Abstract

With the development of China’s economy, the problem of environmental pollution has become increasingly more serious, affecting the sustained and healthy development of Chinese cities and the willingness of residents to invest in fixed assets. In this paper, a panel data set of 70 of China’s key cities from 2003 to 2014 is used to study the effect of environmental pollution on home prices in China’s key cities. In addition to the static panel data regression model, this paper uses the generalized method of moments (GMM) to control for the potential endogeneity and introduce the dynamics. To ensure the robustness of the research results, this paper uses four typical pollutants: per capita volume of SO2 emissions, industrial soot (dust) emissions, industrial wastewater discharge, and industrial chemical oxygen demand discharge. The analysis shows that environmental pollution does have a negative impact on home prices, and the magnitude of this effect is dependent on the level of economic development. When GDP per capita increases, the size of the negative impact on home prices tends to reduce. Industrial soot (dust) has the greatest impact, and the impact of industrial wastewater is relatively small. It is also found that some other social and economic factors, including greening, public transport, citizen income, fiscal situation, loans, FDI, and population density, have positive effects on home prices, but the effect of employment on home prices is relatively weak.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As a pillar industry of the national economy,Footnote 1 real estate receives great concern from the government, investors, consumers, financial institutions, and some intermediate service agencies. In recent years, the promotion of urbanization, the reform of urban household registration system, and the vigorous development of the real estate industry have attracted the enthusiasm of a large number of investors into the market. In addition, most of the Chinese family consumption and investment objects are apartments, for which the Chinese real estate market accounted for the largest piece. However, the scarcity of land resources must not be able to meet the sustained growth of real estate development and housing demand, leading to cities’ home prices rising. China’s urban housing prices-income ratio is even far higher than developed countries’ average level (Shen 2012). The government, nine ministries, and commissions introduced a series of price control policies such as “New Eight Control Regulations on Home Prices,” “Fifteen Control Regulations on Home Prices,” and “New Ten Control Regulations on Home Prices” to cool the market, but the effect was not significant.Footnote 2 , Footnote 3 , Footnote 4

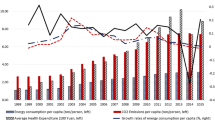

With the improvement of China’s economic level and the growing of household consumption, the extensive economic growth mode characterized by high energy consumption, high emissions, and high levels of pollution has caused heavy pressure on the environment, resulted in rapid growth in energy consumption and CO2 emission (Zhang et al. 2015). In addition, in the process of urbanization in China, the infrastructure for wastewater transportation and wastewater treatment is not satisfactory (Wu et al. 2016). Various factors created serious environmental pollution problems in cities’ development process. China’s cities are one of the most polluted areas in the world.Footnote 5 This paper selects the national data from 2000 to 2014 to observe the trends of urban home prices and environmental pollution in China, with the results shown in Fig. 1. The average selling price of residential real estate characterizes urban home prices, and the volume of three types of pollutant emissions: SO2, industrial soot (dust), and industrial chemical oxygen demand stand for urban environmental pollution levels. It is seen from Fig. 1 that during the 15 years of the sample period, China’s urban home prices basically maintained a stable upward trend. The development of China’s housing market could be roughly divided into three stages. China’s housing market initiated from the market-oriental reform launched in 1998, since when citizens did not receive apartments from their companies or firms directly. Instead, they received some subsidies and had to buy apartments in the housing market. This reform has created huge demand in apartments and houses and propelled the home prices to increase rapidly in many cities especially the megacities of Beijing, Shanghai, Guangzhou, and Shenzhen. However, the impetus of hiking home prices seemed to be reversed during the period between mid-2007 and early-2009, when the “subprime mortgage crisis” initiated in the U.S. affected China’s economy and hit the housing market. During that time there was even a slight decline in home prices in China (and that was the only period when home prices appeared to decrease). Since mid-2009, partly thanks to the economic stimulus program implemented by Chinese government to mitigate the negative impacts of ongoing financial crisis and also because of the appreciation of Chinese currency and the rising demand for investment and speculation, China’s housing market had once again boomed with surging home prices (Shen 2012; Chen and Funke 2013). From 2000 to 2006, the volume of SO2 emissions increased year by year, but the volume of industrial soot (dust) emissions gradually decreased. In 2007–2011, the volume of SO2 and industrial soot (dust) emissions exhibited a downward trend. In 2012–2014, the volume of SO2 emissions still declined; however, the volume of industrial soot (dust) emissions showed a more intense rise. But the volume of industrial chemical oxygen demand discharge showed a steady downward trend during the period of 15 years. Among the three pollutants, the volume of SO2 emissions is the largest, and industrial chemical oxygen demand has the least impact on environmental pollution. This is consistent with the conclusion of Zheng et al. (2010) that China is already the world’s current largest producer of SO2 emissions.

In addition, this study uses the data of home prices and per capita volume of SO2 emissions, which cover 70 cities of China from 2003 to 2014, to observe the home price level and pollution degree of each city. These data are sorted from small to large and divided into five files, and then, Figs. 2 and 3 are created. It can be observed that the home prices of eastern coastal areas are generally higher than those of the central and western regions. Most of the urban industrial SO2 emissions are relatively large and accompanied by serious environmental pollution problems.

