggesting that opening the country boundaries for trade opens the roads for industrial pollution, hence raising carbon emissions levels. The environmental impact of GDP is significantly positive than significantly negative, and then again significantly positive.

In contrast, the effect of GDP2 is significantly positive then significantly negative suggesting that GDP effect is not stable in all models. One possible reason may be that government policies are changing with respect to economic growth. FDI and urbanization impact the environment, suggesting that foreign direct investments and urbanization do not play a role in carbon emissions levels.

Robustness check

To check the robustness of GMM model, Table 7 shows the results. The corresponding model shows no autocorrelation, so we strongly reject the null hypothesis of second order Arellano and Bond autocorrelation tests (AR). The model does not report any heterogeneity, as instruments are not uncorrelated with disturbance term identified by Hansen overidentification restrictions (OIR). Overall, the results show that the model is well established. Furthermore, we also applied fixed effects regressions model for the 7 models as a robustness check. The results were similar to those of the GMM model.

Pool mean group (PMG) analysis

Following Danish (2019) and Sarkodie and Strezov (2018) to validate the estimation model from GMM, we use the pool mean group approach. The results in table showed that the coefficients of MSCI are found to be negative for all models. It showed that the impact of stock market on environmental degradation is negative. The coefficients for TO, TEC, and URB were positive, and it showed a positive relationship between TO, TEC, URB, and CO2 emission. However, if we see the coefficients for GDP and GDP2 were reverse in relation with CO2 emission, first GDP is positive and then negative, but in case of GDP2 coefficient, it has first negative and then positive association with CO2 emission. The coefficient of FD was a positive relationship with CO2 emission in model 5 and model 6 respectively, but a negative association in model 7. Additionally, the coefficients of MSCI, GDP, GDP2, FD, TEC, and URB are significant, whereas TO in one model was insignificant and then significant in all other models. Therefore, the findings of the pool mean group analysis are inconsistent with the GMM estimation results (Table 8).

Discussion

This study examines the relationship between stock market development, renewable energy, foreign direct investment, trade openness, and urbanization on environmental degradation. For this, we estimate the panel root test, which justifies the results of the macro panel. The panel root test deals with the non-stationarity and rejects the assumption of homogeneity. It also helps to identify the cross dependency of variables while dealing with panel data.

Empirical results illustrate that the relationship exists between the stock market and CO2 emission across the panel in fixed effect, GMM, and pooled mean group. For instance, graph 1 shows a statistically significant negative relationship between stock market and environmental degradation in emerging economies, whereas Brazil shows a positive relationship. Empirical results advocate regulators and policymakers to ensure that listed firms of emerging and developed economies must develop their stock markets and follow low emission along with energy saving technologies. Our results are consistent with Paramati et al. (2017a, b) who investigated that stock market price per capita has positive impact on the CO2 emissions in emerging economies while the negative effect in the developed market. Developed markets have effective policies against environmental degradation, especially for listed firms, and have advanced technologies that lag behind emerging markets. Khan et al. (2020) investigated that economic growth increases the CO2 emissions by using traditional energy sources such as coal, gas, and oil. While Işık et al. (2019) connected the relationship between economic growth and CO2 emissions, renewable energy resources help lower environmental degradation (carbon emission), whereas fossil energy has a negative impact on CO2 emissions. Our results are also consistent with Shahbaz et al. (2020) study, who concluded that CO2 levels increase financial development of an economy. Growth in economic sector of a country positively affects environemtal degradation wheras economic globalization negativly impacts CO2 emissions. Whereas environmetal quality is improved by electricity consumption for industries, they recommend to maintain standards to implement environmentally friendly technologies and investment efficiency. For instituions, government, and banks, they suggest to initiate and engage in projects of code of good pracitces and highlighting and implementing the clean and green environmental issues and technologies.

Stock market development plays a prominent role in environmental degradation by emitting more CO2. The foremost reason is through business expansion. As the stock market provides a platform for effortlessly exchanging funds across parties (both equity and debt financing), they are of prime importance to business activities. Growth in business activities also enhances the production process for exports and conserve more energy, leading to more carbon dioxide emissions. On the other hand, the availability of additional funds via stock markets helps businesses and customers diversify risks. This availability enhances business activities, which increases energy consumption and then environmental degradation (Sadorsky 2011; Paramati et al. 2017a, b; Kutan et al. 2018).

