Abstract

The assessment of productivity change over time and its drivers is of great significance for water companies and regulators when setting urban water tariffs. This issue is even more relevant in privatized water industries, such as those in England and Wales, where the price-cap regulation is adopted. In this paper, an input-distance function is used to estimate productivity change and its determinants for the English and Welsh water-only companies (WoCs) over the period of 1993–2009. The impacts of several exogenous variables on companies’ efficiencies are also explored. From a policy perspective, this study describes how regulators can use this type of modeling and results to calculate illustrative X factors for the WoCs. The results indicate that the 1994 and 1999 price reviews stimulated technical change, and there were small efficiency gains. However, the 2004 price review did not accelerate efficiency change or improve technical change. The results also indicated that during the whole period of study, the excessive scale of the WoCs contributed negatively to productivity growth. On average, WoCs reported relatively high efficiency levels, which suggests that they had already been investing in technologies that reduce long-term input requirements with respect to exogenous and service-quality variables. Finally, an average WoC needs to improve its productivity toward that of the best company by 1.58%. The methodology and results of this study are of great interest to both regulators and water-company managers for evaluating the effectiveness of regulation and making informed decisions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In many countries, the water and sewerage industry is regulated because water services are provided through a monopoly regime. In this context, the assessment of the total factor productivity (TFP) has been evidenced as a useful tool for both water companies and regulators. The importance of evaluating productivity growth is especially marked in countries where the performance evaluation of water companies is part of the process of setting water tariffs (Maziotis et al. 2016a). While there are several countries whose process to update water tariffs is based on price-cap regulation (Marques 2011), the English and Welsh water industry has become a paradigmatic case (Molinos-Senante et al. 2016a).

After the privatization of the water companies in England and Wales in 1989, the regulator (Ofwat) adopted the RPI-K price-cap methodology to regulate the water industry (Saal and Reid 2004) (see more details in section 2). Moreover, since the privatization, there have been two types of water companies operating in England and Wales: Water and Sewerage Companies (WaSCs) and Water Only Companies (WoCs) (Molinos-Senante et al. 2015a).

Given the importance of the productivity-growth estimation in the framework of the English and Welsh water-industry regulation, several researchers have assessed the TFPs of the water companies in England and Wales. To this end, from a methodological point of view, three main approaches have been used. Most of the previous studies employed stochastic-frontier techniques to provide TFP growth estimates (Saal and Parker 2000, 2001, 2006; Bottasso and Conti 2009a, b; Saal et al. 2007). A second methodological approach based on index numbers was applied by Maziotis et al. (2015, 2016a). In addition, alternative productivity indices (Malmquist, Luenberger, Färe-Primont) based on non-parametric techniques were also employed to evaluate TFP changes of water companies in England and Wales (Portela et al. 2011; Molinos-Senante et al. 2014, 2016a; Maziotis et al. 2016b).

In spite of the methodological differences among these previous studies, all of them have in common that they evaluated the productivity growth of WaSCs or WaSCs and WoCs. However, with the exception of Bottasso and Conti (2009a), none of the previous papers focused exclusively on English and Welsh WoCs. In this context, it should be highlighted that Saal and Parker (2006) and Molinos-Senante et al. (2015a) evidenced that English and Welsh WaCs and WoCs operate under different technologies and therefore cannot be modeled together.

In the framework of benchmarking studies applied to the water industry, the importance of accounting for the operational environment in which the water companies are working has been illustrated (Carvalho and Marques 2011). Thus, some exogenous factors, along with the quality of the service provided by water companies, may influence their operational costs (Saal et al. 2007; De Witte and Marques 2010). Hence, it is essential to integrate these variables into productivity-growth assessment. This issue has not been ignored by previous studies on this topic since Saal et al. (2007) pioneered by integrating quality-adjusted outputs in TFP estimates for English and Welsh WaSCs. However, they focused only on analyzing the effect of exogenous variables on the productivity growth of the English and Welsh water companies. In other words, none of the previous studies assessing the TFP change based on stochastic methods have integrated quality-of-service to customers as operating variables that might influence input requirements.

Against this background, the objectives of this paper are threefold. The first is to analyze the impact of regulation on the productivity growth and its drivers, namely, efficiency, technical, and scale changes of the English and Welsh WoCs from 1993 to 2009. It should be highlighted that regulation is essential for leading water companies towards long-term sustainability (Molinos-Senante and Sala-Garrido 2016). The second objective is to explore explanatory variables (external factors and quality of service) affecting the productivity changes of WoCs. Finally, an X factor for each WoC is proposed to be applied in CPI-X price regulation.

To the best of our knowledge, only Bottasso and Conti (2009b) focused on the performance assessment of English and Welsh WoCs instead of WaSCs or both WaSCs and WoCs. Moreover, their study only involved 144 observations since the period observed was 1995/1996–2004/2005. In this context, our study extends significantly the period of time analyzed. The main objective of Bottasso and Conti (2009b) was to evaluate the presence of scale economies in the UK WoCs. By contrast, our study goes much further because it also evaluates the contributions of technical and efficiency changes to productivity growth of WoCs. Our paper also innovates with respect to the explanatory variables of productivity change of English and Welsh water companies since quality-of-service variables are also integrated into the model.

The methodology and results of this research are of great interest from the policy point of view. First, the methodology applied allows estimating an X factor for each WoC, which is essential to promote innovation and competition in the CPI-X price-regulation framework. Second, the integration of quality of service into the assessment provides essential information to the water regulator to develop policies (incentives or new standards) to improve the sustainability of the urban water cycle.