Foreign research has indicated that people pay increasingly more attention to environmental quality with economic development, and environmental pollution would reduce the living comfort and affect people’s psychological feelings and physical health, thus affecting home buyers’ willingness to purchase and home prices. As the largest developing country, China still has great potential for urbanization for a long period of time in the future (Fan et al. 2017). Besides, China’s urban development is facing multiple pressures, including the transition from “production” to “consumption” and the construction of an urban ecological civilization. In this context, it is necessary to study whether environmental pollution affects home prices.

There is much research on the influencing factors of home prices done by domestic and foreign scholars. Rosen (1979) showed that a good environment and developed labor markets mainly caused higher home prices. Mankiw and Weil (1989) studied the changes in America’s home prices in the 1970s and found that for the first time, the demographic factor was an important cause. In their study basis, Fortura and Kushner (1986) joined the analysis of the relationship between income factor and home prices. Breedon and Joyce (1993) also increased the low cost of loans and housing ownership rate. Bramley (1993) argued that home price was a function of housing supply, demographic factor, economic factor, and geographical location. Abraham and Hendershott (1994) suggested that real estate prices depended on actual construction costs, household income growth rate, employment ratio, and post-tax real interest rate. Green (1999) considered that the determinants of real estate prices were from both supply and demand. The supply side mainly included wage, construction costs, and land supply. Demand factors took population, income, and age into account. Jud and Winkler (2002) argued that population growth, income, construction costs, and interest rate were important factors influencing home prices. Glaeser and Gyourko (2002), after regression analysis of land zoning, found that land resources caused home prices to change, and market competition resulted in differences between home prices and housing construction costs. Capozza et al. (2002) used the time series method to study the impact of population, disposable income, and urbanization on home prices. Martinez Pagés and Maza (2003), using multivariate regression analysis, found that income and nominal interest rate were key factors in explaining home prices in Spain. Kim et al. (2003) used the spatial-econometric hedonic housing price model to measure the marginal value of the improved concentration of SO2 and nitrogen dioxide (NOx) in the Seoul metropolitan area. It showed that the SO2 pollution level had a greater impact on home prices than that of nitrogen dioxide. Jacobsen and Naug (2005) observed that interest rates influenced home prices more than other factors by using the least squares regression estimation. Hwang and Quigley (2006) used US panel data to study the impact of revenue, construction costs, and economic condition on home prices.

The research on the influencing factors of home prices in domestic academic circles started late, mainly in the past 10 years. Wang and Li (2006) made use of the logit model to study the housing preference of Guangzhou citizens and found that neighbors and location had the greatest impact on home choice. In addition, factors such as household income, age, educational level, and the nature of employment units affected housing preference to varying degrees. Yu (2010) utilized the panel data of 35 major Chinese cities from 1998 to 2007 and the real estate price dynamic panel data model to estimate the impact of real estate policy control variables on home prices. The results demonstrated that land supply and sold and vacant housing area reflected that the housing supply and demand had a negative impact on home prices. Real estate mortgage loans had a positive impact on home prices. The influencing factors of home prices in eastern and western cities were different. Ren et al. (2012) applied the rational expectation bubble theory proposed by Blanchard and Watson (1982) to the Chinese real estate market. Based on the calculation of 35 cities in China, there was no evidence to support the existence of China’s real estate bubble.

It can be found that the domestic and foreign scholars’ research directions focused on the calculation of the relationship between socioeconomic factors and home prices, but there is almost no relevant research on the relationship between environmental pollution and home prices. The research methods are mainly based on the time series method, mathematical models, multivariate regressions, and spatial econometrics.

Based on the rich research results of domestic and foreign scholars, this paper introduces four typical environmental pollutants as influencing factors of real estate prices and discusses whether environmental pollution would affect home prices. The contributions of this article have three main points. First, this paper aims to seek a win-win situation between stable home prices and environmental protection by measuring the impact of environmental pollutants and other socioeconomic factors on China’s urban home prices. Second, the generalized moment estimation (GMM) method is used to estimate the panel data to effectively control for endogeneity and introduce the dynamics. Moreover, the GMM method could address the problems of over-identification. Third, given the dramatic differences in economic development, the impacts of environmental quality on housing prices in different regions of China have been distinguished and estimated separately. Because the panel data includes municipalities, provincial cities, and provinces containing major cities, this 12-year period coincides with China’s urbanization and residential real estate market boom. The sample size is relatively large and representative, so the empirical results are more reasonable and may serve as valuable references to corresponding policymakers.

The rest of this paper is organized as follows. In “Data,” the source of the data used in the study is briefly introduced. In “Empirical methods,” the applied model and econometric estimation methods are explained. “Empirical results and discussions” reports the estimated results and corresponding discussions. Finally, the conclusions and related policy recommendations are given in “Conclusions and policy implications.”

Data

The panel data set used in this paper covers the observation records of China’s 70 key cities from 2003 to 2014, with the highest number of observations reaching 840 times. All the data are picked from the National Bureau of Statistics of the People’s Republic of China, China City Statistical Yearbook in 2004–2015, national and provincial Statistical Communiqué of The People's Republic of China on the National Economic and Social Development from 2003 to 2014, and the provincial and urban Environmental Status Bulletin. To control for inflation, the cities’ home prices, income, and GDP-related variables have been converted into constant 2000 prices. In addition, we take the natural logarithm of the non-proportional variables to eliminate the variance among the municipal data.