Stock market development also plays a prominent role in minimizing CO2 emissions. As listed firms operate under stock market rules and regulations and stock markets especially in developed countries, stock markets have strong regulations and strike actions on any violation. They use more efficient production processes, smarter technologies for industrial pollution, and sustainable energy sources (Lanoie et al. 1998). With respect to conserving the environment, listed firms also compete with each other in playing an environmentally friendly role for its consumers (Lanoie et al. 1998). In contrast, traditional technologies and energy sources that use fossil fuel burning contribute to environmental degradation. Their findings are inconsistent with those of Dogan and Inglesi-Lotz (2017), Shahbaz et al. (2017), Shahbaz et al. (2019b), and Solarin et al. (2018) They argue that the consumption of energy through fossil fuel increases environmental pollution.

Additionally, our study’s findings support Onafowora and Owoye (2014) findings, who study the link between stock market growth and CO2 emissions. Sample countries for this study were China, Egypt, Brazil, Mexico, Nigeria, and South Africa. The results showed that government policies are more favorable for economic development and less favorable for environmental protection, resulting in enhanced CO2 levels and economic development. In 2018, Sarkodie and Adams claim that renewable energies and smarter technologies build a clean environment.

We also reveal that FDI, urbanization, and trade openness showed a positive relation with carbon dioxide emissions, which interprets that with the removal of trade barriers, inflow of FDI and growth of urbanization leads toward environmental degradation. The results were consistent in both fixed effects and GMM estimation. Hence, it proves that trade opening in BRICS countries leads toward environmental degradation due to weak regulations (Copeland and Taylor 1994; Talukdar and Meisner 2001; Xing and Kolstad 2002; Dinda 2004; Hoffmann et al. 2005; Baek and Koo 2009). FDI and CO2 also showed positive relationship. With the increase in FDI, CO2 also increases. These results were consistent with Chandran and Foon (2013), D’Agostino (2015), Sun et al. (2017), Solarin et al. (2017), and You and Lv (2018). The rationale for these findings is due to weak environmental and production regulations in host countries; developed countries shift their operation to host countries due to cheap processes.

Additionally, urbanization and CO2 emissions from fossil fuels also showed a significant positive relationship. In BRICS countries, an increase in urbanization also increases CO2 emissions and hence environmental degradation. In BRICS countries, trade openness is another factor which leads toward environmental degradation. One rationale for this is that as countries open their boundaries for trade activities, countries especially developing countries compromise on conserving the environment due to the affordability of unfriendly production machinery and reliance on cheap technologies, of which most of times outdated machinery and technologies which emit more pollutant and consume more energy. Additionally, opening trade also increases energy demand. Here again, production processes compromise on energy sources and prefer cheap conventional non-renewable energy sources like fossil fuels, which emits more CO2 in the environment (Wang et al. 2017; Danish 2019; Akif and Asumadu 2019). Furthermore, due to slack environmental rules and regulations, trade agreement among BRICS and outside countries also leads to transferring old technologies, hence contributing to the degrading environment (Danish et al. 2017 ; Sarkodie and Strezov 2019b). Trade openness also leads toward environmental degradation. Enhanced trade needs enhanced energy demands; this energy demand requires more energy sources that are scarce and conventional like fossil fuels, and coal. The use of these unsustainable sources results in environmental degradation (Akif and Asumadu 2019).