The English and Welsh water industry

The water and sewerage industry in England and Wales was privatized in 1989, and before privatization, there were 10 regional water authorities responsible for the water and sewerage supply in England and Wales and 20 statutory water companies, which were already privatized companies that were only responsible for the supply of water. After 1989, the regional water authorities were privatized and formed the WaSCs and the statutory water companies became WoCs. While in 1993 the total number of companies was 30, they were 22 in 2008 due to mergers and acquisitions. The 10 WaSCs are responsible for the supply of water in areas that are not supplied by the WoCs and the collection, treatment, and disposal of sewerage in all areas. Due to mergers and takeovers between WaSCs/WoCs and WoCs/WoCs that occurred during the period 1993–2010, the number of WoCs fell since privatization. In 1993, there were 20 WoCs and subsequent mergers in 1997 and 1998 led to a reduction in the number of WoCs, from 20 to 16. Further mergers between WaSCs/WoCs and WoCs/WoCs in 2010 reduced the number of WoCs to 12. There are three regulatory bodies in the UK water and sewerage industry: the Office of Water Services (Ofwat), which is the economic regulator and sets the price limits for each company every 5 years; the Environment Agency (EA), which is responsible for pollution control, licensing, and regulation of water abstraction; and the Drinking Water Inspectorate (DWI), which is responsible for controlling and monitoring drinking water quality.

In England and Wales, the water industry is regulated based on the RPI-K price-cap methodology (Saal and Reid 2004). K can be decomposed into two factors, namely, Q and X, where Q is the price increase necessary to finance the required environmental and quality improvements, and X is the productivity offset (Bottasso and Conti 2009a). At privatization in 1989, price limits were set by the Secretary of State for a period of 10 years and were, on average, RPI +5.2 per annum for the industry, RPI + 5 per annum for WaSCs, and RPI + 6.1 per annum for WoCs. The K factor was set at a high level in order to make up for years of underinvestment before privatization and to ensure that the shares of the public companies would be attractive to potential investors. However, as documented in past studies (see for instance Maziotis et al. 2015), the first price caps were relatively lax and as a result, Ofwat exercised its right to reset price caps in 1994. Thus, the average K factor after the 1994 review was RPI + 0.9 for the industry, RPI + 1.0 for the WaSCs, and RPI-0.4 for the WoCs, representing a considerable tightening of price caps (Ofwat 1994). This continued in the price review of 1999 with an average K factor of RPI-2.1 for the industry, RPI-2.0 for the WaSCs, and RPI-2.8 for the WoCs (Ofwat 1999). In the 2004 price review, the K factor increased again to an average of 4.2% per annum (Ofwat 2004b), whereas in 2009, Ofwat published its final price determinations suggesting an average K factor of RPI + 0.5 per annum for WaSCs,and RPI + 0.3 per annum for WoCs for the next 5 years (Ofwat 2009a, b).

The determination of X-factors in the UK water and sewerage industry, and therefore of price limits, is carried out through benchmarking techniques, which provide information about the relative performance of companies. As there are companies that are regulated under the same framework, the regulator can compare the performance of each company against the performance of the others in the industry. When establishing price limits, Ofwat uses cross-section econometric techniques and unit cost models to assess operating expenditure (OPEX) and capital expenditure (CAPEX) relative efficiency separately, for water and sewerage services. For instance, operating expenditure relative efficiency for water services is derived by the use of four econometric models: water distribution, resources and treatment, power, and business activities. OPEX efficiency of sewerage services is derived using two econometric models, namely, network including power and large sewerage treatment works, and three unit cost models, namely, small sewerage treatment works, sludge treatment, and disposal and business activities (Ofwat 2005a). Once the most efficient company has been determined by Ofwat from these models, then the regulator tests how much each company needs to reduce its actual costs to appear as efficient as the most efficient company. Finally, Ofwat also takes into consideration factors that are not included in the efficiency models, called “special factors,” for instance, the high levels of deprivation in a region supplied by a water company which might result in high levels of bad debt.

Methodology

To explore the input-output relationship affecting the performance of the water industry, we adopt an input-distance function estimated using a translog function following Orea (2002) and Coelli et al. (2003). The input-distance function provides an input-oriented measure of technical efficiency by finding the maximum possible radial contraction of an input that can produce a given quantity of output. The nature of production and regulation in the water industry in England and Wales justifies the use of an input-distance function rather than an output-distance function. In this context, water companies do not seek to increase outputs given an exogenous input allocation but rather try to reduce input use for a given exogenous output level, such as the water produced or the number of customers. The relationship can be stated formally as

where Ф is the distance by which the input vector can be deflated, and the input set L(X, Y) represents the set of all input vectors that can produce the output vector. We follow the axioms of Färe and Primont (1995), according to which the input-distance function has the following properties: (i) d input (X, Y) is non-decreasing, positively linearly homogenous and concave in X and non-increasing and quasi-concave in Y; (ii) X belongs to the input set of Y if and only if d input (X, Y) > 1. When a company operates on the frontier of the period t technology, isoquant L(X, Y), then d input (X, Y) = 1.

