Abstract

This study analyses whether hedging activities of oil and gas firms have a significant effect on the performance of the companies. The performance of companies is proxied by Tobin’s Q and panel regression models are built to estimate the coefficients for firm value and derivative use. The speculative use of derivatives is eliminated in models by the regulations under IFRS and GAAP. The results give critical information regarding asymmetric information and signalling effect. Since the coefficient of derivatives use is negative, it shows the critical meaning of disclosures on the financial healthiness. If companies are publishing high level of hedging activities, it might be a warning for investors to avoid investing at that company. This study also seeks for explanation behind firms’ hedging decisions. To our knowledge, it is among the first studies with a wide range of region and data.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

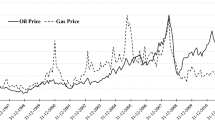

The power of most of the industrial firms is that they could change the price of the goods at certain times to adjust the economic situation. However, it is not possible for oil and gas companies, yet oil and natural gas prices are set in public markets. Clearly, lack of flexibility in oil and gas sector makes the undiversified oil and gas exploration and production firms vulnerable and the commodity price, primary risk. Not only the price of oil but also exchange and interest rate risks are reflected in stock price movements, considering oil and gas companies’ cross-border revenues and costs.

This research tries to identify if there is a hedging premium for oil and natural gas companies. The motivation behind this topic is related to the changes in the economic factors. Since 2011, Brent oil prices have fluctuated from $30 to $125. Hence, changes in the oil price may accelerate the commodity price risk for companies, which take the commodity price primary or secondary risk. For Turkey case, not only the Brent oil price but also the currency exchange rate changed dramatically and USD rate went from 1.5 to 7.03 against Turkish Liras from 2011 to 2018. It may increase the currency risk and the need for companies to act against the volatility. Companies, which had golden years when the Brent oil price was $125, might not invest properly. In addition, companies, which have higher debts under lower price situations, might face with interest rate risk. For BP (2017), if the floating interest rate increases by one percentage point in 2017, finance costs will increase by $488 million. The uncertainty and the impact of the event rises clearly through the years, which also indicates the increase in risk. Companies under these circumstances should have an active management for the less profitable and more volatile environments. The question of this research rises at this point: Are hedging activities good instruments for the investors to value the firm positively in such situations?

As Dionne et al. (2018) mentioned in their paper, oil industry is a good field to investigate risk management. Firstly, oil firms share homogenous risk exposures. Secondly, there are several hedging methods used by oil firms because of firm characteristics and production risk. Lastly, since the firms have operations internationally, data is available for further research.

In the literature, there are some contrary ideas. Some researchers found supporting evidence for hedging premium. Nance et al. (1993) concluded hedging activities increase firm value by decreasing tax liabilities, transaction costs and agency problems. Rene M. Stulz (1996) emphasized the importance of risk management and the positive impact on financial distress and outside debt.

Some researchers found different companies act differently. Carter et al. (2004) conducted a research on airline companies. Since those companies have oil as their primary operational expenditure item, big companies, which actively manage hedging activities during downturns, benefit from hedging. However, small firms prefer not to hedge and not to profit from hedging. According to Lookman (2004), exploration and production (E&P) firms and integrated firms differ. Exploration and production firms take the price risk as primary risk and they suffer from hedging. However, integrated firms benefit from hedging.

Studies also resulted that hedging has negative impact on firm value. Mayers and Smith Jr (1990) found that outstanding debt and agency problems are the main incentives to use hedging which may have negative impacts on firm value. Booth et al. (1984) noted that financial distress is the main incentive to use hedging which shows the weakness of the company.

There are inconclusive studies as well. Ayturk et al. (2016) found no evidence for hedging premium. Jin and Jorion (2006) discussed the risk factors and divided it to easy to detect and hard to detect. They concluded that there is no benefit of hedging. Bartram et al. (2011) found positive impacts of hedging activity in terms of lower cash flow volatility, however could not find high significance on firm value impact.

The literature has a broader perspective regarding the topic; however, since many companies avoided the numeric disclosures until 2005, most of the studies are either theoretical or covering a small area. After 2005, IFRS and GAAP regulations force the companies to disclose hedging-related activities in their financial statements. This study aims to be a pioneer as a quantitative and worldwide research. To our knowledge, it is the first study covering such a multinational data set in that specific research area.