Conclusion and policy implication

Keeping in view the nexus between environmental degradation, renewable energy, and stock market development, this study analyzes the impact of stock market, FDI, renewable energy consumption, trade openness, and urbanization on environmental degradation in BRICS countries. The analysis is conducted on data for years from 1993 to 2018. The results showed that there is a negative relationship between CO2 emissions and stock market development in Russia, India, China, and South Africa. In Brazil, the relationship was found to be positive. One possible reason for this is strong environmental regulations and their enforcement by Brazilian government. Variables such as FDI, trade openness, and urbanization have significant positive relationship with CO2 emissions; thus, it can be said that these variables contribute adversely to environmental degradation. As BRICS countries have weak regulations, developed countries shift their production to BRICS countries for availing cost-effective cheap production and energy sources. From the results, the study urges that BRICS countries should focus on formulating environment-friendly policies for business entities and ensure that policies are strictly enforced for conserving the environment. As urbanization also showed significant positive effect on the environment, the government of BRICS countries should take new initiatives and projects for remote and village areas so that migration from village to urban areas may be lessen. As this migration increases demand for energy, shelter, and transportation, this also lessens per acre environment levels. In this study, the analysis is conducted on the national data of BRICS countries and it does not go down to include various sectors within this economics. Hence, it is suggested that future studies may extend this analysis using big data and comparing BRICS, G20, and ASIAN countries. Also, future studies may incorporate other econometric techniques to further refine the results.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Ahmad M, Ul Haq Z, Khan Z, Khattak SI, Ur Rahman Z, Khan S (2019) Does the inflow of remittances cause environmental degradation? Empirical evidence from China. Econ Res Istraz 32:2099–2121. https://doi.org/10.1080/1331677X.2019.1642783

Akif M, Asumadu S (2019) Science of the total environment investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Ali R, Bakhsh K, Yasin MA (2019) Impact of urbanization on CO2 emissions in emerging economy: evidence from Pakistan. Sustain Cities Soc 48:101553. https://doi.org/10.1016/j.scs.2019.101553

Ali S, Yusop Z, Shivee K, Lee C (2020) Dynamic common correlated effects of trade openness, FDI, and institutional performance on environmental quality: evidence from OIC countries. doi:https://doi.org/10.1007/s11356-020-07768-7

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy 84:382–389. https://doi.org/10.1016/j.energy.2015.03.004

Al-Mulali U, Fereidouni HG, Lee JYM, Sab CNBC (2013) Exploring the relationship between urbanization, energy consumption, and CO2 emission in MENA countries. Renew Sust Energ Rev 23:107–112. https://doi.org/10.1016/j.rser.2013.02.041

Alola AA (2019a) The trilemma of trade, monetary and immigration policies in the United States: accounting for environmental sustainability. Sci Total Environ 658:260–267. https://doi.org/10.1016/j.scitotenv.2018.12.212

Alola AA (2019b) Carbon emissions and the trilemma of trade policy, migration policy and health care in the US. Carbon Manag 10:209–218. https://doi.org/10.1080/17583004.2019.1577180

Alola AA, Yalçiner K, Alola UV, Akadiri SS (2019) The role of renewable energy, immigration and real income in environmental sustainability target. Evidence from Europe largest states. Sci Total Environ 674:307–315. https://doi.org/10.1016/j.scitotenv.2019.04.163

Arellano M, Bond S (1991) Some tests of specification for panel Carlo application to data: evidence and an employment equations. 58:277–297

Azam M, Khan AQ, Ozturk I (2019) The effects of energy on investment, human health, environment and economic growth: empirical evidence from China. Environ Sci Pollut Res 26:10816–10825. https://doi.org/10.1007/s11356-019-04497-4

Baek J, Koo WW (2009) A dynamic approach to the FDI-environment nexus: FDI

13:87–108

13:87–108Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos JM (2019) An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ Sci Pollut Res 26:23010–23026. https://doi.org/10.1007/s11356-019-05446-x

Ben M, Ben S (2015) The environmental Kuznets curve , economic growth , renewable and non-renewable energy, and trade in Tunisia. Renew Sust Energ Rev 47:173–185. https://doi.org/10.1016/j.rser.2015.02.049

Bhat JA (2018) Renewable and non-renewable energy consumption—impact on economic growth and CO2 emissions in five emerging market economies. Environ Sci Pollut Res 25:35515–35530. https://doi.org/10.1007/s11356-018-3523-8

Boutabba MA (2020) The impact of fi nancial development , income , energy and trade on carbon emissions: evidence from the Indian economy Mohamed Amine Boutabba ⁎. Econ Model 40:33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Caglar AE (2020) The importance of renewable energy consumption and FDI in fl ows in reducing environmental degradation: Bootstrap ARDL bound test in selected 9 countries. J Clean Prod 264:121663. https://doi.org/10.1016/j.jclepro.2020.121663