The translog function can be used as a second-order approximation to a true but unknown technology. This characteristic is of particular interest because it reduces the estimation bias resulting from an improper assumption concerning functional form (Saal et al. 2007). For N (i : 1, … , N) companies observed in T (t : 1, … , T) time periods, M (m : 1, … , M) outputs, and K (k : 1, … , K) inputs, the translog input-distance function is specified as follows:

where y mit is the mth output quantity and x kit is the kth input quantity for company i at time t, and π, γ, ξ, β , ϕ, κ, ψ, and η are the parameters to be estimated. Equation (1) satisfies the properties of the distance function.

Technical efficiency is given in our case by the ratio of the minimal inputs required to the actual inputs used. This ratio tells the regulator or the company manager the amount by which all inputs could be reduced for a given level of output. After the estimation of the parameters, the value of the input-oriented distance function is predicted as \( {TE}_{it}={e}^{{- u}_{it}}, \)which varies between 0 and 1. A value of 1 means that the unit evaluated (WoC in this study) is efficient, and u it is an inefficiency index. Consequently, lnd I = u it .

As ln d I (X it , Y it , t) is not observable, we can select one of the outputs and take advantage of the distance function’s homogeneity properties to write an estimable distance-function specification. Indeed, homogeneity of degree 1 implies

which will be satisfied if \( \sum_{m=1}^M{\pi}_m=1 \) and \( \sum_{m=1}^M{\gamma}_{m n}=\sum_{m=1}^M{\varphi}_{m k}=\sum_{m=1}^M{\eta}_m=0 \).

Homogeneity of degree 1 in input means also that d(τX it , Y it , t) = τd(X it , Y it , t) ∀ τ > 0; normalizing the input-distance function by one of input is equivalent to setting \( \tau =1/{x}_{it}^k \) and then \( d\left({X}_{it}/{x}_{it}^k,{Y}_{it}\right)=\frac{d\left({X}_{it},{Y}_{it}, t\right)}{x_{it}^k} \) (Mellah and Ben Amor 2016). Accounting for these restrictions in Eq. (2) yields the following estimating form:

where \( {\overset{\sim }{x}}_{kit} \) = \( \frac{x_{kit}}{x_{Kit}} \) and ε it = v it − ln d it = v it − u it . In this specification, the error term has two components: the symmetric error term v it , which represents random error and is assumed to be independent and identically distributed, ν it ̴ N(0, \( {\sigma}_{\nu}^2 \)), and the asymmetric error term u it ,which captures the inefficiency effects and is drawn from an exponential distribution, u it ̴ exp(θ) (Saal and Parker 2006).

Following the approach of Saal et al. (2007), we add p exogenous operating characteristics, whose impact on the input requirements is captured in the term ∑p p=1χpʓpit. We also replace the single intercept parameter with firm-specific dummies α i Di to control for unobserved heterogeneity that has not been specifically controlled for in the model (Greene 2005, Kumbhakar et al. 2015). The inclusion of firm-specific dummies is appropriate in our case as 13 years of data are observed, covering several regulatory changes, such as the imposition of new environmental and drinking-water quality regimes, and different price reviews from the regulator. Because of the many years considered in this study and the changes in the companies’ operating and management conditions, the firm-specific dummies capture unobserved heterogeneity in the companies’ operating characteristics, which would otherwise not be controlled for in the model.

As our approach is characterized by multiple inputs and outputs, TFP is measured as the ratio of the aggregate output produced relative to the aggregate input used. In our case study, a useful TFP change measure provides insight into potential productivity improvements. The widely used generalized Malmquist Index is the measure of TFP change from various sources of productivity change. In this paper, we follow the approach of Orea (2002), Saal and Parker (2006), and Mellah and Ben Amor (2016) for the parametric estimation of a translog input-oriented distance function. The parametric generalized Malmquist Index is written as follows:

where the three terms on the right side represent technical efficiency change (TEC), technological change (TC), and scale efficiency change (SEC), respectively. TEC represents the catching-up effect of the company. TC occurs as a feasible input-output combination set, which either expands or contracts. SEC refers to the movement of firm production along the boundary set, making use of its curvatures. Our model thus allows one to better evaluate the impact of SEC on productivity growth even if technology is characterized by globally decreasing or increasing returns to scale. Finally, following standard practice, we normalize the inputs, outputs, and time variables around their mean values, and monotonicity and curvature conditions on the distance function’s partial derivatives with respect to inputs and outputs are imposed before estimation (O’Donnell and Coelli 2005; Saal and Parker 2006; Saal et al. 2007; Mellah and Ben Amor 2016).

Variable specification and data

The selection of variables was guided by a review of the literature (Worthington 2014; See 2015; Mellah and Ben Amor 2016); the specific cost drivers of the English and Welsh water industry such as the value of assets, the length of mains, and number of employees (Saal et al. 2007; Molinos-Senante et al. 2014; CEPA 2014; Maziotis et al. 2016a); and the available data. It should be noted that productivity assessment integrates physical parameters such as the volume of water supplied; economic parameters such as the operational, capital, and labor costs (Jabran et al. 2016); and exogenous factors such as the proportion of water that is abstracted from rivers, reservoirs or boreholes, average pumping head, population density, and proportion of metered properties (CEPA 2014).