In recent years, finance sector is more global than ever. Hence, investors need to understand and compare financial statements of a company from a country to another company from a different country. It is the main reason for many companies to follow standardized rules and the regulatory authorities to force companies for such standards. It is also good for researchers to include more companies in studies and have robust results.

This study includes companies who are following either IFRS or GAAP rules and publish their hedging activities in their financial reports. In accordance with IFRS 7 Financial Instruments: Disclosures (IASB 2008), a reporting entity is required to provide disclosures in its financial statements that enable users to evaluate the significance of financial instruments for the entity’s financial position and performance as well as the nature (and extent) of risks arising from financial instruments and how the entity manages those risks.

Literature review

The literature investigating firms’ hedging activities is relatively rich. In literature, most of the researches support the value adding rationale of hedging (Bessembinder 1991; Froot et al. 1993; Rene M.Stulz 1996; Smith, and C.,, and M.Stulz, R. 1985; Katircioglu 2017; Katircioglu et al. 2018a; Katircioglu et al. 2018b; Katircioglu et al. 2018c).

Several articles studied on the main incentives for hedging activities and they found agency problems, risk averse managers, information asymmetries, firm size and outstanding debt are the initial matters (Booth et al. 1984, Block and Gallagher 1986, Houston & Mueller, 1988, Mayers and Smith Jr 1990).

Wall and Pringle (1989) studied 250 swap users from their annual report footnotes in 1986. Their conclusion was beyond the popular reason of using swaps, arbitraging quality spread differentials. Swap users usually benefit from this activity by reducing agency costs and information asymmetries, adjusting the interval of outstanding debt, tax and regulatory arbitrage.

Nance et al. (1993) investigated 169 firms to discuss the main motives behind hedging and conclude that companies with convex tax schedules have incentives to hedge. Moreover, their study suggests there is a relationship between firm size and hedging. Another interesting finding in that study was that firms with more R&D expenditures and growth options have lower leverage and higher leverage respectively.

Firms usually benefit from hedging because it decreases the probability of bankruptcy, underinvestment, the cost of asymmetric information and agency. They also benefit from tax incentives (Dadalt et al. 2002; Froot et al. 1993; Leland 1998; DeMarzo and Duffie 1995; Rene M.Stulz 1996; Smith, and C.,, and M.Stulz, R. 1985).

Allayannis and Weston (2001) deployed a regression analysis to understand the impact of foreign currency derivatives on firms’ market value by controlling size, profitability, leverage, growth opportunities, ability to access financial markets, geographic and industrial diversification, credit quality, industry effects, firm fixed effects and time effects for 720 companies. They found significant evidence that using foreign currency derivatives has a positive effect on Tobin’s Q, which they used as a proxy for firm market value.

Carter et al. (2004) investigated the US airlines’ way of dealing with jet fuel price volatility. Since jet fuel prices take the biggest portion in the operating costs of airlines, hedging becomes essential for cash flows. Results also indicated that since hedging creates value when there is a downturn in airline market, it also creates acquisition opportunities. However, benefits of hedging were only clear for bigger firms according to the research and small firms prefer not to hedge.

Lookman (2004) discussed the oil and gas producing firms’ value increasing hedging activities for 1999 and 2000 in USA, Canada and Cayman Islands. He divided the commodity price volatility as a primary or secondary risk. He defined that undiversified E&P firms take the commodity price as a primary risk, while integrated firms take the commodity price as secondary risk. The results are not parallel with hypothesis that hedging increases firm value. In fact, firms hedging their primary risk trade at a discount compared to their unhedged rivals. In contrary, firms hedging their secondary risk trade at a significant premium compared to their unhedged counterparts. Surprisingly, he concluded that hedging for primary risk might be proxy for bad management and high agency cost, while hedging for secondary risk might be proxy for good management and low agency cost.

Jin and Jorion (2006) discussed the firm value and hedging activities of 119 US oil and gas producer firms from 1998 to 2001. They stated that the homogenous sector helped them avoid the spurious results and they could test the relation clearly. However, they could not find an obvious hedging premium and they concluded that there might be different explanations for the lack of that correlation. Firstly, they thought that the commodity price risk is easy to detect and avoid, so individual investors can also hedge. On the other hand, exchange risk is hard to detect for US companies, hence, hard to hedge by individuals using exotics. There is also the spurious hedge premium, which intrinsically reflect the information asymmetry and operational hedges.