Capello R, Camagni R (2000) Beyond optimal city size: an evaluation of alternative urban growth patterns. doi:https://doi.org/10.1080/00420980020080221

Chandran VGR, Foon C (2013) The impacts of transport energy consumption , foreign direct investment and income on CO 2 emissions in ASEAN-5 economies. Renew Sust Energ Rev 24:445–453. https://doi.org/10.1016/j.rser.2013.03.054

Cheng C, Ren X, Wang Z, Yan C (2019) Heterogeneous impacts of renewable energy and environmental patents on CO 2 emission - Evidence from the BRIICS. Sci Total Environ 668:1328–1338. https://doi.org/10.1016/j.scitotenv.2019.02.063

Çoban S, Topcu M (2013) The nexus between financial development and energy consumption in the EU: a dynamic panel data analysis. Energy Econ 39:81–88. https://doi.org/10.1016/j.eneco.2013.04.001

Copeland BR, Taylor MS (1994) North-South trade and the environment. Q J Econ 109:755–787. https://doi.org/10.2307/2118421

D’Agostino LM (2015) How MNEs respond to environmental regulation: Integrating the Porter hypothesis and the pollution haven hypothesis. Econ Polit 32:245–269. https://doi.org/10.1007/s40888-015-0010-2

Danish WZ (2019) Does biomass energy consumption help to control environmental pollution? Evidence from BRICS countries. Sci Total Environ 670:1075–1083. https://doi.org/10.1016/j.scitotenv.2019.03.268

Danish, Wang B, Wang Z (2017) Imported technology and CO2 emission in China: collecting evidence through bound testing and VECM approach. Renew Sust Energ Rev:1–11. https://doi.org/10.1016/j.rser.2017.11.002

Danish KN, Baloch MA et al (2018) The effect of ICT on CO2 emissions in emerging economies: does the level of income matters? Environ Sci Pollut Res 25:22850–22860. https://doi.org/10.1007/s11356-018-2379-2

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42:310–335. https://doi.org/10.1006/jeem.2000.1161

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49:431–455. https://doi.org/10.1016/j.ecolecon.2004.02.011

Dogan E, Inglesi-Lotz R (2017) Analyzing the effects of real income and biomass energy consumption on carbon dioxide (CO2) emissions: Empirical evidence from the panel of biomass-consuming countries. Energy 138:721–727. https://doi.org/10.1016/j.energy.2017.07.136

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Doytch N, Narayan S (2016) Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ 54:291–301. https://doi.org/10.1016/j.eneco.2015.12.010

Effiong EL (2016) Munich Personal RePEc Archive Urbanization and Environmental Quality in Africa Urbanization and Environmental Quality in Africa

Fan Y, Liu LC, Wu G, Wei YM (2006) Analyzing impact factors of CO2 emissions using the STIRPAT model. Environ Impact Assess Rev 26:377–395. https://doi.org/10.1016/j.eiar.2005.11.007

Gasimli O, ul Haq I, Gamage SKN et al (2019) Energy, trade, urbanization and environmental degradation nexus in Sri Lanka: bounds testing approach. Energies 12:1–16. https://doi.org/10.3390/en12091655

Gorus MS, Aslan M (2019) Impacts of economic indicators on environmental degradation: Evidence from MENA countries. Renew Sust Energ Rev 103:259–268

Grossman G, Krueger A (1991) Environmental impacts of a North American free trade agreement. Natl Bur Econ Res. https://doi.org/10.3386/w3914

Halkos GE (2003) Environmental Kuznets Curve for sulfur: evidence using GMM estimation and random coefficient panel data models. Environ Dev Econ 8:581–601. https://doi.org/10.1017/s1355770x0300317

Hanif I (2018) Impact of economic growth, nonrenewable and renewable energy consumption, and urbanization on carbon emissions in Sub-Saharan Africa. Environ Sci Pollut Res 25:15057–15067. https://doi.org/10.1007/s11356-018-1753-4

Hanif I, Faraz Raza SM, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: Some empirical evidence. Energy 171:493–501. https://doi.org/10.1016/j.energy.2019.01.011