The volume of drinking water distributed (y 1), expressed in megaliters per day, and the number of connected properties (y 2) were selected as outputs. Following Portela et al. (2011), the water distributed was considered as a proxy for the volume of water abstracted from several water sources and therefore does not include water leakage. Three variables were used as inputs: (i) capital stock (x 1); (ii) operating expenses (OPEX) as variable input usage (x 2); and (iii) labor (x 3). In general, the measurement of capital stock is a challenge since these data are not readily available (Mellah and Ben Amor 2016). However, for the UK water industry, previous studies (Saal and Parker 2006; Maziotis et al. 2015) measured this variable based on the inflation-adjusted modern-equivalent asset estimates of the replacement cost of net tangible fixed assets. Following the approach of Saal and Parker (2006), operating costs were deflated using the Office of National Statistics’ producer price index for material and fuels purchased in the collection, purification, and treatment by the water industry. Operating expenses involve business costs, energy costs, and resource and treatment costs. In other words, they are total operating costs less labor costs. Labor was proxied by full-time equivalent (FTE) employee numbers, which are available for each WoC.

A literature review (e.g. Marques et al. 2014; Ananda 2014; Molinos-Senante et al. 2015b) illustrated that a large variety of variables might be used as explanatory variables of water companies’ performances. Actually, there is no formal theory as to what should be the determinants of the performances of water companies. Based on extant literature (Saal et al. 2011; Marques et al. 2014; CEPA 2014; Pinto et al. 2016; Brea-Solis et al. 2017), six exogenous variables were integrated in the assessment: (i) customer density; (ii) average pumping head; (iii) percentage of water taken from reservoirs; (iv) percentage of drinking-water losses; (v) percentage of billing contacts (e.g., complaint and payment handling, meter reading, meter installation) not responded to within 5 working days, with respect to the total number of billing contacts; and (vi) percentage of bursts in mains per connected property. As Marques et al. (2014) pointed out, some factors are not completely exogenous for long run management of water companies, but in the short run, the ability of the managers is limited and therefore they should be considered as potential explanatory factors.

Our empirical application focused on the English and Welsh WoCs for the period 1993–2009. The data used for estimation were retrieved from the “July Returns for the Water and Sewerage Industries in England and Wales” published by Ofwat each year. The panel is unbalanced due to the consolidation process that occurred in the UK water industry. Thus, the number of WoCs declined over the sample period due to both WoC/WoC and WaSC/WoC mergers (Saal and Parker 2006). When mergers occurred between firms of similar size, we considered the merged entity as a new firm entering the panel, whereas if a WoC was acquired by a WaSC, we simply dropped the company from the sample (Bottasso et al. 2011). In 2009, Ofwat published new accounting requirements as part of the wider process of further developing competition in the water industry. These new reporting requirements are seen by Ofwat as a necessary first step to improve data quality, before such accounting separation could be finalized in updated regulatory accounting guidelines (RAGs)Footnote 1 (Ofwat 2009a). Hence, these changes in the UK water and sewerage regulatory framework did not allow us to collect consistent data to accurately assess the productivity growth of water companies in subsequent years (Maziotis et al. 2016b). Therefore, our study involves 243 observations. The descriptive statistics for the variables are shown in Table 1.

Empirical results

The estimated parameters of the distance functions are reported in Table 2. We also check if the input-distance function satisfies monotonicity and curvature conditions, i.e., non-decreasing and concave in inputs and non-increasing and quasi-concave in outputs. The results confirm that the estimated function is non-decreasing in inputs and non-increasing in outputs, as shown by the first-order coefficients of inputs and outputs, respectively. Moreover, the Hessian matrix of the translog input-distance function with the second-order coefficients and the interaction term between inputs as elements is negative semi-definite (Mellah and Ben Amor 2016). Every principal minor of odd order is non-positive, and every principal minor of even order is non-negative (Simon and Blume 1994). The condition of quasi-concavity in output is only partially satisfied at the sample mean.Footnote 2 This does not imply the absence of an underlying cost-minimization process but may reflect the inability of the translog input-distance function to approximate the true input distance over the range of the data (Wales 1977). As Färe et al. (2010) and Wolf et al. (2010) noted, the translog function may lose flexibility when subjected to curvature restrictions. Overall, the estimated translog input-distance function is acceptable.

The firm-specific dummies are all statistically different from zero. Note that a negative coefficient suggests an increase (decrease) in technical efficiency (inefficiency), and the reverse is also true. Since all variables have been normalized around their means, the first-order coefficients of outputs and inputs can be, respectively, interpreted as distance-function output and input elasticities for the average WoC of the sample.

The output elasticities are statistically significant and suggest that creating more water-connected properties requires more input requirements than providing additional volumes of water. This also evident from the second-order coefficient of water volumes and water-connected properties. The scale elasticity, the sum of the inverses of the output elasticities, is 1.04 at the sample mean, which implies that a 1% increase in outputs will require an increase in input of 0.96%. This finding is consistent with other studies that reported economies of scale for English and Welsh WoCs (Bottasso et al. 2011). As far as the input elasticities are concerned, they are all positive and statistically different from zero, implying that the distance function is increasing with respect to inputs. The input elasticities of capital, operating expenses, and labor are 0.445, 0.436, and 0.118, respectively. Labor input was used as the normalized variable in the distance function, so its elasticity is recovered from the sum of capital and operating-expense (OPEX) elasticities. This finding suggests that both capital and operating expenses are the main drivers of increased input requirements to abstract, treat, and distribute water to downstream users. The second-order coefficient of water distribution and the water-connected property is positive and insignificant, which suggests that these outputs are not complementary. This finding is consistent with the results of Saal and Parker (2006) and Bottasso and Conti (2009b). The second-order coefficient of inputs with respect to capital and operating expenses suggest that input requirements increase more when additional capital investment increases than when operating expenses increase. This is also evident when looking at the interaction term between time and inputs. Capital elasticity over time is positive and statistically significant, which means that WoCs have carried out substantial capital-investment programs since privatization. The estimated coefficient of the time factor is negative and statistically significant, suggesting that the sample-average firm has undergone technological regression from 1994 to 2009 at a small rate of 0.28%. The time-squared coefficient is relatively small and insignificant, suggesting that the estimated rate of technical change has been further declining, by 0.02% per year. The coefficients of time related to each of the input variables are statistically significant, suggesting that technical change has resulted in the use of capital and the reduction of operating expenses. The statistically significant parameter of the interaction term between time and outputs suggests that technical change increases the relative magnitude of connection elasticity, whereas it decreases the relative magnitude of the elasticity of the amount of water delivered.