There are 12 independent variables in this paper, including four major explanatory variables: per capita volume of SO2 emissions, per capita volume of industrial soot emissions, per capita volume of industrial wastewater discharge, and per capita volume of industrial chemical oxygen demand discharge. Besides, we also add eight socioeconomic factors as control variables. The variables and the reasons to choose them are as follows:

-

1.

Per capita volume of SO2 emissions (PSO 2), per capita volume of industrial soot (dust) emissions (PSOOT), per capita volume of industrial wastewater discharge (PIWW), and per capita volume of industrial chemical oxygen demand discharge (PCOD). Zheng et al. (2014) used the cross-border urban air pollution source as an exogenous variable to show a new estimate of local real estate prices and air pollution, finding that a 10% drop in cross-border urban air pollution would lead to a 0.76% increase in local home prices. Chen et al. (2017) selected the industrial emissions data of SO2 and soot (dust) as the indicators of air pollution. In this paper, the four typical pollutants, SO2, industrial soot (dust), industrial wastewater, and industrial chemical oxygen demand, are selected as the main environmental variables, characterize the environmental pollution level, and are calculated as the relationship between them and home prices.

-

2.

Per capita area of parks and green land (PGREEN). This measures cities’ greening levels. Kong et al. (2007) quantified the monetary value of green facilities of Jinan City by hedonic pricing models. The results confirmed that the increase of urban green area and environmental comfort have a positive impact on home prices. High vegetation coverage helps reduce the concentration of pollutants, improves the comfort of living environment, and affects homebuyers’ willingness and home prices.

-

3.

Number of public transportation vehicles per 10,000 persons (PVEHICLE), which is on behalf of the degree of urban public transport development. McMillen and McDonald (2004) explored the before and after opening impact of the new rapid transit line from downtown Chicago to Midway Airport on single-family home prices. The results illustrated home price was indeed affected by the proximity of the station, and home price in the sample area and value of property far from the new transit stations had a gap of approximately 216 million US dollars from 1986 to 1999. As seen, when consumers intend to invest in fixed assets, they consider whether the city’s public transport system is developed and whether it is easy to travel. It might have a certain impact on home prices.

-

4.

Per capita gross domestic product (PGDP). This is the core variable to reflect the level of urban economic development. Grossman and Krueger (1994) suggested that the long-term relationship between environmental pollution and economic growth is inverted, both of which meet the Environmental Kuznets Curve (EKC) hypothesis. That is, the level of economic growth is different, and then, quality requirements are different. To improve the reliability of the estimated results, this paper transforms the nominal GDP into the actual value based on 2000.

-

5.

The ratio of total fiscal deficit to GDP (DR). This is an important index of the government debt situation. Afonso and Sousa (2012) used the Bayesian Structural Vector Autoregression (B-SVAR) method to study the macroeconomic impact of fiscal policy and found that government expenditure shocks had less impact on GDP. In addition to that, it also caused a different impact on home prices, resulting in rapid decline in stock prices. However, the influence of government revenue shocks on home prices was mixed and on stock prices was positive. Empirical evidence also suggested that it was important to explicitly consider government debt dynamics in the model.

-

6.

The ratio of loans of national banking system at year-end to GDP (FIR) represents the impact of the credit factor on home prices. Gimeno and Martinez-Carrascal (2010) examined the relationship between Spanish home prices and mortgages through a vector error-correction model. The results showed that the two variables were interdependent for a long time and were higher than their equilibrium level before the end of the sample period. Restricted by the level of income, the majority of consumers’ housing consumption models were of those applying for loans from banks and other financial institutions and then using the mortgage for purchase. To a certain extent, it encouraged the purchase behavior of investors and consumers.

-

7.

The proportion of employed persons to total population (ER). Reichert (1990) found that regional home prices were consistent with economic factors (such as mortgage rates) in some countries. However, local factors such as population transfer, employment and income trends often had a unique impact on home prices. Generally, employment affects income, and income level determines the ability to pay, further affecting the willingness for fixed assets investment and real estate prices.

-

8.

Per capita flows of foreign direct investment (PFDI). This shows the degree of openness of a city and the attractiveness of foreign investment, which affect urban production. Furthermore, it may have a role in urban home prices. Zheng et al. (2010) found that cities with higher foreign direct investment might cause lower levels of pollution. Because it is possible that cities with higher levels of environmental pollution had lower home prices, it is reasonable to investigate whether foreign direct investment has an impact on home prices.

-

9.

Population density (PD). This is usually used to measure the size of the population of the city. Under the premise of urban living area unchanged, population density increases when total population increases, and it would stimulate the demand of real estate market and promote home prices. In contrast, when the total population decreases or the growth slows, it is bound to reduce house demand and make home prices fall. Rappaport (2008) used a simple, static general equilibrium model to find that the moderate/slight differences in consumption facilities in metro areas of the USA could lead to significant differences in population density. These facilities did improve population density levels and became a more important chosen determinant.

Table 1 provides the variables’ names, definitions, and descriptive statistics. From Table 1, there is a large difference among the observations, which provides the possibility of the fixed effect regression and GMM estimation below.

Empirical methods

China’s economic development and urbanization processes promote China’s rising home prices and cause a series of environmental pollution problems. A panel data set of key cities in China is used to study the impact of environmental pollution on home prices.