Hao Y, Liu YM (2015) Has the development of FDI and foreign trade contributed to China’s CO2 emissions? An empirical study with provincial panel data. Nat Hazards 76:1079–1091. https://doi.org/10.1007/s11069-014-1534-4

Haq IU, Zhu S, Shafiq M (2016) Empirical investigation of environmental Kuznets curve for carbon emission in Morocco. Ecol Indic 67:491–496. https://doi.org/10.1016/j.ecolind.2016.03.019

Harris PG (2008) Bringing the in-between back in: Foreign policy in global environmental politics. Polit Policy 36:914–943. https://doi.org/10.1111/j.1747-1346.2008.00145.x

Hoffmann R, Lee C, Ramasamy B, Yeung M (2005) FDI and pollution: a granger causality test using panel data. 317:311–317. doi:https://doi.org/10.1002/jid.1196

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub- Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43. https://doi.org/10.1016/j.renene.2018.02.041

Işık C, Ongan S, Özdemir D (2019) Testing the EKC hypothesis for ten US states: an application of heterogeneous panel estimation method. Environ Sci Pollut Res 26:10846–10853. https://doi.org/10.1007/s11356-019-04514-6

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441. https://doi.org/10.1016/j.econmod.2012.09.033

Katircioğlu S, Katircioğlu S (2018) Testing the role of urban development in the conventional Environmental Kuznets Curve: evidence from Turkey. Appl Econ Lett 25:741–746. https://doi.org/10.1080/13504851.2017.1361004

Khan MK, Khan MI, Rehan M (2020) The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ Innov 6:1–13. https://doi.org/10.1186/s40854-019-0162-0

Koçak E, Şarkgüneşi A (2018) The impact of foreign direct investment on CO2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis. Environ Sci Pollut Res 25:790–804. https://doi.org/10.1007/s11356-017-0468-2

Komal R, Abbas F (2015) Linking financial development, economic growth and energy consumption in Pakistan. Renew Sust Energ Rev 44:211–220

Kutan AM, Paramati SR, Ummalla M, Zakari A (2018) Financing renewable energy projects in major emerging market economies: evidence in the perspective of sustainable economic development. Emerg Mark Financ Trade 54:1761–1777. https://doi.org/10.1080/1540496X.2017.1363036

Lanoie P, Laplante B, Roy M (1998) Can capital markets create incentives for pollution control? Ecol Econ 26:31–41. https://doi.org/10.1016/S0921-8009(97)00057-8

Le TH (2016) Dynamics between energy, output, openness and financial development in sub-Saharan African countries. Appl Econ 48:914–933. https://doi.org/10.1080/00036846.2015.1090550

Liobikienė G, Butkus M (2019) Scale, composition, and technique effects through which the economic growth, foreign direct investment, urbanization, and trade affect greenhouse gas emissions. Renew Energy 132:1310–1322. https://doi.org/10.1016/j.renene.2018.09.032

Liu Y, Hao Y, Gao Y (2017) The environmental consequences of domestic and foreign investment: evidence from China. Energy Policy 108:271–280. https://doi.org/10.1016/j.enpol.2017.05.055

Maji IK, Habibullaha MS (2015) Impact of economic growth, energy consumption and foreign direct investment on CO2 emissions: evidence from Nigeria. World Appl Sci J 33:640–645. https://doi.org/10.5829/idosi.wasj.2015.33.04.93

Muhammad A, Abdul QK (2014) Effect of hydrothermal carbonization reaction parameters on. Environ Prog Sustain Energy 33:676–680. https://doi.org/10.1002/ep.11974

Nasir M, Ur Rehman F (2011) Environmental Kuznets Curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39:1857–1864. https://doi.org/10.1016/j.enpol.2011.01.025

Naz S, Sultan R, Zaman K, Aldakhil AM, Nassani AA, Abro MMQ (2019) Moderating and mediating role of renewable energy consumption, FDI inflows, and economic growth on carbon dioxide emissions: evidence from robust least square estimator. Environ Sci Pollut Res 26:2806–2819. https://doi.org/10.1007/s11356-018-3837-6