Looking at the estimated parameters of the exogenous factors, it is concluded that the elasticity of input requirements with respect to density is positive and statistically significant. This implies that increased density reduces input requirements, which may be explained by the fact that a company with a relatively high customer to area-size ratio might use shorter pipes and hence have lower distribution costs (Torres and Morrison 2006). Increased billing contacts not dealt with within five working days reduces input requirements, which implies that companies had already achieved high levels of service to customers (Ofwat 2004a, b). The elasticity of input requirements with respect to reservoirs is positive and significant. This implies that water taken from reservoirs does not require higher inputs than water taken from rivers or groundwater resources, which may be more energy intensive than reservoirs and therefore might require higher inputs. Finally, the estimated parameter of bursts per connected property is positive and significant, whereas water losses are still positive but insignificant. This implies that increased investments in reducing bursts or water losses may reduce long-term input requirements because of input-saving effects resulting from the investment in technologies that improve prediction of bursts in mains and manage water leakage. It should be noted that customer research carried out by Ofwat and other stakeholders suggested that customers in general believe that water companies in England and Wales have achieved a broadly satisfactory level of service in relation to costs (Ofwat 2004a, 2005a, b, 2009b).

Table 3 illustrates the trends in the average, maximum, and minimum efficiency levels of WoCs over the period from 1993/1994 to 2008/2009.

Several conclusions can be drawn from the analysis of the trend in the efficiency levels of WoCs. First, the tightening of the regulatory regime till 2001/2002 had a positive impact on the efficiency levels of WoCs but did not have a positive effect on companies’ efficiency levels in the subsequent years. Moreover, since the WoCs’ average and maximum efficiency levels were relatively high at privatization, it was difficult to achieve substantial efficiency gains after privatization. Finally, the minimum efficiency levels have improved considerably since privatization, which means that price-cap regulation had a positive impact on those companies that were less inefficient when privatized.

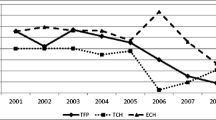

The year-by-year average for TFP change (TFPC) and its decomposition into EC, TC, and SEC are depicted in Fig. 1. TFPC increased till 1994/1995 by 2.52%, with technical change being the major determinant of productivity growth. The tight 1994 price review led to a declining trend for TFPC; however, it remained at a positive level. In the year ending 1998, average technical change remained at 0.40% per year, suggesting that the potential for productivity improvements through technical change still remained in the industry. The further tightening of the regulatory regime created more volatility in TFPC. In the year ending 2001/2002, TFPC remained at 0.56% per year with efficiency change increasing by 1.26% per year. Technical change and scale change had consistent negative impacts on productivity growth. However, the efficiency gains were not sustained the following years and in 2004/2005, TFPC dropped by −1.44%, with TC and TEC being the major determinants of deterioration in productivity. This finding is consistent with Portela et al. (2011) and Molinos-Senante et al. (2014; 2016b) where the authors concluded that less efficient companies improved their performance towards the frontier company whereas the frontier company did not continue to improve its performance. This conclusion reinforces Ofwat’s statement in 2004 that “the improvement in relative efficiency since 1999 is striking. We now see companies clustering around the industry frontier for operating costs and capital expenditure, with several companies showing at or near best in class performance in both operating and capital maintenance efficiencies” (Ofwat 2004b). Moreover, managing a stepped change in price limits to remove excess returns from past price reviews and continuing high capital investment to improve overall performance was challenging for the frontier companies (Molinos-Senante et al. 2016a). The introduction of new prices in 2005 led to small efficiency gains in the year ending 2006, which were offset by substantial reductions in TC and scale effect. Overall, the imposition of the price-cap regulation regime was meant to stimulate efficiency improvements and TC; in the longer term, it was not particularly effective in maintaining efficiency and productivity growth. Evidence of technical regress for WoCs was also found in Saal et al. (2011) where the authors estimated a quadratic total cost function for the period 1993–2009 without controlling for exogenous factors. In contrast, other authors such as Bottasso and Conti (2009b) reported positive technical change for WoCs by estimating a variable cost function for the period 1995–2005. Brea-Solis et al. (2017) also found technical progress by estimating an input distance using both WaSCs and WoCs. Therefore, the model specification, the choice of outputs/inputs, the sample period, the inclusion or not of exogenous factors, and the type of companies can lead to different conclusions with regard to the existence of technical progress. We also note that there might be other factors beyond the regulatory cycle that have impacted companies’ productivity growth. For instance, water companies use substantial amounts of electricity to treat water and in 2005/2006, electricity prices increased more than the producer price index for material and fuels purchased in the collection, purification, and treatment (the index used to deflate operational costs). Moreover, Molinos-Senante et al. (2016a) noted that exogenous climate characteristics might explain the decline in companies’ performance. For instance, during the extended dry period which started in the winter of 2004–2005, water companies successfully minimized the risk of serious supply problems by using restrictions and undertaking additional water efficiency programs, increasing therefore their costs (Ofwat 2007).