The first estimation is about the regression of home prices. The panel data regression model is as shown in Eq. (1).

where ln(HP)it is the natural logarithm of the average selling price of the residential real estate in the i city of the t year; the explanatory variables have been explained in the previous section of data. Because the main purpose of this study is to investigate the impact of environmental pollution on home prices, the pollutant emissions and the interactive terms of the emissions and GDP per capita are key explanatory variables. The other regressors are control variables, including per capita area of parks and green land (PGREEN), public transportation vehicles per 10,000 persons (PVEHICLE), GDP per capita (PGDP), fraction of fiscal deficit in GDP (RD), ratio of commercial loans to GDP (FIR), ratio of employed people to total population (ER), FDI per capita (PFDI), and population density (PD). LN denotes taking logarithm. Because DR it, FIR it, and ER it are the proportional terms, they are utilized in the original forms rather than being transformed into logarithms. These control variables were frequently utilized in previous relevant studies such as Reichert (1990), Kong et al. (2007), Gimeno and Martinez-Carrascal (2010), and Afonso and Sousa (2012). β 0 is the constant term and β is the regression coefficient; μ it is the individual effect for distinguishing time and cross-sectional effects; and ε it is a random disturbance term.

In terms of Eq. (1), we choose to apply the fixed effect model to estimate. Fixed effect regression is a type of measurement method that controls the change of the panel data with the individual but does not change with time. The research object is a number of specific individuals, and the research conclusion is mainly based on these individual behaviors. Because the home prices and average income might probably affect each other and therefore there may be bilateral causality between the two and also because there are inevitably some factors that may affect home prices but are ignored to be introduced in Eq. (1), there may be endogeneity problem. In this regard, the conventional ordinary least square (OLS) estimator would cause biased estimations and therefore is inappropriate (Wooldridge, 2016).

To eliminate the possible hysteresis effect, solve the bias problem of the fixed effect estimator due to endogeneity, and introduce the dynamic factors, this paper introduces the GMM for further estimation. GMM is a parameter estimation method based on the actual parameters satisfying a certain moment condition. GMM allows for the existence of heteroscedasticity and sequence correlation in the random disturbance term. The obtained parameter estimator is more effective. There are two commonly utilized GMM methods: first-different GMM developed by Arellano and Bond (1991) and system GMM raised by Arellano and Bover (1995) and Blundell and Bond (1998). The main difference between these two GMM estimators is in the way the instrumental variables are designed. Compared with the first-difference GMM approach, the system GMM estimator is more effective and therefore chosen as the benchmark estimation method of this study. In the following contents, the term “GMM” refers to system GMM unless otherwise specified.

Empirical results and discussions

Pure effects of pollution on home prices

Tables 2 and 3 show the empirical results of pure effects of pollution on home prices of 70 cities and 59 cities, with the natural logarithm of the average selling price of residential real estate as explanatory variables. Among them, Table 2 reports the estimated results of the fixed effect model, and Table 3 displays the calculated results of the GMM method.

For ensuring the robustness of the results, this paper makes use of per capita emissions of four typical pollutants as environmental variables: SO2, industrial soot (dust), industrial wastewater, and industrial chemical oxygen demand; the chemical oxygen demand constitutes the main pollutants of industrial wastewater. In the calculation of 70 cities, the environmental variables are per capita emissions of SO2, industrial soot (dust), and industrial wastewater. Because the data is limited in the case of 59 cities, this study utilizes per capita emissions of SO2, industrial soot (dust), and industrial chemical oxygen demand as environmental variables. At the same time, the studied cities are divided into the eastern and non-eastern regionsFootnote 6 and estimated with nationwide cities. Comparing the obtained empirical results, we find some differences and try to explain them below.

Comparing the estimated results of the national, eastern, and non-eastern cities, it is found that the four pollutants are negatively correlated with home prices. Table 2 columns (1) and (2) report that the coefficients for SO2 and industrial soot (dust) across the country are − 0.034 and − 0.030, respectively, with statistical significance at the 1 and 5% levels, but industrial wastewater and industrial chemical oxygen demand’s coefficients are negative and insignificant. Column (4) shows that in the eastern region, the coefficient of industrial soot (dust) is − 0.039, and the significance level is 5%. In non-eastern areas, industrial wastewater and industrial chemical oxygen demand’s coefficients, which are − 0.165 and 0.156, are both significant at the 1% level.

The results are almost in line with our expectations. The continuous development of the economy requires the city to improve productivity and brings about environmental pollution problems in the process. It shows that environmental pollution has a negative impact on urban home prices, that is, the higher the pollution levels, the lower the home prices. The eastern region’s economic development and urbanization levels are higher than non-eastern areas’. Therefore, the resource is consumed more, resulting in a large volume of industrial soot (dust) emissions. Industrial wastewater discharge and industrial chemical oxygen demand discharge are almost concentrated in some heavy pollution industries such as the chemical, energy, paper, and electricity, and these industries are mainly located in non-eastern areas, so the effect of industrial wastewater and chemical oxygen demand on home prices is more significant in this region.

Observing the results of the fixed effect estimation, we know that some other socioeconomic factors also have a significant effect on urban home prices. The per capita area of parks and green land, number of public transportation vehicles per 10,000 persons, per capita gross domestic product, the ratio of total fiscal deficit to GDP, the proportion of employed persons to total population, and population density represent the city’s greening, public transport, economic development level, finance situation, employment status, and population scale, respectively. The six controlled variables have a positive effect on home prices in the country, the eastern, and non-eastern region. Specifically, the city, which has high greening rate, developed public transport, high level of economic development, low fiscal deficit ratio, high level of employment, and large population density, has higher home prices.