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252. https://doi.org/10.1016/j.eneco.2015.01.008

Onafowora OA, Owoye O (2014) Bounds testing approach to analysis of the environment Kuznets curve hypothesis. Energy Econ 44:47–62. https://doi.org/10.1016/j.eneco.2014.03.025

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Paramati SR, Alam M, Apergis N (2017a) PT SC. doi:https://doi.org/10.1016/j.ememar.2017.12.004

Paramati SR, Mo D, Gupta R (2017b) The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries. Energy Econ 66:360–371. https://doi.org/10.1016/j.eneco.2017.06.025

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312. https://doi.org/10.1002/jae.951

Poumanyvong P, Kaneko S (2010) Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecol Econ 70:434–444. https://doi.org/10.1016/j.ecolecon.2010.09.029

Rafindadi AA, Muye IM, Kaita RA (2018) The effects of FDI and energy consumption on environmental pollution in predominantly resource-based economies of the GCC. Sustain Energy Technol Assessments 25:126–137. https://doi.org/10.1016/j.seta.2017.12.008

Sachs G (2003) Dreaming with BRICs: the path to 2050. New York, Global Economics Paper No. 99

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38:2528–2535. https://doi.org/10.1016/j.enpol.2009.12.048

Sadorsky P (2011) Trade and energy consumption in the Middle East. Energy Econ 33:739–749. https://doi.org/10.1016/j.eneco.2010.12.012

Sadorsky P (2014) The effect of urbanization on CO2 emissions in emerging economies. Energy Econ 41:147–153. https://doi.org/10.1016/j.eneco.2013.11.007

Saidi K, Mbarek MB (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24:12748–12757. https://doi.org/10.1007/s11356-016-6303-3

Sarkodie SA, Strezov V (2018) AC SC. J Clean Prod. https://doi.org/10.1016/j.jclepro.2018.08.039

Sarkodie SA, Strezov V (2019a) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Sarkodie SA, Strezov V (2019b) Effect of foreign... - Google Scholar

Sarkodie SA, Ntiamoah EB, Li D (2019) Panel heterogeneous distribution analysis of trade and modernized agriculture on CO2 emissions: the role of renewable and fossil fuel energy consumption. Nat Resour Forum 43:135–153. https://doi.org/10.1111/1477-8947.12183

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sust Energ Rev 52:347–356

Seto KC, Sánchez-Rodríguez R, Fragkias M (2010) The new geography of contemporary urbanization and the environment. Annu Rev Environ Resour 35:167–194. https://doi.org/10.1146/annurev-environ-100809-125336

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121. https://doi.org/10.1016/j.rser.2013.04.009

Shahbaz M, Sbia R, Hamdi H, Ozturk I (2014) Economic growth, electricity consumption, urbanization and environmental degradation relationship in United Arab Emirates. Ecol Indic 45:622–631. https://doi.org/10.1016/j.ecolind.2014.05.022

Shahbaz M, Loganathan N, Muzaffar AT, Ahmed K, Ali Jabran M (2016) How urbanization affects CO2 emissions in Malaysia? The application of STIRPAT model. Renew Sust Energ Rev 57:83–93. https://doi.org/10.1016/j.rser.2015.12.096

Shahbaz M, Solarin SA, Hammoudeh S, Shahzad SJH (2017) Bounds testing approach to analyzing the environment Kuznets curve hypothesis with structural beaks: the role of biomass energy consumption in the United States. Energy Econ 68:548–565. https://doi.org/10.1016/j.eneco.2017.10.004

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019a) Foreign direct Investment–CO2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614. https://doi.org/10.1016/j.jclepro.2019.01.282

Shahbaz M, Balsalobre D, Shahzad SJH (2019b) The influencing factors of CO2 emissions and the role of biomass energy consumption: statistical experience from G-7 countries. Environ Model Assess 24:143–161. https://doi.org/10.1007/s10666-018-9620-8

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res 27:10685–10699. https://doi.org/10.1007/s11356-019-07085-8

Sharif A, Mishra S, Sinha A, et al (2020) The renewable energy consumption-environmental degradation nexus in top-10 polluted countries: fresh insights from quantile-on-quantile regression approach. doi:https://doi.org/10.1016/j.renene.2019.12.149