Figure 2 shows cumulative TEC, TC, SEC, and TFP growth indices for an average WoC. The 1994 tight price review had a positive impact on TFPC, which increased by 5.4% in 1998 relative to 1993, mainly due to an improvement in TC. This finding is consistent with Bottasso and Conti (2009b) where the authors reported small but positive rates of technical change for WoCs. Using both WaSCs and WoCs, Ashton (2008) reported a rate of technical change 1.8% during the period 1991–1996 and Portela et al. (2011) reported an increasing trend for technical change for the years 1993–1997. A declining trend was then observed for TFPC for the subsequent years, which was attributed to decreases in SEC and TEC. In 2000, TFPC increased by 4.8% relative to 1993 due to a substantial increase in technical change of 5.36% and small efficiency gains. The 1999 price review helped less efficient companies to improve their efficiency, whereas the best performing companies continued to improve their performance but at a lower rate. This finding is consistent with Bottasso and Conti (2009b) and Portela et al. (2011) where the industry showed an increasing trend in technical change till 2000 but in the second half of the regulatory period, technical change falls. In 2004/2005, the average TFPC index fell below its level at the first years of privatization. Deterioration of TFPC is attributed to a decrease in TC. TEC and SEC also decreased but at lower rates. The introduction of new prices in 2005 did not improve the average company’s productivity growth, which declined substantially due to substantial reductions in TC and SEC. Overall, relative to 1993, TFPC dropped by almost 14%, mainly due to the reduction in TC by 10%, whereas SEC dropped by 3% and TEC by 1%. This finding implies that it will be wiser for water companies to not base productivity plans only on technical efficiency but to focus further on scale efficiency and technological progress.

Linking the TFPC results with the regulatory cycle, it is concluded that the 1994 price review had a positive impact on productivity growth, which was attributed to TC, i.e., the shift to the efficient frontier. This finding suggests that during the years 1994–2000, the frontier company improved its managerial practices significantly. The scale effect became negative during the years 1997–2000, which implies that the acquisition/mergers of WoCs from WaSCs did not have a positive impact on WoCs’ productivities. Moreover, the additional tight price review in 1999 had a positive effect on WoCs’ performances. During the years 2001–2005, less efficient companies moved closer to the frontier company, the productivity of which was following a downward trend. This finding is consistent with Portela et al. (2011) and Ofwat’s statement that several companies were at or near the frontier company in terms of both operating and capital-maintenance efficiencies (Ofwat 2004b; Portela et al. 2011). TC also improved but followed a downward trend, whereas the scale effect remained constantly negative. Overall, the 2004 price review did not further accelerate efficiency changes or stimulate technical changes. There were deteriorations in productivity for both best firms and other firms, meaning that less efficient companies did not move closer to the frontier, nor did the benchmark company continue to improve productivity. This finding is consistent with the results of Molinos-Senante et al. (2014), which showed that during the years 2004–2008, the UK water industry experienced a decline in productivity growth mainly due to technical regression.

From a policy and managerial perspective, this study allowed the identification of the primary drivers of productivity change and the assessment of the impact of regulation on companies’ performances. This step is of great importance, as it will aid regulators and water companies in defining measures that can be employed to improve performance in a regulated industry. Moreover, the utility’s regulators can use this type of modeling and the results to propose X factors for the WoCs over a 5-year period (See Table 4). This was illustrated by using results from the year 2008 as an example.

The potential (anticipated) productivity improvement of WoC1 obtained by catching up to company WoC10 over time is 0.988/0.859 = 1.149. Assuming that WoC1 achieves 50% catch-up for total costs over a 5-year period, then its productivity should improve by [1.000 + (1.125 − 1)/2] = 1.075 over a 5-year period. That means that WoC1 should catch up to the best firm \( {(1.075)}^{\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$5$}\right.}=1.015 \) per year. Assuming that the regulator entity requires a 1% continuing improvement factor (technical change), the required productivity growth or X factor for WoC1 is X = 1.015 × 1.01 = 1.025, or 2.46% per year. Analogously, illustrative X factors are computed for the other WoCs and for the average company.

Conclusions

The assessment of the productivity change over time and its determinants is of great importance for regulators when setting urban water tariffs. In a regulatory framework, such as that of England and Wales, where water companies consolidate and make up a technologically mature industry, some exogenous factors become significant in the assessment of the performances of water companies. This issue is of great importance for the English and Welsh water industry which is regulated based on RPI-K price-cap methodology. Given the importance of this topic, several studies have aimed to assess TFP of water companies in England and Wales. However, they focused on assessing the productivity performances of WaSCs or both WaSCs and WoCs, whereas the only study that specifically addressed the assessment of WoCs’ performances aimed to evaluate the presence of scale economies. Hence, this study adds to the debate over the impact of regulation on WoCs’ productivity, technology, and scale changes.

This paper reports our empirical research dealing with the estimation of technology, assessment of efficiency, and identification of determinants of productivity change in WoCs in England and Wales during the years 1993–2009. To achieve this, an input-distance function is used to estimate and decompose the productivity change into TEC, TC, and SEC using stochastic frontier techniques. We also explore the impacts of several exogenous and service-quality variables on companies’ efficiencies. Finally, we show how the utility’s regulator can use this type of modeling and the results to calculate illustrative X factors for the WoCs.