Fauver and Naranjo (2010) found that firms with high agency cost and monitoring problems suffer from hedging activities. Less transparency, poorer corporate governance, higher information asymmetry problems, higher agency costs and worse monitoring create a bad impression on firms and affect the firm value negatively.

Ayturk et al. (2016) conducted a pioneer research for Turkey, regarding the impact of hedge use on firm value. For Turkey case, there is a very limited or no hedging premium. They collected the data by referencing IFRS disclosure regulations; however, lack of data limited their research. Hence, they saw the great need for further research in emerging countries.

Lau (2016) found that taking all control variables into account, hedging has a negative impact on firm value. At operational level, net profit margins and operating income decrease with hedging activities. Hedging has positive impact on return on assets because firms need to widen their regional markets for better returns, and it creates sensitivity to exchange rates and interest rates. Firms, which use derivatives, perform better in such environment than non-hedgers.

Mnasri et al. (2017) concluded that the revenue sensitivity of oil prices leads the nonlinear hedging activities to create significant marginal and average firm value effects. For homogeneity and self-selection problems, they added the differential between sensitivities of firms’ revenues and exploration expenditures to oil price fluctuations.

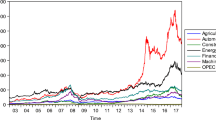

Dionne et al. (2018) also investigated the determinants of the maturity structure of hedging contracts for oil producers. They found the negative relationship between the oil price volatility and firm value. They found the oil sector as a good portfolio for risk management research because of homogenous risk exposures and diversity in hedging methods. They used an instrumental variable, namely Kilian (2009) index, to control demand changes in global industrial commodity markets (Table 1).

Research methods

This study identifies 76 exploration, production and integrated oil and gas firms that use hedging instruments and recorded in their balance sheet or income statement. Data is collected from IHS Markit database. There were 198 companies in the database; however, companies, which do not have complete data to analyse, are eliminated for better results. Companies in the study are following either IFRS or GAAP rules and publish their hedging activities in their financial reports. The general increasing use of derivatives leads the regulators to control and account them for the stakeholders. In 2001, FAS 133 (USA-based FASB) and IAS 32 and IAS 39 (London-based IASB) emerged to clarify the matters (James 2003).

Before the regulations, derivative-related loss or profit were off-balance sheet and it was not obligatory to present it in the balance sheet. These regulations require companies to report their portfolios at their marked to market, in other words, fair value. It means more than reporting the latest cash flow, showing any unrealized loss or profit from the derivatives on their balance sheet.

Based on the availability of disclosures, data period is covering 2007 to 2016. STATA is used for modelling and tests.

The data is investigated and some companies are omitted to see a clear picture of derivative usage effectiveness. In some countries like Turkey, National Oil Companies are not allowed to use derivatives to eliminate risks due to legal regulations. Companies, which do not use derivatives during the selected years of this research for such reason or any other reason, are ignored (Table 2).

Results

In this research, the value adding impact of derivative usage is being investigated. Since it is a comparatively new regulation for companies which follow IFRS, there are not many firm-based data research. As it can be seen from the literature review tabulation, the data set selection is either theoretical or US based. For energy companies, it is really critical to operate outside the main country. For example, Shell is a Dutch company; however, it has operations in the Middle East, Northern Sea, USA, South America, Far East, etc. These regions have different economic dynamics, different currencies and different interest rates. It makes the company really vulnerable.

The risk perception is not only important for the company, but also for the investors. A market which has information asymmetry would price any kind of information and reflect it to the firm value.

Energy companies have another vulnerability in such an environment. Since oil and gas prices are decided by main producer countries, many small and mid-size companies suffer from down-turns. However, in most manufacturing sectors, pricing would be a good means of surviving in a recession period.