The two influencing elements, the ratio of loans of national banking system at year-end to GDP and per capita flows of FDI, generate a negative impact on home prices. One possible explanation is that the main customers of financial institutions in the eastern region are inefficient state-owned enterprises, causing this part of the loans and the mortgage to compete against each other. Because of this, the difficulty of the real estate business and homebuyers to obtain the loan qualifications is increased, resulting in a negative impact on home prices. Another feasible reason is that the consumers and real estate developers of the eastern region may obtain financing from private companies and other channels, making the mortgage business of the banks and other financial institutions reduced, so financial institutions’ loans affect the rising of home prices less. Foreign direct investment is mainly centralized in the eastern coastal areas. With the FDI flow into the city, foreign direct investment requires the city to establish some new factories or expand the scale of production. It may exacerbate the degree of environmental pollution and reduce home prices of the eastern region.

In addition, this paper also reports three indicators, R squared, AIC, and BIC. They are used to judge the model’s goodness of fit. From the results in Table 2, the fixed effect model has a better fit effect.

In the analysis of the role of environmental pollution on home prices, although we take the impact of other socioeconomic factors on home prices into account, there exists a large difference, which is about the function of these controlled factors in different areas. Based on this, the results of the fixed effect model are not as reliable as expected. To control the endogeneity, introduce the dynamic factors, and make the results of the article more persuasive, this paper introduces a more effective method named GMM to estimate the model. The results are shown in Table 3.

In Table 3, the effect of four environmental variables on home prices is measured by the GMM method. The results are different from those of the fixed effect estimation. In all regions, volume of industrial soot (dust) emissions and industrial chemical oxygen demand discharge would have a significant negative impact on home prices, which is almost consistent with the above fixed effect estimates. Across the country, the correlation coefficient of SO2 is negative, but the industrial wastewater is positive. SO2 and industrial wastewater are positively correlated with home prices in eastern and non-eastern areas. This point differs from the fixed effect estimates.

Some more reasonable explanations for these results are proposed. As the level of economic development increases, people’s awareness of environmental protection and the preference for a clean environment are also enhanced. Therefore, the volume of SO2 emissions, industrial soot (dust) emissions, industrial wastewater discharge, industrial chemical oxygen demand discharge, and other pollutant emissions would largely affect the choice of home buyers and reduce the home price level. In the eastern and non-eastern regions, capital-intensive and technology-intensive industries continue to increase. Meanwhile, clean production technologies have also been introduced into this region, leading to improved production efficiency and a reduced volume of SO2 and other pollutant emissions to a certain extent, so SO2’s impact on home prices is weak here. Because industrial wastewater usually discharges to sparsely populated outskirts, people cannot see it in the city center commonly, so its impact on home prices is smaller.

The other controlled variables are observed. After controlling for the endogenous problem, the five controlled variables, per capita area of parks and green land, number of public transportation vehicles per 10,000 persons, per capita gross domestic product, the ratio of total fiscal deficit to GDP, and population density, still have a positive effect on the home prices. Although the correlation coefficients of the partial controlled variables are negative, their significance levels are not high. These results are basically consistent with the results of the abovementioned fixed effect regression. High green coverage and evolutive public transport can reduce the emission of pollutants such as SO2. Simultaneously, increasing fiscal expenditure that is used in preventing pollution and protecting the environment would also effectively ease the pollution of the air and rivers. All of the above have a positive effect on home prices.

The relationship between the ratio of loans of national banking system at year-end to GDP and the price of houses presents a positive correlation in all areas that is different from the fixed effect estimates, but this result is more in line with the economic theory. This paper tries to explain this result here. The current real estate industry is booming, with much enthusiasm in rating speculation, so residents of this region would be more enthusiastic to invest in fixed assets. A direct result of this is that mortgage loans account for a significant proportion of financial institutions’ business. The proportion of employed persons to total population is almost negatively correlated with the home prices, but the significance levels are not high. One possible explanation is that the income level of the working class is low, greatly weakening people’s real estate speculation, so the level of employment and home prices has no significant relationship. The GMM estimation effect of foreign direct investment and home prices is opposite to that of fixed effect model, and there is a positive correlation between FDI and home prices. With the inflow of foreign direct investment, capital and clean technology are also being introduced, which reduce the generation and discharge of pollution, alleviate the pollution problem, and play a positive role in raising home prices.

Incorporating the interactive items

With the increase in urban development, changes in household income would have an impact on home prices. Taking it into account, the interactive items of pollutants and income have also been added into the estimation equations to observe their relationship with home prices. As following, the empirical results after incorporating the interactive items are presented. Tables 4 and 5 report the results of the fixed effect of 70 and 59 cities, and Tables 6 and 7 present the GMM estimates.

It is seen from Tables 4 and 5 that the correlation coefficients of the four pollutants are negative, and the coefficients of interactive items of four pollutants and income are positive. Moreover, the significance levels are relatively high. This result means that the higher is the economic level, the smaller is the negative impact of sulfur dioxide, industrial soot (dust), industrial wastewater, and industrial chemical oxygen demand on home prices. When the per capita income reaches 949.91 million RMB, the impact of sulfur dioxide on home prices can be ignored. However, China cities’ annual per capita income is lower than 949.91 million RMB at the present. Therefore, SO2 and other pollutants still have a certain impact on the home prices.