The primary findings of our empirical research can be summarized as follows. First, the 1994 and 1999 price reviews stimulated technical change, and there were small efficiency gains. During the years 1993/1994–2001/2002, the best company improved its productivity over time and several companies were at or near the frontier company in terms of both operating and capital-maintenance efficiencies. Mergers between WoCs or WaSCs and WoCs did not have positive effects on WoC performance, as the scale change was negative. The 2004 price review did not speed up TEC or stimulate TC, whereas SEC remained negative. Second, the average and maximum efficiency levels of WoCs had been relatively high at privatization, so it was difficult to achieve substantial efficiency gains after privatization. Moreover, the minimum efficiency levels have been improved considerably since privatization, which means that price-cap regulation had a positive impact on those companies that were less inefficient when privatized. Furthermore, the inclusion of several exogenous factors did not broadly increase long-term input requirements. On average, companies reported relatively high efficiency levels during the period of study, which suggests that they had already been investing in cost-efficient technologies or using inputs with respect to exogenous factors in a cost-efficient way. Finally, an average WoC needs to improve its productivity or reduce its costs relative to the benchmarking company by 1.58%.

From a policy and managerial perspective, our empirical study is of great significance for researchers and policy makers for the following reasons. First, our methodology allows the identification of the factors that affect productivity change over time, which could aid regulators and managers to define measures that can be employed to improve performance in a regulated industry. Moreover, calculating appropriate X factors in price-cap regulation is essential to create incentives to improve the efficiency and productivity of water companies. Finally, it provides a better understanding of the relative importance of various productivity components, which is essential to water regulators and water companies for the sustainable and efficient management of the urban water cycle.

Notes

Interested readers can consult the Regulatory accounting guidelines 2016–2017 published by Ofwat at its webpage: www.ofwat.gov.uk/wp-content/uploads/2016/10/prs_in1609RAG1617.pdf

In our model, 77% of the observations satisfy quasi-concavity in output, while 56 observations (23%) violate this condition.

References

Ananda J (2014) Evaluating the performance of urban water utilities: robust nonparametric approach. J Water Resour Plan Manag 140(9):04014021

Ashton JK (2008) Capital utilisation and scale in the English and Welsh water industry. Serv Ind J 23(5):137–149

Bottasso A, Conti M (2009a) Price cap regulation and the ratchet effect: a generalised index approach. J Prod Anal 32(3):191–201

Bottasso A, Conti M (2009b) Scale economies, technology and technical change: evidence from the English water only sector. Reg Sci Urban Econ 39(2):138–147

Bottasso A, Conti M, Piacenz M, Vannoni D (2011) The appropriateness of the poolability assumption for multiproduct technologies: evidence from the English water and sewerage utilities. Int J Prod Econ 130(1):112–117

Brea-Solis H, Perelman S, Saal DS (2017) Regulatory incentives to water losses reduction: the case of England and Wales. J Prod Anal In press

Carvalho P, Marques RC (2011) The influence of the operational environment on the efficiency of water utilities. J Environ Manag 92(10):2698–2707

CEPA (2014). Cost assessment—advanced econometric models. Cambridge Economic Policy Associates Ltd, Report prepared for Ofwat

Coelli TJ, Estach A, Perelman S, Trujillio L (2003) A primer on efficiency measurement for utilities and transport regulations. WBI development studies. The World Bank, Washington, D.C.

De Witte K, Marques RC (2010) Influential observations in frontier models, a robust non-oriented approach to the water sector. Ann Oper res 181(1):377–392

Färe R, Primont D (1995) Multi-output production duality: theory and applications. Kluwer Academic Publications, Boston

Färe R, Martins-Filho C, Vardanyan M (2010) On functional form representation of multi-output production technologies. J Prod Anal 33(2):81–96

Greene W (2005) Fixed and random effects in stochastic frontier models. J Prod Anal 23(7):7–32

Jabran K, Hussain M, Fahad S, Farooq M, Alharrby H, Nasim W (2016) Economic assessment of different mulches in conventional and water-saving rice production systems. Environ Sci Pollut res 23(9):9156–9163

Kumbhakar SC, Wang H-J, Horncastle A (2015) A practitioner’s guide to stochastic frontier analysis using STATA. Cambridge University Press

Marques RC (2011) Regulation of water and wastewater services: an international comparison. IWA publishing

Marques RC, Berg S, Yane S (2014) Nonparametric benchmarking of Japanese water utilities: institutional and environmental factors affecting efficiency. J Water Resour Plan Manag 140(5):562–571

Maziotis A, Saal DS, Thanassoulis E, Molinos-Senante M (2015) Profit, productivity and price performance changes in the water and sewerage industry: an empirical application for England and Wales. Clean Techn Environ Policy 17(4):1005–1018

Maziotis A, Saal DS, Thanassoulis E, Molinos-Senante M (2016a) Price cap regulation in the English and Welsh water industry: a proposal for measuring performance. Util Policy 41:22–30

Maziotis, A., Molinos-Senante, M., Sala-Garrido, R. (2016b). Assessing the impact of quality of service on the productivity of water industry: a Malmquist-Luenberger productivity index approach for England and Wales. Water Resour Manag in Press doi:10.1007/s11269-016-1395-6