The models created are as below:

MODEL 1: DTQ = f(DHAL, DTLD, DOPREV, CASH, CAPEXA)

MODEL 2: DTQ = f(DHAL, DTLD, ROA, CASH, CAPEXA)

MODEL 3: DTQ = f(DHAL, DTLD, NINC, CASH, CAPEXA)

MODEL 4: DTQ = f(DHAL, TNLD, DOPREV, CASH, CAPEXA)

MODEL 5: DTQ = f(DHAL, TNLD, ROA, CASH, CAPEXA, SP500)

MODEL 6: DTQ = f(DHAL, TNLD, NINC, CASH, CAPEXA, SP500)

MODEL 7: DTQ = f(DHAL, TCL, DOPREV, CASH, CAPEXA, SP500)

MODEL 8: DTQ = f(DHAL, TCL, ROA, CASH, CAPEXA, SP500)

MODEL 9: DTQ = f(DHAL, TCL, NINC, CASH, CAPEXA, SP500)

The variable selection is based on the literature of firm value. Tobin’s Q is used for firm value proxy as in Allayannis and Weston (2001), Lau (2016), Bartram et al. (2011) and Jin and Jorion (2006). As it is hard to calculate exact Tobin’s Q, the approximate Tobin’s Q is included.

The hedging variable is proxied by the derivative usage of the company which is measured by the total derivatives reported under IFRS and GAAP rules, stated under current assets related to hedging, non-current assets related to hedging, current liabilities related to hedging and non-current liabilities related to hedging. Hence, a hedging portfolio is created. Six hundred ninety-five observations of full data set have a percentage of less than 20% hedging activity over operational revenue.

Different variables, which are highly correlated and substitute for each other, are included in different models for robust results. TLD, TNDL and TCL, OPREV, NINC and ROA are taken as substitutes. In first models, the intercept was significant; to avoid omitted variable bias, a macroeconomic variable S&P 500 index is included in the model. Moreover, the null hypothesis and alternative hypothesis are:

The hedging activities of the firms are used as a proxy for risk management. Firms, under the regulations of IFRS and GAAP, are required to publish their assets and liabilities related to hedging. For every firm, a hedging portfolio is created with these figures. Surprisingly, all models indicate that hedging activities have a negative impact on firm value. This can be explained with the asymmetric information and signalling affect. DeMarzo and Duffie (1995) state that as there are disclosure regulations, hedging is seen as a signal and it gives private information that only managers are aware. Houston and Mueller (1988) and Mayers and Smith Jr (1990) found the relation between agency problems, financial distress and hedging activities. Dionne et al. (2018) also mentioned that investors prefer higher exposures and penalize hedging activities.

Other findings indicate the negative impact of debt level on firm value. Investors price the debt as an increase on financial distress; hence, the symbol is negative at 1% significance level. The profitability variables, ROA, NINC and OPREV, create a positive perception and the firm value increases with higher profitability measures.

Another firm-specific variable, CAPEXA, shows relatively low significance level but big capital expenditure figures create bigger risks for oil and gas companies, and it is priced as a bad signal in the market.

The market conditions indicator S&P500 is one of the most significant variables. If the market goes well, the investors are willing to invest; macroeconomic figures such as inflation, employment rates and interest rates create a stable climate. Hence, the market value of the firm increases.

Dionne et al. (2018) discussed the endogeneity problem that might occur in such a study and they used Kilian (2009) index to control the endogeneity, self-selection and omitted variables. In the first models of this study, constant variable took a significant figure and it raised the question if the model lacks an important variable; hence, S&P500 variable is deployed for better results. Such as Kilian (2009) index, S&P500 also shows the aggregate shocks at the global industries. There are also other control variables such as SIZE and CRISIS to control other potential bias.

Descriptive statistics are given in Table 3.

Since the big integrated companies are compared to other regional areas, the region dummy display that those companies use their know-how to realize greater market values and they are significantly succeeding. When the companies are compared to their first year in data set, they are improving their market performance eventually.

For robust results, the size and crisis dummy are also included to the model. The crisis dummy takes value 1 for years 2008, 2009, 2014 and 2015 where the oil price declines dramatically. For size dummy, the average market value of all firms is found. Then, if the market value of the company for 10 years average is higher than the firms’ average, dummy takes value 1, and if the market value of the company for 10 years average is lower than the firms’ average, dummy takes value 0. In the alternative model, hedging proxy variable is also divided to market value to normalize company size. The variance inflation factor also gives robust results that show the healthy model structuring.