It is also seen that the six controlled variables of greening, transportation, income, finance, employment, and population density remain positive effect for home prices, as observed by the fixed effect estimates after incorporating the interactive items. The correlation coefficients of financial institution loans and foreign direct investment are almost negative, but their significance levels are low.

The results of GMM estimates are exhibited in Tables 6 and 7. We see that the four pollutants are negatively correlated with home prices, and their correlation coefficients are positively correlated with the per capita income. The results are consistent with the results of fixed effects. It further shows that there is an interaction between per capita volume of pollutants emission and per capita income. In other words, the impact of environmental pollution on home prices depends to a large extent on the income level of citizens.

In addition, per capita garden green area and home prices are positively related to the country and the eastern region, but the two are negative correlation in the non-eastern areas. The possible reason for this is that differences in the level of economic development lead to different requirements for the living environment in different regions, and high greening rates have a greater positive impact on home prices in the eastern region. Moreover, traffic, income, finance, loans, foreign direct investment, and population density have a significant positive impact on home prices, while employment has a weaker impact on home prices.

Conclusions and policy implications

Based on the panel data of China’s 70 cities from 2003 to 2014, this paper uses the fixed effect model and the system GMM method to analyze the relationship between environmental pollution factors and home prices. We draw the following conclusions and policy implications.

-

(1)

In terms of fixed effect model estimates, the negative effects of SO2 and industrial soot (dust) on home prices are significant across the country and in the eastern region. In addition, home prices in non-eastern region are mainly affected by industrial wastewater and industrial chemical oxygen demand. Furthermore, the per capita area of parks and green land, number of public transportation vehicles per 10,000 persons, per capita gross domestic product, the ratio of total fiscal deficit to GDP, the proportion of employed persons to total population, and population density in all regions have a positive effect on home prices. The ratio of loans of national banking system at year-end to GDP and the per capita flows of foreign direct investment is negatively correlated with the home prices.

-

(2)

The results of the GMM measurement are different from those of the fixed effect estimation. Across the country, the correlation coefficient of SO2 is negative, but that of the industrial wastewater is positive. SO2 and industrial wastewater are positively correlated with home prices in the eastern and non-eastern regions. Similarly, after controlling for the endogenous problem, there are still positive correlations between the controlled variables that characterize greening rate, public transport, economic development level, fiscal situation and population size, and home prices. The ratio of loans of national banking system at year-end to GDP is positively related with home prices. The proportion of employed persons to total population is negatively correlated with home prices. Moreover, the relationship between foreign direct investment and home prices is negatively correlated.

The analysis finds that environmental pollution indeed has a negative impact on home prices, and of the four pollutants, industrial soot (dust) has the greatest affect, but the impact of industrial wastewater is relatively small. If the other conditions remain unchanged, home prices of the eastern region would increase by 1.59 percentage points when per capita volume of industrial soot (dust) emissions was lowered by 10 percentage points. The study also reveals that other social and economic factors will also significantly affect the price level. Greening, public transport, income, fiscal situation, loans of financial institutions, FDI, population density, and other factors have a positive effect on home prices, but employment and other factors affect the home prices insignificantly. The coefficients for the interactions between pollutant emissions and income indicate that the impact of environmental pollution on home prices is dependent on the income level of citizens. In addition, there are remarkable differences in the magnitudes of the impacts for the different regions.

Therefore, the positive of “external” of the improvement of environmental quality for real estate prices is comparative. China’s environmental governance has a stable and positive role on enhancing fixed asset prices.

Based on the above results, for promoting comprehensive and coordinated and sustainable development of the real estate market and urban environment, it is important to focus on the following points in addressing the problem of high home prices.

-

(1)

Environmental policies and price regulation policies interact and produce side effects. China’s environmental laws and supervision system are imperfect at present, so the government needs to coordinate the policies mix (Zhang et al. 2017). Governance of environmental pollution problems would help to raise the value of fixed assets; therefore, adjust, speed up the upgrade of industrial structure, and promote the city’s transformation from the “production” to “consumption.” In the industrial production process, we should eliminate backward production capacity with the feature of high pollution, high energy consumption, and high emissions. The most sensible approach is to introduce emerging clean technology into production. The government should increase environmental protection funds, improve the environmental management system, which could gradually reduce the level of environmental pollution, and improve the comfort of urban living environment.

-

(2)

There are differences in the impact of different regions on the price of premises, so environmental policies should be different. It is noteworthy that in the process of addressing the relationship between home prices and environmental pollution, it is important to distinguish between different regions and follow the principle of “concrete analysis of specific issues.” The eastern region needs to focus on pollution problems of SO2, industrial soot (dust), and industrial chemical oxygen demand. The non-eastern areas should be more concerned about the treatment of industrial soot (dust) and industrial wastewater.

-

(3)

Although environmental pollution affects home prices, it is not the most important factor. The main problems affecting housing prices are credit and population. To curb home prices from overheating, inhibit the real estate bubble, and implement a stable effect on home prices, it is urgent to reduce bank credit and control mortgages and stabilize the flow of foreign population to reduce the size of urban population pressure. Cities should also pay attention to increasing vegetation coverage, improving the urban public transport system, playing a positive role in environmental expenditure, strictly controlling non-eastern areas of foreign direct investment, introducing cleaner production investment, and solving the problem of labor employment reasonably.