Mellah T, Ben Amor T (2016) Performance of the Tunisian water utility: an input-distance function approach. Util Policy 38:18–32

Molinos-Senante M, Sala-Garrido R (2016) Performance of fully private and concessionary water and sewerage companies: a metafrontier approach. Environ Sci Pollut res 23(12):11620–11629

Molinos-Senante M, Maziotis A, Sala-Garrido R (2014) The Luenberger productivity indicator in the water industry: an empirical analysis for England and Wales. Util Policy 30:18–28

Molinos-Senante M, Maziotis A, Sala-Garrido R (2015a) Assessing the relative efficiency of water companies in the English and welsh water industry: a metafrontier approach. Environ Sci Pollut res 22(21):16987–16996

Molinos-Senante M, Sala-Garrido R, Lafuente M (2015b) The role of environmental variables on the efficiency of water and sewerage companies: a case study of Chile. Environ Sci Pollut res 22(13):10242–10253

Molinos-Senante M, Maziotis A, Sala-Garrido R (2016a) Assessment of the total factor productivity change in the English and Welsh water industry: A Fare-Primont productivity index approach. Water Resour Manag In press. doi:10.1007/s11269-016-1346-2

Molinos-Senante M, Maziotis A, Sala-Garrido R (2016b) Estimating the cost of improving service quality in water supply: a shadow price approach for England and Wales. Sci Total Environ 539:470–477

O’Donnell CJ, Coelli TJ (2005) A Bayesian approach to imposing curvature on distance functions. J Econ 126:493–523

Ofwat (1994) Future charges for water and sewerage services. Office of Water Services, Birmingham

Ofwat (1999) Future water and sewerage charges 2000–2005; final determinations. Office of Water Services, Birmingham

Ofwat (2004a) Levels of service for the water industry in England & Wales 2003–2004 report. Office of Water Services, Birmingham

Ofwat (2004b) Future water and sewerage charges 2005–10: final determinations. Available from: http://www.ofwat.gov.uk/pricereview/pr04/det_pr_fd04.pdf

Ofwat (2005a) Water and sewerage service unit; costs and relative efficiency 2004–2005 report. Office of Water Services, Birmingham

Ofwat (2005b) Levels of service for the water industry in England & Wales 2004–2005 report. Office of Water Services, Birmingham

Ofwat (2007) Levels of service for the water industry in England & Wales 2006–2007 report. Office of Water Services, Birmingham

Ofwat (2009a) Levels of service for the water industry in England & Wales 2008–2009 report. Office of Water Services, Birmingham

Ofwat (2009b) Accounting separation-consultation on June return reporting requirements 2009–10. The water services regulation authority. Birmingham

Orea L (2002) A parametric decomposition of generalized Malmquist productivity index. J Prod Anal 18(1):5–22

Pinto FS, Simoes P, Marques RC (2016) Water services performance: do operational environmental and quality factors account? Urban Water J In press

Portela MCAS, Thanassoulis E, Horncastle A, Maugg T (2011) Productivity change in the water industry in England and Wales: application of the meta-malmquist index. J Oper Res Soc 62(12):2173–2188

Saal DS, Parker D (2000) The impact of privatization and regulation on the water and sewerage industry in England and Wales: a translog cost function model. Manag Decis Econ 21(6):253–268

Saal DS, Parker D (2001) Productivity and price performance in the privatized water and sewerage companies in England and Wales. J Regul Econ 20(1):61–90

Saal DS, Parker D (2006) Assessing the performance of water operations in the English and Welsh water industry: a lesson in the implications of inappropriately assuming a common frontier. In: Coelli T, Lawrence D (eds) Performance measurement and regulation of network utilities. Edward Elgar, Cheltenham

Saal DS, Reid S (2004) Estimating OPEX productivity growth in English and Welsh water and sewerage companies: 1999–2003. RP0434. Aston Business School Research Papers

Saal DS, Parker D, Weyman-Jones T (2007) Determining the contribution of technical efficiency, and scale change to productivity growth in the privatized English and Welsh water and sewerage industry: 1985–2000. J Prod Anal 28(1):127–139

Saal DS, Arocena P, Maziotis A (2011) Economies of integration in the English and Welsh water only companies and the assessment of alternative unbundling policies. ACCIS Working Paper, No 7

See KF (2015) Exploring and analysing sources of technical efficiency in water supply services: some evidence from southeast Asian public water utilities. Water Resour Econ 9:23–44

Simon CP, Blume L (1994) Mathematics for economists. W.W. Norton & Company, New York, London, New York

Torres M, Morrison PC (2006) Driving forces for consolidation or fragmentation in the US water utility industry: a cost function approach with endogenous outputs. J Urban Econ 59:104–120

Wales TJ (1977) On the flexibility of functional forms: an empirical approach. J Econ 5(2):183–193

Wolf H, Heckelei T, Mittelhammer RC (2010) Imposing curvature and monotonicity on flexible functional forms: an efficient regional approach. J Comput Econ 36(4):309–339

Worthington AC (2014) A review of frontier approaches to efficiency and productivity measurement in urban water utilities. Urban Water J 11(1):55–73

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Rights and permissions

About this article

Cite this article

Molinos-Senante, M., Porcher, S. & Maziotis, A. Impact of regulation on English and Welsh water-only companies: an input-distance function approach. Environ Sci Pollut Res 24, 16994–17005 (2017). https://doi.org/10.1007/s11356-017-9345-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-017-9345-2