Sharma SS (2011) Determinants of carbon dioxide emissions: empirical evidence from 69 countries. Appl Energy 88:376–382. https://doi.org/10.1016/j.apenergy.2010.07.022

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711. https://doi.org/10.1016/j.renene.2017.12.058

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719. https://doi.org/10.1016/j.energy.2017.02.089

Solarin SA, Al-Mulali U, Gan GGG, Shahbaz M (2018) The impact of biomass energy consumption on pollution: evidence from 80 developed and developing countries. Environ Sci Pollut Res 25:22641–22657. https://doi.org/10.1007/s11356-018-2392-5

Sun C, Zhang F, Xu M (2017) Investigation of pollution haven hypothesis for China: an ARDL approach with breakpoint unit root tests. J Clean Prod 161:153–164. https://doi.org/10.1016/j.jclepro.2017.05.119

Talukdar D, Meisner CM (2001) Does the private sector help or hurt the environment? Evidence from carbon dioxide pollution in developing countries. World Dev 29:827–840. https://doi.org/10.1016/S0305-750X(01)00008-0

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37:246–253. https://doi.org/10.1016/j.enpol.2008.08.025

Tang CF, Tan BW (2014) The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Qual Quant 48:781–797. https://doi.org/10.1007/s11135-012-9802-4

Terzi H, Pata UK (2020) Is the pollution haven hypothesis (PHH) valid for Turkey? Panoeconomicus 67:93–109. https://doi.org/10.2298/PAN161229016T

Wang Y, Kang Y, Wang J, Xu L (2017) Panel estimation for the impacts of population-related factors on CO2 emissions: a regional analysis in China. Ecol Indic 78:322–330. https://doi.org/10.1016/j.ecolind.2017.03.032

Wang Z, Danish ZB, Wang B (2018) The moderating role of corruption between economic growth and CO2 emissions: evidence from BRICS economies. Energy 148:506–513. https://doi.org/10.1016/j.energy.2018.01.167

Wang L, Zhao Z, Xue X, Wang Y (2019) Spillover effects of railway and road on CO2 emission in China: a spatiotemporal analysis. J Clean Prod 234:797–809. https://doi.org/10.1016/j.jclepro.2019.06.278

Xing Y, Kolstad CD (2002) Do lax environmental regulations attract foreign investment? Environ Resour Econ 21:1–22. https://doi.org/10.1023/A:1014537013353

You W, Lv Z (2018) Spillover effects of economic globalization on CO2 emissions: a spatial panel approach. Energy Econ 73:248–257. https://doi.org/10.1016/j.eneco.2018.05.016

Zhang C, Lin Y (2012) Panel estimation for urbanization, energy consumption and CO 2 emissions: a regional analysis in China. Energy Policy 49:488–498. https://doi.org/10.1016/j.enpol.2012.06.048

Zhao B, Yang W (2020) Does financial development influence CO2 emissions? A Chinese province-level study. Energy 117523:117523. https://doi.org/10.1016/j.energy.2020.117523

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248. https://doi.org/10.1016/j.econmod.2016.05.003

Acknowledgments

We pay our thanks to the National Nature Science Foundation of China for providing us funds to undertake this study.

Funding

This research is funded by the National Nature Science Foundation of China (71271114).

Author information

Authors and Affiliations

Contributions

All authors have contributed to the study. Ijaz Younis developed the contextual framework of the study and prepared the original draft. Miss Aziza Naz assisted in the methodological formulation and data analysis. Mr. Muhammad Nadeem helped with the software analysis and result interpretation. Mr. Syed Ahsan Ali Shah reviewed and improved the initial draft. Mr. Cheng Longsheg provided valuable supervision and arranged funding’s for the study.

Corresponding authors

Ethics declarations

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Younis, I., Naz, A., Shah, S.A.A. et al. Impact of stock market, renewable energy consumption and urbanization on environmental degradation: new evidence from BRICS countries. Environ Sci Pollut Res 28, 31549–31565 (2021). https://doi.org/10.1007/s11356-021-12731-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-12731-1

13:87–108

13:87–108