Finally, it should be noted that, although this paper has deeply investigated the impact of environmental pollutants on China’s home prices, there are still some limits and unanswered important questions that could be further explored in the follow-up researches. For instance, due to data availability, this study only examines the traditional pollutants such as SO2, soot, wastewater, and COD. Given that haze pollution is the most serious and significant environmental problem that besets China nowadays, it is meaningful and reasonable to investigate how haze pollution (e.g., PM2.5 concentrations) would affect home prices when enough data are available. Moreover, fully considering the dramatic fluctuation of China’s home prices, the threshold regression method could be utilized to test whether the impact of pollutants on home prices may change over time if the time series is long enough. To sum up, the economic and social influence of pollution in China is an interesting and important issue that deserves in-depth researches in the future.

Notes

Issued at the end of August 2003, Circular of the State Council on Promoting the Continuous and Healthy Development of the Real Estate Markets clearly noted that the real estate industry with high correlation and strong driving force has become a pillar industry of the national economy. For more information, please refer to http://www.gov.cn/test/2005-06/30/content_11344.htm (in Chinese, accessed at 11/08/2017).

In May 2005, the General Office of the State Council issued a notice (Opinions on Doing a Good Job in Stabilizing Home Prices) to forward the Ministry of Construction and other six ministries. That notice required all regions and departments to solve some urgent problems such as excessive investment and surging price of the real estate, which was as an important task to strengthen macro-control at that time. For more information, one could refer to http://www.gov.cn/ztzl/2006-06/30/content_323680.htm. (in Chinese, accessed at 11/08/2017).

Issued by the General Office of the State Council at May 29, 2006, Opinions on Adjusting the Housing Supply Structure and Stabilizing Housing Prices, made quantitative provisions on the dwelling size, small unit’s ratio, the proportion of new homes down payment and so on. For more information, please refer to http://www.gov.cn/ztzl/2006-06/30/content_323678.htm (in Chinese, accessed at 11/08/2017).

Issued at April 17, 2010, Notice on Resolutely Curb Some Cities in the Home Prices Rose Quickly by the State Council, proposed to limit the purchase of different places, raising substantially the standards of granting mortgages for the purchase of the second apartment. For more information, one could refer to http://www.gov.cn/zhuanti/2015-06/13/content_2878981.htm (in Chinese, accessed at 11/08/2017).

For more information, please refer to http://www.nap.edu/catalog.php?record_id=11192 and http://www.chinadaily.com.cn/china/2007-11/19/content_6264621.htm (accessed at 11/08/2017).

The eastern region includes 12 provinces, autonomous regions and municipalities directly under the Central Government, which are Beijing, Tianjin, Hebei, Liaoning, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, Guangxi, and Hainan. Other provinces, autonomous regions and municipalities are classified in the non-eastern region.

References

Abraham JM, Hendershott PH (1994) Bubbles in metropolitan housing markets (no. w4774). Natl Bur Econ Res. https://doi.org/10.3386/w4774

Afonso A, Sousa RM (2012) The macroeconomic effects of fiscal policy. Appl Econ 44(34):4439–4454. https://doi.org/10.1080/00036846.2011.591732

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297. https://doi.org/10.2307/2297968

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68(1):29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Blanchard OJ, Watson MW (1982) Bubbles, rational expectations and financial markets (no. w945). Natl Bur Econ Res. https://doi.org/10.3386/w0945

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Bramley G (1993) Land-use planning and the housing market in Britain: the impact on housebuilding and house prices. Environ Plan A 25(7):1021–1051. https://doi.org/10.1068/a251021

Breedon FJ, Joyce MA (1993) House prices, arrears and possessions: a three equation model for the UK. Bank of England. https://doi.org/10.2139/ssrn.91408

Capozza DR, Hendershott PH, Mack C, Mayer CJ (2002) Determinants of real house price dynamics (no. w9262). Natl Bur Econ Res. https://doi.org/10.3386/w9262

Chen X, Funke M (2013) Real-time warning signs of emerging and collapsing Chinese house price bubbles. Natl Inst Econ Rev 223(1):R39–R48. https://doi.org/10.2139/ssrn.2175661

Chen X, Shao S, Tian Z, Xie Z, Yin P (2017) Impacts of air pollution and its spatial spillover effect on public health based on China’s big data sample. J Clean Prod 142:915–925. https://doi.org/10.1016/j.jclepro.2016.02.119

Fan JL, Zhang YJ, Wang B (2017) The impact of urbanization on residential energy consumption in China: an aggregated and disaggregated analysis. Renew Sust Energ Rev 75:220–233. https://doi.org/10.1016/j.rser.2016.10.066

Fortura P, Kushner J (1986) Canadian inter-city house price differentials. Real Estate Econ 14(4):525–536. https://doi.org/10.1111/1540-6229.00401

Gimeno R, Martinez-Carrascal C (2010) The relationship between house prices and house purchase loans: the Spanish case. J Bank Financ 34(8):1849–1855. https://doi.org/10.1016/j.jbankfin.2009.12.011

Glaeser EL, Gyourko J (2002) The impact of zoning on housing affordability (no. w8835). Natl Bur Econ Res. https://doi.org/10.3386/w8835

Green RK (1999) Land use regulation and the price of housing in a suburban Wisconsin County. J Hous Econ 8(2):144–159. https://doi.org/10.1006/jhec.1999.0243