MODEL 10: DTQ = f(DHALMV, DTLD, ROA, CAPEXA, SP500, SIZE,CRISIS)

The results are robust with the previous models. The effect of hedging activities is negative on market value. Crisis dummy, on the other hand, gives interesting results. Tobin’s Q is significantly and positively dependent with the crisis dummy. It might not indicate that market value increases under crisis conditions, but market value does not decline as fast as the asset value. Another interpretation might be the other macroeconomic factors. The commodity price was taken as crisis proxy, but other factors might have year-specific stimulations on firms’ performance which overcomes the price effect.

As in Lau (2016), the relation between hedging activities and other control variables are investigated in model 11:

MODEL 11: DHALMV = f(DTLD, ROA, CASH, CAPEXA, SP500, SIZE,CRISIS)

Houston and Mueller (1988) and Stulz (1996) found similar results as model 11 in terms of DTLD. It indicates that when the outstanding debt of a firm is big, then hedging activities to eliminate the debt-related financial risks are more severe.

Model 11 also shows that smaller companies tend to use derivatives more than bigger companies. It may be a critical finding for the fragility of small undiversified companies to market risks.

Another important finding is the positive and significant crisis dummy. Since the crisis dummy is directly related to commodity price, companies try to bear with price risk using hedging strategies (Table 4).

All results of other models are summarized in Table 5.

Conclusion

Risk is always a great interest for researchers. It would be great if one can evaluate the risk perfectly and use the right instruments to avoid or even benefit from risk. However, it was a political decision for producing leaders to keep the supply at a high level in 2014, and not many could expect it. Unconventional gas in US was seen as a new era recently, but the current events did not help new investors and many small firms stopped their low-profit, long-term investments.

Oil and gas is long seen as a really profitable sector and it has many stakeholders. Governments would like to take royalties; the highest wages are mentioned in drilling fields. However, it is risky in nature. The probability of finding a reservoir in wild cat is really low, and it costs million dollars to drill a well in the middle of the sea. When everything is going well, market value of oil and gas companies are very high as well. Moreover, managers would not want to limit their profits by hedging activities. When there is a downturn, companies reduce their capital expenditures, lower the salaries, reduce the headcount and follow a conservative approach. Hence, it might not be forecasted to last long, so they do not work hard for active portfolio management.

The results of this research give critical information regarding asymmetric information, signalling effect and financial distress.

All models indicate that hedging activities have a negative impact on firm value. Financial disclosures might signal the financial healthiness of a company. If companies are informing the public high hedging activities, it might be a warning for investors to avoid investing in that company. It might give a bad impression to the public having high level of asset and liability items related to hedging on balance sheet.

The model results are robust when it is econometrically and rationally tested. The variance inflation factor is deployed to test for perfect multicollinearity. Hedging is also normalized with market value to avoid any size affect. Results are similar.

When the outstanding debt of a firm is big, then hedging activities to eliminate the debt related financial risks are more severe. Results demonstrate that companies which are small and have more outstanding debt tend to use derivatives.

Another important finding is the positive and significant crisis dummy. Since the crisis dummy is directly related to commodity price, companies try to bear with price risk using hedging strategies.

In this research, the general risk perception of oil and gas companies and their risk management activities are investigated. As the sector has its own unique features, companies’ way of bearing with price risk is also discussed generally. However, the classification of the risk factors was not in the scope of this thesis. It would be an interesting research field for the researchers who are interested in energy sector and risk management. Evaluation of risk factors and the importance of risk management from every risk factor perspective would give great attribute to the literature.

References

Allayannis G, Weston JP (2001) The use of foreign currency derivatives and firm market value. Rev Financ Stud 14(1):243–276

Ayturk Y, Gurbuz AO, Yanik S (2016) Corporate derivatives use and firm value: evidence from Turkey. Borsa Istanbul Rev 16(2):108–120. https://doi.org/10.1016/j.bir.2016.02.001

Bartram SM, Brown GW, Conrad J (2011) The effects of derivatives on firm risk and value. J Financ Quant Anal 46(4):967–999

Bessembinder H (1991) Forward contracts and firm value : investment incentive and contracting effects. J Finan Quan Anal 26(4):519–532

Block SB, Gallagher TJ (1986) The use of interest rate futures and options by corporate financial managers. Financ Manag 15(3):73–78. https://doi.org/10.2307/3664846

Booth JR, Smith RL, Stolz RW (1984) Use of interest rate futures by financial institutions. Journal of Bank Research 15(1):15–20

BP (2017). Annual report and Form 20-F 2016. https://doi.org/10.1017/CBO9781107415324.004

Carter, D. A., Rogers, D. A., & Simkins, B. J. (2004) Does fuel hedging make economic sense? The Case of the US Airline Industry. In AFA 2004 San Diego Meetings. https://doi.org/10.2139/ssrn.325402

Dadalt P, Gay GD, Nam J (2002) Asymmetric information and corporate derivatives use. J Fut Markets: Fut, Options Other Derivative Products 22(3):241–267

DeMarzo PM, Duffie D (1995) Corporate incentives for hedging and hedge accounting. Rev Financ Stud 8(3):743–771. https://doi.org/10.1093/rfs/8.3.743

Dionne G, Gueyie JP, Mnasri M (2018) Dynamic corporate risk management: motivations and real implications. J Bank Financ 95:97–111

Fauver L, Naranjo A (2010) Derivative usage and firm value: the influence of agency costs and monitoring problems. J Corp Finan 16(5):719–735. https://doi.org/10.1016/j.jcorpfin.2010.09.001

Froot KA, Schafstein DS, Stein JC (1993) Risk mangement: coordinating corporate investment and financing policies. J Financ 48(5):1629–1658

Houston CO, & Mueller GG (1988) Foreign Exchange Rate Hedging And SFAS No. 52-Relatives Or Strangers. Accounting Horizons 2(4):50–57

James, T. (2003) Energy price risk. Palgrave Macmillan UK https://doi.org/10.1016/S0378-4371(00)00276-4

Jin Y, Jorion P (2006) Firm value and hedging: evidence from US oil and gas producers. J Financ 61(2):893–919. https://doi.org/10.1111/j.1540-6261.2006.00858.x

Katircioglu ST (2017) Investigating the role of oil prices in the conventional EKC model: evidence from Turkey. Asian Econ Finan Rev 7(5):498–508

Katircioglu ST, Alkhazaleh MMH, Katircioglu S (2018a) Interactions between oil prices and financial sectors’ performances: empirical evidence from Amman Stock Exchange. Environ Sci Pollut Res 25(2):33702–33708

Katircioglu ST, Katircioglu S, Altun O (2018b) The moderating role of oil price changes in the effects of service trade and tourism on growth: the case of Turkey. Environ Sci Pollut Res 25(35):35266–35275

Katircioglu ST, Ozatac N, Taspinar N (2018c) The role of oil prices, growth and inflationin bank profitability. Serv Ind J. https://doi.org/10.1080/02642069.2018.1460359

Kilian L (2009) Not all oil Price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99(3):1053–1069

Lau CK (2016) How corporate derivatives use impact firm performance? Pac Basin Financ J 40:102–114. https://doi.org/10.1016/j.pacfin.2016.10.001

Leland H (1998) Agency costs, risk management, and capital structure. J Financ 53(4):1213–1242

Lookman, AA (2004) Does Hedging Increase Firm Value? Evidence from Oil and Gas Producing Firms. In EFA 2004 Maastricht Meetings (p. Paper No:1574)

Mayers D, Smith CW Jr (1990) On the corporate demand for insurance: evidence from the reinsurance market. J Bus 63(1):19–40

Mnasri M, Dionne G, Gueyie JP (2017) The use of nonlinear hedging strategies by US oil producers: motivations and implications. Energy Econ 63:348–364. https://doi.org/10.1016/j.eneco.2017.02.003

Nance D, Smith C, Smithson C (1993) On the determinants of corporate hedging. J Financ 48(1):267–284

Smith CW, Stulz RM (1985) The determinants of firms’hedging policies. J Financ Quant Anal 20(4):391–405

Stulz RM (1996) Rethinking risk management. J Appl Corporate Finan 9(3):8–25. https://doi.org/10.1111/j.1745-6622.1996.tb00295.x

Wall LD, Pringle JJ (1989) Alternative explanations of interest rate swaps: a theoretical and empirical analysis. Financ Manag 18(2):59–73. https://doi.org/10.2307/3665893

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yildiz Savas, E., Kapusuzoglu, A. Risk management activities for oil and gas producers and the impact on firm value. Environ Sci Pollut Res 27, 7087–7095 (2020). https://doi.org/10.1007/s11356-019-07180-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-07180-w