Grossman GM, Krueger AB (1994) Economic growth and the environment (no. w4634). Natl Bur Econ Res. https://doi.org/10.2307/2118443

Hwang M, Quigley JM (2006) Economic fundamentals in local housing markets: evidence from US metropolitan regions. J Reg Sci 46(3):425–453. https://doi.org/10.1111/j.1467-9787.2006.00480.x

Jacobsen DH, Naug BE (2005) What drives house prices? Norges Bank Econ Bull 76(1):29–41

Jud D, Winkler D (2002) The dynamics of metropolitan housing prices. J Real Estate Res 23(1–2):29–46. https://doi.org/10.5555/rees.23.1-2.363x90jp6p70pp26

Kim CW, Phipps TT, Anselin L (2003) Measuring the benefits of air quality improvement: a spatial hedonic approach. J Environ Econ Manag 45(1):24–39. https://doi.org/10.1016/S0095-0696(02)00013-X

Kong F, Yin H, Nakagoshi N (2007) Using GIS and landscape metrics in the hedonic price modeling of the amenity value of urban green space: a case study in Jinan City, China. Landsc Urban Plan 79(3):240–252. https://doi.org/10.1016/j.landurbplan.2006.02.013

Mankiw NG, Weil DN (1989) The baby boom, the baby bust, and the housing market. Reg Sci Urban Econ 19(2):235–258. https://doi.org/10.1016/0166-0462(89)90005-7

Martinez Pagés J, Maza LÁ (2003) Analysis of house prices in Spain (no. 0307). Banco de España

McMillen DP, McDonald J (2004) Reaction of house prices to a new rapid transit line: Chicago’s midway line, 1983–1999. Real Estate Econ 32(3):463–486. https://doi.org/10.1111/j.1080-8620.2004.00099.x

Rappaport J (2008) Consumption amenities and city population density. Reg Sci Urban Econ 38(6):533–552. https://doi.org/10.1016/j.regsciurbeco.2008.02.001

Reichert AK (1990) The impact of interest rates, income, and employment upon regional housing prices. J Real Estate Financ Econ 3(4):373–391. https://doi.org/10.1007/BF00178859

Ren Y, Xiong C, Yuan Y (2012) House price bubbles in China. China Econ Rev 23(4):786–800. https://doi.org/10.1016/j.chieco.2012.04.001

Rosen S (1979) Wage-based indexes of urban quality of life. Current Issues in Urban Econ 3:324–345

Shen L (2012) Are house prices too high in China? China Econ Rev 23(4):1206–1210. https://doi.org/10.1016/j.chieco.2012.03.008

Wang D, Li SM (2006) Socio-economic differentials and stated housing preferences in Guangzhou, China. Habitat Int 30(2):305–326. https://doi.org/10.1016/j.habitatint.2004.02.009

Wooldridge JM (2016) Introductory econometrics: a modern approach (6e). South-Western Cengage Learning, USA, Mason

Wu G, Miao Z, Shao S, Jiang K, Geng Y, Li D, Liu H (2016) Evaluating the construction efficiencies of urban wastewater transportation and treatment capacity: evidence from 70 megacities in China. Resour Conserv Recycl (in press). doi:https://doi.org/10.1016/j.resconrec.2016.08.020

Yu H (2010) China’s house price: affected by economic fundamentals or real estate policy? Front Econ China 5(1):25–51. https://doi.org/10.1007/s11459-010-0002-7

Zhang YJ, Bian XJ, Tan W, Song J (2015) The indirect energy consumption and CO2 emission caused by household consumption in China: an analysis based on the input–output method. J Clean Prod 163:69–83. https://doi.org/10.1016/j.jclepro.2015.08.044

Zhang YJ, Peng YL, Ma CQ, Shen B (2017) Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 100:18–28. https://doi.org/10.1016/j.enpol.2016.10.005

Zheng S, Cao J, Kahn ME, Sun C (2014) Real estate valuation and cross-boundary air pollution externalities: evidence from Chinese cities. J Real Estate Financ Econ 48(3):398–414. https://doi.org/10.1007/s11146-013-9405-4

Zheng S, Kahn ME, Liu H (2010) Towards a system of open cities in China: home prices, FDI flows and air quality in 35 major cities. Reg Sci Urban Econ 40(1):1–10. https://doi.org/10.1016/j.regsciurbeco.2009.10.003

Acknowledgements

The authors appreciate the help of Prof. Sebastian Wandelt and Associate-Prof. Xiaoqian Sun at Beihang University to assist us in conducting some empirical estimations. The authors are also very grateful to four anonymous reviewers and Editor-in-Chief Prof. Dr. Jiri Philippe Garrigues for their insightful comments that help us sufficiently improve the quality of this paper. The usual disclaimer applies.

Funding

The authors acknowledge financial support from the National Natural Science Foundation of China (71403015, 71521002), the Beijing Municipal Natural Science Foundation (9162013), the National Key Research and Development Program of China (2016YFA0602801, 2016YFA0602603), and the Joint Development Program of Beijing Municipal Commission of Education.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Rights and permissions

About this article

Cite this article

Hao, Y., Zheng, S. Would environmental pollution affect home prices? An empirical study based on China’s key cities. Environ Sci Pollut Res 24, 24545–24561 (2017). https://doi.org/10.1007/s11356-017-0073-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-017-0073-4